Project Gigabit Delivery Plan: Autumn update

Published 29 October 2021

Ministerial foreword

As the world’s digital revolution continues apace, the infrastructure that connects us is more important than ever. This is the third Project Gigabit quarterly update and, thanks to the work of industry and our record £5 billion investment, we are making phenomenal progress delivering the biggest broadband rollout in UK history.

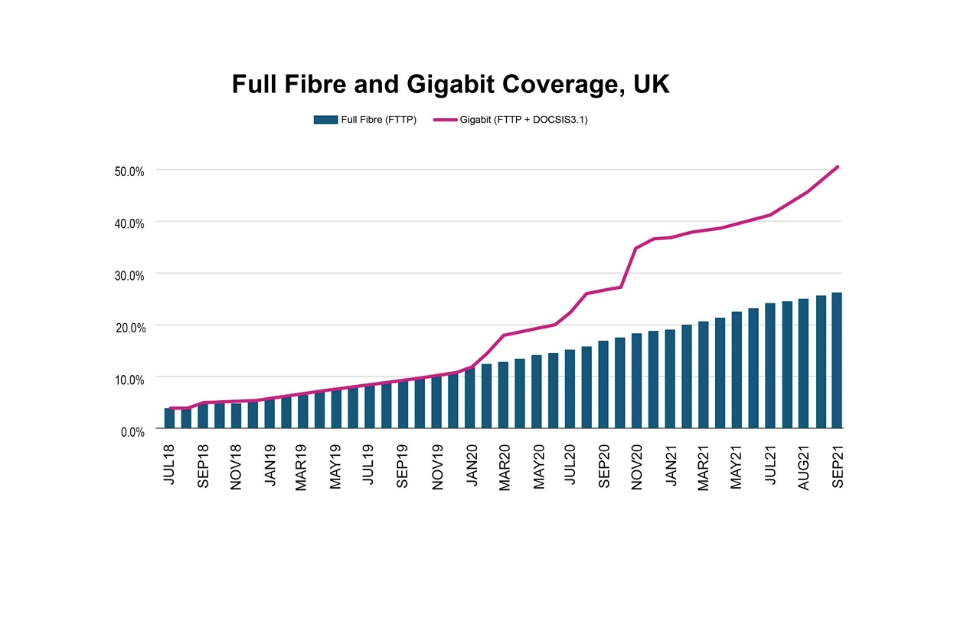

We have now passed the connectivity halfway mark. More than 57 percent of UK homes and businesses - that’s 17.5 million properties - can now access the fastest broadband speeds available; and I’m delighted to share the news that children in more than a thousand schools are now enjoying gigabit internet speeds thanks to government investment.

While we have already made great strides, we still have some of the most challenging parts of our four nations to reach - a considerable undertaking involving industry, regulators, investors, local councils, MPs, consumer groups, landowners, landlords, and citizens working together to push us further and faster towards being a fully gigabit nation.

As gigabit-capable connectivity accelerates, we will ensure the right measures are in place to support the market to deliver as much as possible, not least in connecting hard-to-reach premises.

In this update to the Project Gigabit Delivery Plan, we report on progress with Phase 1 roll-outs and Phase 2 procurements. We also include the sequencing and dates of English Phase 3 rural projects, covering around 500,000 premises in Essex, Lincolnshire, Devon & Somerset, Herefordshire & Gloucestershire, Dorset, Cheshire, and North Yorkshire.

We provide details of an additional £8 million to deliver full-fibre to 3,600 premises in Scotland, as part of the Scottish Government’s R100 project, and c.£22.6m to connect rural and remote parts of Northern Ireland.

Gigabit broadband will bring much faster and more reliable connectivity to rural and hard-to-reach communities. This will make them more attractive places for people to settle, raise families and start and grow businesses, improve education and healthcare services and increase accessibility.

This is how we level up - ensuring rural communities have the same chances and opportunities as our urban towns and cities. That’s why this is at the top of the Government’s agenda, and as Secretary of State, I am fully committed to doing everything I can to make Project Gigabit a UK success story.

Nadine Dorries

Secretary of State for Digital, Culture, Media and Sport

Summary

We are confident that with the support of the £5bn we have committed, the UK is on track for 85% gigabit coverage by 2025 and that we can push further towards 100% coverage.

Our Project Gigabit Summer Update showed there are more commercial plans to deliver gigabit capability in the UK than ever before. In this Project Gigabit Autumn Update, we report on a significant further expansion in commercial plans, including more telecoms providers focused on building in under-served rural areas. Greater commercial investment is positive for the UK and shows strong market confidence in customer demand for gigabit infrastructure.

We have now received information from 38 telecoms providers in surveys of 18 of our 38 Regional Supplier areas, and we are announcing timing for more of the remaining areas. We have made adjustments to some of our procurement plans, which underscores the need for us to react and adapt our approach to give room for commercial investment, while targeting interventions to the hardest-to-reach homes and businesses.

The extent of commercial investment plans, considerably in excess of any previous plans we have seen, has led to more rounds of discussions with the market and as a result, a small amount of delay. We have reduced our forecasts for the number of premises which we will include in the scope of our first procurements, and in one case, do not believe that procurement is the right option at this stage. We note that the subsidy required to deliver gigabit infrastructure has not been correspondingly reduced, since residual premises are the hardest to reach.

Key changes are as follows:

-

In Cumbria, the first of our Regional Supplier procurements, we have launched a procurement for 62,000 premises, down from 66,300, for up to £109m.

-

In Cambridgeshire, we now expect to procure 40,000 to 50,000 premises rather than our previously modelled estimate of 98,500.

-

In east Essex, the first area we targeted for a Local Supplier procurement, commercial plans were so extensive that there were only approximately 800 premises where we could justify intervention, compared to an original model estimate of 6,500. We believe targeted Gigabit Vouchers will provide a better solution than procurement in this case.

-

In Dorset, we have identified a potential Local Supplier procurement which combines two potential Local Supplier areas and will complement significant commercial plans for telecoms providers active in the area.

-

We are planning to combine Regional Supplier procurement areas in Northumberland and Durham, and have found two areas where we believe Local Supplier procurements will offer bidding opportunities to more telecoms providers.

We are therefore continuing to learn and adapt our processes and are very grateful for the work telecoms providers and local partners have contributed to help improve our plans.

This Autumn Update includes more information on how we plan procurements, expanding on the Public Review classifications we reported in the Summer. Further information is also provided on our approach to Gigabit Vouchers. Where significant voucher projects are underway, we are looking to keep momentum by deferring other interventions, even in areas where we are procuring, such as Cumbria, Northumberland and Durham.

Finally in this update, we provide more information on the evaluation of the benefits of our Superfast Broadband programme, including the latest independent assessment calculating that between £3.60 and £5.10 of benefit is generated per £1 of net public sector spending.

Update on commercial investment in UK gigabit infrastructure

We reported last time on Openreach’s updated target of 25 million full-fibre premises, including an extra 3 million premises in predominantly rural areas. Virgin Media O2’s ongoing upgrades to bring their existing hybrid fibre/copper network infrastructure up to gigabit speeds has helped the UK reach the halfway point, and it now intends to ultimately replace this existing network with full-fibre, on top of its ambition to grow it out by a further 7-10 million premises.

In the last few weeks, CityFibre has raised £1.125bn to fund the next phase of its network rollout to over 8 million premises and to participate in Project Gigabit; and Axione Fibre has been established with an initial £300m to target both suburban and rural areas. These are on top of funding announcements by Broadway Partners (£145m), Zzoomm (£100m), Grain (£75m), Trooli (£67m) and internet service provider TalkTalk investing in Freedom Fibre.

Other suppliers have provided updates on the scale of their networks and their plans: Gigaclear with 175,000 premises passed, Netomnia with 50,000, Fibrus with 58,000, and Full Fibre with 15,000 per month. Beacons Telecom, Borderlink, County Broadband, YouFibre, Upp, Voneus, VX Fibre, Wildanet, and 1310 have all announced progress in building networks or connecting customers. Connexin, Ecom, G.Network, Glide, InterneTY, Jurassic Fibre, Kloud9, SWS and WeFibre all provided updates on their plans during the period. AJ Technology, Alnwick, Hampstead Fibre, Ociusnet, Rymote, Scotnet and Simwood have all applied to Ofcom for Code Powers to help them progress their own full-fibre plans.

Progress has also been made with community projects, such as StrathspeyNow delivering gigabit connectivity over fixed wireless in rural areas beyond Grantown-on-Spey.

This expansion is creating hundreds of new jobs, including 400 at Virgin Media O2 and 100 at Wessex Internet. Ogi has recently grown to 100 employees and expects this to reach 140.

Collectively, these announcements demonstrate the market’s commitment to deliver gigabit-capable networks to at least 80% of UK premises by December 2025. With the £5bn Project Gigabit targeted at the remaining uncommercial areas, we are increasingly confident in delivering gigabit coverage for 85% of UK premises by 2025 and pushing further towards 100% nationwide coverage.

Update on Project Gigabit delivery plans

Many telecoms providers are now extending gigabit coverage beyond urban areas into rural communities, including many places we anticipated would require public funds.

There are still a significant number of places, however, where public funding is required and people who live in those places want action as soon as possible. We expect more of these areas to become evident in the coming years as telecoms providers’ plans change, potentially as a result of market forces or delivery challenges.

We want to provide space, time and support for firm commercial plans to deliver, but we also need to ensure that no one gets left behind. We need the support of suppliers to do this, so that we can assess where commercial plans are likely to deliver, target our funding to support the remaining areas, and put in place fall-back approaches in case commercial plans change.

As part of this approach we are:

-

Giving room for active voucher projects to deliver fully: We will help extend commercial plans using vouchers if these are likely to achieve earlier coverage and value for money.

-

Addressing remote areas: Local Supplier contracts are an agile way for us to target government subsidies at pockets of hard to reach premises. The first of these procurements begins shortly.

-

Appointing the first Regional Suppliers to deliver at scale: The Regional Supplier contracts include two categories of intervention: Initial Scope, where the Regional Supplier should build as quickly as possible; and Deferred Scope where we wait and see whether commercial plans or voucher projects translate to delivery, but could then build if not.

Designing the scope of procurements

To meet this challenge, we are working area-by-area to identify the likely and potential gaps in coverage and develop a plan for Regional and Local Supplier procurements, and vouchers. The plan balances our desire to leave room for commercial investment against the need to ensure all homes and businesses can access gigabit as soon as possible. Telecoms providers are being extremely helpful by providing detailed plans and supporting evidence to help us evaluate their plans.

Key inputs into this process are our Open Market Review and Public Review processes which survey the market’s investment plans. We have now surveyed 18 of the 38 Regional Supplier areas in line with our procurement pipeline and have collected plans from 38 telecoms providers.

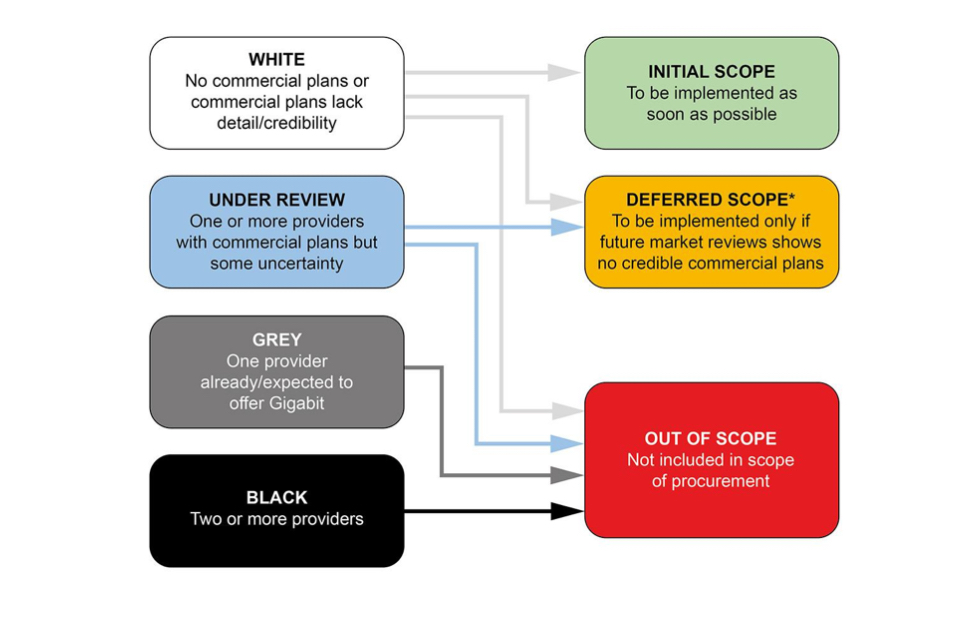

We assess the information provided to determine the existing or likely planned investment over the next three years. We assign a classification to each premises:

- White where there are no commercial plans or limited evidence to support commercial plans

- Under Review where there are commercial plans but a risk they will not be delivered

- Grey/Black where one or more telecom providers has delivered or is expected to deliver gigabit infrastructure in the next three years

We use these classifications, together with our assessment of how to achieve the best value and greatest coverage, to define the scope of each procurement:

In both Regional and Local Supplier contracts, we will only build to premises that have been designated as ‘White’ - premises with no gigabit network infrastructure and where none is likely to be developed within three years. Conversely, unless premises are classified as White, we will not authorise intervention.

In both Regional and Local Supplier contracts, we will only build to premises that have been designated as White - premises with no gigabit network infrastructure and where none is likely to be developed within three years. Conversely, unless premises are classified as White, we will not authorise intervention.

In some cases, we may choose either to defer intervention to some White premises or to descope them from the procurement where we believe that will deliver the best value. For instance, we may descope White premises if they are adjacent to Grey premises because although there are no declared plans to build there, it is likely to be straightforward to reach them once the Grey premises have been delivered.

For premises that are included in the Deferred Scope of contracts, we will seek a price from the Regional Supplier, but will not authorise build unless and until they are re-classified as White. We will always either descope Under Review premises or defer build to them and we will always descope Grey or Black premises. There is no Deferred Scope in the Local Supplier contracts: premises are either in scope or out of scope, so Local Supplier procurements will never include Under Review premises in their scope.

We will continue to monitor and verify telecoms providers’ plans, and in the event that commercial plans fall away or are not progressed sufficiently or fulfilled in their entirety, any premises can be re-classified as White and will then become eligible for intervention under our contracts.

This is an inevitably complex process requiring time and effort from telecoms providers and BDUK. We will assess carefully and treat all telecoms providers fairly, based on evidence and are engaging with telecoms providers who are new to the market to ensure that the decision-making process, and the evidence which informs our decisions, are clear.

Local Supplier procurements complement Regional Supplier procurements

We are identifying smaller Local Supplier Intervention Areas that can be carved out from our larger Regional Supplier procurements in order to attract more potential suppliers and potentially maximise the pace of delivery in an area. These are procured using the Dynamic Purchasing System.

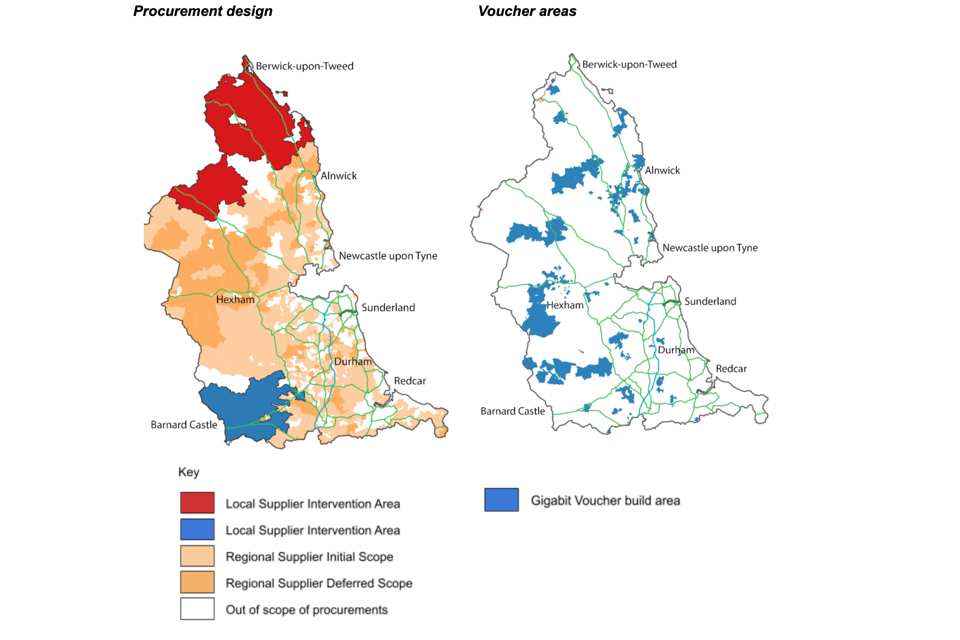

In Northumberland and in Durham, also Phase 1a procurement areas, we have incorporated two of the most challenging rural areas into Local Supplier procurements, designed to be attractive to rural specialists active in the area. Meanwhile, we are combining the remainder of the Northumberland and Durham areas into a single Regional Supplier procurement area to increase scale and make it more attractive to larger-scale suppliers focused on that region.

Telecoms providers and local authorities can submit their suggestions for Local Supplier Intervention Areas to the supplier mailbox at [email protected]. We will review all suggestions fairly and equitably, and will only proceed to procurement once we have conducted Public Review and consulted with telecoms providers.

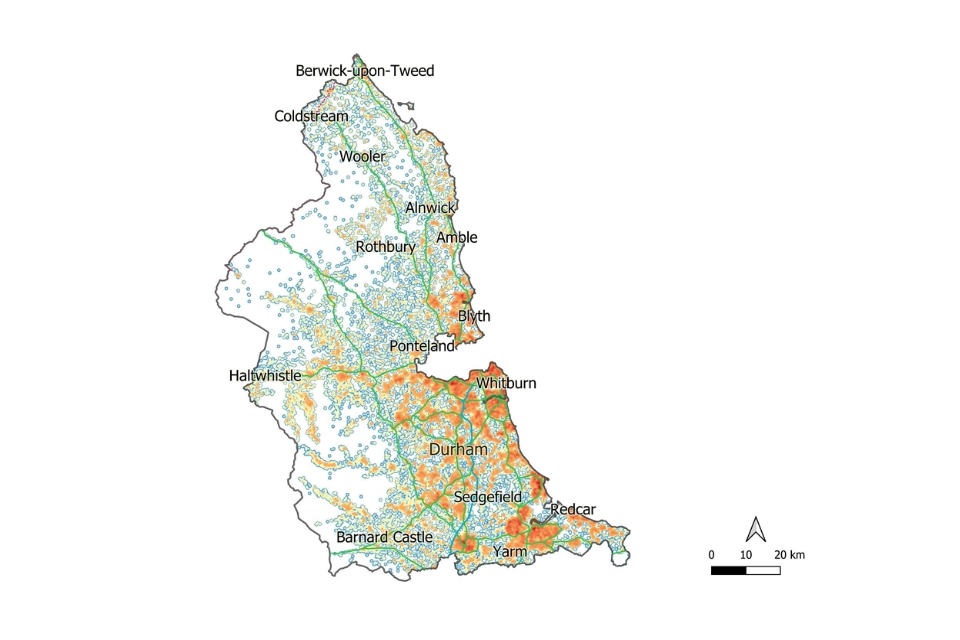

Illustration for Northumberland and Durham

This process is illustrated well in the North East of England. The map below shows a “heatmap” of commercial plans to deliver gigabit infrastructure in the Durham and Northumberland Regional Supplier areas (note: the Newcastle area is excluded as it is scheduled for a future phase). All coloured areas show commercial activity - with red the most and green the least.

The maps below show how we have designed our procurements to pick up the remaining premises, and where Gigabit Voucher projects are delivering:

The Local Supplier procurements are designed to complement the commercial plans of telecoms providers active in the area, maximising the potential for competition. Many Gigabit Voucher projects are underway around the area, and we will continue to support these communities.

The maps clearly illustrate the very broad extent of commercial plans to deploy gigabit infrastructure and the dispersed nature of remaining premises where intervention is required.

Vouchers potentially avoid the need for a procurement altogether

Vouchers remain an effective way to provide support to hard-to-reach premises so that a commercial case can be made for the delivery of gigabit infrastructure. We will continue to balance the benefits of procurement against the alternative delivery approaches, including the Gigabit Broadband Voucher Scheme.

For example, in east Essex, our initial analysis suggested that a Local Supplier procurement of up to 6,500 premises could help deliver gigabit infrastructure where there are currently very limited broadband speeds. When we surveyed the market in detail, however, we found extensive commercial plans from providers including Openreach and County Broadband. We could identify only approximately 800 premises in an area of over 300km2 where we could confidently intervene without potentially “crowding out” commercial investment.

We also found, not surprisingly, that these 800 premises have a real and present need for connectivity; they are the hardest-to-reach with often very poor broadband speeds. A good solution would be for the telecoms providers with plans in adjacent areas or providers specialising in rural delivery to reach these premises. To do this, any telecoms providers will still need government support.

Our analysis is that subsidy, in this case, would best be directed using Gigabit Vouchers rather than a procurement. There are currently more than five suppliers actively using the Gigabit Vouchers in Essex. This level of activity means that communities potentially have a choice of suppliers and most of these 800 premises could be served faster and more efficiently with vouchers than a procurement process.

Gigabit Vouchers are not, however, equivalent to procurements: our vouchers are grants to individual eligible customers rather than contracts with telecoms providers, so we cannot be certain that providers’ voucher-supported plans will all materialise. As a result, we will always stand ready to intervene through a procurement to complete coverage in an area if necessary.

Active voucher projects

Gigabit Vouchers have been extremely successful. Over 70 telecoms providers are currently actively building in challenging rural areas. Their ambitions have grown, with the average size of projects increasing four-fold, meaning they are covering larger, contiguous areas and increasingly including the very hardest-to-reach premises.

Several telecoms providers have been so successful with vouchers that they have incorporated them substantially within their business model and growth plans.

Although we have planned in general to pause the use of vouchers to provide a stable intervention area for bidders for our procurements, we also recognise the risk to community-supported projects in an advanced stage of development that might then be put on hold while waiting for a procurement outcome.

Therefore, to maintain momentum in the hardest-to-reach areas, we will now designate areas within Regional Supplier areas as voucher priority areas. telecoms providers will continue to be able to submit proposals and request vouchers for premises within these areas during the regional supplier procurement process to ensure building continues apace

Update on Gigabit Infrastructure Subsidy (GIS) procurements

We have now launched our first Gigabit Infrastructure Subsidy procurement, with the rest of our first phase of Regional Supplier and Local Supplier procurements due to launch very shortly following this and preparations for subsequent phases are underway.

Local Supplier procurements

In the Summer Update, we announced that we had launched the Supplier Selection Questionnaire for the Dynamic Purchasing System to call off Local Supplier procurements.

We received ten successful supplier applications to join the Dynamic Purchasing System and have helped other suppliers develop knowledge and understanding, enabling them to reapply.

Registration for the Dynamic Purchasing System has now reopened and we are already seeing new applications and expect the number of suppliers appointed to grow rapidly.

We had intended to begin our first Local Supplier procurement in Essex. However, as described above, we have chosen to defer this procurement while we monitor the extent of commercial and voucher-supported build in the area.

We have now prepared a Local Supplier procurement area for Dorset (combining the previously anticipated two areas) and have begun pre-procurement market engagement activity in preparation for launch imminently. We have also created new Local Supplier procurement areas in North Northumberland, and Teesdale in County Durham. We are also continuing discussions with other local authorities including Devon & Somerset and Lincolnshire about the potential for Local Supplier procurements ahead of their Regional Supplier procurements.

The pipeline for Local Supplier procurements is as follows:

Local Supplier Procurements

| Phase 1a | Procurement Start Date subject to change | Estimated contract commencement date subject to change | Modelled number of uncommercial premises in the procurement area(ref1) subject to change | Indicative Contract Value subject to change | |||

|---|---|---|---|---|---|---|---|

| North Dorset (Lot 14) | Nov 2021 - Jan 2022 | Jun 2022 - Aug 2022 | 5,000-9,000(ref2) | £5m - £18m | |||

| North Northumberland | Dec 2021 - Feb 2022 | Jun 2022 - Aug 2022 | 3,750 | £3.5m - £7.5m | |||

| Teesdale | Dec 2021 - Feb 2022 | Jun 2022 - Aug 2022 | 3,300 | £3.5m - £7m |

Ref1: The number of premises in scope of the procurement which are expected to require public funding – either as modelled by DCMS or as superseded following Public Review and Pre-Procurement Market Engagement. This value may change significantly leading up to commencement of the procurement process.

Ref2: We are currently consulting with the market to help refine the scope of this procurement.

Regional Supplier procurements

We have been making progress with Regional Supplier procurements in line with the sequence and timing published in the Summer Update:

- We have launched our first Phase 1a procurement in Cumbria.

- We are now undertaking or about to launch pre-procurement market engagement for the rest of the Phase 1a projects.

- We have closed the Public Reviews for the Phase 1b projects in order that we are able to define our procurement scope.

- We have closed the Open Market Reviews for the Phase 2a projects

- We are preparing to launch the Open Market Reviews for the Phase 2b projects.

The extent of commercial investment plans - considerably in excess of any previous plans we have seen - has led to further discussion with the market and a small amount of delay. The effect of more extensive commercial plans is that the residual premises where we need to target subsidy are fewer and more remote than expected. The subsidy per premises passed is higher, on average, as the Regional Supplier will still need to build a far-reaching fibre network (at a high cost), but this now reaches fewer premises (so cost is allocated over a smaller number of premises). This does not increase the overall cost of the contract but does mean that the average subsidy per premises passed has increased above our original estimates.

Feedback from the market is that Regional Supplier procurements need to be of a reasonable scale to offset transaction and management costs and to create a sustainable network. After taking account of further commercial plans in Northumberland and separating the harder-to-reach areas out into a Local Supplier procurement, we have decided to combine the remaining premises in the south-east of Northumberland with the Durham procurement lot. This will provide a coherent area for bidders and the critical mass of premises required to make the procurement attractive.

We have now set a provisional timetable for the next phase of English procurements:

- Cheshire (Lot 17)

- Devon & Somerset (Lot 6)

- Herefordshire & Gloucestershire (Lots 15, 18)

- Dorset (Lot 14) (note, this is for the premises remaining after the Local Supplier procurements)

- Essex (Lot 21)

- Lincolnshire (including NE Lincolnshire and N Lincolnshire) and East Riding (Lot 23)

- Northern North Yorkshire (Lot 31)

The pipeline for Regional Supplier procurements is set out below. As previously, this represents an indicative forward view of commercial activity to be undertaken by the programme. Some of the information provided is based on modelled data that will be superseded. The low and high contract values represent a possible range of funding; actual contract values are likely to be spread across the range for each lot. This pipeline is subject to change based on emerging data and feedback, following open market reviews, public reviews and market engagement.

Regional Supplier Procurements

| Phase 1a | Procurement Start Date | Estimated contract commencement date subject to change | Modelled number of uncommercial premises in the procurement area subject to change | Indicative Contract Value subject to change | |

|---|---|---|---|---|---|

| Cumbria (Lot 28) | Oct-21 | Sep 2022 | 62,000 | up to £109m | |

| Cambridgeshire and adjacent areas (Lot 5) | Dec 2021 - Jan 2022 | Nov - Dec 2022 | 40,000 - 50,000 | £40m - £100m | |

| Durham, Tyneside and Teesside areas and Northumberland (Lots 4 and 34) | Dec 2021 - Jan 2022 | Nov - Dec 2022 | 55,300 | £55m - £111m | |

| Cornwall and Isles of Scilly (Lot 32) | Feb - Apr 22 | Jan - Mar 2023 | 53,800 | £54m - £93m |

Regional Supplier Procurements

| Phase 1b | Procurement Start Date subject to change | Estimated contract commencement date subject to change | Modelled number of uncommercial premises in the procurement area subject to change | Indicative Contract Value subject to change | |

|---|---|---|---|---|---|

| Shropshire (Lot 25) | Feb - Apr 2022 | Jan - Mar 2023 | 64,300 | £61m - £104m | |

| Norfolk (Lot 7) | Feb - Apr 2022 | Jan - Mar 2023 | 111,400 | £115m - £195m | |

| Suffolk (Lot 2) | Feb - Apr 2022 | Jan - Mar 2023 | 86,100 | £89m - £151m | |

| Hampshire and Isle of Wight (Lot 27) | Feb - Apr 2022 | Jan - Mar 2023 | 148,100 | £148m - £251m | |

| Worcestershire (Lot 24) | May - Jul 2022 | Apr - Jun 2023 | 45,600 | £50m - £84m |

Regional Supplier Procurements

| Phase 2 | Estimated Procurement Start Date subject to change | Estimated contract commencement date subject to change | Modelled number of uncommercial premises in the procurement area2 subject to change | Indicative Contract Value subject to change | |

|---|---|---|---|---|---|

| Oxfordshire and West Berkshire (Lot 13) | May - Jul 2022 | Apr - Jun 2023 | 67,000 | £67m - £114m | |

| Kent (Lot 29) | May - Jul 2022 | Apr - Jun 2023 | 109,500 | £119m - £203m | |

| Buckinghamshire, Hertfordshire and East of Berkshire (Lot 26) | May - Jul 2022 | Apr - Jun 2023 | 137,100 | £140m - £237m | |

| Staffordshire (Lot 19) | May - Jul 2022 | Apr - Jun 2023 | 70,800 | £72m - £123m | |

| West Sussex (Lot 1) | May - Jul 2022 | Apr - Jun 2023 | 56,700 | £66m - £112m | |

| East Sussex (Lot 16) | Aug - Oct 2022 | Jul - Sep 2023 | 41,200 | £49m - £83m | |

| Bedfordshire, Northamptonshire and Milton Keynes (Lot 12) | Aug - Oct 2022 | Jul - Sep 2023 | 81,300 | £85m - £144m | |

| Derbyshire (Lot 3) | Aug - Oct 2022 | Jul - Sep 2023 | 57,000 | £64m - £110m | |

| Wiltshire, South Gloucestershire and Swindon (Lot 30) | Aug - Oct 2022 | Jul - Sep 2023 | 84,800 | £85m - £145m | |

| Lancashire (Lot 9) | Aug - Oct 2022 | Jul - Sep 2023 | 82,000 | £90m - £153m | |

| Surrey (Lot 22) | Aug - Oct 2022 | Jul - Sep 2023 | 99,400 | £101m - £171m | |

| Leicestershire and Warwickshire (Lot 11) | Nov 2022 - Jan 2023 | Oct - Dec 2023 | 112,900 | £114m - £194m | |

| Nottinghamshire and West of Lincolnshire (Lot 10) | Nov 2022 - Jan 2023 | Oct - Dec 2023 | 89,700 | £90m - £152m | |

| West Yorkshire and parts of North Yorkshire (Lot 8) | Nov 2022 - Jan 2023 | Oct - Dec 2023 | 125,200 | £128m - £218m | |

| South Yorkshire (Lot 20) | Nov 2022 - Jan 2023 | Oct - Dec 2023 | 56,800 | £61m - £103m |

Regional Supplier Procurements

| Phase 3 | Estimated Procurement Start Date subject to change | Estimated contract commencement date subject to change | Modelled number of uncommercial premises in the procurement area subject to change | Indicative Contract Value subject to change | |

|---|---|---|---|---|---|

| Dorset (Lot 14) | May - Jul 2023 | Apr - Jun 2024 | 56,500 | £62m - £105m | |

| Cheshire (Lot 17) | Feb - Apr 2023 | Jan - Mar 2024 | 74,300 | £85m - £144m | |

| Devon & Somerset (Lot 6) | Feb - Apr 2023 | Jan - Mar 2024 | 159,600 | £198m - £337m | |

| Herefordshire & Gloucestershire (Lots 15, 18) | Feb - Apr 2023 | Jan - Mar 2024 | 64,600 | £67m - £113m | |

| Essex (Lot 21) | May - Jul 2023 | Apr - Jun 2024 | 78,351 | £79m - £135m | |

| Lincolnshire (including NE Lincolnshire and N Lincolnshire) and East Riding (Lot 23) | May - Jul 2023 | Apr - Jun 2024 | 105,700 | £106m - £180m | |

| Northern North Yorkshire (Lot 31) | Aug - Oct 2023 | Jul - Sep 2024 | 28,200 | £25m - £42m |

We expect this list, including the size, order and timing to vary - potentially significantly - as we get greater clarity about commercial plans and responses to the initial procurements.

We are assessing further Regional Supplier procurements for the following areas where very extensive commercial delivery continues and will provide information in subsequent quarterly publications:

- Birmingham and the Black Country (Lot 35)

- Merseyside and Greater Manchester (Lot 36)

- Greater London (Lot 37)

- Newcastle and North Tyneside (Lot 38)

Project Gigabit across the Union

Many of the hardest-to-reach areas in the UK are in Scotland, Wales and Northern Ireland. We are working closely with the devolved governments to develop and deliver Project Gigabit plans.

Wales The Welsh Government sought responses to their Open Market Review (24 August to 8 October), to identify commercial plans across the nation and update our estimate of up to 234,000 premises potentially in the scope of intervention. With supplier responses now received, we will be working with the Welsh Government in the coming weeks and months to define procurement intervention areas. Commercial rollout is likely to cover places such as Aberdare, Abergavenny, Aberystwyth, Bangor, Barry, Bridgend, Caerphilly, Cardiff, Carmarthen, Cwmbran, Llandudno, Llanelli, Newport, Pontypridd, Port Talbot, Prestatyn, Pwllheli, Rhyl, Swansea, Welshpool and Wrexham. Project Gigabit will target the remaining, hardest-to-reach communities.

In addition, there is a considerable amount that has already been delivered or is under contract.

- The Superfast Cymru programme has provided access to gigabit-capable connections to over 70,000 premises on top of the 650,000 premises previously provided with access to superfast connections in Wales. The remaining delivery under Superfast Cymru will enable a further 39,000 premises to become gigabit-capable by Summer 2022.

- Over 600 public sector buildings in Wales (including GP surgeries and libraries) have been or are being connected to gigabit to help revolutionise public services by March 2022. In the Cardiff region there will be approximately 160 public sites, across North Wales there will be approximately 330 public sites, in Pembrokeshire there will be approximately 70 public sites, and in rural areas of Wales a further 78 public sites.

- Just over 1,900 vouchers (29 September 2021) have been issued to help communities in the hardest-to-reach parts of Wales. This is on top of just over 1,500 vouchers that connected homes and businesses between 2018 and September 2021.

Scotland Gigabit coverage in Scotland is now over 54%, with buoyant competition in Scotland’s towns and cities. Scotland is also benefiting from gigabit speeds as a result of coverage delivered through the Scottish Government’s Reaching 100% ‘R100’ contracts, into which the UK Government has now invested over £33.5 million.

The final scope of the R100 contracts was confirmed in August 2021 and as part of Project Gigabit’s Superfast Extension programme, BDUK has committed to provide £8m to enable the delivery of gigabit rather than superfast coverage for 3,600 premises across the north of Scotland in Aberdeenshire, Angus, Highland, Moray and Perth & Kinross. This agreement follows a similar upgrade to the delivery in Central Scotland, with £4.5m of Project Gigabit funding agreed in March 2021 to fund gigabit coverage for 5,368 premises.

The UK and Scottish governments continue to collaborate to develop the next phase of gigabit activity, with the potential to deliver, alongside R100, a number of new gigabit contracts at a local, regional and, if appropriate, cross-regional level. Early discussions have focused on possible opportunities around some of Scotland’s most rural locations including in the islands and parts of the Highlands.

In addition, BDUK continues work to complete the gigabit build to connect over 530 Scottish public sector buildings. The sites are located right across the Scottish mainland and the Islands and are future-proofing vital services such as NHS Scotland GP surgeries and hospitals; schools; libraries; leisure and community centres.

Northern Ireland Northern Ireland is leading the other nations with over 77% gigabit-capable broadband coverage already, as a result of a competitive commercial supplier market. The marketplace was stimulated by over £35m UK Government funding for local council and health agency hub projects connecting over 1,200 public buildings with gigabit-capable broadband. Project Stratum is a £165m (£150m UK Government Funding and £15m from Northern Ireland Department for Agriculture, Environment and Rural Affairs) project delivering gigabit-capable broadband to over 76,000 premises by March 2024. We announced in August that up to £25 million UK Government funding from Project Gigabit will be added to the Project Stratum contract with Fibrus to reach another 8,500 premises currently without superfast broadband by March 2025. We are working closely with the Northern Ireland Department for Economy Telecoms Branch on plans for the remaining premises that will not have gigabit-capable broadband. The next steps include planning for an Open Market Review to identify precisely the premises that will remain in scope, taking into account suppliers’ commercial plans for the region and then identifying the best solutions to reach these premises.

Update on the benefits of broadband

The UK government has now funded full-fibre networks to supply gigabit broadband to 1,084 schools and thousands of other public buildings previously stuck with speeds of less than 30 Megabits per second. We are also on track to connect around 6,800 public buildings across England, Scotland, Wales and Northern Ireland by the end of the year - including hospitals, GP surgeries, fire stations, leisure centres and libraries.

We have now published a report exploring the early and expected benefits of gigabit connections for schools, based on a survey of 261 schools connected under the Rural Gigabit Connectivity Programme.

Our research identified benefits including:

- time-saving across the whole school including teachers, office staff and pupils

- increased confidence and creativity in the classroom - for planning and using technology in lessons

- improved pupil experience and opportunity

- staff satisfaction and reduced frustration due to lags and slow speeds

We also published our final independent evaluation of the Superfast programme. Ipsos Mori concluded that the programme had a substantial effect in accelerating the roll-out of superfast broadband infrastructure between 2012 and 2019 and met its objectives to reduce the digital divide by enabling a substantial share of the premises upgraded to receive improved broadband services earlier than they would have done in its absence

The Superfast programme has produced significant local economic impacts, including creating over 17,000 jobs and enabling an increase in the annual turnover of local businesses of approximately £1.9bn.

At a national level, the Superfast programme is estimated to have resulted in £1.1bn in productivity gains between 2012 and 2019 and led to an increase in house prices of between £1,700 and £3,500 on average and £0.7bn and £1.5bn in total in the beneficiary areas.

Around 50 per cent of businesses in the Superfast programme area have taken up faster connections since improved broadband networks have been available. The adoption of faster connections was reported to bring about a range of incremental efficiency gains, largely driven by the improvements to administrative processes. In addition, the programme has had a beneficial effect on public services and organisations. Council services were able to continue running without the need for face-to-face contact during the COVID-19 pandemic. There has also been increased engagement of primary school children with online learning: children gained more enjoyment from online learning resources than before the programme.

The benefits of the Superfast Programme are expected to significantly exceed its costs. The estimated Benefit to Cost Ratio was between £2.70 and £3.80 per £1 of net public sector spending, based on its impacts between 2012 and 2019. Allowing for future benefits to 2030, the Benefit to Cost Ratio is estimated to rise to between £3.6 and £5.1 per £1 of net public sector spending.