Review of the automatic enrolment earnings trigger and qualifying earnings band for 2020/21: supporting analysis

Published 27 February 2020

Background

Automatic enrolment (AE) obliges employers to enrol all workers who ordinarily work in Great Britain and who satisfy age and earnings criteria into a qualifying workplace pension and pay at least the minimum level of contributions.

The automatic enrolment earnings trigger determines who is eligible to be automatically enrolled into a workplace pension by their employer in terms of how much they earn. There is also a qualifying earnings band in respect of which contributions are made – the band is defined by the lower earnings limit and the upper earnings limit. The earnings trigger and the qualifying earnings bands are often jointly referred to as the automatic enrolment earnings thresholds. They are set in legislation and reviewed annually. This report sets out the methodology, analysis and outcome of this year’s review. It is a statutory requirement that the Secretary of State reviews all 3 thresholds in each tax year.

The lower earnings level of the band is also relevant to defining who falls into the category of ‘non-eligible job-holders’. People in this group can opt-in to their employer’s workplace pension and will received a mandatory employer contribution if they earn between the lower earnings limit and the earnings trigger.

Automatic enrolment has been introduced gradually and is now in force for all employers and eligible workers. By the end of December 2019, over 10 million workers have been automatically enrolled and more than 1.6 million employers have met their duties[footnote 1].

Annual review

Within the review of the automatic enrolment earnings trigger and qualifying earnings band for 2020/21 the Secretary of State has some flexibility in the level to which the amounts for the earnings trigger and qualifying earnings band are set[footnote 2]. Section 14 of the Pensions Act 2008 also sets out certain factors which the Secretary of State may take into account in reviewing these amounts. This statutory review will continue each year as the law requires. Whilst decisions are made for this year and the government can set out policy objectives and the principles that should inform the setting of the thresholds, it cannot pre-determine the approach for future years, consistent with current legislation. This maintains the ability for the Secretary of State to exercise judgement on the appropriate levels to set the thresholds at each year, without being impeded by decisions that have been made previously.

The first 2 annual reviews established 3 principles to be used when reviewing the automatic enrolment thresholds. These principles were endorsed by stakeholders and the government’s view is that they remain relevant:

a) Will the right people be brought in to pension saving?

In particular, at what level will the earnings trigger bring in as many people as possible who will benefit from saving? At what level does the trigger need to be set to avoid the automatic enrolment of those who are unlikely to benefit from saving? And what are the equality implications of the different options?

b) What is the appropriate minimum level of saving for people who are automatically enrolled?

Everyone who is automatically enrolled should pay contributions on a meaningful portion of their income. To ensure this, we need to maintain an appropriate gap between the lower limit of the qualifying earnings band and the earnings trigger.

c) Are the costs and benefits to individuals and employers appropriately balanced?

The cost implications of the thresholds remain relevant and we need to factor in the continuing importance of simplicity. Alignment as far as possible with recognisable tax and National Insurance contributions (NICs) thresholds simplifies system builds, provides compatibility with existing payroll systems and makes automatic enrolment as easy as possible to administer and explain.

The Secretary of State has considered each of the above principles alongside an assessment of the relevance of the review factors set out in the Pensions Act 2008 in reaching a conclusion on the level at which to set each threshold for 2020/21.

Results of this year’s review

Earnings trigger

The earnings trigger is one of the three key factors which ultimately governs who gets enrolled into a workplace pension scheme through automatic enrolment. The government remains of the position that if the trigger is too high, then low to moderate earners who can afford to save (and who are the main target group of the policy), may miss out on the benefits of a workplace pension. Set it too low and the predominant impact will be upon people for whom it could make little economic sense to divert income away from their day to day needs.

The Secretary of State has considered the latest analytical evidence and the policy objectives and has concluded that the existing threshold of £10,000 remains the correct level at this point in the establishment of automatic enrolment and will not change for 2020/21. This represents a real terms decrease in the value of the trigger when combined with assumed wage growth and will bring in an additional 80,000 individuals into the target population. The decision reflects the key balance that needs to be struck between affordability for employers and individuals and the policy objective of giving those, who are most able to save, the opportunity to accrue a meaningful level of savings with which to use for their retirement. It also reflects the need for stability at this point whilst we continue to learn from the increases in minimum contribution rates in April 2018 and April 2019 and provides consistency of messaging for both employers and jobholders.

The Secretary of State has also assessed the equality impacts associated with this decision which are detailed later in this report. The Secretary of State remains of the view that voluntary opt-in provides the most appropriate option for those earning less than the earnings trigger who wish to save. Research published by the Institute for Fiscal Studies (IFS) in 2016[footnote 3] showed that automatic enrolment had increased workplace pension membership by 29 percentage points among those earning under £10,000 per year (compared to a baseline of 18% prior to the reform). Feedback from stakeholders also continues to suggest that many employers are contractually enrolling their non-eligible and entitled jobholders (for example, those earning at a level below that set by the earnings trigger) anyway.

The Secretary of State has accounted for the impact of both the National Minimum wage and the National Living Wage when considering what the earnings trigger should be and continues to monitor the impact of this on low earnings and the automatic enrolment earnings trigger.

Qualifying earnings band – lower limit

Automatic enrolment into a workplace pension with an employer contribution in addition to that of an individual is intended to build on the foundation of state pension entitlement. The lower limit of the qualifying earnings band sets the minimum amount that people have to start saving from and minimum employer contributions.

The Secretary of State has considered all review factors against the analytical evidence and has decided to maintain the link with the National Insurance contributions lower earnings limit at its 2020/21 value of £6,240 by setting this as the value of the lower limit of the qualifying earnings band for 2020/21.

The 2017 Review of Automatic Enrolment – Maintaining the Momentum – proposed the removal of the lower earnings limit. It is the government’s ambition to make this change in the mid-2020s, in light of learning from the phased contribution increases and following full discussions and consultation. We will work to maintain the consensus that has underpinned AE’s success, including giving employers and savers time to plan for future changes. In that way, we can help avoid any risk of deterring individuals from continuing to save or undermining employer engagement with the reforms. This longer term policy direction does not pre-empt this year’s or any future annual thresholds review, pending the introduction of legislation which would need to be enacted to remove the lower earnings limit of the qualifying earnings band[footnote 4].

Qualifying earnings band – upper limit

The upper limit of the qualifying earnings band caps mandatory employer contributions. It aims to distinguish the automatic enrolment target group of low to moderate earners and the statutory minimum contributions from earners in a higher tax band who might reasonably be expected to have access to a scheme that offers more than the minimum and are more likely to make personal arrangements for additional saving. The Secretary of State has concluded that mandatory employer contributions should still be capped and decided that the National Insurance contributions upper earnings limit at its 2020/21 value of £50,000 is the factor that should determine the upper limit of the qualifying earnings band.

Retaining the link between National Insurance contribution levels and the qualifying earnings band limits, provides an important element of consistency for employers, the pensions industry and payroll services.

Proposed thresholds for 2020/21

The current (2019/20) and proposed (2020/21) automatic enrolment thresholds are displayed in Table 1.

Table 1 – Current and proposed automatic enrolment thresholds

| Trigger | Lower limit qualifying earnings band | Upper limit qualifying earnings band | |

|---|---|---|---|

| Current (2019/20) | £10,000 | £6,136 | £50,000 |

| Proposed (2020/21) | £10,000 | £6,240 | £50,000 |

Methodology

This section describes the methodology used to estimate the impact of proposed changes to the automatic enrolment thresholds. Impacts are calculated by comparing a modelled baseline scenario in 2020/21 against one where changes to the 2020/21 thresholds are made.

The baseline thresholds for 2020/21 are the 2019/20 thresholds uprated in line with forecast earnings growth. This effectively holds the thresholds constant in real earnings terms. The Office for Budget Responsibility’s (OBR’s) March 2019 forecast for earnings growth between 2018 quarter 4 and 2019 quarter 4 of 2.69% was used.

Broadly, we model three different types of options for each threshold for comparison against the baseline. They are:

1. freezing the thresholds at their 2019/20 level

2. setting the thresholds in line with relevant 2020/21 National Insurance or tax thresholds

3. uprating the 2019/20 thresholds by a relevant index (for example, earnings, consumer price index (CPI) etc)

In the model, total individual and employer pension contributions in each scenario are estimated for the 2020/21 tax year using:

-

private sector employees’ average earnings estimated using the Annual Survey of Hours and Earnings (ASHE) data[footnote 5]. The survey data from 2012 is used to represent the pension landscape prior to the implementation of automatic enrolment

-

estimates of the proportions of private sector employees for and from whom additional contributions are due in 2020/21, based on DWP modelling using ASHE data

-

existing volumes of the number of employees working for employers who have undergone the automatic enrolment process. These volumes are informed by HMRC Pay As You Earn data and consistent with The Pension Regulator’s estimates

-

estimates of the bands of earnings on which individuals are making pension contributions, based on 2018 ASHE data. We account for evidence which suggests that some employers contribute on a band of earnings between £0 and the UEL, rather than the LEL and the UEL

-

contribution rates for employers and employees, where the minimum for a qualifying pension scheme in 2020/21 is 8% total contributions (including tax relief) on relevant earnings, of which at least 3% is from the employer

These figures then inform estimates of:

-

income tax relief – individuals receive tax relief on their pension contributions. It is estimated by multiplying total pensions contributions from individuals by the appropriate income tax rates[footnote 6].

-

employer tax relief – because employers have indicated that they have responded to increases in the cost of employer pension contributions by reducing wages and/or profits, it follows that they will have paid less employer National Insurance contributions and/or corporation tax due to these increased contributions than they would have otherwise done. We estimate both of these effects by multiplying the overall size of employer pension contributions by:

- the percentage of employers who indicated that they behaved in that way, and

- the appropriate tax rate, either employer NICs or corporation tax[footnote 7]

All estimates of the contributions and tax relief associated with different thresholds are uncertain due to the use of modelling techniques that draw on a range of different data sources. Caution should be exercised in interpreting the figures presented.

The methodology outlined above looks only at those eligible to be automatically enrolled. As highlighted above, IFS analysis shows that automatic enrolment has increased pension participation amongst those outside of the eligibility rules. This group are not included within this modelling. If their pension arrangements are impacted by changes to the qualifying earnings band for automatic enrolment, then the impact of the reforms would be larger than estimated here.

Finally, estimates of the equalities impacts of different thresholds are produced using 2018 ASHE data and the 2018/19[footnote 8] Labour Force Survey (LFS). Analysis is presented for two groups: the population eligible for automatic enrolment (“the eligible population”)[footnote 9] and the population who are eligible but not currently saving in a qualifying workplace pension (“the target population”)[footnote 10]. ASHE was used to analyse the eligible target population by gender and age. LFS was used to analyse the eligible population by disability status and ethnicity[footnote 11]. The breakdowns of these demographics are presented in Annex A.

Results

A – Trends in pension saving

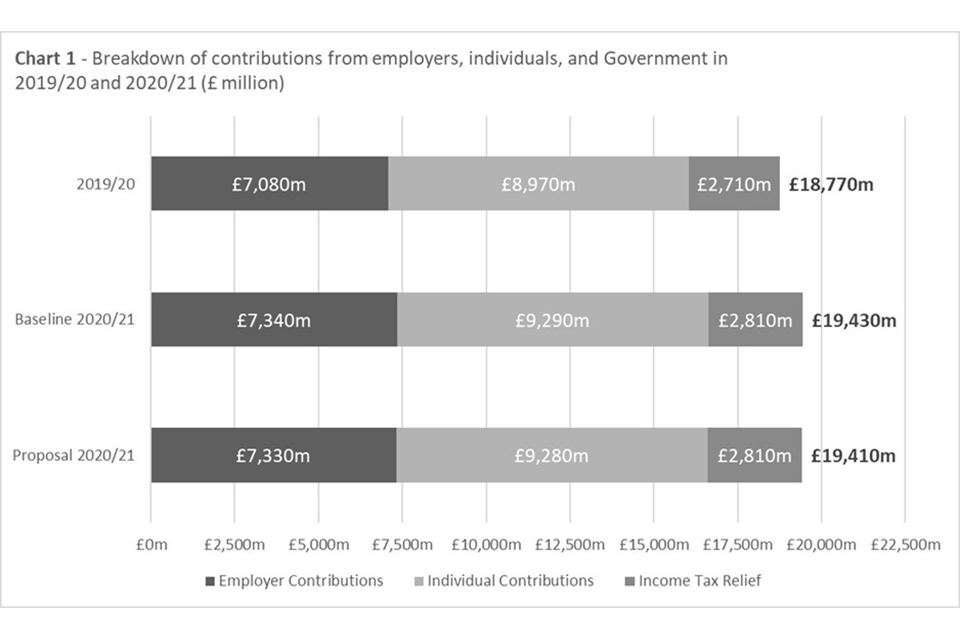

In April 2019 the minimum contributions for a qualifying pension scheme rose to 8% (on a band of earnings). There are no corresponding increases in April 2020, so the increase in the estimate of contribution costs this year relative to the previous year is largely driven by earnings growth. Table 2 compares the pension contributions under the baseline thresholds in 2019/20 and 2020/21, showing a £668 million increase in pension saving. This comparison is also made in Chart 1.

In 2018/19, employees eligible for automatic enrolment saved a total of £90.4 billion into their pension. This represented an increase of £7.0 billion on 2017/18[footnote 12]. By 2020/21, we estimate here that there will be an extra £19.4 billion of workplace pension saving per year as a result of automatic enrolment, before the impact of threshold changes is taken into account.

Table 2 – Increase in total pension contributions from employers, individuals and initial impacts on income tax relief. 2019/20 and 2020/21 (£ million)

| Employer contributions | Individual contributions | Income tax relief | Total pension saving | Employer tax relief | |

|---|---|---|---|---|---|

| Baseline thresholds - level of pension saving in 2019/20 | £7,080m | £8,970m | £2,710m | £18,770m | £730m |

| Baseline thresholds - level of pension saving in 2020/21 | £7,340m | £9,290m | £2,810m | £19,430m | £756m |

| Difference | +£252m | +£319m | +£97m | +£668m | +£26m |

Source: DWP Modelling

Notes:

1. The baseline thresholds in 2019/20 are the 2019/20 automatic enrolment thresholds. To estimate the baseline level of pension saving in 2020/21, these thresholds are uprated in line with earnings growth forecasts.

2. Figures over £1,000m are rounded to the nearest £10 million and figures below are rounded to the nearest £1 million to reflect uncertainties associated with the modelling used. They therefore may not sum exactly.

3. Total pension saving is the sum of employer contributions, individual contributions, and income tax relief on the individual’s contribution.

B – Impact of proposed thresholds for 2020/21

The proposed thresholds for 2020/21 are:

(i) retaining the 2019/20 automatic enrolment earnings trigger (£10,000)

(ii) aligning the LEL with the 2020/21 National Insurance lower earnings limit (£6,240) and

(iii) aligning the UEL with the 2020/21 National Insurance upper earnings limit (£50,000)

Table 3 compares the impact of the baseline to the proposed thresholds on employers, individuals, and government. This information is also presented in Chart 1.

Under the proposed thresholds, the overall level of pension saving amongst the eligible target population is estimated to be £19,410 million in 2020/21, £25 million lower than it would have been if the thresholds remained at 2019/20 levels in equivalent earnings terms. This decrease consists of £10 million fewer in employer contributions, £12 million in employee contributions, and £4 million in income tax relief on the individual’s contribution.

Table 3 – Estimated direct impacts of changes to the earnings trigger and upper and lower limits of the qualifying earnings band on contributions from employers, individuals and tax-relief (in 2020/21)

| Earnings trigger | Qualifying earnings band lower limit | Qualifying earnings band upper limit | Eligible target group | Employer contributions | Individual contributions | Income tax relief | Total pension saving | Employer tax relief | |

|---|---|---|---|---|---|---|---|---|---|

| Baseline (2019/20 thresholds in 2020/21 earnings terms) | £10,269 | £6,301 | £51,347 | 11,180,000 | £7,340m | £9,290m | £2,810m | £19,430m | £756m |

| Proposal | £10,000 | £6,240 | £50,000 | 11,260,000 | £7,330m | £9,280m | £2,810m | £19,410m | £755m |

| Difference | +80,000 | -£10m | -£12m | -£4m | -£25m | -£1m |

Source: DWP Modelling

Notes:

1. The baseline thresholds are the 2020/21 AE thresholds uprated in line with the OBR’s earnings growth forecasts.

2. Volumes of savers in the eligible target group are rounded to the nearest 10,000.

3. The OBR’s March 2019 forecast for earnings growth between 2018 quarter 4 and 2019 quarter 4 of 2.69% is used.

4. Figures over £1,000m are rounded to the nearest £10 million and figures below are rounded to the nearest £1 million to reflect uncertainties associated with the modelling used. They therefore may not sum exactly.

5. Total pension saving is the sum of employer contributions, individual contributions, and income tax relief.

Source: DWP Modelling

Notes:

1. The baseline thresholds for 2020/21 are the 2019/20 automatic enrolment thresholds adjusted for earnings growth.

2. Figures over £1,000m are rounded to the nearest £10 million.

C – Impact of changing the earnings trigger in 2020/21

Table 4 shows the impact on employers, individuals, and government associated with the various options for the value of the earnings trigger in 2020/21. These are isolated effects – both the LEL and UEL remain unchanged compared to the baseline.

Freezing the threshold at £10,000 increases the number of individuals who are in the automatic enrolment target population by approximately 80,000 people. The eligible population increases because some people’s earnings will increase to take them above the £10,000 trigger in 2020/21. This will increase total pension saving by an estimated £39m.

Lowering the earnings trigger would open up eligibility for AE to more lower earners. For example, aligning the earnings trigger with the NI lower earnings limit would increase the eligible population by 1.32 million people, increasing total pension saving by £480m.

Raising the earnings trigger would exclude more people from the eligible population for automatic enrolment. For example, aligning the earnings trigger with the Personal Income Tax Threshold would remove eligibility to automatic enrolment for an estimated 560,000 people, reducing total pension saving by £332m.

As part of this review the government has also considered the impact of the increase in the personal allowance to £12,500 and the interaction with pension’s tax relief administration. As a result of maintaining the earnings trigger at £10,000, we estimate that an additional 40,000 people will be eligible to be automatically enrolled into a pension for the first time in 2020/21, whilst earning below the personal tax allowance of £12,500. In total there will be 300,000 people who will be eligible to be automatically enrolled into a pension in 2020/21 who earn less than the personal tax allowance.

The government recognises the different impacts of the two systems of paying pension tax relief on pension contributions for workers earning below the personal allowance. To date, it has not been possible to identify any straightforward or proportionate means to align the effects of the net pay and relief at source mechanisms more closely for this population. The government’s 2019 manifesto included a commitment to conduct a comprehensive review to look at how to fix this issue.

The Pensions Regulator (TPR) provides guidance to employers on choosing a pension scheme for their staff in order to discharge their statutory obligations under automatic enrolment. This guidance covers the choice between net pay and relief at source schemes, and the implications for employees who do not pay income tax. More information can be found here on the TPR website[footnote 13].

Table 4 – Estimates of the direct impact of changing the earnings trigger on contributions from employers, individuals and tax relief (in 2020/21)

| Earnings trigger | Rationale | Eligible target group | Employer contributions | Individual contributions | Income tax relief | Total pension saving | Employer tax relief |

|---|---|---|---|---|---|---|---|

| £10,269 (Baseline) | Current trigger (2019/20) uprated by earnings inflation | 11,180,000 | £7,340m | £9,290m | £2,810m | £19,430m | £756m |

| £6,240 | NI lower earnings limit (20/21) | +1,320,000 | +£181m | +£230m | +£70m | +£480m | +£19m |

| £9,500 | NI primary threshold (20/21) | +240,000 | +£43m | +£55m | +£17m | +£115m | +£4m |

| £10,000 | Freeze 2019/20 trigger | +80,000 | +£15m | +£19m | +£6m | +£39m | +£2m |

| £10,140 | Uprate by estimated price inflation (CPI) | +50,000 | +£9m | +£12m | +£4m | +£24m | +£1m |

| £10,269 | Uprate by earnings inflation (baseline) | 0 | 0 | 0 | 0 | 0 | 0 |

| £12,500 | Income tax personal allowance (19/20) | -560,000 | -£125m | -£159m | -£48m | -£332m | -£13m |

Source: DWP Modelling

Notes:

1. Scenarios after the baseline present the change in costs when compared to the baseline.

2. Figures over £1,000m are rounded to the nearest £10 million and figures below are rounded to the nearest £1 million to reflect uncertainties associated with the modelling used. They therefore may not sum exactly.

3. The LEL and UEL are held constant at their 2019/20 levels uprated in line with earnings growth, to isolate the impact of changes to the trigger.

4. The CPI measure of inflation was 1.4% in quarter 4 2019. The annual £10,000 trigger is uprated by this figure to be consistent with the earnings forecasts used and rounded to the nearest £.

5. The OBR’s March 2019 forecast for earnings growth between 2018 quarter 4 and 2019 quarter 4 of 2.69% was used.

6. Total pension saving is the sum of employer contributions, individual contributions, and income tax relief.

7. Employer tax relief represents the tax no longer paid by employers who respond to the additional pension contribution costs of the workplace pension reforms by reducing profits or wages paid to their employees.

8. Volumes of savers in the eligible target group are rounded to the nearest 10,000

D – Impact of changing the limit of the qualifying earnings band in 2020/21

Table 5 shows the impact on employers, individuals and government associated with the baseline thresholds and various options considered for the value of the 2020/21 qualifying earnings band lower limit. As before, these are the impacts of isolated LEL changes. Unlike the earnings trigger, the LEL does not impact the number of people who are eligible for AE target group and as such, population effects are not included.

Total pension saving increases as the LEL decreases (compared to the baseline), as pension contributions are paid on a larger proportion of an individual’s income. Aligning the lower limit of the qualifying earnings band with the National Insurance lower earnings limit of £6,240 represents a slight decrease against the baseline threshold, so it results in an increase in pension saving by around £24 million when compared to the baseline scenario.

Increasing the LEL would reduce total pension saving. For example, aligning the LEL with the 2020/21 NI Primary Threshold of £9,500 would reduce total pension saving by £1,270m when compared to the baseline scenario.

Table 5 – Estimates of the direct impact of changing the lower limit of the qualifying earnings band on contributions from employers, individuals and tax relief (in 2020/21)

| Qualifying earnings band LEL | Rationale | Employer contributions | Individual contributions | Income tax relief | Total pension saving | Employer tax relief |

|---|---|---|---|---|---|---|

| £6,301 (Baseline) | Current LEL (19/20) uprated by earnings inflation | £7,340m | £9,290m | £2,810m | £19,430m | £756m |

| £6,136 | Freeze | +£25m | +£31m | +£9m | +£65m | +£3m |

| £6,240 | NI lower earnings limit (20/21) | +£9m | +£12m | +£4m | +£24m | +£1m |

| £6,246 | Uprate by price inflation (CPI) | +£8m | +£10m | +£3m | +£22m | +£1m |

| £6,301 | Uprate by earnings inflation (baseline) | 0 | 0 | 0 | 0 | 0 |

| £9,500 | NI primary threshold (20/21) | -£477m | -£605m | -£183m | -£1,270m | -£49m |

Source: DWP Modelling

Notes:

1. Scenarios after the baseline present the change in contributions when compared to the baseline.

2. Figures over £1,000m are rounded to the nearest £10 million and figures below are rounded to the nearest £1 million to reflect uncertainties associated with the modelling used. They therefore may not sum exactly.

3. The earnings trigger and UEL are held constant at their 2019/20 levels uprated in line with earnings growth, to isolate the impact of changes to the LEL.

4. The CPI measure of inflation was 1.8% in quarter 3 2019.

5. To calculate the NI lower earnings limit for 2020/21, HMT rounded the uprated the 2019/20 weekly threshold down to the nearest £1. The ‘Uprate by price inflation’ effect is calculated by uprating the 2019/20 annual rate by also using quarter 3 2019 CPI and rounding to the nearest £1.

6. The OBR’s March 2019 forecast for earnings growth between 2018 quarter 4 and 2019 quarter 4 of 2.69% was used.

7. Total pension saving is the sum of employer contributions, individual contributions, and income tax relief.

8. Employer tax relief represents the tax no longer paid by employers who respond to the additional pension contribution requirements of the workplace pension reforms by reducing profits or wages paid to their employees.

E – Impact of changing the upper limit of the qualifying earnings band in 2020/21

Table 6 shows the impact on employers, individuals and government associated with the baseline upper earnings limit and various options considered for its value in 2020/21, where these changes are made in isolation.

Increasing the UEL increases total pension saving, because it increases the amount of income on which employers and employees pay contributions. Like the LEL, the UEL does not affect who is eligible for AE so population impacts are not included.

Continuing to align the upper earnings limit for National Insurance contributions would mean freezing it at 2019/20 limit and represent a real term decrease. This would decrease total pension saving by approximately £89m against the baseline scenario. Of this, employers would approximately contribute £34m less while employees would contribute £42m less, with the rest coming from a reduction in income tax relief by the government.

Finally, uprating the UEL according to price inflation would mean decreasing it slightly in real earnings terms, thereby marginally decreasing total pension saving by approximately £29m.

Table 6 – Estimates of the direct impact of changing the upper limit of the qualifying earnings band on contributions from employers, individuals and tax relief (in 2020/21)

| Qualifying earnings band UEL | Rationale | Employer contributions | Individual contributions | Income tax relief | Total pension saving | Employer tax relief |

|---|---|---|---|---|---|---|

| £51,347 (Baseline) | Current UEL (19/20) uprated by earnings inflation | £7,340m | £9,290m | £2,810m | £19,430m | £756m |

| £50,000 | Freeze | -£34m | -£42m | -£13m | -£89m | -£3m |

| £50,000 | NI upper earnings limit (20/21) | -£34m | -£42m | -£13m | -£89m | -£3m |

| £50,900 | Uprate by estimate price inflation (CPI) | -£11m | -£14m | -£4m | -£29m | -£1m |

| £51,347 | Uprate by estimate earnings inflation (baseline) | 0 | 0 | 0 | 0 | 0 |

Source: DWP Modelling

Notes:

1. Scenarios after the baseline present the change in costs when compared to the baseline.

2. Figures over £1,000m are rounded to the nearest £10 million and figures below are rounded to the nearest £1 million to reflect uncertainties associated with the modelling used. They therefore may not sum exactly.

3. The earnings trigger and LEL are held constant at their 2019/20 levels uprated in line with earnings growth, to isolate the impact of changes to the UEL.

4. The CPI measure of inflation was 1.8% in quarter 3 2019. Quarter 3 2019 is used to be consistent with how tax thresholds are uprated when using CPI.

5. The OBR’s March 2019 forecast for earnings growth between 2018 quarter 4 and 2019 quarter 4 of 2.69% was used.

6. Total pension saving is the sum of employer contributions, individual contributions, and income tax relief.

7. Employer tax relief represents the tax no longer paid by employers who respond to the additional pension contribution costs of the workplace pension reforms by reducing profits or wages paid to their employees.

Annex A – Equalities impacts on affected groups

Introduction

This section describes the estimated impact of the proposed changes to the automatic enrolment earnings trigger on the demographics of private sector pension savers. Freezing the earnings trigger at £10,000 in 2020/21 whilst average earnings increase leads to a lower trigger in real-terms. The qualifying earnings bands do not impact eligibility and are therefore not included in this analysis.

The demographic breakdowns for the following characteristics are presented:

a) women

b) disabled people

c) those from black and minority ethnic (BME) backgrounds.

d) age

For each of the groups analysed three figures are presented:

a) the demographic breakdown of private sector pension savers under the baseline, earnings-adjusted 2019/20 thresholds

b) the demographic breakdown of private sector pension savers who are newly eligible under the proposed threshold changes in 2020/21

c) the demographic breakdown of all private sector pension savers under the newly proposed thresholds for 2020/21

These figures can be found in Table 7, along with the estimated size of each of these groups.

Women

Table 7 shows that approximately 37% of the eligible group under the baseline are women. Women are under-represented in this group because they earn less than men[footnote 14]. They are also less likely to work full time and more likely to work part-time[footnote 15].

Conversely, women make up a much larger percentage of people earning below the equivalent of £10,000. They are therefore over-represented in the newly eligible group. Three quarters of those who will become eligible for automatic enrolment will be women, as their incomes grow above £10,000 between 2019/20 and 2020/21

Because women are over-represented in the newly eligible group, there is a marginal change in the demographics of the AE eligible population as a result of the threshold changes. Under the proposals an estimated 39% of the eligible population are women.

Age

The median age of the eligible group under the baseline is 39. The newly eligible group appear to be a little older on average than the previously eligible, with an average age of 41. The median age of the eligible group under the proposed changes remains unchanged at 39. This is because the newly eligible group is much smaller than the existing population.

Disabled people

Disabled people make up 15% of the eligible group under the baseline scenario. They are better represented in the newly eligible group – 20% of this group are disabled, according to estimates informed by the LFS. 15% of the eligible group under the proposed thresholds are disabled.

Black and minority ethnic

Those from BME groups make up 12% of the eligible group under the baseline and the proposed thresholds. They are slightly better represented in the newly eligible group, at 14%.

Other groups

As in previous years, the changes under consideration for the 2020/21 review are not expected to particularly affect individuals according to their marital status, sexual orientation, gender identity, religion or belief.

Table 7 – Demographic breakdown of savers under baseline and proposed thresholds

| Estimated Size of Group | Female | Disability | BME | Median Age | |

|---|---|---|---|---|---|

| Eligible under baseline thresholds | 11,180,000 | 37% | 15% | 12% | 39 |

| Newly eligible under proposed thresholds | +80,000 | 75% | 20% | 14% | 41 |

| Overall eligible under proposed thresholds | 11,260,000 | 39% | 15% | 12% | 39 |

Source: ASHE 2018 and LFS 2018/19

Notes

1. Percentage figures are rounded to their nearest percentage point.

2. BME and disability estimates are derived from the Labour Force Survey 2018/19. This survey does not have data on pension contributions, so it cannot identify whether one has a pension or not. Therefore, demographic estimates for disability and ethnicity are for those eligible to be automatically enrolled, rather than those eligible and not saving (for example in the target group).

3. Gender and age estimates are derived from ASHE 2018; as this does have data on pension contributions, the splits for these variables are in terms of proportions in the eligible target group.

Contact Details

Press enquiries should be directed to the Department for Work and Pensions press office.

Media enquiries: 020 3267 5144

Out of hours: 07659 108883 (journalists only)

Website: www.gov.uk/government/organisations/department-for-work-pensions

Follow us on Twitter: www.twitter.com/dwppressoffice

Other enquiries about the content of this document should be directed to:

Paul Crust [email protected]

-

Latest “Automatic enrolment declaration of compliance” report can be found at www.thepensionsregulator.gov.uk/doc-library/research-analysis ↩

-

‘The purposes of subsection (1) the Secretary of State may take into account any of the factors specified in subsection (4) (as well as any others that the Secretary of State thinks relevant).

(4) The factors are –

(a) the amounts for the time being specified in Chapter 2 of Part 3 (personal allowances) of the Income Tax Act 2007;

(b) the amounts for the time being specified in regulations under section 5 of the Social Security Contributions and Benefits Act 1992 (earnings limits and thresholds for Class 1 national insurance contributions);

(c) the amounts for the time being specified in section 44(4) of that Act (rate of basic state pension) and in regulations under section 3(1) of the Pensions Act 2014 (full rate of state pension);

(d) the general level of prices in Great Britain, and the general level of earnings there, estimated in such manner as the Secretary of State thinks fit.’ Pension Act 2008: http://www.legislation.gov.uk/ukpga/2011/19/contents/enacted ↩ -

IFS Working Paper (W16/19), ‘What happens when employers are obliged to nudge? AE and pension saving in the UK’: https://www.ifs.org.uk/publications/8723 ↩

-

https://www.gov.uk/government/publications/automatic-enrolment-review-2017-maintaining-the-momentum ↩

-

For more details on ASHE methodology, see the ONS documents at www.ons.gov.uk/ons/taxonomy/index.html?nscl=Annual+Earnings ↩

-

As in last year’s report, this calculation assumes that all savers are in a Net Pay Arrangement (NPA), rather than a Relief at Source (RAS) system. This assumption has a minimal impact on the aggregated estimates present, although the distinction is important for a small group of individuals. ↩

-

EPP 2017 Survey https://www.gov.uk/government/publications/employers-pension-provision-survey-2017 ↩

-

The data sets: April – June 2018, July – September 2018, October – December 2018 and January – March 2019 were combined to represent 2018/19. ↩

-

Eligible employees in 2018/19 are defined as those:

1. ordinarily working in Great Britain;

2. aged at least 22 and under State Pension Age;

3. earning more than £10,000 a year. ↩ -

The target population consists of eligible individuals who are either (i) not saving in a pension scheme, or (ii) saving in a pension scheme where the employer contributes less than 3% of the individual’s salary, and is not a defined benefit scheme. ↩

-

The LFS does not collect data on employer contributions to pensions so it is not possible to produce analysis for the eligible target population. ↩

-

Workplace Pensions Participation and Saving Trends 2008 to 2018 https://www.gov.uk/government/statistics/workplace-pension-participation-and-saving-trends-2008-to-2018 ↩

-

https://www.thepensionsregulator.gov.uk/en/business-advisers/automatic-enrolment-guide-for-business-advisers/6-choosing-a-pension-scheme/what-to-consider-when-choosing-a-scheme#d9567402515148d9a1e35201574bc728 ↩

-

See analysis of the pay differences between men and women published by the Office of National Statistics: https://www.ons.gov.uk/employmentandlabourmarket/peopleinwork/earningsandworkinghours/bulletins/genderpaygapintheuk/2019 ↩

-

See ONS statistics: https://www.ons.gov.uk/employmentandlabourmarket/peopleinwork/employmentandemployeetypes/bulletins/uklabourmarket/january2020 ↩