Trade in goods: guidance for traders on complying with the UK Internal Market Act 2020

Updated 16 February 2022

Disclaimer

This guidance clarifies and explains the practical operation of the market access principles as outlined in Part 1 of the UK Internal Market Act (UKIMA) 2020. It does not create or amend any legal obligations. Traders (with support from their solicitor, trade association or other appropriate body if necessary) should refer to relevant goods legislation, and the UK Internal Market Act 2020 itself, if they are unsure of any legal obligations.

This guidance is for traders of goods. There is different guidance if you are an enforcement authority of goods.

Overview: the UK Internal Market Act 2020

On 1 January 2021, following the end of the Brexit Transition Period, the rules on how goods move between the UK nations are now decided by the UK government and the devolved administrations in Scotland, Wales, and Northern Ireland.

The UK Internal Market Act 2020 is legislation that helps traders continue to sell their goods freely across the UK without barriers between the nations. This is done through two market access principles called the mutual recognition principle and the non-discrimination principle.

The mutual recognition principle means that if goods can lawfully be sold in the part of the UK where they were ‘produced in’ or ‘imported into’, they can be sold in other parts of the UK.

The non-discrimination principle means that discriminatory rules will generally not apply if, and to the extent that, they either directly or indirectly discriminate against goods with a ‘relevant connection’ with another part of the UK.

As a trader, you must know if, when, and how you can rely on these principles to sell your goods in another part of the UK. There are some modifications to these principles as they apply in relation to Northern Ireland, as explained below.

You do not need to rely on these principles if the sale of your goods already complies with the relevant statutory requirements of the part of the UK where they are sold.

Check if the market access principles apply to the sale of your goods

The mutual recognition principle and the non-discrimination principle do not apply to:

- requirements that were in force in a part of the UK before 31 December 2020 and remain unchanged

- goods sold within Great Britain (England, Scotland and Wales) where requirements are the same across Great Britain

The market access principles apply with modifications to trade from Great Britain to Northern Ireland, where the provisions of the Northern Ireland Protocol take precedence for as long as the Protocol is in force. This means that any differing requirements on goods sold in Northern Ireland which apply as a result of the Protocol will have to be complied with.

For ‘qualifying Northern Ireland goods’ moving from Northern Ireland to Great Britain, the market access principles apply. Read the definition of ‘qualifying Northern Ireland goods’.

Definitions of sale and goods for the purposes of the market access principles

The concepts of ‘sale’ and ‘goods’ underpin the market access principles.

‘Sale’ means supplying goods in almost any way. It can include:

- exchange for money

- trial samples

- free gifts

- goods bartered

- goods that are leased or hired

‘Sale’ can also mean agreeing to sell, advertising or storing for sale.

Supplies of goods for the purpose of carrying out a public function (e.g. supplies of medical equipment or food by public health services) are not defined as a sale.

‘Goods’ are defined widely to include any tangible movable thing (except water or gas that isn’t sold in limited quantities).

Check if the sale of your goods qualifies for the benefits of the mutual recognition principle

Goods moved between parts of Great Britain (England, Scotland and Wales)

The mutual recognition principle enables goods that comply with the relevant statutory requirements in the part of Great Britain they were ‘produced in’ or ‘imported into’ to be sold in any other part of Great Britain, without having to comply with the relevant statutory requirements in that other part.

For example, a jam producer in Wales does not need to meet the Scottish labelling requirements for jam when selling in Scotland, as long as the jam label meets the Welsh requirements.

Goods moved from Northern Ireland into Great Britain

Mutual recognition applies if the goods in question are ‘qualifying Northern Ireland goods’. Read further guidance on qualifying Northern Ireland goods.

If the goods are not ‘qualifying Northern Ireland goods’, mutual recognition does not apply. The goods will have to comply with the relevant statutory requirements of the part of Great Britain where they are first moved into. If they do, the goods can subsequently be sold in another part of Great Britain in reliance on the mutual recognition principle.

Goods moved from Great Britain into Northern Ireland

Mutual recognition does not apply to goods sold in Northern Ireland where those goods need to comply with relevant EU rules under the Northern Ireland Protocol. Read further guidance on the Northern Ireland Protocol.

If the goods are not regulated by requirements that apply to Northern Ireland under the Northern Ireland Protocol, mutual recognition applies.

Exclusions from the mutual recognition principle

Some areas of goods regulation are excluded from the mutual recognition principle and in these cases goods will need to comply with the rules in the part of the UK in which they are sold. Exclusions include certain regulations related to:

- controlling pests or diseases

- unsafe food or animal feed

- chemicals

- pesticides

- fertilisers

Legislation relating to the imposition of any tax, rate, duty or similar charge is also excluded.

Further information, including the conditions that have to be met for the exclusions to apply, is available in Schedule 1 of the UKIMA 2020.

Relying on the mutual recognition principle

If your goods comply with the rules in the part of the UK in which they are sold, then you do not need to rely on the mutual recognition principle. If you want to sell goods unchanged into another part of the UK where different rules apply, you should make sure you understand the mutual recognition principle. If an enforcement authority thinks the goods you sell are non-compliant with local requirements, they may ask if you are relying on the mutual recognition principle, and if so, for documentary evidence on where your goods were ‘produced in’ or ‘imported into’.

The following sections of this guidance set out how you can do this.

Step 1: Determine where your goods were ‘produced in’ or ‘imported into’

If you want to use the mutual recognition principle to sell your goods, you will need to know if they are ‘produced in’ or ‘imported into’ England, Scotland or Wales, or in the case of Northern Ireland, whether the goods meet the definition of ‘qualifying Northern Ireland goods’.

‘Produced in’

For the purposes of the mutual recognition principle, your goods are regarded as ‘produced in’ a part of the UK (if not wholly produced there), if the most recent significant production step, which is also a regulated step, has occurred in that part.

Significant production step

A production step is significant if it affects the character of the goods or their purpose. For example, baking a loaf of bread would be a significant production step.

Production steps that are not significant include:

- activities carried out specifically to ensure goods do not deteriorate before being sold (such as maintaining them at or below a particular temperature);

- activities carried out solely for purposes relevant to their presentation for sale (such as cleaning or pressing fabrics or sorting different coloured items for packaging together);

- activities involving communication with a regulatory or trade body (such as registering the goods or notifying the goods or anything connected with them or their production);

- activities carried out for the purpose of testing or assessing any characteristic of the goods (such as batch testing a pharmaceutical product);

- packaging, labelling, stamping or marking of goods (except if it is fundamental to the character of the goods or their purpose).

Regulated production step

If a step is significant then it must also be regulated in the part of the UK where it occurred. A step is regulated if it would either:

- be subject to regulation in the part of the UK where it is being produced;

- affect whether the goods can be lawfully sold in that part of the UK.

How to evidence location of production

If you are contacted by an enforcement authority, you can use existing, readily available documents to evidence where your goods were produced in (or that goods are ‘qualifying Northern Ireland goods’), such as a dispatch note or technical file for manufactured goods, or an invoice or labelling for agri-food. You may wish to retain information regarding the location of production of your goods.

You must tell the enforcement authority if you do not have documents that show which part of the UK your goods were ‘produced in’, or that they are ‘qualifying Northern Ireland goods’. The enforcement authority may ask you for evidence regarding who supplied you with the goods in order to determine the location of production.

‘Imported into’

For the purposes of mutual recognition, the part of the UK where the goods first arrive is where goods are regarded as having been ‘imported into’ (that is the geographical point of entry determines where goods are ‘imported into’ not customs or any other import formalities).

So, for example, if goods arrive in the UK by ship via the port of Felixstowe, they are regarded as having been ‘imported into’ England when the ship carrying them enters Felixstowe port. To benefit from the mutual recognition principle for sale elsewhere in the UK, the goods would need to comply with the relevant requirements for sale in England.

Goods that are ‘produced in’ or first ‘imported into’ one part of the UK (the originating part) and are then subsequently exported outside of the UK before being re-imported back into the UK, are generally still considered as being ‘produced in’ or ‘imported into’ the originating part.

If goods (including ‘qualifying Northern Ireland goods’) were ‘imported into’ one part of the UK and then underwent a significant and regulated production step in a different part of the UK, the goods would be treated as having been ‘produced in’ that second part of the UK.

How to evidence location of importation

You can use an existing document like a customs declaration which shows the port of entry to show where your goods were imported into.

If you do not have suitable documentation showing the location of importation of your goods, you must tell the enforcement authority. The enforcement authority may ask you for evidence regarding who supplied you with the goods in order to help determine their location of importation.

Step 2: Determine if your goods comply with the relevant requirements for mutual recognition

Once you have established the location of production or importation of the goods, you then need to determine whether they comply with the relevant requirements for that part of the UK. If so, you can rely on the mutual recognition principle to sell the goods.

The relevant requirements (which are statutory requirements that prohibit the sale of the goods, or impose conditions which must be met for the goods to be sold) for the mutual recognition principle must relate to one or more of the following:

a) characteristics of the goods themselves (such as their nature, composition, age, quality or performance);

b) presentation of the goods (such as the name or description applied to them or their packaging, labelling, lot-marking or date-stamping);

c) anything connected with the production of the goods or anything from which they are made or is involved in their production (including the place at which, or the circumstances in which, production or any step in production took place);

d) anything relating to the identification or tracing of an animal (such as marking, tagging or micro-chipping or the keeping of particular records);

e) the inspection, assessment, registration, certification, approval or, authorisation of the goods or any other similar dealing with them;

f) documentation or information that must be produced or recorded, kept, accompany the goods, or be submitted to an authority;

g) anything not falling within paragraphs (a) to (f) which must (or must not) be done to, or in relation to, the goods before they are allowed to be sold.

Statutory requirements that affect the manner or circumstances in which goods are sold (such as where, when, by whom, or to whom the goods can be sold, the price of the goods, or other terms on which they may be sold) are not ‘relevant requirements’ for the purposes of mutual recognition. These ‘manner of sale’ requirements are instead covered by the non-discrimination principle. For example, a ban on selling particular goods to under 18s would be a ‘manner of sale’ requirement; whereas a requirement to label the goods in a particular way would be a ‘relevant requirement’ under the mutual recognition principle.

There is however, one exception to this, where ‘manner of sale’ requirements will be considered ‘relevant requirements’ for the purposes of mutual recognition. This is where a ‘manner of sale’ requirement is artificially designed to avoid the mutual recognition principle (for example, where a restriction on the hours of the day in which goods could be sold was so extreme that it left businesses with no practical chance of selling the goods).

How to evidence compliance with the relevant requirements

You must ensure the sale of your goods comply with the relevant requirements in the part of the UK they were produced in or imported into, or are qualifying Northern Ireland goods, to benefit from the mutual recognition principle.

In most cases you will not need to provide specific evidence demonstrating this as the enforcement authority should be able to make this assessment independently based on the evidence you provide for the location of production or importation of the goods.

It is however in your interests to engage with the enforcement authority in an open and constructive way to help determine, and act on, an assessment of whether the mutual recognition principle applies. If the mutual recognition principle is found not to apply, you may be subject to enforcement action.

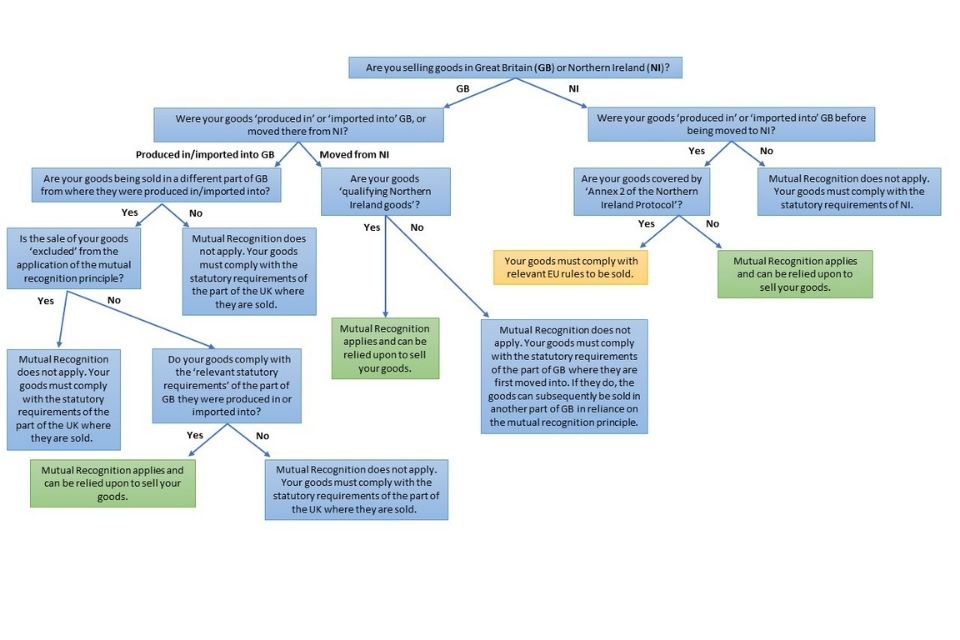

Flowchart to check whether the sale of your goods qualifies for the mutual recognition principle

The following diagram outlines for illustrative purposes how you can determine whether the sale of your goods qualify for the benefits of the mutual recognition principle.

Check if the non-discrimination principle applies to the sale of your goods

The non-discrimination principle ensures that regulation made by any part of the UK does not directly or indirectly discriminate against the sale of goods from another part of the UK.

Under the non-discrimination principle, a relevant statutory requirement will have no effect if and to the extent that it either directly or indirectly discriminates against incoming goods (i.e. goods with a relevant connection with another part of the UK).

Relevant requirements for the non-discrimination principle are defined as statutory provisions, contained in legislation, that apply to, or in relation to, goods sold in a part of the UK, and relate to any one or more of the following:

a) the circumstances or manner in which goods are sold (such as where, when, by whom, to whom, or the price or other terms on which they may be sold);

b) the transportation, storage, handling or display of goods;

c) the inspection, assessment, registration, certification, approval or authorisation of the goods or any similar dealing with them (unless failure to meet the requirement results in sale of the goods being prohibited, in which case it would fall under the mutual recognition principle);

d) the conduct or regulation of businesses that engage in the sale of certain goods or types of goods.

Goods are deemed to have a relevant connection with a part of the UK if they, or any of their components:

- are ‘produced in’ that part;

- are produced by a business based in that part (such as where its registered office is, its head office is or principal place of business is – assessed in that order)

- come from, or pass through, that part before reaching the destination part

Goods that are not ‘qualifying Northern Ireland goods’ do not have a relevant connection with Northern Ireland for the purposes of the non-discrimination principle.

Test for direct discrimination

A requirement will be directly discriminatory if, because of the goods having a relevant connection with another part of the UK, it puts those goods at a disadvantage when compared to locally produced goods. The disadvantage occurs where the relevant requirement placed on the incoming goods do not apply to the locally produced goods.

For example, a Welsh requirement that goods coming from Scotland or England must be chilled, but local goods produced in Wales do not.

Goods are put at a disadvantage if it is made in any way more difficult, or less attractive, to sell or buy the goods, or do anything in connection with their sale.

For the purposes of direct discrimination, ‘local goods’ are actual or hypothetical goods that lack the relevant connection of the incoming goods with the part of the UK they came from, but otherwise are materially the same as, and share the material circumstances of, the incoming goods. The inclusion of hypothetical goods covers a situation where, for example, goods are protected by an intellectual property right and is not yet available in both parts of the UK.

Exclusions from direct discrimination

Statutory requirements that are excluded from direct discrimination include:

- legislation that relates to the imposition of any tax, rate, duty or similar charge

- requirements created in response to a public emergency that poses an extraordinary threat to human health

- regulatory safeguards that manage risks associated with the movement of pests or diseases

You can check the details of these exclusions by looking at paragraphs 1, 5, and 11 of Schedule 1 of the UKIMA 2020.

Relying on direct discrimination

In most cases, enforcement authorities should be able to make an independent assessment of whether a relevant requirement directly discriminates by examining if the requirement applies equally to both the local and incoming goods. Enforcement authorities should therefore generally be able to determine that directly discriminatory relevant requirements have no effect in respect of the incoming goods if and when they are identified without needing to engage you directly.

Test for indirect discrimination

Indirect discrimination occurs, in general terms, when a relevant requirement, which does not directly discriminate, disadvantages incoming goods compared to local goods and as a result has a significant adverse effect on competition for those goods. For example, a requirement adopted in Wales that milk must be sold a maximum of 20 miles from the site of production would exclude most milk from England and all milk from Scotland and Northern Ireland without expressly banning it.

For a relevant requirement to indirectly discriminate against goods connected with another part of the UK, all of the following must apply:

- it does not directly discriminate against the goods;

- it applies to, or in relation to, the goods connected with another part of the UK in a way that puts those goods at a disadvantage;

- it has an adverse market effect; and

- it cannot reasonably be considered a necessary means of achieving a legitimate aim.

‘Adverse market effect’

A relevant requirement has an adverse market effect if it puts goods connected with another part of the UK at a disadvantage (but not comparable local goods, or not to the same extent), and by so doing causes a significant adverse effect on competition for those goods. The goods will be at a disadvantage if it is made more difficult, or less attractive, to sell or buy them.

Comparable local goods are goods that are alike to the incoming goods in all respects (or closely resemble them), or could reasonably be said, from the view of a purchaser, to be interchangeable with them.

‘Legitimate aim’

Where a relevant requirement can reasonably be considered a necessary means of achieving a legitimate aim, it will not be indirectly discriminatory. Legitimate aims are:

- the protection of the life or health of humans, animals, or plants; and/or

- the protection of public safety or security

Exclusions from indirect discrimination

Statutory requirements that are excluded from indirect discrimination include:

- Legislation relating to the imposition of any tax, rate, duty or similar charge

- Regulatory safeguards needed to manage the risks associated with the movement of pests or diseases

- Requirements made in, or under, an Act of Parliament will not be taken to indirectly discriminate against incoming goods if the same requirement also applies in the part of the UK where the goods came from (and that requirement was also in, or made under, an Act of Parliament).

You can check the details of these exclusions by looking at paragraphs 1, 11, and 12 of Schedule 1 of the UKIMA 2020.

Relying on indirect discrimination

You should talk to enforcement authorities (with support from your solicitor, trade association or other appropriate body if necessary) to help determine whether the indirect discrimination principle applies to the sale of your goods. They will be able to help you understand what evidence you may need to demonstrate that a relevant requirement has had an ‘adverse market effect’ on your goods, when compared to ‘comparable local goods’.

As for assessing whether a relevant requirement can reasonably be considered a necessary means for achieving a legitimate aim, enforcement authorities should, in most cases, be able to make an independent assessment without engaging you directly by considering the relevant legislation and any communications from the relevant executive as to its purpose or intended effects.

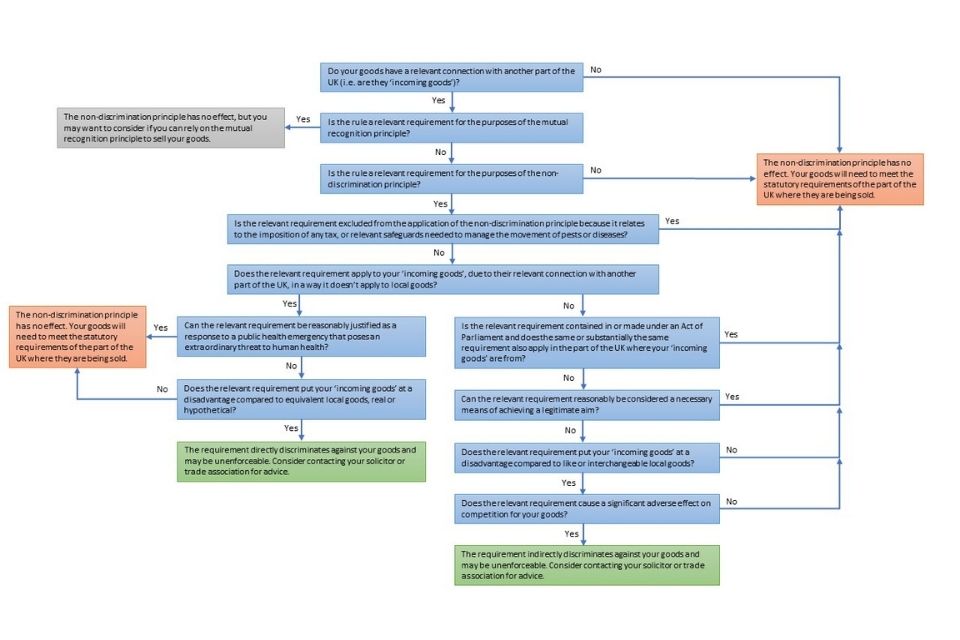

Flowchart for determining whether direct or indirect discrimination applies

The following diagram outlines for illustrative purposes the steps that you can go through to determine whether direct or indirect discrimination applies to the sale of your goods.

More information

- the UK Internal Market Act 2020 in full

- Office for the Internal Market online service for reporting UKIM issues

Contact

Email [email protected] if you have any questions about this guidance.