Destinations of claimants receiving a benefit sanction, explanation of methodology

Updated 14 May 2024

Purpose of the statistics

In November 2017, the Department for Work and Pensions (DWP) released statistics on the benefit destinations of sanctioned claimants for the first time as part of its benefit sanctions statistics publication.

These measures provide insight into the extent to which people move off, on and between DWP working age benefits following a benefit sanction.

From November 2018 we added statistics on numbers of people who have had some earnings during the 180 day period following their first adverse sanction decision; for JSA and UC.

Context of the statistics

The statistics are available for claimants receiving a Jobseeker’s Allowance (JSA), Employment and Support Allowance (ESA) or Universal Credit (UC) live service sanction. For ESA claimants, only those in the Work-Related Activity Group (WRAG) can be sanctioned. The statistics are not yet available for Universal Credit full service (UCFS) sanctions, but may be included in future updates.

The statistics are calculated using Department for Work and Pensions (DWP) administrative data or Real Time Information data (RTI) to track the benefit status and/or earnings of claimants over a 180 day period following an original decision by DWP to impose a sanction.

Further work is ongoing to continue to refine and improve the methodology used to calculate claimant destinations. As it stands, the methodology can be split into three sub-sections:

1. identifying sanctioned claimants

2. identifying benefit or earning spells

3. estimating time spent on benefits or earning

Identifying sanctioned claimants

The first stage of the new destinations measure is to determine which individuals and decisions are included, as the process for administering a benefit sanction can involve several different decisions, depending on the type of benefit, the decision outcomes, and whether the claimant appeals a decision (see benefit sanction statistics for more details). It is also possible for an individual claimant who commits multiple infractions to receive multiple sanctions.

For the destinations measures, three groups were used: one each for JSA, ESA and UC sanctions. Each group is created by applying the following conditions to the sanction decisions data for the specified benefit:

a. include only original sanction decisions made under the new sanctions regime for JSA, ESA and UC (live service). The new sanctions regime was introduced on 22nd October 2012 for JSA claimants and 3rd December 2012 for ESA claimants. Universal Credit (Live Service) sanctions cover the period from August 2015 which is the earliest point from which we have complete sanctions information for UC

b. include only decisions made 6 months before the latest available decision date. This is so that we have a period of at least 180 days to track benefit destinations following the decision

c. include only adverse original decisions. We only track claimants who were initially informed that a sanction would be imposed (this includes some decisions that were later overturned)

d. include only the earliest decision for any individual claimant that meets all 3 of the above conditions

Applying these conditions to our sanctions decisions data provides us with three benefit groups, each comprising a single, adverse, original sanction decision for each individual claimant who had such a decision within the cohort period.

The reasoning behind keeping only one sanction decision per person is that it avoids ‘double counting’ of benefit destinations, which could otherwise occur for an individual if their tracking periods following multiple sanction decisions overlapped.

Identifying benefit or earning spells

Each individual in the three benefit groups is tracked for 180 days following their original sanction decision. The number of days after receiving the sanction is calculated for:

- Jobseeker’s Allowance (JSA)

- Employment Support Allowance (ESA)

- Universal Credit (UC)

- Income Support (IS)

- earnings

The number of spells within the 180 day tracking period is also calculated for each individual.

To identify spells on Jobseeker’s Allowance, Employment and Support Allowance and Income Support, data is collected from the National Benefits Database (NBD). Benefit spells for claimants in our three benefit groups are identified and recorded alongside their original sanction decision date. We retain the start and end date of each benefit spell.

To identify spells spent on Universal Credit; data is collected from the Universal Credit Reference Data Sets. Whilst we can currently only use Universal Credit live service data for sanction decisions, we can track claimants on Universal Credit live and full service. There are currently two Universal Credit processing systems (Live Service and Full Service), which administer claims in slightly different ways. There are, therefore, two slightly different definitions for the start and end date of claims on each of these systems:

For ‘live service’ Universal Credit claims:

- the start date is defined as the date the claim’s first Claimant Commitment was signed

- the end date is defined as the date of the end of the last Assessment Period for the claim

For ‘full service’ Universal Credit claims:

- the start date is the date a UC claim is officially considered an ‘inflow’ to UC. This is defined as the latest of the:

- claimant commitment sign date

- ID verification date

- the end date is defined as the date of the end of the last Assessment Period for the claim

UC benefit spells for claimants in our three benefit groups are identified and recorded alongside their original sanction decision date. We retain the start and end date of each benefit spell.

Universal Credit is administered at a household level, which means that some benefit spells have both a primary and secondary claimant on our administrative data. If either the primary or secondary claimant is in our group, then the benefit spell is retained and matched to the corresponding claimant.

To identify spells in Earnings, data is collected from HMRC via bespoke Real Time Information (RTI) data extracts. These bespoke extracts are currently only available for UC and JSA. Periods of earnings for claimants in our benefit groups are identified and recorded alongside their original sanction decision date. We retain the start and end date of each benefit spell.

It is important to note that there are some assumptions made around Earnings spells when developing the RTI data as the data actually only shows payments for work and not start and end dates of employment. For more detail see annex A.

In cases where the data shows overlapping UC or Earnings spells for an individual, the dates are adjusted to remove the overlaps.

Claimants in any of the cohorts may have multiple benefit and / or earning spells during the 180 day tracking period and those spells may be a combination of one or more benefit or spell of earnings.

Estimating time spent on benefits or earning

Once the original sanction decision date has been combined with the start and end dates of all benefit or earnings spells undertaken, it is then possible to calculate a number of measures of interest for each individual in the three benefit groups. The following measures are calculated:

1. the number of days spent on each benefit (JSA, ESA, UC and IS) or earning in the 180 days following the original sanction decision

2. the total number of days spent on any of the included benefits (JSA, ESA, UC and IS) or earning in the 180 days following the original sanction decision

3. the number of unique spells on each benefit (JSA, ESA, UC and IS) or earning in the 180 days following the original sanction decision

4. the number of unique spells on any of the included benefits (JSA, ESA, UC and IS) or earning in the 180 days following the original sanction decision

We have produced the mean number of days spent by individuals in a benefit or earning spell during the 180 days following an original adverse sanction decision on UC live service, JSA and ESA. The mean number is used for representing destinations data because the mean is a good measure of the average for datasets such as the ones we’re using in this methodology, where values are relatively evenly spread with no exceptionality high or low values

Limitations of the statistics

There are some limitations with the methodologies used in calculating sanction benefit destinations. These are outlined below:

1. Some sanction decisions that would otherwise be included are dropped from the analysis because they have no identifying variable. This applies to less than 5% of all sanction decisions in the underlying data.

2. Some sanction decisions cannot be matched to an associated benefit spell due to dates being misaligned. This applies to less than 1% of all decisions meeting the criteria for this analysis.

3. In some cases where a claimant has transferred from UC Live Service to Full Service and then ended their claim within a short period, the spell end date may be calculated as being up to a few months after the claim actually ended. This applies to around 0.1% of the UC benefit spells included in the analysis.

4. The National Benefit Database (NBD), which we have used to identify JSA and ESA is pre-processed before analytical use. This means that any administrative entry errors showing an individual as receiving multiple benefits simultaneously have been corrected (in cases where the benefits are incompatible). However, as the Universal Credit benefit spells are drawn from a different data source, it is possible for overlaps to appear between Universal Credit spells and spells on other benefits. This occurs in less than 0.1% of benefit spells. When presenting the statistics, it is assumed that all benefit spells are correct even when overlaps occur, which may lead to a slightly inflated number of days on benefit being reported. This can lead to the total number of days on benefit being greater than 180 days out of 180; in such cases we simply treat the total number of benefit days as precisely 180.

5. The Real Time Information (RTI) data is used to identify when a claimant has a payment as a result of employment, excluding self-employed earnings which are not recorded within the data. There are other limitations in the data which means that a methodology has been developed to enable us to impute start and end dates of an Earnings spell from RTI data. Therefore we refer to periods of earnings rather than employment spells. For more detail see annex A.

As these are Official Statistics, we hope to address some of the above issues as we become more familiar with the data and underlying patterns.

Comparisons between the statistics

Direct comparisons should not be made between the destinations statistics and other sanctions statistics (decision statistics or duration statistics) produced by DWP, as the underlying data is not compatible.

The ‘decisions’ statistics include original decisions, decision reviews, Mandatory Reconsiderations, and Appeals, as well as adverse, non-adverse, cancelled, and reserved decisions.

The ‘durations’ statistics use only decisions where a reduction in benefit is observed as a result of a sanction. The statistics do not include any decisions where the claimant left benefit on the same day as their payment reduction.

The ‘destinations’ statistics comprises a single, adverse, original sanction decision for each individual claimant in the three benefit groups who had such a decision within the cohort period.

Source of the statistics

The data comes from the following systems:

- JSA and ESA sanctions information come from the Decision Making and Appeals System (DMAS), the Labour Market System (LMS) and the Decision Makers and Appeals Case Recorder (DMACR)

- UC Live Service sanction information comes from the Work Services Platform (WSP), Payment Manager Systems (PMX) and Decision Makers and Appeals Case Recorder (DMACR)

- JSA, ESA and IS benefit spells information comes from the National Benefit Database (NBD)

- UC benefit spells information comes from the Universal Credit Reference data sets

- earnings and earnings spells information come from the Real Time Information (RTI) system, this is from a bespoke extract for UC and JSA claimants

Definitions within the statistics

Sanction

A reduction or loss in payment until a claimant re-engages, or for a fixed period.

Disallowance

The claim to benefit is ended, and claimants have to re-apply for the benefit (JSA only).

Intermediate Sanction

In JSA, a claimant will receive a disallowance to benefit for intermediate level sanctions. The reasons for an intermediate sanction are: Not Actively Seeking Employment, and Not Being Available for Work.

Duration

The length of a sanction as determined by the effect it has on the claimants’ benefit.

Standard Allowance

In UC, claimants are entitled to a Standard Allowance. This is the basic UC benefit amount before any extra benefit is added on such as child benefit, housing costs, and work allowance.

WRAG

Work-Related Activity Group for ESA. Claimants in this group are expected to prepare for work, as opposed to those in the Support Group who have no requirements placed upon them.

Earnings

This relates to payments data within the RTI scans. The data from the HMRC system does not show every payment and doesn’t give employment start and end dates. Therefore there are assumptions made around the earnings spell itself as the start and end dates of the spell need to be imputed by analysing the underlying data. For further details see Annex A.

Revisions to the statistics

DWP have a policy for planned revisions describing how we will handle revisions and give confidence that all revisions will be handled in a transparent manner. For sanction statistics, to reflect any updates to the figures, the full historic statistical series is refreshed each time the figures are released.

Status of the statistics

Official Statistics

These statistics are designated Official Statistics.

We have reviewed the Official Statistics in Development label on all Benefit Sanctions Statistics, following the reinstated duration measures and rate methodology improvements. We are removing the “in development” label. As of 14 May 2024, these statistics will be published under the “Official Statistics” label.

We will continue to progress developments to meet user needs through the DWP Statistical Work Programme. Read for more information on types of official statistics.

Quality Statement

Our statistical practice is regulated by the Office for Statistics Regulation (OSR).

OSR sets the standards of trustworthiness, quality and value in the Code of Practice for Statistics that all producers of official statistics should adhere to.

You are welcome to contact us directly at [email protected] with any comments about how we meet these standards.

Alternatively, you can contact OSR by emailing [email protected] or via the OSR website

Feedback

We welcome feedback.

To give feedback on the destinations statistics:

Email: [email protected]

Write to:

Tracy Hills

Development Team Client Statistics

Digital, Data and Analytics

Room BP5201

Benton Park View

Longbenton

Newcastle Upon Tyne

NE98 1YX

Useful links

The Benefit sanctions statistics publication.

JSA, ESA, IS and UC sanction statistics, including the links to the most recent statistics in Excel tables, including the durations underlying statistics, the link to this document, the JSA, ESA and IS Background Information and Methodology document, and the UC Background Information and Methodology document.

Annex A

RTI Background

Identifying when a claimant has spells of earning is a key piece of evidence used to support UC evaluation. UCAD analysts have created an approach, outlined below, to impute start and end dates from RTI data. The approach has evolved over time, as our understanding of the data has improved. This note gives details of the methodology applied to the data to estimate periods of earnings / employment.

Data Issues

Periods when people are earning (their earning spells) have been constructed from the RTI data. The RTI data itself only gives information about the payments made for work done, the date of the payment and the amount paid. It does not specify directly the period in which the work was done (employment spells). Earning spells have been estimated using the methodology below.

The RTI data also contains a number of incorrect entries, repeated entries and there are some payments which are not reported. So some cleaning up of the data has also been done.

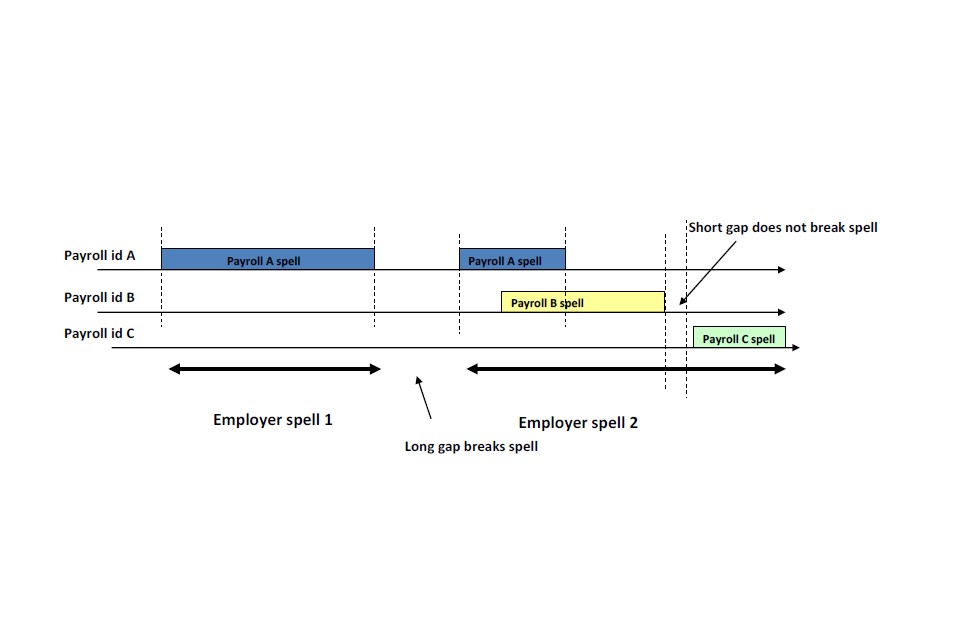

In the RTI data all the payments to an individual can be split down into payments from a particular employer and then for that employer all the payments under a particular payroll identifier. In building up to the earnings spells this payroll identifier level is taken as the starting point but also includes low level payment information. This approach outlined below has been developed from earlier methodology and in consultation with analyst colleagues in DWP and HMRC.

Spells Methodology

Payroll spells

Having identified all the payments made to a person by an employer under a particular payroll identifier, the first step in the analysis is to determine the normal frequency of payment. This is most commonly either weekly or monthly but some are paid 4-weekly and some 2-weekly. The RTI data does indicate what the payment frequency is but the information is not always reliable and so this is combined with information on the actual time gaps between payments to determine this normal frequency.

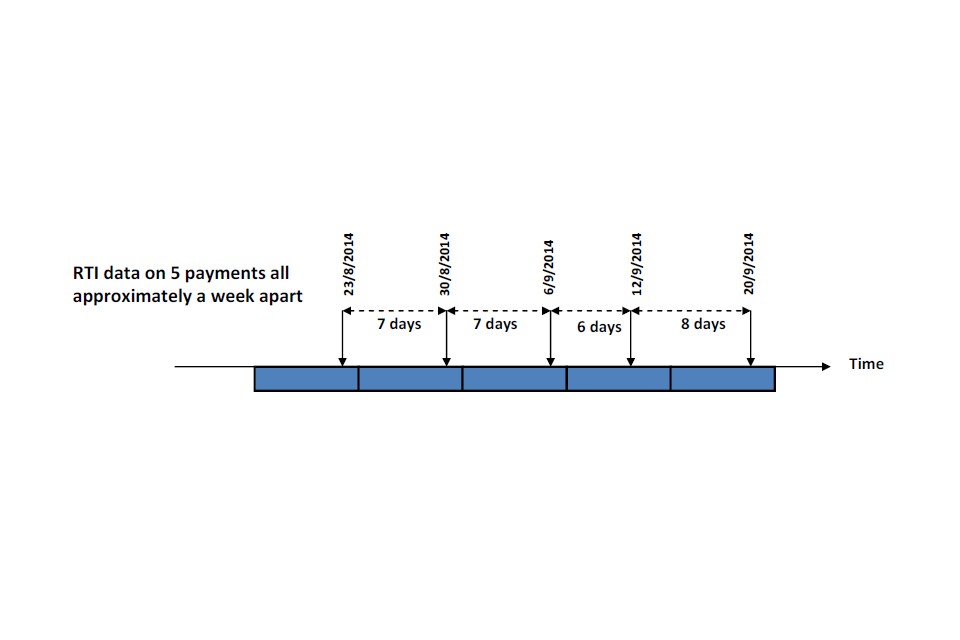

The following example shows a case with a series of 5 individual payments and the time gaps between them. In this case the normal frequency can be seen to be weekly although it is not always exactly so.

Having determined that the payments are weekly each individual payment has then been assigned to a period of time by assuming in this case that the weekly payments are paid towards the end of the week in which the work happened. Similarly for someone paid monthly the payment period would normally run from the first of the month to the last of the month in which the payment was made. Usually the actual payment occurs near the end of the month.

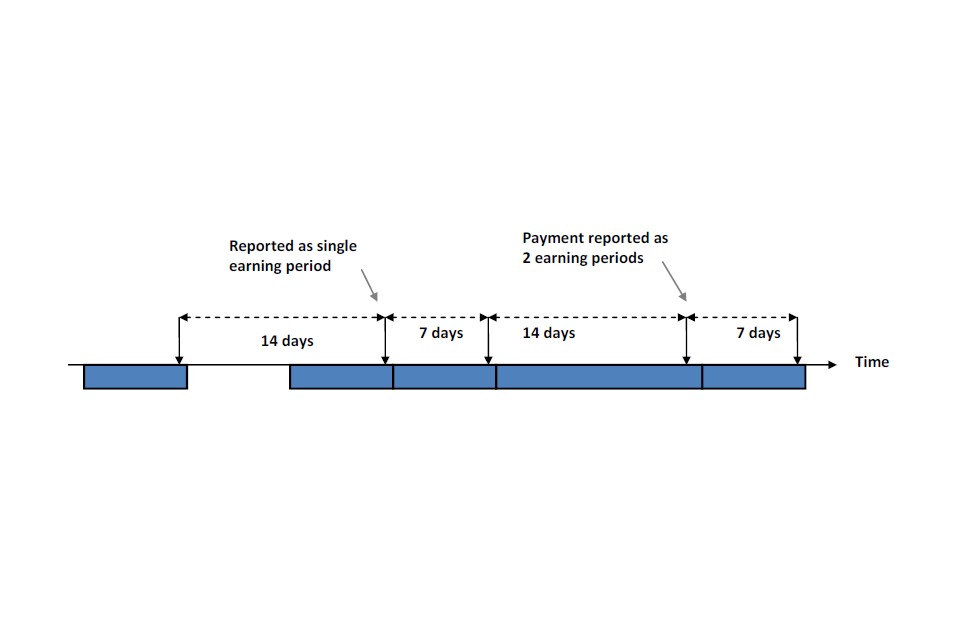

In this case the result is a continuous period of earnings of 5 weeks. In other cases there can be longer gaps between payments. Here the information recorded in the RTI to indicate how many periods were covered by the payment can be used to determine whether there is a gap where no payment was made or if the payment period was longer than normal. In the example below of someone paid weekly, there are two gaps of 14 days. In the first case the payment is just for one period so the assumption is that there is a gap in payments for a week. In the second the payment made was for a two week period so there is no gap.

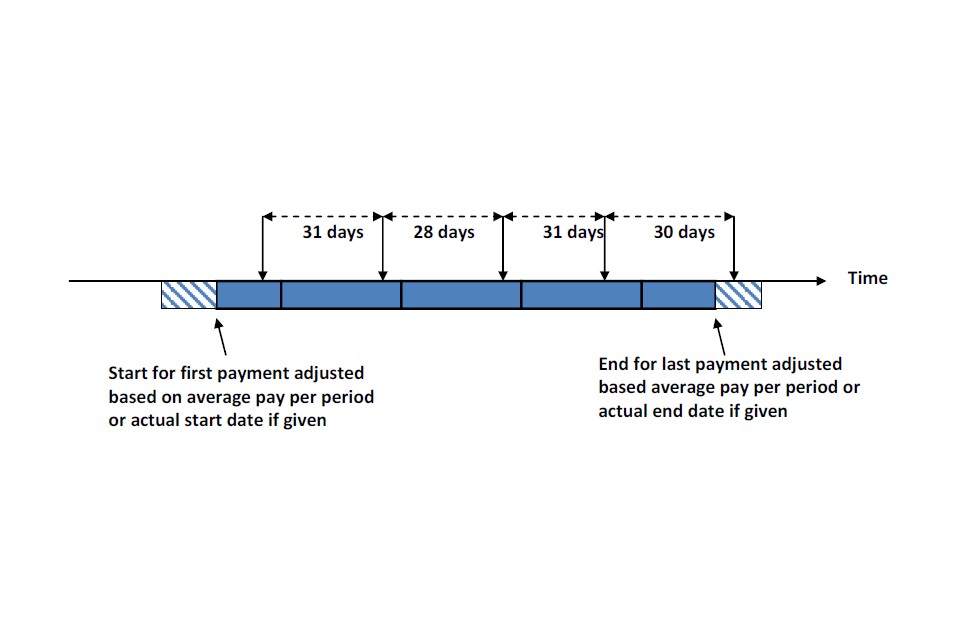

The work period for the first and last payments can be further adjusted to allow for people who may not have started or ended work part way through. This matters most for those paid monthly, with an example shown in the following of 5 monthly payments recorded in RTI.

Creating earnings/employment spells

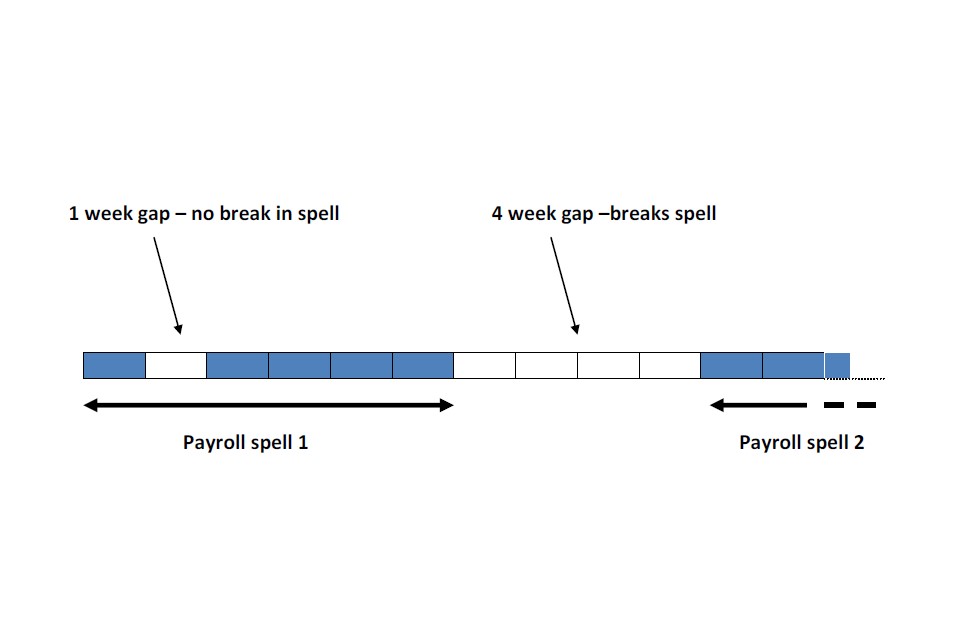

The result of this work is to convert a series of payment dates under a particular payroll identifier into one or more continuous spells of earnings/employment. The gaps found have then been judged to represent continued earnings/employment as long as the gap is less than 4 weeks long. Above that there is assumed to have been a break in the employment and the person is assumed not to have been working for the whole of the gap.

Where the gap is less than 4 weeks the person is assumed to have still been employed but not earning during that period.

One person may have several spells of work for the same employer under different payroll identifiers. These have been combined to produce spells of work/earnings for that employer.

Having created employer spells, these have then been combined again to produce overall earnings/employment spells for that person using similar rules.