Academies accounts return 2023 to 2024: guide to completing the online form

Updated 5 November 2024

Applies to England

General information - 2023 to 2024 academies accounts return

This section includes:

- about the academies accounts return

- new features

- who should complete the academies accounts return

- who is responsible for each trust’s academies accounts return submission

- further help and information

- guidance review date

About the academies accounts return

This guide provides guidance to academy trusts on how to complete and submit the 2023 to 2024 accounts return (AR) to the Department for Education (DfE).

For more information about the AR read the academies accounts return.

Government departments, including DfE, prepare accounts based on International Financial Reporting Standards (as amended for the public sector context) described in HM Treasury’s Financial Reporting Manual (FReM).

The annual accounts prepared by the DfE for the academies sector is known as the Sector Annual Report & Accounts (SARA). The AR is the tool used to collect financial data to produce the SARA.

Academy trusts’ annual financial statements are prepared in accordance with the Charities Statement of Recommended Practice (FRS102), known as the Statement of Recommended Practice (SORP), with guidance and requirements given in the Academies Accounts Direction.

As the AR and audited financial statements follow different financial reporting frameworks, there are some areas where the AR requires additional information or information that is more detailed compared to that required in the financial statements. Read the ‘Academies accounts return 2023 to 2024: additional information requirements’ from the [Academies accounts return] (https://www.gov.uk/guidance/academies-accounts-return) to find detailed information on the differences between the financial statements and the information required for the AR.

New features

| Quick links - new features | |

|---|---|

| 1.2.1 New features AR 2023/24 | 1.2.2 Key areas to draw attention to when completing the academies accounts return |

1.2.1 New features AR 2022/23:

As with previous years, the AR has been updated in response to user feedback and policy and regulatory changes. The main changes this year are:

Overview

DfE Sign-in role name changes - the role names of the following users have been updated.

- ‘Internal Approver’ role name changed to ‘Accounts Return Trust Approver’

- ‘Internal Preparer’ role name changed to ‘Accounts Return Trust Preparer’

- Superuser’ role name changed to ‘Approvers’

New question added to the Academy Trust Information section - this question asks for information about which actuarial firms provide the local government pension scheme (LGPS) valuation included in this AR

Statement of financial accounts (SoFA)

-

Field removed - RGR011_PY – Prior year 16 to 19 allocations. This field is removed from Revenue Grants – DfE. This data was collected as a one-off in AR 2022 to 2023 so that we could collect the previous year figure

-

New field - STF061 – ‘Other Employee Benefits’ added to ‘Staff Costs’ table. This amount is included in ‘other employee benefits’ in the academies model accounts, note 10a as part of ‘Staff costs’

Balance Sheet Funds and Other Disclosures

- New field - DBO061 - ‘Pension Surplus Deemed Irrecoverable’ added to Changes to the present value of the defined benefit obligation section to report any increase to the obligation required to reflect the pension surplus deemed irrecoverable under FRS102

- New field - DBO061_PY - ‘Pension Surplus Deemed Irrecoverable Prior Year’ added to Changes to the present value of the defined benefit obligation section to report any increase to the obligation required to reflect the pension surplus deemed irrecoverable under FRS102 for the previous year (September 2022 - August 2023)

- New field - FVA051 - ‘Pension Surplus Deemed Irrecoverable’ added to Changes to the fair value of assets section. This field will be pre-populated with DBO061.

- New field - ROD101 added to ‘Reconciliation of deficit section’. This field will be pre-populated with DBO061.

- Updated field guidance for DBO070 - ‘Actuarial loss/(gain) - financial assumptions’ updated to remove reference to Pension Surplus Deemed Irrecoverable which should now be reported in DBO061- ‘Pension Surplus Deemed Irrecoverable’.

- Updated field description – SAP030 and SAP040 in the ‘Sensitivity Analysis’ table has been changed from using ‘Mortality rate’ to ‘Life expectancy rate’. The guidance also reflects this change of wording.

Benchmarking

- Guidance for BAE230 - Educational consultancy updated to include high needs support for pupils.

Reports

Users can now access their previous years accounts returns on the accounts return index page. This is available on the right hand side of the index page under the title ‘Download Previous return’.

1.2.2 Key areas to draw attention to when completing the academies accounts return:

This section is intended to draw attention to areas where inconsistencies were noted within the submission of the academies accounts return or where more recently changes have taken place. This is to highlight where improvements can be made in the quality of the return data:

- Number of employees whose emoluments exceed £60,000 and £100,000: Ensure that for both sections, emolument bandings are selected based on total emoluments which includes salary, employer pension contributions and other benefits. It was noted that previously, in particular for the emoluments over £60,000 that employer pensions contributions were not always included when selecting the emoluments banding.

- Staff numbers: permanent and temporary staff numbers should be full time equivalent figures which differs from the requirement in the audited financial statements which requires average headcount (with an optional FTE disclosure allowed if preferred).

- COVID-19 funding: ensure that any COVID-19 grant income is disclosed in either of the following fields: RGR151, RGR152, RGR153, ORG041 or ORG042.

Academies chart of accounts (ACoA) reallocations: Refer to After accepting the FMS submission - accounts return for information on how to manually reallocate values in the AR if you are completing the online form through automation.

Who should complete the academies accounts return?

All academy trusts with academies open at any point during the year from 1 September 2023 to 31 August 2024, including trusts that transferred out all their academies on 1 September 2024, are required to complete the AR online form.

Throughout this guide, the term ‘academy’ includes the following entities:

- sponsored academies

- academy converters

- free schools

- university technical colleges

- special academy schools

- alternative provision academies

- studio schools

- sixth form academies

Who is responsible for each trust’s academies accounts return submission?

These guidance notes use the terms ‘academy trusts’ and ‘trusts’ interchangeably to avoid confusion as to the nature of the reporting entity.

The legal requirement to prepare, have audited and file financial statements sits with the charitable companies (academy trusts) and arises from the Companies Act 2006. This means that multi-academy trusts (MATs), which operate more than one academy, have one corporate legal entity (the charitable company) but several operational units and trading names (the individual academies).

The requirements to file a trust’s audited financial statements and provide information to enable the the DfE to fulfil their statutory duty to prepare the SARA, fall on the trustees (directors) of the charitable companies (the trusts).

Note: although the trust assigns an external auditor approver to submit the accounts return to the DfE, the responsibility for accurate data remains with the trust’s financial accounts preparer or approver, that is the trustees.

Further help and information

This guidance is complementary to other information available to help trusts complete the AR. The additional resources and guidance available are:

| Resources and guidance available | Description |

|---|---|

| AR online form guidance | This is the primary source of guidance with many tables displaying guidance text at the top of the table. Most fields have a ‘Help with’ link below the field name to provide specific guidance. |

| Reports | On the online form homepage, the right-hand column ‘Information and guidance on completing the Academies accounts return’ includes a drop-down box under ‘Download return’ where trusts can select a table to print or can download most of the return into Excel or PDF. You are also able to run a report for your trusts previous years accounts returns. |

| Online tutorial videos | To help with completion of the AR, we advise you to view these before accessing the AR as they will include tips on how to assign an external auditor, navigate the form and how to clear validations. Online videos can be found in this guidance. |

| AR workbook | A workbook which mirrors the AR online form as far as possible. Trusts may find it useful to complete this workbook prior to completing the online AR. However, it should be noted that this workbook cannot be used to submit the AR data, the online form itself must be submitted. The AR workbook can be found on in academies accounts return. |

| Academies accounts return 2022/23: Additional requirements to the financial statements | The DfE published a document outlining the main differences between the financial statements and the AR to help trusts prepare for the returns. The document can be found in the academies accounts return. |

| Additional pensions information | A guide and example pension actuarial results schedules are available to help trusts complete the pension sub-section. The additional pension information can be found on the AR web page. |

| Academies Chart of accounts | The updated standardised Academies chart of accounts (CoA) can be found in Academies chart of accounts and automating the accounts return which provides a workbook showing detailed mapping of income and expenditure into the AR online form fields. Within the document, the tab named ‘CoA structure and mappings’ tab provides support to complete the AR. |

| Academies Accounts Direction | The Academies Accounts Direction is used by academy trusts, their auditors and reporting accountants to prepare and audit financial statements for the accounting period ending on 31 August annually. |

| Academies model accounts | These are model accounts based on a fictional academy trust (Coketown Academy Trust), which helps academy trusts to see what the accounts should look like. |

| Framework and guide for external auditors and reporting accountants of academy trusts | Supports external auditors with their obligations to issue an audit opinion as to whether the financial statements present a true and fair view. The document may also be of interest to trustees, accounting officers and chief financial officers to help them understand the requirements, roles and responsibilities of external auditors and reporting accountants. |

| Help with specific queries | Any questions not addressed in the above tools and guidance should be submitted to the customer help portal by providing an explanation of the issue and an accompanying screen shot where applicable. |

| Help with incorrect pre-populated data | If the pre-populated data in the academy trust information or academy information table is incorrect, email [email protected] including the trust unique provider identification number (UPIN) and details of what should be changed. |

| “Having trouble with this service?” | If yoou are experiencing technical difficulties with the AR online form, use the link available on the right-hand menu of the index page to report the problem. If we are already aware of an issue, it will be posted under ‘Known issues’, along with advice on how to proceed. If your issue is not listed here, click ‘customer help portal’ to report it. |

| Help forums | Once the AR form has launched, dial ins (by phone or through Microsoft Teams) and web chat sessions will be available for AR users to ask questions or raise issues directly with a member of the AR team. A full schedule is published on academies accounts return. |

Guidance review date

This guide is only applicable to completing and submitting the AR 2023 to 2024 .

The next review of this guide will be in summer 2025.

Accounts return completion process

This section includes:

- steps to follow when completing the accounts return

- getting started (DfE Sign-in registration)

- accounts return review, approval and submission

- important points to note when completing the return

A trust should submit a return that matches the scope of its financial statements. Therefore, a trust preparing consolidated financial statements should submit a consolidated return, which includes the same legal entities (for example, trading subsidiaries, or in some cases a subsidiary academy trust).

The AR must be submitted no later than 28 January 2025

Steps to follow when completing the accounts return

Below is a summary of the steps to follow when completing the return.

| Step | Action |

|---|---|

| 1 | Log into DfE Sign-in to either register or review and update existing information. Approvers must review user roles and approve any new positions. Register for a DfE Sign-in account |

| 2 | Log into the online forms service for academy trusts and select the accounts return online form for 2023 to 2024. |

| 3 | Where a trust has submitted an AR the previous period, we will use details from that submission to pre-populate the current year External auditor details table. If the details are correct, tick the box and mark the table as complete or edit/add the correct details. See section 3.1 for more information about setting up external auditor details. |

| 4 | Academy trust preparer/approver or external auditor preparer completes the Overview to Counterparty sections of the return. The external auditor preparer/approver cannot complete the External auditor details table in the overview section. |

| 5 | Then clear all hard validations and provide explanations (where applicable) to all soft validations. |

| 6 | If a preparer completed the return, then they should complete the preparer declaration table so that the accounts return internal approver can review the form and if happy approve it. |

| 7 | The external auditor approver reviews the form, approves and submits it to DfE when satisfied. The external auditor approver can reject the form and send it back to the accounts return approver for amendments. |

Getting started – DfE Sign-in registration and roles

| Quick links - DfE Sign-in registration and roles | |

|---|---|

| 2.2.1 DfE Sign-in registration | 2.2.2 DfE Sign-in user roles within the AR |

2.2.1 DfE Sign-in registration and roles:

- all preparers and approvers will need to be set up on the DfE Sign-in system to fulfil their relevant responsibilities in the AR form

- users who completed the AR 2022 to 2023 can use the same DfE Sign-in details to access AR 2023 to 2024

- new users will need to be set up, including an Approver for new trusts which should be registered at the earliest opportunity

- an approver must invite appropriate staff within their trust to register to use DfE Sign-in and assign specific roles

New external auditors must register for an external user account with DfE Sign-in. The External Auditor will then need to request access to the trust’s AR by submitting a query to DfE using the customer help portal. Once this has been checked with the trust, access will be approved. External auditors will have access to the online form once the trust has assigned a role by completing the external auditor details table in the overview section of the online form. For further information read Access the DfE Sign-in service.

2.2.2 DfE Sign-in user roles within the AR:

| Role | Description | Type |

|---|---|---|

| Approver | Can invite new users to register and allocate roles to already registered users within the DfE Sign-in system. This role is administrative and only applicable to the DfE Sign-in system. | Mandatory |

| Accounts return trust preparer | Can input information on the online form and send to the accounts return internal approver for approval. | Optional |

| Accounts return trust approver | Can input information on the online form and can approve this information. A trust can have multiple accounts return internal approvers who will have access to the AR online form at any point during the collection window. | Mandatory |

| External auditor preparer | Can input information on the online form to send to the accounts return trust approver for approval. | Optional |

| External auditor approver | Can view the return in a read only format at any point. Once the accounts return trust approver has approved the return, they can go in and review it. If happy, they can approve and submit to the DfE. If changes are required, the external auditor approver can send the return to the trust approver for amendments. Although the external auditor approver is assigned to submit the accounts return to the DfE, the responsibility for accurate data remains with the trust’s financial accounts preparer, that is trustees. |

Mandatory |

Throughout this guidance, the term ‘AR preparer’ refers to the accounts return internal preparer or the external auditor preparer.

2.2.3 AR navigation:

It is possible to have multiple sessions open at the same time, however only the first user (who can input information in the online form) to login will have read/write access, subsequent users will have read only access, that is they will not be able to edit any fields while the first user is online.

If another user (who can input information in the online form) requires read/write access they will need to wait until the first user has ended their session so that they can then login as the first user.

Accounts return review, approval and submission

| Quick links - AR review, approval and submission | ||

|---|---|---|

| 2.3.1 Reviewing the accounts return | 2.3.2 Approving the AR – trust stage | 2.3.3 Approving the AR – auditor stage |

Once the return has been completed by the AR preparer, the AR trust approver can then review the entries made in the form.

2.3.1 Reviewing the accounts return

The accounts return trust approver should review the content of the online form by checking each screen has been correctly populated.

Reports

The online return provides a series of reports to support the accounts return internal approver in their role. The ‘Reports’ menu can be found in the right-hand side of the ‘Academy trust accounts return’ index page. Reports can be downloaded as Excel or PDF files.

Summary tables

In addition, the ‘Summary’ menu on the main ‘Academies trust accounts return’ dashboard contains the following summary tables to help trusts review the data entered into the AR:

SoFA summary: This table is populated with values from the various SoFA tables throughout the form (see table below). Trusts should be able to reconcile this SoFA to the SoFA in their financial statements. There may be genuine reasons for differences between IFRS and SORP, trusts are recommended to retain an audit trail of any such adjustments.

- Income

| SoFA summary AAR reference | SoFA Summary AAR description | Calculation | AR section where the calculation reference can be found |

|---|---|---|---|

| SSM010 | Donations | DONTOT | SoFA |

| SSM020 | Transfer on conversion from local authorities and elsewhere | TSD010 + TSD020 | SoFA |

| SSM030 | Transfer of existing academies into the trust | TSD030 | SoFA |

| SSM040 | Capital grants | CGRTOT+ CGGTOT + OCGTOT | SoFA |

- Income – charitable activities

| SoFA summary AAR reference | SoFA Summary AAR description | Calculation | AR section where the calculation reference can be found |

|---|---|---|---|

| SSM050 | Funding for the academy trust’s educational operations | RGRTOT + RGGTOT + ORGTOT + INCTOT | SoFA |

| SSM060 | Provision of boarding activities | PBITOT | SoFA |

| SSM070 | Other trading activities | OTATOT | SoFA |

| SSM080 | Investments | INVTOT | SoFA |

| SSM090 | Total | SSM010 + SSM020 + SSM030 + SSM040 + SSM050 + SSM060 + SSM070 + SSM080 | SoFA Summary |

- Expenditure

| SoFA summary AAR reference | SoFA Summary AAR description | Calculation | AR section where the calculation reference can be found |

|---|---|---|---|

| SSM100 | Raising funds | CRFTOT * (-1) | SoFA |

| SSM110 | Transfer of existing academies out of the trust | TSD040 * (-1) | SoFA |

- Expenditure – charitable activities

| SoFA summary AAR reference | SoFA Summary AAR description | Calculation | AR section where the calculation reference can be found |

|---|---|---|---|

| SSM120 | Academy trust educational operations | (CADTOT + CASTOT) * (-1) | SoFA |

| SSM130 | Provision of boarding activities | (PBES010 + PBES020) * (-1) | SoFA |

| SSM140 | Other | (OEX010 + TSES010 + TSES020) * (-1) | SoFA |

| SSM150 | Total | SSM100 + SSM110 + SSM120 + SSM130 + SSM140 | SoFA Summary |

| SSM160 | Net income/(expenditure) | SSM090 + SSM150 | SoFA Summary |

| SSM170 | Transfers between funds | TTF070 | Balance Sheet Funds and Other Disclosures |

| SSM180 | Actuarial gain/loss on pension fund | FVA080 - DBO070 - DBO080 - DBO090 | Balance Sheet Funds and Other Disclosures |

| SSM190 | Valuation gain or loss on tangible and intangible fixed assets | IFC100-T + IFA070-T + TFC130-T + TFD070-T | Balance Sheet Assets |

| SSM200 | Valuation gain or loss on investment portfolio | NCI130-T + CUI130-T | Balance Sheet Assets |

| SSM210 | Net movement in funds | SSM160 + SSM170 + SSM180 + SSM190 + SSM200 | SoFA Summary |

Balance sheet summary: This table is populated with values from the various balance sheet tables throughout the form (see table below). Trusts should be able to reconcile this balance sheet to the balance sheet in their financial statements.

- Fixed assets

| Balance sheet summary AR reference | Balance sheet summary AR description | Calculation | AR section where the calculation reference can be found |

|---|---|---|---|

| BSM010 | Intangible assets | IFVTOT | Balance Sheet Assets |

| BSM020 | Tangible assets | TFVTOT | Balance Sheet Assets |

| BSM030 | Long term non-current investments | NCITOT-T | Balance Sheet Assets |

| BSM040 | Debtors greater than 1 year | DEBTOT-B | Balance Sheet Assets |

| BSM050 | Total fixed assets | BSM010 + BSM020 + BSM030 + BSM040 | Balance Sheet Summary |

- Current Assets

| Balance sheet summary AR reference | Balance sheet summary AR description | Calculation | AR section where the calculation reference can be found |

|---|---|---|---|

| BSM060 | Stock | STO010 | Balance Sheet Assets |

| BSM070 | Debtors less than 1 year | DEBTOT-A | Balance Sheet Assets |

| BSM080 | Cash at bank and in hand | CSH010 | Balance Sheet Assets |

| BSM090 | Current investments | CUITOT-T | Balance Sheet Assets |

| BSM100 | Total current assets | BSM060 + BSM070 + BSM080 + BSM090 | Balance Sheet Summary |

- Liabilities

| Balance sheet summary AR reference | Balance sheet summary AR description | Calculation | AR section where the calculation reference can be found |

|---|---|---|---|

| BSM110 | Creditors: amounts falling due within one year | CRDTOT-A * (-1) | Balance Sheet Liabilities |

| BSM120 | Net current assets | BSM100 + BSM110 | Balance Sheet Summary |

| BSM130 | Total assets less current liabilities | BSM050 + BSM100 + BSM110 | Balance Sheet Summary |

- Long term liabilities

| Balance sheet summary AR reference | Balance sheet summary AR description | Calculation | AR section where the calculation reference can be found |

|---|---|---|---|

| BSM140 | Creditors: amounts falling due after more than one year | CRDTOT-B * (-1) | Balance Sheet Liabilities |

| BSM150 | Provisions | PMTTOT * (-1) | Balance Sheet Liabilities |

| BSM160 | Pension liability | FVATOT - DBOTOT | Balance Sheet Funds and Other Disclosures |

| BSM170 | Total long-term liabilities | BSM160 + BSM140 + BSM150 | Balance Sheet Summary |

| BSM180 | Net assets/(liabilities) | BSM130 + BSM170 | Balance Sheet Summary |

- Restricted Funds

| Balance sheet summary AR reference | Balance sheet summary AR description | Calculation | AR section where the calculation reference can be found |

|---|---|---|---|

| BSM190 | Fixed asset fund | RFFTOT-T | Balance Sheet Funds and Other Disclosures |

| BSM200 | Restricted income fund | RGFTOT-T - RGFTOT-D | Balance Sheet Funds and Other Disclosures |

| BSM210 | Pension fund | RGFTOT-D | Balance Sheet Funds and Other Disclosures |

| BSM220 | Endowment fund | UEFTOT-A | Balance Sheet Funds and Other Disclosures |

| BSM230 | Unrestricted fund | UEFTOT-B | Balance Sheet Funds and Other Disclosures |

| BSM240 | Total funds | BSM190 + BSM200 + BSM210 + BSM220 + BSM230 | Balance Sheet Summary |

Outstanding validation triggers: This table lists any validation errors that have not been resolved. These errors will need to be cleared before the accounts return internal approver can approve the return. Once there are no remaining validations errors, the screen will display a message to confirm this.

The AR internal approver can amend the data in the return prior to completing the approval process.

2.3.2 Approving the AR – trust stage

When all validations have been cleared and all available tables show a status of ‘Complete’, the ‘Approval and submission’ tables will become available to complete.

| Step | Description |

|---|---|

| Step 1 - Preparer declaration | This is optional. If you have no AR preparer, you will need to answer ‘No’ to question 29 in the questionnaire. The questionnaire can be found in the ‘Overview’ section. The designated AR preparer, either a trust employee or an external auditor preparer, would need to confirm they have completed the AR accurately and resolved all validations. Once the AR preparer completes and approves the preparer declaration table, the AR form will become read only for them. The external auditor preparer must not also act as the external auditor approver for the same trust. No amendments can be made by the AR preparer until they revoke their approval before the academy trust approver approves the AR or the academy trust approver rejects the AR form.. |

| Step 2 - Academy trust declaration | To be completed by a responsible finance officer within the trust. If the individual is the trust accounting officer, they should confirm ‘yes’ read the declaration that appears and click the final box to approve the AR. If the accounts return trust approver is not the accounting officer, the form will ask for confirmation that the approver has the authorisation of the accounting officer to approve the return. Once approved, the accounts return trust approver should inform the trust’s external auditor approver that the trust has approved the AR. The return will be locked in read-only mode for the internal approver. Unlocking the form - The accounts return internal approver can unlock the form for editing, providing it has not been approved by the external auditor approver, by revoking their approval on the academy trust declaration table. Trusts should only do this in conjunction with their auditors who may have completed some of their review work on the previously approved version. To unlock the form the accounts return internal approver must untick the approval box on the academy trust declaration table. |

2.3.3 Approving the AR – auditor stage

| Step | Description |

|---|---|

| Step 3 - External auditor approval | The external auditor approver role is to review the data which has been entered into the form to ensure that it is consistent with the audited financial statement. Also and that is has been properly extracted from financial records and presented in the AR in accordance with the guidance notes issued by the DfE. See the sample declaration below this table. If the external auditor approver has approved the AR and wants to revoke their approval, this can be done by ticking the reject option on the ‘External auditor declaration’ page. |

| Step 4 - Submission | Once the external auditor approver completes the external auditor approval table, the submission table will then become available for them to submit the return to DfE on behalf of the trust. Trusts should note that once the external auditor approver has approved and submitted the return, no further amendments can be made as the AR form becomes read only for every user and any subsequent issues will need to be raised by contacting our enquiry service using the customer help portal It is not possible to amend your submitted return. Subsequently, any data submitted in error could be used for further information requests such as Freedom of Information. The external auditor approver for the AR can be different to the auditor who signed off the trust’s financial statements. |

Sample external auditor declaration

“INDEPENDENT REPORTING ACCOUNTANT’S REPORT ON THE ACCOUNTS RETURN FOR COKETOWN ACADEMY TRUST FOR THE YEAR ENDED 31 AUGUST 2024

We have examined the Accounts Return, together with the audited statutory financial statements of Coketown Academy Trust for the year ended 31 August 2024 prepared under section 396 of the Companies Act 2006, and the applicable framework comprising the Charities SORP and the Academies Accounts Direction 2023 to 2024.

This report is made solely for Coketown Academy Trust in accordance with our instructions. Our work has been undertaken so that we might state for Coketown Academy Trust those matters we are required to state to them in an independent reporting accountant’s report and for no other purpose. To the fullest extent permitted by law, we do not accept or assume responsibility to anyone other than Coketown Academy Trust, for our work, for this report, or for the conclusions we have drawn.

Respective responsibilities of the trustees and independent reporting accountant

The trustees are responsible for preparing the Accounts Return, in accordance with the requirements set out in the guidance notes issued by the Education Skills Funding Agency, and the audited statutory financial statements.

It is our responsibility to report to you our conclusion as to whether:

- information in the Accounts Return is consistent with Coketown Academy Trust ‘s audited statutory financial statements for the period; and

- where appropriate has been properly extracted from Coketown Academy Trust ‘s financial records and presented in the Accounts Return in accordance with the guidance notes issued by the Education Skills Funding Agency.

Scope

As a practising member firm of the Institute of Chartered Accountants in England and Wales, the Association of Chartered Certified Accountants or other relevant accounting body, we are subject to the ethical and other professional requirements of that body.

We have not been instructed to carry out an audit or a review of the Accounts Return or of the underlying accounting records from which the Accounts Return is prepared. For this reason, we have not verified the accuracy or completeness of the accounting records or information and explanations you have given to us. Consequently, the procedures undertaken do not provide all the evidence that would be required in an audit and, therefore, we do not express an audit opinion on the information presented in the Accounts Return nor do we express an audit opinion in respect of the underlying accounting records from which the Accounts Return is prepared.

Conclusion

It is our conclusion that the information in the Accounts Return is consistent with the audited statutory financial statements of Coketown Academy Trust for the year ended 31 August 2024 and where appropriate has been properly extracted from Coketown Academy Trust ‘s financial records and presented in the Accounts Return in accordance with the guidance notes issued by the Education Skills Funding Agency.

I understand that the data which I am submitting may be shared by the Department for Education with their service providers. If you would like to find out more about how we process your data. Visit our privacy policy for details.”

Deadline for submitting the AR - the external auditor approver must submit the completed return to the DfE by 28 January 2025.

Important points to note when completing the return

- It is possible to have multiple sessions open at the same time, however only the first user (who can input information in the online form) to login will have read/write access, subsequent users will have read only access, that is they will not be able to edit any fields while the first user is online. If another user (who can input information in the online form) requires read/write access they will need to wait until the first user has ended their session so that they can then login as the first user.

- data is saved automatically every 2 minutes. Alternatively, you can save the data at any time by pressing the ‘Mark as complete’ button at the bottom left on each table.

- the AR form can be downloaded from the index page. You can download each section of the AR form (excluding the overview section) in either Excel or PDF format

- to print a specific page of the AR form, use the print facilities of the web browser you are using

- for further help and guidance, refer to the tutorial videos and the specific user guidance in academies accounts return

- to search a word on the AR screen you are viewing, press Ctrl + F, and type in your word in the search bar. For example, to find a section on ‘Pensions’ you may click ‘Open all’ to expand all sections of the index page, press Ctrl + F and search for ‘Pensions’. The word ‘Pensions’ will be highlighted wherever it appears. This functionality will also find cell references on a page. For example, if you are on the ‘Donations’ page and press Ctrl + F and search ‘DON020’, it will highlight the relevant field

Watch this tutorial video for more details about navigating around the AR online form.

2.4.2 Input data for AR

- where possible, the data used to populate the return should be taken directly from the trust’s audited financial statements without any amendments

- some entries will require some degree of aggregation or disaggregation of financial statement balances or FReM-style disclosures

- if there are differences between the disclosures in the accounts of individual trusts and those set out in the return, trusts will have to re-analyse their disclosures to fit those required by the return

- nursery numbers should be included within the trust’s total numbers in all tables with exception of the ‘Benchmarking’ and ‘Land & buildings’ tables where it would be included as part of the appropriate academy, and should also include private, voluntary and independent (PVI) nurseries if the DfE defines the school and nursery as a single entity

2.4.3 Validations

- validation checks ensure that values entered are consistent across different sections of the form

- when a validation is triggered, the validation reference will appear below the affected field which will also be highlighted in red and error details for the said validation will be available via a link at the bottom of the related cell reference

- the validation error message shows the values entered into each field within the validation, and where the validation triggers on an Academy level table, a link will be available to each academy

- the number of validation errors within each table is also displayed on the colour coded status buttons on the ‘index’ page next to each section header

- validations that have been triggered can be resolved as soon as they appear within a table, or later by clicking ‘next’ to continue with the return. Any unresolved validation errors will appear in the Outstanding validation triggers table in the Summary section

Watch this tutorial video for more details about validations.

Academies Accounts Return (AAR): Validation Introduction

2.4.4 Validation types

| Validation type | Description |

|---|---|

| Hard | Occur where data in various parts of the return should match, but do not. Hard validations must be resolved by correcting the values in the return or by ticking a confirmation box when you agree with the statement displayed. Hard validations end with a ‘H’ in the format VALXXXXH. |

| Soft | Occur where data entered is outside a particular threshold. The value can simply be corrected if entered in error. Where the value is correct, an ‘explanation’ box will appear next to the value in question and trusts will be required to provide an explanation for the figure. Soft validations end with a ‘S’ in the format VALXXXXS. |

Watch these tutorial videos for more details about clearing validations.

2.4.5 Clearing soft validations

Academies Accounts Return (AAR): Clearing soft validations

2.4.6 Clearing hard validations

Academies Accounts Return (AAR): Clearing hard validations

2.4.7 DfE Group organisations

Throughout the return, additional analysis is required so we can identify academy trust balances with designated bodies and the wider DfE group of organisations, composed of the core department, its executive agencies and non-departmental public bodies (NDPBs). Collectively, for the period 1 September 2023 to August 2024, these bodies are referred to as the DfE group:

- Department for Education (DfE)

- Education and Skills Funding Agency (DfE)

- Teaching Regulation Agency (TRA)

- Standards and Testing Agency (STA)

- Oak National Academy

- Social Work England

- Office of the Children’s Commissioner (OCC)

- Construction Industry Training Board (CITB)

- Office for Students (OfS)

- Engineering Construction Industry Training Board (ECITB)

- Institute for Apprenticeships and Technical Education

- Student Loans Company (SLC)

- LocatED

Overview table

This section includes:

The ‘Overview’ section of the AR has four tables. All four tables must be completed to proceed with the rest of the AR form.

Many of the AR tables and data entry rows/columns displayed within the AR form are dependent on information provided in the four tables within the ‘Overview’ section.

External auditor details

External auditor details will be prepopulated with the information provided in the 2022 to 2023 AR submitted by the trust. If the prepopulated data is correct, tick the box to confirm this. If the data is no longer relevant, update it by either using the ‘Add another external auditor’ link, and/or use the ‘edit’/ ‘remove’ links to the right of each prepopulated auditor details.’ If the trust did not submit an AR in 2022 to 2023, complete the external auditor details table by using the ‘Add another external auditor’ link.

Watch this tutorial video for more details about the external auditor section of the AR.

Academy trust information

Check the trust’s prepopulated data is correct and confirm by clicking the ‘Yes’ button. If the data is incorrect, click the ‘No’ button and use the e-mail link [email protected] to send the correct information to the AR team who will update the relevant details. Trusts are advised to check these details and feedback any updates to the AR team at the earliest opportunity.

Academy information

If an academy school within the trust is a teaching school hub it should report income and expenditure relating to the teaching school hub separately. Any such trust should select ‘Yes’ against the question “Is this academy school a teaching school hub?” to display additional fields relating to teaching school hub within the ‘SoFA’ and ‘Benchmarking’ sections.

The trust is required to confirm the status of each academy school within the trust. This can be done by selecting the correct status from the drop-down list which is situated below the DfE recorded status in the academy information table.

A trust should only select ‘closure in period’ where the academy school has shut down.

When the academy school has transferred to another trust, it should be classed as an ‘in period transfer out’ and where an academy school has joined from another academy trust, it should be classed as ‘in period transfer in’.

Where there is a transfer or a conversion, additional cells will be available on various tables within the AR form. The ‘Transfers and conversions’ section will also need to be completed.

Before marking the table as complete, check if the prepopulated data is correct and confirm by clicking the ‘Yes’ button. If the data is incorrect, click the ‘No’ button and use the e-mail link [email protected] to send the correct information to the AR team who will update the relevant details. Trusts are advised to check these details and feedback any updates to the AR team at the earliest opportunity.

Questionnaire

Most trusts will not have disclosures for every table in the return and completing this questionnaire tailors the return to the tables that are relevant to them.

Watch this tutorial video for more details about the questionnaire.

Trusts can change the answers to questions at any time before the form is approved. Note that doing so would also remove any associated data previously entered.

Trusts may find that certain responses are pre-populated and in a ‘read only’ (greyed out) format. This is because of the closing balances disclosed in the previous year AR.

Guidance can be found for many questions by clicking on the ‘Help’ link under the question. Additional guidance for specific questions (not included in the online form) is as follows:

| Question | Guidance |

|---|---|

| Question 5 - Has the Trust incurred any loss of office payments during the accounting period? | answer ‘yes’ to this question if the Trust has made payments in the accounting period to Trustees or Accounting Officers for loss of office. Exit payments made to other members of staff are not loss of office payments for the purpose of this question. |

| Question 6 - Has the trust included a note for ‘Related party transactions – Trustees - remuneration and expenses’ in its annual report and accounts? | We expect most academies to have a staff member who is a trustee. Their remuneration would therefore class as trustee remuneration. This is the case even if paid solely for their substantive role (for example, as head teacher). If a trust answers ‘No’ to this question, a soft validation will trigger. If no staff are trustees, then trusts can simply state this in the explanation box. |

| Question 26 - Did the Trust make any losses or special payments? | Answer ‘yes’ to this question if the Trust has transactions such as cash losses, claims abandoned, administration write-offs, fruitless payments, stock losses, gifts and special payments. Special payments are payments which may fall outside of the usual planned range of activity and may exceed statutory and contractual obligations. Examples include honoraria, ex-gratia, non-contractual exit payments, severance, termination, compensation or other payments. |

SoFA - income and expenditure tables

This section includes:

- SoFA: income: donations

- SoFA: income: grants questionnaire

- SoFA: income: capital and revenue grants

- SoFA: income: other income

- SoFA: expenditure

- SoFA: provision of boarding activities

Trusts should be able to reconcile the SoFA in the return to the SoFA in their annual financial statements. The completed SoFA can be found in the summary section of AR dashboard.

Donations

Information to be entered here can be found in the donations and capital grants disclosure section in the trust audited financial statements.

Capital grants should not be included in the ‘Donations’ table (DON) but under ‘Capital grant income’ table below (CGR).

Any capital donations entered in this section (DON) should equal donations shown in the fixed asset tables under balance sheet assets.

A capital donation is the gift of an asset. Where cash is donated, even if it is specifically for capital purposes, trusts should record it as other donations – revenue (DON040).

Transfers on conversion are not donations and should be shown under transfers on conversion lines, not in this section.

Grants questionnaire

All questions are related to any adjustments made for grants included within the trust’s financial statements.

If the trust has any repayable cash advances, answer Yes to question 1 and provide more detail in the box provided.

Question 3 will only be relevant for those trusts who have had an in-year transfer of an academy in/out of the trust.

Capital and revenue grants

| Quick links - capital and revenue grants | ||

|---|---|---|

| 4.3.1 DFE (CGR and RGR) | 4.3.2 DFE group (CGG and RGG) | 4.3.3 Other (OCG and ORG) |

DfE requires all grant income (revenue and capital) to be included within the charitable activities academy’s educational operations section.

Trusts should include capital grants in this section and not under donations.

Any re-presentation compared to a trust’s financial statements will therefore be reflected in the SoFA totals.

Academy Trusts can use the Academies chart of accounts workbook which shows detailed mapping of each type of grant into the AR form categories.

4.3.1 DfE (CGR and RGR)

Trusts should identify the correct grant heading to record income against.

Trusts are required to record DFE capital and revenue grants separately.

Teachers’ employers contribution pension grant (TPECG) should be included within field RGR150 ‘Revenue grants – DfE > Other’ until such time that it is included within GAG allocations.

4.3.2 DFE group (CGG and RGG)

DFE group grants should be used to record grants income from the departments executive agencies and non-departmental public bodies (NDPBs) ), for example, Student Loans Company (SLC), Standards and Testing Agency (STA) and Office for Students (OfS). See section 2.4 for the full current list.

Trusts should identify the correct grants heading to record income against and may use the Academies chart of accounts workbook which shows detailed mapping of each type of grant into the AR form categories.

4.3.3 Other (OCG and ORG)

Included within this section are grants from outside the Department of Education which might include Local Authorities, other Government departments and ALBs, such as National Lottery Community Fund and Sport England.

Local authority grants, for example, special educational needs (SEN) and early years grants, are not provided by the DfE and should be recorded as ‘Capital grants’ > ‘Other’ under OCG010, or ‘Revenue grants’ > ‘Other’ under ORG010, ORG020, or ORG030. They should not be recorded under the DfE grants table or the ‘other income’ table.

There are also a small number of COVID-19 funding income streams which fall into this section such as the Coronavirus catch up funding.

Other government grants could include grants from any other government departments excluding the DfE and local authority.

Non-government grants are any grants received from non-government organisations such as charities and philanthropic organisations.

Other income

| Quick links - other income |

|---|

| 4.4.1 Transfer SOFA disclosure |

Non-grant income should be detailed within this section.

Any income from educational visits and school trips should be included within ‘Non-government revenue’ (INC030).

Catering income should be split into two categories: ‘Student catering income’ (INC040) which should only include income from pupils; and ‘Catering income’ (OTA020) within the Other trading activities table which should include the income from staff and visitors.

Guidance relating to ‘Notional apprenticeship levy income’ (INC050) is available in section 5.1.1 of this guidance, within the staff and trustees information.

For ‘Teaching school hub income’ (INC060), if an academy within the trust is a teaching school hub, select ‘Yes’ in the academy information table for the said school. This field will then become available to complete.

Trusts with one or more teaching school hubs should include all grant income under ‘Revenue teaching school hub grants’ (RGR140), ‘ITT Bursaries Grant’ (RGR130) and ‘Capital teaching school hub grants’ (CGR090).

Any income in respect of claims made under the risk protection arrangement (RPA) scheme should be shown within the ‘Other trading activities’ table (OTA050). Further details on RPA are captured in the SoFA expenditure section 4.5 of the guidance

4.4.1 Transfer SOFA disclosure – conversions and academy transfers (TSD)

The return requires trusts to disclose the financial position of academies that have moved in or out of the trust during the academic year.

Information provided in this table is required at trust level, which is validated against the detailed academy level disclosures entered in the ‘Transfers and conversions’ section.

Expenditure

4.5.1 Costs of raising funds (CRF)

All expenditure incurred by the academy trust to raise funds for its charitable purposes, including the cost of all fundraising activities events and non-charitable trading, should be included in this section. These costs should also be included within the benchmarking section where relevant.

4.5.2 Charitable activities

These are costs incurred on the academy trusts educational operations, including support costs and costs relating to the governance of the academy trust apportioned to charitable activities.

CAS390 “Revenue expenditure from capital funding” should be used in the specific scenario where the Trust has derecognised assets under a Church Supplemental Agreement (e.g. owned by the Diocese), however has received capital funding within the year and spent this on capital improvements.

We are aware that Trusts who are in this situation do not have assets on their balance sheet and therefore cannot report capitalised costs relating to these assets. To ensure expenditure for this scenario is reported clearly, field CAS390 is available to prevent this being reported via maintenance or other premises costs.

4.5.3 Risk protection arrangement (RPA)

The RPA for academy trusts is an alternative to insurance where losses that arise are covered by UK government funds.

Academy trusts that opt to join the RPA will have the RPA fees deducted at source from their general annual grant (GAG) funding paid by DfE. In accounting terms, the contractual GAG amount, before deduction of RPA fees, should be accounted for as income. We expect trusts to make a monthly journal adjustment in their financial ledgers to gross up the GAG cash receipt to the contractual amount and thereby recording a matching expense for ‘Risk protection arrangement fees’ (CAS140) paid by the trust as educational activities.

Any income in respect of claims made under the arrangement should be shown as income in the ‘Other income’ > ‘Other trading activities’ table (OTA050) following on from trusts own entries in their financial ledgers.

4.5.4 Private Finance Initiative (PFI)

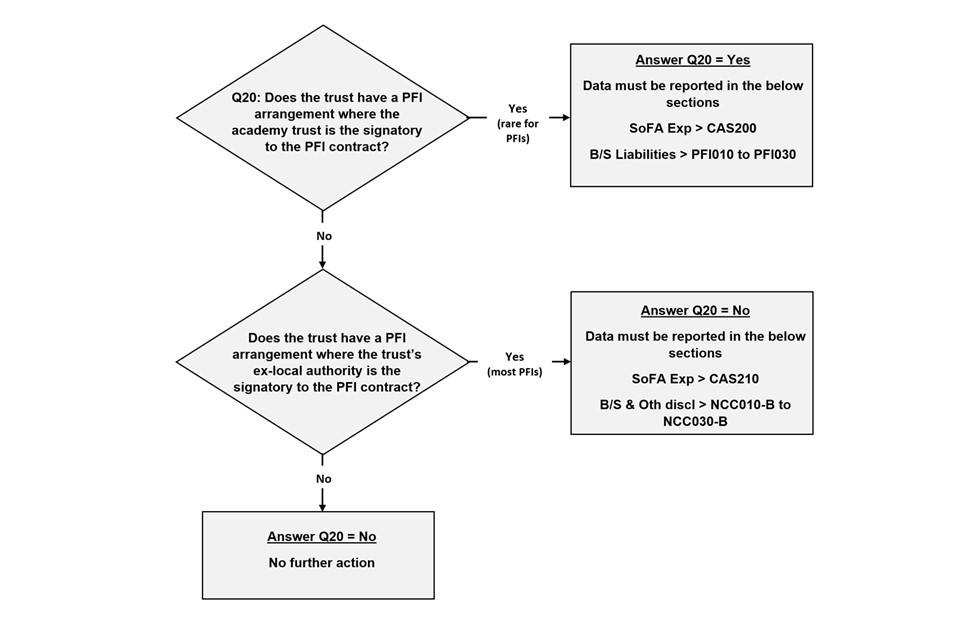

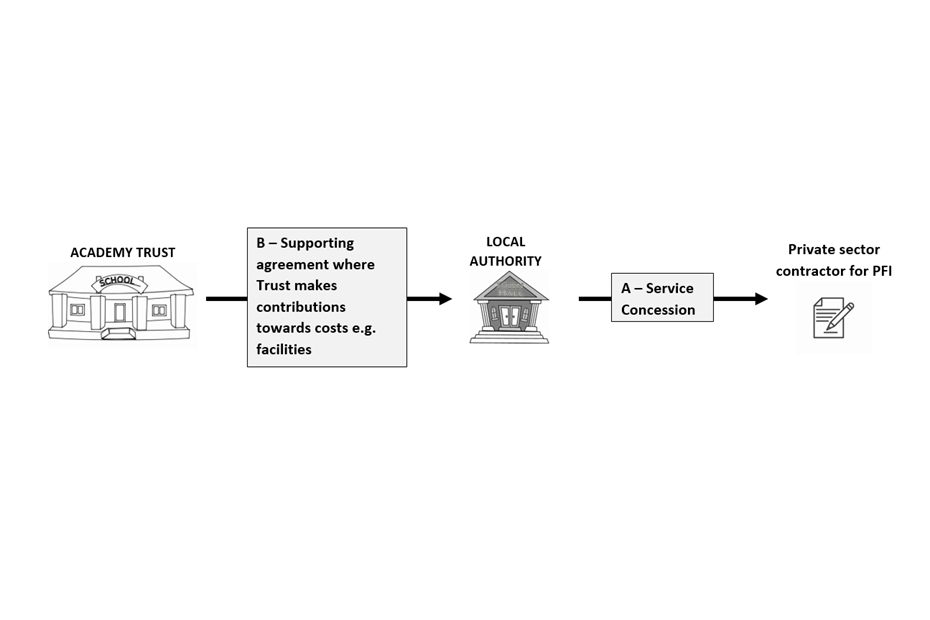

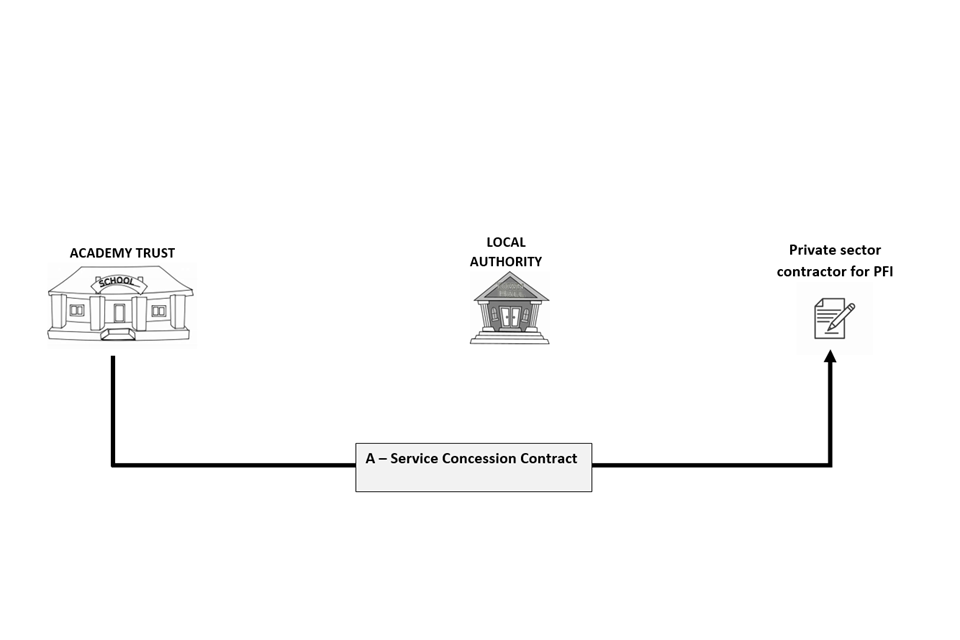

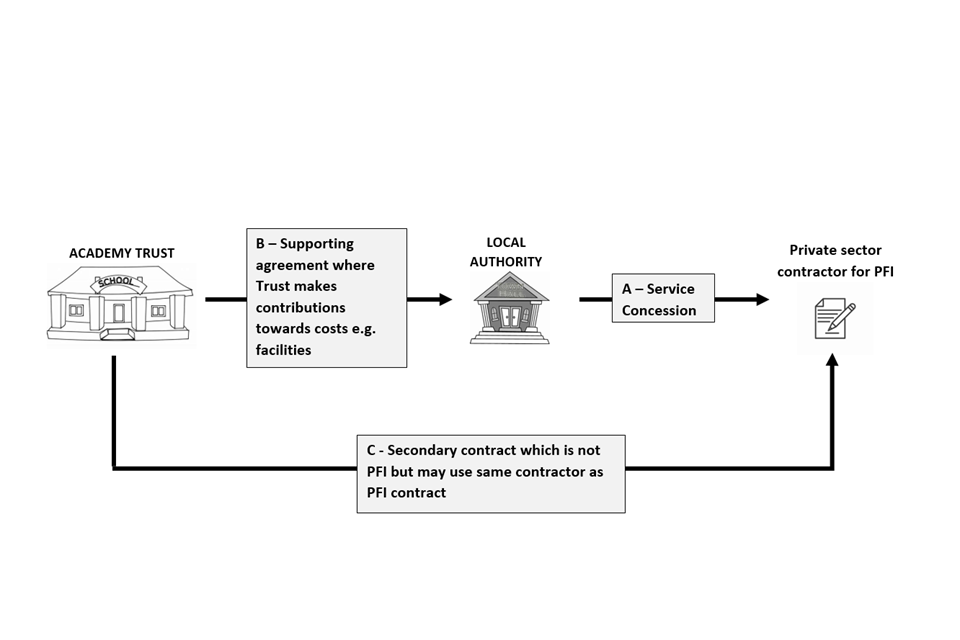

A flow chart and additional guidance is included in Section 10: Commitment under PFI to assist trusts in deciding whether PFI costs should be reported in ‘PFI support costs to Local Authority’ (CAS210) or ‘PFI service costs’ (CAS200) and whether outstanding PFI commitments should be reported in Balance sheet liabilities (PFI010 - PFI030) or non-cancellable contract disclosures (NCC010B - NCC030B).

Note that most arrangements are not held directly by the Academy Trust and per the flow chart in Section 10 should be recorded as non-cancellable contracts with the associated costs being disclosed as PFI support costs to Local Authority.

4.5.5 Other expenditure not attributable to a specific expenditure heading

Expenditure disclosed in OEX010 should not be included in the benchmarking section.

4.5.6 Teaching school hub expenditure (TSE)

If an academy school within a trust is a teaching school hub, answer ‘Yes’ to this question against the relevant academy in the ‘Academy information’ table. The ‘Teaching school hub expenditure’ table will then become available to complete. Fields will also become available within the income section of the SoFA.

Further detailed help text is available within the online AR form tables.

Provision of boarding activities (PBE)

If the trust included a note for academy boarding account (Academies model accounts: note 35) in its annual report and accounts, answer ‘Yes’ to question 8 in the ‘Questionnaire’. The questionnaire can be found within the ‘Overview’ section. Provision of boarding activities tables for income and expenditure will then become available for completion.

Further detailed help text is available within the online AR form.

SoFA - staff and trustees tables

This section includes:

- staff costs

- staff numbers

- number of employees whose emoluments exceed £60,000 and £100,000

- exit packages – non civil service schemes

- loss of office payments

- related party transactions: trustee remuneration

Staff costs (STF)

| Quick links - expenditure |

|---|

| 5.1.1 Apprenticeship levy |

This section requires the disclosure of actual costs incurred. Staff costs disclosed within the SoFA are required to be broken down by role, that is split by where staff spend most of their time.

The total wages and salaries are required to be split into three categories:

| Category | Description |

|---|---|

| Teachers (STF010) | Include wages and salaries for staff with day to day teaching duties, including senior leadership team members with day to day teaching duties. |

| Leadership (STF020) | Include wages and salaries for senior leadership team members who do not have day to day teaching duties. Leadership would be those persons having authority and responsibility for planning, directing and controlling the activities of a reporting entity, directly or indirectly, including any director (whether executive or otherwise). |

| Administration and support category (STF030) | Include all other staff. Examples of this would be office manager, business manager, finance officers and teaching assistants |

All costs in the staff and trustees table must be further split into permanent and temporary staff costs as required by accounting standards applicable to DfE and SARA.

The split between permanent (column A) and interim/temporary staff (column B) is not based on hours worked but on length of contract. Accordingly, all supply and maternity cover staff would automatically be classified as interim staff since they are employed by the trust for a specific period, which is the period of illness or maternity leave.

Part-time staff such as teaching assistants and lunch-time staff could be either permanent or temporary staff depending on the terms stipulated in their contract. For example, a teaching assistant who has an open-ended contract of employment with a trust, but may not have guaranteed weekly hours, would still be classified as a permanent staff member. However, a teaching assistant brought into a trust to cover a known staff absence would be temporary, since their contract has a set end date.

Agency staff are, by definition, temporary. The total cost of agency staff included in a trust’s accounts should be shown as temporary staff costs on the ‘Agency’ line (STF070).

The agency numbers to be reported in the AR should be based on FTE and averaged over the year.

Fixed term contract staff should be included within the ‘Temporary/interim staff’ column.

The AR form calculates the average staff costs by dividing the total basic wages and salaries (STF010-T, STF020-T and STF030-T) by the total staff numbers (SSNTOT-T), and then by the number of months to which the return relates. The average staff cost is expected to be within the range of £15,000k to £45,000. If the calculated value falls outside of this range, the AR preparer will be prompted to check the data and tick a box to confirm they are satisfied with the data entered.

Trusts are required to accrue for any outstanding holiday entitlement at the end of the accounting period. Trusts should accrue for the value of untaken holiday entitlement at 31st August 2024 for academies covered by the return.

The term ‘pay costs’ is used throughout the return to indicate all staff pay costs, including employer’s national insurance and pension contributions. Staff-related non-pay costs such as travel and training should not be included in pay costs and disclosed under another appropriate heading according to the format of the analysis being completed. Note that the AR and the trust’s financial statements differ here in that the Academies Accounts Direction asks for pension finance costs to be excluded from pay costs in the financial statements.

Where there is a total in cell STFTOT-B, trusts must disclose the number of temporary/interim staff numbers in the ‘staff numbers (full time equivalent)’ table.

5.1.1 Apprenticeship levy – STF050, INC050 and CAD040

Employers with an annual pay bill of £3 million or more are required to pay a Levy of 0.5% of their annual pay bill to the government. The levy is collected by HMRC as part of an employer existing PAYE process. This payment should be recorded in the ‘Apprenticeship levy’ line (STF050).

Employers that use their levy charge to fund apprenticeships benefit from receiving training in addition to any directly funded training. The value of the additional training between 1 September 2023 and 31 August 2024 should be recognised as part the employer’s financial reporting. As employers do not receive these funds directly, the amount recorded will be non-cash. Accordingly, there is a notional apprenticeship levy income category (INC050) within other income and a notional apprenticeship levy expenditure category (CAD040) within charitable activities – direct costs where this can be disclosed.

The value of the levy-training will be available to employers from their own discussions/records with approved training providers. Employers should already be aware of the agreed cost of the training prior to training starting. In addition, it is expected that the balances reported include the additional 10% match funding provided by government (STF050).

If training courses are priced above the funds available in an employer’s levy account, the employer will settle the difference directly with the training provider. These extra costs should be treated in the same way as directly funded training.

Staff numbers – full time equivalent (SSN)

This table requires disclosure of the average full time equivalent (FTE) staff undertaking a trust’s charitable activities. An analysis of all permanent and temporary staff at the trust is required, which should be split in line with the three staff cost categories in STF010, STF020 and STF030 (teachers, leadership, administration and support respectively). Review the table in section 5.1 which describes how the FTE’s should be categorised.

The staff numbers entered for permanent and temporary staff should be the average FTE for the year for each category (teachers, leadership and administration and support. This should be the total FTEs for all staff under each category per month for the 12 accounting periods divided by 12. Guidance and examples of calculating an FTE are provided below:

- calculations of FTEs should be based on contracted hours. Teachers are generally contracted and paid 12 months per year. If a teacher is contracted to work 25 hours per week then the FTE should be calculated by dividing 25 by the number of ‘standard’ contracted hours of a full-time teacher, usually 32.5 hours. Such an individual would therefore be counted as 0.77 FTE

- employees who only work part of the year (for example, those on term time only contracts) should be counted only at the time they are being paid. If someone works full time in term time only but they are paid as if they worked for the full 12 months per year they should be counted as 1 FTE

- if an employee works full time in term time only and is only paid in term time, they should only be counted for the period they work (plus any deemed paid holiday). For example, if someone works 39 weeks and has 4 weeks deemed paid holiday, they should count as 0.83 ((39+4)/52) of an FTE

- if you have 200 FTE for 6 months, you report 100 average FTE

- agency staff should be treated in a similar manner as above

Where there is a total in cell STFTOT-B staff costs, trusts must disclose the number of temporary/interim staff numbers in the ‘staff numbers (full time equivalent)’ table.

Trusts are also required to split the FTE of permanent staff disclosed in SSNTOT-A into gender and across the categories of accounting officer, staff who serve as trustees, teachers, leadership and administration and support (SGA010 to SGA050).

Trusts should ensure that each FTE is only listed against one category. Where the accounting officer (SGA010-T) or staff who serve as trustees (SGA020-T) categories are relevant, the average FTE should be recorded here rather than, for example, the teaching category (SGA030).

Number of employees whose emoluments (including off-payroll arrangements) exceed £60,000 and £100,000 (NEE)

| Quick links - emoluments exceeding £60,000 and £100,000 | |

|---|---|

| 5.3.1 Number of employees whose emoluments are between £60,000 and £100,000 | 5.3.2 Number of employees whose emoluments exceed £100k |

Emoluments includes all remuneration, salary, employer pension contributions and other benefits such as termination payments and bonuses. All elements of emoluments should be included in the online Accounts Return when considering which banding to place staff into.

In addition, the emoluments should all be FTE and annualised except for one-off benefits. Examples have been provided below.

Note that the AR guidance differs here from the Academies Accounts Direction guidance which asks for individual Academy Trust financial statements to exclude employer pension costs from this calculation in line with SORP reporting requirements. This is a difference between the reporting requirement for Academy Trust financial statements and the online Accounts Return.

Please also include any off-payroll arrangements as defined in section 2.140 of the Academies Accounts Direction.

5.3.1 Number of employees whose emoluments (including off-payroll arrangements) are between £60k and £100k

In this section trusts should disclose FTE details on the staff whose emoluments (including salary, employer pension contributions and other benefits) exceed £60,000 per annum but are less than £100,000 per annum.

For emoluments between £60,000 and £100,000, the form requires the total number of FTE staff per £10,000 bands (NEE010-040) with the maximum banding as £90,001 – £100,000.

For example, if someone works 3 days a week, that is 0.6 (3/5) and earns £50,000 (including employer pension contributions and other benefits), then an annualised FTE emolument would put them in the £80,001 – £90,000 category as their annualised FTE emolument is £83,333 calculated as (5/3) x £50,000.

5.3.2 Number of employees whose emoluments (including off-payroll arrangements) exceed £100k

Total emoluments including salary, employer pension contributions and other benefits should be disclosed per £10,000 bands with the maximum banding as £380,000+, which again, should be the FTE annualised emoluments as outlined in the section above for the number of employees whose emoluments are between £60k and £100k. For each banding above £100,000, trusts should use a separate row for each individual within these bandings. They should disclose:

- the relevant job title from the drop-down options in column B. If the exact title does not appear on the list, select the closest role based on the descriptions provided. If you cannot see a relevant job title or description, select ‘other’ and provide a brief description of the individual’s responsibilities.

| Job role | Additional guidance |

|---|---|

| Chief Executive Officer or equivalent | Typically, the most senior figure within a multi or single academy trust. They are unlikely to have day-to-day teaching duties. |

| Headteacher/Principal | Typically, a senior leader who spends most of their time leading and managing the academy. |

| Deputy/Assistant Headteacher – business lead | Typically, a senior leader who spends the most of their time leading and managing the academy. |

| Deputy/Assistant Headteacher – predominantly teaching | Typically, a senior leader and who spends the most of their time teaching. |

| Chief Financial Officer or equivalent | Takes responsibility to manage the trust finances and will not have teaching duties. |

| Other | For roles not described above, including predominantly teaching and specialist roles, please provide further details. |

- the FTE position of an individual is between 0.01 and 1. For example, if an employee works 4 days a week, that is 0.8, and the pro-rated total emolument (including salary, employer pension contributions and other benefits) is £85,000, then the annualised FTE emolument would put them in the £100,001 – £110,000 banding as their annualised FTE emolument is £106,250 calculated as (5/4) x £85,000. 0.8 should be declared in column D – FTE

- their contracted annual salary (FTE) in the relevant £10k banding should be declared in column F (on the same basis as the overall band in column A). If salary is £0, which would be unusual, the trust must provide an explanation in column I – Comments to explain why the employee has received no salary.

- their employer pension contributions (FTE) in the relevant £10k banding. If this is not applicable, select £0 in column G (on the same basis as the overall band in column A). If £0 is selected the trust must provide an explanation in column I – Comments to explain why no pension contributions are included.

- the total of all other benefits received by the individual (this should include bonuses, benefits in kind, termination payments and any other one-off monetary payments) in the relevant £10k banding should be declared in column H, any one-off payments should be as paid and not averaged. If this is not applicable, select £0.

Employer’s National Insurance Contributions should not be included in emoluments.

Exit packages – non civil service schemes (EXP)

Exit payments are payments made to an employee or office holder by their employer on leaving the organisation. Examples of staff exit packages include compensation payments which are made on termination of employment, payment in lieu of notice, redundancy, severance or unplanned loss of employment or loss of office. Exit payments may include:

- cash lump sums – such as a redundancy payment which is normally calculated based on the salary at the point of exiting the organisation and length of service

- early access to unreduced pensions – for employees close to the relevant pension scheme’s normal pension age some employers offer the option to take early retirement on a pension with the reduced amount for early payment being met by the employer, or otherwise enhanced, in place of or in addition to a cash lump sum compensation payment

- non-financial and other benefits – in a smaller number of instances, employers may offer other benefits such as additional paid annual leave at the end of an individual’s employment

DfE discloses breakdowns of employee exit packages agreed during the period of the accounts. Consequently, the consolidated SARA also requires trusts to provide similar disclosures in line with guidance issued by HM Treasury for public sector bodies Annex 4.13 Special payments- Managing public money

FReM-compliant disclosures are split between civil service and non-civil service exit schemes, although it is expected that only non-civil service schemes will be applicable to trusts. The value of the packages disclosed is the total cost including pension contributions, split by the contractual element of the package and the non-contractual element, and not just sums paid directly to the departing employees.

Any non-contractual element of exit packages reported must also be included as a special payment in the ‘losses and special payments’ table as detailed in the balance sheet funds and other disclosures section (field LSP010). This table becomes available to complete when the answer to question 26 ‘Did the trust make any losses or special payments? in the Questionnaire table is “Yes”.

Non-contractual exit packages are payments which are made outside of normal statutory or contractual requirements.

Loss of office payments (LOP)

If trusts make any loss of office payments to the accounting officer, or any other trustee, then these are required to be disclosed here.

Related party transactions: trustee remuneration (RPT)

If a trust has related party transactions (RPTs) to disclose for trustee remuneration, the AR preparer must answer ‘Yes’ to question 6 in the ‘Overview’ > ‘Questionnaire’ table. The relevant tables will then become available under the ‘SoFA’ > ‘Staff & trustees’ heading to enable completion of the trust’s RPT trustees information. If the trust has no RPT trustee remuneration, then question 6 should be answered accordingly and the tab will not be visible.

The information requested on remuneration payments to trustees by the number of FTE trustees receiving payments of £1 to £60,000 and then in £10,000 bands up to £380,000+ has been updated. Remuneration should include salary, employer pension contributions and other benefits such as bonuses. The disclosures required here are:

- number paid as trustees: the FTE number of trustees where the remuneration is a result of their role of trustee in column A, that is purely in their capacity as a trustee which does not include other roles they carry out in the trust, e.g. headteacher

- number paid as staff: the FTE number of trustees where the remuneration is a result of a role they carry out in the trust in column B e.g. headteacher

- once the trust has selected the total remuneration banding overall, they must then confirm that salaries have been included in the remuneration in column C for all FTEs in the banding. If salary is not included, the trust must provide an explanation in column G – Comments to explain why this is the case

- once the trust has selected the total remuneration banding overall, they must then confirm that employer pension contributions have been included in the remuneration in column D for all FTEs in the banding. If employer pension contributions are not included, the trust must provide an explanation in column G – Comments to explain why this is the case

- once the trust has selected the total remuneration banding overall, they must then confirm whether other benefits if applicable have been included in the remuneration in column F for all FTEs in the banding

Use the on-screen help text when considering which staff fall within ‘Number paid as trustees’ and ‘Number paid as staff’ columns. It is uncommon for a trustee to be paid in their role as trustee – in most cases most trustees are paid as members of staff for example in their role as a headteacher.

Trusts should note that a staff member receiving remuneration above £60k and serving as a trustee should be disclosed in both this section and the staff emoluments disclosure (NEE). The banding emoluments selected in both sections should be the same as the requirements to include salary, employer pension contributions and other benefits are the same for both disclosures.

For completeness, trusts should enter the average number of non-staff trustees who are unpaid into category ‘Number of unpaid non-staff trustees’ (NUT010), for example, if an individual is identified as an unpaid non-staff trustee for 9 months during the 12-month accounting period, 0.75 (9 months/12 months) should be reported in NUT010 and not 1.

Off payroll arrangements

Where a trust has entered into (or continues to have) an off-payroll arrangement, please ensure you answer ‘yes’ in the questionnaire table in the overview section of the online form (Question 7) and then complete the off-payroll arrangement table in the SoFA – Staff and trustees sub-section.

An off-payroll arrangement is where an individual is paid for work completed not through the trust payroll; for example, they may be paid via a private service company. Note - this section is not intended to capture temporary staff paid by invoice via an employment agency or curriculum services such as peripatetic teachers. Further details are included in the help text for OPA010/OPA020 within the online form.

Balance sheet assets

This section includes:

Intangible fixed assets (IF)

| Quick links - intangible fixed assets |

|---|

| 6.1.1 Amortisation periods (IAP) |

If a trust has included a note for intangible fixed assets (Academies model accounts: note 14) in its annual report and accounts, the AR preparer must answer ‘Yes’ to question 9 in the ‘Overview’ > ‘Questionnaire’ table. The relevant intangible fixed assets tables will then be available for completion. If the trust has no intangible fixed assets, the question can be answered accordingly, and the table will not be visible.

The return requires separate disclosures of intangible fixed assets:

- additions

- transferred in on conversion of academies from Local Authorities/ in on conversion – elsewhere/ in on existing academies joining the trust/out on existing academies leaving the trust (where applicable)

- donations

- disposals

- revaluations

- reclassifications

Under the SORP, trusts should disclose software fixed assets in column A, all other intangible fixed assets should be disclosed in column B.

As well as the closing net book value (NBV), the SARA will also have to disclose the split of the NBV by the owner of the intangible fixed asset in the asset financing table, including assets owned by the trust, finance leased or on-balance sheet PFI schemes. All trusts should provide an analysis of their closing net book value accordingly.

6.1.1 Amortisation periods (IAP):

Trusts should enter the periods of the useful economic lives used to calculate the amortisation charges as disclosed in the trusts accounting policies note.

For example, if a trust’s accounting policy is to amortise software over 5 years, the value to be entered is 60 (5 years x 12 months).

If trusts have a range of periods for any single asset class, they should disclose both the lower and upper ranges in the rows provided.

Alternatively, if trusts use a reducing balance methodology for an asset class, they should enter the rate used in the row provided.

Investment assets (current and non-current)

If the trust holds investment assets, the AR preparer must ensure the correct asset types are available on the AR form for current and/or non-current investments. Asset types will be pre-populated in the AR form based on 2022/23 closing balances. Therefore, if the trust has new asset categories in year, the preparer must also select the appropriate asset type on question 10 for non-current investments and question 11 for current investments within the ‘Overview’ > ‘Questionnaire’ table. Columns within the current and non-current investments tables will then be available for all relevant asset types for completion.

Two tables are provided for investments, one for non-current investments (longer than one year) (NCI) and one for current investments (held less than one year) (CUI). Both tables require the same level of disclosure and include two broad categories of investments:

- investments carried at market (fair) value

- investments carried at cost

The investment asset classes appear in more than one place as asset class can be accounted for under either cost or market value depending on the individual circumstances.

A summary of the assets that we expect to find within each asset class is given below:

| Asset class | Description |

|---|---|

| Subsidiaries | Companies wholly owned by the trust but not included in the trust’s consolidated financial statements, which is why the shares held are recorded as investments. In addition, we would expect the subsidiaries to be limited by shares with all issued shares owned by the trust. Subsidiaries are only carried at cost. |

| Investment properties | Properties owned by a trust that are not used in the furtherance of their educational activities, such as rental houses and flats. Under SORP such assets can be carried at either cost (depreciated) or fair value (non-depreciated). |

| Shares | Shares held by the trust but not subsidiaries. These shares should be held for investment purposes (capital growth or dividend income). Therefore, these shares can be carried at either cost (unlisted private companies) but more likely at market value (listed public limited companies such as e.g. FTSE100 or FTSE250). In all cases the percentage of shares held will not be significant compared to the number the investment has issued otherwise the non-subsidiary classification would not be permitted. |