Guidance relating to the UK’s operational implementation of the social security coordination provisions of Part 2 of the EU Withdrawal Agreement: Citizens’ Rights

Updated 29 November 2021

Introduction

1. This guidance is produced by the Department for Work and Pensions, HM Revenue and Customs and the Department of Health and Social Care.

2. This guidance covers the citizens’ rights provisions, in respect of social security coordination, of Part Two of the Agreement on the Withdrawal of the United Kingdom from the European Union and the European Atomic Energy Community (the “Withdrawal Agreement”). This is the Withdrawal Agreement as agreed at the European Council on 17 October 2019 and implemented in the United Kingdom by the European Union (Withdrawal Agreement) Act 2020.

3. The guidance is separated into three chapters.

-

Chapter 1: covers the determination of those who are covered by the provisions of the social security coordination Title (Title III) of the Withdrawal Agreement, and determining their rights under these provisions.

-

Chapter 2: covers the citizens’ rights provisions in Part Two of the Withdrawal Agreement as they relate to social security coordination and provides examples as an aid to interpretation.

-

Chapter 3: provides a summary of the EU Regulations on social security coordination (the “EU Coordination Regulations”) to assist with comprehension of the guidance on implementation of the Withdrawal Agreement.

4. The Withdrawal Agreement is available on GOV.UK.

5. This guidance explains the effect of the Withdrawal Agreement on social security coordination but it is not a definitive statement of, or a substitute for, the law itself. The purpose of this guidance is to assist staff who are responsible for implementing the Withdrawal Agreement when making determinations relating to social security coordination under the Withdrawal Agreement. This guidance only covers social security coordination elements of the Withdrawal Agreement, and so should only be used in relation to these provisions.

6. This guidance is published on GOV.UK to ensure that we are conducting our work in a transparent and open way. We publish this guidance to help people understand how we make decisions.

7. Further guidance for individuals covering the whole of Part 2 (Citizens Rights) of the Withdrawal Agreement can be found at: https://www.gov.uk/government/publications/withdrawal-agreement-explainer-for-part-2-citizens-rights

About this Guidance

This guidance is an aid to implementation of the Withdrawal Agreement and will assist staff in the Department for Work and Pensions, HM Revenue & Customs, and Department of Health and Social Care when considering an application to a social security coordination department or determining eligibility under the EU social security coordination regulations (“Coordination Regulations”) from 1 January 2021.

This guidance will also be shared with the Devolved Administrations which will be responsible for the implementation of the devolved healthcare elements of the Citizens’ Rights Agreement. The Northern Ireland Department for Communities in particular are responsible for the implementation of some areas of social security within the scope of the social security coordination rules.

The EU countries are:

Austria, Belgium, Bulgaria, Croatia, Republic of Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Poland, Portugal, Romania, Slovakia, Slovenia, Spain and Sweden.

The European Economic Area, (EEA) countries are the EU countries as well as: Iceland, Liechtenstein and Norway.

Switzerland is part of the European Free Trade Association (EFTA) but not an EU or EEA member state, and is part of the single market. This means Swiss nationals have the same rights to live and work in any of the EU and EFTA countries as their nationals.

Where EU citizens are referred to it should be noted that this includes Irish nationals who do not also hold a UK nationality. Where an EU citizen also holds a UK nationality then staff should refer to Chapter 2, Article 10, dual nationals.

The content of the examples in this document is for illustrative purposes only.

Contacts

If you notice any formatting errors in this guidance (broken links, spelling mistakes and so on) or have any comments about the layout or navigability of the guidance then you can email EU[email protected].

If you have any questions about the guidance or you think that the guidance has factual errors, then email:

The Department for Work and Pensions: EU[email protected]

HM Revenue & Customs: [email protected]

Department of Health and Social Care: Contact form for general enquiries

Publication

Below is information on when this version of the guidance was published:

- Version Number: Version 2

- Published on: 11 November 2020

- First Published on: 11 November 2020

- Revisions since last publication: 1

Chapter 1: Overview of Implementation of the Social Security Provisions of the EU Withdrawal Agreement

Summary

1. This chapter is intended to assist decision making in relation to the social security provisions in the citizens’ rights part of the Withdrawal Agreement and associated agreements. This is mainly concerned with the determination of those who are covered by the provisions of the social security coordination Title (Title III) of the Withdrawal Agreement, and determining their rights under these provisions. It should be read in tandem with any department specific guidance covering these provisions.

Interaction with the EEA EFTA Separation Agreement and Swiss Citizens’ Rights Agreement

2. The EEA EFTA Separation Agreement and the Swiss Citizens’ Rights Agreement extend the citizens’ rights provisions of the Withdrawal Agreement to nationals of these states and UK nationals who have moved between the UK and these states before the end of the transition period.

3. Provisions within the Withdrawal Agreement ensure that these three agreements work together and so references in this chapter to EU citizens, or EU member states should be read as including the citizens and states of the EEA EFTA countries (Norway, Liechtenstein and Iceland) and Switzerland.

Interaction with Irish Reciprocal Agreements

4. When considering the extent of an individual’s rights and obligations under the Withdrawal Agreement it is also important to consider the interaction between the Withdrawal Agreement and other existing arrangements with Ireland. These are:

i. the 2019 Irish Social Security Reciprocal Agreement[footnote 1];

ii. the 2007 Irish Bilateral Agreement on Social Security[footnote 2]; and

iii. the 2019 Memorandum of Understanding between the UK and Ireland on the Common Travel Area[footnote 3].

5. The 2019 Irish Reciprocal Agreement covers UK and Irish nationals moving between the UK and Ireland, and their family members, and largely applies equivalent provisions to the EU Coordination Regulations for this group for cash benefits (this does not include access to healthcare). Therefore, there will be certain individuals who are covered by both the Irish Reciprocal Agreement and the Withdrawal Agreement. Where an individual is covered by both the Withdrawal Agreement and the Irish Reciprocal Agreement, the more generous provisions will take precedence.

6. Without prejudice to any other previous bilateral agreements the UK had with EU member states, staff should also be aware of other reciprocal agreements between the UK and Ireland, covering social security coordination, when considering claims from Ireland. This includes the 2007 Irish Bilateral Agreement on Social Security[footnote 4] which principally covers persons who have worked in parts of the UK, including the Isle of Man and the Channel Islands, who are not covered by the EU Coordination Regulations.

7. The 2019 Memorandum of Understanding between the UK and Ireland on the Common Travel Area includes access to healthcare services and affords British citizens residing in Ireland and Irish citizens residing in the UK the right to access emergency, routine and planned publicly funded health services in each other’s state, on the same basis as citizens of that state. In addition, a reciprocal healthcare agreement in the context of the Common Travel Area is being negotiated but this will be separate from the Withdrawal Agreement arrangements.

Interaction with the UK-EU Trade and Cooperation Agreement

8. On 30 December 2020 the United Kingdom and the European Union signed the Trade and Cooperation Agreement (TCA) which was applied from 1 January 2021. The TCA includes a Protocol on Social Security Coordination which sets out a framework providing social security and healthcare protection for individuals moving between the UK and the EU, including their family members and survivors.

The provisions of the Trade and Cooperation Agreement do not impact the provisions of the Withdrawal Agreement for Social Security Coordination.

The Withdrawal Agreement/ Trade and Cooperation Agreement benefits table illustrates the difference between each agreement with regards to UK benefits.

See Figure 4 (WA/TCA benefits table).

Determining those in scope of the EU Withdrawal Agreement for Social Security Coordination

Overview

9. The UK left the EU on 31 January 2020 and entered a transition period (lasting until 31 December 2020). The Withdrawal Agreement creates a cohort who, following the end of the transition period, will continue to be covered by the EU Coordination Regulations. From this point, operational teams need to determine if a person is either in scope of the social security coordination provisions of the Withdrawal Agreement, and so apply the EU Coordination Regulations, or if they are not and so come under UK domestic legislation or other international agreements which are in place. The main alternate agreements to consider would generally be the UK-EU Trade and Cooperation Agreement (TCA) or the reciprocal agreements with Ireland.

10. The Withdrawal Agreement creates three different cohorts that are in scope of the social security coordination provisions, and will continue to be subject to the EU Coordination Regulations to varying degrees.

- Full scope: Those in full scope (in personal scope of Article 30 of the Withdrawal Agreement) who will continue to be subject to the EU Coordination Regulations in full, while they continue to satisfy the requirements of the Withdrawal Agreement.

- Partial scope: Those in partial scope (in scope of Article 32 of the Withdrawal Agreement) who will be covered by the EU Coordination Regulations for certain scenarios and benefits.

- Derived rights as a family member: Those with derived rights as family members of those in full personal scope, will be covered by the EU Coordination Regulations for certain scenarios in their capacity as a family member.

11. This section outlines the general principles of determining an individual’s eligibility under the Withdrawal Agreement across government. Departmental and other operational guidance should also be consulted. All other eligibility requirements, including competency determinations, will continue to be carried out during the benefit application or Portable Document[footnote 5] process or when accessing a service.

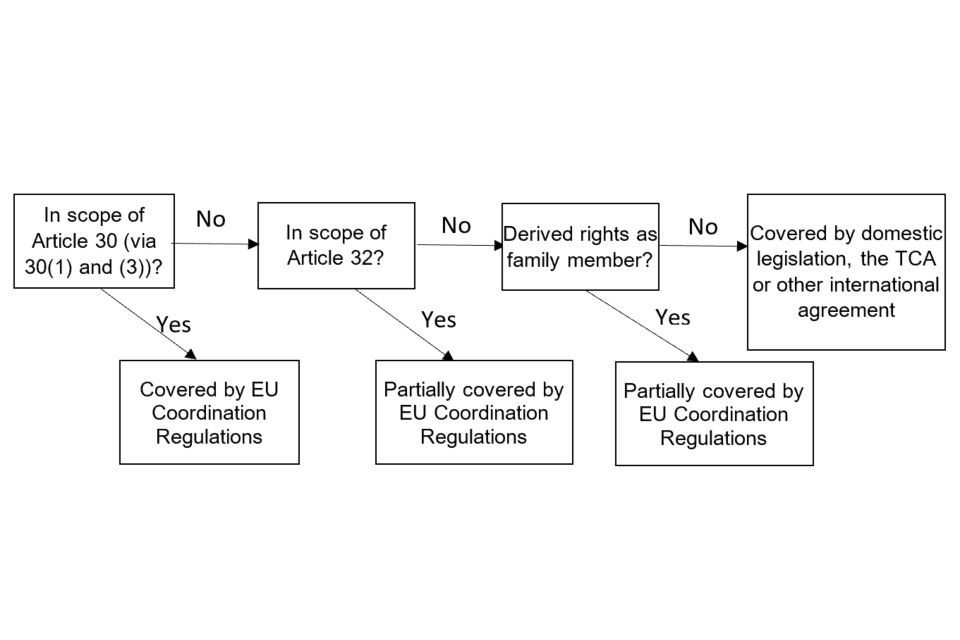

Considering an application

12. When determining if an individual is in scope of the social security coordination provisions it is necessary to consider if they are in full scope under Article 30 of the Withdrawal Agreement (including those who fall under Article 30(3) because they have residence rights as a result of being within scope of Article 10 of the Withdrawal Agreement). If not then, where relevant, it is necessary to consider if they are in partial scope (Article 32 of the Withdrawal Agreement) or have derived rights as family members. If an individual is not in scope under any of these tests, then their social security situation will be dependent on domestic legislation or any international agreement between the UK and the relevant state such as the UK-EU TCA or the reciprocal agreements with Ireland. There may be slight variations in this order for certain benefit lines.

When to assess

13. An assessment to establish whether an individual is in scope of the Withdrawal Agreement for Social Security Coordination should be undertaken either during a new claim or application process or at a change of circumstance, or when accessing a service. It should be undertaken if the entitlement which is being claimed relates to the EU Coordination Regulations, and there is an indication that the individual would be in scope of the Withdrawal Agreement, as set out below.

New claims

14. When processing a new claim for a social security coordination benefit, or an application for a portable document such as a PDA1 or S1, where there is an indication of a cross-border element, then it should be determined whether the individual is in scope of the social security coordination provisions of the Withdrawal Agreement. Indications of a cross-border element could include, but are not limited to:

i. an EU citizen who is resident in the UK and holds a status under the EU Settlement Scheme, or a UK national who is resident in the EU;

ii. a third country national whose partner (marriage/civil partnership/durable relationship) is a person listed above;

ii. an individual who is in receipt of a UK social security benefit in the EU which is not exported under domestic regulations or a reciprocal agreement with the relevant state;

iv. an EU citizen with evidence of contributions in the UK before 1 January 2021, or a UK national with evidence of contributions in the EU before 1 January 2021;

v. a UK/EU dual national with evidence of residence or contributions in both the UK and EU before 1 January 2021;

vi. a third country national with evidence of residence or contributions in both the UK and EU before 1 January 2021.

These factors do not definitively mean that an individual is in scope of the social security coordination provisions but indicate that a full check should be carried out to determine whether the individual is in scope.

Change of circumstances

15. An individual’s status under the Withdrawal Agreement for social security coordination purposes is not fixed and an individual can move between cohorts, or into or out of scope over time based on changes to their circumstances. Therefore, staff will need to ensure that they confirm an individual’s status under the Withdrawal Agreement where they are informed of a change of circumstances.

Determining an individual is not covered by the Social Security Coordination provisions

16. If an individual does not meet the conditions to be covered by the social security coordination provisions of the Withdrawal Agreement, then the individual’s eligibility for the social security benefits, or whether they have to pay UK National Insurance contributions, will be determined under domestic law or certain reciprocal agreements with the relevant state. The main alternate agreements to consider would generally be the UK-EU TCA or the reciprocal agreements with Ireland.

17. In reaching this decision all criteria for being treated as in scope should be considered, including derivative rights through a family member.

Full Scope

18. Individuals in full scope of the social security coordination provisions of the Withdrawal Agreement are those covered by Article 30 (including those in scope of Article 30 through Article 10) of Part Two of the Agreement (citizens’ rights). This group will continue to be covered in full by the EU Coordination Regulations while they remain in one of the situations listed under Article 30.

Those in scope

19. Those in full scope of the social security coordination provisions are primarily those in a cross border situation, one involving both the UK and an EU member state, on 31 December 2020 and who continue to be in a cross-border situation at the relevant time. An individual can be in a cross-border situation covered under Article 30(1) or under Article 30(3) of the Withdrawal Agreement.

20. Article 30(3) brings into scope of the social security coordination provisions all those in scope of Article 10 who would not otherwise be in scope of Article 30. This means that EU citizens with a right of residence in the UK, and UK nationals with a right of residence in the EU, under the Withdrawal Agreement, will be in full scope of the social security coordination provisions.

21. Those covered by the social security coordination provisions under Article 30(3) are:

- EU citizens who have a right to reside in the UK on 31 December 2020 and who continue to have a right to reside in the UK. This must be residence in accordance with EU law, which includes those residing as a worker, self-employed, jobseeker, self-sufficient person with comprehensive sick insurance, a person with permanent residence, or a student with comprehensive sickness insurance

- UK nationals who have a right to reside in an EU member state on 31 December 2020 and who continue to have a right to reside in the EU member state. This must be residence in accordance with EU law, which includes the categories set out above

- UK/EU dual nationals who, by 31 December 2020, have exercised their free movement rights under EU law before acquiring citizenship in the host country.

- EU citizens who reside in an EU member state and work as frontier workers in the UK by 31 December 2020 and continue to do so after that date

- UK nationals who reside in the UK and work as frontier workers in an EU member state by 31 December 2020 and continue to do so after that date

- the family members of those listed above whose residence in the host state[footnote 6] is facilitated by the primary right holder under EU law[footnote 7]. For a full explanation of family members under Article 10[footnote 8] see Chapter 2. This includes:

- spouse, civil partner or durable partner where the relationship was established by 31 December 2020;

- dependent direct relative in the ascending line (parent or grandparent) where the relationship was established by 31 December 2020;

- dependent direct relatives in the descending line (children, grandchildren) either where the relationship was established by 31 December 2020, or where they were born to or legally adopted by the primary right holder after 31 December 2020;

- extended family members whose residence in the host state had been facilitated by the primary right holder by 31 December 2020. This includes where it has been applied for by 31 December 2020

22. Those covered by Article 30(1) are those who are in one of the situations listed below on 31 December 2020 while they continue to be:

- EU citizens who reside in the UK or who reside in the EU and are subject to the legislation of the UK;

- EU citizens who are subject to the legislation of an EU member state but are employed or self-employed in the UK (for example posted workers[footnote 9]);

- UK nationals who reside in the EU or who are residing in the UK and subject to the legislation of an EU member state;

- UK nationals who are subject to the legislation of the UK but are employed or self-employed in an EU member state (for example posted workers);

- asylum seekers, stateless persons or refugees in one of the situations listed above;

- third country nationals who are in one of the situations listed above who are also in scope of regulation No 859/2003[footnote 10]

Rights of those in full scope

23. Those in full scope of the Withdrawal Agreement will be covered by the EU Coordination Regulations while they remain in one of the situations listed above. They will continue to be subject to only one country’s legislation at a time, to receive any benefit they already receive, and be able to apply for new benefits as long as they meet the eligibility requirements. See Figure 2 for an overview of these provisions.

Maintaining rights and falling out of scope

24. Those in full scope will maintain their rights as long as they continue to be in one of the categories listed above.

25. Those in scope of Article 30(3) because they are covered by Article 10 will remain in scope while they have a right of residence under the Withdrawal Agreement in the host state. An individual with a permanent right of residence in the host state can move away for up to 5 years and not fall out of scope, as they will maintain a right of residence in the host state. An individual who is yet to acquire a right of permanent residence under the Withdrawal Agreement can move away for up to 6 months in a 12 month period, or for a single period of up to 12 months with an important reason (for example pregnancy, serious illness or training) and not fall out of scope, as they will have a right of residence in the host state. Absence of a longer duration is permitted for compulsory military service.

26. This means that an individual, who is in scope of Article 30(3) of the Withdrawal Agreement, could spend part of the year outside the host state and remain in scope, as long as they did not exceed the permissible absence period.

27. Under the Withdrawal Agreement, states are able to provide longer absences under their own domestic residence schemes. For example, the UK has decided to allow continuous absences of up to 2 years for those yet to acquire permanent residence for those who have leave to enter or remain under the EU Settlement Scheme, before the right of temporary residence is lost. However, in respect of social security, individuals who exceed the permitted absences for continuity of residence will fall out of scope of Article 30(3). Although individuals will continue to have a right to reside for as long as relevant provisions allow, individuals who exceed the permitted absence periods for continuity of residence will fall out of scope of Article 30(3) but could still be in scope of Title III through Article 32.

28. For those in scope of Article 30(1) it is possible to move between the different situations listed under Article 30(1), and maintain rights under the provision, as long as they continue to be in one of the situations listed without interruption. This means, for example, that a UK national living in one EU member state at the end of the transition period who moves to live in a different EU member state after the end of the transition period continues to be in scope, as they will still be resident in an EU member state.

29. It is also possible for a person who is no longer in one of the situations covered by Article 30(1) to remain within scope of Article 30 if they are in scope of Article 10 and continue to have a right of residence in the host state in accordance with the Withdrawal Agreement.

30. Family members who have been brought into scope of Article 10 acquire an independent right under Article 10 and so remain in scope while they retain a right of residence in accordance with the Withdrawal Agreement in the host state. They will be covered by the EU Coordination Regulations while they remain in scope.

31. If an individual ceases to be in any of the situations listed above, then they will be out of scope and cannot be brought back into scope again by moving into one of the situations listed above.

Determination approach

32. When determining if an individual is in full scope of the social security coordination provisions it is necessary to consider their nationality and residence record from 31 December 2020 to the date of application:

a) a UK national who was resident in an EU member state by 31 December 2020 and has continued to reside in an EU member state since would be considered in scope

b) a UK national who was exercising a right to reside in an EU member state before 1 January 2021 and continues to have a right of residence in that state, and has not been absent since for longer than the period specified in Article 15 of the Withdrawal Agreement (5 years where a person has permanent residence), would be considered in scope. Proof of registration in an EU member state residence scheme would be a good indicator of this

c) an EU citizen who was resident in the UK by 31 December 2020 and has continued to reside in the UK or has maintained a right of residence in the UK since, would be considered in scope. Proof of status under the EU Settlement Scheme would be a good indicator of this. There are other ways this can be evidenced if an individual has not yet applied to the EU Settlement Scheme

33) It is also necessary to consider if an individual is subject to the legislation of another country (UK national subject to the legislation of an EU member state or an EU citizen subject to the legislation of the UK):

a) a UK national who has been paying contributions in the EU since 31 December 2020, and continues to do so, would be considered in scope

b) an EU citizen who has been paying contributions in the UK since 31 December 2020, and continues to do so, would be considered in scope

c) a frontier worker who was resident in the UK while working in an EU member state, or who was resident in an EU member state while working in the UK, at the end of the transition period would be considered in scope

d) a UK/EU dual national who has resided or made contributions in both the UK and EU before 1 January 2021 would likely be considered in scope

34. Or a posted worker on a posting at the end of the transition period:

a) a posted worker who maintained residence in the UK while working in an EU member state, and began their posting by the end of the transition period would be considered in scope of the social security provisions of the Withdrawal Agreement while they continued their posting. They would be identifiable by their PDA1 form issued by the UK. The Withdrawal Agreement does not protect the rights of a posted worker to continue their posting in the host country after the end of the transition period. It will be for the individual EU member state to determine if the worker can continue their posting after the end of the transition period.

b) a posted worker who maintained residence in the EU while working in the UK, and began their posting by the end of the transition period would be considered in scope of the social security provisions of the Withdrawal Agreement. They would be identifiable by their PDA1 form issued by the EU member state. Although the Withdrawal Agreement does not protect the rights of a posted worker to continue their posting in the host country after the end of the transition period, the UK will not differentiate posted workers from other workers. So those posted workers in the UK by the end of the transition period will be able to apply for an immigration status under the EU Settlement Scheme allowing them to stay.

35. If an individual is not in one of the categories listed above, it is then necessary to consider if they are in full scope as a family member of an individual in personal scope of Article 10. It is necessary to establish:

i. the link to the primary right holder on 31 December 2020 (not applicable for future children), and at the point where they joined them in the host state, including proof of dependency where necessary;

ii. whether they have joined them in the host state and when; and

iii. whether the primary right holder was in full scope at this time

36. As it could be several years after they join the primary right holder that a claim, or an application for a document such as a PDA1 or S1, under the Withdrawal Agreement is made (for example an application for benefits), it is important to establish the right of the primary right holder at the time the family member joined them and that the family member has maintained a right of residence in the host state since.

37. As family members in scope of Article 10 can also apply to the EU Settlement Scheme in the UK, or to EU member state residence schemes, a status under these schemes would be a good indicator.

38. As the UK cannot be a host state for a UK national and an EU member state cannot be a host state for an EU citizen, these groups would not be brought into full scope as family members in their state of nationality.

Examples: Full Scope – Article 30(3) (Article 10) (personal Scope)

39. Those in full scope of Article 30(3) (Article 10) include:

a) a UK national lawfully residing and working in Spain on 31 December 2020

b) a French national who is lawfully residing in the UK and self-employed on 31 December 2020

c) a UK national who retired to live in Spain in 2017, where he receives a State Pension from the UK. On 31 December 2020 he is lawfully residing in Spain and is on holiday in the UK for Christmas

d) a German national who lawfully resided in the UK between 2012 and 2020. In July 2020, after acquiring indefinite leave to remain in the UK via the EUSS, they moved to live and work in Germany. They will fall out of scope after 5 years’ continuous residence outside of the UK

e) a Belgian national who resides in Belgium with their family on 31 December 020, and travels to the UK each week for work

f) a UK national who moved to live and work in Malta in 2003 and subsequently acquired UK/Maltese dual nationality. They are residing in Malta on 31 December 2020 as a UK/Maltese dual national. They would continue to be in scope if they subsequently returned to the UK or moved to another EU member state. As they cannot lose their right of residence in Malta (except through serious misconduct) they will continue to be in scope for their lifetime

g) a Romanian national who, after working in Romania for 37 years, moved to live in the UK in 2019, ahead of reaching state pension age in 2022. They are self-sufficient, have comprehensive sickness insurance and are residing in the UK on 31 December 2020

Examples: Full Scope – Article 30(3) (Article 10) (family members)

40. Those in full scope of Article 10 as a family member of those in personal scope of Article 10 include:

a) an Australian national who is lawfully residing in the UK on 31 December 2020 with their Swedish national partner who is self-employed in the UK

b) a Peruvian national who is lawfully resident in Finland on 31 December 2020, living with their UK national civil partner, who is employed in Finland

c) a UK national who is living in the UK on 31 December 2020 and then moves to Italy in 2022 to join their UK national partner (their residence having been facilitated by Italy in accordance with Italy’s legislation), who has been living and working in Italy since 2020. They have been in a durable relationship since 2017

d) a child born to a UK national in 2022, where the UK national parent was lawfully resident in Greece on 31 December 2020 and continued to reside and work in Greece, and where the child lives with the UK national parent in Greece

e) a Japanese partner of a UK national, who in August 2020 moves with their UK national partner to Malta and whose residence has been facilitated by Malta in accordance with its legislation. The couple are in a durable relationship and have been living together for 4 years. They are both residing and working in Malta on 31 December 2020. In 2023, while continuing to lawfully reside in Malta they legally adopt a UK national child. This child will also be in scope of this provision.

Not in full scope - Article 30(3) (Article 10) (family members):

f) A UK national who is living and working in the UK on 31 December 2020. In July 2021 they start a relationship with a UK national who is living in France and in 2022 they get married. If the UK national moves to join their spouse in France, then they will not be brought into full scope of Article 10 as the relationship was not established by 31 December 2020.

Examples: Full Scope – Article 30(1)

41. Those in full scope of Article 30(1) include:

a) A UK national who is posted by their UK employer to work temporarily in Austria by 31 December 2020. They continue to be subject to the legislation of the UK, but will be in scope of Article 30(1) for the duration of their posting. It will be for Austria to determine if they are permitted to continue their posting in Austria after 31 December 2020

b) a Croatian national who has previously only worked in Croatia and is retired in the UK on 31 December 2020. They receive a State Pension from Croatia based on the years that they worked there

c) a Portuguese national who is not working but is resident in the UK with their family on 31 December 2020

d) a UK national who receives a job offer to work in Estonia shortly before 31 December 2020 and moves with their family to live in Estonia on 15 December 2020

e) a Canadian national residing in the UK with their family on 31 December 2020, and who travels to Belgium during the week for work

f) an Argentinian national who resides in Ireland with their family and works in Ireland and the UK, regularly travelling between the two. An Argentinian national in the same situation but whose situation was purely confined to Ireland would not be covered as they would not be in a situation involving the UK and an EU member state

Example: Maintaining rights (falling out of scope)

42. A UK national who moved to live and work in France in 2014, after working in the UK for 30 years. She is living in France at the end of the transition period and registers for residence under the French Withdrawal Agreement registration scheme. As she has been living in France in accordance with EU law for over 5 years she has a permanent right to reside in France. She has full rights under the social security provisions. In 2021 she retires and decides to return to the UK where she lives for the following 3 years. In 2024 she decides that she wants to return to France as the weather is better. While there was a break in her residency in France she has maintained a permanent right of residence as has not been absent for more than 5 years and therefore will continue to have full rights under the social security provisions as she is still in scope of Article 10.

Partial Scope – Article 32(1)(a) and (2) – past contributions

43. The Article 32 provisions cover individuals who have exercised their free movement rights before the end of the transition period (1 January 2021) but who are either not, or are no longer, in one of the situations listed above (full scope).

Those in partial scope (Article 32(1)(a) and (2)

44. Those covered by these provisions are those not in full scope who are:

- UK nationals, stateless persons and refugees who have periods of residence, insurance or employment in an EU member state before 1 January 2021 and are residing in the UK on 31 December 2020

- EU citizens, stateless persons and refugees, who have periods of residence, insurance or employment in the UK before 1 January 2021 and are residing in the EU on 31 December 2020

- third country nationals who have periods of residence, insurance or employment in the UK and EU before 1 January 2021

- UK/EU dual national with periods of residence, insurance or employment in the UK and EU before 1 January 2021

Rights of those in partial scope (Article 32(1)(a) and (2))

45. Article 32 does not bring the individual into full scope of the EU Coordination Regulations. Those in scope of this provision will continue to be able to rely on these past periods of residence, insurance or employment completed in the UK or EU for the purpose of rights and obligations derived from these periods. This includes the ability to aggregate periods of insurance or residence in one state to meet minimum periods of entitlement in another. It also entitles the individual to receive the benefit as a result of these past periods in accordance with the EU Coordination Regulations, and so provides for export and payment at the same rate as those who receive the benefit in the country of payment.

46. For the purpose of aggregation, periods completed both before and after the end of the transition period can be used, where the right is at least partially derived from periods completed before. This is primarily for the purpose of meeting minimum qualifying periods, for example for contributory benefits.

47. Article 32(2) also covers sickness benefits in kind for those in scope where entitlement is derived from receipt of the relevant benefit. This includes reciprocal healthcare entitlements such as access to healthcare on an equal treatment basis, S1, European Health Insurance Card (EHIC) and S2, funded by the competent state[footnote 11].

Maintaining rights and falling out of partial scope (Article 32(1)(a) and (2))

48. Individuals will continue to be covered by these provisions while they continue to derive rights from the past periods of residence, insurance or employment. They will not be in scope to access reciprocal healthcare rights if they are not at that point relying on a member state benefit.

Determination approach

49. When determining if an individual is in partial scope of the Social Security Coordination provisions based on past periods, for entitlement to contributory benefits (Contribution-based Jobseeker’s Allowance, Contributory Employment and Support Allowance, Maternity Allowance), or for State Pensions (aggregation and uprating), it is necessary to consider their nationality and their contribution record before 1 January 2021.

a) A UK national with contributions in an EU member state before 1 January 2021 would be considered in scope.

b) An EU citizen with contributions in the UK before 1 January 2021 would be considered in scope.

c) A third country national with contributions in the UK and EU before 1 January 2021 would be considered in scope.

d) A UK/EU dual national with contributions in the UK and EU, contributions in the UK and residence in the EU, or contributions in the EU and residence in the UK before 1 January 2021 would be considered in scope.

50. When determining if an individual is in partial scope of the Social Security Coordination provisions for entitlement to residency or employment based benefits, the same questions can be asked but based on residence or employment before 1 January 2021.

51. When determining whether the individual is in partial scope for entitlement to reciprocal healthcare, it is important to know the current state of residence as well as any previous contributions paid in the UK and the EU and their duration.

Examples

52. Those in partial scope based on their past contributions include:

a) A Slovenian national who worked and has paid or been credited with National Insurance contributions for 8 years in the UK between 2001 and 2009, and is living and working in Slovenia on 31 December 2020. While they will not be in full scope of the social security provisions, they will still be able to rely on these past periods for rights derived from them. In this case they will be able to rely on these contributions when they come to claim their State Pension in 2024, and so will be able to aggregate periods of insurance in Slovenia to meet the minimum qualifying period in the UK, and their UK State Pension will increase in line with those in the UK while they live in the EU.

b) A UK national who had lived and worked in the Republic of Cyprus for 3 years between July 2017 and August 2020, where they have paid or been credited with national insurance contributions. In August 2020 they return to the UK and are living and working in the UK on 31 December 2020. After working in the UK for a year they become unemployed. While they will not be in full scope of the social security provisions they will still be able to rely on these past periods of contributions in the Republic of Cyprus for rights derived from them. In this case they will be able to rely on these past contributions to meet the minimum period of insurance in the UK to claim unemployment benefits (Contributory Jobseeker’s Allowance).

c) An Estonian national who has worked and has paid or been credited with National Insurance contributions in the UK between 1975 and 2014, and then moved to Latvia where they lived and worked, paying contributions, between 2014 and 2021. They decide to retire in Estonia in 2022 and apply to claim their UK State Pension. The UK will pay their UK State Pension based on the qualifying years worked in the UK, and this will increase in line with those in the UK while they live in the EU. The UK will also be competent for their healthcare in kind (S1 form insured) as competency lies with the state in which they were insured the longest as they are not receiving a State Pension from the state of residence. Latvia will be able to aggregate periods of insurance in the UK to meet the minimum qualifying period of 15 years to pay their State Pension. If the Estonian national decided to move to Latvia in 2024 then competency for the individual’s healthcare would switch to Latvia as the state of residence.

Family member derived rights

53. The family members of those in scope of the Social Security Coordination provisions, whether in full (Article 30(1) or 30(3)), or partial scope (Article 32(1)), will have derived rights and obligations in their capacity as family members.

Family member definition

54. The definition of family members under the social security provision of the Withdrawal Agreement (Article 30(1) and 32) is taken from the EU Coordination Regulations, unless specified in the competent state’s legislation. Full guidance on family member definitions is set out in individual benefit guidance, but this standardly covers:

- spouses or civil partners

- children under 18

- children over 18 who are dependent

Those in full scope

55. As covered in the full scope section, family members of those in full scope of Article 10 will be brought into full scope once they join the primary right holder in the host state, where their residency has been facilitated by the primary right holder.

56. This group will have full rights under the EU Coordination Regulations while they maintain a right of residence in the host state.

Those with derived rights

57. Family members of those in personal scope of the social security coordination provisions (Article 30(1) and (3)), who are not in full scope themselves, will be covered by the provisions to the extent they derive rights in their capacity as a family member.

58. This cohort includes:

- family members of those in scope of Article 10 who do not themselves fall under Article 10 because:

- the family link was not established by 31 December 2020 (excluding future children)

- they have not joined the primary right holder in the host state, or

- whose residence in the host state was not facilitated by the primary right holder, for example, a UK national residing in the UK with their French spouse (who is in full scope)

- family members of those in full scope of Article 30, or in partial scope of Article 32

Rights of those in derived scope

59. Those with derived rights as family members will continue to be covered by the social security provisions of the Withdrawal Agreement only to the extent they derive their rights and obligations under the EU Coordination Regulations in their capacity as a family member of the primary right holder.

60. They will not though have an independent right under these provisions and are not considered in full scope of the social security provisions. This is a more restrictive right than family members who are brought into full scope under Article 10.

61. As stated above all other eligibility requirements, including competency determinations, will continue to be carried out during the benefit application or Portable Document[footnote 12] process or when accessing a service.

Maintaining rights and falling out of scope

62. The rights of those deriving rights in their capacity as a family member continue while the person continues to meet the definition of a family member under the EU Coordination Regulations and their rights and obligations are derived in this capacity. This means that, for example, rights would cease once a child reaches the age of majority and is no longer dependent on their parent.

63. Rights are also only maintained while the primary right holder remains in personal scope of the Citizen’s Rights provisions. If they cease to be in scope, then the family member would no longer be able to derive rights from them.

Determination questions

64. When determining if an individual has family member derived rights from a person in scope of Article 30, it is necessary to establish:

a) if the individual is a family member under the EU Coordination Regulations for the benefit. This includes any dependency checks where relevant

b) if the primary right holder is in personal scope of the Social Security Coordination provisions, and in which capacity (full/partial scope)

If the individual meets these tests, then they would be considered in scope of this provision, to the extent they derive rights in this capacity.

Examples: Family member derived rights (difference between Articles 10 and 30)

65. A UK national is living and working in Poland on 31 December 2020. Their spouse (married) and two children, all UK nationals, are living in the UK. While they continue to live in the UK they will have derived rights as family members (under Article 30), and will be able to derive rights in this capacity. This includes rights for family benefits, where Poland is the state of primary competence, and healthcare benefits in kind. As the parent living in the UK is unemployed Poland has primary competence for Child Benefit for the children and for the family’s EHIC if they access healthcare while temporarily in an EU member state.

i. In 2021 one of the children ceases to be dependent, and so would no longer be covered by this provision. This means that they will no longer be able to derive rights or obligations under the EU Coordination Regulations in their capacity as a family member and Poland would cease to be responsible for their healthcare benefits in kind.

ii. In 2024 the spouse living in the UK and the youngest child decide to join the UK national partner in Poland, while the youngest child is still a minor. As their residence in Poland has been facilitated by the UK national in full scope, they are also brought into full scope in their own right as family members under Article 10. It also means that if the family link breaks, for example the child reached the age of majority and is no longer dependent, they will remain in full scope provided that they continued to reside in accordance with the Withdrawal Agreement.

66. A UK national is living with their Bulgarian national spouse (civil partnership) (self-employed) in the UK, on 31 December 2020. The Bulgarian national is in full scope of Article 10 and 30. The UK national is not brought into full scope as their residence in the UK is not facilitated by their Bulgarian partner, and so they do not have full rights under the social security provisions. They would though have derived rights in their capacity as a family member, for example they would be entitled to UK insured needs arising healthcare while temporarily in an EU member state (EHIC).

i. If the partner was instead a Namibian national (a third country national), and their residence in the UK had been facilitated by their Bulgarian national partner they would instead be in full scope of Article 10 and have full independent rights under the social security provisions.

Examples: Article 30

67. Those with derived rights as a family member of someone covered under Article 30 include:

a) the UK national civil partner, residing in the UK on 31 December 2020, of a UK national who is resident in the Czech Republic on 31 December 2020, while they continue to reside in the UK

b) the Dutch national partner and children of a Dutch national, who resides in the Netherlands on 31 December 2020 and travels to work in the UK during the week and is subject to UK legislation

c) the Bolivian national family members, of a UK national who is undertaking a 2- year posting in Hungary on 31 December 2020. They all live together in Hungary

d) a UK national is living in Portugal on 31 December 2020. His ex-partner and 2 children are living in the UK on 31 December 2020. As the eldest child is no longer dependent on their parents they cannot derive rights from their UK national parent in Portugal. The younger child, who is 15, can derive rights as a family member while they continue to be dependent on their parents

e) The German spouse of a French national, who are both living in France on 31 December 2020. As the French national worked in the UK for 25 years before 31 December 2020 the German spouse would be entitled to survivor’s benefits based on these periods of past contributions following the death of the French national

Examples: Maintaining rights and falling out of scope

68. a UK national spouse of a Danish national, who are both residing in the UK on 31 December 2020, would continue to have derived rights as a family member while the family member link continues. If the couple were to separate, for example following a divorce, the family member link would be interrupted and the UK national would no longer have derived rights in their capacity as a family member.

69. The family of a Finnish national, who works and resides in the UK on the 31 December 2020, subject to UK legislation, continues to reside in Finland after 31 December 2020. They can derive rights as family members of the Finnish national parent who is working in the UK. In 2022 the eldest child turns 18, starts work and moves to live with friends. They are no longer considered dependent on the parent and so cease to be able to derive rights in their capacity as a family member.

Special healthcare provisions for the end of the transition period Article 32(1)(b)

Ongoing planned treatment (S2)

70. Article 32(1)(b) protects the right to receive state funded planned treatment in another country, under the EU Coordination Regulations, for those who have requested pre-authorisation or started planned treatment before the end of the transition period.

Those in scope of Article 32(1)(b)

71. Those covered by these provisions are those not in full scope of Article 30 and who are:

-

UK nationals/EU citizens/third country nationals for whom the UK is the competent state for their healthcare and whose treatment started or who applied for pre-authorisation for treatment in an EU member state before 1 January 2021

-

UK nationals/EU citizens/third country nationals for whom an EU Member State is competent for their healthcare and whose treatment started or who applied for pre-authorisation for treatment in the UK or a different EU member state before 1 January 2021

Rights of those in scope Article 32(1)(b)

72. This provision does not bring the individual into full scope of the EU Coordination Regulations.

73. Those in scope will be able to enter and exit the country where they will receive their treatment, including when this requires multiple courses of treatment.

74. Patients who are not EU or UK nationals may require an entry visa.

Maintaining rights and falling out of scope Article 32(1)(b)

75. Individuals who are receiving treatment pursuant to Article 32(1)(b) will fall out of scope of that provision when their authorised course of treatment is completed.

Determination questions

76. When determining if an individual is in scope of Article 32(1)(b) it is necessary to consider whether the treatment started or authorisation was sought before 31 December 2020. This can be evidenced through the S2 application date and/or certificate which is issued by the NHS Business Services Authority (BSA).

77. The Devolved Administrations Health Boards will determine the clinical eligibility criteria for S2 holders[footnote 13] who are residents of Scotland, Northern Ireland and Wales.

Example

78. A UK national lives in England and applies in December 2020 for treatment in Germany for a condition. As long as they meet the clinical eligibility criteria for treatment abroad and they are ordinarily resident in the UK, NHS England will approve their treatment and NHS BSA will issue them with an S2 certificate for the period of treatment. The treatment commences in Germany in January 2021. The treatment includes three rounds of treatment which need to take place every two months in January 2021, March 2021, May 2021. The UK national can return to the UK in between their treatment.

Interaction with the UK-EU Trade and Cooperation Agreement (TCA)

79. Under the TCA, state-funded planned treatment via the S2 route continues for all individuals for whom the UK is the competent state for their healthcare. This means that whilst the entitlements of those in scope of Article 32(1)(b) are protected, they may also be covered by the TCA.

Ongoing needs arising treatment (EHIC) (Article 32(1)(c))

80. Article 32(1)(c) covers persons on a temporary stay at the end of the transition period for needs arising treatment.

Those in scope of Article 32(1)(c)

81. Those covered by these provisions are those not in full scope who are:

-

UK nationals/EU citizens/third country nationals for whom the UK is the competent state for their healthcare and are on a temporary stay in an EU Member State which started on or before 31 December 2020

-

UK nationals/EU citizens/third country nationals for whom an EU Member State is competent for their healthcare and are on a temporary stay in the UK which started on or before 31 December 2020

82. Whether someone is on a stay is fact dependent. The two most likely situations in which someone might be on a stay are:

-

tourists on holiday, and

-

students studying a course abroad (providing their habitual residence has not changed)

Rights of those in scope of Article 32(1)(c)

83. This provision does not bring the individual into full scope of the EU Coordination Regulations. Those in scope will, though, continue to be able to access needs arising treatment as necessary in the country they are in at the end of the transition period. They will not be able to use their EHIC in other member states.

Maintaining rights and falling out of scope of Article 32(1)(c)

84. Individuals who are on an ongoing trip will continue to be covered by these provisions until the stay in that state comes to an end. For tourists, their stay will end when they return home or when they go to another state. Students, by contrast, are likely to be on a stay until their studies finish. If the student, for example, returns to their habitual residence over a holiday period, the stay will not come to an end so they will remain in scope.

85. They may also fall out of scope and their EHIC entitlement will no longer be valid if they start a new course of studies or if they become employed in the country they are studying in.

Interaction with the UK-EU Trade and Cooperation Agreement (TCA)

86. Under the TCA, needs arising treatment within an EU Member State continues for individuals for whom the UK is the competent state for their healthcare, so long as they are on a temporary stay and meet the immigration requirements in their Member State of stay. The same coverage for needs arising treatment also applies to individuals for whom an EU Member State is competent for their healthcare, when needs arising treatment is required in the UK. People covered by Article 32(1)(c) will likely also be covered by the TCA.

Partial Scope - Article 32(1)(d) Family benefits and (1)(e) sickness benefits in kind

87. The Article 32 provisions covering family benefits (1)(d) and family member derived rights (1)(e), cover those who are not in full scope of the Social Security Coordination provisions, but are entitled to benefits under the EU Coordination Regulations at the end of the transition period. While they are not personally in a cross-border situation at the end of the transition period (31 December 2020) they have an entitlement to family benefits (1)(d) and derived rights as family members (e) derived from the EU Coordination Regulations. The scope of those covered by these provisions are the same but the entitlements under each differ.

Those in scope of Article 32(1)(d) and (e)

88. Those covered by these provisions are those not in full scope who are:

- UK nationals, stateless persons and refugees who reside in, and are subject to, the legislation of the UK, and whose family reside in an EU member state on 31 December 2020

- EU citizens, stateless persons and refugees who reside in, and are subject to the legislation of, an EU member state, and whose family reside in the UK on 31 December 2020

- third country nationals who are covered by regulation 859/2003 who are in one of the situations listed above

This covers the situation where an individual receives a benefit from either the UK or EU member state in which they do not reside as a result of their link to a family member (as set out above). This is primarily children or the other parent or guardian of the child for whom a family benefit is claimed, though it is not a requirement for the family to include children. A spouse can be covered by Article 32(1)(e) even where there are no children and no family benefits paid.

Rights of those in full scope of Article 32(1)(d)

89. This provision does not bring the individual into full scope of the EU Coordination Regulations. Those in scope of Article 32(1)(d) will, though, continue to be entitled to family benefits where the entitlement existed on 31 December 2020. The benefit does not need to be in receipt at this point but the eligibility must exist. This means that the provision does not cover family benefits payable in respect of children born or legally adopted after the end of the transition period.

Rights of those in full scope of Article 32(1)(e)

90. This provision does not bring the individual into full scope of the EU Coordination Regulations. Those in scope of Article 32(1)(e) will, though, continue to be entitled to derived rights as family members where the entitlement existed on 31 December 2020. Benefits, including benefits in kind (healthcare) do not need to be in receipt at this point but the eligibility must exist. This means that the provision does not cover derived rights as family members payable in respect of children born, or spousal relationships formed, after the end of the transition period.

Maintaining rights and falling out of scope of Article 32(1)(d) and (e)

91. The rights under these provisions continue while the eligibility to the benefit continues under the EU Coordination Regulations and national legislation. Therefore, if the individual ceases to be entitled to family benefits under national legislation, or ceases to rely on the EU Coordination Regulations in order to be entitled, the individual will no longer be covered by Article 32(1)(d) or (e). This includes if the family members moved to join the other family members in the host state. This would result in the award no longer being made under the EU Coordination Regulations, and so would no longer be in scope of Article 32(1)(d) or (e). Once an individual cease to be in scope of Article 32(1)(d) or (e) they cannot come back into scope of the provisions.

92. Changes between primary and secondary competence do not result in an interruption in entitlement. This means that an individual will continue to be covered by Article 32(1)(d) or (e) if primary competence switches from that individual’s state of residence to the state in which the individual’s family resides, and the individual’s state of residence becomes the state of secondary competence.

Determination approach

93. When determining if an individual is in partial scope of the Social Security Coordination provisions for Article 32(d) or (e) it is necessary to consider the nationality, residency and family links at the end of the transition period and whether these factors have been maintained.

94. It is necessary to establish the following:

a) was the family link established by 31 December 2020; were the children born by 31 December 2020 or the partner relationship established (either marriage or civil partnership) by 31 December 2020?

b) was the family in one of the situations set out above on 31 December 2020, and have they remained resident in the respective states since this point?

If the individual meets both these tests, then they will be considered in scope of this provision.

Examples

95. Those in partial scope as family members include:

a) a UK national who works and resides in the UK on 31 December 2020, subject to UK legislation. Their Dutch partner and 2-year-old child reside in the Netherlands on 31 December 2020. As the Dutch partner is unemployed the UK has primary competence for any family benefits for the family members living in the Netherlands. The Netherlands has secondary competence. In this case the UK pays Child Benefit for the child, and the Netherlands will pay a differential supplement if required

i. in 2022 the Dutch partner starts working in the Netherlands, at which point the primary competence for any family benefits switches to the Netherlands, and the Netherlands would now pay the Dutch family benefit for the child. The UK has secondary competence. As the rate of the Dutch family benefit is lower than the Child Benefit in the UK, the UK will pay a differential supplement as a top up. This does not count as an interruption for being in scope of this provision

ii. in 2023 the Dutch partner stops work and primary competence for family benefits switches back to the UK, who starts paying Child Benefit again. Secondary competence switches to the Netherlands

iii. in 2024 the couple have a second child. As this child was born after 31 December 2020, benefits in respect of that child do not come under Article 32(1)(d) and any award will be in line with domestic legislation

b) a Luxembourg national who works, paying contributions, and resides in Luxembourg on 31 December 2020, while their UK national partner resides in the UK. As the UK national partner is not working, Luxembourg has primary competence for their family benefits

c) a UK national lives and works in the UK while their Slovakian partner lives with their two children in Slovakia on 31 December 2020. As the Slovakian partner is unemployed the UK has primary competence for family benefits payable in respect of their children living in Slovakia. They are in scope of this provision while their family resides in Slovakia

i. In 2022 the UK national is offered a job in Slovakia and moves to live there with their partner and children. At this point they are no longer covered by this provision because they are no longer entitled to UK Child Benefit under either the EU Coordination Regulations or national legislation.

ii. In 2024 the UK national moves back to the UK and starts working there. As there was an interruption to the entitlement the UK national is no longer in scope of this provision and so the UK would not pay Child Benefit for the children living in Slovakia.

Figure 1: Summary of groups under the social security coordination provisions.

This table is intended to summarise the groups within each scope under the social security coordination provisions. It is illustrative and so should not be viewed in isolation, and as such does not list all situations or requirements under these cohorts.

| Scope | Groups | Special considerations /clarifications | Falling out of scope | Coverage while in scope |

|---|---|---|---|---|

| Full Scope (Article 10 –residence) |

EU citizens lawfully resident in the UK by 31 December 2020. EU citizens with a right to reside in the UK by 31 December 2020. EU citizens working in the UK and habitually resident in the EU by 31 December 2020 (frontier worker). UK nationals lawfully resident in an EU member state by 31 December 2020. UK nationals with a right to reside in an EU member state by 31 December 2020. UK nationals working in an EU member state and habitually resident in the UK by 31 December 2020 (frontier worker). UK/EU dual nationals who exercised free movement rights before acquiring the nationality of the host state. Family members of those above whose residence in the host state has been facilitated by the primary right holder. |

Residence or a right to reside must be in accordance with EU law. For core family members (including durable partners) the relationship must have been established by 31 December 2020 or be the children of the primary right holder. Extended family members, must have had their residence facilitated by the host state, or have applied for their residence to be facilitated by 31 December 2020. |

Lose residence rights in the host state (5-year absence for those with permanent residence). Residence rights restricted through conduct – for example a deportation order. |

Full coverage – continue to be covered by EU Coordination Regulations in full. |

| Full Scope (Article 30 – SSC) | Those in scope of Article 10 (above). EU citizens who are habitually resident in the UK on 31 December 2020 and are subject to the legislation of an EU member state. EU citizens who are subject to the legislation of the UK on 31 December 2020. UK nationals who are habitually resident in an EU member state on 31 December 2020 and are subject to the legislation of the UK. UK nationals who are subject to the legislation of an EU member state on 31 December 2020. Third country nationals who are habitually resident in the UK and subject to the legislation of an EU member state on 31 December 2020. Third country nationals who are habitually resident in an EU member state and subject to the legislation of the UK on 31 December 2020. |

Article 30 is based on whether there is a UK/EU cross-border element at the end of the transition period. There must be a link to the UK and EU. | Cease to be in scope of Article 10 or in a cross-border situation as listed in Article 30(1). | Full coverage – continue to be covered by EU Coordination Regulations in full |

| Partial Scope – Article 32, (1)(a), (2) past contributions | UK nationals who have been subject to the legislation of an EU member state before 1 January 2021. EU citizens who have been subject to the legislation of the UK before 1 January 2021. Dual UK/EU dual nationals who have been subject to the legislation of the UK and an EU member state before 1 January 2021. Third country nationals who have been subject to the legislation of the UK and an EU member state before 1 January 2021. |

Only covers those who are not in full scope. Covers periods completed before and after 1 January 2021, as long as reliance on periods before 1 January 2021. |

Not relevant as long as they continue to rely on these past periods | Partial coverage – continue to be covered by EU Coordination Regulations for rights derived from the past periods |

| Partial Scope – Article 32(1)(b) Healthcare provisions for the end of the transition period (planned treatment) | UK nationals/EU citizens/third country nationals for whom the UK is the competent state for their healthcare and whose treatment started or who applied for pre-authorisation for treatment in an EU member state before 1 January 2021; UK nationals/EU citizens/third country nationals for whom an EU Member State is competent for their healthcare and whose treatment started or who applied for pre-authorisation for treatment in the UK or a different EU member state before 1 January 2021. |

Only covers those who have requested pre-authorisation or started planned treatment before 1 January 2021. Does not bring the individual into full scope. Those in scope will be able to enter and exit the country where they will receive their treatment, including when this requires multiple courses of treatment. An accompanying person will be entitled to travel with them. Patients who are not EU or UK nationals may require an entry visa. |

Once the authorised treatment is completed and reimbursed for, individuals will fall out of scope. | Partial coverage – conditional and time limited coverage by EU Coordination Regulations for planned healthcare (S2). |

| Partial Scope – Article 32(1)(c) Healthcare provisions for the end of the transition period (EHIC for visitors and students) | UK nationals/EU citizens/third country nationals for whom the UK is the competent state for their healthcare and who are on a temporary stay in an EU Member State which started before 1 January 2021; UK nationals/EU citizens/third country nationals for whom an EU Member State is competent for their healthcare and who are on a temporary stay in the UK which started before 1 January 2021. The two most likely situations in which someone might be on a stay are: – tourists on holiday; and – students studying a course abroad (providing their habitual residence has not changed) |

Entitled to use the EHIC to access needs arising treatment in a specific State, on equal terms as people insured in that country. | Visitors: as soon as they leave the country they were visiting at the end of the transition period. Students: they may fall out of scope or change their entitlements if their course ends, they become employed or the state of residence becomes competent for their healthcare. |

Partial coverage – conditional and time limited coverage for needs arising treatment. (EHIC) |

| Partial Scope – Article 32(1)(d) Family benefits |

EU citizens who are not in full scope: reside in the EU before 1 January 2021 and are subject to the legislation of an EU member state, and whose family reside in the UK before 1 January 2021. UK nationals who are not in full scope: reside in the UK before 1 January 2021 and are subject to the legislation of the UK, and whose family reside in an EU member state before 1 January 2021. Third country nationals, who reside in and are subject to the legislation of either the UK or an EU member state before 1 January 2021, and whose family reside in the opposing state. |

Covers those who are not in full scope. Only covers where there is an entitlement to family benefits by 31 December 2020, so does not cover children born after 31 December 2020. Covers changes between primary and secondary competence. |

If the entitlement to family benefits stops – child no longer dependent. If the cross-border element ceases – EU Coordination Regulations no longer apply. |

Partial coverage – continue to be covered by EU Coordination Regulations for family benefits, where entitlement existed at 31 December 2020. |

| Partial Scope – Article 32(1)(e) Family benefits |

EU citizens who are not in full scope: reside in the EU before 1 January 2021 and are subject to the legislation of an EU member state, and whose family reside in the UK before 1 January 2021. UK nationals who are not in full scope: reside in the UK before 1 January 2021 and are subject to the legislation of the UK, and whose family reside in an EU member state before 1 January 2021. Third country nationals, who reside in and are subject to the legislation of either the UK or an EU member state before 1 January 2021, and whose family reside in the opposing state. |

Only covers those who are not in full scope Only covers where there is an entitlement to derived rights as family members by 31 December 2020, so does not cover children born after 31 December 2020. Covers changes between primary and secondary competence. |

If the entitlement to family benefits stops – child no longer dependent. If the cross-border element ceases – EU Coordination Regulations no longer apply. |

Partial coverage – continue to be covered by EU Coordination Regulations for derived sickness benefits, where entitlement existed at 31 December 2020 |

| Family member derived rights and obligations | Family members of those listed as in full scope of Article 30 within the meaning of the EU Coordination Regulations. Family members of those listed as in full scope of Article 10 who have either not joined the primary right holder in the host state or whose residence in the host state has not been facilitated by the primary right holder. Family members of those in partial scope (Article 32(1)(a)). |

This could include the UK national partner of an EU citizen, covered by Article 10, who are living together in the UK. | If the primary right holder is no longer in full scope If the family link breaks, for example Child is no longer dependent or following divorce. |

Partial coverage – continue to be covered by EU Coordination Regulations for rights and obligations derived in their capacity as a family member of primary right holder |

Figure 2: Summary of EU Coordination provisions under the scopes of the social security coordination provisions.

This table is intended to summarise the EU Coordination Regulation provisions covered by the different scopes under the Withdrawal Agreement provisions. It is illustrative and so should not be viewed in isolation. For all benefits individuals must continue to meet all other existing eligibility criteria.

| Relevant claims under EU Coordination Regulation | Benefit lines | Full Scope (Article 30(1) or 10) | Partial Scope past periods – Article 32 | Partial Scope family benefits – Article 32(1)(d) | Partial Scope derived family member rights – Article 32(1)(e) | Family member derived rights under the WA | Partial Scope persons on a stay at end of transition period – Article 32 | Partial Scope planned healthcare – Article 32 |

|---|---|---|---|---|---|---|---|---|

| Contribution based benefits (aggregation) | JSA – C ESA – C State Pension (uprating in EU) |

X | X – where relying on past periods | |||||

| Family benefits (paid in EU) | Child Benefit Child Tax Credit |

X | X | X | ||||

| Death grant | Bereavement support payment | X | X | X | ||||

| Maternity Benefit | Maternity allowance | X | X | |||||

| Non- contributory cash sickness benefits (paid in EU) | PIP (Daily living component) DLA (care component) Attendance allowance Carers allowance |

X | X | |||||

| Sickness benefits in kind |

EHIC – unplanned overseas treatment S1 cover – in country treatment S2 – planned healthcare |

X | X – where the UK is competent due to past periods | X | X | X – EHIC while on an ongoing trip in member state X- EHIC while on ongoing studies |

X– S2 until the completion of treatment | |

| Coordination of contribution payments | PDA1 – demonstration of applicable legislation | X | X | |||||

| Cold weather payment | Winter Fuel Payment | X |

Figure 3: Summary of family member groups under the social security coordination provisions.

This table is intended to summarise the different family member scopes under the social security coordination provisions. It is illustrative and so should not be viewed in isolation.

| Article 10 | Article 10 | Article 10 | Article 30 and 32 | |

|---|---|---|---|---|

| Relationship to primary right holder | Close family members, as defined by the EU Free Movement Directive: Partners (marriage/civil partnership durable relationship[footnote 14]) Dependents in the descending line (children under 21 or dependent) Dependents in the ascending line[footnote 15] Relationship must be established by 31 December 2020[footnote 16]. |

Close family members, as defined by the EU Free Movement Directive: Partners (marriage/civil partnership durable relationship[footnote 14]) Dependents in the descending line (children under 21 or dependent) Dependents in the ascending line[footnote 15] Relationship must be established by 31 December 2020[footnote 16]. |

Extended family members whose residence has been facilitated by the primary right holder | Close family members as defined under EU Coordination Regulations (EC 883)[footnote 17] Partners (marriage/civil partnership) Dependents in the descending line (Children under 18 or dependent) |

| Residence on 31 December 2020 | Lawful residence in the host state facilitated by 31 December 2020 | Resided outside of the host state on 31 December 2020. | Lawful residence in the host state facilitated by 31 December 2020[footnote 18] | Residency on 31 December 2020 does not impact on whether the family member is in scope of the provisions |

| Scope under the social security coordination provisions (Article 30) | In full scope. | In full scope once they have joined the primary right holder in the host state. Will have derived rights before this. | In full scope | In scope to the extent that they derive rights in their capacity as a family member. |

| Impact of break in family link (for example child no longer dependent) | Will remain in full scope while they maintain a right of residency in the host state. | Will remain in full scope, if they have joined the family member in the host state before the break, while they maintain a right of residency in the host state. | Will remain in full scope while they maintain a right of residency in the host state. | Will no longer be in scope of the social security coordination provisions as have no independent rights under these provisions.[footnote 19] |

Figure 4: Social security coordination provisions in UK-EU trade and cooperation agreement

The table below compares the benefit position under the Withdrawal Agreement (WA) and under the Trade and Cooperation Agreement (TCA) from 1/1/2021 (for those in scope of the TCA).

Note:

- there is no change to the social security position for persons in scope of the Withdrawal Agreement (existing provisions under EU Regulation 883 will continue to apply to them) for as long as they remain in scope

- the table contains information relating solely to the WA and the TCA, it does not reflect other international agreements in place such as the UK/Ireland social security agreements

| Branch of social security | UK benefits coordinated under WA | UK benefits under TCA from 1 January 2021 (EU only) | Change from 1 January 2021 under TCA |

|---|---|---|---|