Insolvency Service: annual report and accounts, 2018 to 2019

The Insolvency Service annual report and accounts 2018 to 2019

Documents

Details

I’m happy to report on another solid year of delivery by the Insolvency Service. Our principle objective is to deliver economic confidence, and we do this by supporting people in financial distress, maximising returns to creditors and tackling financial wrongdoing. Across all of these goals we have delivered against our published objectives.

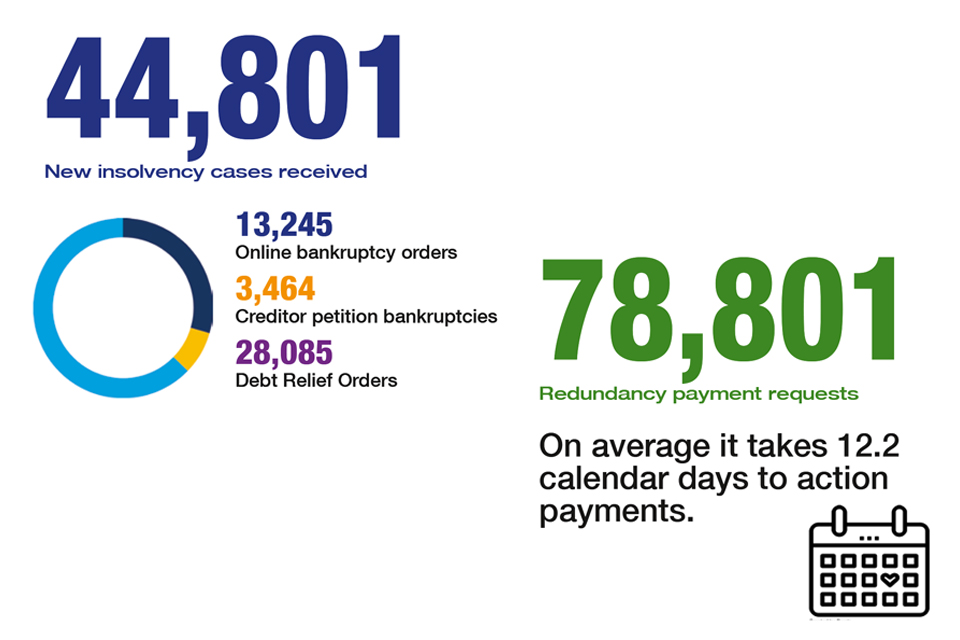

There have been many highlights throughout the year. In November, we granted the 250,000th Debt Relief Order (DRO). In the current reporting period we granted over 28,000 DROs and the agency marked the 10-year anniversary of their introduction. In that decade more than £2.3 billion in debt relief has been provided.

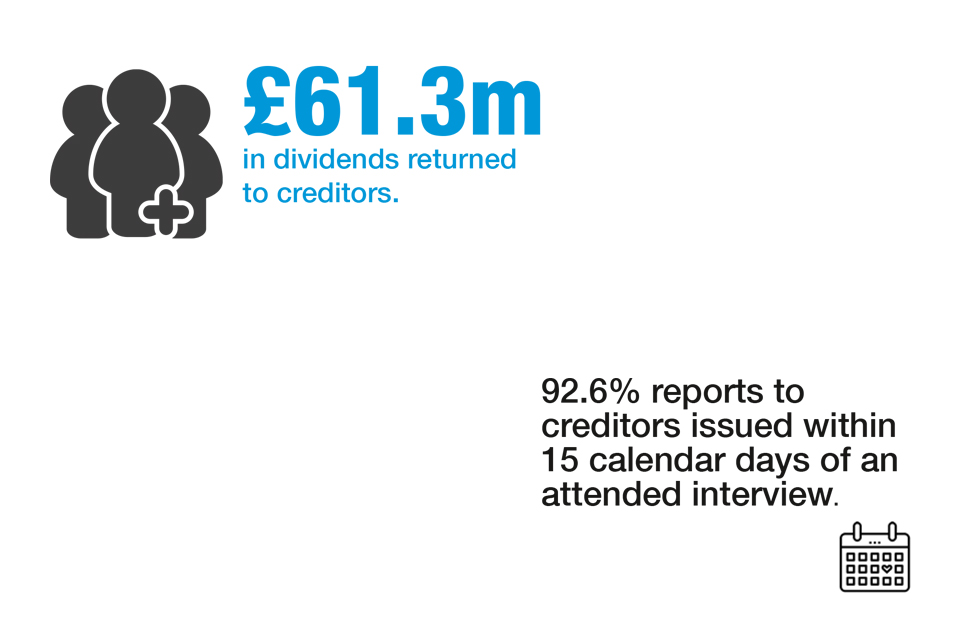

We returned over £61.3 million to creditors in the current year, up from the £55.3 million we reported in last year’s report. The recycling of funds lost through insolvencies is vital to ensure confidence in our economy.

This past year we disqualified 1,242 directors for misconduct, with an increased percentage being banned from the market for 10 years or more. These cases often have a significant community impact. The 10-year disqualification of Howard Grossman, who was behind the failed development of Northampton Town’s stadium, is an example of such a case. Our investigators worked with Northampton Police and found that Mr Grossman had not kept proper accounting records and could not account for at least £5.6 million of transactions before the project folded.

I reported last year that the collapse of Carillion was the largest, most complex liquidation the agency had faced, and while our work to transfer its important public sector contracts concluded in August, the Official Receiver continues to wind down the company’s affairs and determine why it failed. I’m hugely proud that our achievements in this case were recognised with the Insolvency Team of the Year award at the Turnaround, Recovery and Insolvency Awards in November.

We’ve also continued to modernise our technical infrastructure. This past year we brought a newnfinance system online as part of our vision to integrate our various legacy systems to achieve better efficiencies and improved customer service.

Finally, I’ve written previously about how pleased I’ve been to see the improvements in our Civil Service People Survey results and this has continued this year with our engagement scores reaching their highest level ever. Our people remain at the heart of making this agency successful and helping to deliver the best possible services for our customers.

As we prepare for the coming year, I have every confidence the agency remains well placed to meet whatever challenges lay around the corner.

Sarah Albon Chief Executive

Year in review

Supporting those in financial distress

We administer debt solutions that help people get back on their feet. These solutions include bankruptcy and debt relief orders (DROs).

Our online adjudicator service removes the stress of attending court from the debtor bankruptcy process.

We also help employees of insolvent companies via our redundancy payments service.

Our Official Receivers and redundancy payments teams play a vital role in helping and supporting people in times of financial distress.

In November 2018 we granted the 250,000 Debt Relief Order

(DRO). These DROs have provided a low cost debt relief solution to a quarter of a million people.

Tackling financial wrongdoing

Our investigation and enforcement teams help tackle individuals and companies who act against the public and corporate interest. This work helps to retain confidence in Britain as a great place to do business.

We remain alert to abuse in the corporate market place and proactively monitor intelligence received from various sources, including complaints from the public. Consideration of the conduct of directors prior to insolvency is a fundamental part of our regime. This is backed by powers to prevent an unfit director from running a business for up to 15 years.

Maximising returns to creditors

Our official receivers act on behalf of creditors to realise assets in bankruptcy and liquidation cases, and distribute these funds fairly.

It is worth noting that a large proportion of the monies distributed to creditors have arisen primarily due to compensation claims where bankrupts have historically been mis-sold Payment Protection Insurance.

The UK insolvency regime continues to enable the assets of insolvent companies to be realised and returned to creditors more quickly than in comparable jurisdictions, such as the USA, France and Germany.

Carillion

The first 6 companies under the Carillion umbrella went into liquidation on 15 January 2018.

These companies had been identified by the Official Receiver and Special Managers as those most critical to continued trading and who were also the largest employers.

It was the largest trading liquidation in UK corporate history and the Official Receiver, with assistance from PwC as special managers, continued trading to August 2018. In November 2018, the Insolvency Service and PwC team won the Insolvency Team of the Year award at the prestigious Turnaround, Recovery and Insolvency ‘TRI’ Awards.

The complexity of Carillion’s trading means that no date is currently set for when the liquidation will end. The Official Receiver, with assistance from PwC, will seek where possible to resolve any outstanding matters as quickly as possible in 2019–20.

To give an idea of scale:

- 379 companies have been identified as part of the Carillion group

- Of these, 123 companies were based overseas

- There were over 40,000 employees worldwide

- There were over 18,000 employees in the UK

- 90 UK companies are currently in some form of insolvent liquidation

- The Official Receiver is currently liquidator of 78 companies

Customer satisfaction

In 2018–19 we successfully achieved reaccreditation of the Customer Service Excellence (CSE) standard, recognising our continued focus on putting customers at the heart of everything we do.

We remain fully compliant with the CSE standard and this year we gained a further 2 Compliance Plus ratings. We now hold 19 Compliance Plus and 38 Compliant ratings. In his report, our CSE assessor said:

“This is a very good service that serves the needs of customers well. The agency is a longstanding and a fully deserving holder of the CSE Standard.”