eNews from GAD: issue 35, April 2019

Published 30 April 2019

eNews from GAD Issue 35, April 2019

Welcome to eNews

Welcome to GAD’s regular newsletter. This year sees the 100th anniversary of the creation of GAD, a dedicated actuarial department within government, as one of the recommendations of the landmark Haldane Report. Throughout this year we are celebrating the central role we play in helping our clients deliver on public policy, as explained in this edition. We also examine the social security developments that were GAD’s original focus, and a recent GAD and HM Treasury event that considered the wider areas of public financial risk where we now offer support.

Martin

I hope that you enjoy this issue. Previous issues of eNews are available on our website

News from GAD

International Finance Review (IFR) awards

The IFR awarded the EMEA 2018 Structured Finance Issue of the year to the government’s Student Loan Sale programme. This programme’s ground-breaking securitisation of student debt had its first sale to private investors in December 2017. GAD had an integral role throughout the project and developed the underlying valuation model used. After this success, and with GAD’s continued support, a second sale went to market in December 2018 and work on future sales continues.

Review of the Local Government Pension Scheme Northern Ireland

Experts from GAD have carried out the first ever review of the Local Government Pension Scheme Northern Ireland (LGPS NI) required under Section 13 of the Public Services Pensions Act (Northern Ireland) 2014 . As part of our review GAD assessed the fund in terms of its compliance, consistency, solvency and long term cost efficiency. We concluded that the 2016 actuarial valuation of LGPS NI and the resulting employer contribution rates achieve the aims set out in Section 13 of the Act.

New government indemnity scheme for GPs

On 1 April the government introduced comprehensive, automatic cover for NHS GPs in England for future clinical negligence claims. This is part of the new contract for GPs and marks a key step in delivering the NHS Long Term Plan. The Clinical Negligence Scheme for General Practice is designed to provide more stable and affordable indemnity cover for GPs. GAD provided key advice throughout the development of the new scheme, including advising on the structure of the new scheme, supporting the valuation of the liabilities, and analysing costs and benefits

Celebrating GAD’s centenary!

The Government Actuary’s Department was established in 1919 to be a dedicated source of actuarial advice within government. The last 100 years have seen GAD’s expertise in actuarial analysis evolve and flourish through continued innovation and development within the department. The modern GAD is a diverse, flexible and esteemed Civil Service department that our first Government Actuary, Sir Alfred Watson, could have only imagined.

100 Years at GAD

Year of celebration

We will be marking this milestone year with a programme of celebration including a centenary lecture, which is scheduled for 6 June.

GAD'S Centenary programme

eNews from GAD will showcase a series of engaging ‘deep dives’ into each of GAD’s main specialist areas; social security, pensions, investment, insurance and modelling. The series begins in this edition with a discussion of our work in social security.

A century of progress

In 1919, the UK government faced many challenges. In public health, high rates of childhood mortality and the impact of infectious diseases left average life expectancy at birth at around 55 years. The influenza pandemic of 1918 was only then subsiding, leaving a global death toll of more than 50 million in its wake.

Fast forward to today and through a combination of rapid healthcare improvements and rising living standards, the UK’s average life expectancy at birth is now around 80 years. There are around 15,000 centenarians alive in the UK and during 2019 we expect more people than ever before will be celebrating this milestone birthday.

A century ago, there were also opportunities for government to address social inequalities. British society has changed substantially since then, on the whole becoming more inclusive, although there is still much to be done. As an example, the House of Commons was historically the preserve of men. Now, new stats show the Commons are becoming increasingly more representative of society with a record number of women and or LGBTQ MPs, as well as many from ethnic minorities and a range of educational backgrounds.

GAD’s contributions

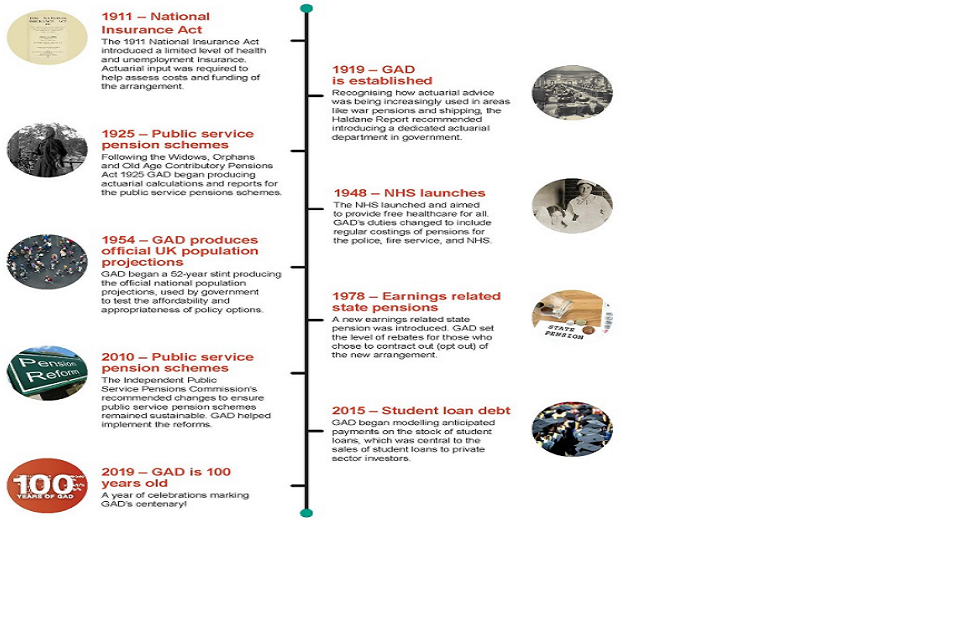

For the last 100 years, GAD have advised government, helping public servants to make informed choices on the path to creating a better society. Our centenary provides an opportunity to recall and reflect on the contributions by GAD experts to building the United Kingdom of today. The timeline on the next page looks back at some key highlights from GAD’s first 100 years.

Key highlights from GAD's first 100 years

Embracing the future

We now live in an increasingly global and digital age with few barriers to communication and information sharing. The tools at government’s disposal for maintaining robust public finances are more sophisticated than ever, including:

- The Office for Budget Responsibility’s ‘Fiscal Risks Report’

- The Orange Book: ‘Management of risk – Principles and Concepts

There are many uncertainties for the government to navigate, including emerging climate change, rapid changes to our digital world (including developments in artificial intelligence), and the risk of economic shocks. GAD will continue to evolve to ensure that, whatever challenges the next century brings, our government will continue to receive the high quality risk analysis and support it requires.

Please contact [email protected] for further details on the centenary celebrations.

Centenary deep dive: GAD’s role in social security

Successive government actuaries have supported the state pension and welfare system. This has included advising on government policies, projecting the financial effects of changes and providing regular reports to parliament throughout a century of social security reform.

Beginnings

In 1908, David Lloyd George introduced non-contributory means tested pensions from age 70. Benefits on sickness and disability followed soon after, funded by national insurance contributions. In the 1920s pensions became contributory, pension age was reduced to 65, and regular increases were introduced to prevent erosion by inflation. The 1940s saw the female pension age reduced to age 60. The newly formed GAD provided advice on all these changes.

Beveridge’s vision

While Britain fought World War II, senior civil servant Sir William Beveridge explored post-war societal improvements with a committee that included the Government Actuary George Epps. Their 1942 report envisaged a contributory state pension supporting rich and poor alike: * pension benefit rate sufficient to meet basic living costs for all recipients * flat-rate contributions paid by all workers (above an earnings threshold) * a National Insurance Fund to collect any surplus of contributions over benefit payments

After the war ended in 1945, Clement Attlee’s government was elected with a mandate for social reform. They implemented Beveridge’s proposals, albeit with some changes due to financial and other constraints. The pension benefit payment rate was lowered, and the scheme operated on a largely pay-as-you-go basis. (The National Insurance Fund operates as a buffer to smooth out year-on-year fluctuations.) Ongoing regular reviews, still supported by annual GAD reports, keep benefit rates broadly in line with inflation.

Earnings related reform

In 1961, a partially earnings related top-up to the flat-rate pension was introduced along with additional contributions. These later became fully earnings related in 1978. Members of occupational pension schemes could opt out of the top-up pension benefit (‘contract out’) in return for paying a lower contribution rate. Rebate rates were set by the Government Actuary. Among several changes in the 1980s, contracting out was extended to personal pension arrangements.

Back to the future

Further changes in the early 21st century led to growing complexity. In 2014 the Government decided that full scale reform was needed.

These most recent reforms have a ‘back to the future’ feel. As was Beveridge’s vision, the focus has shifted back to supporting low earners. In addition, phased increases to the state pension age (SPA – the age from which state pension is paid) are being introduced over time.

What next?

Since 2016 those reaching SPA have received a flat-rate main state pension. This is set above the threshold for means-tested benefits (ie the amount deemed necessary to cover basic living costs). Women now reach SPA at the same age as men, and since December 2018 both now reach SPA after their 65th birthday. The newly introduced state pension ages will be kept under regular review, as will the sustainability of the new flat rate pension. Advice from the Government Actuary has been a key part of this process and is likely to continue to be so for many years to come.

Managing contingent liabilities in the public sector

On 21 February 2019 GAD and HM Treasury co-hosted an event to discuss obligations which may arise from uncertain future events (‘contingent liabilities’). The event explored questions as to how departments can best identify, measure, monitor and manage the risks they face; and how HM Treasury can help to further improve the management of these liabilities. This article reports from the event and summarises its key outcomes.

Who attended?

We were pleased to welcome over 60 attendees from across the public sector, representing organisations including: Ministry of Defence, Pension Protection Fund, Ministry of Housing, Communities and Local Government, Local Government Mutual, Department for Education and Department for Transport.

What was discussed?

The event focused on contingent liabilities: for example costs relating to contractual guarantees or natural disasters. Topics covered included:

- Background to the contingent liabilities framework: A framework used to approve new contingent liabilities, developed by HM Treasury.

-

Sharing and learning from good practice: Departments provided an overview of their approaches to managing contingent liabilities. In addition, the Department for International Development explained how they helped set up Kenya’s Hunger Safety Net Programme that directly supports Kenyans impacted by droughts.

-

Techniques for modelling risk: GAD illustrated how modelling can help support effective contingent risk management, providing demonstrations of:

-

World Bank case study: GAD has developed tools to help countries understand and develop financing strategies to mitigate against natural disasters

-

Department for Education (DfE) case study: closer to home, GAD’s scenario modelling is helping DfE to understand its risks, such as the cost of a serious flooding event on academy schools

-

Looking forward

Attendees contributed to round table discussions that will support an HM Treasury policy paper feeding into 2019 Spending Review. A selection of proposed actions are shown below:

- provide a central source of information, expertise and tools to support departments and decision making

- incentivise the effective risk management of contingent liabilities

- continue to develop the existing contingent liabilities framework

There was a recognition that contingent liabilities stem from long-term risks but government funding and decision-making focuses on a one-year time horizon. Overcoming this remains challenging.

Next steps

A huge thank you to our speakers and attendees for making the event such a success. GAD and HM Treasury plan to keep in touch with attendees and use case studies of current best practises to support policy recommendations. Please contact [email protected] for a copy of the slides, to contribute your ideas, or if you would like to discuss the topic in more detail.

Developments

Public service pensions valuations – cost control mechanism

In December 2018 the Court of Appeal ruled that the transitional protection offered to some public service pension scheme members as part of the 2015 pension reforms was discriminatory. The government is currently seeking leave to appeal this ruling. In light of the significant but uncertain impact the Court of Appeal judgement may have on accrued pension benefits, HM Treasury (following consultation with the Government Actuary) recently published amended directions to pause the “cost control mechanism” element of the valuations of public service pensions. The part of the valuations which sets employer contribution rates between 2019 and 2023 had already been completed.

Collective Defined Contribution Pension Schemes

The Department for Work and Pensions has published the government’s response to the department’s consultation on delivering collective defined contribution (CDC) pension schemes. (See GAD’s Technical Bulletin for background). In his foreword, Guy Opperman MP, the Parliamentary Under Secretary of State for Pensions and Financial Inclusion, commented that the vast majority of the responses to the consultation were supportive of the proposals. He confirmed that the government intends to move forward with legislating to facilitate CDC provision as soon as parliamentary time allows.

Life expectancy

The UK actuarial profession’s Continuous Mortality Investigation has published a revised projections model for estimating future improvements in life expectancy of the UK population. This model is widely used by actuaries in advising private pension schemes and insurance companies. The update recognises the recent trend of slowing improvements in lifespans. (See GAD’s December 2018 Mortality Insights) for more details. The updated model suggests that the expected average remaining lifespans of people reaching age 65 now could be around six months lower than the model had estimated previously.

Restricting exit payments in the Public Sector

The government has launched a consultation on draft regulations to implement a cap of £95,000 on exit payments, such as payments associated with loss of employment, in the public sector. Powers to cap exit payments were introduced in the Small Business, Enterprise and Employment Act 2015. This consultation sets out secondary legislation to implement this cap, including a proposed method and details of which bodies should be in scope.

Review of the Financial Reporting Council

Following the Kingman Review, the Department for Business, Energy and Industrial Strategy has announced that the Financial Reporting Council (FRC) will be replaced with a new regulator. Currently the FRC oversees the regulation of the actuarial profession in the UK. The review’s final report recommends that the government should review the regulation of the actuarial profession. The report advises that neither the FRC, nor its replacement, is best placed to be the oversight body. No changes in the profession’s oversight or standards have been announced at this stage.

Contact GAD: Email: [email protected], Telephone: 020 7211 2601