Simpler annual benefit statements

Updated 19 October 2020

Introduction

This consultation seeks views and evidence on options for the policy approach to the content and presentation of information provided to members through their annual workplace pension benefit statements, including the presentation of information on costs and charges. It also seeks views on a transfer of ownership of the assumptions underpinning annual benefit statements from the Financial Reporting Council to the Department for Work and Pensions (DWP), and amendments to these assumptions.

About this consultation

Who this consultation is aimed at

We would particularly welcome responses from:

- members of occupational and personal pension schemes

- employee representatives

- trades unions

- consumer groups

- employers

- pension industry professionals – including scheme administrators, payroll administrators, accountants, payroll bureaux, independent financial advisors, employee benefit consultants and members of the advisory community

Purpose of the consultation

The purpose of this consultation is to seek views and evidence on 3 related issues. First, how the use of simpler and more consistent annual pension benefit statements across the pensions industry through greater standardisation of structure, design and content could help improve engagement with pensions. The consultation does not at the current time propose changes to trustees’ obligations in the Occupational and Personal Pension Schemes (Disclosure of Information) Regulations 2013 (“the Disclosure Regulations”). Subject to the outcome of this consultation, we will consult on the detail of draft regulations or guidance that might place additional obligations on trustees.

Second, we are seeking views on proposed amendment of the Disclosure Regulations to require relevant schemes to include member level charges and transaction costs information in pounds and pence on the annual benefit statement. Thirdly, we are seeking views on amendment of the Disclosure Regulations so that they no longer refer to the Financial Reporting Council as the body responsible for the guidance underpinning Statutory Money Purchase Illustrations (SMPI) and that the Secretary of State for Work and Pensions will issue guidance under statute to which trustees must have regard when producing SMPIs. We will consult on regulations and guidance in due course subject to the views expressed by respondents.

Scope of consultation

This consultation applies to England, Wales and Scotland.

Duration of the consultation

The consultation period begins on 1 November 2019 and runs until 20 December 2019.

How to respond to this consultation

Please send your response, highlighting that you are responding to this consultation, preferably by email to: [email protected]

Or by post to:

Department for Work and Pensions

Automatic Enrolment Policy Team: Simpler Statements

Zone C, First Floor

Caxton House

London

SW1H 9NA

Please ensure that your response reaches us by 20 December 2019. When responding, please state whether you are doing so as an individual, or behalf of a company or representing the views of an organisation. If you are responding on behalf of an organisation, please make sure you tell us who the organisation represents, and where applicable, how the views of the members were assembled.

Any queries about the subject matter of this consultation should be addressed to

[email protected].

Government response

We will publish the government response to the consultation on the GOV.UK website. The consultation principles encourage departments to publish a response within 12 weeks or provide an explanation why this isn’t possible.

The report will summarise the responses.

How we consult

Consultation principles

This consultation is being conducted in line with the revised Cabinet Office consultation principles published in March 2018. These principles give clear guidance to government departments on conducting consultations.

Feedback on the consultation process

We value your feedback on how well we consult. If you have any comments about the consultation process (as opposed to comments about the issues which are the subject of the consultation), including if you feel that the consultation does not adhere to the values expressed in the consultation principles or that the process could be improved, please address them to:

DWP Consultation Coordinator

4th Floor

Caxton House

Tothill Street

London

SW1H 9NA

Or by email to [email protected].

Freedom of information

The information you send us may need to be passed to colleagues within the Department for Work and Pensions, published in a summary of responses received and referred to in the published consultation report.

All information contained in your response, including personal information, may be subject to publication or disclosure if requested under the Freedom of Information Act 2000. By providing personal information for the purposes of the public consultation exercise, it is understood that you consent to its disclosure and publication. If this is not the case, you should limit any personal information provided, or remove it completely. If you want the information in your response to the consultation to be kept confidential, you should explain why as part of your response, although we cannot guarantee to do this.

To find out more about the general principles of Freedom of Information (FoI) and how it is applied within DWP, please contact the Central Freedom of Information team by email [email protected].

The Central FoI team cannot advise on specific consultation exercises, only on Freedom of Information issues. Read more information about the Freedom of Information Act.

Background

Automatic enrolment has transformed workplace pension participation with millions of workers saving for the first time, or saving more, into a workplace pension. In this new workplace pension environment, it is increasingly important that members have access to easily understandable information about their savings to help them plan for the retirement they want.

The government’s Automatic enrolment review 2017: Maintaining the momentum looked at how to build on the success of automatic enrolment, including the opportunities presented by better engagement with working age savers. It considered how engagement can be improved so that savers have a stronger sense of personal ownership of their workplace pension.

The review concluded that better engagement can complement automatic enrolment and reinforce individuals’ saving behaviour, and that to be successful, engagement should reflect a number of key principles. Approaches should be:

- simple

- personalised

- timely

- accessible

- work with the grain of peoples’ busy lives.

The review recognised that there is no single ‘silver bullet’ which will lead to stronger personal ownership of pension saving but that this can come from the cumulative impact of more effective engagement tools and interventions.

The review identified annual pension benefit statements as being often ineffective and a lost opportunity because they are too long and complex which means some savers do not understand or engage with the information they receive.

As individuals progress through employment they are likely to have more than one workplace pension pot and will receive a number of statements which may be inconsistent in length, language and style. That inconsistency presents another potential barrier to engagement and planning because individuals cannot quickly and easily compare multiple statements.

Industry is continuing to invest in the development of simpler pension statements, often as part of work to simplify their pension communication strategies more broadly, but without a sufficiently joined-up approach this may not drive greater consistency.

During the 2017 review, a 2-page simpler annual benefit statement for use in defined contribution schemes was developed by Ruston Smith, Quiet Room and Eversheds Sutherland as a best practice example. It was further refined through user research during 2018 before being launched at the Pensions and Lifetime Savings Association Conference in October 2018, for voluntary use by providers, with the support of the Minister of Pensions and Financial Inclusion.

This year the Association of British Insurers (ABI) and the Pensions and Lifetime Savings Association (PLSA) have been working to support adoption of simpler statements through their Cross-Industry Steering Group on Simpler Annual Statements and Wider Pensions Communication.

The group was set up to advocate for and drive adoption of simpler annual statements across the entire pension sector and ensure coherence with wider regulatory changes and industry initiatives on pension communications. The work of that group has included considering whether design principles or descriptors adopted on a voluntary basis might drive greater simplicity and consistency, and understanding whether their members are using simpler statements on a voluntary basis. We welcome the work of that group.

Whilst there is activity across industry, we want to explore how progress can happen more quickly and what the options to achieve this are. In this consultation we have therefore set out 3 options informed by the 2017 review; the work of Ruston Smith, Quiet Room and Eversheds Sutherland; and of the ABI and PLSA.

We want to explore whether reliance on voluntary adoption of the simpler statement template; design principles; or descriptors can gain sufficient traction to deliver the degree of simplification and greater consistency that can help members engage with their pension savings during the accumulation stage.

This consultation also discusses whether or not a regulatory approach may be needed and, if so, how that could be framed to drive greater standardisation of the length, format, and content of statements. As part of this we want to explore what costs may be incurred by providers and others on adopting any new approach.

We recognise that the variety of workplace pension schemes and their need to comply with differing regulatory requirements presents a possible barrier to standardisation. Our focus in this strand of the consultation is therefore on qualifying schemes – specifically, members of defined contribution workplace pension schemes which have been used to meet their employers’ automatic enrolment duties. This includes occupational and workplace personal pension schemes. Trustees and providers may of course wish to extend the application of the proposals in this section of the consultation further, for administrative simplicity.

The development of new technology, including pensions dashboards, is changing the way that people engage with and consume information. As part of this consultation we are inviting views on the relationship between simpler paper-based workplace pension statements and new technology that increasingly offers innovative and creative ways to engage people with their pension saving.

It is important that in simplifying statements and making them more consistent through a standardised approach, future opportunities to innovate for different memberships and cohorts should not be lost, and that the principles of simplicity and consistency also inform innovative approaches.

The relationship of simpler statements with the development of pensions dashboards – which are themselves intended to be key to opening up pensions for millions of people – will be crucial.

We recognise that it is important that any approach taken to the information and data presented in simpler statements should be consistent with work being undertaken by the new Industry Delivery Group on data standards and data display, and should recognise also the impact on schemes.

While the 2 projects are separate and will proceed at their own pace, DWP will continue to engage with the Industry Delivery Group in relation to this, mindful of the value of alignment.

The 2017 review recognised that whilst annual statements can be redesigned to be short and simple, if individuals do not open them, they will remain a lost opportunity to inform and engage. The review therefore called upon the pension industry to explore the concept of a ‘statement season’ that could support engagement through raising awareness and facilitating a national conversation about pension saving and retirement.

We want to drive this thinking further and as part of this consultation we are inviting views to explore whether, for example, the Swedish ‘orange envelope’ approach to high impact visibility and consistency when mailing statements, and a specific statement season during which statements are sent out, can support awareness of the importance of workplace pension saving at national and individual level and support the normalisation of pension saving.

Alongside this consultation on simpler statements, we are also looking at how to help members identify whether their savings are on track by moving towards greater standardisation in the assumptions which underpin the Statutory Money Purchase Illustration (SMPI). Providing a common basis for calculation will allow members to more accurately estimate their future pension pot and pension income by simply totalling the illustrations across their statements.

This would also involve a transfer of ownership of the guidance which underpins the SMPI from the Financial Reporting Council to statutory guidance issued by the Secretary of State for Work and Pensions. The scope of this measure would cover the same schemes as the existing guidance, i.e. all money purchase benefits whether occupational, workplace personal or individual personal pensions.

Finally, we are seeking views on the benefits, risks, practicalities and timing of including approximate member-level charges and transaction costs on the annual benefit statement itself, to make it easier for members to identify what they’ve actually paid.

Government supports the fundamental principle that as investors in variable return long-term savings products where the effect of costs and charges on members’ savings can be significant, members have a right to the information in a proportionate way. The scope of this measure is all occupational and workplace personal pensions.

Our ambition is to achieve simpler statements, which through design and content presents the information that people need on their pension savings in a way they can understand and which engages their interest.

Simpler annual statements: helping members engage

Background

1. The current requirements relating to the form and contents of the annual benefit statement and illustrations for members with money purchase benefits are set out in the Occupational and Personal Pension Schemes (Disclosure of Information) Regulations 2013. These regulations apply to all annual benefit statements, whether produced for occupational or personal pensions.

2. The length and detailed design of annual benefit statements are not prescribed. The Pension Regulator’s ‘Communicating and reporting guide for DC pension schemes’ notes the importance of good member communications, provided at the right time and in the right format, including in the way that information is provided through annual benefit statements

3. Section 113 of the Pension Schemes Act 1993 (as amended by section 44 of the Pensions Act 2014) enables the Secretary of State to make regulations in respect of the information to be provided to members of occupational and personal pension schemes.

4. Annual pension benefit statements offer a well-established opportunity to provide individuals with information about their workplace pension that can engage them with their saving and help them plan towards greater security in retirement. However, the length, complexity and inconsistent design of statements may present barriers to understanding.

What do we want to achieve?

5. We believe that short statements, with simpler, jargon-free, language and key figures that are presented in a consistent way, have the potential to enable members to understand both their individual pension pots more easily and the cumulative picture of their pension savings when, as will increasingly be the case, they have more than one pot. This can provide a foundation which can help them plan for their future retirement.

6. We believe that statements should be structured to enable a member to quickly see the answer to 3 questions, identified during the work on the simpler statement developed by the group led by Ruston Smith, and considered by the ABI and PLSA Cross-Industry Group. 2 key questions will be the starting point for planning:

- How much money do you have in your pension pot?

- How much money could you have when you retire?

7. In addition, statements should include a call to action to nudge a member to consider their future planning by addressing a third key question:

- What can you do to give yourself more money in retirement?

8. Information in respect of the third question is not a requirement of the Disclosure Regulations, but is intended to provide additional information that can encourage and support thinking about retirement planning.

- We would welcome your views on this twin ambition:

a) Is it one that you recognise as offering benefits in terms of an individual’s understanding of - and better engagement with – their workplace pension saving? Yes/No?

b) In what ways could consistent workplace pension annual benefit statements offer an opportunity to improve engagement with and understanding of pension provision?

Relationship with wider communication materials and engagement approaches

9. We recognise that annual statements will often form part of a wider suite of communication material and engagement approaches that trustees, scheme providers and others send to members to inform and engage them with their pension saving. Those materials may have been informed by user testing and research on how to improve engagement/understanding.

10. This relationship places an additional focus on the need for consistency in the way that information is presented, for example, in the use of simple language, throughout the material members receive or access.

11. We are interested in how simpler annual statements may impact on providers’ materials and engagement strategies more broadly.

2. We would welcome:

a) views on how annual statements are positioned within your broader member engagement strategy?

b) views on the implications of requiring trustees and scheme providers to have regard to principles; descriptors or a simpler statement template on other communication materials, including the need for and cost of redesigning approaches.

c) evidence/user testing about how to improve engagement/understanding which you have used to support your wider communications.

Which pension schemes are in scope?

12. The work undertaken on the development of a simpler annual statement during the 2017 review and subsequent discussions of the industry group convened by the ABI and PLSA has highlighted the challenge of achieving consistency of statements given the range of pension schemes that exist, and the differing regulatory requirements that may apply.

13. Automatic enrolment has brought millions of individuals into workplace pension saving, often for the first time. Automatic enrolment has changed the savings behaviour of those individuals so that they are now savers. It is a behavioural change that is sticking – the number of those who stop saving is low; participation in workplace pension saving has been transformed; and attitudes towards saving are positive. We want to support this cohort of people on their savings journey.

14. Our focus in this strand of the consultation is therefore on qualifying schemes – specifically, members of defined contribution workplace pension schemes (strictly, members with money purchase benefits, including money purchase benefits in non-money purchase schemes), which have been used to meet their employers’ automatic enrolment duties. This includes occupational and workplace personal pension schemes. Defined Benefit schemes and public sector schemes are not in scope, but there will be the opportunity to learn lessons about the potential applicability to them in the future.

3. We would welcome your views on:

- our intended scope – does this make sense or should the scope be broadened, or narrowed?

How can we achieve simplicity and consistency?

Short statements

15. We believe that simplicity starts with brevity and that for most individuals, statements which are short are more likely to be read, are less likely to appear intimidating, but can still provide the key information required. Statements need to work with the reality of peoples’ busy lives which mean they may not engage with long and complex documents.

16. With brevity in mind, the 2-page approach of the simpler statement (in paper format) which is readable in a couple of minutes, was designed to strike a balance in terms of information provided and readability. Where there is useful additional information not included in the 2 pages it can be signposted via links to online material so that an engaged or interested recipient who wants to find out more is shown clearly where to find it.

17. Alternatively, a ‘layered approach’ could be adopted so that the 2 pages serve as a top sheet that provides the recipient with key information, but additional material is provided for those who want to know more and who are more likely to engage with a longer document.

18. As part of examining how best to achieve both simplicity and consistency we want to explore how brevity can be balanced against personalised approaches and what the ideal length for a statement used across industry should be.

4. We would welcome your views on the length of statements:

a) short statements of 2 pages in length have been proposed. What evidence can you provide where the adoption of this approach has been beneficial? In what ways? For whom?

For trustees and scheme providers:

b) are your statements typically longer, or shorter, than 2 pages? How many pages are your statements in total?

c) what strategies have informed the design and length of your annual statements? What feedback, if any, has been sought? What changes have been made to improve the usability of statements? What future changes are planned?

Options to drive simplification

19. In considering how information can be presented to achieve the twin aims of simplicity and consistency we want to explore 3 alternative options, informed by the work of Ruston Smith’s group and that of the ABI and PLSA Cross-Industry Group, and are seeking views on those:

- a simpler statement template

- a design-principles based approach

- an approach based on descriptors

20. We want to explore whether voluntary adoption of these options can deliver change and genuine consistency; whether a regulatory approach may be the way forward; and the costs of transitioning to any new approach.

Principles to inform our approach

21. We recognise that in any approach adopted there is a need to balance the level of prescription in the structure, content and design of annual statements against a range of factors which will guide our decisions:

- the evidence base for improving engagement and understanding, partly built through this consultation

- future regulatory changes which may have an impact on disclosure requirements

- innovations in communication tools and technology, including pensions dashboards

- the cost implications, including value for members

- the extent to which the approach will allow for personalised and accessible statements

5. Do you agree with these principles, or are there other or additional principles that you think we should consider?

A simpler statement template

22. During the course of the 2017 review, a 2-page simpler annual benefit statement was developed by Ruston Smith, Quiet Room and Eversheds-Sutherland as an example of what good might look like in terms of brevity, engaging design and simple language. The statement was subsequently further revised during 2018 and was launched to a positive response at the PLSA Conference in October 2018. It has since been hosted on the PLSA’s website.

23. The simpler statement has been available for all providers and trustees to use should they wish to do so, with no legal liability to be attributed to the authors or government. The simpler statement and accompanying technical guide were created to comply with existing regulations, in such a way as to provide members with all of the required information in a simple format they can understand. The simpler statement was designed with a basic defined contribution structure in mind, and the technical guide noted that users with schemes that have more complex arrangements may need to amend the statement to better reflect such arrangements.

24. The simpler statement is attached at Annex A. The technical guidance to explain how it can be used and additional considerations around applicability is at Annex B.

25. Government welcomed the development of the simpler statement as an example of what good could look like in this area.

26. We recognise that voluntary adoption of the example developed by Ruston Smith and his colleagues has so far been limited. We therefore want to understand what the advantages and disadvantages of use of the simpler statement would be for individuals, trustees and scheme providers; whether providers are voluntarily intending to adopt the statement – or a variant – and if so when. If not, we want to understand what the barriers to doing so are.

We would welcome views on:

6. What do you think are the advantages or disadvantages of this simpler statement?

From trustees and scheme providers, we would welcome views on:

7. If you are intending to adopt this simpler statement, what is your anticipated timescale and, if you are varying the statement, where will you make changes?

8. If you do not intend to adopt this simpler statement on a voluntary basis, what barriers or issues have informed your thinking? For example:

- not workable for your scheme?

- implications for your other communications/products for savers?

- additional information that customers have requested that is not included in the statement? Insight from user-testing and evaluation?

- considerations around the needs of different groups?

- the costs of switching? Please specify

- value for members?

- other?

9. If you consider that the simpler statement is not workable for your scheme due to regulatory requirements, please explain how it would need to be varied or amended to meet those whilst still remaining within 2 pages.

10. Is there any information you think is currently not included, or signposted, in the statement attached at Annex A that would support the ambition to inform members and enable them to make retirement planning decisions? If so, what additional information do you think needs adding or signposting?

A design principles based approach

27. In addition to the regulatory requirements, we have considered whether a set of design principles could be applied to annual statements, and whether they would achieve the dual aim of simplicity and consistency, enabling members to quickly access and understand relevant information from their statements. Under this approach, schemes would have regard to a set of principles when designing their statements.

28. The overarching design principle could be that:

- annual statements should be designed to inform members and empower them to make decisions, having regard to relevant regulations, and recognising the different needs of different demographics.

29. A number of principles could address the length, structure and content of the statement:

1. Length and Structure: statements should be concise with information presented in 2 pages and structured to enable the reader to identify key information easily.

What might this mean in practice?

Key information should be presented upfront in the 2-page statement, with clear signposting to enable readers to find it quickly. Other information relevant to the individual, beyond the key information, may be provided through links, or hard copy material that is additional to the statement. The statement may be in a non-paper format, recognising the use of different communication channels.

2. Format: statements should use a format which is informative, engages the reader and is easy to navigate

What might this mean in practice?

Statements should be creatively designed, informed through effective and meaningful user testing, to engage the interest of the reader, recognising that different demographic groups may have different needs and preferences. Creative design could include use of colours and shapes to highlight key pieces of information; accessible fonts and text size; and graphics and charts.

3. Content: statements will inform readers with accurate and relevant information

What might this mean in practice?

The purpose of disclosure and information is to give individuals access to their information, provide them with relevant options and prompt action at certain points.

Information should be presented to enable an individual to see the answers to 2 key questions:

- how much money do you have in your pension pot?

- how much money could you have when you retire?

And information may be presented to help an individual consider a third question:

- what can you do to have more money in retirement?

Statements should make the next steps as clear and as frictionless as possible, so that recipients are clear on what their next steps should be.

4. Language and numbers: statements should use clear language which the reader finds easy to understand, and which is free from jargon

What might this mean in practice?

Statements should use language that reflects that they are used by a non-expert customer and assume limited prior knowledge of pensions and how they work. Statements should present information in short, easy to read sentences and could draw on best practice guides.

Figures should be presented in pounds and pence and percent format.

5. Customer focused: statements should be designed to reflect research, evidence-led insight and customer feedback

What might this mean in practice?

The design and content of statements should be informed by the views of those who receive them and who may have limited financial literacy or understanding of the pensions industry. Statements should be designed with user insight and evaluated through ongoing ‘real world’ user-testing.

Key information may differ for different customer groups, but the principle of brevity should continue to apply.

30. Whilst we think a set of design principles could help shape statements so that they have a greater degree of simplicity and to some extent consistency, it is not clear to what extent a sufficient degree of consistency will be achieved to help members. We believe that there is a risk that schemes will simplify their statements in isolation and apply an interpretation of the design principles to help their members, but that individuals who are members of several schemes, and in receipt of multiple statements, will not able to easily compare them because they remain inconsistent due to different interpretation of the principles. It is also not clear that voluntary adoption of a set of design principles will drive sufficient use and therefore consistency across the industry.

11. We would welcome your views on a design principles based approach:

a) To what extent would such an approach deliver both simplicity and consistency?

b) Given what we say about the aim to drive simplicity and consistency, are the principles described above the right ones? If not, how could they be improved? Are there alternative or additional principles that would better achieve our aims?

c) What barriers exist to adoption of the principles, and to what extent can they be mitigated? For example: design cost; member preferences; regulatory implications?

For trustees and scheme providers:

d) To what extent do your existing statements meet the principles set out above? What other principles, if any, inform your approach?

e) Would you adopt principles on a voluntary basis, and to what timescale? If not, what factors would preclude this?

Descriptors

31. A set of descriptors could be framed to be more detailed than design principles and would set out requirements for the length, structure and content of simpler statements to address the 3 key questions identified in paragraphs 6 and 7.

32. As with principles the intention would be to inform members and empower them to take decisions - if they want to – however, descriptors could potentially achieve greater consistency than a principles-based approach, given they would be more specific in terms of the content and structure.

33. Descriptors could be framed along the following lines:

Overall statement structure and length

The statement should be structured with two sections to enable the member to see:

- how much money do you have in your pension plan?

- how much money could you have when you retire?

The statement may also have a third section with information to enable the member to consider:

- what could you do to give yourself more money in retirement?

To enable members to quickly engage with the information presented the information provided in the 3 sections should be no more than 2 pages.

Additional information may be provided, but the 2 pages should be upfront and easily identifiable.

The language used in the statement must be clear, concise and free of jargon.

Figures quoted in the statement should be in pounds and pence wherever possible.

Information should be provided in a way which engages the member, and may include simple diagrams and illustrations.

Key information and figures should be highlighted so that they are easily identifiable to the member.

Information should be provided in a way which reflects the needs.

Section 1: How much money do you have in your pension pot?

This section will provide the key snapshot to enable a member to understand how much they have saved, with links to additional information for those who are more engaged.

This section will include the information as required in Regulation 17 of, and Part 1 of Schedule 6 to the Disclosure Regulations.

Links to supporting material may be provided to enable more engaged members to easily access supporting information, and which must include links to where to go to find out more about costs and charges, funds and investments.

Section 2: How much money could you have when you retire?

This section will help members understand how much income they will have when they retire, to help prompt thinking about whether this will give them the retirement they want.

This section will include the information required in Regulation 17 of, and paragraphs 6 to 14 of schedule 6 of the Disclosure Regulations.

The section will provide information about how much money the member could have at age 67 (or when the member intends to retire) with a clear explanation that this is an illustration and is not guaranteed.

Links to the assumptions underlying the calculations.

Section 3: What you could do to give yourself more money in retirement?

Information here should enable the member to consider whether they are on track to achieve the retirement lifestyle they want, consider their saving and lifestyle options and prompt action that increase their contributions into their pension if desirable.

This section could include a link to lifetime retirement living standards, or other retirement planning tools including Pension Dashboards.

This section would provide information on what members can do to increase their income in retirement, including giving an example of how much income a member could contribute and the additional retirement income that could be provided (a default value could be calculated that is proportionate the income of the individual saver).

34. We believe that requiring statements to have regard to descriptors may enable some degree of greater consistency, in particular where they frame the length and structure so that members are met with the same flow of information in any statement that they read. However, it is not clear that the degree of consistency will be sufficient to allow members receiving multiple statements to make quick and easy comparisons.

35. A logical further step may be to illustrate the principles or the descriptors through a template setting out in more detail a standard structure and design, and how information should be presented.

36. As with voluntary adoption of design principles, it is not clear that voluntary adoption of a set of descriptors will drive sufficient use by providers and therefore consistency across industry.

12. We would welcome your views on a descriptor-based approach:

a) to what extent do you think such an approach would deliver both simplicity and consistency?

b) given what we say about the aim to drive simplicity and consistency, are the descriptors described above the right ones? If not, how can they be improved? Are there alternative or additional descriptors that would better achieve our aims?

c) what barriers exist to adoption of descriptors? For example: design cost; member preferences; regulatory implications?

For scheme trustees and providers.

d) to what extent do your existing statements meet the descriptors set out above?

e) would you adopt descriptors on a voluntary basis, and to what timescale? If not, what factors would preclude this?

Achieving change

37. Whilst recognising the work which has been done by industry to simplify statements, including adoption of the simpler statement template, it is not clear that voluntary adoption of principles, descriptors or the statement can deliver sufficient consistency, nor where ownership of them should lie to ensure that adoption is encouraged and that they are subject to ongoing development where necessary to reflect evolving best practice or changing regulatory requirements.

38. We want to understand the potential for voluntary approaches to deliver change or whether we should mandate statutory guidance based on principles; descriptors or a simpler statement template.

13. We would welcome your views on:

a) the advantages/disadvantages of reliance on the voluntary adoption of a simpler statement template; design principles; or descriptors

b) where responsibility for maintaining a template; design principles or descriptors for voluntary use should lie: with government or industry.

c) the advantages/disadvantages of mandating an approach through statutory guidance.

Presentation of costs and charges: helping members identify what they’ve paid

Our current approach

39. Government legislated in 2018[footnote 1] to require ‘relevant schemes’ (broadly, occupational defined contribution schemes, including defined contribution sections of hybrid schemes) to publish information on charges and transaction costs on a publicly-available website. Trustees are required to publish this information for each arrangement and fund in which members are invested, alongside other relevant information, such as illustrations of how those charges compound over time, the trustees’ assessment of value for money, and details of the funds’ default strategy.

40. Relevant schemes are required to signpost members to this published information, by informing them of its location via a weblink included in the members’ annual benefit statement. Members who access the link will typically be given both charges and transaction costs as a percentage of the funds under management. Where schemes have more complex structures, such as tiered charges or a combination charge, we also expect that to be explained.

41. Members are also able to request the information where it is unreasonable for trustees to expect them to provide it electronically.

42. These regulations are taking effect on a rolling basis. As each scheme’s scheme year which was ongoing on 6 April 2018 came to an end, the scheme had 7 months to publish its charges and transaction costs along with the other information referred to above. This means the first deadlines for publication (those with scheme years ending in April 2018) fell due in November 2018, whereas the deadline for the very last scheme on which the regulations bite is 5 November 2019.

43. The FCA consulted on a corresponding approach earlier this year[footnote 2]. They proposed that Independent Governance Committees (IGCs) should be required to publish both charges and transaction costs for each fund and that the provider should make members aware annually of where that information was available. We anticipate that many or most workplace personal pension providers will elect to use the annual benefit statement for this purpose.

Our proposal - costs and charges on the benefit statement

44. Given that it has been 18 months since the introduction of these measures in 2018 and that rollout of chair’s statement publication is very close to completion, a number of industry commentators and consumer representative groups have suggested that it is an appropriate time to consider taking the next step. This would be to make it easier for savers to get member-level charge and transaction cost information on the face of their annual benefit statements.

45. We still believe that the signposted charge and cost information is beneficial as this provides contextual information such as the value for money and the default strategy. It will help members understand what they are paying for, why and allow more effective comparisons between schemes.

46. However, we also recognise that only the most engaged members will access this detailed information. We also appreciate the argument that all members of defined contribution schemes have the right to know how much money they are paying, as with other financial products which do not deliver a guaranteed return. It will not be trivial for members whose pension pot is spread across a number of funds, whose pot size has varied significantly through the year, or who are not aware of the fund in which they are invested, to take percentage charges from the published extracts of the Chair’s Statement and identify a pounds and pence figure for charges and transaction costs.

47. We therefore propose to amend the disclosure regulations to require relevant schemes to include member level charges and transaction cost information in pounds and pence on the annual benefit statement. This is consistent with recommended good practice by The Pensions Regulator in their ‘Communicating and reporting’ guide for DC Pension schemes’[footnote 3], and we understand that some pension schemes, especially personal pension providers, already provide charges data.

48. We propose that the scope of this measure is all workplace money purchase benefits, including both occupational and personal pensions. We do not propose to extend requirements to annual benefit statements produced for non-workplace pensions at the present time. Consideration of transparency measures in relation to non-workplace schemes, is already the subject of further consideration by the FCA following its feedback statement in July[footnote 4].

49. We appreciate that there will be some presentational and technical issues to consider in more detail as the regulations for this are developed, and the timing of introduction of any such measure should take account of this. We have also heard some concerns that there is the potential for very prominent cost disclosure to inadvertently lead to increased member opt-outs, particularly in the event of an economic downturn. We would appreciate evidence from any stakeholders who have experience of displaying charges and transaction costs on the statement, what the effects were, and how (if at all) these were mitigated.

50. It will naturally be important that this information is presented in a simple format so the member understands the context of the information. We propose to require separate reporting of (relatively fixed) charges and (much more variable) transaction costs, to align with the categorisation of deductions in the chair’s statement. We are also considering requiring a figure for the percentage of funds under management which each of the charges and transaction costs represent, alongside the pounds and pence cost, to aid comparison with other annual benefit statements which the member receives. We would welcome stakeholder views on how the data should be presented and whether there is any additional information which we should require to be shown alongside.

51. Finally, we will need to consider the best way this information should be calculated in order to provide a consistent approach for all members. We do not envisage that an exact figure per individual will be possible, due to for example pooling of investments and the variability and unevenness of transaction costs. We are currently minded to permit an approximate or average ‘pounds and pence. However, we would welcome stakeholder views on whether this easement is necessary for charges as well as for transaction costs, and how we might mitigate the risk of figures being presented which are so approximate to undermine member decision-making or harm consumer confidence.

We propose to include individualised member pounds and pence costs and charges information on the annual benefit statement.

14. Do you agree with this proposal and its scope? If not, why?

15. (a) What preparation is necessary by schemes to display information in this way? Would a phased approach, starting with large schemes, be beneficial?

(b) Do you think there are any risks to members by doing this? If so, do you have any evidence or suggestions of how these have been or could be mitigated?

16. (a) Do you agree with separate reporting of charges and transaction costs? Do you think other data, such as the percentage of funds under management these charges represent, should be presented alongside?

(b) Do you think approximate or averaged charge and transaction cost figures should be permitted for charges as well as transaction costs. Could this impair saver confidence and decision-making, and if so, how would that risk be mitigated?

Assumptions: helping members identify if their savings are on track

Background

52. This consultation has sought views on a number of options to improve the simplicity and comparability of the information in the annual benefit statement. Clearly one key purpose of the statement is to help members identify whether their saving is on track, through the use of the Statutory Money Purchase Illustration or SMPI[footnote 5].

53. SMPIs were introduced in 2003. The assumptions underpinning the SMPI are set out in Actuarial Standard Technical Memorandum 1 (AS TM1)[footnote 6]. This guidance is owned by the Financial Reporting Council, who have told us for some time that this should not be their responsibility. Whilst reviewed annually, AS TM1 has been rarely updated in recent years, and allows considerable discretion in many areas of the SMPI, including investment growth and the type of retirement product purchased.

54. Following the Kingman Review, which identified a number of shortfalls in the Financial Reporting Council and recommended its replacement by a new organisation[footnote 7], and the BEIS consultation[footnote 8] to implement those recommendations, we believe that now is the appropriate time to change ownership of the guidance which underpins the SMPI and seek to move towards greater standardisation in the underlying assumptions. With the development of dashboards, which may allow in time for SMPIs for multiple schemes to be shown alongside one another, the need for standardisation will only become more pressing.

55. There are also inconsistencies between products. Members receive a number of communications in which there are pension numbers. Members of both workplace and non-workplace personal pensions will also receive a Key Features Illustration, which must be produced according to a different set of assumptions set out in the FCA Conduct of Business Sourcebook (COBS) 13 Annex 2[footnote 9].

56. Due to these different regulatory requirements, a member could receive a projection in the Welcome Pack that would be different to the projection in their first annual statement which they may receive shortly after.

57. Differences include:

-

3 projections under COBS with the investment return assumption for the intermediate projection capped at 5% pa, whereas AS TM1 requires a single projection on a ‘best estimate’ basis.

-

relatively higher projected pensions under COBS compared to SMPI requirements, particularly for younger members, due to higher assumed salary growth and lower assumed (CPI based) inflation assumptions under COBS.

58. There has therefore been strong support across relevant regulators and legislators to work collaboratively to develop simpler, consistent and more stable projected numbers by standardising assumptions where possible.

59. Ruston Smith, who chaired the engagement strand of the 2017 Automatic Enrolment Review, subsequently convened a discrete Working Group to discuss and make proposals on standardising projection assumptions used for pension projections for both trust and contract based defined contribution arrangements, through the saving journey. The group met 4 times between June 2018 and March 2019, and included representatives of DWP, TPR and the FCA. We gratefully acknowledge the input of Ruston Smith and others from the ABI, PLSA, FRC, IFoA and ACA in this work, which has informed the proposals here.

Ownership, alignment and regulation

60. We therefore propose to amend DWP Disclosure regulations so that they no longer refer to the Financial Reporting Council as the body responsible for the guidance underpinning SMPIs, or to AS TM1 as a specific guidance product.

61. Instead the Secretary of State will issue guidance under statute to which trustees must have regard when producing the SMPI. This would apply to all pension schemes which currently produce an annual benefit statement in relation to money purchase benefits – whether occupational, workplace personal or individual personal.

62. We do not propose to produce guidance comparable in length to the AS TM1. We recognise the evidence base behind FCA’s assumptions. We therefore propose to align the assumptions which trustees and providers use in the annual benefit statement, with the assumptions in FCA’s rules for the production of key features illustrations, except where we consider that there are strong reasons to justify doing something different or being more specific. This is covered in the next section.

63. Subject to the views expressed by respondents to this consultation, we intend to consult on regulations and statutory guidance in due course. The intention is to find the right balance, to fit with existing primary powers, between those areas that must be followed, and are put into regulations, and those to which trustees and providers must have regard and are added to the new statutory guidance.

We propose DWP should take on ownership of the assumptions underpinning the annual benefit statement from the FRC.

We propose to use a mixture of statutory guidance and regulation to set out assumptions.

We propose to align assumptions for the SMPI with those set by the FCA for KFIs, except where we identify good reasons for taking a different approach.

17. Do you agree with these proposals? If not, why not?

Assumptions

64. Our General Principles in setting standardised assumption are that they should be:

- simple

- clear

- consistent

- relevant

- evidence based

- long-term (using an evidence base of a forward and/or backward 15-year time horizon)

65. We make the following initial proposals for the key assumptions. We will consult on some of the lower level detail of these assumptions when we consult on regulations and statutory guidance, in due course.

- Inflation assumptions – We propose that inflation should be set based on a long term view. In line with FCA COBS rules, we propose setting the CPI inflation rate at 2.0%

- Salary growth assumptions - We propose that salary growth should be set at 3.5% nominal terms, equivalent to 1.5% in real terms. Again, this is in line with FCA rules

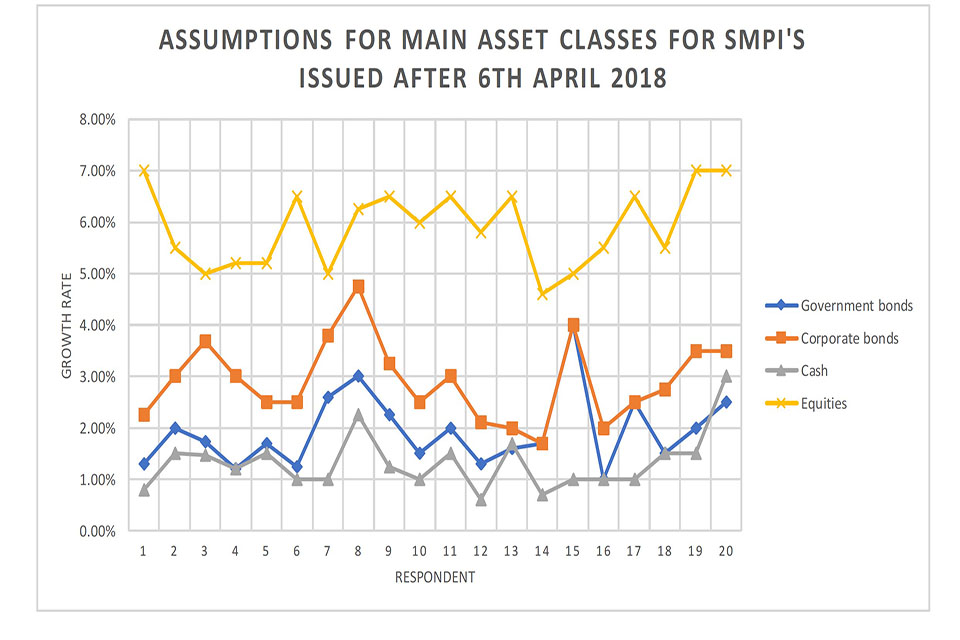

- Investment growth rates – We support the FCA’s practice of imposing a cap on projected investment growth rates. Allowing schemes to set any best estimate can result in significant optimism bias or over-estimation of ‘alpha’ amongst investment managers and the providers or trustees who appoint them. Whilst recent research by the FRC[footnote 10] did not find evidence of outlandish returns, there is still significant variation – of more than 2% in equities, and 3% in both government and corporate bonds. One firm assumed government bond growth rates of 4 times another’s estimates.

However, one aspect where we diverge from the assumptions used in the KFI are asset-class-level maximum growth rates. Whilst the FCA have evaluated and published assessments of the future growth rates in different asset classes[footnote 11], they impose a cap all pensions and investment products based on the maximum growth rate which is likely to be available in a balanced managed fund. Given the very long term nature of pension saving and the diversity of schemes’ asset allocation, this imposition of a single cap on investment growth rates could have a significant effect on assumed members’ pension pots, leading to excess optimism or pessimism on whether they are saving enough.

We therefore propose to impose the following nominal maximum growth rates, in line with the FCA modelling work referred to above. We propose that these rates are net of transaction costs, but gross of explicit charges.

- Government bonds 2.0%

- Corporate bonds 3.0%

- Equities 7.0%

- Property 5.5%

- Cash and money market 1.5%

Where a fund does not reasonably sit in one of the above fund or asset class types then consistent return assumptions should be used. We propose that guidance should sit alongside the proposed categories so that providers are clear how to treat non-standard assets such as alternatives.

- Annuity assumptions – neither the FCA’s COBS rules nor AS TM1 guidance require providers to assume a particular kind of annuity will be purchased. However, the type of annuity purchased by the member has a profound influence on the income quoted in retirement. A level annuity will buy an initial income of more than double the rate offered by an inflation protected annuity. To allow members not only to total the values of their projected pension pots, but to total their projected pension income on a consistent basis, we propose to mandate a single standard annuity assumption for the SMPI

Recent data by the ABI suggested that more than two-thirds of annuities sold are single life rather than joint life; and more than 85% of sales are of level annuities rather than inflation protected.

We therefore propose that a single life annuity with no indexation is the most appropriate annuity to require for the SMPI. However, we would welcome views on whether this might have unintended or undesirable consequences in provision made by members for their dependants.

- Adjustment for tax free lump sum (PCLS) – DWP regulations, FCA COBs rules and AS TM1 guidance all allow providers to adjust their SMPI to take account of a tax-free lump sum (up to 25%), although this is not mandatory.

Evidence from the ABI suggests that nearly 100% of members take their lump sum when purchasing an annuity and 80% take all of their tax free cash when taking income drawdown, with the remaining 20% taking less at the initial move to drawdown (phased drawdown).

We therefore propose that the SMPI should be adjusted by a 25% tax free lump sum. We recognise this approach is different to that of the existing simpler statement at Annex A and would mean that change to the statement would be required were it to be adopted.

- Number of projections – there is a lack of clear evidence as to whether consumers benefit from annual benefit statements showing a range of projections. On the one hand, more numerate savers might benefit from an illustration showing the possible variation in size of their future pension pot, and a range of outcomes helps reinforce understanding that the returns are not guaranteed. On the other, additional illustrations may distract from the central estimate, or result in pension scheme members wrongly assuming that the lower and upper illustrations indicate the full range in outcomes, and that returns could not be worse than the most pessimistic illustration.

In the absence of strong evidence, we do not propose to require schemes to show more than one projection. However, where they do choose to show more than 1 assumption, we propose that they are required to show 3 and that these are carried out in line with FCA COBS 13 Annex 2. This means that:

- The maximum investment return is reduced by 3% for the lower rate and increased by 3% for the higher rate.

Inflation assumptions and salary growth are reduced by 2% for the lower rate and increased by 2% for the higher rate.

We’ve proposed the following assumptions for legislation and DWP statutory guidance on the annual benefit statement:

- inflation assumptions

- salary growth rates

- investment growth rates * annuity assumptions * 25% tax free lump sums

- number and basis of projections

18. Do you think these are the right assumptions for providing simple, comparable estimates? If not, why not?

Next steps

Subject to responses, we will work closely with the FCA and others in developing regulation and statutory guidance for consultation. Where we have consulted on assumptions here, we do not propose to do so again as part of the next stage of the consultation.

Costs of transition

67. We are mindful of the need to strike a balance between ensuring that scheme members receive statements that enable them to understand and engage with their pension saving on a consistent basis, and have key information on costs and charges, whilst avoiding placing unnecessary burdens on pension providers and which may impact on members through increased administration costs.

68. We recognise that with millions of statements sent to individuals each year, a need to redesign statements to ensure consistency through the standardisation of assumptions, the use of design principles or descriptors, or adoption of the simpler annual benefit statement, as well as inclusion of costs and charges has implications for providers and members in terms of statement cost. We anticipate that these will vary according to whether statements are primarily sent by email rather than hard copy, and according to whether statements have been designed to be consistent with a wider suite of communications material. The introduction of any new approach to statements or their underlying assumptions may require additional communications to individuals of why they have changed.

69. Where statements have been developed on the basis of research and on-going user-testing, we recognise that there may be costs associated with reframing that research and testing.

70. To help inform the three elements of this consultation we would therefore welcome information on the following:

Simpler annual statements

19. We would welcome your views on:

a) The possible initial costs of moving to each of the three options in terms of redesign and delivery of existing statements. Do you have plans to update your statement, and if so, when do you currently plan to do that? To what extent, could these changes be incorporated into existing or planned work?

b) For each of the options, is the ongoing cost of providing the information required anticipated to be lower, or greater, than with existing statements?

c) What do you anticipate will be the one-off and ongoing impact of redesigning your statements (and associated materials)? Where costs are incurred, would you expect them to be absorbed, passed on to employers, or passed on to individual members.

d) What are the cost implications for established and future research and evaluation approaches?

e) Where you have developed simpler statements on the basis of feedback from recipients, do you have any cost/benefits analysis or research which shows:

- the impact on individuals in terms of the time spent/saved on reading the statement or through increased understanding of the content and/or of increased saving in response to any call for action to save more?

f) If you have adopted the simpler statements at Annex A do you have any cost/benefits analysis or research which shows the impact on individuals in terms of the time spent/saved on reading the statement, understanding of the content, and/or of increased saving in response to any call for action to save more?

Presentation of costs and charges

20. We would welcome your views on the initial and ongoing costs of incorporating information on costs and charges into annual statements.

Assumptions

21.We would welcome your views on the initial and ongoing costs of adopting the standardised approach to assumptions set out in paragraphs 64-65 above.

71. We recognise that digital innovation is increasingly shaping the way that people receive and consume information, including a move away from traditional paper based communications and, for example, with the development of personalised videos to encourage recipients to access their statements. It is important that there is flexibility to reflect technological advances in any communications that people receive and access about their workplace pension saving.

72. The government response to the consultation on pensions dashboards[footnote 12] noted the link in terms of information provided in dashboards with that included in annual statements and the potential to learn from the work behind simpler statements. The Industry Delivery Group (IDG) will be developing advice on data standards and options for displaying data that maximise the consumer’s understanding. It will be crucial that the approach to information and data in simpler statements is consistent with the outcome of that work, and we will be engaging with the IDG as work goes forward.

22. We would welcome your views on:

a) the relationship between each of the options presented in this document, and the flexibility to respond to or harness future innovations in the way that people receive and access information, whether in hard copy or in digital form

b) the relationship between each of the options presented in this document and the future development of Pension dashboards, including data standards.

c) the implications for schemes on a need to amend/update their data for Pension dashboards alongside any future requirement to simplify their pension statements.

How can we encourage people to open their statements?

73. The 2017 Review recognised that redesigning statements will not by itself engage members if they do not open them, regardless of whether they are sent in the post or digitally. The Review called upon providers to test communication approaches that prompt people to expect their statements, help them understand why they are important and encourage them to open and read them[footnote 13].

74. The success of the ‘orange envelope’ approach used by the Swedish Pension Agency when sending out state pension statements during a short period each year shows how people can be encouraged to engage with the pensions by generating a national conversation about pensions, supporting the social norming of pension saving. The Swedish example suggests that having opened their orange envelopes a majority of recipients read their statements[footnote 14].

75. We want to drive thinking on this and explore how the principles behind the orange envelope approach of high-impact visibility could be applied to sending out simpler statements for workplace pensions so that recipients are encouraged to open and, when they are met by the shorter and more engaging format of the simpler statement, to read them.

76. As part of this, we also want to explore if a ‘statement season’ – a short specific period during the year when statements are sent out – might support the national conversation and individual awareness. A specific period in the year during which members receive statements from all of their pension schemes might also help them to understand the totality of their pension savings.

23. We would welcome your views on:

a) what are the potential benefits or downsides of using a single, standardised, colour of envelope when sending statements to members in terms of driving engagement?

b) what the benefits of a ‘statement season’ would be in terms of raising awareness of the importance of statements and pension saving for individuals, and as part of normalising pension saving?

c) how a ‘statement season’ might operate, including in terms of length and scope?

d) what might the opportunity and/or downsides, be for example, in terms of delivery and management of a ‘statement season’ for providers, the advisory community and others?

e) how a seasonal approach to statements sit with communications that are personalised to the needs and preferences of individuals?

f) other approaches that could be effective, based on user research and/or international experience related to pensions or other sectors?

Further evidence and analysis and research

24. We would welcome any further evidence or analysis which you would like to share about the issues under discussion in this consultation and which can inform the development of simpler annual benefit statements.

Equality Act

77. Under the Equality Act 2010, public bodies have a duty to give due regard to the needs of people with ‘protected characteristics’. The Equality Duty covers the protected characteristics of:

- age

- disability

- gender reassignment

- pregnancy and maternity

- race

- religion or belief

- sex

- sexual orientation

- marriage and civil partnership – in respect of eliminating unlawful discrimination only

78. Paying ‘due regard’ means that, in our roles as policy makers, we are required to consciously think about the three aims of the Equality Duty:

- eliminate unlawful direct or indirect discrimination, harassment and victimisation and other conduct prohibited by the Act

- advance equality of opportunity between people who share a protected characteristic and those who do not share it

- foster good relations between people who share a protected characteristic and those who do not share it

25. As part of this consultation we would therefore welcome views on the impact of each of the options for simplified annual pension statements on protected groups, and how any negative effects may be mitigated, including the impact on disabled people and the provision of information in alternative formats.

Summary of questions

When responding, please state whether you are doing so as an individual, or behalf of a company or representing the views of an organisation. If you are responding on behalf of an organisation, please make sure you say who the organisation represents, and where applicable, how the views of the members were assembled.

Simpler annual statements: helping members engage

What do we want to achieve?

1. We would welcome your views on this twin ambition:

a) Is it one that you recognise as offering benefits in terms of an individual’s understanding of - and better engagement with – their workplace pension saving? Yes/No?

b) In what ways could consistent workplace pension annual benefit statements offer an opportunity to improve engagement with and understanding of pension provision?

Relationship with wider communication materials and engagement approaches

2. We would welcome

a) views on how annual statements are positioned within your broader member engagement strategy?

b) views on the implications of requiring trustees and scheme providers to have regard to principles; descriptors or a simpler statement template on other communication materials, including the need for and cost of redesigning approaches.

c) evidence/user testing about how to improve engagement/understanding which you have used to support your wider communications.

Which pension schemes are in scope?

3. Our intended scope – does this make sense or should the scope be broadened, or narrowed?

How can we achieve simplicity and consistency?

4. We would welcome your views on the length of statements:

a) Short statements of two pages in length have been proposed. What evidence can you provide where the adoption of this approach has been beneficial? In what ways? For whom?

For trustees and scheme providers:

b) Are your statements typically longer, or shorter, than two pages? How many pages are your statements in total?

c) What strategies have informed the design and length of your annual statements? What feedback, if any, has been sought? What changes have been made to improve the usability of statements? What future changes are planned?

Principles to inform our approach

5. Do you agree with these principles, or are there other or additional principles that you think we should consider?

A simpler statement template

We would welcome views on:

6. What do you think are the advantages or disadvantages of this simpler statement?

From trustees and scheme providers, we would welcome views on:

7. If you are intending to adopt this simpler statement, what is your anticipated timescale and, if you are varying the statement, where will you make changes?

8. If you do not intend to adopt this simpler statement on a voluntary basis, what barriers or issues have informed your thinking? For example:

- not workable for your scheme? * implications for your other communications/products for savers?

- additional information that customers have requested that is not included in the statement? Insight from user-testing and evaluation? * considerations around the needs of different groups? * the costs of switching? Please specify * value for members?

- other?

9. If you consider that the simpler statement is not workable for your scheme due to regulatory requirements, please explain how it would need to be varied or amended to meet those whilst still remaining within two pages.

10. Is there any information you think is currently not included, or signposted, in the statement attached at Annex A that would support the ambition to inform members and enable them to make retirement planning decisions? If so, what additional information do you think needs adding or signposting?

A design principles based approach

11. We would welcome your views on a design principles based approach:

a) To what extent would such an approach deliver both simplicity and consistency?

b) Given what we say about the aim to drive simplicity and consistency, are the principles described above the right ones?

If not, how could they be improved?

Are there alternative or additional principles that would better achieve our aims?

c) What barriers exist to adoption of the principles, and to what extent can they be mitigated?

For example: design cost; member preferences; regulatory implications?

For trustees and scheme providers:

d) To what extent do your existing statements meet the principles set out above? What other principles, if any, inform your approach?

e) Would you adopt principles on a voluntary basis, and to what timescale? If not, what factors would preclude this?

Descriptors

12. We would welcome your views on a descriptor-based approach:

a) To what extent do you think such an approach would deliver both simplicity and consistency?

b) Given what we say about the aim to drive simplicity and consistency, are the descriptors described above the right ones? If not, how can they be improved? Are there alternative or additional descriptors that would better achieve our aims?

c) What barriers exist to adoption of descriptors? For example: design cost; member preferences; regulatory implications?

For scheme trustees and providers.

d) To what extent do your existing statements meet the descriptors set out above?

e) Would you adopt descriptors on a voluntary basis, and to what timescale? If not, what factors would preclude this?

Achieving change

13. We would welcome your views on:

a) the advantages/disadvantages of reliance on the voluntary adoption of a simpler statement template; design principles; or descriptors

b) where responsibility for maintaining a template; design principles or descriptors for voluntary use should lie: with government or industry.

c) the advantages/disadvantages of mandating an approach through statutory guidance.

Presentation of costs and charges: helping members identify what they’ve paid

We propose to include individualised member pounds and pence costs and charges information on the annual benefit statement.

14. Do you agree with this proposal and its scope? If not, why?

15. a) What preparation is necessary by schemes to display information in this way? Would a phased approach, starting with large schemes, be beneficial?

b) Do you think there are any risks to members by doing this? If so, do you have any evidence or suggestions of how these have been or could be mitigated?

16. a) Do you agree with separate reporting of charges and transaction costs? Do you think other data, such as the percentage of funds under management these charges represent, should be presented alongside?

b) Do you think approximate or averaged charge and transaction cost figures should be permitted for charges as well as transaction costs. Could this impair saver confidence and decision-making, and if so, how would that risk be mitigated?

Assumptions: helping members identify if their savings are on track

Ownership and alignment

We propose DWP should take on ownership of the assumptions underpinning the annual benefit statement from the FRC.

We propose to use a mixture of statutory guidance and regulation to set out assumptions.

We propose to align assumptions for the SMPI with those set by the FCA for KFIs, except where we identify good reasons for taking a different approach.

17. Do you agree with these proposals? If not, why not?

Assumptions

We’ve proposed the following assumptions for legislation and DWP statutory guidance on the annual benefit statement:

- inflation assumptions

- salary growth rates

- investment growth rates

- annuity assumptions

- 25% tax free lump sums

- number and basis of projections

18. Do you think these are the right assumptions for providing simple, comparable estimates? If not, why not?

Costs of transition

Simpler annual statements

19. We would welcome your views on:

a) The possible initial costs of moving to each of the three options in terms of redesign and delivery of existing statements. Do you have plans to update your statement, and if so, when do you currently plan to do that? To what extent, could these changes be incorporated into existing or planned work?

b) For each of the options, is the ongoing cost of providing the information required anticipated to be lower, or greater, than with existing statements?

c) What do you anticipate will be the one-off and ongoing impact of redesigning your statements (and associated materials)? Where costs are incurred, would you expect them to be absorbed, passed on to employers, or passed on to individual members.

d) What are the cost implications for established and future research and evaluation approaches?

e) Where you have developed simpler statements on the basis of feedback from recipients, do you have any cost/benefits analysis or research which shows: - the impact on individuals in terms of the time spent/saved on reading the statement or through increased understanding of the content and/or of increased saving in response to any call for action to save more?

f) If you have adopted the simpler statements at Annex A do you have any cost/benefits analysis or research which shows the impact on individuals in terms of the time spent/saved on reading the statement, understanding of the content, and/or of increased saving in response to any call for action to save more?

Presentation of costs and charges

20. We would welcome your views on the initial and ongoing costs of incorporating information on costs and charges into annual statements.

Assumptions

21. We would welcome your views on the initial and ongoing costs of adopting the standardised approach to assumptions set out in paragraphs 64-65 above.

Impact on innovation and Pension Dashboards

22. We would welcome your views on:

a) the relationship between each of the options presented in this document, and the flexibility to respond to or harness future innovations in the way that people receive and access information, whether in hard copy or in digital form.

b) the relationship between each of the options presented in this document and the future development of Pension dashboards, including data standards.

The implications for schemes on a need to amend/update their data for Pension dashboards alongside any future requirement to simplify their pension statements.