UK Single Trade Window - Policy discussion paper

Updated 11 February 2022

Summary

The 2025 Border Strategy sets out our vision for the UK border to be the most effective in the world. A Single Trade Window is a key commitment within the Strategy. The Government has committed £180 million to build a UK Single Trade Window which will reduce the cost of trade by streamlining trader interactions with border agencies.

There are a number of design choices to shape what services the UK Single Trade Window will offer. This discussion paper sets out a number of questions which we are seeking stakeholder views on to help inform early design work.

This document and the questions within it will form the basis for further engagement with border industry and users of the border. We will seek to explore these questions further in conversation through one-to-one discussions until early spring 2022 and encourage you to take part. Please contact [email protected] if you are interested.

If you are unable to attend a discussion or would like to respond in writing, you can submit responses in written form before midday on 28 February 2022. Submit your written response online.

The UK Single Trade Window

Single Trade Windows simplify traders’ interactions with the border. The World Customs Organisation (WCO) defines such Single Windows as ‘a facility that allows parties involved in trade and transport to lodge standardised information and documents with a single entry point to fulfil all import, export, and transit related regulatory requirements’.

A Single Trade Window, at its core, ensures a single entry point for border data, which results in reduced duplication for users. The World Customs Organisation (WCO) sets out a number of key principles and features regarding data:

- The Single Trade Window allows the trader or intermediary to submit all border data needed in a standardised format. This would mean submitting only once to border authorities through a single portal.

- The Single Trade Window puts the onus on government to facilitate data sharing amongst border authorities and agencies to then receive the information they need.

- This therefore eliminates the need for the user to submit the same data to different border authorities or agencies, via multiple different portals.

We are not alone in developing a Single Trade Window. Many customs administrations such as Singapore, Sweden, the USA and New Zealand already have a Single Trade Window in place, with more in development worldwide, including the EU. We can learn from these countries’ experiences to inform our development and implementation of the UK Single Trade Window.

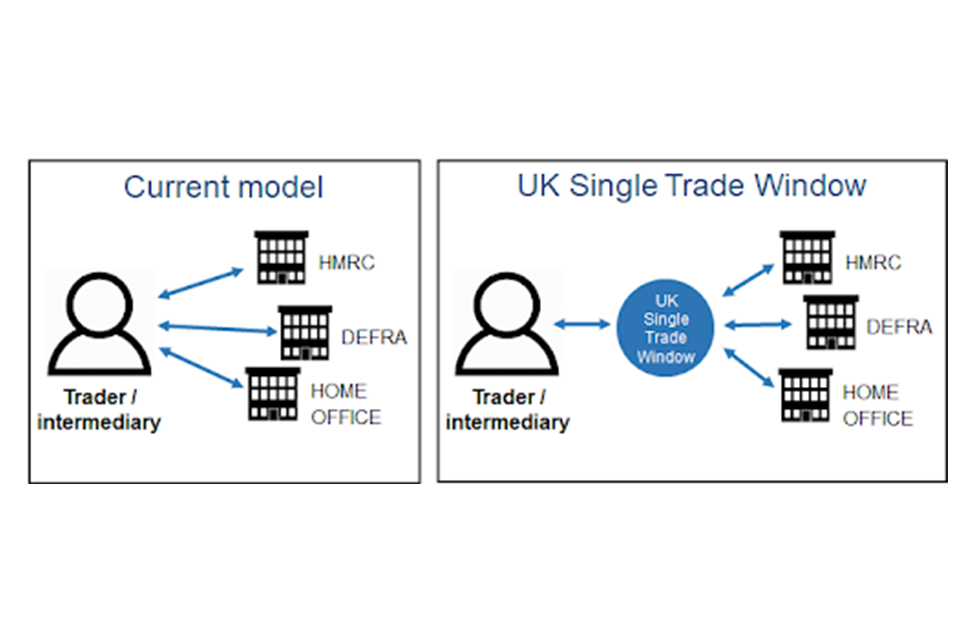

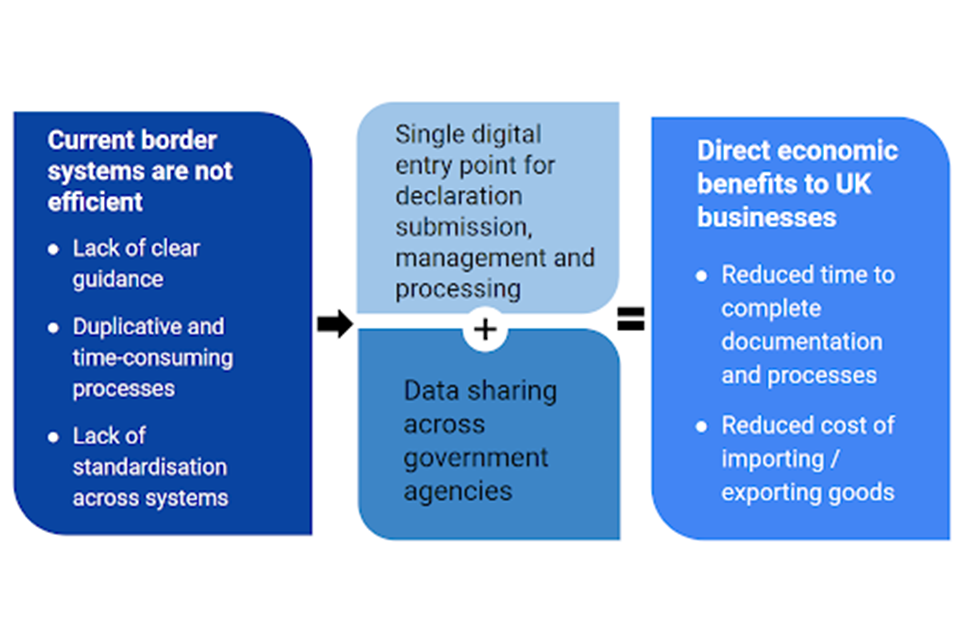

Currently there are multiple government systems which are involved in moving goods across the UK border. Traders and intermediaries submit data to each system as required, with some of this data being duplicative. This creates additional complexity and cost for border users. A UK Single Trade Window will provide a single data portal into which traders and intermediaries can submit data once to government. The delivery of the UK Single Trade Window will also take account of areas of devolved competence.

Through centralising data entry into one point, traders and intermediaries will no longer have to duplicate entry of data and would see reduced administrative burdens. This will also allow for better data sharing amongst government agencies. Ultimately the UK Single Trade Window will lead to reduced costs of importing and exporting goods for businesses.

In addition the Government is interested in exploring other opportunities within, alongside, and following the development of a UK Single Trade Window. As part of bringing together services and processes within a UK Single Trade Window, we will also review the guidance available for border users to ensure that is easily accessible and more tailored to the needs of users.

The Government recently confirmed multiple year funding of £180m for the UK Single Trade Window and the Government is considering the design of the UK Single Trade Window both in terms of the core model of a single data entry point, but also the further opportunities enabled by it. We want to engage with stakeholders in this early design stage to understand how we can achieve the best outcomes for traders and the UK and ensure views and implications are fully understood.

There are four key areas we are looking to explore and understand stakeholder views on, one which relates to the core model of a single data entry point, and three which relate to broader opportunities and considerations. In terms of the core model of the UK Single Trade Window, we are seeking views on;

- Approaches to data collection, and usage, through the UK Single Trade Window. We want to improve how border data is submitted to the government through new data collection options in the Single Trade Window in the short term.

And in terms of the additional and longer term opportunities we want to explore, there are 3 key areas we are seeking views on;

- The potential scope for self-declaration of border data directly into the UK Single Trade Window. Under the UK Single Trade Window, we are exploring the scope for allowing traders and intermediaries to give border data directly to the Government.

- How the UK Single Trade Window should work with existing port and commercial systems, including Community System Providers (CSPs). As we look at the data flows and design choices presented with the UK Single Trade Window, we need to understand how CSPs and other border industry stakeholders can best interact with it.

- The further opportunities and considerations for data in the longer term, including use of supply chain data and interoperability.

For each of these areas, this paper sets out a number of questions which we are seeking stakeholder views on. We wish to discuss this with a broad range of interested stakeholders during the consultation period until early Spring 2022. You can submit a written response using our online form.

This engagement will inform the short term, and future, design choices within the UK Single Trade Window, and there will be further consultation and opportunities for stakeholder input as development continues.

Approaches to data collection, and usage, through the UK Single Trade Window

A Single Trade Window is, at its core, focused on data including how it is captured, used and shared. Improving and automating goods’ data and processes at the border is a key goal for the Government. More timely, complete, reliable and accessible data could provide benefits for traders, government and wider economic and security benefits.

Currently, the border is suboptimal in how it captures, uses and shares data - processes and requirements are duplicative, differentiated and burdensome. This was a key finding from the Government’s 2025 Border Strategy consultation. Respondents raised the need for the Government to:

- Remove duplicating requests for the same data,

- Standardise the format data is requested in,

- Make data sharing processes more automated,

- Develop data sharing agreements with EU and FTA partners, and

- Better manage the significant rise in data volumes.

The Government has taken steps to improve data sharing through the Trade Act 2021, which has provided us with the foundation for a better understanding of the border and trade flows, and supported associated operations and planning through the better use of data. Government has also made progress in standardising the format in which data is collected, for example HMRC has continued to progress adoption of the WCO Data Model across its systems.

There are legal considerations which will be important factors in seeking to improve the sharing and use of industry data. Further legislation will likely be required to ensure we can deliver and make the best use of data improvements through the UK Single Trade Window, and the Government will engage with industry on this in due course.

There are also commercial considerations. For example, commercial sensitivities may impact different actors’ ability and willingness to share their data with government, other businesses and consumers. Furthermore, the data provided is often required to fulfil legal requirements. If a broader range of data sources are used, clarity on responsibilities and ability and willingness to ensure its accuracy will be important.

These considerations are complex, impacting actors along supply chains. Government wants to explore these issues with stakeholders, focussing in particular on improvements that can be delivered in both the short term and longer term as part of the development of the UK Single Trade Window.

Data Sharing and Usage in the Short term

There are two key data sharing features which could deliver direct benefits to industry through the UK Single Trade Window as the service is developed over the coming years:

- Pre-population of data, and

- Multi-filing.

Pre-population of data refers to where declarations would be automatically completed using data previously received, with a view to reducing duplicative entry of data for traders.

The data used to prepopulate declarations could be drawn from multiple sources. For example, and from the easiest to most complex, the data could be drawn from:

- an earlier declaration – be it the same type of declaration or another type of declaration from the same declarant;

- data that the Government already holds from other sources. This includes, for example, data provided in a declaration by one actor in the supply chain and using it to complete a declaration for another supply chain actor;

- the supply chain.

Initial research suggests that, for some declarations, a significant proportion of data can be pre-populated from data collected elsewhere by the Government. This is dependent, to some degree, on data being shared across actors in the supply chain.

Multi-filing refers to where multiple actors in the supply chain input data into the same declaration based on their own knowledge / responsibilities, reducing the burden on one individual actor to manually collate data from other actors.

We would like to understand the extent to which it would be beneficial to allow multiple actors such as traders, carriers and intermediaries to play a direct role in providing the data required to submit declarations, where more than one actor is involved. We recognise that there are both commercial and compliance considerations relating to the visibility of data to other actors in the supply chain involved in the same declaration. In addition, the actor responsible for the declaration would nevertheless still be accountable for the accuracy of the data and timely submission of the declaration.

Questions for discussion on data sharing and usage in the short term:

On pre-population:

- What are the benefits and risks to the pre-population of data in declarations?

- Where do you see pre-population being beneficial and what information might you expect to be in scope of pre-population?

- What considerations should the Government make in relation to the various potential sources of data for pre-population (recognising that some data collection techniques would take longer to develop than others)?

- To what extent are there concerns about who might be liable for mistakes in declarations, as a result of data that is pre-populated? Does industry have other concerns about validating data that is prepopulated, and if so what are they?

On multifiling:

- As with pre-population, to what extent are there concerns about who might be liable if there are mistakes in declarations?

- Should data be visible to some or all other actors in the supply chain who input to the same declaration? If not, what restrictions should be in place? Would restrictions limit the benefits of multi-filing for industry?

- More generally, would industry use multifiling? Would industry prefer to use this service or an intermediary / software and why?

On the role of the Government in providing these features:

- Are you aware of, and have you used private sector logistics or supply chain software which supports pre-population and/or multi-filing for declarations? Do you see benefits/risks in the Government and/or the private sector offering these features?

Additional and longer term opportunities: the 3 key areas

Self-declaration of border data directly into the UK Single Trade Window

Alongside looking at the capture and usage of border data, we need to consider where that border data is sourced from, including whether we should allow more border data to be submitted directly by traders and intermediaries.

The 2025 Border Strategy detailed that a simple ‘self-serve’ function allowing traders or intermediaries to complete border formalities themselves, where desirable, is a feature of a world-leading Single Trade Window. Indeed, these functions are commonplace in international Single Trade Windows.

There are two types of processes which are to be considered here;

- Processes which are done once, or occasionally, to permit or assist traders and intermediaries to trade internationally, e.g. the licences and authorisations users need such as Economic Operator Registration and Identification (EORI) registration, applying for trade simplification schemes such as Simplified Customs Declaration Process or SCDP (previously known as Customs Freight Simplified Procedures or CFSP) or Authorised Economic Operator (AEO), or an Open General Export Licence (OGEL).

- Processes which are completed for every goods movement to enable that trade to take place, e.g. the transactional declarations which are made to the Government such as customs declarations, Sanitary and Phytosanitary (SPS) pre-notifications and Safety and Security (S&S) declarations.

It is intended that the UK Single Trade Window will allow traders and intermediaries to self-complete the processes for licences and authorisations required to trade internationally. Annex A lists some common forms of licences and authorisations.

With regard to transactional declarations, traders and intermediaries can already submit specific types of these free at the point of use, using the Government-provided online tools. This includes export customs declarations, currently through the National Export System (NES), and Sanitary and Phytosanitary (SPS) pre-notifications through Defra’s IPAFFS system. It is intended that the capability to undertake these and other existing self-declaration functions will be incorporated into the UK Single Trade Window, allowing traders and intermediaries to complete actions in one place and therefore streamline processes and interaction with Government. Annex B lists some common forms of transactional declarations and details whether they currently have self-declaration options.

What is being considered regarding self-declaration?

We are considering whether the Government should expand the offering for self-completion of transactional declarations within the UK Single Trade Window. Self-declaration could be done by the Government developing a free-to-use User Interface which enables traders and intermediaries to make a broader range, or all, of the transactional declarations required to move goods into or out of the UK, such as customs import declarations. We recognise the critical role that customs intermediaries and software providers play - and will continue to play - in the UK trade environment, and are clear that a government tool would not seek to replace these options, but sit alongside them. Indeed a key goal of the Single Trade Window is that we enable innovation amongst the intermediary and software development sector.

In the design choices of the UK Single Trade Window, the Government wants to focus on what offering would give the best experience for the user. We know that many users will still want to use intermediaries or commercial software which provide additional value in their offerings for completing border declarations. We want to reduce complexity wherever possible to enable traders to make the best choice for them in how to complete border requirements.

Currently, traders have a number of options available to them to submit transactional declarations. They can either appoint an intermediary (e.g. a freight forwarder, customs agent/broker or fast parcel operator) to do their declarations for them, or they can purchase software through commercial providers, which enables them to submit their declarations into the Government systems.

We will consider which border users would see benefits from a government offering and design the service accordingly, and we are keen to understand from stakeholders which users may benefit from this service. Government recognises that intermediaries provide additional support for traders when submitting declarations, including advising on and completing declarations for which it would be beyond the role of Government to provide as a control authority. Similarly, commercial software provides additional functionality, such as bespoke services and the ability to submit multiple declarations in one transaction. Traders would still be able to choose to use an intermediary and/or commercial software if they wish.

Considering the inclusion of a broader range of transactional declarations, such as full customs import declarations, for self-declaration directly into the UK Single Trade Window is more complex than the authorisation, licence and certification requirements which we already intend to incorporate into the UK Single Trade Window. This is because transactional declarations;

- Can be highly complex for border users to complete. Import customs declarations, for example, require a good understanding of customs information such as commodity codes, Rules of Origin and valuation. Many traders therefore currently use an intermediary to complete declarations on their behalf.

- Can involve and rely on multiple actors to complete processes, for example groupage movements where several individual importers or exporters may contribute to the required transactional declarations. This can also be influenced and improved by the presence of multi-filing functionality as considered above.

- Can require interactions with other, external-to-the Government, systems and processes e.g. port IT/CSP systems.

Therefore, we could deliver a model in which the UK Single Trade Window is focussed solely on encompassing existing self-serve options and relatively simple processes such as licence applications (see Annex A for examples). This would deliver benefits to some traders and intermediaries as all of these existing services would now be consolidated in one system. This is particularly true where traders and intermediaries currently face multiple such requirements for their movements, e.g. applying for a licence or authorisation alongside submitting an export customs declaration. Traders could still engage an intermediary to complete their remaining border requirements if they wish.

However, an alternative model is one which is broader, by offering traders and intermediaries the opportunity to submit other, or all, transactional declarations through the UK Single Trade Window. This would provide a greater choice for how they complete their border formalities and reduce complexity and costs as they would be able to complete all their border requirements in one place

Benefits and challenges of expanding self-declaration

In considering whether the UK Single Trade Window should encompass all or an expanded list of transactional declarations for self-declaration, there are a range of considerations which we would like to gather stakeholders’ views on. Firstly there are a number of potential benefits;

- Broadening the offering to more, or all, transactional declarations and border processes would give border users greater choice, which could help to make international trading more accessible. This could help businesses to expand to new markets, which may result in a positive impact on UK trade.

- By including a broad self-serve declaration function, this would provide an end-to-end integrated Single Trade Window where users are able to access guidance, register for relevant processes, and submit declarations to the Government in one place. This could make the trading journey more streamlined, reducing administrative burdens. The implementation of a self-serve function would not affect existing options for border users, who would still be able to use customs intermediaries and commercial software to complete declarations if they so choose.

- The availability of a self-declaration function could potentially reduce barriers to a business considering international trade for the first time.

However, we also know there are a number of potential challenges and considerations to expanding the offering;

- Border declarations can be complex, and declarants need to have a sound understanding of customs and other requirements such as commodity codes and Rules of Origin. Many traders will therefore still wish to use an intermediary or commercial software to complete their transactional declarations, who can also add other value such as bespoke advice. We are therefore seeking to understand how likely it is that traders would use a self-declaration option for the different declaration types.

- A border declaration meets legal requirements and government enforces border requirements on the basis of its contents. Government would therefore provide guidance and not provide advice to declarants. We would not seek to replace the bespoke service intermediaries offer, but we would like to hear from stakeholders what level of guidance would be required and how we can design the service in a way that supports declarants.

- We would not want to undermine innovation in the private sector, so need to consider how a government offering could complement, and compare with, private sector services which offer declaration services. With this in mind, we are seeking responses on the following questions in particular:

Questions for discussion on self-declaration offerings within the UK Single Trade Window

- Would you use a self-service offering for some, or all, of your border requirements such as import declarations?

- Which declarations and processes should be included in a self-serve offering within the UK Single Trade Window, and how would that support businesses to trade?

- What support and guidance would users need to be able to use this service?

- What do you see as the benefits and disbenefits of a government-provided service over private sector offerings?

How the UK Single Trade Window works with existing port and commercial systems, including Community System Providers (CSPs)

At the UK border, a model of joint delivery operates between the Government and private industry. Community System Providers (CSPs) are a fundamental part of this delivery partnership across many border locations, in particular at inventory linked ports.

CSPs are commercial enterprises and there are currently five in operation across the UK. Which CSP operates at each border location is a commercial decision for that location. It is a requirement for those moving goods through a location where a CSP operates to use the services, systems and processes of that CSP, of which some may be chargeable to the user.

CSPs offer a range of services to port and other stakeholders, including;

- Services in support of port operations, such as confirming arrival of goods at ports; logistics and movement of the goods within the port, and notifying carriers about customs status and clearance of goods.

- Declaration submission services to traders and intermediaries. At relevant ports, traders currently provide their customs and other declaration data to the corresponding CSP, which is submitted to government in order to fulfil border clearance requirements.

In order to deliver these services, CSPs have developed and operate IT systems which are directly connected with key partners including government systems, carriers, freight forwarders, and ports. CSP systems facilitate communications between these different parties and with government agencies, enabling them to coordinate their activities and allow goods to move into and through the port securely and efficiently.

CSP inventory systems provide a single, secure record of location and status of all consignments at the relevant port, or External Temporary Storage Facility (ETSF), ensuring that all the appropriate official and commercial requirements have been met, and that goods are held where not.

Regarding declaration processes, the movement of all customs declarations processing to the new Customs Declaration System (CDS) from March 2023, will mean that traders are able to submit most declarations (excluding customs frontier import declarations) via a public application programming interface (API) rather than through a CSP. However, CSPs will still maintain their port operation services and therefore traders will still need to engage with CSPs processes and systems at relevant ports.

Interactions between CSPs and the Single Trade Window

As set out above, a Single Trade Window seeks to create a single entry point for border data, and facilitate data sharing between border and port authorities, and businesses, to result in reduced complexity and cost for users. We want to explore how the Single Trade Window can best achieve this aim within the context of CSP operations at relevant ports.

In particular we are interested in views on:

- The functions the Government Single Trade Window systems and private sector systems should each undertake in this new environment, and how they should interact;

- How the Government, CSPs, and other affected parties should best transition to the new model under the UK Single Trade Window.

We want to engage with stakeholders to ensure that we design the Single Trade Window in a way which enhances user experiences. This includes assessing the future potential for reducing the complexity users currently experience in using the services of multiple CSP operators delivering services across different locations, with different levels of interoperability and standardisation of process across them.

With these issues in mind, we are seeking responses on the following questions:

Questions for discussion on how the UK Single Trade Window works with existing port and commercial systems, including Community System Providers (CSPs)

- How should the STW take account of CSPs to deliver the most effective border system for traders, recognising the existing commercial models of the CSPs; and what impact could a UK Single Trade Window have on their operating model and the third parties who currently connect to their systems?

- What would the benefits be from further developing the UK Single Trade Window to encourage greater interoperability between private sector systems providers? Would you see it as beneficial to enable increased interoperability specifically between CSP processes and systems?

- What other opportunities do you think there are for improving the way the UK port ecosystem works, and are there any international examples which you would consider are preferable?

Wider opportunities for data usage in the Single Trade Window

There are a number of longer term data acquisition initiatives to improve the Single Trade Window that the Government is exploring, including:

- International interoperability, and

- Increased supply chain visibility.

International interoperability

International interoperability could enable information to be exchanged securely between Single Windows in two or more countries. The potential benefits of this include closer cooperation between countries and reduced administrative costs for traders from the same information needing to be submitted to two or more national authorities.

In principle there could be benefits from national authorities exchanging a variety of digital information, such as export declarations, certificates of origin, e-Phyto certificates and other types of licenses and permits. This could reduce the need to use paper documentation., provide quicker approvals and deliver cost savings for traders.

The Association of Southeast Asian Nations (ASEAN) Single Window provides one example of this type of functionality, where a regional electronic platform promotes ASEAN economic integration by enabling the electronic exchange of border trade-related documents among member states. Traders can exchange customs documentation through the platform, expediting cargo clearance and reducing paperwork.

In October 2021, the Digital Trade Principles, agreed by the G7 countries including the UK, were published. As part of this, developing Single Window interoperability was included as a key goal.

International interoperability of Single Trade Windows could be facilitated by consistent, or straightforwardly compatible data and technological standards. We welcome views on the standards the UK, and potentially the wider international community ought to use moving forward to future-proof and maintain the high quality of systems. We also wish to understand the extent to which international standards, and requirements set by other countries, are influencing businesses’ decisions regarding system choices and capabilities.

Any interoperability between the UK Single Trade Window and the systems of other countries will need to address a number of key issues. These include determining the conditions that should be placed on the use by customs and borders authorities in other countries of data provided by the Single Trade Window. We would like to explore privacy and commercial confidentiality considerations with sharing data internationally. Another key issue to consider is that declarations needed to export, and those needed to import a product are typically the legal responsibility of separate businesses, with associated liabilities on each if the information is incorrect.

The Government is keen to understand the benefits, and potentially test the technical feasibility of interoperability with other countries, and we welcome views on the conditions, and legal framework businesses would want to have in place before agreeing to their data being shared with other national authorities.

Questions for discussion on interoperability

- What benefits do you see with developing interoperability with other countries to automatically share data collected by the UK Single Trade Window? What information should we prioritise exchanging? What are the challenges?

- Which international standards should the UK consider adopting and promoting to support interoperability?

Increased supply chain visibility

Increased supply chain visibility in Government is a further long-term potential capability within the Single Trade Window.

The various parties involved in the creation and distribution of a product, for example the raw material and component providers, manufacturer, distributors, carriers and retailers – and the transactions between them - comprise a supply chain. Product information at each step, and the specifics of the involvement of each party, is increasingly held in digital form (called ‘supply chain data’) and increasingly is shared across parties involved in the supply chain to facilitate commerce and secure supply chains.

Government wants to work alongside the private sector to harness the power of supply chain data at the border, exploiting the new technological capabilities and creating the right legal and regulatory frameworks in order to create a more frictionless trading experience.

In the long-term, supply chain data visibility is likely to bring several benefits:

- It could provide robust traceability of the provenance and movements of goods to Government, businesses and consumers. For government, access to this data could enable better targeted and automated risk assessments, and therefore more timely clearances.

- It could reduce the administrative burden from manually inputting information at successive steps in the supply chain.

- It could be used to support automated customs and other border processes, significantly reducing trader costs and administrative burdens.

More complete, real-time mapping of key supply chains may also carry a range of strategic benefits for business and Government. For example, on critical raw materials, it could allow a robust early warning system to be put in place, which could identify points of failure on the supply side, and allow vulnerabilities to be mitigated with a reduced impact on the end users. Industry would be able to use supply chain data to track its own interests e.g. monitoring the implementation and success of environmental commitments in the production and trading of goods.

Understanding industry’s ability and appetite to share supply chain data

Pilots have shown that it is feasible to connect high integrity supply chain data platforms to Government’s trade systems. One example is the Government’s Reducing Friction in International Trade project, which demonstrated that supply chain data could be extracted securely from the wine industry and then securely distributed and inputted into Government systems. In the future, UK Single Trade Window systems could interact with these platforms resulting in improved timeliness, accuracy, and richness in the data provided to government.

Reducing Friction in International Trade (RFIT) project

This pilot demonstrated that technology-enabled platforms (including Distributed Ledger Technology) could potentially remove the need for traders to generate additional data, as part of customs formalities, to meet government requirements. Instead, under this pilot, commercial supply chain data on the RFIT platform was used to generate declarations in a pre-agreed format accepted by HMG’s customs and trade systems. This pilot demonstrated that by utilising these platforms, the cost of trade in the UK could be reduced, and timeliness improved. It also gave Government access to higher quality, assured data in easier to process formats.

Specifically, the proof of concept collected relevant upstream data from wine producers. This data was made available to authorised parties downstream in the supply chain and was also directly integrated into HMRC’s Customs Declaration System. Such a proof of concept could be extended further to develop interoperable platforms/ networks with other global entities and covering many other commodities.

The Government will continue exploring with industry how supply chain data might become increasingly visible to Government border systems, through piloting technology development work with industry over the coming months.

To future proof the STW and make it truly world leading we believe it is critical that we design it to be able to take advantage of advances in the use of supply chain data. To do this we need to understand:

- the different types of supply chain data already being captured within commercial systems, how much of the data required for customs and other border declarations and processes is currently being generated, and the earliest point at which data could be provided.

- Industry’s appetite to share high integrity, end-to-end supply chain data with the Government given its commercial sensitivity.

- How private sector platforms for supply chain data are likely to evolve and what role the Government could and should play in enabling these.

On the sharing of supply chain data, we want to understand what data businesses would and would not allow to be shared, with whom, and under what conditions. We are keen to explore whether an organisation’s willingness to share additional data would differ according to whether the Government:

- has access to digital supply chain data (allowing call up, but not retention of additional data from private sector systems to verify information provided as part of the declaration), or;

- is provided with an ongoing, pre-specified feed of supply chain data from private sector systems, which it then retains, subject to standard data protection and management requirements.

On the platforms through which supply chain data can be shared we would like to understand industry’s views on those platforms that already exist, their suitability as the basis for integration with the Single Trade Window, and whether industry and government need to partner to create new platforms for supply chain data.

Questions for discussion on supply chain data visibility

- What benefits do you see in providing the Government with access to supply chain data?

- What sort of data would you be able to provide to the Government and what sort of data would you be willing to provide to the Government? How might your data needs change in the future (e.g. your need for increased tracking/traceability of particular goods, assurance of provenance, etc)?

- Beyond the Government visibility of your data, would you have concerns about other third parties e.g. ports, carriers, distributors, other parties involved in the supply chain, or supply chain software or platform providers themselves - having access to your supply chain data? What measures, enabling you to control which other parties have permission to access your data, would need to be in place before you start using a supply chain data platform?

- How should the Government determine which supply chain data systems to support? For example, should we be seeking to integrate supply chain data from existing commercial platforms into HMG systems, or should we build a more ambitious platform with wider benefits?

Glossary of terms

| ASEAN | Association of Southeast Asian Nations |

| CHIEF | Customs Handling of Import and Export Freight |

| CSP | Customs Handling of Import and Export Freight |

| CDS | Customs Declaration System |

| ETSF | External Temporary Storage Facility |

| IPAFFS | Imports of Products, Animals, Food and Feed Systems |

| NES | National Exports System |

| OGEL | Open General Export Licence |

| SPS | Sanitary and Phytosanitary |

| WCO | World Customs Organisation |

Annex A

The table below lists common types of licences, authorisations, and certifications. This list is not exhaustive.

| Licence / authorisation / certification type | Current self-application? |

|---|---|

| Economic Operator Registration and Identification (EORI) number | Yes -via gov.uk |

| Simplified Customs Declaration Process (SCDP) authorisation (previously Customs Freight Simplified Procedures (CFSP) | Yes - via application form |

| Authorised Economic Operator (AEO) authorisation | Yes - via application form |

| Common Transit authorisations | Yes - via application form |

| Customs Comprehensive Guarantee (CCG) | Yes - via gov.uk |

| Duty Deferment Account (DDA) | Yes - via gov.uk |

| Strategic goods exports licences | Yes - via SPIRE |

Annex B

The table below lists common types of transactional declarations, and confirms whether they are intended to be included within the UK Single Trade Window. This list is not exhaustive.

| Transactional declaration type | Current self-declaration option? | Intended for inclusion in the UK Single Trade Window self-declaration offering? |

|---|---|---|

| Full import customs declaration | No | TBC |

| Full export customs declaration | Yes - through National Export System (NES) | Yes |

| Customs supplementary declarations | No | TBC |

| Customs Simplified Frontier Declaration (SFD) | No | TBC |

| Customs import declarations made into authorisations for special procedures | No | TBC |

| Sanitary and Phytosanitary pre-notifications | Yes - through Imports of Products, Animals, Food and Feed System (IPAFFS) | Yes |

| Fishing Certificates for Illegal, Unreported and Unregulated (IUU). This will include the catch certificate, processing statement and proof of storage. | Yes - through the Fish Export Service (FES) for exports. IPAFFS will be used to declare a catch certificate reference number. | Yes |

| Plant health services | Yes - through eDomero | Yes |

| Export health certificates | Yes - through EHCO | Yes |

| Common Transit declarations | Yes - through NCTS | Yes |