Assessing and monitoring the economic and financial standing of suppliers guidance note (HTML)

Updated 23 April 2024

1. Context

1.1 Overview

1.1.1 Assessing and monitoring the economic and financial standing (EFS) of suppliers is about understanding the financial capacity of suppliers to perform a contract in order to safeguard the delivery of public services.

1.1.2 This Guidance Note provides advice on how to:

- assess the EFS of bidders during a procurement;

- monitor the ongoing EFS of suppliers during the life of a contract;

- mitigate the financial risks identified from the EFS evaluation of a bidder, either upfront or during the course of the contract.

1.1.3 Effective evaluation and monitoring of the EFS of suppliers both pre and post procurement, forms part of a wider strategy to maintain a healthy market as detailed in HMG’s Sourcing Playbook.

1.1.4 The contents of this Guidance Note are relevant to all Central Government Departments, their Executive Agencies and Non Departmental Public Bodies.

1.2 Timing and Scope

1.2.1 This Guidance Note is expected to apply to all new procurements with an expected contract value exceeding the relevant threshold set out in the Public Contracts Regulations 2015 (Public Contracts Regulations). In applying the guidance however, bodies will need to consider whether the recommended approach is appropriate to their particular procurement and to adopt a ‘Comply or Explain’ approach.

1.2.2 This Guidance Note applies to services and construction contracts. Model contractual provisions dealing with monitoring the ongoing EFS during the life of a contract are set out in the Model Services Contract and Mid-Tier Contract. Generally, the provisions for services and construction contracts in this Guidance Note will be the same; where there will be differences, we have highlighted these in this Guidance Note.

1.2.3 Construction is part of public works, which also includes all building, civil engineering and infrastructure including refurbishments and retrofit. This includes construction of equipment (e.g. construction enablers, such as scaffolding, drilling equipment), excluding goods (e.g. goods utilised as part of the works, such as window frames).

1.3 Contact

1.3.1 Feedback on and enquiries about this Guidance Note should be directed to [email protected].

2. Assessing the Economic and Financial Standing of Bidders and Suppliers

2.1 Purpose

2.1.1 The purpose of assessing the EFS of bidders and suppliers as part of a procurement is twofold:

- To assess the bidders’ financial capacity to perform the contract and;

- To assess whether appropriate risk mitigations can be put in place to address any identified issues with bidders’ financial capacity.

2.1.2 Failure to assess EFS effectively could result in the appointment of a financially challenged supplier which may subsequently:

- Adopt sub-optimal behaviours;

- Fail to deliver aspects of a contract to a satisfactory standard;

- Fail to deliver all elements of the contract if it subsequently experiences financial distress1 or becomes insolvent.

2.1.3 A Contracting Authority may then:

- Incur additional time and cost in managing and re-procuring the contract or bringing the delivery of the service in-house;

- Potentially bear an increased contract price, particularly if urgent short-term or interim arrangements are required;

- Suffer from delays to the provision of important public works and/or risks to the quality and continuity of critical public services.

2.2 Principles

2.2.1 Procurement law requires that requirements of bidders to demonstrate EFS are related and proportionate to the subject matter of the contract and are limited to those that are appropriate to ensure that the bidder has the financial capacity to perform the contract. Therefore, all assessments of bidders’ EFS should be tailored to the contract while ensuring protection of taxpayer value.

2.2.2 All bidders, whatever their size and constitution, shall be treated equally and without discrimination during the assessment of their EFS. No SMEs (small and medium sized enterprises), public service mutuals or third sector organisations should be inadvertently disadvantaged by the EFS assessment approach and metrics applied. This can be achieved by allowing all bidders to propose relevant mitigations where risks are identified that arise from an organisation’s size or structure. [footnote 1]

2.2.3 EFS should be utilised as a critical hurdle to assess bidders’ capacity to deliver the contract at selection stage. The selection stage may also include assessment against other, non-financial criteria.

2.2.4 Assessment of EFS shall be transparent and objective. It should be based on a set of metrics and ratios appraised against pre-determined thresholds to provide a set of risk classifications for each bidder. Bidders should be able to see their risk classifications as they complete the financial assessment and, where relevant, given the opportunity to explain why different risk classifications may be more appropriate.

2.2.5 In many cases the assessment can be based on a standardised set of metrics and ratios, although these should be reviewed to ensure they are related and appropriate to the contract. For example, for certain contracts, such as procurements of more critical, complex works and services, or for longer periods, additional or alternative metrics and ratios may be appropriate.

2.2.6 The assessment of a bidder’s EFS should be conducted by staff with a financial background, calling on specialist in-house or external expertise as necessary. This may include consulting the Markets, Sourcing & Suppliers team in the Cabinet Office for suppliers operating across Government to understand any systemic risks.

2.2.7 Suppliers’ financial information may be available through the Supplier Registration Service (where it is being used to complete the Selection Questionnaire), which may reduce the burden on bidders and Contracting Authorities.

The assessment of a bidder’s EFS should be conducted by staff with a financial background, calling on specialist in-house or external expertise as necessary.

This may include consulting the Markets, Sourcing & Suppliers team in Cabinet Office for suppliers operating across Government to understand any systemic risks and wider sector performance. Queries can be directed to: [email protected]

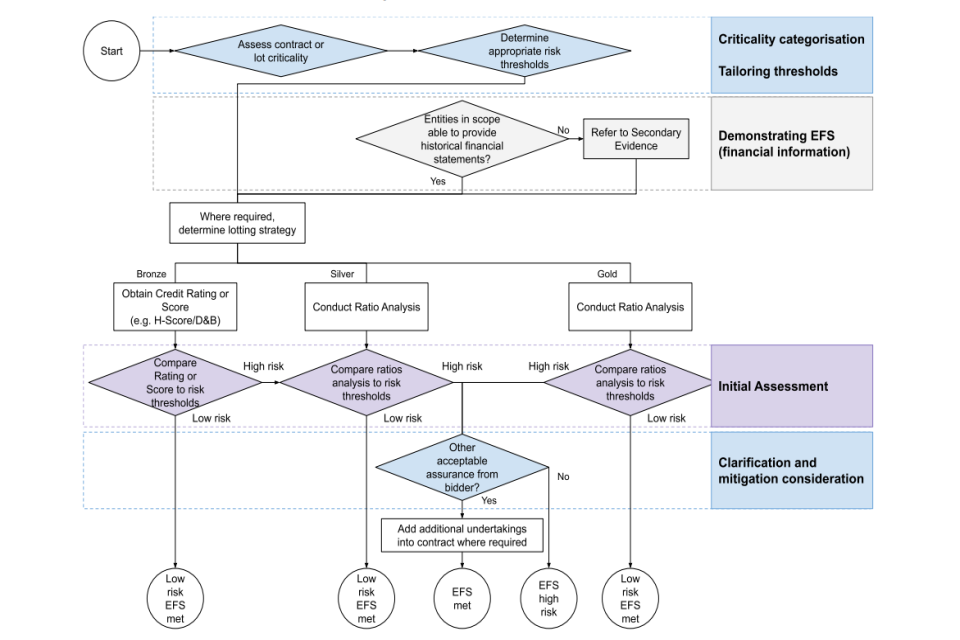

2.3 Process map

2.4 Contract categorisation and risk thresholds

Categorising contracts

2.4.1 In order to determine what constitutes a proportionate assessment of EFS, Contracting Authorities should, prior to commencing a procurement, determine the criticality of the potential contract or framework lot. The criticality should drive the level of EFS assessment and risk thresholds as well as any associated contract management requirement or need for financial assessment subject matter expertise.

2.4.2 Cabinet Office has developed a Contract Tiering Toolo measure criticality. The Tool takes into account various criteria, including the potential impact of service failure, the speed and ease of switching suppliers and the contract value. Contracting Authorities should use this tool for consistent categorisation of contracts or lots between ‘Gold’ (most critical), ‘Silver’ and ‘Bronze’ (least critical).

2.4.3 As detailed in the table below, the Gold:Silver:Bronze categorisation should inform both the level of financial analysis of bidders and the financial thresholds utilised for this analysis, although these would need to be reviewed to ensure they are related, proportionate and appropriate. Contract classification will be made known to suppliers as part of the EFS assessment process.

| Category | Description | Assessment |

|---|---|---|

| Bronze (least critical) | Bronze contracts are typically smaller, simpler contracts for non-critical works and services. In these cases it may be appropriate to carry out a more basic financial assessment. | In order to keep the assessment proportional, Contracting Authorities may wish to use ‘off-the-shelf’ financial analyses and risk assessments from a credit score or ratings agency. Examples include Experian, Company Watch and Dun & Bradstreet. High risk thresholds could be set at the level that indicates high risk of default, for example: 25 for a Company Watch H score; 10 for a Dun & Bradstreet failure score. Where a bidder falls below the thresholds set, a more detailed assessment, including ratio analysis, should be undertaken, with bidder clarification or mitigation as required. ‘Off-the-shelf’ scores should not, on their own, be used to assess a bidder as high risk, without further investigation. |

| Silver | Silver contracts are typically contracts for important but not critical works and services. In these cases a more detailed financial assessment is appropriate and risk thresholds should be set accordingly. | The assessment should use the standard financial metrics and ratios set out in ‘APPENDIX I – Standard Financial Ratios’ and appropriate and proportionate risk thresholds; these can be tailored from ‘APPENDIX II – Interpreting standard financial metrics’ |

| Gold (most critical) | Gold contracts are typically larger, longer contracts for complex or critical works and services. In these cases a very detailed financial assessment is appropriate; risk thresholds should be set at the same level as for Silver contracts or higher. | The assessment should normally include as a minimum the standard financial metrics and ratios set out in ‘APPENDIX I – Standard Financial Ratios’ and appropriate and proportionate risk thresholds at the same level or higher than those for Silver; these can be tailored from ‘APPENDIX II – Interpreting standard financial metrics’. Contracting Authorities should also consider whether to carry out additional analysis, for example the use of additional financial metrics, ratios and/or trend analysis |

Tailoring thresholds

2.4.4 In setting high medium or low risk thresholds, Contracting Authorities should always seek to reflect industry specific circumstances. APPENDIX II sets out some suggested thresholds that Contracting Authorities should tailor to ensure they are related and proportionate to the contract or lot.

2.4.5 Thresholds at which a bidder would be required to provide additional mitigations should be specified in advance. Such thresholds may be linked to the risk rating across multiple financial metrics or ratios. Thresholds shall be transparent, objective and proportionate to the requirement under procurement.

Using credit scores and credit ratings

2.4.5 Credit ratings issued by major credit ratings agencies can also be used to provide an indication of a bidders EFS in support of other metrics.

2.4.6 Contracting Authorities should not use the lack of a credit rating, a minimum credit rating or its accompaniment by a negative outlook on the bidder’s rating as a reason to eliminate a bidder; other financial ratios should also be considered.

2.4.7 Credit ratings should be distinguished from the credit scores issued by credit scoring agencies Credit scores are based on algorithms; while they provide a predictive indication, their usefulness is limited by their dependence on backwards-looking published financial information which can be out of date. Credit scores should be used to corroborate other analysis or to assist identifying potential risk for investigation, but should not be relied upon as the sole measure of EFS for Gold and Silver procurements.

2.5 Application to frameworks

2.5.1 Where a Contracting Authority is procuring a framework agreement, it should assess the EFS of bidders in a similar manner to the procurement of a standard contract. The Contracting Authority procuring the framework agreement should also monitor the ongoing EFS of suppliers on the framework agreement.

2.5.2 To manage the burden of a high volume of EFS testing, a Contracting Authority procuring a framework agreement could explore reducing the numbers of periods of accounts tested or use of simplified ratios. Any measure should remain consistent with the principles outlined in this guidance and the legal frameworks in place at the time and should be fully articulated in the framework documentation for the benefit of bidders and customers.

2.5.2 Generally a Contracting Authority entering into a call off contract under a framework agreement[footnote 2] may be able to rely on the assessment of EFS already undertaken, as long as the level of assessment meets the criticality categorisation of the contract, although it should always satisfy itself as to the validity of the EFS assessment in the light of any new information or change in circumstances regarding a supplier, such as new financial statements, since the original framework agreement assessment. This is not a new EFS assessment and should be a check that the original EFS requirements defined within the framework agreement are still being met based on more recent information.

2.5.3 If the level of a framework EFS assessment is inappropriate for the criticality of the call off contract, then an alternative framework or route to market must be used. Digital marketplace routes to market, do not currently undertake EFS assessments. It is therefore the responsibility of the contracting authority calling off from these agreements to ensure that an appropriate EFS assessment is undertaken. The contracting authority must also review the contract documentation of any call off from a framework to ensure that the provisions are suitable for the level of contract criticality.

2.5.4 Where a Contracting Authority runs a mini-competition under a multi-supplier framework agreement it shall invite to tender all bidders capable of performing the contract.[footnote 3] Careful consideration of EFS in the context of capability assessment at the time of the competition to establish the framework agreement should help enable appropriate and proportionate assessments for the assumed range of risk associated with the call-off contracts. Publishing the details of the EFS assessments including the metric calculations, thresholds, entities and accounts tested is important to enable customers to understand the level of assessment undertaken.

2.5.5 Similar to the Model Services Contract, the framework agreement should require the supplier to warrant their financial position before a call-off contract is signed.

2.6 Demonstrating economic and financial standing

2.6.1 Proof of a bidder’s EFS should be in accordance with Public Contract Regulations, Regulations 60(6), (7) and (8). Contracting Authorities are encouraged to exercise flexibility when specifying the financial information they require from bidders. The regulations specify that financial data utilised to evaluate a bidder’s EFS may be provided by one or more of the following[footnote 4]:

- financial statements or extracts from the financial statements[footnote 5], where appropriate (i.e. where publication of financial statements is required by law); or

- a statement of the bidder’s overall turnover and, where appropriate, of turnover in the area covered by the contract for a maximum of the last 3 financial years available; or

- appropriate statements from banks or, where appropriate, evidence of relevant professional risk indemnity insurance.

2.6.2 Where the information set out above is not appropriate in a particular case the Contracting Authority may require the bidder to provide other information to prove its EFS[footnote 6]. Similarly, where the bidder is unable to provide the information set out above for any valid reason, the bidder may provide evidence of its EFS by any other document which the Contracting Authority considers appropriate[footnote 7].

2.6.3 Audited financial statements provide the strongest evidence for assessment and should be considered if offered before available on Companies House. However, where audited statements are not available, other financial information that Contracting Authorities may use, in accordance with Regulation 60(7), to demonstrate a bidder’s EFS includes but is not limited to:

- Parent or ultimate parent company audited accounts (if applicable);

- Guarantees and bonds;

- Bankers’ statements and references;

- Management accounts;

- Financial projections (including cash flow forecasts) and order book pipeline;

- Details and evidence of previous contracts, including contract values; and

- Other evidence of capital availability.

2.6.4 Contracting Authorities should be aware that use of historical financial information is subject to various shortcomings such as timeliness and lack of forward view.

2.6.5 The majority of companies are only legally required to file accounts nine months after their year-end. Where the latest published financial statements have been drawn up to an accounting reference date more than 12 months previous to the submission of the EFS information, Contracting Authorities should consider requesting management accounts drawn up to a more recent date to evaluate the bidder’s EFS. Such accounts may need to cover a 12 month period to reduce the need for extrapolation. In addition, where the backward looking information generates a medium or high-risk outcome in the financial tests, Contracting Authorities may, subject to legal advice, consider requesting forward-looking information as part of the permissible additional information if such information is appropriate in the particular case. However, the requirement for permissible additional information needs to be clearly disclosed at the SQ stage and offer a few options so that bidders can select the most appropriate evidence (e.g. forecasts for listed entities may be market sensitive).

2.6.6 Management accounts and financial projections should be supported at the minimum by written representations from the Boards of bidders and ideally by independent assurance. The acceptability of different forms of information and assurance will depend on the criticality of the potential contract; where the procurement is for a ‘Gold’ contract the appraisal should be supported by the latest audited financial statements or independent support of the bidder’s EFS.

2.6.7 A number of frequent bidders have registered with central information repositories such as the Supplier Registration Service. Contracting Authorities are encouraged to use central repositories, such as the Supplier Registration Service, as sources of financial information on bidders but should take care that the information is the most recent available and that it relates to the correct bidding entity, particularly in the case of corporate groups.

2.6.8 Bidding entities may be registered in different countries, have similar names to subsidiaries or have recently changed their names. The standard Selection Questionnaire requires bidders to submit their company name and company registration numbers (this may be from Companies House or an equivalent). Where a bidding entity is registered overseas, provision of translated accounts and appropriate supporting documentation should be requested.

2.6.9 Any non-public information shared with the Contracting Authorities during the procurement process will be treated as confidential and will be used solely for the purposes of assessing the financial standing of the supplier on that particular procurement.

2.7 Clarifying risk classifications

2.7.1 Bidders should be able to see their risk classifications as they complete their financial assessments and offer a written explanation as to why different risk classifications may be more appropriate. Clarification questions from Contracting Authorities should:

- Clearly specify the source of the concern;

- Ask why this is the case;

- Probe how the bidder is seeking to address the issue raised;

- Invite additional evidence to be provided as required.

2.7.2 Bidder’s explanations may include:

- Non-underlying or one-off items;

- Improvements in a bidder’s EFS since the accounting reference date used in the assessment due to management actions, improved financial performance or raising of additional capital for example;

- Adoption of new accounting policies/standards;

- Alternative ratio calculations[footnote 8]; and

- One-off use of restricted reserves accumulated by a charity.

2.7.3 A Contracting Authority should consider the validity of such explanations (Appendix I provides an outline set of possible mitigations for each metric) and take them into consideration in its assessment of a bidder’s EFS. Where a significant period of time has passed since the bidder last published financial accounts, Contracting Authorities might consider asking bidders for latest management accounting data to confirm that these are consistent with narrative explanations provided.

2.7.4 A Contracting Authority can contact the Markets, Sourcing & Suppliers team in the Cabinet Office in relation to the EFS of Government Strategic Suppliers[footnote 9] and Critical Contracts. The Contracting Authority may also share EFS assessments with another government body subject to taking appropriate care to protect any confidential information provided by bidders. As each Contracting Authority may have different risk appetites and different assessment requirements and methodologies tailored to individual procurements, the relevance of shared EFS assessments may be limited.

2.7.5 The bidder’s EFS is assessed at the selection stage of a procurement but may be revisited if there are any concerns subsequently based on a change in circumstances or new information available since the initial assessment. It is good practice to monitor any changes to the EFS of bidders in the case of a long procurement. It is also prudent for Contracting Authorities to include provision in the procurement documentation obliging bidders to disclose any such change in circumstances promptly after occurring; some forms of model contract require bidders or suppliers to warrant no Financial Distress Events (FDE) has occurred or is subsisting at the time of entering in to a contract.

2.7.6 Immediately prior to contract, a Contracting Authority should confirm whether there has been any change to a bidder’s EFS which would have resulted in a different risk classification if it had been known at the time of the original assessment. If such a change has occurred, a Contracting Authority should consider whether adequate risk mitigations can be implemented. If the EFS of a winning bidder is considered to have deteriorated to such an extent as to pose an unacceptable risk, the contract should not be awarded to that bidder.

2.7.7 Where there has been a change in circumstances affecting a bidder, a Contracting Authority may seek to calculate proforma ratios based on the event or change of circumstances. This should be considered in the light of circumstances at the time and would normally only be appropriate where updated figures are available from the bidder or a reputable independent source or can be estimated with reasonable certainty[footnote 10].

2.7.8 The Contracting Authority should explain how it has derived the proforma ratios and give a bidder the right to explain in writing why application of a different risk classification would be more appropriate before using the proforma ratios as a basis for its appraisal of EFS. Examples of changes in circumstances in which use of proforma ratios might be appropriate include but are not limited to:

- The announcement of an acquisition or a change of control;

- The declaration or payment of large dividends or other distributions; and

- Publicly announced interim or final results or profits warnings.

2.7.9 Where bidders are not yet felt to have addressed concerns raised satisfactorily, Authorities should now consider whether they should be asked to commit to relevant mitigations as a condition of being taken forward. See Section 3 for more detail.

A Financial Viability Risk Assessment Tool is available which can be completed by individual bidders.

The model automatically calculates a series of financial ratios and, subject to the insertion of the desired individual ratios and thresholds, can generate potential risk bands by ratio for each bidder subject to override by the Contracting Authority as set out above. Input of information should be checked by the Contracting Authority back to the source material provided by the bidder. Where there is a compelling rationale, the Contracting Authority may tailor their Tool to be more suited to the assessment of EFS of potential bidders.

2.8 Considerations relating to the types of entities in scope

Groups and parent companies

Where a bidder is a member of a group, it may benefit from the greater financial resources available to the group.

If a bidder is unable to demonstrate low or medium risk EFS a parent company guarantee may be sought as a potential mitigation. A written commitment from the parent to provide such a guarantee would normally be sufficient at selection stage.

In this case, the EFS assessment should include the bidding entity and the guarantor. If the guarantor is assessed as high risk, the Contracting Authority should determine that the bidder is high risk due to their reliance on a high risk guarantor.

Key sub- contractors[footnote 11]

The Cabinet Office standard Selection Questionnaire requires bidders to set out whether they will be using sub-contractors and to include the approximate percentage of the contractual obligations to be performed by each sub-contractor.

Where a key sub-contractor is identified, the EFS assessment should include the bidding entity and the key sub-contractor.

The Contracting Authority may apply the same tests and thresholds as applied to the bidding entity or may tailor the thresholds, for instance pro-rata, to represent the proportion of the works or services to be delivered by the key sub-contractor.

If the key sub-contractor is assessed as high risk, the Contracting Authority could require the bidder to replace the key sub-contractor as a mitigation, providing a key sub-contractor that can be assessed at lower risk can be found. If this is not possible, the Contracting Authority should determine that the bidder is high risk due to their reliance on a high risk sub-contractor.

Joint Ventures (JV), Special Purpose Vehicles (SPVs) and Consortia

These bidders may not be able to demonstrate capacity through EFS assessment on a standalone basis and specific consortia members may be less well placed to achieve low risk EFS assessments.

In order to mitigate this risk, the Contracting Authority should normally seek ‘joint and several’ guarantees from the major shareholders (i.e. not ‘proportionate’) or consortia members.

A written commitment to provide such guarantees would normally be sufficient at selection stage.

In this case, the EFS assessment should include all the entities bidding or party to guarantees.

Support

Where they have questions or issues, Contracting Authorities are encouraged to consult with colleagues in the Markets, Sourcing & Suppliers Team ([email protected]) in Cabinet Office.

3. Mitigating Financial Risk

3.1 Introduction

3.1.1 This section reviews ways to mitigate risks arising from a bidder’s EFS which have been identified at the procurement stage. It also reviews ways to manage changes to a supplier’s EFS which may occur during the life of the contract. Authorities should ensure that any such additional commitments agreed to by the bidder in the procurement, for example more regular financial monitoring, appear in any contract awarded to the bidder, should the bidder be successful.

3.1.2 Some of these mitigations, for example bonds and other financial instruments, can be expensive and their cost and availability can be impacted by the wider economic conditions at the time of procurement. The requirement and choice of a mitigation should be proportionate to the identified risk and procurement. The selected mitigation should also be carefully assessed against the costs and expected protection for the Contracting Authority. Contracting Authorities should ensure that the cost of any such security is included in the bidder’s price.

3.2 Insurance

3.2.1 Employers’ Liability Insurance is generally required by law to cover employees and many insurers incorporate it into their business insurance policies.

3.2.2 Public Liability Insurance provides cover where a customer, contractor or member of the public is injured and the service provider is at fault. This is often combined with Employers’ Liability Insurance.

3.2.3 Professional Indemnity Insurance is typically required to cover the provision of professional services such as financial services or IT consultancy. It may be required if advice is being provided to customers, if data belonging to a customer is being handled or the service provider is responsible for a customer’s intellectual property.

3.2.4 Levels of cover: A Contracting Authority will typically wish to specify the level of insurance cover required; the Authority should therefore formulate its intentions before commencing a procurement.

3.2.5 A blanket approach to levels of cover should be avoided. The level of cover should be based on the risk inherent in the contract under procurement. Adopting a blanket approach can create unnecessary expense and friction for small businesses which do not trade regularly with the public sector.

3.2.6 Contracting Authorities should therefore be proportionate in their specification of insurance requirements having appropriate regard to the balance of risk and value for money in setting the level of cover required. Contracts should be considered on an individual basis.

3.2.7 Unless the employer is exempt, Employers’ Liability Insurance minimum cover of £5m is fixed by law.

3.2.8 If at the bidder selection stage a bidder does not hold the level of insurance cover required, an undertaking to secure the cover if it should be awarded the contract should normally be sufficient. It is not necessary at the bidder selection stage to insist that the cover be in place.

3.3 Guarantees and Bonds

3.3.1 Guarantees and bonds can be either performance or financial guarantees, or a hybrid of both. They only crystallise when a supplier has failed to perform works or services (performance guarantee) or to pay a sum due (payment guarantee). As such, they provide a remedy once a supplier has failed to deliver the works or service rather than directly supporting performance of the contract.

3.3.2 The financial markets can provide a variety of alternative financial instruments to protect customers. Since these can be expensive and their cost is likely to be reflected in bidders’ tenders, it is generally preferable to seek a parent company bond or guarantee first where this is available and credible. It should be noted however that bidders’ existing debt terms may prevent the creation of new guarantees in some cases.

3.4 Guarantees

3.4.1 Under a guarantee, another party (the guarantor) undertakes to fulfil the terms of the contract (a performance guarantee) and/or make payments due but not made by the supplier and/or provide financial compensation to the Contracting Authority (a financial guarantee) if the contract is not fulfilled or a sum of money not paid.

3.4.2 Where a potential supplier’s EFS appears lower than the thresholds required and subject to any clarifications with the potential supplier in this regard, Contracting Authorities should ask it to procure a guarantee from a guarantor with greater EFS or alternative means of support. It is important that any guarantor has adequate assets and is an entity of substance as a guarantee is only as good as the EFS of the entity providing it (see also Section 2.8 ‘Entities In Scope’ above). An assessment of the guarantor’s EFS will need to be performed. Contracting Authorities should ensure that any guarantee will survive a change of control of the guarantor or that a mechanism exists to ensure that appropriate alternative arrangements are in place if necessary.

3.4.3 A guarantee can be provided by a member of the supplier’s group or by a bank or insurance company. The latter would normally provide a financial guarantee where the guarantor agrees to indemnify the Contracting Authority against specific financial losses, liabilities and expenses incurred if the supplier defaults on its contractual obligations. These guarantees may be less advantageous, assuming the guarantor remains solvent, than a performance guarantee from the supplier’s parent company or another company in the group which obliges the guarantor to perform the contract if the supplier fails to do so.

3.5 Bonds

3.5.1 Bonds are typically provided by independent third parties, such as lenders and specialist surety providers / insurance companies, and provide financial compensation in the event of supplier failure. A range of different types of bonds are available.

3.5.2 A performance bond can provide some compensation if the supplier is proven to have defaulted on its obligations. It is usually provided at contract award, for an agreed percentage of the total contract value until its expiry date. A performance bond will not of itself ensure that contracts are carried out efficiently and to time, but it will be an additional incentive on the supplier to perform well.

3.5.3 Conditional bonds can usually only be called on (invoked) following a serious breach by the supplier (including becoming insolvent, which would normally allow the Contracting Authority to terminate the contract). These bonds provide a third party incentive to the supplier not to default under a contract it has entered into. They also provide compensation to the Contracting Authority where there is a proven default. They may be required where there are identifiable risks of default by the supplier, subject to value for money considerations.

3.5.4 On-demand bonds include within their terms and conditions the trigger and mechanism for calling on them. These are expensive and therefore more onerous for the supplier; they should typically only be used for high risk and/or high value projects where the costs and/or consequences of default by the supplier are high. They can be called on at the sole discretion of the customer, i.e. there may be no need to establish that the contract has been breached; if the agreed conditions for calling are met, the payment shall be made.

3.5.5 Contracting Authorities should seek professional advice on the use, best choice, and drafting of bonds, taking into account that the availability and cost of bonds can be affected by the wider economic climate. In particular, they should be used proportionately as they can be burdensome requirements for small/medium value contracts and their costs are likely to be reflected in tenders. They should only be used where appropriate to the procurement in question. Consideration should also be given to whether any requirements for bonds could effectively preclude smaller firms from bidding.

3.5.6 Performance bonds and sureties are often used in construction contracts where there is an active private market in the provision of such bonds and where performance can more easily be measured; they would not normally be used to support services contracts.

3.6 Other methods to mitigate financial risk

3.6.1 Risk mitigations should be proportionate to the risk identified and the inherent criticality of the contract. Please refer to the Resolution Planning guidance for more details on various protection mechanisms.

3.6.2 Contract management and monitoring procedures should help ensure that contractual services are delivered in accordance with the terms and conditions of the contract. Active and thorough contract management is essential; monitoring reports provide the basis for deciding whether action should be taken if there is a specific performance issue. In many cases, the contract will also contain specific financial (service credit) and non-financial (correction plan) remedies in the event of poor performance.

3.6.3 Project Bank accounts (PBAs) for construction projects can protect payments to the supply chain. PBAs are ring-fenced bank accounts whose sole purpose is to act as a channel for payment on construction projects to ensure that subcontractors and other members of the supply chain are paid on the contractually agreed dates. The employer (i.e. the Contracting Authority) pays money owed to subcontractors and others in the supply chain into a project bank account, rather than paying the main contractor (who would in turn cascade the payments down). Payments are made directly from the account to the relevant subcontractors and other supply chain members in accordance with the payment arrangements agreed. This is a common practice on Government construction projects to protect the supply chain from the insolvency of the main contractor on a project.

3.6.4 Step-in rights allow a Contracting Authority to take over some or all of a supplier’s contractual obligations for a temporary period to rectify a problem (usually a major performance failure), after which control is returned to the supplier. A trigger could be where a failure by the supplier causes the Contracting Authority to be in breach of a statutory duty where the Contracting Authority has no option but to assume control of the service in order to remedy the statutory breach. A permanent replacement supplier cannot be appointed under these measures; that would require a fresh competition in accordance with applicable procurement law. The Model Services Contract contains standard step-in rights for services contracts and they are often contained in collateral warranties on construction projects or other complex procurements.

3.6.5 Escrow arrangements can be used, where appropriate, to protect critical software and technology assets. Escrow services are provided by neutral third party escrow and verification specialists. Risk is mitigated by ensuring the Contracting Authority has access to source code and other proprietary information needed to maintain technology should the service provider go out of business or fail to provide support. The trusted third party escrow specialist will securely hold the source code and release it under specific contractual conditions.

3.6.6 Whether an escrow arrangement is entered into and who bears the cost[footnote 12] is subject to agreement between the parties. Escrow arrangements should not be required for open source software since the source code would normally be provided with the software.

Suppliers of Gold (critical) contracts and Public Sector Dependent suppliers[footnote 13] should be required to provide resolution planning information to allow Contracting Authorities to understand better the potential impact of a supplier’s insolvency.

This should enable Contracting Authorities to work more closely with suppliers to develop mitigations to protect short-term service continuity together with plans for the accelerated transfer of responsibility for service provision to protect longer-term service continuity. Further details, including best practice for contingency planning, are set out within the Resolution Planning guidance.

4. Monitoring the Economic and Financial Standing of Suppliers following Contract Award

4.1 Background

4.1.1 The EFS of suppliers (previously bidders) can change throughout the term of a contract. Therefore, Contracting Authorities should regularly monitor the EFS of their suppliers.

4.2 Principles

4.2.1 Contracting Authorities should identify their Key Suppliers and monitor their EFS[footnote 14] on an ongoing basis. Its frequency should reflect the perceived risk of failure, the frequency of the supplier’s own financial reporting regime and any contractual arrangement for data provision. Monitoring should be carried out at least annually and include a review of EFS metrics and wider business considerations using interim or full year results, public and/or reported information under the contract. More regular reviews are particularly recommended for Public Sector Dependent Suppliers and suppliers flagged by Contracting Authorities as critical for their services or which are perceived to have other than a low risk of financial failure.

4.2.2 Monitoring should also reflect the criticality of the contract and, where appropriate, should cover not just the contractual Financial Distress Events[footnote 15] (or their equivalent) but take a wider view of the supplier’s business[footnote 16] performance against the contract KPIs and wider commercial behaviours (e.g. prompt payment to the supply chain, regular requests for review of contractual mechanisms and recoverable costs). The focus should primarily be on liquidity and solvency.

4.2.3 Where no Financial Distress Event has been notified, boards of suppliers of critical (Gold) contracts and Public Sector Dependent Suppliers should provide formal annual confirmations that no Financial Distress Event or any matter which could cause a Financial Distress Event has occurred.

4.2.4 Where monitoring and follow-up with a supplier suggests a raised level of concern, more regular monitoring and supplier reporting may be appropriate. In such cases, contract managers should ensure their contingency plans are up-to-date and consider whether any further action or enhanced monitoring is required.

4.3 Identifying and monitoring Key Suppliers

4.3.1 Contracting Authorities should identify their key contracts and suppliers using the Contract Tiering Tool Key Suppliers include all suppliers of critical (Gold) contracts or important (Silver) contracts. Contracting Authorities should also consider whether any other suppliers should also be regarded as Key Suppliers.

4.3.2 It can be difficult or impractical for Contract Managers involved in the day-to-day management and monitoring of service under a contract to stand back and appraise a supplier’s EFS; there is also a risk of ‘optimism bias’. Where practicable, an independent specialist team or function should therefore undertake first level monitoring. Several Departments ask their Finance function to undertake this role.

4.3.3 The EFS of all suppliers of ‘Gold’ and ‘Silver’ contracts and any other Key Suppliers should be reviewed at least once per year.

4.3.4 EFS should be a standing item on the agenda of supplier relationship meetings. Reviews should normally take place following publication of the supplier’s statutory accounts and, in the case of Gold contracts, receipt of the annual statement of compliance. In the case of publicly quoted suppliers, interim reviews may also be appropriate following publication of interim results. Where the contract provides for more frequent (e.g. quarterly) testing of Financial Distress Events, the monitoring frequency should adopt the same pattern. Any key supplier considered to be at heightened risk of failure should be monitored more frequently.

4.3.5 Monitoring teams should establish ‘alert’ systems under which they are immediately informed, in respect of Key Suppliers, of:

- any change in a measure that forms part of the EFS assessment, for example changes in credit scores or ratings (where specified and available);

- any stock exchange announcements (where suppliers are quoted);

- press articles commenting on a supplier’s profitability or financial standing.

4.3.6 The Markets, Sourcing & Suppliers Team in the Cabinet Office currently monitors the overall financial health of Strategic Suppliers to Government. Subject to observing any applicable confidentiality obligations, the Markets, Sourcing Suppliers Team should regularly share information on the EFS of Strategic Suppliers with the relevant Contracting Authorities. For their part, Contracting Authorities should liaise closely with the Markets & Suppliers Team and make them aware of any relevant information they receive.

4.4 Coverage

4.4.1 Monitoring of Key Suppliers should cover not just the contractual Financial Distress Events but take a wider view of a supplier’s business and financial health and the level of risk. Although suppliers can collapse suddenly and unexpectedly, declines in financial health typically occur over a longer period as a result of changes in the market and/or business performance which then lead to a longer-term solvency problem. It is therefore helpful to be aware of the wider business context and performance metrics, the trends over time and non-financial indicators.

4.4.2 Financial monitoring should cover the supplier, key sub-contractors, any guarantor or monitored supplier specified in the contract and, if this is not the ultimate holding company, the ultimate holding company. Exceptions to this would be where the supplier and/or any guarantor have been deliberately ring-fenced, operationally and financially, from the remainder of the group or where the ultimate holding company acts as a pure investor (as in the case of a private equity investor for example) and the supplier and parent company guarantor have no other financial dependence on the ultimate parent company in which case references to the ultimate parent company should be read as references to the highest parent company of the ring-fenced entity or the highest parent company in the group which does not act as a pure investor.

4.5 The importance of access to liquidity

4.5.1 In terms of immediate risk, lack of access to liquidity is the typical cause of financial failure. It is therefore important to understand a supplier’s, or a supplier group’s, funding strategy and the nature of any borrowing arrangements. Relevant items include:

Committed

If uncommitted, access to credit may be withdrawn by the lender if they determine the supplier’s risk profile has deteriorated. A supplier relying on uncommitted facilities may be an indicator of risk.

Covenants

These are conditions, often financial ratios, that the borrower must meet. These are sometimes attached to the extent drawn down. A supplier close to breaching covenants could be an indicator of risk (this may also be described as limited “headroom”).

Headroom

How much space is there between the potential future peak cash needs and the borrowing already in place? Any lack of headroom should be identified and managed by management.

Extent Drawn Down

How much of the total credit line the supplier has received. A supplier drawing the maximum could be an indicator of risk.

Maturity profile

The dates at which debts fall due. Borrowers typically need to start looking at replacing funding lines 12-18 months prior to maturity. A supplier with a maturity profile that is not spread evenly or is coming up very soon could indicate a higher level of risk.

Repayment type

The capital and interest profile. For example, is it repaid regularly throughout the life of the loan or is it a “bullet loan” whereby there is no payment until the maturity date? On construction projects lenders may permit the ‘roll up’ of interest during the build phase, only commencing payments once the building is complete.

Other items to consider:

- How much reliance is there on other group entities for liquidity?[footnote 17]

- What is the working capital profile of the supplier? Where the business has a negative working capital cycle it collects cash in advance of need. Where the opposite is true there will always be a cash working capital requirement.

- Has the supplier or its group provided security to its lenders?

- Are there any restrictions on how liquidity can be used, for example grants provided for specific activities?

- If a supplier has been identified for enhanced monitoring, what further detail can the aged debtors and WIP report provide in the supplier’s ability to meet its short term liabilities? This is particularly relevant for construction companies with complex supply chains.

4.5.2 Not all of this information is readily available in the public domain; some suppliers may be reluctant to provide details of their borrowing facilities such as details concerning covenants and headroom. Contracting Authorities should consider whether their reluctance to provide such information stems from genuine concerns over commercial confidentiality or potential issues in the supplier’s financial standing.

4.6 Access to forward-looking information

4.6.1 The limitation of using published information is that it is backward-looking and can often be a year or more out of date. Monitoring should therefore include access to forward-looking information where possible. In the case of publicly quoted suppliers, the share price performance relative to its peers or a relevant stock market index can provide a useful indication of investor sentiment towards the company. The short percentage of a supplier’s shares can also be useful; as this indicates some investors are “betting against” the company.

4.6.2 In the case of private suppliers which are not members of a publicly quoted group, it may be appropriate to seek access to forward-looking information such as financial projections or a simplified business plan. Many suppliers will provide this information to their banks as a matter of course to support their credit lines so will have a standard pack available on request.

4.6.3 Suppliers which are publicly quoted (or part of publicly quoted groups) are generally very reluctant to provide access to forward-looking information as such information may be price sensitive. In extreme situations, for example, if an FDE contractual clause is triggered, government may be willing to become an insider and to enter into appropriate non-disclosure agreements; Contracting Authorities should always take legal advice and/or consult Cabinet Office Markets, Sourcing & Suppliers Team first in such circumstances because of the obligations involved.

4.6.4 Where analyst research reports are available, these provide a view on investors’ expectations of a supplier’s future performance (the most useful reports are typically those issued by a supplier’s retained stockbroker). Note however that these can only ever represent a third-party view, that such reports are written without access to the supplier’s internal budget and forecasts, that they cannot be relied upon and that they are written for the benefit of investors, not customers.

Price sensitive information

Contracting Authorities shall take legal advice or consult Cabinet Office Markets, Sourcing & Suppliers Team ([email protected]) prior to accepting price sensitive information and becoming insiders because of the obligations that this status can create.

4.7 Annual confirmation of compliance

4.7.1 The Model Services Contract provides that Suppliers should promptly notify a Contracting Authority following the occurrence of a Financial Distress Event or any matter which could cause a Financial Distress Event. Where no Financial Distress Event or any matter which could cause a Financial Distress Event has been notified, boards of suppliers of critical (Gold) contracts should provide an annual confirmation in writing to the Contracting Authority that no Financial Distress Event or any matter which could cause a Financial Distress Event has occurred and/or is subsisting. Standard wording is included in the Model Services Contract. For construction contracts and Public Sector Dependent Suppliers of critical contracts that are subject to more frequent monitoring, it is recommended that confirmation by boards should be six monthly.

4.7.2 Strategic Suppliers to Government and members of their groups should additionally be required to report by exception to the Cabinet Office Markets, Sourcing & Suppliers Team where they are unable to provide the confirmation. Standard wording is included in the Model Services Contract.

4.8 Follow up

4.8.1 Whether or not a review indicates any concerns, it should be discussed promptly with the Contract Manager. Any concerns should normally then be discussed with the supplier and reassurance sought; it is good practice to hold at least an annual meeting with Key Suppliers to discuss their financial health and strategy.

4.8.2 Where financial monitoring and follow-up suggest a raised or continuing level of concern, contract managers should ensure their contingency plans are up-to-date and consider whether any further action or enhanced monitoring is required. Any concerns and actions should be raised with a senior business owner at an early stage.

4.9 Financial Distress Events

4.9.1 The Model Services Contract contains a set of standard Financial Distress Events or triggers. These should be included in all new critical and important contracts (‘Gold’ and ‘Silver’ contracts). Their purpose is to provide an early warning signal of a supplier’s possible future financial distress and give an Authority the time and opportunity to investigate and take further action if required.

4.9.2 The Model Services Contract also contains a list of Financial Distress Events

based on the principal financial indicators or metrics used to assess bidders’ EFS at the procurement stage. The more important of these metrics should normally be included in Gold and Silver contracts. Contracting Authorities should also consider whether to include any additional Financial Distress Events to reflect the particular circumstances of the requirement under procurement.

4.9.3 Financial Distress Events should generally be applied to each of (a) the supplier, (b) any guarantor, (c) any key sub-contractors and (d) ‘monitored suppliers’. Monitored suppliers would normally be limited to key members of the supplier’s group on which the supplier depends financially or to provide a substantial or critical part of the works or services.

4.9.4 Suppliers of Gold and Silver contracts should be required to warrant to the Contracting Authority, on entering into a contract, that no Financial Distress Event or any matter which could cause a Financial Distress Event has occurred and/or is subsisting4. Standard wording is included in the Model Services Contract.

4.9.5 If a Financial Distress Event is triggered, a Contracting Authority should promptly discuss the position with the supplier. Subject to the detailed mechanism set out in the contract, where the supplier satisfies the Authority that it is a false alert and/or that it has the necessary plans in place to manage the situation, it is appropriate for the Authority not to pursue its full rights, having agreed any enhanced monitoring or other conditions the Authority deems appropriate. In such circumstances a Contracting Authority should revisit their contingency and business continuity plans to ensure that these remain up to date.

4.9.6 If a Contracting Authority remains concerned that the supplier could be entering financial distress, it should actively pursue the situation. See Guidance on Corporate Financial Distress for further assistance.

Information sources and support

Subject to observing any confidentiality obligations, information and best practice should be shared between Contracting Authorities. The Markets, Sourcing & Suppliers Team in the Cabinet Office acts as a Centre of Excellence for Financial Monitoring; it is contactable on [email protected].

5. APPENDIX I: Standard Financial Ratios

This Appendix provides guidance on the standard ratios and metrics that should normally be used as a minimum when assessing the economic and financial standing (EFS) of bidders and suppliers.

The list is not exhaustive and should be tailored to the particular requirement under procurement. Any ratios used should be transparent, objective, proportionate and non-discriminatory.

The methodology for assessing EFS should be clearly described and any minimum financial thresholds for ratios and metrics clearly stated in the Selection Questionnaire or other procurement document.

Where bidders are asked to insert figures in a response or model, a copy of the underlying financial statements or other document supporting those figures should be sought so that they can be checked if required.

A check of all bidders’ inputs may be appropriate during the selection stage but should always be performed on the winning bidder. Where the procurement relates to a critical or important (Gold or Silver) contract, checks should be performed on all bidders at the selection stage to mitigate against delay to the procurement.

Bidder commentary / mitigating explanation

Where a bidder’s ratio score results in an indicative High Risk classification, there is an opportunity within the Financial Viability Rating Assessment template for the bidder to provide explanations in the form of mitigating commentary. If an alternative tool is used the same opportunities should be provided to bidders. In addition to those detailed under each metric, other mitigations should also be considered such as those detailed in Section 3 of this guidance.

Terminology and locating figures

The terms used in the ratio calculations are intended to describe financial statement line items largely found on the face of the primary statements in published accounts; Statement of Financial Position, Statement of Comprehensive Income and Cash Flow Statement. If an entity is not a UK private or public company, the closest matching line item should be used, even if the terminology is slightly different (for example a not for profit entity would refer to a surplus or deficit rather than a statement of comprehensive income).

Groups

Where consolidated financial statements are prepared, consolidated figures should be used.

Currency conversion

The Contracting Authority should specify in procurement documentation the exchange rate for conversion to Sterling. This could be specified at current exchange rates (ie. the rate prevailing at the date of issue of the Selection Questionnaire) or the rate at the relevant date for which the financial metric is being calculated. The Financial Viability Rating Assessment offers space to specify the rate and input non-Sterling figures on the input sheets.

Treatment of non-underlying / exceptional items

Ratios should generally be based on IFRS (or appropriate accounting framework) figures from the financial statements. Where this produces other than a low risk outcome, Contracting Authorities should permit adjustment for non-underlying items or ‘exceptional’ items, subject to satisfying themselves of their nature as both material and out of the ordinary course of business, on the basis that this is likely to provide a better representation of underlying performance. It is recommended that the authorities allow such adjustment after they have engaged with the affected bidder for additional information around the non-underlying items and the overall financial performance.

A Contracting Authority may also adjust for non-underlying items which are material and out of the ordinary where this would move the categorisation to a higher risk banding. Where adopted, the Contract Authority shall:

- include explanation in the Selection Questionnaire or other procurement document;

- disclose the proposed adjustments to the bidder;

- allow the bidder adequate time to respond; and

- appropriately consider any representations the bidder wishes to make.

Note that within the Financial Viability and Risk Assessment tool, exceptional and non-underlying items are not included in ratio calculations where the net total entered is positive (i.e. income). This means operating profit for the purpose of ratio calculation may be less than the operating profit reported as it is net of exceptionals where the total entered is negative.

Accounting periods of other than 12 months: Where metrics are measured for a period rather than at a specific date (for example, operating profit), they should generally be based on figures for periods of 12 months to allow for potential seasonality and comparability. Contracting Authorities should discuss the basis of the adjustments with their Finance Teams if any adjustments are required.

Post balance sheet events (‘PBSEs’): Bidders may draw attention to post balance sheet events in explaining why application of a different risk threshold may be more appropriate than that generated by the ratios. Similarly, Contracting Authorities may adjust for post balance sheet events in preparing proforma ratios.

Modifications of Independent Auditor’s Opinions and Reports: Where the Independent Auditor’s Opinion on the entity’s financial statements is not unmodified / unqualified or contains additional disclosures[footnote 18], Contracting Authorities should review the qualification or emphasis of matter and decide how to proceed. Additional assurance may be required to confirm the entity’s EFS. Particular care should be taken with any Auditor commentary in relation to the going concern assumption.

Metric 1 - Turnover Ratio

Assesses whether winning the contract could have a such a material impact on the organisation that it might struggle to deliver the contract

Turnover Ratio = Bidder Annual Revenue / Expected Annual Contract Value

Definition

Revenue should be shown on the face of the Income Statement. It should exclude the entity’s share of the revenue of joint ventures or associates.

Interpretation

The Turnover Ratio is used to understand how large the contract is compared to the annual revenue of a bidder for the contract. A larger number might suggest that the bidder can accommodate the contract more easily and be better able to deliver the contract.

Where the contract will exceed one year and where the Contract Value is expected to vary over time it is recommended that the highest anticipated Annual Contract Value is utilised in the calculation above. Contracting Authorities should use outputs from any Estimating and Should Cost Modelling activities to arrive at this figure.

Benchmark

The Public Contract Regulations 2015 (Regulation 58.9) permit Contracting Authorities to require a minimum annual turnover of up to twice the estimated contract value (save where a higher figure can be justified by reference to the special risks attaching to the nature of the works, services or supplies). Turnover thresholds should be set at a reasonable level so as to provide assurance of the capacity of the bidder to deliver the goods and services required, without imposing inappropriate and unfair barriers to smaller, particularly social sector, suppliers. Bidders should normally not be eliminated on the basis of the Turnover Ratio alone.

For assessments relating to framework agreements, where there is no single estimated contract value, authorities may use an adapted approach. For example, where a supplier seeks to bid for more than one lot, the maximum contract value across all of the relevant agreement lots could be used in place of an estimated contract value.

Potential mitigations

Where application of the test generates a ratio which would fall into the medium or high risk band, potential mitigations could include:

- Extension of the test to the bidder’s wider group where the bidder is part of a group and the bidder is supported by a parent company guarantee;

- Inclusion of new contracts won by the bidder since the publication of its financial results or the full impact of which is not reflected in the financial statements used for the assessment; and

- Assessment of historic turnover trends or forward looking order books.

Metric 2 - Operating Margin

Measures what proportion of revenues remain after deducting operating expenses

Operating Margin = Operating Profit / Revenue

Definition

The elements used to calculate the Operating Margin should be shown on the face of the Income Statement in a standard set of financial statements. Figures for Operating Profit and Revenue should exclude the entity’s share of the results of joint ventures or associates.

Where an entity has an operating loss (i.e. where the operating profit is negative), Operating Profit should generally be taken to be zero.

Since Operating Margin can vary, the test should normally be based on the higher of (a) the Operating Margin for the most recent accounting period and (b) the average Operating Margin for the last two accounting periods.

Interpretation

Operating Margin is a measure of an entity’s profitability or ability to generate a surplus. A higher ratio would normally suggest, other things being equal, that the entity’s business is more sustainable and able to withstand any change in business and financial circumstances. Conversely, a low or negative ratio may raise doubts over the sustainability of the business and hence the entity.

Contracting Authorities who have completed Should Cost Models should use these as a benchmark to evaluate whether bidders’ may have submitted financially unsustainable bids.

Benchmark

See standard ratios by sector in ‘APPENDIX II – Interpreting standard financial metrics’.

Potential mitigations

The Operating Margin may not be representative of a bidder’s future profitability and hence sustainability. It may also not reflect a bidder’s mission. Where application of the test generates a ratio which would fall into the medium or high risk band, potential mitigations could include:

- Adjustment for any one-off costs or expenses that unduly affected the Operating Margin for the period(s) under consideration and are unlikely to be repeated to the same extent in future years;

- Adjustment for profitable new business won or loss-making business closed since the publication of its financial results or the full impact of which is not reflected in the financial statements used for the assessment; or

- Recognition that the Operating Margin may not be an appropriate indicator of sustainability where, for example, if the bidder is a charity or other not for profit organisation with a mission to subsidise provision of services the bidder may well make a deficit in any one period. Where this is the case it is important to understand the longer term trends, reserve position and what is driving the deficit.

Metric 3(A)* - Free Cash Flow to Net Debt Ratio

Shows what percentage of the supplier’s debt could be repaid in one year if all free cash flow was used to repay debt

- (Metrics 3(A) and 3(B) are alternative measures. Metric 3(A) is more relevant to capital intensive sectors and Metric 3(B) to less capital intensive sectors.)

Free Cash Flow to Net Debt Ratio = Free Cash Flow / Net Debt

Definition

Free Cash Flow = Net cash flow from operating activities – Capital expenditure

Capital expenditure = Purchase of property, plant & equipment + Purchase of intangible assets

Net Debt = Bank overdrafts + Loans and borrowings, including balances owed to other group members + Finance leases + Deferred consideration payable – Cash and cash equivalents, including short-term financial investments

The majority of the elements used to calculate the Free Cash Flow to Net Debt Ratio should be shown on the face of the Statement of Cash Flows and the Balance Sheet in a standard set of financial statements.

- Net cash flow from operating activities: This should be stated after deduction of interest and tax paid.

- Capital expenditure: The elements of capital expenditure may be described slightly differently but will be found under ‘Cash flows from investing activities’ in the Statement of Cash Flows; they should be limited to the purchase of fixed assets (including intangible assets) for the business and exclude acquisitions of other companies or businesses. The figure should be shown gross without any deduction for any proceeds of sale of fixed assets.

- Net Debt: The elements of Net Debt may also be described slightly differently and should be found either on the face of the Balance Sheet or in the relevant note to the financial statements. All interest bearing liabilities (other than retirement benefit obligations) should be treated as borrowings as should, where disclosed, any liabilities (less any assets) in respect of any hedges designated as linked to borrowings (but not non-designated hedges). Borrowings should also include balances owed to other group members.

Deferred consideration payable should be included in Net Debt despite typically being non-interest bearing. Cash and cash equivalents should include short-term financial investments shown in current assets.

Where an entity has net cash (i.e. where application of the formula would produce a negative figure), the outcome of the test should be treated as ‘low risk’ interpretation. An entity’s free cash flow represents the cash generated from its operations which is available for other purposes after ongoing capital expenditure. The Free Cash Flow to Net Debt Ratio effectively shows the proportion of its outstanding net debt (debt less cash), which it could pay off in a year if all its free cash flow went towards repaying debt and is a measure of the bidder’s leverage. A high ratio would normally indicate, other things being equal, that an entity is better able to pay back its debt and/or may be able to take on more debt if necessary. Conversely, a low ratio may raise doubts over an entity’s ability to service its existing debt. Where a bidder is scored as other than low risk, the Authority may want to consider whether the bidder has any supply chain finance or invoice factoring facilities in place.

Benchmark: See standard ratios by sector in ‘APPENDIX II – Interpreting standard financial metrics’.

Potential mitigations: A bidder’s free cash flow for one year in isolation may not be representative of its future ability to generate cash. It may also have other means to service its debt or its debt may not be due for repayment for a significant period. Where application of the test generates a ratio which would fall into the medium or high risk band, potential mitigations could include:

- Adjustment for any one-off costs that unduly affected the free cash flow for the year under consideration and are unlikely to be repeated to the same extent in future years;

- Adjustment for profitable new business won or loss-making business closed since the publication of its financial results or the full impact of which is not reflected in the financial statements used for the assessment;

- Adjustment for exceptionally high capital expenditure which unduly depressed the free cash flow for the year under consideration and is unlikely to be required at the same level in future years;

- A bidder’s ability or plans to repay debt from sources other than the generation of free cash flow from operations, for example through other available unused debt facilities, the sale of an asset or business currently generating limited cash flow or through the use of parent company resources where the bidder is a member of a wider group;

- Access to further liquidity, for example, level of undrawn facilities available; access to financial markets and/or new equity through equity markets. If the bidder plans to repay existing debt with new debt, clarification as to why this would be sustainable should be provided;

- Adjustment for elements of debt or deferred consideration which are only due for repayment in the long-term (for example beyond the maturity of the contract under procurement) or debt which is held with other companies in the same group which is not likely to be required to be repaid;

- Adjustment for changes in relevant Financial Reporting guidance impacting on financial results. Changes in UK and non-UK Financial Reporting standards could result in a change in the Red:Amber:Green Ratio result produced by the FVRA, even though there has been no actual commercial impact on the reporting entity.

- Adjustment for contingent deferred consideration to the extent that the liability is unlikely to crystallise in practice.

Metric 3(B)* - Net Debt to EBITDA Ratio

Shows how many years it would take to repay net debt if EBITDA remained constant and was used in full to repay financial debt

*(Metrics 3(A) and 3(B) are alternative measures. Metric 3(A) is more relevant to capital intensive sectors and Metric 3(B) to less capital intensive sectors. Please see text box below for a new alternative metric for the construction sector).

Net Debt to EBITDA ratio = Net Debt / EBITDA

Definition

Net Debt = Bank overdrafts + Loans and borrowings, including balances owed to other group members + Finance leases + Deferred consideration payable – Cash and cash equivalents, including short-term financial investments

EBITDA = Operating profit + Depreciation charge + Amortisation charge

The majority of the elements used to calculate the Net Debt to EBITDA Ratio should be shown on the face of the Balance sheet, Income statement and Statement of Cash Flows in a standard set of financial statements but will otherwise be found in the notes to the financial statements.

- Net Debt: The elements of Net Debt may be described slightly differently and should be found either on the face of the Balance Sheet or in the relevant note to the financial statements. All interest bearing liabilities (other than retirement benefit obligations) should be included as borrowings as should, where disclosed, any liabilities (less any assets) in respect of any hedges designated as linked to borrowings (but not non- designated hedges). Borrowings should also include balances owed to other group members.

Deferred consideration payable should be included in Net Debt despite typically being non-interest bearing.

Cash and cash equivalents should include short-term financial investments shown in current assets.

Where an entity has net cash (i.e. where Net Debt is negative), the outcome of the test should be regarded as ‘low risk’.

- EBITDA: Operating profit should be shown on the face of the Income Statement and, for the purposes of this test, should include the entity’s share of the results of any joint ventures or associates.

The depreciation and amortisation charges for the period may be found on the face of the Statement of Cash Flows or in a Note to the Accounts.

Where EBITDA is negative, the outcome of the test should be regarded as ‘High risk’ unless Net Debt is also negative in which case the outcome of the test should be regarded as ‘low risk’.

Interpretation

An entity’s EBITDA is a proxy for the cash flow it generates from its ongoing operations. The Net Debt to EBITDA Ratio is often used by lenders as a measure of an entity’s ability to service its debt. A low ratio would normally indicate, other things being equal, that an entity is better able to pay back its debt and/or may be able to take on more debt if necessary.

Conversely, a high ratio may raise doubts over an entity’s ability to service its existing debt. Where a bidder is scored as other than low risk, the Authority may want to consider whether the bidder has any supply chain finance or invoice factoring facilities in place.

Benchmark

See standard ratios by sector in ‘APPENDIX II – Interpreting standard financial metrics’.

Potential mitigations

A bidder’s EBITDA for one year in isolation may not be representative of its future ability to generate cash. It may also have other means to service its debt or its debt may not be due for repayment for a significant period. Where application of the test generates a ratio which would fall into the medium or high risk band, potential mitigations could include:

- Adjustment for any one-off costs that unduly affected EBITDA for the year under consideration and are unlikely to be repeated to the same extent in future years; or

- Adjustment for profitable new business won or loss-making business closed since the publication of its financial results or the full impact of which is not reflected in the financial statements used for the assessment;

- A bidder’s ability or plans to repay debt from sources other than the generation of cash flow from operations, for example through the sale of an asset or business currently generating limited cash flow or through the use of parent company resources where the bidder is a member of a wider group;

- Access to further liquidity, for example, level of undrawn facilities available; access to financial markets and/or new equity through equity markets. If the bidder plans to repay existing debt with new debt, clarification as to why this would be sustainable should be provided.

- Adjustment for changes in relevant Financial Reporting guidance impacting on financial results. Changes in UK and non-UK Financial Reporting standards could result in a change in the Red:Amber:Green Ratio result produced by the FVRA, even though there has been no actual commercial impact on reporting entity.

- Adjustment for elements of debt or deferred consideration which are only due for repayment in the long-term (for example beyond the maturity of the contract under procurement) or debt which is held with other companies in the same group which is not likely to be required to be repaid;

- Adjustment for contingent deferred consideration to the extent that the liability is unlikely to crystallise in practice. The use of the bidder’s Average Month-end Net Debt to EBITDA ratio if the Contracting Authority believes this could be a better reflection of the entity’s financial indebtedness or they are found to be an Average Net Cash position through the year.

- For construction businesses average month end Net debt may provide a better representation of the financial indebtedness of Construction businesses. It uses an average of the month-end Net Debt throughout the year rather than the level of Net Debt at the year-end or half-year which can be positively impacted by withholding payments prior to reporting dates. This may also be a helpful metric for monitoring purposes throughout the lifetime of a contract.

Definitions and calculations, average month end Net debt:

Net debt: Balances owed to other group undertakings + all interest bearing liabilities (other than retirement benefit obligations) + finance leases + deferred consideration payable – Cash and cash equivalents. Note that this does not include hedges linked to borrowings or supply chain finance.