Opportunity and Innovation: The Defence Small and Medium-sized Enterprise (SME) Action Plan

Published 27 January 2022

Foreword by the Minister for Defence Procurement

In the Defence and Security Industrial Strategy (DSIS) we set out our vision for a competitive, innovative, and world-class defence sector in the UK that supports and strengthens our Union and is able to give our Armed Forces the state-of-the art equipment that they need to meet the evolving threats that we face.

We recognise that Small and Medium-sized Enterprises (SMEs) are at the heart of the vibrant and flexible UK defence industry supporting a wide variety of high quality jobs across the four nations of the United Kingdom. However, we also recognise that these smaller businesses face unique challenges and barriers preventing them from fulfilling their potential of delivering both defence capability and contributing to UK prosperity.

In this plan, we will set out how we will further improve the engagement we have with SMEs, focusing on procurement models that are easier to navigate, a recognition of the role the MOD and its major suppliers play in supporting the whole of the defence supply chain and understanding how best to support innovation and exports for UK suppliers.

We want cutting-edge and innovative suppliers to see defence as a priority market, enabling us to exploit the very latest technological advances to maintain the UK’s world-class Armed Forces’ battle winning edge. Key to this aim is making sure that SMEs have a fair opportunity to contribute to UK defence and security, and the ability to compete successfully in international markets. This plan sets out how we intend to do this.

We published our first SME Action Plan in March 2019, and we have achieved significant progress. I am delighted to present this updated plan, following the publication of DSIS. It will help us deliver our vision of a vibrant, sustainable and competitive UK industrial base.

Jeremy Quin MP, Minister for Defence Procurement

Foreword by Andrea Hough and Andrew Forzani, co-chairs of the Defence Suppliers Forum SME Working Group

The publication of this second MOD SME Action Plan comes at a crucial moment. The Government’s Integrated Review and the Defence and Security Industrial Strategy (DSIS) give us a unique opportunity to deliver the vision of an agile, sustainable and export focused UK defence sector by finding new ways to engage with the diverse and innovative smaller suppliers who will contribute to the future of defence.

A first step in realising that ambition is the formation of the new Defence Suppliers Forum SME Working Group – it helps give SMEs a voice alongside our ongoing engagement with our established major suppliers. We are delighted to be acting as the group’s first co-chairs and we are excited by the unique opportunity that it provides to bring SMEs, established defence prime contractors, the defence focused Trade Associations and MOD together to drive change. More importantly it gives SMEs the opportunity to be involved from the outset in identifying priorities, helping develop solutions and for holding us to account for progress against our commitments.

Our activity in the Working Group is being partly guided by the outcome of a survey of SMEs working in defence that we commissioned in 2021. The survey provided some clear areas for focus and has provided a baseline against which we can measure progress. Details of the survey and the outcome are contained in Annex H of this plan.

It is vital that we succeed. SMEs are already adding immense value to UK defence through their innovation, customer focus and agility. Our aim, through this Action Plan and the work of the SME Working Group, is to ensure that we remove the unnecessary barriers to SMEs fully participating in the advanced, sustainable and world beating defence industry that we want to develop for the UK.

We look forward to working closely together on this important task, utilising the collaborative approach of the Defence Suppliers Forum to allow government, industry and wider contributors to shape solutions to the challenge we have set ourselves. In this way we can ensure that our Armed Forces continue to be provided with the best capabilities and that our industry can support national prosperity throughout the United Kingdom.

Andrew Forzani, Andrea Hough

Section 1 - Introduction

The Defence and Security Industrial Strategy (DSIS) sets out the government’s vision for the defence and security sector in the UK. The DSIS report highlights the importance of smaller suppliers’ ability to deliver innovation and develop solutions against a changing threat and international security landscape. This plan builds on the priorities set out in DSIS , the Integrated Review, and the Defence Command Paper.

In this document we set out our commitments to SMEs and explain how we will meet them. We also highlight practical ways in which smaller and non-traditional defence suppliers can find and compete for opportunities in UK defence, and provide an overview of what a new supplier needs to know in order to work with us.

For MOD staff and for our prime contractors this Action Plan is a call to arms: a clear statement of our ambition and the role that each of us needs to play in realising those ambitions. We need to change our behaviours to ensure that a diverse and sustainable UK defence supply chain is developed, contributing to the strength of our Union and increasing national prosperity.

Context

SMEs are the backbone of the UK economy and are a vital part of the UK defence and security supply chain. They lead the way in developing world beating technologies and services that are essential to maintaining the UK Armed Forces’ advantage in an increasingly uncertain world. The Defence and Security Accelerator (DASA), which finds and funds innovative ideas for the benefit of national security, has consistently found that at least 50% of the scientific and technical ideas which it assesses to be desirable, feasible and viable come from SMEs. SMEs bring a unique customer focus and agility that adds value throughout the defence supply chain. In 2019-20 they contributed work worth over £4.5-billion [footnote 1] to defence projects, accounting for over 21% of Defence’s total spend with industry.

This importance is reflected in DSIS, which set out an ambitious vision for the future of MOD’s relations with industry. Through this strategy the government is determined to ensure the UK continues to have competitive, innovative and world-class defence and security industries, that drive investment and prosperity, and which underpin our national security now and in the future. DSIS recognises the importance of SMEs; the innovation, diversity, and resilience they bring to our supply chain, and their contribution to national prosperity through high value jobs, training, and skills across the whole of the United Kingdom. DSIS also emphasises the importance the Government has placed on transforming the support to SMEs in defence and security export markets, recognising the contribution SMEs can make in our ability to continue to compete in the global marketplace.

That is why the MOD is committed to supporting SMEs seeking to work in defence, whether contracting directly with us or through larger prime contractors. Our aim is to become a customer of choice for these suppliers.

Section 2 – Key Facts

The MOD manages some of the most complex and technologically advanced requirements in the world. Our customers include our Armed Forces and national security agencies, and we buy everything from military fighting vehicles to education services, nuclear submarines to facilities management and everything in between.

Since the publication of our 2019 SME Action Plan we have:

- Established a new Defence Suppliers Forum SME Working Group.

- Established regular meetings with the Defence focused Trade Associations (ADS, Make UK Defence and techUK) to identify and address existing and emerging SME specific issues.

- Changed our approach to Limits of Contractor Liability, allowing SMEs to work more easily in defence.

- Supported fair payment practices by implementing government policy on excluding bidders who do not demonstrate fair payment practices[footnote 2] and promoting the Prompt Payment Code.[footnote 3]

- Refreshed our Early Market Engagement strategy, making opportunities easier to find.

- Required suppliers of major contracts to advertise sub-contracting opportunities on the Defence Sourcing Portal, helping make opportunities more visible for SMEs.

- Introduced simplified, plain English contracts for lower value, less complex procurements, and for the procurement of innovative requirements below £1-million.

- Applied the government’s Social Value policy allowing MOD to take into account bidders approach to social value, including business creation and growth, and the development of more diverse supply-chains.

Our aim is to build on this progress, to continue to draw on the skills and capabilities of SMEs to ensure that our customers are provided with the best capabilities. This will enable them to protect the UK’s security and to advance the UK’s interests, both now and in the long term; and in doing so, to obtain the best possible value for money for the taxpayer.

Our procurement activity covers a very wide range of requirements, including:

- Technology: cloud and digital, network services, software and technology products and services.

- Equipment and Support: ships, submarines, aircraft, vehicles, weapons, missiles, commodities and their support (maintenance, repair, and upgrade).

- Infrastructure: construction, hard and soft facilities management, property consultancy.

- Research and Development: with significant funding uplift over the next 4 years.

- Project Support Services: including Professional, Management and Consultancy services.

The MOD will invest more than £85-billion on equipment and support in the next four years. This pipeline of opportunities gives us the opportunity to make real improvements in our engagement with SMEs. A minimum of £6.6-billion will be invested in defence research and development over the next four years.

The UK is one of the largest exporters of defence equipment in the world, winning orders of £7.9-billion in 2020. For security exports, sales were £7.95-billion in 2020.

Our Spend

In 2019/20 the MOD spent approximately £21.1-billion with industry. A breakdown of our 2019/20 spend by Crown Commercial Service Category coding is provided below which is expressed in millions.

A pie chart labelling the category spend in £M. Figures are as follows: Defence (Military Equipment, Weapons, Ammunition, Research & Development) £7,815.76; IT £3,355.61; Facilities £1,834.43; Travel £252.37; Industrial Services £2,260.94; Other (Comms, Logistics, Operation Goods) £724.20; Professional Services Other £1,267.69; Professional Services – CCL £1,147.33; Construction £947.31; Fleet £243.72; Energy and Fuels £603.80; Engineering Goods £622.28; Learning and Development £538.99.

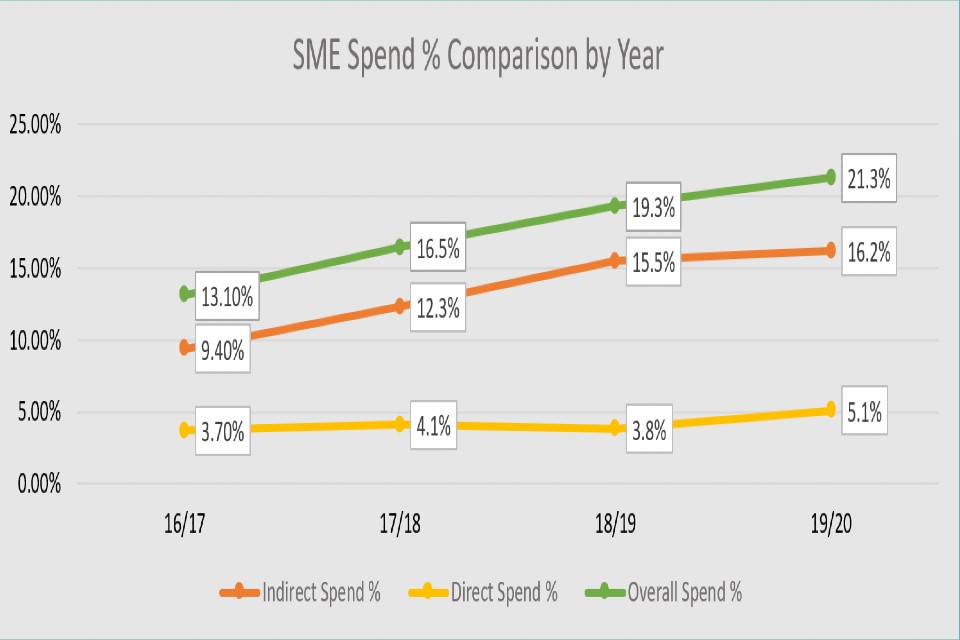

In Financial Year 2019/20 we spent some £1.1-billion directly with SMEs, up from £775-million in the previous year. For indirect spend, which makes up most of our engagement with SMEs, the figures were £3.4-billion up from £3.2-billion. The chart below illustrates progress since 2017 towards our target that 25% of our spend will go to SMEs by 2022.

A line graph detailing SME Spend % Comparison by Financial Year (FY), including Indirect Spend, Direct Spend and Overall Spend. Figures are as follows: Indirect spend; 9.40% in FY 16/17, 12.3% in FY 17/18, 15.5% in FY 18/19 and 16.2% in FY 19/20 Direct spend; 3.70% in FY 16/17, 4.1% in FY 17/18, 3.8% in FY 18/19 and 5.1% in FY 19/20 Overall spend: 13.10% in FY 16/17, 16.5% in FY 17/18, 19.3% in FY 18/19 and 21.3% in FY 19/20.

Section 3 - Adding Value: SME Contributions to Defence

Smaller suppliers add real value to MOD’s procurement activity, accounting for some £4.5-billion of our spend with third party suppliers in 2019/20. SMEs are engaging in our supply chain in a wide variety of ways, reflecting their diversity, customer focus and agility.

The following examples highlight some of the success stories and demonstrate different routes that SMEs take to engage in UK defence. Defence will actively promote these to enable the lessons learned to be shared and adopted across the whole of MOD’s business.

Collaboration with other SMEs

2iC, D3A and 4GD are three independent UK SMEs. 2iC are global leaders in providing digital interoperability in the battlespace; D3A Defence specialises in the development and delivery of training solutions to the military; and 4GD offers measurable close-combat virtual and reality training at its 4GD SmartFacility™.

They are bringing their expertise together to jointly create a reconfigurable, data-driven, non-ballistic shoot house that is designed to improve soldiers’ close combat skills.

Support for Innovation: Defence and Security Accelerator (DASA)

Over the last 3 years DASA has invested over £103-million on innovative projects with industry and academia; over 60% of this has gone to SMEs.

Cervus Defence – data-led innovation to improve training and readiness. As part of a £240,000 contract, Cervus Defence’s system was trialled with the Parachute Regiment in Kenya, improving shot accuracy. Cervus director Alan Roan said: ‘With DASA’s funding and access to the end-user we have been able to achieve in one year what would have otherwise taken us three years and multiple rounds of fundraising.’

Oxford Space Systems – Defence invested £1-million in a new generation of pioneering British deployable satellite antennas. The ‘wrapped rib’ antenna is lighter, less complex and more cost-competitive than those currently available commercially. It will make the UK the first European country with the capability of a flight-proven parabolic deployable antenna.

SimCentric - is a veteran-run technology company focused on transforming training, safety, and operational decision making through innovation. In 2020, DASA awarded the company £300,000 through the Open Call for Innovation (Rapid Impact), to improve training for personnel, making it more realistic, intuitive and immersive, while lowering the costs. Trials have taken place with the Parachute Regiment, the RAF Regiment, and the Royal Marines. These tests have proven that Immersive reality technologies have the potential to transform training within the UK MOD, providing affordable and effective capability that bridges the gap between synthetic and live training.

Engaging through the Supply Chain

Atec Engineering Solutions are a UK based, privately owned SME manufacturing business, currently working with several Defence primes, both in the UK and globally. The company has long-term agreements in place with Boeing Defence UK in support of the MOD’s Chinook fleet.

Atec’s chair, Andrea Hough says: “Taking the opportunity to engage with and listen to the needs of the global defence sector and the large prime contractors is critical to building long term relationships and the opportunities to do this are there for SMEs. Over the years, we have learned that investing time to both understand and challenge our customers, has enabled us to tailor our approach and collaborate with them more effectively.”

Providing Expertise

Geometric Manufacturing Ltd is a specialist machining company with a long history of supplying the defence industry via different routes and entry points. Their products can be found in a multitude of end use applications.

The company believe that maintaining close collaborative relationships with its customers ensures that the manufacturability of client designs is reviewed right from product conception, and the company has an in-house design capability to take that support to a high level.

Expertise extends down the supply chain, with a network of approved subcontractors helping to meet specialised requirements. The expert support offered by Geometric Manufacturing over many years has contributed to meeting UK MOD, NATO and foreign government requirements, earning valuable export revenue for the UK economy.

Customer Focus

Copernicus Technology provides Maritime Patrol Aircraft Training and Consultancy Services. The company won contracts through an MOD framework contract supporting the RAF P-8 Poseidon programme providing visual recognition training material and a comprehensive, ground-breaking training management system, along with a partner micro-SME, Aquila Learning.

The Poseidon Delivery Team found it highly successful dealing with a micro-SME that really understands and empathises with their needs.

Engagement with Defence Prime Contractors

Of course, MOD recognises that improving access to opportunities for SMEs also requires support from MOD as the end customer and just as importantly aligning the interests of our prime contractors, who manage so much of the defence supply chain. We are working closely with these prime contractors, to ensure that together we are maximising the opportunity for all suppliers to contribute their skills and experience in delivering UK defence and security requirements.

Section 4 - Our Action Plan

The sections below set out how we will help deliver on our commitment to SMEs and support the aims of DSIS, allowing defence to benefit from the significant value that SMEs deliver. This requires us to improve access to opportunities and engagement with smaller suppliers throughout the supply chain. It also means harnessing the experience and expertise of SMEs in how we achieve this through the DSF SME Working Group.

The actions being taken are informed by our ongoing engagement with the SME community, reflecting their expressed priorities and the barriers that prevent them from working in support of UK defence.

This approach is endorsed by the Minister for Defence Procurement in his role as the department’s SME Lead Minister. The following action plan includes target dates and outcomes to allow us to track our progress.

Driving Improvement: The Defence Suppliers Forum SME Working Group

In the Defence and Security Industrial Strategy (DSIS), we committed to strengthening the Defence Suppliers Forum[footnote 4] to help ensure that SMEs have a voice in the development of the UK defence sector. Central to ensuring that we deliver against this commitment and the action plan is the new Defence Suppliers Forum SME Working Group.

The inclusion of the government customer, SMEs, prime contractors, and Make UK Defence[footnote 5] (representing the defence focused Trade Associations) means that the solutions that we find will be relevant and achievable. The continuous dialogue enabled through the Working Group means that our approach will evolve, keeping it focused on the most pressing issues for SMEs. The DSF SME Working Group will explore opportunities for improvement. For example, standardising and simplifying procurement processes to reduce the overheads associated with working in defence.

Our aim is that the SME Working Group will provide a focus for ongoing dialogue, and that collectively we will deliver real change to benefit smaller suppliers. As a starting point for this process we asked the SME members of the Working Group to develop a list of their highest priority concerns – those that were most pressing and if addressed would make the greatest difference to their businesses.

In order to ensure that SMEs have a clear voice and can lead the activities of the Working Group, the methodology used ensures that a majority of the members are small businesses and that the Working Group and each of the three sub-groups are co-chaired by SMEs. This allows us to benefit from their expertise and experience and guarantees that SME’s genuine concerns are reflected in our work.

In the following tables we lay out the three key priorities that the SME members have identified as the initial focus for the Working Group.

|

Priority #1 |

Workstreams Action |

Action Dates |

|

Improve visibility of Framework landscape. The scope of this workstream will include frameworks run by MOD, CCS and primes. |

· Gather data on the SME engagement with Frameworks and impact of Frameworks on SMEs. Identify what steps can be taken to address these concerns. · Develop a route map illustrating the framework landscape across defence and wider government, and improve awareness of opportunities. · Develop a Framework Library to be hosted on GOV.UK providing information on key Frameworks. · Learn from examples of best practice, and identify areas for improvement. |

· End 2021.

· Dec 2021.

· Jan 2022.

· Jan 2022. |

|

Priority #2 |

Workstreams |

Action Dates |

|

Improve the visibility and transparency of opportunities for SMEs through the defence supply-chain. |

· Initial Proposal for JOSCAR-Lite portal for speculative registrations.

· Develop proposal to improve Trade Association co-ordination through Defence Trade Association Alignment Council (DTAAC).

· Ts&Cs pilot - proposed recommendations by end January 2022.

· Develop proposal to improve access to FLC end customer.

· Develop proposal to improve access to primes and inform role of SME Champions. |

· Dec 2021.

· End 2021.

· End 2021.

· Q4 2021.

· Q4 2021. |

- Initial Proposal for JOSCAR[footnote 6] -Lite portal for speculative registrations.

|

Priority #3 |

Workstreams |

Action Dates |

|

Develop ways to measure MOD’s engagement with SMEs to aid understanding and measure progress. |

· Identify other measures of SME engagement.

· Consider how the available data might be used as a dashboard to help monitor the effectiveness of policy. Combine lag and lead indicators to give us an opportunity to improve.

· Trade Associations (Make UK Defence, ADS and techUK) to consider value of undertaking an annual survey to track SME defence activity. |

· Complete. · Jan 2022.

· Q1 2022.

|

Progress against these priorities is being driven by focused workstreams involving government, SMEs, the Trade Associations and prime suppliers working together to develop actions. The workstreams will report progress regularly to the DSF SME Working Group for scrutiny and discussion.

We are always seeking new participants to improve the DSF Working Group. If you are an SME either working in defence or considering working in defence and believe you have something to offer the Working Group, then please let us know by emailing us [email protected].

4.1 Industry as a Strategic Asset

We recognise the value added by the whole defence supply-chain, with vital contributions being made by primes, mid-tiers and SMEs. To support smaller suppliers in our supply chain and to ensure that we maximise opportunities for UK based suppliers, we are strengthening our engagement with the defence industry and putting in place measures to improve opportunities for suppliers based throughout the UK.

We are engaging with our Strategic Suppliers through our Strategic Partnering Programme (SPP)[footnote 7] to influence behaviours to improve the global competitiveness of the supply-chain by encouraging wider diversity, innovation and sustainability at all tiers of the defence supply chain.

|

Commitment #1 |

Outcome |

Target Date |

|

As a standard part of SPP engagement we will seek evidence from Strategic Suppliers that they have or are developing effecting ways of engaging SMEs. Strategic supplier SME Champions will report regularly on progress. |

Strategic Suppliers focus on how to engage SMEs in the supply chain and we can share best practice across our business. |

By March 2022. |

Revised Industrial Participation Policy. In order to maximise opportunities for the UK supply-chain, the government intends to introduce a revised Industrial Participation policy. The policy will ask suppliers to set voluntary targets for UK content and articulate their plans for opening up opportunities for the UK supply chain pre-contract; they will then be regularly assessed against them (with Ministers briefed on progress towards targets).

The government will launch a pilot programme to develop these approaches, including engaging with major defence equipment suppliers on an initial set of MOD procurement programmes for both options.

|

Commitment #2 |

Outcome |

Target Date |

|

Revise the UK’s Industrial Participation Policy, launching a programme to develop an approach asking suppliers to set voluntary targets for UK content and articulate their plans for opening up opportunities for the UK supply chain.

|

Encouraging Prime contractors to give further consideration to what the UK supply chain can offer, opening up more opportunities for UK companies including SMEs. Helping inform HMG regarding barriers to making greater use of the UK industrial base. |

Q1 2022. |

We will establish a Defence Supply Chain Development and Innovation Programme, leveraging wider government investment and informed by successful BEIS initiatives in civil sectors, to support the development of a more productive and competitive UK defence sector. The programme will aim to develop stronger mid-tier defence companies and support SME growth across the UK.

|

Commitment #3 |

Outcome |

Target Date |

|

Establish an MOD and Industry funded Defence Supply Chain Development and Innovation Programme, leveraging wider government investment and informed by successful initiatives in civil sectors. |

Support the development of a more productive and competitive UK defence sector, including the sector’s SMEs, reducing cost and risk within MOD programmes and supporting a UK defence sector better able to win domestic and export work. |

Launch in Q2 2022. |

We will establish a UK-wide Defence Technology Exploitation Programme (DTEP) initiative. Building upon the successful National Aerospace Technology Exploitation Programme (NATEP) and informed by the Northern Ireland pilot Defence Technology Exploitation Programme (run by Invest Northern Ireland with support from BEIS) MOD will establish a UK-wide DTEP. This programme will seek to support SMEs across the Defence sector in developing innovative technologies and winning new business, through working collaboratively with higher tier companies. It will offer partial grant funding of projects which are a collaboration between UK SMEs and one or more higher-tier partners, and support MOD’s current and upcoming equipment capabilities and technology priorities.

|

Commitment #4 |

Outcome |

Target Date |

|

Establish a UK-wide Defence Technology Exploitation Programme (DTEP) initiative to support collaborative projects between SMEs and higher tier companies across the UK. |

Support SME suppliers across the UK to develop innovative materials, technologies and products and enable them to join Defence supply chain. The Programme will specifically seek proposals which support MOD’s current and upcoming equipment capabilities and technology priorities. |

Development of UK-wide scheme, aiming to launch in Q2 2022. |

4.2 Acquisition and Procurement Policy

The size and complexity of defence procurement can be daunting for prospective suppliers, and especially SMEs working with the MOD for the first time. That is why we are continually seeking ways to make our procurement simpler, more transparent, and more accessible.

We need a Defence Acquisition System that drives pace, efficiency, and value in acquisition processes to meet the threats of the modern world. We are empowering programme teams to tailor their approach to reflect the level of risk and complexity, and encouraging collaborative working, including with industry, to set programmes up for success from the outset. Transformation of our acquisition system will be enabled by changes in behaviour, including encouraging individuals to take appropriate risk.

Within the MOD we are encouraging teams to consider breaking up larger procurements into lots where this is appropriate, opening up competitions to a wider range of suppliers including smaller suppliers and those with innovative solutions.

The UK’s departure from the European Union is an opportunity to reform the Defence and Security Public Contracts Regulations (2011) (DSPCR) which control defence and sensitive security procurement in the public sector. A significant proportion of MOD’s procurement is conducted under this regime.

The following section lays out the government’s high-level policy commitments and how we are implementing them to benefit SMEs seeking to work in defence.

The MOD has embarked on an ambitious and comprehensive review of the DSPCR as part of the broader government review of the Public Procurement Regulations. The Cabinet Office has published a Green Paper on Transforming Public Procurement which aims to speed up and simplify procurement processes and place value for money at their heart. Through this we will improve the pace and agility of acquisition, simplify the regulatory framework, tailor it to better enable innovation and support the pull through of new technology into defence and security capability.

As set out in the December 2021 Government response to the public consultation on transforming public procurement, the Government intention is to combine four sets of regulations – including DSPCR – into a simpler, single set of rules, with legislation brought forward when Parliamentary time allows. This will include defence and security sector-specific rules where these are required to protect our national security interest or our industrial base.

SMEs will benefit from a new regime that aims to speed up and simplify procurement processes, with greater uniformity in the rules across different departments, more modern commercial purchasing tools, and greater flexibility in the pull-through of new technology. This in turn should make it easier to access funding and investment.

|

Commitment #5 |

Outcome |

Target Date |

|

As part of the wider Cabinet Office led Procurement Reform Programme, we intend to replace the current PCR and DSPCR with a single uniform set of rules supplemented with specific features to give greater flexibility to better suit the characteristics of defence and security procurements and those markets.

|

SMEs will benefit from a simplified procurement regime, which will remove duplication and make procurement more agile and flexible. It is intended that SMEs will benefit from greater levels of transparency throughout the procurement lifecycle, and there will be new rights for subcontractors experiencing payment delays in public sector supply chains. A new single digital platform for supplier registration will reduce complexity for bidding for public procurement. New flexible procurement tools will be introduced allowing suppliers to apply to join at any time, benefiting SMEs and new entrants. |

To be confirmed – dates for introduction of the Bill are subject to Parliamentary business. |

The MOD has also been undertaking a comprehensive review of the Single Source Contract Regulations. There are several proposals that will simplify the regime, and speed up the contracting process, which will benefit SMEs. Specific proposals include cutting the number of steps in the profit calculation process, reducing the reporting requirements and improving the dispute resolution process. Policy proposals for reforming the Regulations will be published in a Command Paper.

|

Commitment #6 |

Outcome |

Target Date |

|

We will publish updated proposals in a Command Paper laying out how we will drive the desired outcomes through our major prime suppliers. |

Simplification and speeding up of procurement processes and incentivising major suppliers to access innovation and support wider objectives, including support to UK SMEs, will open up new opportunities for smaller suppliers. |

Subject to parliamentary timetable agreement. |

Limiting contractor liability. The MOD has published an updated policy on the limitation of contractor’s liability, responding to industry concerns that too often the department has sought to put uncapped liability onto bidding companies, which they may be unable to manage, may deter competition, and which do not reflect the degree of technical risk inherent in some defence projects. This approach had a disproportionate effect on smaller suppliers’ ability to work in defence and the new policy removes many of these barriers.

|

Commitment #7 |

Outcome |

Target Date |

|

Ensure commercial staff have the skills required to take proportionate risk-based approach in line with the policy through training and awareness programme. |

Proportionate approach will remove barrier for smaller suppliers, allowing them to manage an appropriate level of risk. |

Ongoing. |

Continuing to increase the capability of the commercial function. Defence will continue to work to increase the capacity and capability of its commercial function. Along with other departments, we will continue to invest in the commercial expertise required to support the delivery of DSIS and this action plan, for example, by ensuing our teams can assess markets in which we operate in a more sophisticated way and by continuing to develop teams capable of contracting for open systems in an agile way.

|

Commitment #8 |

Outcome |

Target Date |

|

Upskilling of commercial function to capitalise on the additional freedoms delivered by policy and practice improvements. New training available. |

MOD commercial staff approach the market in a more agile way, engaging smaller suppliers earlier in the process and considering appropriate routes to market. |

Ongoing. |

4.3 Technology and “Pull Through”

We want to encourage innovation in our business and attract new and non-traditional suppliers, including SMEs, at all levels of the defence supply chain. Our customers have put innovation high on their agenda and we expect this to be reflected in their future requirements. Technology is creating both threats and opportunities for the UK’s security and prosperity, and innovation is vital to maintaining our military advantage.

Accelerating deployment of technology and planning for through-life capability management. The MOD is investigating potential changes to planning and commissioning processes with the aim of ensuring new technology is exploited effectively and brought into service seamlessly. We are considering how the MOD might need to change further to deliver this vision.

Identifying opportunities for co-creation and co-investment. MOD is supporting industry and Local Enterprise Partnerships (LEPs) in piloting a network of new Regional Defence and Security Clusters (RDSCs), starting with the South West of England. As a part of the implementation of the Defence Supplier Forum Innovation Operating Model for MOD and industry, these clusters will allow industry and government to share ideas and challenges, promoting collaboration and commercialisation. By creating collaborative pathways for non-traditional and established SMEs to engage with MOD Strategic Suppliers and Tier 1 companies the clusters will offer a route into the defence supply chain. An increasing number of regions supported by MOD are currently working to establish the next RDSCs in Scotland, London and the North West and Western Gateway areas of England with other areas under active consideration.

South West Regional Defence and Security Cluster – engaging SMEs

The first of the Regional Defence and Security Cluster (RDSC) pilots was launched in the South West in November 2020 through the active participation of the regional Defence Suppliers - Leonardo, Babcock, Thales and Atlas Elektronik along with the Heart of South West Local Enterprise Partnership, Universities of Exeter and Plymouth, Plymouth City Council and a large number of SMEs. The South West RDSVC offers a route into Defence for non-traditional SMEs based in Devon, Dorset, Somerset, Cornwall and the Isles of Scilly. It provides the means to collaborate and commercialise opportunities with Strategic Suppliers and other SMEs by addressing innovation challenges faced by Defence with opportunities from both MOD, the Strategic Suppliers and export markets. Membership is drawn from across the whole region, with affiliates in neighbouring regions. Since its launch over 150 participating organisations have become members, including 90 SMEs, with over half new to defence.

|

Commitment #9 |

Outcome |

Target Date |

|

Pilot a network of new Regional Defence and Security Clusters (RDSCs). |

Allow industry and government to share ideas, promoting collaboration and commercialisation. They are intended to develop innovative regional industrial capabilities to contribute to UK military capability by creating collaborative pathways for SMEs as a route into the defence supply chain. |

Experience and evaluation of the pilot clusters (Q1 2022). |

Ensuring that our acquisition system supports rapid exploitation of new and emergent technologies. Increasing the pace and agility of the MOD’s acquisition processes will enable the pull-through of emergent technology and the delivery of capability while it is still technologically relevant. We have recognised that we need to tailor our acquisition and approvals approach to better support agile delivery. We have drawn on both internal and external experience, to develop revised approaches that we are currently testing. We will codify these changes in our guidance to teams.

|

Commitment #10 |

Outcome |

Target Date |

|

Revised guidance available to support teams in adopting an agile approach to delivery. |

Fast moving technologies have routes which ensure they are delivered more quickly and effectively. |

Apr 2022. |

The Defence and Security Accelerator (DASA)

DASA’s mission to find and fund exploitable innovation to support UK defence and security quickly and effectively, and support UK prosperity extends to all SMEs who are regularly submitting over half of all new ideas. The DASA vision is for the UK to have strategic advantage through the most innovative defence and security capabilities in the world and this relies on an ever broadening and deepening supplier base. DASA’s unique team of regionally based Innovation Partners seek out new ideas and are hand to provide support to those SMEs who have not previously worked with Government.

The Defence and Security Accelerator funds innovation through two main mechanisms: Themed Competitions and the Open Call for Innovation.

- Themed Competitions offer innovators the opportunity to submit proposals around specific government areas of interest, with the aim of driving the development of technologies that address predefined challenges in national security.

Through Themed Competitions, we work with the MOD, other government departments and organisations across the wider public sector to maximise access to cutting-edge science and technology, providing a route to strategic advantage.

- The Open Call for Innovation is open to innovators with good ideas for defence and security, offering them the opportunity to submit their ideas to defence and security stakeholders. Innovations are welcomed that address any defence or security challenges where there is a relevant security Innovation Focus Area (IFA).

It is open for proposals all year round, with assessment dates scheduled across the year. We will gauge end users’ interest, then assess and contract the very best of these ideas.

|

Commitment #11 |

Outcome |

Target Date |

|

DASA will run innovation challenges enabling SMEs to bid for funding in order to raise technical readiness levels of innovative ideas which would address National security challenges. |

SMEs with innovative ideas can easily accelerate technical readiness levels and effectively. |

Ongoing. |

Defence Innovation Loans

DASA has launched a new Defence funding competition: The Defence Innovation Loan, which currently has £10-million available to fund Innovative Defence solutions.

This service provides an opportunity for single small and medium enterprises (SMEs) with Defence solutions to apply for a Defence Innovation Loan of between £250,000 and £1.6-million with an interest rate of 7.4% per annum. This loan can be used to cover up to 100% of eligible project costs to aid the commercialisation of the solution. This new opportunity is delivered by a unique partnership between DASA and Innovate UK, and builds upon our goal of helping to convert mature defence innovations into a viable business proposition that can compete for Defence procurement.

|

Commitment #12 |

Outcome |

Target Date |

|

Run a competition for SMEs to bid for Defence Innovation Loans to develop mature defence innovations into viable business propositions. |

At least 3 SMEs per year are provided with loan funding to aid commercialisation of their innovative ideas. |

Ongoing. |

Access to Mentoring and Finance

DASA’s Access to Mentoring and Finance (A2MF) service is designed to provide innovators with access to the extensive national and regional business support, company growth and funding ecosystem. A team of Regional A2MF Partners, working across the UK, is making these vital links which offer businesses a greater chance of commercial success for the products and services they have developed for the Defence and Security sectors. A2MF identifies, nurtures and educates:

- Business support and incubation providers about working in the Defence and Security sector.

- Equity finance and investors about the opportunities of the Defence and Security sector.

The service also manages a bench of mentors, funders and sub-contractors that can support and grow the DASA innovators.

|

Commitment #13 |

Outcome |

Target Date |

|

Provide an A2MF service to all DASA funded SMEs. DASA will hold at least one Investor Showcase a year to introduce SMEs to potential investors. |

SMEs are supported in commercialising their innovative ideas and raising their business readiness level. |

Apr 2022. |

Simple contracting

DASA uses the Innovation Standard Contract (ISC), a short set of terms and conditions that have been created specifically for the provision of innovative requirements. This easy to understand contract aims to simplify engagement with DASA.

These terms and conditions are tailored for each competition, are published at the outset of each Themed Competition and are available on the DASA website for all Open Call Cycles.

Case Study: Dstl SME Searchlight

Dstl is committed to working with a wider range of innovative SMEs. This is underpinned by the SME Searchlight[footnote 8] project, set up to attract SMEs and non-traditional defence suppliers.

In 2019-20 Dstl extended its Searchlight outreach activities, holding events for SMEs to understand priority Defence Science & Technology (S&T) areas and engaging in innovation events such as Venturefest South. Over 27% of DSTL’s procurement spend on S&T was with SMEs, either directly or via a prime supplier.

Dstl has sought feedback and begun to take action to further reduce barriers as part of its own SME Action Plan, improving its webpages and making engagement easier for SMEs by sharing more information. Dstl contracts are now simpler, with document length cut on average by 75%.

There will be further clarity available regarding Dstl’s Intellectual Property (IP) position, particularly with regard to IP “ownership and exploitation” that in most cases will rest with industry. Dstl also intend to increase industry and SME engagement in the design phases of their work to enable increased innovation.

Dstl SME Searchlight is excited to continue to grow and improve engagement with potential new suppliers and to support them to work with Dstl at the cutting edge of Defence research, Science and Technology, bringing increased innovation, agility and capability, whilst supporting UK prosperity and economic growth. SME Searchlight priorities for FY 20/21 are Air Systems, Artificial Intelligence/Data Science, Cyber, Futures research, Robotics/Autonomous Systems, Space Systems and Weapons Systems (in particular Directed Energy Weapons). Dstl has a particular interest in non-traditional Defence suppliers in the areas of Futures research.

For further information visit “how to work with or sell to Dstl”[footnote 9] on GOV.UK, contact [email protected], or search on Linkedin (Dstl) or Twitter (@dstlmod).

Section 5 - Targets and Reporting

The Ministry of Defence has set an ambitious target that 25% of our procurement spend will go directly and indirectly to SMEs in 2022.

In order to achieve this and to drive the right behaviours through our business and the supply-chain our refreshed Action Plan includes targets for delivery against each specific commitment that we have made and illustrates effective approaches to engagement through real-life examples. The DSF SME Workstream on Measures and Transparency is looking at what other metrics are available to give a more rounded picture of SME engagement.

Progress towards our 2022 target that 25% of our procurement spend will go directly and indirectly to SMEs is tracked annually and is published by Cabinet Office as part of the government’s reporting of its SME spend[footnote 10]. The methodology used to calculate these figures is contained in Annex E.

Progress against the specific commitments made in this Action Plan will be discussed at the DSF SME Working Group, and the WG members will have an active role in developing solutions to the challenges that we are seeking to overcome. The activity will form part of the wider DSF Programme of Work which is monitored by the DSF Executive Group.

We recognise that spend is only one measure for tracking the effectiveness of our approach, and as part of the work of the Defence Suppliers’ Forum SME Working Group we are considering the development of additional measures.

We are looking at how to better understand the economic contribution of defence to the UK economy. We are working to ensure access to good quality data on the economic footprint of the defence sectors. We will continue to grow and develop the Joint Economic Data Hub[footnote 11] (JEDHub) working collaboratively across government, industry and academia to provide consistent and impartial economic data on the sector. The JEDHub achieved Initial Operating Capability (IOC) at the end of 2020. The JEDHub 2021 Annual Survey surveyed members of the Defence Growth Partnership (DGP) and some of their main suppliers on a wide range of employment related topics, which will help demonstrate Defence’s contribution to the UK economy. We will continue to take an incremental approach to building the JEDHub, seeking to work with the defence focused Trade Associations like Make UK Defence, ADS and techUK, where appropriate, using their published data and their primary research to add to the JEDHub work.

Annexes

Annex A: Doing Business with our Strategic Suppliers

Opportunities to work indirectly for defence through our supply chain are accessible through our major suppliers’ own websites. The following information is provided to help new and non-traditional defence suppliers navigate the defence environment.

|

Supplier |

How to register your interest* |

|

Airbus Defence and Space |

Register here https://eprocstrategic.airbus-group.com

|

|

Babcock |

Complete the Supplier Registration Form at https://www.babcockinternational.com/who-we-are/suppliers/becoming-a-supplier

|

|

BAE Systems |

Complete the Contact Us form at https://www.baesystems.com/en/our-company/corporate-responsibility/suppliers-and-supply-chain

|

|

Boeing Defence UK |

https://www.boeing.co.uk/products-services/defence.page

|

|

Capita |

Complete the supplier expression form https://www.capita.com/contact-us/new-supplier-requests

|

|

Cobham |

|

|

DXC Technology |

|

|

General Dynamics UK |

Contact us for business enquiries and supply chain enquiries |

|

KBR |

Complete the Supplier Registration form https://kbrsupplier.com/Supplier/Supplier_Faq.aspx |

|

Leidos Supply UK |

For information about opportunities and support to the MOD’s Logistics Commodities and Services Transformation |

|

Leonardo MW |

https://www.leonardocompany.com/en/suppliers/becoming-a-supplier |

|

Lockheed Martin UK |

https://www.lockheedmartin.com/en-gb/suppliers.html Please submit relevant marketing details and contact information to [email protected] |

|

MBDA |

Supplier enquiries can be shared here: https://www.mbda-systems.com/contact-us

|

|

QinetiQ |

The QinetiQ SME Hub has been designed to collate information, insights and intelligence to help SMEs break into the defence and security market For more information please visit: https://www.qinetiq.com/campaigns/sme-hub

or contact us at [email protected]

|

|

Raytheon |

Please direct business enquiries to our Supply Chain and Subcontracts email address [email protected] |

|

Rolls Royce |

https://www.rolls-royce.com/sustainability/customers-and-suppliers.aspx#section-supplier-information

|

|

Serco |

If you are interested in working with Serco, please send your details to [email protected] Your details will be made available to the Procurement & Supply Chain team for future reference https://www.serco.com/about/business-relationships

|

|

Thales UK |

https://www.thalesgroup.com/en/europe/united-kingdom/uk-suppliers

|

|

Ultra Electronics |

Contact us

|

*Please note that registering on any supplier website does not guarantee that you will be offered work.

Annex B: Further information and websites

The MOD spends some £21-billion every year procuring a huge variety of goods and services, providing excellent opportunities for suppliers of all types to get involved in our procurement activity. Opportunities for working directly with MOD can be accessed through the Defence Sourcing Portal and the government’s Contract Finder.

Procurement at MOD

MOD Organisations

The majority of MOD’s procurement activity is undertaken through our buying organisations:

Defence Equipment and Support (DE&S)

DE&S manage complex projects to buy, support and supply equipment and services that the Armed Forces Royal need to operate effectively.

Submarine Delivery Agency

An executive agency of the Ministry of Defence.

Defence Infrastructure Organisation (DIO)

DIO is the estate expert for defence, planning, building, maintaining, and servicing infrastructure.

DIO refreshed procurement pipeline

Defence Digital (DD)

The Defence Digital organisation manages digital and information technology (D&IT). It leads on defensive cyber strategy, capability development and policy.

Defence Science and Technology Laboratory

The Defence Science and Technology Laboratory (Dstl) ensures that innovative science and technology contribute to the defence and security of the UK. Dstl supply sensitive and specialist science and technology services for MOD and wider government.

Defence and Security Accelerator

The Defence and Security Accelerator (DASA) finds and funds exploitable innovation to support UK defence and security quickly and effectively, and support UK prosperity.

Annex C The National Defence Focused Trade Associations

The MOD works closely with defence focused trade associations to help deliver its objectives. Make UK Defence are the lead trade association in the DSF SME Working Group, co-ordinating the support and engagement of the industry side.

ADS

ADS represents more than 1100 UK businesses operating in the aerospace, defence, security and space sectors. ADS focuses on supporting its defence members on a range of activities by shaping the market and generating business opportunities to enable members’ growth.

Make UK Defence

Make UK Defence is a national not-for-profit, member owned defence trade association, part of Make UK – the manufacturers’ organisation. It champions and supports the UK’s innovative and diverse defence manufacturers and the wider defence supply chain.

techUK

techUK is the trade association which brings together people, companies, and organisations to realise the positive outcomes of what digital technology can achieve. With over 800 members (the majority of which are SMEs) across the UK, techUK creates a network for innovation and collaboration across business, government, and stakeholders to provide a better future for people, society, the economy and the planet.

Annex D Progress since 2019

The MOD published its first SME Action Plan in 2019. The plan set out the department’s commitments to smaller suppliers and the specific actions we would undertake to deliver against these. We have made good progress since, and below we set out the actions that have been taken so far.

Commitments delivered

- Changed our approach to Limits of Contrator Liability, allowing SMEs to work more easily in defence

- Support fair payment practices by implementing new government policy on excluding bidders and promoting the prompt payment code

- Introduced new policy to improve Early Market Engagement, making opportunities easier to find

- New policy which requires suppliers of major contracts to advertise sub-contracting opportunities on the Defence Sourcing Portal

- Introduced simplified, plain English contracts for lower value, less complex procurements, and for the procurement of innovative requirements below £1-million

- Additional social benefits which can be achieved through the delivery of contracts are evaluated at the supplier selection stage and delivered throughout the life of the contract.

- Implemented the Government’s Social Value policy for PCR and DSPCR procurements

- Introduced new Intellectual Property (IP) Strategies into MOD’s acquisition processes making it easier for SMEs to win new MOD work, and to retain and protect their IP

Annex E How government calculates SME spend figures

The department’s SME target is made up of both direct and indirect spend with SMEs, and below we set out how the published figure is calculated.

The government wants small and medium-sized enterprises (SMEs) to benefit from central government procurement spend, either directly or indirectly via the supply chain.

Reports on this aspiration are represented as the sum of two figures: direct spend and indirect spend, as the figures are calculated using different methodologies. Their addition provides the figure against which the overall aspiration is measured.

Methodology

These figures on SME spend are management information published in the interests of transparency. The data sources for direct and indirect spend are described in more detail below. Given the differences in methodology between direct and indirect spend and changes in methodology between years, caution should be exercised when making comparisons over time.

Methodology: Direct Spend

To calculate direct spend, we use Dun and Bradstreet, a leading provider of business information, to classify all government suppliers as either SMEs or non-SMEs in line with consistent definitions. We then use the departments’ accounting systems to calculate how much money has been directly spent with those SMEs. Departments are asked to include the core department and its Executive Agencies and Non-Departmental Public Bodies (NDPBs). Returns are reviewed and signed off by Commercial Directors.

Methodology: Indirect Spend

Indirect spend with SMEs via the supply chain was collected through a survey issued by departments to their suppliers. For each department, we calculated the percentage of their procurement spend with large suppliers which had been captured by supplier responses. For those departments with over 70% of spend captured (i.e. with high levels of confidence in the supply-chain data) an extrapolation has been applied over the remaining spend to obtain a more complete picture.

The most recently published government estimates of departments’ spend with SMEs is available here: SME Spend 2019 to 2020. The Cabinet Office publishes these estimates on an annual basis.

Annex F Summary of commitments

|

Commitment |

Outcome |

Target Date |

|

Commitment #1 As a standard part of SPP engagement we will seek evidence from Strategic Suppliers that they have or are developing effective ways of engaging SMEs. Strategic Supplier SME Champions will report regularly on progress. |

Strategic Suppliers focus on how to engage SMEs in the supply chain and we can share best practice across our business. |

By March 2022. |

|

Commitment #2 Revise the UK’s Industrial Participation Policy, launching a programme to develop an approach asking suppliers to set voluntary targets for UK content and articulate their plans for opening up opportunities for the UK supply chain.

|

Encouraging Prime contractors to give further consideration to what the UK supply chain can offer, opening up more opportunities for UK companies including SMEs. Helping inform HMG regarding barriers to making greater use of the UK industrial base. |

Q1 2022. |

|

Commitment #3 Establish an MOD and Industry funded Defence Supply Chain Development and Innovation Programme, leveraging wider government investment and informed by successful initiatives in civil sectors. |

Support the development of a more productive and competitive UK defence sector, including the sector’s SMEs, reducing cost and risk within MOD programmes and supporting a UK defence sector better able to win domestic and export work. |

Launch in Q2 2022. |

|

Commitment #4 Establish a UK-wide Defence Technology Exploitation Programme (DTEP) initiative to support collaborative projects between SMEs and higher tier companies across the UK. |

Support SME suppliers across the UK to develop innovative materials, technologies and products and enable them to join Defence supply chain. The Programme will specifically seek proposals which support MOD’s current and upcoming equipment capabilities and technology priorities. |

Development of UK-wide scheme, aiming to launch in Q2 2022. |

|

Commitment #5 As part of the wider Cabinet Office led Procurement Reform Programme, we intend to replace the current PCR and DSPCR with a single uniform set of rules supplemented with specific features to give greater flexibility to better suit the characteristics of defence and security procurements and those markets.

|

SMEs will benefit from a simplified procurement regime, which will remove duplication and make procurement more agile and flexible. It is intended that SMEs will benefit from greater levels of transparency throughout the procurement lifecycle, and there will be new rights for subcontractors experiencing payment delays in public sector supply chains. A new single digital platform for supplier registration will reduce complexity for bidding for public procurement. New flexible procurement tools will be introduced allowing suppliers to apply to join at any time, benefiting SMEs and new entrants. |

To be confirmed – dates for introduction of the Bill are subject to Parliamentary business. |

|

Commitment #6 We will publish updated proposals in a Command Paper laying out how we will drive the desired outcomes through our major prime suppliers.

|

Simplification and speeding up of procurement processes and incentivising major suppliers to access innovation and support wider objectives, including support to UK SMEs, will open up new opportunities for smaller suppliers. |

Subject to Parliamentary timetable agreement. |

|

Commitment #7 Ensure commercial staff have the skills required to take proportionate risk-based approach in line with the policy through training and awareness programme. |

Proportionate approach will remove barrier for smaller suppliers, allowing them to manage an appropriate level of risk. |

Ongoing. |

|

Commitment #8 Upskilling of commercial function to capitalise on the additional freedoms delivered by policy and practice improvements. New training available. |

MOD commercial staff approach the market in a more agile way, engaging smaller suppliers earlier in the process and considering appropriate routes to market. |

Ongoing. |

|

Commitment #9 Pilot a network of new Regional Defence and Security Clusters (RDSCs). |

Allow industry and government to share ideas, promoting collaboration and commercialisation. They are intended to develop innovative regional industrial capabilities to contribute to UK military capability by creating collaborative pathways for SMEs as a route into the defence supply chain. |

Experience and evaluation of the pilot clusters (Q1 2022). |

|

Commitment #10 Revised guidance available to support teams in adopting an agile approach to delivery. |

Fast moving technologies have routes which ensure they are delivered more quickly and effectively. |

Apr 2022. |

|

Commitment #11 DASA will run innovation challenges enabling to SMEs to bid for funding in order to raise technical readiness levels of innovative ideas which would address National security challenges. |

SMEs with innovative ideas can easily accelerate technical readiness levels and effectively. |

Ongoing. |

|

Commitment #12 Run a competition for SMEs to bid for Defence Innovation Loans to develop mature defence innovations into viable business propositions. |

At least 3 SMEs per year are provided with loan funding to aid commercialisation of their innovative ideas. |

Ongoing. |

|

Commitment #13 Provide an A2MF service to all DASA funded SMEs. DASA will hold at least one Investor Showcase a year to introduce SMEs to potential investors. |

SMEs are supported in commercialising their innovative ideas and raising their business readiness level. |

Apr 2022. |

Annex G Note on the definition of Small and Medium-Sized Enterprises

The UK government currently uses the following definition of Small and Medium-Sized Enterprises (SMEs). Throughout this document any reference to “SME”, “smaller supplier” or similar should be taken to refer to this definition.

The main factors determining whether an enterprise is an SME are

- staff headcount

- either turnover or balance sheet total (per annum)

|

Company category |

Staff headcount |

Turnover |

or |

Balance sheet total |

|

|

Medium-sized |

< 250 |

≤ € 50 m |

≤ € 43 m |

||

|

Small |

< 50 |

≤ € 10 m |

≤ € 10 m |

||

|

Micro |

< 10 |

≤ € 2 m |

≤ € 2 m |

||

These ceilings apply to the figures for individual firms only. A firm that is part of a larger group may need to include staff headcount/turnover/balance sheet data from that group too.

How is the data calculated?

To work out the data to be considered and assessed against the thresholds, an enterprise must first establish whether it is:

(a) an autonomous enterprise (by far the most common category)

(b) a partner enterprise

(c) a linked enterprise

The calculations for each of the three types of enterprise are different and will ultimately determine whether the enterprise meets the various ceilings established in the SME Definition. Depending on the situation, an enterprise may have to take into account:

(a) only its own data

(b) a proportion of the data in case of a partner enterprise

(c) all the data of any enterprise considered linked to it

Any such relationships an enterprise has with other enterprises (direct or indirect) need to be taken into consideration. The geographical origin or the field of business activity of these enterprises is not relevant.

Annex H Summary of 2021 Survey of Defence SMEs

We undertook a limited independent survey of SMEs currently working in the UK MOD supply chain during the summer of 2021. The intention was to provide assurance that the work that we are taking on is focused in the right way, and to provide a baseline against which we can measure progress. Below is a summary of the findings.

The aim of the survey was to understand, measure and validate SME perceptions regarding the level of commitment and support from the MOD and Primes, and to identify key areas to focus on to improve relationships with the SME community.

This was a small survey, conducted by a third party; 51 SMEs were invited to participate, and 39 responses were received, indicating a 76% response rate. The survey explored overall satisfaction with MOD and primes’ level of engagement with SMEs; the overall results confirmed that there are clear areas for focusing improvement activity, and these are reflected in the work being taken forward by the DSF SME Working Group. The overall score for MOD was 43.8, and 44.8 for primes, whereas we could expect a ‘good’ result to be in the region of 60 or 70. The results reflect many of the concerns and priorities that we are addressing through the SME Working Group. It has confirmed that the priority areas to address include measurement and audit, and access to primes including an SME Champion role.

|

Performance Area |

Combined rating |

MOD rating |

Primes rating |

|

Commercial relationships

|

36.9 |

40.0 |

34.3 |

|

People

|

55.7 |

52.7 |

58.5 |

|

Ways of working

|

36.6 |

36.5 |

38.1 |

|

SME Champions

|

- |

- |

10.1 |

|

Procurement process and frameworks

|

34.0 |

36.3 |

32.9 |

|

Early market engagement

|

35.8 |

40.7 |

25.4 |

|

Legal, terms and conditions, payment

|

54.9 |

60.8 |

49.5 |

|

Measurement and audit process

|

24.7 |

27.8 |

21.7 |

Feedback or suggestions on the MOD SME Action Plan can be submitted to: [email protected]

Follow us on Twitter @defenceproc

-

Source: https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/983652/Central_government_direct_and_indirect_spend_with_SMEs_2019_to_2020.pdf ↩

-

https://www.gov.uk/government/publications/procurement-policy-note-0821 ↩

-

The Defence Suppliers Forum (DSF) enables strategic engagement between government (MOD) and the Defence Industry, including Primes, Mid-Tier, and Small and Medium-sized Enterprises (SME). Its focus is to provide real improvement for both MOD and Defence Industry by the sharing of information, alignment of objectives where possible, and by optimising the contribution both Defence and Industry can jointly make to defence capability. ↩

-

The Joint Supply-Chain Accreditation Register: https://hellios.com/joscar/ ↩

-

The Strategic Partnering Programme is the name given to MOD’s approach to managing relationships with its 19 Strategic Suppliers. It is focused on continuous improvement in the delivery of MOD requirements based on a collaborative and open approach. ↩

-

The figures are based on draft accounts (subject to audit). The figures for both years have been recalculated to include improved data, direct spend with SMEs and spend via framework contracts. They may be revised in the future to include other contract types. ↩

-

https://www.gov.uk/guidance/how-to-sell-to-dstl-industry-academia-and-other-research-organisations#SMEs ↩

-

https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/983652/Central_government_direct_and_indirect_spend_with_SMEs_2019_to_2020.pdf ↩

-

The MOD has been working with the DGP to develop the JEDHub within the UK Defence Solutions Centre (UKDSC). The JEDHub will collect and aggregate economic data from across the defence sector and provide better, consistent and impartial data on the defence sector’s contribution to the economy. ↩