Pensions dashboards: consultation on the draft Pensions Dashboards Regulations 2022

Updated 15 July 2022

Applies to England, Scotland and Wales

Ministerial foreword

With record numbers of people saving for retirement, it is more important than ever that people understand their pensions and prepare for financial security in later life.

We know many people lack confidence when making decisions about their finances – and it can be difficult to understand and keep track of multiple pensions. Pensions dashboards will revolutionise the way people interact with their pensions. They will make accessing pensions information easier by allowing people to see what they have in their various pensions at the touch of their smartphone, laptop, or computer.

It is, of course, important to get the design of the service right to ensure it is accurate, secure and focused on the individual. That is why we took the time to undertake a comprehensive feasibility study and consulted on this before introducing primary legislation. This current consultation on draft Regulations provides a further opportunity for both industry and individuals to continue to influence that process.

We acknowledge that our proposals are ambitious and that making a success of pensions dashboards is a significant task for both Government and industry. But dashboards are an essential part of our plans to modernise the pensions industry and make it fit for the 21st century digital age. Dashboards will open huge opportunities to reunite individuals with lost pots and transform the way people think about and plan for their retirement.

The draft Regulations, that we have published with this consultation, would ensure the connection of pension schemes is managed in a way that we believe is feasible. By prioritising the connection of the largest pension schemes first, we can ensure that dashboards serve the greatest number of people as soon as possible. We have also been mindful that initially some schemes may need time to turnaround certain information on the value of pensions for the purposes of dashboards, nevertheless, it is our intention that this will all become instantaneous in the future.

Government is playing its part in ensuring dashboards provide a comprehensive view of what a person may receive in retirement, as information on State Pensions will be included on dashboards from day one. People will be able to access a dashboard service that is publicly owned, provided by the Money and Pensions Service, which will form part of a comprehensive retirement planning hub. We want dashboards to be accessed by as many people as possible and, to that end, we will allow other organisations who meet prescribed requirements to develop and host their own dashboards.

The consumer is at the heart of every one of our proposals to ensure that data is managed in a way that is secure and is presented in a way that is useful and easy to understand. We have also ensured our proposals include a robust set of tools for regulators to ensure individuals remain protected and to target instances of non-compliance with penalties if required.

We are confident that these proposals will be widely supported by individuals that have pension savings, by the pensions industry, and by people across the political spectrum. They deliver on our commitment to facilitate the introduction of pensions dashboards and have the potential to transform retirement planning forever.

Guy Opperman MP

Minister for Pensions and Financial Inclusion

About this consultation

Purpose of the consultation

The purpose of this consultation, pursuant to section 317(1) of the Pensions Act 2004, is to seek views on the draft Pensions Dashboards Regulations, which make provision for requirements to be met by pension dashboard services or the providers of these services, and by trustees or managers of relevant occupational pension schemes (meaning occupational pension schemes which are not stakeholder pension schemes) in Great Britain (England, Scotland and Wales).

- Issued: 31 January 2022

- Respond by: 13 March 2022

- Territorial Extent: This consultation applies to England, Wales and Scotland. It is envisaged that Northern Ireland will make corresponding legislation

Who is this consultation aimed at?

We welcome views from any interested parties. We are particularly keen to hear from:

- individuals with a UK pension

- pensions and lifetime savings industries

- finance and consumer representative groups with an interest in pensions capability, financial capability, data protection and security

- trustees or managers of occupational pension schemes

- pensions administrators

- pensions administration software providers

- firms interested in offering Integrated Service Provider (ISP) services

- Financial Technology (Fintech) companies

- organisations interested in setting up pensions dashboards

How to respond to this consultation

Please provide your consultation responses, using the form on our consultation webpage, and email to: [email protected]

When responding please indicate whether you are responding as an individual or representing the views of an organisation.

Government response

We will publish the Government response to this consultation on the GOV.UK website. The report will summarise the responses and set out the Government’s proposed next steps, taking account of the responses.

Consultation principles

This consultation is being conducted in line with the Cabinet Office consultation principles.

Confidentiality and data protection

The information you send us may need to be passed to colleagues within the Department for Work and Pensions and may be published in a summary of responses received and referred to in the published consultation report. We also anticipate that we may share information with our key working partners: the Financial Conduct Authority (FCA), The Pensions Regulator (TPR), and the Money and Pensions Service (MaPS) through the Pensions Dashboards Programme (PDP). All information contained in your response, including personal information, may be subject to publication or disclosure if requested under the Freedom of Information Act 2000.

By providing personal information for the purposes of the public consultation exercise, it is understood that you consent to its disclosure and publication. If this is not the case, you should limit any personal information provided, or remove it completely. If you want the information in your response to the consultation to be kept confidential, you should explain why as part of your response, although we cannot guarantee to do this.

Executive Summary

Purpose and scope of the Regulations

1. This consultation is about introducing pensions dashboards, an electronic communications service intended to be used by individuals to access information about pensions. Pensions dashboards will put individuals in control of planning for their retirement by bringing together their pensions information from multiple sources, including information on their State Pension, which can then be accessed at a time of their choosing.

2. The proposals in this consultation have been informed by extensive engagement with our stakeholder community. Its purpose is to seek views on a range of policy questions relating to the creation of pensions dashboards. An indicative draft of the Regulations that would give effect to the policy (“the Regulations”) are included to show how we envisage the policy would be turned into law. In summary, the Regulations set requirements to be met for a pensions dashboards service to be a “qualifying pensions dashboard service,” and requirements to be met by the trustees or managers of relevant occupational pension schemes, along with provisions to ensure their compliance with the requirements. Such requirements are set out in these Regulations to ensure that proper standards are met for delivering information on dashboards and for handling people’s pensions information.

3. Responses to the consultation will help to inform the drafting of the Regulations, and the supporting standards and guidance which are referred to in the Regulations. This consultation contains questions on specific issues where we would like detailed feedback, but we also invite comments on any aspect of the regulations not covered by the consultation questions.

4. Further to Part 1 of the Regulations (see draft regulation 3), the Regulations would apply to all registrable UK-based occupational pension schemes with active and/or deferred members, including public service pension schemes. The staging profile (as set out in Schedule 2 to the Regulations and outlined in chapter 5: Staging) is a plan requiring the progressive connection of pension schemes to the digital architecture (see annex D) and annex B)), prioritising schemes by their size and taking into account deliverability factors. Schemes will be able to connect earlier than their staging deadline should they choose to (subject to permission from MaPS).

5. The Regulations set out:

a. Requirements to be met by pensions dashboards services in order to be “qualifying pensions dashboards services” (Part 2 of the Regulations).

b. Requirements on trustees or managers of relevant occupational pension schemes in relation to cooperating with and connecting to the Money and Pensions Service (MaPS) (which we have referred to in the consultation as the digital architecture), and the data they must provide to individuals via MaPS (Part 3 of the Regulations).

c. Provisions for TPR to take enforcement action in relation to pension schemes that do not comply (Part 4 of the Regulations).

Structure of the consultation

6. The Regulations are in the form of a statutory instrument, which is a form of secondary legislation and is structured accordingly. We have sought to make this consultation document as accessible to readers as possible, by presenting information to the reader and taking the reader through the key issues in a logical way, so that both the high-level design and policy intent of dashboards is clear, and the detail is presented within this context. We have taken this approach so that the reader is well equipped to understand the proposals and provide considered responses to the questions asked.

7. The table below sets out the structure of this consultation, and the relevant Parts within the statutory instrument:

| Consultation Document | Statutory Instrument |

|---|---|

| Chapter 1: Overview of Dashboards | Part 1, General: Oversight of standards |

| Chapter 2: Data | Part 3, Chapter 2: Requirements relating to the provision of information Schedule 3: Value Data |

| Chapter 3: How will pensions dashboards operate? Find and View | Part 3, Chapter 1: Requirements relating to cooperation and connection |

| Chapter 4: Connection: What will occupational pension schemes be required to do? | Part 3, Chapter 1: Requirements relating to cooperation and connection |

| Chapter 5: Staging – the sequencing of scheme connection | Part 1, General: Application Part 3, Chapter 1: Requirements relating to cooperation and connection Schedule 2: Staging profile |

| Chapter 6: Compliance and enforcement | Part 4: Compliance and enforcement |

| Chapter 7: Qualifying pensions dashboard services | Part 2: Requirements relating to qualifying pensions dashboard services |

Chapters

8. The chapters within this consultation set out our detailed proposals for how pensions dashboards will work, and how the Regulations would provide for the proposals in legislation. The chapters are split into specific sections: data; find and view; connection; staging; compliance and enforcement; and qualifying pensions dashboard services. However, the chapters are inter-related, and the document would best be read as a whole. Summaries of the content of each chapter are below.

Chapter 1: Overview of Pension Dashboards

9. This chapter provides an overview of pensions dashboards. This important contextual information is to support consultees’ understanding of the Regulations and consultation. It covers:

a. The background.

b. How the dashboards will work, including what dashboards are, the process, and consumer protection.

c. Requirements, including what is required of schemes, dashboard providers, and the standards.

Chapter 2: Data

10. This chapter explores the interactions between the data which schemes will receive to match individuals to their pensions, and the different types of data that schemes will then have to provide to individuals via the individual’s chosen dashboard. This includes ‘find data’ (personal data provided by individuals) and ‘view data’ (returned to dashboards by schemes, including administrative data, signpost data, and value data, as defined in the Regulations).

11. It sets out proposals for the value data required from different types of relevant occupational pension schemes, including money purchase, non-money purchase, collective money purchase and hybrid schemes, with proposals for both accrued and projected values, and proposals on where exemptions apply. There are also specific requirements proposed for State Pension information.

Chapter 3: How will pensions dashboards operate? Find and View

12. This chapter looks at the proposed requirements on trustees or managers of pensions schemes in relation to “find requests” and “view requests.”

13. It outlines how schemes must be ready to receive find requests from the digital architecture, complete matching to identify whether information held in the find request matches with an individual’s pension and return a pension identifier. It also sets out how intermediaries could be used to fulfil a scheme’s duties to return an individual’s data.

14. Chapter 3 further outlines details of ‘view data’ including how, and how quickly we expect schemes to return this information to individuals, and how long we expect schemes to have to return administrative data and value data. It also sets out how management information would need to be reported to regulators and MaPS, so they can monitor compliance and ensure that dashboards are delivering a good service.

Chapter 4: Connection: What will occupational pension schemes be required to do?

15. This chapter includes our proposals on what trustees or managers of occupational pension schemes must do to prepare to connect to the digital architecture, and some of the ongoing responsibilities associated with being connected to it.

16. It proposes a deadline for schemes to connect to the digital architecture, which includes being able to respond to find and view requests. Schemes would have a duty to cooperate with requests from MaPS relating to connection, and would have to report certain information to MaPS, which will be set out in published standards. Schemes would have to comply with those standards, and any future updates to them.

17. Chapter 4 also sets out that schemes can connect before their deadline, at the discretion of MaPS and TPR. At that point, they would be required to conform with all requirements. It also sets out that small and micro-occupational pensions schemes can also connect should they wish to.

Chapter 5: Staging – the sequencing of scheme connection

18. This chapter provides information on the rationale that underpins the staging proposals and how analysis was used to determine the proposed order in which schemes will be required to participate in the provision of pensions dashboards.

19. It sets out the rationale for requiring schemes to connect to the digital architecture in a staged manner, including that the staging profile should prioritise schemes by the number of members they have, to maximise the level of member coverage in the shortest possible timeframe. It details the three staging cohorts: large schemes (April 2023 – September 2024), then medium schemes (October 2024 – October 2025), followed by small and micro schemes (expected from 2026, but not covered by the Regulations).

20. The chapter also sets out that State Pension information would be available from day one. It details how scheme size should be calculated and the types of schemes that would be out of scope of the Regulations. It includes proposals for hybrid schemes, collective money purchase schemes, new schemes and schemes that change size. It also proposes staging breaks and some limited flexibility around the staging deadline in specific circumstances.

Chapter 6: Compliance and enforcement

21. This chapter provides detail on the consequences for pension scheme trustees or managers that do not comply with the requirements in Part 3 of the Regulations. It sets out how the Regulations would provide TPR with powers to issue compliance notices, third-party compliance notices, penalty notices, and that financial penalties for individual dashboard-related breaches can be up to £5,000 if the person is an individual and £50,000 in other cases. All enforcement action relating to non-compliance with Part 3 of the Regulations would be at the discretion of TPR.

22. This chapter also explains that the Regulations have been developed to be consistent with existing data protection requirements set out in law, including the UK GDPR. Therefore, it would remain the responsibility of the Information Commissioner’s Office to investigate any breaches of data protection law and take the action it considers appropriate, in the usual way. The Regulations would not make any changes to this existing role.

Chapter 7: Qualifying pensions dashboards services (QPDS)

23. This chapter sets out the proposed requirements that pensions dashboard service providers would have to comply with to be a QPDS.

24. It proposes that they would need to connect to the specified digital architecture, conform to MaPS standards (or TPR standards with respect to reporting standards) and be FCA-authorised. Chapter 7 also sets out how dashboard providers will be monitored on their compliance with the Regulations and sets out the requirements on QPDS in relation to reporting and monitoring.

25. This chapter also discusses proposals on allowing data to be exported from dashboards, the approach to delegated access, and additional functionality on dashboards.

Timing of the legislation

26. We are seeking views through this consultation to inform the further development of the Regulations before they are laid before Parliament. Our aim is to lay the Regulations when parliamentary time allows.

27. There are also plans for other dashboard-related consultations led by different organisations, including the Financial Conduct Authority (FCA), The Pensions Regulator (TPR), Financial Reporting Council (FRC) and Pensions Dashboards Programme (PDP). Further details are at annex B.

Chapter 1: Overview of Pensions Dashboards

What is the purpose of the Pensions Dashboards?

1. With the shifting pensions landscape, low levels of understanding of pensions and increased responsibility on individuals, there is a need for a new way to help people keep track and re-connect with their pensions information in one place. Pensions dashboards will bring together an individual’s pensions information from across their pensions, including their State Pension. This will help improve awareness and understanding among individuals, reconnect them with any lost pension pots and transform how they think and plan for their retirement. By enabling easier access to pensions information, we envisage that pensions dashboards will change how people perceive some of the challenges that historically prevented them from pursuing advice and guidance. Building on the benefits of automatic enrolment, and by prioritising these schemes as part of our approach to staging (see chapter 5), dashboards can particularly help those who have historically been less likely to save for their pensions, including women, ethnic minority groups and disabled people, who are more likely to have these savings.[footnote 1] In this way we expect dashboards can have a positive influence from an equalities impact perspective.

2. Separate to these Regulations, as required under the Pension Schemes Act 2021, MaPS will develop and host its own pensions dashboard, situated within a newly developed retirement planning hub on the Money Helper website.[footnote 2] Other organisations will also be able to develop and host their own dashboards, creating scope for innovation and engagement amongst a broad range of people. These Regulations set out requirements to be met in relation to these dashboards, which will be known as Qualifying Pensions Dashboard Services if they meet all the requirements.

3. Pensions dashboards will tech-charge the pensions industry and bring it into the 21st century. The emergence of qualifying pensions dashboards will bring opportunities to reach individuals where they already interact with digital services and provide opportunities to engage people who prefer to use tools from organisations that they already have a trusted relationship with, such as their employer or bank. We expect that this will encourage people to take greater ownership of their pensions, whilst paving the way for future innovations across pensions and beyond.

4. We expect that pensions dashboards will provide an opportunity for engaged individuals to consider taking action to consolidate their deferred small pots. Dashboards can help to drive individual engagement and could support people in making better informed decisions about their retirement. This includes in relation to Pension Freedoms, where individuals have greater choice in what to do with their pension savings, and the fact that there is a growing proportion of people in money purchase schemes, who have more responsibility to plan and make decisions around their retirement.

5. Dashboards would offer the potential for future innovations as they develop and become more sophisticated, which could better support people in planning their retirement, and managing their pensions more effectively. We may in future seek to include modelling tools as well as explore the potential to facilitate member-initiated transfers or consolidation, subject to any necessary consumer protections and legislative requirements. However, as we set out in the Government’s previous consultation on dashboards[footnote 3], a phased approach is important, especially given the scale and complexity of this project. During this first phase of dashboards these functions will not be in operation and are out of scope of these Regulations. Any recommendation to Government to make future changes such as these would need to be informed by ongoing user testing.

How will dashboards work?

What are dashboards?

6. Pensions dashboards will be online platforms for individuals to access information about their pensions in one place. Pensions Dashboards will bring together information from multiple sources and will include information on their State Pension and accrued and projected values of their pensions.

7. Seeing this information all together, in one place, will allow individuals to better understand their pensions and may support their planning for retirement.

How dashboard interactions will work for people - what will the process be?

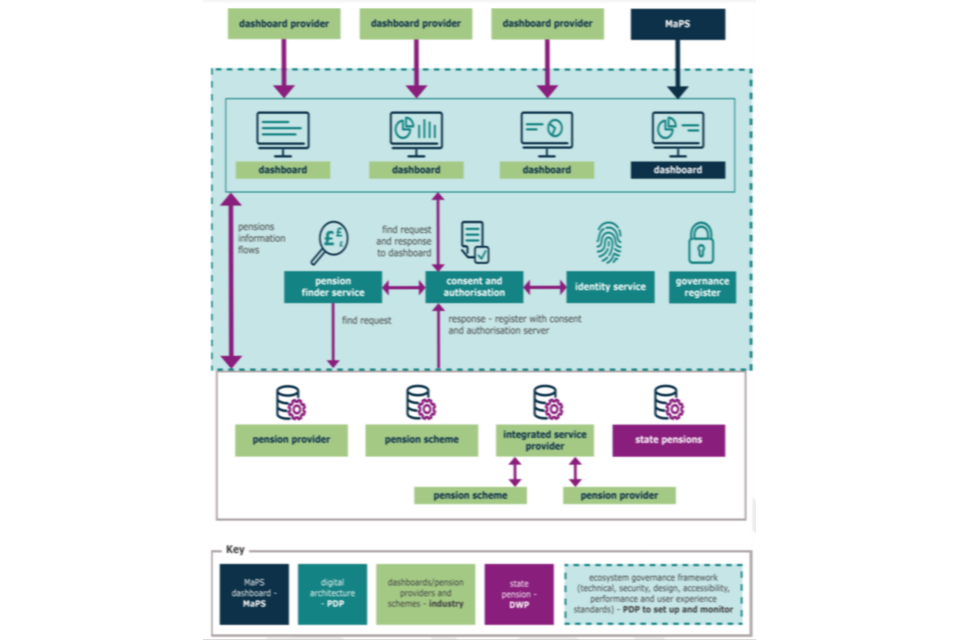

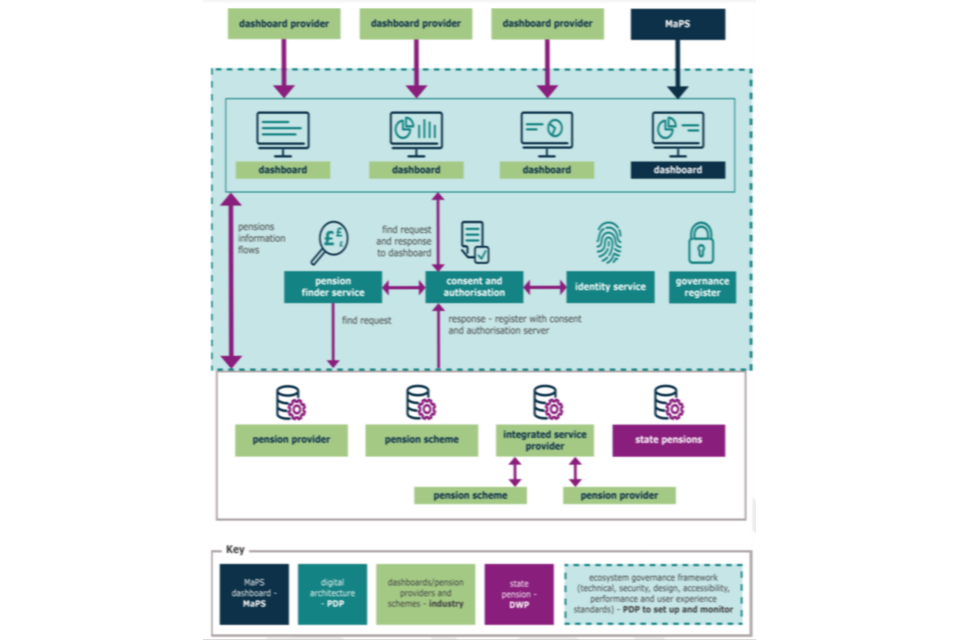

8. The diagram below outlines how, by accessing a dashboard of their choosing (whether this is a qualifying pensions dashboard service, or the MaPS dashboard), an individual will be able to make a request to find and subsequently view their pensions information.

9. An individual will start their journey by submitting a request to find their pensions information. To keep individuals’ data safe, an identity service will confirm the individual is who they say they are. Furthermore, via the consent and authorisation service, the individual must also provide consent for their information to be used to perform the search on their pensions and authorisation for schemes to send the pensions information to the dashboard of an individual’s choosing for them to view. At any point, an individual can withdraw their consent.

10. At this stage, the pension finder service takes over. The pension finder service does not hold any pensions data. It acts as a switchboard sending the individuals find request to all pension schemes.

11. For each match found, a pension scheme will register a Pensions Identifier (PeI) with the consent and authorisation service. This does not include pensions data but acknowledges that there is a match. Once this has been confirmed, an individual can request to view their information and the individual’s dashboard will pull the data directly from the pension scheme for the individual to see (or someone to whom an individual has delegated access – see chapter 7 for further information).

12. Overseeing this process is a governance register. The governance register will work to ensure that the dashboard ecosystem (see glossary) is kept safe and that the required security and performance standards are met.

13. For further detail on the various components of the pensions dashboard digital architecture, please see annex B. There is also further detail on the various interactions that take place between an individual and components of the digital architecture when processing both find and view requests within the UK data protection legislation section of chapter 3.

How dashboard interactions will work for individuals – consumer protection

14. Consumer protection can be defined as action to minimise consumer detriment, including both prevention of harm, and access to redress for individuals if things do go wrong. We expect that the potential risks of scams, mis-selling or individuals making poor decisions about some, or all, of their pensions will be mitigated to some extent by our consumer protection measures which include MaPS standards and any relevant FCA rules which are in development. Ensuring these measures are in place will aim to instil trust and confidence in the pensions dashboards initiative.

15. For many people, a pension is one of the most significant financial investments that they will make throughout their life, so it is essential that pensions dashboards are safe and secure. For that reason, consumer protection is central to our pensions dashboards plans.

16. Consumer protection was of particular interest to Members of both houses during the passage of the Pensions Schemes Act 2021. While very supportive of pensions dashboards generally, in the House of Lords in particular, there was concern with the idea that transactions might one day be allowed to take place on dashboards. Also, many parliamentarians felt that there should be just one non-commercial dashboard (as opposed to multiple commercial dashboards) to reduce the risk of scams, miss-selling, or potential for confusion. There was also a lot of interest in data security via dashboards and the application of data protection legislation.

17. As set out in the response to the Government’s consultation, published in April 2019, there are three overarching design principles which underpin our approach to pensions dashboards with an aim to maximise consumer protection:

a. Put the consumer at the heart of the process by giving people access to clear information online.

b. Ensure consumers’ data is secure, accurate and simple to understand, minimising the risks to the consumer and the potential for confusion.

c. Ensure that the consumer is always in control over who has access to their data.

18. The key principle of our consumer protection proposal is that people using dashboards will have full control of who has access to their data. This includes:

a. Access to the data should be available only to the individual unless specific consent for delegated access is given (regulation 7(5)(b)).

b. Qualifying dashboard operators should not be allowed to access the data for any purpose unless they have the specific consent of the individual. Although caching (in other words, temporary storage of) the data on behalf of the individual (who must still give their consent) needs to happen for display purposes, the individual should be the only entity who can see their data on dashboards.

c. As provided for in regulation 7(5)(c), the individual has the right to withdraw their consent at any time. The dashboard provider should tell them how to do this, it should make it easy, and it should act on requests as soon as possible.

19. Several design principles were also included that may be reviewed in future, subject to advancements in technology and the development of dashboards. This included that the storing of pension data beyond caching at dashboards would not be allowed; and that there would be no aggregation of an individual’s information in any part of the ecosystem other than by the pension scheme or an Integrated Service Provider operating on their behalf and in respect of the benefits built up in that scheme.

20. Individuals will be provided with privacy information about the collection and use of their personal data. They will also be asked to provide consent for the dashboard providers to process their personal data in order to search for their pensions.

21. The proposals in this consultation document uphold the rights and freedoms enshrined in data protection legislation. They also mitigate the risk of consumers being confused or misled into making detrimental decisions.

Proposals

22. Our proposals to place specific duties on the trustees or managers of schemes and on Qualifying Pensions Dashboards Services (QPDSs) are intended to mitigate much of the risk identified above.

23. Chapter 2 outlines the ambitious data requirements that we propose placing on trustees or managers of pension schemes and will make clear how our approach puts the interests of users first, helping them to get the most from dashboards through the provision of information designed to meet their needs. Regulation 22(5)(a) would place a requirement on trustees or managers to check with MaPS that the individual to whom the find request relates has given consent to their view data being provided to their dashboard. This prevents an individual’s pensions information being sent to the wrong person. Furthermore, we have proposed a requirement that no information about State Pensions, other than that provided by DWP, should be presented on dashboards. The Government believes that this is important to ensure that any information that users view about State Pension is accurate, complete, and relevant.

24. In chapter 7, we are proposing specific requirements on dashboard providers for them to become a QPDS. Ensuring that QPDSs only use the specified digital architecture means that an individual is within all of the protections that the ecosystem offers. Protections including adhering to all MaPS standards, having permission under Part 4A of the Financial Services and Markets Act 2000 (referred to as obtaining FCA authorisation throughout this document), and ensuring that QPDS providers are undertaking their requirements in reporting and monitoring are all paramount in seeking to ensure that individuals using QPDS are protected as much as possible.

25. QPDSs must adhere to all design standards set out by MaPS. The design standards will cover matters such as the way the view information is presented to the individual on the dashboard. Design standards will be developed through user centred testing and user centred design, which will include standards to ensure accessibility for dashboard users. How QPDSs display the view data will be controlled by MaPS’ design standards. This is to ensure that values are presented consistently, accurately, and clearly, and that information is not misleading. We have therefore proposed mandating that the view data would need to be displayed in accordance with the design standards which will be published by MaPS. This also means that the values should not be manipulated for presentation beyond the relatively restrictive bounds set out in regulations (where design standards will detail the circumstances where data may be added up, displayed graphically or displayed in alternatives to annual amounts). Standards will include information around the messaging which would need to accompany the return values and the way the return values must be presented. Our aspiration is that restricting the way in which view data can be presented and manipulated on dashboards will help to build trust and confidence in the information shown.

26. In restricting the ways in which QPDSs can use and present view data, care needs to be taken not to inhibit other aspects of user experience, such as the enabling of innovation by QPDSs, and the ability of individuals to make other use of the data provided on their dashboards. Although this is not a part of the accompanying Regulations, we have set out in this consultation ways in which a balanced approach might be taken, so that pensions dashboards themselves retain a relatively consistent approach to the use of data. However, QPDSs are not prevented from offering people the ability to export their data away from the dashboard, either to another page within the QPDS provider’s system, or beyond. Chapter 7 provides further detail on this.

27. In addition, any entity that wishes to provide a qualifying pensions dashboard must obtain FCA authorisation to do so. Authorisation is an important mechanism through which the FCA can prevent the occurrence of harm to individuals, barriers to effective competition, and damage to market integrity.

28. An application for FCA authorisation will not be considered until the applicant is considered able to comply with the requirements set out in the Regulations which include requirements to comply with various MaPS standards. It is proposed that confirmation of this ability to comply will be provided to the FCA by MaPS, informed for certain standards by assurance from a third-party auditor.

29. The authorisation process ensures that all FCA regulated firms meet common sets of minimum standards (Threshold Conditions). They must meet these requirements before the FCA will authorise them and are expected to continue meeting the threshold conditions, as well as the FCA principles for business, and relevant Handbook rules (including any the FCA may set specifically for dashboard providers) for as long as they are authorised. If they fail to do so, the FCA can take a range of actions, including varying or cancelling providers’ FSMA authorisation.

30. It is vital that people accessing their pensions information through a pensions dashboard can have trust in the safety and security of the service and their data. That is why MaPS, through the PDP, will facilitate the delivery of a secure digital ecosystem, enveloped in a robust framework of DWP and regulator-led regulation. In addition, people using dashboards will be fully in control of who has access to their data.

31. The whole process of accessing information on dashboards rests on the consent of the individual using dashboards. The nature of an individual’s consent must be clear, explicit, understood, and informed. It cannot merely be perceived as a tick box condition of usage. The PDP will articulate this more clearly in their UK GDPR publication due to be published in the summer of 2022.

32. We passionately believe that pensions dashboards will have wider, positive effects on consumer protection by increasing engagement and building understanding. It is our view that dashboards will help to protect people from potential poor choices and non-engagement associated with a lack of awareness. Pensions dashboards will offer individuals a better experience of engaging with their pensions, in a single place online which, in turn, is intended to help them to make better informed choices.

What is required of pension schemes and dashboard providers?

Compliance with legislation and standards

33. As we will outline throughout this consultation, these Regulations set out the requirements to be met by both pension schemes and dashboard providers. The Regulations would provide that for pension schemes, they must:

a. Connect to the digital architecture. Further information on the digital architecture is set out in annex B.

b. Complete matching to identify whether information held in the find request matches with an individual’s pension and return a pension identifier.

c. Return view data to individuals. Chapter 2 outlines further details.

d. Comply with standards to meet their legislative duties.

34. We propose that for providers of Qualifying Pensions Dashboard Services (QPDSs), the regulations will require them to:

a. Connect to the specified digital architecture.

b. Be FCA-authorised.

c. Comply with standards to meet their legislative duties.

35. Further details are set out at chapter 7: Qualifying Pension Dashboard Services.

36. As made clear above, a clear duty for both pension schemes and dashboard providers is to comply with standards. Given this, it is important to understand what the standards are, the role that they will play, and the mechanisms for their oversight and approval which is set out in the section below.

The role of standards

37. Throughout this consultation, we will set out the requirements in the Regulations that we propose placing on trustees or managers of occupational pension schemes and QPDSs. In some parts of the Regulations, we propose requiring compliance with standards, which will be set initially by MaPS (and in limited cases, TPR).

a. Regulation 4 outlines our proposed approach to the oversight of standards.

b. Part 2 – Prescribed requirements for qualifying pensions dashboard services sets out where QPDSs must adhere to standards to fulfil their dashboard duties.

c. Part 3 – Requirements relating to trustees or managers of relevant occupational pension schemes, Chapter 2 Requirements relating to the provision of pensions information outlines where trustees or managers of schemes must adhere to standards in relation to the provision of pensions information.

38. Standards provide further detail on how schemes and QPDSs must comply with their legislative duties. Because of their importance in the operation of pensions dashboards, compliance with them will be mandatory. Standards provide a greater level of technical or operational detail that would not be appropriate to set out in Regulations. It is also likely that standards will need to develop more regularly and rapidly than changes to Regulations could allow for.

39. Given the potential for regular iteration, it is not considered to be an appropriate use of parliamentary time for Parliament to be considering regular changes to standards, particularly when this could impact on the effective operation of dashboards. For that reason, we have proposed (as set out in annex A: background in this document and in regulation 4) an approval process that requires Secretary of State approval of standards.

40. We propose that MaPS (and in one limited case set out below, TPR) should set standards covering the legislative requirements. We expect there will be a range of standards covering:

a. Data – data standards will outline the data elements and the formatting requirements that trustees or managers must follow when returning data, including contextual data to accompany value data, to members via dashboards.

b. Technical – covering matters such as how the pensions dashboards service must connect to MaPS and pension providers, including:

i. The connectivity mechanisms to be used (i.e. APIs).

ii. The protocols for authorising the sharing of information between pensions dashboards services, the trustees or managers of occupational pensions schemes, the Secretary of State, and MaPS.

iii. How schemes will be required to generate and register PeIs.

c. Design – design standards will cover elements of how the State Pension and view data should be presented on the dashboard, messaging, signposts and guidance.

d. Reporting – reporting standards will cover the specific details of what information we expect schemes and QPDSs to keep and report to MaPS and regulators in relation to monitoring compliance and performance. In limited circumstances, these reporting standards may be set by TPR as well as or instead of by MaPS.

41. A code of connection will address how to connect to the digital architecture and will incorporate the following standards:

a. Security – covering matters such as the connection points and minimum information assurance the provider must provide to MaPS for connection purposes.

b. Service – providers must follow service standards which will cover things like interoperability, software conformance, maintenance, and outage handling.

c. Operational – providers must follow operational standards which will cover things like, the process for raising issues, escalation processes, on-boarding processes, and remediation routes for failures.

42. Each chapter will outline in more detail where and why we propose referring to standards. It is important to first set out how we anticipate ensuring the effective oversight and monitoring of the standards.

Oversight and approval of standards

43. It is crucial that we have an effective mechanism for the oversight and approval of standards. Below, we set out how we propose the Regulations would ensure that standards are effectively scrutinised and agreed, in order to ensure they are effective.

| Oversight and approval of standards | |

|---|---|

| Standards referred to | In the Regulations we have referred to each of the standards that would be set by MaPS or TPR. There are several types of standards that have been referred to in the Regulations: connection and security, technical, service, reporting, design, Pensions Identifiers (PeIs), and data standards. These standards would apply to the trustees or managers of occupational schemes or to QPDSs, as indicated: - connection, technical, security, operational and reporting standards would apply to both schemes and QPDSs - design standards are for dashboard providers only - technical and data standards are for trustees or managers of schemes only to consider |

| Compliance with standards and the effect of non-compliance | In relation to the code of connection and technical standards, compliance is essential because failing to comply with these poses a risk to the digital security of the dashboard ecosystem. MaPS, through the digital architecture, will be able to detect non-compliance with the connection, technical, security and operational standards. Failure to adhere to any of these standards would lead to deregistration from the Governance Register and disconnection from the architecture. This would be automatic and is proportionate given the importance of protecting the safety of the dashboard ecosystem. TPR will also be able to take enforcement action if schemes fail to comply with any of the requirements in Part 3 of the regulations. QPDSs would not be able to operate unless they are compliant with these standards as well as meeting the other requirements that apply to pensions dashboards services or their providers. In relation to reporting, design, technical and data standards, the risk of non-compliance for both QPDSs and occupational pension schemes poses a threat to the credibility of the dashboard ecosystem rather than its security. Compliance is essential to ensure that dashboards are successful and failure to adhere to any of these standards by trustees or managers of occupational pension schemes would be a breach of regulation requirements that may result in a compliance or penalty notice being issued by TPR. For QPDSs, if MaPS notifies the FCA that a dashboard provider is no longer complying with these standards and therefore no longer meets the criteria of being a QPDS, the FCA can de-authorise the provider. Further detail about the FCA’s role is set out in chapter 7. As we set out, we are proposing an additional function whereby a third-party auditor is engaged by dashboard providers to assure MaPS of adherence to Design and Reporting standards, where relevant, at the outset and on an annual basis thereafter. It will also be capable of being wider than just for reporting and design where necessary. |

| Oversight and review of standards | To ensure that the setting of standards is appropriate, we think it is crucial that the Secretary of State has oversight powers. We propose that the Regulations would require the Secretary of State to approve the first set of standards and any subsequent amendments to standards which contains amendments that are more than minor technical changes. |

| Interplay between DWP legislation | The Pensions Act 2004 (as amended by the Pensions Scheme Act 2021) will provide powers to set requirements to comply with standards relating to pensions dashboards. The standards referred to in this consultation for the purpose of delivering pensions dashboards are referred to in Regulations that would be made under the Pensions Act 2004. |

44. A provision at the end of Part 1 of the draft SI indicates that the Secretary of State must approve any standard referred to in the Regulations before it is published for the first time. Where subsequent changes are made that MaPS view as going beyond minor technical changes, they must also be approved by the Secretary of State. We anticipate that there are likely to be several situations where a change to standards will require re-approval by the Secretary of State because the change goes beyond something that is minor technical. Examples of these type of changes could be:

a. Substantial (i.e., incurring significant resource to implement) technological developments or changes in the way the schemes are required to connect and receive or return information. For example, an upgrade of the API standard to a newer technology stack, or the use of new security software.

b. A substantial change to business processes required to meet duties. For example, additional reporting or record keeping requirements that means schemes are required to provide significantly more information to MaPS or the regulators for the monitoring and detection of non-compliance.

45. We expect MaPS (or TPR with respect of reporting standards) to consult on the first set of standards before approval is sought from the Secretary of State. Where it is determined that Secretary of State approval is required for a change in standards because the proposed change goes beyond a minor technical amendment, it is expected that MaPS will consult on the change before the Secretary of State would approve the revised standard. Flexibility in MaPS’ consultation approach is important to avoid unnecessary burden. It is likely that more minor changes to standards, or changes that are significant but may only affect a few parties, would be preceded with a lighter-touch or more focused consultation.

46. As a matter of course, we expect that MaPS would engage closely with the regulators (FCA / TPR) in agreeing changes to the standards and the deadlines by which the parties to whom they apply would be expected to comply with these changes. The PDP will publish information on standards shortly.

Consultation questions

Question 1: Do you have any comments on any aspect of the Regulations or consultation, that is not covered in the following consultation questions?

Question 2: Do you agree with the proposed approach to the oversight and approval of standards?

Chapter 2: Data

1. This chapter refers to Chapter 2 of Part 3 of the Regulations, along with Schedule 3. It explains the policy rationale and proposed requirements (as contained in the Regulations) for the proposed data elements that would be central to the operation of dashboards. This includes find data – to be used for matching savers to their pensions– and view data, which trustees or managers of schemes return to dashboards.

2. The following table describes in broad terms the key elements within this consultation chapter, and the proposed requirements made in the Regulations.

| Chapter sub section | Summary of policy aims / proposed legislative requirements |

|---|---|

| Find data | Find data consists of personal data provided by individuals to the central dashboards architecture and sent by the Pension Finder Service to schemes, that enables schemes to search their records for a match. Some find data elements would be verified by the Identity Service, and some will be self-asserted by the individual using the dashboard. Trustees or managers would not be compelled to hold particular data for matching purposes, and schemes may use different data elements to search for a match. |

| View data | View data is pensions data that is returned to the dashboard by pension schemes once the individual’s identity has been verified and a ‘view’ request has been made (by the individual or by the party to whom they have delegated access at the Consent and Authorisation Service). View data is the collective term to describe administrative data, additional signpost data, and value data. |

| Administrative data | Administrative data is broken down into three categories: - information about the pension scheme - information about the scheme’s administrator - information about the employment that gave rise to the pension All schemes would need to provide administrative data, with the exception of certain employment details, which schemes would need to provide if they hold it. Trustees or managers would be required to be able to provide administrative data to a new member who seeks view data within 3 months of joining the scheme no later than three months after the member joined the scheme. Administrative data should be returned to individuals by trustees or managers immediately after a request is received. |

| Signpost data | Trustees or managers would need to provide a website address to individuals where they can access (where these apply): - information on member-borne costs and charges - the scheme’s statement of investment principles - the scheme implementation statement The Regulations propose that signpost data should be returned to individuals by trustees or managers immediately after a request is received. |

| Value data | Value data is the collective term used to describe accrued and projected pension values. The methodology to be used to calculate certain values in money purchase pensions is set out in Actuarial Standards Technical Memorandum 1 (AS TM1), which ensures parity with annual statements provided to most individuals with these pensions. The Financial Reporting Council (FRC) will be consulting on changes to AS TM1 which seek to improve the consistency of projections. The following value data should be returned to individuals by trustees or managers within the time scales regulation 25 proposes. |

| Value data for money purchase schemes | |

| Accrued pension data | Schedule 3, Part 1 of the Regulations proposes that: For money-purchase benefits, trustees or managers, would be required to provide individuals with the value of the member’s accrued rights under the scheme, which may be a value generated for a benefit statement within the last 12 months or a calculation performed within the last 12 months. Trustees or managers would also need to provide individuals with the above value expressed as an annualised income based on the same illustration date. The calculation of this figure should follow the methodology set out in AS TM1, omitting elements which concern future contributions and fund growth. This value would only be required after the first statutory money purchase illustration (SMPI) is produced, after October 2023, as set out in the projections section below. |

| Projections (active members only) | Schedule 3, Part 1 of the Regulations proposes that: - for money purchase benefits, trustees or managers would be required to provide individuals with an illustration of what their pension might be worth in retirement, as an income, and as a projected pot value if it is held by the scheme. This would incorporate the current value along with any future contributions and anticipated investment returns. The Regulations would require trustees or managers to follow the relevant guidance in AS TM1. The FRC intend to consult on changes to AS TM1 in early 2022, with changes due to come into force for SMPIs from October 2023. The Regulations will only require money-purchase schemes to provide projections from the point at which an SMPI has been produced for the individual, after October 2023 - there are several exemptions, outlined in Schedule 3, Part 2 of the Regulations, that mean certain individuals with money purchase benefits would not receive a projected value on pensions dashboards. These exemptions largely reflect the existing exemptions set out in The Occupational and Personal Pension Schemes (Disclosure of Information) Regulations 2013 (‘Disclosure Regulations’) under regulation 17, paragraph 6. Individuals would still receive accrued pension information in these circumstances |

| Value data for non-money purchase schemes | |

| Accrued pension data | For non-money purchase benefits, Schedule 3, Part 1 of the Regulations proposes that trustees or managers would be required to provide active scheme members with the amount of pension that would be payable if pensionable service were to have ended at the illustration date, presented as if the individual has reached normal pension age, calculated in line with scheme rules. The value provided must be from a statement provided within the last 12 months, or from a calculation performed in the last 12 months. For deferred members, we are proposing that trustees or managers of non-money-purchase schemes provide members with a value that has been revalued to the illustration date, presented as if the individual has reached normal pension age. |

| Projections | Schedule 3, Part 1 of the Regulations proposes that: - for non-money purchase benefits, trustees or managers would be required to provide active members with an illustration of their pension in retirement - calculations made by these schemes should be made following scheme rules, assuming that the member continues in pensionable service until normal pension age, and assuming no increase in the individual’s salary - the projected value would be required from non-money purchase schemes from the point at which they connect to the digital architecture |

| Other data requirements | |

| Cash balance schemes | The proposals for cash balance schemes, as set out in Schedule 3, Part 1, are for members to be provided with an accrued pot, calculated in the same way as the accrued value for non-money purchase schemes, but presented as a pot, and an annualised accrued value which applies AS TM1 assumptions, minus elements on future contributions and growth, to that accrued pot. We also propose that these schemes provide a projected pot value and a projected income value, with the projected pot value built up in the same way as set out for non-money purchase schemes. The annualised accrued value would only be required from October 2023. |

| Collective money purchase schemes | As proposed in Schedule 3, Part 1, collective money purchase schemes, also known as Collective Defined Contribution (CDC) schemes would be required to provide their active members with an annualised accrued value, as well as a projected value. Deferred members would be provided with an accrued value. These values reflect the values set out for CDCs in the amendments to the rules on disclosure proposed in the Occupational Pension Schemes (Collective Money Purchase Schemes) (Modifications and Consequential and Miscellaneous Amendments) Regulations 2022, which are due to be laid in March. |

| McCloud judgement and Public Service Pension Schemes | Schedule 3, Part 1 of the Regulations propose that the information requirements for public sector pension schemes may include two alternative values for accrued and projection requirements to cater for those schemes and individuals affected by the McCloud judgement and Deferred Choice Underpin (as defined in the glossary). |

| Hybrid schemes | Trustees or managers of hybrid schemes (schemes which offer both money purchase and non-money purchase benefits) would provide the same data elements as other occupational pension schemes, as relevant to that element of the hybrid pension. Where a benefit is a mix of money purchase and non-money purchase benefits, and the calculation for value data is made with reference to both benefit types, then only one value is returned. The value returned should be that of the greater benefit. |

| State Pension information | Regulation 9 proposes specific requirements for what State Pension data is to be shown and the messaging that would accompany this. |

Introduction

3. For dashboards to be a useful tool, and to support the operation of finding and displaying an individual’s pensions information, both trustees or managers of relevant occupational pension schemes, and individuals using dashboards must provide data. Individuals will need to provide personal data, ‘find data,’ which will allow trustees or managers to search their records for a match, and, if successful, trustees will subsequently return scheme data for that individual, ‘view data.’

4. The view data which we are proposing to require trustees or managers to provide is broadly within the scope of the Disclosure Regulations 2013, and for the most part, is available to individuals on statements issued annually or on request – although as this chapter will note, there are areas where we propose additions to ensure that the needs of individuals using dashboards are met. Throughout this chapter we have highlighted where proposed information requirements go beyond the scope of the Disclosure Regulations 2013. Chapter 3 will address the legislative requirements on trustees or managers of schemes in relation to pensions data and chapter 7 will address legislative requirements on QPDSs.

5. The Data Standards Usage Guide, published by the Pensions Dashboards Programme in December 2020 gives an overview and description of the individual data elements that we expect to see on dashboards. An updated Data Standards guide will be published by the Pensions Dashboards Programme around the same time as this consultation to reflect the requirements proposed in the Regulations and described in this consultation. Data returned by trustees or managers to dashboards would show individuals information about the pension scheme, the pension scheme administrator, the employment(s) linked to the pension scheme, if known, and accrued and projected retirement income values.

6. Dashboards would receive the pensions details back from the pension scheme following a view request made by an individual using a dashboard. The data that is sent is then presented on the screen to the individual, and the dashboard can cache this data for the duration of the individual’s session. If the individual closes their browser or logs off their dashboard (i.e., their session is closed) then that data would no longer be available.

7. Subject to the parameters set out in design standards, dashboards would not alter the data that is sent from the pension scheme but would be able to read/see the data, which they would have permission to do based on the individual’s consent to the access policy. A qualifying dashboard provider should choose the most appropriate lawful basis for its processing of view data. It may be that user consent is not required. The provider should also ensure that it complies with MaPS design standards. This will enable the dashboard to select the correct values to display to the individual and present any accompanying messaging. The individual would consent to a dashboard of their choice being able to retrieve their pension details on their behalf and display them on the dashboard.

Find data

8. Find data consists of personal data provided by individuals to the digital architecture and is sent to schemes by the Pension Finder Service within the digital architecture (a more detailed explanation can be found in the find and view chapter), to allow pension schemes to match individuals against their records. Information such as the individual’s name, date of birth and address would be verified by the Identity Service within the dashboards architecture, and other elements – NI number, email address, mobile number – would be self-asserted by the individual. Information related to the identity of the individual who is the subject of the request would be provided to schemes for the purposes of locating pension records only.

9. We have not proposed any requirements on trustees or managers to use particular data for matching purposes. We believe they should instead be given discretion over which data elements they use to suitably search their records for a match. Schemes would, however, need to ensure they take reasonable, diligent steps to search for matches and minimise the risks of data breaches or, conversely, not returning pensions matches. In this, trustees or managers will need to have regard to any guidance issued on matching by TPR.

10. Find data would be sent to schemes (from the Pension Finder Service) in a format described in standards published by MaPS, but we have not proposed any requirements on trustees or managers to hold it in the way described. This means that schemes could process the data to re-format it and enable them to search for a match in a format more akin to their systems, the same of which is true for an integrated service provider who may be undertaking these duties on the trustees’ behalf.

View data

11. ‘View data’ refers to the data that the occupational pension scheme would need to return to the dashboard and is made available to the individual once a request for information has been received, and the identity of the individual authenticated. View data would need to be returned to the individual using the dashboard in the format to be outlined in MaPS standards. View data that schemes would be expected to supply is split into three categories: administrative data, additional signpost data, and value data, which are described in more detail below.

12. We wish to give trustees or managers discretion as to how the view information should be held in their internal systems. However, this information would need to be sent to dashboards in the format outlined in MaPS standards within set time limits.

Administrative data

13. Regulation 23 outlines the administrative data that would need to be sent to an individual by trustees or managers when returning their data following a view request. It is split into three categories:

a. Information on the pension scheme – which would need to be provided by all occupational pension schemes to which the Regulations apply and gives details about the pension scheme. Proposed data elements to be provided by trustees or managers in respect of information on the pension scheme are outlined in regulation 23(1)(a).

b. Information on the scheme’s administrator – which would need to be provided by all occupational pension schemes to which the Regulations apply and gives details about the administrator of the scheme. Proposed data elements to be provided by trustees or managers in respect of information on the scheme’s administrator are outlined in regulation 23(1)(b).

c. Employment details – which would need to be provided by trustees or managers only if they hold the information and gives details about the employment that gave rise to the pension. Proposed data elements to be provided by trustees or managers in respect of employment details are outlined in regulation 23(1)(c).

14. We propose that an additional data field is provided as part of administrative data, which is the date of birth of an individual. This is being proposed as PDP user testing has suggested that qualifying pensions dashboards be able to display not only the retirement age, but the number of years the individual is away from it. The inclusion of the date of birth as a data field is for display logic purposes only – to enable dashboards to present the time to retirement: the date of birth itself would not be shown.

15. The proposed requirements to provide information on the pension scheme exceed what is currently required by trustees or managers under the Disclosure Regulations 2013. However, they have been included on the basis that this information will not be difficult for trustees or managers to provide, and the content is unlikely to change often. The administrative data elements would be useful in helping individuals using dashboards to understand more about their pension scheme and administrator, as well as providing information to enable them to get in contact.

16. Under the Disclosure Regulations 2013, there is a possibility that some new scheme members may not receive information about their pension via a benefit statement for nearly two years. While it would be reasonably rare for a member to have to wait nearly two years, it would be possible if an individual joined a scheme just after the most recent statement cycle, and then must make a full year of contributions before receiving information. However, we feel that it is reasonable for new members to receive administrative data (pension scheme information, administrator information, and employment details) on dashboards before this time. Regulation 23(3) proposes that trustees or managers would be required to provide this information to new members in response to a dashboard request no later than three months after the member joined the scheme. Despite this proposed requirement going beyond current Disclosure Regulations 2013, we feel it is reasonable and proportionate as this information should be readily available and consistent.

17. We envisage that design standards set out by MaPS will provide QPDSs with wording to show on dashboards to inform the individual using the dashboard that they may not see their pension information displayed if they are very new to a scheme.

Signpost data

18. Signpost data, which are proposed at regulation 24, would need to be provided, where applicable, by relevant occupational pension schemes by way of a website address, where individuals can see:

a. Information on member-borne costs and charges.

b. The schemes’ statement of investment principles.

c. The scheme’s implementation statement.

Response times for administrative data and signpost data

19. As outlined in regulation 23(2) (for administrative data), and 24(2) (for signpost data), we have proposed that schemes should provide the administrative data and the signpost data immediately following receipt of a view request. Providing this information would not require schemes to complete calculations, does not change often and should be readily available.

Value data

20. Value data is the collective term used to define accrued pension values data and projected pension values data elements.

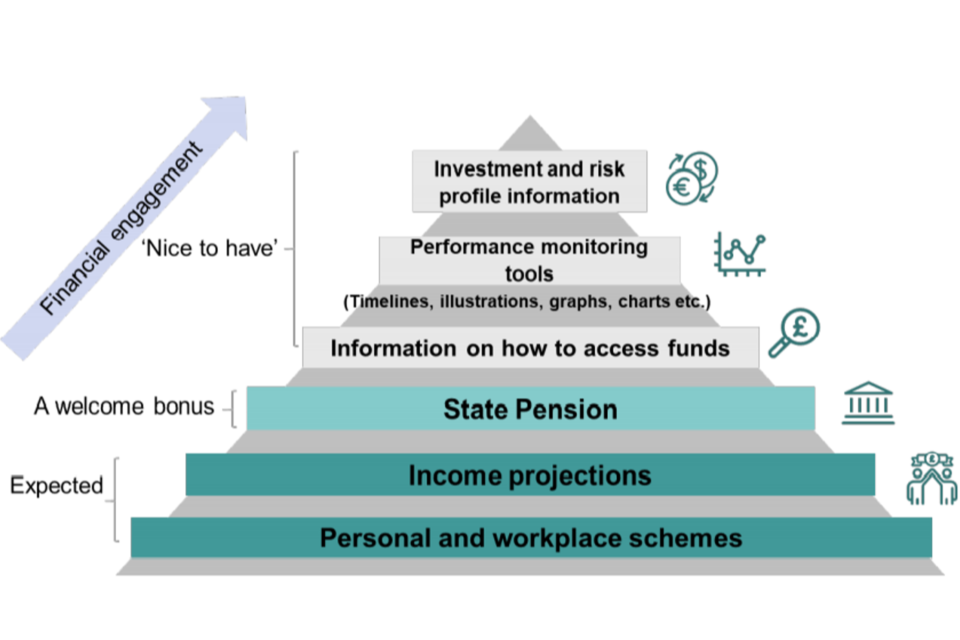

21. In the Regulations, we are proposing a requirement on schemes to provide both accrued and projected values, including values which represent annual income amounts.

22. Recent qualitative research undertaken by Ipsos MORI on behalf of MaPS has confirmed the findings of previous research and shows that prospective users expect to see information about income projections, as the pyramid diagram below shows. Research undertaken by 2CV in 2017 found that “most people don’t know the value of their pensions, yet they feel this is the most important piece of information they need to make decisions about them. The most pressing information is the current value and projected value for retirement.” [footnote 4] Research undertaken by DWP and Pension Wise as part of the 2018 Pensions Dashboards consultation found that a “user need” for dashboards is “to be able to see a full picture of all my pensions.”[footnote 5]

23. Additionally, the PDP published a Rapid Evidence Assessment of existing domestic and international literature on what prevents people from engaging with their pensions in June 2021. This assessment stated that “information on projected balances and income levels is generally found to increase engagement with pensions. Hence, providing information about current and future balances, as well as projected retirement incomes, is likely to enhance a dashboard”.[footnote 6]

24. PDP user testing suggested that while the presentation of income-based values is important in supporting understanding and engagement. The presentation of the suite of values together – that is, accrued and projected income values alongside each other – aids comprehension further. It is easier to understand what each means if the other is also present.

25. However, our engagement with industry has highlighted the challenges certain schemes will face in providing some of these values, and we are keen to strike the right balance between delivering an ambitious and successful dashboards service for individuals, whilst acknowledging the demands placed on schemes. We are keen to further understand the challenges for industry as well as the benefits for individuals.

26. We propose that pensioner members (as defined in the Pensions Act 1995), are out of scope of pensions dashboards. Given our policy position that pensioner members are not in scope, these members would not receive information on dashboards for the scheme(s) under which they are considered a pensioner. While this will lead to a number of scenarios whereby people do not see some or any of their pensions, we believe that if a member is taking benefits from a pension (or a portion of it), they are likely to be better engaged and aware of what that pension is worth. Benefits which would be out of scope include pensions where a tax-free lump sum has been taken, and money purchase pensions which have been annuitized or are in drawdown, including partial drawdown. We have proposed that members who have taken uncrystallised funds pension lump sums (UFPLS) payments who continue to be active or deferred members of the scheme remain in scope and would need to be provided with their accrued pension information, based on the remaining value of their pension.

27. Our proposals in this section would see dashboards present a static set of values, each calculated at a specific point in time, based on a scheme’s normal retirement date. This means that different entitlements in different schemes may be payable at different times. Where this is the case, and in line with MaPS design standards, dashboard providers will be required to communicate this clearly to individuals. Dashboards would present a simplified view of values, which would be indications, rather than detailed quotes. We believe this ensures values will be presented on dashboards that are meaningful to individuals, without disproportionate burden on industry to calculate and/or make available these figures. While the values would be a simplified view to aid readability, dashboards will present contextualising information which shows additional/linked benefits (e.g., additional voluntary contributions) and information about calculation or indexation differences, as required by MaPS data standards.

28. The response times section of the Find and View chapter (chapter 3) explains the proposed requirements for response times for money purchase and non-money purchase schemes in detail. As that chapter describes, the response times differ among scheme type and the information that is to be provided.

29. The below table summarises the value data elements from different schemes that we propose that members should see:

Value: Accrued

| Scheme/member type | Pot | Annualised |

|---|---|---|

| Money purchase | Yes – Schedule 3, Part 1, 1(2)(a) | Yes – Schedule 3, Part 1, 1(2)(b)(i) |

| Active non-money purchase | No | Yes – Schedule 3, Part 1, 2(1)(a)(i) |

| Deferred non-money purchase | No | Yes – Schedule 3, Part 1, 2(1)(b) |

| Active Cash balance | Yes – Schedule 3, Part 1, 3(1)(a)(i) | Yes – Schedule 3, Part 1, 3(2)(a)(i) |

| Deferred cash balance | Yes – Schedule 3, Part 1, 3(1)(b) | Yes – Schedule 3, Part 1, 3(2)(b) |

| Active CDC | No | Yes – Schedule 3, Part 1, 4(a)(i) |

| Deferred CDC | No | No |

| Hybrid | Follow rules to money purchase and non-money purchase pension elements. Where the benefit is a hybrid benefit, calculated with regard to both money purchase and non-money purchase benefits, schemes should return only one set of values. | Follow rules to money purchase and non-money purchase pension elements. Where the benefit is a hybrid benefit, calculated with regard to both money purchase and non-money purchase benefits, schemes should return only one set of values. |

Value: Projected

| Scheme/member type | Pot | Annualised |

|---|---|---|

| Money purchase | If held – Schedule 3, Part 1, 1(2)(b)(ii) | Yes – Schedule 3, Part 1, 1(2)(b)(iii) |

| Active non-money purchase | No | Yes – Schedule 3, Part 1, 2(1)(a)(ii) |

| Deferred non-money purchase | No | No |

| Active Cash balance | Yes – Schedule 3, Part 1, 3(1)(a)(ii) | Yes – Schedule 3, Part 1, 3(2)(a)(ii) |

| Deferred cash balance | No | No |

| Active CDC | No | Yes – Schedule 3, Part 1, 4(a)(ii) |

| Deferred CDC | No | Yes – Schedule 3, Part 1, 4(b) |

| Hybrid | Follow rules to money purchase and non-money purchase pension elements. Where the benefit is a hybrid benefit, calculated with regard to both money purchase and non-money purchase benefits, schemes should return only one set of values. | Follow rules to money purchase and non-money purchase pension elements. Where the benefit is a hybrid benefit, calculated with regard to both money purchase and non-money purchase benefits, schemes should return only one set of values. |

30. As the State Pension is not an entitlement in the same way that an occupational pension is, in that actual entitlement only exists to State Pension when an individual reaches their State Pension age and meets the relevant entitlement conditions, the value data to be provided is not referred to as “accrued” and “projected.” Value information provided in respect of an individual’s State Pension will be “current amount” and “forecast amount.”

31. Furthermore, non-money purchase schemes may return accrued and projected values as lump sums rather than annual amounts if this reflects the way in which that scheme operates. MaPS Data Standards will ensure that values returned in this format can be displayed to members.

Proposed Value data requirements

Proposed value data requirements for schemes providing money purchase benefits

Accrued pension data requirements

32. The proposed requirements on schemes providing money purchase benefits for pensions dashboards, which are specified at Schedule 3, Part 1(1) in the Regulations, are as follows:

a. Trustees would need to provide individuals with the value of the member’s accrued rights under the scheme (the accrued pot value), defined in the Regulations at Schedule 3, Part 1(5), at a date specified by the scheme trustees, but which must be no more historic than the accrued value as provided on a benefit statement in the last 12 months, or from a calculation done in the last 12 months, as regulation 25(3) states. This means that, should a scheme store it, it would be acceptable to use the value from the most recent benefit statement.

b. Trustees would also need to provide individuals with the above value expressed as an annualised accrued value, defined in the Regulations at Schedule 3, Part 1(5) as the value of a member’s pension benefits built up so far, expressed as an annual income. This would follow the methodology set out in AS TM1, omitting elements which concern future contributions and fund growth, and should be based on the same calculation date as the pot value. The value should be presented as if the member has reached normal pension age, based on the member’s current pensionable salary/earnings.

33. The accrued pot value (specified at ‘a’ above) is routinely provided by schemes providing money purchase benefits as part of a member’s annual benefit statement as mandated under requirements contained in the Disclosure Regulations 2013. The annualised accrued value, as stated at ‘b,’ is a new proposal for schemes offering money purchase benefits that is not currently required under Disclosure Regulations 2013. However, we believe this information will help individuals to contextualise and better understand the amount of pension they have accrued in a scheme, by seeing it as an income as well as a single pot value and being more understandable when presented against any state pension and non-money purchase entitlement.

34. Because for this new ‘annualised’ value for accrued entitlements money-purchase schemes will be reliant on methodology set out in AS TM1, which is to be updated by the Financial Reporting Council (FRC), we will not require these values to be provided to dashboards until such a time as an SMPI has been provided to the individual, from 1 October 2023, as Schedule 3, Part 1(1)(b)(i) states. If schemes wish to provide a value before that date using the current guidance, they may do, and must use the version of the AS TM1 guidance which is current at the time of the illustration. Plans for the FRC’s consultation on AS TM1 changes are set out in more detail as part of the projected values section below.

Pension projection data requirements

35. As proposed in Schedule 3, Part 1, trustees or managers would provide individuals with an illustration of their pension, projected to the scheme’s normal retirement date, expressed as an annual income. The projection would incorporate the current value along with any future contributions and anticipated investment returns, and methodology for calculating this, alongside the methodology to convert to an annualised amount will be set out in AS TM1.

36. Should a scheme store it, it would be acceptable to use the value from the most recent benefit statement with a calculation that follows updated AS TM1 methodology, as the following paragraphs set out. Additionally, should schemes hold it, we propose that trustees or managers also provide members of money purchase schemes with the ‘projected pot’ value, defined at also at Schedule 3, Part 1, para 5.