LP12 Make and register your lasting power of attorney: a guide (web version)

Updated 2 April 2024

Applies to England and Wales

How to use this guide

This guide gives you information about making and registering your lasting power of attorney (LPA). It will be helpful to read this guide through before starting your LPA form to ensure no errors are made. You can also refer to it section by section whilst filling in your application.

Your lasting power of attorney (LPA)

An LPA is a legal document that lets you (the ‘donor’) choose trusted people (‘attorneys’) to make property and financial decisions or health and welfare decisions on your behalf.

You can only make an LPA if you have the necessary mental capacity. If you are making a property and financial affairs LPA you can choose whether your attorneys can make decisions as soon as the LPA is registered, or only when you have lost the capacity to make those decisions yourself. Attorneys can only make decisions under a health and welfare LPA when you have lost the capacity to make them.

Mental capacity is the ability to make a specific decision at the time that it needs to be made.

Your LPA is made under the law of England and Wales. If you would like to make a power of attorney that has effect outside of England and Wales you should consider taking legal advice on how best to achieve this.

You don’t need a lawyer to make an LPA, unless you have unusual or specific requirements.

It’s up to you to decide whether you want legal advice to fill in certain sections of the LPA.

Making your LPA: which type?

You’ll have to choose what sort of decision you’ll need help with. There are two kinds of LPA, covering two kinds of decisions:

-

property and financial affairs decisions

-

health and welfare decisions

Each LPA has its own form. To choose both, fill in both forms.

Property and financial affairs decisions: use form LP1F

Property and financial affairs decisions might be about:

-

opening, closing, and using your bank and building society accounts

-

claiming, receiving, and using your benefits, pensions and allowances

-

paying your household, care, and other bills

-

making or selling investments

-

buying or selling your home

With this type of LPA, you choose whether your attorneys can act for you as soon as the LPA is registered or only if you can no longer understand and make decisions (see section 5 of this guide).

You don’t have to own your own home or have a lot of money to make an LPA for property and financial decisions. For example, if it’s hard to manage your bank account or bills alone, you may want someone to help.

You can appoint different attorneys for your personal finances and your business affairs. To do this, fill in two LP1F forms.

Health and welfare decisions: use form LP1H

Health and welfare decisions might be about:

-

giving or refusing consent to health care

-

staying in your own home and getting help and support from social services

-

moving into residential care and finding a good care home

-

day-to-day matters such as your diet, dress, or daily routine

With this type of LPA, your attorneys can only make decisions when you don’t have mental capacity.

One very important decision has its own section in a health and welfare LPA. You can choose whether your attorneys or your doctors should make decisions about accepting or refusing medical treatment to keep you alive, if you can’t make or understand that decision yourself.

Read more about life-sustaining treatment in section 5 of this guide.

You don’t have to have complex health or welfare problems to make an LPA. It’s a way of planning for your care in case you can’t make decisions for yourself in the future.

People involved in your LPA

You (the donor) need to choose people for your LPA. Discuss this with them before you name them in your LPA form.

Before the official form starts, there’s a page to make a note of everyone involved in the LPA – you don’t have to fill it in, but you might find it useful.

The people that are needed to make an LPA

Donor:

see section 1 of this guide.

Attorneys:

see section 2 of this guide.

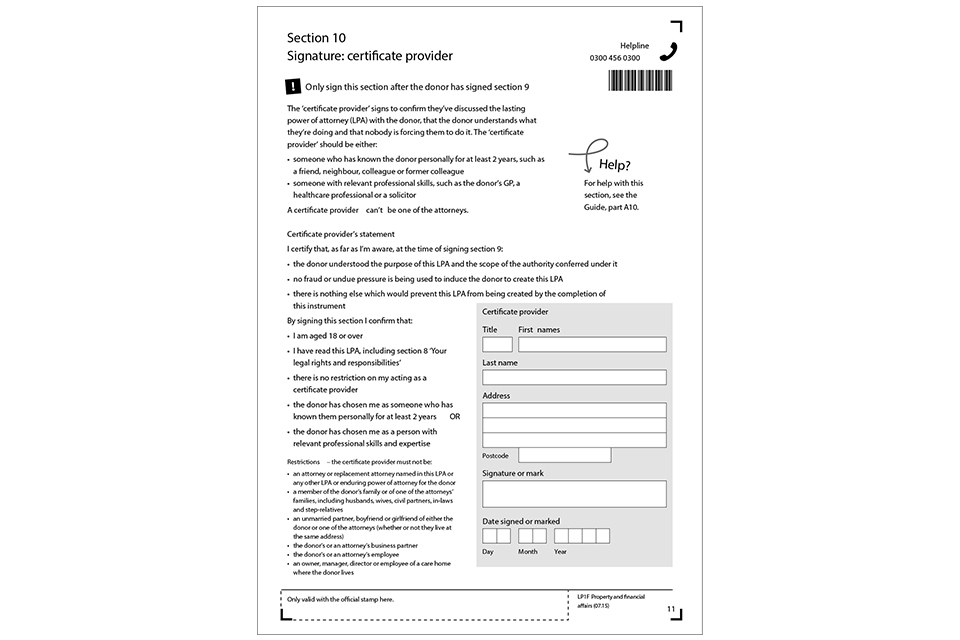

Certificate provider:

see section 10 of this guide.

Witnesses:

An impartial person must witness you and your attorneys signing your LPA. You can’t witness your attorneys’ signatures and they can’t witness yours.

People you might want to include in your LPA

Replacement attorneys:

see section 4 of this guide.

People to notify:

see section 6 of this guide.

Registering your LPA

Before you can use your LPA, you must register it with the Office of the Public Guardian (OPG). It costs £82 to apply to register your LPA so that it’s ready to use. It’s best to apply to register your LPA as soon as you’ve filled in the first part of the form.

Helping a friend to make an LPA

If you’re helping a friend or relative with an LPA by filling in the form for them, that person must make all the choices when making the LPA. If they can no longer make these choices independently, you can’t make an LPA for them.

Instead, you can apply to the Court of Protection who will appoint a deputy to make decisions for them. A deputy is similar to an attorney as they will make decisions on behalf of the relevant person, and must act in the best interests of that person at all times when making such decisions. Deputies are supervised by the OPG and they have to provide yearly reports to the OPG. Find out more.

Complete the LPA forms online

You can create your LPA using our digital service. It’s quick and easy to do.

If you need help making your LPA online

If you’d like to make your LPA online but are unsure about using computers and websites, please ring our contact centre on 0300 456 0300 and we’ll try to help.

Your LPA pack

If you decide not to make your LPA online, either all the documents you need to make and register your LPA have been sent to you or you can find them on the same GOV.UK page as this guidance. These documents are:

-

form LP1F to make a property and financial affairs LPA

-

form LP1H to make a health and welfare LPA

-

form LP3 if you want to notify people when your LPA is sent for registration

-

continuation sheets 1 to 4 – you only use these if the LPA form says you should

-

form LPA120 to apply for a reduced fee if you have low income or to pay no fee if you receive one of the benefits mentioned on the form

If we have sent you a pack and any of these are missing, please call us on 0300 456 0300 or download them.

What is ‘mental capacity’?

Your LPA – and this guide – mentions ‘mental capacity’ a lot. It’s important to understand what this means before you make an LPA.

‘Mental capacity’ is the ability to make a specific decision at the time the decision needs to be made.

A person with mental capacity has at least a general understanding of:

-

the decision they need to make

-

why they need to make it

-

any information relevant to the decision

-

what is likely to happen when they make it

They should be able to communicate their decision through speech, signs, gestures or in other ways.

People can sometimes make specific decisions but don’t have the mental capacity to make others. For example, someone may be able to decide what to buy for dinner but be unable to understand and arrange their home insurance. You should not assume someone does not have the mental capacity to make all decisions if they do not have mental capacity for a specific decision.

Assessing mental capacity

To work out whether someone lacks the mental capacity to make a decision, you need to answer ‘yes’ to these two questions:

Do they have a problem with the functioning of the mind or brain?

Does that problem mean they are unable to make a specific decision at the time it needs to be made?

Being ‘unable to make a specific decision’ means that the person can’t:

-

understand relevant information about the decision that needs making

-

keep that information in their mind long enough to make the decision

-

weigh up the information in order to make the decision

-

communicate their decision – this could be by talking, using sign language, pictures or even just squeezing a hand or blinking

Sometimes – especially in the case of big or complex decisions – you may want to get professional advice, for example, from the person’s GP, psychiatrist or psychologist.

Mental Capacity Act 2005 and Code of Practice

The Mental Capacity Act 2005 covers LPAs. The Mental Capacity Act Code of Practice explains more and has examples, including how attorneys must act. The Code of Practice also has more information about mental capacity.

You can download the Mental Capacity Act Code of Practice or buy a printed version from the Stationery Office.

Your local library may be able to help if you can’t get online by yourself.

Making decisions for you

Attorneys can make some decisions on your behalf, but they can’t do as they please. They always have to act in your best interests. Attorneys also can only act under an LPA for health and welfare decisions if you do not have mental capacity. They can act under an LPA for property and financial affairs decisions if you do still have mental capacity; however, they must have your permission to do this.

The Mental Capacity Act Code of Practice goes into this much more fully. It sets out five basic principles an attorney has to follow when working out whether and how to act on your behalf. These are:

-

your attorneys must assume that you can make your own decisions unless it is established that you cannot do so

-

your attorneys must help you to make as many of your own decisions as you can. They must take all practical steps to help you to make a decision. They can only treat you as unable to make a decision if they have not succeeded in helping you make a decision through those steps

-

your attorneys must not treat you as unable to make a decision simply because you make an unwise decision

-

your attorneys must act and make decisions in your best interests when you are unable to make a decision

-

before your attorneys make a decision or act for you, they must consider whether they can make the decision or act in a way that is less restrictive of your rights and freedoms but still achieves the purpose

Attorneys always have to follow these principles.

Make your LPA

Choose form LP1F to make an LPA for property and financial affairs decisions or form LP1H to make an LPA for health and welfare decisions.

Start filling in the form now. It will be helpful to read this guide before starting your LPA form to ensure no errors are made. You can also refer to it section by section whilst filling in your application.

When you see the word ‘you’ from now on, in sections 1 to 11 of this guide, it means the donor: the person appointing other people to make decisions on their behalf.

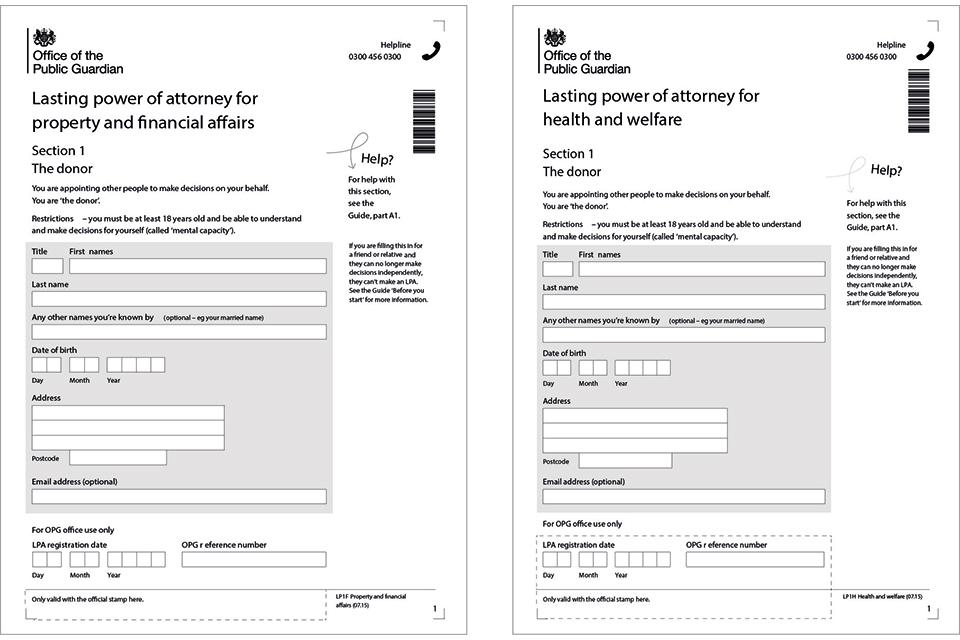

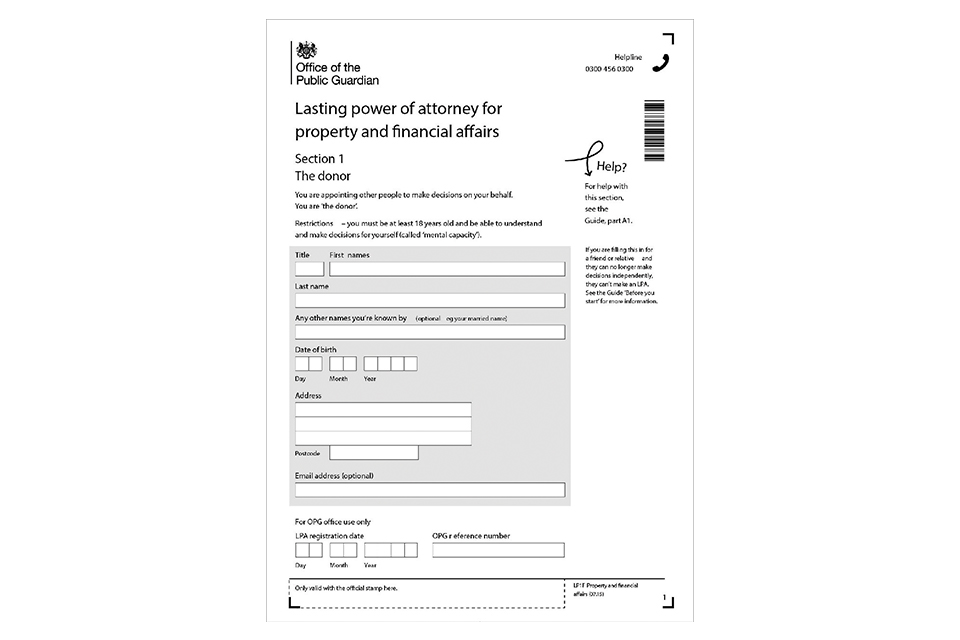

The first proper pages of the forms look like this:

Correcting mistakes

Your attorneys will need to show your LPA document to third parties when they begin to act for you. Therefore, it’s important that all the details on the LPA are correct.

Do not use any type of correction fluid or stickers as OPG won’t be able to register your LPA and you will have to pay again for a new LPA.

Each mistake on an LPA form needs to be corrected and initialled.

The person who made the mistake must write their initial next to the correction.

Examples of corrections

Example 1: If you have put the wrong date of birth for your attorney on section 2, you (the donor) should:

-

put a line through the wrong date

-

write the correct date next to it

-

write your initials next to the correction

Example 2: If the witness has put the wrong address on section 9, the witness should:

-

put a line through the wrong address

-

write the correct address next to it

-

write their initials next to the correction

Section 1: the donor

Fill in section 1

Fill in your (the donor’s) details in section 1 of the LPA form. You can also provide an email address; this would enable us to contact you quicker regarding your application.

Give any other names that you use, such as your married name. If your LPA does not include all the names you’re known by, there may be confusion or delays if your attorneys need to use it.

More information on section 1

Who can be a donor?

An LPA is for just one person. You can make an LPA if:

-

you are at least 18 years old

-

you have the mental capacity to do so

‘Mental capacity’ means the ability to make and understand a specific decision at the time it needs to be made.

Most people can make an LPA. However, there could be complications because of:

-

residency – if you live or have property outside England and Wales

-

bankruptcy – if you are bankrupt or subject to a debt relief order and want to make an LPA for your property and financial affairs

Can someone help you fill in the form?

Yes. However, if anyone else is filling the form in for you, you must still choose what goes into your LPA. Only you can give others the power to make decisions with your LPA on your behalf.

Complications: residency and property

LPAs cover people who live or own assets in England and Wales. Your LPA may not work in other countries, including Scotland and Northern Ireland. You may want to get legal advice if:

-

you live outside England and Wales

-

you have property outside England and Wales and you’re making an LPA for property and financial affairs

-

you’re planning to move away from England and Wales

-

there are other reasons why where you live complicates your situation

Complications: bankruptcy and debt relief orders (LPA for property and financial affairs only)

If you’re bankrupt or subject to a debt relief order, you should think about getting legal advice before you make your LPA.

If you become bankrupt or subject to a debt relief order after your property and financial affairs LPA is made or registered, it will be cancelled.

If an attorney becomes bankrupt or subject to a debt relief order, they can no longer be your attorney under your LPA for property and financial affairs. You must notify OPG of this. OPG will take the appropriate action and advise you on how this affects your LPA. Depending on how many attorneys you have and how they are appointed, it might cancel your LPA.

Bankruptcy does not affect a health and welfare LPA.

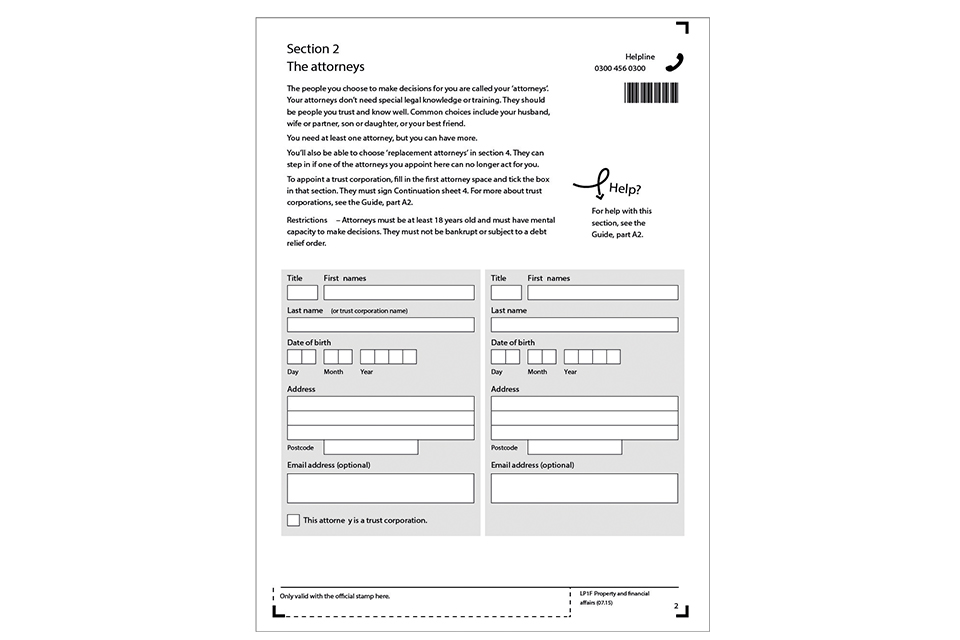

Section 2: the attorneys

Fill in section 2

Fill in the full names, addresses and dates of birth for your attorneys. Your attorneys may have problems using the LPA if these details are incorrect or missing.

The order in which you write the attorneys’ details on the form doesn’t matter. Each attorney is as important as the others.

If you want more than four attorneys, mark the ‘More attorneys’ box on this page with an ‘X’. Take a copy of Continuation sheet 1, called ‘Additional people’. For each extra attorney, mark the ‘Attorney’ box on the sheet and add their details. You must sign and date Continuation sheet 1 before you sign the LPA form in section 9.

If you need more than one continuation sheet, you can make copies.

If you want to choose a trust corporation as an attorney for your LPA for property and financial affairs, fill in the details here and mark the ‘trust corporation’ box with an ‘X’. Make sure that you write the exact name that the trust corporation uses.

The trust corporation representatives must fill in and sign Continuation sheet 4.

More information on section 2

The people you choose to act for you are called your attorneys.

You must have at least one attorney. There’s no upper limit on how many attorneys you can have; however, you may want to think carefully about how you want them to work together.

Make sure that each person agrees to be your attorney before you name them in your LPA. Your attorney can later object to their appointment which may prevent the LPA from being registered.

When selecting attorneys, think about:

-

how many you want to appoint and if they’ll be able to work together

-

whether you trust them to act in your best interests

-

how well you know each other and how well they understand you

-

how willing they’ll be to make decisions for you

-

how well they organise their own affairs, such as how well they look after their own money

Don’t feel you have to choose someone just because you don’t want to offend them. If you want them to feel involved, you could make them a ‘person to notify’ instead. (See section 6 of this guide.)

Who can be an attorney?

In legal terms, an ‘attorney’ is a person who’s allowed to act on behalf of someone.

Attorneys don’t need to be solicitors. Most people choose family members, friends and other people they trust with no legal background. If an attorney is not a professional, the important thing is that you know each other well and that they respect your wishes and feelings and will act in your best interests.

You can ask anyone with mental capacity aged 18 or over to be your attorney. Some examples include:

-

your wife, husband, civil partner, or partner

-

a family member

-

a close friend

-

a professional, such as a solicitor

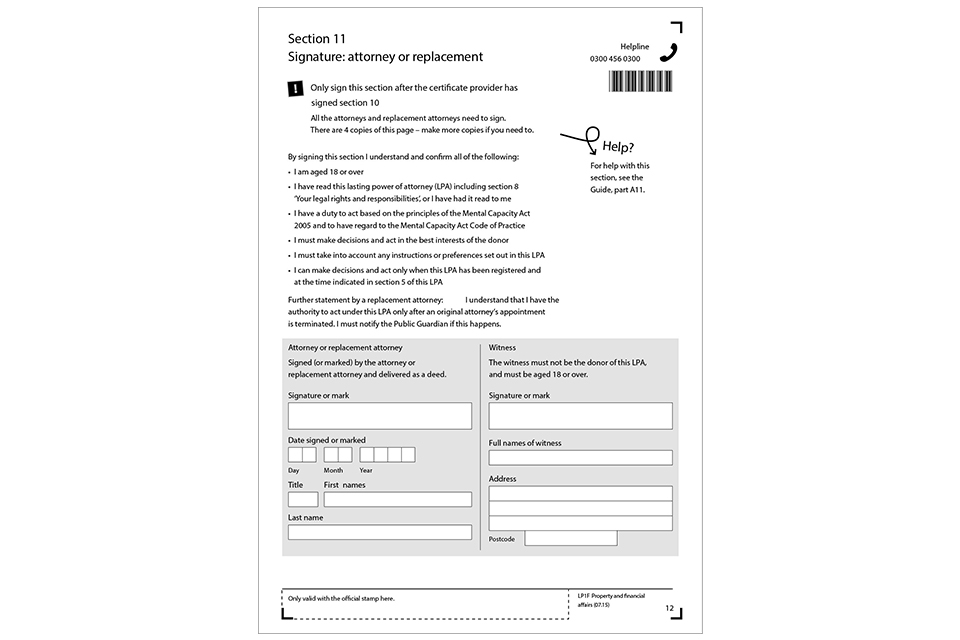

Attorneys must sign your LPA after you have signed section 9 and the certificate provider has signed section 10. They must sign as soon as reasonably possible after the certificate provider – ideally on the same day.

What attorneys must do

Attorneys can make some decisions on your behalf, but they can’t do as they please. They must always act in your best interests.

The Mental Capacity Act Code of Practice goes into this much more fully. It sets out five basic principles an attorney must follow when working out whether and how to act on your behalf:

-

your attorneys must assume that you can make your own decisions unless it is established that you do not have the mental capacity to do so

-

your attorneys must help you to make as many of your own decisions as you can. They must take all practical steps to help you to make a decision. They can only treat you as unable to make a decision if they have not succeeded in helping you make a decision through those steps

-

your attorneys must not treat you as unable to make a decision simply because you make an unwise decision

-

your attorneys must act and make decisions in your best interests when you are unable to make a decision

-

before your attorneys make a decision or act for you, they must consider whether they can make the decision or act in a way that is less restrictive of your rights and freedoms but still achieves the purpose

Attorneys must always follow these principles.

Property and financial affairs LPA attorneys

Some people choose a professional attorney, such as a solicitor, for their property and financial affairs LPA.

If you appoint an individual professional attorney for a property and financial affairs LPA, such as a solicitor, you must provide their full name. You can’t just give a job title or the name of a firm. Be aware that the person you appoint will continue to be your attorney even if they leave their job unless they disclaim as an attorney (meaning formally ending their appointment by form LPA005). Alternatively, you can appoint a trust corporation where you can just give the name of the corporation. If you choose this option, you must tick the box on section 2 of the LPA form which says ‘This attorney is a trust corporation’.

Professional attorneys usually charge fees. Ask what fees they will charge you. You must add instructions in section 7 about what you’ve agreed to pay them. (See section 7 of this guide.)

An undischarged bankrupt or a person subject to a debt relief order can’t be an attorney for a property and financial affairs LPA. Bankruptcy and debt relief orders don’t affect health and welfare LPAs.

Trust corporation – property and financial affairs LPA only (form LP1F)

People with complex finances or who don’t have anyone to manage their finances may choose a trust corporation as their attorney. These are often set up by commercial banks or firms of solicitors.

You should ask what fees they will charge you. You may want to get legal advice if you are thinking of choosing a trust corporation as an attorney.

Health and welfare LPA attorneys

An attorney for a health and welfare LPA must be a person, not a company. You can have as many attorneys as you need.

Who can’t be an attorney

A person aged under 18 can’t be an attorney. You cannot say in the instructions section (section 7) that you want to appoint someone who is currently younger than 18 years old so they can act as an attorney when they reach the age of 18.

A person who is currently bankrupt or has a debt relief order can’t be an attorney on an LPA for property and financial affairs.

Bankruptcy and debt relief orders don’t affect health and welfare LPAs.

A person who is on the Disclosure and Barring Service’s barred list cannot act as an attorney – unless they’re a family member and they’re not getting a fee to be your attorney. They will break the law if they don’t follow these rules.

What attorneys can do

Your attorneys can only make decisions that you’ve allowed them to make in your LPA. For example, if your LPA is for your property and financial affairs, your attorneys can’t make decisions about your care or daily routine. If your LPA is for your health and welfare, they can’t make decisions about your money.

When attorneys can no longer act

An attorney can’t act for you if they:

-

lose mental capacity

-

decide they no longer want to act as your attorney (known as ‘disclaiming their appointment’)

-

become bankrupt or subject to a debt relief order and were an attorney for a property and financial affairs LPA – if your attorney is subject to an interim bankruptcy order their appointment would be suspended.

-

were your wife, husband or civil partner but your relationship has legally ended – unless you write instructions in section 7 of the LPA form that they can continue to be your attorney if your relationship legally ends

Sometimes, if an attorney dies or has to stop acting for one of the reasons above, it can cause serious problems:

-

if you appointed only one attorney, your LPA would stop working altogether

-

if you’ve said your attorneys have to act ‘jointly’ for some or all decisions (see section 3 of this guide) then they won’t be able to make those decisions unless you’ve specifically stated otherwise in section 7.

If either of these apply to you, consider appointing replacement attorneys to prevent your LPA from coming to an end. Read more about replacement attorneys in section 4 of this guide.

If you cancel your LPA, your attorneys can no longer act on your behalf.

Section 3: how should your attorneys make decisions?

Fill in section 3

Mark only one box on this page with an ‘X’.

If you’ve chosen just one attorney, tick the box: ‘I only appointed one attorney’ and go to section 4.

If you’ve chosen two or more attorneys, you must state how they should make decisions on your behalf. Choose one of three options by marking only one box with an ‘X’:

If no option is selected, the legislation provides that your attorneys will be appointed to act jointly. This may mean the LPA will not work in the way you want it to.

Each choice is explained in section 3 of the LPA form and below. If you are not sure which option is best for your circumstances, you may want to get legal advice.

Most people choose ‘jointly and severally’ because it is the most flexible and practical way for attorneys to make decisions.

If you choose a different option from ‘jointly and severally’ and your attorneys can’t agree on a joint decision, it can’t be made. Your LPA might become unworkable.

If you choose ‘jointly for some decisions, jointly and severally for other decisions’, you must use Continuation sheet 2. On Continuation sheet 2:

-

mark the box ‘Decisions attorneys should make jointly’

-

write in the space which decisions your attorneys must make jointly

If you use Continuation sheet 2, you must sign and date it (and any extra copies that you use) before you sign section 9 of your LPA.

More information on section 3

You must state how your attorneys should act – whether they can make decisions separately, or whether they must all agree on some or all decisions. You need to choose one of three options. The details are below.

Jointly and severally (attorneys act either together or individually)

Your attorneys can make decisions on your behalf on their own or together.

If you have more than one attorney appointed, they may act alone as if they were the only attorney. It’s up to your attorneys to choose how they make decisions, but they must always act in your best interests.

Most people choose this option because:

-

attorneys can make simple or urgent decisions quickly and easily, without asking your other attorneys

-

if an attorney can no longer act, the LPA won’t be cancelled

If you choose this option, you must not say anywhere else in the LPA that certain decisions must be made by:

-

one particular attorney

-

some or all of your attorneys

-

a minimum number of attorneys

Instructions like this contradict your choice here, so your LPA may be rejected.

There is a section later in the LPA that lets you give more specific instructions to your attorneys. Most people don’t do this, and it can be more complicated than it seems. Read section 7 of this guide before deciding whether to add anything there. You may wish to seek legal advice.

Jointly (attorneys must agree on every decision)

Your attorneys must always make all decisions together. They must all be in agreement and they must all sign any relevant documents.

Choose this option if you want your attorneys to agree on every decision, whether it’s big or small.

If your attorneys can’t all agree on a decision, the decision can’t be made.

With this option:

-

if your attorneys can’t work together, your LPA won’t work

-

if one attorney can no longer act or dies, your LPA will stop working – unless you’ve appointed replacement attorneys.

If your attorneys live far apart, they may find acting jointly difficult – for example, going to the bank together.

If one of your original joint attorneys can no longer act, all your original attorneys stop acting for you. This is because the law treats attorneys who act jointly as a single unit. If you’ve appointed replacement attorneys, they will all replace your original attorneys at the same time.

You can change this arrangement, so that if one of your joint attorneys can no longer act, your remaining joint attorney(s) can continue to make all decisions. If you want this alternative arrangement to apply, state that clearly in the instructions box in section 7 of the LPA form or on Continuation sheet 2 if you run out of space.

If you have appointed two attorneys, you could use an instruction in section 7 like the one below, swapping your attorneys’ names for ‘A’ and ‘B’:

“If one of my original joint attorneys, A or B, is unable or unwilling to act, I then reappoint my remaining original attorney(s), A or B, as a replacement attorney”.

Jointly for some decisions, and jointly and severally for other decisions

Your attorneys must make certain decisions together and all agree on them – but they can make other decisions individually.

If you choose this option you must clearly state which decisions your attorneys must make together and all agree on: that is, when they should act jointly.

If your attorneys can’t all agree on a joint decision (one they are to make together), the decision can’t be made.

Some people pick this option because they don’t mind their attorneys taking everyday decisions alone but want them to make important decisions together, such as selling a house.

If your attorneys live far apart, they may find acting jointly difficult.

With this option:

-

you must write on Continuation sheet 2 which decisions must be made jointly – if you don’t, your LPA won’t work

-

you can also write on Continuation sheet 2 which decisions can be made jointly and severally however this isn’t essential

-

if your attorneys can’t agree on a joint decision, the decision can’t be made

-

if one attorney can no longer act or dies, your remaining attorneys won’t be able to make any of the joint decisions, unless you’ve appointed replacements or instructed otherwise.

With this option, if one attorney stops acting for you but you do have replacement attorneys:

-

the replacement attorneys will take over, making all joint decisions instead of your original attorneys

-

both the replacement and remaining original attorneys can make any decisions they’re allowed to make individually

There is an alternative. As with joint attorneys, you can state that your original and replacement attorneys can carry on making decisions they used to have to make jointly even if one is unable or unwilling to act.

State this clearly in section 7 of the LPA form or on Continuation sheet 2 if you run out of room.

You could use an instruction in section 7 like the ones below, swapping your attorneys’ names for ‘A’ and ‘B’:

“If one of my original attorneys, A or B, is unable or unwilling to act, I then reappoint my remaining original attorney(s), A or B, to continue to make the decisions I have specified to be jointly made”.

“If one of my replacement attorneys, A or B, is unable or unwilling to act, I then reappoint my remaining replacement attorney(s), A or B, to continue to make the decisions I have specified to be jointly made”.

Examples of working jointly for some decisions, and jointly and severally for others

Property and financial affairs LPA examples:

If you choose ‘jointly for some decisions, jointly and severally for other decisions’, you must make a statement like one of these on Continuation sheet 2:

My attorneys must act jointly for decisions about selling or letting my house and may act jointly and severally for everything else.

My attorneys must act jointly for decisions about investments in stocks and shares and may act jointly and severally for everything else.

In the first example, ‘everything else’ means all financial decisions apart from selling or letting your house. In the second example, ‘everything else’ means all money matters apart from investing in stocks and shares.

Don’t use these examples unless they’re exactly what you want – you need to state what is right for you.

Health and welfare LPA examples:

If you choose ‘jointly for some decisions, jointly and severally for other decisions’, you must make a statement like one of these on Continuation sheet 2:

My attorneys must act jointly for decisions about where I live and may act jointly and severally for everything else.

My attorneys must act jointly for decisions I have authorised them to make about life-sustaining treatment and may act jointly and severally for everything else.

In the first example, ‘everything else’ means all decisions about your day-to-day care and medical treatment. In the second example, ‘everything else’ also means day-to-day care and medical treatment and larger decisions about where you should live. It only excludes decisions about treatments needed to keep you alive.

You can only use something like the second example if you give your attorneys the authority to give or refuse consent to life-sustaining treatment by choosing option A in section 5 of your LPA form. See section 5 for more on life-sustaining treatment.

Don’t use these examples unless they’re exactly what you want – you need to state what is right for you noting that your attorneys under a health and welfare LPA can only begin to act once you lose mental capacity.

Protecting your interests

Whichever way you appoint your attorneys to act, the law says that they must always act in your best interests and make every effort to find out whether you can make a decision before they do.

Attorneys must also follow any instructions and bear in mind any preferences that you write in section 7 of your LPA form.

The Mental Capacity Act Code of Practice explains attorneys’ duties.

Questions to ask yourself

-

Are you clear about why ‘jointly and severally’ is the most flexible and practical option?

-

What might stop your attorneys working together? Do they get on? What could happen if they were to fall out?

-

Are you happy for your attorneys to choose whether they make decisions together or individually? Choose ‘jointly and severally’, which is the most straightforward option.

-

Even if your attorneys can make most decisions on their own, are there some big decisions that you want them to agree on? Choose ‘jointly for some decisions, jointly and severally for others’.

-

Do you want your attorneys or replacement attorneys to make all their decisions together and all agree on every decision, whether big or small? Choose ‘jointly’.

-

Do your attorneys understand how you would like them to make decisions? Make sure you discuss your choice with them.

-

Do you know what will happen if one attorney can’t act anymore? Read this section again if you’re not sure.

-

Do you want replacement attorneys as a back-up if your attorneys have to make some or all decisions together? If you don’t choose replacements, your LPA may be at risk if an attorney stops acting on your behalf.

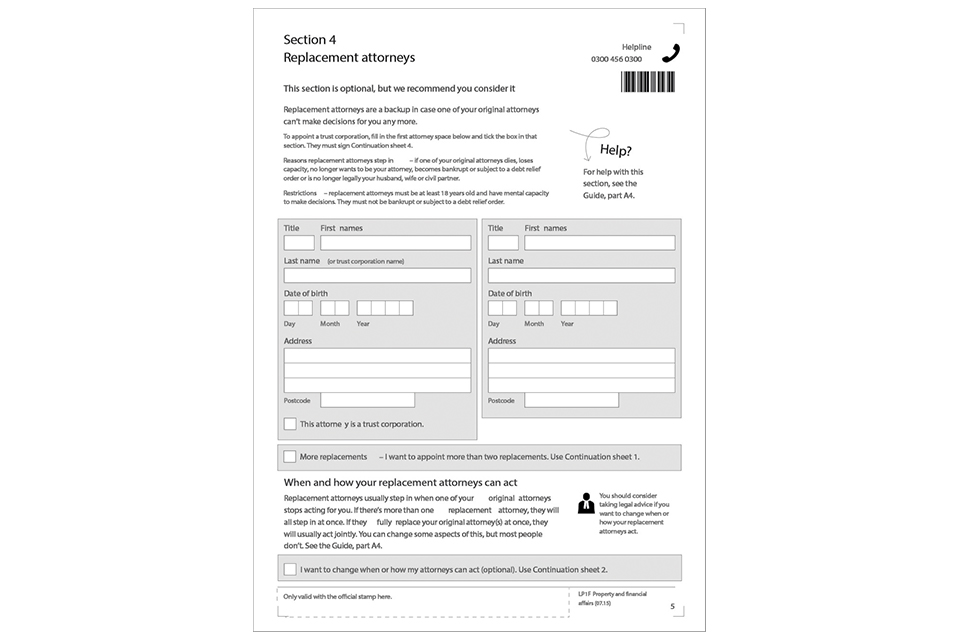

Section 4: replacement attorneys

Fill in section 4

If you want one or more replacement attorneys, write their details in section 4 of the LPA form. If you don’t want any replacement attorneys leave this section blank when submitting the LPA to OPG; however, you must still include this page within the LPA.

If you want more than two replacements, mark the ‘More replacements’ box on this page. Take a copy of Continuation sheet 1, called ‘Additional people’. For each extra replacement attorney, mark the ‘Replacement attorney’ box on the sheet and add their details.

You must sign and date Continuation sheet 1 before you sign the LPA in section 9.

If you need more than one continuation sheet, you can make copies.

Changing when and how your replacement attorneys can act

Mark this box with an ‘X’ if you have appointed more than one replacement attorney and you want to change how or when they act.

Marking this box can create complications for your LPA. There’s more guidance below – please read it. You may also want to get legal advice.

More information on section 4

Replacement attorneys are people you choose to step in if one of your original attorneys can no longer make decisions on your behalf.

A replacement attorney will automatically step in if one of your attorneys:

-

dies

-

loses mental capacity

-

decides they no longer want to act on your behalf (known as ‘disclaiming their appointment’)

-

was your wife, husband, or civil partner but your relationship has legally ended (unless you’ve added an instruction for them to continue)

-

becomes bankrupt or subject to a debt relief order – if your attorney is subject to an interim bankruptcy order their appointment would be suspended. This only applies to property and financial affairs LPAs

A replacement attorney can only act if the original attorney they’re replacing is permanently unable to make decisions for one of the reasons above.

Replacement attorneys usually step in as soon as one of your original attorneys stops acting for you. However, you can change this arrangement if you want your original attorneys to continue making joint decisions even if one is unable or unwilling to act.

See section 3 of this guidance for examples of what to write on the LPA form if you want this alternative arrangement to apply.

A replacement attorney:

-

cannot temporarily stand in for an attorney who is still able to act (for example, while the first attorney is on holiday)

-

you can’t add any instructions telling replacement attorneys to start acting in specific circumstances.

If your original attorneys must make all or some decisions jointly and one can no longer act, your replacement attorneys will make those joint decisions instead, unless you’ve instructed otherwise on section 7. Both your remaining original attorneys and your replacements can make any decisions that don’t have to be made jointly.

Protecting your LPA

Having replacement attorneys means that your LPA will still work if an original attorney can no longer act on your behalf.

Without replacements:

-

if you have only one attorney and that attorney can no longer act for you, your LPA will no longer work

-

if you have attorneys who must make all or some decisions together (‘jointly’) and one attorney can no longer act, the rest will not be able to make those joint decisions unless you state otherwise within your instructions.

If your LPA can’t be used and you don’t have mental capacity, someone you know will have to apply to the Court of Protection to get the power to act on your behalf – this can be expensive and will usually take a long time.

Who can be a replacement attorney

A replacement attorney must meet the same requirements as an original attorney. This includes having mental capacity and being 18 years old or over when you sign your LPA.

One of your original attorneys can also be appointed as a replacement attorney in the same LPA. You would usually do this if the appointment type is either jointly or jointly for some decisions and jointly and severally for other decisions. It would mean the original attorneys can continue to act on joint decisions if one of the original attorneys becomes unable to act.

A person who is on the Disclosure and Barring Service’s barred list cannot act as an attorney – unless they’re a family member and they’re not getting a fee to be your attorney. They will break the law if they do.

When replacement attorneys step in

If you include more than one replacement attorney in your LPA, they all step in at the same time, unless you’ve:

-

appointed your attorneys to act jointly and severally

-

and stated the order in which your original attorneys will be replaced within your instructions

Replacing an attorney who acts ‘jointly and severally’

If you appoint your attorneys to act jointly and severally, replacement attorneys usually step in if one original attorney can’t act for you anymore. The replacement attorneys and any remaining original attorneys can then make decisions ‘jointly and severally’.

Replacing attorneys who act ‘jointly’ or ‘jointly for some decisions, jointly and severally for other decisions’

If you appoint your attorneys either ‘jointly’ or ‘jointly for some decisions, jointly and severally for other decisions’, it is important to have replacement attorneys.

If one of your original attorneys can no longer act for you, all your other attorneys must stop making any joint decisions. If this happens, any replacement attorneys step in to make the joint decisions. If you don’t have any replacements, your LPA will stop working for joint decisions. This is because the law sees a group appointed ‘jointly’ as a single unit.

However, there is a way around this. If you want your original attorneys to continue to act if one of them becomes unable, you must state this on section 7 of the LPA, you may want to seek legal advice on how you would word this to avoid making an error which would cause the LPA to become unworkable.

Changing when and how your replacement attorneys can act

Mark this box with an ‘X’ if you have appointed more than one replacement attorney and you want to change how or when they act.

There are two main situations where this is useful. You have more than one replacement attorney and:

-

you’ve appointed your original attorneys jointly and severally. You want your replacements to step in a particular order. Read Stating an order for replacement attorneys

-

you have only one original attorney. You don’t want your replacement attorneys to act jointly. Read through the guidance about complications called ‘1. A sole attorney plus two or more replacements’

There are some other situations where you may want to mark this box. You’ll find examples under the Complications: replacement attorneys section.

Stating an order for replacement attorneys

If you mark the box and you appointed your original attorneys to act ‘jointly and severally’ in section 3 of the LPA form, you can state the order in which your replacement attorneys step in.

Use Continuation sheet 2. Mark the box: ‘How replacement attorneys step in.’ Use the space to write how you want your replacements to step in. You might write something like:

If one of my attorneys (my mother and father) can no longer act, I would like that attorney to be replaced by my sister. If, later on, my other parent can no longer act, I would like my brother to replace that person as my attorney.

If my attorney John Smith becomes unable to act under this LPA, I want replacement attorney Anne Hall to step in and act in his place.

Do not state an order to replace attorneys if your original attorneys act ‘jointly’ or ‘jointly for some decisions, jointly and severally for others.’ You will stop your LPA from working. If you still want to do this, you should seek legal advice.

Complications: replacement attorneys

Appointing replacement attorneys is a sensible way to protect an LPA, especially if there’s only one original attorney, or your attorneys have to make some or all decisions jointly.

Usually, replacing attorneys will work as you expect. For example, you could name one original attorney and one replacement attorney. Then, if the original attorney stops acting, the replacement attorney will take their place.

However, if your attorneys have to make some or all decisions jointly or you have more than one replacement attorney, unexpected things can happen.

Look at the examples below: they cover some fairly common situations.

1. A sole attorney plus two or more replacements

What will happen

Unless you say otherwise, the replacements will have to act jointly.

Example

You’ve appointed your spouse or partner as your only attorney. You appoint your son and daughter as replacement attorneys. You don’t say anything about how they should act.

As soon as your spouse or partner can’t act any more, your children step in. They’re now joint attorneys, and have to all agree on every decision, no matter how small.

Alternatives

This might be what you want – however, a lot of people prefer their attorneys to act ‘jointly and severally’, giving them more freedom and flexibility.

To make this happen:

-

at the bottom of section 4 of the LPA, mark the box called ‘I want to change when or how my attorneys can act’

-

take a copy of Continuation sheet 2 and mark the box ‘How replacement attorneys step in and act’

-

write this on the sheet: “I want my replacement attorneys to act jointly and severally”

-

sign and date the sheet before you sign section 9 of the LPA

2. Joint attorneys plus one or more replacements

What will happen

The original attorneys will not be able to act at all as soon as one stops acting. The replacements will take over all decisions.

Example

You appoint your two brothers and your sister as attorneys, acting jointly, and appoint your daughter as a replacement attorney.

Something happens to one of your siblings that means they can no longer act. Now your daughter steps in. She is the sole attorney, and your two remaining siblings no longer have any say in decisions made under this LPA – they can’t act at all on your behalf.

Alternatives

If you’ve appointed your original attorneys ‘jointly’, it isn’t straightforward to arrange things so that the others can carry on acting after one of them has to stop – it’s part of what ‘jointly’ means.

You could think about appointing the original attorneys ‘jointly and severally’ instead. If there are some big decisions you want them to agree on, you could appoint them ‘jointly for some decisions, jointly and severally for other decisions’ – however, as the example below shows, the same problem would occur again.

There are ways around the problem. However, you may want to seek legal advice or call our helpline.

You can state to reappoint your remaining original attorneys in the instructions section (section 7).

You can also make a second LPA in case your first one stops working. In this second LPA, you can appoint the joint attorneys from your first LPA.

If you appoint your attorneys jointly and severally in your second LPA, you’ll avoid the problem you had with your first LPA.

If you make a second LPA, you must write an instruction in section 7 of your second LPA saying that it comes into force if your first LPA stops working. You might write something like:

If my original LPA for property and financial affairs stops working, this LPA comes into force.

If my health and welfare LPA fails, this LPA replaces it.

3. Attorneys appointed jointly for some decisions and jointly and severally for other decisions plus one or more replacements

What will happen

The original attorneys will have no say in the joint decisions as soon as one stops acting. The replacements will take over the joint decisions.

Example

You’ve appointed your daughter and her husband as attorneys. They have to act jointly for any decision about selling your house but can act jointly and severally for all other decisions. You appoint your two grandchildren (who are aged over 18) as replacement attorneys.

Your son-in-law stops acting as an attorney. Now, your daughter and your grandchildren are your attorneys. However, your daughter no longer has a say in selling your house. Your grandchildren can make that decision without consulting her – they are the only attorneys for joint decisions.

Alternatives

This has the same problem as 2. Joint attorneys plus one or more replacements.

If you’re sure you don’t want to appoint your original attorneys jointly and severally, then you can either make an instruction or make two LPAs.

To do this, follow the instructions in 2. Joint attorneys plus one or more replacements.

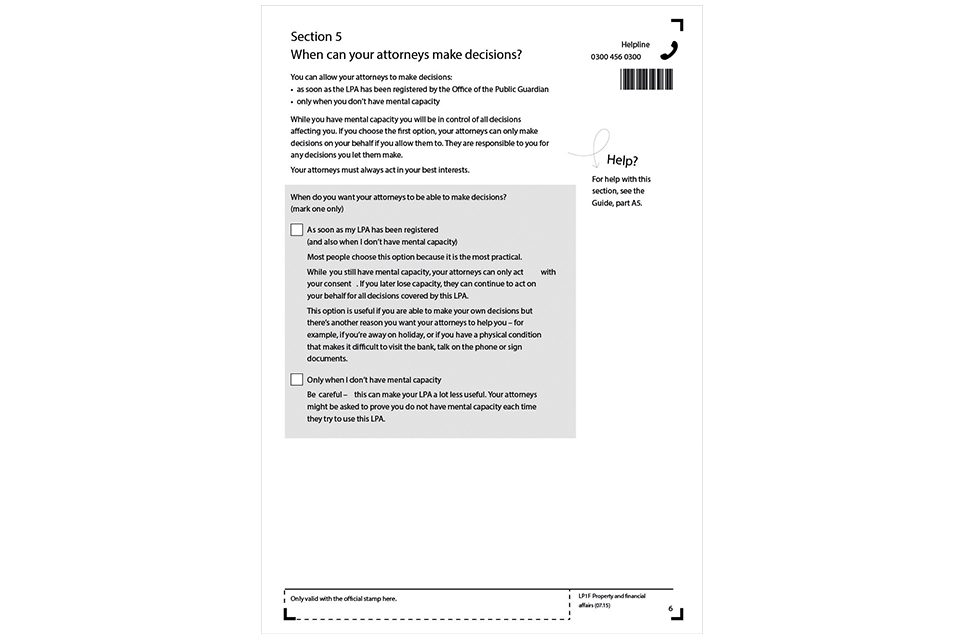

Section 5: when can your attorneys make decisions? (LPA for property and financial affairs only)

Fill in section 5

You must choose when you want your attorneys to be able to make decisions. Mark only one box with an ‘X’.

You have two options:

-

as soon as my LPA has been registered (and also when I don’t have mental capacity)

-

only when I don’t have mental capacity

More information on section 5 (for property and financial affairs LPAs)

You can choose whether your attorney can make decisions on your LPA as soon as it has been registered, or that it can only be used when you don’t have mental capacity.

As soon as my LPA has been registered (and also when I don’t have mental capacity)

Mark this box with an ‘X’ if you want your attorneys to help you with your finances while you have mental capacity.

For example, if you can’t leave the house or it’s hard to talk to your electricity supplier, you might ask your attorneys to deal with the bank or pay bills. You could ask your attorneys to act for you if you are away – for example, on holiday.

You can give instructions in LPA section 7 (see section 7 of this guide) about decisions your attorneys can’t make – for example, about selling your house. You might write instructions like:

While I have mental capacity, my attorneys must not make any decisions about selling my house.

As long as you have mental capacity, you control your finances.

Only when I don’t have mental capacity

Mark this box with an ‘X’ if you don’t want your attorneys to make decisions or act for you while you have mental capacity. This means you’ll look after your finances while you still have mental capacity. Then, if you ever lose that capacity, your LPA will be ready for your attorneys to use.

Banks and other financial institutions sometimes want written confirmation that a donor does not have mental capacity before they’ll recognise an attorney’s authority to act under an LPA.

Your attorney(s) may have to ask your GP, care co-ordinator, social worker or care home staff about a mental capacity assessment.

When you reach section 7 of the LPA form, you can add instructions. Some people explain how their mental capacity should be assessed, such as:

My attorneys shall only act under this power if they have obtained a written medical opinion stating that I am no longer mentally capable of managing and administering my property and financial affairs.

However, if you trust your attorneys to assess your mental capacity, you do not need to add instructions like these.

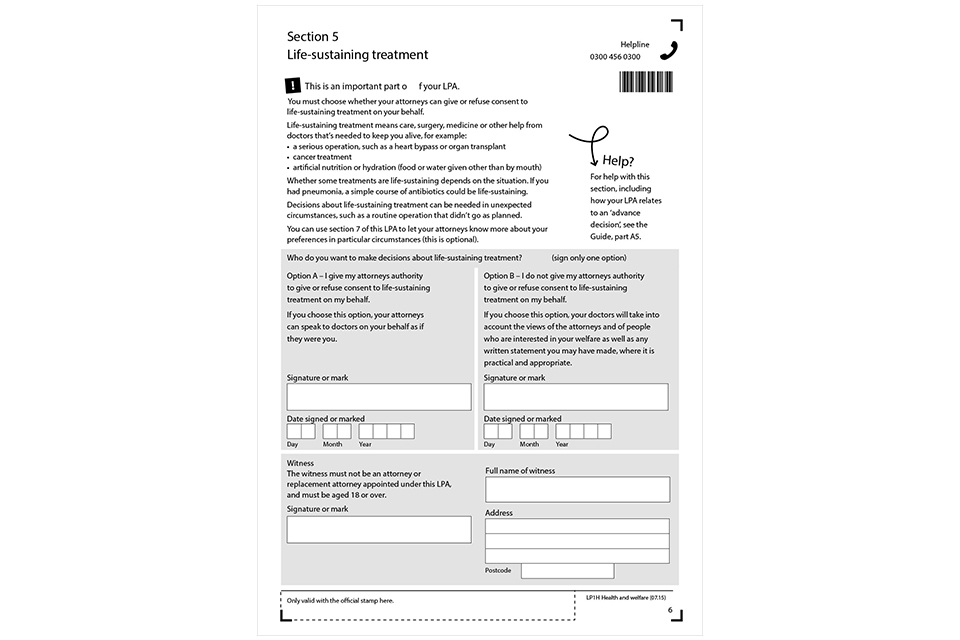

Section 5: life-sustaining treatment (LPA for health and welfare only)

Fill in section 5

Remember here unlike the LPA for your property and financial affairs decisions, your attorneys can only begin to act under your LPA for your health and welfare decisions once you have lost mental capacity.

You have two options:

-

option A – I give my attorneys authority to give or refuse consent to life-sustaining treatment on my behalf

-

option B – I do not give my attorneys authority to give or refuse consent to life-sustaining treatment on my behalf

Sign only one option.

You must sign and date this page.

Your signature must be witnessed, and your witness must always provide their full name and address. The witness must be aged 18 or over and can’t be an attorney or replacement attorney under this LPA. Please note the witness details are formatted differently from the other parts of the LPA and are across the bottom of the page, from left to right.

Sign this section before you sign your LPA in section 9. You can sign both sections on the same day.

If you are unable to sign or make a mark and you have directed someone else to sign your LPA for you, that person must sign this page and date their signature. Their signature must be witnessed. They will also have to sign and date continuation sheet 3 at the same time they complete section 5.

It is important this page is completed correctly, and no information is omitted, otherwise the OPG may not be able to register your LPA. You may have to pay a fee again to complete another LPA.

More information on section 5 (for health and welfare LPAs)

You must choose what you’d want to happen if you needed medical help to keep you alive and you no longer had mental capacity.

If you sign option A and ever need life-sustaining treatment but can’t make decisions, your attorneys can speak to doctors on your behalf as if they were you. You can write instructions or preferences for your attorneys in section 7 of the LPA form. See below for some examples.

If you choose option B, doctors will make decisions about life-sustaining treatment.

Life-sustaining treatment: definition

‘Life-sustaining treatment’ means care, surgery, medicine or other help from doctors that’s needed to keep someone alive.

Life-sustaining treatment can include:

-

a serious operation, such as heart bypass surgery

-

chemotherapy, radiotherapy or another cancer treatment

-

an organ transplant

-

artificial nutrition or hydration (food or water given other than by mouth)

Whether some treatments are life-sustaining depends on the situation. For example, if someone had pneumonia, a course of antibiotics could be life-sustaining.

Decisions about life-sustaining treatment can be needed in unexpected circumstances. One example is a routine operation that didn’t go as planned.

Option A: attorneys

Choose option A if you want your attorneys to decide about life-sustaining treatment in case you ever can’t make the decisions yourself.

Life-sustaining treatment: preferences (optional)

You can use section 7 of the LPA form to let your attorneys know your preferences, so that any decisions they make are as close as possible to the decisions you would have made.

For example, you might write something like:

If I were in the last days of a terminal illness, I would only want treatments to make me comfortable. I wouldn’t want treatments to prolong my life or that meant I couldn’t die at home.

Attorneys should pay attention to your preferences, although they don’t have to follow them. You don’t have to give any preferences for life-sustaining treatment – your attorneys can act without them.

Life-sustaining treatment: instructions (optional)

You can write instructions in section 7 of the LPA form to specify medical conditions where your attorneys must or must not consent to life-sustaining treatment on your behalf. For example, you might write something like:

My attorneys must not agree to life-sustaining treatment if I am in a persistent vegetative state.

You may feel that your attorneys understand you well enough and you don’t need to write instructions. Talk to them about what you want.

If you write instructions, your attorneys must follow them. You must be careful not to write anything that contradicts what you have said elsewhere in your LPA or requires your attorneys to break the law. If you do, it could make your LPA unworkable. If you want to write instructions but are uncertain, you may want to seek legal advice.

You don’t have to give instructions about life-sustaining treatment.

Option B: doctors

Choose option B if you want your doctors to decide about life-sustaining treatment in case you can’t. If the situation arises, they must:

-

assess what’s in your best interests

-

take into account, where possible, the views of your attorneys and other people involved in your welfare

-

take into account what you’ve said or written about life-sustaining treatment, including any guidance you’ve given in your LPA

Other ways to make your treatment preferences clear

There are other ways to explain what you want to happen if you need medical treatment and you can no longer make decisions for yourself.

An advance decision is a legally binding document in which you write which specific treatments you don’t want, in case you can’t decide or make your wishes known. Some people call it a ‘living will’ or ‘advance directive’.

If you’ve made an advance decision that your doctors or attorneys should take into account, refer to it in your instructions in section 7 of the LPA form.

You can find information about advance decisions on NHS Choices.

If you give your attorneys the power to decide about life-sustaining treatment and have made an advance decision, your LPA might override your advance decision.

You may want to get legal advice, particularly if the advance decision and the LPA say very different things.

You can also let people know your views on treatments and care in:

-

statements of preference

-

care plans

There’s more about life-sustaining treatment, advance decisions and how health professionals must respond to your written wishes in chapter 9 of the Mental Capacity Act Code of Practice.

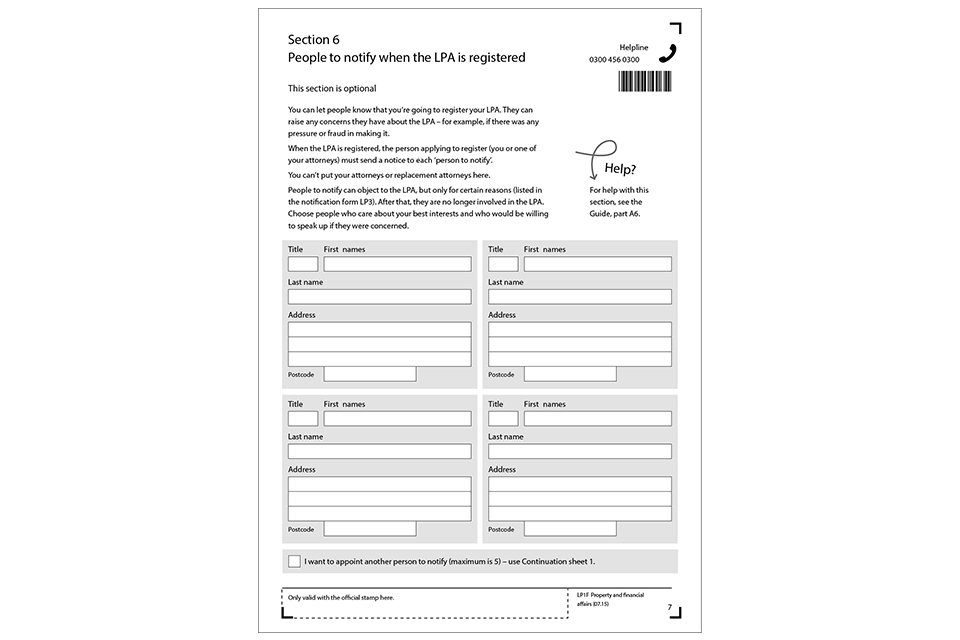

Section 6: people to notify when the LPA is registered

Fill in section 6 (optional)

You can choose up to five people to notify about your LPA when it’s about to be registered.

These should be people who know you well and would be willing to raise concerns about your LPA. They can object to the LPA if they think you were under pressure to make it or if they think fraud was involved.

However, this section is optional and you don’t have to choose people to notify.

If you want to appoint people to notify, you can write the names and addresses of up to four in section 6. If you want to appoint five people to notify, tick the box that says ‘I want to appoint another person to notify’. Fill in the person’s name and address on Continuation sheet 1 and mark the ‘Person to notify’ box on that sheet.

You must sign and date Continuation sheet 1 before you sign the LPA in section 9. If you need more than one continuation sheet, you can make copies.

The person applying to register the LPA – either you or your attorneys – must tell any people to notify that the LPA is being sent for registration. They must use form LP3 to do this, just before sending the LPA form to the OPG. See the ‘People to notify: use form LP3’ section of this guide which explains how to notify these people.

More information on section 6

Letting people know about your LPA just before it’s registered protects you. It’s especially important if there’s a long time between making your LPA and registering it.

Choose people to notify

You can choose up to five people to notify but they can’t be your attorneys or replacement attorneys. Many donors choose family members or close friends. Check with the people you’re planning to notify that they’re happy to be named in your LPA.

Explain that:

-

they don’t have to do anything right away

-

they will only be told when you or your attorneys apply to register your LPA

-

their names and addresses will be sent to OPG

-

they do not have to do anything when they are contacted, unless they have concerns

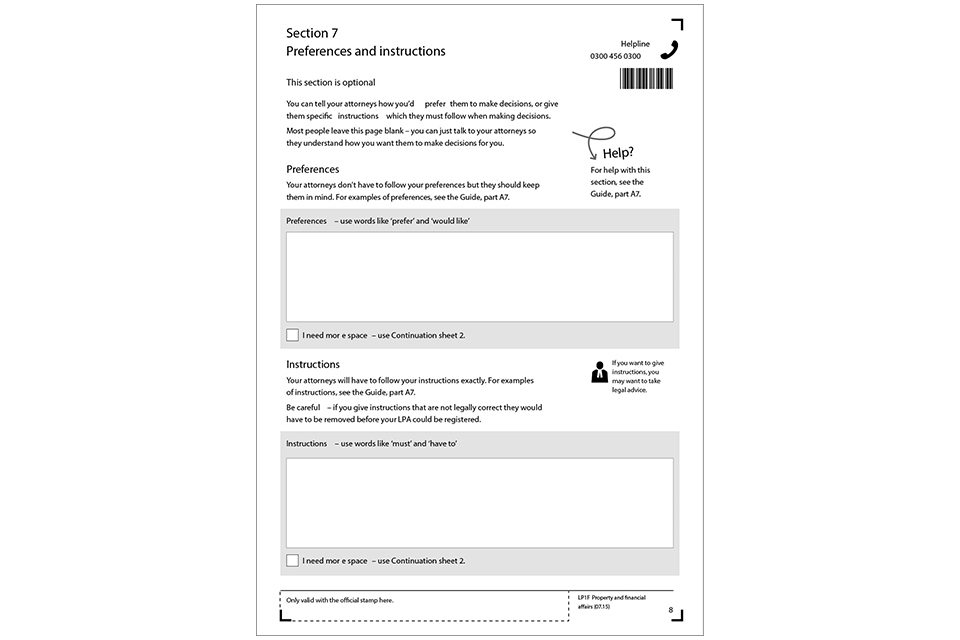

Section 7: preferences and instructions

Fill in section 7 (optional)

If you fill in this page and need more space, tick the box at the bottom of section 7 and use Continuation sheet 2. Mark with an ‘X’ either the ‘Preferences’ box or the ‘Instructions’ box on Continuation sheet 2.

If you still need more space, you can make copies of Continuation sheet 2.

You must sign Continuation sheet 2 before you sign section 9 of your LPA.

More information on section 7

You can give your attorneys instructions or tell them your preferences in this LPA section – but you don’t usually have to. Most people leave this page blank.

You can just talk to your attorneys and explain how you’d like them to act for you. Your attorneys will then be free to make decisions they think are right, and they will know how you’d want them made.

If you’re not sure about what you can put in this section of your LPA, you might want to get legal advice.

In circumstances where you already have investments that are managed on your behalf by an investment professional (known as discretionary investment management), or would like to allow your attorneys to use any scheme involving discretionary investment management, you should consider taking legal advice on whether it is necessary to make specific provision for this in your LPA.

This is because at least one major financial institution has taken the position that existing contracts relating to discretionary investment management schemes will come to an end on the loss of capacity of the donor of an LPA, and that any new investments by attorneys in discretionary investment management schemes will only be permitted if there is an express instruction on the matter in the LPA.

Complicated or badly worded instructions or preferences can make an LPA unworkable.

Preferences and instructions: definitions

Preferences

Preferences are what you’d like all your attorneys to think about when they make decisions for you. Your attorneys don’t have to follow them but should bear them in mind.

If you write any preferences, avoid words such as ‘must’ and ‘shall’. Instead use words such as ‘prefer’ and ‘would like’, so it’s clear that you’re giving your attorneys advice. If your attorneys must do something, include it in your instructions.

Instructions

Instructions tell your attorneys what they must do when acting on your behalf.

If you write any instructions, use words such as ‘must’, ‘shall’ and ‘have to’.

Instructions can cause more problems than preferences. If you want to give instructions, read through the information below to find out about common problems and mistakes. It may be better to phrase them as preferences.

If you include an instruction requiring your attorney to use your funds to benefit someone other than yourself this is likely to be ineffective because it may conflict with the attorney’s obligation to act in your best interests. As an alternative, you could consider including a preference that your funds be used in this way.

If you want to pay fees to your attorneys, explain this in the instructions. See Instructions to pay fees in this guide.

There are some examples below of common preferences and instructions for both types of LPA. They may not be right for you – they are just to give you an idea of what you might write. Your preferences and instructions should be about what matters to you.

Examples of preferences

Health and welfare LPA

Here are some examples of preferences you might write in a health and welfare LPA:

I prefer to live within five miles of my sister.

I’d like to be prescribed generic medicines where they are available.

I would like to take exercise at least three times a week whenever I am physically able to do so. Whether or not I am mobile, I would like to spend time outdoors at least once a day.

I’d like my pets to live with me for as long as possible – if I go into a care home, I’d like to take them with me.

I’d like to have regular haircuts, manicures, and pedicures.

Property and financial affairs LPA

Here are some examples of preferences you might write in a property and financial affairs LPA:

I like to reinvest all interest from each year’s investments into next year’s ISA allowance.

I would like to maintain a minimum balance of £1,000 in my current account.

I prefer to invest in ethical funds.

I’d like my attorneys to consult my doctor if they think I don’t have the mental capacity to make decisions about my house.

I would like to donate £100 each year to Age UK.

Examples of instructions

Health and welfare LPA

Here are some examples of instructions you might write in a health and welfare LPA:

My attorneys must not decide I am to move into residential care unless, in my doctor’s opinion, I can no longer live independently.

My attorneys must not consent to any medical treatment involving blood products, as this is against my religion.

My attorneys must ensure I am given only vegetarian food.

Property and financial affairs LPA

Here are some examples of instructions you might write in a property and financial affairs LPA:

My attorneys must consult a financial adviser before making investments over £10,000.

My attorneys must not sell my home unless, in my doctor’s opinion, I can no longer live independently.

My attorneys must not make any gifts.

My attorneys must send annual accounts to my brothers and sisters.

My attorneys must instruct a tax accountant to prepare my annual tax return.

If you have opted (in section 5 of the LPA form) for your attorneys to act under your property and financial affairs LPA only if you’ve lost mental capacity, you might add instructions about how your mental capacity should be assessed. For example, you might write:

This lasting power of attorney only applies if a doctor confirms in writing that I don’t have the capacity to make decisions about my finances.

If you trust your attorneys to judge your level of mental capacity, you don’t need to add instructions like these.

Special case: making two LPAs for property and financial affairs

You may want to make two LPAs for property and financial affairs, one for your personal finances, and another for your business affairs, so that different attorneys can look after different things. If this is the case, you should explain what you want to happen in the instructions for each one.

For instance, in one LPA you could say:

My attorneys only have the authority to use my personal bank account. They are not permitted to access my business account or make any decisions relating to my business.

In the other LPA you’d say:

My attorneys only have the authority to use my business accounts and make decisions relating to my business. They are not permitted to use my personal account or make decisions about my personal finances.

Avoiding problems

Instructions and preferences can create problems. It can be easy to ask for something that the law won’t allow.

If you’d like to add instructions and preferences, here are some common mistakes to avoid.

You can’t change the way attorneys are appointed to act

Don’t appoint attorneys to make decisions in one way, then include instructions to make them act differently.

If you said your attorneys should act ‘jointly and severally’ – so they can make any decision on their own or together – you must not add these sorts of instructions:

-

that one attorney must do what another attorney says

-

that one attorney must deal with your business and another with your private affairs

-

that where attorneys disagree, the majority should decide

-

that they must make some decisions together – if this is what you want, you should appoint them in LPA section 3 to act ‘jointly for some decisions, jointly and severally for other decisions’ instead

Your LPA won’t work if you include instructions like these.

Be careful with gifts and other arrangements relating to the provision of your money to third parties

Instructions about gifts often cause problems. There are strict limits on the kinds of gifts that attorneys may give on your behalf. Your attorneys may give gifts to your family, friends, associates or to themselves on ‘customary occasions’, including weddings, anniversaries, birthdays and religious holidays. They may donate to charities you’ve previously given to.

You cannot include instructions that make it compulsory for your attorneys to give gifts on customary occasions in the same way you did when you still had the mental capacity to do so. Such instructions would include words such as “must”, “shall” or “has to”. Similarly, you cannot include instructions that make it compulsory for your attorneys to use your money to benefit or maintain others (e.g third parties). If you include such instructions, they will be invalid as they could stop your attorneys from acting in your best interests. Your attorneys may need to make an application to the Court of Protection for permission to make such gifting or to use your funds to maintain someone else.

If you include a preference (wording similar to “would like”, “may” “can”) to suggest that your attorneys can make a gift, then it will be valid. However, your attorneys will need to carefully consider the reasonableness of the gift and take into account how much money you have.

You should carefully consider the wording of your instructions and whether you should take legal advice.

Here are some non-exhaustive examples of gifts you can’t authorise unless they are expressed as a preference:

-

trust funds for grandchildren

-

payment of school fees for grandchildren

-

interest-free loans to family

-

maintenance for any family member other than your wife, husband, civil partner or a child aged under 18 years old

Your attorneys must apply to the Court of Protection if they want to make gifts like this on your behalf. The Office of the Public Guardian provides guidance on gifts for attorneys.

Other preferences and instructions relating to the use of your funds to benefit others (that is, where this use is not a gift) are likely to be ineffective if they seek to make it compulsory for the attorney to use funds in this way.

Other mistakes

You should avoid these common mistakes:

-

you can’t tell your attorneys to do anything against the law – this includes anything to do with euthanasia and assisted suicide

-

you can’t say that attorneys should act in the best interests of anyone else, including your wife, husband, partner or children. Your attorneys act for you alone

-

you can’t say a replacement attorney can only start acting in specific circumstances. For instance, you can’t use instructions to add special circumstances – such as an original attorney being on holiday – in which your replacement attorney can step in

-

don’t add health and welfare instructions to a property and financial affairs LPA. Don’t add property and financial affairs instructions to a health and welfare LPA. You should make a separate LPA for each instead

-

you can’t tell an attorney to change your will – it’s outside their powers

-

you can’t give an attorney power to appoint a replacement attorney

Instructions to pay fees

Professional attorneys

Professional attorneys, such as solicitors or accountants, charge for their services. They may also claim fees and reasonable expenses.

Write what you’ve agreed to pay in section 7 instructions or set their fee by referring to standard rates and writing something like:

I wish my professional attorneys to be paid the standard solicitor rate as set by [state the name of a relevant professional organisation here].

Fees and expenses are paid out of your funds.

Non-professional attorneys

Many attorneys don’t get fees. For example, if you appoint a non-professional attorney – such as your husband, wife, partner, a family member or a friend – they’ll probably be happy to act for you without being paid. However, they can still claim reasonable expenses, such as postage, travel costs and the cost of an accountant preparing annual accounts.

If you don’t want to pay your attorneys fees, don’t write anything. They can still claim expenses.

If you agree to pay a fee, you must write this in your instructions. If you don’t, your attorney can’t be paid. You can set different fees for different attorneys.

For non-professional attorneys, fees are often set as a payment each year.

Here are examples of the sort of instructions you might write to pay a fee to your attorneys:

Each attorney must be paid a single fee of £1,000 each year, the payment to be made on 20 December each year. The fees will stop when my estate drops to £[fill in amount].

I wish each of my attorneys to be paid £ [fill in the amount] per year for their services under this LPA. My attorneys will stop being paid when my money drops to £[fill in amount].

Fees and expenses will be paid out of your funds.

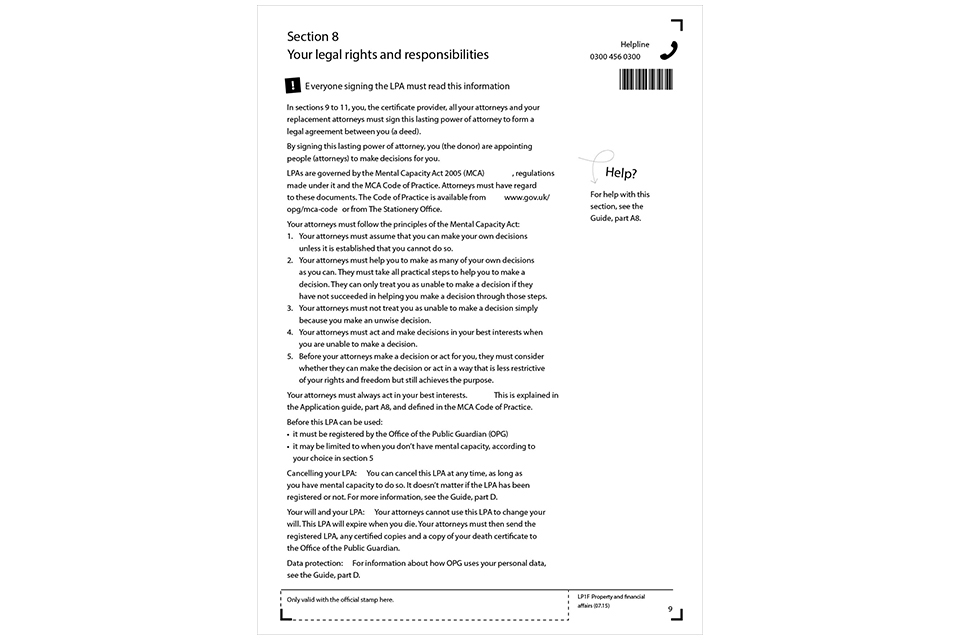

Section 8: your legal rights and responsibilities

Read section 8

Everyone involved in this lasting power of attorney must read this section before signing.

More information on section 8

An LPA is a legal agreement (also called a ‘deed’) between you and your attorneys.

Section 8 contains important information that you, your attorneys and your certificate provider must read, as it is part of the legal agreement that you and they are making. The principles of the Mental Capacity Act 2005 and the rules in the Mental Capacity Act Code of Practice, which your attorneys must follow, are set out in this section of the LPA.

If you need help to look at websites, visit your local library.

Your best interests

The law says that your attorneys must always act in your best interests when making decisions and acting for you.

They must:

-

do everything they can to help you make all or part of a decision

-

identify what you would take into account if you were making a decision

-

be guided by your personal, political, cultural, moral, or religious beliefs and values when making any decisions for you

To do this, they should:

-

find out your preferences and views from you or from how you’ve behaved and what you’ve said or written in your LPA and elsewhere

-

assess whether the decision can be left for another time, when you might find it easier to make

-

avoid restricting your rights

-

consult family and friends and anyone else who knew or understood your wishes, feelings and views

-

not make assumptions about your quality of life or about what you need just because of your age, appearance, condition or behaviour

Before you sign

Check that you have completed all the sections that you must fill in and any optional sections you want to use.

Once you’ve signed, you cannot change your LPA – you will need to make a new LPA if you want to make changes.

Below is a summary of all the information you need to give and everything you should have done before you sign. Some sections are required, others are optional.

Section 1: The donor (required)

Give your name, date of birth and address. There’s also the option to give an email address if you have one.

Section 2: The attorneys (required)

You will need to give the names, addresses and dates of birth of your attorneys.

If you have more than four attorneys, use Continuation sheet 1 and sign it before you sign the LPA.

Section 3: How should your attorneys make decisions? (required)

Mark one box to show how your attorneys make decisions.

Section 4: Replacement attorneys (optional)

You will need to give the names, addresses and dates of birth of any replacement attorneys.

If you have more than two replacement attorneys, use Continuation sheet 1 and sign it before you sign the LPA.

If you are changing the way your replacement attorneys act or step in, use Continuation sheet 2 and sign it before you sign the LPA.

Section 5: When can your attorneys make decisions? (required)

LPA for property and financial affairs only - tick one box to choose when your attorneys can make decisions.

LPA for health and welfare only: life-sustaining treatment - sign one box to give either your attorneys (option A) or your doctors (option B) the power to decide about life-sustaining treatment.

Section 6: People to notify when the LPA is registered (optional)

You will need to give the names and addresses of any people to notify.

If there are five people to be told, use Continuation sheet 1 and sign it before you sign the LPA.

Section 7: Preferences and instructions (optional)

You can specify any preferences or instructions you want your attorneys to follow or keep in mind.

If there are more preferences and instructions, use Continuation sheet 2 and sign it before you sign the LPA.

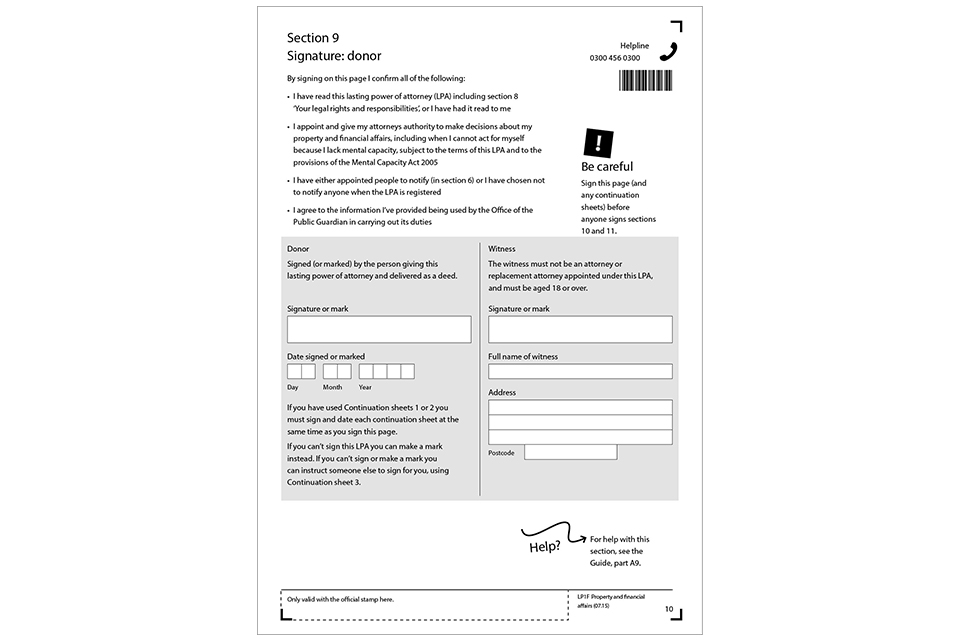

Section 9: donor’s signature

Section 9: sign your LPA

The people involved in the LPA must sign it in the correct order. If they don’t, the Office of the Public Guardian (OPG) won’t register it and your attorneys will not be able to use it.

You must sign your LPA before anyone else does.

If you’ve used Continuation sheets 1 or 2, make sure you’ve signed them before you sign this section.

If you cannot sign or mark section 9 and have directed someone else to sign on your behalf using Continuation sheet 3, they must sign this section as if it were section 9 (meaning before anyone else does) and the signature must be witnessed.

If you’re making a health and welfare LPA, also sign section 5 – life-sustaining treatment – before you sign this section. If you cannot sign or mark section 9 and have directed someone else to sign on your behalf using Continuation sheet 3, they must also sign section 5 on your behalf and the signature must be witnessed.

When you sign LPA section 9 or Continuation sheet 3 is signed on your behalf, you are forming a legal agreement with your attorneys. You are legally bound by everything written in the form up to this point, including LPA section 8 (‘Your legal rights and responsibilities’) and the declaration on this page.

More information on order of signing

Read the instructions in this section carefully.

You must sign the LPA in the right order or OPG cannot register it.

The LPA must be signed in this order:

1. You (the donor) sign first

You must sign your LPA before anyone else.

You must sign:

-

section 5 of the LPA, about life-sustaining treatment if it is an LPA for health and welfare decisions

-

continuation sheet(s) 1, if used

-

continuation sheet(s) 2, if used

-

section 9 of the LPA

It’s better to sign everything on the same day – though you don’t have to – but you must sign section 9 after these other sections (that is, section 5, if appropriate, and any continuation sheets).

If you can’t sign, you can make a mark. If you can’t sign or make a mark, look at Donors who cannot sign or mark, below. The person you’ve chosen will be able to sign for you.

2. The witness signs next

There must be an independent witness to watch you (the donor) signing your LPA. The witness must sign straight after you.