Business population estimates for the UK and regions 2020: statistical release (HTML)

Published 8 October 2020

Headline statistics

The number of private sector businesses in the UK at the start of 2020 was

6.0 million

5.94 million businesses were small (0 to 49 employees)

36,100 businesses were medium-sized (50 to 249 employees)

7,800 businesses were large (250 or more employees)

Compared with 2019, the private sector business population has increased by

1.9% (+113,000 businesses)

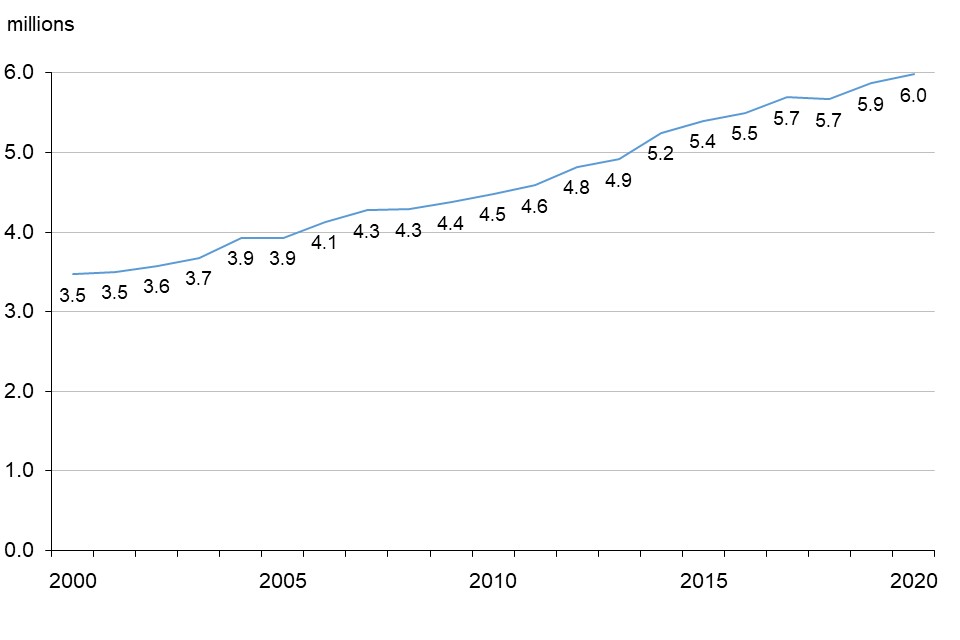

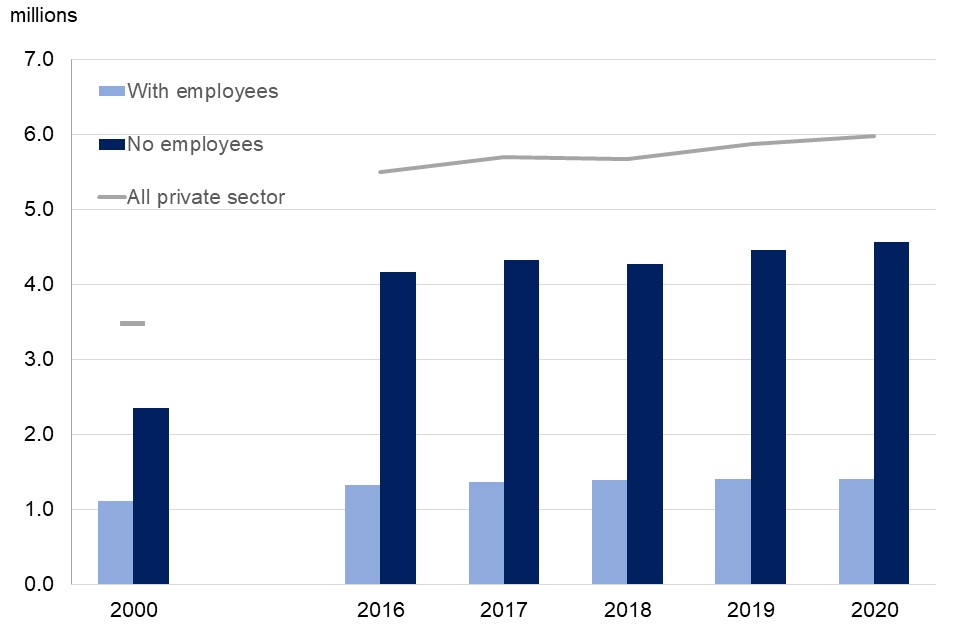

Figure 1: Number of private sector businesses in the UK, 2000 to 2020

What you need to know about these statistics

This publication provides the only official estimate of the total number of private sector businesses in the United Kingdom (UK) at the start of each year. This edition’s estimates do not capture changes in the business population caused by the Covid-19 pandemic.

These estimates, produced by the Department for Business, Energy and Industrial Strategy (BEIS), cover a wider range of businesses than Office for National Statistics (ONS) outputs, which report on value-added tax (VAT) traders and pay as you earn (PAYE) employers. See related statistics section for links to ONS publications and Guide to business statistics explaining how each publication differs.

Composition of the 2020 business population

The UK private sector comprises largely of non-employing businesses and small employers, as shown in Table A. SMEs (small and medium-sized enterprises) account for 99.9% of the business population (6.0 million businesses). At the start of 2020:

- there were estimated to be 6.0 million UK private sector businesses

- 1.4 million of these had employees and 4.6 million had no employees

- therefore, 76% of businesses did not employ anyone aside from the owner(s)

- there were 5.94 million small businesses (with 0 to 49 employees), 99.3% of the total business population

- there were 36,100 medium-sized businesses (with 50 to 249 employees), 0.6% of the total business population

- a further 7,800 businesses were large businesses (with 250 or more employees), 0.1% of the total business population

Table A: Estimated number of businesses in the UK private sector and their associated employment and turnover, by size of business, start of 2020

| Business | Employment (thousands) | Turnover (millions) | |

|---|---|---|---|

| All businesses | 5,980,520 | 27,732 | 4,346,969 |

| SMEs (0-249 employees) | 5,972,685 | 16,836 | 2,270,229 |

| Small businesses (0-49 employees) | 5,936,545 | 13,302 | 1,576,540 |

| With no employees | 4,567,775 | 4,966 | 315,627 |

| All employers | 1,412,745 | 22,766 | 4,031,341 |

| of which: | |||

| 1-9 employees | 1,156,925 | 4,196 | 615,251 |

| 10-49 employees | 211,845 | 4,140 | 645,662 |

| 50-249 employees | 36,140 | 3,534 | 693,689 |

| 250 or more employees | 7,835 | 10,896 | 2,076,740 |

Notes for table A:

- turnover column: figures exclude Section K (financial and insurance activities) where turnover is not available on a comparable basis

- “with no employees” category comprises sole proprietorships and partnerships with only a self-employed owner-manager(s) and companies with one employee, assumed to be a working proprietor

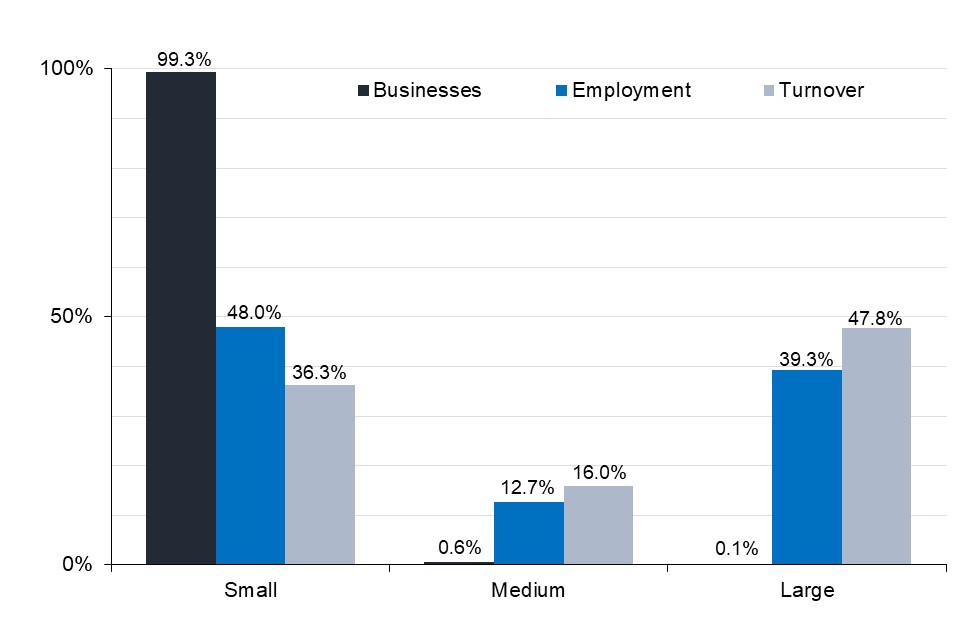

The 7,800 large businesses in the UK make a major contribution to employment and turnover. Nonetheless, SMEs account for three fifths of the employment and around half of turnover in the UK private sector. At the start of 2020:

- total employment in SMEs was 16.8 million (61% of the total), whilst turnover was estimated at £2.3 trillion (52%)

- employment in small businesses was 13.3 million (48%) and turnover £1.6 trillion (36%)

- employment in medium-sized businesses was 3.5 million (13%) and turnover £0.7 trillion (16%)

- employment in large businesses was 10.9 million (39%) and turnover £2.1 trillion (48%)

- further information on composition is shown in Table 1 in the detailed tables that accompany this publication, and in Figure 2

Figure 2: Contribution of different sized businesses to total population, employment and turnover, start of 2020

Note for figure 2: turnover figures exclude Standard Industrial Classification (SIC) 2007 Section K (financial and insurance activities) where turnover is not available on a comparable basis

Legal form

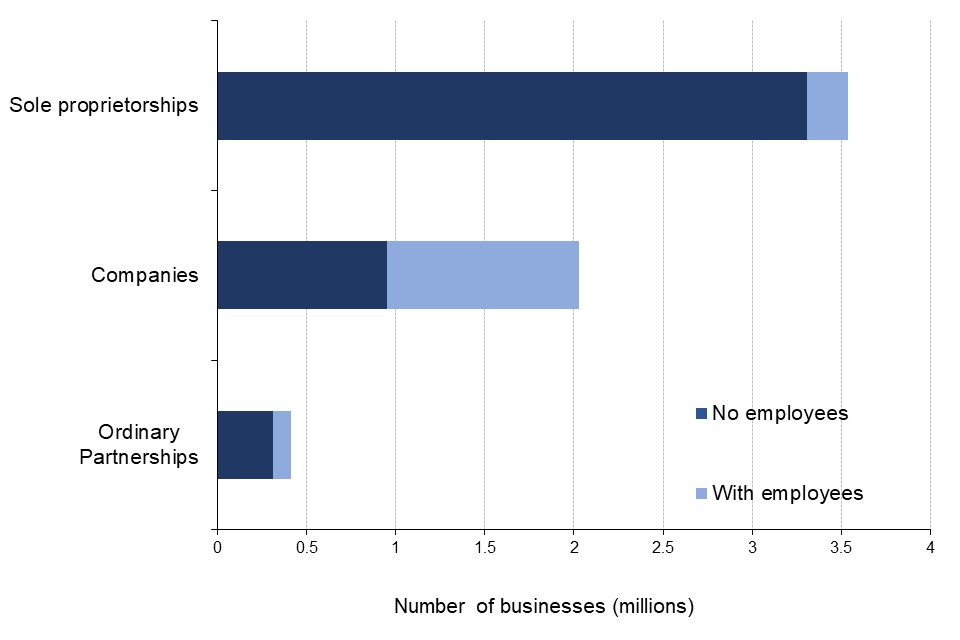

There are three main legal forms of businesses in the private sector; sole proprietorships, ordinary partnerships, and companies. Sole proprietorships are the most common legal form. At the start of 2020:

- the UK private sector business population comprised 3.5 million sole proprietorships (59% of the total), 2.0 million actively trading companies (34%) and 414,000 ordinary partnerships (7%)

- 1.1 million companies were employers, as were 229,000 sole proprietorships and 103,000 ordinary partnerships

- 3.3 million sole proprietorships, 946,000 companies and 311,000 ordinary partnerships did not employ anyone aside from the owner(s)

- further information on legal form is given in Figure 3 and Table C, and Table 3 of the detailed tables

Figure 3: Number of businesses in the UK private sector with and without employees, by legal status, start of 2020

Registration for VAT and PAYE

Just over three quarters of UK private sector businesses are non-employers, and the majority of these are not registered for either VAT (value added tax) or PAYE (paye as you earn). At the start of 2020:

- the Office for National Statistics recorded 2.7 million private sector businesses as registered for VAT or PAYE, 44% of the estimated total population

- 3.3 million businesses (56%) traded without being registered for VAT or PAYE and are classified here as ‘unregistered’

- 12% of sole proprietorships and 47% of ordinary partnerships were registered for VAT or PAYE

Trends in the business population

Between 2000 and 2020:

- the business population increased by 2.5 million (+72%)

- the average rate of annual growth in the business population was +3%

- the highest rate of increase was +7% between 2003 and 2004, and between 2013 and 2014

- in contrast, there was a decrease in the business population (for the first time in the series) between 2017 and 2018 of 27,000 (-0.5%)

Between 2019 and 2020:

- the total business population grew by 113,000 (1.9%)

- there were 3,000 more (+0.2%) employing businesses and 110,000 more (+2.5%) non-employing businesses

- the net change in the business population is determined by the balance of new business start-ups and de-mergers (inflows) against those businesses that closed, merged or were taken over by another business (outflows)

- further information on trends is in Tables B and C, Figures 4, 5 and 6, and Tables 25 to 28 of the detailed tables

Table B: Estimated number of businesses (in thousands) in the UK private sector by employment size-band, start of 2000, and 2016 to 2020

| 2000 | 2016 | 2017 | 2018 | 2019 | 2020 | |

|---|---|---|---|---|---|---|

| All private sector | 3,467 | 5,498 | 5,695 | 5,668 | 5,868 | 5,981 |

| All SME (0-249) | 3,460 | 5,491 | 5,687 | 5,660 | 5,860 | 5,973 |

| All small (0-49) | 3,433 | 5,457 | 5,653 | 5,625 | 5,825 | 5,937 |

| All employers (1+) | 1,111 | 1,325 | 1,367 | 1,389 | 1,410 | 1,413 |

| Non-employers | 2,356 | 4,173 | 4,328 | 4,278 | 4,458 | 4,568 |

| Micro (1-9) | 914 | 1,081 | 1,118 | 1,137 | 1,155 | 1,157 |

| Small (10-49) | 163 | 204 | 208 | 210 | 211 | 212 |

| Medium (50-249) | 27 | 33 | 34 | 35 | 36 | 36 |

| Large (250+) | 7 | 7 | 7 | 8 | 8 | 8 |

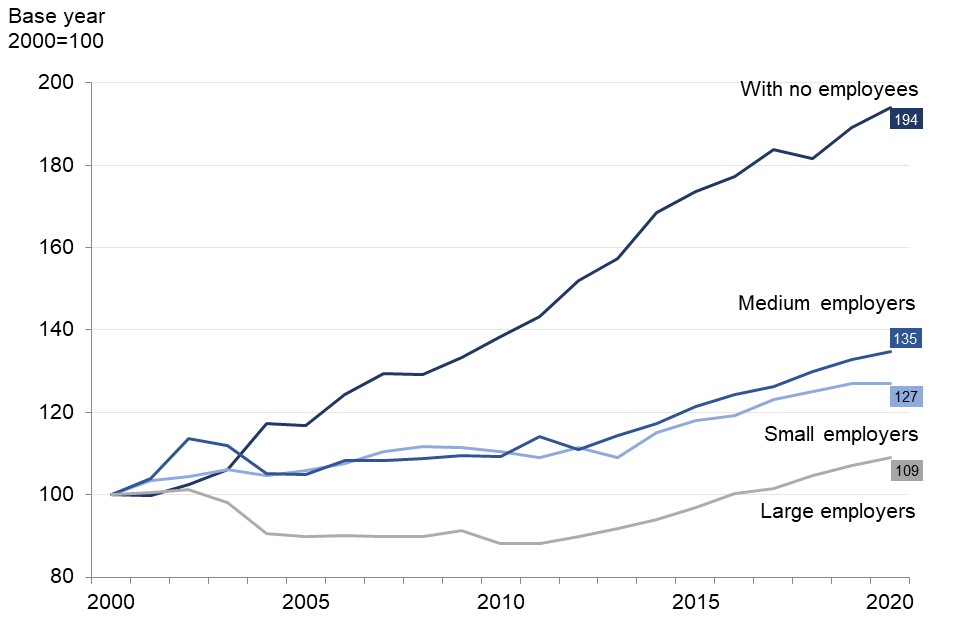

Growth in the UK private sector business population since 2000 has mainly been due to increasing numbers of non-employing businesses, as shown in Figures 4 and 5. Since 2000:

- the number of non-employing businesses has increased by 2.2 million (+94%)

- the number of employing businesses has increased by 301,000 (+27%)

- non-employing businesses accounted for 88% of total growth over the period

Figure 4: Growth in the number of UK private sector businesses by size band, 2000 to 2020 (index: base year = 2000)

Figure 5: Non-employing and employing businesses in the UK private sector, 2000 and 2016 to 2020

Overall the number of SMEs has increased by 2.5 million (+73%) since 2000, including 301,000 SME employers (+27%). Over this period:

- the number of small employing businesses grew by +27%

- the number of medium-sized employers grew by +35%

- the number of large businesses grew by +8%

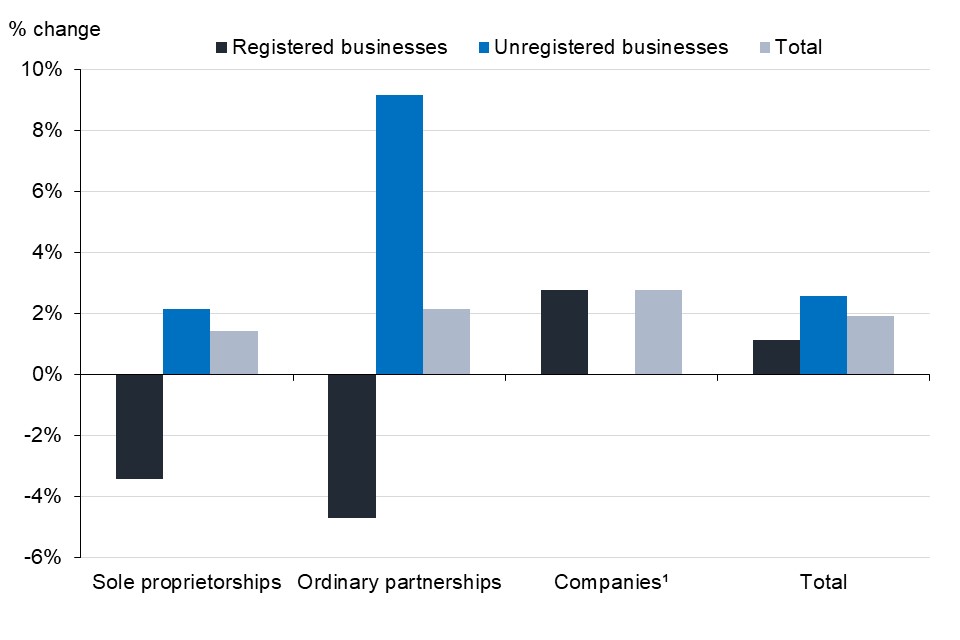

In the last year, the number of companies increased by 54,000 (+3%) and sole proprietorships by 50,000 (+1%). Ordinary partnerships increased by 9,000 (2%).

Looking at the period between 2010 and 2020:

- overall, the number of sole proprietorships grew by 783,000 (+28%) and the number of companies increased by 757,000 (+60%)

- in contrast, the number of ordinary partnerships fell by 42,000 (-9%)

Table C: Changes in the number of businesses, by legal status, between the start of 2019 and the start of 2020

| Sole proprietorships | Ordinary Partnerships | Companies | Total | |

|---|---|---|---|---|

| Unregistered businesses | 65,100 | 18,300 | N/A | 83,400 |

| Registered businesses | -15,300 | -9,600 | 54,300 | 29,400 |

| Of which | ||||

| with employees | -10,200 | -5,800 | 18,700 | 2,800 |

| without employees | -5,200 | -3,900 | 35,600 | 26,600 |

| All private sector | 49,700 | 8,700 | 54,300 | 112,700 |

Notes for table C:

-

numbers of businesses are rounded, in order to avoid disclosure. Consequently, totals may not exactly match the sum of their parts

-

the unregistered business category comprises self-employed people working alone or in partnership

-

BPE methodology assumes all companies are registered, hence N/A value for unregistered companies

-

‘registered’ businesses are those businesses registered for VAT and/or PAYE

Figure 6: Percentage change in the number of VAT/PAYE registered and unregistered businesses by legal form, between the start of 2019 and the start of 2020

Notes for figure 6:

- the BPE methodology assumes all companies are registered: see paragraph 29 of the Methodology note

In terms of employment trends:

- total employment across all private sector businesses increased from 27.5 million at the start of 2019 to 27.7 million at the start of 2020, a rise of 1%

- the SME share of total employment was 61% in 2020

- total employment in SMEs increased from 16.6 million at the start of 2019 to 16.8 million at the start of 2020, a rise of 1%

- further information on employment trends is in Table 28 of the detailed tables

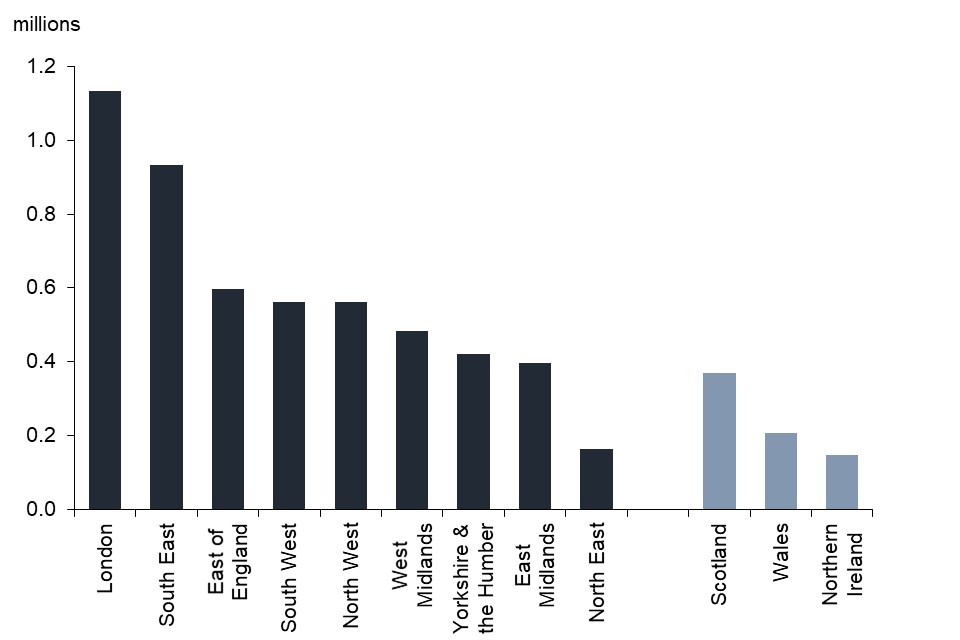

UK countries and the regions

Counts of businesses (and associated employment and turnover) are based on businesses’ head office location. A business operating in a particular region/country with a head office located elsewhere is not included in the business count for the region/country in question.

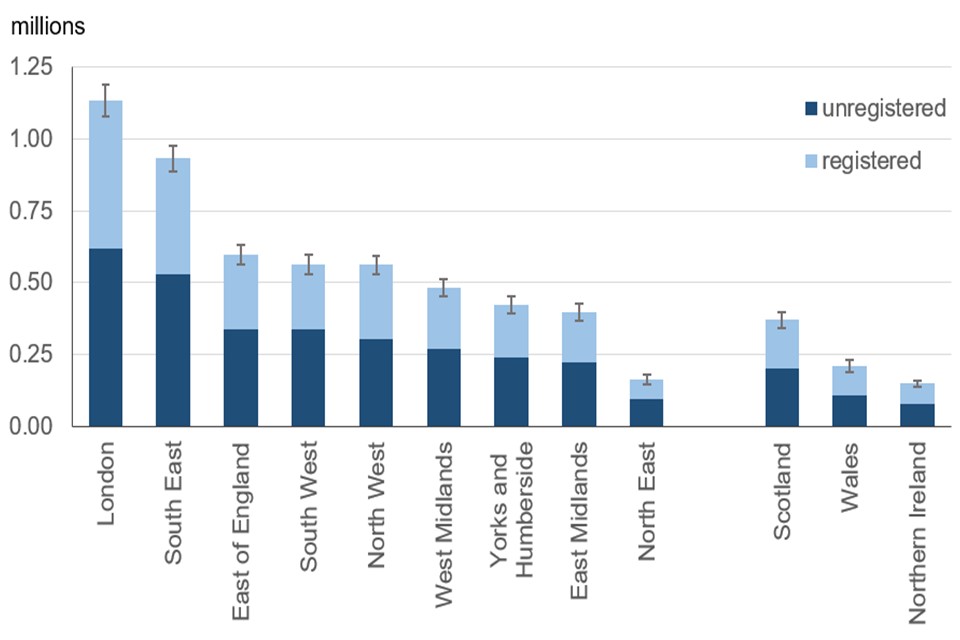

Private sector businesses are not evenly distributed across the UK. London and the South East of England have considerably more businesses than any other UK country or region of England, as shown in Figure 7. At the start of 2020:

- there were 5.3 million private sector businesses in England, 370,000 in Scotland, 209,000 in Wales, and 148,000 in Northern Ireland

- London (1.1 million) and the South East of England (932,000) had the most private sector businesses, accounting for 35% of the UK business population

- the North East of England had 163,000 private sector businesses, the least of any English region

- further information on location is in Table 9 of the detailed tables

Figure 7: Number of private sector businesses by English region and UK country, start of 2020

For regions and countries below UK level there is some volatility in estimates of year on year change. Looking in the longer term:

- the number of businesses has increased in all the UK countries and regions since 2010

- the biggest percentage increase in the number of businesses since 2010 was +58% in London

- the smallest percentage increase in the number of businesses since 2010 was +9% in Wales

- further information on regional trends is in Table 26 of the detailed tables

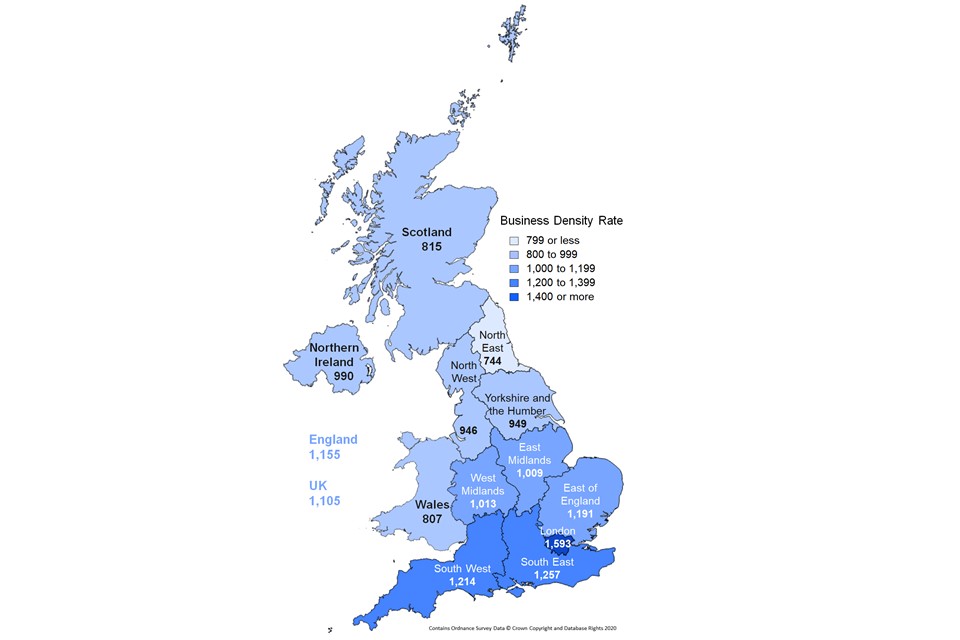

Along with the South West, London and the South East of England also had the highest business density rates in the UK, based on the size of the resident adult population, as shown in Figure 8. At the start of 2020:

- London (1,593) had the highest number of businesses per 10,000 resident adults

- there were also relatively high rates in the South East of England (1,257), the South West of England (1,214), and the East of England (1,191)

- the North East of England had the lowest business density rate (744) of any English region or UK country

- Wales (807), Scotland (815) and Northern Ireland (990) also had relatively low business density rates compared to the UK average.

- further information on business density is in Table 8 in the detailed tables

Figure 8: Number of businesses in the UK private sector per 10,000 adults, UK region and country, start of 2020

Industries

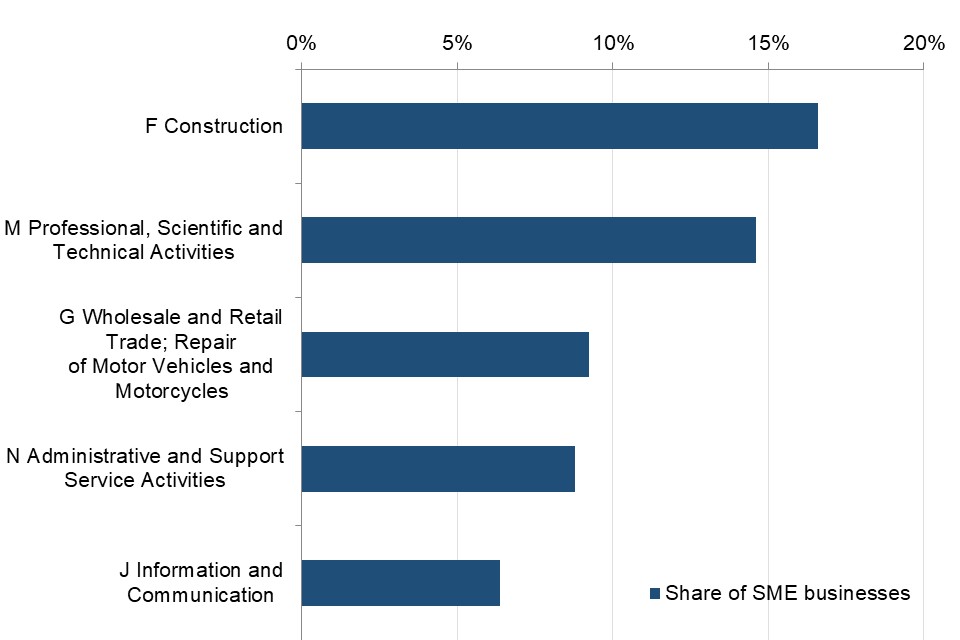

SMEs account for at least 99.5% of the overall population in each of the main industry sectors and are therefore distributed similarly to the business population overall. At the start of 2020:

- The largest number of SMEs (992,000 or 17%) were operating in Construction, as shown in Figure 9, compared with less than 1% in the Mining, Quarrying and Utilities sector (40,000)

- there were also a considerable number of SMEs operating in the Professional, Scientific and Technical Activities (872,000 or 15%), and Wholesale and Retail Trade and Repair sectors (552,000 or 9%)

Figure 9: Industrial sectors with most SMEs, as percentage of total SME numbers, start of 2020

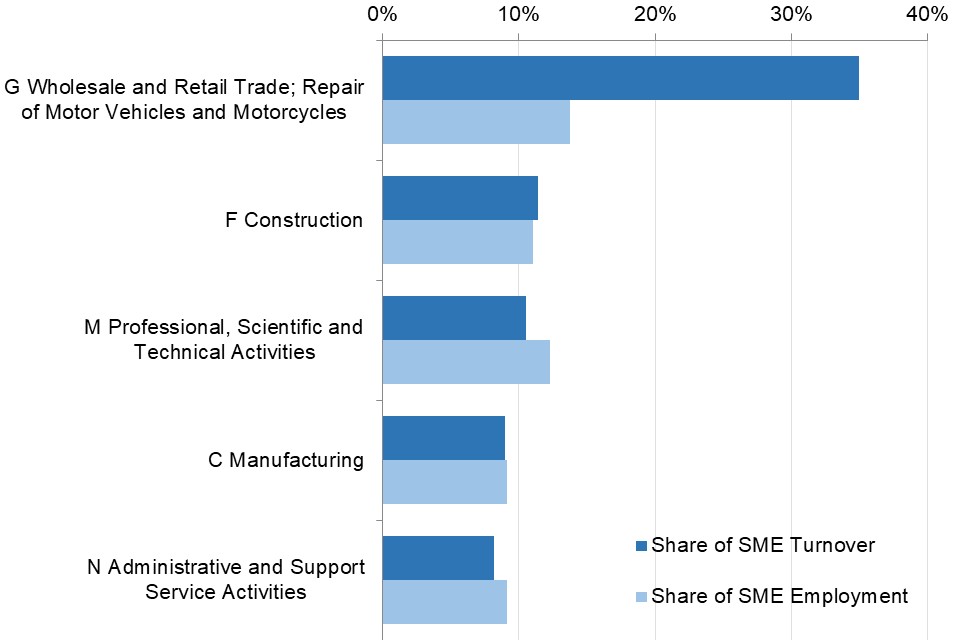

SMEs accounted for 61% of employment and 52% of turnover at the start of 2020. Wholesale and Retail Trade is the industrial sector which has the highest share of both SME employment and turnover, see Figure 10. At the start of 2020:

- Wholesale and Retail Trade and Repair accounted for 14% of all SME employment and just over a third of SME turnover in the UK private sector

- almost a third of SME turnover was spread across three more sectors: Construction (11%), Professional, Scientific and Technical (11%) and Manufacturing (9%)

- further information for industries is in Table 5 in the detailed tables

Figure 10: Industrial sectors with highest SME turnover and employment, as percentage of total SME employment and turnover, start of 2020

Note for figure 10: turnover figures exclude SIC 2007 Section K (financial and insurance activities) where turnover is not available on a comparable basis

Large businesses accounted for 39% of employment and 48% of turnover - at the start of 2020:

- Wholesale and Retail Trade and Repair accounted for 25% of all large business employment and 35% of large business turnover in the UK private sector

- the second largest sector in terms of large business employment was Administrative and Support Service Activities, which accounted for 14% of the total

- the second largest sector in terms of large business turnover was Manufacturing, which accounted for 20% of the total

Uncertainty in the business population estimates

This section, new to the publication for 2020, quantifies uncertainty around key estimates of business numbers. The section “Accuracy” in the Methodology and Quality Note outlines the process used to quantify uncertainty.

Uncertainty is quantified using two measures; 95% confidence intervals (CIs) and coefficients of variation (CV). The former indicate the range of values around an estimate within which the ‘true’ value of the estimate is likely to lie, with 95% probability. CVs, the ratio of an estimate’s standard error to the estimate itself expressed as a percentage, indicate the quality of estimates. The smaller the CV, the more precise the estimate. Values less than 5% indicate an estimate is precise for most practical purposes, those over 20% indicate that an estimate is unreliable.

Numbers of unregistered businesses reported in this publication are estimated, based on Labour Force Survey data, and therefore subject to uncertainty. This leads to uncertainty in counts of all businesses in the private sector, because these estimates comprise the sum of estimated unregistered business numbers and registered business numbers. Registered businesses are not estimated, being derived from an administrative data source, the Inter-Departmental Business Register (IDBR), and so not subject to sampling error. IDBR data will, however, contain other sources of error, which are likely to be small for counts of businesses. These are difficult to quantify and not captured in the CIs reported here, which are the same for unregistered business numbers and all private sector businesses numbers. CVs will differ, being smaller for the combined total than for the unregistered component.

At the start of 2020, the 95% CI around the total number of private sector businesses, estimated at 5,981,000 was ±113,000. On this basis, at the start of 2020:

- there was a 95% probability that the total number of business in the private sector was between 5,868,000 and 6,093,000

- the CV was 1%, indicating the estimate was precise

Figure 11: Estimated private sector businesses numbers in each English region, Scotland, Wales and Northern Ireland, with 95% CIs, start of 2020

For data shown in Figure 11:

- The lowest CV for the regions shown in Figure 11 was 2% for the South East, indicating the estimate was precise

- Wales and the North East had the largest CVs (5%), indicating the estimates of private sector business numbers to be less reliable than elsewhere, though still reasonably precise

For private sector businesses in England, estimated at 5,253,000, the 95% CI was ±107,000, with a CV of 1%.

Table 29 in the detailed tables provides further details of CIs and CVs for all business numbers and unregistered business numbers, by country and English region.

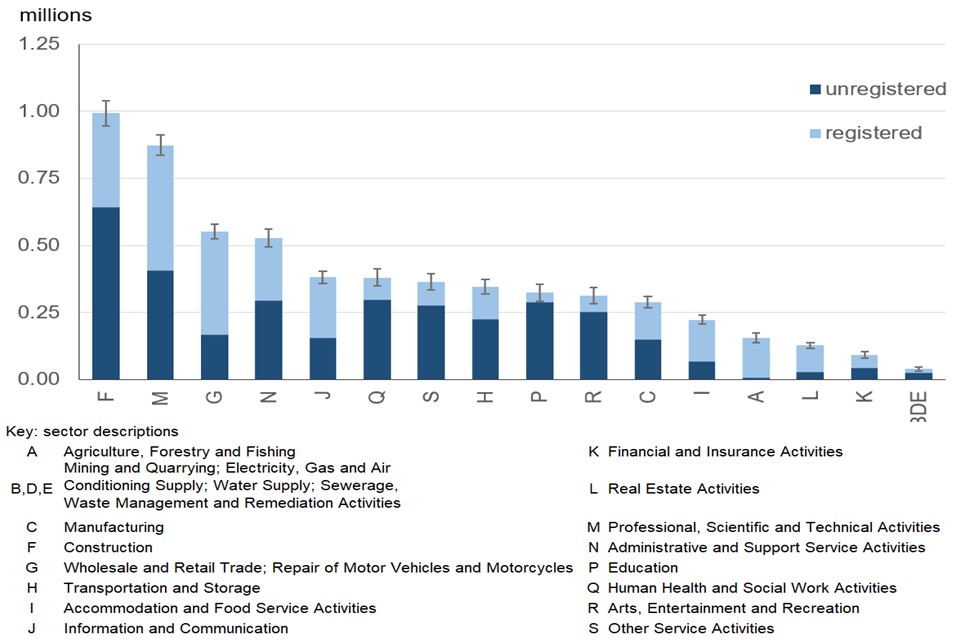

Figure 12: Estimated private sector businesses numbers by industrial sector, with 95% CIs, start of 2020

For data shown in Figure 12:

- CVs for Sectors F (Construction), G (Wholesale and Retail Trade; Repair of Motor Vehicles and Motorcycles) and M (Professional, Scientific and Technical Activities) were lowest (2%) indicating estimates were precise

- The combined sector B, D and E (Mining and Quarrying; Electricity, Gas and Air Conditioning Supply; Water Supply: Sewerage, Waste Management and Remediation Activities) had the largest CV (11%), indicating the estimate was acceptable, followed by sector A (Agriculture, Forestry and Fishing) and K (Financial and Insurance Activities), both with CVs of 6%, indicating reasonably precise estimates

Table 29 in the detailed tables provides further details of CIs and CVs for all business numbers and unregistered business numbers, by industry sector.

Technical information

This publication is the latest in a series providing estimates of the total number of private sector businesses in the UK. This publication estimates the total number of UK private sector businesses at a point in time, including those that are registered for VAT or PAYE and those that are unregistered. Related ONS publications report only on VAT/PAYE registered businesses.

A guide explaining how this publication relates to other National Statistics on business population and demography has been published to help users understand the differences and choose the most appropriate source.

There is no single database containing all private sector businesses in the UK. The main source for this publication is the Inter-Departmental Business Register (IDBR), managed by the Office for National Statistics (ONS), which is used to provide the number of VAT/PAYE registered businesses in the UK. This publication also includes estimates of smaller non-employing (unregistered) businesses which are calculated using a combination of information from the ONS Labour Force Survey and HMRC self-assessment tax return data. Up-to-date self-assessment data was not available for this edition of the publication, so the last available data (from 2017/2018) was used. This is unlikely to have had a large effect on the estimates, as previous self-assessment data used in the publication has been relatively stable over time. More detail of the estimation process is provided in the Methodology and Quality Note.

Companies can take a range of legal forms, including Public Limited Companies, Private Limited Companies, Limited Liability Partnerships, and others. The IDBR only counts actively trading companies, rather than all those recorded on the Companies House register.

This edition uses the same methodology as that used since the 2011 edition of this publication. However, the methodology is not directly comparable to that used for BPE 2010 or to the older SME Statistics series (1994 to 2009).

To enable robust comparison over time, a time series is calculated using the latest methodology and data. This shows annual estimates of numbers of private sector businesses in the UK between 2000 and 2020. Estimates for UK countries/English regions and for different legal forms are provided for years since 2010 (the first year for which consistent estimates can be produced).

Known impacts from changes to HMRC systems have been adjusted for – further details are in the methodology note.

Information on the employment and turnover in these businesses is also provided. The function of the employment and turnover data provided is primarily to (i) classify businesses by employee size band and (ii) calculate shares of employment and turnover across industrial sectors, regions and legal statuses. This release includes an employment time-series in Table 28 of the detailed tables. However, users should note that these employment estimates are indicative and that ONS publishes other sources of employment data more suitable for monitoring total jobs and people in employment. See the Workforce Jobs series, the Business Registers Employment Survey (BRES), and the wider Labour Market Statistics (refer to the Methodology and quality note for more information).

All statistics relating to 2020 released in this publication are new. No data from earlier years have been revised.

The definition of the private sector used in this publication excludes the non-profit sector but includes public corporations and nationalised bodies.

Turnover data throughout this release excludes SIC2007 Section K (Financial and insurance activities) as turnover is not available on a comparable basis.

Businesses that have sites (and employees) in more than one region or country are counted here only in the region or country where they are registered. These estimates may therefore differ from actual employment in a region, since some people in one region will work for businesses that are registered in another region.

All figures and percentages in this document are rounded. Therefore, totals may not exactly match the sum of their parts. Suppression and controlled rounding have been used to protect the data in this publication from disclosure. For further information, refer to the Methodology and quality note.

Definitions and terminology

| Term | Description |

|---|---|

| Company | Companies can take a range of legal forms, including Public Limited Companies, Private Limited Companies, Limited Liability Partnerships, and others such as public corporations and nationalised bodies in which the working directors are classed as employees |

| Employers | a company with a single employee director is treated as having no employees |

| Large business | a business with 250 or more employees |

| Medium-sized business | a business with 50 to 249 employees |

| Ordinary partnership | a business run by two or more self-employed people |

| Small business | a business with 0 to 49 employees |

| Small and medium-sized enterprises (SMEs) | businesses with 0 to 249 employees |

| Sole proprietorship | a business run by one self-employed person |

Further information

Future updates to these statistics

The next publication in this series is scheduled for Autumn 2021.

Related statistics

UK business; activity, size and location, published annually by the ONS, gives information about UK businesses broken down by legal status, industry, region, employment and turnover size bands.

Business Demography, published annually by the ONS, provides information on births, deaths and survivals of businesses in the UK, by geographical areas and standard industrial classification groups.

Businesses in Scotland, published annually by the Scottish government, provides information on numbers of enterprises (businesses) operating in Scotland, broken down by industry, business size, local authority area, urban and rural area and country of ownership.

Business Structure, published annually by the Welsh Government, contains data on the estimated number of businesses active in Wales.

Northern Ireland business; activity, size and location, published annually by the Northern Ireland Statistics and Research Agency, provides an overview of Northern Ireland’s business population.

Revisions policy

The BEIS statistical revisions policy sets out the revisions policy for these statistics, which has been developed in accordance with the UK Statistics Authority Code of Practice for Statistics.

Uses of these statistics

This publication is used extensively by government, the public, public bodies and businesses to analyse the scale, structure and significance of the total business population in the UK and to monitor change over time. For example, they are used by:

- government in understanding the likely impact of policy changes and monitoring the impact of recessions on different sections of the business population

- businesses in understanding market share and planning marketing strategies

- banks in developing an understanding of their customer base

- foreign firms in making UK location decisions

- academics to inform research into businesses at a local and national level

- a range of public bodies in decision making and in evaluating the success of regeneration and business-related policies

- public and private business support providers in targeting business support

User engagement

Users are encouraged to provide comments and feedback on how these statistics are used and how well they meet user needs. Comments on any issues relating to this statistical release are welcomed and should be sent to: [email protected].

The Business Population and Demographics Statistics (PDF) (BPDS) user group provides a forum for discussion of statistics and statistical research on the business population and demographics and is open to users based in central and local government, academia and the private sector.

The BEIS statement on statistical public engagement and data standards sets out the department’s commitments on public engagement and data standards as outlined by the Code of Practice for Statistics.

Get in touch

Comments about this statistical release and its usage are welcomed. Send to: [email protected]

National Statistics designation

National Statistics status means that our statistics meet the highest standards of trustworthiness, quality and public value, and it is our responsibility to maintain compliance with these standards. The designation of these statistics as National Statistics was confirmed in October 2012 following an assessment. Since the latest review, we have continued to comply with the Code of Practice for Statistics, and have made the following improvements:

- alterations to processing of ONS Labour Force Survey (2013 and 2016) and HMRC self-assessment tax returns (2016) data have improved data quality

- reduction in numbers of people with pre-release access to the publication

- changes have been made to format and layout of the statistical release in 2019 to make it more accessible and consistent with format of similar publications

- in 2019 detailed tables are published in OpenDocument spreadsheet format as well as excel format – for accessibility purposes

- in 2020, uncertainty around key estimates of business numbers was quantified

Pre-release access to statistics

Some ministers and officials receive access to these statistics up to 24 hours before release. Details of the arrangements for doing this and a list of the ministers and officials that receive pre-release access to these statistics can be found in the BEIS statement of compliance with the Pre-Release Access to Official Statistics Order 2008.

Contact

- Responsible statistician: Darren Barton

- Email: [email protected]

- Media enquiries: 020 7215 1000

- Public enquiries: 020 7215 5297