Civil Service Pension Scheme: 2015 Remedy and civil service member contributions: government response (HTML)

Updated 4 March 2022

Executive Summary

In April 2015 the Coalition Government introduced reformed (defined benefit) public service pension schemes (“reformed schemes”). The changes followed a fundamental structural review of public service pensions by the Independent Public Service Pension Commission, chaired by Lord Hutton of Furness. As part of these changes, protection was afforded to certain members of the existing public service schemes which allowed them to remain in their existing pension schemes and not transfer to the new reformed schemes (referred to as ‘transitional protection’). Members in the civil service pension scheme who were eligible for this protection were either (a) within ten years of their normal pension age as at 31 March 2012 (known as ‘full protection members’) or (b) within ten years and thirteen years and six months of their normal pension age and could elect to remain in their existing scheme for a particular period of time after that scheme closed as a result of the reforms (known as ‘tapered protection members’).

In December 2018 the Court of Appeal found that transitional protection unlawfully discriminated against younger members of the judicial and firefighters’ pension schemes in particular, as transitional protection was only offered to older scheme members. It also indirectly discriminated against women and ethnic minorities. The Courts required that this unlawful discrimination be remedied by the Government.

In order to remedy the discrimination, HM Treasury held an open consultation to consider the potential options to remove the discrimination. Following the close of the consultation in February 2021, the Public Service Pensions and Judicial Offices Bill (“PSPJO Bill”) was introduced in Parliament in July 2021. The scheme manager for the civil service (defined benefit) pension schemes will be required to implement the scheme-level changes mandated by the Bill.

The first stage of the scheme-level implementation process is to amend the scheme rules to ensure that, from 1 April 2022, all scheme members will accrue service in the reformed scheme, thus ending the discrimination identified in the McCloud litigation (referred to as the ‘prospective remedy’).

Introduction and contact details

This document is the post-consultation report for the consultation ‘Civil Service Pension Scheme: 2015 Remedy and civil service member contributions’ which began on 22 November 2021 and ended on 17 January 2022.

It will cover:

- the background to the report

- a summary of the responses to the report

- a detailed response to the specific questions raised in the report

- the next steps following this consultation.

Further copies of this report and the consultation paper can be obtained by contacting the address below:

CSPS Consultation

Cabinet Office

Priestley House

Priestley Road

Basingstoke RG24 9NW

Email: [email protected]

Alternative format versions of this publication can be requested from: [email protected].

Complaints or comments

If you have any complaints or comments about the consultation process you should contact the Cabinet Office at the above address.

Background

The consultation addressed the changes being made to implement the ‘prospective remedy’, which involves moving all remaining active members (including partially retired members in active service) to the reformed scheme for civil servants, ‘alpha’, from 1 April 2022. The legacy scheme (i.e. the Principal Civil Service Pension Scheme, “PCSPS”) will be closed to future service accrual from 31 March 2022.

Alongside consulting on the prospective remedy, the consultation addressed the continuation of member contributions for alpha. Member contributions are usually set every four years as part of the scheme valuation process. However, the cost control element of the 2016 valuations was paused in light of the McCloud and Sargeant judgments. This was because it was not possible to assess the value of current public service pension arrangements with any certainty, and the cost control mechanism was being paused until certainty around the value of public service pensions to employees from April 2015 onwards could be determined.

HM Treasury announced the resumption of the cost control element of the 2016 valuation process in July 2020. HM Treasury published The Public Service Pensions (Valuations and Employer Cost Cap) (Amendment) Directions 2021 on 7 October 2021, which allowed schemes to complete this process. As the results of the process were not expected until late 2021 at the earliest, we proposed to rollover the 2021/22 member contributions in the draft prospective remedy regulations. Subsequently the results of the 2016 valuation released on 17 December 2021, determined that the cost cap of the scheme is 0.4% below the employer cost cap. As the result lies within the 2% corridor specified in HM Treasury’s regulations, this means that no changes to benefits or member contributions are required.

In addition several miscellaneous technical amendments were included in the consultation.

The consultation paper ‘2015 Remedy and civil service member contributions’ was published on 22 November 2021. It invited comments from civil service scheme members who are impacted by being moved to alpha from 1 April 2022 and all active members of the scheme in relation to member contributions.

The consultation was aimed at members currently in the civil service legacy pension scheme (PCSPS) who will be moving to the reformed scheme (alpha) from 1 April 2022 as a result of the prospective remedy. It was also aimed at persons who would have been afforded transitional protection on re-joining the civil service pension scheme arrangements. Such as those transferring in from a New Fair Deal employer, but as a result of the prospective remedy, will now join alpha from 1 April 2022.

In addition to provisions relating to the McCloud prospective remedy, the draft prospective remedy regulations cover:

- the proposed member contributions from 1 April 2022 to 31 March 2023;

- miscellaneous technical amendments.

These regulations apply to the United Kingdom. HM Treasury has published a policy impact assessment and an equality impact assessment, which consider the impact of the proposed PSPJO Bill powers and requirements. The scope of the assessments carried out by the Cabinet Office therefore focused on the impact of the proposed changes to scheme rules necessary to deliver the PSPJO Bill requirements. The Cabinet Office has produced an Equality Impact Assessment (see Annex B).

The consultation closed on 17 January 2022 and this report summarises the responses, including how the consultation process influenced the final policy proposals consulted upon.

The consultation stage Equality Impact Assessment will be revisited at the next consultation on the remedy work.

A list of respondent organisations is at Annex A.

Consultation

Between 22 November 2021 and 17 January 2022 the Cabinet Office sought views on the following proposals to amend the scheme regulations:

- To make the amendments required to implement the prospective remedy, which requires moving all active members of the PCSPS (including partial retirees in active service) to alpha on 1 April 2022 and making consequential changes to the regulations, pursuant to the requirements of the PSPJO Bill.

- To amend Schedule 2 (transitional provisions) of the Public Service (Civil Servants and Others) Pensions Regulations 2014 to end any future service accrual in the PCSPS from 1 April 2022 for all classes of member in respect of pensionable service under civil service pension terms. This means that from 1 April 2022, all members of the civil service pension arrangements will only be able to build up benefits in alpha and concurrently the PCSPS will be closed, meaning no further benefits will accrue in the PCSPS.

- Remove the restriction on members purchasing alpha added pension by lump sum in the first 12 months of alpha service for members with service in the PCSPS.

- Provide that members who apply for ill-health retirement under PCSPS before 1 April 2022, where the application is determined in their favour after that date, will not be placed in a less generous position than if their application had been approved on 31 March 2022.

- Due to the pay pause for Civil Servants earning above £24,250, as well as tax thresholds being frozen, it was proposed to rollover member contribution rates and salary thresholds from 2021/22 for use in 2022/23.

Stakeholder Engagement

During the consultation period, the Cabinet Office ran a number of engagement sessions to ensure members and other stakeholders were given the opportunity to directly engage with them on the proposals set out in the consultation. Meetings with unions representing civil service members were held on 7 December 2021 and 9 December 2021. These sessions allowed unions to seek clarification on any of the aspects presented in the proposals. A number of stakeholders followed up with formal written responses and the feedback received during the stakeholder sessions and in formal written responses has been considered in deciding the final policy proposals.

There were also a number of member and employer engagement activities that included; publishing of the consultation on the civil service pensions website, issue of an employer pensions notice informing employers of the consultation and an information session was held for members on the move to alpha, whilst the consultation was open.

Stakeholder engagement will remain important as the government continues to develop and then implement the final policy. The government will continue to engage with member representatives, employer representatives and other relevant stakeholders to support the successful implementation of the pension changes set out in this response.

Summary of responses

As part of the consultation, consultees were asked to respond to a total of six questions. Responses to each question were considered in making decisions about how to take the proposals forward, and in the drafting of this response. Some elements of the prospective remedy policy, in particular the closure of legacy schemes, had previously been consulted on by HM Treasury.

Responses to the consultation were received by email and presented in different formats. Some emails answered all questions, some a few of the questions and some answered none of the questions asked in the consultation document. Whilst some responses did not necessarily address the specific questions posed in the consultation document, all responses have been considered appropriately.

In addition, some of the responses received were not within the scope of this consultation or covered by the proposed scheme regulation amendments for the prospective remedy. These however will be relevant for the retrospective remedy and have been noted accordingly. The retrospective remedy will implement the Deferred Choice Underpin for members.

Where respondents have written the same point to multiple questions, we have answered that point under the most relevant question.

A number of members wrote in asking for guidance around their specific circumstances and were directed to speak with MyCSP (the scheme administrator),and provided with a link to the relevant 2015 remedy pages on the civil service pensions website. Any comments received after the date the consultation closed were not taken into account.

The Cabinet Office has undertaken quantitative and qualitative analysis of the responses, and the common themes and views are summarised within this document. While trade unions and other representative bodies represent a large portion of civil service workers, the Cabinet Office recognises that the number of responses received (particularly from individuals) does not accurately represent all civil service pension scheme members.

Therefore, any quantitative data has its limitations and has been handled with caution during the decision-making process. Where we have supplied data in this document, it is to simplify and summarise responses and provide the reader with a sense of trends. The Cabinet Office did not treat respondents’ answers in a binary way (agree or disagree) when forming its final policies.

The Cabinet Office received 1,268 responses in total from scheme members and trade unions which directly addressed the questions in the consultation. These consisted of 1,263 responses from individuals, and five responses from trade unions, being Prospect, FDA, Public and Commercial Services Union (PCS), Defence Police Federation (DPF) and Government Communications Group (GCG) a branch of PCS. In addition, a response from Audit Wales was also received. Another 32 responses were received from individuals that did not address the questions posed by the consultation; instead, these responses questioned how the remedy would impact them.

The number of responses received in respect of each consultation question are set out in Table 1 immediately below. The subsequent Table 2 quantifies the response method used by responders.

Table 1: summary of number and nature of responses by question

| Question | Number of responses | What was the nature of the responses? | |

|---|---|---|---|

| 1) Please comment on whether the draft regulations are sufficient for the purposes of implementing the prospective remedy? | 8 | 6 agreed that the regulations were sufficient and 2 raised further concerns | |

| 2) The ill-health retirement amendment reflects the unique position of the group being moved to alpha and will ensure that a member who applies for ill health retirement before 31 March, and where the application is successful, is treated no less favourably than if the application had been determined on that date. Do you have any views on this proposal, in particular, whether there are any adverse impacts about which you are concerned? | 1,249 | 1,249 supported the ill health underpin. | |

| 3) Are there any other areas which you think should be addressed in these regulations in order to ensure that all members are successfully moved to alpha from 1 April 2022? | 7 | 7 respondents requested clarification | |

| 4) Are there any further considerations and evidence that you think Cabinet Office should take into account when assessing any equality issues arising as a result of the proposed amendments? Any comments should be made after reading the accompanying Equality Impact Assessment in Annex B. | 5 | 5 raised additional considerations around equality impacts. | |

| 5) Given that the results of the cost cap valuation are not yet known and that schemes must set a lawful basis for collecting member contributions at this time so that it is effective from 1 April 2022, do you agree the current proposals meet these policy objectives? | 1,257 | 1,253 disagreed with the roll forward of contributions, 4 agreed with it | |

| 6) Do you agree that the amendments referenced in [3.3] are correct and are you aware of any adverse impacts on members or the scheme that will result from them? | 6 | 3 agreed with the amendments and 3 others queried them |

Table 2: response method and source

| Response From | Response method | Total Received |

|---|---|---|

| Individuals | 1,295 | |

| Of which: Queried the effect of the remedy (i.e. didn’t answer the consultation questions) | 32 | |

| Of which: Responded to some or all questions in personalised responses (rather than in a standard response) | 24 | |

| Unions | 5 | |

| Other organisations | 1 | |

| 1,301 |

Further analysis of the consultation responses by question, including where alternative proposals were suggested, is below. We have grouped the six questions listed above into three areas, as per the consultation: the closure of PCSPS and move to alpha (questions 1-4); the proposed member contribution rates for 1 April 2022 to 31 March 2023 (question 5); and technical amendments (question 6).

The vast majority of responses from individuals relating to the consultation (1,239 out of 1,268) used a standardised template provided by one union, which is reproduced below. Each of these responses were identical. Each email using this template was from a different member, so we have classed these as individual responses.

Union response template

Dear Stephen Barclay MP,

I am writing to respond to the Cabinet Office consultation on member contribution rates in the civil service pension scheme, and the implementation of the first phase of amendments to remedy age discrimination.

Prospective Changes for 2015 Remedy:

- Support the introduction of transitional arrangements for ill health retirements that are ongoing and not completed by 1 April 2022.

Member Contributions 2022/23:

- Member contribution rates for 2022/23 should be informed by the results of the 2016 cost control mechanism without the inclusion of the costs of McCloud.

- We believe the inclusion of the costs of McCloud is unlawful and are monitoring legal action on this as an interested party. The Cabinet Office and Treasury should finalise the cost control mechanism without the costs of McCloud and implement the Civil Service Scheme advisory board proposals respectively.

- The Cabinet Office shouldn’t be adopting such a short-term approach to the setting of member contribution rates.

- The Cabinet Office should publish a timetable for finalisation of the 2016 cost control mechanism and the complete 2020 valuation. This includes implementing member contribution rates from April 2023.

Proposal: prospective changes to remove discrimination (questions 1-4)

Core prospective remedy (question 1)

Making the amendments required to implement the prospective remedy, which requires moving all active members of the PCSPS (including partial retirees in active service) to alpha on 1 April 2022 and making consequential changes to the regulations, pursuant to the requirements of the PSPJO Bill.

The draft regulations amend Schedule 2 (transitional provisions) of the Public Service (Civil Servants and Others) Pensions Regulations 2014 by not allowing any future in the PCSPS from 1 April 2022 for all classes of member, in respect of service pensionable under civil service pension terms. This means that from 1 April 2022, all members of the civil service pension arrangements will only be able to accrue benefits in alpha and concurrently the PCSPS will close to future service accrual.

Added pension (question 1)

Remove the restriction on members purchasing alpha added pension by lump sum in the first 12 months of alpha service for members with service in the PCSPS.

This is necessary as the remedy will create an oddity where no members being moved to alpha will be able to buy added pension by lump sum as they do not have 12 months of alpha service. Furthermore, as part of the retrospective remedy all remedy members already in alpha will be rolled back to PCSPS in respect of any pensionable service rendered between 1 April 2015 and 31 March 2022. This will be implemented retrospectively in 2023, meaning that their first year of service in alpha would be 2022-23, invalidating any added pension purchased in this year.

This was not the policy intent of the original rule, hence the change. We clarified in the consultation the position on added pension in light of the McCloud remedy implementation This does not require rule changes, but members who have existing PCSPS added pension or added years contracts to make future contributions will be allowed to continue with them post 1 April 2022.

Question 1 asked respondents to comment on whether the draft regulations are sufficient for the purposes of implementing the prospective remedy?

Responses to Question 1

In total eight stakeholders responded directly to Question 1. The majority of respondents (six out of eight) supported the proposal and agreed it would meet the objective to move all active members of the PCSPS (including partial retirees in active service) to alpha on 1 April 2022.

Concerns were raised by one member about how fairness could be achieved for members who transitioned into alpha from 2015 and later through the tapered protection arrangements, particularly in respect of the purchase of Added Pension in light of the proposed arrangements for those being transitioned to alpha on 1 April 2022. The member noted that members who were tapered into alpha before 1 April 2022 were not able to purchase added pension by lump sum for the first 12 months and argued that members had suffered a financial loss as a result.

The FDA raised concerns about members needing to receive interest on pension payments or contribution refunds when the remedy is implemented.

The PCS union, whilst agreeing that the regulations met the objective of closing the legacy schemes and moving remaining members to alpha, raised a number of concerns around the wider remedy, principally in respect of the need to process immediate detriment cases. An extract from their response is reproduced below.

Extract from PCS response to Question 1

In particular, the draft regulations leave unclear and unresolved issues of “immediate detriment”, i.e. those who have already suffered a clear detriment that might not have occurred except for the improper imposition of Alpha with its now identified discriminatory element, such as those who have received Ill Health Retirement compensation under scheme rules that would not have applied if they had the benefits of the remedy, i.e. the choice of other and more beneficial scheme rules to determine rates of IHR compensation.

The draft regulations make provision that affected members who are already in receipt of pensions benefits, under IHR or by another route, will be given a choice “as soon as possible after the necessary changes to the scheme are implemented via legislation”, but it does not specify what this provision means exactly. PCS is concerned that it may be taken to mean “as soon as possible” after all the logistical and administrative changes and calculations have been finalised and the full remedy is ready to be applied to all individual cases, i.e. from October 2023.

If so, this is far too long to wait for those suffering an immediate detriment. PCS asks and expects that the provision be taken to mean “as soon as possible” after the regulations become law, and that there be a specific commitment to apply the remedy to those suffering immediate detriment no longer than 90 days from the date the regulations become law.

The Defence Police Federation (DPF) disagreed that the regulations are sufficient and raised a number of concerns in respect of their members, reproduced below.

Extract from DPF response

We agree that the draft Regulations will have the effect that the Treasury aims at, to close the PCSPS to the members who are still accruing PCSPS benefits. We do not agree that they are “sufficient” however.

We note that the NPA [Normal Pension Age] for Home Office Police officers is age 60 in the 2015 Police Pension Scheme, whilst also noting that the contribution rate for members of the Police Pension Schemes is considerably higher.

The MOD has agreed to fund a lower NPA for MDP officers by paying for an effective pension age equal to three years below State pension age. That still leaves officers who are over age 60 but who have not yet reached State pension age in the difficult position that they cannot afford to retire, are not sufficiently fit to remain in an operational role, and who therefore face dismissal on capability grounds. In our view a facility should be introduced to allow alpha members to pay increased contributions which allow them to retire at the age of 60 without any actuarial reduction to their pension. This should not be restricted by the current alpha rules which place an upper cash limit on the additional voluntary contributions that a member may pay.

The actuarial modelling that we have commissioned suggests that the additional contributions that members would have to pay would equal about 5% of pay. This would or should be at nil cost to the employing department. It would allow the member to pay an amount equal to the difference between Police Pension Scheme contributions and alpha contributions if they so choose and would allow members to retire with dignity and without an acrimonious dispute between the officer concerned and the MOD about whether the reason why they have to go is ill-health, incapability or some other reason.

We note what the High Court said about the Government’s proposal to close legacy schemes with effect from 31 March 2022 in the judicial review proceedings brought by the Police Superintendents Association. Like them, we are disappointed that this consultation addresses how the PCSPS should be closed to future accrual and not whether it should be.

Cabinet Office Response to Question 1

The Cabinet Office is pleased that nearly all of the respondents who specifically replied to this part of the consultation were in agreement with the proposal. This is the first step to removing the discrimination identified by the Court of Appeal in December 2018. The courts required that this unlawful discrimination be remedied by the Government. It is important to note that the transitional protection element of the 2015 reforms was found to be discriminatory, not the reformed scheme (alpha) itself. The courts ruled the transitional protection afforded to older scheme members unlawfully discriminated against younger members, as transitional protection was only offered to older scheme members.

The DPF response made reference to a High Court Case brought by the Police Superintendents’ Association (PSA) against HM Treasury and the Home Office. On Wednesday 15 December, the High Court dismissed the judicial review claim brought by the Police Superintendents’ Association (PSA) against HM Treasury and the Home Office. The PSA sought to challenge HM Treasury’s decision to close legacy public sector pension schemes (mostly final salary schemes) and move all current members to reformed pension schemes (based on career average earnings) from 1 April 2022, and the consultation process leading up to that decision. In that case the judge refused to interfere with the decision to close the legacy schemes, confirming that quashing the consultation would amount to an ‘’impermissible interference with proceedings in Parliament” because it would inevitably result in disruption to the Parliamentary timetable given the current passage of the PSPJO Bill.

In respect of the DPF’s response, any proposed members’ enhancements would first need to be agreed with the employer(s) and then with the scheme, so as not to impose any additional cost on the scheme. We do not intend to address these points in this document as they do not form part of the prospective remedy.

The implementation of the remedy and relevant timescales via the Deferred Choice Underpin (DCU) will be dealt with through the planned retrospective regulations and will be consulted on at a future date. The Cabinet Office recognises the need to process cases as soon as possible, but there are substantial legislative and administrative challenges to doing so earlier than the planned October 2023 date. Interest due on pension payments and refunds will form part of this process.

Members who believe they have been disadvantaged by not being able to purchase added pension by lump sum for their first 12 months in alpha will be able to apply under the contingent decisions route. This route will be set out in the retrospective regulations. The Cabinet Office therefore plans to implement the proposed added pension changes.

Ill Health Retirement (question 2)

The Cabinet Office will provide members who apply for ill-health retirement under PCSPS before 1 April 2022, where the application is determined in their favour after that date, will not be placed in a less generous position than if their application had been approved on 31 March 2022.

From 1 April 2022 onwards, active members who will be moved to alpha and subsequently become subject to ill-health retirement, will be assessed, and receive ill health benefits, in accordance with the ill-health arrangements in alpha – this means that cases will become subject to different qualifying criteria than under the legacy scheme rules.

There will be cases where the ill-health process will begin on or before 31 March 2022 and will not conclude until 1 April 2022 or later. Current transitional provision allows the date a legacy scheme member would otherwise join the new scheme to be delayed until their ill-health pension application has been decided or, where it is not decided in the member’s favour, until the member withdraws the application or all appeal routes have been exhausted.

This provision was permitted by exceptions in the Public Service Pensions Act (PSPA) 2013 that allowed certain members to remain in the legacy scheme after the date they were due to join the new scheme (between 1 April 2015 and 31 March 2022). The powers under which those exceptions were made are removed from the PSPA 2013 by the PSPJO Bill from 1 April 2022. This means that all legacy scheme members, including any members who have submitted an application for a legacy scheme ill-health pension, will join the new scheme on that date.

Therefore there is a need to deal with legacy scheme ill-health pension applications received before 1 April 2022 which have not been completed by 31 March 2022. Cases where an application is completed after 31 March 2022 need to be considered and the benefits determined.

For any ill-health cases where this is the case, the intended policy is that there should be an “ill-health retirement underpin”. This will mean that such members receive a 2015 scheme ill-health pension calculated at the date they actually retire; but that if a legacy scheme ill-health pension calculated as at 31 March 2022 would have been more favourable, the 2015 Scheme pension must be increased by the difference between the two.

The “underpin” will effectively guarantee the member an ill-health pension that is at least as much as the they would have received had they been ill-health retired under the terms of their PCSPS legacy scheme on 31 March 2022.

The proposed ill health underpin will work as follows:

- The member applies for ill health retirement on or before 31 March 2022, but the outcome of the application is still outstanding as of that date. The date of the application is based on the receipt of the application by the Scheme Medical Adviser.

- The member moves to alpha on 1 April 2022 and remains in the scheme until the date of ill-health retirement.

- An ill health pension is calculated under the rules of alpha.

- A notional ill-health pension is calculated in accordance with the member’s legacy scheme provisions if they would have met the criteria for an ill-health pension under the legacy scheme had their case been determined on 31 March 2022.

- Where the ill health pension award is more favourable under the rules of alpha, the award will be paid from alpha based on the standard ill health retirement rules of alpha.

- Where the notional legacy scheme award is more favourable, the difference between both calculations will be paid to the member as a pension enhancement alpha on top of the benefit, if any, that would be paid under the standard alpha ill health retirement provisions.

- Survivor benefits would be paid in accordance with the benefits the member receives.

- However, the underpin will also need to allow for the retrospective remedy provisions for choice set out in the PSPJO Bill and provided for in due course under scheme regulations for retrospective remedy. The provision and continuation of an underpin ill health pension or death and survivors’ benefits related to legacy service for the remedy period would depend on legacy service applying for the remedy period (i.e. for the service between 1 April 2015 and 31 March 2022 taken into account for purposes of determining the alpha ill health retirement “underpin” pension). Therefore, if as a result of a decision by or on behalf of a member, alpha terms were applied for the remedy period, such underpin benefits would either not be payable (if the ill health process begun before 1 April 2022 had still not been completed) or, if already paid, would be removed and replaced by the benefits that would be payable under the standard 2015 scheme terms without an underpin. Excess benefits already paid would then be recoverable.

Question 2: the ill-health retirement amendment reflects the unique position of the group being moved to alpha and will ensure that a member who applies for ill health retirement before 31 March [2022], and where the application is successful, is treated no less favourably than if the application had been determined on that date. Do you have any views on this proposal, in particular, whether there are any adverse impacts about which you are concerned?

Responses to Question 2

All respondents to this question (1,249) supported the proposal that members should not be treated less favourably due to the move to alpha on 1 April 2022.

Matters of concern raised by the unions PCS, Prospect, Government Communications Group and FDA, as well as two members, were focused on:

- the need to ensure the process was efficient (i.e. not assessing under PCSPS and then assessing under alpha, causing a delay in payment of benefits); ensuring members understand the process and how it interacts with the future choice under the Deferred Choice Underpin;

- the need for clarification on how survivor benefits will be determined; calls for dual assessment or reassessment of all existing and new ill health cases, to understand what entitlement those members have; and the need to process immediate detriment cases sooner as per question 1.

One member also queried why ill health benefits were not aligned with service in particular schemes – an extract from their response is as follows:

Given that pension benefits are paid out for each and every scheme individuals are in according to the rules of that particular scheme (Classic, Premium etc) when they retire, why cannot ill health retirement be based upon the same?

Cabinet Office Response to Question 2

The proposed regulations refer to the closure of the legacy schemes with effect from 31 March 2022 and moving all members to the reformed scheme alpha, with effect from 1 April 2022. This is known as the prospective remedy. The regulations to enable the immediate detriment cases to be worked through form part of the next stage of the remedy to be covered by further regulation amendments later in the year, known as the retrospective remedy. There will be an opportunity to comment on these regulations which will be consulted upon. Once the necessary legislation is in place it is our intention to look at this population at the earliest opportunity, and put in a timeframe to process these cases.

The priority member group for this consultation consists of those members who are in the unique position of having made an ill health application before 1 April 2022 that has not been completed by that date. We will use powers provided under the PSPJO Bill to make regulations protecting the position of ill health retirees whose cases are pending on 31 March 2022, and in particular to ensure they are no worse off as a result of a decision being made after that date. The date of the application is based on the receipt of the application by the Scheme Medical Adviser, i.e. this must be received on or before 31 March 2022.

In addition, consideration will be given to the introduction of a parallel assessment process to assess members under the criteria for both legacy and reformed schemes to avoid delays where the application for ill health retirement benefits is successful.

In respect of survivor benefits, the amount of any survivor benefit payable will be determined from the ill-health pension, including any underpin. The underpin provides that legacy members and their dependants are not placed in a less beneficial position than they would have been had the outcome of their application been determined under legacy scheme criteria and their retirement on ill-health grounds taken place on 31 March 2022. This clarifies what was in the original consultation.

In respect of the query around ill health retirement benefits being paid from multiple schemes, ill-health retirement pensions include early payment of the benefits that have been built up in each scheme an individual has been a member of, but in circumstances where the individual is entitled to a further benefit enhancement, this has to reflect the rules of the scheme they were a member of at the point of ill-health retirement. It is for this reason that the intended policy is that there should be an ill-health retirement underpin.

Other areas needed for the prospective remedy (question 3)

Question 3: are there any other areas which you think should be addressed in these regulations in order to ensure that all members are successfully moved to alpha from 1 April 2022?

Responses to Question 3

All respondents (seven) who provided an answer to this question were seeking clarity on the implementation and policy of the next stage of the 2015 Remedy, rather than highlighting anything lacking in the proposed draft regulations to move all members to alpha from 1 April 2022.

The FDA (and other unions) raised concerns around those members with reduced life expectancy and the need to assess and process these members as a priority.

Extract from FDA response to question 3

There is no mention of members already in receipt of an ill health retirement pension prior to 01/04/2021, and the urgency that needs to be applied when addressing the remedy period and corresponding benefits for these individuals.

Additionally, we believe that scheme members who apply for ill health retirement up to the 1 April 2022, should be automatically given the option of having a dual ill health retirement assessment applied.

There is need for clarification and confirmation of how those who are retired on the grounds of ill health due to reduced life expectancy will be assessed. We believe that these members should be given the highest priority and dealt with immediately the legislation is implemented.

Cabinet Office Response to Question 3

Based on the above feedback, the Cabinet Office does not intend to propose any additional measures for the prospective remedy regulations.

As referenced in Questions 1 and 2, we continue to view the ill health population as a priority group and are examining how they can be reassessed and processed ahead of the planned DCU date of October 2023. Any such regulatory changes needed would form part of a future Statutory Instrument dealing with the retrospective element of the remedy, rather than the closure of the PCSPS.

The Cabinet Office is committed to keeping members fully informed of the McCloud judgment and the subsequent 2015 Remedy Programme by dedicating a section of the Civil Service Pensions website to this topic. The content is updated regularly and contains video clips, quarterly newsletters, FAQs as well as interactive tools. In addition, virtual sessions are held regularly to update members of progress with the Programme.

Equality considerations (question 4)

Question 4: Are there any further considerations and evidence that you think Cabinet Office should take into account when assessing any equality issues arising as a result of the proposed amendments? Any comments should be made after reading the accompanying Equality Impact Assessment in Annex B.

Responses to Question 4

Seven respondents raised the need to consider further equality impacts which were not explicitly referenced in the Equality Impact Assessment. These were:

Respondent 1

For the 20/21 and 21/22 [financial years] I have made the maximum added pension contribution that the alpha rules allowed, I asked (in writing) before making both contributions if I could pay in to the pension the Classic maximum added pension contribution (£11k more PA), but I was told this was not possible until there was a legislation change. Therefore despite being able to choose whether I want my pension for 2015-22 to be classic or alpha I was denied the opportunity to purchase added pension at the levels classic permitted.

Respondent 2

I have contributed to an EPA since being moved to Alpha. I have already decided I will want to be moved back to Nuvos, for the period concerned, when I am given a choice. Presumably my EPA payments will be refunded to me for the period as they will not be necessary to ensure a retirement age of 65 in the Nuvos scheme. If I was close to retirement I might not mind having to wait to receive this refund. As I am around 20 years away from retirement I am unhappy about being denied this refund for such a long period by not being given the option to make this decision now – ready cash can have more utility than potential retirement benefits for those furthest from retirement. For this reason, I feel age discrimination remains in an underpin solution - if the option to receive a refund of EPA payments as soon as possible is not provided.

Respondent 3

In the circumstances cited above regarding how tapered members who had wished to purchase added pension by lump sum are affected, the proposal does not completely remove the discrimination on the basis of age, because they will continue to be treated less favourably than older, fully protected colleagues because they have been unable to purchase added pension by lump sum in any scheme for a 12 month period after they were moved to Alpha. In addition, the equality impact assessment does not offer an analysis of tapered members by gender. If tapered members continue to be treated less favourably than fully protected members on the basis of age, it could also be the case that a breakdown of gender would reveal further discrimination on the basis of gender.

Respondent 4

To be consistent, there needs to be a time frame for the removal of discrimination in which sensitive cases will be dealt with. I suggest a 90 day deadline.

Respondent 5

I believe for anyone due to retire within 2 years after 1 April 2022 (ie: up to 31 Mar 2024) having been moved into Alpha on 1 April 2022 - will be unfairly treated in the fact that they will not accrue any pension in Alpha (or Classic) and may only receive those ‘less than 2 yrs’ benefits in the form of cash (reduced by 35% for retiring before age 67) and not yearly pension (as required to have 2 years or over in a scheme to receive a pension from NPA). Therefore those individuals are LOSING 2 years of pension and are exposed to AGE DISCRIMINATION. If they decided to work a further year so that they have 3 years in Alpha and can then receive a yearly pension from Alpha, they would lose 30% of that figure due to retiring before age 67 (the new NPA under Alpha rules). So whichever choice they make they will lose 30% or over of the Alpha pension.

Respondent 6

PCS believes that the Cabinet Office should include and take cognisance of relevant data on the overall Gender Pension Gap in British society, i.e. the difference in final pension outcomes found to exist between men and women and that these operate to the detriment of women.

Respondent 7

We [the DPF] believe that it is unacceptable to make pension arrangements that result in officers, whatever their age and gender but particularly older and female officers, who are not able to meet a fitness standard and who are not offered a post elsewhere in the civil service, to be forced to retire with a drastically reduced pension or leave the service with nothing but a deferred pension. As stated in opening, any pension scheme design will shape the workforce and will determine to at least some extent the career decisions that employees make. The MDP are a small but unique segment of the wider civil service pension schemes’ membership. The scheme design needs to take them into account.

Cabinet Office Response to Question 4

We have set out below how we have responded to each of the above:

Members who have purchased added pension in one scheme will be given an option to convert to the scheme they choose at the Deferred Choice Underpin stage. This will be covered in more detail in the retrospective regulations.

Effective Pension Age (EPA) is an option available to members of alpha. By paying higher contributions, members are able to take part of their pension earlier than their Normal Pension Age (NPA) without any early payment reduction. In alpha the NPA is the same as the State Pension Age (SPA), or 65 if the SPA is over 65, and if members choose to take alpha pension benefits before their NPA they would be reduced as they may be paid to them for longer. Members who remained in PCSPS were not able to purchase EPA (as the retirement age is significantly lower), so members will be given the choice in a future exercise of a refund of EPA contributions. This will ensure members are treated fairly. This will be covered in more detail in the retrospective regulations.

The Cabinet Office has addressed the purchase of lump sum within 12 months as part of the response to Question 1 and does not agree that a more detailed analysis of tapered members is necessary. If a member believes they were financially disadvantaged because of lump sum purchase restrictions they can apply via the contingent decisions route referenced in Question 1.

In respect of the call for a 90 day deadline for dealing with sensitive cases, the Cabinet Office has considered and does not agree that not processing a subset of cases within a set timeframe has a negative equality impact.

Members with relevant service in PCSPS will be entitled to receive an alpha pension for the alpha portion of their pensionable service, as there is no two year limit required to receive benefits. Any benefits paid out are reduced if a member takes this before the age at which they are entitled to an unreduced alpha pension. To change this for members with relevant service in the PCSPS and allow them to take an unreduced pension from alpha before this age is likely to be discriminatory on grounds of age.

In respect of the gender pensions gap (i.e. women receiving on average lower pensions than men), this is not within the scope of the remedy to rectify. The planned reforms will treat all members equally in respect of the remedy by ensuring they have a choice of PCSPS or alpha benefits for the remedy period from 1 April 2015 to 31 March 2022 and alpha service thereafter (if still active).

The DPF’s concerns around a specific group of the scheme population do not form part of the remedy within the prospective regulations and have been addressed in Question 1

Proposal: member contributions 2022/23 (question 5)

Member contribution rates are usually set for a four-year period following a pension scheme valuation and an assessment of scheme costs against the employer cost cap through the cost control mechanism. Following the valuation beginning 31 March 2012, which concluded in July 2014, contribution rates were set from 2015/16 to 2018/19.

The next valuation, due as at 31 March 2016, was paused in January 2019 on account of the McCloud judgment. One of the impacts of pausing the cost control element of the 2016 valuations was that member contributions in the Civil Service Pension Scheme for the four years following 2018/19 were not set up front, as member contributions can only be changed through the cost control mechanism.

Following the pause of the cost control element of the 2016 valuations, member contribution rates and salary thresholds for 2018/19 were extended for a one-year period to 31 March 2020. The rates were then further extended to 31 March 2021, but this time with increased salary thresholds. This process was repeated again to cover 2021/22 member contributions. The consultation considered member contribution rates for 2022/23 to ensure there is legislation in place to lawfully collect member contributions from April 2022.

HM Treasury announced that the pause on the cost control element of the 2016 valuations would be lifted in July 2020. On 7 October 2021 HM Treasury published amending directions to allow schemes to complete the 2016 valuations. At the time the consultation was issued, the results of the valuation were not available, so a further rollover of member contributions was proposed.

It was proposed that member contributions rates for 2021/22 are rolled over to 2022/23 (i.e. from 1 April 2022 to 31 March 2023).

Due to the pay pause for Civil Servants earning above £24,250, as well as tax thresholds being frozen, it was proposed to rollover member contribution rates and salary thresholds from 2021/22 for use in 2022/23.

The results of the 2016 valuation, released on 17 December 2021 (whilst the consultation was live), determined that the cost cap of the scheme is 0.4% below the employer cost cap. As the result lies within the 2% corridor specified in HMT regulations, this means that no changes to benefits or member contributions are required as there is no breach to the cost cap. The full report can be viewed here.

Question 5: Given that the results of the cost cap valuation are not yet known and that schemes must set a lawful basis for collecting member contributions at this time so that it is effective from 1 April 2022, do you agree the current proposals meet these policy objectives?

Responses to Question 5

Nearly all respondents (1,253 out of 1,257) objected to the roll forward of contributions. 1,239 of these respondents provided identical responses and an extract of the typical response is provided below:

Member Contributions 2022/23:

- Member contribution rates for 2022/23 should be informed by the results of the 2016 cost control mechanism without the inclusion of the costs of McCloud.

- We believe the inclusion of the costs of McCloud is unlawful and are monitoring legal action on this as an interested party. The Cabinet Office and Treasury should finalise the cost control mechanism without the costs of McCloud and implement the Civil Service Scheme advisory board proposals respectively.

- The Cabinet Office shouldn’t be adopting such a short-term approach to the setting of member contribution rates.

- The Cabinet Office should publish a timetable for finalisation of the 2016 cost control mechanism and the complete 2020 valuation. This includes implementing member contribution rates from April 2023.

Two members also objected to the non-updating of the salary bands, as it meant they (either due to promotion or pay rises) went into the next salary band and so paid a higher contribution rate.

Cabinet Office Response to Question 5

When the consultation was issued in November 2021 the 2016 cost control mechanism calculations had not been finalised. The calculations have now been completed and it has been determined that there is no breach, therefore there is no mechanism for member contribution rates to be either raised or reduced.

The results of the 2016 valuation, released on 17 December 2021 (whilst the consultation was live), determined that the cost cap of the scheme is 0.4% below the employer cost cap. As the result lies within the 2% corridor specified in HMT regulations, this means that no changes to benefits or member contributions are required as there is no breach to the cost cap. There are currently two Judicial Review applications against the inclusion of the Remedy costs within the Cost Control Mechanism. Unless there is an adverse judgement at some point in the future requiring the recalculation of the 2016 Valuation, we are required to base the contributions on the 2016 Valuation which has just been concluded and which includes Remedy costs.

In respect of the salary bandings not changing, these are set with reference to the wider civil service pay environment, rather than any individual pay awards. On 25 November 2020, following the publication of the 2020 Spending Review, the chancellor announced a public sector wide pay pause, other than a £250 rise for workers earning under £24,000. The Cabinet Office has therefore chosen to keep the existing levels in place to reflect the lack of salary growth. Any future pay settlement will be considered for salary bandings in future years for member contributions.

The 2020 valuation, due at a later date, will be the next time when there is the possibility of adjusting employee contribution rates. HM Treasury is expected to provide directions to all public service pension schemes during 2022, which will facilitate the completion of the valuation and cost control mechanism. The results of the valuation will be published as soon as the process has been completed and we anticipate any changes to the employee contribution rates, if required, will be implemented for the 2023/24 financial year. This will help us take a longer term view on the setting of member contributions, which was one of the issues raised.

Proposal: technical amendments (question 6)

Opportunity was also being taken in the consultation to make the following proposed corrections and clarifications:

- amendment to regulation 121 to make clear that payment of the lump sum death benefit is discretionary. This will bring alpha provisions into line with existing practice, the PCSPS and other public service pension schemes, and will achieve the intended effect in relation to inheritance tax. This amendment is not considered to have an adverse effect on members. The provision would be effective from 1 April 2015;

- amendment to regulation 142 to correct a cross reference to the wrong subsection of the Pension Schemes Act 1993;

- amendment to regulation 173 to correct the date by which the scheme manager must provide members with information about payment of the annual allowance charge. This brings the date into line with the requirements of regulation 14A(4) of the Registered Pension Schemes (Provision of Information) Regulations 2006;

- amendment to paragraph 7 of schedule 1 to remove the initial 12-month bar on making lump sum payments towards added pension for members transferring into alpha from the legacy scheme; and

- amendment to paragraph 16, 17, 25 and 26 of Schedule 2 to make clear that in circumstances where transitional protection applied to people who returned to the Civil Service pension arrangements by virtue of employment with an organisation admitted under the Government’s New Fair Deal policy, protection also applied to people who returned by virtue of employment in the civil service.

Question 6: Do you agree that the amendments referenced [above] are correct and are you aware of any adverse impacts on members or the scheme that will result from them?

Responses to Question 6

The three unions who responded to this question were not aware of any issues with the proposed amendments. The three respondents who replied not in agreement were seeking clarity on the reason for the death benefit lump sum being classed as discretionary.

One respondent (Audit Wales) highlighted that in respect of the proposed death benefit lump sum changes:

Regulation 121(4) does not contain the phrase “if it is impractical to pay it” but rather “if it is impracticable to pay it”. “Impracticable” is usually held to mean impossible in practice rather than just difficult. In any event, the amendment appears to increase the extent of scheme manager discretion to not pay lump sum death benefit very considerably, leading to scope for potential discriminatory treatment.

Cabinet Office Response to Question 6

Under pensions tax rules, in order for the death benefit lump sum to be paid free of Inheritance Tax, it must be paid within 2 years of the administrator being made aware of the death for members aged under 75 at date of death and it must be discretionary, i.e. it cannot be automatically paid without consideration from the scheme manager or trustees. Lump sum death benefits paid at the discretion of the pension scheme providers or trustees do not form part of the member’s estate or are chargeable to Inheritance Tax.

The existing rules were judged not to be fully clear on this last point, so this is an opportunity to clarify the rules and bring them into line with all sections of the PCSPS (where the rules provide that a death benefit “may be paid”, not “is payable” as the alpha rules currently do) and other public service pension schemes. There will be no change to existing practice and there is no impact on members or potential beneficiaries.

With regards to drafting the amendment to regulation 121, Cabinet Office’s legal advisors have advised that, instead of altering regulation 121(4) to confirm that the payment is discretionary, it would clearer for a reader of these regulations if the amendments to regulation 121 operated as follows:

1) In regulation 121(1), “is payable” will be changed to “may be payable”; and

2) Regulation 121(4) will be omitted.

These drafting updates have the same effect as the drafting originally presented with the consultation. They are also in keeping with provisions covering the same matter in the PCSPS.

Separately, Cabinet Office has decided not to proceed with the amendment of regulation 142 to update a cross-referencing error due to concerns about the effect of the amendment on the transfer of member benefits. Cabinet Office will consider further and make an amendment if appropriate.

Conclusion and next steps

The consultation respondents have raised a number of helpful points and the Cabinet Office will use the feedback to help shape the next phase of the remedy, with particular focus on the ill health cohort. A consultation on a further Statutory Instrument (SI) covering the implementation of the remedy is expected to be launched later on in 2022.

After careful consideration of the responses received the Cabinet Office will continue with the proposed scheme closure through the Statutory Instrument, the laying of which will follow receipt of Royal Assent for the Public Service Pensions and Judicial Offices (PSPJO) Bill. Current parliamentary planning indicates that Royal Assent of the PSPJO will be received early March, to be followed by the SI. This will enable the important first step to end the discrimination identified by the Court in 2018.

As the 2016 valuation has now been completed and no breach occurred, the member contributions will be set for 1 April 2022 to 31 March 2023 using the same percentages and salary bands as the current year.

Annex A: List of respondent organisations

Responses received from:

- Prospect

- The Association of First Division Civil Servants FDA

- Public and Communication Services Union (PCS)

- Defence Police Federation (DPF)

- Government Communications Group (Branch of PCS)

- Audit Wales

- Individuals – 1295

Annex B: Equality Impact Assessment

Introduction

Purpose of Equality Impact Assessment

This document records the equality analysis undertaken by the Cabinet Office (CO) in respect of the secondary legislation that will implement the prospective elements of the McCloud remedy. This follows the introduction of the Public Service Pensions and Judicial Offices Bill (PSP&JO Bill) produced by His Majesty’s (HM Treasury). This equality impact assessment enables the Minister to fulfil the requirements placed on them by the Public Sector Equality Duty (PSED) as set out in section 149 of the Equality Act 2010.

When formulating policy, the Government is required to comply with the PSED. The duty requires public bodies to have due regard to the need to –

- eliminate discrimination;

- advance equality of opportunity and

- foster good relations between people with different protected characteristics when carrying out their activities.

This document includes the assessment of the equality impacts of all the measures outlined in the legislation, by reference to the protected characteristics identified in the Equality Act 2010 of: sex, age, disability, race, religion or belief, gender reassignment, pregnancy and maternity, sexual orientation and marital or civil partnership status.

Scope of Use

This Equality Impact Assessment (EQIA) has been drafted to accompany the secondary legislation that will implement the prospective changes of the McCloud remedy (the Prospective Remedy).

The number of civil servants impacted by the Prospective Remedy is 419,000 (as at June 2021).

Approach / Data

This EQIA assesses the impact of the secondary legislation implementing Prospective Remedy against each of the protected characteristics as outlined in the PSED. The data used in this analysis has been collected from various sources listed in Annex A.

The secondary legislation proposed follows the PSP&JO Bill introduced by HM Treasury, which, once enacted and on coming into force, will require public service (defined benefit) schemes to implement the Prospective Remedy. The EQIA produced to assess the impact of the Bill can be found here under ‘Impact Assessments’: https://bills.parliament.uk/bills/3032/publications

Background

McCloud Judgment

In April 2015 defined benefit (DB) public service pension schemes were reformed; the cost of the legacy schemes had significantly increased over the previous decades, with most of those costs falling to the taxpayer. To protect against unsustainable increases in costs, new schemes were introduced with career average revalued earnings design and increased Normal Pension Ages, alongside the introduction of a cost control mechanism. They were also progressive, providing greater benefits to some lower paid workers.

As part of the 2015 reforms, those members of the legacy schemes who were within 10 years of their Normal Pension Age (NPA) on 31 March 2012 and had active status both then and on 1 April 2015 remained in the relevant legacy pension schemes, known as ‘full protection members’. In addition those legacy scheme members within ten years and thirteen years and six months of their normal pension age could elect to remain in their existing scheme for a particular period of time after that scheme closed as a result of the reforms (known as ‘tapered protection members’). This transitional protection was provided following negotiations with member representatives and was intended to protect and give certainty to people who were close to retirement. In December 2018 the Court of Appeal found that this part of the reforms unlawfully discriminated against younger members of the judicial and firefighters’ pension schemes in particular, as transitional protection was only offered to older scheme members. The courts required that this unlawful discrimination be remedied by the Government.

In July 2019 the Government confirmed it accepted that the Court’s judgment had implications for the other public service schemes that had similar transitional arrangements.

Between 16 July and 11 October 2020, HM Treasury consulted on two options (an immediate choice exercise or a Deferred Choice Underpin (DCU)) to remedy discrimination that arose when reformed unfunded public service pension schemes were introduced.

Following the HM Treasury consultation on the approach to implementing a remedy for this discrimination, the government is proceeding with the DCU for all unfunded schemes, other than the judicial schemes. The DCU enables eligible members to make a choice as to whether to take legacy or reformed scheme benefits for the remedy period (31 March 2015 – 31 March 2022, for most civil servants) when their pension benefits become payable or, if a pension is already in payment, as soon as practicable once the necessary legal provisions are in force. This was supported by the majority of respondents to HM Treasury’s consultation.

The reformed scheme (alpha) is not discriminatory, and the Government wants to ensure that all members are treated equally in respect of the scheme design available to them after the discrimination has been addressed.

Therefore, all civil servants who continue in service from 1 April 2022 onwards will do so as members of Alpha. The legacy schemes (with sections classic, classic plus, premium and nuvos) will be closed in relation to service after 31 March 2022, ending the remedy period, during which members in scope have a choice of benefits.

Move to Reformed Scheme (Alpha) and Closure of the Legacy Schemes

The secondary legislation being assessed in this EQIA allows provision for the move of all active and partially retired members in active service, to the reformed scheme (alpha) from 1 April 2022. This ensures that from 1 April 2022 all active and partially retired active members of the Civil Service Pension Scheme will be accruing benefits in the same scheme. The legislation also allows for the closure of the legacy schemes to future service accrual from 1 April 2022.

Table 1: Civil Service Pension Scheme Protection Status at 31st March 2016

| Section | Number of Members | Number of Members by % |

|---|---|---|

| Protected Members | 105,875 | 22.82% |

| Tapered Protected Members | 54,807 | 11.81% |

| Eligible Unprotected Members | 222,424 | 47.93% |

| Ineligible and joined between 2012 - 2015 | 52,139 | 11.23% |

| Ineligible and joined after April 2015 | 28,756 | 6.21% |

| Total | 464,002 | 100% |

Source: Government Actuary’s Department - 2016 Valuation Dataset

In comparison, the total active membership by protection type for the Public service pension schemes data is:

Protected Members: 17%

Tapered Members: 8%

Unprotected Members: 75%

Source: Public service pension scheme data

Impact Assessment

Of the 419,000 members within scope of the Prospective Remedy, as at 30 June 2021 there were 39,000 deferred members of the legacy scheme. This number will reduce further by 1 April 2022 as members leave, retire or transition into alpha.

There are also some members who have taken partial retirement and continue to accrue pension in a legacy scheme.

It is expected that by 1 April 2022 there will be between 30,000 and 40,000 members who will cease to accrue pension in a legacy scheme and instead move to alpha for future service accrual.

General Impact Assessment

These equality impacts have been explored and grouped by each protected characteristic as identified in the Equality Act 2010, in line with the government’s duty to have regard to the need to eliminate discrimination, advance equality of opportunity, and foster good relations. The protected characteristics explored are as follows:

- Age

- Disability

- Sex, pregnancy and maternity

- Race

- Other protected Characteristics (sexual orientation, gender reassignment, religion or belief and marital or civil partnership status)

Conduct prohibited by the Equality Act 2010 includes direct and indirect discrimination:

Direct Discrimination refers to less favourable treatment because of a protected characteristic, e.g. A treats B less favourably than A treats or would treat others due to B’s age. Direct discrimination also includes discrimination by association, meaning A treats B less favourably due to the protected characteristics of a spouse, friend, partner, parent or another person with whom they are associated. As well as discrimination by perception (because of a perceived protected characteristic which an individual may not, in fact, possess). Direct discrimination cannot be justified except where the relevant protected characteristic is age.

Indirect Discrimination is set out under Section 19 of the Equality Act 2010 and is a provision, criterion or practice which covers acts, decisions or policies which are not intended to treat anyone less favourably, but which in practice have the effect of disadvantaging a group of people with a particular protected characteristic. Where such a policy disadvantages an individual with that characteristic, it will amount to indirect discrimination unless it can be objectively justified.

Age: Impact Assessment

This section of the EQIA sets out the impact of the secondary legislation that will implement the Prospective Remedy against the protected characteristic, age, as identified in the Equality Act 2010, in line with the Government’s duty to have regard to the need to eliminate discrimination, advance equality of opportunity, and foster good relations.

The proposed secondary legislation will see that all active or partially retired members in active service are moved into the reformed scheme, Alpha, from 1 April 2022 and will secure the closure of the legacy schemes to future accrual from 1 April 2022. From 1 April 2022 when the legislation comes into force, it will mean that all active and deferred members are part of a single scheme.

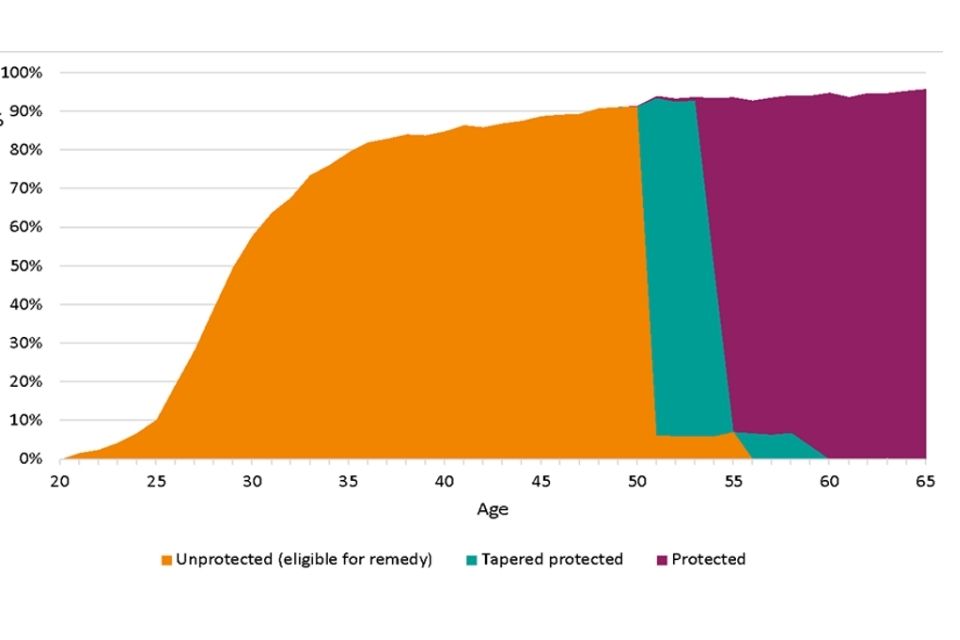

There will be no difference in treatment between those who are in the ‘remedy cohort’ (i.e. those members impacted by the original 2015 pension reforms), those who are not in scope of the retrospective elements of the McCloud remedy (the Retrospective Remedy) and those who are already in Alpha, the reformed scheme. And this will mean that those members who were entitled to transitional protection (typically older members) will not be accruing pension benefits in a different scheme to those members who were unprotected (and typically younger) from 1 April 2022. The breakdown in member age and members who were eligible for protection is demonstrated in Chart 1 and Table 3 below. Therefore, all members will be treated equally in this sense, regardless of age.

As well as ensuring there are no discrepancies between members in scope of the Retrospective Remedy, by moving all active and deferred members to Alpha from 1 April 2022, it means there is no difference in treatment for those members who have joined the scheme since 1 April 2015 and were automatically enrolled to Alpha. Typically, members who have joined since 1 April 2015 are likely to be younger than those members in scope of the Retrospective Remedy.

The fact that those with tapered protection will be over a certain age reflects the discriminatory nature of the tapered protection, and the government does not consider that the removal of that unjustified discrimination itself to be a discriminatory act.

The analysis carried out indicates that there will be no significant negative impact on the protected characteristic of age as a result of the prospective legislation. We will reconsider and review this when the retrospective legislation is consulted on.

Chart 1: Proportion of Civil Service members eligible for the transitional protection remedy by age

Source: Government Actuary’s Department - 2016 Valuation Dataset

40% of members in the Civil Service Pension Scheme in 2016 were aged between 35 to 49, over 40% were over the age of 50 and around 20% fell below the age of 34.

Table 2: Total membership by age (public service scheme data compared to population)

| Age | Working Population | Public Service Pensions Population |

|---|---|---|

| 16-17 | 1% | 0% |

| 18-24 | 11% | 5% |

| 25-34 | 23% | 24% |

| 35-49 | 33% | 41% |

| 50-64 | 28% | 30% |

| 65 plus | 4% | 1% |

Source: Labour Force Survey (LFS) Q1 2020 and Public service pension scheme data

Table 3: Total member by age (scheme data broken down into protected types)

| Public Service Pension Scheme | Civil Service Pension Scheme | ||||||

|---|---|---|---|---|---|---|---|

| Age | Protected | Tapered | Unprotected | Protected | Tapered | Unprotected | % |

| 16-17 | - | - | 100% | - | - | 100% | 0% |

| 18-24 | - | - | 100% | - | - | 100% | 3% |

| 25-34 | - | - | 100% | - | - | 100% | 16% |

| 35-49 | 2% | 3% | 95% | - | - | 100% | 40% |

| 50-64 | 51% | 23% | 25% | 53% | 30% | 17% | 40% |

| 65 plus | 84 | 0% | 16% | 96% | 0% | 4% | 2% |

Source: Public Service pension scheme data 2016

Source: Civil Service (GB) pension scheme data 2016

Sex, Pregnancy and Maternity: Impact Assessment

This section of the EQIA sets out the impact of the legislation implementing the Prospective Remedy on the protected characteristics of sex and/or pregnancy and maternity, as identified in the Equality Act 2010, in line with the Government’s duty to have regard to the need to eliminate discrimination, advance equality of opportunity, and foster good relations. These characteristics are considered together in this section, due to the similar concerns that may arise under these circumstances.

The legislation being analysed in this EQIA, sees that all active and deferred members, will collect any future accrual in the reformed alpha pension scheme from 1 April 2022 and ensures that the legacy schemes are closed to future accrual from 31 March 2022. alpha is based on a career average revalued earnings (CARE) scheme structure, as opposed to the legacy schemes, which predominantly follow a final salary structure. A CARE scheme structure is likely to benefit those with lower salary growth more than higher earners. A larger proportion of males currently reach higher salary bands than females across the public service pension schemes, and therefore among those who may be better off under legacy scheme (and final salary) arrangements, a higher proportion will be male. A higher proportion of women (and those of other protected characteristics) are likely to be better off under CARE schemes, which are broadly more beneficial for lower and some middle earners[footnote 1].

Individuals who were in service on or before 31 March 2012 but subsequently left and re-joined are also in scope of the Retrospective Remedy and Prospective Remedy, provided their break in service is less than five years and meets the criteria for continuous service set out in scheme regulations. The government recognises that women are more likely to take a career break and work part time than men.[footnote 2]The continuity of service provision allows those who have taken career breaks, for example to care for young children or elderly relatives, to maintain parity with their colleagues in respect of their pension rights.

The analysis carried out indicates that there will be no significant negative impact on the protected characteristics of sex, pregnancy and/or maternity as a result of the prospective legislation.

Table 4: Sex proportion for each public service pension scheme

| Sex | Civil Service | Armed Forces | Firefighters | Police | Teachers | NHS |

|---|---|---|---|---|---|---|

| Male | 47% | 90% | 95% | 70% | 29% | 22% |

| Female | 53% | 10% | 5% | 30% | 71% | 78% |

Source: Public Service pension scheme data 2016

The Civil Service Statistics published on 31/03/20 recorded 53.8% of Civil Servants are women.

Race: Impact Assessment

This section assesses the equality impacts of the secondary legislation on the protected characteristic of race as identified in the Equality Act 2010, in line with the Government’s duty to have regard to the need to eliminate discrimination, advance equality of opportunity, and foster good relations.

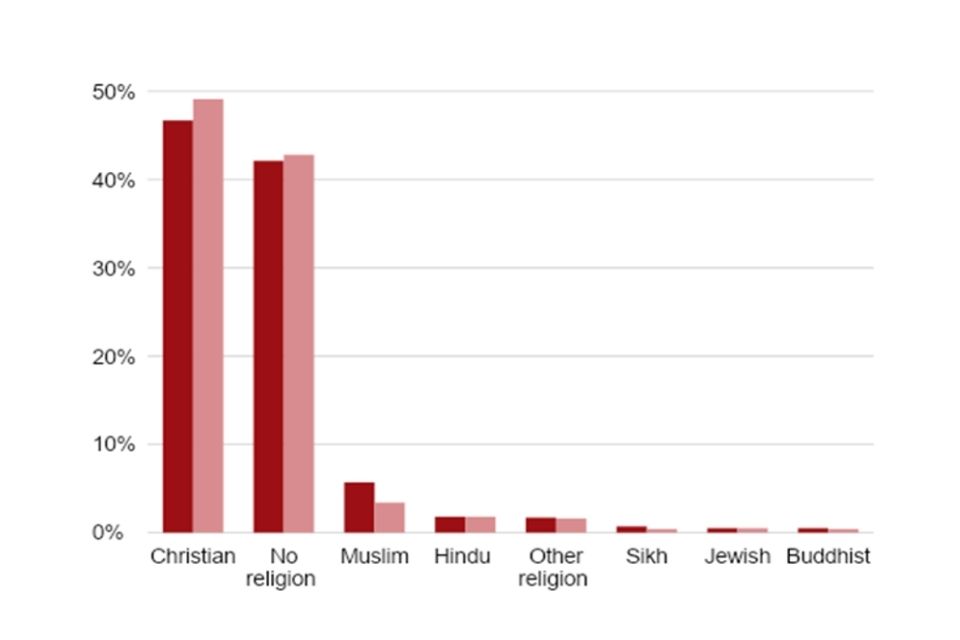

The Court of Appeal’s findings in 2018 outlined that transitional protection provisions gave rise to indirect discrimination on the grounds of race. The potential differential impacts by race are evidenced in Table 4 below, demonstrating that younger members who were not entitled to transitional protection, had a higher proportion of members from an ethnic minority, than those members who were likely to be older and entitled to protection.

In the Civil Service the proportion of employees from an ethnic minority group has increased between 2012[footnote 3]and 2020[footnote 4] by 3.9 percentage points (9.3% to 13.2%) . This is slightly higher than the public sector average, and indicates that new starters in the Civil Service are more likely to be from an ethnic minority group.

As set out above, overall, a CARE scheme structure may offer relatively fairer outcomes to ethnic minority groups who, like women, in some public sector workforces tend to experience lower salary progression.

The analysis carried out indicates that there will be no significant negative impact on the protected characteristic of race as a result of the proposed legislation.

Table 5: Total and public sector population by ethnicity

| Ethnicity | Working population | Public sector population |

|---|---|---|

| White (excluding white minorities) | 88% | 88% |

| Mixed | 1% | 1% |

| Indian | 3% | 2% |

| Pakistani | 1% | 1% |

| Bangladeshi | 1% | 1% |

| Chinese | 1% | 0% |

| Black/African/Caribbean | 3% | 4% |

| Other ethnic groups | 2% | 3% |

Source: LFS Q1 2020

Disability: Impact Assessment

This section sets out the equality impacts of the secondary legislation on the protected characteristic of disability as identified in the Equality Act 2010, in line with the Government’s duty to have regard to the need to eliminate discrimination, advance equality of opportunity, and foster good relations.

The proportion of individuals reporting a disability in the Civil Service is increasing over time. Since 2010 there has been a year-on-year increase in the percentage of civil servants who declare themselves as disabled. This figure now stands at 12.8%, 5.2 percentage points higher than in 2010. The proportion of civil servants with a declared disability has increased across all grades since 2010. The percentage of civil servants declaring themselves as disabled remains below that of the economically active working age population (14.2%)[footnote 5].