DCMS Sector Economic Estimates Methodology

Updated 8 December 2022

1. Introduction

This document sets out the methodology underlying the Economic Estimates for DCMS Sectors. They contain Official and National Statistics published by the Department for Digital, Culture, Media and Sport (DCMS). The latest releases are available on the DCMS Sectors Economic Estimates release page.

The Economic Estimates measure the economic contribution to the UK of each sector for which DCMS has responsibility:

- Civil Society

- Creative Industries

- Cultural Sector

- Digital Sector

- Gambling

- Sport

- Telecoms

- Tourism

This methodology note covers gross value added (GVA) expressed in current prices (not taking into account inflation) and chained volume measures (taking into account inflation), jobs, earnings, exports and imports of goods and services, and number of businesses. The estimates in the publications are consistent with national (UK) estimates, published by the Office for National Statistics (ONS).

These statistics are produced in accordance with the Code of Practice for Statistics.

1.1 Updates to this guidance

The following table outlines when this guidance has been updated and what the updates include.

Table 1.1: Updates to DCMS Sector Economic Estimates Methodology

| Date | Update |

|---|---|

| 19th December 2016 | Included a list of the sub-sectors SIC codes for the Creative Industries, Digital Sector and Cultural Sector. |

| 26th June 2017 | Included a methodology for the Exports and Imports of goods estimates and to add details on the methodology for producing estimates for the Civil Society, following the move of the Office for Civil Society from the Cabinet Office to DCMS in summer 2016. In addition SIC 93.21 has been added to Table 2.1, having been incorrectly omitted in the previous version. |

| 29th November 2017 | Included the methodology for GVA shown in chained volume measures. |

| 14th February 2018 | Included the chapter on business demographics and the breakdowns developed. |

| 28th February 2018 | Included the chapter on regional GVA. |

| 6th June 2018 | Included an update to the chapters on export and imports of goods and services. |

| 18th July 2018 | Included an update on the Tourism employment data. |

| 28th August 2018 | Included the definitions for Audio Visual and Computer Games. |

| 28th November 2018 | Included further clarification of the overlaps between DCMS sectors and an update on GVA estimates. This includes an update on the methodology changes for the Tourism Satellite Account. |

| 30th January 2019 | Included some extra information around methodology for the Business Demographics publication. |

| 13th February 2019 | Included additional information around the methodology for the Regional GVA publication. |

| 4th September 2019 | Included the chapter on earnings in the Digital sector (Chapter 12), to provide an update in Chapter 1 on the UK National Statistics assessment of our economic estimate series as well as an update to the Trade statistics (Chapter 8, 9 and 10). |

| 11th December 2020 | Included updates in the methodology of the Trade statistics, inclusion of the Business Births and Deaths publication and links to the quality assurance documents for each of the estimates. |

1.2 Summary of data sources

Data sources used in the Economic Estimates include:

- Gross value added data are obtained from the ONS Input-output supply and use tables and the Annual Business Survey (ABS), a survey of businesses listed on the Inter-departmental Business Register (IDBR). These businesses are classified by industry under the Standard Industrial Classifications (SIC07), which was first used in the 2008 data.

- Regional gross value added data are obtained from the ONS balanced regional gross value added series and the Annual Business Survey (ABS). These estimates are consistent with the UK National Accounts. National aggregates for the components of GVA are allocated to regions using the most appropriate regional indicator available.

- Jobs/employment data are obtained from the Annual Population Survey (APS), which is itself a derivative of the Labour Force Survey (LFS). Methodological information about the LFS can be found on the ONS website.

- Imports and Exports of services statistics are derived from the International Trade in Services (ITIS) survey, a survey of businesses looking at their overseas trade, based on definitions set out by SIC2007, which was introduced in the 2009 data. Tourism trade data is taken from the International Passenger Survey.

- Imports and Exports of goods statistics are based on data from the EU-wide Intrastat survey and from Customs import and export entries, collected by HMRC.

- Data on number of businesses is from the Annual Business Survey (ABS), available at the 4-digit SIC code level.

- Earnings data are obtained from the Annual Survey of Hours and Earnings (ASHE) dataset, available at the 4-digit SIC code level and 4-digit SOC code level.

1.3 Users

The users of these statistics fall into five broad categories:

- Ministers and other political figures

- Policy and other professionals in DCMS and other Government departments

- Industries and their representative bodies

- Charitable organisations

- Academics

The primary use of these statistics is to monitor the performance of the industries in the DCMS sectors, helping to understand how current and future policy interventions can be most effective.

1.4 UK statistics authority assessment of the DCMS Sectors Economic Estimates series

Following a report by the Office for Statistics Regulation in December 2018, the following DCMS Sector Economic Estimates were designated as National Statistics on 26th June 2019:

- DCMS Sector Economic Estimates: GVA

- DCMS Sector Economic Estimates: Regional GVA

- DCMS Sector Economic Estimates: Business Demographics

- DCMS Sector Economic Estimates: Employment

Since the report we have striven to improve our publications by providing summaries of other notable sources of data, more detail on the nature and extent of the overlap between the sectors, and further information on the quality and limitations of the data. We will continue to improve the series in the future, in line with the recommendations of the report.

1.5 Quality Report

Please note that DCMS have also produced a quality report alongside each Economic Estimate publication which has been published since 2019. The quality report summarises the quality assurance processes applied during production of DCMS Economic Estimate statistics as well as quality assurance processes and the methodology from the data providers (ONS).

2. Definitions

In order to measure the size of the economy it is important to be able to define it. DCMS uses a range of definitions based on internal or UK agreed definitions. All definitions are based on the Standard Industrial Classification 2007 (SIC) codes. The Standard Industrial Classification is a means of classifying businesses according to the type of economic activity that they are engaged in. The latest version is SIC 2007. This means nationally consistent sources of data can be used and enables international comparisons.

The 4-digit SICs that make up each DCMS sector and sub-sector are shown in the tables published alongside this guidance note.

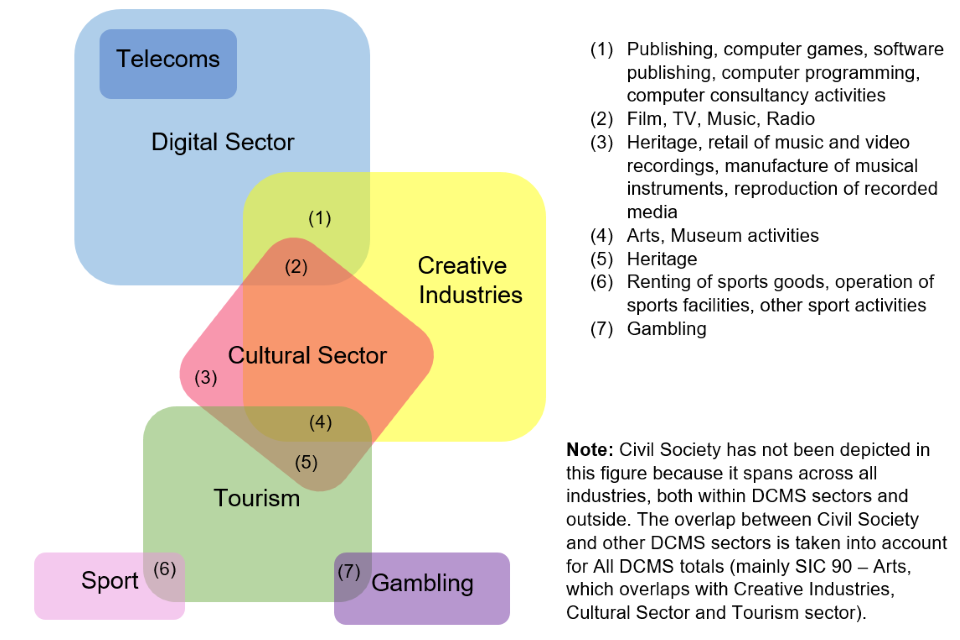

The development of individual sector definitions in isolation as new sectors have fallen within the department’s remit has meant that there is overlap between DCMS sectors. For example, the Cultural Sector is defined using SIC codes that are nearly all within the Creative Industries, whilst the Telecoms Sector is completely within the Digital Sector.

Figure 2.1 below visually shows the overlap between DCMS Sectors in terms of SIC codes. Users should note that this does not give an indication of the magnitude of the value of overlap. For this, users should consult the corresponding statistical release where the value of the overlap is shown.

Figure 2.1: Overlap of SIC codes within DCMS Sectors

2.1 Civil Society

The Office for Civil Society, which moved to DCMS in 2016, is responsible for charities, voluntary organisations or trusts, social enterprises, mutuals and community interest companies. The Civil Society sector is not like a traditional industry and therefore data are not readily available in the usual data sources. Where possible, data are provided from official sources. Some estimates from other sources are quoted to provide a wider context but cannot be added to the official results. It is therefore likely that the estimates for the civil society are an underestimate for this sector.

For employment, people who work in a “charity, voluntary organisation or trust” are reported in the DCMS estimates. There are no reported estimates for exports or imports of goods and services for civil society.

For GVA in current prices, an estimate for charities has been published. The Civil Society figure published covers non-market charities in the NPISH (non-profit institutions serving households) sector. It does not include market provider charities who have passed the market test and therefore sit in the corporate sector (these data are not currently measured by ONS on a National Accounts basis), mutuals, social enterprises or community interest companies. An estimate of the economic contribution of volunteering is also provided, but this is not included in the “All DCMS Sectors” total due to it being part of the informal economy and therefore not part of the traditional methodology of calculating GVA. An estimate for the Office for Civil Society has not been included in the GVA expressed in chained volume measures. This may be developed in the future if there is sufficient user demand.

For the business demographics, the Civil Society sector cannot be uniquely identified in the Annual Business Survey; the data source used for the other DCMS Sectors. Contextual information on the number of businesses in the Civil Society sector is provided. However these are non-official statistic sources and therefore should not be added to the other DCMS Sector totals.

2.2 Creative Industries

The Creative Industries were defined in the Government’s 2001 Creative Industries Mapping Document as “those industries which have their origin in individual creativity, skill and talent and which have a potential for wealth and job creation through the generation and exploitation of intellectual property”. Based on this definition DCMS worked closely with stakeholders to determine which occupations and industries should be considered creative.

These were determined on the basis of creative intensity:

- Through consultation a list of Creative Occupations were identified[footnote 1].

- The proportion of creative jobs in each industry was calculated (the creative intensity)

- Industries with creative intensity above a specified threshold are considered Creative Industries

The definition is a UK definition based on international industrial classifications. The SIC codes used to capture the Creative Industries sector and sub-sectors are shown in the tables published alongside this guidance note. See the Creative Industries Economic Estimates methodology note for a more detailed explanation of how the definition has been derived.

2.3 Cultural Sector

DCMS has proposed a definition of the Cultural Sector that best reflects UK policy based on the availability of data through the existing standard industrial classification (down to 4 digits). DCMS have defined the Cultural Sector as those industries with a cultural object at the centre of the industry. Based on this principle the 4-digit SICs proposed to make up the Cultural Sector and sub-sectors are shown in the tables published alongside this guidance note.

2.4 Digital sector

The definition used in this release was developed by the OECD using the UN Standard Industrial Classifications (SICs) and therefore has the advantage of international comparability. The SIC codes used in this definition and for Digital sub-sectors are shown in the tables published alongside this guidance note.

2.5 Gambling

The definition of gambling used in the DCMS Sectors Economic Estimates is consistent with the internationally agreed definition, SIC 92, Gambling and betting activities.

2.6 Sport

For the purposes of these publications the EU agreed core/statistical Vilnius definition of sport has been used, this incorporates only those 4-digit SIC codes which are predominately sport (see tables published alongside this guidance note).

DCMS also publish estimates of sport based on the broad Vilnius definition. This is a more comprehensive measure of sport which considers the contribution of sport across a range of industries, for example sport advertising, and sport related construction. The DCMS Sport Satellite Account is based on an EU agreed methodology. However, due to the time lag with the sport satellite account and further development required to make the sport satellite account replicable on an annual basis, the statistical definition is being used in this publication of estimates for DCMS sectors to allow the contribution of sport to be considered in a way which is consistent with the other sectors.

2.7 Telecoms

The definition of telecoms used in the DCMS Sectors Economic Estimates is consistent with the internationally agreed definition, SIC 61, Telecommunications. Please note that as well as appearing as a sector on its own, Telecoms is also entirely included within the Digital Sector as one of the sub-sectors.

2.8 Tourism

Tourism is defined by the characteristics of the consumer in terms of whether they are a tourist or resident. This, therefore, differs from “traditional” industries such as gambling or telecoms which are defined by the goods and services produced themselves, and means that a different approach to defining the industry must be used. The UK estimates are based on the methodology and definition set out in the UN International Recommendations for Tourism Statistics 2008 (IRTS 2008).

The table published alongside this guidance gives details of the ‘tourism industries’. The ‘tourism industries’ are a broad category that can be used to define tourism however they are much more extensive than tourism alone (e.g. hospitality). Therefore ratios are calculated (primarily based on tourism spend data from surveys) which can then be applied in order to obtain direct tourism estimates. There is also a tourism contribution from outside the tourism industries which is described as ‘other consumption products’. Once calculated, the tourism ratios are applied to give estimates for tourism GVA and employment.

Exports and Imports for tourism are from estimates of spend by overseas residents in the UK and spend by UK residents overseas respectively. Data are taken directly from the ONS International Passenger Survey, in which there is no attempt to classify goods and services or spend by industry.

2.9 Other definitions

DCMS also publish estimates for the Audio Visual sector (for all measures) and the Computer Games sector (for GVA Current Price estimates and Employment measure).

The definition of the Audio Visual sector (see below) is intended to reflect the sectors covered by the EU Audio Visual Media Services Directive.

- 59.11 - Motion picture, video and television programme production activities

- 59.12 - Motion picture, video and television programme post-production activities

- 59.13 - Motion picture, video and television programme distribution activities

- 59.2 - Sound recording and music publishing activities

- 60.1 - Radio broadcasting

- 60.2 - Television programming and broadcasting activities

- 63.91 - News agency activities

- 63.99 - Other information service activities n.e.c.

- 77.22 - Renting of video tapes and disks

- 77.4 - Leasing of intellectual property and similar products, except copyrighted works

For Computer Games, a 5-digit SIC code is used alongside a 4-digit SIC. The estimates for the Computer Games industry have been calculated based on the SIC codes:

- 58.21 - Publishing of Computer Games

- 62.01/1 - Ready-made interactive leisure and entertainment software development

A number of software programming companies in 62.01 – ‘Computer programming activities’ may also contribute to the output of computer games, as part of a range of programming activities. This is not included in these computer games estimates, but will have been implicitly included in the ‘IT, software and computer services’ group in the main estimates.

3. Limitations

DCMS makes all efforts to provide the best possible estimates. However, inevitably there are a number of limitations to the data which users should be aware of.

3.1 Measurement issues

Civil Society

In July 2016 DCMS took on responsibility for the Office for Civil Society, which is responsible for charities, voluntary organisations or trusts, social enterprises, mutuals and community interest companies. The Civil Society sector is not like a traditional industry and therefore data are not readily available in the usual data sources. Where possible, data are provided from official sources. Some estimates from other sources are quoted to provide a wider context but cannot be added to the official results. It is therefore likely that the estimates for the civil society are an underestimate for this sector.

For employment, people who work in a “charity, voluntary organisation or trust” are reported in the DCMS estimates.

There are no reported estimates for exports or imports of goods and services for the civil society sector.

For the business demographics, the Civil Society sector cannot be uniquely identified in the Annual Business Survey, the data source used for the other DCMS Sectors. Contextual information on the number of businesses in the Civil Society sector is provided. However these are non-official statistic sources and therefore should not be added to the other DCMS Sector totals.

Standard Industrial Classifications (SICs)

Estimates have been constructed from ONS Official Statistics which use international classifications. This is an important element of the methodology due to availability of data and to enable international comparability. However, as a result there are substantial limitations to the underlying classifications. As the balance and make-up of the economy changes the international classifications are less able to provide the detail for important elements of the UK economy related to DCMS sectors, and therefore best fit SIC codes have been used to produce these estimates.

Tourism sector - GVA and Employment estimates

The data in the latest Tourism Satellite Account (2018) contain revised estimates for 2016 and 2017, incorporating improved data from a number of Tourism Satellite Account (TSA) source datasets. The largest impact on revisions has been driven by the incorporation of revised International Passenger Survey (IPS) data following the introduction of new and improved methodologies to this survey. More information on the improved IPS methodology and the associated impacts is available. The new methodology produces higher estimates of spend for UK residents visiting abroad and overseas residents visiting the UK. This means that published estimates of UK and overseas visitors are now consistent with administrative data on total passenger numbers entering and leaving the UK.

As well as recent improvements to the IPS, several improvements were made to the Great Britain Day Visits Survey (GBDVS) in 2016:

- Questionnaire improvements to make the survey more engaging and easy to complete

- Questionnaire revisions required as part of the ‘merging’ of GBDVS with the Great Britain Tourism Survey (GBTS) online piloting

- From January 2016, the weekly sample size contacted for the wider GBDVS/GBTS combined surveying increased from 673 to 1,000

As a result of these changes, a 15% increase was observed in the levels of visits reported by respondents. To ensure 2015 data are consistent with the methodological improvements, and to allow suitable comparisons with 2016 data, the 2015 data have been revised in line with the increased level of reporting of day visits. This change has not been implemented in the UK Tourism Satellite Account prior to 2015.

More information on the changes to the GBDVS can be found on slide 8 of The Great Britain Day Visitor 2017 Annual Report and in the ONS Tourism Satellite Account report published on 28th November 2018.

Blue Book-consistent revisions to other source data have also driven smaller revisions to the TSA, for example, the household final consumption expenditure data as contained within the input–output supply and use tables.

Due to these revisions, the new GVA and employment figures for 2016 to 2019 published in 2020 are not comparable with UK-TSA figures prior to 2016, as these changes have not been implemented in the data prior to 2016.

Tourism GVA and employment figures for the latest year are provisional and will be updated when the Tourism Satellite Account estimates are published annually.

Industry breakdowns

The estimates in the Employment release are based on survey data from the Annual Population Survey (APS), which is itself a derivative of the Labour Force Survey (LFS). This is a household survey with industry self-reported by the individual completing the survey. This provides good information on demographics, but leads to some inaccuracies on the industry breakdown. This should be borne in mind when using these estimates. Methodological information about the LFS can be found here.

3.2 Data sources

Survey data

All of the Economic Estimates are based on survey data. As with all data from surveys, there will be an associated error margin surrounding these estimates[footnote 2]. While these data provide the best available source of information there is often volatility, especially at the 4 - digit SIC level which is used to produce estimates for DCMS sectors.

ABS survey design changes

The ABS (Annual Business Survey) is used to break down the Supply and Use tables estimates to the 4 digit level. However, users should note that the ABS population was expanded in 2015 to include approximately 92,000 solely Pay As You Earn (PAYE)-based businesses. This led to an increase in the number of businesses in the overall population of approximately 4%. In 2015, these businesses increased the level of turnover by 0.4% and GVA by 0.8%.

Users should also note that a sample re-optimisation has been included in the ABS estimates for 2016. This is carried out every five years to improve the efficiency of the sample estimation and reduce sampling variability as part of the regular process to improve estimates.

Both of these survey design changes have a possible impact on the DCMS GVA and Business Demographics estimates although for the GVA estimates, the ABS is only being used to provide a proportion of the SUT so these changes should have minimal impact on the overall figures.

Regional GVA

Regional GVA estimates are only available at a 2 digit SIC code breakdown, and higher. Where the required detail is not available in these tables the ABS has been used to allocate regional GVA at the 4-digit level. However, data for aGVA in the ABS are negative for some aspects of SIC 91 so estimates for SIC 91.01, 91.02 and 91.03 make use of sales data from the ABS to allocate SIC 91 at the 4-digit level.

Employment

The Annual Population Survey (APS) is considered to be the best source of information for headlines estimates of UK jobs, including employed and self-employed jobs. However there are significant weaknesses with the industry breakdowns as they are based on self-reporting of individuals (and therefore are often inconsistent with how businesses are allocated in National Accounts). This should be borne in mind when using these estimates. However, comparisons show that the differences between APS and other sources with better industry breakdowns (e.g. the Business Register and Employment Survey, BRES, which is a business survey and therefore all employees are allocated to the same SIC as the business itself, giving greater accuracy and consistency with other measures) are not large. Therefore, APS has been used in this analysis for its demographic information and information on occupations.

Businesses

The number of businesses are published, and broken down by different demographics. As the data are from the ABS there are some areas of the economy which are not covered. It covers the non-financial businesses economy. It excludes financial and insurance (Section K), Public administration and defence (Section O), Education (public provision in Section P) and Health (SIC 86.2, public provision in SIC 86.1 and 86.9 in Section Q). This is not a significant issue for DCMS sectors where there is a good coverage, but does have an impact on UK totals. Time series comparisons should also be treated with caution as the ABS is set up with the intention of providing good information on the structure of the economy in a given year, rather than an accurate trend over time (for example revisions are not made to historic data to allow consistent comparison over time).

Digital trade and E-commerce

The importance of digital trade is growing. E-commerce (i.e. those goods and services that are ordered and/or delivered digitally) is an important subset of the wider digital trade, however, little information currently exists on the scale of cross-border trade flows that are affected by this.

There are substantial challenges in relation to the measurement of cross-border e-commerce flows. There is a lack of clear definition of what constitutes ‘digital trade’ and of a comprehensive conceptual measurement framework. This problem is compounded by the emergence of enterprises with new business models (e.g. Airbnb, Uber etc) whose activity is difficult to capture with conventional statistical methods.

Although most statistical agencies, including the ONS and HMRC, indicate that current trade statistics do not significantly under-report digital trade flows, it is generally accepted that e-commerce is creating significant international trade that is not picked up by existing data collection systems. The most problematic area is the measurement of trade in e-services such as digital downloads and applications. International organisations like OECD and WTO recognise this problem and have prioritised work in this area. However it is a significant weakness in the current approach.

Exports and imports of goods

Estimates for exports and imports of goods were published for the first time last year (2017). The estimates are based on data from HMRC’s Overseas Trade Statistics, in which entries are listed in Combined Nomenclature 2008 (CN08) format, which is based on the Harmonised System (HS) of tariff nomenclature. This is an internationally standardised system of coding for classifying goods for trade. DCMS Sectors are defined at the 4 digit SIC code level, and therefore a conversion tool from SIC to the CN08 codes was used to find the best match. In response to consultation feedback since the last publication, the CN08 codes associated with the Crafts sub-sector have been revised. These revisions have been made to the back time series, as published in June 2018

Trade in goods and trade in services

Estimates are provided for both trade in goods and trade in services. These are based on different data sources, and as a result have been presented as two separate figures. Data on trade in goods are collected from HMRC’s Intrastat survey and Customs import and export entries, which record the movement (for trade purposes) of goods across international borders. As such, the data are gathered under the cross-border principle of trade. Meanwhile, DCMS estimates of trade in services are based on data from the ONS International Trade in Services (ITIS) datatset. These data are collected via survey and are gathered under the change of ownership principle of trade. To reflect these differences, between the two data sources, the trade in services and trade in goods data are presented separately and caution is advised when adding the two sources together.

3.3 Sector definitions

Civil Society

The Office for Civil Society are responsible for charities, voluntary organisations or trusts, social enterprises, mutuals and community interest companies. The Civil Society sector is not like a traditional industry and therefore data are not readily available in the usual data sources. Where possible, data are provided from official sources. Some estimates from other sources are quoted to provide a wider context but cannot be added to the official results. It is therefore likely that the estimates for the civil society are an underestimate for this sector

For employment, people who work in a “charity, voluntary organisation or trust” are reported in the DCMS estimates. There are no reported estimates for exports or imports of goods and services for civil society. For GVA in current prices, an estimate for charities has been published for the first time in November 2017. An estimate of the economic contribution of volunteering is also provided, but this is not included in the “All DCMS Sectors” total due to it being part of the informal economy and therefore not part of the traditional methodology of calculating GVA. An estimate for the Office for Civil Society has not been included in the GVA expressed in chained volume measures.

For the business demographics, the Civil Society sector cannot be uniquely identified in the Annual Business Survey, the data source used for the other DCMS Sectors. Contextual information on the number of businesses in the Civil Society sector is provided. However these are non-official statistic sources and therefore should not be added to the other DCMS Sector totals.

Creative Industries

Estimates in the DCMS Sectors Economic Estimates for the Creative Industries have replaced the previously used methodology for Creative Industries Economic Estimates. While there are many of the limitations which apply to the previous methodology, particularly around definitions and SIC codes, there are a number of benefits to the new approach which reduce the data limitations. These include:

- Accounting for under-coverage (including microbusinesses and black market activity)

- Better GVA time series data (the ABS is not intended to be used for comparison over time)

- Better industry information for employment (jobs)

- An approach which allows consistent comparison with national estimates across economic measures including the potential to produce productivity estimates

See the Creative Industries methodology note for more details on limitations, including specifics on crafts, music, fashion and computer games.

Culture

Whilst the DCMS approach to measurement of culture attempts to better define this sector, there are significant limitations due to the limited granularity of the standard industrial classifications. There are many cases where culture forms a small part of a different industry classification and therefore for cannot be separately identified and assigned as culture using standard data sources. DCMS consulted on definition of Culture and published a response in April 2017.

Operation of historical site and similar visitor attractions

The Heritage sub-sector is depicted in our estimates by one SIC code “91.03 Operation of historical sites and building and similar visitor attractions”. DCMS use standard industrial classification (SIC) codes to construct these estimates, which enables international comparability as well as comparability with national estimates. As the balance and make-up of the economy changes, the international SIC codes used here are less able to provide the detail for important elements of the UK economy related to DCMS sectors. It is therefore recognised that the published estimates are likely to be an underestimate for the Heritage sub-sector.

Digital

Economic estimates for the Digital sector supersede the previous Digital Sector estimates. The definition used for the Digital Sector has the advantage of international comparability. However, it does not allow consideration of the value added of “digital” to the wider economy e.g. in health care of construction. DCMS policy responsibility is for digital across the economy and therefore this is a significant weaknesses in the current approach.

Sport

For the purposes of this publication the statistical Vilnius definition of sport has been used. This incorporates only those 4 digit Standard Industrial Classification (SIC) codes which are predominately sport. DCMS also publishes estimates of sport based on the broad Vilnius definition. This is a more comprehensive measure of sport which considers the contribution of sport across a range of industries, for example sport advertising, and sport related construction. The DCMS Sport Satellite Account is currently being developed and therefore has not been used in these estimates.

Tourism

Estimates for tourism used are based on a different methodology to all other sectors, they are taken from the Tourism Satellite Account. This is an internationally recommended methodology for measurement of the contribution of tourism to the economy.

This methodology uses survey data to allocate spend by industry, which produces robust measures of GVA and “tourism ratios”. The tourism ratios are then applied to employment and number of enterprises to get estimates of direct tourism for these measures. This requires a significant assumption about the ratio of spend to employment/number of enterprises. The same ratios are also applied for employed and self-employed, despite the potential differences in the make-up of these two groups. While there are limitations to this approach, it provides a much better estimate than purely taking the broad group of “tourism industries”, a number of which only contain small proportions of tourism jobs.

4. GVA

The methodology for estimates of gross value added (GVA) for DCMS sectors has been moved to a technical and quality assurance report, published alongside the latest release.

5. Regional GVA

The methodology for estimates of regional gross value added (GVA) for DCMS sectors has been moved to a technical and quality assurance report, published alongside the latest release.

6. Employment

This section provides details of the methodology used to estimate employment. Employment in the publication is measured by number of jobs. For more information, please see the quality assurance document for the employment estimates.

Employment estimates are made up of all first and second jobs in each of the DCMS sectors. The jobs are included if the job is in a DCMS sector, regardless of the occupation. For example, an accountant in an advertising firm would be counted as being in the Creative Industries, despite the occupation not being creative. Estimates are produced for both employed and self-employed jobs.

6.1 Data Sources

The Labour Force Survey (LFS) which feeds into the Annual Population Survey (APS) is considered to be the best source of information for headlines estimates of jobs, including employed and self-employed jobs. However there are significant weaknesses with the industry breakdowns as they are based on self-reporting of individuals, rather than on information from business returns (and are therefore often inconsistent with where businesses are allocated in National Accounts). Therefore the LFS and APS data on industry breakdowns should be treated with caution. However, comparisons show that the differences between APS and other sources with better industry breakdowns (e.g. the Business Register and Employment Survey, BRES, which is a business survey and therefore all employees are allocated to the same SIC as the business itself, giving greater accuracy and consistency with other measures) are not large. Therefore, APS has been used in this analysis for its demographic information and information on occupations.

It should be noted, this approach is not consistent with national estimates by industry, but is comparable with national totals for all industries, and demographic information at a national level.

6.2 Estimates

Employment in the release covers all first and second occupations.

In order to count the occupations, the data are first restricted to those who are employees or self-employed (main job - INECAC05 = 1 or 2; second job – SECJMBR = 1, 2 or 3). They are then restricted only to those who work in the relevant DCMS sector. Finally, data are weighted according to the person weighting (PWTA16). Confidence intervals can be constructed at the 95 per cent confidence level according to guidance in the LFS user manual.

With the exception of Tourism, each sector is made up of full 4-digit SICs which means that overlaps between sectors can be easily estimated, based on where a specific code is included in multiple sectors.

6.3 Demographics

The data can be split by various demographic groups. These (and the APS variables used) are:

- Employed/Self-employed (INECAC05, SECJMBR)

- Nationality - EU/non-EU (NATOX7)

- Region (first job GORWKR, second job GORWK2R)

- Ethnicity (ETHUK11)

- Gender (Sex)

- Age (Age)

- Highest level of qualification (HIQUL15D)

- Full time/part time (FTPT)

- Socio-economic classification (NSECMJ10)

6.4 Disclosure

All figures under 6,000 are supressed in order to prevent any disclosure of personal data in the statistics in accordance with APS guidance. The mean value for weights in the APS data set is around 200 (199 in 2014 and 196 in 2013), although the maximum can take values of 3,000 or more. Therefore a figure of 6,000 could typically be based on a sample of 30 individuals, but may in some cases refer to fewer.

6.5 Tourism

A different methodology is used to estimate employment in the Tourism sector. Tourism total employment up to 2015 is provided in the Tourism Satellite Account (TSA) Table 7. Tourism ratios are applied to Tourism Industry figures to give an estimate of tourism direct employment.

In the July 2018 publication, the 2017 Tourism Satellite Account was not available and therefore provisional estimates were produced to produce the 2016 and 2017 tourism direct employment estimate. Tourism direct employment estimates for 2016 and 2017 were calculated using tourism ratios as at 2015 and applied to the latest Tourism industries data. Tourism total employment up to 2015 is provided in the Tourism Satellite Account (TSA) Table 7. The 2016 and 2017 figures are provisional and will be updated in 2019 with the Tourism Satellite Accountestimates published on 28 November 2018.

To calculate overlap between the Tourism sector and other DCMS sectors, SIC codes that appear in the TSA and in other DCMS sectors are identified. The relevant tourism ratio (from the TSA) is applied to the total employment number in these SICs (from APS data) to produce an estimate of the number of jobs that need to be discounted from the tourism direct employment figure to avoid double counting. This is done at the four digit SIC level. There is a complete overlap with the ‘Cultural activities’ section of the TSA and a partial overlap with the ‘Sport and recreation activities’ category (SICs 92.00, 93.11, 93.19 and 77.21).

6.6 Civil Society

The employment estimates included in this report attempt to measure jobs for this sector for people who “work in a charity, voluntary organisation or trust” (SECTRO03=7). This is an underestimate for the sector and does not include volunteers, social enterprises and mutuals. External data sources have been used where appropriate to give an approximation of the size for these elements not captured in the DCMS sectors. Employment estimates have been produced from 2011 including the Office for Civil Society to aid comparisons over time.

7. Imports and Exports of Services

The next few chapters (Chapters 7, 8 and 9) relate to the Trade statistics for the DCMS Sectors. For a more comprehensive explanation of the data sources and data quality processes used for these statistics, please refer to the Quality Assurance reports – located here and here. However, these chapters have been kept here for further reference.

This section provides details of how estimates of imports and exports of services are produced. Estimates in the publication are in current prices (i.e. not adjusted for inflation) and are based on data from the International Trade in Services (ITIS) survey.

7.1 Method

For all sectors except Tourism and Civil Society, to obtain estimates of imports and exports the data is first limited to organisations that are listed as belonging to a SIC code for one of the DCMS sectors. Checks are then made to the output tables by market to ensure that the statistics published do not disclose any potentially sensitive information relating to any identifiable business. Data are found per SIC code and then aggregated up for each DCMS sector and for all DCMS sectors combined.

Imports and exports in Civil Society sector are minimal and not easily recognisable in official statistics data sources. Civil Society are therefore not included in the DCMS sector totals. Estimates of imports and exports for Tourism are based on a different methodology to other DCMS sectors, as described in Chapter 10.

Total UK estimates which are used to calculate the percentage of UK total for each sector are taken from the annual Pink Book, which balances inward and outward transactions:

- Exports of services, KTMQ

- Imports of services, KTMR

Note on SIC 92.00: The Gambling sector (SIC 92.00) is relatively small and therefore changes in trading activity, reporting structure or industrial classification for any business can have a large impact on the overall sector figures. This was witnessed in 2015 and 2017 data particularly, whilst in 2018 the exports for services failed disclosure checks for similar reasons. Care should therefore be taken when comparing these figures over time.

7.2 Trade by destination/source

The estimates in the release are further broken down by (correct as of the 2018 data, published February 2020):

- EU (including figures for all EU member states)

- Selected non-EU countries (e.g. Australia, Canada, China, India, Japan, USA)

- Continent (Europe, Americas, Asia, Africa and Oceania)

- Selected sub-regional breakdowns (e.g. Latin America & Caribbean)

Plans are being developed to publish for a wider selection of countries in the February 2021 publication.

8. Imports and Exports of Goods

This section provides details of how estimates of imports and exports of goods are produced.

8.1 Background

DCMS sectors are normally defined using the 4 digit Standard Industrial Classification (SIC) code level, and the focus is whether the industry doing business is a DCMS sector. For trade in goods, focus is on whether the good, or commodity, is a DCMS sector ‘good’.

Goods are listed using the Combined Nomenclature (CN) format for commodity codes, which in turn is based on the Harmonised System (HS) of tariff nomenclature. This is an internationally standardised system of coding for classifying goods for trade. CN codes are 8 digit codes that identify categories of goods. The first 6 digits correspond to the HS code, with the 7th and 8th digits adding further detail.

Data for non-EU trade in goods are collected from customs declarations made to HMRC when goods leave or enter the UK (Customs Handling of Import and Export Freight (CHIEF) system). Data for goods trade with EU countries are currently collected through a survey of trading businesses known as Intrastat, also managed by HMRC. This reflects the fact that, in the absence of customs controls for trade within the EU, declarations are not appropriate as a method for measuring trade. A reporting of total trade above set thresholds (£250,000 for exports and £1,500,000 for imports) is reported; below threshold trade averages (BTTA) are estimated.

8.2 Method

The methodology involves the following processes:

- Identifying the DCMS Sector commodity codes (goods)

- Summing up trade values from both Intrastat and CHIEF for those codes to get total trade values

8.3 Identifying commodity codes

To identify DCMS Sector commodity codes, it has been necessary to apply a conversion between DCMS sector 4 digit SIC codes and CN codes to specify an initial set of CN codes linked to DCMS sectors. This is done using the European Classification of Economic Activities (NACE) 2.1 at the 4 digit level which is equivalent to 4 digit SIC codes.

Unlike SIC codes, which have been unchanged since 2007, commodity codes are liable to be refreshed every year. Therefore, once DCMS sector commodity codes have been identified for a baseline year, codes can be fed forwards and backwards to work out how they have evolved over time and ensure that the codes comprising our sectors are appropriately captured. Additionally, for the 2020 autumn publication (covering data from 2015-2019), a short refresh of for NACE-CN look-up process (in practice the Classification of Products by Activity (CPA)-CN lookup process, which mirrors NACE) was carried out, and identified six extra codes from 2015, and eight extra codes from 2017, applicable for the DCMS sectors.

From this process, it has been consistently found that there are no goods associated with the Gambling and Telecoms sectors. Additionally, there are no formally recognised imports or exports associated with the Civil Society sector.

Overall, this means that estimates of the value of imports and exports of goods in DCMS sectors only cover Creative Industries, Cultural Sector, Digital Sector and Sport.

The full list of DCMS SIC codes which did not have any corresponding CN codes, i.e. they did not have any goods associated to that industry are listed in Table 8.3 below.

Table 8.3: List of SIC codes without any goods

| SIC | Description |

|---|---|

| 18.2 | Reproduction of recorded media |

| 46.51 | Wholesale of computers, computer peripheral equipment and software |

| 46.52 | Wholesale of electronic and telecommunications equipment and parts |

| 47.63 | Retail sale of music and video recordings in specialised stores |

| 47.64 | Retail sale of sports goods, fishing gear, camping goods, boats and bicycles |

| 58.12 | Publishing of directories and mailing lists |

| 58.21 | Publishing of computer games |

| 59.12 | Motion picture, video and television programme post-production activities |

| 59.13 | Motion picture, video and television programme distribution activities |

| 59.14 | Motion picture projection activities |

| 60.1 | Radio broadcasting |

| 60.2 | Television programming and broadcasting activities |

| 61.1 | Wired telecommunications activities |

| 61.2 | Wireless telecommunications activities |

| 61.3 | Satellite telecommunications activities |

| 61.9 | Other telecommunications activities |

| 62.01 | Computer programming activities |

| 62.03 | Computer facilities management activities |

| 63.91 | News agency activities |

| 63.99 | Other information service activities n.e.c. |

| 70.21 | Public relations and communication activities |

| 73.11 | Advertising agencies |

| 73.12 | Media representation |

| 74.1 | Specialised design activities |

| 74.3 | Translation and interpretation activities |

| 77.21 | Renting and leasing of recreational and sports goods |

| 77.22 | Renting of video tapes and disks |

| 77.4 | Leasing of intellectual property and similar products, except copyrighted works |

| 85.51 | Sport and recreation education |

| 85.52 | Cultural education |

| 90.01 | Performing arts |

| 90.02 | Support activities to performing arts |

| 90.04 | Operation of arts facilities |

| 91.01 | Library and archive activities |

| 91.03 | Operation of historical sites and buildings and similar visitor attractions |

| 92 | Gambling & betting activities |

| 93.11 | Operation of sports facilities |

| 93.12 | Activities of sports clubs |

| 93.13 | Fitness facilities |

| 93.19 | Other sports activities |

| 95.11 | Repair of computers and peripheral equipment |

| 95.12 | Repair of communication equipment |

Additionally, the set of commodities relating to the Crafts subsector was revised in 2018, following engagement between DCMS and the Crafts Council to fully understand which codes best represented it. This has resulted in the use of some codes which do not match the Crafts SIC code (32.12), and the removal of some codes which do match it (32.12).

A spreadsheet providing a list of product codes within DCMS sectors for the data from 2017-19 is also available from our latest trade in goods statistics.

8.4 From commodity codes to total trade values

In simple terms, the Intrastat and CHIEF datasets for exports and imports are respectively added up for the DCMS sector commodity codes to derive estimates for the DCMS sectors.

However, a revision to the data means that the “below threshold trade average” (BTTA) estimates for EU trade are no longer provided at the 8-digit CN level we work to, when they were found to be less robust at this level of granularity. They are instead only available at a less granular level (2-digit HS commodity code).

Analysis carried out by DCMS showed that removing BTTA trade had an impact of around 3.6% on the estimate of exports of DCMS Sector goods; and 5.3% on the estimate of imports of DCMS Sector goods.

However, DCMS had a clear user need of comparability of trade in goods between EU and non-EU countries. Therefore, a revised BTTA metric developed by DCMS has been used for this publication. This uses 2-digit BTTA (a more robust estimate) to “allocate” BTTA to different 8-digit commodity codes. Analysis for this found results broadly similar to the original approach (the new estimate was 0.2-0.3% higher for exports; and 0.6-0.7% higher for imports, for DCMS Sector goods). This has now been applied for this publication, and a back-series calculation applied to 2015. As the change took effect from 2015, it means that data before 2015 is no longer comparable with the most recent estimates.

This calculation forms part of the process above, where such revised BTTA estimates are added to the Intrastat estimates of trade so that the final calculation is:

- Imports: EU Intrastat arrivals + DCMS BTTA arrivals estimates + CHIEF imports

- Exports: EU Intrastat dispatches + DCMS BTTA dispatches estimates + CHIEF exports

A further change to note is that, since 1 May 2016, the UK has moved from a General Trade system to a Special Trade system. This means, for example, that something moving from Iceland to Norway via a British port will be counted as Iceland-Norway trade. Under the general system, if the goods had moved into a warehouse on the UK mainland after arriving from Iceland, and before moving to Norway, it would have counted as Iceland-UK and UK-Norway trade respectively. This does not affect the comparability of data before and after May 2016; however, it is still important to know that the change has been made.

8.5 Disclosure

HMRC have suppressed data which may disclose sensitive information relating to business or national interests. This is predominantly at the request of businesses with the majority of trade. More information can be found here.

8.6 Goods estimates using ONS data (August 2016)

In August 2016, an ad hoc release was published providing estimates of exports of goods for DCMS sectors. These estimates were based on Office for National Statistics UK Trade in Goods by Classification of Product by Activity CPA(08). The definitions for each sector were based on the closest matching product code for each industry. There were no associated product codes for Telecoms or Gambling industries.

It was recognised that whilst this definition was not a perfect comparison of the products exported to DCMS sectors, it provided an indication of exports of related products. Feedback from users also suggested that these data were not granular enough to be able to identify specific products within DCMS sectors. This was the main reason for using the HMRC trade in goods data.

The HMRC and ONS trade in goods statistics are not directly comparable as they are compiled on a different basis:

- HMRC statistics are based on the ‘Cross-border’ or ‘Physical movement’ principle: a good is recorded as an export (import) if it physically leaves (enters) the economic territory of a country

- ONS Balance of Payments estimates are based on the ‘Change of Ownership’ principle: goods entering and leaving the UK border are not recorded as imports or exports unless they change ownership between UK residents and non-residents. In addition, the ONS data are seasonally adjusted.

The products in the HMRC data also are more granular which means we can be more selective than was possible when using the ONS data in 2016. All these adjustments mean that the ONS and HMRC data are not directly comparable and should be treated as two different sources.

9. Imports and Exports for the Tourism sector (Goods and Services Combined)

This section provides details of how estimates of imports and exports for the Tourism sector are produced. Estimates in the publication are in current prices (i.e. not adjusted for inflation).

Estimates for the Tourism sector are taken from the International Passenger Survey, and are based on the following definitions:

- Imports of tourism – spending by UK residents on trips abroad

- Exports of tourism – spending by overseas residents during visits to the UK

These figures represent trade in goods and services combined and therefore are not directly comparable with the trade in services or trade in goods estimates presented for all other sectors (excluding Civil Society). Therefore, estimates of imports and exports of Tourism are not presented in the DCMS sector totals.

For the autumn 2020 publication, methodological improvements were made to the International Passenger Survey (IPS) by the ONS. These particularly relate to the survey’s weighting process and, in particular, related to evidence that the previous estimation method was not providing accurate results for certain groups (e.g. underestimating visits by Chinese residents). As a result, a back-series from 2014 to 2019 has been produced for this year with these revisions. This means that data published this year are not directly comparable with previously published estimates, including those for data from before 2014.

Total UK estimates which can be used to calculate the percentage of UK total for Tourism are taken from the annual Pink Book:

- Exports of goods and services combined, KTMW

- Imports of goods and services combined, KTMX

10. Business Demographics

This section provides details of the methodology used for the estimates within the Business Demographics publication including the number and characteristics of businesses in DCMS sectors. Please note that data for the Civil Society sector are not available on a basis consistent with the other DCMS sectors, and are therefore not included in the DCMS Sector total. Further information can be found in the quality assurance document here

Users should note that there were a number of changes between the August 2016 publication and the February 2018 publication which affect the comparability of estimates between these two releases. More recent iterations have continued to follow the February 2018 framework, except for smaller year-on-year methodology changes:

- In August 2016, we published estimates of the number of enterprises in DCMS sectors. In comparison, from February 2018, we have been publishing estimates of the number of businesses in DCMS sectors. Further information about this difference is included in the ‘Definition of a business’ section of this chapter.

- In the August 2016 publication, a direct definition of Tourism was used to estimate the number of enterprises in the Tourism Sector. Stakeholder feedback and further discussions with Visit England and Tourism Intelligence Unit suggested that this was not the most accurate approach. From February 2016, published estimates for the Tourism Sector are based on the “tourism industries” definition which covers all establishments for which the principal activity is a tourism characteristic activity.

- Between 2015 and 2016, the Office for National Statistics (ONS) carried out a sample re-optimisation for the Annual Business Survey (ABS) – the survey on which the Business Demographics estimates are based. Sample re-optimisations are carried out every five years as part of the regular process to improve estimates. The purpose of such exercises is to improve the efficiency of the sample and estimation, and reduce sample variability. This re-optimisation led to discontinuity between 2015 and 2016 within small- and medium-sized businesses (those with less than 250 employees).

- In 2015, the ONS business population was expanded to include approximately 92,000 solely Pay-As-You-Earn (PAYE)-based businesses. This led to an increase in the number of businesses in the overall population of approximately 4%. Nearly all of these businesses (99.3%) were in employment size-band one (0 to 9 employees) and nearly half of them were in the non-financial services sector. Within the ABS the new population was used for the first time in 2016. New estimates for 2015 were therefore calculated to assess the impact of the inclusion of these additional businesses. An impact article and corresponding reference tables showing the new 2015 estimates were published on Friday 20 October 2017 by ONS. New estimates for 2015 (and before) cannot be produced for disaggregation of the data, which includes the level of data for DCMS sectors. This means that only 2016 data have been provided for DCMS sectors (except for region for foreign owned tables where 2015 is the latest year), and comparisons with historic data are therefore not possible. Further information can be found in the ABS bulletin

10.1 Data sources

The data underpinning this release are taken from the Office for National Statistics (ONS) Annual Business Survey (ABS). Example copies of the questionnaire itself are available here. The survey covers the UK non-financial business economy, which accounts for approximately two-thirds of the economy in terms of gross value added (GVA). The industries covered are:

- non-financial services (includes professional, scientific, communication, administrative, transport, accommodation and food, private health and education, and entertainment services)

- distribution (includes retail, wholesale and motor trades)distribution (includes retail, wholesale and motor trades)

- production (includes manufacturing, oil and gas extraction, energy generation and supply, and water and waste management)

- construction (includes civil engineering, house building, property development and specialised construction trades such as plumbers, electricians and plasterers)

- parts of agriculture (includes agricultural support services and hunting), forestry and fishing

The industries not covered by the ABS are: public administration and defence, public provision of education and health, all medical and dental practice activities, and finance and insurance.

The sampling frame for the ABS is the Inter-departmental Business Register (IDBR) which records all organisations registered for Value Added Tax (VAT) with HM Revenue and Customs (HMRC); registered for a Pay As You Earn (PAYE) scheme with HMRC; or registered as incorporated businesses at Companies House.

ONS provide us with data at the 4-digit SIC level, which we can then aggregate up to produce estimates for our sectors and sub-sectors.

NB: Whilst ONS are the providers of the data underpinning the Business Demographics releases, they bear no responsibility for their further analysis and interpretation within DCMS Sectors Economic Estimates publications.

10.2 Method

Definition of a business

Within the IDBR, information is held about a variety of types of “business unit”. These are described below along with how they are referred to within DCMS Business Demographics releases. Businesses are defined as any Reporting Units held on the Inter-Departmental Business Register (IDBR). Meanwhile, business sites (also referred to within DCMS Business Demographics releases) are defined as any local units held on the IDBR. The table below outlines the differences between these types of unit and another high-level grouping – the enterprise. Prior to the February 2018 publication, DCMS provided estimates of the number of enterprises rather than the number of businesses.

In practice, in the vast majority of cases, the local unit and business unit are the same unit - only about 2% of businesses operate more than one local unit[footnote 3]. As such, most of the time the terms ‘enterprise’, ‘business’, and ‘local unit’ may be used interchangeably.

Table 10.2 Types of unit in the IDBR[footnote 4]

| Business unit | Description | Example | Referred to as… |

|---|---|---|---|

| Enterprise | The smallest combination of legal units (generally based on VAT and/or PAYE records) which has a certain degree of autonomy. An enterprise carries out one or more activities at one or more locations, but may still be a sole legal unit. | Arcadia (who own Topshop, Topman, Dorothy Perkins and Burton among others) | “Enterprise” in the August 2016 publication |

| Reporting unit | Put simply, the Reporting Unit holds the mailing address to which the survey questionnaires are sent. The questionnaire can cover the enterprise as a whole, or parts of the enterprise identified by lists of local units. | Topshop | “Business” from the February 2018 publication onwards |

| Local unit | A local unit is an enterprise or part thereof (e.g. a workshop, factory, warehouse, office, mine or depot) situated in a geographically identified place. | An individual Topshop store e.g. on a local highstreet or in a shopping mall | “Business site” from the February 2018 publication onwards |

Number of businesses

ONS provide us with data on the number of businesses (reporting units) at the 4-digit SIC level. The relevant SICs have been aggregated to produce estimates for each DCMS sector.

Size of businesses (Employment band)

The standard definition of a small and medium sized enterprise (SMEs) is any business with fewer than 250 employees. Taking this into account, DCMS have classified employment size in the following categories:

- 0-9 employees (representing micro businesses)

- 10-49 employees (representing small businesses)

- 50-249 employees (representing medium businesses)

- 250+ employees (representing large businesses)

Information on number of employees is collected as part of the ABS. ONS provide DCMS with data on the number of businesses (reporting units) within each of the employment size bands listed above.

Size of businesses (Turnover band)

Turnover consists of total takings or invoiced sales and receipts of the business in connection with the sale of goods and services. Interest and similar income, “Other Operating Income” and extraordinary income is excluded. VAT invoiced to the customer is excluded.

Information on turnover is collected as part of the ABS. ONS provide data on the number of businesses (reporting units) within specified turnover size bands.

For the May 2020 publication, the work on Turnover was extended, whereby breakdowns by employment size, region etc. were also done by turnover (e.g. for each employment band, what is the total turnover generated for each DCMS sector?). This was in response to user need as a way of better understanding the sectors, particularly following the outbreak of coronavirus (COVID-19).

Region

The regional distribution of DCMS businesses is based on the number of business sites (local units). A local unit represents an individual site (for example a factory or shop) in a business (reporting unit). One business may have many sites, and, where this is true, the location of the business is generally the main operating site or the head office.

Generally, businesses (reporting units) are the same as enterprises (legal entities of the business) but larger enterprises can be split into a number of reporting units based on divisional structure, geographical considerations, type of activity, or other agreed reporting structures. Reporting units return total values that represent one or many local units of that business.

To produce these estimates, the reporting unit data must be apportioned amongst the local units of that business. Regional data are apportioned based on local unit industry classification, employment size and regional location. All ABS national results for the UK are produced using reporting unit data, and the UK national total for each variable at the “all industry” level is the figure that the regional estimates for that variable will add up to.

ONS provide DCMS with data on the number of business sites (local units) within each region (or devolved administration) for each 4-digit SIC. This information is then aggregated up to produce estimates for DCMS sectors.

Foreign-owned businesses

Ownership status is determined by the nationality of a business’ parent company. The industry of the business has been taken at the reporting unit level so may not fully reflect the structure of the business. Industry data are not available at the local unit level for these questions and so this breakdown should be treated with caution.

Data are split into UK-owned and foreign-owned (EU and non-EU) businesses. The definitions for each category are defined by Eurostat and figures for the EU exclude the UK-owned figures.

Number of exporters and importers

Within the ABS, there are questions covering whether a business has purchased from or provided goods and/or services to individuals, enterprises or organisations outside of the UK. This includes transactions with any of the business’ parents or subsidiaries based outside of the UK (if applicable). The statistics published within the DCMS release cover the number and proportion of businesses in Great Britain engaged in the international trade in goods and services. Northern Ireland estimates on exporters and importers are published by the Department of Finance and Personnel Northern Ireland (DFPNI).

International trade is defined as the import and/or export of goods and/or services. Businesses trading internationally are those who import or export goods or services.

Industry breakdowns of these data are based on the main activity of the business. For example, if a business undertakes both distribution and service activities, but most of its employment is within distribution, then the whole business will be classified as distribution. Due to methodological differences between the statistics from HM Revenue and Customs (HMRC) and the ABS statistics, the “trade in goods” figures within each dataset are not directly comparable and may differ. Methodological differences between the two releases include differences in data sources and coverage, measurement of employee count, disclosure control procedures and the handling of revisions.

Business Births and Deaths

In July 2020, following internal user interest, DCMS published for the first time estimates on the number of newly-registered businesses (‘business births’) and the number of recently de-registered businesses (‘business deaths’) for the DCMS sectors (excluding Civil Society), for the period 2010-2018. An adjustment is made to the two most recent years of the data by the data owner (the Office for National Statistics (ONS)) to allow for potential re-activations of businesses (which therefore may not have entirely ceased trading), ensuring a balance between timely statistics and subject guidance about the likelihood of re-activations.

Unlike the previous business demographics estimates listed above, for this data the focus is on “enterprises” rather than “reporting units”. Estimates are reported for all DCMS sectors except for Civil Society, and for the subsectors of the Creative Industries, Cultural Sector and Digital Sector. Users should also note, however, that the definition of Tourism used in this report is equivalent to that used in the Business Demographics publication, but differs to that used in all other DCMS Sector Economic Estimates reports. Specifically, this release is based on a “tourism industries” approach, which counts any establishment for which the principal activity is a tourism characteristic activity.

The data underpinning this release are taken from the Office for National Statistics (ONS) Inter-Departmental Business Register (IDBR). The information used to create and maintain the Inter-Departmental Business Register (IDBR) is obtained from five main administrative sources. These are:

- HM Revenue and Customs (HMRC) Value Added Tax (VAT) – traders registered for VAT purposes with HMRC

- HMRC Pay As You Earn (PAYE) – employers operating a PAYE scheme, registered with HMRC

- Companies House – incorporated businesses registered at Companies House

- Department for Environment, Food and Rural Affairs (DEFRA) farms

- Department of Finance and Personnel, Northern Ireland (DFPNI)

As well as these five main sources, a commercial data provider, Dun and Bradstreet, is used to supplement the IDBR with Enterprise Group information.

DCMS receives the data under agreement, calculates the totals for its SIC codes, and aggregates it up to its sectors and sub-sectors. To help minimise the risk of disclosure, figures are then rounded to the nearest five, again following consultation with the ONS on best practice.

For more information, please see the quality assurance document.

11. Earnings

This section provides details of the methodology used to estimate earnings in the Digital Sector. Please note that this is the first release where DCMS have introduced analysis on earnings in the Digital Sector and Digital Occupations, based on a request from policy colleagues for information in this area. It is therefore classed as an experimental statistic. DCMS plan to widen this analysis further to include all DCMS sectors, if there is sufficient interest in these statistics in the future.

11.1 Definition

The ONS’s [definition of earnings] is the payment received by employees in return for employment. Most analyses of earnings consider only gross earnings, which is earnings before any deductions are made in light of taxes (including National Insurance contribution) and benefits[footnote 5].

11.2 Quality Report

A detailed quality report outlining the characteristics of the data (e.g. data collections, sampling design, and response rate) has been published alongside the Digital Sector earnings report. This document also summarises the quality assurance processes applied during production of these statistics by the ONS as well as by DCMS.

11.3 Data collection

The estimates of earnings for the Digital sector are based on the Annual Survey of Hours and Earnings (ASHE) dataset provided by Office for National Statistics (ONS). This includes information about the levels, distribution and make-up of earnings and hours paid for employees in all industries and occupations across the UK.

Businesses are surveyed in April of each year. The survey uses a random sample of 1% of all employee jobs from HM Revenue and Customs’s (HMRC’s) Pay As You Earn (PAYE) system, taken in January of the reference year. The sample is drawn in such a way that many of the same individuals are included from year to year, thereby allowing longitudinal analysis of the data.

Since ASHE is a survey of employee jobs, it does not cover the self-employed or any jobs within the armed forces. Given the survey reference date in April, the survey does not fully cover certain types of seasonal work, for example, employees taken on for only summer or winter work.

Validation is carried out on returned data that is regarded as incomplete or potentially inaccurate, based on automatic comparisons with data for similar jobs or against data for the same job in previous years. In these cases, respondents may be re-contacted by ONS in order to verify the information that has been provided.

11.4 Method

The definition of the Digital sector and Digital occupations are consistent with DCMS definition of these sectors. Table 2.4 in this report outlines the SIC codes used for the Digital sector.

The table below shows the list of occupations used in the earnings report based on 4 digit Standard Occupational Classification 2010 (SOC) codes. These SOC codes have been used based on by work that has been undertaken by Nesta and techUK (2015) .

Table 11.4: List of occupations in Earnings estimates based on 4 digit Standard Occupational Classification 2010 (SOC) codes.

| SOC | Description |

|---|---|

| 1136 | IT and telecommunications directors |

| 2133 | IT specialist managers |

| 2134 | IT project and programme managers |

| 2135 | IT business analysts, architects & systems designers |

| 2136 | Programmers and software development professionals |

| 2137 | Web design & development professionals |

| 2139 | IT & telecommunications professionals not elsewhere classified |

| 3131 | IT operations technicians |

| 3132 | IT user support technicians |

| 5242 | Telecommunications engineers |

| 5245 | IT Engineers |

Mean vs Median

The headline statistics for ASHE are based on the median rather than the mean. The median is the value below which 50% of employees fall. It is ONS’s preferred measure of average earnings as it is less affected by a relatively small number of very high earners and the skewed distribution of earnings. Thus, provides a better indication of typical pay than the mean.

What is reported?

These statistics cover the following areas:

- Digital Sector earnings - this looks at the breakdown of median annual earnings by employment status e.g. full time and part time, age, and by sub-sector

- Gender pay gap - looking at the percentage difference between men’s and women’s earnings in the digital sector

- Annual earnings by place of work - looking at the median annual earnings of digital sector employees by place of work (English regions, Scotland, Wales and NI)

- Annual incentive pay - looking at the amount paid to an employee as a result of meeting a performance or productivity objective (bonuses etc.)

- Earnings by Digital Occupation - (by sex, employment status, age) - looking at earnings of those employees working in digital-related jobs across all UK economic sectors, not just within the digital sector itself.

- Earnings for those working in the Digital Economy - (i.e. median annual earnings for those working in the Digital Sector + those working in Digital Occupations outside the Digital Sector)

11.5 Strengths and Limitations of the data

The ASHE data used for this analysis are robust and have a number of strengths:

- Size and coverage - the ASHE dataset contains information on approximately 180,000 jobs in all industries, occupations and regions, making it the most comprehensive source of earnings information in the UK and enabling a vast range of analyses

- Quality - alternative sources of earnings information such as the Labour Force Survey (LFS) rely on self-report or proxy data, which are known to be less reliable than information from employers’ administrative systems

- Uniqueness - for many uses, ASHE is the main data source and for some uses it is the only data source

but there are some limitations of which users should be aware:

- Analysis presented here have been calculated on a consistent basis in DCMS. Due to minimal differences in the methodology and analysis used to calculate the median, results in this report may not match the ONS published results, in particular when looking at further breakdowns to some data e.g. by region or age. These differences are small but should be treated with caution

- Lack of personal demographic information - characteristics such as ethnicity, religion, education, disability and pregnancy are not recorded in the ASHE dataset

- The quality of estimates at low levels of disaggregation can be poor

- The dataset does not cover those who are self-employed

The strengths and limitations of the Annual Survey of Hours and Earnings (ASHE) can be found in the Quality and Methodology Information report and the Guide to sources of data of earnings and income.

12. Further information

For enquiries on this release, please email [email protected].

For general enquiries contact: Department for Digital, Culture, Media and Sport 100 Parliament Street London SW1A 2BQ Telephone: 020 7211 6000

DCMS statisticians can be followed on Twitter via @DCMSInsight.

The Economic Estimates of DCMS Sectors are Official Statistics and have been produced to the standards set out in the Code of Practice for Statistics.

-

Bakhshi et al (2013) propose criteria which can be used to assess which occupation codes should be considered creative for measurement purposes. ↩

-