Low Pay Commission analysis of 1 April 2017 minimum wage rise

The 1 April 2017 minimum wage rise is set to benefit 2.3 million but create pressure for employers. Read the Low Pay Commission's analysis.

- National Living Wage for workers aged 25 and over rises to £7.50 on 1 April. Up to 2.3 million workers (8.5%) set to be on one of the minimum wage rates.

- Pay floor at its highest ever real-terms value – by contrast, typical wages not expected to reach pre-recession levels until end of 2019.

- Highest proportion of workers set to gain in Northern Ireland (12.9%) and the North East (10.8%) compared with London (4.8%), South East (6%) and Scotland (7.7%).

- Local authorities with the highest proportion of mw workers: West Somerset, Torridge, West Devon in the South West, Rossendale in the North West, Boston in the East Midlands and Castle Point in the East of England, where up to 1 in 5 workers will receive a pay rise.

- Too early to draw conclusions about any employment effects: some weakening in employment in low-paying occupations though causality is unclear and labour market still performing strongly overall.

Increases in the minimum wage taking effect on 1 April 2017 will directly benefit up to 2.3 million workers (8.5%), but also create pressures for employers.

These are some of the findings of the independent body that officially advises the government on the minimum wage, the Low Pay Commission (LPC), which has released a detailed assessment of the anticipated consequences of the higher rates.

Commenting on the increases, the Chair of the Commission Bryan Sanderson said:

The minimum wage increases on 1 April will bring another year of substantial pay rises for the lowest-paid. The minimum wage will cover more workers than ever, and ripple effects mean that the benefits could affect people earning above the minimum as well.

Thanks to the minimum wage, hourly pay for the lowest-paid is at its highest ever level – unlike pay for other workers which remains well below its pre-recession peak.

Accompanying pay increases there will inevitably be pressure for employers. Early data on employment effects remain inconclusive. While the labour market is performing strongly overall, there has been some weakening in employment growth across some low-paying occupations since 2015, though others are still seeing employment grow.

These are turbulent times and we will continue to monitor the situation closely.

Key findings on the increases in the rates include:

- The April 2017 increase in the National Living Wage (25+) to £7.50 will increase pay for a typical minimum wage worker (working 26 hours per week) by £400 a year in cash terms (£180 adjusted for inflation), and £600 (£260 adjusted for inflation) for a full time minimum wage worker (38 hours).

- An increase of 4.2% is, apart from the introduction of the National Living Wage in April 2016, the largest increase in the main rate of the minimum wage since 2006.

- The new rates will raise coverage - the number of workers paid at or below the minimum - for the minimum wage as a whole by up to 300,000, from 2 million jobs (7.3% of the cohort) in April 2016 to up to 2.3 million (8.5%) in April 2017. Just over 1.5 million workers were on the minimum wage in April 2015 (5.6%).

- A wider group of workers is also likely to benefit: a ripple effect up the pay distribution meant the bottom quarter of workers saw pay increases from the introductory rate of the NLW in 2016.

- The growth in the minimum wage has helped ensure that the lowest paid have seen their real hourly earnings increase. Accounting for inflation, the minimum wage is at its highest ever value. By contrast, hourly pay for other workers is not forecast to surpass pre-recession peaks until the end of 2019. Average pay growth is currently around 2.2%, around half the rate of increase of the NLW.

- Gains and pressures are set to vary sharply by nation and region. Northern Ireland is set to have coverage of almost 13 per cent, while the North East, East Midlands and Yorkshire and Humber will have coverage approaching 11 per cent. Coverage is set to be much lower in London (4.8%), the South East (6%) and Scotland (7.7%). However differences can be as significant within regions, as between them. In London, 8 local authorities have expected coverage above the UK average.

- The top 10 local authorities with the highest proportion of workers set to receive a higher minimum from the April 2017 increases comprise West Somerset (22%), Torridge (21%) and West Devon (20%) in the South West, Rossendale in the North West, Boston in the East Midlands, and Castle Point in the East of England (18%), Lincoln in the East Midlands, Wyre Forest in the West Midlands, Redcar and Cleveland in the North East, and East Renfrewshire in Scotland (17%). The local authority in the South East with the highest proportion of workers set to receive a higher minimum is Shepway (14%)

- The 10 local authorities with the lowest proportion of workers set to receive a higher minimum comprise: City of London (1%, London), Runnymede, Spelthorne, Mole Valley, Oxford, Test Valley, Guildford, Surrey Heath, Hart (South East) and South Cambridgeshire (East of England) (all 2%).

- A higher minimum affects some industries more than others with more than 3 in 10 workers in cleaning and maintenance, hair and beauty and hospitality set to be on the minimum wage. This present challenges for employers in preserving differentials between those on the minimum wage and slightly above, as well as managing employee progression and motivation.

- The consensus of research is that past increases in the minimum wage have not harmed employment. It is too early to know about the effect of the higher rates of the National Living Wage. Evidence on the benefits, such as increased pay, comes earlier and more visibly than any costs, like job losses, increased prices or reduced profits

- Comparing 2015 with 2016, there has been some weakening in employment growth across low-paying occupations. Almost half of low-paying occupations have seen an increase in employment. The other half have seen a decrease in the number of employees over the year. Employment and hours have increases in large workplaces but decreased in the smallest. Employment has grown in most regions while it has decreased in 3.

- The National Living Wage is subject to an ‘ambition’ set by the government to increase to 60% of typical earnings by 2020. Because it is measured relative to average earnings, this is a moving target (the cash figure will move in line with pay data and earnings forecasts). The current projected rate for 2020, using the latest OBR forecasts is £8.75. The April 2018 rate putting the NLW linearly on course for 60% is £7.90. The LPC will recommend a figure to government in October based on the best forecast available at that time.

- Using the latest OBR forecasts, the minimum wage is set to cover up to 3.3 million workers (12%) in 2020.

Notes

- The Low Pay Commission is an independent body made up of employers, trade unions and experts whose role is to advise the government on the minimum wage. The National Living Wage is the legally binding pay floor for workers aged 25 and over. The other minimum wage rates comprise: the 21-24 Year Old Rate, the 18-20 Year Old Rate, the16-17 Year Old Rate, and the Apprentice Rate.

- The LPC responds each year to a remit, the requirements of which differ by age of worker. For the National Living Wage, applicable to workers aged 25 and over, we are required to make recommendations on the pace of increase towards a target: an ‘ambition…that it should continue to increase to reach 60% of median earnings by 2020, subject to sustained economic growth’. For the other rates, affecting workers aged under 25 and apprentices, we are asked to make recommendations that ‘help as many low-paid workers as possible without damaging their employment prospects’.

- The findings reported above come from a report published on our website ‘A rising floor: the latest evidence on the NLW and youth rates’. Estimates use the Annual Survey of Hours and Earnings 2016. For the analysis of the impact of the NLW at £7.50 on local authorities, figures are workplace-based, rather than residence-based. The report provides breakdowns by local authority for Greater London, Scotland, Wales and Greater Manchester. Coverage by local authority for the whole country is available on request (apart from Northern Ireland where data aren’t available).

- The members of the Low Pay Commission comprise: * Bryan Sanderson, Chair * Sarah Brown, Professor of Economics at the University of Sheffield * Kay Carberry, TUC * Neil Carberry, Director of Employment and Skills, CBI * Clare Chapman, Non-Executive Director & Remuneration Committee Chair at Kingfisher PLC * Richard Dickens, Professor of Economics, Sussex University * Peter Donaldson, Managing Director, D5 Consulting Ltd * John Hannett, General Secretary, Usdaw * Brian Strutton, General Secretary, BALPA

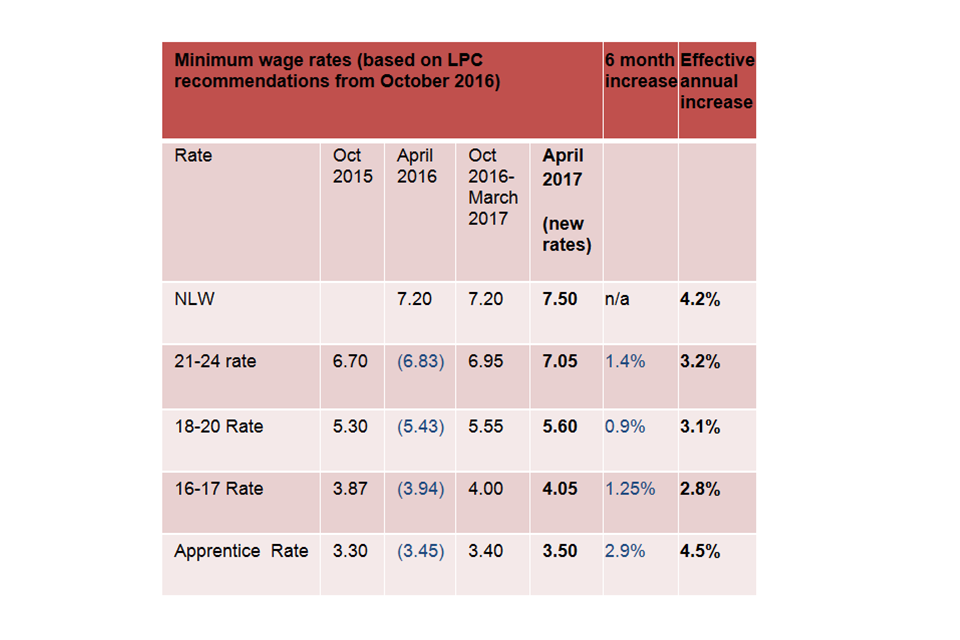

- All the minimum wage rates will increase simultaneously for the first time on Saturday, as the age-related rates move from an October uprating to an April calendar. The rates are shown in the table attached below.

- The National Living Wage is different from the UK Living Wage and the London Living Wage, which are currently £8.45 and £9.75 respectively. Differences include that: the UK Living Wage and the London Living Wage are voluntary pay benchmarks that employers can sign up to if they wish, not legally binding requirements; the hourly rate of the UK Living Wage and London Living Wage is based on an attempt to measure need, whereas the National Living Wage is based on a target relationship between its level and average pay; the UK Living Wage and London Living Wage apply to workers aged 18 and over, the National Living Wage to workers aged 25 and over. The Low Pay Commission has no role in the UK Living Wage or the London Living Wage.

Press enquiries

Low Pay Commission Ground Floor 10 South Colonnade Canary Wharf

London

E14 4PU