Civil Justice Statistics Quarterly: October to December 2023

Published 7 March 2024

Applies to England and Wales

1. Main Points

| Increase in County Court claims, driven mostly by money claims | Compared to the same period in 2022, County Court claims from October to December 2023 were up 11% to 402,000. Of these, 335,000 (83%) were money claims (up 13%). Compared to the same quarter in 2019 (pre-covid baseline), County Court claims were down 16%. |

| Damages claims were down 10% at 21,000 | The decrease in damages claims was driven by a fall in personal injury claims (down 24% to 13,000) compared to the same quarter in 2022. Compared to the same quarter in 2019 (pre-covid baseline), total damages claims were down 29%. |

| The number of claims defended increased compared to 2022 while the number of trials decreased | There were 65,000 claims defended (up 13%) and 11,000 claims that went to trial in October to December 2023 (down 19%) compared to the same quarter in 2022. Compared to the pre-covid baseline, claims defended were down 11% and claims that went to trial were down 36%. |

| Mean time taken from claim to hearing continues to rise for multi/fast track claims | The mean time taken for small claims and multi/fast track claims to go to trial was 55.8 weeks and 85.7 weeks, 4.3 and 6.9 weeks longer than the same period in 2022 respectively. Compared to 2019, these measures are 18.7 weeks longer for small claims and 24.7 weeks longer for multi/fast track claims. |

| Judgments were up 18% and default judgments were up 21% | Judgments were up 18% (to 252,000) in October to December 2023, compared to the same period in 2022; with 93% of these being default judgments. Compared to the same period in 2019, judgments were down 20%, 88% of which were default judgments. |

| Enforcement applications rose to 13,000 and orders remained stable at 8,300 | Enforcement applications were up 23%, while enforcement orders were stable when compared to the same quarter in 2022. Compared to 2019 (pre-covid baseline), volumes of enforcement applications were down 51% and enforcement orders were down 50%. |

| Warrants issued increased to 81,000 | Warrants issued were up 34% when compared to the same quarter in 2022, and up 19% compared to 2019 (pre-covid baseline). |

| 670 judicial review applications | There were 670 applications for Judicial Reviews in Q4 2023, down 1% on Q4 2022. Of the 82 cases in 2023 Q4 that have so far reached the permission stage, 7 (9%) were found to be ‘totally without merit’. |

| There were 7 applications for interim privacy injunction proceedings in the final half of 2023 | There were no proceedings on whether to continue or amend an interim injunction, one proceeding on whether to issue a final permanent injunction, no proceedings on whether to continue or amend an undertaking, and no proceedings considered for a final undertaking. |

This publication gives civil county court and judicial review statistics for the latest quarter (October to December 2023), compared to the same quarter in 2022. Should users wish to compare the latest outturn against earlier time periods, they can do so using the accompanying statistical tables. This quarter’s publication also includes data on Privacy Injunctions considered during the second half of 2023. For more details, please see the supporting document.

Statistics on the Business and Property Court for England and Wales have also been published alongside this quarterly bulletin as Official Statistics. For technical detail, please refer to the accompanying support document.

A visualisation tool that provides further breakdowns in a web-based application can be found here. For general feedback on the tool and related content of this publication, please contact us at: [email protected]

2. Statistician’s comment

County court claims have continued their steady increase in 2023, consistently increasing in the past three years. The increase in 2023 is mainly driven by Money and Mortgage possession claims. The number of Personal injury claims continues to fall, dipping by 25% compared to 2022.

This quarter, claims received increased, with a subsequent increase in claims defended. However, the number of claims allocated to track and claims gone to trial decreased – the latter is at its lowest level since the pandemic, and prior to that since around 2013. The decline in allocations is thought to have been caused by the closure of the County Court Money Claims Centre in Salford and the transfer of work to the Civil National Business Centre and this decline resulted in the decrease in claims gone to trial.

After appearing to be stabilising in the previous quarter, both the average time between issue and trial for small and fast/multi track claims increased this quarter, by 4.3 weeks and 6.9 weeks respectively. This is the highest level since our series started in 2009.

There were seven applications for new interim privacy injunctions in the High Court between July to December 2023, details of which are included this quarter.

3. Claims Summary

County court claims have been steadily increasing in the last 3 years. There were 1,714,000 claims in the 2023 calendar year, up 11%, from 1,539,000, in the previous year.

Quarter on quarter claims were up 11% on the same quarter of 2022, driven mostly by money claims.

There were 402,000 County Court claims lodged in October to December 2023. Of these, 357,000 (89%) were money and damages claims (up 12% from October to December 2022).

Non-money claim volumes were at 46,000, up 4% when compared to the same quarter in 2022.

Mortgage and landlord possession claims were up 18% over the same period to 28,000, ‘other non-money claims’ were down 10% to 16,000 and claims for return of goods were down 22% to 2,100.

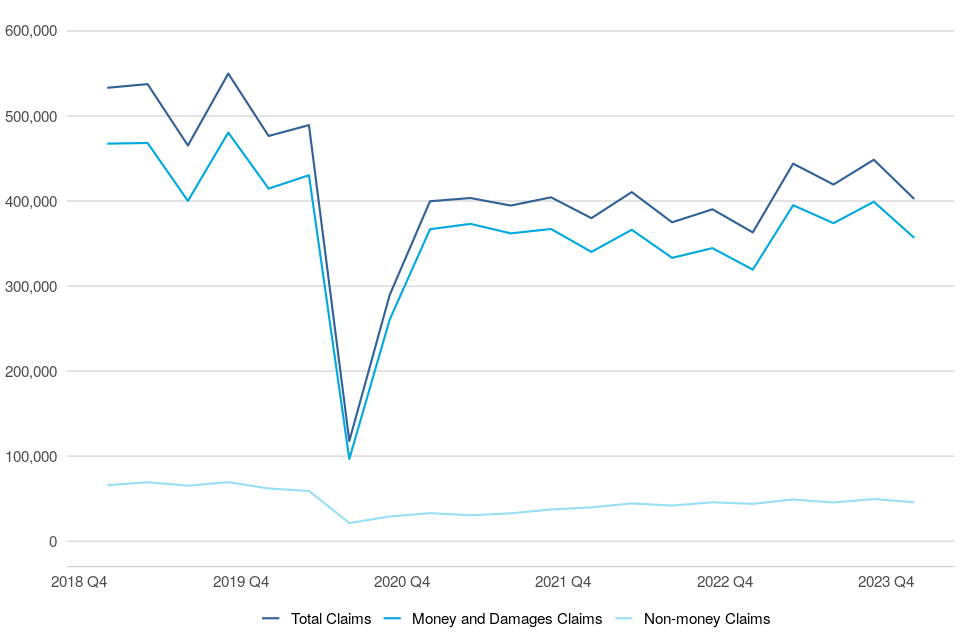

Figure 1: County Court claims by type, Q4 (October to December) 2018 to Q4 (October to December) 2023 (Source: table 1.2)

In the most recent quarter, total claims were up 11% compared to the same period in 2022 (from 363,000 to 402,000). Of these, 357,000 were money and damages claims, up 12% from October to December 2022 (from 319,000). Money and damages claims made up 89% of all claims in October to December 2023, up 1pp on its share in October to December 2022.

Prior to 2020, claim volumes had been relatively unchanged but volatile, driven by a few “bulk issuers” slowing down and then ramping up their volume of claims. Claim volumes decreased significantly following the outbreak of Covid-19. After an initial recovery towards pre-pandemic levels in the second half of 2020, claims issued remained relatively stable. Although volumes have risen in this quarter this is still down 16% compared to the same quarter in 2019.

Non-money claims generally decreased between 2015 and Q1 2020. While these showed less of an impact following Covid-19 in contrast to money and damages claims, the recovery to pre-Covid19 volumes has been slow. In the current quarter, these claims were up 4% (from 44,000 to 46,000) compared to the same period in 2022, driven by increases in Mortgage and Landlord Possession claims. However, these remain down 26% below the same quarter in 2019 (pre-covid baseline).

Within non-money claims, ‘other’ non-money claims have shown a decline since 2018. In the most recent quarter, these were down 10% (from 18,000 to 16,000) compared to the same period in 2022. These continued decreases are likely to be partly as a result of whiplash reforms reducing the volume of road traffic accident claims going to court.

The overall trend in Mortgage and Landlord Possession claims has been decreasing since a peak of 60,000 in January to March 2014. Following the impact of Covid-19, when it fell to 3,200 – lowest recorded, these have increased gradually to 28,000 claims in October to December 2023, up 18% compared to the same quarter of 2022 (24,000 claims). However, this remains down 12% compared to the same quarter in 2019. Further details can be found in the Mortgage and Landlord Possessions publication here.

Claims for return of goods increased steadily to a high of 3,500 in July-September 2018 but have since declined. Following a further decline due to the impact of Covid-19 to 700 in Q2 2020, there has been recovery in these figures and volumes have remained relatively stable since Q1 2022 around pre-covid levels. This quarter, volumes are down 22% (from 2,700 to 2,100) compared to the same period in 2022.

4. Money and Damages Claims

There were 1.5m money and damages claims in the calendar year of 2023, an increase of 12% when compared to the previous year. This increase was mainly driven by a 14% increase in money claims which forms the bulk (94%) of these claims, from 1,253,000 in 2022 to 1,428,000 in 2023.

Both damages and personal injury claims have continued their downward trend over the course of the year. There was a decrease in damages claims in 2023 of 12% (to 97,000) compared to 2022 (from 110,000). While personal injury claims fell by 25% to record its lowest level at 61,000 since 2009.

Quarter on quarter, money claims were up 13% (to 335,000 claims) in October to December 2023 compared to the same quarter in 2022.

Money claims valued up to £500 were up 12% over this period to 152,000 and claims between £1,000 and £3,000 were up 15% to 75,000, mostly driving the overall trend in money claims.

Damages claims were down 10% at 21,000 driven by a decrease in personal injury claims (down 24%) to 13,000 compared to the same quarter in 2022, offsetting an increase in other damages claims (up 25%) to 8,600 over the same period.

Personal injury claims have continued a generally downwards trend since Q4 2020. This is likely due to a combination of factors including the introduction of whiplash reforms (with some cases being processed via the online portal rather than going to court).

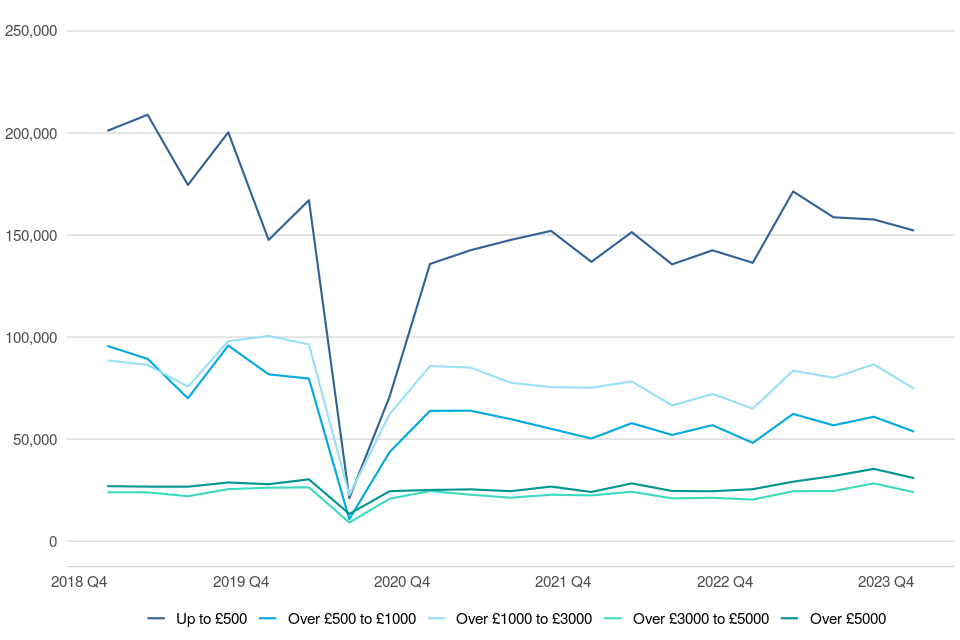

Figure 2: Money claims by monetary value, Q4 (October to December) 2018 to Q4 (October to December) 2023 (Source: civil workload CSV[footnote 1])

Historically, money claims reached a peak in April to June 2017, after which the implementation of the Pre-Action Protocol (PAP) for Debt Claims in October 2017 led to a sharp drop in claims. An increasing trend resumed the following quarter, suggesting that the impact of the PAP on claim volumes was temporary. The main aim of the protocol is to encourage early engagement between parties to resolve disputes without needing to start court proceedings. In the most recent quarter (October to December 2023), there were 335,000 claims, up 13% on the same quarter in 2022 (296,000 claims).

This quarter, the majority (82%) of money claims were processed and issued at the County Court Business Centre (CCBC). There were 275,000 such claims at the CCBC in October to December 2023 (up 13% on the same quarter in 2022). CCBC claims were particularly affected by Covid-19 and associated actions, recording a more significant decrease than other money claims. This is due to bulk issuers almost completely ceasing their issue during the immediate response to the pandemic. These have now returned to historic trend levels and may account for the increase this quarter.

The increase in money claims is driven by claims valued under £500 and claims between £1,000 and £3,000. These were up 12% and 15%, to 152,000 and 75,000 claims respectively in the period October to December 2023 compared to the same quarter in 2022. Claims valued under £500 account for 45% of total money claims in the most recent quarter. This is up from historical levels with this category making up 38% of total money claims in October to December 2019. This trend may be typical of the current economic cycle where people are more likely to claim – even for small amounts – in a cost-of-living crisis when disposable income falls due to high inflation, low or no economic growth, and continued rises in interest rates.

Other than in Q2 2020, damages claims – made up of personal injury and other damages claims - have fluctuated between 22,000 and 38,000 claims each quarter over the last five years (since October to December 2018). However, in the current quarter volumes were down 10% to 21,000 in October to December 2023 compared to the same period in 2022. This was driven by a decrease in personal injury claims down 24% from 17,000 to 13,000 – the lowest level since Q2 2009. Other damages claims volumes can be prone to volatility and this quarter was up 25% from 6,900 to 8,600. Other damages claims accounted for 40% of all damages claims in the most recent quarter, up 11pp compared to October to December 2022, when they accounted for 29% of all damages claims. Personal injury claims were down 24% compared to the same period in 2022, continuing a generally decreasing trend since Q4 2020.

4.1 Allocations (table 1.3)

In October to December 2023, 28,000 money and damages claims were allocated to track, down 29% (from 39,000) compared to the same period in 2022. The decline in allocations follows the closure of the County Court Money Claims Centre in Salford and the transfer of work to the Civil National Business Centre. The volumes of claims allocated to track are expected to increase in the coming months as the Civil National Business Centre recovers performance to previous levels. Compared to October to December 2022, of these allocations:

- 19,000 were allocated to small claims, down 29% on October to December 2022. This accounts for 69% of all allocations (unchanged compared to the same quarter of 2022);

- 6,800 were allocated to fast track, down 27% on October to December 2022. This accounts for 25% of all allocations (compared to 24% of all allocations in the same quarter of 2022);

- 1,700 were allocated to multi-track, down 35% on October to December 2022. This accounts for 6% of all allocations (compared to 7% of all allocations in the same quarter of 2022);

In October 2023, the extension of Fixed Recoverable Costs saw the introduction of a new Intermediate track which sits between the Fast and Multi track, the Intermediate track will be the normal track for claims valued between £25,000 and £100,000, with some exemptions[footnote 2]. The track applies to both money and damages claims and introduces fixed recoverable costs to claims in this track which would previously have been allocated to the multi-track. Cases from the new intermediate track will be included in subsequent publications, as they appear in the caseload.

5. Defences (including legal representation) and Trials

Claims defended increased from 250,000 to 259,000 (up 4%) in 2023 compared to the previous calendar year, while the number of trials decreased by 1% in 2023 (from 54,000 to 53,000) on the 2022 calendar year.

The number of claims defended was up 13% to 65,000 compared to the same quarter in 2022.

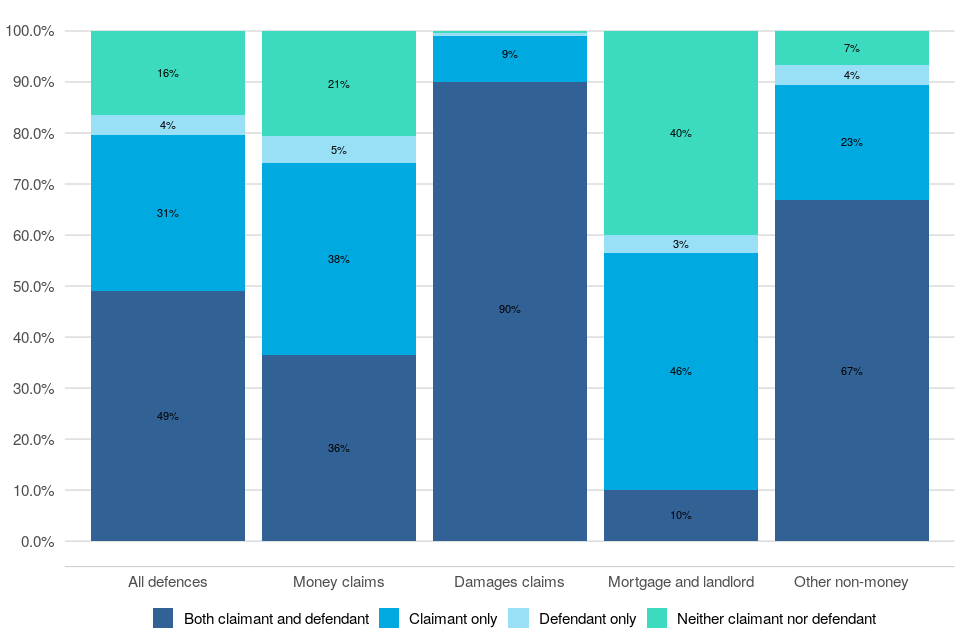

Of those claims defended, 49% had legal representation for both claimant and defendant, 31% had representation for claimant only, and 4% for defendant only.

The number of trials was down 19% to 11,000 compared to the same quarter in 2022.

Average time taken for small claims was 55.8 weeks (4.3 weeks longer compared to the same quarter in 2022) and for multi and fast track claims it was 85.7 weeks (6.9 weeks longer than October to December 2022).

Of those claims defended in October to December 2023, 49% had legal representation for both claimant and defendant, 31% had representation for claimant only, and 4% for defendant only. Almost all (90%) damages claim defences had legal representation for both the defendant and claimant, compared with 36% of money claim defences.

Figure 3: Proportion of civil defences and legal representation status, October to December 2023 (Source: table 1.6)

The total number of claims defended was up 13% in October to December 2023 compared to the same quarter in 2022, from 57,000 to 65,000 cases. The number of claims defended continues to rise after a brief decline in Q2 2023 following the closure of the County Court Money Claims Centre in Salford and the transfer of work to the Civil National Business Centre which created a temporary backlog. Mortgage and landlord possession defences were up 20% from 3,700 to 4,400 compared to October to December 2022. On the contrary, a decrease was seen in defended damages claims (down 12% from 19,000 to 17,000).

5.1 Trials and Time Taken to Reach Trial (table 1.5)

Defended cases which are not settled or withdrawn, generally result in a trial. In total, there were 11,000 trials in October to December 2023, down 19% compared to the same period in 2022. This decline is likely due to the decrease in claims allocated to track caused by the closure of the County Court Money Claims Centre in Salford. Of the claims that went to trial, 8,000 (75%) were small claims trials (down 20% compared to the same quarter in 2022) and 2,600 (25%) were fast and multi-track trials (down 18% from the same quarter of 2022).

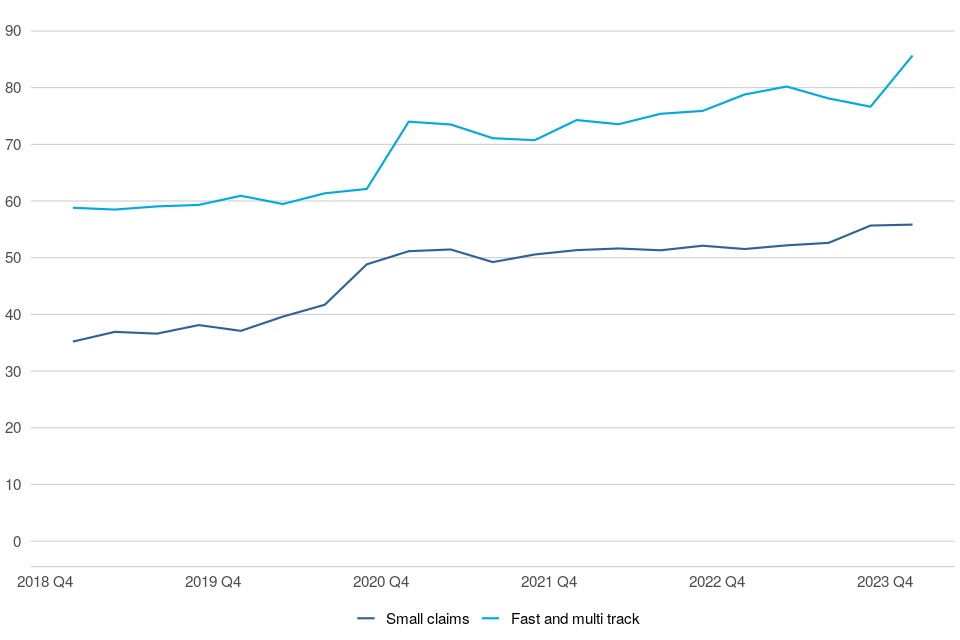

Figure 4: Average number of weeks from claim being issued to initial hearing date, Q4 (October to December) 2018 to Q4 (October to December) 2023 (Source: table 1.5)

In October to December 2023, it took an average of 55.8 weeks between a small claim being issued and the claim going to trial, 4.3 weeks longer than the same period in 2022, and the highest in our series which started in 2009. Timeliness for Small Claims remains a challenge with this metric measuring only those cases concluding at trial (rather than through settlement following mediation for example). There is regional variation within this metric with longer waiting times experienced in London and the South East.

Mediation is being fully integrated as a key step in the court process for small civil claims valued up to £10,000. This, when successful, results in outcomes which are not used within the timeliness calculations. This means the final cases used in timeliness measures include a disproportionate number of more complex cases which take longer to dispose of.

The HMCTS Reform programme is modernising and digitising the systems to allow the courts to work more efficiently and cases are expected to progress from issue to directions more quickly.

For multi/fast track claims, it took on average 85.7 weeks to reach a trial, 6.9 weeks longer than in October to December 2022, continuing to exceed the upper limit of the range seen in 2009-2019 (which was 52 to 61 weeks) and the highest in our series which started in 2009.

Covid-19 and associated actions have led to an uptick in time taken for all claims to reach trial. Prior to this, a sustained period of increasing receipts had increased the time taken to hear civil cases and caused delays to case progression.

6. Judgments

In the 2023 calendar year there were 1,058,000 judgments compared to 901,000 in 2022 (up 17%). 92% of judgments in 2023 were default judgments (972,000).

Judgments were up 18% compared to the same quarter in 2022.

There were 252,000 judgments made in October to December 2023, compared to 214,000 in the same quarter of 2022. Of these judgments, 234,000 (93%) were default judgments.

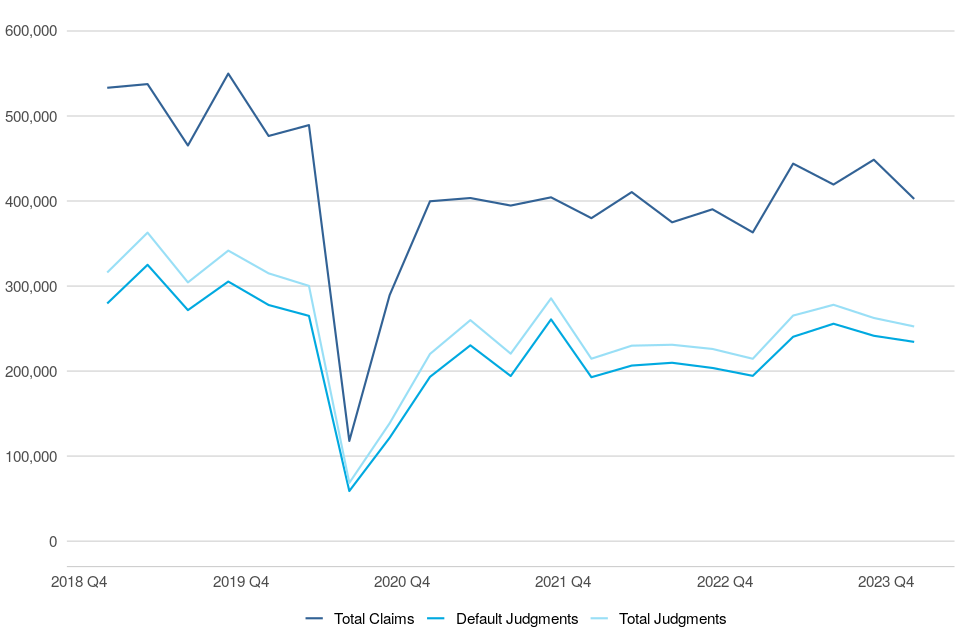

Figure 5: All claims, judgments and default judgments, Q4 (October to December) 2018 to Q4 (October to December) 2023 (Source: tables 1.2 and 1.4)

There were 252,000 judgments made in October to December 2023, up 18% compared to the same quarter of 2022. Of these, 93% were default judgments, up 2pp on its share in October to December 2022. These have remained relatively stable since 2018, with around 9 out of every 10 judgments resulting in a default judgment.

The second largest type of judgment was ‘admissions’[footnote 3], of which there were 10,000 in October to December 2023, up 5% on the same quarter in 2022 (from 9,900). ‘Admission’ judgments accounted for 4% of all judgments.

7. Warrants and Enforcements

Warrants and enforcements increased in 2023.

Warrants issued were up 22% on the 2022 calendar year (from 279,000 to 342,000). Warrants of control made up 84% of these in 2023 (289,000, up 22% on 2022).

Similarly, enforcement applications were up 9% (from 46,000 to 50,000) and enforcement orders were stable (at 36,000) when compared to 2022.

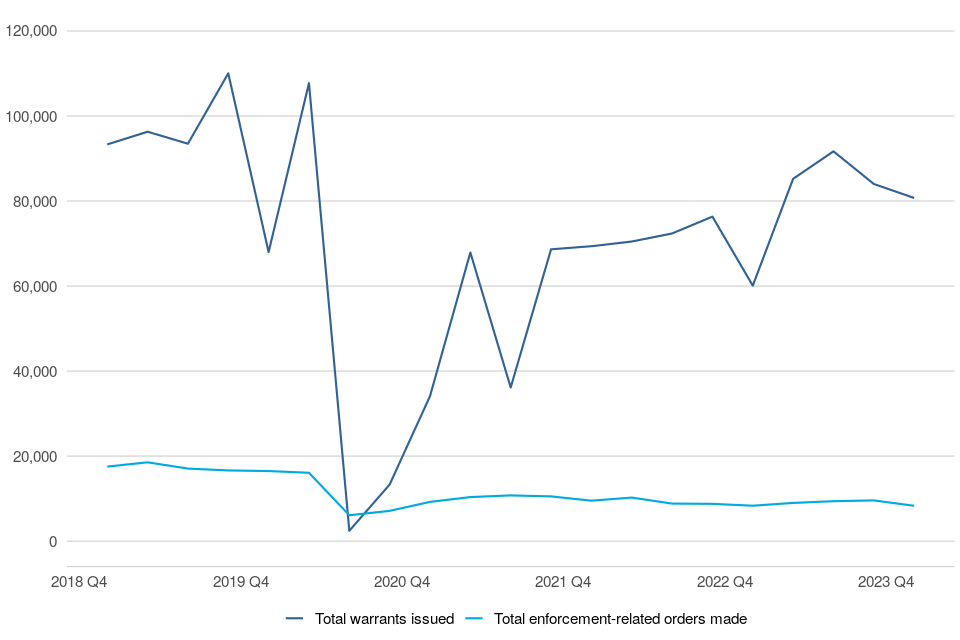

When compared to the same quarter in 2022, warrants issued were up 34%.

In October to December 2023, 81,000 warrants were issued, up 34% from 60,000 in the same quarter of 2022. Of these, 68,000 (84%) were warrants of control, up 40% compared to the same period in 2022.

Enforcement applications were up 23% and enforcement orders were stable when compared to October to December 2022.

This rise in enforcement applications was mostly driven by an increase in Attachment of earnings (AoE) applications which were up 32% (from 4,800 to 6,400), whilst a decline in Attachment of earnings (AoE) orders, down 14% (from 2,900 to 2,500) was offset by a rise in Charging orders, up 14% (from 3,600 to 4,100).

Figure 6: Warrants and enforcements issued – Q4 (October to December) 2018 to Q4 (October to December) 2023 (Source: tables 1.7 and 1.8)

7.1 Warrants (table 1.7)

In the latest quarter (October to December 2023) there were 81,000 warrants issued, up 34% (from 60,000) on the same quarter in 2022. Warrants of control accounted for 84% of total warrants, and were up 40%, from 49,000 to 68,000, compared to the same period in 2022.

There were 12,000 possession warrants issued in October to December 2023, up 10% (from 11,000) on the same quarter in 2022. These have continued a general upwards trend since Q3 2020, following a sharp drop in Q2 2020 due to the impact of Covid-19.

7.2 Enforcements (table 1.8)

In October to December 2023, there were 13,000 enforcement-related order applications (which include attachment of earnings orders, charging orders, third party debt orders, administration orders, and orders to obtain information), up 23% compared to the same quarter of 2022. All application types increased, attachment of earnings (AoE) applications up 32%, third party debt applications up 9%, charging order applications up 16% and administration orders applications up 14%.

There were 8,300 enforcement-related orders made in October to December 2023, stable compared to the same quarter of 2022. AoE orders fell, which were down 14% (from 2,900 to 2,500). Charging orders rose, which were up 14% (from 3,600 to 4,100), offsetting the fall in AoE orders. All other types of enforcement order remained relatively stable over this period.

Over the longer term, there has been a decreasing trend in enforcement-related applications received and orders made since 2009, possibly due to claimants’ preference for using warrants instead to retrieve money, property or goods.

8. Judicial reviews[footnote 4]

Judicial review applications increased to 2,500 in 2023, up 4% on the 2022 calendar year. Of the applications received in 2023, 45% of these have been closed. 11% of cases that reached the permission stage were found to be ‘Totally Without Merit’ (98 cases).

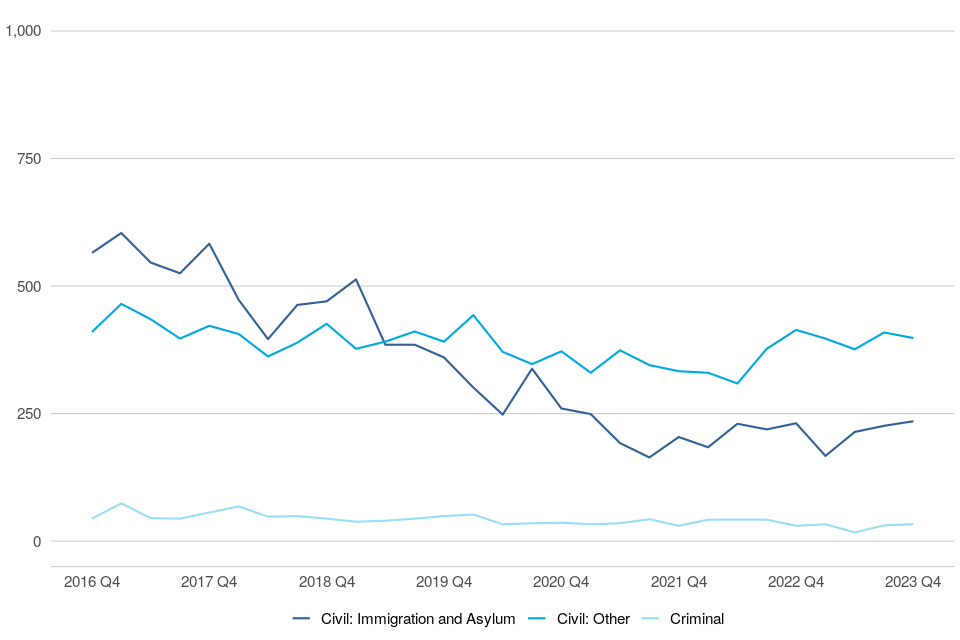

There were 670 judicial review applications received in Q4 2023, down 1% on Q4 2022 (680) and down 17% on Q4 2019 (from 800) as a pre-Covid19 baseline.

Of the 670 applications received in Q4 2023, 17% have already closed, and 7 were found to be ‘Totally Without Merit’ (9% of cases that reached the permission stage).

Judicial review cases moved to a new management system, CE-file, from September 2023. Only cases open from 2020 have been moved to the new system, and these cases may have small revisions when compared to previous publications. Cases prior to 2020 will no longer be revised as these have not been moved to CE-file; over 99% of these cases have already been closed.

Figure 7: Judicial Review Applications, by type; Q4 2016 to Q4 2023 (Source: JR CSV)

Quarterly JR Receipts – October to December 2023:

Of the 670 applications received in Q4 2023, 240 were civil immigration and asylum applications, 400 were civil (other), and 33 were criminal, up 2%, down 4% and up 10% respectively on Q4 2022. 1 of the civil immigration and asylum cases have since been transferred to the UTIAC.

Of the applications that were made in Q4 2023, 17% are now closed. Of the total applications, 82 reached the permission stage in Q4 2023, and of these:

- 9% (7) were found to be totally without merit.

- 20 cases have already been granted permission or granted permission in part to proceed and 38 were refused at the permission stage. 1 case refused at permission stage went on to be granted permission at the renewal stage.

- 21 cases were assessed to be eligible for a final hearing and of these, 3 have since been heard.

- the mean time from a case being lodged to the permission decision was 38 days. Although timeliness for cases being lodged to final hearing are included in the tables, this is based on too few cases to be meaningful. The actual time taken for these cases will only be known when they have had time to work their way through the system.

8.1 Applications lodged against departments (table 2.5)

Table 2.5 presents judicial review figures by defendant type (i.e. individual government department or public body). This table provides the number of judicial review applications lodged, permission granted to proceed to final hearing, and decisions found in favour of the claimant at final hearing.

The information presented is derived from the ‘defendant name’ – a free text field completed by the claimant, which is matched and grouped by department. All efforts have been made to quality assure the data presented. However, this is a manually typed field, and as such is open to inputting errors and should be used with caution.

The key findings for Q4 2023 are:

- Local Authorities had the largest number of JR applications lodged against them, with 210 applications. Of these, 16 were granted permission or granted permission in part to proceed to final hearing (8% of applications) to date.

- The second largest recipient of JR cases was the Home Office, with 200 cases received, of which to date 2 were granted permission or granted permission in part to proceed to final hearing (1% of applications).

- The third largest recipient was the Ministry of Justice, having 110 applications lodged against it. Of these, 1 were granted permission or granted permission in part to proceed to final hearing (1% of applications) to date.

A more granular view of the JR data by department and case type can be found in the data visualisation tool found here. Feedback is welcome on this tool to ensure it meets user needs.

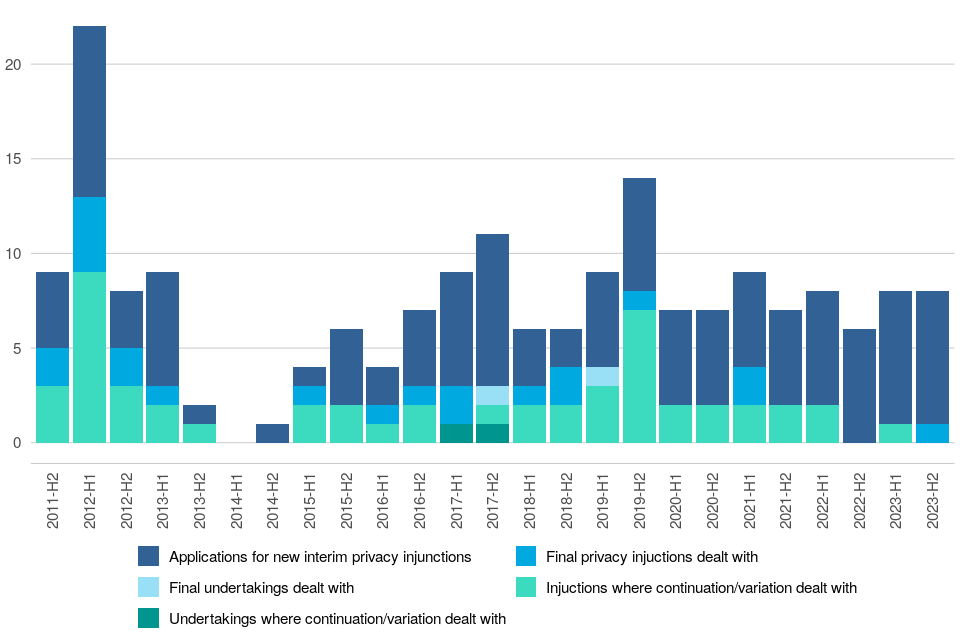

9. Privacy Injunctions[footnote 5]

In the final six months of 2023, there were 7 proceedings where the High Court considered an application for a new interim privacy injunction.

One proceeding was considered at the High Court on whether to issue a final permanent injunction.

There were no proceedings considered at the High Court on whether to continue or amend an interim injunction, no proceedings considered on whether to continue or amend an undertaking, and no proceedings considered a final undertaking[footnote 6].

Figure 8: Number of privacy injunction proceedings, by type of proceeding, from Aug-Dec 2011[footnote 7] to Jul-Dec 2023 (Source: tables 3.1, 3.2 and 3.3)

9.1 New interim privacy injunctions (Table 3.1)

Five of the seven proceedings at the High Court that took place in July to December 2023 were granted. In one of these an undertaking was given. The remaining two were refused. In the final six months of the previous year (July to December 2022) six new interim privacy injunction proceedings took place, and all of these were granted. In two of these cases an undertaking was given.

9.2 Continuation of existing interim injunctions (Table 3.2)

There were no applications for existing interim injunction proceedings between July to December 2023. There were also no applications for existing interim injunction proceedings between July to December 2022.

9.3 Final privacy injunctions (Table 3.3)

There was one final privacy injunction dealt with in July to December 2023, and no final undertakings dealt with in the same period. There were no final privacy injunctions or final undertakings dealt with in the same period from the previous year (July to December 2022).

10. Further information

10.1 Provisional data and revisions

The statistics in the latest quarter are provisional and revisions may be made when the next edition of this bulletin is published. If revisions are needed in subsequent quarters, these will be annotated in the tables.

10.2 Accompanying files

As well as this bulletin, the following products are published as part of this release:

- A supporting document providing further information on how the data is collected and processed, as well as information on the revisions policy and legislation relevant to civil justice.

- The quality statement published with this guide sets out our policies for producing quality statistical outputs for the information we provide to maintain our users’ understanding and trust.

- A set of overview tables (also available in accessible format) and CSV files, covering each section of this bulletin.

- A set of tables providing statistics on the Business and Property Courts of England and Wales, also available in accessible format.

- A Judicial Review data visualisation tool (to provide a more granular view of the JR data by department and case type). This can be found here.

- A Sankey tool which shows case progression of civil cases in the county courts is here.

- A Civil data visualisation tool to provide a more granular and interactive view of cases through the civil claims system. This can be found here.

10.3 Rounding convention

Figures greater than 10,000 are rounded to the nearest 1,000, those between 1,000 and 10,000 are rounded to the nearest 100 and those between 100 to 1,000 are rounded to the nearest 10. Less than 100 are given as the actual number.

10.4 National Statistics status

National Statistics status are accredited official statistics that meet the highest standards of trustworthiness, quality and public value.

Accredited official statistics are called National Statistics in the Statistics and Registration Service Act 2007. These accredited official statistics were independently reviewed by the Office for Statistics Regulation in January 2019. They comply with the standards of trustworthiness, quality and value in the Code of Practice for Statistics and should be labelled ‘accredited official statistics’.

It is the Ministry of Justice’s responsibility to maintain compliance with the standards expected for National Statistics. If we become concerned about whether these statistics are still meeting the appropriate standards, we will discuss any concerns with the Authority promptly. National Statistics status can be removed at any point when the highest standards are not maintained, and reinstated when standards are restored.

10.5 Future publications

Our statisticians regularly review the content of publications. Development of new and improved statistical outputs is usually dependent on reallocating existing resources. As part of our continual review and prioritisation, we welcome user feedback on existing outputs including content, breadth, frequency and methodology. Please send any comments you have on this publication including suggestions for further developments or reductions in content.

10.6 Contacts

Press enquiries should be directed to the Ministry of Justice (MoJ) press office:

Sarah Cottrill - email: [email protected]

Other enquiries about these statistics should be directed to the Courts and People division of the Ministry of Justice:

Matteo Chiesa - email: [email protected]

Next update: 6 June 2024

-

Following the alignment of the fees for online and paper civil money and possession claims in May 2021, figure 2 shows all data with the updated claim brackets for comparison, a further breakdown of these brackets is available within the CSV. The CSV shows updated claim brackets from 2021. ↩

-

PART 28 - THE FAST TRACK AND THE INTERMEDIATE TRACK - Civil Procedure Rules (justice.gov.uk) ↩

-

Judgment by admission is where the defendant admits the truth of the claim made. ↩

-

The judicial review data are Official Statistics ↩

-

The privacy injunction data are Official Statistics ↩

-

An undertaking is different from an injunction, in that it is a promise given by the defendants, rather than an injunction which is an order of the court ↩

-

H2 2011 only covers the period August-December 2011 and is not a full half-year ↩