Pensions dashboards: Working together for the consumer

Updated 4 April 2019

Presented to Parliament by the Secretary of State for Work and Pensions by Command of Her Majesty.

December 2018

Cm 9719

ISBN: 978-1-5286-0826-8

Foreword

This government is supporting industry to deliver a private pensions revolution. In just 5 years, the proportion of eligible employees participating in a workplace pension rose from 55%, in 2012, to 84% in 2017. This increase has been especially marked for young people. Among those aged 22 to 29 years, participation increased from 35% to 79% over the same period. Automatic enrolment, launched in 2012, has driven this creating millions of new savers – with nearly 10 million eligible employees having been automatically enrolled. Since April 2018, these savers will now be contributing at least 5% of their eligible income into their private pensions pot, inclusive of employer contribution. Next year this will rise to 8%, including employer contributions. This is a transformation of our savings culture.

And we know more can be done to help people – young and old – get the most of their growing pensions. People lack confidence when faced with decisions about their finances, and engagement with pensions is low. A quarter of people aged 55 and over and who are retired say they do not know the size of their pension savings. Eight in 10 people with a defined contribution (DC) pension have not given much thought to how much they should be paying into it to maintain a reasonable standard of living when they retire[footnote 1] .

Pensions dashboards will offer people access to their information from multiple pensions at a time of their choosing. In the internet age, people expect information at their fingertips. When it comes to crucial information such as pensions, people should have access to accurate and useful information, which alongside guidance or advice will allow them to make the best choices for their investments and retirements. Harnessing the power of technology to give people easier access to their information will help them be more informed when planning their retirement – one of the most important financial decisions in a person’s life. They will need to be intuitive to use, and speak to the different needs of the 22 million individuals with private pensions wealth. This is why we have committed to facilitating industry to deliver dashboards.

For users, this means harnessing the innovation, ideas and expertise of industry to provide a choice of dashboards. At the same time, safeguarding the data and protecting consumers will be paramount. For taxpayers, this means industry foots the bill.

But government will facilitate this, as we said we would, which is why we are putting forward ideas in this report – from intensive engagement with industry – and consulting on our approach.

In the absence of a clear industry lead, we propose that there is a role for the new Single Financial Guidance Body (SFGB) to convene and oversee an industry delivery group to enable successful implementation. Under this model, we expect the SFGB to appoint an independent chair who will bring together a range of key players from industry, FinTech and consumer organisations in a similar approach to Open Banking. The SFGB will launch services to the public from January 2019.

We believe that these proposals can be supported by everyone across industry and political parties. But most of all, we believe it is an approach that will deliver the best outcome for consumers – innovation, choice and safeguarded data. Over time, industry led pension dashboards will transform retirement savings and pensions forever.

Guy Opperman MP

Minister for Pensions and Financial Inclusion

General information

Purpose of the consultation

This consultation is to seek views on a range of questions relating to the creation of pensions dashboards.

Start of consultation

3 December 2018

Respond by

28 January 2019

Territorial extent

This consultation applies to England, Wales and Scotland. It is envisaged that Northern Ireland will make corresponding legislation.

How to respond

An online questionnaire is available through Citizen Space. This is our preferred method for receiving responses. Responses and enquiries can also be sent to the email address or postal address set out below.

Pensions Dashboard team

Department for Work and Pensions

Level 1

Caxton House

Tothill Street

SW1H 9HA

Email: [email protected]

Your response will be most useful if it is framed in direct response to the questions posed, though further comments and evidence are also welcome.

Additional copies

You may make copies of this document without seeking permission.

Confidentiality and data protection

Information provided in response to this consultation, including personal information, may be subject to publication or disclosure in accordance with the access to information legislation (primarily the Freedom of Information Act 2000).

If you want information that you provide to be treated as confidential please say so clearly in writing when you send your response to the consultation. It would be helpful if you could explain to us why you regard the information you have provided as confidential. If we receive a request for disclosure of the information we will take full account of your explanation, but we cannot give an assurance that confidentiality can be maintained in all circumstances. An automatic confidentiality disclaimer generated by your IT system will not, of itself, be regarded by us as a confidentiality request.

Executive summary

Introduction

1. This publication responds to the department for Work and Pensions’ commitment to undertake a feasibility study looking into the key issues surrounding the delivery of pensions dashboards and report on its findings. It also outlines a set of proposals on which the department wants to hear your views. This will be used to inform how government can best facilitate industry to deliver dashboards.

2. A pensions dashboard is a service which will let people access their pension information in a single place online, in a clear and simple form. Putting individuals in control of their data, it will bring together their pensions information from multiple sources, which can then be accessed at a time of their choosing.

3. The government has committed to facilitating industry to lead the creation of pensions dashboards to deliver the best of industry innovation. Government is prepared to legislate to compel pension schemes to provide their data for dashboards, and to take steps to provide State Pension data via dashboards.

4. Industry is best placed to design, develop and own dashboards. However, government will help to convene a delivery group, comprising experts, industry and government, to facilitate implementation of the technology that will enable dashboards to operate. We propose that this group is convened and stewarded by the SFGB, which will help to ensure that industry safely and securely deliver their part in making dashboards happen. Government will also work with the regulators and industry to help ensure that industry meets its responsibilities to protect consumers.

5. We believe that multiple dashboards will improve choice for consumers, allowing them to use the dashboard that most meets their needs. However, these should exist alongside a non-commercial dashboard hosted by the SFGB, offering an impartial service to those who prefer it, or who may not be targeted by the market.

6. Putting individuals in control of how and when they access their data can help to increase awareness and understanding of saving for retirement. The technology involved in making dashboards, and the innovation that it will support, should act as an enabler to help increase consumer engagement, offering individuals a greater sense of ownership of their pensions. As dashboards are used to enable people to make informed choices, supported by guidance or advice, they can encourage more effective planning for retirement.

Background

7. The concept of a pensions dashboard has existed for some time but industry on its own has made limited progress in its delivery. Reflecting this, the Financial Conduct Authority (FCA) recommended in its Financial Advice Market Review in 2016[footnote 2] that government should challenge industry to make a pensions dashboard available to consumers by 2019. This view was echoed by government in its Budget that same year.

8. Following the Budget announcement in 2016, an industry-led Pensions Dashboard Project Group[footnote 3] was set up, sponsored by HM Treasury and managed by the Association of British Insurers (ABI). In April 2017, the group demonstrated a prototype for a dashboard, showing that the technology behind it can work. The industry Project Group continued independently of government with a research phase, publishing its findings in a report[footnote 4] in October 2017. This made a number of recommendations, including the need for a government-backed delivery authority to proceed. Since then there have been further publications concerning the pensions dashboard, including a report from Which?[footnote 5], in February 2018.

9. The Minister for Pensions and Financial Inclusion, Guy Opperman MP, announced in October 2017 that the Department for Work and Pensions (the department) would take lead policy responsibility for a pensions dashboard. Subsequently, the Minister for Work and Pensions (Lords), Baroness Buscombe, outlined to Parliament the department’s plans for a feasibility study to look at areas including:

- what would be of most use to individuals in order to help them plan effectively for their retirement

- safeguarding consumer interests

- different delivery models

- the participation of pension schemes

10. In September 2018, the Minister for Pensions and Financial Inclusion announced in a Written Statement[footnote 6] to Parliament that an industry-led dashboard, facilitated by government, will harness the best of industry innovation. This report sets out the department’s findings from its feasibility work, and invites contributions that will help to inform how government can best facilitate an industry-led delivery. It seeks the views of as wide a range of people and organisations with an interest in pensions dashboards as possible, in particular pension providers, administrators, consumer bodies, financial services and technology suppliers / intermediaries.

Summary

Pensions and the individual: a changing landscape

11. The experiences of people saving for a pension in the UK are changing. An increasing shift to DC pensions is placing increased responsibility on the individual to plan and make decisions about their retirement. People are tending to live longer and, with the changing nature of the labour market, are more likely to take on a multitude of different jobs, or become self-employed.

12. The government has introduced a number of changes to help people save and support effective planning for their retirement. With the introduction of automatic enrolment in 2012, participation in workplace pensions has been transformed. At the end of October 2018, almost 10 million workers have been automatically enrolled into a workplace pension. Yet despite the success of automatic enrolment, there are still around 12 million people thought to be under-saving for their pension and savers are not engaged fully with their savings.

13. The responsibility to engage individuals in saving and planning for retirement does not rest in any one place. Pension providers, employers, the advice and guidance community and government all have a role to play. The potential difficulty in engaging with information about various savings can lead people to lack a sense of ownership of their pension pots, or knowledge about pension rights. All this adds complexity, as people can struggle to understand what their cumulative savings mean for them in retirement. It may also increase the risk of more pension pots being lost or people losing track of what they have.

14. The Pension Freedoms, introduced in 2015, have provided many scheme members with greater flexibility and choice with what to do with their savings. Government has taken steps to improve the provision of effective pensions information, guidance and advice at the point when an individual needs it. The Check Your State Pension service was introduced in 2016, which enables people to find out about their State Pension age, entitlement and how they can increase it, while the Pension Tracing Service helps people to trace lost workplace pensions. The launch in January 2019 of a new SFGB will build on the existing provision and will make it easier for people to access free and impartial information and guidance on pensions, money and advice on debt.

15. The private pensions industry is complex, with around 40,000 different pension schemes managed by 4,500 administrators and thousands of employers doing their own in-house administration. The provision of straightforward pensions information via dashboards will require all schemes to ensure their data and systems are ready to enable this. With the freedom then to innovate, in response to the demands of consumers, industry can maximise its chances of increasing engagement and help more people to plan effectively for their retirement.

Aims and objectives

16. The widely shared aim of dashboards is to enable citizens to securely access their pensions information online all in one place and at a time of their choosing, to support better planning for retirement.

17. As a minimum, pensions dashboards can help to:

- increase individual awareness and understanding of their pension information and estimated retirement income

- build a greater sense of individual control and ownership of pensions

- increase engagement, with more people taking advantage of the available advice and impartial guidance

- support the advice and guidance process by providing people with access to their pensions information at a time of their choosing

- reconnect individuals with lost pension pots, benefitting the individual and industry

- enable more informed user choices in the decumulation phase (the point when a decision is made by a saver on how to access their savings) by making it easier to access the information on which to base these decisions

18. Industry will determine the longer term potential of pensions dashboards, such as improved consumer choice through innovation and potentially increased competition.

19. As a minimum, the design principles that underpin pensions dashboards and the infrastructure that sits behind them should:

- put the individual at the heart of the process by giving people access to clear information in one place online

- ensure individuals’ data are secure, accurate and simple to understand – minimising risks to the user and the potential for confusion

- ensure the individual is always in control over who has access to their data

Architecture, data and security

20. A dashboard service must operate in a way that balances industry innovation with data security. Industry will pull together the technical infrastructure to make this happen. The department has explored the various elements that enable dashboards to function and some of their key features.

21. The industry-led delivery group responsible for implementing dashboards will decide on the final detailed architectural model. However, for government to legislate to enable dashboards, there are certain architectural principles which the department believes should, as a minimum, underpin the technology. These are outlined in Chapter 4. Essentially, in developing this infrastructure, industry must adhere to the rights of the individual and principles as set out in the Data Protection Act 2018[footnote 7] (which reflects the General Data Protection Regulation (GDPR)). This includes the individual’s right to data portability and principles of accuracy, storage, access and security.

Meeting the users’ needs

22. Putting the consumer at the heart of dashboards is about enabling people to access their information online, at a time of their choosing, in a way that is accurate, secure and simple to understand.

23. Chapter 5 discusses how industry can meet different users’ needs by harnessing its potential to innovate. This includes how government can act to best safeguard consumers’ interests while also minimising the impact on schemes.

Providing a complete picture

24. The department has listened to views from across the sector that compulsion is needed to maximise scheme participation within a reasonable timeframe. This means that pension schemes would be required in legislation to provide that person’s data (with their consent) via pensions dashboards. Government will act to deliver this legislation when parliamentary time allows and following the creation of a robust delivery model with the appropriate governance.

25. There may also be merit in exempting some schemes from compulsory participation in a dashboard, while leaving it open for these schemes to join on a voluntary basis. For example, there are certain types of micro-schemes such as Small Self-Administered Schemes (SSAS) and Executive Pension Plans (EPP) whose members would be significantly less likely to need to use a dashboard. The department is interested in views on this.

State Pension data

26. Regardless of their pensions wealth, for many people, the State Pension will form a significant part of their retirement income.

27. It will be the responsibility of the industry delivery group, working with government, to ensure that the necessary data standards and security are in place in order to allow State Pension data to connect to the service. Government will work with the industry delivery group to integrate the State Pension into pensions dashboards. Subject to the delivery timetable, a link for Check Your State Pension can be made available for an interim period. This is an existing digital service that has provided more than 10 million online estimates since its introduction in 2016.

Implementing dashboards

28. The department found that a number of pension schemes / providers would want to participate in the dashboard service on a voluntary basis, as soon as is practical. The proposed architectural model, underpinned by the Data Protection Act 2018 (GDPR), would allow this. DC schemes such as Master Trusts would represent a good opportunity to maximise coverage over a relatively short period of time. The current Master Trust market consists of 90[footnote 8] schemes covering almost 10 million memberships, more than a quarter of total workplace pension memberships.

29. Other schemes will need longer lead-in times in order to prepare their data and implement required changes to their systems. For example, Public Sector Pension Schemes, defined benefit (DB) and DB/DC Hybrid schemes will require longer lead-in times to ready their data prior to on-boarding.

30. Our expectation is that industry should start to supply data to a dashboard, on a voluntary basis, from 2019. The existing legislative framework does allow for this. However, our international research found that legislation played a crucial role in ensuring that all schemes supply data to dashboards in a reasonable timeframe. We will seek to legislate to facilitate industry in delivering dashboards, including compelling schemes to provide their data for dashboards, when parliamentary time allows. This will result, we expect, in the industry-led dashboard facilitated by the SFGB being introduced from 2019.

31. The final timeline for onboarding will need to be agreed by industry through the delivery group, involving regulators and government following more detailed work. However, we expect that the majority of schemes will be on-boarded within 3 to 4 years from the first dashboards being available to the public. The department will seek to legislate in a way that supports a phased approach to on-boarding over a reasonable timeframe agreed by industry.

A single Pension Finder Service

32. The single Pension Finder Service (PFS) is a key element of the technical infrastructure behind dashboards (as set out in Chapter 4). In the context that government will seek to compel schemes to supply their data to the PFS, it is the department’s view there should only be one PFS that fully aligns to the architectural principles as set out also in Chapter 4. While the department recognises the commercial opportunities created by multiple dashboards, it believes that there should only be a single PFS which, as a matter of principle, is run on a non-profit basis and with strong governance. The industry delivery group will need to decide how best to deliver a PFS and how it can adapt to changes in approach over time.

Protecting the consumer

33. It is essential that industry innovation, and a degree of commerciality, builds people’s trust in pensions. The user research in Chapter 3 demonstrates how data security, reliability and consistency in the way information is presented will be essential factors in building credibility and trust in the service.

34. It is also essential that commercial organisations’ use of dashboard information is adequately regulated so as to maintain a high standard of conduct among all participating firms. With this in place, the consumer will have a clear form of redress if a firm should fall below this standard.

35. The department, working with industry and the regulators including the FCA, will ensure that appropriate and robust controls are in place. This will utilise existing legislation and regulatory frameworks wherever possible. If new activities are identified that are not covered by existing regulation, the department will seek to amend legislation as necessary. Industry is responsible for meeting its responsibilities to protect consumer data in line with the legislation.

Accessing dashboard services

36. Those seeking pensions information are already supported by the information that individual pension providers are required to send to their members, through for example annual benefit statements, and this will continue. The online pensions dashboard is intended to build on existing information provision (both online and offline) by bringing it together in one place. Currently, the proposed architectural model does not include an offline solution for users. Through a multiple dashboard approach, there is an opportunity for industry to maximise engagement with everyone. Accessibility should be carefully considered by the industry-led delivery group, however, and the department welcomes views on this in this consultation.

Facilitating delivery

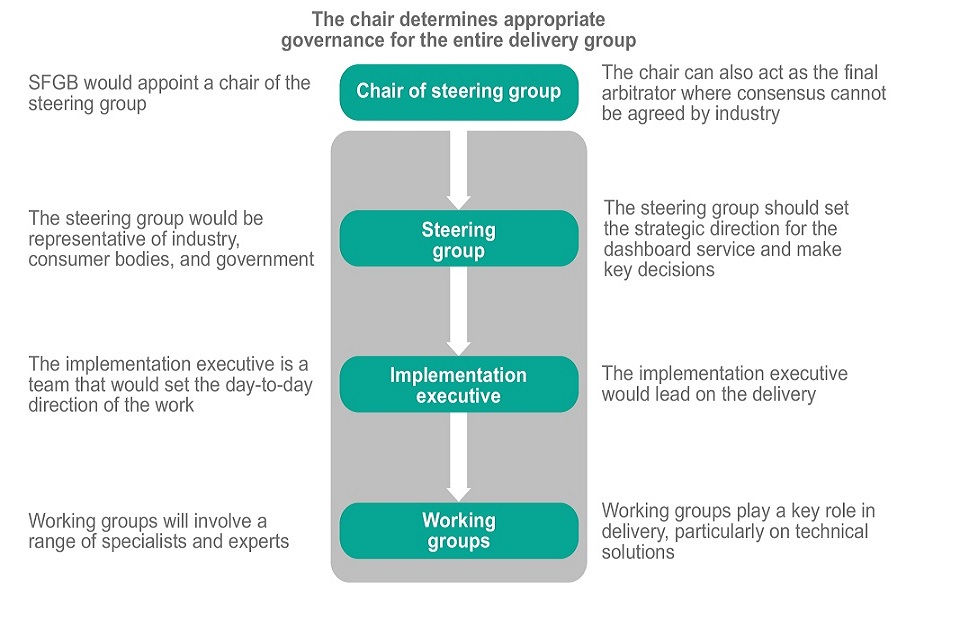

37. In the absence of a clear industry lead, pensions dashboards and the technology that enables them will need a clear governance structure to enable successful delivery. This ensures that all parties understand their roles, responsibilities and accountabilities and helps to facilitate effective decision making.

38. A majority of members of this governance should come from outside government, to oversee implementation. A chair should be appointed to bring together a small but representative delivery group of key decision makers from across the broader industry, including consumer organisations.

39. The government recognises a role for itself to ensure that the delivery group comes into being. We have concluded that the SFGB is ideally placed to convene and oversee the industry delivery group. Considerations for governance are discussed further in Chapter 6.

Costs and funding

40. In the Autumn Budget 2018, government committed funding for 2019/20 to help fulfil its role in facilitating industry to make dashboards a reality.

41. The costs of the governance structure should be met by the pensions industry. The industry should also fund:

- the development and delivery costs of the dashboard infrastructure, such as the PFS and identity verification

- the development of a non-commercial, consumer-focused dashboard hosted by the SFGB

- any new regulatory functions related to dashboards

42. There may be an opportunity to use existing industry levies to fund the dashboard service in a fair and equitable way.

Next steps

43. Through December, the department intends to run a series of engagement roundtables aimed at hearing views from different stakeholders including pensions and financial service providers, public sector pension schemes, consumer groups and other interested parties. These activities will inform our approach to facilitate an industry-led delivery strategy.

44. A full list of consultation questions can be found at Annex C. The consultation will last 8 weeks and the government will respond within twelve weeks of its closure.

List of questions for consultation

Wider benefits of a dashboard

I. What are the potential costs and benefits of dashboards for:

a) individuals or members?

b) your business (or different elements within it)?

Architecture, data and security

II. Do you agree with:

a) our key findings on our proposed architectural elements; and

b) our proposed architectural design principles?

If not, please explain why.

Providing a complete picture

III. Is a legislative framework that compels pension providers to participate the best way to deliver dashboards within a reasonable timeframe?

IV. Do you agree that all Small Self-Administered Schemes (SSAS) and Executive Pension Plans (EPP) should be exempt from compulsion, although they should be allowed to participate on a voluntary basis?

V. Are there other categories of pension scheme that should be made exempt, and if so, why?

Implementing dashboards

VI. Our expectation is that schemes such as Master Trusts will be able to supply data from 2019/20. Is this achievable? Are other scheme types in a position to supply data in this timeframe?

VII. Do you agree that 3-4 years from the introduction of the first public facing dashboards is a reasonable timeframe for the majority of eligible schemes to be supplying their data to dashboards?

VIII. Are there certain types of information that should not be allowed to feature on dashboards in order to safeguard consumers? If so, why? Are there any other similar risks surrounding information or functionality that should be taken account of by government?

IX. Do you agree with a phased approach to building the dashboard service including, for example, that the project starts with a non-commercial dashboard and the service (information, functionality and multiple dashboards) is expanded over time?

X. Do you agree that there should be only one Pension Finder Service? If not, how would you describe an alternative approach, what would be the benefits and risks of this model and how would any risks be mitigated?

Protecting the consumer

XI. Our assumption is that information and functionality will be covered by existing regulation. Do you agree and if not, what are the additional activities that are not covered?

Accessing dashboard services

XII. Do people with protected characteristics, or any customers in vulnerable circumstances, have particular needs for accessing and using dashboard services that should be catered for?

Governance

XIII. The department has proposed a governance structure which it believes will facilitate industry to develop and deliver a dashboard. Do you agree with this approach? If not, what, if anything, is missing or what workable alternative would you propose which meets the principles set out in this report?

Costs and funding

XIV. What is the fairest way of ensuring that those organisations who stand to gain most from dashboard services pay and what is the best mechanism for achieving this?

General

XV. Do you have any other comments on the proposed delivery model and consumer offer?

Chapter 1 – Pensions and the individual: a changing landscape

Pensions and the individual

45. The experiences of people saving for a pension in the UK are changing. The responsibility for making decisions is shifting increasingly towards the individual as the proportion of those in DC schemes increases, largely driven by the introduction of automatic enrolment (AE). This larger reliance on DC schemes means that, for the individual, it is less clear what their income will be at retirement than if their entire pension was a DB[footnote 9] arrangement. With increased responsibility there is increased risk for the individual and more decisions to be made.

46. People are tending to live longer and, with the changing nature of the labour market, are more likely to take on a multitude of different jobs, or become self-employed. On average, an individual might work for 11 employers during their working life[footnote 10]. For many, this could lead to a very different relationship with their pension saving from the one often experienced by previous generations, working in a more long-term and stable career.

47. The government has introduced a number of changes to help people save and support effective planning for retirement. Automatic enrolment (AE) has already succeeded in transforming pension participation with millions more of today’s workers saving into a workplace pension. At the end of October 2018, almost 10 million workers have been automatically enrolled into a workplace pension. This is helping to make saving into pensions a social norm again, yet despite the success of AE there are still around 12 million people under-saving for their pension.

48. With a changing labour market and the subsequent impact of AE, we expect people will be enrolled into more pension schemes than before[footnote 11]. Currently the 22 million individuals with private pensions wealth have an average of around 2 un-accessed pension pots[footnote 12]. This is expected to increase as AE matures, with individuals having more deferred pension pots than ever before[footnote 13].

49. Overall, workplace pension participation increased from 55% of eligible employees in 2012 to 84% in 2017. This meant that, in 2017, 17.7 million eligible employees were participating in a workplace pension and annual pension contributions were £90 billion. The largest increases in workplace pension saving have been seen within the private sector. Since 2012, private sector participation has risen by 39 percentage points to 81% of private sector eligible employees participating (12.9 million) in 2017. We have gained significant ground on participation among younger workers and low earners. Workplace pension participation by 22 to 29 year olds increased from 35% of eligible employees in 2012 to 79% in 2017. Workplace pension participation by women also increased between 2012 and 2017, rising from 58% of eligible employees to 84%.

50. By defaulting individuals into saving through AE and harnessing their natural inertia, we are helping people save. However, whilst millions more people are now saving, they are not necessarily engaged with saving, and the default process means that they do not need to be. That means they may not be taking greater personal responsibility to plan, or save more, for their retirement. A quarter of people aged 55 and over and not retired say they do not know the size of their pension savings while 8 in 10 people with a DC pension have not given much thought to how much they should be paying into it to maintain a reasonable standard of living when they retire[footnote 14].

51. The department’s review of AE[footnote 15] recognised the complexity of engagement, but that effective engagement can reinforce individual’s savings behaviour and support the social normalisation of saving. The review recognised the barriers to engagement, and the reality of people’s busy lives, and found that there is no single ‘silver bullet’ that will create engagement. Rather, interventions may have a cumulative effect and they need to be well designed. Evidence suggests that the key to successful engagement is for the design approach to be simple, personalised, accessible and timely.

52. The responsibility to engage individuals in saving and planning for retirement does not rest in any one place. Pension providers, employers, the advice and guidance community and government all have a role to play. The challenge is for the key principles referred to above to be reflected in the work that they do, recognising as part of this that there is still a long way to go before people can access and understand simple and consistent information about their pensions[footnote 16]. An industry initiative to simplify annual benefit statements is an example of how the principles of better engagement can be put into practice[footnote 17].

Information, guidance and advice

53. The potential difficulty of accessing information about various savings can lead people to lack a sense of ownership of their DC pension pots, or knowledge about their DB pension rights. All of this adds complexity, as people can struggle to understand what their cumulative savings position means for them in retirement. It may also increase the risk of more pots being lost, adding to the estimated[footnote 18] £400 million that is currently unclaimed. Reflecting the fact we are living longer and thinking differently about work and retirement, the Pension Freedoms, introduced in 2015, have provided many scheme members with greater flexibility and choice with what to do with their savings.

54. The department previously estimated (in 2012[footnote 19]) that by 2050, there could be as many as 50 million ‘dormant’ workplace DC pension pots, where dormant means that the pot is not being contributed to. These pots are otherwise known as deferred (or unaccessed) pots and are not equivalent to lost pots. A recent briefing note[footnote 20] from the Pensions Policy Institute highlights the difficulty in estimating the number of ‘lost’ pension pots and their value.

55. Government has taken steps to improve the provision of effective pensions information, guidance and advice at the point when an individual needs it. The Check Your State Pension service was introduced in 2016, which enables people to find out their state pension age and entitlement, and how they can increase it. In 2005, the Pension Tracing Service was introduced to help people trace their lost work place pension. This service launched a digital self-serve option in 2016. In 2017/18 the digital service undertook circa 1.2 million traces.

56. The introduction of the new SFGB builds on existing provision from the Money Advice Service (MAS), The Pensions Advisory Service (TPAS) and Pension Wise. Launching to the public early 2019, this new, single body will make it easier for the individual to access free and impartial information, guidance and advice on pensions, money and debt, all in one place. It is a free and impartial service offering information and guidance on pensions and money issues as well as advice on debt. It will also coordinate the UK’s Financial Capability Strategy and other strategic activities.

57. Research has shown that going through the guidance process is likely to increase a person’s financial capability and raise awareness of financial advice[footnote 21]. However, take up of guidance (and financial advice) could be higher. As highlighted in the FCA’s Financial Advice Market Review[footnote 22], people often find it difficult to access their data from financial institutions. This not only impedes an individual’s ability to make informed decisions, as they are unable to view and bring together information about their financial picture, it can also make the task of providing advice or guidance more difficult. Without adequate information, guidance and advice, people can be more exposed to potentially inappropriate investments and scams, which can have a devastating impact on the individual.

58. As highlighted by the department’s review of AE, the evidence suggests there is no single tool or form of communication that will transform engagement on its own. However, using technology as an enabler, through a pensions dashboard, is one of a number of ways we can build engagement and support better planning for retirement.

59. Dashboards are an enabling tool that can support the aim of increasing people’s engagement in pensions by offering people straightforward access to their pensions information. They are an opportunity to put the individual in control of how and when they access their data.

60. Dashboards also reflects principles of improving outcomes for people as set out in the EAST (easy, accessible, social, timely) framework[footnote 24]. For example, the dashboards could potentially make the behaviour of ‘accessing pension information’ easier, and more timely, and thereby facilitate more informed decision making. It will give people straightforward access to their pensions information in a simple and clear manner at a time of their choosing, providing the individual with greater control. By helping people understand what they have, they are better able to take responsibility for it. Dashboards can be accessed at any time and will likely be used when someone needs the information to hand. This could influence people at key moments in their lives, such as moving job, home or making financial decisions. It has been shown that reaching people at these more significant moments is more effective at changing behaviour than at other times[footnote 25].

61. By supporting better planning for retirement, a dashboard can help to smooth a person’s transition between saving for a pension (which is driven by inertia) and making informed decisions at retirement (when there is increased flexibility and choice).

A changing landscape

62. The new State Pension, introduced in April 2016, has simplified the State Pension system and allowed government to introduce the check your State Pension service online, making it clear to people what State Pension they will get, and when they will get it. However, for those with private pension savings, accessing information about them at a time when they choose to, and making sense of what it means, can be a real challenge.

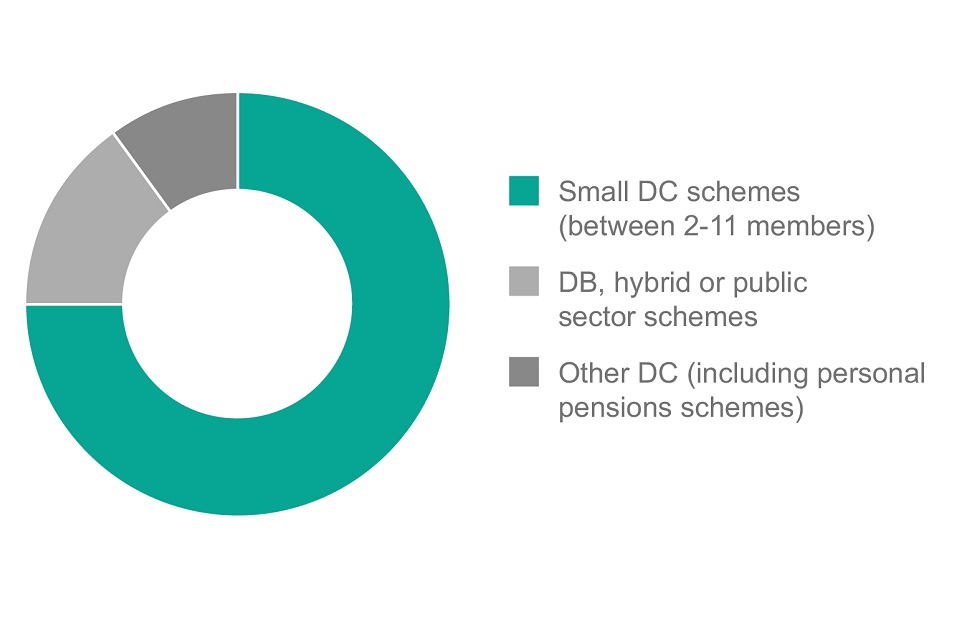

63. The private pensions industry is fragmented and complex. There are in the region of 40,000 private pension schemes of which about three-quarters are occupational DC schemes with between 2 to 11 members, the majority of which are member directed. Of the remainder, there are around 6,000 DB, hybrid (schemes which combine aspects of DC and DB) or public sector schemes and a further 4,000 other DC schemes including personal pensions[footnote 26] (see figure 1). Managing these schemes are around 4,500 different administrators including thousands of employers doing their own in-house administration[footnote 27].

Figure 1: Estimated breakdown of UK private pensions schemes by type.

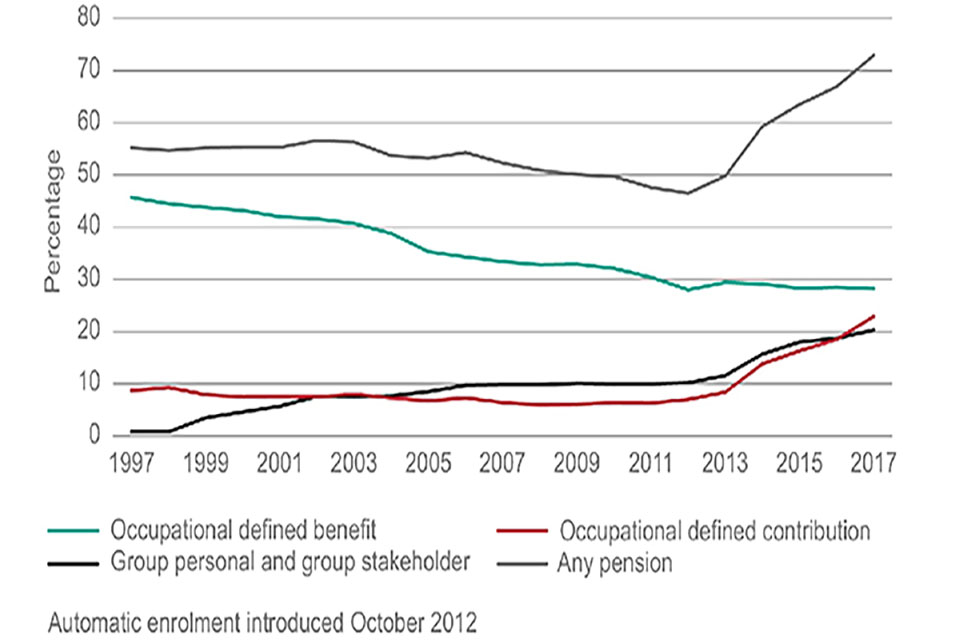

64. Together, these schemes contain tens of millions of ‘pension pots’ for people. Over time, we have seen a shift away from DB towards a larger reliance on DC pensions due to employers no longer wishing to bear the burden of investment and longevity risk. In 1997, 46% of eligible employees were contributing to DB schemes with 10% in DC schemes. By 2017 this had changed to 28% of eligible employees in DB schemes and 43% in DC schemes[footnote 28] (see figure 2).

Figure 2: Proportion of employees with work place pensions by type of pension, 1997 to 2017

65. Automatic enrolment has resulted in an explosion of memberships in Master Trust schemes, rising from 270,000 in 2012 to nearly 10 million in 2017[footnote 29]. Most (94%) of eligible employees who are enrolled into occupational DC schemes are enrolled into Master Trusts. The majority of these will be in one of the largest 4. These 4 account for at least 12 million memberships according to their accounts in 2018[footnote 30].

66. We have seen DC occupational schemes with more than 12 members continue to consolidate in recent years with volumes more than halving since 2009[footnote 31]. The government has laid regulations, which came into force in April 2018, to remove barriers to further consolidation among DC occupational schemes. Further work is also underway to facilitate consolidation in the wider pensions market. DC Master Trust schemes are being required to be authorised by The Pensions Regulator (TPR). Those who do not apply for authorisation or where the application fails will be required to transfer their members to another Master Trust scheme and wind up. In addition, the recent White Paper on DB schemes[footnote 32] sets out proposals on consolidation within this section of the market.

67. The rules that apply to DB schemes in particular, are varied and complex. For example, the type and level of pension, and when it can be paid, will depend on the rules of the relevant scheme.

68. The provision of straightforward pensions information via dashboards will require all schemes to ensure their data and systems are ready to enable this. With the freedom then to innovate in response to the demands of consumers, industry will maximise its chances of increasing engagement and help more people to plan effectively for their retirement.

Chapter 2 – Aims and objectives

Aims for a dashboard

69. There are many ways to tackle low levels of understanding and engagement and no single tool or form of communication can provide a single solution. The Automatic Enrolment Review in 2017 identified that for engagement to be successful, approaches must be simple, personalised and accessible.

70. The widely shared aim for pensions dashboards is to enable citizens to access their pensions information online, securely and all in one place, thereby supporting better planning for retirement.

Objectives of a dashboard

71. The department looked at the key consumer outcomes that dashboards can support. As a minimum, pensions dashboards can help to:

- increase individual awareness and understanding of their pension information and estimated retirement income

- build a greater sense of individual control and ownership of pensions

- increase engagement, with more people (regardless of their pension wealth) taking advantage of the available advice and impartial guidance

- support the advice and guidance process by providing people with access to their pensions information at a time of their choosing

- reconnect individuals with lost pension pots, benefitting the individual and industry

- enable more informed user choices in the decumulation phase (the point when a decision is made by a saver on how to access their savings) by making it easier to access the information on which to base these decisions

72. Industry will determine the longer term potential of pensions dashboards, such as improved consumer choice through innovation and potentially increased competition.

Design principles

73. The department also looked at the design principles which should, as a minimum, underpin pensions dashboards and the infrastructure that sits behind them. These are to:

- put the consumer at the heart of the process by giving people access to clear information in one place online

- ensure individuals’ data are secure, accurate and simple to understand – minimising the risks to the consumer and the potential for confusion

- ensure that the individual is always in control over who has access to their data

Wider benefits of dashboards

74. As already touched upon, pensions dashboards will not help people to achieve better outcomes on its own, but they do have the potential to transform understanding. They sit alongside government and other industry-led initiatives including AE, Pension Freedoms, the introduction of the new SFGB and, for example, the simplification of annual benefit statements.

75. The department has outlined above the key objectives that dashboards should support, as a minimum, in the interests of consumers. It also notes potential longer term benefits of dashboards for consumers, such as increased consumer choice through innovation and competition. The department considered also the potential wider benefits of dashboards to industry which may indirectly lead, in some cases, to a benefit for consumers. The department would welcome views on these as well as understand the likely costs to industry. The potential wider benefits of dashboards may include:

- as users begin to find lost pots through dashboards, or are reconnected with those they may have lost track of, there will be lower costs to providers to locate the owners of these pots.

- if dashboards can make pensions easier to understand, they may encourage people to engage more actively with their long term savings. They will also enable increases in financial capability. They will give people easier access to relevant information on their pensions ahead of any advice and guidance, which can then take them up to the ‘choose and buy’ moment (i.e. just before they make a decision). This could help encourage more people to take up financial advice and encourage growth in the advice market.

- essentially, dashboards could support clearer journeys for users, from finding out information about their pensions through to accessing guidance, obtaining advice and making informed decisions.

- the guidance and advice process can be hampered by the length of time it takes for people to gather their pension information. This information is often then brought to the guidance session as volumes of paper, often with key parts missing. Straightforward access to all of the information online could improve the guidance or advice process, for all parties, and potentially reduce the cost of advice for consumers.

- as people use dashboards, insights can be gained on what design works for people and dashboards can be adapted accordingly (a test and learn approach). Not only would this help improve the effectiveness of dashboards but can provide lessons for how providers communicate with their customers. Providers may also benefit from increased engagement in their online services as members are signposted via dashboards.

- further potential benefits include the fact that dashboards would provide an opportunity for consumers to ensure that the data held by their pension schemes is accurate, thus reducing the risk of errors, which can have a significant impact over a long period of time. It could prompt consumers to update their data by contacting the relevant pension scheme.

- improving data and systems in order to join dashboards could also yield additional benefits for schemes by reducing the number of (potentially costly) errors and support other modernisation activities such as automation.

- as part of a broader, UK-wide approach to data portability (see Chapter 5) a more ‘open pensions’ infrastructure, used with other forms of open data, like Open Banking, could play a part in driving innovation across the financial services sector, not just pensions.

76. Of course, there may be other benefits; the nature of measuring benefits in the pensions policy landscape is complex. Effective measurement can require the monitoring of the impacts of policies upon cohorts of the population throughout their working age. The ongoing evaluation of the success of dashboards, and its potential impact on consumer outcomes will be important.

Question I

What are the potential costs and benefits[footnote 33] of a dashboard for:

a. your business (or different elements within it); and

b. individuals or members?

Chapter 3 – Building the evidence

User Research

Introduction

77. In order to inform the department’s thinking on the design of pensions dashboards, a team jointly led by Pension Wise and the department’s Digital Group was set up to understand the potential user needs for the service.

78. The idea that dashboards should offer a meaningful and useful service for people, to enable them to plan better for later life was tested throughout the research. Following a review of existing consumer-based research on the pensions dashboard, the team carried out a further round of qualitative research comprising 35 in-depth interviews.

79. Special thanks go to colleagues from The Pensions Advisory Service (TPAS), The Money Advice Service (MAS) and the Association of British Insurers (ABI) who provided valuable insight from their own services and research.

Existing user research

80. Three existing pieces of research[footnote 34] from 2014-2016 were reviewed to provide background and to help inform the structure of the research for the feasibility study. The following common themes emerged:

- the pensions dashboard concept was received overwhelmingly positively – users immediately recognised the benefits of seeing all their pensions in one place, however, users were not already seeking this service

- users tended to prefer a single dashboard with a single point of access – this was simplest to understand from a user perspective

- government involvement was seen as crucial to ensure trust in an online environment

- users were wary of being sold to or having their data misused

- the idea of multiple dashboards potentially confused some users, not understanding how, for example, their data could be kept secure or the information presented in a consistent format

- users may have a low tolerance for an incomplete dashboard at launch (i.e. not covering all providers/pensions), but good communications and framing around this could help avoid disappointment and raise their acceptance

The department’s user research

81. In order to ensure that the department’s research covered all potential user-types, participants from a range of backgrounds were recruited. All participants had at least one un-accessed pension. This could be either a pension into which they were currently contributing, a deferred one (such as from a previous employer) or both. There was also representation from different age groups, careers, pension types and levels of engagement.

82. The 35 qualitative sessions were conducted across the country[footnote 35] and took the form of one hour in-depth interviews. The issues explored included:

- pensions engagement

- reactions to the concept of a dashboard

- multiple v. single dashboard models

- the differences between an industry or public sector-led service

- the information on a dashboard

- the impact of missing data

Main findings

83. Previous research findings were largely confirmed. These included a strong, if not quite universal, preference among users for:

- a single dashboard with a single point of access (respondents cited data security, trust and simplicity in an area already seen as too complicated as key reasons)

- a government-sponsored dashboard (respondents again cited reasons of data security and trust as well as fear of commercial bias)

- the service to be an information service and not be used to sell products

- pension information to be complete from first use

84. The research also confirmed findings that users:

- tended to view commercial organisations (including pension providers) with some suspicion, but may prefer to use their own bank due to higher levels of familiarity and trust

- tended to accept identity verification requirements as necessary reassurance that the system would achieve the required level of security

- tended not to actively pursue this kind of service, but showed an immediate positive reaction when hearing about the concept

85. The research further confirmed the longstanding acknowledgement of the broad lack of engagement and understanding of pension provision, and the need for simplicity and convenience of information in what is seen as a confusing field. For older users in particular, having an aggregated view of all pensions was particularly desirable. However, some younger users with less experience of dealing with pensions showed an expectation that such a service would already exist.

User needs

86. The outcomes of the user research, combined with the research from existing publications, allowed the researchers to create one high level user need underpinning the entire dashboard concept, with a further 4 user needs influencing the way in which dashboards may be delivered.

High level user need

- “I need to know how much money I’ll have to live on when I retire so that I can plan for my future”.

Additional user needs

- “I need to be able to see a full picture of all of my pensions otherwise I don’t see the benefit of logging on as it will give me less information than I already get from my annual statements”.

- “I need to know that the information will be displayed in a clear and easy to understand way, as I am already confused by current pension information and this may put me off from logging on”.

- “I need to know that the service is secure and that my information is safe and protected so that I am reassured other people cannot see and access my financial information”.

- “I need to know that I am accessing the correct service provided by one impartial and reliable source so that I’m reassured I can trust the guidance and information I am given”.

Summary of key findings

a) Currently, there is a limited understanding among individuals of how pensions work. Users are not actively looking for a dashboard but are overwhelmingly positive about the concept when it is introduced.

b) To support engagement, it is important to consider how a dashboard service can meet additional user needs, including trust in the security and impartiality of the service, completeness of the information displayed and simplicity of the service.

c) Users generally preferred the idea of a single, non-commercial and government-sponsored dashboard. However, there are different types of user, including those who would trust a provider they already had a relationship with, such as their bank.

International lessons

Introduction

87. A number of countries have introduced pensions dashboards. The department was keen to learn from their experiences, both through reviewing the existing information gathered by other organisations and through its own research.

88. In its review of existing research carried out into other countries’ dashboards the department focused on publications from the industry-led Pensions Dashboard Project Group[footnote 36] and Royal London[footnote 37].

89. To explore further questions and build understanding, the department also engaged with dashboard representatives from 6 countries, which currently have pensions dashboards: Belgium[footnote 38], Denmark[footnote 39], Israel[footnote 40], the Netherlands[footnote 41], Sweden[footnote 42] and Australia[footnote 43]. The department is extremely grateful for their time and willingness to answer our questions.

Contextual differences

90. Before reviewing the evidence gained from the experience in these other countries it is important to acknowledge the differences between the pension systems in place in these countries and our own. Given the complexity and scale of the UK pension system it cannot be directly compared with these other countries.

91. As highlighted in Chapter 1, in the UK there are 40,000 private pension schemes administered by around 4,500 administrators (with many more employer in-house administrators). By comparison, Denmark for example has around 75 providers and Holland has an estimated 200 pension funds maintained through 15-20 pension providers and insurers. However, despite these significant differences, there are important lessons in other countries’ experiences that can inform the approach taken in this country.

Findings

Usage (including single and multiple dashboards)

92. Increased usage was sometimes linked to having full coverage of pension schemes. For example, in Denmark, which has an industry-owned, non-commercial dashboard, they found that the number of unique users increased significantly once all providers had come on board. They now have around a third of the working age population using their dashboard with around 1.3 million unique users in 2017 (compared with around 240,000 in 2007). It was also suggested by some countries that usage of the dashboard was generally improved where data could be applied to other financial services, such as mortgage or life insurance applications.

93. In 5 of the 8[footnote 44] countries looked at there was a single ‘non-commercial’ dashboard endorsed (if not directly run or owned) by government. However, we came across some evidence that having multiple dashboards can encourage usage. In Israel, where multiple dashboards are allowed, the market-leading dashboard, ‘Wobi’, has been used by 60% of the adult population.

94. In Denmark, they allow users to send information direct to authorised third parties, via their single, industry-owned dashboard. This is often used by individuals to, for example, verify their income in retirement to support life insurance or mortgage applications. In the Netherlands, information cannot be sent direct to third parties via the dashboard, as it was agreed by its independent governance board not to have any direct commercial association. In these and other examples, users can generate copies of their information, which they themselves can forward to third parties.

95. The countries we spoke to often highlighted the care they took in ensuring the information presented on a dashboard was simple to understand and accurate. In Australia, user research showed that people often just want to know the basics and whether they are ‘on track’ in terms of provision for their retirement. In Israel, the leading provider ‘Wobi’ emphasised the need to design an engaging product for consumers, in order to encourage take-up. They recommended focussing on the key information that people want and avoid using technical pensions language.

Achieving full coverage

96. As highlighted in our user research, attaining sufficient coverage on dashboards in order to meet user expectations will be key to their success. The need to legislate in order to compel schemes to participate and achieve full coverage on dashboards within a relatively short timeframe was found to be important in the international research. Five of the 8 countries introduced or used existing legislation to ensure pension providers participated in a dashboard. Also, according to the industry-led Pensions Dashboard Project Group, the remaining 3 felt in hindsight that compulsion was ‘absolutely necessary…to gain critical mass as quickly as possible’.

97. The research highlighted that without compulsion it took a significant amount of time, over a decade, to deliver a complete dashboard. What was highlighted in our user research was that the consumer expects to see all of their pensions. Full scheme coverage may not be necessary to meet this expectation in the vast majority of cases. The question of full coverage and government’s role in legislating to achieve this is discussed further in Chapter 5.

98. It was also evident from the international research that care should be taken not to introduce compulsion too quickly. Other countries recognised that pension providers need sufficient time to prepare before sharing their members’ data via a dashboard. This has been echoed by schemes in the UK.

Scheme participation

99. Even in some of the countries with relatively small populations, a gradual or phased approach to introduction seems to have been the norm. In Sweden, a dashboard was launched in 2004 with 8 insurance companies participating and has gradually expanded to the point where now more than 30 companies are involved, covering the vast majority of its pensions market.

100. Where legislation was used to compel scheme participation, a phased approach to ‘on-boarding’[footnote 45] was necessary. For example, in the Netherlands, they went ‘live’ with a complete dashboard after using legislation to bring schemes on board over a 4 year period.

101. It would not be realistic to have all providers in the UK brought onto the dashboard service from the outset given the practical implications from a delivery perspective and the variable states of readiness of different pension schemes. Those countries who adopted a phased approach highlighted the benefits, as it enabled them to test and learn, and build trust and confidence among both consumers and industry. Our own experience of the successful introduction of AE, which started in 2012 and was progressively rolled out over 6 years starting with the largest employers, also supports the idea of a phased approach to a major initiative.

Delivery and funding

102. In most countries, government has played an important role in the development of their pensions dashboard service, although the level of government involvement has varied. For example, the Israeli government led the procurement of a ‘data clearing house’ and provided underpinning legislation before opening the development of consumer-facing dashboards to the market. By contrast, in Belgium and Australia their dashboards were set up by the government and remain under government control. In both the Netherlands and Denmark, their dashboards are non-commercial services developed and led by the industry.

103. Funding was also mixed with most (if not all) of the development costs put forward by the respective governments in Australia, Belgium, Israel (infrastructure only) and Sweden. Industry funded both the infrastructure and the dashboard itself in Denmark and the Netherlands.

104. In the countries we spoke with, on-going costs are largely borne by industry, calculated and paid for using various methods including general levies or provider contributions based on usage of the dashboard.

Governance

105. Government’s role in each country was often to ensure fair stakeholder representation in the governance arrangements and to at least ensure appropriate regulation was in place to protect consumers. Government was in most cases represented in managing the day-to-day running of the service, but its role as a decision-maker varied. Decisions were often made by consensus among key stakeholders or by an independent chair. As one country reflected, consensus did mean not everyone necessarily agreed, but they accepted decisions in order to keep things moving.

Outcomes and benefits

106. We were keen to understand more about tangible benefits and results from other countries. There was limited evidence of the impact the pension dashboards have had on customer engagement or tracking outcomes for users, but what we did find was largely positive.

107. In Denmark it was found that making it easier for the user to share their pensions information with third parties (either directly or by generating a printout) has encouraged more providers to offer modelling tools. It was felt that this has helped to inform financial planning discussions with consumers.

108. Enabling users in Denmark to send information direct to approved third parties has led to a smoother customer journey, while the provision of information in a standardised format has eased transaction processes, potentially reducing costs.

109. In Sweden a survey is carried out every 2 years to measure pensions engagement between dashboard users and non-users. As part of this they explore whether people believe they have enough information to make informed pension decisions. Between 2005 and 2015 the number of dashboard users who said they have enough information to make pension decisions increased from 5% to 48%, compared to 13% of non-dashboard users in 2015[footnote 46]. The Swedish representative reported that the government-sponsored nature of their dashboard has helped to build trust among consumers that the service is there to help them.

110. In Australia they have found that the dashboard, accompanied by regular media campaigns, is helping to reconnect people with otherwise potentially lost pension pots.

111. In Israel, among users of the Wobi dashboard service[footnote 47] it was estimated there had been around a 25% increase in savings during the last few years. In addition it was estimated some 10% of these customers had transferred retirement accounts[footnote 48]. It was also suggested that pension providers were able to significantly reduce their costs for new business acquisitions through analysis of dashboard use and what decisions people make.

Summary of key findings

112. While the UK pensions landscape is very different in scale and complexity to these other countries, there are some important observations to be made, including:

a) most countries delivered a single, government-sponsored / non-commercial dashboard

b) in the few examples of multiple dashboards, only positive outcomes for consumers were reported

c) where delivery was industry led it was often facilitated by government through legislation, with the dashboard usually a non-commercial service

d) where legislation was used to compel scheme participation, a complete dashboard was delivered more quickly

e) a phased approach to implementation helped build confidence and trust in the dashboard among both consumers and industry

f) the level of take up among consumers increased significantly once the country’s dashboard had achieved full coverage.

113. Other lessons we have drawn from our conversations with other countries include:

g) the importance of clarifying data standards early on and the need to invest time in assuring the quality of data before using it on a live dashboard

h) the need to build flexibility into the dashboard service (including the data requirements) so that it can be adaptable and responsive to changes over time

i) to keep the presentation of information in a dashboard as simple as possible – jargon free and consumer centric.

114. Some of the key benefits highlighted for consumers and industry include:

j) helping people understand their own financial circumstances better

k) for pension providers, resolving anomalies or errors in personal data and cleansing it, which is also beneficial to the consumer

l) creating an opportunity for providers, using dashboard information, to offer modelling tools and follow-up conversations to inform people’s retirement planning

Industry and other stakeholder involvement

External engagement activity

115. In addition to exploring the user needs and lessons from other countries we have been keen to engage a broad range of stakeholders from across wider industry and draw from existing material. We are grateful to all those who have contributed to our thinking during the feasibility study.

116. The Pensions Dashboard Project’s report[footnote 49], published on 12 October 2017 represents the findings of a consortium of 17 large organisations. It provides useful evidence, which we have reviewed for the purposes of our feasibility study. There have been many further insightful contributions since then, including a report from Which?[footnote 50], in February 2018.

117. To help inform our feasibility study in its earlier stages, a DWP-led event attended by the Minister for Pensions and Financial Inclusion was held on 11 December 2017. This attracted around 250 stakeholders from across the sector. Building on this, ministers and departmental officials have continued to meet with representatives from many different organisations, spoken at external stakeholder events and held discussion forums in smaller groups. It has included, for example, targeted roundtable discussions involving consumer organisations, the managers and representatives of public sector pension schemes, and technology suppliers. Our aim has been to ensure we receive balanced input into the study from as broad a range of stakeholder perspectives as possible.

118. What we have learnt from this activity is considerable and invaluable in shaping our findings. Some of the key points made by industry and other sectors at the stakeholder development day on 11 December 2017 are captured in the table in Annex A. We also discuss what we mean by ‘industry’, in Annex B.

Chapter 4 – Architecture, data and security

Introduction

119. A dashboard service must operate in a way that balances industry innovation with data security. Industry will design, develop and implement dashboards, including creating the technical infrastructure to make this happen. In this chapter the department explores the various elements that enable dashboards to function and some of their key features. It sets out the key architectural principles which should, as a minimum, underpin the technology.

120. It is the design (or architecture) of the entire dashboard ecosystem that provides the link between the data held by pension schemes and the user who wants to be able to view their pension information on a dashboard (the user interface). The architectural design of the dashboard ecosystem is important because it ensures that users’ data are secure, the service is able to perform to a level that is expected and data are processed according to agreed standards. The ecosystem is made up of elements including user-facing dashboards, the providers of the data (pension schemes), the identity verification service, a Pension Finder Service (PFS), governance register and an Integrated Service Provider (ISP).

121. The proposed model outlined in this chapter has been used to inform the department’s view on many of the wider questions explored in Chapter 5. In arriving at this model, the department reviewed the architectural aspects of previous projects run by the industry-led Pensions Dashboard Project Group and the Open Identity Exchange, and considered the opinions of various parties.

122. The industry-led delivery group responsible for implementing dashboards will decide on the final, detailed architectural model, in line with the department’s overarching design principles and the architectural principles set out below. The industry group should also consider the department’s findings in relation to different elements of the dashboard ecosystem.

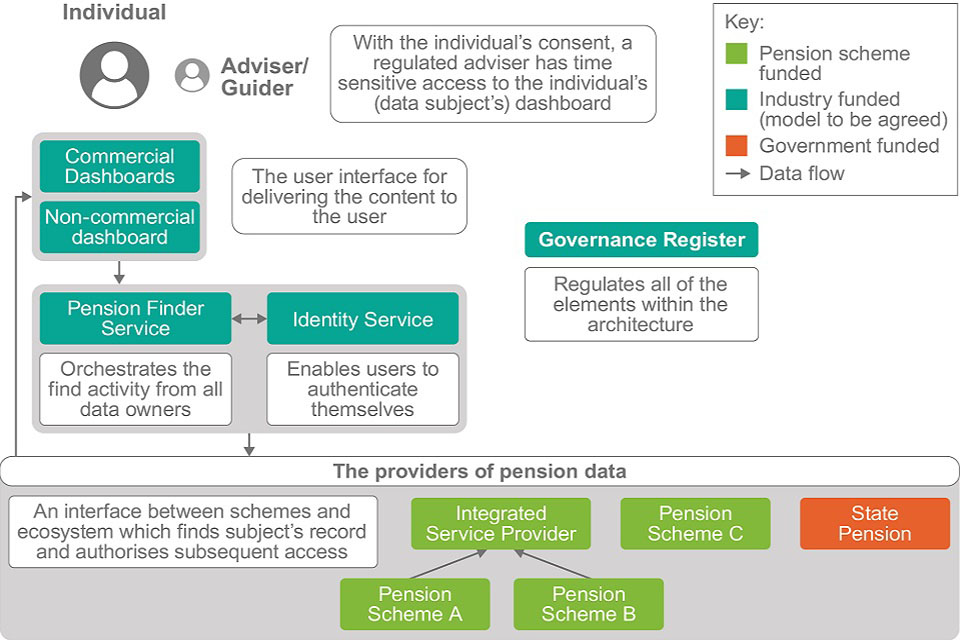

Diagram 1: Model of a dashboard ecosystem

Architectural elements and key findings

123. The key architectural elements within the dashboard ecosystem (see diagram 1) and their attributes, are:

- dashboards (the user interface)

- Pension Finder Service (PFS)

- pension schemes (providers of the data)

- State Pension

- identity service (security and access control)

- Integrated Service Provider (ISP)

- governance register

Dashboards (the user interface)

124. Dashboards are the user interface for delivering the content (data) to the individual user. This is the entry point for the user to initiate a search for their pensions and gather information about, for example, the value of their pension pot(s) (see Chapter 5 for discussion of the type of information and potential functionality of a dashboard).

125. The proposed architecture would support a single dashboard hosted by a single organisation or multiple dashboards hosted by different organisations. In the diagram there is a non-commercial dashboard and commercial dashboards. Whether the dashboard is commercially-orientated or not depends on the nature of the organisation hosting it. As explored in Chapter 5, industry will develop dashboards and will have the opportunity to innovate. It is proposed that a non-commercial dashboard is hosted by the SFGB.

Pension Finder Service (PFS)

126. The PFS acts like a search engine to find the pension schemes linked to the individual. Once the individual has given their consent, it will use information gathered during the identity verification process to send requests to pension schemes to access and retrieve their data.

127. In order to reduce risk and remove data access traffic from the PFS, the details and values of a pension should not pass through the PFS, and nor should the PFS aggregate data. This would be in keeping with the Data Protection Act 2018 and will help to reduce its value as a target for hackers. As the diagram above shows, where the provider receives a request and finds a match, the returning data flows directly through a dashboard to the individual. It does not flow through the PFS.

128. The potential for having multiple PFSs has been looked at as part of feasibility, including wider market considerations discussed in Chapter 5. The department believes that a single PFS will keep the cost of build and operation down, alongside reducing the costs and complexity of assurance, compliance and the governance of multiple entities. Industry will build and pay for this. A single PFS provides greater assurance (than would be achieved with multiple PFSs) on the way users’ data are to be processed and minimises costs. This is an important factor particularly if the department is to require schemes to participate in the dashboard ecosystem and provide State Pension information. (Chapter 5 explores these issues in more detail.)

Pension schemes (providers of the data)

129. These are the providers of pensions holding individual users’ pensions data. Before pension schemes are able to return data, they must be connected to the dashboard ecosystem. Where desired, schemes will utilise a contractual relationship with an Integrated Service Provider (ISP) (see below) to enable their data to be accessed by the ecosystem. This may be the case, for example, where a pension scheme does not have the system capability or resources to connect to the ecosystem directly.

State Pension

130. As set out in Chapter 5, we expect State Pension data to ultimately be part of the service. It will be the responsibility of the industry-led delivery group, working with government, to ensure that the necessary data standards and security are in place in order to allow State Pension data to connect to the service. Government will work with the industry-led delivery group to integrate the State Pension into pensions dashboards. Subject to the delivery timetable, a link for Check your State Pension can be made available for an interim period. This is an existing digital service that has provided more than 10 million online estimates since its introduction in 2016.

Identity service (security and access control)

131. The identity service enables users to authenticate themselves so that they can access other elements of the ecosystem. It provides the verification required to assure data providers that they are returning data to the correct individual user and no one else.

132. Provision of the identity service will be determined by the market, according to the standard set in the principles section below. The identity service forms part of a technical trust framework, along with the technical services of a governance register, which will ensure that only appropriately assured parties can participate in the ecosystem (whether this be dashboards, users, ISPs (see below) or pension schemes).

133. We note that the National Insurance Number (NINO) is used as a common identifier within the pensions industry. We expect that the architecture enables the customer to provide their own National Insurance Number which, when accompanied with a standard identity check will be used by providers (pension schemes, ISPs or DWP for State Pension) to match their customer records.

134. The authorisation to access State Pension values will only be returned if the user’s self-asserted NINO and the identity attributes match. This is not the same as a NINO validation service, which some in industry have requested but which cannot be offered by government for security reasons. A NINO alone is not sufficient for accreditation and access.

Governance Register

135. In order to become part of the dashboard ecosystem, different elements such as dashboards (user interfaces) and pension schemes will be required to meet certain standards and requirements. Their participation in the ecosystem will require assurance, without which they will not be able to interact with other elements and data will not flow between them.

136. The governance register described here is a technical service that would ensure the individual elements operate correctly within the ecosystem. It would provide the trust upon which all of the elements operating within the architecture are authorised to talk to each other. As current practice, schemes will be responsible for any data provided to the dashboard ecosystem.

137. The delivery group (see Chapter 6) will establish a suitable governance model and oversee the governance register. It should explore options with the regulators to properly assure the different elements within the ecosystem. Some of our high level findings on consumer protection are explored in Chapter 5.

Integrated Service Provider (ISP)

138. An ISP enables an individual’s pension information to be securely held (on behalf of pension schemes) and accessed by the other elements in the dashboard ecosystem where the provider is unable to do so directly.

Architectural design principles

139. Having considered the various elements that make up the dashboard ecosystem, the department has set out some additional ‘architectural principles’ that should form the basis of the final architecture. These are in line with the overarching design principles set out in Chapter 2 which:

- put the consumer at the heart of the process by giving people access to clear information in one place online

- ensure that individuals’ data are secure, accurate and simple to understand – minimising the risks to the consumer and the potential for confusion

- ensure that the individual is always in control over who has access to their data

Data access and consent

140. The quality and integrity of the data presented on a user interface (dashboard) are key to its success. For the ecosystem to work effectively all parties must have trust in the service, which means there must be clarity over where data are stored, controlled and processed.