Foam merger raises competition concerns

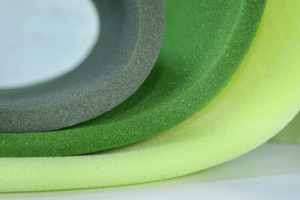

The CMA has found that the merger of 2 firms that make foam used in products like bedding and cleaning sponges could lead to higher prices and less choice.

The Competition and Markets Authority (CMA) is concerned that the loss of competition brought about by the merger of Carpenter and Recticel’s global engineered foams business could result in a worse deal for manufacturers. This could ultimately mean that consumers face higher prices and less choice. The firms must now address the concerns identified or face a further, more in-depth, Phase 2 investigation.

US-based Carpenter agreed to buy Belgian firm Recticel’s global engineered foams business in a €656 million (Euros) deal announced in 2021. The firms both make flexible polyurethane foam used in the manufacture of products like mattresses and sponges. They also produce processed foam, sometimes called converted foam. Both companies own and operate plants in the UK.

The CMA’s initial Phase 1 investigation has found that the merger would remove a close competitor of Carpenter’s, with the firms representing 2 of just 3 foam producers with plants in the UK. The CMA is concerned that, if the deal goes ahead, the combined companies will face limited competition in the UK in 3 foam-related markets.

Sorcha O’Carroll, Senior Director at the CMA, said:

Carpenter and Recticel may not be household names but their products can be found in homes throughout the UK.

We’re concerned that this merger could reduce competition in the supply of foam and foam products. This could ultimately lead to shoppers paying more for bedding products as well as everyday items like kitchen sponges.

If the firms fail to address our concerns, the deal will be referred for an in-depth investigation.

The firms now have 5 working days to submit proposals to address the CMA’s competition concerns. The CMA then has a further 5 working days to consider whether to accept any offer instead of referring the case for an in-depth Phase 2 investigation.

For more information, visit the Carpenter / Recticel merger inquiry page.

Notes to editors

- The CMA found that the merger gives rise to a realistic prospect of a substantial lessening of competition in the supply of comfort foam; the supply of technical foam; and the supply of converted comfort foam in the UK.

- The CMA found that the relevant foam markets are national markets. The CMA is concerned that the firms represent 2 of only 3 foam producers with plants in the UK and, if the deal goes ahead, the combined companies will face limited competition in the UK. The German (Bundeskartellamt), Polish (UOKiK) and Turkish (Rekabet Kurumu) competition authorities have been notified of, and have subsequently cleared, the merger based on conditions in their national markets. While the CMA will consider the findings of other authorities, its concerns are specific to the UK market.

- Under the Enterprise Act 2002 the CMA has a duty to make a reference to Phase 2 if the CMA believes that it is or may be the case that a relevant merger situation has been created, or arrangements are in progress or contemplation which, if carried into effect, will result in the creation of a relevant merger situation; and the creation of that situation has resulted, or may be expected to result, in a substantial lessening of competition within any market or markets in the United Kingdom for goods or services.

- For media enquiries, contact the CMA press office on 020 3738 6460 or [email protected].