Staffordshire (Lot 19) Public Review Closure Notice

Updated 14 July 2023

New procurement to extend coverage of gigabit-capable broadband across the Staffordshire (Lot 19) region.

1. Introduction

The government’s ambition is to deliver nationwide gigabit-capable broadband as soon as possible. We recognise that there is a need for government intervention in the parts of the country that are not commercially viable; this is why the government has committed £5 billion for the hardest to reach parts of the country, ensuring that all areas of the UK can benefit. This will be spent through a package of coordinated and mutually supportive interventions, collectively known as Project Gigabit.

We wish to work collaboratively with industry to maximise efficiency, minimise market distortion and achieve our objectives within a tight time frame. To do this, we first identified the areas that were not commercially viable through the Open Market Review (OMR) and Public Review (PR) stages. This allowed us to understand from suppliers if there were any current or planned investment over the next three years in broadband infrastructure (Next Generation Access broadband, ultrafast and gigabit-capable) in the identified geography. For this Lot, the identified geography lay within the Staffordshire region.

The box below shows the order of stages, from OMR to procurement.

-

OMR

-

Public Review

-

Determine intervention areas for procurement

-

Procurement

Through these stages, BDUK classifies premises as eligible/ineligible for subsidy on the basis of their existing or planned qualifying broadband infrastructure. Details on the classification system of White, Grey, Black and Under Review and methodology can be found in section 3.2 BDUK Classifications and methodology for this PR.

Premises categorised as White by BDUK during OMRs and PRs (ie eligible for subsidy) are grouped into Intervention Areas (IAs). IAs list those premises that will be targeted for subsidy in any potential procurement to follow this PR. To be clear, not all eligible premises may have been targeted for subsidy. The finalised IAs will be issued to the market at the Invitation to Tender (ITT) stage of procurement so that suppliers can bid for subsidy to support delivery to these IAs.

Further information on the OMR/PR process and how we reach our conclusions can be found in the Subsidy Control Guidance document.

2. Outcome of the preceding Open Market Review

Preceding the current PR stage, BDUK conducted an OMR for Staffordshire (Lot 19) from 12 August to 13 September 2021. This OMR requested information from suppliers regarding current and planned broadband infrastructure within the next three years.

All meaningful responses to the OMR were considered and where necessary used to determine eligible premises. Suppliers who responded to the OMR were informed of the classifications applied to the existing and planned infrastructure relevant to their submission.

The key findings of the OMR are presented in the postcode-level map showing eligible premises identified through the OMR for Staffordshire (Lot 19), and a list of eligible postcodes can be found on our website.

3. Outcome of the Public Review

3.1 Background

The PR for Staffordshire (Lot 19) ran from 4 February to 4 March 2022. During the PR, BDUK invited stakeholders (including broadband infrastructure operators, internet service providers, the public, and businesses) to provide feedback regarding which areas were made up of eligible premises.

BDUK also carried out market engagement to seek feedback from suppliers about the design of the proposed IA and Lot, the procurement type (A - local supplier, B - regional supplier or C - cross-regional supplier) and also the capacity of the market to bid for a potential procurement.

The PR stage aimed to validate the outcome of the preceding OMR to ensure that it correctly represented the information provided by suppliers over the course of the OMR.

Suppliers who missed contributing to the preceding OMR, had no definitive plans and/or evidence base on which to substantiate claims at that earlier stage, or had subsequently updated their plans had a final opportunity to notify BDUK before final determinations were made on premises eligibility. All meaningful responses were carefully considered and where necessary utilised to determine eligible premises. BDUK also sought feedback from Staffordshire County Council. The finalised postcode-level map showing eligible premises is shown in Annex A of this PR Closure Notice. See Postcode-level map.

A finalised list of postcodes showing White, Grey, Black and Under Review PR outcome has been published. A list of eligible (White/Under Review) premises is also available to suppliers upon request.

Changes to the Lot Area

Please note, Lot areas are not fully aligned to Local Authority boundaries. Specific Lot boundaries (and IAs) may flex during the OMR, PR and Pre-Procurement Market Engagement (PPME) processes to enable an optimum procurement to be put to the market.

Since the PR closed on 4 March 2022 there have been no amendments to the proposed Lot Boundary Area. The PR outcomes provided below, and shown in Annex A, are consistent with the proposed Lot Boundary Area that is now going to procurement.

3.2 BDUK classifications and methodology for this PR

During the PR, BDUK categorised premises as gigabit White, Grey, Black or Under Review.

Subsidy control classifications are set out below:

-

White - indicates premises with no gigabit network infrastructure and none is likely to be developed within 3 years[footnote 1]

-

Grey - indicates premises where a single qualifying gigabit infrastructure from a single supplier is available, or is to be deployed within the coming 3 years[footnote 1]

-

Black - indicates premises with two or more qualifying gigabit infrastructures from different suppliers being available, or will be deployed within the coming 3 years[footnote 1]

-

Under Review - indicates premises where suppliers have reported current or planned commercial broadband coverage, but where claimed current gigabit coverage has not been verified, or, in respect of planned build, where evaluators are confident that gigabit infrastructure will be delivered, but some risks to delivery remain, or there are some gaps in evidence

BDUK will only provide subsidy to target premises that have been designated as White. Premises which have been designated as Under Review may be included within the Deferred Scope of a procurement. Where this is the case, a further review will be undertaken to confirm whether they are Grey or White before they are released for build.

In accordance with the OMR/PR processes, supplier data submitted during the OMR and PR has been mapped using a methodology that protects commercially sensitive supplier data. To reflect this sensitivity, we will only release White and Under Review Unique Property Reference Numbers (UPRNs).

3.3 Summary of PR findings - premises eligibility

For presentational purposes only, postcode-level mapping has been used to present the map showing eligible premises. (NB we will only subsidise build to premises which have been designated as White - postcodes are not used to determine IAs for subsidy).

For this purpose, postcodes have been classified as follows:

-

A postcode is White if any White premises are present.

-

A postcode is Under Review if any Under Review premises are present.

-

A postcode is Black if all premises in the postcode are classified Black.

-

A postcode is Grey if all premises are Grey, or a mixture of Grey and Black.

A postcode-level map summarising these premises classifications is provided in Annex A. Suppliers - please note that this map does not show which UPRNs have been determined as White and Under Review.

The outcome of the PR is summarised in terms of White, Grey, Black and Under Review postcodes and premises below:

| Postcode Classification | Number of Postcodes | Number of Gigabit Black Premises | Number of Gigabit Grey Premises | Number of Gigabit Under Review Premises | Number of Gigabit White Premises |

|---|---|---|---|---|---|

| White | 11,909 | 4,264 | 70,479 | 30,065 | 105,486 |

| Under Review | 6,127 | 1,893 | 41,736 | 76,276 | 0 |

| Grey | 10,094 | 13,738 | 196,878 | 0 | 0 |

| Black | 1,404 | 29,084 | 0 | 0 | 0 |

| Total | 29,534 | 48,979 | 309,093 | 106,341 | 105,486 |

3.4 Forthcoming procurement

During the PR stage for Staffordshire (Lot 19), BDUK sought responses from the market and other stakeholders to validate the Annex A Subsidy Control map (showing Gigabit White, Grey, Black and Under Review determinations).

BDUK also carried out market engagement to seek feedback from suppliers about the design of the proposed IA and Lot, the procurement type (A - local supplier, B - regional supplier or C - cross-regional supplier) and also the capacity of the market to bid for a potential procurement.

The outcome of this market engagement in relation to the proposed IAs (information provided below) which took place from May to June 2022 was that BDUK did not receive sufficient and clear interest from suppliers in bidding for our proposed IAs.

Therefore, BDUK decided to not progress Staffordshire (Lot 19) to procurement based on the proposed IA options at that time.

For informational purposes, the indicative funding that was initially allocated to this Lot during the PPME exercise was as follows:

Type B - Total of 25,999 UPRNs approximately £37,000,000 split as follows:

-

Initial Scope: 19,920 UPRNs approximately £32,008,000

-

Deferred Scope: 6,079 UPRNs approximately £4,992,000

Type A - Total of 13,525 UPRNs approximately £23,970,000

As referenced above, no procurement type was selected for Staffordshire (Lot 19) following engagement with stakeholders and the market via the completion of our market engagement exercises from May to June 2022.

3.5 Staffordshire (Lot 19) Post PR - Closure Notice Updates June 2023

Since then, alternative procurement approaches have been developed for Staffordshire (Lot 19) for 2023 following the outcome of additional market engagement undertaken by BDUK.

BDUK undertook further market engagement between December 2022 and March 2023 for multiple areas of the UK being considered for inclusion within the initial call-off areas for the planned type C - cross-regional supplier framework contact, with Staffordshire (Lot 19) being one of those areas identified for potential inclusion; as an area which previously had no or no appropriate market interest for our previously proposed type A or type B procurement IAs.

The conclusion of these subsequent market engagement activities identified credible market interest to progress with both a revised type A local supplier contract in Staffordshire (Lot 19) referred to as North East Staffordshire (Lot 19.01). This procurement was successfully launched on 4 April 2023.

In addition, BDUK also found established supplier interest to progress the remaining area of Staffordshire (Lot 19) for inclusion within the initial call-off areas via the cross-regional supplier framework contract referred to as Staffordshire (Lot 19C).

Further details on the proposed IAs identified for potential inclusion in the initial call-offs to be procured at the same time as the framework can be found in the Type C Post Public Review - Closure Notice Update - June 2023.

Indicative funding allocated to these two procurements for Staffordshire (Lot 19) are as follows:

- North East Staffordshire (Lot 19.01) Type A - Total of 6,229 UPRNs approximately £16,560,000

- Staffordshire (Lot 19C) Type C - Total of 11,728 UPRNs approximately £31,500,000

Both of these procurements were designed utilising data from the PR conducted in February 2022 mentioned above, supplemented with information derived from the recent January 2023 National Rolling Open Market Review (NR OMR) undertaken by BDUK.

As of January 2022, BDUK has been asking suppliers delivering gigabit-capable infrastructure to submit national data returns on a 4-monthly basis (January, May and September) to provide detailed build plans at premises level. The purpose of the NR OMR is to ensure that BDUK has the most up to date information about suppliers’ existing and planned commercial build with supplier submissions being used to inform eligibility across Project Gigabit.

Following the completion of the evaluation process of responses received from suppliers to the January 2023 NR OMR, the subsequent subsidy control classification results were overlaid and used by BDUK to design and create IAs for the initial call-off areas. Further information can be found within the January 2023 NR OMR Closure Notice published 14 June 2023.

BDUK is confident that integrating these NR OMR findings will ensure the best possible outcome for these IAs, maximising both coverage and value for money accordingly. Our interventions will always flex to respond to both changes in the dynamic marketplace, and the appetite for our procurements. Further information on the NR OMR process can be found in in our Open Market Review (OMR) and Public Review (PR) subsidy control classification guidance document.

Timescales

The following tables summarise the indicative timescales for each of the two procurements:

North East Staffordshire (Lot 19.01) Type A local supplier contract

| Activity | Date |

|---|---|

| Procurement start date (SQ Launch) | 4 April 2023 |

| Estimated contract award date | September to November 2023 |

Staffordshire (Lot 19C) Type C cross-regional supplier contract

| Activity | Date |

|---|---|

| Procurement start date (SQ Launch) | July 2023 |

| Estimated contract award date | April to June 2024 |

See Project Gigabit procurement timelines for more information.

3.6 Summary of PR findings

- There were 105,486 White premises (out of 569,899) where the market does not intend to build, indicating a strong commitment from active suppliers in Staffordshire to reach a large proportion of premises in the county

- As such, in order to develop viable procurements that could be released to the market, BDUK ensured all supplier feedback provided during the soft market testing and PPME exercises was considered during the IA design process, resulting in the design of these procurements

- The IAs have been designed to address areas outside of where we expected the commercial sector to build to, prioritising footprints where there is an appetite for BDUK to go further, faster

- We contacted all known national and local suppliers to ask them to respond to the OMR and PR and multiple iterations of market engagement exercises that have been undertaken for Staffordshire. This included working closely with Staffordshire County Council to ensure active and prospective suppliers were aware of these activities and could feed in their responses

4. Conclusion

A key output for the OMR/PR for Staffordshire (Lot 19) is the maps showing premises that are eligible for subsidy.

From this map, BDUK developed the IAs which were proposed to the market during the PPME phase eligible for subsidy. Annex B sets out the draft IA maps at UPRN level.

This identifies the areas where premises are eligible for subsidy. A full list of White and Under Review UPRNs is available on request to suppliers via [email protected].

Unfortunately, the initial market testing exercise undertaken for Staffordshire (Lot 19) from May to June 2022 did not identify sufficient supplier competition to support viable local or regional supplier contracts within the area at the time.

Since then, alternative procurement approaches have been developed for the area, with BDUK redesigning our proposed original IAs to make Staffordshire (Lot 19) more attractive to the market to invest in.

BDUK were pleased that these additional market engagement activities identified credible interest to progress with a combination of a revised type A local supplier contract referred to as North East Staffordshire (Lot 19.01) which launched its procurement on 4 April 2023 and developed an IA for inclusion within the initial call-offs under the type C cross-regional supplier framework contract for Staffordshire; referred to as Lot 19C.

BDUK would like to thank all suppliers who provided us with feedback regarding the proposed eligible areas for government intervention via the market engagement exercises.

The responses and outputs derived from these exercises have allowed us to gain further confidence that the proposed interventions are targeting the right areas for subsidy, ie areas which are not commercially viable and require government intervention to address market failure.

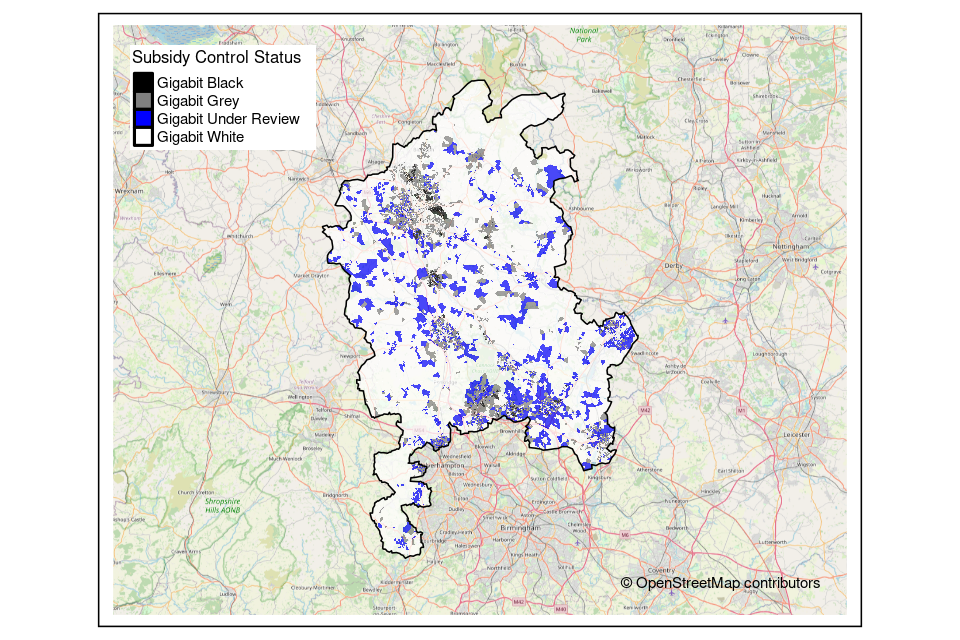

5. Annex A – Map indicating locations of eligible premises

The postcode level map below indicates areas where those premises eligible for subsidy are located ie White areas. These eligible premises may be included within the IAs.

Black, Grey and Blue (Under Review) areas indicate where those premises ineligible for subsidy are located.

Staffordshire Lot 19 Postcode level map (showing subsidy control classifications at a postcode level)

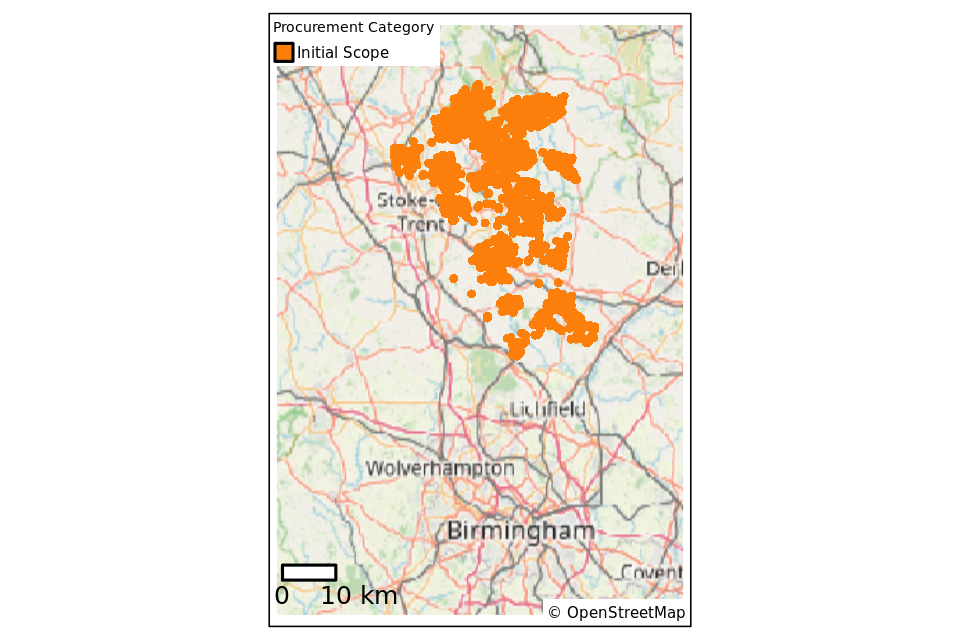

6. Annex B – Map of proposed intervention areas

The two maps below highlight the Staffordshire IAs that were approved following completion of the PPME exercises in 2023.

North East Staffordshire (Lot 19.01) 6,229 Initial Scope UPRNs

Please see section 3 above for information on BDUK’s findings, contextualising how eligible premises were included in the proposed IAs.

The above premises-level map indicates eligible premises that form the type A procurement.

The local supplier contract only includes a single category of intervention: Initial Scope, where the supplier should build as quickly as possible. We will always either descope Under Review premises or defer build to them and we will always descope Grey or Black premises.

Those premises which are highlighted in orange (6,229 premises) are referred to as the Initial Scope premises that will be targeted for subsidy.

This map is accompanied by a list of UPRNs that fall within the IA, clearly demarcating which premises are within the Initial Scope which suppliers can request via Atamis. If you are unable to access Atamis, please contact the Supplier Mailbox [email protected].

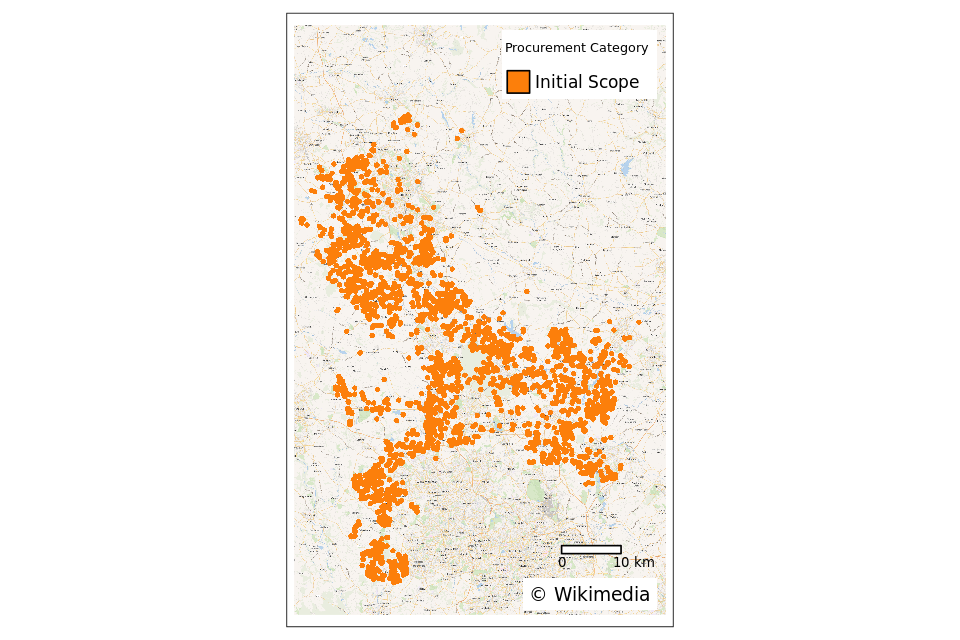

Staffordshire (Lot 19C) 11,728 Initial Scope UPRNs

Please see section 3 above for information on BDUK’s findings, contextualising how eligible premises were included in the proposed IAs.

The above premises-level map indicates eligible premises that form the proposed IA for inclusion in the initial call-off area for Staffordshire as part of the type C cross-regional supplier framework contract.

The cross-regional framework supplier contract only includes a single category of intervention: Initial Scope, where the supplier should build as quickly as possible. We will always either descope Under Review premises or defer build to them and we will always descope Grey or Black premises.

Those premises which are highlighted in orange (11,728 premises) are referred to as the Initial Scope premises that will be targeted for subsidy.

This map is accompanied by a list of UPRNs that fall within the IA, clearly demarcating which premises are within the Initial Scope which suppliers can request via Atamis. If you are unable to access Atamis, please contact the Supplier Mailbox [email protected].