Department for International Trade inward investment results 2015 to 2016

Updated 6 September 2016

1. Types of foreign direct investment (FDI)

United Kingdom

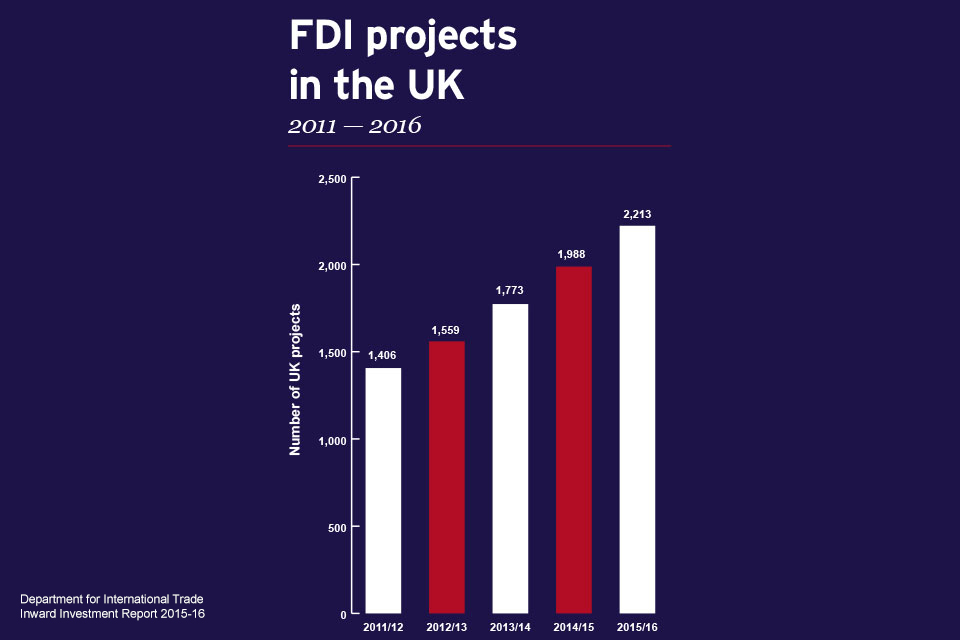

| Types of investment | 2011/12 | 2012/13 | 2013/14 | 2014/15 | 2015/16 | Increase % | |

|---|---|---|---|---|---|---|---|

| New investments | 752 | 777 | 820 | 1,058 | 1,130 | 7% | |

| Expansions | 506 | 577 | 677 | 740 | 821 | 11% | |

| Mergers and acquisitions (including joint ventures) | 148 | 205 | 276 | 190 | 262 | 38% | # |

| Total | 1,406 | 1,559 | 1,773 | 1,988 | 2,213 | 11% |

2. New projects and jobs

United Kingdom

| UK region | Number of FDI projects | Sum of number of new jobs |

|---|---|---|

| East Midlands | 85 | 3,678 |

| East of England | 116 | 3,280 |

| England (excluding London) | 1,043 | 39,716 |

| London | 889 | 24,191 |

| North East | 77 | 2,991 |

| North West | 151 | 7,715 |

| Northern Ireland | 33 | 2,068 |

| Scotland | 108 | 4,178 |

| South East | 253 | 5,507 |

| South West | 89 | 2,434 |

| Wales | 97 | 5,443 |

| West Midlands | 168 | 11,119 |

| Yorkshire and the Humber | 104 | 2,992 |

FDI projects in the UK

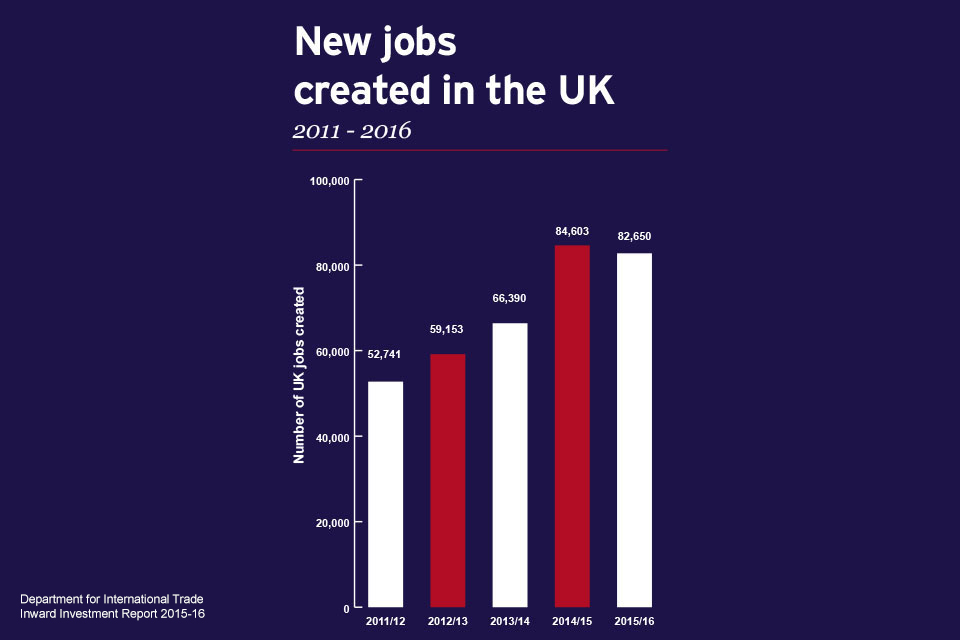

New jobs created in the UK

3. Projects and total new and safeguarded jobs by industry

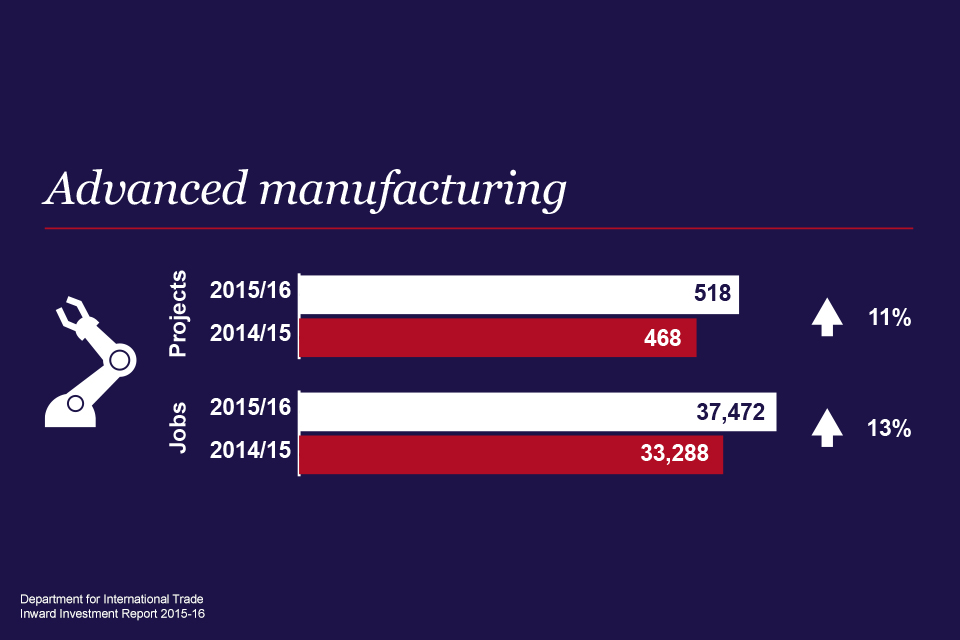

Advanced manufacturing

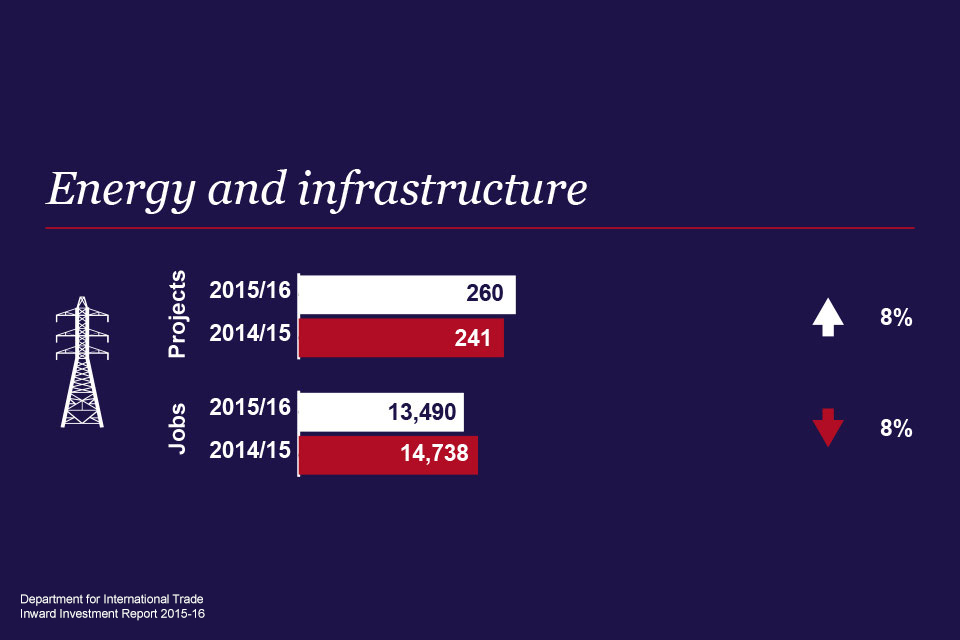

Energy and infrastructure

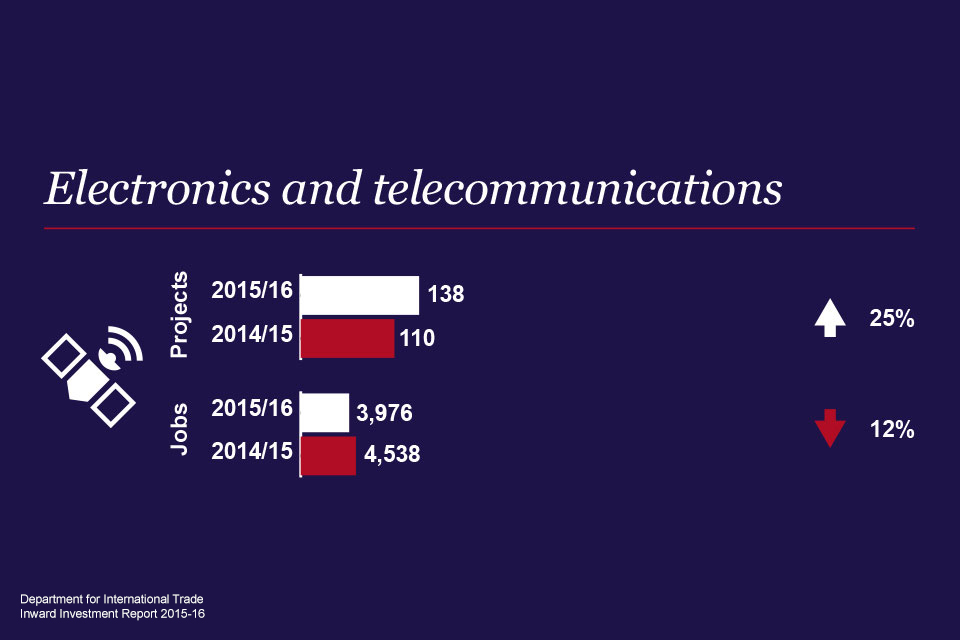

Electronics and telecommunications

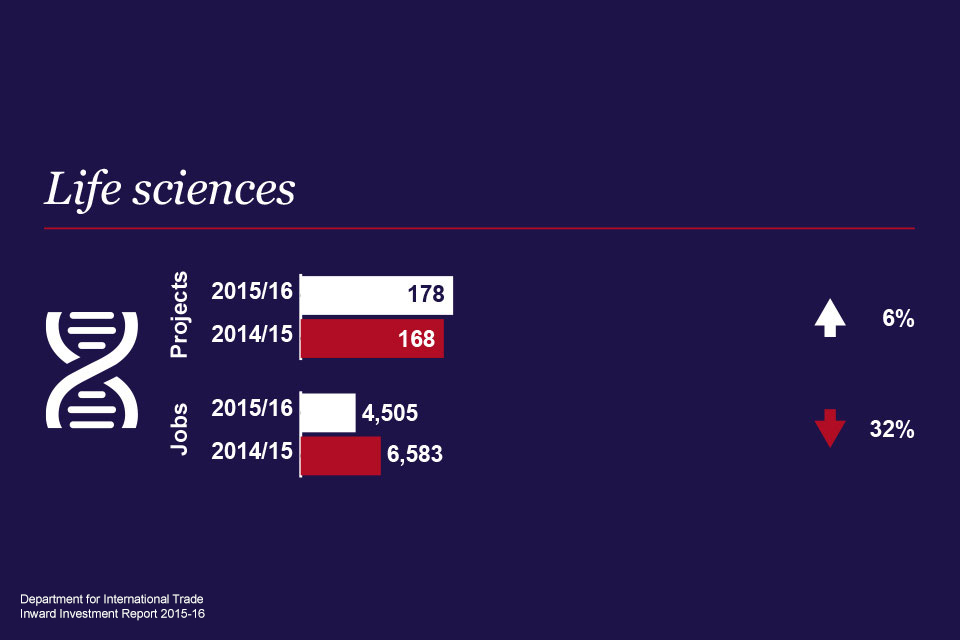

Life sciences

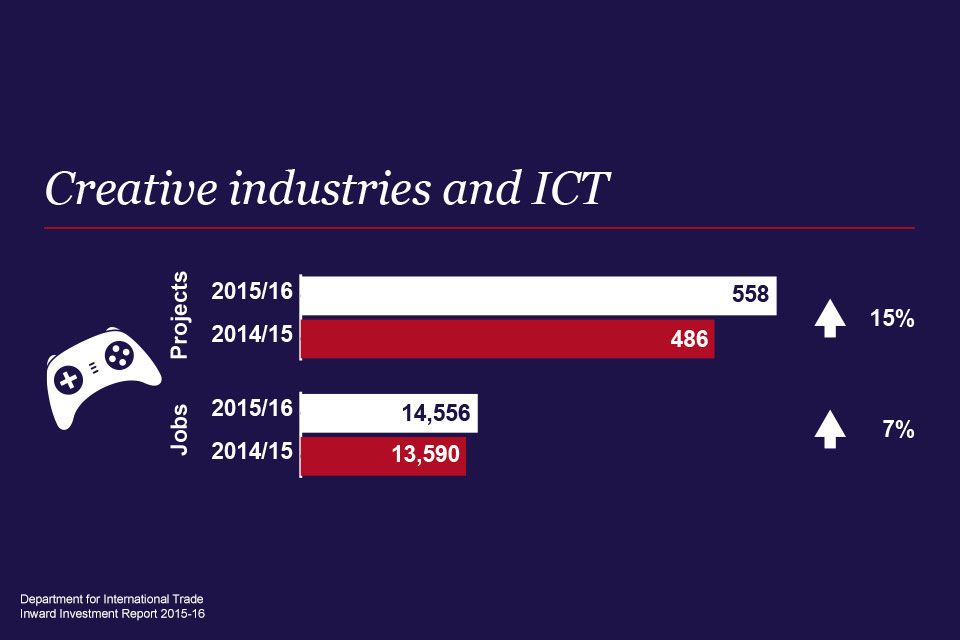

Creative industries and ICT

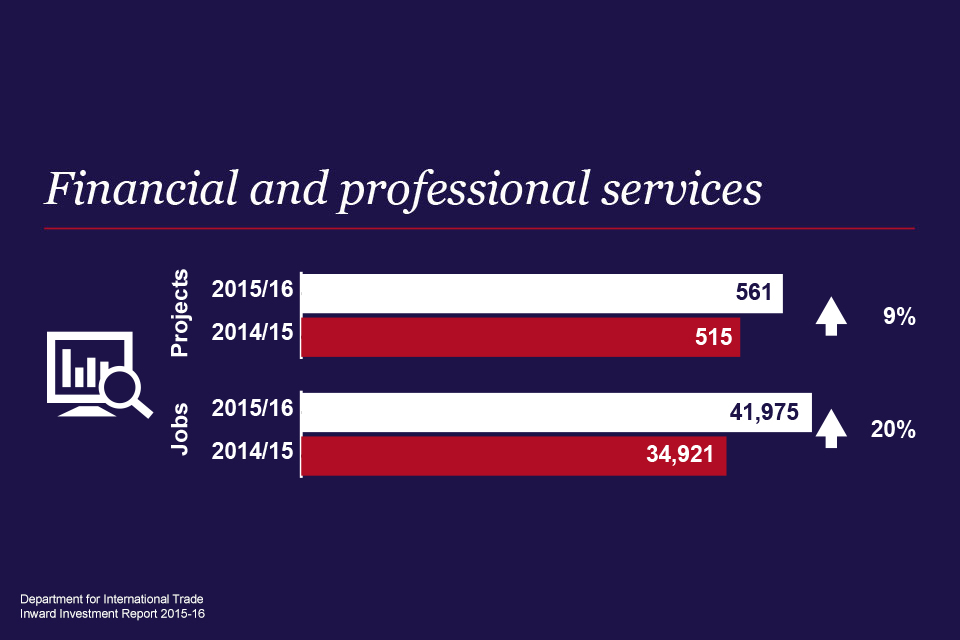

Financial and professional services

4. Top source markets for FDI projects

United Kingdom

| Source country | FDI projects | New jobs | Safeguarded jobs |

|---|---|---|---|

| Americas | |||

| Canada | 90 | 1,740 | 8,948 |

| United States | 570 | 25,694 | 3,956 |

| Rest of Americas | 61 | 1,194 | 756 |

| Asia Pacific | |||

| Australia | 97 | 3,156 | 6 |

| China (including Hong Kong) | 156 | 2,833 | 3,899 |

| India | 140 | 7,105 | 344 |

| Japan | 115 | 2,618 | 5,036 |

| Rest of Asia Pacific | 116 | 2,987 | 896 |

| Europe | |||

| France | 116 | 5,155 | 1,846 |

| Germany | 99 | 5,291 | 1,422 |

| Ireland | 50 | 2,075 | 544 |

| Italy | 91 | 2,477 | 356 |

| Netherlands | 49 | 2,048 | 208 |

| Nordic and Baltic region | 141 | 4,520 | 2,651 |

| Spain | 66 | 2,376 | 770 |

| Switzerland | 50 | 1,540 | 430 |

| Rest of Europe, Middle East and Africa | 229 | 10,489 | 1,261 |

| Total | 2,213 | 115,974 | 33,324 |

DIT supported FDI projects: 1,731

5. Department for International Trade can help investors

Whether you are a start-up, a medium-sized or family business, a corporate or an institutional investor, Department for International Trade (DIT) supports the realisation of your international business ambitions.

DIT is recognised as one of the best investment promotion agencies in the world.

DIT offers flexible support packages for every aspect of your investment. Our service doesn’t stop once you are based in the UK - it continues as your business expands internationally. We have helped thousands of businesses locate and expand in the UK.

We listen to their feedback to help strengthen and improve our services.

5.1 Not sure which country is best for your business?

Comparing the benefits of locating in different countries is complicated.

It is our job to explain the business environment in competitor countries. We provide the detailed factual information and market insights that let you draw meaningful conclusions about the UK’s competitiveness.

5.2 Already decided to bring your business to the UK?

We help you set up business quickly and efficiently, saving valuable time and money by guiding you through essential steps such as choosing the right location, finding premises, recruiting staff and connecting with the value chain.

We have specialists covering all the industry sectors, as well as important issues such as visas, taxation, skills, planning permission and financial analysis.

5.3 Already established here, but looking to expand your business?

We can help you develop the relationships that enable expansion in the UK and exports to European and global markets. This could include:

- connecting you with innovation

- support for new products and services

- using our overseas network to increase your exports

- helping you access finance

6. Contact DIT

DIT’s services to international investors in the UK are free of charge and commercial-in-confidence.

Enquiries for overseas companies looking to set up in the UK

Overseas companies can contact the Investment Services Team for information about setting up in the UK including the help that is available.

Investment staff at a British embassy, high commission or trade office can also put investors in touch with the Investment Services Team.

7. Methodological note on FDI statistics

FDI projects:

DIT and its partners make all reasonable efforts to record and report all eligible FDI projects that meet DIT’s definitions and verification and reporting criteria.

Figures about the recorded FDI projects include those investments which received support from DIT and/or one of its regional and local partners (‘involved’ projects), as well as ‘non-involved’ projects, meaning those projects which have ‘landed’ in the UK without any involvement from DIT or partners.

Various external sources and FDI project and company databases have been used to identify, qualify and report eligible ‘non-involved’ FDI projects.

DIT’s definition of FDI projects covers wider types of investment, including those projects which are not announced by companies. This and other differences in methodology and verification processes explains the difference in the FDI project numbers published by DIT and other organisations, such as FT and EY.

Estimates of jobs and value of investment:

Job figures and investment values included in this report are estimates, made at the start of each investment project. New jobs capture total jobs likely to be created within 3 years from the start of the project. Safeguarded jobs include those jobs which were ‘saved’ as a result of the additional/ new inward investment.

© Crown Copyright 2016

You may re-use this publication (not including logos) free of charge in any format or medium, under the terms of the Open Government Licence.

To view this licence visit: www.nationalarchives.gov.uk/doc/open-government-licence or email: [email protected].

Where we have identified any third party copyright information in the material that you wish to use, you will need to obtain permission from the copyright holder(s) concerned.

Published September 2016 by Department for International Trade.