Crown Commercial Service SME Action Plan

Published 30 November 2021

1. Objectives

Government has a commitment to obtain value for money and support small and medium-sized enterprises (SMEs) through procurement. Crown Commercial Service (CCS) understands the challenges and barriers, especially for smaller firms, and is committed to tackle them.

Central government (CG) departments and CCS are supporting this commitment to SMEs through a range of shared measures:

1.1 Paying suppliers on time

-

Government has a target of paying 90% of invoices within 5 days and all within 30 days

-

any supplier bidding for a CG contract over £5 million a year need to demonstrate it has effective payment systems in place to ensure a reliable supply chain

1.2 Increasing visibility of tenders and contracts

- all opportunities over £10,000 are published on Contracts Finder

1.3 Removing barriers to support SMEs

-

the Cabinet Office SME advisory panel, made up of entrepreneurs and leading business figures, boasts a wide range of experience to remove barriers and level the playing field for SMEs

-

the Cabinet Office Small Business team works across CG departments and stakeholders to capture and improve the quality of spend data, oversee and publish SME action plans, ensure effective performance management, share best practice on SMEs and ensure effective stakeholder management with SMEs

1.4 Measuring success

-

SME spend data: government wants SMEs to benefit from CG spend, either directly or indirectly through the supply chain

-

case studies: encouraging departments to share case studies about how they are working with SMEs

1.5 SME champions

- departments, including CCS, have appointed SME champions to lead on supporting SMEs and to lead on their own individual action plan

These measures are designed to make sure that more businesses, including smaller firms, will be able to supply goods and services to the public sector, while also making public procurement more transparent.

This action plan outlines how we will help government departments and their agencies meet the government’s aspiration to level the playing field for SMEs. It highlights the work that we are currently doing to support departments in achieving the overall aspiration.

2. Foreword from Richard Denney

CCS has a crucial role in the provision of common goods and services across CG and the wider public sector (WPS). SMEs have always been a key component of the commercial agreements we create, not only because of the Government’s aspirations to increase spend with them, but for the diversity that they bring to our supply chains and, more broadly, the economy.

As well as offering access to products and services in a compliant manner through the creation and provision of leading-edge agreements, CCS also provides access to supply markets.

As procurement policy adapts and evolves, that market access becomes increasingly concerned with the delivery of social value. There are many ways in which social value can be achieved, and CCS recognises that SMEs are a crucial part of this picture. Supporting the growth of the SME sector can often, in itself, be a creator of social value. But more broadly, SME businesses can support greater localisation, reduce carbon footprints associated with delivery, create jobs, and deliver social good for communities in many other ways, helping the UK to build back better and more fairly.

In creating this SME Action Plan, CCS is bringing together in one place the existing practices that are in place to make sure that SMEs are properly represented in our agreements and supply chains. By September 2021 three quarters of suppliers in CCS agreements were SMEs but only 13.5% of direct spend through these agreements was with SMEs. So in this action plan, as well as setting out the continued commitment of CCS to take positive action to make sure that the SME sector is well represented in our agreements, we also set out how we will work with our customers across both CG and the WPS to make sure that the proportion of spend with SMEs increases.

At the time of publishing this action plan, our country is in the midst of recovery from the coronavirus pandemic and most sectors of the UK economy are suffering badly. Economic revival continues to be crucial to the prosperity of our nations, and SMEs will play a huge role in this. At CCS we want to make sure that we continuously create opportunities for this to happen.

3. About our department

3.1 Department Overview

Established in April 2014, CCS is a trading fund and Executive Agency of the Cabinet Office. CCS is the biggest public procurement organisation in the UK. We use our commercial and procurement expertise to help buyers across CG and the WPS (local authorities, NHS, police, education providers, devolved administrations). The collective buying power of our customers, plus our procurement knowledge, means we can get the best commercial deals in the interests of taxpayers.

CCS commercial agreements use competition among suppliers to increase quality and value. In 2020/21 we helped more than 20,000 customers achieve commercial benefits totalling over £2 billion of public money by using our agreements. CCS is structured into four pillars to enable category expertise to best support customers.

3.2 CCS Structure (pillars and categories)

Buildings

- Construction

- Energy

- Workplace

Corporate

- Document management and logistics

- Financial services

- Fleet

- Marketing, communications and research

- Travel

People

- Contact centres

- People services

- Professional services

- Workforce health and education

- Public Sector Resourcing and permanent recruitment

Technology

- Digital future

- Network services

- Technology products and services

- Technology solutions and outcomes

3.3 CCS vision, purpose, goals, and strategy

Our vision is for CCS and our alliances to be the go-to providers for the public sector, delivering outstanding value, commercial benefits and excellent services.

Our purpose is to deliver commercial benefits for the UK CG, arm’s length bodies and the WPS. We do this by establishing and managing outstanding customer-focused commercial agreements for common goods and services, bringing to bear our category expertise and procurement capability so that our customers can buy as effectively and efficiently as possible.

Our goals are to maximise commercial benefits, focus on the customer and support the UK Government’s public procurement policy priorities.

Our Strategy is to increase the spend through our agreements and alliances to £30bn within the next four years, including through the development of our portfolio of digital products, and in doing so, enable our customers to achieve greater value for money and commercial benefits from their procurement of common goods and services.

4. Why CCS uses SMEs

CCS understands the benefit and value that using SMEs can have to support in achieving our strategy and objectives, which includes:

4.1 Improved Customer Engagement

SMEs:

-

have a flatter management structures and so can be more responsive to client needs, as decision makers are frequently in direct contact with operations / delivery

-

bring an understanding of local culture in the areas in which they work, together with a bespoke, specialist service

-

are often seen as more relatable to customers, particularly those in the WPS

-

offer more personalised customer service with a ‘hands on’ approach

-

have the speed and agility to respond and engage with customers

4.2 Pricing

- have a track record of providing more competitive rates

4.3 Specialist Expertise

- are often subject matter experts with niche industry knowledge and specialist expertise of their sector and / or market

- can offer better support for customers with bespoke needs

- are often more agile and adept at driving innovation

- are often flexible, open to discussing alternatives, and able to provide rounded advice on the direction of the market and how different customer industries operate in the category

4.4 Diversity

- offer a wider choice of suppliers, locations and cultures

- offer a diversity of product and service, with innovation often present

4.5 Social Value

- environmental benefits - locality of SMEs, together with regional lots and delivery models, can help with carbon reduction

- many regional customers strongly prefer working with local companies and SMEs in order to support their own social value commitments

- provide value in local communities by creating jobs

5. Spend with SMEs through CCS agreements

The figures in this section are for direct and public sector commercial agreement spend (PSCA) and are accurate as of 10 November 2021.

CCS deals are focused on helping customers to buy from SMEs directly, rather than in the supply chain, and because of that CCS’s spend data only represents direct spend. We are aware that in many commercial agreements there is additional spend being awarded indirectly through the supply chain.

The supply chain data (known as indirect spend) is collected by our CG customers, in line with a central agreement with the Cabinet Office and is reported separately by the government.

5.1 Spend summary

| Financial Year | Total CCS Spend (Million) |

Total Direct and PSCA spend (Million) | SME spend (Million) |

Percentage of spend with SMEs | ||||

|---|---|---|---|---|---|---|---|---|

| Total | CG | WPS | Total | CG | WPS | Total | ||

| 2017/18 | £13,069 | £6,382 | £5,022 | £11,404 | £730 | £516 | £1,246 | 10.9% |

| 2018/19 | £15,967 | £8,026 | £5,369 | £13,395 | £931 | £537 | £1,467 | 11.0% |

| 2019/20 | £18,6663 | £9,125 | £6,558 | £15,683 | £1,213 | £912 | £2,125 | 13.6% |

| 2020/21 | £22,767 | £13,305 | £6,798 | £20,103 | £1,554 | £963 | £2,517 | 12.5% |

| 2021/22 Months 1 to 6 | £12,491 | £7,845 | £3,890 | £11,735 | £971 | £605 | £1,576 | 13.4% |

5.2 Spend analysis

In 2020/21 CCS showed continued progress to enable SMEs to participate in our commercial agreements with direct spend to SMEs reaching £2.5 billion. This is an additional £392 million (up 18%) directly compared to 2019/20. CCS is committed to increase SME spend year on year through continuing to create agreements that are suitable for active SME participation. The two graphics below show the split of spend to CG and WPS split across the four pillars of our business.

As of 2020/21, 12.5% of spend through our agreements went directly to SMEs. We continue to design our deals so that SMEs are able to benefit and that is why now around 75% of the suppliers on our deals are either micro (45%), small (20%) or medium (11%) enterprises (as of November 2021).

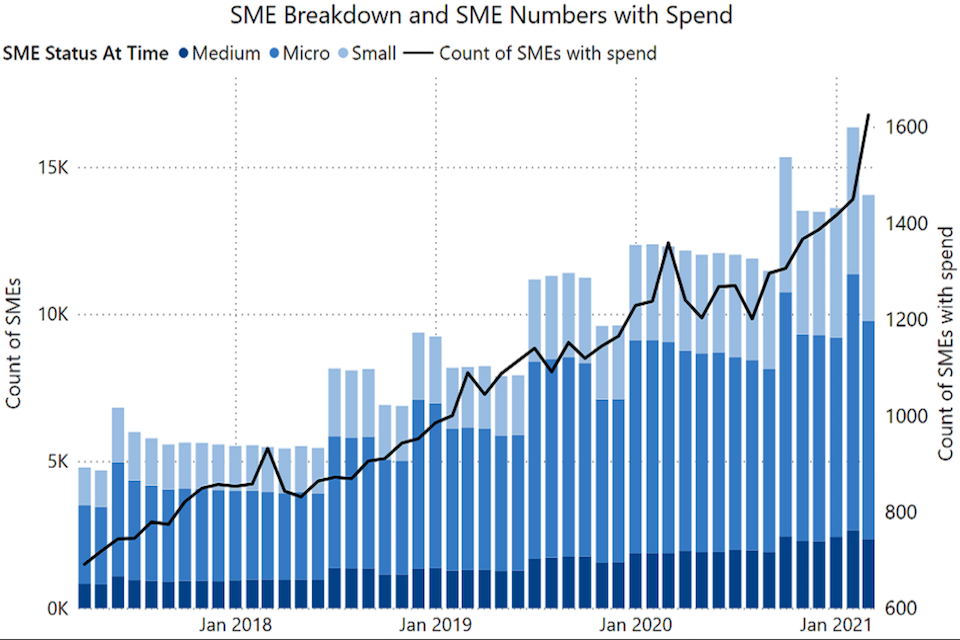

It is positive to see the number of SMEs on our agreements has risen from around 5,400 in April 2018 to around 13,000 in November 2021. Additionally the SMEs with spend are also showing an upward trend over the past 3 years, increasing from about 800 in April 2018 to 1,500 in September 2021. However, this also shows that approximately only 12% of these suppliers are winning spend. This demonstrates that CCS is effectively increasing the diversity of its supply base, but that there is still more to do across government to make sure that these SMEs are awarded a greater share of the work.

5.3 SME Numbers Growth Over Time

The number of SMEs on our agreements has grown month by month from April 2017 to March 2021. In April 2017 we had just under 5000 SMEs and this number has increased to around 15000. The increase includes Micro, Small and Medium sized SMEs, but the largest increase occurred with Micro SMEs.

Some of the frameworks in CCS show very substantial spend being awarded to SMEs. The below tables summarises the areas of largest SME spend.

| Framework | SMEs with spend | SME spend | Total supplier count with spend | Total spend |

|---|---|---|---|---|

| G-Cloud 11 | 611 | £621 million | 1,356 | £2,119 million |

| Technology Products 2 | 23 | £526 million | 51 | £3,069 million |

| G-Cloud 10 | 520 | £486 million | 1,097 | £1,731 million |

| Digital Outcomes & Specialists 2 | 220 | £441 million | 343 | £1,544 million |

| G-Cloud 9 | 455 | £437 million | 922 | £1,750 million |

| G-Cloud 12 | 541 | £253 million | 1,374 | £958 million |

| Digital Outcomes & Specialist 3 | 197 | £218 million | 317 | £820 million |

| G-Cloud 8 | 212 | £191 million | 422 | £552 million |

6. Our planned actions

For us to achieve our Action Plan objectives, alongside our wider strategic and corporate objectives, 8 key action areas have been established against which we will continue to drive and monitor our progress.

6.1 Action 1: SME champion and board sponsor

We have already appointed an SME champion who has set up an SME working group with the aim of embedding the SME agenda across the organisation. The SME champion chairs this working group which comprises individuals drawn from across a wide range of business areas. We have also appointed an SME board sponsor who ensures that the SME agenda is given appropriate consideration in key decision making.

Following these appointments, the SME champion and board sponsor will work together to push positive change within the organisation and encourage ongoing commitment to the SME agenda. There will be continued engagement with the Cabinet Office Policy team and SME team to make sure that policy and practice remain well aligned in this area.

6.2 Action 2: SME Working Group

CCS has created an SME Working Group which has been active since the start of 2020. The group has representatives from all pillars and their category teams, policy and user research. It is also attended by the CCS SME executive sponsor and representatives from the Cabinet Office Small Business Team.

The main purpose of this group is to drive forward the action plan and promote the SME agenda across CCS. The group needs to ensure a consistency and quality of internal messaging and ensure greater alignment across the organisation. This group meets regularly and members are being encouraged to champion the use of SMEs across their areas of the business. Members are responsible for reaching out to their wider teams to collate feedback, initiatives and facilitate learning. Greater work will be undertaken across the group to share experience, lessons learnt and provide suggested improvements into future activity.

6.3 Action 3: Continued Simplification of CCS’s procurement process

What has been done so far: Public Sector Contract

The Public Sector Contract is designed so that buyers and suppliers can focus on building sustainable relationships that support the delivery of products and services that help meet the needs of citizens. The move also makes it easier than ever for smaller businesses, who may lack the resources to read and digest lots of complicated terms and conditions, to supply goods and services to the government.

The key benefits to SMEs of the PSC are:

1. we use the standard core terms across multiple framework agreements

2. the PSC is written in plain English

3. the structure of the PSC encourages buyers to only use those elements that are relevant

This means that both suppliers and buyers do not need to acquire expensive legal advice every time CCS issues a contract opportunity.

CCS has recently published an updated version of the PSC and its Dynamic Purchasing System (DPS) agreement.

The major change was the capping of liabilities on GDPR (it was previously uncapped) reducing further the barriers for SMEs.

CCS is committed to continual improvement of its processes and procedures. CCS is aware that we need to continue to develop the PSC.

6.4 Action 4: Improve Market Engagement and Access

Our category teams will continue to engage with the SME supplier community in a way that best suits their customers’ needs and this will vary by agreement. CCS will also continue to engage with SMEs through the Customer Experience Directorate (CxD) team working in the WPS.

Pre-Procurement Engagement

Pre-market engagement with suppliers informs them of new opportunities and helps to encourage SMEs to bid. It is also an opportunity for them to give feedback on the scope and structure of the commercial agreement.

Greater work needs to be done to make sure sufficient time is set aside within project plans to run extensive pre-market engagement with all suppliers including SMEs in ways that encourage SMEs to actively contribute, such as 1 to 1 calls or face to face sessions with SMEs to capture their feedback on a proposed commercial agreement and the associated timescales.

Recognising that SMEs may be reluctant to contribute at group supplier days either in person or online is key. By enabling SMEs to give honest and open feedback on the structure and scope of commercial agreements, SMEs will be better able to help shape and define the opportunities and make sure key factors that would enable greater SME participation are taken into account, for example considering regional lotting or the use of a DPS.

To better improve the process for SMEs, CCS will continually consider the best way to publish its pre-market engagement opportunities in one place which would be beneficial to smaller firms. One of the ways to keep updated on upcoming commercial agreements is through the ‘Upcoming Deals’ page on our website.

The teams across CCS will make sure they consider the most appropriate approaches to engaging with the market, for example personally inviting SMEs, rather than relying on advertising events through Eventbrite that not all SMEs may use or register with.

Post Procurement Engagement (Agreement Launch)

CCS will continue to hold launch / onboarding / supplier day events to provide a summary of the commercial agreement, including supplier contractual obligations, support and communication suppliers can expect from CCS, any initial supplier activities, and what is expected of the suppliers.

However, consideration needs to be given to the most appropriate way of communicating this information to SMEs. Some SMEs like supplier day events and feel comfortable asking questions in an open forum to consolidate their own understanding. Others prefer a webinar or at least the opportunity for follow up 1 to 1 calls, potentially as part of a Supplier Relationship Management programme.

Ongoing Supplier Relationship Management

Although many CCS suppliers receive regular supplier newsletters focused on the agreements they have been awarded a place on, this may be the only form of supplier relationship management that SMEs receive, due to the outcome of supplier segmentation exercises. The newsletters provide suppliers with an update on topics such as customer engagement activity CCS has been undertaking, supplier needs, potential competition opportunities and spend summaries. These can help SMEs to understand where to focus their promotional activities and for this reason should be continued and enhanced to include relevant information that SMEs would like to see and that would help them to win more business.

However it should be recognised that not all SMEs will have the time or resource to read the newsletters and where possible a focus within categories on individual 1 to 1s with SMEs as well as the larger suppliers is likely to be of considerable benefit.

CCS works with SMEs who have won call off contracts to produce case studies to help promote their success to customers and other SMEs. Our aim is to increase the number of case studies that are shared in newsletters, social media and on our website to enable customers and other suppliers to see the great work our SMEs can do. It should be recognised that many SMEs do not have large teams behind them, so providing examples of other SME case studies and tailored guidance that explains what CCS’s Marketing team is looking for in a case study can be beneficial.

6.5 Action 5: Agreement Structure

As CCS seeks to develop its commercial deals its main aim is to reduce costs to the taxpayer and part of that strategy is to structure our deals in a way that encourages a more diverse supply chain. This is a key policy for the UK Government as set out in its new National Procurement Policy Statement.

When drafting business cases for the (re)procurement of a framework or DPS, CCS colleagues must state how SMEs and VCSEs could participate effectively in a market or supply chain. Business cases should detail proposals on how best to support SME participation. A new version of the business case template has been developed which includes more in depth sections for category teams to complete to make sure they’ve considered their approach and how it supports SMEs.

CCS’s individual categories conduct market research with suppliers and customers to help them decide on the most appropriate commercial vehicle. This could be a Dynamic Purchasing System (DPS), where a DPS is deemed appropriate.

The use of a DPS enables suppliers to progress their bids in their own time and allows suppliers to join the agreement at any point in its lifetime. Applying to a DPS also reduces up-front work for the supplier. In addition, some DPS will allow suppliers who would otherwise have failed the economic and financial stability threshold for a commercial agreement to obtain a financial contract guarantor to enable them to become a supplier on the DPS. For all the above reasons a DPS is considered more accessible to SMEs than a traditional framework.

CCS’s individual categories work with suppliers and customers to develop the best lotting structure for their commercial agreements to make sure that SMEs are not squeezed out of bidding. This is one of the key reasons CCS places so much emphasis on pre-market engagement.

Where there is a need, CCS is increasingly looking to have lots based on geographical regions, so that more local suppliers are able to bid that don’t have a national reach. This supports SMEs both directly or indirectly through the supply chain.

6.6 Action 6: Digitisation

CCS is currently digitising many aspects of its commercial agreements to improve the user journey and provide a simple and consistent user journey irrespective of pillar, spend type or sector. This standardised digital platform, using the same documentation across CCS, will make it easier to understand what the buyer wants and makes the bidding process easier and quicker.

The key improvements we are carrying out that will benefit SMEs include:

-

a common portal with documents that will become familiar to suppliers will speed up the bidding process

-

building of contracts and E-signatures online supporting suppliers which don’t have that service in house

-

digital filtering which will guide users to the right commercial agreement and the right lot for their needs

-

this means SMEs won’t need to promote and signpost customers to them as the tool will guarantee the right route to buy will be taken

-

standard catalogue and payment process to buy certain products giving SMEs a level playing field to bigger players in the market

-

helps give SMEs the opportunity to advertise their products to be in the market

-

the centralised payment process will give customers access to use a CCS credit card

This means SMEs don’t have to be registered with a merchant, which can be expensive as many take a rebate if you don’t have volume. CCS will put a payment provider in place that suppliers can onboard through and take the CCS rate, which will be negotiated down due to volume and provides a faster payment.

6.7 Action 7: Better systems

CCS is currently developing a new system that will make it easier to conduct procurement activity across the whole of the public sector. It is based on a ‘tell us once’ principle, removing the need for suppliers and buyers to duplicate effort in providing the same information time and time again.

1. single sign on

- this will make sure our customers no longer need to remember multiple login IDs to access CCS services

2. central identification index

- this will create a consistent supplier identification across the public sector using Companies House, Dun & Bradstreet and other registry data sources

3. Evidence locker

-

this will provide functionality to enable suppliers to reuse answers from commonly asked questions (such as those in Selection Questionnaires) and supporting data to save providing data each time they bid for a procurement activity

-

it will also store supplier documents, such as insurance certificates, saving the need to upload them for every tender

The new system will benefit all suppliers but in particular SMEs. Engagement with the SME Crown Representative suggests that it will save suppliers on average 6 to 8 days per engagement to submit a bid, which for smaller firms with less staff will substantially reduce the burden on resources. It will also have functionality that includes a supplier alert service, making suppliers aware of new opportunities within their area of business. This will again support SMEs who may not have the resources to monitor all portals across government for potential opportunities.

The programme team has already had engagement with over 1,100 SMEs as part of a survey, and are also actively engaging with the SME community as part of user testing for system access.

The current timelines are:

-

private beta: Autumn 2021

-

public beta: Spring 2022

6.8 Action 8: Greater Collaboration

CCS has a whole host of good practices but ensuring alignment and collaboration can enhance what we offer our customers.

Customer Experience Directorate (CxD)

In 2019 CCS created the CxD team to manage CCS’s relationships with our customers and make sure that what they say informs the work CCS is doing as an organisation. The WPS team within CxD manages our strategic relationships with large numbers of public sector bodies including local authorities, NHS Trusts, universities, colleges and housing associations.

This team is an extremely valuable resource to build customer awareness of CCS’s commercial solutions, identify customer needs, and deliver expert support to enable the WPS to access our offers. They are often the team that gets first visibility of new needs and this provides the perfect opportunity to work with customers to engage local SMEs and connect them to category colleagues. Through these engagements the team are then able to build an understanding of localised needs and suppliers to inform these recommendations.

The WPS team has highlighted that ‘local first’ is key to many of our customers. Most local authorities have strategies and plans in place to support more niche and/or local suppliers, both directly and indirectly through their supply chains as a key element of their economic recovery planning. Local authorities are also looking to build on their own usage of SMEs as we are increasingly hearing that they want to grow local economic success. The UK’s exit from the EU means CCS can now begin to exercise additional freedoms in relation to spend on goods and services where these fall below the relevant procurement thresholds. It is important for CCS to begin work to review regional lotting structures in commercial agreements to enable this initiative where appropriate.

Our category teams work with CxD to make sure that they have the knowledge and tools to promote their agreements, so in return they can share visibility of opportunities and ways to promote ourselves better in the WPS.

We welcome feedback, suggestions or questions and these can be submitted to [email protected]