Competition Document

Updated 30 March 2023

Any references to the Department for Business, Energy and Industrial Strategy (BEIS) in this Competition Document or any other documents associated with this competition shall, where appropriate, be treated as references to the Department for Energy Security and Net Zero (DESNZ) which was created through the Machinery of Government changes on 7 February 2023

Please note Clarifications resulting from questions raised at the recent Stakeholder and 1 to 1 Events have been added as Appendix 4 on 15 March 2023

30 March 2023. An error in Annex 3A has been corrected. If you previously downloaded a copy of this spreadsheet, please replace it with the latest version.

1. Introduction

The purpose of this document is to provide an overview of the Windfarm Mitigation for UK Air Defence (AD) Phase 3 competition.

The competition is organised by the Defence and Security Accelerator (DASA), funded by the Department for Business, Energy, and Industrial Strategy (BEIS) Net Zero Innovation Portfolio (NZIP); and is undertaken in partnership with the Royal Air Force (RAF) and the Defence Science and Technology Laboratory (Dstl).

This is an open competition and participation in previous phases is not a requirement to submit into Phase 3. This Phase 3 competition builds on Phase 1 and Phase 2 and continues the development of innovative technologies to enable the long-term co-existence of offshore windfarms and Air Defence radar. The technologies we are interested in can be broadly categorised into the following three areas:

- use of signal processing or an alternative/supplementary radar to mitigate the impact of the windfarm,

- use of stealthy materials to reduce the radar signal returned from wind turbines,

- and alternative surveillance methods to monitor the airspace.

IMPORTANT

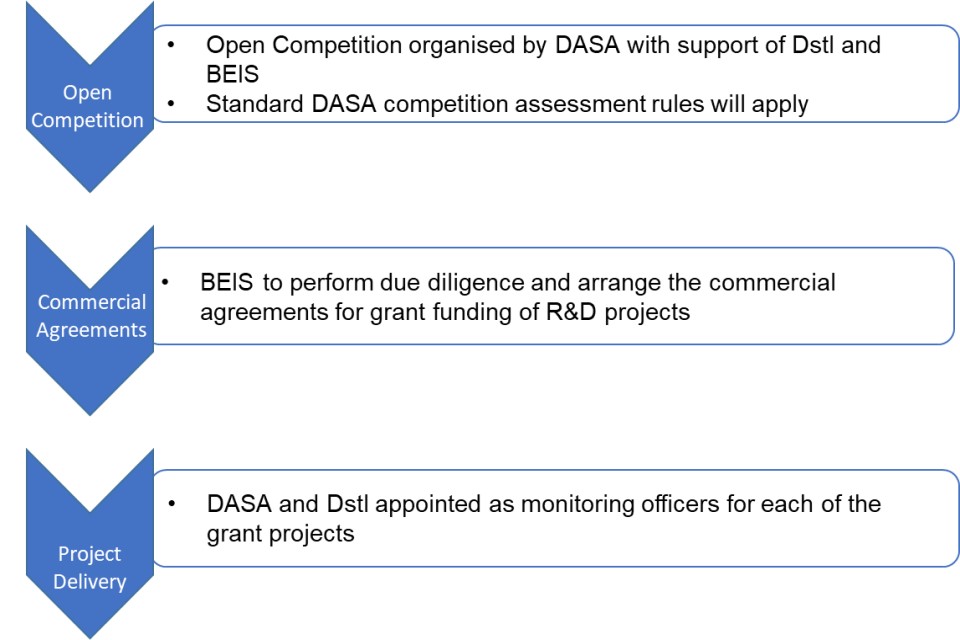

Funding for successful projects will be awarded by BEIS using BEIS’ Grant Funding Agreement (GFA) T&C’s which require match funding from the applicants. It should be noted at the outset that Phase 3 is split into 2 streams (see Section 2.3). This Competition Guidance is focused on Stream 1. The new delivery model is as follows:

Figure 1 - Stream 1 Delivery Model

2. Programme Overview

2.1 Context

Offshore Wind (OW) will play an increasingly critical role in the UK’s renewable energy supply to enable the Net Zero ambitions. This is manifested by a 50 GW by 2030 target in the British Energy Security Strategy (BESS) and predictions by the Climate Change Committee (CCC) of between 65-140GW of OW capacity by 2050, depending on which pathway is adopted.

The offshore windfarm installations may adversely impact the quality of data obtained from the long-range Primary Surveillance Radars (PSR) which are the backbone of the UK’s AD detection capability. A technological solution, or combination of solutions, is needed to enable the long term co-existence of windfarms and AD and enable the deployment of offshore wind.

Through the Joint Air Defence and Offshore Wind Task Force, the MOD is currently working on procuring mitigation solutions in the near term that will enable the next generation of large-scale offshore windfarms to be built that will become operational from 2025 and beyond.

This innovation programme is complementing the MOD work and focuses on helping to find solutions that will enable the long term co-existence of AD and offshore wind.

2.2 Background

Phase 1 and Phase 2 advanced a range of innovations, increased their Technology Readiness Levels (TRL) and provided evidence for the scope of this Phase 3 competition.

2.3 Programme Aim & Structure

The overall aims of the programme are as follows:

- to accelerate the development of windfarm mitigation technologies across three technology categories of radar, stealthy materials and alternative tracking

- to disseminate the findings to support the decision making on further development of the most promising technologies and potential deployment at scale.

The programme aims will be delivered via two different Streams:

2.3.1 Stream 1: Demonstration – BEIS grant T&Cs (up to £14.15m available) [This competition]

A grant funding competition for demonstration projects, with funding allocated as per Section 6.1. Applicants will need to provide match funding. Number of grants will depend on funding available and quality of bids. These projects will demonstrate innovative technologies with the potential to mitigate the effect of windfarms on the AD radar. See Section 3 for scope. Stream 1 projects will be required to cooperate with the winner of Stream 2 competition, which will include provision of ad hoc technical and troubleshooting support to enable the development of an Analytical Evaluation Study comparing trade-offs between the different mitigation technologies. As part of their budgeting, Stream 1 projects are asked to make provisions for up to 25 person-days for the anticipated support to be provided to the Stream 2 winner (support required will be reviewed once Stream 2 contract is in place). Cooperating with Stream 2 winner is an eligibility criterion for Stream 1 projects. See section below for more information on Stream 2.

2.3.2 Stream 2: Analytical Evaluation Study – DASA Contract T&Cs (up to £0.5m available) [Future competition]

Note: The information provided for Stream 2 is not final and is subject to change. It is provided to allow Stream 1 applicants make an informed decision on their participation in this competition and to help them plan accordingly. The Stream 2 study will not be used for assessment or performance monitoring purposes of Stream 1 projects. The purpose of Stream 2 is to build an evidence base to inform future policy decisions.

A contract competition for an analytical evaluation study to objectively compare the performance trade-offs between the different mitigating technologies in Stream 1 (radar, materials, alternative tracking).

It is anticipated that the Stream 2 competition will launch once the winners of Stream 1 are confirmed(~July 2023). There will be 1 contract available, which is anticipated to start in Q4 2023. Scope of work and value will be fully defined in the future competition guidance – Sections 2.3.2.1 and 2.3.2.2 below outline the preliminary scope. The Stream 2 competition winner will be required to work with the Stream 1 grant recipients in order to meet the objectives of the study.

2.3.2.1. Stream 2 Preliminary Objectives

To allow the comparison of disparate mitigation techniques, including those that are based on:

- Improved radar tracking approaches, whether by the use of better discrimination algorithms to allow the windfarm clutter to be rejected or additional radars to improve tracking performance over the windfarm.

- Materials approaches, where the materials used to construct the turbine are altered to reduce the clutter observed by the radar.

- Alternative tracking approaches, where non-radar sensors are used to supplement the existing radar network over the windfarm.

To measure the effectiveness of these approaches over a representative set of scenarios that are designed to challenge proposed mitigation approaches.

2.3.2.2. Stream 2 Preliminary Scope

This activity is designed to assess the effectiveness of different windfarm mitigation approaches by modelling. Although evidence of validation will be required, the intent is not to conduct flight trials at this stage.

To measure the effectiveness of the proposed mitigations, the supplier will work with Dstl to define a set of metrics that can be used to compare different techniques. These metrics should include: track maintenance effectiveness, latency and any increases to the false alarm rate.

Where possible, reuse of existing, validated, models is encouraged. However, it is accepted that some adaptions may be needed to meet all the requirements listed. For planning purposes, bidders should assume that the technologies and scenarios to be modelled are as listed below and design their proposal accordingly. The actual cases modelled will be agreed between Dstl and the supplier.

How this links to Stream 1:

- The Stream 2 supplier will be required to interact with all the suppliers in Stream 1 to define and model their proposals in a way that suitably respects the intellectual property of all parties.

- Suppliers who wish to bid into both streams will need to ensure that suitable arrangements and ethics walls are in place to prevent commercially sensitive information from this modelling exercise being passed to the Stream 1 programme.

- Stream 2 will be a fully funded programme; there is no expectation for matched funding. Therefore, this is being run as separate competition.

Technologies to be modelled:

- Radar approaches: enhanced signal processing to reduce the impact of windfarm clutter and / or additional radars to provide enhanced cover

- Materials approaches: model the impact of a proposed radar absorbing material, including the effects of directionality, bandwidth and absorption.

- Alternative tracking approaches: model the effects of supplementary sensors and how these might be incorporated into an integrated picture.

Examples of scenarios to be modelled (specific set to be notified once Stream 2 commences):

- An airliner loses height over the windfarm (such as Sheringham Shoal)

- Several military jets cross over the windfarm

- A fast jet performs a high g turn over the windfarm

- A supersonic fast jet traversing the windfarm at high altitude

- A conventional cruise missile traversing the windfarm at very low altitude

- A moderately stealthy fast jet traversing the windfarm.

- A helicopter traversing the windfarm at typical civilian operating altitude.

- Repeat of scenarios 1-7, but with a more distant windfarm such as Hornsea 3. That second windfarm should include the turbines with the largest diameter likely to be in use today and in 2030s, and with appropriate spacing between the turbines.

3. Competition Scope

Stream 1 of Phase 3 is seeking to fund projects which will demonstrate innovative technologies with the potential to mitigate the effect of windfarms on the AD radar up to Technology Readiness Level (TRL) 6, which is a demonstration in a relevant environment. See Appendix 1 for TRL definitions.

It is anticipated that this may require collaboration between several suppliers (technology provider, OEM, onshore/offshore windfarm owner/operators, developers etc.) and consortia to be formed. Close collaboration with the wider windfarm industry is expected. The level of funding available in Phase 3 reflects these ambitions. As part of the Grant funding Agreement, we expect a relevant demonstration of the mitigation technology showing how it can enable the co-existence of offshore windfarms and AD radar. Key element of the scope is to evidence how the technology will perform in the context of future offshore windfarms with larger turbines.

3.1 Impact of windfarms on radars

Presence of windfarms impacts AD radars. Windfarms have the potential to reduce the ability of a radar to track aircraft, due to two main effects:

Clutter

Each wind turbine reflects radio waves, which is perceived by the radar as an increased level of clutter over the area of the windfarm. This clutter is hard for the radar to distinguish from the target of interest, such as an aircraft, leading to false tracks being generated. This clutter cannot be eliminated using the Doppler processing techniques that are applied to returns from stationary objects, because the blades of the turbines are moving at considerable speed, comparable to an aircraft. As more, and larger, turbines are added, the impact of this clutter will grow.

Desensitisation

Radars have a limited dynamic range which means that, in the vicinity of a very large return, it is not possible to detect much smaller objects as their signal is swamped by the larger reflection. Also, some radars may automatically reduce sensitivity in the region of large returns to prevent the system being swamped by false tracks.

Both these issues need to be resolved to allow the UK to reconcile its environmental and defence commitments.

3.2 Potential Mitigations

There are several potential approaches to mitigating the impact of wind turbines on radars:

- Radar approaches, where signal processing or an alternative/supplementary radar is used to mitigate the impact of the windfarm.

- Materials approaches, where the turbine uses different materials to reduce the Radar Cross-Section (RCS) of the blades and hence the level of clutter.

- Alternative tracking approaches, where other technologies are used to provide supplementary tracking over the windfarm.

These approaches need not be used in isolation, it may be possible that a combination of methods would produce the best mitigation.

The mitigation would need to work for radars operating at S band (2-4 GHz), with peak performance at 3.1-3.4 GHz. An ability to provide benefits at other radar bands, such as L band (1-2GHz) would be desirable. The proposed solution should be applicable to all windfarms within radar line of sight of the current AD radar sites in the UK.

3.3 Impact of Future Offshore Windfarms

To meet the targets for offshore wind energy generation it will be necessary to build more and bigger windfarms. This will increase the affected areas both horizontally and in height. Minimising the gaps in surveillance coverage is required to maintain the ability to detect incoming threats. In addition, the possibility of cumulative interference caused by two separate windfarms in proximity, or in the same radar line of sight, has to be considered.

It is likely that floating structures will be used in the future meaning the horizontal vertical position (bob and sway) of turbines is not fixed.

Where a demonstration takes place onshore, or offshore, but on smaller sized devices, the projects must develop robust plans on how the performance of the technology can be translated onto the windfarms and wind turbines of the future. State of the art devices similar to the IEA 15MW reference turbine should be considered. 20MW+ devices, likely available in early 2030s, can be scaled by increasing the rotor diameters.

3.4 Stream 1 Challenges

The fundamental challenge is to find a technological solution, or a combination of solutions, to maintain the effective surveillance of airspace despite the presence of future offshore windfarms, which will enable the long term co-existence of offshore windfarms and AD.

Whilst the context must take into account current practices and the wide use of radar the enduring requirement is one of effective monitoring of airspace. This should be achieved without compromising the performance of offshore wind turbines in terms of energy output or reliability which are critical in the UK reaching its decarbonisation targets.

The following topics are not restrictive nor exhaustive but present areas upon which innovation may have an impact. Scenarios are given here as illustrations and are not to be considered as direct problems to be solved.

3.4.1 Radar Approaches

In this challenge area we are looking for innovative radar signal processing and/or alternative radar techniques (such as multistatic systems) that can be used to maintain air surveillance over the area of interest.

The work done in Phase 1 and 2 has addressed different radar approaches to the fundamental challenge. e.g.

- Clutter data from existing windfarms has been measured and used to develop new signal processing techniques that improve the mitigation of existing radar systems.

- New techniques have been developed to synchronise multistatic radars and thus allow them to reject clutter more effectively. These synchronisation techniques have been experimentally tested at short ranges. A design for a full-scale system suitable for AD applications has been developed.

For Phase 3 we are looking for further development of these, or other radar processing approaches, culminating in a demonstration of how the innovation works in a representative environment and a detailed analysis explaining how it is expected to be applicable to future development of larger and bigger windfarms.

In this phase consideration of how the technology could be integrated into the existing air surveillance infrastructure must be given. The ability to work with a broad range of radar frequencies should be considered. Outcomes form the proposed work should include:

- An estimate of the probability of successfully tracking a variety of representative targets over the windfarm, both with and without the technology being applied.

- The impact (if any) of the proposed technology on tracking when there is no windfarm present.

- How the proposed radar(s) would be integrated with existing systems to produce a coherent air picture.

- What a realistic fully installed and operational network might look like and any obstacles to installation that might arise (e.g. transmission licences).

For further guidance about the demonstration requirements please see Section 3.4.4.

3.4.2 Materials Approaches

In this challenge we are looking for innovations around the incorporation of smart materials or surface structures into windfarm turbines that can be used to reduce the impact of clutter on radar surveillance

Work done in Phases 1 and 2 has explored

- the use of radar absorbing nano particle fillers in the bulk of windfarm turbine blades and

- metamaterial structures which can be tuned to reduce radar reflections form the turbine blades

For Phase 3 we are looking for further development of these or other materials based approaches. Outcomes from the proposed project should include:

- What impact the proposed material would have on the RCS of the blades and turbine as a whole, including an assessment of the radar bandwidth over which this occurs and therefore how much each proposed solution would vary depending upon the local radars.

- RCS performance using a variety of polarisations of the radar beam such as vertical, horizontal and circular.

- How well the material would withstand a realistic offshore environment, including corrosion, salt spray etc.

- An assessment of the impact of the technology on other performance aspects of the turbine, such as longevity, susceptibility to lightning strike, loss of lift of the blade, increased blade leading edge erosion or other performance requirements (e.g. visual signatures).

- Assess any impact of the change of materials on recyclability and sustainability of the wind turbines.

- A realistic appraisal of how the proposed technology would be introduced into the supply chain and fitted in UK waters.

- An assessment of any security issues that may result from any radar absorbing materials tuned to UK defence radars being readily accessible in open water.

All solutions should be developed to a scale to allow demonstration on a representative turbine(s). Additionally, it will be necessary to obtain some representative radar information demonstrating the effectiveness of the material mitigation and to demonstrate how this performance would be maintained when applied to larger and bigger windfarms.

For further guidance about the demonstration requirements please see Section 3.4.4.

3.4.3 Alternative Tracking Approaches

In this challenge we are looking to fill the capability gap in surveillance cover for conventional long range air defence radars caused by the radar returns from wind turbines.

Work done in Phases 1 and 2 has explored the use modular sensor networks based on RF, visual and acoustic passive sensors to create a composite surveillance picture which can be incorporated into the air defence system.

For Phase 3 we are looking for further development of these or alternative non radar based surveillance technologies. Outcomes from the proposed project should include:

- A demonstration of a candidate alternative tracking system in a realistic operational environment over a windfarm.

- An estimate of the probability of successfully tracking a variety of representative targets over the windfarm, both with and without technology being applied.

- How the proposed tracking system would be integrated with existing systems to produce a coherent air picture.

- What a realistic fully installed and operational network might look like.

- How well the equipment would withstand a realistic offshore environment, including corrosion salt spray etc.

- Any susceptibility of the system to hostile countermeasures (e.g. spoofing, emission control).

- Range of the alternative non radar based surveillance technologies beyond the turbine

For further guidance about the demonstration requirements please see Section 3.4.4.

3.4.4 Demonstration Requirements

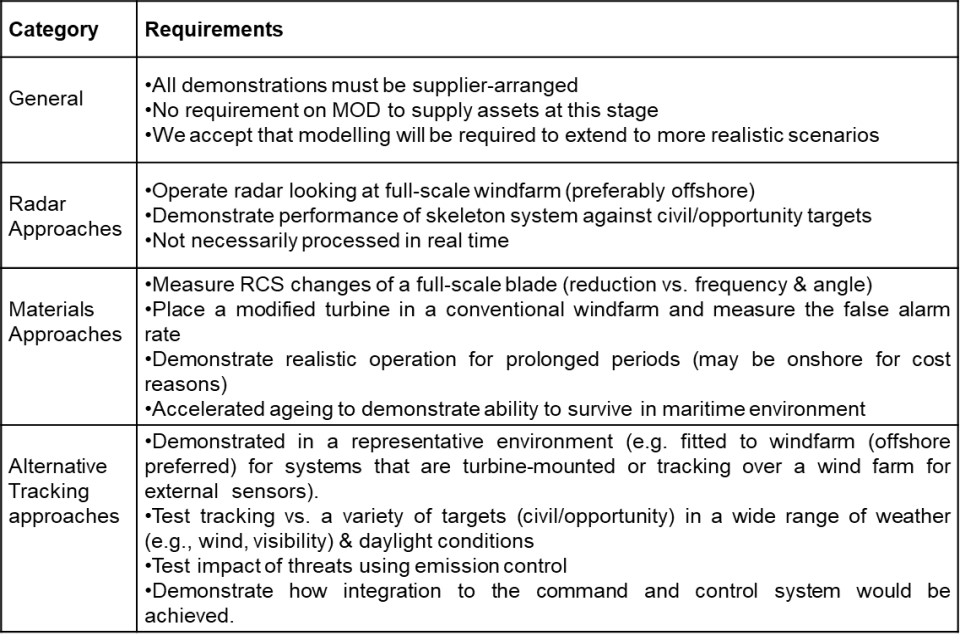

As part of this competition, we expect proposals to detail how they intend to validate/demonstrate the performance of their mitigation at the end of the project. The application must specify the intended TRL of the demonstration (TRL 5 or 6). Bidders are required to arrange their own demonstrations, which meet the minimum requirements outlined in the relevant challenge areas above and Table 1 below:

Table 1 - Demonstration Requirements

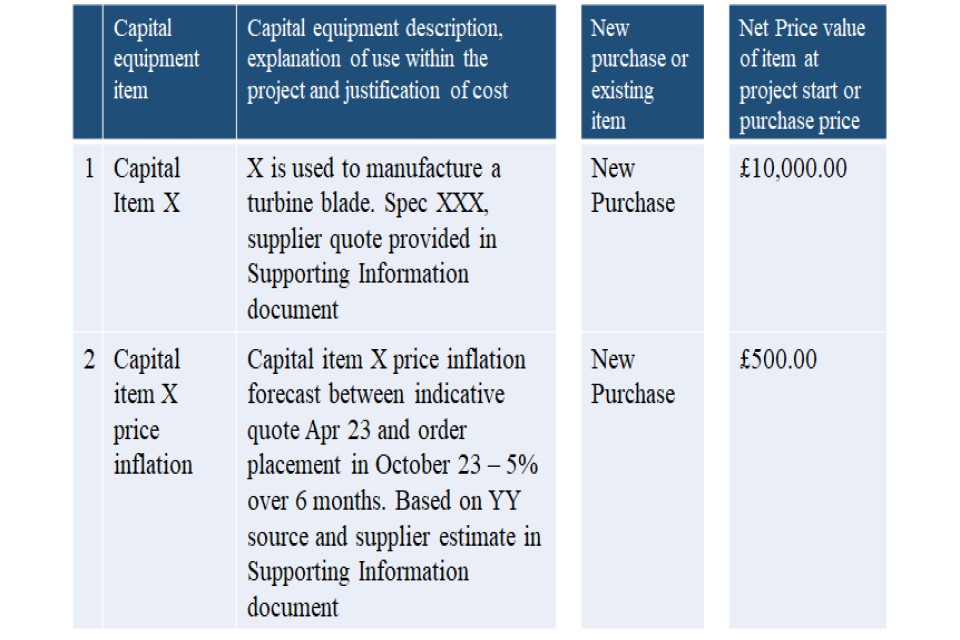

4. Eligible Costs

Eligible costs for Stream 1 are those directly associated with the development and implementation of the demonstration; see Appendix 2: Eligible and Ineligible Costs and Appendix 3: Residual Values for more information.

5. Competition Timetable, Application and Assessment Process

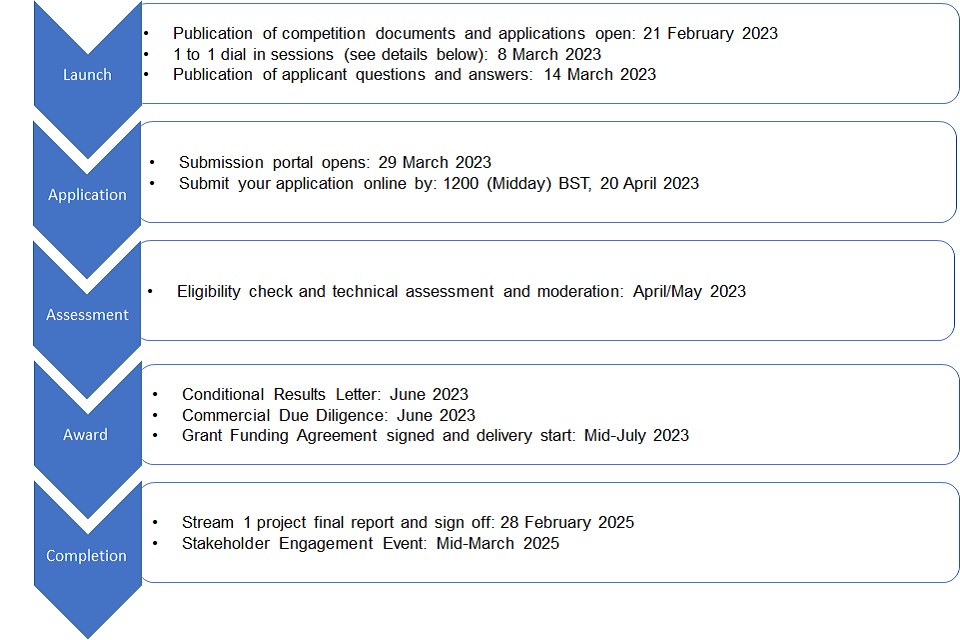

5.1 Competition Timetable

Key indicative dates applicable to Stream 1 of the competition are shown in Figure 2 below. Please note that we reserve the right to vary these dates.

Figure 2 - Stream 1 Timeline

Dial In Session - 8 March 2023 - A series of 20 minute one-to-one teleconference sessions, giving you the opportunity to ask specific questions. If you would like to participate, please register on the Eventbrite page. Booking is on a first come first served basis.

If you have any questions about the competition, please submit them by 17:00 GMT, 7th March 2023 to [email protected]; questions submitted after this deadline may not be answered. We will provide replies to any questions (whether asked at the one-to-one sessions or sent in written form) which, in our judgement, are of material significance, through an online anonymised FAQ sheet published on the competition website by 14th March 2023. All applicants should take the answers to the clarification questions (Q&A) and this competition guidance into consideration when preparing their own bids. Bids will be evaluated on the assumption that they have done so.

5.2 How to Apply

IMPORTANT INFORMATION - Please make sure you have read this guidance (including Appendices and Annexes) before starting your application.

DASA Online Submission Service

The full proposal must be submitted via the DASA Online Submission Service, for which you will require an account (instructions at the link). Only proposals submitted through the DASA Online Submission Service will be accepted. For IT reasons the Online Service will, not be open until 29 March 2023)

Offline DASA Submission Walkthrough

Offline DASA Submission Walkthrough (Annex 4A), is a key part of the submission process. Given that the commercial agreements will be with BEIS, some of the standard DASA application sections are not applicable. Annex 4A is an offline version of what you will see on the DASA Online Submission Service, but it also contains important supplementary notes, which will be essential in guiding you through the submission of the application online. We strongly recommend making yourself familiar with Annex 4A and having it open during the submission online to complete the application correctly and avoid unnecessary duplication.

Declaration Forms Submission by Email

You will also be required to complete, sign and submit five declarations via email to [email protected] quoting the application number and ‘Windfarm Mitigation Phase 3’ in the subject. More detail on that in Section 5.3.2.

5.3 Submission Content

Each proposal must include the following information, which must be submitted in accordance with Sections 5.3.1 and 5.3.2 below.

You should endeavour to answer all questions on the DASA Online Submission Service in full. Incomplete applications and any containing incorrect information will be rejected.

Any applications or supporting documentation received after the application deadline will not be considered. Please do not leave the uploading of your bid to the last few days – please plan ahead and prepare well in advance.

5.3.1 DASA Online Submission Service

Complete all fields on the DASA Online Submission Service (consult Annex 4A). In the online submission you must attach the following documents, in the following sections:

Section 3 – Question (C) Feasibility:

- Project organogram (overview of the consortium)

- Partner Information Form (Annex 5A)

Section 3 – Question (D) Viability:

- GANNT Chart Project Plan (including all work packages and deliverables)

Section 3 – Question (K):

- Project Cost Breakdown Form (Annex 3A)

Section 3 – Question (R):

- Cyber Risk Assessment (confirmatory email from DCPP)

Section 5 – Additional Information:

- Project Risk Register

- Key Project and technical team (CVs not required)

5.3.2 Submission by Email

The following declarations must all be completed and submitted with your bid via email by the deadline. The lead applicant is responsible for all the below Declarations being completed, submitted and accurate – see Annex 2A for details.

The following forms can be found in Annex 2A:

- Declaration 1: Statement of non-collusion

- Declaration 2: Form of bid

- Declaration 3: Conflict of Interest

- Declaration 4: Standard Selection Questionnaire (SSQ) Parts 1, 2 & 3

The following form can be found in Annex 2B:

- Declaration 5: The UK General Data Protection Regulation Assurance Questionnaire for Contractors Optional letters of Intent can also be submitted as .pdf files via e-mail

5.4 Key information about your application

Application costs:

You will not be entitled to claim from DASA or BEIS any costs or expenses that you incur in preparing your bid, whether or not your proposal is successful.

Bid Validity:

Bids shall be valid for a minimum of 120 calendar days from the submission deadline.

Where required, your application may be shared with other government departments or public authorities during the assessment and due diligence phase to ensure there is no overlap between funded projects. Your public project abstract may be shared with others in BEIS and wider government for information purposes.

Consortia:

Bids may be submitted by single applicants or project teams (consortia). For consortium bids, only one application should be submitted for each project.

The lead organisation must sign up to the terms and conditions outlined within the Stream 1 Grant Funding Agreement. How the consortium manages the commitments that the lead organisation makes on its behalf is the responsibility of the consortium.

BEIS recognises that arrangements in relation to consortia and sub-contractors may (within limits) be subject to future change. Suppliers should therefore respond in the light of the arrangements as currently envisaged and are reminded that any future proposed changes in relation to consortia and sub-contractors must be submitted to BEIS for approval.

If a consortium is not proposing to form a separate corporate entity, the project partners will need to complete a consortium agreement. We would expect to see included the following non-exhaustive list:

- Arrangements for the management and coordination of the project

- Responsibilities (including funding) and liabilities of the partners

- IP arrangements

- Reporting and publication arrangements, access to results and confidentiality provisions

- Consequences of termination or default and ways of handling disputes

Please note that a consortium agreement will not be required at application stage but must be provided within one month of the funding agreement being signed. Funding will not be paid by BEIS until a signed consortium agreement has been finalised between all the members of the project consortium. BEIS reserves the right to require a successful consortium to form a single legal entity in accordance with Regulation 28 of the Public Contracts Regulations 2015 (as amended by the Public Procurement (Amendment etc.) (EU Exit) Regulations 2020).

Applicants will be required to provide information about their partners at application stage by completing the Partner Information Form (Annex 5A) and attaching it to the online submission service.

For the purposes of this competition, a project partner is likely to be an organisation responsible for the delivery of a significant innovative programme element or standard service; partners must sign the consortium agreement and use a grant intensity appropriate for their organisation and activity. A sub-contractor is likely to be an organisation delivering a standard service, as organised through a separate contract at market value. Sub-contractors will not be required to sign the consortium agreement. Subcontractors delivering more than 10% of the work (by value) must be named in the application, with information provided on the organisation size, what work they will be delivering, where the work will be located, who they are subcontracted to, justification for subcontracting the work, and evidence of their commitment to the project (e.g. a signed letter of support). If a small organisation, receiving a higher grant intensity, is subcontracting a significant portion (>20%) of labour or services to a large organisation, BEIS will review at assessment and due diligence stage whether this is appropriate and whether the funding requested is at an acceptable level; clarifications may be required. Sufficient detail and evidence for subcontractor costs is required in the stipulated documents e.g. in the Project Cost Breakdown Form. Typically, a supplier supplies goods, whereas a subcontractor supplies services.

Staff nationalities:

Applicants are requested to provide the nationalities of proposed staff that you intend to work on this project in the online submission service. If your proposal is recommended for funding, DASA reserves the right to undertake due diligence checks including the clearance of proposed employees. Please note that this process will take as long as necessary and could take up to 6 weeks in some cases for non-UK nationals.

5.5 Grant Award

Successful Stream 1 applicants should expect a Conditional Award letter in June 2023 and, subject to commercial and financial due diligence, are expected to enter into Grant Funding Agreements for the delivery to commence in mid-July 2023. Please note that BEIS reserves its right to not award any grant agreements under this competition.

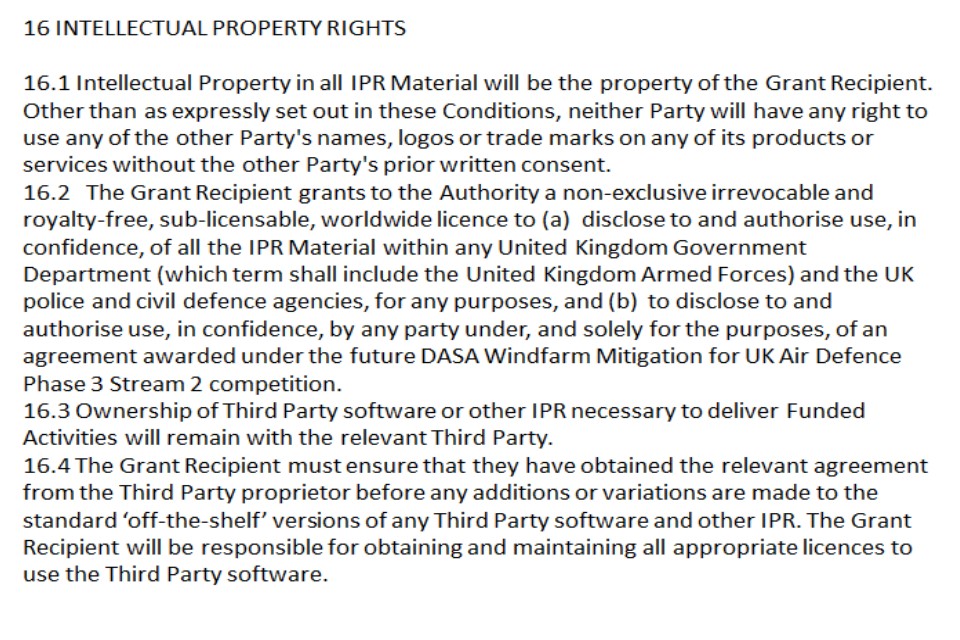

The terms and conditions will be based on the BEIS template Grant Funding Agreement ( provided in Annex 1A). These terms and conditions are final and non-negotiable: by applying to the competition, you are agreeing to these terms and conditions.

There will be an opportunity for successful applicants, prior to the grant funding agreement being signed, to discuss the funding agreement at a meeting with official(s) from BEIS. The BEIS official(s) will explain the terms and conditions and respond to any queries which the applicant may have at this stage, but they will not allow any changes to be made to the funding agreement. It is crucial that all applicants review the terms and conditions prior to the submission of their application and ask any questions prior to submitting the bid.

For consortium bids, the lead company (project co-ordinator) will be the recipient of the funding agreement and will be responsible for managing payment to the other project partners.

6. Budget and Restrictions on Funding

6.1 Competition Budget and Availability

The total budget available for Stream 1 is up to £14.15m, excluding VAT. See Appendix 2 for further guidance on VAT. The competition funding will be awarded via grants. Grant funding available per project is dependent on the challenge area. The maximum limits of grant funding per project are specified in Table 2 below. Grant Recipients shall provide match funding to cover the remainder of their project costs in accordance with the guidance set out in Section 6.2.

| Challenge | Technology | Maximum Grant funding available per project |

|---|---|---|

| A | Radar | up to £4.5m |

| B | Stealthy Materials | up to £3.5m |

| C | Alternative Tracking | up to £1.5m |

| D | Integrated Demonstration of at least 2 from A, B and C | See Table 3 below |

Table 2 - Grant limits per challenge

The actual number of projects funded depends on the number of eligible project applications and their quality. We intend to fund a minimum of 1 project per challenge area A, B and C. However, BEIS may also, at its discretion, choose not to fund projects in challenge areas A, B or C, if a project in challenge area D is deemed to sufficiently demonstrate the requirements outlined in challenge areas A, B or C. Multiple submissions are allowed, but they must be standalone projects with unique scope (no duplication) and must not be interdependent. e.g. if application for challenge D contains elements of A and B – supplier cannot submit a standalone application for the same element of A. We will make the final decision on which projects get funded, based on the number and quality of applications received and on a portfolio approach to ensure a good balance of technologies.

The maximum funding for projects in Challenge D will reflect the risk and amount of technological innovation involved in the project, as indicated in the Table 3 below.

| Challenge D: Indicative Funding Expectations | |

|---|---|

| Project addresses technologies from challenge A & B | Up to £8m |

| Project addresses technologies from challenge B & C | Up to £5m |

| Project addresses technologies from challenge A & C | Up to £6m |

| Project addresses ALL three technology areas | Up to £9.5m |

Table 3 - Challenge D Maximum Funding

BEIS reserves the right to allocate more or less than the total budget depending on the number and quality of applications received and budget availability. Bidders should not rely on there being further funding available for the competition in excess of the allocated budget. BEIS may also, at its discretion, choose not to make an award or allocate an award that is less than the total budget depending on the quality of applications.

IMPORTANT INFORMATION

No Reliance

Nothing in this funding call requires BEIS to award any applicant a funding agreement of any particular amount or on any particular terms. BEIS reserves the right not to award any funding agreements.

Applicants apply for funding in this competition at their own risk and expense. BEIS will not, under any circumstances, be liable for nor make any contribution to the costs of participation, preparing proposals and taking any professional or specialist advice. Applicants accept the risk that they may not be awarded a grant. BEIS gives no guarantee or warranty as to the nature, or number of projects funded.

6.2 Grant Funding Intensities

The Stream 1 competition will support successful applicants through subsidies awarded in the form of grants towards the eligible costs of the proposal. Since 1 January 2021, public authorities must comply with the UK’s international commitments on subsidies as set out in the UK-EU Trade and Co-operation Agreement (TCA), the Northern Ireland Protocol (where applicable), other trade agreements, as well as the World Trade Organisation (WTO) rules on subsidies. This section specifies the types of costs that applicants can claim grant support for, as well as the maximum level of grant funding that they can receive which may differ by organisation type, size, and location.

BEIS will operate within the UK-EU TCA requirements and WTO rules. The funding rules set out in this Guidance Document are specific to this Competition only.

The rules set out in this document apply equally to all applicants from England, Wales, Scotland, and Northern Ireland that are eligible to receive funding (except where specifically indicated below, regarding the definition of a parent and associated grant intensity requirements). Grants awarded to applicants and partner organisations from Northern Ireland will also be subject to scrutiny from the European Commission in accordance with Article 10 of the Northern Ireland Protocol in the UK/EU Withdrawal Agreement.

If a business or any enterprise has been incorrectly in receipt of grant funding, that enterprise is likely to be required to repay any subsidy received to the value of the gross grant equivalent.

Definitions

The following definitions will apply:

-

Business means an organisation undertaking economic activities. As given in Table 4, businesses are categorised as small, medium or large determined by both their:

- staff headcount; and,

- either turnover or balance sheet total

| Company category | Staff headcount | Turnover | OR | Balance sheet total |

|---|---|---|---|---|

| Medium | < 250 | ≤£45m | OR | ≤£39m |

| Small | < 50 | ≤£9m | OR | ≤£9m |

Table 4: Small and Medium-sized Enterprises Definition

Applicants will be required to specify whether project costs classify as Experimental Development or Industrial Research in the Project Costs Breakdown Form(Annex 3A) at application stage.

Experimental Development

Experimental development means acquiring, combining, shaping and using existing scientific, technological, business and other relevant knowledge and skills with the aim of developing new or improved products, processes or services. This may also include, for example, activities aimed at the conceptual definition, planning and documentation of new products, processes or services.

Experimental Development may comprise prototyping, demonstrating, piloting, testing and validation of new or improved products, processes or services in environments representative of real life operating conditions. The primary objective is to make further technical improvements on products, processes or services that are not substantially set. This may include the development of a commercially usable prototype or pilot which is not necessarily the final commercial product and which is too expensive to produce for it to be used only for demonstration and validation purposes.

Experimental development does not include routine or periodic changes made to existing products, production lines, manufacturing processes, services and other operations in progress, even if those changes may represent improvements.

Industrial Research

Industrial Research means planned research or investigation aiming to gain new knowledge and skills for developing new products, processes, or services and/or significantly improving existing products, processes or services. Work may include but isn’t limited to; making component parts for complex systems, building prototypes in a lab, or with simulated interfaces to existing systems, and trialling short manufacturing runs (pilot lines) if relevant.

Research Organisation Definition

When referring to research organisations, BEIS uses the following definition: “‘research and knowledge dissemination organisation’ or ‘research organisation’ means an entity (such as universities or research institutes, technology transfer agencies, innovation intermediaries, research-oriented physical or virtual collaborative entities), irrespective of its legal status (organised under public or private law) or way of financing, whose primary goal is to independently conduct fundamental research, industrial research or experimental development or to widely disseminate the results of such activities by way of teaching, publication or knowledge transfer. Where such entity also pursues economic activities, the financing, the costs and the revenues of those economic activities must be accounted for separately. Undertakings that can exert a decisive influence upon such an entity, for example in the quality of shareholders or members, may not enjoy a preferential access to the results generated by it.”

Within this competition, this means:

- universities (higher education institutions)

- non-profit research and technology organisations (RTOs), including Catapults

- public sector organisations (PSO)

- public sector research establishments (PSRE)

- research council institutes

- research organisations (RO)

- charities.

This list is not comprehensive and is subject to change and exceptions.

Grant Intensities

The maximum amount of grant funding that can be provided towards project costs (as a percentage of the overall eligible project cost) is summarised in Table 5. The maximum funding level available varies by organisation size and research category (activity). These maximum grant intensities apply to applicants and, if relevant, consortium partners.

If an application or partner business has a parent company, the data concerning the parent company and the applicant company (cumulatively) must be used when calculating the organisation size (as outlined in Table 4) and subsequent maximum grant intensity (as outlined in Table 5). For applicants and project partners based in Great Britain, a parent company is defined as an enterprise with controlling interest (>50% control) of the subsidiary company.

For applicants or project partners based in Northern Ireland, for the purposes of this competition, the definition of a parent company includes any ‘partner enterprise(s)’ or ‘linked enterprise(s)’ as defined in Annex 1 of COMMISSION REGULATION (EU) No 651/2014

When calculating the organisation size (as outlined in Table 4) and subsequent maximum funding entitlement (as outlined in Table 5), applicants & project partners based in Northern Ireland must adhere to the instructions outlined in Annex I of the linked guidance.

| Research Category (type of innovation activity) | Organisation Size | Maximum amount of public funding towards total eligible Project Costs |

|---|---|---|

| Industrial Research (collaborative) | Small | 80% |

| Industrial Research (collaborative) | Medium | 75% |

| Industrial Research (collaborative) | Large | 65% |

| Experimental Development (collaborative) | Small | 60% |

| Experimental Development (collaborative) | Medium | 50% |

| Experimental Development (collaborative) | Large | 40% |

Table 5: Maximum Grant Intensities

Match funding

Match funding must be provided for Stream 1. Confirmation that match funding will be available must be provided at application stage, for example a Letter of Intent from the funder/investor specifying their intent/agreement to provide an amount of funding and any conditions on that funding.

Before the grant letter is issued, the applicant will need to demonstrate a credible plan to raise the match-funding required for the whole lifetime of the project. This needs to be evidenced, for example by relevant bank statements, Memorandum of Understanding or agreement within the signed consortium agreement.

Debt and equity are acceptable sources of match funding, provided that this is accessible and projects are able to provide evidence of the availability of this funding by the first project milestone. In circumstances where equity or debt is not accessible for use against project costs by the first milestone, for example where equity has not been sold/released, this would not be an acceptable form of match funding. In kind contributions such as staff time can be included in the match funding total, as long as they relate to eligible project costs, are appropriately costed at a fair market value, and are robust, realistic and justified in terms of the proposed project plans.

Requirements

It is a requirement of receiving this funding that projects ensure that the results of the project are disseminated through e.g. conferences, publication, open access repositories, or free or open source software. See Section 13 for more information.

Compliance with grant intensity and overall funding limits is a further requirement of this Competition and the risk of non-compliance rests with the grant recipient. It is therefore crucial that you address these rules within your application, as any errors at this stage may result in BEIS being able to offer only a reduced level of funding or repayment of grant by applicants.

Grant recipients must adhere to all Subsidy Control obligations set out in the Grant Funding Agreement. Failure to do so may result in termination and clawback of funding.

If an applicant breaches the grant funding requirements for this Competition, for whatever reason, BEIS requires repayment of any grant received, including interest, above that which was due. In this situation applicants will be required to repay any funding received.

Whilst applications cannot be led by universities, we welcome university consortium partners when they can add value; there is no requirement to have academic involvement in an application. As with other government funding bodies funding higher education institutions, we will not pay more than 80% of the Full Economic Costs (FEC) calculated using the Transparent Approach to Costing (TRAC) methodology. Any applications requesting items that would ordinarily be found in a department, for example non-specialist computers, should include justification. Where applicable, other research organisations (i.e. Research and Technology Organisations) that are not higher education institutions, can receive up to 100% funding if they are not undertaking economic activities in the project. Our assumption is that the work undertaken as part of this programme is defined as economic activity.

Advice for Collaborative Applications

For collaborations containing different sized enterprises or research organisations, funding intensity is related to the partner company (and/or parent company if applicable) receiving the subsidy. Hence for example, for a collaborative Industrial Research project: a large enterprise consortium member can only be reimbursed up to 65% of its costs, whereas a small enterprise collaborator/partner can be reimbursed up to 80% of its costs. Similarly, for a collaborative Experimental Development project: a large enterprise consortium member can only be reimbursed up to 40% of its costs, whereas a small enterprise consortium member can be reimbursed up to 60% of its costs.

If you are applying to Stream 1 as a collaboration and your application is successful, you must also submit a copy of your consortium agreement within a month of the Grant Funding Agreement being signed. BEIS will review the consortium agreement before any grant payment is made to ensure that proposed collaborations are viable and robust. For collaborative projects BEIS will only issue a grant to a single legal entity, so collaborative bids will be required to appoint a lead organisation/applicant for grant award.

Projects may include a mix of industrial research and experimental development related costs. For such projects the maximum subsidy levels will be based on the individual thresholds for that type of research activity (further guidance can be found in the Project Cost Breakdown Form).

For example, a project led by a small business, 25% of whose costs classified as industrial research and 75% classified as experimental development, would have a maximum subsidy threshold, based on project out-turn costs, of 65%. A large business consortium partner ,50% of whose project costs classified as industrial research and 50% classified as experimental development, would have a maximum subsidy threshold, based on project out-turn costs, of 52.5%. This scenario is demonstrated in Table 6.

| Business Size | Research Activity | Maximum Subsidy Threshold | Percentage of project | Effective Subsidy Threshold |

|---|---|---|---|---|

| Small Business | Industrial Research | 80% | 25% | 20% |

| Small Business | Experimental Development | 60% | 75% | 45% |

| Maximum project subsidy rate | 65% | |||

| Large Business | Industrial Research | 65% | 50% | 32.5% |

| Large Business | Experimental Development | 40% | 55% | 25% |

| Maximum project subsidy rate | 52.5% |

Table 6: maximum subsidy thresholds for research categories, as based on project out-turn costs

Whilst BEIS will check the information provided to try and ensure that applicants meet the requirements of the subsidy categories, it is the responsibility of applicants to establish that they fall within the thresholds before submitting applications. BEIS requires applicants to notify them of any change to situation or circumstance during the project.

Calculating Other Public Funding

When considering levels of subsidy (described above), public funding includes the grant and all other funding from, or which is attributable to, other government departments, UK public bodies, other Governments or Government organisations. Such funding includes grants or other subsidies made available by those bodies or their agents or intermediaries (such as grant funded bodies).

In applying to this competition, you must state if you are applying for, or expect to receive, any funding for your project from public authorities (in the UK or elsewhere). Any other public funding will be cumulated with BEIS funding to ensure that the public funding limit and the subsidy intensity levels are not exceeded for the project. Public funding cannot be used as part of the match funding contribution.

Whilst BEIS will check the information provided to try and ensure that applicants meet the requirements of the subsidy categories, it is the responsibility of applicants to establish that they fall within the competition rules before submitting applications. BEIS requires applicants to notify them of any change to situation or circumstance during the project. It is essential to ensure that the total grant funding for the project from public sources does not exceed the permitted percentages stated for the relevant subsidy category.

For any breach of subsidy requirements, please consult the generic grant funding agreement (GFA) that BEIS will be providing with this Guidance (Annex 1A). Grant recipients must adhere to all Subsidy Control obligations set out in Clause 15 of the Grant Funding Agreement. Failure to do so may result in termination and clawback of funding as per Clause 26.

As part of the assessment process, the added value and additionality of public funding will be tested. Applicants will need to demonstrate why public funding is required to deliver this project.

7. Eligibility for Funding

7.1 Competition Eligibility Criteria

To be eligible for funding under Stream 1, proposed projects must meet all the following eligibility criteria. These will be listed in the online application form as the Yes/No questions exemplified below. BEIS will consider all information on the application form when reviewing project eligibility. If, after reading this competition guidance, you are still uncertain whether your project is eligible, organisations may seek clarifications on eligibility by sending an email to [email protected] during the Q&A clarification window.

1. Technology and Project Scope

Eligibility question: Is this project and technology in scope? (Yes/No)

Each funded project is required to deliver a demonstration project in one of the challenge areas A, B, C or D described in this guidance. Please see Section 3 for more detail on stipulations and exclusions of the project scope.

2. Innovation and Technology Readiness

Eligibility question: Is the anticipated project demonstration at TRL 5-6? (Yes/No)

A description of TRLs is provided in Appendix 1. This competition will support projects that can demonstrate and trial innovative technologies and processes which meet the following technology readiness requirements:

- It is expected that demonstrated technologies should be able to show an increase in maturity through testing and validation of components and sub-systems. The majority of project activity and the majority of project costs are expected to be delivering work at TRLs 5 to 6.

- The competition will not support projects aiming to finish the demonstration at TRL below 5 and above 6.

- The competition will not support any commercialisation activities or development or trial of solutions which are already commercially or widely deployed in the UK or internationally.

3. Project Activity

Eligibility question: Can you confirm that your application does not seek funding for retrospective work on this project? (Yes/No)

BEIS is unable to fund retrospective work on projects.

4. Project Timescale

Eligibility question: Can you confirm that your project will be completed within the timescales set out? (Yes/No)

Target dates for key project milestones (e.g. start of construction, start of operational trialling) will be agreed between the successful bidder, BEIS and any private sector partners prior to awarding grant funding.

- It is anticipated that project delivery will begin in mid-July 2023, and all project work must be completed, and final report sent for approval by 28 February 2025. This is approximately 19 months timeline for all of the project activities.

- All projects will be required to attend a Stakeholder Engagement Event to present the outcomes of their work in mid-March 2025.

5. Additionality

Eligibility question: Can you confirm that this project would not be taken forward (or would progress at a much slower rate) without public sector funding? (Yes/No)

Projects can only be funded where evidence can be provided that innovation would not be taken forwards (or would be taken forwards at a much slower rate) without public sector funding.

6. Contract Size and Match Funding

Eligibility question: Can you confirm the funding requested from BEIS is below the maximum levels of funding specified in Section 6 and that you are able to source the required match funding for this project and that any other public funding required is already secured? (Yes/No)

The maximum BEIS funding available will be dependent on the challenge area as outlined in Section 6.1 and the project teams must provide match funding in accordance with the guidance set out in in Section 6.2. Any other public funding required to deliver the project must be confirmed at application stage and cannot be used towards the match funding contribution.

Given the subsidy categories, applicants will need to have private funding in place to cover the balance of the eligible costs. Such funding may come from a company’s own resources or external private sector investors but may not include funding attributable to any public authority. The level of private (match) funding for a project will depend on the status of the applicant organisation(s) and the specific nature of the proposed project; Section 6.2 provides details of the grant intensity levels. Before the grant letter is issued, the applicant will need to demonstrate a credible plan to raise the match-funding required for the whole lifetime of the project. This needs to be evidenced, for example by relevant bank statements, Memorandum of Understanding or agreement within the signed consortium agreement.

7. Eligible Project Costs

Eligibility question: Can you confirm that requested funding is for eligible costs only and meets the grant intensity thresholds? (Yes/No)

The eligible costs are set out in Appendix 2: Eligible and Ineligible Costs. Guidance on capital costs and residual value is given in Appendix 3: Residual Values . The grant intensity thresholds are given in Section 6.2. Funding can only be used for activities and items directly required for the proposed project.

8. Knowledge Sharing

Eligibility Question: Do you agree to share the knowledge gained publicly and in line with Section 13? (Yes/No)

Projects will be expected to share the knowledge gained through the funded activities publicly. See Section 9 for deliverables and Section 13 for dissemination requirements.

9. Applicants and Project Team Composition

Eligibility Question: Do you confirm that this project is led by a private organisation or RTO? and if you or a member of your consortium are part of multiple funding applications, you/they would be able to successfully deliver all projects?(Yes/No)

Stream 1 applications can be led by a single organisation or by consortium. For consortium bids, a single project application must be submitted by the lead project member (lead applicant or project co-ordinator) on behalf of the consortium.

Stream 1 applications must be led by private organisations or research and technology organisations (RTO) and may not be led by universities or non-commercial organisations. Similarly, other Government Departments, Agencies and local authorities are not eligible to enter as the lead applicant, but they can act as a project partner or sub-contractor. Special Purpose Vehicles are permitted to lead projects only if they are constituted as legal entities.

10. UK Requirements

Eligibility question: Can you confirm that the demonstration would be located in the UK? (Yes/No)

The lead applicant or project co-ordinator for the funded activities must be registered with Companies House. Projects can work with international partners but should aim to maximise the benefit to the UK. The physical demonstrations must be located in the UK.

11. Regulatory Factors

Eligibility Question: Have you considered any ethical / legal / regulatory factors relating to your proposal and how the associated risks will be managed? (Yes/No)

You must consider any ethical/legal/regulatory factors relating to your proposal and how the associated risks will be managed. For example, Ministry of Defence Research Ethics Committee (MODREC) approvals can take up to 5 months therefore you should plan your work programme accordingly. If you are unsure if your proposal will need to apply for MODREC approval, then please refer to the MODREC Guidance for Suppliers or contact your Innovation Partner for further guidance..

12. Export Control:

Eligibility Question: Have you considered any export control factors relating to your proposal and how the associated risks will be managed? (Yes/No)

If we believe that you will not be able to obtain export clearance, additional checks may be conducted, which may also result in your proposal being sifted out of the competition.

7.2 General BEIS Conditions

Applicants must not meet any of the BEIS grounds for mandatory rejection, and as a general rule they should not meet any of the BEIS grounds for discretionary rejection (see Annex 2A. Applicants will be required to declare this as part of completing the Standard Selection Questionnaire.

There are five declaration forms to be completed (see Annex 2A and Annex 2B):

- Declaration 1: Statement of non-collusion

- Declaration 2: Form of bid

- Declaration 3: Conflict of Interest

- Declaration 4: Standard Selection Questionnaire (SSQ) Parts 1, 2 & 3

- Declaration 5: The UK General Data Protection Regulation Assurance Questionnaire for Contractors

See Section 5.3.2 for details on how to submit these declarations.

7.3 Conflicts of Interest

The BEIS standard terms and conditions of contract include reference to conflict of interest and require contractors to declare any potential conflict of interest to the Secretary of State.

For research and analysis, conflict of interest is defined as the presence of an interest or involvement of the contractor, subcontractor (or consortium member) which could affect the actual or perceived impartiality of the research or analysis.

Where there may be a potential conflict of interest, it is suggested that the consortium or organisation designs working arrangements such that the findings cannot be influenced (or perceived to be influenced) by the organisation which is the owner of a potential conflict of interest. For example, consideration should be given to the different roles which organisations play in the research or analysis, and how these can be structured to ensure an impartial approach to the project is maintained.

This is managed in the procurement process as follows:

- During the bidding process, applicants may contact BEIS to discuss whether or not their proposed arrangement is likely to yield a conflict of interest.

- Suppliers are asked to sign and return Declaration 3 to indicate whether or not any conflict of interest may be, or be perceived to be, an issue. If this is the case, the contractor or consortium should give a full account of the actions or processes that it will use to ensure that conflict of interest is avoided. In any statement of mitigating actions, contractors are expected to outline how they propose to achieve a robust, impartial and credible approach to the research.

- When bids are assessed, this declaration will be subject to a pass/fail score, according to whether, on the basis of the information in the proposal and declaration, there remains a conflict of interest which may affect the impartiality of the research.

- Failure to declare or avoid conflict of interest at this or a later stage may result in exclusion from the procurement competition, or in BEIS exercising its right to terminate any contract awarded.

Applicants will be subject to financial viability checks, as described in Section 11.1. The outcome of BEIS financial due diligence may result in preferred bidder(s) not being awarded a Contract.

8. DASA Assessment Process and Criteria

8.1 Assessment Process

DASA is responsible for running the competition and the assessment process outlined in this section. All submitted applications will pass through an initial sift against all the eligibility criteria described in Section 7.1, and then against the assessment criteria outlined below in Section 8.2, which are based on the competition objectives. The assessment process following the pre-sift can be found on the DASA website, but involves these key stages:

Assessment:

After the initial sifting process, experts from across UK government will be assigned to assess your proposal.

Moderation:

After assessment, a moderator will compile an overview of all assessments, pulling together comments to provide a collective outcome in the form of a ‘Fund’ or ‘No Fund’ recommendation against the proposal.

Challenge:

Stakeholders/moderators are invited to challenge the ‘Fund’ or ‘No Fund recommendation made against each proposal. Challengers should present their argument both in written form for circulation and at the decision conference.

Decision conference:

Key stakeholders come together to discuss the recommendations. The moderator attends the decision conference to present the ‘Fund’ or No Fund’ recommendation for the proposal and to defend the proposal against any challenges that may have been submitted. Challengers attend the decision conference to present their challenges in order to promote robust discussion prior to the ‘Fund’ or ‘No Fund’ decision being made. During the decision conference, the decision will be made as to whether the project remains fundable, then a priority list is prepared from those. At the end of the decision conference, the priority list will be taken forward to due diligence (depending on affordability). Innovators are not permitted to attend the Decision Conference.

We will select projects that best meet the Programme’s objectives, offer value for money and present effective project delivery approaches. We reserve the right to select projects that contribute to a balanced portfolio of projects in line with the different technical areas, overall programme objectives and budget availability. The decisions are final, and no challenges will be considered or entered into. Proposals that are unsuccessful will receive brief feedback after the Decision Conference.

DASA reserves the right to disclose on a confidential basis any information it receives from innovators during the procurement process (including information identified by the innovator as Commercially Sensitive Information in accordance with the provisions of this competition) to any third party engaged by DASA for the specific purpose of evaluating or assisting DASA in the evaluation of the innovator’s proposal. In providing such information the innovator consents to such disclosure. Appropriate confidentiality agreements will be put in place.

8.2 Assessment Criteria

Proposals that pass the Stage 1 pre-sift against the eligibility criteria will be assessed against the following criteria:

- desirability: strategic fit, end user support/pull

- feasibility: technical credibility, innovation, risk, expertise of team/capability

- viability: costs and value for money, project delivery/plan

Each of the three criteria carries a 33% weighting. Guidance on the type of information that is required in your proposal can be found in Annex 4A.

8.3 Cyber Risk Assessment

Supplier Assurance Questionnaire (SAQ)

DASA has completed a Cyber Risk Assessment (CRA) for this competition. In order to submit to this competition innovators are required to work towards cyber resilience. If selected for funding, the innovator must prove cyber resilience before funding will be provided under this competition.

It is not mandatory to compete this before submission but we strongly advise Innovators complete a Supplier Assurance Questionnaire (SAQ), using the DASA Risk Assessment Reference (RAR) for this competition: RAR-165322475 and answer questions for risk level “Very Low”.

Defence Cyber Protection Partnership

The Defence Cyber Protection Partnership (DCPP) will review your SAQ submission and respond with a reference number within 2 working days. The resulting email response from DCPP should be attached (.jpg or .png format) and included within the DASA submission service when the proposal is submitted. You will also b e asked for your SAQ reference number. Please allow enough time to receive the SAQ reference number prior to competition close at midday on 20 April 2023.

If the proposal is to be funded, the SAQ will be evaluated against the CRA for the competition, and it will be put it into one of the following categories:

- compliant – no further action

- not compliant – if successful in competition and being funded, the innovator will be required to complete a Cyber Implementation Plan (CIP) before the contract is placed, which will need to be reviewed and agreed with the relevant project manager

Innovators can enter a proposal without all controls in place, but are expected to have all the cyber protection measures necessary to fulfil the requirements of the project in place at the time of grant award, or have an agreed Cyber Implementation Plan (CIP).

The CIP provides evidence as to how and when potential innovators will achieve compliance. Provided the measures proposed in the Cyber Implementation Plan do not pose an unacceptable risk to the MOD, a submission with a Cyber Implementation Plan will be considered alongside those who can achieve the controls.

A final check will be made to ensure cyber resilience before the grant is awarded. Commercial staff cannot progress without it. This process does not replace any project specific security requirements.

Further guidance for completing this process can be requested by emailing the DASA Help Centre: [email protected].

Additional information about cyber security can be found at: DCPP: Cyber Security Model industry buyer and supplier guide.

9. Deliverables

All Stream 1 projects will be expected to deliver:

- A physical demonstration of their technology

- Knowledge dissemination activities (see Section 13 for more information)

- An evidence-based final project report detailing:

- the design and development of the demonstration

- demonstration trials results, including performance of the solution and detailed technical data

- The expected performance of the solution at full scale

- assessment of the benefits and challenges of the solution and process risks

- environmental, safety and regulatory considerations and requirements

- how the process could be scaled and replicated more widely, including potential costs of the solution at full scale and comparison with incumbent technologies e.g. indicative costs of capex increases

- key successes and lessons learned in the project

- how to address any risks, challenges and uncertainties associated with the proposed technology

- An assessment of how the process, technologies and knowledge will continue to be developed, commercialised and/or used after funding ends

- an implementation plan of how the project will be developed further after the end of the BEIS project funding

- A concise version of the final project report that can be published.

If there are aspects of the final project report which are commercially confidential, then project teams will be required to provide a version of the report that can be published. Omissions on the basis of commercial reasons should be discussed with DASA/BEIS at the earliest opportunity once the contract has been awarded.

BEIS will appoint a Monitoring Officer to each project to monitor the delivery of the project deliverables and review submissions. Project teams will be required to meet with their Monitoring Officer at least monthly. For more information about the monitoring and reporting requirements for this Competition, see Section 10.

9.1 Stage Gates

The projects will undergo a stage gate approximately every 6 months, so there will be two or three stage gate reviews for Stream 1 projects. The purpose of the stage gates is to review the technical, commercial and financial progress towards the agreed objectives for each project and they provide an opportunity for the projects to demonstrate their capability to deliver the remaining duration of the project. There are three possible outcomes of the process: ‘Continue’, ‘Rectify’ or ‘Terminate’.

The projects will share document(s) 2 weeks in advance of the meeting summarising their progress, including technical, financial, schedule, risks and issues. The reviewing panel may include, but is not limited to, the BEIS theme lead, BEIS programme and project managers, DASA/Dstl Monitoring Officers and independent technical experts, which may be internal to BEIS or through a BEIS contractor. Projects will be assessed considering criteria such as technical, schedule, finance, quality, resource, risks and issues.

For Stream 1, the first stage gate is expected to occur around February 2024. The exact timing and requirements for this stage gate will be similar across projects but will be agreed between individual projects and BEIS prior to contracts being signed, based on the specific requirements of the project. The anticipated requirements for this stage gate are:

- Detailed mobilisation and demonstration planning documents: a. Updated project plan and evidence that delivery plan can achieve all objectives, including being complete by February 2025 b. Updated detailed risk register, mitigation strategies and contingency planning

- Formalisation of all key supply chain relationships. Heads of terms/final draft commercial contracts for key work packages and draft end-user commercial contracts if applicable (note – this is applicable for sub-contractors/suppliers only, details of project partners must be provided at application stage, with a consortium agreement completed within one month of the Grant Funding Agreement being signed)

- Evidence of planning permission/certificate of lawfulness obtained for build and operation of the demonstrator (where relevant), or at minimum pre-application checks and a provisional plan for approval

- Evidence of compliance with relevant regulations and consultation with relevant authorities (where relevant). Evidence of reviewing and accounting for the relevant environmental and safety guidelines and that all appropriate approvals are in place for the demonstrator

- Proof of match funding e.g. bank statement, MOU or section in consortium agreement

- Where needed, Final Investment Decision taken for full project

The stage gate will include a discussion between the project team, the monitoring officer, technical experts and BEIS representatives focussed on the progress, delivery plan and the key risks and challenges. The discussion will ascertain how well the project is progressing against the criteria, as well as whether any of the residual risks are unacceptable to BEIS and the project team, to make a joint decision on if/how to progress. Where, in the opinion of the BEIS project team, unsatisfactory progress has been made, the BEIS Senior Responsible Owner will review the evidence and make the final decision on progressing.

Subsequent stage gates will occur at approximately 6 month intervals. The exact timing and requirements for these stage gates will be agreed between individual projects and BEIS prior to contracts being signed. It may be based on project specific milestones, such as final design or construction.

10. Monitoring and Reporting

10.1 Project Monitoring and Reporting

If successful, each project will be required to submit a completed BEIS project plan and finance form (template to be provided by BEIS), to be signed off by BEIS prior to the start of delivery. This will provide information about the project’s deliverables, milestones and invoice schedule.

This competition also has a requirement to demonstrate the key performance indicators (KPIs) for the wider Net Zero Innovation Portfolio. Project monitoring and reporting is required to track project progress against these KPIs, as well as progress towards milestones.

The programme will be overseen by a BEIS Programme Manager. Each project will be allocated a Monitoring Officer at the point of notification. For this competition the Monitoring Officer function will be performed jointly by a Technical Partner from Dstl and a Project Manager from DASA. External organisations will be subject to a confidentiality agreement. Applicants will undertake their own project management and will be overseen by their appointed Monitoring Officer. Projects are required to engage with the appointed project monitoring officer regularly and effectively throughout the duration of the project. In addition, the DASA/BEIS team will work with you to support delivery and exploitation including, when appropriate, introductions to end-users and business support to help develop their business.

Regular project monitoring and reporting will take three forms:

- Project teams will be required to meet with their Project Manager and Technical Partner at a kick-off meeting (planned for mid-July) and then once per month to update on project progress. Projects will share a slide pack covering progress, project achievements, technical challenges, spend against forecast, invoice update, risks and issues and RAG.

- Projects will be required to submit a project progress report every quarter. We expect this report to cover, as a minimum: • progress against the project delivery plan and project milestones • upcoming work over the next quarter • financial information (including budget spend so far and budget forecast) • an updated risk register (including flagging where risk ratings have changed or new risks/issue have emerged) • recent highlights and outputs •any key lessons learnt during delivery, and progress against relevant programme benefits.

- Projects will be required to undergo approximately two or three stage gate reviews, as per Section 9.1

Projects will also be required to share deliverables and a final project report, as per Section 9.

It is important to allow for this work, as well as the milestone invoicing, when resourcing the project management and reporting element of the demonstration project.

10.2 Milestones and Invoicing

Milestone payments will only be made by BEIS after an agreement has been signed between the applicant and BEIS. Further details on payments and financial requirements will be provided by BEIS as part of any funding agreement. These will include the requirement for detailed statements of expenditure and requests for funds in a specified format. Payments will be made on a milestone basis upon receipt of a detailed statement of expenditure. They will be subject to satisfactory progress against the project’s work plan. The exact milestones and associated payment amounts will be agreed on a project-by-project basis prior to the start of delivery.

Applicants must satisfy the due diligence, financial and organisational checks required prior to receiving public funds.

Milestone claims for Stream 1 must be invoiced in time to be processed and paid by 31 March 2025. If circumstances outside the control of the project occur which impact on delivering the expected outputs, the project must inform their Monitoring Officer as soon as possible. The Monitoring Officer will consult with BEIS to determine the best course of action.

After each stage of work is completed, you will be expected to complete and submit a claim form. Claims should be submitted to the Monitoring Officer for processing and will be paid within 30 working days of a complete and satisfactory claim being received. Finance is released against work carried out rather than a lump sum on approval.