Council Tax: challenges and changes statistical summary

Published 29 August 2024

Applies to England and Wales

About this release:

This release includes statistics on challenges against and changes made to the England and Wales Council Tax valuation lists between 1 April 1993 and 31 March 2024.

Responsible statistician

Sarah Windass

Statistical enquiries

Date of next publication

Summer 2025

1. Headline facts and figures – 1 April 2023 to 31 March 2024

-

The number of received challenges in 2023 to 2024 was 43,820, down from 51,300 in 2022 to 2023.

-

The number of resolved challenges in 2023 to 2024 was 39,590, down from 56,820 in 2022 to 2023.

-

The number of outstanding challenges as at 31 March 2024 was 14,160, up from 9,940 as at 31 March 2023.

-

The percentage of challenges resulting in no change to the Council Tax band in 2023 to 2024 was 65%, down from 66% in 2022 to 2023.

-

The number of amendments to the Council Tax lists in 2023 to 2024 was 68,600, down from 86,600 in 2022 to 2023.

2. About these statistics

The statistics in this publication relate to England and Wales only. The Valuation Office Agency (VOA) does not carry out Council Tax valuations in Scotland and Northern Ireland, where the valuation law and practice differ from England and Wales.

The statistics are available at national, regional, and billing authority level.

This publication is released to bring greater transparency to VOA functions. The data are also used to inform government policy and conduct analyses to support the operations of the VOA.

This publication contains updates to numbers published in the previous publication; further details can be found in the Background Information.

3. Challenges against the Council Tax valuation lists for England (1993) and Wales (2005)

Challenges consist of band reviews and appeals, for England before 1 April 2008 and for Wales. For England from 1 April 2008, challenges consist of band reviews, proposals and, of these proposals, the number which were sent to the Valuation Tribunal Service for appeal, referred to as appeals.

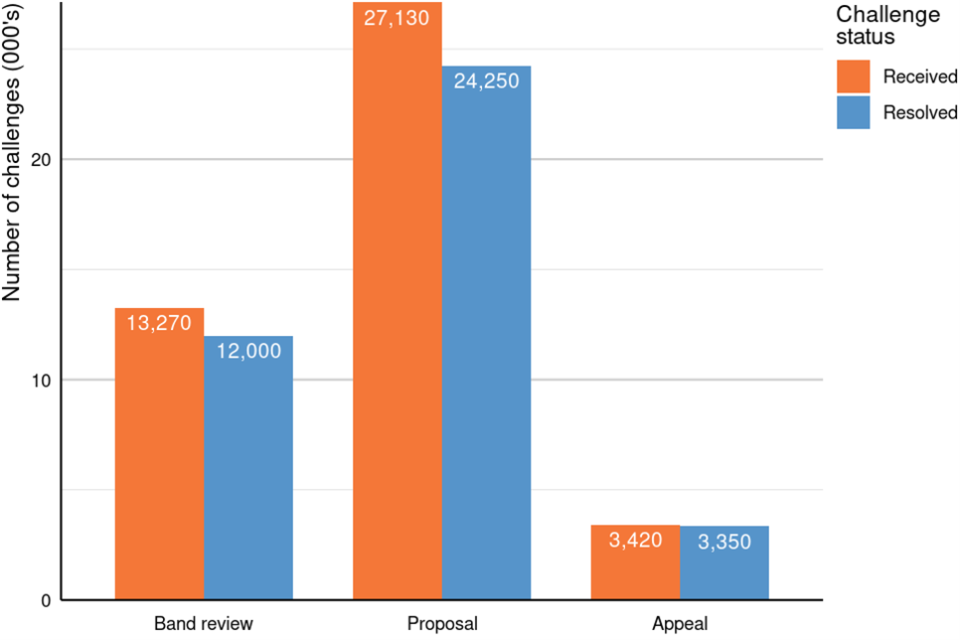

Figure 1: The number of challenges received and resolved in England and Wales, 1 April 2023 to 31 March 2024

Source: Tables CTCAC1.2 to CTCAC1.4

Figure notes: Counts are rounded to the nearest ten.

Figure 1 shows that, of the 43,820 challenges received by the VOA in 2023-24, there were:

- 27,130 (62%) proposals

- 13,270 (30%) band reviews

- 3,420 (8%) appeals

Of the 39,590 challenges resolved by VOA in 2023-24, there were:

- 24,250 (61%) proposals

- 12,000 (30%) band reviews

- 3,350 (8%) appeals

Of the resolved challenges:

- 65% resulted in no change to the Council Tax band

- 27% resulted in a reduction to the Council Tax band

- less than 1% resulted in an increase to the Council Tax band

- 5% resulted in a property being deleted from the Council Tax list

- less than 1% resulted in a new entry to the list

- 2% resulted in either a property being split or multiple properties being merged

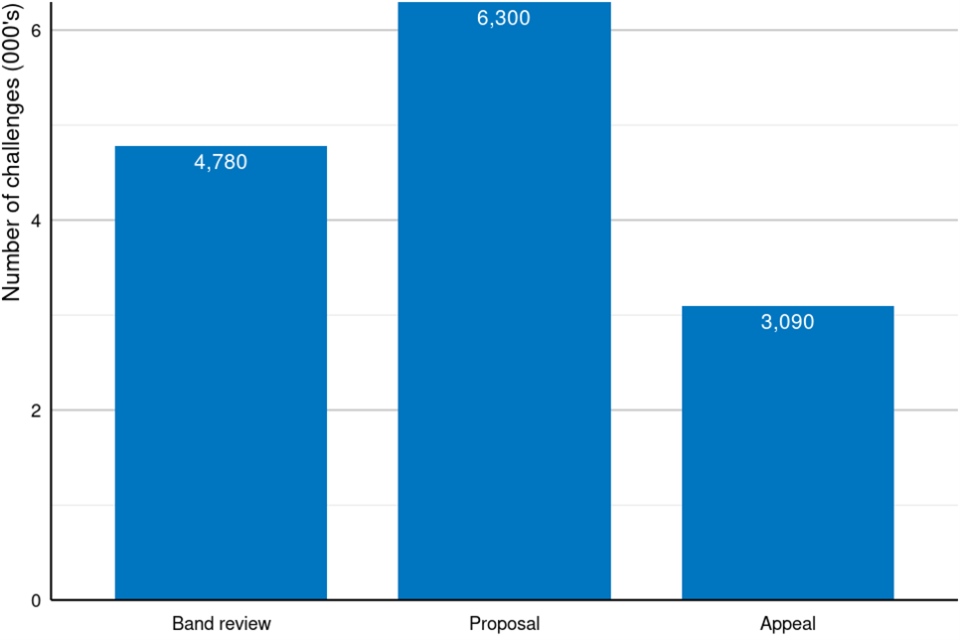

Figure 2: Number of challenges outstanding in England and Wales, 31 March 2024

Source: Tables CTCAC1.2 to CTCAC1.4

Figure notes: Counts are rounded to the nearest ten.

Figure 2 shows that, of the 14,160 challenges outstanding at 31 March 2024, there were:

- 4,780 (34%) band reviews

- 6,300 (44%) proposals

- 3,090 (22%) appeals

4. Band reviews

Band reviews were introduced in the 2004-05 financial year. A band review is carried out when the taxpayer brings a potential inaccuracy to the attention of the VOA. The taxpayer must provide sufficient evidence to the VOA to show why they consider their Council Tax band to be incorrect. The VOA will investigate the matter and inform the taxpayer of the outcome. The taxpayer does not have the right to appeal the outcome of a band review.

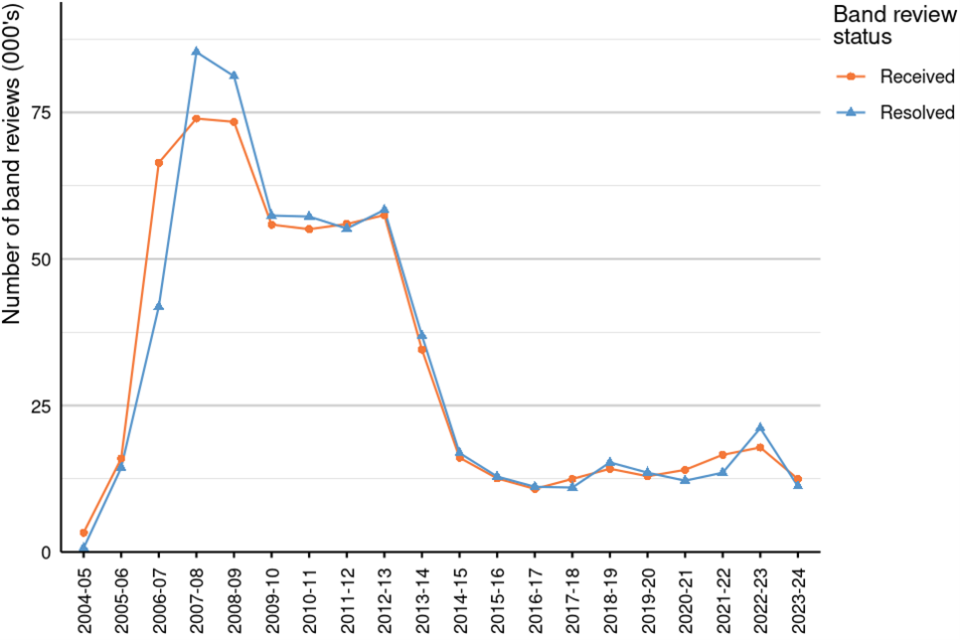

Figure 3: Number of band reviews received and resolved in England, 1 April 2004 to 31 March 2024

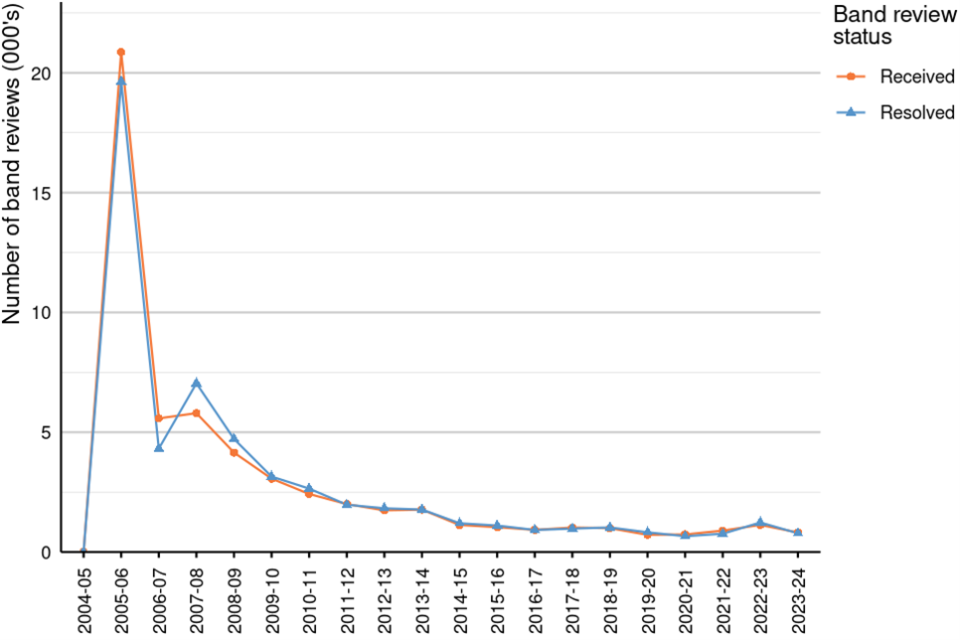

Figure 4: Number of band reviews received and resolved in Wales, 1 April 2004 to 31 March 2024

Figures 3 and 4 show that in England and Wales in 2023-24, there were 13,270 band reviews received, a decrease of 30% compared with 18,970 in 2022-23. There were 12,000 resolved band reviews in 2023-24, a decrease of 46% compared with 22,370 resolved in 2022-23.

Following the introduction of a new Council Tax list on 1 April 2005 in Wales, there was an increase in the number of band reviews received for Welsh properties. This increase constituted most of the total band reviews received in 2005-06. Media campaigns began in early 2007 which drew public attention to the process of taxpayers challenging their Council Tax band. As a result, the number of band reviews increased.

From October 2015, a change in VOA standard practice to only raise band reviews when sufficient evidence is brought to its attention likely contributed to the reduction in band reviews. Between October 2015 and January 2022 the number of band reviews received and resolved was relatively stable.

There was a temporary increase in band reviews after February 2022, when the government announced that households in Council Tax bands A to D in England would receive a £150 rebate on their Council Tax bills; this scheme ended in November 2022.

4.1 Outstanding band reviews

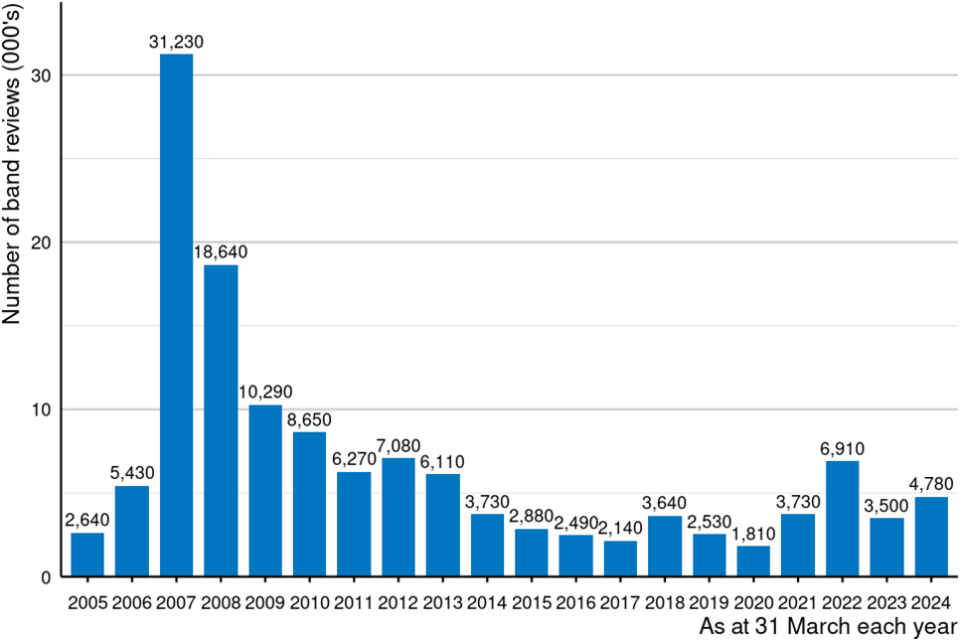

Figure 5: Number of band reviews outstanding in England and Wales, 31 March 2005 to 31 March 2024

Source: Table CTCAC4.3

Figure notes: Counts are rounded to the nearest ten.

Figure 5 shows that there were 4,780 outstanding band reviews on 31 March 2024, an increase from 3,500 on 31 March 2023. During 2023-24, VOA have reallocated operational resources to other priority areas, resulting in fewer band reviews being resolved and more band reviews outstanding at the end of the year.

The number of outstanding band reviews spiked following their introduction in the 2004-05 financial year until 2007, but since 2007 the number outstanding reduced steadily.

There was a spike in outstanding band reviews in 2022 as a result of the increase in band reviews received in 2021-22 resulting from the £150 Council Tax rebate.

4.2 Outcomes of band reviews

Band reviews can result in a Council Tax band increase, a Council Tax band decrease or no change to the Council Tax band.

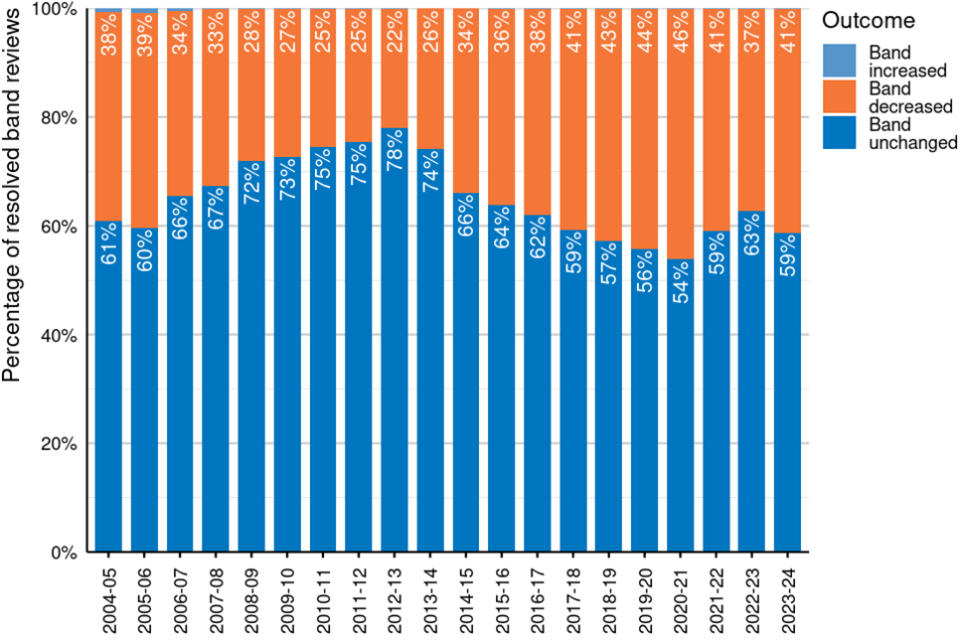

Figure 6: Outcomes of band reviews resolved in England and Wales, 1 April 2004 to 31 March 2024

Source: Table CTCAC4.2

Figure notes:

Please note that the percentage labels are displayed for the outcomes of ‘Band decreased’ and ‘Band unchanged’ only; therefore, the percentages will not sum to 100 per cent for each year. The band increase percentage for all years is less than 1 per cent.

Figure 6 shows that, between 1 April 2023 and 31 March 2024:

- 7,030 (59%) of resolved band reviews resulted in no change to the Council Tax Band

- 4,960 (41%) of resolved band reviews resulted in a reduction to the band

- 10 (less than 1%) of resolved band reviews resulted in an increase to the band

By comparison, in 2022-23:

- 14,010 (63%) resolved band reviews resulted in no change to the Council Tax Band

- 8,340 (37%) resolved band reviews resulted in a reduction to the band

- 10 (less than 1%) resolved band reviews resulted in an increase to the band

5. Proposals in England since 1 April 2008

A proposal is a formal challenge to a Council Tax list entry. There are limited circumstances under which a proposal can be accepted; the main route is that of a new occupier making a proposal within the first six months of becoming the taxpayer for their home. If the taxpayer has a statutory right to make a proposal, they do not need to provide evidence upfront that the banding is wrong unlike band reviews.

In England since 1 April 2008, the VOA will review the proposal and provide the taxpayer with a written decision, usually within two months. The taxpayer then has up to three months to appeal to a Valuation Tribunal.

In Wales, and in England before 1 April 2008, the VOA transmits all proposals to the Valuation Tribunal Service for appeal within 30 days of receiving them. Therefore, only proposals in England since 1 April 2008 are included in these statistics.

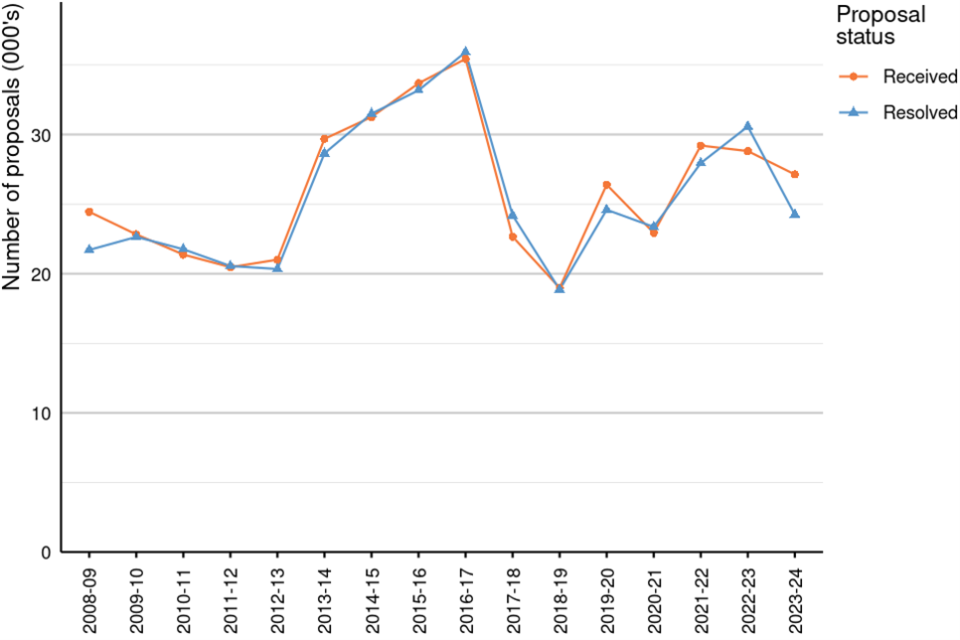

Figure 7: Number of proposals received and resolved in England, 1 April 2008 to 31 March 2024

Source: Tables CTCAC5.1 & CTCAC5.2

Figure 7 shows that there were 24,250 proposals resolved and 27,130 proposals received in 2023-24.

The numbers of proposals received and resolved in each year track each other consistently, though there has been considerable fluctuation in the number of proposals received over the years. Numbers started to increase in 2012 to 2013, fell sharply from 2017 to 2019, and since then there appears to be a slight upward trend.

5.1 Outstanding proposals

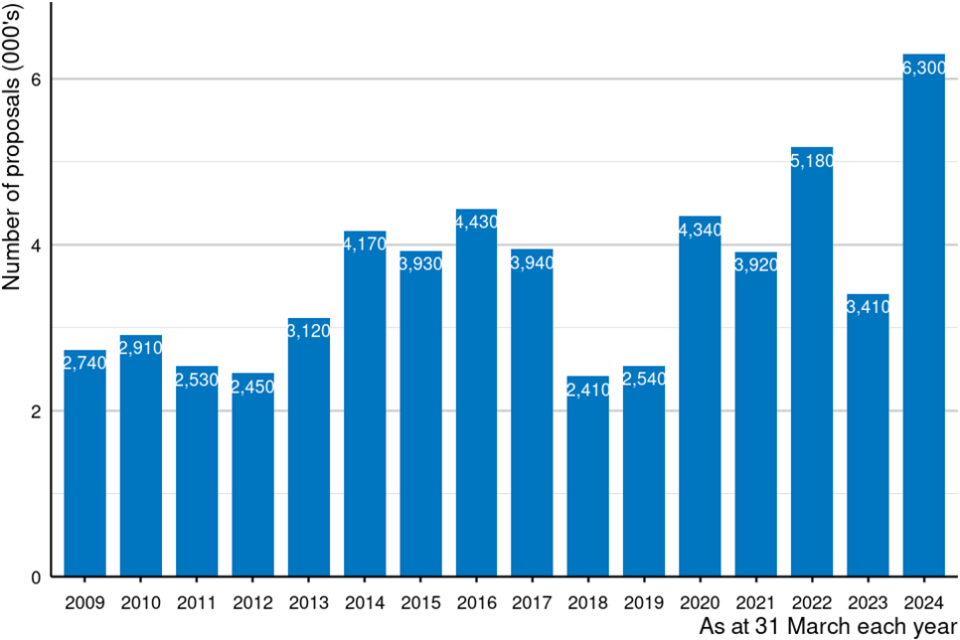

Figure 8: Number of proposals outstanding in England, 31 March 2009 to 31 March 2024

Source: Table CTCAC5.3

Figure notes: Counts are rounded to the nearest ten.

Figure 8 shows the number of proposals outstanding on 31 March each year from 2009 to 2023. Over the years, these numbers generally follow the same pattern as the number of proposals received and resolved.

There were 6,300 proposals outstanding on 31 March 2024; this is 85% higher than the 3,410 outstanding at 31 March 2023. The increase in outstanding proposals has been caused by a change in operational process regarding property deletions. This change occurred from February 2024 and resulted in an increase in proposals received at the end of the year.

5.2 Outcomes of proposals

Proposals can result in a Council Tax band increase, a Council Tax band decrease, no change to the Council Tax band, a new entry to the Council Tax list, a deleted entry from the list or a property on the list being either split or merged.

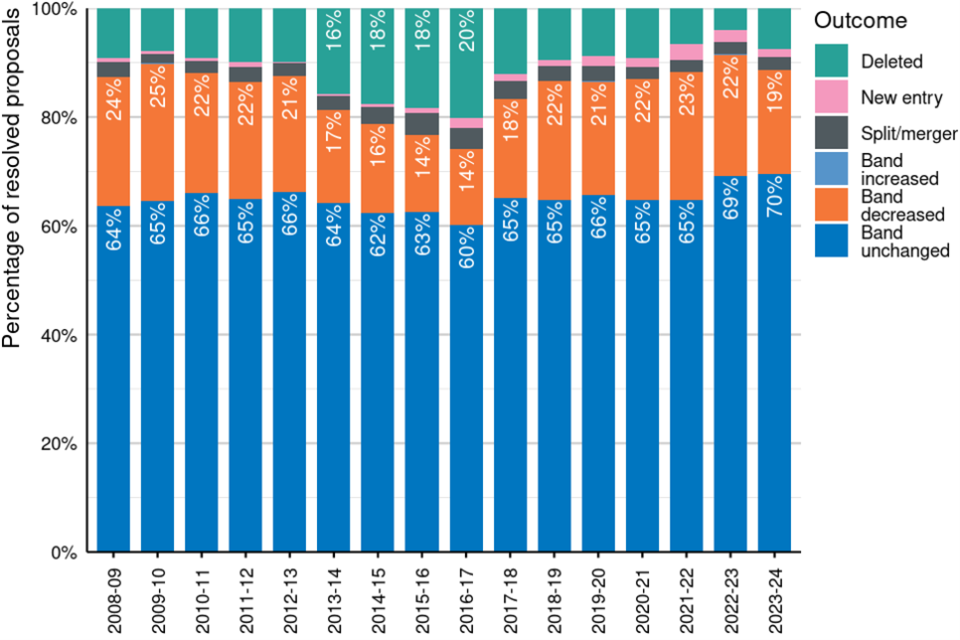

Figure 9: Outcomes of proposals resolved in England, 1 April 2008 to 31 March 2024

Source: Table CTCAC5.2

Figure notes:

Please note that the percentage labels are only displayed for the outcomes of ‘Band decreased’ and ‘Band unchanged’, as well as for any other outcome that accounts for at least 15 per cent of the total in the year. Therefore, the percentages will not sum to 100 per cent for each year.

Figure 9 shows that the percentage of proposals resulting in each outcome in 2023-24 has remained largely similar to figures from previous years. In 2023-24, 16,860 (70%) of proposals resulted in no change to the band and 4,630 (19%) resulted in a band decrease. In 2022-23, these figures were 21,140 (69%) and 6,840 (22%) respectively. The number of proposals resulting in no change to the band has now been at a peak for two consecutive years.

6. Appeals in England from 1 April 2008

In England since 1 April 2008, the VOA will review a proposal and provide the taxpayer with a written decision, usually within two months. The taxpayer then has up to three months to appeal this decision to an independent Valuation Tribunal. In order to demonstrate the connection between proposals and appeals, appeals are recorded using the date that their associated proposal was resolved.

Over the years, percentages of proposals resolved that were subsequently appealed have remained fairly steady, with the percentages of proposal decisions appealed ranging from 8% to 10% in the last five years. Of the 24,250 proposals resolved in 2023-24, 9% were subsequently appealed. This is higher than the 8% in 2022-23.

6.1 Outstanding appeals

Currently, the appeal process at the Valuation Tribunal Service takes about nine months, from submission of an appeal form to final decision. Consequently, of the 2,150 appeals outstanding in England on 31 March 2024, 1,930 (90%) were from proposals resolved in 2023-24 and 160 (7%) were from proposals resolved in 2022-23. A small number of complex cases remain outstanding from earlier years.

Given the large number of proposals from 2023-24 that are now sitting in the appeals process at the Valuation Tribunal Service, statistics on the resolution of proposals in 2023-24 represent an interim position, awaiting the resolution of proposals with outstanding appeals.

6.2 Outcomes of appeals in England from 1 April 2008

Appeals are often withdrawn or settled before reaching the Valuation Tribunal.

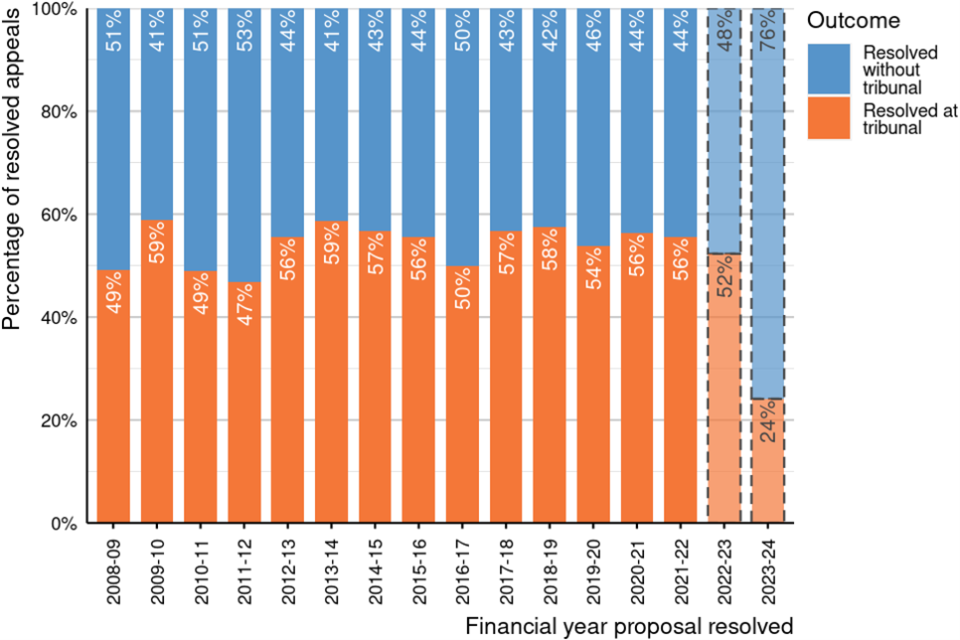

Figure 10: Percentage of appeals resolved without a Valuation Tribunal and resolved at Valuation Tribunal in England, 1 April 2008 to 31 March 2024

Source: Table CTCAC5.2

Figure notes:

The bars outlined with a dashed line represent provisional figures that will be revised in next year’s release as appealed cases proceed to Valuation Tribunal and the VOA is notified of the outcome.

Figure 10 shows the percentage of appeals resolved without a Valuation Tribunal and at Valuation Tribunal, by the year that the associated proposal was resolved. In the ‘Council Tax Challenges and Changes in England and Wales, March 2023’ release, we reported that 38% of appeals were resolved at tribunal where the associated proposal was resolved in 2022-23. This has now increased to 52%. In 2023-24 the percentage of appeals resolved at tribunal is currently 24%. The VOA expects this figure to increase as the proposals resolved in 2023-24 which have been subsequently appealed are resolved at tribunal and the VOA notified of the outcome.

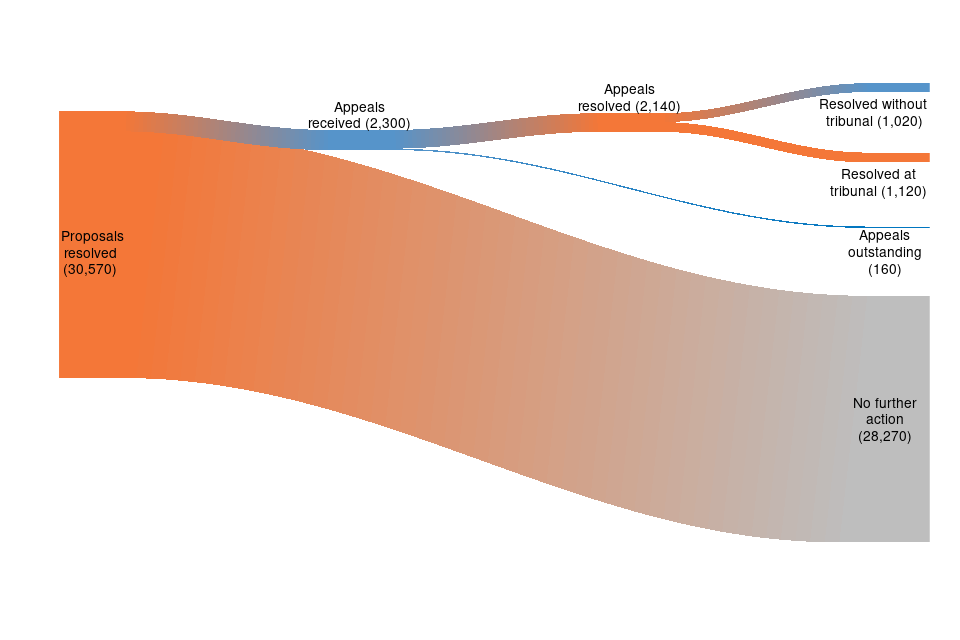

Figure 11: Proposals resolved in England from 1 April 2022 to 31 March 2023 with the action taken by the taxpayer following the issuing of the decision notice

Source: Table CTCAC5.2

Figure notes: Counts are rounded to the nearest ten.

In 2022-23, 30,570 proposals were resolved (figures 7 and 11) and 2,300 (8%) of those proposals were subsequently appealed (figures 11). Of the proposals that were subsequently appealed:

- 2,140 were resolved as at 31 March 2024 (figure 11)

- 1,020 (48%) of them were resolved without a tribunal

- 1,120 (52%) required a tribunal (figures 10 and 11).

In 2023-24, 24,250 proposals were resolved (figure 7) and 2,210 (9%) of those proposals were subsequently appealed. Of the proposals that were subsequently appealed, 280 were resolved at 31 March 2024. These figures will be revised in next year’s release.

Appeals, like proposals, can result in a Council Tax band increase, a Council Tax band decrease, no change to the Council Tax band, a new entry to the Council Tax list, a deleted entry from the list, or a property on the list being either split or merged.

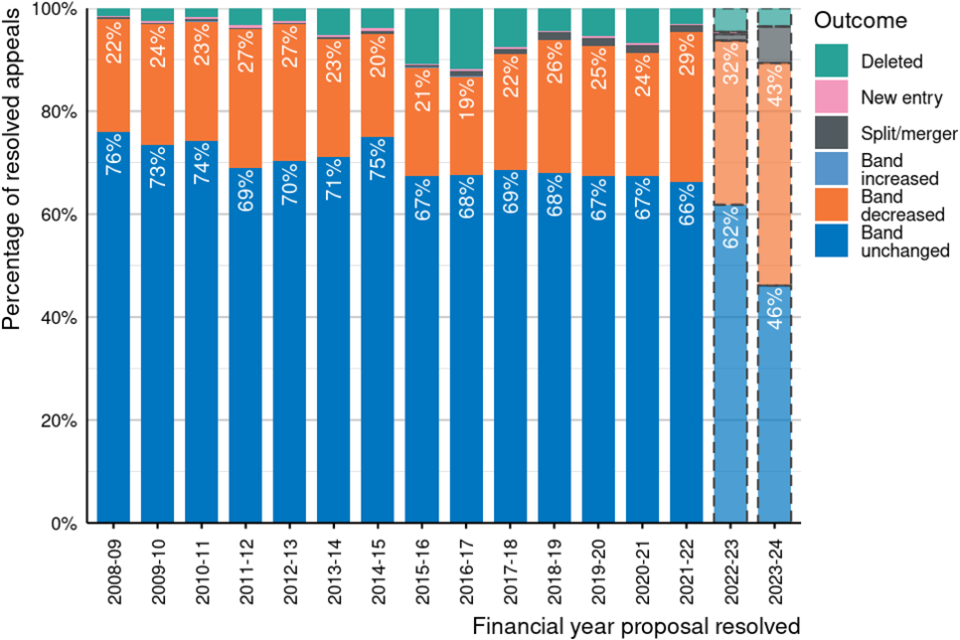

Figure 12: Outcomes of resolved appeals in England, 1 April 2008 to 31 March 2024

Source: Table CTCAC5.2

Figure notes:

The bars outlined with a dashed line represent provisional figures that will be revised in next year’s release as appealed cases proceed to Tribunal and the VOA are notified of the outcome.

Please note that the percentage labels are displayed for the outcomes of ‘Band decreased’ and ‘Band unchanged’ only. Therefore, the percentages will not sum to 100 per cent for each year.

Figure 12 shows the outcomes of resolved appeals since 1 April 2008, by the year that the associated proposal was resolved. Of the resolved appeals where the associated proposal was resolved in 2023-24, 43% of proposals resulted in a band decrease, 46% resulted in no change to the band and 4% resulted in a deletion. These figures will be revised in next year’s release. In 2022-23, these figures were 32%, 62% and 5% respectively.

7. Appeals in Wales

The proposal system in Wales differs from the system in England that was introduced on 1 April 2008. All proposals received in Wales, if unresolved, are automatically transmitted as appeals to Valuation Tribunal Service (VTS) within 30 days of receiving them.

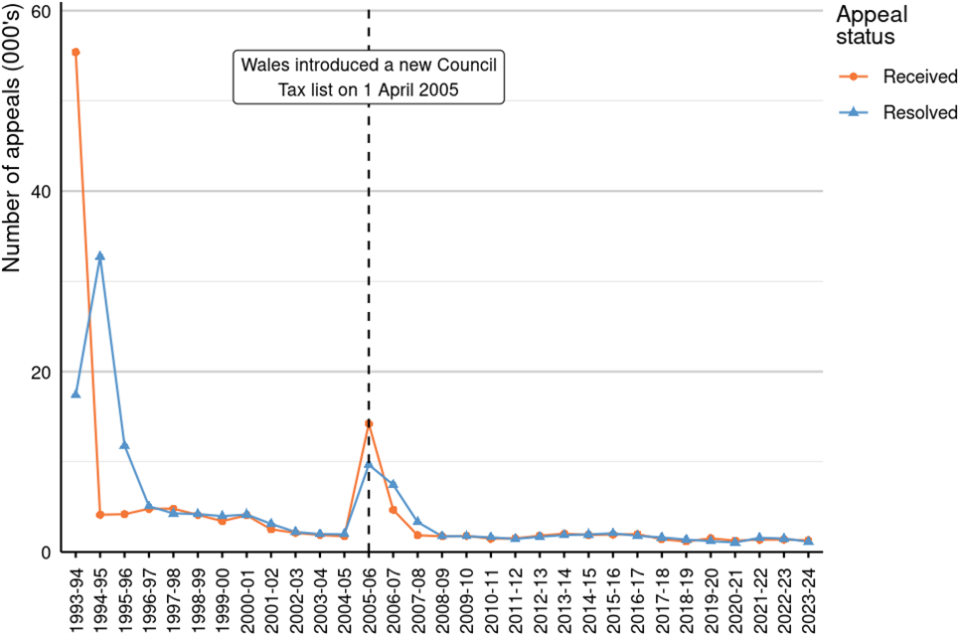

Figure 13: Number of appeals received and resolved in Wales, 1 April 1993 to 31 March 2024

Source: Table CTCAC6.2

Figure 13 shows the spike of appeals that were submitted in 2005-06. This was due to the new Council Tax list that was introduced in Wales on 1 April 2005.

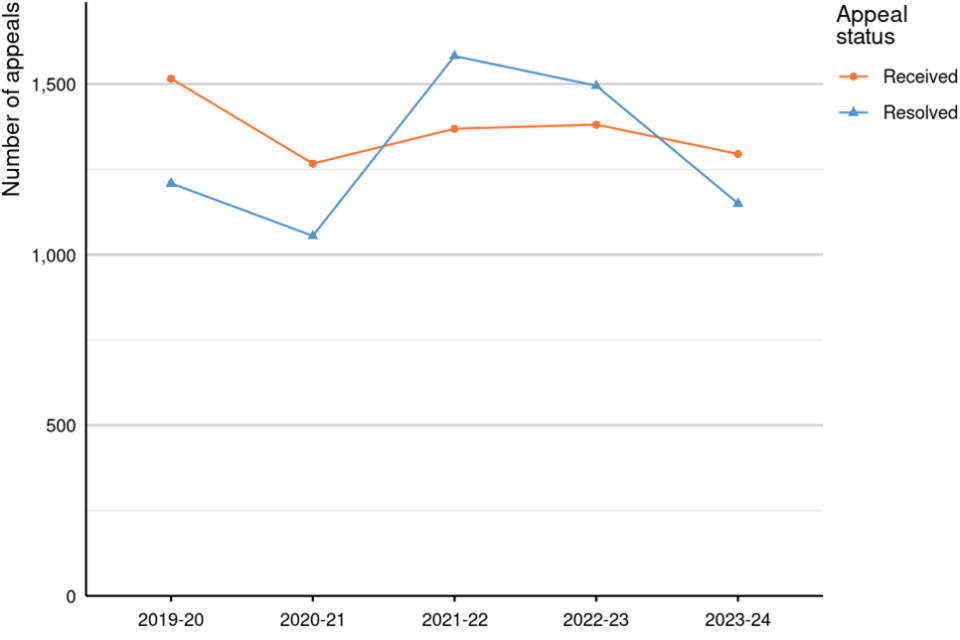

Figure 14: Number of appeals received and resolved in Wales, 1 April 2019 to 31 March 2024

Source: Table CTCAC6.2

Figure 14 shows the number of appeals received and resolved between 1 April 2019 and 31 March 2024. While these numbers have been decreasing over the years, there was an increase in the number of appeals received in 2019-20. This could be attributed to the implementation of changes in Wales where empty or second homes may be charged a Council Tax premium of up to 100%. Volumes of appeals have remained at roughly this level since.

7.1 Outstanding appeals in Wales

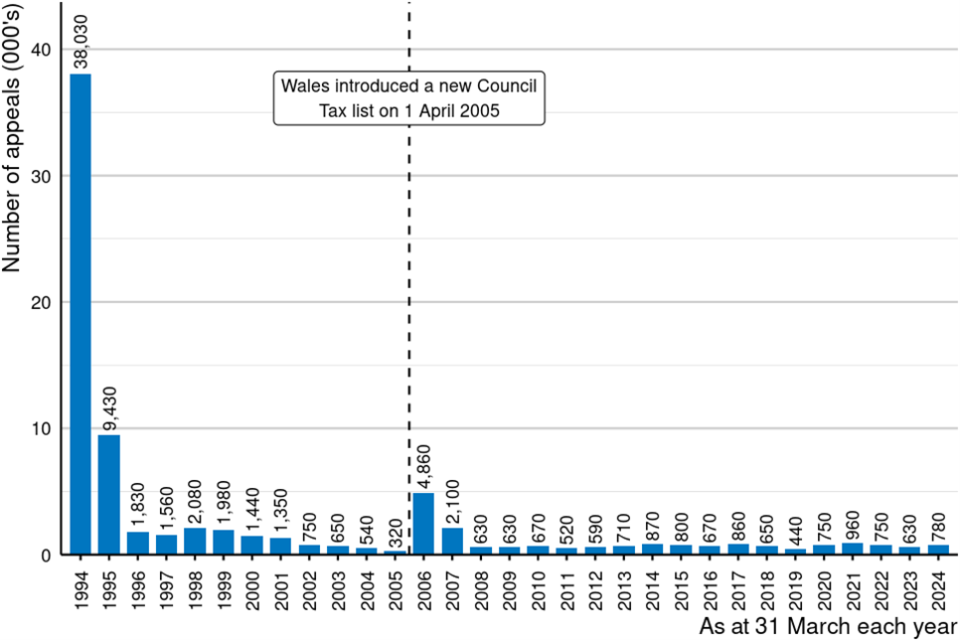

Figure 15: Number of appeals outstanding in Wales, 31 March 1994 to 31 March 2024

Source: Table CTCAC6.2

Figure notes: Counts are rounded to the nearest ten.

Figure 15 shows the appeals outstanding in Wales from 1994 to 31 March 2024. There was a brief spike in outstanding appeals after the introduction of the new Council Tax list on 1 April 2005. The number of outstanding appeals has fluctuated over these years. There were 780 appeals outstanding on 31 March 2024, which is 23% higher than the 630 outstanding on 31 March 2023.

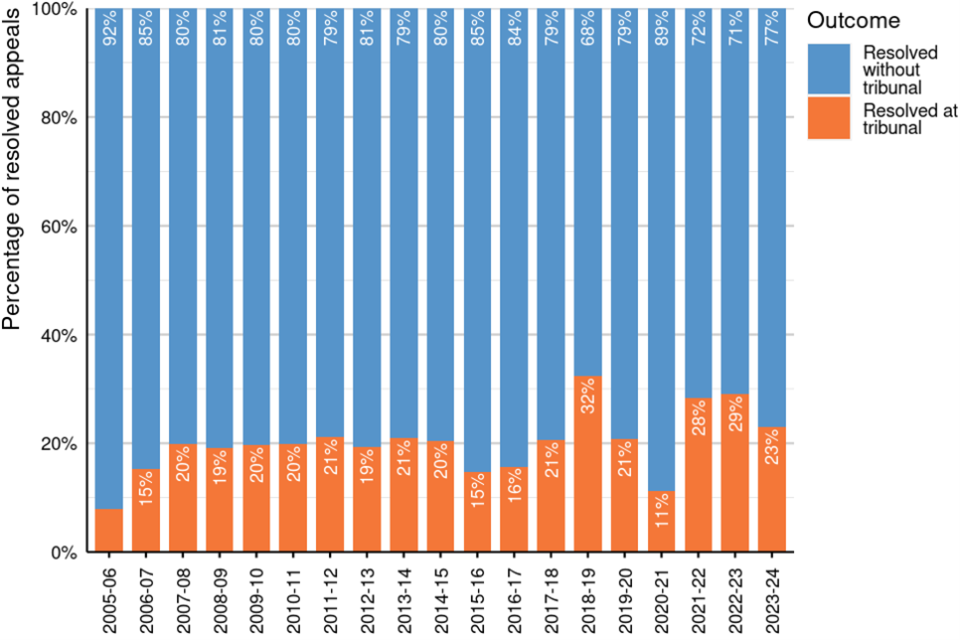

7.2 Outcomes of appeals in Wales

Figure 16: Percentage of appeals resolved without a tribunal and resolved at tribunal in Wales, 1 April 2005 to 31 March 2024

Source: Table CTCAC6.2

Figure notes:

Please note that in years where the outcome of ‘Resolved at tribunal’ accounts for less than 10 per cent of the total, the percentage labels are displayed for the outcome of ‘No tribunal required’ only. Therefore, the percentages will not sum to 100 per cent for these years.

Figure 16 shows that the percentage of appeals resolved without a tribunal is consistently significantly higher than the percentage resolved at tribunal, ranging from 68% to 92%. The year with the highest percentage of appeals that were resolved at tribunal was 2018-19, with 32%. Of the 1,150 appeals resolved in 2023-24 in Wales, 77% were resolved without a tribunal and 23% required a tribunal. In 2022-23, 430 (29%) appeals were resolved at tribunal.

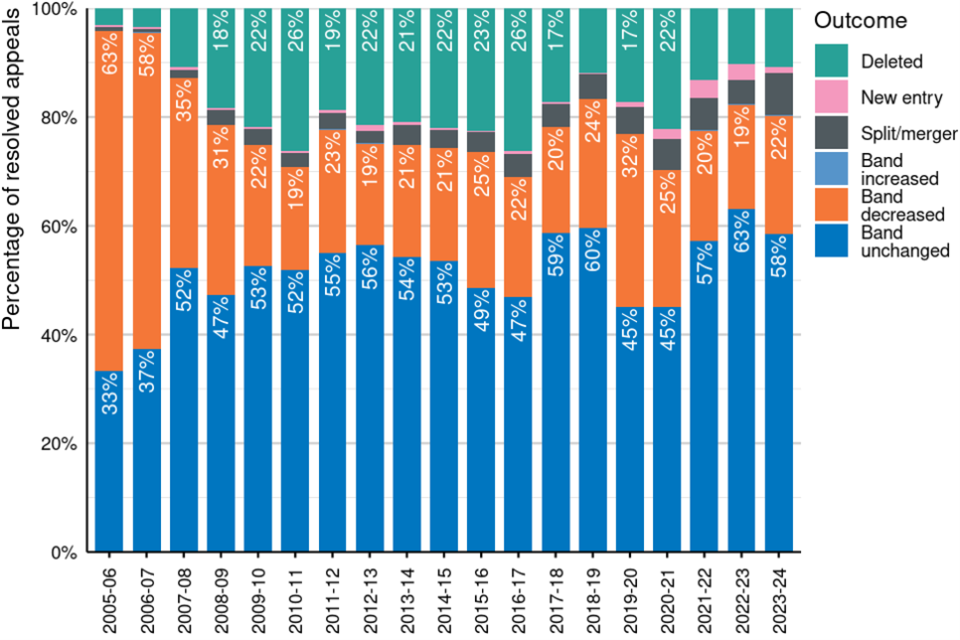

Figure 17: Outcomes of appeals resolved in Wales, 1 April 2005 to 31 March 2024

Source: Table CTCAC6.2

Figure notes:

Please note that the percentage labels are only displayed for the outcomes of ‘Band decreased’ and ‘Band unchanged’, as well as for any other outcome that accounts for at least 15 per cent of the total in the year. Therefore, the percentages will not sum to 100 per cent for each year.

Figure 17 shows the outcomes of resolved appeals in Wales from 1 April 2005 to 31 March 2024. Due to the relatively small number of appeals resolved each year, the percentages of appeals resulting in each outcome vary significantly over the years. In 2023-24, 670 (58%) of appeals resulted in no change to the band and 250 (22%) resulted in a band decrease. In 2022-23, these figures were 940 (63%) and 290 (19%) respectively.

8. Amendments to the Council Tax valuation lists for England (1993) and Wales (2005)

Amendments are changes that have been made as a result of either a challenge or a report. A report happens when the VOA has been made aware of a change to the property that warrants a change in the valuation list entry (for example, when a house is extended and subsequently sold). This may result in a band increase, band decrease or no change to the Council Tax band. Even when the band is unchanged, property attribute details (for example number of bedrooms) may have been updated on the VOA’s administrative system.

In this publication, amendments do not include properties that have been deleted from the Council Tax valuation lists, inserted to the Council Tax valuation lists or properties amended on the Council Tax valuation lists as a result of being split or merged. These are reported in our Council Tax Stock of Properties release, published on 11 July 2024.

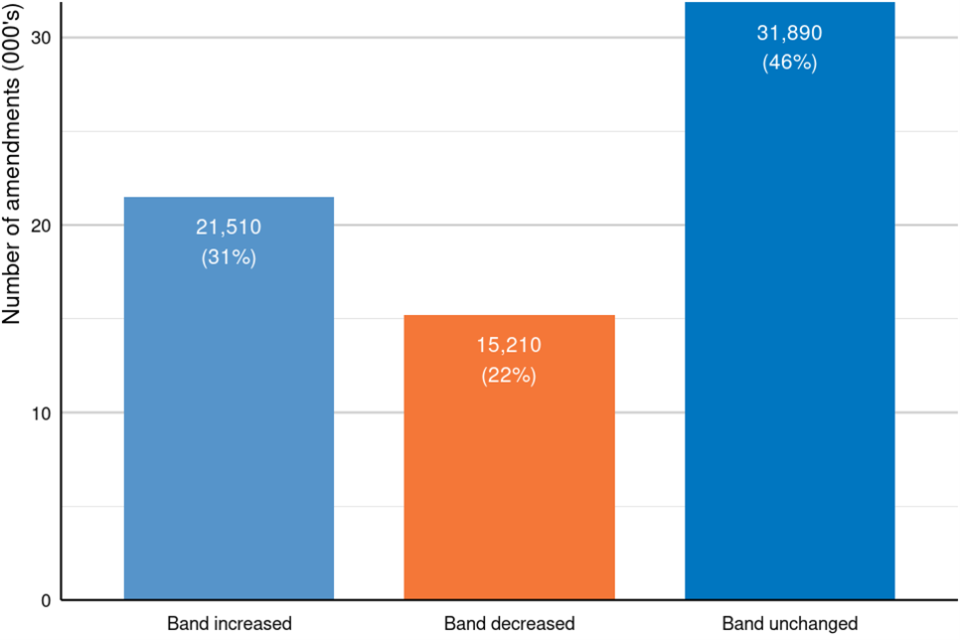

Figure 18: Number of amendments to Council Tax valuation lists in England and Wales, 1 April 2023 to 31 March 2024

Source: Table CTCAC2.1

Figure notes: Counts are rounded to the nearest ten.

Figure 18 shows the amendments made to the Council Tax valuation lists between 1 April 2023 and 31 March 2024 as a result of both challenges and reports. Of the 68,600 amendments:

- 31% resulted in an increased Council Tax band

- 22% resulted in a reduction to the Council Tax band

- 46% resulted in no change to the Council Tax band

Between 1 April 2022 and 31 March 2023, there were 86,600 amendments made to the Council Tax valuation lists as a result of both challenges and reports. These consisted of:

- 39% with an increased Council Tax band

- 25% with a reduction to the Council Tax band

- 36% with no change to the Council Tax band

In 2022-23, a number of factors led to a temporary increase in the number of amendments. This includes the increased number of resolved band reviews linked to £150 Council Tax rebate discussed above and other work within the VOA to update Council Tax information and resolve outstanding reports.

Further information

Further information about the data and methodology presented in this summary can be found in the Background information.

GOV.UK has more information on:

- how domestic properties are assessed for Council Tax bands

- how to check your Council Tax band

- how to challenge your Council Tax band

Timings of future releases are regularly placed on the VOA research and statistics calendar.

Any updates or announcements regarding VOA’s statistics can be found on our Announcement page.