Cheshire Public Review Closure Notice

Updated 16 October 2023

New procurement to extend coverage of gigabit-capable broadband across the Cheshire (Lot 17) region.

1. Introduction

The government’s ambition is to deliver nationwide gigabit-capable broadband as soon as possible. We recognise that there is a need for government intervention in the parts of the country that are not commercially viable; this is why the government has committed £5 billion for the hardest to reach parts of the country, ensuring that all areas of the UK can benefit. This will be spent through a package of coordinated and mutually supportive interventions, collectively known as Project Gigabit.

We wish to work collaboratively with industry to maximise efficiency, minimise market distortion and achieve our objectives within a tight time frame. To do this, we first identified the areas that were not commercially viable through the Open Market Review (OMR) and Public Review (PR) stages. This allowed us to understand from suppliers if there were any current or planned investment over the next three years in broadband infrastructure (Next Generation Access broadband, ultrafast and gigabit-capable) in the identified geography. For this Lot, the identified geography lay within the Cheshire region.

The box below shows the order of stages, from OMR to procurement.

-

OMR

-

Public Review

-

Determine intervention areas for procurement

-

Procurement

Through these stages, BDUK classifies premises as eligible/ineligible for subsidy on the basis of their existing or planned qualifying broadband infrastructure. Details on the classification system of White, Grey, Black and Under Review and methodology can be found in section 3.2 BDUK Classifications and methodology for this PR.

Premises categorised as White by BDUK during OMRs and PRs (ie eligible for subsidy) are grouped into Intervention Areas (IAs). IAs list those premises that will be targeted for subsidy in any potential procurement to follow this PR. To be clear, not all eligible premises may have been targeted for subsidy. The finalised IA will be issued to the market at the Invitation to Tender (ITT) stage of procurement so that suppliers can bid for subsidy to support delivery to this IA.

Further information on the OMR/PR process and how we reach our conclusions can be found in the Subsidy Control Guidance document.

2. Outcome of the preceding Open Market Review

Preceding the current PR stage, BDUK conducted an OMR for Cheshire (Lot 17) from 6 April to 6 May 2022. This OMR requested information from suppliers regarding current and planned broadband infrastructure within the next three years.

All meaningful responses to the OMR were considered and where necessary used to determine eligible premises. Suppliers who responded to the OMR were informed of the classifications applied to the existing and planned infrastructure relevant to their submission.

The key findings of the OMR are presented in the postcode-level map showing eligible premises identified through the OMR for Cheshire (Lot 17), and a list of eligible postcodes can be found on our website.

3. Outcome of the Public Review

3.1 Background

The PR for Cheshire (Lot 17) ran from 5 September to 5 October 2022. During the PR, BDUK invited stakeholders (including broadband infrastructure operators, internet service providers, the public, and businesses) to provide feedback regarding which areas were made up of eligible premises.

Furthermore, BDUK carried out market engagement to seek feedback from suppliers about the design of the IA and Lot design, the procurement type (A - local supplier, B - regional supplier or C - cross-regional supplier) and also the capacity of the market to bid for a potential procurement.

The PR stage aimed to validate the outcome of the preceding OMR to ensure that it correctly represented the information provided by suppliers over the course of the OMR.

Suppliers who missed contributing to the preceding OMR, had no definitive plans and/or evidence base on which to substantiate claims at that earlier stage, or had subsequently updated their plans had a final opportunity to notify BDUK before final determinations were made on premises eligibility. All meaningful responses were carefully considered and where necessary utilised to determine eligible premises. BDUK also sought feedback from Cheshire West and Chester, Cheshire East, Halton Borough and Warrington Borough Councils. The finalised postcode-level map showing eligible premises is shown in Annex A of this PR Closure Notice. See Postcode-level map.

A finalised list of postcodes showing White, Grey, Black and Under Review PR outcome has been published. A list of eligible (White/Under Review) premises is also available to suppliers upon request.

The proposed IA shown in Annex B has been submitted to BDUK’s National Competence Centre and obtained approval to proceed. The finalised IA will be available to bidders at the forthcoming ITT stage.

Changes to the Lot Area

Please note, Lot areas are not fully aligned to Local Authority boundaries. Specific Lot boundaries (and IAs) may flex during the OMR, PR and Pre-Procurement Market Engagement (PPME) processes to enable an optimum procurement to be put to the market.

Since the PR closed on 5 October 2022 there have been no amendments to the proposed Lot Boundary Area. The PR outcomes provided below, and shown in Annex A, are consistent with the proposed Lot Boundary Area that is now going to procurement.

3.2 BDUK classifications and methodology for this PR

During the PR, BDUK categorised premises as gigabit White, Grey, Black or Under Review.

Subsidy control classifications are set out below:

-

White - indicates premises with no gigabit network infrastructure and none is likely to be developed within 3 years[footnote 1]

-

Grey - indicates premises where a single qualifying gigabit infrastructure from a single supplier is available, or is to be deployed within the coming 3 years[footnote 1]

-

Black - indicates premises with two or more qualifying gigabit infrastructures from different suppliers being available, or will be deployed within the coming 3 years[footnote 1]

-

Under Review - indicates premises where suppliers have reported current or planned commercial broadband coverage, but where claimed current gigabit coverage has not been verified, or, in respect of planned build, where evaluators are confident that gigabit infrastructure will be delivered, but some risks to delivery remain, or there are some gaps in evidence

BDUK will only provide subsidy to target premises that have been designated as White. Premises which have been designated as Under Review may be included within the Deferred Scope of a procurement. Where this is the case, a further review will be undertaken to confirm whether they are Grey or White before they are released for build.

In accordance with the OMR/PR processes, supplier data submitted during the OMR and PR has been mapped using a methodology that protects commercially sensitive supplier data. To reflect this sensitivity, we will only release White and Under Review Unique Property Reference Numbers (UPRNs).

3.3 Summary of PR findings - premises eligibility

For presentational purposes only, postcode-level mapping has been used to present the map showing eligible premises. (NB we will only subsidise build to premises which have been designated as White - postcodes are not used to determine IAs for subsidy).

For this purpose, postcodes have been classified as follows:

-

A postcode is White if any White premises are present.

-

A postcode is Under Review if any Under Review premises are present.

-

A postcode is Black if all premises in the postcode are classified Black.

-

A postcode is Grey if all premises are Grey, or a mixture of Grey and Black.

A postcode-level map summarising these premises classifications is provided in Annex A. Suppliers - please note that this map does not show which UPRNs have been determined as White and Under Review.

The outcome of the PR is summarised in terms of White, Grey, Black and Under Review postcodes and premises below:

| Postcode Classification | Number of Postcodes | Number of Gigabit Black Premises | Number of Gigabit Grey Premises | Number of Gigabit Under Review Premises | Number of Gigabit White Premises |

|---|---|---|---|---|---|

| White | 7,389 | 2,223 | 32,155 | 28,009 | 54,996 |

| Under Review | 10,214 | 2,178 | 61,394 | 110,110 | 0 |

| Grey | 12,437 | 15,268 | 220,671 | 0 | 0 |

| Black | 2,929 | 53,099 | 0 | 0 | 0 |

| Total | 32,959 | 72,768 | 314,220 | 138,119 | 54,996 |

3.4 Forthcoming procurement

During the PR stage for Cheshire (Lot 17), BDUK sought responses from the market and other stakeholders to validate the Annex A Subsidy Control map (showing Gigabit White, Grey, Black and Under Review determinations).

BDUK also carried out market engagement to seek feedback from suppliers about the design of the proposed IA and Lot, the procurement type (A - local supplier, B - regional supplier or C - cross-regional supplier) and also the capacity of the market to bid for a potential procurement.

The total public funding investment has been based on the final number of premises requiring subsidy. BDUK will confirm a budget drawn from public funding for this area within the forthcoming tender documentation. Details of any restrictions on the use of public subsidy will be explained within the tender documentation.

Indicative funding allocated to this Cheshire (Lot 17) procurement is as follows:

Type B - (Total of 17,745 UPRNs) approximately £44,777,807 split as follows:

-

Initial Scope: 10,636 UPRNs approximately £29,741,925

-

Deferred Scope: 7,109 UPRNs approximately £15,035,882

The procurement type selected for Cheshire (Lot 17), following engagement with market and other stakeholders, is anticipated to be a single Type B regional supplier procurement. A premises-level map detailing the proposed IA can be found in Annex B.

This procurement was designed utilising data from the PR conducted in October 2022 mentioned above, supplemented with information derived from the recent January 2023 National Rolling Open Market Review (NR OMR) undertaken by BDUK.

As of January 2022, BDUK has been asking suppliers delivering gigabit-capable infrastructure to submit national data returns on a 4-monthly basis (January, May and September) to provide detailed build plans at premises level. The purpose of the NR OMR is to ensure that BDUK has the most up to date information about suppliers’ existing and planned commercial build with supplier submissions being used to inform eligibility across Project Gigabit.

Following the completion of the evaluation process of responses received from suppliers to the January 2023 NR OMR, the subsequent subsidy control classification results were overlaid and used by BDUK in the design of this type B regional supplier contract. Further information on the January 2023 NR OMR can be found within the January 2023 NR OMR Closure Notice published 14 June 2023.

BDUK is confident that integrating these NR OMR findings will ensure the best possible outcome for this IA, maximising both coverage and value for money accordingly. Our interventions will always flex to respond to both changes in the dynamic marketplace, and the appetite for our procurements. Further information on the NR OMR process can be found in the Subsidy Control Guidance document.

The regional supplier contract includes two categories of intervention: Initial Scope, where the regional supplier should build as quickly as possible; and Deferred Scope where we wait and see whether commercial plans or voucher projects translate to delivery, but could then build if not.

For premises that are included in the Deferred Scope of contract, we will seek a price from the regional supplier, but will not authorise build unless and until they are re-classified as White. We will always either descope Under Review premises or defer build to them and we will always descope Grey or Black premises.

Cheshire’s (Lot 17) forthcoming procurement will be carried out in accordance with the Public Contracts Regulations 2015 (PCR2015). BDUK procurement approaches are designed to address the scale of the individual procurements. Cheshire’s (Lot 17) procurement will be conducted in a transparent and non-discriminatory manner.

The Authority, BDUK, reserves the right to amend or withdraw the procedure for the competitive sourcing process at any time. Any amendments will be done in line with the Procurement Regulations.

Suppliers acknowledge and accept that by issuing this document (PR Closure Notice) BDUK shall not be bound to progress or conclude any related procurement activity.

Under no circumstances shall the Authority incur any liability in respect of the information contained in this Closure Notice or any supporting documentation.

Timescales

The following table summarises the indicative timescales for the procurement.

| Activity | Date |

|---|---|

| Procurement start date (SQ Launch) | July 2023 |

| Estimated contract award date | January to April 2024 |

See Project Gigabit procurement timelines for more information.

3.5 Summary of PR findings

- There are 54,996 White premises (out of 580,103) where the market does not intend to build, indicating there is a strong commitment from active suppliers in Cheshire (Lot 17) to reach a large proportion of premises in the county

- The IA was designed to address areas outside of where we expect the commercial sector to build to, prioritising footprints where there is an appetite for BDUK to go further, faster

- We contacted all known national and local suppliers to ask them to respond to the OMR and PR. This included working closely with Cheshire West and Chester, Cheshire East, Halton Borough and Warrington Borough Councils to ensure active and prospective suppliers were aware of the OMR and PR and could feed in their responses

4. Conclusion

A key output for the OMR/PR for Cheshire (Lot 17) is the map showing premises that are eligible for subsidy.

From this map, BDUK developed an IA which was proposed to the market during the PPME phase. Annex B sets out the draft IA map at UPRN level.

This identifies the areas where premises are eligible for subsidy. A full list of White and Under Review UPRNs is available on request to suppliers via [email protected].

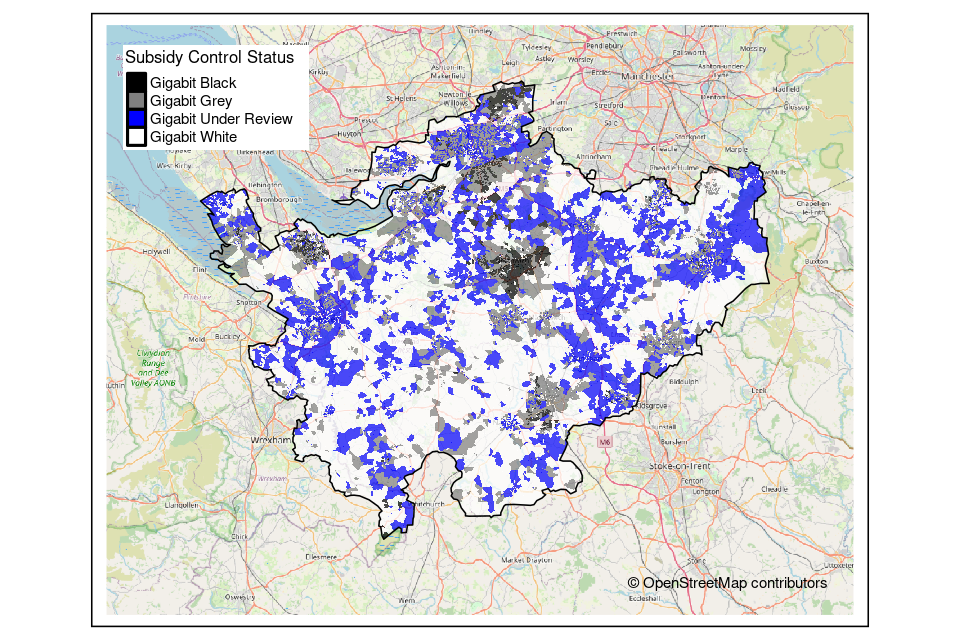

5. Annex A – Map indicating locations of eligible premises

The postcode level map below indicates areas where those premises eligible for subsidy are located ie White areas. These eligible premises may be included within the IA.

Black, Grey and Blue (Under Review) areas indicate where those premises ineligible for subsidy are located.

Cheshire (Lot 17) Postcode level map (showing subsidy control classifications at a postcode level)

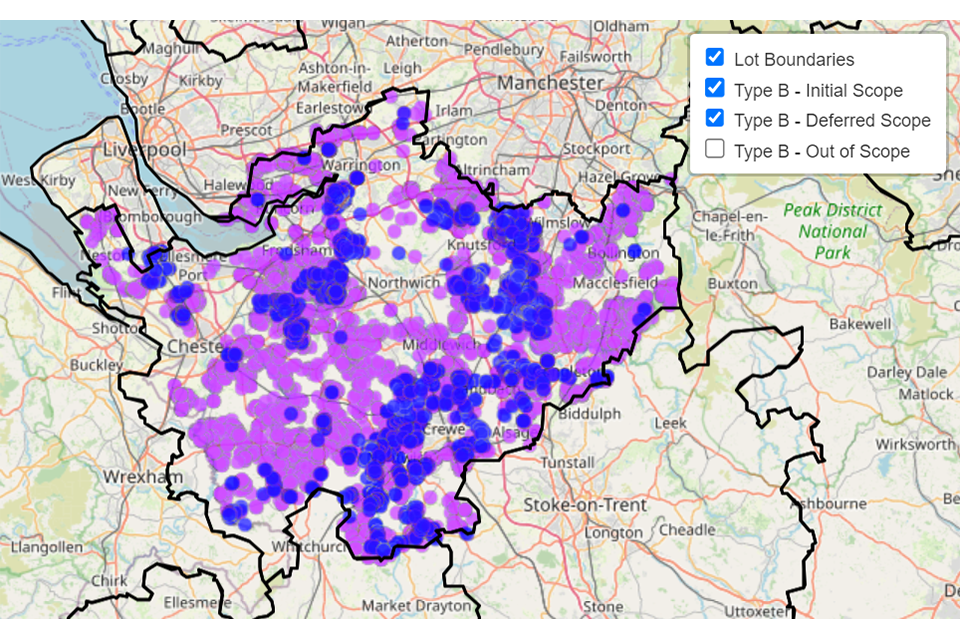

6. Annex B – Map of proposed intervention area

The map below highlights the IA that were approved following completion of the PPME exercise.

Please see section 3 above for information on BDUK’s findings, contextualising how eligible premises were included in the proposed IA.

The above premises-level map indicates eligible premises that form the proposed type B procurement.

Those premises which are highlighted in pink (10,636 premises) are referred to as the ‘Initial Scope’ premises that will be targeted for subsidy.

Those premises which are highlighted in blue (7,109 premises) are referred to as the ‘Deferred Scope’ premises, which will not be targeted for subsidy unless they have been determined to be eligible (White) as part of BDUK’s monitoring process.

This map is accompanied by a list of UPRNs that fall within the IA, clearly demarcating which premises are within the ‘Initial’ or ‘Deferred’ Scope which suppliers can request via Atamis. If you are unable to access Atamis, please contact the Supplier Mailbox [email protected].

7. Annex C – Post PR Closure Notice Updates - October 2023

Everything prior to Annex C within this PR Closure Notice reflects the outcomes of the PR conducted in Cheshire (Lot 17) from 5 September to 5 October 2022, which was published on 6 July 2023.

As of October 2023, the single type B regional supplier contract procurement referenced in Section 3.4 of this PR Closure Notice, was successfully launched for Cheshire (Lot 17) on 6 July 2023 via BDUK’s procurement portal Atamis.

During this live procurement which is ongoing, some minor changes have been made to the IA that was initially released to the market following feedback from stakeholders and an internal review conducted by BDUK. This has resulted in a slight reduction in the number of premises included in the IA for subsidy.

Please note that this update does not impact the estimated contract award timescales noted above.

Changes to the proposed Cheshire (Lot 17) volumes of premises eligible and an updated IA map are detailed below:

Cheshire (Lot 17) Type B (original versus revised funding and UPRNs)

| Original | Original figure | Revised figure |

|---|---|---|

| Funding Allocated | £44,777,807 | £43,137,190 |

| Total number of uncommercial premises in IA | 17,745 | 16,428 |

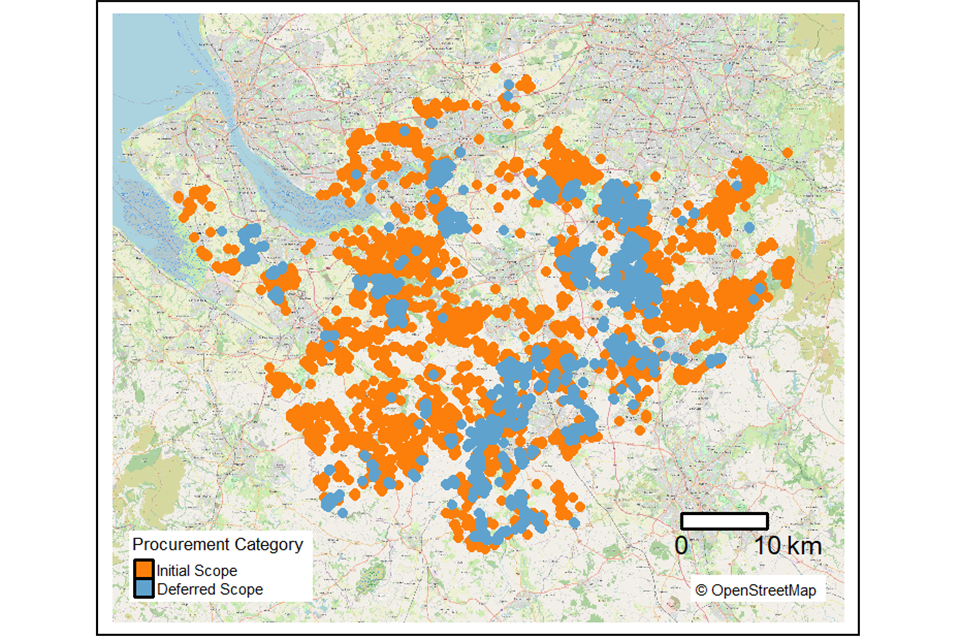

Map of Proposed Intervention Area - Revised Cheshire (Lot 17)

The below map shows the updated eligible premises that form the proposed revised IA for the Cheshire (Lot 17) contract.

Those premises which are highlighted in orange (9,573 premises) are referred to as the Initial Scope premises that will be targeted for subsidy.

Those premises which are highlighted in blue (6,855 premises) are referred to as the Deferred Scope premises, which will not be targeted for subsidy unless they have been determined to be eligible (White) as part of BDUK’s monitoring process.

This map is accompanied by a list of UPRNs that fall within the IA, clearly demarcating which premises are within the Initial or Deferred Scope which suppliers can request via Atamis. If you are unable to access Atamis, please contact the Supplier Mailbox [email protected].