Business Rates: transparency and disclosure of information on business rates valuations

Updated 30 October 2024

Summary

Subject of this consultation

This consultation seeks further views on the proposals set out in the earlier ‘Business Rates Review: Final Report’, for the Valuation Office Agency (VOA) to provide greater transparency by disclosing more information about business rates valuations. This consultation sets out further detail on what data might be included, with chapters 2 and 3 providing more details about specific proposals.

Scope of this consultation

In the Business Rates Review Final Report and subsequent Technical Consultation, the government committed to greater transparency. Stakeholders asked for more information to understand their rating valuation so they can make more informed decisions about whether to challenge their business rates valuation or not.

Increased transparency was proposed in two stages in the Business Rates Review Final Report. The first stage has been delivered, following user research. It focused on improving on-line guidance and making more information visible and easier to understand. This consultation focuses on the second stage see 1.24, simply referred to as ‘transparency’ or ‘greater transparency’ throughout the remainder of the document. This involves the proposal that ratepayers have access to an analysis of the evidence used to set their rateable value, which was set out in the earlier Technical Consultation.

During earlier consultations and engagement covering greater transparency proposals, some stakeholders had concerns about the confidentiality of their data. The government recognises the need to protect information that might not be suitable for disclosure. The VOA also has existing legal obligations to protect taxpayer information.

Final decisions on the government’s approach to greater transparency will be made in due course. Decisions will have to balance the request for greater transparency from some stakeholders alongside the concerns expressed by others and against what is technically and operationally feasible to deliver.

This consultation looks to more fully:

- explain the proposal

- explain how this might work in practice

- understand any concerns

- gather stakeholder views.

Alongside this consultation, additional user research and stakeholder meetings will also be held. Taken together, this will assist ministers in their decisions on how to proceed and ensure these are made with the benefit of broad external input.

Who should read this

The government would like views from:

- ratepayers (including occupiers or tenants of non-domestic properties who do not pay rates due to reliefs)

- landlords

- agent representatives

- business representative bodies

- local authorities

- any other stakeholders who have an interest in the business rates system.

This consultation builds on the earlier work by the UK government during its review of the business rates system and is specific to England. Business rates are devolved in Wales. The Welsh Government recently consulted on Reforming non-domestic rates in Wales.

Non-domestic rating is the statutory terminology, but throughout this document we will refer to business rates, except where necessary.

Duration

The consultation will run from 15 March 2023 to 7 June 2023

Lead official

T Crick, Valuation Office Agency

How to respond or enquire about this consultation

You may respond by completing an online survey.

Respondents do not have to respond to all the questions. The government also welcomes partial responses, focused on individual perspectives most relevant to the respondent.

Alternatively, you can email your response or write to:

NDR Reforms Disclosure Consultation

Valuation Office Agency

8th floor

10 South Colonnade

Canary Wharf

London

E14 4PU

If you are responding by email or in writing, please make it clear which questions you are responding to. Please also confirm if you are responding as an individual or submitting an official response on behalf of an organisation and include:

- your name

- the name of organisation (if applicable)

- your position (if applicable)

- an email address and/or a contact telephone number

- if you are responding as a rating agent or representative body, whether the views of your clients/members were sought prior to your response.

Additional ways to be involved

We will hold a series of online sessions to ensure that as many views as possible are heard. We will be talking proactively to different stakeholder groups affected by this proposal, working with stakeholders and representative bodies to invite their members to contribute views through their own meetings or other channels. This will be alongside and in addition to user research on the wider reforms.

We anticipate we will engage a wide audience and reach people who could be affected by this proposal. We welcome requests from those who would like to take part in the engagement activity or user research, though we cannot undertake to accommodate every request. Requests should be sent by email to [email protected].

After the consultation

We will record and analyse all the responses and feedback. Comments, concerns and expressions of support will be considered. Along with current government digital and data security standards, all the feedback will inform the subsequent work and ministerial decisions. A report summarising the responses, feedback and conclusions will be published in due course.

Getting to this stage

The government consulted on reviewing business rates during 2020 and 2021:

- the Fundamental Review of Business Rates terms of reference set out the objectives and scope of the review.

- a call for evidence sought views on how the rating system works and ideas for changes to the taxation of non-domestic property.

- a summary of responses was published in Business rates review: interim report

- a Consultation: more frequent revaluations sought views on a package of reforms to support delivering three-yearly revaluations.

- the Business rates review: final report outlined the outcome of the review, including measures to be adopted to support more frequent revaluations.

- a Business Rates Review: technical consultation sought views on how the government intended to give effect to a number of measures in November 2021.

A summary of the responses to the technical consultation and details about any new legislation required will be published alongside this consultation.

Previous engagement

The above section sets out the public consultations to date. During the call for evidence stakeholders asked for information to better understand their rateable value. Alongside the opportunities during the consultations, there has been extensive stakeholder engagement. In addition, user research took place with a small sample of stakeholders on this specific proposal (see paras 2.8.to 2.11).

Key points

Policy proposal

Stakeholders asked for more information (earlier and outside the Challenge process) to make more informed decisions about whether to Challenge.

The government has undertaken to ensure ratepayers can request access to an analysis of evidence used to set an RV for a specific property, an explanation of how evidence has been used and further guidance.

Rationale for consultation

To date, the government has not set out detail on how disclosure might work in practice.

It is unclear if all ratepayers fully understand what greater transparency means in terms of sharing their data with others, when their data forms part of the evidence to support a valuation, or that there is a risk of onward disclosure.

Feedback to date has highlighted stakeholders might want different levels of information: rating agents might want more detailed information, whereas ratepayers don’t want to be overwhelmed with complex information. Some ratepayers have said seeing the RVs on other similar/neighbouring properties would be sufficient.

Earlier consultation also highlighted some concerns regarding certain data being shared.

This formal consultation gives visibility to the issues and seeks further views, to ensure any final decisions are informed by engagement with stakeholders.

Executive summary

During the Review of Business Rates, some stakeholders asked for more information to better understand their rateable value and how it had been determined. It is anticipated that greater transparency will help build trust and a perception of fairness, by helping ratepayers[footnote 1] to better understand their rating assessment. It should also enable ratepayers to make swifter and more informed decisions about whether to challenge their rating assessment or not.

Currently in England, specific information about the underlying evidence used to determine a rateable value can only be provided at the formal Challenge stage (of Check Challenge Appeal). Paragraphs 1.26 to 1.28 provide further details about that system.

Some stakeholders expressed concerns about the confidentiality of their data under the transparency proposal. Balancing these concerns with the ask for greater transparency is important. We will also need to ensure the collection of information vital for carrying out revaluations (see paragraphs 1.22 and 1.23 on the new duty) is not adversely impacted by concerns over disclosure of that information. In addition, any final decisions will need to ensure that a system is digitally and operationally feasible and designed around the appropriate treatment of data. This will be particularly important when data is potentially personal or commercially sensitive.

As a result, the government is asking for views on specific questions to ensure decisions over what information is disclosed, and what is not, is informed by extensive engagement with a wide range of stakeholders.

This consultation document provides further detail to help stakeholders understand and comment on the proposal and highlight any risks and concerns more fully.

Below are some key points for stakeholders to note and understand about the proposal.

We would like stakeholders to understand:

- How rateable values are assessed – including the approach to valuing properties based on income and costs and why, in determining valuations, actual rents are adjusted due to the variety of lease arrangements that exist. Some of these arrangements could be considered sensitive.

- Current GOV.UK information and guidance – information already exists to help ratepayers understand their rateable value, including how to compare rateable values on similar properties.

- How greater transparency might work in practice – and differ for different types of properties and valuation approaches.

- Data sharing – why transparency means disclosing details of the rent and lease arrangements between a landlord and tenant and details could be provided to other ratepayers as part of the evidence for a locality.

We are seeking stakeholders’ views on:

- What further information might help ratepayers to understand if their rateable value is fairly assessed, in addition to information already publicly available. Some examples are provided which we welcome views on.

- Data Sharing – what might be considered sensitive or commercially sensitive and the risk of onward data sharing.

Chapter 1: Background

Key points

This section explains the basics about business rates and how rateable values are assessed in more detail, to help understand the nature of the property information VOA collects and the way in which this information is used.

Business rates

1.1 Business rates are a tax on the occupation of non-domestic property unless the property is specifically exempt from rating.

1.2 A property’s rateable value is not the same as its business rates bill. The bill is worked out by multiplying the rateable value by a ‘multiplier’ (a rate in the pound) and then applying any reliefs. The multiplier is set by central government.

1.3 Around one third of properties, more than 700,000, pay no rates due to small business rates relief. Even where a business/ratepayer is eligible for relief the property still has a rateable value. Eligibility to a number of reliefs is based on the rateable value and set thresholds.

1.4 The Valuation Office Agency (VOA) is an executive agency of HM Revenue and Customs (HMRC). It is responsible for valuing over 2.1 million rating assessments and is one of the largest employers of valuation professionals and Chartered Surveyors.

Rateable value

1.5 Legislation [footnote 2] sets out the definition of rateable value. Rateable value is an estimation of the annual open market rental value that a property might achieve at a set valuation date. They are also based on a set of assumptions, including that the tenant is responsible for all outgoings, such as business rates, taxes, repairs and insurance.

1.6 The set valuation date is known as the Antecedent Valuation Date (AVD). It ensures a consistent basis for valuations, as all rateable values are based on market rental values at a given point in time.

1.7 Periodic national revaluations take place to update rating lists, so the lists reflect changes in property markets over time. The AVD is currently set two years prior to the date of a revaluation. For example, for the 1 April 2023 revaluation, rateable values are based on estimated rental levels on 1 April 2021.

Valuation methods

1.8 There are three main valuation methods.

- rental comparison method is used for the majority of properties (around 90%); rateable value is determined by comparing rental evidence on similar, comparable properties to arrive at a unit rate (usually a rent value per m2 ) for the property being valued. This approach is used, for example, for most shops, offices and workshops.

For properties which are not normally let, or where there is no reliable rental evidence, there are two alternative, industry recognised methods of valuation:

-

receipts and expenditure method, used when the property is occupied in pursuit of profit – this involves an analysis of income and costs to ascertain what a tenant might pay in rent (examples include hotels and cinemas).

-

contractor’s basis, used where the property is not occupied with a view to generating profit – the value of land and cost of replacing the building is used to determine a notional annual rent (examples include schools, libraries and hospitals).

1.9 A rateable value may not be the same as the actual rent a tenant pays. The business rates system is not intended to reflect the specific amount of actual rent paid on a property. To maintain fairness and consistency, rateable values are based on a standard set of assumptions, as mentioned above. This is often referred to as the hypothetical tenancy.

1.10 Actual rental evidence often shows a range of values. The VOA has to arrive at what is a reasonable expectation of the rent within that range, ensuring there is consistency across similar types of properties in a locality.

Valuation stages

1.11 When assessing rateable value, the VOA goes through three broad steps which are set out below. These mainly describe the rental comparison method, as this is applied to the vast majority of properties.

Step 1 evidence gathering

1.12 This involves collecting relevant rental evidence and other valuation information, including information about the property, local and national markets and trends. Currently, ratepayers are asked to complete Forms of Return or Rent and Lease Details requests for the VOA, as part of this evidence gathering. In the future there will be an obligation on ratepayers to provide this information proactively, if there are changes in occupation, to the lease/rent or to the property.

Step 2 adjustment and analysis

1.13 Rating valuations follow the property market, by analysing the market evidence and rents being paid. Rents are adjusted to bring them into line with the statutory definition of rateable value (see 1.5 above). This is because not all leases are agreed at, or close to, the set valuation date or the terms of a lease can differ from those that must be assumed in assessing rateable value, so actual agreements don’t always precisely match the assumptions that need to be made (see 1.5 above). The exact criteria of lease arrangements can vary in their complexity and terms. Below are some factors that can require adjustments to be made to the evidence:

- rent free periods

- premiums or reverse premiums

- repairing obligations

- stepped rents - different levels of rent (up or down) fixed at the start of the lease and can apply over a short period or the whole term

- responsibility for services/service charges, along with the amounts

- costs of improvements, including fit out

- other financial inducements to take the tenancy

- gearing to turnover arrangements (for example, turnover rents)

- Company Voluntary Arrangements (an insolvency arrangement)

- connections between landlord and tenant

- gearing to inflation indices

1.14 Given the wide range of arrangements that can exist, valuations often require subjective judgements to be made on a case-by-case basis by VOA’s experienced and qualified staff, with their knowledge of the property market. This is similar to how a rental valuation is carried out by surveyors advising landlords or tenants.

1.15 Once adjusted, rents are analysed against an appropriate unit of comparison – this will generally be by size (m2). Different parts of the property can have different values - each area is adjusted dependent on its relative value to the main space, and this results in a value per m2 that can be used for comparison purposes.

1.16 Consideration is given to the ‘weight’ placed on individual pieces of evidence. Broadly the following considerations are made when weighting evidence:

- if the rent is for the subject property

- closeness to the fixed valuation date

- proximity of the rented property to the property being valued (locality)

- the degree of adjustments made - the more adjustment made the less weight

- the type of agreement – a new let generally carries more weight than a lease renewal

- whether the landlord and tenant are connected and to what extent.

Step 3 valuation

1.17 This involves applying the analysis to individual properties to determine rateable values. To do this, similar properties in the same locality are grouped together and the analysed evidence is used to set the levels of value that create a valuation scheme. The scheme is then used to value those properties with a consistent and coordinated approach.

Revaluations

1.18 All properties are revalued at a new valuation date on a regular basis. This means that rateable values reflect relative changes in the rental property markets over time (either up or down).

1.19 Before new rating lists come into effect, the VOA publishes ‘draft’ lists and invites ratepayers to tell them if there are any factual errors. This also allows ratepayers to plan ahead and estimate their rates bill for the coming year.

1.20 Draft lists have previously been published three to six months in advance of lists coming into effect. The next revaluation takes effect from 1 April 2023, and draft lists were published on 17 November 2022. As the government has undertaken going forward to have revaluations every three years (see below), the subsequent revaluation is expected to take place in 2026.

Wider reforms

1.21 The government consulted in summer 2021 on increasing the frequency of revaluations in England. It set out a range of reforms considered necessary to support sustainable three-yearly revaluations and provide benefits to ratepayers. These benefits include:

-

more accurate valuations

-

greater transparency on valuations

-

a streamlined appeals process.

1.22 The reforms will introduce a new duty for ratepayers to notify the VOA when there are changes in occupation, changes to a lease/rent or changes to a property, and to provide trade information used for valuation and confirm details annually. These changes will ensure valuations will be based on more comprehensive and up-to-date evidence and bring business rates more in line with other taxes.

1.23 The new duty, which will increase the quantity and quality of evidence used to derive valuations, is a necessary step for more frequent revaluations. It will improve valuation accuracy, and this is expected to benefit ratepayers by reducing the need to challenge their valuations. The duty, which will be introduced first, was seen as an essential counterpart to transparency to ensure any information VOA provides to ratepayers through transparency is more timely and complete. The duty was also seen as a fair exchange for, and as a pre-requisite to, increased transparency that would follow.

1.24 Increased transparency was proposed for delivery in two stages, as set out in the earlier scope section, and this consultation focuses on the second phase.

-

Phase 1 - was delivered, ahead of 1 April 2023 when new rating lists will come into force. Ratepayers are now able to access improved guidance covering rating principles and class-specific valuation approaches for the most common property types. See Appendix 1 for further information and links to information that is already available. These changes were based on user research with ratepayers.

-

Phase 2 - under the proposal set out in the earlier technical consultation, it is envisaged ratepayers will be able to access an analysis of the evidence used to set their rateable value, with an explanation of how the evidence has been used and any further guidance appropriate.

1.25 Introducing transparency before the new duty (mentioned above) is fully embedded means that transparency could look different initially, compared to how it might be in future years once ratepayers are actively providing more information to the VOA.

Check, Challenge, Appeal

1.26 A ratepayer can formally Challenge their rateable value if they don’t agree with it.

1.27 Before making a Challenge, ratepayers are currently required to ‘Check’ and agree the physical facts about their property. The reforms, set out in the Business Rates Review Final Report, include removing Check, to streamline the appeal system. As a result of the new information duty, ratepayers will be updating their details and confirming they are correct as and when things change. This effectively replaces the Check process.

1.28 Current legislation [footnote 3] only allows the VOA to disclose information about the evidence relied on to supports the rateable value in response to a formal Challenge. Under the greater transparency proposals, the information provided during a formal Challenge is not expected to change. The VOA will still be required to respond to formal Challenges.

Chapter 2: Greater transparency proposals

Key points

This section sets out the transparency proposal, early stakeholder views and what information is already publicly available to help ratepayers understand their own rateable value and how other similar properties are assessed. It also sets out some possible examples, bringing together a summary of similar properties assessed at the same base value per m2, so these can be viewed alongside the subject property.

Policy intent

2.1 The greater transparency proposal involves making available an analysis of the evidence used to set a rateable value for a specific property. This would be available on request, separately from and prior to the Challenge process.

2.2 Under this proposal, ratepayers would be able to access a summary of evidence underpinning their valuation. A ratepayer would only be able to access this information if they had complied with the duty described above, notifying the VOA of changes in occupation, changes to the lease/rent or property and providing an annual confirmation.

2.3 We anticipate responding to ratepayer requests will need to be wholly automated to be viable, from both a user’s perspective and in terms of ensuring a feasible system the VOA can operate for over 2 million rating assessments in England. However, there may be some classes of property or particularly complex evidence that would need to be manually collated, with longer turnaround times for those ratepayers.

2.4 As indicated during the wider review consultations, it is expected ratepayers might access:

- an analysis of rental evidence used to set the rateable value for a specific property

- an explanation of how evidence is used to arrive at the rateable value

- further guidance.

The analysis of evidence might include:

- rent date

- adjusted rent

- analysed rent per m2

Greater transparency for different types of property

2.5 There are a wide variety of different types of properties within the 2.1million rating assessments valued by the VOA. The way greater transparency is provided to ratepayers will, therefore, need to consider many different circumstances.

2.6 What might be provided to ratepayers could look different for different types of properties. Some valuation evidence could contain more sensitive information than others. For properties valued by comparison to rental evidence, the VOA will need to make an assessment of what information should be released, taking into account stakeholder views from this consultation and any legal constraints. For properties valued by receipts and expenditure and contractor’s basis, there is usually no rental evidence. The valuation approach here follows industry standards, considering turnover and the estimated rental value for the property or the value of the land and the replacement cost of the building (see 1.8 above).

2.7 Some examples of how greater transparency might work in practice, and the evidence summary that might be accessed, are set out below in figure 2 (and in chapter 3, figures 3 and 4).

Early stakeholder views

2.8 Initial research with a sample of stakeholders highlighted differing views about the level of detail that might be helpful for ratepayers to understand, and have confidence in, their rateable value.

2.9 The ratepayers interviewed had a clear preference for non-technical explanations and data. They did not want to be overwhelmed by information. Some indicated that seeing the rateable values on neighbouring or similar properties would be sufficient and give them confidence their rateable value is fair.

2.10 Rating agents interviewed expressed a preference for more detailed rental evidence, along with details of any analysis or calculations made, to be able to make better decisions on rateable values and whether to advise clients to Challenge.

2.11 This research was undertaken about the reforms more widely and did not go into more detail about exactly what information might be disclosed to provide confidence in a rateable value and it did not cover any concerns about data sharing (set out in chapter 4).

Information already available to help understand your rateable value

2.12 For those less familiar with business rates valuations, a lot of information already exists about business rates valuations on VOA’s GOV.UK website. Appendix 1 provides more details and links to some of the existing website content. A glossary of some key terms can also be found at the end of this document.

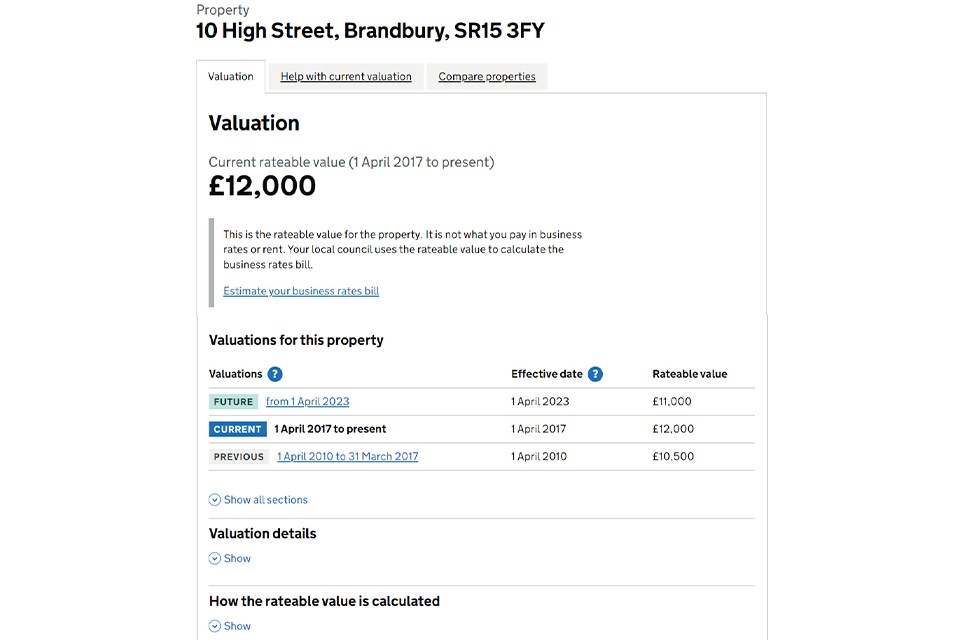

2.13 The information already available includes the published Rating lists, so anyone can find the rateable value for a particular property that is assessed. For most properties (valued based on size and by rental comparison) the information listed below is also available at Find your business rates valuation see figure 1 below:

- how the rateable value is calculated – shows how the property has been measured, the size of the property broken down by the different floor areas, the value applied per m2 to the different areas and the total rateable value.

- the valuation scheme – within the valuation details section, shows the approach to similar, comparable properties that are grouped together and valued in the same scheme. Each scheme has a range of values for the different floor areas of a property (such as the shop or office area) and additional items (such as parking spaces, land or storage areas). Properties in the scheme are given a price from within that range (the ‘base rate’).

- compare properties – provides access to details of other similar properties in the same valuation scheme, with their address, size and rateable value, so that comparisons can be made about rateable values.

Figure 1 – Information available at Find your business rates

Examples in figure 1 are also available in table and word format in Appendix 3

This information is already available for ratepayers on GOV.UK using VOA’s find your business rates tool, after searching for an address through ‘find a property’. You can see how the rateable value is calculated, view the valuation scheme in the valuation details section and compare properties (by clicking the third tab under the address).

2.14 The first phase of transparency addressed feedback on the disjointed and, at times, complex nature of the information available. Changes improved the on-line guidance by making information more accessible and user-friendly. These changes were implemented ahead of the government’s proposed April 2023 introduction date. Further improvements and guidance are being considered, to support any future changes of providing more information about rating assessments. Future changes will also follow research with and input from ratepayers and stakeholders.

2.15 The government wants to explore if the type of information currently available and changes made to increase the accessibility of this information to date provide sufficient information for a ratepayer to feel they understand their rateable value and be confident that it is fair.

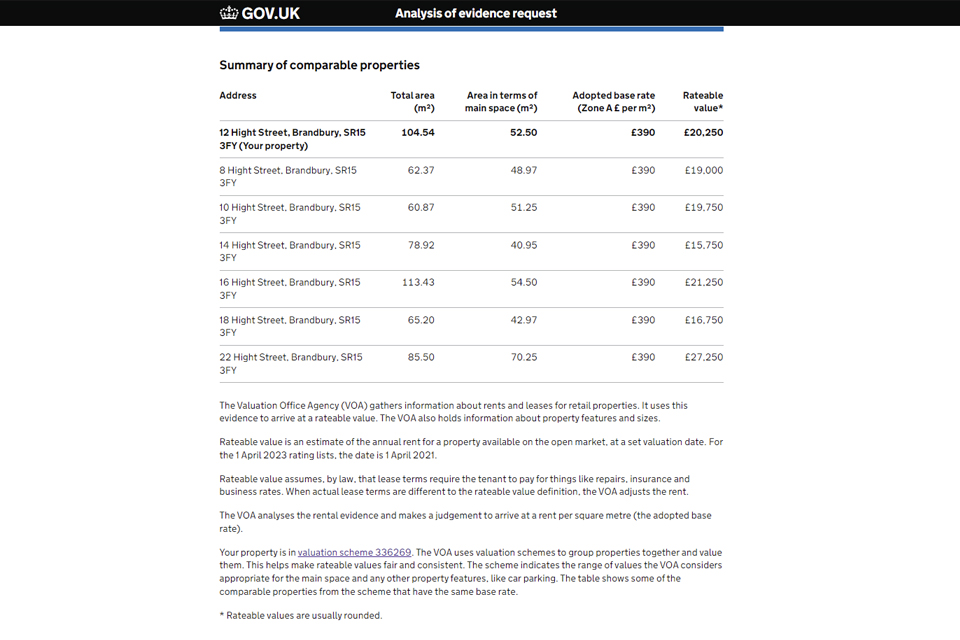

2.16 Figure 2 shows possible examples of greater transparency by providing more information in a more easily accessible format. We welcome views on this and explore this with the questions in this section.

2.17 If ratepayers believe the information disclosed needs to go further than this, then government would like to explore the level of concern over confidentiality and data sharing that this might create. This is explored later in chapter 4.

Figure 2

These examples show a summary of similar properties alongside the subject property.

Entries in the table are nearby comparable properties valued at the same rate, based on underlying rental evidence.

Example A - shop premises

Examples in figure 2 are also available in table and word format in Appendix 3

Examples in figure 3 are also available in table and word format in Appendix 3

For more information about zoning retail premises, see the glossary at the end of this document and this explanation and video on GOV.UK.

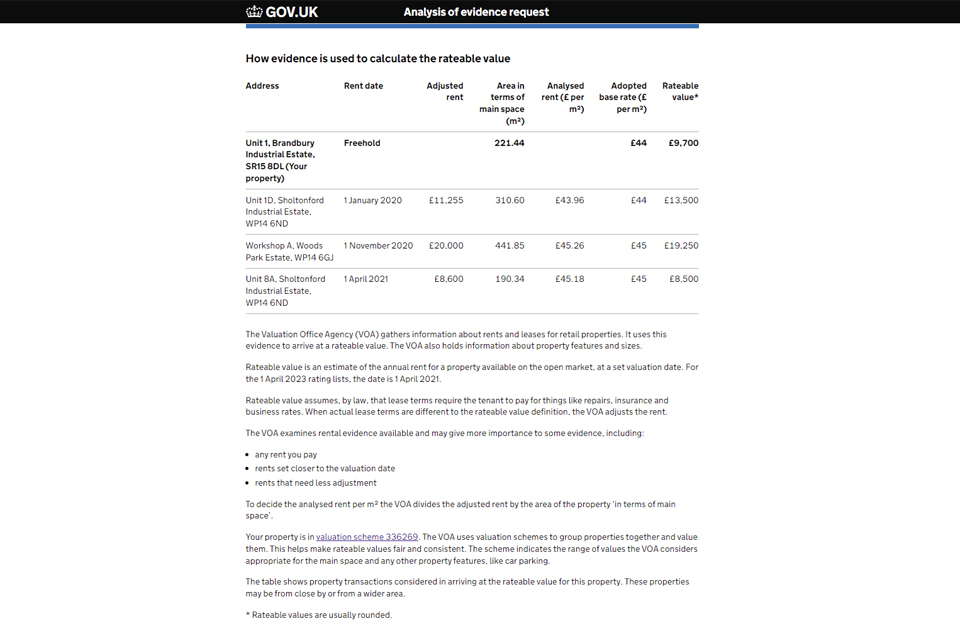

Example B – Industrial premises

Examples in figure 2 are also available in table and word format in Appendix 3

Chapter 2 Questions

Question 1. Did you know the Find Your Business Rates online tools mentioned at 2.13 and shown at figure 1 existed? Yes/No

If yes, have you used the tools to:

- see how a/your rateable value is calculated (Yes/No)

- access valuation schemes details (Yes/No)

- compare properties (Yes/No)

Question 2. In what ways does the information on Find Your Business Rates help you understand if the rateable value is fairly assessed? What specifically is helpful or what specifically could be improved?

Question 3. Examples A and B in figure 2 show tables of similar or comparable properties, with the same adopted base rate. Would information like this help you understand if the rateable value is fairly assessed? What specifically is helpful or what specifically would improve the information?

Chapter 3: Going further on transparency: Greater disclosure and practical considerations

Key points

This section looks at the approaches the VOA takes to different categories of properties (local or national coordinated schemes) and what information might be disclosed for these. It also includes further examples, this time with additional information that isn’t currently available to ratepayers unless they have made a formal challenge.

Possible approaches for different categories of property

3.1 While there are the three recognised valuation methods, set out above at 1.8, properties fall into “categories” where similarities exist in terms of analysis of the evidence and what, therefore, might be provided under the transparency proposal. These categories and possible examples of the approaches are set out below.

Local valuation schemes

3.2 Local valuation schemes cover the vast majority of properties in rating lists, such as most shops, offices and workshops. These properties are likely to have underlying rental comparison evidence.

3.3 The amount of rental evidence available can differ; there can be more for some localities or properties than others. An evidence summary could include information about several nearby/similar properties. Where there is limited or no evidence in the immediate area, evidence may come from a wider locality.

3.4 Some types of leases may include information that might be considered sensitive, such as turnover rents or Company Voluntary Agreements (as mentioned at 1.13) and providing more details about the actual adjustments that have been made could disclose these more sensitive details.

3.5 As mentioned earlier, it is expected ratepayers might access an analysis of rental evidence used to set their rateable value and an explanation of how the evidence was used to arrive at the rateable value.

3.6 While no final decisions have been taken, and what could ultimately be provided to ratepayers might not replicate the examples provided, we are providing some further examples purely to illustrate what might be disclosed if transparency went further and provided details about property transactions.

3.6 While no final decisions have been taken, and what could ultimately be provided to ratepayers might not replicate the examples provided, we are providing some further examples purely to illustrate what might be disclosed if transparency went further.

3.7 See figure 3 below for examples of a shop and an industrial property. We welcome views on these.

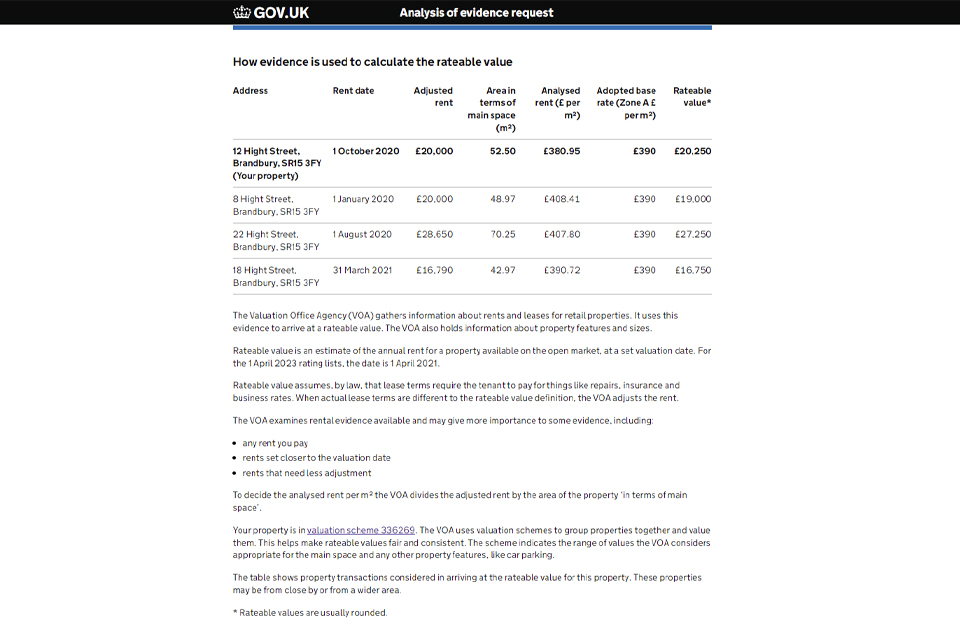

Figure 3

These examples, unlike those in figure 2, provide a table of property transactions that support the adopted value.

They provide information about the adjusted rent and the rent date, not currently available to ratepayers.

As this approach would provide actual property transactions as evidence, the number of entries will vary and at times could include fewer properties than the approach above in figure 2.

Example C – Shop premises

Examples in figure 3 are also available in table and word format in Appendix 3

For more information about zoning retail premises, see the glossary at the end of this document and this explanation and video on GOV.UK.

Example D - Industrial premises

Examples in figure 3 are also available in table and word format in Appendix 3

National valuation schemes

3.8 For some types of properties, valuation schemes are national rather than local. This is because the VOA is reflecting the market approach to values. Properties here are mainly valued by receipts and expenditure and contractor’s basis (for example, oil refineries or power stations) but will also include some properties valued by reference to rents where ‘fair maintainable trade’ (FMT)[footnote 4] is used as comparison, rather than size (for example, public houses).

3.9 Some national valuation schemes are subject to central discussions and, where possible, agreed with industry representative bodies or agents. In many cases, the underlying evidence includes trade or commercially sensitive data, such as actual turnovers or throughputs.

3.10 For properties valued by the receipts and expenditure method, the ratepayer would likely access details and explanations about how their own turnover had been considered and adjusted to assess their rateable value. This would not include evidence about the turnover linked to other properties, even if other properties were considered as part of arriving at the valuation. This information is generally sensitive and not suitable for disclosure.

3.11 For properties valued by the contractor’s basis, the information disclosed (as with receipts and expenditure method), would not include details from other properties. The valuation approach here considers the replacement cost by reference to an approved cost guide, which is already available on request.

3.12 Where schemes are agreed prior to coming into effect, it is likely that the explanation provided would be about how the appropriate scheme is applied. Agreed guidance and approaches are published for some classes, an example being public houses (The valuation of public houses – approved guide).

3.13 As mentioned above, while no final decisions have been taken about what could ultimately be provided to ratepayers, and this might not replicate the examples provided, further examples below at figure 4 illustrate what might be disclosed for properties valued in a national valuation scheme. We welcome views on these.

Figure 4

These examples show the possible summary that could be provided for three different properties valued by reference to a coordinated national scheme.

Appendix 2 shows a list of the types of properties that are covered by national schemes.

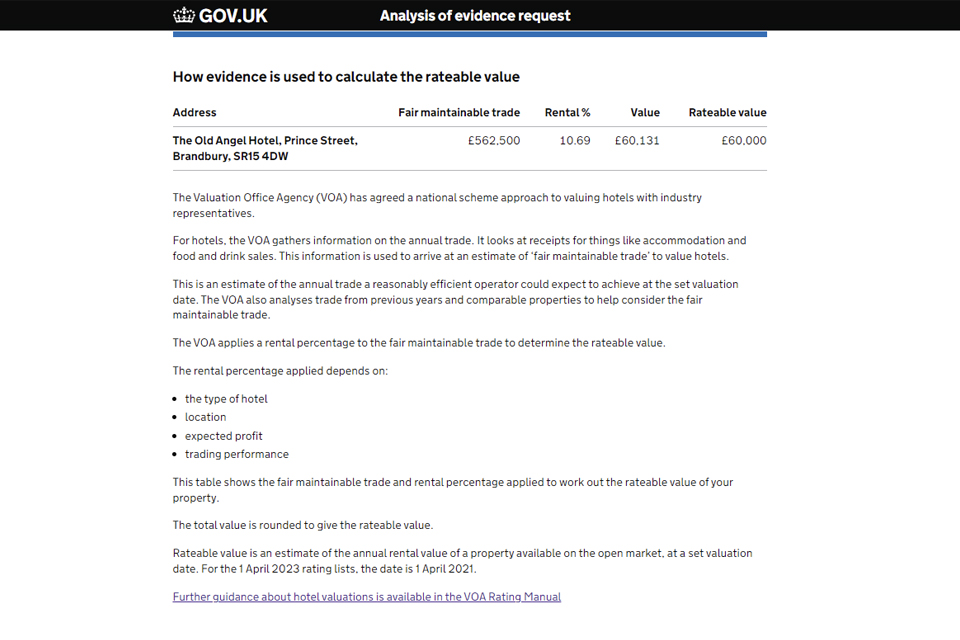

Example E – Hotel

Examples in figure 4 are also available in table and word format in Appendix 3

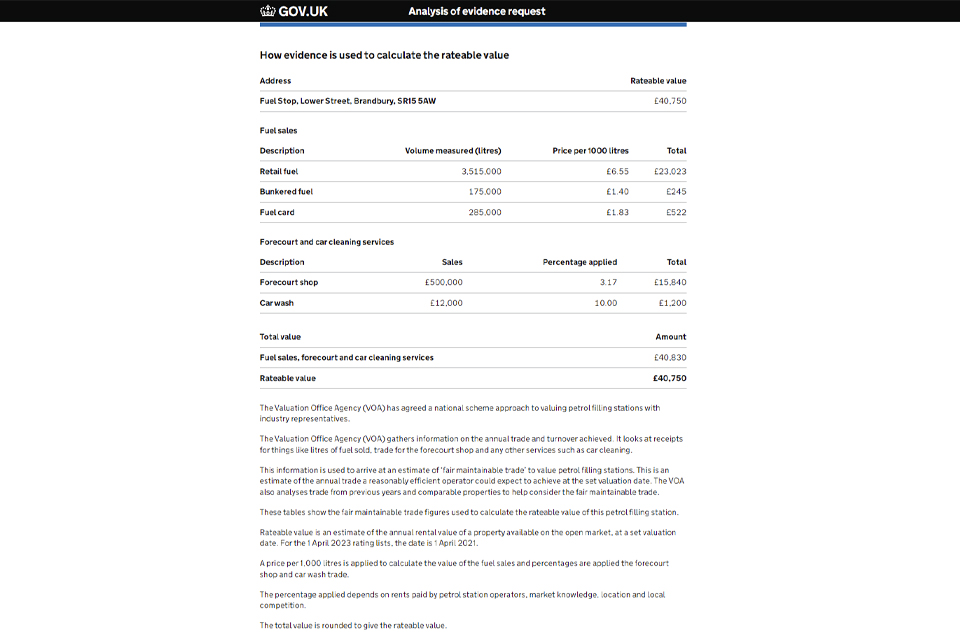

Example F - Petrol Filling Station

Examples in figure 4 are also available in table and word format in Appendix 3

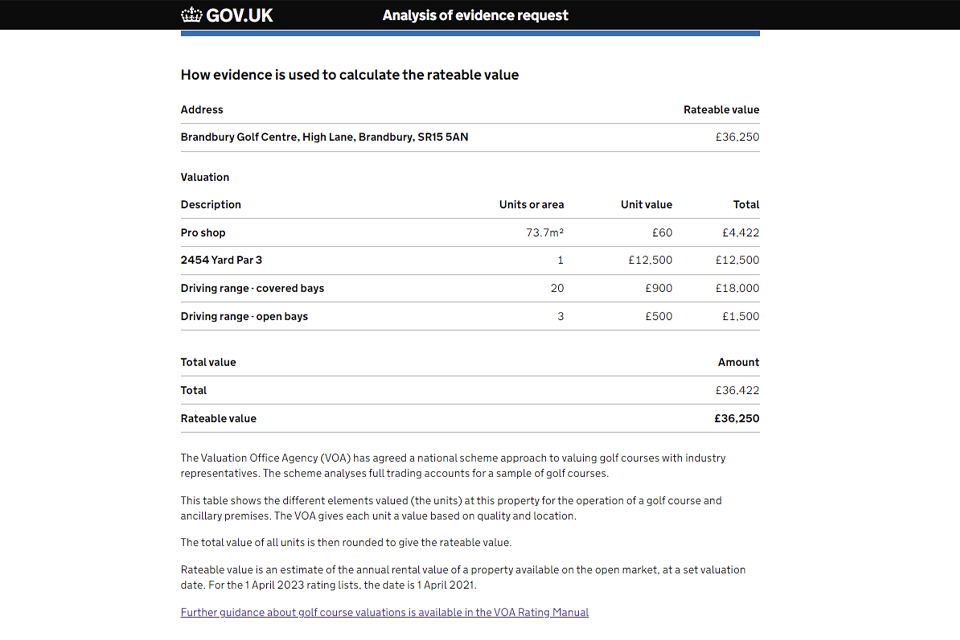

Example G - Golf Course

Examples in figure 4 are also available in table and word format in Appendix 3

Bespoke valuations

3.14 On a very few occasions a bespoke valuation is undertaken, with either a full receipts and expenditure or full contractor’s basis valuation, specific to the individual property.

3.15 The expected approach here is likely to be that the VOA would explain how the ratepayer’s own information, about their accounts or the building, have been used to value their property; valuations here do not need to consider (or disclose) information relating to other properties.

Chapter 3 Questions

Question 4: Figure 3 shows examples with more specific details on other properties, including adjusted annual rents, which have been used to determine the adopted value/ £ per m2. Would information like this help you understand if the rateable value is fairly assessed? What specifically is helpful or what specifically could/would improve the information?

Question 5: What are your views around the examples at figure 4 regarding properties valued under a national scheme?

Chapter 4: Data sharing and data concerns

Key points

This section explores what transparency means in practice in terms of data provided by one ratepayer being shared with another ratepayer. It also sets out some initial requirements and key principles that could be applied to any future disclosure system.

4.1 During the Business Rates Review consultation process, the government asked for views about making a public lease register available. While some were supportive, nearly all respondents were concerned about data protection and the sensitivity of the data that could be disclosed in a public register. As a result, this proposal was not taken forward and the focus turned to disclosing information on an individual basis to help ratepayers understand their rateable value.

4.2 The VOA has a legal duty to protect taxpayer information appropriately. Greater transparency would – in many cases – mean providing information to a ratepayer that relates to other businesses and their property. We do not intend to disclose any detail of business’ sensitive contractual or commercial arrangements, between a tenant and landlord. Disclosing the specific analysis of the rents or other property information undertaken by the VOA could reveal sensitive information and could potentially harm a business’ goodwill or economic interests.

4.3 The proposal for greater transparency is about providing a summary of the evidence underpinning a valuation, where this is not sensitive. A key principle in any future system design will be assessing what might be disclosed and what might be sensitive.

4.4 Below are some of the questions and concerns stakeholders raised about the proposal on greater transparency during earlier engagement and consultation.

Data sharing:

- would information be made available more publicly or limited to relevant interested parties

- could there be potential conflicts with existing regulations such as UK General Data Protection Regulation (UK GDPR) principles

- did landlords fully appreciate the data sharing proposals, as a party in rental agreements.

Sensitive/confidential data

- leases can contain agreements or details that could be commercially sensitive

- turnover-linked rents could be used to deduce turnover data

- views that sensitive data should remain confidential.

4.5 As mentioned, this proposal would give access to information on request, through an online service. The ratepayer’s identity would need to be confirmed first before the information was disclosed.

4.6 Only the ratepayer or, where authority to act has been confirmed, their agent would be able to request information about how their property’s rateable value was determined. Other parties, whether connected or not, would not have access to this information.

Data sharing under greater transparency proposals

4.7 While the proposals do not extend to publishing the data so it can be freely accessed, there are several key points for landlords, tenants and ratepayers to be aware of.

4.8 While stakeholders to date say they would welcome greater transparency and more information being disclosed, we are keen to ensure the approach and your views through the consultation are based on an understanding that the proposal would mean sharing data more widely than is currently the case. This has not been fully explored in the previous consultations.

Sharing ‘your’ data with other ratepayers (and their agents)

4.9 Ratepayers would be provided with rents from other nearby or similar properties, and, in turn, ‘your’ information could be shared with others.

4.10 This is because when properties are valued on a rental comparison basis, rents paid on similar properties in a similar area are considered. The valuation evidence underpinning an individual rateable value would likely include rents from several properties (sometimes referred to as a basket of evidence). The summary of evidence (as in outline examples in figure 3) would therefore contain information about other ratepayers/businesses and their rental agreements, which could in practice be neighbouring properties or competing businesses.

4.11 Some classes of property or types of lease arrangements may include more sensitive data. This might include trade or profit information, or lease incentives (which are not known to potential competitors).

4.12 The approach to what information is shared as part of greater transparency will need to be in line with wider regulations regarding data protection, including GDPR. Alongside these legal constraints, the VOA will need to make informed decisions about what other information should and should not be disclosed.

4.13 Views from stakeholders may help devise some operating principles and provide views on what information can be shared.

Onward data sharing

4.14 The VOA could look to apply stated terms and conditions on how data provided under this proposal should be used by the recipient. However, there is still a risk that onward data sharing and onward use could take place and be unknown to the VOA. Once the information has been provided to a ratepayer or their appointed agent, it would be difficult, if not impossible, for the VOA to know if it was then being used or shared inappropriately.

4.15 Going further with transparency than the examples set out at figures 3 and 4, and disclosing more information or calculations, would likely present more disclosure risks and more data sharing concerns.

A future disclosure system

4.16 The VOA will require new legal disclosure powers (a statutory gateway) to disclose this type of information to ratepayers outside the Challenge process.

4.17 Stakeholder’s views will be considered as a result of this consultation, to ensure, as far as possible, any system works effectively and protects data appropriately. However, the below sets out some of the key principles that will likely inform the design of any future disclosure system:

- Ensuring sensitive and commercially sensitive information is treated appropriately, and not disclosed, will be a core principle of the system design, as will protecting personal data. Work following this consultation will ensure data and privacy concerns are carefully considered and that any approach reflects relevant existing and overriding regulations (e.g. UK GDPR and Human Rights legislation).

- The creation of any information to be disclosed is likely to form part of the preparation for a revaluation, ensuring some manual input and consideration of the information that is thought necessary and reasonable to disclose in a summary to the ratepayer.

- While the technical design of a system may include flags for data that is not to be released, complete automation of processing data is unlikely to take place, particularly at the outset of any future system (though automated replies in response to ratepayers’ requests are envisaged).

- Specific information considered personal, particularly sensitive or commercially sensitive would not be disclosed (this includes turnover rents and insolvency agreements, such Company Voluntary Arrangements, and any individual lease terms or side agreement). This might however limit the amount of information for some sectors where these arrangements are prevalent.

- The actual calculations and valuer judgements undertaken to move from headline to adjusted rent would not be provided, as this is likely to reveal more sensitive information, however analysed rent to indicate the levels of value (in terms of rateable value definition) could, subject to stakeholder views, be provided.

Chapter 4 Questions

Question 6: When it comes to business rates valuations what specific information do you consider to be sensitive or commercially sensitive and why?

Question 7: Do you have any specific data sharing concerns as a result of understanding the disclosure and transparency proposal set out in more detail in this consultation?

Question 8: What, if anything, specifically concerns you about the risk of onward data sharing – where data might be put into the wider public domain by others?

Question 9: Which of these is more important to you and why? (a) Having more information about the underlying evidence used to assess a/your rateable value(b) protecting data from disclosure (and wider disclosure)?

Question 10: Do you have any views about how best to balance providing greater transparency with the concerns on disclosure?

Question 11: Are there any other views not covered in previous answers that you’d like to share about the transparency/disclosure proposal?

Chapter 5: Summary of consultation questions

Chapter 2 questions

Question 1: Did you know the Find Your Business Rates online tools mentioned at 2.13 and shown at figure 1 existed? Yes/No

If yes, have you used the tools to:

- see how a/your rateable value is calculated (Yes/No)

- access valuation schemes details (Yes/No)

- compare properties (Yes/No)

Question 2: In what ways does the information on Find Your Business Rates help you understand if the rateable value is fairly assessed? What specifically is helpful or what specifically could be improved?

Question 3: Examples A and B in figure 2 show tables of similar or comparable properties, with the same adopted base rate. Would information like this help you understand if the rateable value is fairly assessed? What specifically is helpful or what specifically would improve the information?

Chapter 3 questions

Question 4: Figure 3 shows examples with more specific details on other properties, including adjusted annual rents, which have been used to determine the adopted value/ £ per m2. Would information like this help you understand if the rateable value is fairly assessed? What specifically is helpful or what specifically could/would improve the information?

Question 5: What are your views around the examples at figure 4 regarding properties valued under a national scheme?

Chapter 4 questions

Question 6: When it comes to business rates valuations what specific information do you consider to be sensitive or commercially sensitive and why?

Question 7: Do you have any specific data sharing concerns as a result of understanding the disclosure and transparency proposal set out in more detail in this consultation?

Question 8: What, if anything, specifically concerns you about the risk of onward data sharing – where data might be put into the wider public domain by others?

Question 9: Which of these is more important to you and why? (a) Having more information about the underlying evidence used to assess a/your rateable value (b) protecting data from disclosure (and wider disclosure)?

Question 10: Do you have any views about how best to balance providing greater transparency with the concerns on disclosure?

Question 11: Are there any other views not covered in previous answers that you’d like to share about the transparency/disclosure proposal?

Chapter 6: Assessment of impacts

| Year | 2022 to 2023 | 2024 to 2025 | 2025 to 2026 | 2026 to 2027 | 2027 to 2028 |

|---|---|---|---|---|---|

| Exchequer impact (£m) | +/- | +/- | +/- | +/- | +/- |

Exchequer Impact Assessment

Any Exchequer impact will be estimated following consultation.

| Impacts | Comment |

|---|---|

| Economic impact | Any economic impacts will be identified following consultation and final design of the policy. |

| Impact on individuals, households and families | There is impact on individuals subject to business rates that decide to request an analysis of evidence, as access would be through an online service where the ratepayer’s identity would need to be confirmed first before the information was disclosed. The measure is not expected to impact on households or family formation, stability, or breakdown. One beneficial impact for individuals is that ratepayers will be able to see more information about their business rates assessment and how this has been valued. |

| Equalities impacts | It is not anticipated that there will be disproportionate impacts for those in groups sharing protected characteristics. Equality impacts will be further considered following this consultation. A full equality impact assessment is not recommended at this point. VOA will consider alternative provisions for those who are digitally excluded or need digital assistance. |

| Impact on businesses and Civil Society Organisations | As set out under individuals, above, ratepaying businesses and also companies or organisations that represent ratepayers (such as rating agents) will need to request the information using an online service and provide details to identify they are eligible to receive the information. |

| Impact on HMRC/VOA or other public sector delivery organisations | The government will consider the responses to the consultation when deciding how to proceed. The resulting IT design and operational system design requirements will determine the resource impacts on HMRC/VOA. No other public sector impacts identified at this stage. |

| Other impacts | Responses to the consultation will help the government assess any other impacts. |

Chapter 7. The consultation process

This consultation document and consultation process have been planned to adhere to the Consultation Principles issued by the Cabinet Office.

The purpose of the consultation is to seek views on the detailed policy design and a framework for implementation of a specific proposal, rather than to seek views on alternative proposals.

Representative groups are asked to give a summary of the people and organisations they represent, and where relevant who they consulted in reaching their conclusions when they respond.

How to respond

Responses should be sent by 7 June 2023.

Respondents do not have to respond to all questions. We also welcome partial responses. A summary of the questions in this consultation is included at chapter 5.

You may respond by completing an online survey hyperlink. Alternatively, you can email your response or write to us at the address below. When writing please make it clear which questions you are responding to.

When responding please say if you are a business, individual or representative body. In the case of representative bodies please provide information on the number and nature of people you represent. In addition, for representative bodies or rating agents, please advise if your members or clients were consulted prior to your response (as mentioned above).

NDR Reforms Disclosure Consultation

Valuation Office Agency

8th floor

10 South Colonnade

Canary Wharf

London

E14 4PU

For any other enquiries or questions about the consultation, please email [email protected]

Confidentiality

HMRC (including VOA) is committed to protecting the privacy and security of your personal information. This privacy notice describes how we collect and use personal information about you in accordance with data protection law, including the UK General Data Protection Regulation (UK GDPR) and the Data Protection Act (DPA) 2018.

Information provided in response to this consultation, including personal information, may be published or disclosed in accordance with the access to information regimes. These are primarily the Freedom of Information Act 2000 (FOIA), the Data Protection Act 2018, UK General Data Protection Regulation (UK GDPR) and the Environmental Information Regulations 2004.

If you want the information that you provide to be treated as confidential, please be aware that, under the Freedom of Information Act 2000, there is a statutory Code of Practice with which public authorities must comply and which deals with, amongst other things, obligations of confidence. In view of this it would be helpful if you could explain to us why you regard the information you have provided as confidential. If we receive a request for disclosure of the information we will take full account of your explanation, but we cannot give an assurance that confidentiality can be maintained in all circumstances. An automatic confidentiality disclaimer generated by your IT system will not, of itself, be regarded as binding on HM Revenue and Customs.

Consultation Privacy Notice

This notice sets out how we will use your personal data, and your rights. It is made under Articles 13 and/or 14 of the UK General Data Protection Regulation.

Your data

We will process the following personal data:

- Name

- Email address

- Phone number

- Job title / position

- Postal address (in written responses)

- Purpose

The purpose(s) for which we are processing your personal data is: Business Rates: Transparency & Disclosure of information on business rates valuations.

Legal basis of processing

The legal basis for processing your personal data is that the processing is necessary for the exercise of a function of a government department.

Recipients

Your personal data may be shared by us with HMRC, HM Treasury and the Department for Levelling Up, Housing and Communities.

Retention

Your personal data will be held for 2 years from the closure of the consultation and will then be deleted.

Your rights

You have the right to request:

- information about how your personal data are processed, and to request a copy of that personal data.

- any inaccuracies in your personal data are rectified without delay.

- any incomplete personal data are completed, including by means of a supplementary statement.

- your personal data are erased if there is no longer a justification for them to be processed.

You have the right in certain circumstances (for example, where accuracy is contested) to request that the processing of your personal data is restricted.

Complaints

If you consider that your personal data has been misused or mishandled, you may make a complaint to the Information Commissioner, who is an independent regulator. The Information Commissioner can be contacted at:

Information Commissioner’s Office

Wycliffe House

Water Lane

Wilmslow

Cheshire

SK9 5AF

0303 123 1113

Any complaint to the Information Commissioner is without prejudice to your right to seek redress through the courts.

Contact details

The data controller for your personal data is HMRC, of which VOA is an executive agency. The contact details for the data controller are:

HMRC

100 Parliament Street

Westminster

London SW1A 2BQ

The contact details for HMRC’s Data Protection Officer are:

The Data Protection Officer

HM Revenue and Customs

14 Westfield Avenue

Stratford

London

E20 1HZ

Consultation principles

The Consultation Principles are available on the Cabinet Office website: Consultation Principles Guidance

If you have any comments or complaints about the consultation process, please contact the Consultation Coordinator. Please do not send responses to the consultation to this link.

Appendix 1 - Existing information already published on GOV.UK for ratepayers

VOA’s GOV.UK website provides a great deal of information for ratepayers and surveying practitioners.

A high level overview and introduction to business rates provides guidance and explanations about:

- how rates are calculated

- revaluations

- reliefs

- what to do if there are changes to your property

- where to go for help.

In addition, there are some more specific explanations for some sectors or situations where customers might contact us about business rates, for example for:

Key links from the above pages also include tools to estimate your business rates and find your business rates valuation online.

There are also several videos available at https://www.youtube.com/@VOAgovuk that cover, for example:

- What is a rateable value?

- How we assess pubs for business rates

- How we measure properties for business rates

- How we use retail zoning for business rates

- Revaluations

For experienced practitioners and those seeking a detailed understanding, more technical guidance remains available in the VOA’s Rating Manual published on GOV.UK. This has also recently been reviewed and now has an updated structure. Feedback from users was central to making it more accessible and easier to find and navigate.

Appendix 2 - National scheme properties

| A | Administration of justice (courts) Agricultural showgrounds Aircraft works with airfields Airports – air strips Airports – major international / regional airports Airports – small civil Airport let outs Aluminium smelting works Ambulance stations Amusement parks & theme parks Aquaria Archive stores Arenas Asphalt plants / coating plant |

| B | Bagging plants Beach huts Beet sugar factories Bingo halls Bird sanctuaries Boathouses Bowling alleys Bowling centres (indoor) Bowling centres (outdoor) Bus garages Bus stations and park and ride Breweries Brickworks and clay tileworks Bulk cement storage depots |

| C | Cable headend buildings Canal properties Caravan sites, parks and pitches Casinos and gambling clubs Cemeteries and burial grounds Cement works Cement tile works Changing rooms Chemical works Cinemas Civic amenity sites Club houses for sports clubs (no grounds or pitches, e.g. amateur boxing, bridge, sailing/rowing, drama clubs) Coaching inns Coastguard and coast watch stations Coking and carbonisation plant Colleges of further education Concrete batching plants Concrete block works Concrete product works Conference and exhibition centres County cricket grounds Crematoria Cricket centres Cricket grounds (non-county) |

| D | Domestic fuel installations District heating undertakings Docks Docks and harbours (statutory) Docks, harbours and tolls (non statutory) Dry ski slopes |

| E | Educational properties Electricity distribution networks Eventing courses Equestrian hospitals |

| F | Ferry terminals Fire stations Flour and provender mills Football and football rugby league stadia Football grounds Football pitches (no ancillary accommodation) |

| G | Gas processing plants Golf courses Golf driving ranges GP Surgeries (contactor’s basis valuations) Grain silos Greyhound racetracks Guest houses and bed and breakfast accommodation Gymnasia/fitness suites |

| H | Harbours Heliports and helipads Heritage railways Historic properties (incl. conference centres in county houses) Holiday accommodation - self catering Holiday centres Horse racecourses Hospices Hospitals and healthcare centres Hostels, outdoor activity centres and religious retreats Hostels |

| I | Information / visitor centres Iron and steelworks |

| J | |

| K | |

| L | Land used for waste composting Leisure accommodation (other - e.g. chalet parks) Leisure attractions Licensed sports, social and private members clubs Lifeboat stations Liquid bulk storage (including petrol and oil) Livestock markets Local authority occupations Local authority sports centres, tennis centres, swimming pools and leisure centres Local authority and other maintained schools Lodges |

| M | Maltings Marinas Mineral depots Mineral producing sites (incl. block stone, brine, chalk, china clay, clay, coal, fluorspar, gas, hard rock, inert, oil, putrescible, sand, gravel, slate) Mineral producing sites - other mineral category) Minerals - other miscellaneous Mine water treatment plants Model villages Mortuaries Motor racetracks and go kart rinks Motorway service areas, let outs and truck stops Museums and art galleries (not valued on contractor’s basis) |

| N | NHS clinics and health centres (contractor’s basis valuations) Night clubs and discotheques Nuclear power stations Nursing homes |

| O | Oil refineries |

| P | Peat fields Petrol filling stations Petrol and oil storage depots Piers (e.g. Thames piers) Pipes and pipelines Pleasure piers Point-to-point racecourses Police stations and other police buildings Processing of minerals / primary treatment Public libraries Public conveniences Public halls Public houses, licensed restaurants and wine bars Public and other independent schools |

| Q | |

| R | Rail freight sites Rail maintenances sites Railway and tramway utilities Renewable power generators (incl. hydro, photovoltaic, wind, coal, gas, diesel, oil, anaerobic digesters and biomass) Residential training and conference centres Rifle ranges / shooting grounds (non-MOD) Roller skating rinks Royal palaces Rugby union grounds |

| S | Sea dredged aggregate processing plants Secondary aggregate processing sites Serviced apartments Sewage treatment works Shipbuilding yards Ship repairing yards Skating rinks and skateboard parks Small pavilions (similar to club houses) Snooker halls and clubs Speedway racetracks Spoil heap workings Sports and leisure centres (within / part of specialist property) Sports and leisure centres (private) Sports grounds Sports stadia Squash courts Surgeries, clinics, health centres (contractor’s basis valuations) Surgeries (other than GP/NHS) (contractor’s basis valuations) Swimming baths |

| T | Telecommunication - cable networks Telecommunication - fixed line networks Telecommunication masts and other wireless transmission sites Telecommunication switching centres Telescope sites Tennis centres Tennis courts & clubs Telephoned kiosks (incl. public, interactive and automobile club kiosks) Theatres, concert halls & opera houses Time-share complexes & holiday property bond Toll roads & bridges (incl. ferries) Totalisators on horse racecourses Town halls & civic centres |

| U | Universities & university colleges University ancillary land or buildings University occupation within hospitals |

| V | |

| W | Waste anaerobic digestion plants Waste incinerator plants Waste recycling plants Waste transfer stations Water undertakings / water supply sites Windmills |

| X | |

| Y | |

| Z | Zoos and safari parks |

Appendix 3 - Disclosure examples in alternative table and text format

Example A

Summary of comparable properties

| Address | Total area (m2) | Area in terms of main space (m2) | Adopted base rate (Zone A £ per m2) | Rateable value* |

|---|---|---|---|---|

| 12 Hight Street, Brandbury, SR15 3FY (Your property) |

104.54 | 52.50 | £390 | £20,250 |

| 8 Hight Street, Brandbury, SR15 3FY |

62.37 | 48.97 | £390 | £19,000 |

| 10 Hight Street, Brandbury, SR15 3FY |

60.87 | 51.25 | £390 | £19,750 |

| 14 Hight Street, Brandbury, SR15 3FY |

78.92 | 40.95 | £390 | £15,750 |

| 16 Hight Street, Brandbury, SR15 3FY |

113.43 | 54.50 | £390 | £21,250 |

| 18 Hight Street, Brandbury, SR15 3FY |

65.20 | 42.97 | £390 | £16,750 |

| 22 Hight Street, Brandbury, SR15 3FY |

85.50 | 70.25 | £390 | £27,250 |

The Valuation Office Agency (VOA) gathers information about rents and leases for retail properties. It uses this evidence to arrive at a rateable value. The VOA also holds information about property features and sizes.

Rateable value is an estimate of the annual rent for a property available on the open market, at a set valuation date. For the 1 April 2023 rating lists, the date is 1 April 2021.

Rateable value assumes, by law, that lease terms require the tenant to pay for things like repairs, insurance and business rates. When actual lease terms are different to the rateable value definition, the VOA adjusts the rent.

The VOA analyses the rental evidence and makes a judgement to arrive at a rent per square metre (the adopted base rate).

Your property is in valuation scheme 336269. The VOA uses valuation schemes to group properties together and value them. This helps make rateable values fair and consistent. The scheme indicates the range of values the VOA considers appropriate for the main space and any other property features, like car parking. The table shows some of the comparable properties from the scheme that have the same base rate.

*Rateable values are usually rounded.

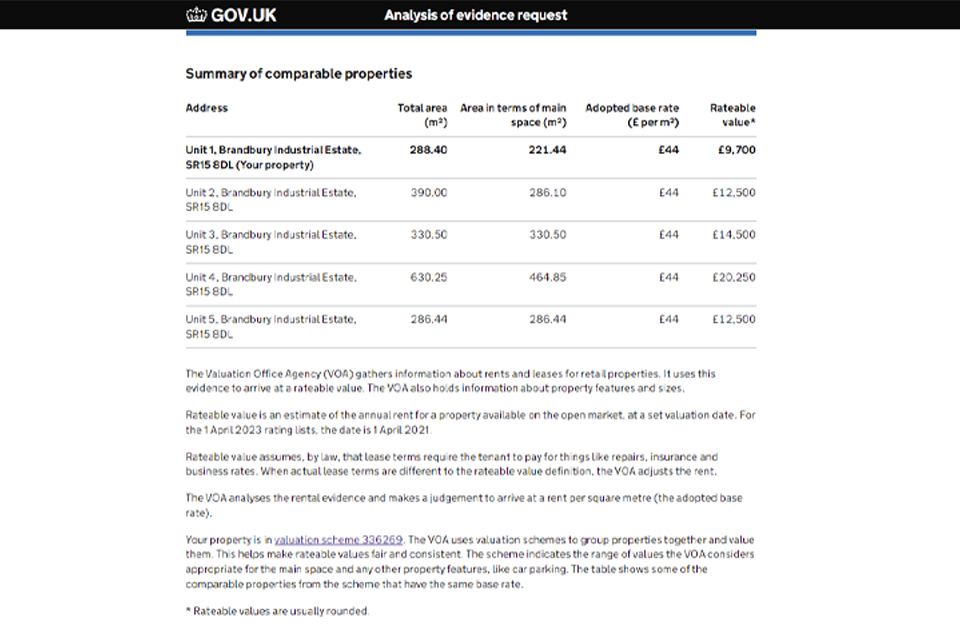

Example B

Summary of comparable properties

| Address | Total area (m2) | Area in terms of main space (m2) | Adopted base rate (£ per m2) | Rateable value* |

|---|---|---|---|---|

| Unit 1, Brandbury Industrial Estate, SR15 8DL (Your property) |

288.40 | 221.44 | £44 | £9,700 |

| Unit 2, Brandbury Industrial Estate, SR15 8DL |

290.00 | 286.10 | £44 | £12,500 |

| Unit 3, Brandbury Industrial Estate, SR15 8DL |

330.50 | 330.50 | £44 | £14,500 |

| Unit 4, Brandbury Industrial Estate, SR15 8DL |

630.25 | 464.85 | £44 | £20,250 |

| Unit 5, Brandbury Industrial Estate, SR15 8DL |

286.44 | 286.44 | £44 | £12,500 |

The Valuation Office Agency (VOA) gathers information about rents and leases for retail properties. It uses this evidence to arrive at a rateable value. The VOA also holds information about property features and sizes.

Rateable value is an estimate of the annual rent for a property available on the open market, at a set valuation date. For the 1 April 2023 rating lists, the date is 1 April 2021.

Rateable value assumes, by law, that lease terms require the tenant to pay for things like repairs, insurance and business rates. When actual lease terms are different to the rateable value definition, the VOA adjusts the rent.

The VOA analyses the rental evidence and makes a judgement to arrive at a rent per square metre (the adopted base rate).

Your property is in valuation scheme 336269. The VOA uses valuation schemes to group properties together and value them. This helps make rateable values fair and consistent. The scheme indicates the range of values the VOA considers appropriate for the main space and any other property features, like car parking. The table shows some of the comparable properties from the scheme that have the same base rate.

*Rateable values are usually rounded.

Example C

How evidence is used to calculate the rateable value

| Address | Rent date | Adjusted rent | Area in terms of main space (m2) | Analysed rent (£ per m2) | Adopted base rate (Zone A £ per m2) | Rateable value* |

|---|---|---|---|---|---|---|

| 12 Hight Street, Brandbury, SR15 3FY (Your property) |

1 October 2020 | £20,000 | 52.50 | £380.95 | £390 | £20,250 |

| 8 Hight Street, Brandbury, SR15 3FY |

1 January 2020 | £20,000 | 48.97 | £408.41 | £390 | £19,000 |

| 22 Hight Street, Brandbury, SR15 3FY |

1 August 2020 | £28,650 | 70.25 | £407.80 | £390 | £27,250 |

| 18 Hight Street, Brandbury, SR15 3FY |

31 March 2021 | £16,790 | 42.97 | £390.72 | £90 | £16,750 |

The Valuation Office Agency (VOA) gathers information about rents and leases for retail properties. It uses this evidence to arrive at a rateable value. The VOA also holds information about property features and sizes.

Rateable value is an estimate of the annual rent for a property available on the open market, at a set valuation date. For the 1 April 2023 rating lists, the date is 1 April 2021.

Rateable value assumes, by law, that lease terms require the tenant to pay for things like repairs, insurance and business rates. When actual lease terms are different to the rateable value definition, the VOA adjusts the rent.

The VOA examines rental evidence available and may give more importance to some evidence, including:

- any rent you pay

- rents set closer to the valuation date

- rents that need less adjustment

To decide the analysed rent per m2 the VOA divides the adjusted rent by the area of the property ‘in terms of main space’.

Your property is in valuation scheme 336269. The VOA uses valuation schemes to group properties together and value them. This helps make rateable values fair and consistent. The scheme indicates the range of values the VOA considers appropriate for the main space and any other property features, like car parking.

The table shows property transactions considered in arriving at the rateable value for this property. These properties may be from close by or from a wider area.

*Rateable values are usually rounded.

Example D

How evidence is used to calculate the rateable value

| Address | Rent date | Adjusted rent | Area in terms of main space (m2) | Analysed rent (£ per m2) | Adopted base rate (£ per m2) | Rateable value* |

|---|---|---|---|---|---|---|

| Unit 1, Brandbury Industrial Estate, SR15 8DL (Your property) |

Freehold | - | 221.44 | - | £44 | £9,700 |

| Unit 1D, Sholtonford, Industrial Estate, WP14 6ND |

1 January 2022 | £11,255 | 310.60 | £43.96 | £44 | £13,500 |

| Workshop A, Woods Park Estate, WP14 6GJ |

1 November 2022 | £20,000 | 441.85 | £45.26 | £45 | £19,250 |

| Unit 8A, Sholtonford Industrial Estate, WP14 6ND |

1 April 2021 | £8,600 | 190.34 | £45.18 | £45 | £8,500 |

The Valuation Office Agency (VOA) gathers information about rents and leases for retail properties. It uses this evidence to arrive at a rateable value. The VOA also holds information about property features and sizes.

Rateable value is an estimate of the annual rent for a property available on the open market, at a set valuation date. For the 1 April 2023 rating lists, the date is 1 April 2021.

Rateable value assumes, by law, that lease terms require the tenant to pay for things like repairs, insurance and business rates. When actual lease terms are different to the rateable value definition, the VOA adjusts the rent.

The VOA examines rental evidence available and may give more importance to some evidence, including:

- any rent you pay

- rents set closer to the valuation date

- rents that need less adjustment

To decide the analysed rent per m2 the VOA divides the adjusted rent by the area of the property ‘in terms of main space’.

Your property is in valuation scheme 336269. The VOA uses valuation schemes to group properties together and value them. This helps make rateable values fair and consistent. The scheme indicates the range of values the VOA considers appropriate for the main space and any other property features, like car parking.

The table shows property transactions considered in arriving at the rateable value for this property. These properties may be from close by or from a wider area.

*Rateable values are usually rounded.

Example E

How evidence is used to calculate the rateable value

| Address | Fair maintainable trade | Rental % | Value | Rateable value |

|---|---|---|---|---|

| The Old Angel Hotel, Prince Street, Brandbury, SR15 4DW |

£562,500 | 10.69 | £60,131 | £60,000 |

The Valuation Office Agency (VOA) has agreed a national scheme approach to valuing hotels with industry representatives.

For hotels, the VOA gathers information on the annual trade. It looks at receipts for things like accommodation and food and drink sales. This information is used to arrive at an estimate of ‘fair maintainable trade’ to value hotels.

This is an estimate of the annual trade a reasonably efficient operator could expect to achieve at the set valuation date. The VOA also analyses trade from previous years and comparable properties to help consider the fair maintainable trade.

The VOA applies a rental percentage to the fair maintainable trade to determine the rateable value.

The rental percentage applied depends on:

- the type of hotel

- location

- expected profit

- trading performance

This table shows the fair maintainable trade and rental percentage applied to work out the rateable value of your property.

The total value is rounded to give the rateable value.

Rateable value is an estimate of the annual rental value of a property available on the open market, at a set valuation date. For the 1 April 2023 rating lists, the date is 1 April 2021.

Further guidance about hotel valuations is available in the VOA Rating Manual

Example F

How evidence is used to calculate the rateable value

| Address | Rateable value |

|---|---|

| Fuel Stop, Lower Street, Brandbury, SR15 5AW | £40,750 |

Fuel sales

| Description | Volume measured (litres) | Price per 1000 litres | Total |

|---|---|---|---|

| Retail fuel | 3,515,000 | £6.55 | £23,023 |

| Bunkered fuel | 175,000 | £1.40 | £245 |

| Fuel card | 285,000 | £1.83 | £522 |

Forecourt and car cleaning services

| Description | Sales | Percentage applied | Total |

|---|---|---|---|

| Forecourt shop | £500,000 | 3.17 | £15,480 |

| Car Wash | £12,000 | 10.00 | £1,200 |

| Total value | Amount |

|---|---|

| Fuel sales, forecourt and car cleaning services | £40,830 |

| Rateable value | £40,750 |

The Valuation Office Agency (VOA) has agreed a national scheme approach to valuing petrol filling stations with industry representatives.

The Valuation Office Agency (VOA) gathers information on the annual trade and turnover achieved. It looks at receipts for things like litres of fuel sold, trade for the forecourt shop and any other services such as car cleaning.

This information is used to arrive at an estimate of ‘fair maintainable trade’ to value petrol filling stations. This is an estimate of the annual trade a reasonably efficient operator could expect to achieve at the set valuation date. The VOA also analyses trade from previous years and comparable properties to help consider the fair maintainable trade.

These tables show the fair maintainable trade figures used to calculate the rateable value of this petrol filling station.

Rateable value is an estimate of the annual rental value of a property available on the open market, at a set valuation date. For the 1 April 2023 rating lists, the date is 1 April 2021.

A price per 1,000 litres is applied to calculate the value of the fuel sales and percentages are applied the forecourt shop and car wash trade.

The percentage applied depends on rents paid by petrol station operators, market knowledge, location and local competition.

The total value is rounded to give the rateable value.

Further guidance about petrol filling station valuations is available in the VOA Rating Manual

Example G

How evidence is used to calculate the rateable value

| Address | Rateable value |

|---|---|

| Brandbury Golf Centre, High Lane, Brandbury, SR15 5AN | £36,250 |

Valuation

| Description | Units or area | Unit value | Total |

|---|---|---|---|

| Pro shop | 73.7m2 | £60 | £4,422 |

| 2454 Yard par 3 | 1 | £12,500 | £12,500 |

| Driving range - covered bays | 20 | £900 | £18,000 |

| Driving range - open bays | 3 | £500 | £1,500 |

| Total value | Amount |

|---|---|

| Total | £36,422 |

| Rateable value | £36,422 |