Interim Gender Pay Gap Employer Insights Survey (HTML)

Published 24 October 2018

Interim Gender Pay Gap Employer Insights Survey

James Murray and Michael Farrer – OMB Research

Research report

October 2018

1. Executive summary

1.1 Introduction

The Government has recently introduced new gender pay gap (GPG) transparency regulations,[footnote 1] which are designed to encourage large employers (with 250+ employees) to take informed action to close their GPG where one exists. These regulations came into force in April 2017 and affected over 10,000 GB employers across the private, voluntary and public sectors, with 94% ultimately complying on time.

The Government Equalities Office (GEO) originally commissioned OMB Research to conduct baseline research on employers’ understanding of the new regulations and their progress towards complying by the deadline of 4th April 2018. That initial work was carried out in Spring 2017, and published in November 2017.[footnote 2] This interim survey, conducted in December 2017 and January 2018, was designed to provide an update on understanding, attitudes and progress among in-scope private sector employers. The findings were then used to inform GEO’s strategy to drive reporting in the final weeks before the deadline.

The research consisted of a telephone survey of 305 private sector employers (with 250+ staff).

1.2 Understanding of the GPG

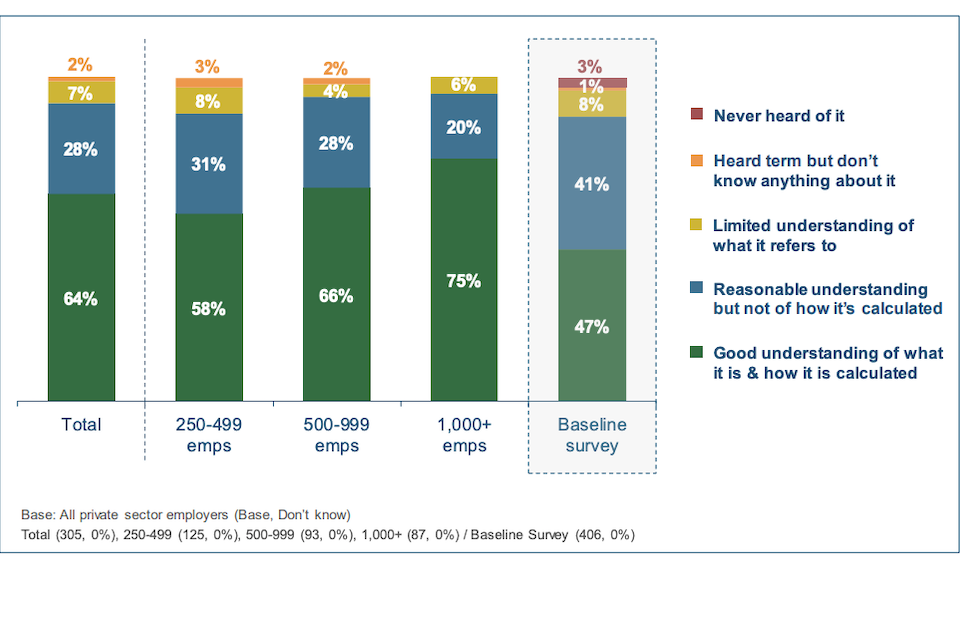

Around two-thirds (64%) of all respondents (those responsible for their organisation’s GPG reporting) felt they had a good understanding of what the GPG is and how it is calculated. A further 28% believed they had a reasonable understanding but were not sure of the specifics of how it was calculated, and the remainder had only a limited understanding of what it referred to (7%) or knew nothing about it (2%).

This represents a significant increase in knowledge of the GPG since the baseline survey (conducted in March/April 2017), when only 47% of private sector respondents felt they had a good understanding of the GPG and how it is calculated.

Two-thirds (64%) of respondents also reported that they had a good understanding of the difference between ‘closing the GPG’ and ‘ensuring equal pay between men and women’. Most of the remainder (27%) knew there was a difference but were unsure exactly what it was, although 8% did not realise there was a difference.

In each of the above areas, self-reported understanding increased with company size and was highest among those with 1,000+ employees.

1.3 The GPG transparency regulations

Awareness and understanding

Awareness of the new GPG transparency regulations was near universal (98%, up from 87% in the baseline survey).

In terms of knowledge, two-thirds (67%) of employers felt that they understood what was required and how to do it, representing a significant rise from the baseline survey when only 52% reported that they knew how to comply with the requirements. A further fifth (22%) believed they knew what was required but were less certain of how to go about it. The level of understanding of the GPG regulations increased in line with organisation size.

Just over three-quarters (77%) of employers correctly identified the deadline for reporting their GPG data as being in April 2018.[footnote 3] Most of those providing an incorrect date believed the deadline was earlier than this (typically March 2018). However, 14% of employers either believed it was later than April 2018, were unsure of the date, or were completely unaware of the regulations.

Progress towards compliance

The majority (60%) of employers had started implementing a plan to meet the regulatory requirements and a further 13% had developed (but not yet implemented) a plan. In terms of progress, these companies were at a range of different stages – 27% were collating the data, 26% were making the calculations, 31% were reviewing the results prior to reporting them, and 24% were developing an accompanying narrative commentary. The relatively even distribution across these stages illustrates the differing priority that employers gave to (early) compliance with the regulations.

A small minority of employers (5%) indicated that they had already reported their GPG results, although only two-thirds of these (3% of all employers) had uploaded their results to the government GPG portal.[footnote 4] The others had typically published the results on their own company website.

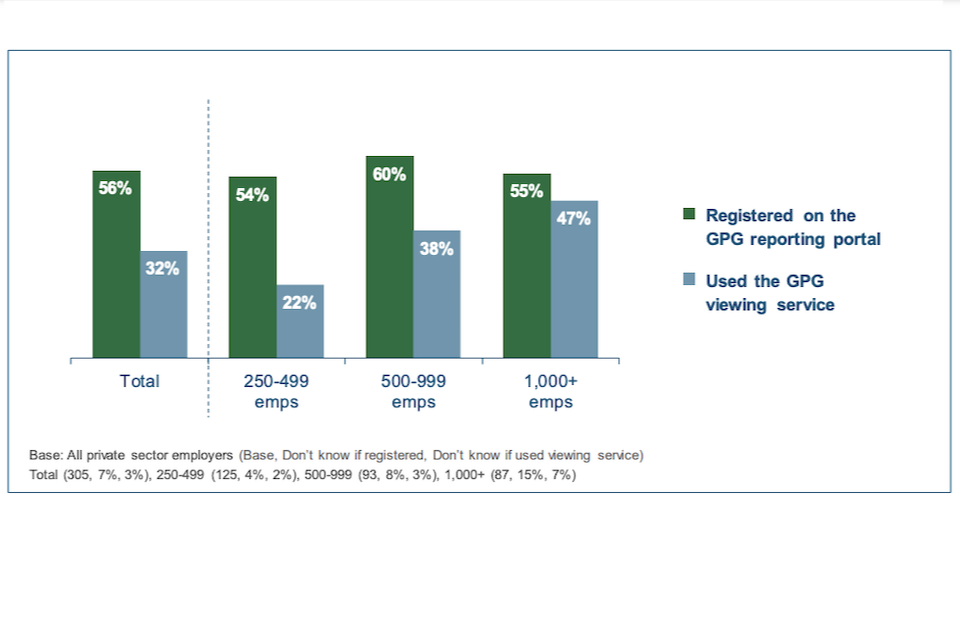

The remaining 19% of private sector employers had taken no firm action to comply with the regulations, with this increasing to 29% of smaller firms with 250 to 499 employees. However, most of these had reviewed the requirements. Just over half (56%) of employers had registered on the GPG reporting portal, and a third (32%) had used the GPG viewing service to see the data already reported by other employers.

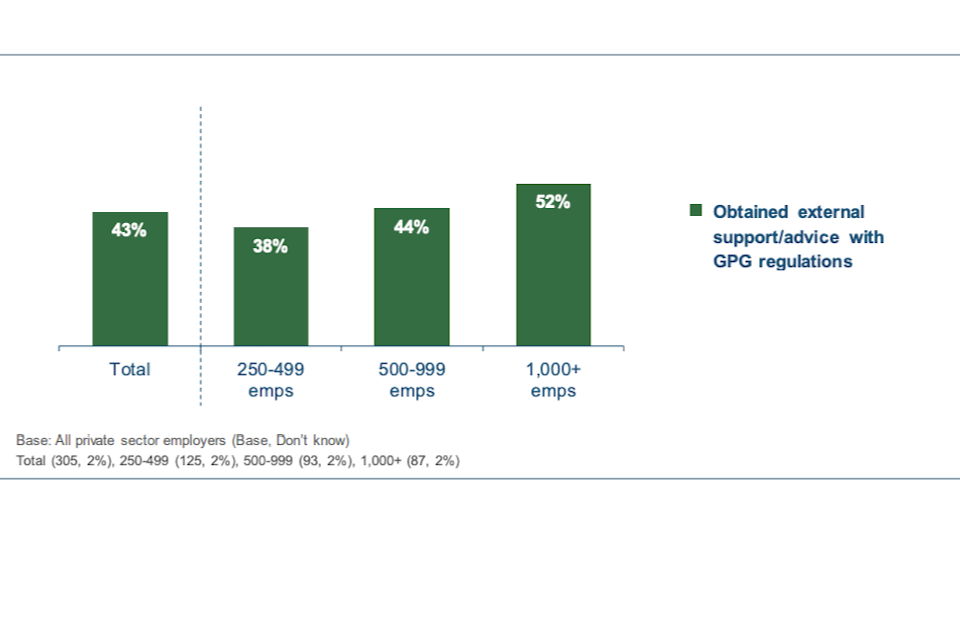

External support

At the time of the interim survey, 43% of in-scope employers had obtained external support or advice to help them with the GPG reporting regulations. Among this group, the most common sources of support were legal advisers (33%), consultants (25%) and external payroll providers (16%). These firms had typically obtained advice or guidance on how to calculate their GPG (58%) or how to report their data (40%).

When those that had not accessed support were asked what, if anything, would help them, 40% felt that they had no need for external assistance. Among those that did, the most common responses were guidance on how to calculate and report their data (17% and 16% respectively).

Approaching three-quarters (71%) of private sector employers had read the GEO/Acas guidance on GPG reporting, up from 55% at the time of the baseline survey.

Publication

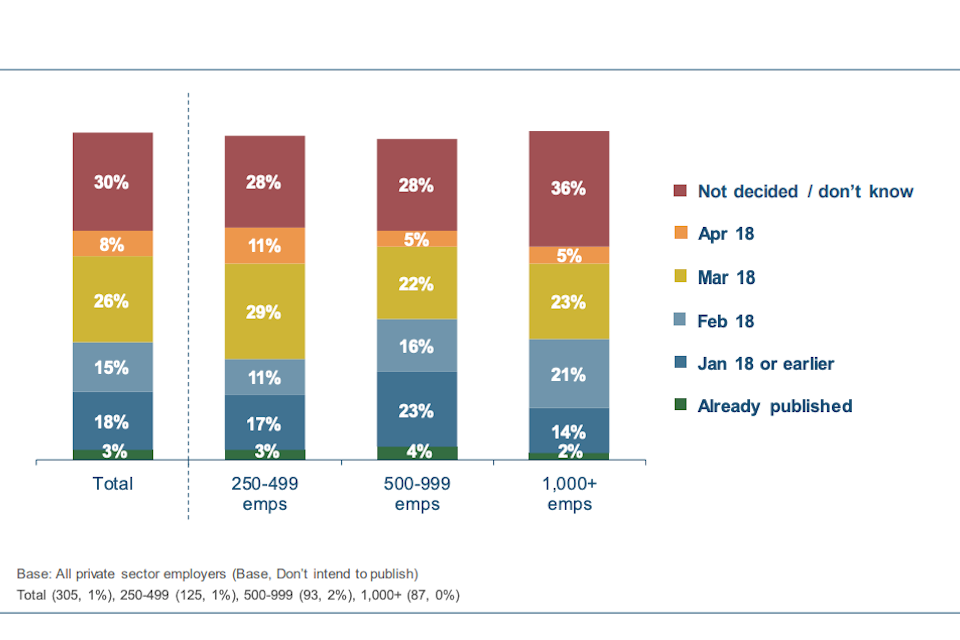

Most employers (61%) expected to publish their results on the government GPG portal prior to April 2018, with a quarter (26%) planning to do so in March. However, almost a third (30%) had not yet decided on their publication date.

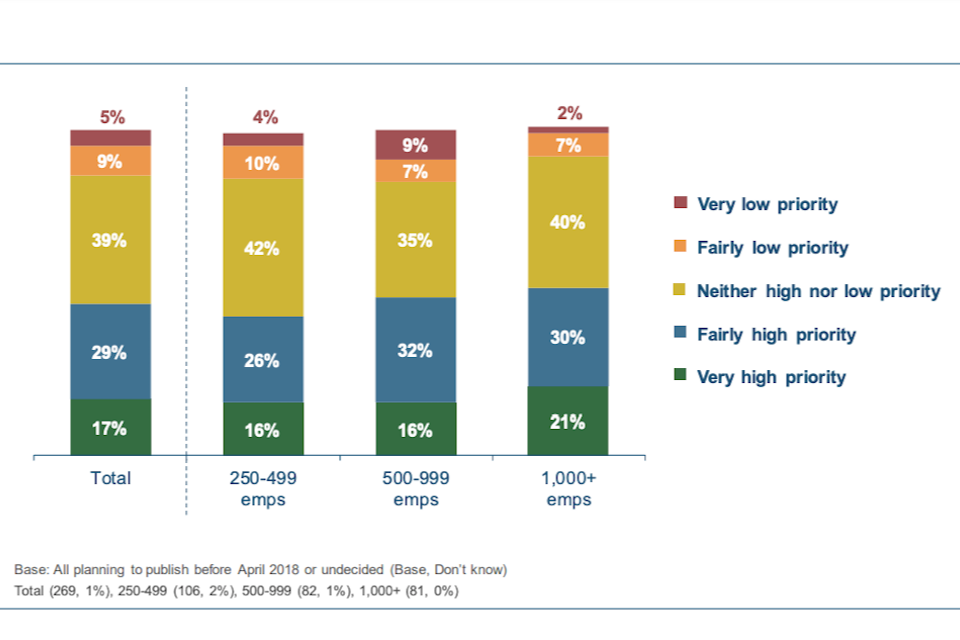

Approaching half (46%) of those employers that intended to publish their GPG results early viewed this as a very or fairly high priority for their business. Almost all (96%) expected to successfully publish in their target month, with 68% describing this as ‘very likely’.

Almost a third (30%) of private sector employers planned to publish additional information alongside the mandatory reporting requirements. This is an increase from the baseline survey, when only 17% of firms intended to do so, suggesting that greater understanding of their likely GPG scores may have prompted employers to provide additional context or explanation of these. The most common type of additional information was an accompanying narrative commentary (20%), and the larger the organisation the more likely they were to publish additional information.

1.4 Reducing the GPG

Employer attitudes to reducing their GPG varied, but around a third (35%) considered this to be a high priority and most of the remainder (39%) saw it as a medium priority. This suggests there has been a change in employer attitudes since the baseline wave, when only 24% felt that reducing their GPG was a high priority. However, almost 1 in 5 employers (19%) interviewed in the interim survey still described it as a low priority or not a priority at all, although this is significantly lower than the 36% seen in the baseline survey.

Opinion was split as to the likely impact of a large GPG on perceptions of their company, though employers were slightly more likely to think that the perceptions of their employees would be affected, than those of their customers or clients. Just over half (53%) of employers believed that if they had a large GPG this would have a very or fairly negative impact on perceptions of their company among current staff and potential recruits (with 42% feeling it would have minimal or no impact). Just under half (47%) felt that a large GPG would have a negative impact on perceptions among clients, suppliers, investors and other external stakeholders (with 46% believing it would have minimal/no impact).

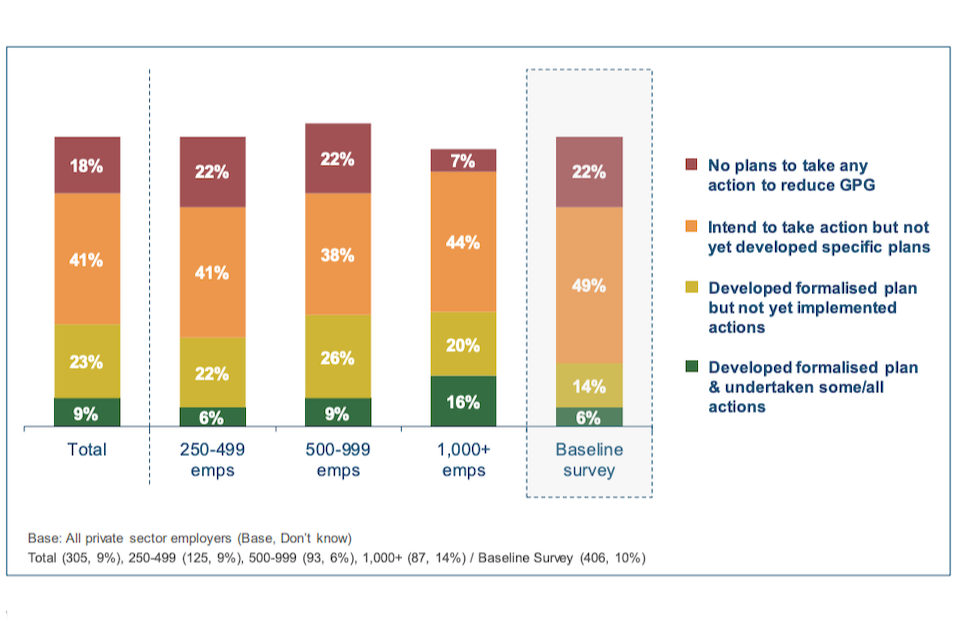

Reflecting the differing priority afforded to reducing their GPG, private sector employers reported a range of approaches to tackling it. A third (32%) had developed a formalised action plan for reducing their GPG (although only 9% had already implemented any of the specified actions), 41% intended to take action but had not yet developed any concrete plans, and 18% did not intend to do anything.

2. Introduction

This report provides the findings from a survey commissioned by the Government Equalities Office (GEO) and carried out by OMB Research. The research provides further evidence on large private sector employers’ understanding of the new gender pay gap (GPG) transparency regulations and their progress towards reporting their GPG data by the deadline of 4th April 2018. This interim survey follows on from a baseline survey of large employers that was carried out in Spring 2017.

2.1 Background

The Government has committed to close the gender pay gap. The GPG is an overall measure which reflects differences in median[footnote 5] hourly earnings and labour market participation by gender. Currently the overall gender pay gap for all employees is 18.4%.[footnote 6]

Employers are well placed to tackle many of the issues that drive the GPG. In 2011, the Government launched the Think, Act, Report initiative, a set of principles and suggestions on how to improve gender equality in the work place. While over 300 businesses signed up to Think, Act, Report only a small proportion of these voluntarily published gender pay gap information.

New regulations introducing mandatory gender pay gap reporting for large employers should encourage employers to take informed action to close their GPG where there is one. These regulations came into force in April 2017 and require private and voluntary sector organisations with 250+ employees to publish GPG statistics every year. The same requirements have been introduced for public sector organisations in England (and non-devolved authorities operating across Great Britain) by amending the Specific Duties regulations made under Section 153 of the Equality Act 2010.

The GEO commissioned OMB Research to develop a robust research programme to measure in-scope employers’ understanding of the GPG and the transparency regulations, and understand the actions they are taking to close their GPG. To date, this has included an initial baseline survey[footnote 7] that was conducted in March/April 2017, and this interim survey which was undertaken in December 2017/January 2018.

The primary aims of this interim survey were to:

-

Provide up-to-date insight on private sector employers’ understanding of the GPG and of the transparency regulations.

-

Gather information on employers’ progress towards reporting their GPG data, including their stage in the process (for example, reviewing requirements, collating data, making calculations) and when they planned to publish their statistics.

-

Provide data to support GEO’s activity to drive compliance, including the types of external support needed by employers, the sources they approached for this, and the channels used for HR and business information (social media, websites and magazines).

The survey took place between December 2017 and January 2018, so 3 to 4 months prior to the 4th April 2018 deadline for private sector employers to report their GPG data.

2.2 Methodology

The research consisted of a quantitative survey of private sector employers with 250+ employees. While voluntary sector organisations are also subject to the regulations, and similar requirements have been introduced for public sector organisations in England, neither of these groups were included in this interim survey. This was for 2 reasons – firstly, because the population of those groups is much smaller most of these organisations had already been contacted for the baseline survey, and so including them here would be overly burdensome and would also reduce the likelihood of them taking part in the next wave of the main GPG survey. Secondly, because the baseline survey indicated that private sector employers were less engaged with the regulations, and so they were a higher priority for additional research.

Telephone interviews were conducted with 305 employers between 5th December 2017 and 10th January 2018. Interviews lasted an average of 15 minutes and were conducted with HR directors/managers or other senior staff involved in the reporting of their company’s GPG data.[footnote 8] The survey communications positioned the research as focusing on employers’ understanding of the GPG and their progress in meeting the requirements of the new GPG transparency regulations.

The sample was provided by the Office for National Statistics and was sourced from the Inter-Departmental Business Register (IDBR), which has comprehensive coverage of large employers. Employers in Northern Ireland were excluded from the sample as they are not subject to the GPG transparency regulations.

Quotas were set on size band and Standard Industrial Classification (SIC) code to ensure good coverage of the population of private sector employers subject to the regulations. These quotas were broadly representative of the target population, but larger companies of 500+ employees were slightly over-sampled to allow robust sub-analysis. This resulted in statistical confidence intervals of +8.6% for firms with 250 to 499 employees, +9.9% for those with 500 to 999 employees and +10.2% for those with 1,000+ employees. At the total sample level the confidence interval was +5.5%.[footnote 9]

Table 1 sets out the profile of all GB private sector employers subject to the GPG transparency regulations, and the profile of the achieved interviews.

Table 1 - Universe and achieved interviews by size

| Size | Universe (ONS data) | Interviews | ||

|---|---|---|---|---|

| Number | % | Number | % | |

| 250-499 employees | 3,659 | 52% | 125 | 41% |

| 500-99 employees | 1,801 | 25% | 93 | 30% |

| 1,000+ employees | 1,651 | 23% | 87 | 29% |

| Total | 7,111 | 100% | 305 | 100% |

Overall, 89% of the interviews were conducted with organisations based in England, 7% in Scotland and 4% in Wales. This closely replicates the geographical distribution of the in-scope private sector employer universe. The final survey data was then weighted back to the size profile of all GB private sector employers with 250+ employees.

2.3 Analysis and reporting conventions

Throughout this report, references to ‘all employers’ and the ‘total’ column in the charts and tables refer only to the employer population sampled for the survey (such as GB private sector organisations with 250 or more employees).

Unless explicitly noted, all findings are based on weighted data. Unweighted bases (the number of responses from which the findings are derived) are displayed on tables and charts as appropriate to give an indication of the robustness of results.

The data presented in this report is from a sample of in-scope employers rather than the total population. This means the results are subject to sampling error. Differences between sub-groups are commented on only if they are statistically significant at the 95% confidence level (unless otherwise stated). This means that there is at least a 95% probability that any reported differences are real and not a consequence of sampling error.[footnote 10]

When interpreting the data presented in this report, please note that results may not sum to 100% due to rounding and/or due to employers being able to select more than one answer to a question.

Where available, comparative results have been provided from the initial ‘baseline’ survey of employers conducted in March and April 2017. While the baseline survey also covered voluntary and public sector organisations, the comparative data shown only relates to private sector employers.

3. Understanding of the GPG

This chapter explores private sector employers’ understanding of the gender pay gap. More specifically, it covers:

- understanding of what the GPG refers to and how it is calculated

- understanding of the difference between closing the gender pay gap and ensuring equal pay between men and women

3.1 Understanding of the GPG and how it’s calculated

Overall, almost two-thirds (64%) of respondents felt they had a good understanding of what the GPG is and how it is calculated. All of those interviewed had heard of the term “gender pay gap”, although a minority either knew nothing about it (2%) or had only a limited understanding of what it referred to (7%).

The results indicate a significant increase in reported knowledge of the GPG among private sector employers as the April 2018 deadline for reporting GPG data approached. At the time of the baseline survey (conducted c.12 months prior to the deadline) only 47% of respondents felt they had a good understanding of the GPG and how it is calculated, compared to 64% in the interim survey (conducted 3-4 months before the deadline).

Figure 1 - Self-reported understanding of the GPG

The larger the organisation, the more likely they were to report a good understanding of the GPG, ranging from 75% of those with 1,000+ employees down to 58% of those with 250 to 499 employees.

Those that had accessed external support to assist them with the GPG reporting regulations were also more likely to claim a good understanding of the GPG (75% vs. 56%).

3.2 Understanding of difference between GPG and equal pay

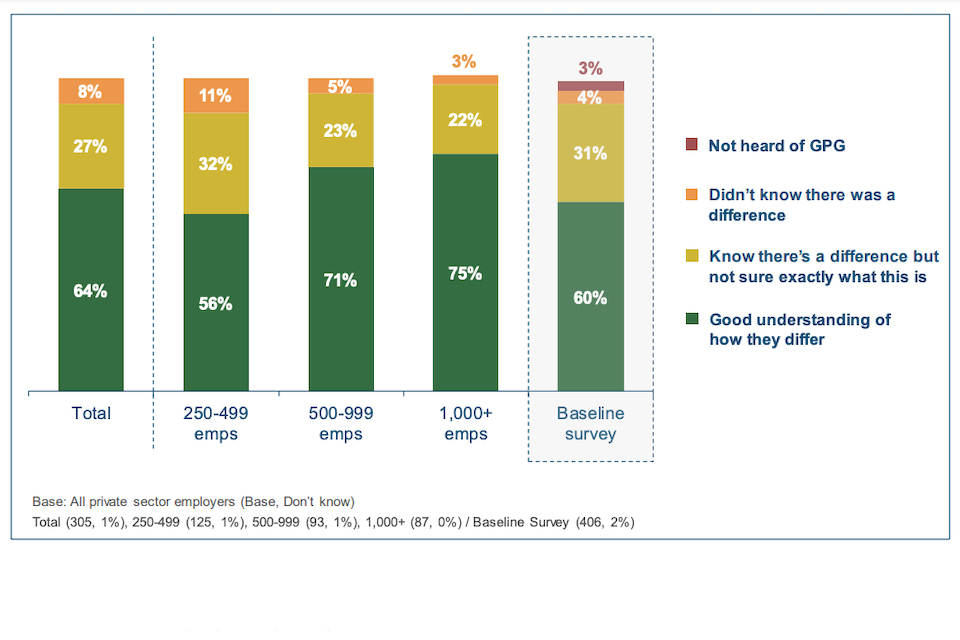

Almost two-thirds (64%) of respondents believed they had a good understanding of the difference between ‘closing the gender pay gap’ and ‘ensuring equal pay between men and women’. A further 27% knew there was a difference but were not sure of the detail, and just 8% did not know it differed from equal pay.

These results are broadly consistent with those seen for private sector employers in the baseline survey. This indicates that while awareness and self-reported understanding of the GPG appeared to have improved, there was not a similar uplift in understanding of the difference between the GPG and equal pay.

Figure 2 - Understanding of the difference between ‘closing the GPG’ and ‘ensuring equal pay’

The proportion with a good understanding was lowest among private sector organisations with 250 to 499 employees (56%).

Approaching three-quarters (71%) of those that had read the GEO/Acas guidance on the GPG had a good understanding of how this differed from equal pay (compared to 46% of those not reading the guidance).

It should be considered that this data refers to respondents’ own perceptions of their understanding, and evidence from the baseline research indicates that this may not always be wholly accurate: a significant proportion of employers involved in that research did not see closing their GPG as a priority because they already paid equally regardless of gender, suggesting a degree of conflation between the concepts of GPG and equal pay.

4. The GPG transparency regulations

This chapter explores private sector employers’ understanding of the new gender pay gap transparency regulations and their approach to complying with them. More specifically, it covers:

- understanding and knowledge of the regulations (including the deadline for publishing their GPG data)

- the progress which employers had made in complying with the requirements

- the types of support and assistance that employers had accessed or would benefit from

- employers’ plans for when they would publish the required gender pay data, and what they intended to publish

4.1 Awareness and understanding of the regulations

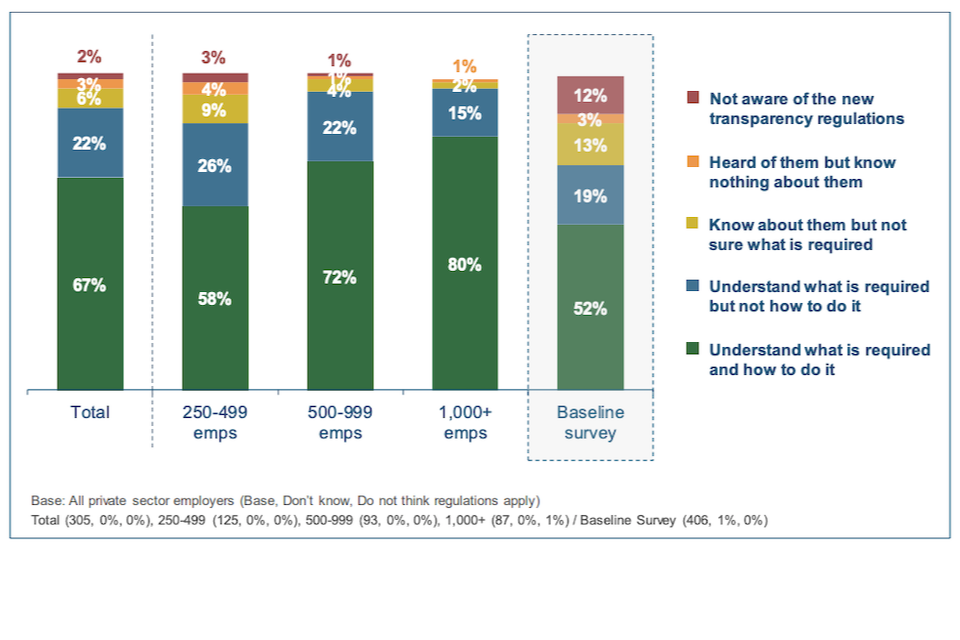

Overall, 98% of private sector employers were aware of the new regulations, up from 87% in the baseline survey. In terms of knowledge, two-thirds (67%) felt that they understood what was required and how to do it, and a further fifth (22%) believed they knew what was required but were less certain of how to go about it. This represents a significant rise from the baseline survey, when only 52% reported that they knew how to comply with the requirements. The proportion of employers who were not aware of the regulations had also fallen since the baseline survey, from 12% to 2%.

Figure 3 - Understanding of the new GPG transparency regulations

Knowledge of the regulations increased with company size. The proportion reporting ‘full knowledge’ (such as what was required and how to do it) ranged from 58% of 250 to 499 employee firms to 80% of those with 1,000+ employees.

As was seen in the baseline survey, exposure to the GEO/Acas guidance on the GPG was strongly associated with self-reported knowledge of the regulations – 79% of those that had read the guidance said that they understood what was required and how to do it, compared to just 36% of those had not read it.

The use of external support was also associated with increased understanding of the regulations. Over three-quarters (78%) of those obtaining advice or support on the topic reported ‘full knowledge’ of the regulatory requirements, compared to 60% of those not doing so.

Employers were also asked when they believed the deadline was for private sector employers to publish their GPG data. As detailed in the table below, just over three- quarters (77%) correctly identified this as being April 2018.[footnote 11] Most of those providing an incorrect date believed the deadline was earlier than this (typically March 2018).

However, 14% of employers either believed it was later than April 2018, were unsure of the date, or were completely unaware of the regulations.

Table 2 - Awareness of the private sector GPG publication deadline (unprompted)

| Total | Size (250-499) | Size (500-999) | Size (1,000+) | |

|---|---|---|---|---|

| Base (unweighted) | 305 | 125 | 93 | 87 |

| January 2018 | 0% | 1% | 0% | 0% |

| February 2018 | 0% | 1% | 0% | 0% |

| March 2018 | 8% | 3% | 16% | 11% |

| April 2018 | 77% | 77% | 73% | 80% |

| Any date later than April 2018 | 2% | 2% | 1% | 2% |

| Don’t know | 10% | 13% | 9% | 6% |

| Not aware of the regulations | 2% | 3% | 1% | 0% |

Base: All private sector employers

4.2 Progress towards meeting the regulations

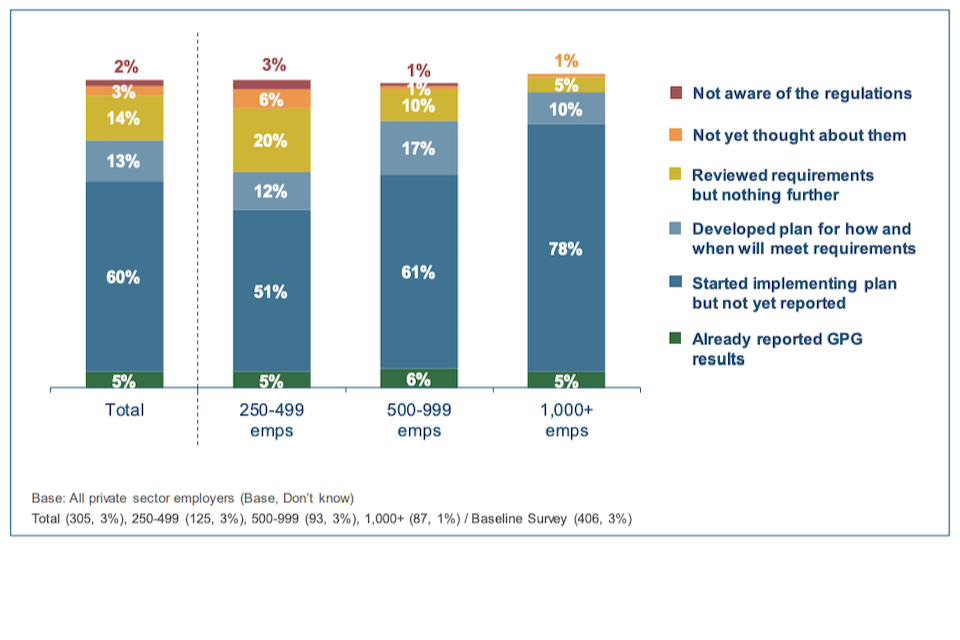

While only 5% of the employers interviewed stated that they had already reported their GPG results[footnote 12], the majority (60%) had started implementing a plan to meet the regulatory requirements and a further 13% had developed (but not yet implemented) a plan.

However, this leaves almost a fifth (19%) of private sector employers that had taken no action other than (in most cases) reviewing the requirements.

Figure 4 - Preparation for the GPG transparency regulations

The larger the employer, the greater the progress they had typically made towards complying with the regulations. 83% of those with 1,000+ employees had started implementing a plan (or had already reported their results), compared to 68% of those with 500 to 999 employees and 56% of those with 250 to 499 employees.

Due to changes to the question response codes, it is not possible to provide exactly comparable data from the baseline survey.[footnote 13] However, it is possible to compare the degree to which firms had prepared for the regulations by combining some of the options.

As set out in Table 3, there was a significant increase in the proportion of private sector employers taking action to meet the regulations (78% in the interim survey vs. 47% in the baseline).

Table 3 - Preparation for the GPG transparency regulations

| Interim Survey | Baseline Survey | |

|---|---|---|

| Base (unweighted) | 305 | 406 |

| Not aware of the regulations | 2% | 12% |

| Not yet thought about them | 3% | 8% |

| Reviewed requirements but nothing further | 14% | 30% |

| Taken action (developed/implemented a plan, reported results, etc) | 78% | 47% |

| Don’t know | 3% | 3% |

Base: All private sector employers

In the interim survey, those employers that had developed or started implementing a plan for meeting the requirements were asked to provide more details of their current progress. While respondents were encouraged to select the one option that best described their current situation, they could choose more than one if needed (for example, if they were reviewing the results and developing a narrative commentary simultaneously).

As detailed below, most of these employers had moved beyond simply learning about the requirements. Around a quarter were collating the data (27%), and similar proportions were in the process of making the calculations (26%) or developing the accompanying narrative commentary (24%). Approaching a third (31%) were reviewing results (for example, with senior management) prior to reporting them.

Table 4 - Current progress towards complying with the regulations

| Total | Size (250-499) | Size (500-999) | Size (1,000+) | |

|---|---|---|---|---|

| Base (unweighted) | 229 | 79 | 73 | 77 |

| Learning about the reporting requirements | 7% | 9% | 7% | 3% |

| Collating the necessary data | 27% | 30% | 29% | 19% |

| In the process of making the calculations | 26% | 29% | 22% | 23% |

| Reviewing results prior to reporting | 31% | 28% | 34% | 32% |

| Developing a narrative or text to accompany the reported data | 24% | 25% | 19% | 26% |

| Don’t know | 1% | 1% | 0% | 3% |

Base: All that had developed or implemented a plan

Overall, just 5% of the interviewed employers indicated that they had already published their GPG results. These firms were asked to provide details of how they had reported their results, with the option to select multiple methods, as shown in Table 5 below. Due to the low base size (16 respondents), caution should be exercised when extrapolating these findings to the wider population of employers subject to the GPG regulations.

At the time of interview, only two-thirds (63%) of those firms that had reported their results had done so on the official government portal, as required to comply with the regulations. This equates to 3% of all private sector employers interviewed (which is broadly in line with GEO data on actual reporting progress at the time of the survey). The majority (71%) had made the results available on their own company website, and a fifth (21%) had published them in some other way (typically using social media).

Table 5 - How employers have reported their GPG results

| Total | |

|---|---|

| Base (unweighted) | 16 |

| Uploaded results to government Gender Pay Gap portal | 63% |

| Published results on own company website | 71% |

| Published results in some other way | 21% |

| Don’t know | 5% |

Base: All that had already reported their GPG results

Over half (56%) of all the private sector employers interviewed had registered on the government GPG reporting portal, and this was broadly consistent across company size. A third had used the GPG viewing service to see the data already reported by other employers, with this increasing to 47% of larger firms with 1,000+ employees.

Figure 5 - Registration on the GPG reporting portal and use of the viewing service

4.3 External support in complying with the regulations

At the time of the interim survey, 43% of private sector employers had obtained external support or advice to help them with the GPG reporting regulations. There is some indication that larger firms with 1,000+ employees were more likely to have accessed external support (52%), but this difference is not statistically significant.

Figure 6 - Proportion of employers obtaining external support with the regulations

Those employers that had accessed support were asked who they obtained it from, and those that had not were asked who they would approach if they needed support.

Table 6 - Where employers have obtained or would seek support with the regulations

| Top mentions only (5%+) | Sources used, all obtaining support | Potential sources (if needed), all not obtaining support | ||||||

|---|---|---|---|---|---|---|---|---|

| Total | 250-499 | 500-999 | 1,000+ | Total | 250-499 | 500-999 | 1,000+ | |

| Base (unweighted) | 134 | 48 | 41 | 45 | 171 | 77 | 52 | 42 |

| Legal professionals/advisers | 33% | 35% | 32% | 29% | 24% | 23% | 23% | 26% |

| External consultants | 25% | 19% | 15% | 47% | 12% | 13% | 6% | 17% |

| External payroll provider | 16% | 17% | 20% | 11% | 5% | 3% | 8% | 7% |

| Acas | 10% | 6% | 20% | 9% | 20% | 17% | 25% | 24% |

| Business/trade association or industry body | 8% | 8% | 10% | 7% | 3% | 4% | 0% | 2% |

| GEO | 2% | 2% | 5% | 0% | 16% | 19% | 8% | 14% |

| CIPD | 2% | 2% | 2% | 0% | 6% | 6% | 4% | 10% |

| Government website | 1% | 2% | 0% | 0% | 11% | 14% | 6% | 10% |

| Other Government dept | 1% | 2% | 0% | 0% | 10% | 10% | 12% | 5% |

| Generic/other website | 0% | 0% | 0% | 0% | 6% | 5% | 8% | 7% |

Base: All private sector employers

As shown in Table 6, among those obtaining support to assist them with the GPG regulations, the most widely used sources were legal professionals/advisers (33%) and consultants (25%). The latter were particularly likely to be used by larger firms with 1,000+ employees (47%).

Employers that had not obtained any support to date were also most likely to contact legal professionals/advisers if they needed assistance (24%). Acas and GEO were mentioned as potential sources of advice by a significant minority of these firms (20% and 16% respectively). However, the survey was positioned as being on behalf of GEO, which may have put it more top of mind.

Employers were asked to provide details of the type of support they had received, or in the case of those not yet obtaining external support, the type of support that would help them to comply with the GPG regulations. The most widely mentioned types of support are detailed in Table 7 below.

Table 7 - Types of support obtained or that would help with the regulations

| Top mentions only (5%+) | Support received, all obtaining support | Support that would help, all not obtaining support | ||||||

|---|---|---|---|---|---|---|---|---|

| Total | 250-499 | 500-999 | 1,000+ | Total | 250-499 | 500-999 | 1,000+ | |

| Base (unweighted) | 134 | 48 | 41 | 45 | 171 | 77 | 52 | 42 |

| Advice/guidance on how to measure or calculate their GPG | 58% | 63% | 44% | 64% | 17% | 21% | 13% | 12% |

| Advice/guidance on how to report their gender pay data | 40% | 33% | 49% | 42% | 16% | 14% | 15% | 21% |

| General advice/guidance (for example, on legislation/requirements) | 9% | 8% | 7% | 13% | 5% | 6% | 2% | 5% |

| Paying someone to calculate GPG figures and/or produce report | 6% | 2% | 10% | 9% | 2% | 3% | 2% | 0% |

| Guidance on the narrative commentary | 5% | 2% | 7% | 7% | 3% | 1% | 6% | 2% |

| Downloadable software to calculate their GPG | 5% | 6% | 0% | 7% | 6% | 8% | 4% | 2% |

| None/do not need external support | - | - | - | - | 40% | 38% | 37% | 52% |

| Don’t know | 5% | 6% | 0% | 7% | 16% | 18% | 17% | 7% |

Base: All private sector employers

The majority of those employers that had obtained external support indicated that this took the form of guidance on how to calculate their GPG (58%) or on how to report their data (40%). Although only a small minority, 6% had paid another organisation to calculate their GPG figures and/or produce the report for them.

When those employers that had not used any external support were asked what might help them comply with the regulations, advice on how to calculate and report their GPG data were also the most common responses (16% and 17% respectively). However, 40% of this group felt that they did not require any external support, and a further 16% were unsure as to what (if anything) they might need.

It should be noted that in many cases the types of assistance suggested by those respondents that had not accessed support were already being provided by Government (for example, the joint GEO/Acas guidance on gender pay gap reporting).

As detailed below, the guidance on GPG reporting produced by GEO and Acas had successfully reached the majority (71%) of employers subject to the new regulations by the time of the interim survey. This represents a significant increase on the baseline survey, when 55% of private sector employers had read this guidance.

Figure 7 - Proportion of employers reading the GEO/Acas guidance

71% had read the GEO/Acas guidance

| Proportion that had read the guidance | |

|---|---|

| 250-499 emps | 63% |

| 500-999 emps | 82% |

| 1,000+ emps | 78% |

| Baseline Survey | 55% |

Base: All private sector employers (Base, Don’t know) Total (305, 1%), 250-499 (125, 0%), 500-999 (93, 0%), 1,000+ (87, 2%) / Baseline Survey (406, 1%)

Over three-quarters of organisations with 500 to 999 and 1,000+ employees had read the GEO/Acas guidance (82% and 78% respectively), but this fell to 63% of those with 250 to 499 employees.

4.4 Publication of results

Private sector employers subject to the regulations were required to publish their gender pay data by 4th April 2018, and survey respondents were reminded of this prior to being asked when they planned to publish their results on the government GPG portal.

Most employers (61%) expected to publish their results prior to April (or had already done so), with a quarter (26%) planning to do so in March. However, at the time of the interim survey interviews (in December 2017 and January 2018), almost a third (30%) of employers had not yet decided on their publication date.

The distribution of planned publication dates was broadly consistent across the 3 employer size bands.

Figure 8 - Planned date of publishing GPG results on government portal

It should be noted that when a similar question was asked in the baseline survey, the proportion of employers who actually went on to report their results in each quarter was significantly lower than implied by the survey results. Further qualitative research found that employers’ expected publication dates were typically general ambitions rather than concrete plans, and other tasks had often taken priority over early compliance with the GPG regulations. In addition, some employers had found the process of collating and analysing their data more involved than initially expected, and others had been delayed due to circumstantial factors (for example, delays in receiving data from third party payroll systems providers).

Those employers that intended to publish their results before April 2018 or were unsure of their likely publication date were asked how much of a priority it was for them to do so earlier than the deadline.

As set out in Figure 9, approaching half (46%) of these employers saw early publication as a very or fairly high priority, and only 14% indicated that it was a low priority. Again, this picture was broadly consistent by employer size.

Figure 9 - Priority given to early publication of GPG results

When this data is analysed by employers’ planned publication date, it shows that those intending to publish in February 2018 or sooner were more likely to treat early publication as a high priority than those expecting to publish in March 2018 (56% vs. 30%). Half (49%) of those employers that were undecided as to when they would publish their GPG results also claimed it was a high priority to do so earlier than the April deadline.

Table 8 - Priority given to early publication of GPG results (by planned publication date)

| Planned publication date | |||

|---|---|---|---|

| Feb 18 or earlier | Mar 18 | Undecided | |

| Base (unweighted) | 101 | 76 | 92 |

| High priority | 56% | 30% | 49% |

| Neither | 34% | 51% | 36% |

| Low priority | 9% | 19% | 13% |

| Don’t know | 1% | 0% | 2% |

Base: All who plan to publish before April 2018 or undecided

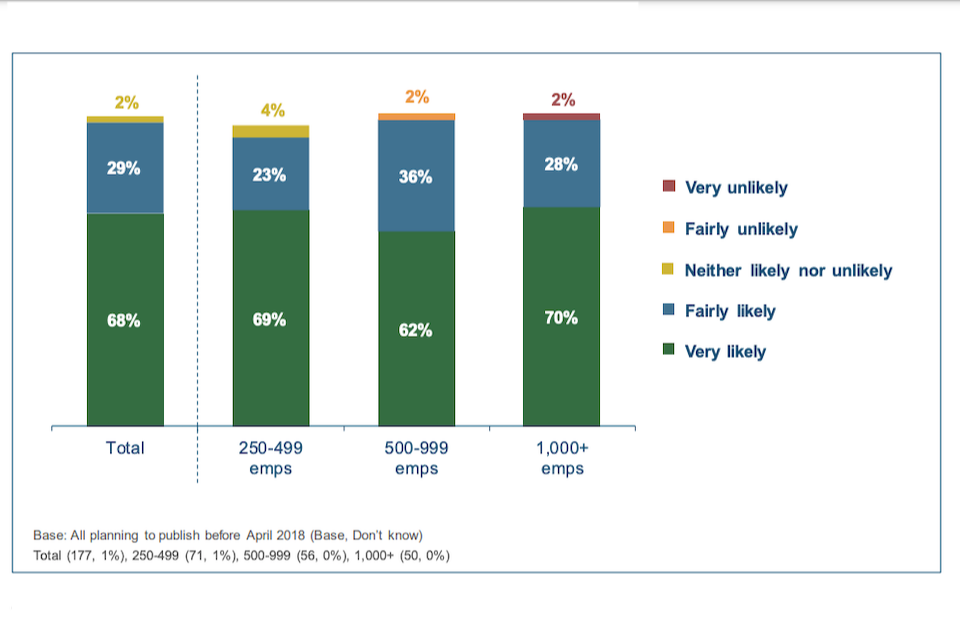

Employers that planned to publish their GPG results early (March 2018 or sooner) were asked how likely they were to achieve this target. The vast majority (96%) believed they would be able to publish in the month they intended, with two-thirds (68%) indicating it was very likely.

Figure 10 - Likelihood of publishing GPG results early

There was no difference in this respect between those planning to publish in March 2018 and those planning to do so in February 2018 or earlier.

Table 9 - Likelihood of publishing GPG results early (by planned publication date)

| Planned publication date | ||

|---|---|---|

| Feb 18 or earlier | Mar 18 | |

| Base (unweighted) | 101 | 76 |

| Likely | 95% | 97% |

| Neither | 3% | 2% |

| Unlikely | 1% | 1% |

| Don’t know | 1% | 0% |

Base: All who plan to publish before April 2018

The interim survey also captured data on whether employers planned to publish any additional information alongside the mandatory reporting requirements. As shown in Table 10 almost a third (30%) intended to do so, with this most likely to be an accompanying narrative commentary (20%). The larger the organisation the more likely they were to plan to publish additional information.

There is evidence that, over time, private sector employers became more inclined to produce further information or commentary alongside their GPG results. In the baseline survey 17% of firms intended to do this, compared to 30% in the interim survey. More specifically, the proportion planning to publish a narrative commentary also increased (from 13% to 20%). Given that employers were significantly more advanced in the calculation process by the time of the interim survey (see Chapter 4.2), this finding may be linked to greater understanding of their likely GPG scores and an associated desire to provide some context and explanation of these.

Table 10 - Whether plan to publish any additional information

| Total | Size (250-499) | Size (500-999) | Size (1,000+) | Baseline survey | |

|---|---|---|---|---|---|

| Base (unweighted) | 305 | 125 | 93 | 87 | 406 |

| Plan to publish additional information | 30% | 24% | 35% | 39% | 17% |

| - Narrative commentary on the results | 20% | 17% | 20% | 28% | 13% |

| - Additional/more detailed breakdowns | 6% | 4% | 4% | 10% | 5% |

| - Analysis of potential drivers of their GPG | 6% | 4% | 5% | 10% | 5% |

| - New/revised GPG action plan | 9% | 7% | 9% | 15% | 5% |

| - Other | 2% | 2% | 3% | 0% | 1% |

| - Do not plan to publish additional info | 50% | 60% | 51% | 29% | 53% |

| Don’t know | 19% | 16% | 14% | 32% | 30% |

Base: All private sector employers

There is also some evidence of an impact on employers’ overall strategies to reduce their GPG, with 9% intending to publish a new or revised GPG action plan (compared to 5% in the baseline survey).

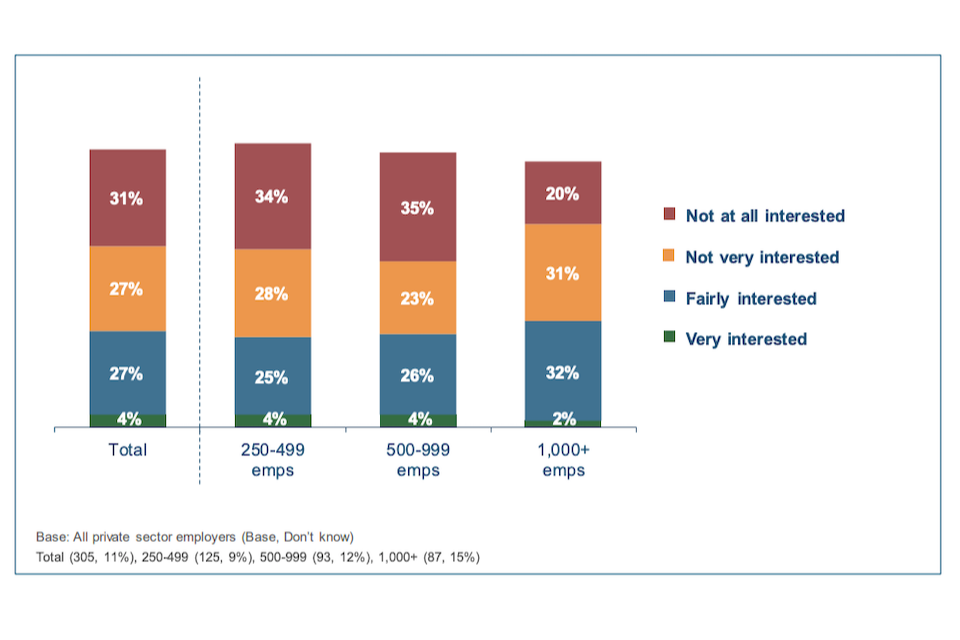

Employers were also asked whether they would be interested in voluntary group reporting, whereby a large number of companies from the same sector agree to report their GPG results on the same day. Approaching a third of employers expressed an interest in this, with results broadly consistent by size of firm.

Figure 11 - Interest in voluntary group reporting

5. Reducing the GPG

This chapter looks at the extent to which employers are seeking to reduce their gender pay gap, and the approaches they are adopting to do so. Specifically, it covers:

- the degree to which reducing the GPG was seen as a priority

- the likely impact of a large GPG on perceptions of the employer

- the extent to which employers had developed (and acted on) plans to reduce their GPG

5.1 Priority given to reducing the GPG

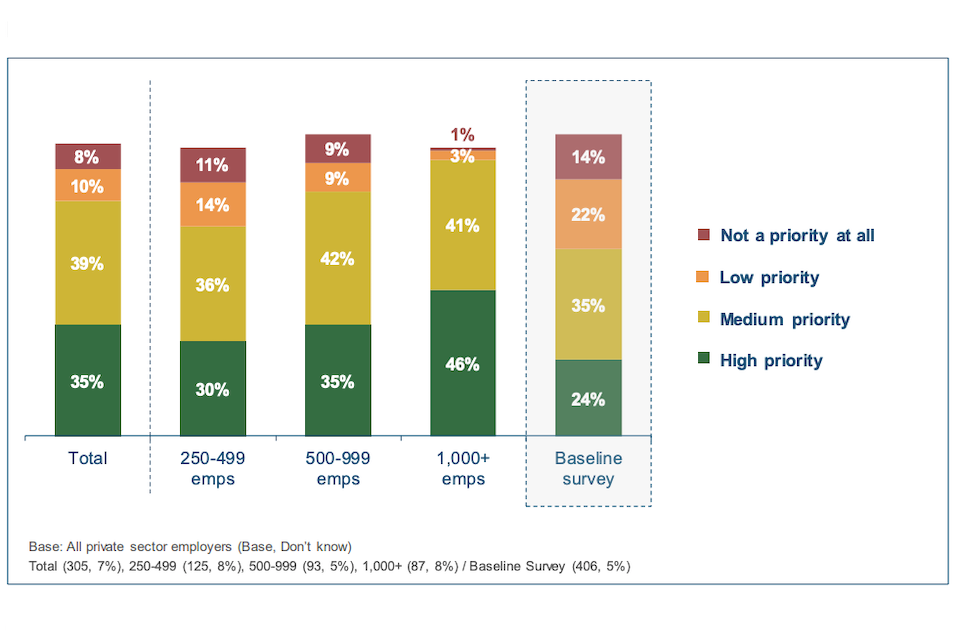

Over a third (35%) of in-scope private sector employers considered reducing their GPG to be a high priority, with most of the remainder (39%) seeing this as a medium priority. However, almost 1 in 5 employers (19%) described this as either a low priority or judged it not to be a priority at all.

There is evidence of a shift in employer attitudes towards reducing their GPG since the baseline wave, when only 24% felt it was a high priority and 36% saw it as a low or non priority.

Figure 12 - Priority given to reducing the GPG

Organisations with 1,000+ employees were comparatively more likely to allocate a high priority to reducing their GPG (46%).

Those employers that viewed reducing their GPG as a low or non priority were less likely to have taken action to comply with the transparency regulations. Over a third (36%) of this group had either not thought about the regulations or had reviewed the requirements but done nothing further, compared to 12% of those that saw it as a high or medium priority for their organisation.

5.2 Perceived impact of a large GPG

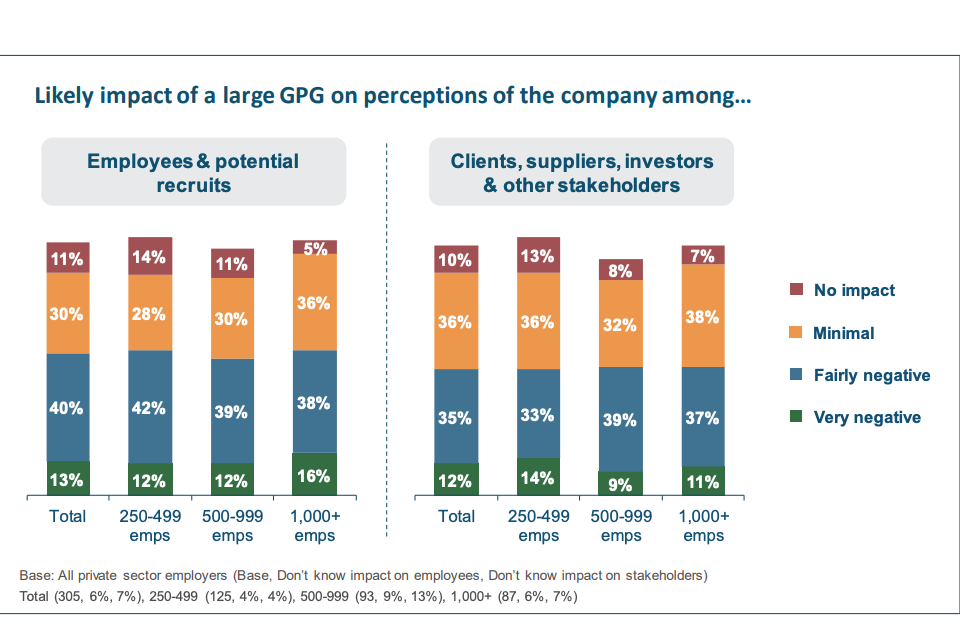

Employers were asked to predict the impact of a large or significant GPG on perceptions of their company, both among current employees and potential recruits, and among other external stakeholders such as clients, suppliers and investors.

Just over half (53%) of private sector employers believed that if they had a large GPG this would have a very or fairly negative impact on perceptions of their company among current or prospective staff. A slightly lower proportion (47%) anticipated a negative impact on how external stakeholders viewed their company. However, in each case, around 1 in 10 employers believed a large GPG would have no impact at all on perceptions of their organisation.

There were no consistent differences in this respect by employer size.

Figure 13 - Expected impact of large GPG on perceptions of the company

As might be expected, those employers that did not view reducing their GPG as a priority were typically less likely to anticipate a negative impact on company perceptions. Just 29% of this group felt that a large GPG would have a negative impact on perceptions among current/future employees and 24% on perceptions among external stakeholders (compared to 60% and 55% respectively for those that identified reducing their GPG as a high or medium priority).

5.3 Approach to reducing the GPG

A third (32%) of private sector employers had developed a formalised action plan for reducing their GPG, although only 9% had already implemented any of the specified actions. Most of the remainder (41% of all employers interviewed) intended to take action but had not yet developed any concrete plans, and approaching a fifth (18%) did not intend to do anything.

While a broadly similar pattern was seen in the baseline survey, the proportion of employers that had developed an action plan increased (from 20% to 32%).

Figure 14 - Employers’ current approach to reducing their GPG

While still in the minority, large organisations (1,000+ employees) were most likely to have already implemented an action plan (16%). They were also least likely to have no plans to take any action to reduce their GPG (7%).

As seen in the baseline survey, there was a correlation between the priority allocated to reducing their GPG and the degree of action employers had taken to achieve this. Two- fifths (39%) of those treating it as a high or medium priority had developed a formalised plan, compared to just 9% of those for whom it was a low or non priority.

6. Sources of HR/business news and information

This chapter looks at the ways in which those individuals responsible for their organisation’s GPG reporting access HR or general business news and information. This topic was covered in order to support the efficacy of Government communications promoting compliance with the regulations. Specifically, it covers:

- Social media sites used

- HR and general business magazines or publications read

- Websites used for HR or general business news and information

6.1 Social media

Among respondents to this survey (such as those responsible for dealing with their organisation’s GPG reporting), over half (55%) did not use social media to keep up to date with HR or general business news and information.

Among those that did use social media for this purpose, the most widely used platform was LinkedIn (29%), followed by Twitter and Facebook (11% and 9% respectively).

Table 11 - Social media sites used for HR and general business news/information (unprompted)

| Total | Size | |||

|---|---|---|---|---|

| 250-499 | 500-999 | 1,000+ | ||

| Base (unweighted) | 305 | 125 | 93 | 87 |

| 29% | 28% | 27% | 34% | |

| 11% | 10% | 12% | 14% | |

| 9% | 9% | 8% | 9% | |

| Google+ | 3% | 1% | 4% | 5% |

| Other social media sites | 1% | 2% | 0% | 0% |

| Don’t know / Can’t remember | 5% | 6% | 5% | 3% |

| Do not use social media for HR/business news | 55% | 55% | 57% | 51% |

Base: All private sector employers

The proportion using social media, and the sites used, was broadly similar across the different sizes of private sector employers.

6.2 Magazines and publications

Survey respondents read a wide range of HR and general business magazines and publications, with those produced by the Chartered Institute of Personnel and Development (CIPD) among the most widely mentioned. Over a third (37%) read People Management, a further 5% read the CIPD’s Work magazine and 8% mentioned a CIPD magazine but did not specify the title.

Of the non-CIPD titles, HR Magazine was the most commonly mentioned (10%). However, approaching a third of respondents did not read HR or general business magazines or publications.

Table 12 - HR and general business magazines and publications read (unprompted)

| Top mentions (2%+) | Total | Size | ||

|---|---|---|---|---|

| 250-499 | 500-999 | 1,000+ | ||

| Base (unweighted) | 305 | 125 | 93 | 87 |

| People Management | 37% | 39% | 34% | 33% |

| HR Magazine | 10% | 10% | 12% | 9% |

| CIPD magazine (unspecified) | 8% | 6% | 8% | 10% |

| Personnel Today | 6% | 4% | 6% | 10% |

| Work | 5% | 5% | 6% | 6% |

| Expert HR | 5% | 4% | 6% | 6% |

| The HR Director | 3% | 2% | 5% | 1% |

| Employee Benefits | 2% | 1% | 0% | 7% |

| Business Insider | 2% | 2% | 2% | 2% |

| Professional in Payroll, Pensions & Reward | 2% | 2% | 1% | 3% |

| The Financial Times | 2% | 2% | 3% | 1% |

| Don’t know / Can’t remember | 6% | 7% | 6% | 5% |

| Do not read HR/business publications | 30% | 32% | 31% | 25% |

Base: All private sector employers

There was little difference in the publications read by employer size.

6.3 Websites

The most widely used websites for HR and business information were those of the CIPD (44%) and Acas (38%). A further 19% visited the official government website, and 15% used Expert HR.

Table 13 - Websites used for HR and general business news/information (unprompted)

| Top mentioned (2%+) | Total | Size | ||

|---|---|---|---|---|

| 250-499 | 500-999 | 1,000+ | ||

| Base (unweighted) | 305 | 125 | 93 | 87 |

| CIPD | 44% | 46% | 41% | 44% |

| Acas | 38% | 42% | 34% | 32% |

| Government website (gov.uk) | 19% | 18% | 22% | 18% |

| Expert HR | 15% | 14% | 17% | 15% |

| HMRC | 7% | 7% | 5% | 10% |

| Personnel Today | 6% | 5% | 8% | 8% |

| HR Grapevine | 4% | 4% | 3% | 6% |

| HR Aspects | 4% | 2% | 2% | 8% |

| EEF | 3% | 2% | 4% | 2% |

| HR Review | 2% | 2% | 2% | 5% |

| CIPP | 2% | 1% | 2% | 6% |

| HR News | 2% | 2% | 2% | 1% |

| Don’t know / Can’t remember | 6% | 6% | 8% | 2% |

| Do not visit websites for HR/business news | 10% | 10% | 8% | 11% |

Base: All private sector employers

As with social media and magazines, there was generally little difference by company size when it came to the websites used for HR and general business information.

7. Annex A. Full survey results

This annex provides the results to each individual question in this interim survey. Results have been shown at the total level and by employer size.

S1b – Please can I take a note of your job title?

| Total | Size (250-499) | Size (500-999) | Size (1,000+) | |

|---|---|---|---|---|

| Base (unweighted) | 305 | 125 | 93 | 87 |

| HR Director/Manager | 37% | 38% | 35% | 34% |

| Payroll Manager/Administrator | 16% | 11% | 23% | 21% |

| HR Administrator/Advisor/Officer | 12% | 14% | 11% | 9% |

| Rewards/Benefits Manager/Analyst | 7% | 1% | 8% | 18% |

| Finance Director/Manager | 7% | 9% | 5% | 5% |

| HR Business Partner/Consultant | 6% | 6% | 6% | 5% |

| Director/Manager (Other/Unspecified) | 4% | 5% | 4% | 1% |

| Accountant/Accounts Manager/Administrator | 4% | 7% | 0% | 0% |

| People/Talent Manager/Advisor | 2% | 1% | 2% | 6% |

| General/Office Manager | 2% | 2% | 3% | 0% |

| CEO/MD | 2% | 2% | 1% | 0% |

| Operations Director/Manager | 1% | 1% | 0% | 1% |

| Other | 1% | 2% | 1% | 0% |

Base: All private sector employers

S2 – Which of the following best describes your organisation?

| Total | Size (250-499) | Size (500-999) | Size (1,000+) | |

|---|---|---|---|---|

| Base (unweighted) | 305 | 125 | 93 | 87 |

| A private sector company that seeks to make a profit | 100% | 100% | 100% | 100% |

| A charity, voluntary sector or not-for-profit organisation | 0% | 0% | 0% | 0% |

| A public sector organisation | 0% | 0% | 0% | 0% |

Base: All private sector employers

S3a/b – How many employees does your organisation currently employ in Great Britain?

| Total | Size (250-499) | Size (500-999) | Size (1,000+) | |

|---|---|---|---|---|

| Base (unweighted) | 305 | 125 | 93 | 87 |

| 250-499 | 51% | 100% | - | - |

| 500-999 | 25% | - | 100% | - |

| 1,000+ | 23% | - | - | 100% |

Base: All private sector employers

A2 – Which of the following statements best describes your understanding of the Gender Pay Gap?

| Total | Size (250-499) | Size (500-999) | Size (1,000+) | |

|---|---|---|---|---|

| Base (unweighted) | 305 | 125 | 93 | 87 |

| You have heard the term but don’t know anything about it | 2% | 3% | 2% | 0% |

| You have a limited understanding of what it refers to | 7% | 8% | 4% | 6% |

| You have a reasonable understanding of it but not of how it’s calculated | 28% | 31% | 28% | 20% |

| Or, you have a good understanding of what the Gender Pay Gap is and how it is calculated | 64% | 58% | 66% | 75% |

Base: All private sector employers

A3 – Which of the following statements best describes your understanding of the difference between ‘closing the Gender Pay Gap’ and ‘ensuring Equal Pay between men and women’?

| Total | Size (250-499) | Size (500-999) | Size (1,000+) | |

|---|---|---|---|---|

| Base (unweighted) | 305 | 125 | 93 | 87 |

| You didn’t know there was a difference | 8% | 11% | 5% | 3% |

| You know there’s a difference but are not sure exactly what this is | 27% | 32% | 23% | 22% |

| You have a good understanding of how they differ | 64% | 56% | 71% | 75% |

| Don’t know | 1% | 1% | 1% | 0% |

Base: All private sector employers

D1 – Which of the following statements best describes how well informed you consider yourself to be about these new regulations?

| Total | Size (250-499) | Size (500-999) | Size (1,000+) | |

|---|---|---|---|---|

| Base (unweighted) | 305 | 125 | 93 | 87 |

| You were not aware of the new transparency regulations before today | 2% | 3% | 1% | 0% |

| You have heard of them but know nothing about them | 3% | 4% | 1% | 1% |

| You know about them, but aren’t sure what is required | 6% | 9% | 4% | 2% |

| You understand what is required but not how to do it | 22% | 26% | 22% | 15% |

| Or, you understand what is required and how to do it | 67% | 58% | 72% | 80% |

| You do not think the regulations apply to you | 0% | 0% | 0% | 1% |

Base: All private sector employers

D2 – At what stage is your organisation in complying with the Gender Pay Gap regulations? Would you say that…?

| Total | Size (250-499) | Size (500-999) | Size (1,000+) | |

|---|---|---|---|---|

| Base (unweighted) | 305 | 125 | 93 | 87 |

| You have not yet thought about them | 3% | 6% | 1% | 1% |

| You have reviewed the requirements but not yet done anything further | 14% | 20% | 10% | 5% |

| You have developed a plan for how and when you will meet the requirements | 13% | 12% | 17% | 10% |

| You have started implementing a plan, but have not yet reported your results | 60% | 51% | 61% | 78% |

| Or, you have already reported your Gender Pay Gap results | 5% | 5% | 6% | 5% |

| Don’t know | 3% | 3% | 3% | 1% |

| Not aware of the regulations (at D1) | 2% | 3% | 1% | 0% |

Base: All private sector employers

D11a – And which one of the following best describes your current progress? Are you…?

| Total | Size (250-499) | Size (500-999) | Size (1,000+) | |

|---|---|---|---|---|

| Base (unweighted) | 229 | 79 | 73 | 77 |

| Learning about the reporting requirements | 7% | 9% | 7% | 3% |

| Collating the necessary data | 27% | 30% | 29% | 19% |

| In the process of making the calculations | 26% | 29% | 22% | 23% |

| Reviewing results prior to reporting (for example, with senior management) | 31% | 28% | 34% | 32% |

| Or, developing a narrative or text to accompany the reported data | 24% | 25% | 19% | 26% |

| Don’t know | 1% | 1% | 0% | 3% |

Base: All who have developed or implemented a plan

D11b – Specifically, which of the following have you done?

| Total | Size (250-499) | Size (500-999) | Size (1,000+) | |

|---|---|---|---|---|

| Base (unweighted) | 16 | 6 | 6 | 4 |

| Uploaded your results to the government Gender Pay Gap portal | 63% | 67% | 67% | 50% |

| Published your results on your own company website | 71% | 83% | 50% | 75% |

| Other: Social media platform | 16% | 33% | 0% | 0% |

| Other: HMRC portal | 5% | 0% | 17% | 0% |

| Don’t know | 5% | 0% | 0% | 25% |

Base: All who have already reported their GPG

D11c – And have you registered on the government Gender Pay Gap reporting portal yet?

| Total | Size (250-499) | Size (500-999) | Size (1,000+) | |

|---|---|---|---|---|

| Base (unweighted) | 305 | 125 | 93 | 87 |

| Yes | 52% | 50% | 56% | 53% |

| No | 35% | 39% | 31% | 30% |

| Don’t know | 7% | 4% | 8% | 15% |

| Have already uploaded to portal (at D11b) | 3% | 3% | 4% | 2% |

| Not aware of the regulations (at D1) | 2% | 3% | 1% | 0% |

| Net: Registered on portal | 56% | 54% | 60% | 55% |

Base: All private sector employers

D11d – And have you used the government’s Gender Pay Gap Viewing Service, where you can see the data already reported by other employers?

| Total | Size (250-499) | Size (500-999) | Size (1,000+) | |

|---|---|---|---|---|

| Base (unweighted) | 305 | 125 | 93 | 87 |

| Yes | 32% | 22% | 38% | 47% |

| No | 63% | 73% | 58% | 46% |

| Don’t know | 3% | 2% | 3% | 7% |

| Not aware of the regulations (at D1) | 2% | 3% | 1% | 0% |

Base: All private sector employers

D12 – Have you obtained support or advice from anyone external to your business to help you with the Gender Pay Gap reporting regulations?

| Total | Size (250-499) | Size (500-999) | Size (1,000+) | |

|---|---|---|---|---|

| Base (unweighted) | 305 | 125 | 93 | 87 |

| Yes | 43% | 38% | 44% | 52% |

| No | 53% | 57% | 53% | 46% |

| Don’t know | 2% | 2% | 2% | 2% |

| Not aware of the regulations (at D1) | 2% | 3% | 1% | 0% |

Base: All private sector employers

D3a – If you needed support in complying with the new regulations, where would you look to for advice?

| Total | Size (250-499) | Size (500-999) | Size (1,000+) | |

|---|---|---|---|---|

| Base (unweighted) | 171 | 77 | 52 | 42 |

| Legal professionals/advisors | 24% | 23% | 23% | 26% |

| Acas | 20% | 17% | 25% | 24% |

| GEO | 16% | 19% | 8% | 14% |

| External consultants | 12% | 13% | 6% | 17% |

| Government website | 11% | 14% | 6% | 10% |

| Other Government department | 10% | 10% | 12% | 5% |

| CIPD | 6% | 6% | 4% | 10% |

| Generic/other website | 6% | 5% | 8% | 7% |

| External payroll provider | 5% | 3% | 8% | 7% |

| Internal source (for example, HR/payroll dept, senior mgt) | 3% | 3% | 2% | 7% |

| HMRC | 2% | 0% | 6% | 5% |

| Accountants/auditors | 3% | 4% | 2% | 2% |

| Business/trade association or industry body | 3% | 4% | 0% | 2% |

| An HR website | 1% | 0% | 4% | 0% |

| Other | 4% | 5% | 6% | 0% |

| Don’t know | 3% | 0% | 8% | 5% |

| Nowhere / Would not need support | 5% | 8% | 2% | 2% |

Base: All not obtaining support

D10a – And what, if any, external support or assistance would help you comply with the Gender Pay Gap regulations?

| Total | Size (250-499) | Size (500-999) | Size (1,000+) | |

|---|---|---|---|---|

| Base (unweighted) | 171 | 77 | 52 | 42 |

| Advice/guidance on how to measure or calculate their Gender Pay Gap | 17% | 21% | 13% | 12% |

| Advice/guidance on how to report their gender pay data | 16% | 14% | 15% | 21% |

| Downloadable software to calculate their Gender Pay Gap | 6% | 8% | 4% | 2% |

| General advice/guidance (for example, on legislation/requirements) | 5% | 6% | 2% | 5% |

| Clearer/more specific guidance | 4% | 1% | 6% | 7% |

| Guidance on the narrative commentary | 3% | 1% | 6% | 2% |

| Gender Pay Gap benchmarks from other organisations/their sector | 3% | 5% | 0% | 2% |

| Case studies/examples from other organisations | 3% | 4% | 2% | 2% |

| Helpline/point of contact | 2% | 1% | 4% | 0% |

| Checks/reviews of calculations etc | 2% | 1% | 2% | 2% |

| Pay someone to calculate their GPG figures and/or produce the report | 2% | 3% | 2% | 0% |

| Support/resource for HR/payroll | 2% | 1% | 0% | 5% |

| Financial support | 1% | 1% | 0% | 0% |

| Training/workshops/seminars/webinars | 1% | 1% | 0% | 0% |

| Legal advice | 1% | 1% | 0% | 0% |

| Other | 3% | 4% | 4% | 0% |

| Don’t know | 16% | 18% | 17% | 7% |

| None / Do not need external support | 40% | 38% | 37% | 52% |

Base: All not obtaining support

D3b – Who did you get this support or advice from?

| Total | Size (250-499) | Size (500-999) | Size (1,000+) | |

|---|---|---|---|---|

| Base (unweighted) | 134 | 48 | 41 | 45 |

| Legal professionals/advisors | 33% | 35% | 32% | 29% |

| External consultants | 25% | 19% | 15% | 47% |

| External payroll provider | 16% | 17% | 20% | 11% |

| Acas | 10% | 6% | 20% | 9% |

| Business/trade association or industry body | 8% | 8% | 10% | 7% |

| External HR provider | 4% | 6% | 2% | 2% |

| Internal source (for example, HR/payroll dept, senior mgt) | 2% | 2% | 5% | 0% |

| Accountants/auditors | 2% | 2% | 2% | 2% |

| An HR website | 2% | 0% | 5% | 2% |

| GEO | 2% | 2% | 5% | 0% |

| CIPD | 2% | 2% | 2% | 0% |

| Other Government department | 1% | 2% | 0% | 0% |

| Government website | 1% | 2% | 0% | 0% |

| HMRC | 1% | 0% | 0% | 2% |

| Other | 3% | 4% | 0% | 4% |

| Don’t know | 3% | 2% | 5% | 2% |

Base: All obtaining support

D10b – And specifically, what sort of support or advice did you receive? What did it relate to?

| Total | Size (250-499) | Size (500-999) | Size (1,000+) | |

|---|---|---|---|---|

| Base (unweighted) | 134 | 48 | 41 | 45 |

| Advice/guidance on how to measure or calculate their Gender Pay Gap | 58% | 63% | 44% | 64% |

| Advice/guidance on how to report their gender pay data | 40% | 33% | 49% | 42% |

| General advice/guidance (for example, on legislation/requirements) | 9% | 8% | 7% | 13% |

| Paid someone to calculate their GPG figures and/or produce the report | 6% | 2% | 10% | 9% |

| Guidance on the narrative commentary | 5% | 2% | 7% | 7% |

| Downloadable software to calculate their Gender Pay Gap | 5% | 6% | 0% | 7% |

| Guidance/advice on specific issues | 4% | 2% | 5% | 7% |

| Training/workshops/seminars/webinars | 4% | 4% | 2% | 4% |

| Gender Pay Gap benchmarks from other organisations/their sector | 3% | 4% | 5% | 0% |

| Support/resource for HR/payroll | 2% | 0% | 7% | 0% |

| Legal advice | 2% | 0% | 7% | 0% |

| Case studies/examples from other organisations | 2% | 2% | 2% | 2% |

| Financial support | 1% | 0% | 2% | 0% |

| Checks/reviews of calculations etc | 1% | 0% | 0% | 2% |

| Other | 3% | 4% | 5% | 0% |

| Don’t know | 5% | 6% | 0% | 7% |

Base: All obtaining support

D4 – Have you read the guidance on Gender Pay Gap reporting that has been produced by the Government Equalities Office and Acas?

| Total | Size (250-499) | Size (500-999) | Size (1,000+) | |

|---|---|---|---|---|

| Base (unweighted) | 305 | 125 | 93 | 87 |

| Yes | 71% | 63% | 82% | 78% |

| No | 26% | 34% | 17% | 20% |

| Don’t know | 1% | 0% | 0% | 2% |

| Not aware of the regulations | 2% | 3% | 1% | 0% |

Base: All private sector employers

D15 – As far as you are aware, when is the deadline by which private sector employers are required to publish their gender pay gap data?

| Total | Size (250-499) | Size (500-999) | Size (1,000+) | |

|---|---|---|---|---|

| Base (unweighted) | 305 | 125 | 93 | 87 |

| January 2018 | 0% | 1% | 0% | 0% |

| February 2018 | 0% | 1% | 0% | 0% |

| March 2018 | 8% | 3% | 16% | 11% |

| April 2018 | 77% | 77% | 73% | 80% |

| Any date later than April 2018 | 2% | 2% | 1% | 2% |

| Don’t know | 10% | 13% | 9% | 6% |

| Not aware of the regulations (at D1) | 2% | 3% | 1% | 0% |

Base: All private sector employers

D5 – To clarify, the regulations require relevant private sector employers to publish their gender pay data no later than the 4th April 2018. When does your organisation intend to publish its results on the official government portal?

| Total | Size (250-499) | Size (500-999) | Size (1,000+) | |

|---|---|---|---|---|

| Base (unweighted) | 305 | 125 | 93 | 87 |

| December 2017 | 2% | 2% | 1% | 0% |

| January 2018 | 16% | 14% | 22% | 14% |

| February 2018 | 15% | 11% | 16% | 21% |

| March 2018 | 26% | 29% | 22% | 23% |

| April 2018 | 8% | 11% | 5% | 5% |

| Have not yet decided when you will publish the results | 22% | 22% | 18% | 25% |

| Don’t know | 8% | 6% | 10% | 10% |

| Don’t intend to publish results | 1% | 1% | 2% | 0% |

| Have already published on the portal (at D11b) | 3% | 3% | 4% | 2% |

| Net: Not decided / Don’t know | 30% | 28% | 28% | 36% |

Base: All private sector employers

D13a – How much of a priority is it for your business to report your Gender Pay Gap results earlier than the April deadline?

| Total | Size (250-499) | Size (500-999) | Size (1,000+) | |

|---|---|---|---|---|

| Base (unweighted) | 269 | 106 | 82 | 81 |

| Very high priority | 17% | 16% | 16% | 21% |

| Fairly high priority | 29% | 26% | 32% | 30% |

| Neither a high or low priority | 39% | 42% | 35% | 40% |

| Fairly low priority | 9% | 10% | 7% | 7% |

| Very low priority | 5% | 4% | 9% | 2% |

| Don’t know | 1% | 2% | 1% | 0% |

Base: All who plan to publish before April 2018 (or haven’t decided or don’t know)

D13b – And how likely do you think you are to achieve your target of reporting before April 2018?

| Total | Size (250-499) | Size (500-999) | Size (1,000+) | |

|---|---|---|---|---|

| Base (unweighted) | 177 | 71 | 56 | 50 |

| Very likely | 68% | 69% | 62% | 70% |

| Fairly likely | 29% | 25% | 36% | 28% |

| Neither likely or unlikely | 2% | 4% | 0% | 0% |

| Fairly unlikely | 0% | 0% | 2% | 0% |

| Very unlikely | 0% | 0% | 0% | 2% |

| Don’t know | 1% | 1% | 0% | 0% |

Base: All who plan to publish before April 2018

D6 – Do you plan to externally publish any additional information beyond that required by the regulations?

| Total | Size (250-499) | Size (500-999) | Size (1,000+) | |

|---|---|---|---|---|

| Base (unweighted) | 305 | 125 | 93 | 87 |

| Yes | 30% | 24% | 35% | 39% |

| No | 49% | 59% | 48% | 29% |

| Don’t know | 19% | 16% | 14% | 32% |

| Don’t intend to publish results (at D5) | 1% | 1% | 2% | 0% |

Base: All private sector employers

D7 – What else do you plan to publish?

| Total | Size (250-499) | Size (500-999) | Size (1,000+) | |

|---|---|---|---|---|

| Base (unweighted) | 305 | 125 | 93 | 87 |

| A narrative commentary on the results | 20% | 17% | 20% | 28% |

| Additional or more detailed breakdowns of your gender analysis | 6% | 4% | 4% | 10% |

| Other types of analysis looking at potential underlying drivers of your gender pay gap | 6% | 4% | 5% | 10% |

| A new or revised action plan or equivalent document on how you aim to address your Gender Pay Gap | 9% | 7% | 9% | 15% |

| Other: Additional information on the company website | 1% | 1% | 2% | 0% |

| Other: Details of all group companies/entities | 1% | 1% | 1% | 0% |

| Don’t know/undecided | 6% | 5% | 10% | 5% |

| Do not plan to publish additional info (at D6) | 49% | 59% | 48% | 29% |

| Don’t know if will publish additional info (at D6) | 19% | 16% | 14% | 32% |

| Don’t intend to publish results (at D5) | 1% | 1% | 2% | 0% |

Base: All private sector employers

D14 – How interested would you be in participating in voluntary group reporting, where a large number of companies from the same sector agree to report their Gender Pay Gap results on the same day?

| Total | Size (250-499) | Size (500-999) | Size (1,000+) | |

|---|---|---|---|---|

| Base (unweighted) | 305 | 125 | 93 | 87 |

| Very interested | 4% | 4% | 4% | 2% |

| Fairly interested | 27% | 25% | 26% | 32% |

| Not very interested | 27% | 28% | 23% | 31% |

| Not at all interested | 31% | 34% | 35% | 20% |

| Don’t know | 11% | 9% | 12% | 15% |

Base: All private sector employers

C1 – How much of a priority to your organisation is reducing your Gender Pay Gap? Would you say it is…?

| Total | Size (250-499) | Size (500-999) | Size (1,000+) | |

|---|---|---|---|---|

| Base (unweighted) | 305 | 125 | 93 | 87 |

| A high priority | 35% | 30% | 35% | 46% |

| A medium priority | 39% | 36% | 42% | 41% |

| A low priority | 10% | 14% | 9% | 3% |

| Not a priority at all | 8% | 11% | 9% | 1% |

| Don’t know | 7% | 8% | 5% | 8% |

Base: All private sector employers

C12a – If your organisation had a large or significant Gender Pay Gap, what impact do you think this would have on the perceptions of your company among current employees and potential recruits? Would this have…?

| Total | Size (250-499) | Size (500-999) | Size (1,000+) | |

|---|---|---|---|---|

| Base (unweighted) | 305 | 125 | 93 | 87 |

| A very negative impact | 13% | 12% | 12% | 16% |

| A fairly negative impact | 40% | 42% | 39% | 38% |

| A minimal impact | 30% | 28% | 30% | 36% |

| No impact | 11% | 14% | 11% | 5% |

| Don’t know | 6% | 4% | 9% | 6% |

Base: All private sector employers

C12b – And what impact would a large or significant Gender Pay Gap have on the perceptions of your company among clients, suppliers, investors and other external stakeholders? Would this have…?

| Total | Size (250-499) | Size (500-999) | Size (1,000+) | |

|---|---|---|---|---|

| Base (unweighted) | 305 | 125 | 93 | 87 |

| A very negative impact | 12% | 14% | 9% | 11% |

| A fairly negative impact | 35% | 33% | 39% | 37% |

| A minimal impact | 36% | 36% | 32% | 38% |

| No impact | 10% | 13% | 8% | 7% |

| Don’t know | 7% | 4% | 13% | 7% |

Base: All private sector employers

C3 – Which of the following best describes your organisation’s current approach to reducing your Gender Pay Gap?

| Total | Size (250-499) | Size (500-999) | Size (1,000+) | |

|---|---|---|---|---|

| Base (unweighted) | 305 | 125 | 93 | 87 |

| You have developed a formalised plan or strategy and undertaken some or all of the specified actions | 9% | 6% | 9% | 16% |

| You have developed a formalised plan or strategy that includes specific actions, but have not yet implemented them | 23% | 22% | 26% | 20% |

| You intend to take action but have not yet developed any specific plans | 41% | 41% | 38% | 44% |

| Or, you have no plans to take any action to reduce your Gender Pay Gap | 18% | 22% | 22% | 7% |

| Don’t know | 9% | 9% | 6% | 14% |

Base: All private sector employers

F1 – Which, if any, social media sites do you use to keep up to date with HR and general business news and information?

| Total | Size (250-499) | Size (500-999) | Size (1,000+) | |

|---|---|---|---|---|

| Base (unweighted) | 305 | 125 | 93 | 87 |

| 29% | 28% | 27% | 34% | |

| 11% | 10% | 12% | 14% | |

| 9% | 9% | 8% | 9% | |

| Google+ | 3% | 1% | 4% | 5% |

| Other social media sites | 1% | 2% | 0% | 0% |

| Social media feeds from other organisations (Acas, CIPD, Expert HR, etc) | 8% | 10% | 6% | 6% |

| Don’t know | 5% | 6% | 5% | 3% |

| Do not use social media for HR/business news | 55% | 55% | 57% | 51% |

Base: All private sector employers

F2 – And which HR and general business magazines or publications do you read?

| Total | Size (250-499) | Size (500-999) | Size (1,000+) | |

|---|---|---|---|---|

| Base (unweighted) | 305 | 125 | 93 | 87 |

| People Management | 37% | 39% | 34% | 33% |

| HR Magazine | 10% | 10% | 12% | 9% |

| CIPD magazine (unspecified) | 8% | 6% | 8% | 10% |

| Personnel Today | 6% | 4% | 6% | 10% |

| Work | 5% | 5% | 6% | 6% |

| Expert HR | 5% | 4% | 6% | 6% |

| The HR Director | 3% | 2% | 5% | 1% |

| Employee Benefits | 2% | 1% | 0% | 7% |

| Business Insider | 2% | 2% | 2% | 2% |

| Professional in Payroll, Pensions & Reward | 2% | 2% | 1% | 3% |

| The Financial Times | 2% | 2% | 3% | 1% |

| Director | 1% | 2% | 0% | 0% |

| Professional Manager | 1% | 0% | 2% | 0% |

| Other | 18% | 20% | 16% | 17% |

| Don’t know | 6% | 7% | 6% | 5% |

| Do not read HR/business publications | 30% | 32% | 31% | 25% |

Base: All private sector employers

F3 – And which websites do you visit for HR and general business news and information?

| Total | Size (250-499) | Size (500-999) | Size (1,000+) | |

|---|---|---|---|---|

| Base (unweighted) | 305 | 125 | 93 | 87 |

| CIPD | 44% | 46% | 41% | 44% |

| Acas | 38% | 42% | 34% | 32% |

| Government website (gov.uk) | 19% | 18% | 22% | 18% |

| Expert HR | 15% | 14% | 17% | 15% |

| HMRC | 7% | 7% | 5% | 10% |

| Personnel Today | 6% | 5% | 8% | 8% |

| HR Grapevine | 4% | 4% | 3% | 6% |

| HR Aspects | 4% | 2% | 2% | 8% |

| EEF | 3% | 2% | 4% | 2% |

| HR Review | 2% | 2% | 2% | 5% |

| CIPP | 2% | 1% | 2% | 6% |

| HR News | 2% | 2% | 2% | 1% |

| Bloomberg | 1% | 1% | 0% | 1% |

| Business.com | 0% | 0% | 1% | 0% |

| Forbes | 0% | 1% | 0% | 0% |

| Other | 21% | 21% | 15% | 29% |

| Don’t know | 6% | 6% | 8% | 2% |

| Do not visit websites for HR/business news | 10% | 10% | 8% | 11% |

Base: All private sector employers

SIC classification (IDBR data)

| Total | Size (250-499) | Size (500-999) | Size (1,000+) | |

|---|---|---|---|---|

| Base (unweighted) | 305 | 125 | 93 | 87 |

| A - Agriculture, Forestry and Fishing | 1% | 2% | 0% | 0% |

| B - Mining and Quarrying | 0% | 0% | 0% | 1% |

| C - Manufacturing | 15% | 13% | 20% | 14% |

| D - Electricity, Gas and Air Conditioning Supply | 0% | 1% | 0% | 0% |

| E - Water Supply – Sewerage, Waste Management and Remediation Activities | 1% | 1% | 3% | 0% |

| F - Construction | 4% | 3% | 1% | 9% |

| G - Wholesale and Retail Trade – Repair of Motor Vehicles and Motorcycles | 20% | 21% | 19% | 17% |

| H - Transportation and Storage | 4% | 1% | 5% | 10% |

| I - Accommodation and Food Service Activities | 10% | 9% | 8% | 17% |

| J - Information and Communication | 1% | 1% | 0% | 1% |

| K - Financial and Insurance Activities | 3% | 2% | 4% | 3% |

| L - Real Estate Activities | 2% | 2% | 2% | 1% |

| M - Professional, Scientific and Technical Activities | 10% | 10% | 11% | 7% |

| N - Administrative and Support Service Activities | 16% | 16% | 19% | 13% |

| P - Education | 2% | 2% | 0% | 1% |

| Q - Human Health and Social Work Activities | 7% | 11% | 2% | 3% |

| R - Arts, Entertainment and Recreation | 4% | 6% | 3% | 1% |

| S - Other Service Activities | 0% | 0% | 1% | 0% |

Base: All private sector employers

Government Office Region (IDBR data)

| Total | Size (250-499) | Size (500-999) | Size (1,000+) | |

|---|---|---|---|---|

| Base (unweighted) | 305 | 125 | 93 | 87 |

| East Midlands | 8% | 11% | 4% | 7% |

| East of England | 12% | 15% | 9% | 10% |

| London | 16% | 18% | 15% | 15% |

| North East | 3% | 2% | 1% | 5% |

| North West | 11% | 10% | 12% | 13% |

| South East | 18% | 14% | 17% | 25% |

| South West | 7% | 8% | 9% | 5% |

| West Midlands | 8% | 9% | 10% | 5% |

| Yorkshire & Humberside | 6% | 6% | 4% | 8% |

| Scotland | 7% | 5% | 13% | 5% |

| Wales | 3% | 2% | 6% | 3% |

Base: All private sector employers

Copyright OMB Research Ltd

Reference: DFE-RR-004

The views expressed in this report are the authors’ and do not necessarily reflect those of the Government Equalities Office.

Any enquiries regarding this publication should be sent to [email protected]. This document is available for download at www.gov.uk/government/publications

-

‘The Equality Act 2010 (Gender Pay Gap Information) Regulations 2017’ for the private/voluntary sector and ‘The Equality Act 2010 (Specific Duties and Public Authorities) Regulations 2017’ for the public sector. ↩

-

https://www.gov.uk/government/publications/gender-pay-gap-employers-action-and-understanding ↩

-

The specific date is 4th April 2018, although in the survey employers were just asked to identify the month. ↩

-

In order to comply with the regulations, employers are required to publish their GPG results on the government portal. ↩

-

The median is used for the headline GPG figure, although the mean is also used in some cases. ↩

-

This is based on Office for National Statistics analysis of median earnings for all employees (full and part time): https://www.ons.gov.uk/employmentandlabourmarket/peopleinwork/earningsandworkinghours/bulletins/ann ualsurveyofhoursandearnings/2017provisionaland2016revisedresults ↩

-

https://www.gov.uk/government/publications/gender-pay-gap-employers-action-and-understanding ↩

-

In cases where the employer had not yet taken any action on their GPG analysis/reporting, we interviewed someone who would be involved in this process. ↩

-

Calculated at the 95% level of confidence, and showing the ‘worst case’ scenario of 50% of the sample answering in the same way, which would result in the largest confidence intervals. If the responses are less evenly distributed, then the confidence intervals will reduce. ↩

-

Strictly speaking, calculations of statistical significance apply only to samples that have been selected using a probability (for example, fully random) sampling design. However, in practice it is reasonable to assume that these calculations provide a good indication of significant differences for quota sampling (as used for this research). ↩

-

The specific date was 4th April 2018, although in the survey employers were just asked to identify the month. ↩

-

Please note that not all of those ‘reporting’ their results had published them on the government Gender Pay Gap portal (as detailed in Table 4). ↩

-

The baseline survey did not include the ‘Started implementing plan but not yet reported’ or ‘Already reported GPG results’ options, but instead had an option for ‘Already able to meet the requirements’. ↩