Council Tax: stock of properties statistical commentary

Updated 7 October 2024

Applies to England and Wales

This release includes statistics on the stock of domestic properties by Council Tax Band and property attributes in England and Wales between 1 April 1993 and 31 March 2024.

Responsible Statistician

Sarah Windass

Statistical enquiries

Date of next publication

Summer 2025

1. Headline facts and figures – 1 April 2023 to 31 March 2024

- There were 27.0 million properties on the Council Tax list as at 31 March 2024, up from 26.8 million as at 31 March 2023.

- In England, the most frequent council tax band was Band A: 6.1 million properties, or 23.8% of all properties, are Band A.

- In Wales, the most frequent council tax band was Band C: 0.3 million properties, or 21.8% of all properties, are Band C.

- There were 274,470 properties inserted into the Council Tax Valuation Lists in England and Wales, down from 291,710 in 2022 to 2023.

- There were 49,060 properties deleted from the Council Tax Valuation Lists in England and Wales, up from 44,400 in 2022 to 2023.

2. About these statistics

The statistics in this publication relate to England and Wales only. Property valuations are not carried out by the Valuation Office Agency (VOA) in Scotland and Northern Ireland, where the valuation law and practice differ from England and Wales.

Council Tax policy is devolved in Wales and the banding systems are different in England and Wales. There is one more Council Tax band in Wales (band I), and bandings in Wales are based on a more recent valuation. Further details are in the background information document.

The statistics are available at national, regional and billing authority level. Some tables are also available at Westminster Parliamentary Constituency level, middle layer super output area (MSOA), lower layer super output area level (LSOA), and local authority level.

This publication is released in support of bringing greater transparency to VOA functions. The data are also used to inform government policy and conduct analyses to support the operations of the VOA.

3. Properties by Council Tax band

3.1 Properties by Council Tax band and country, 31 March 2024

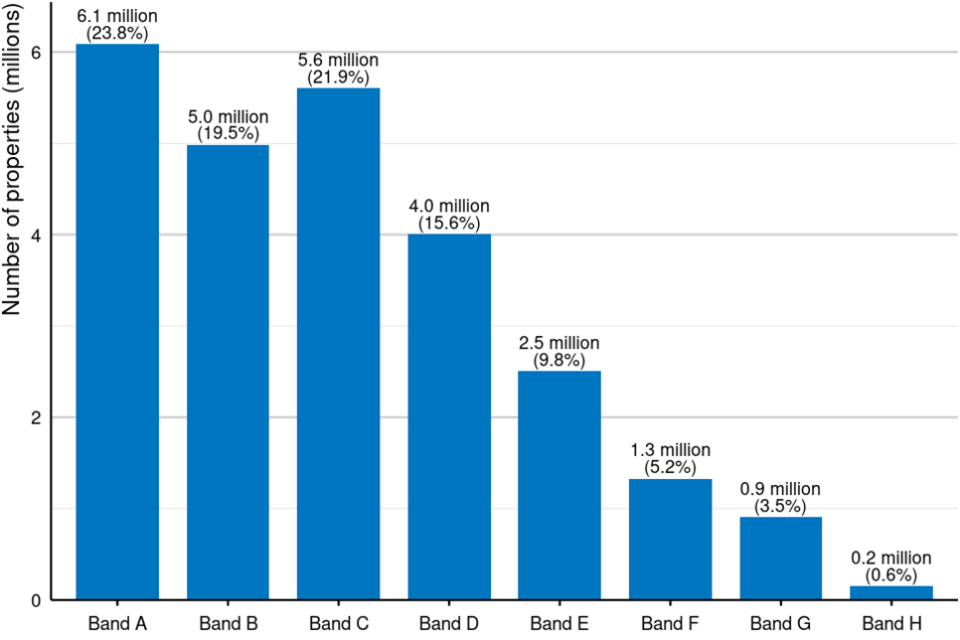

Figure 1.1: The number of properties by Council Tax band in England, 31 March 2024

Source: Table CTSOP1.0

Figure notes: Counts are rounded to the nearest hundred thousand. Percentages are rounded to one decimal place.

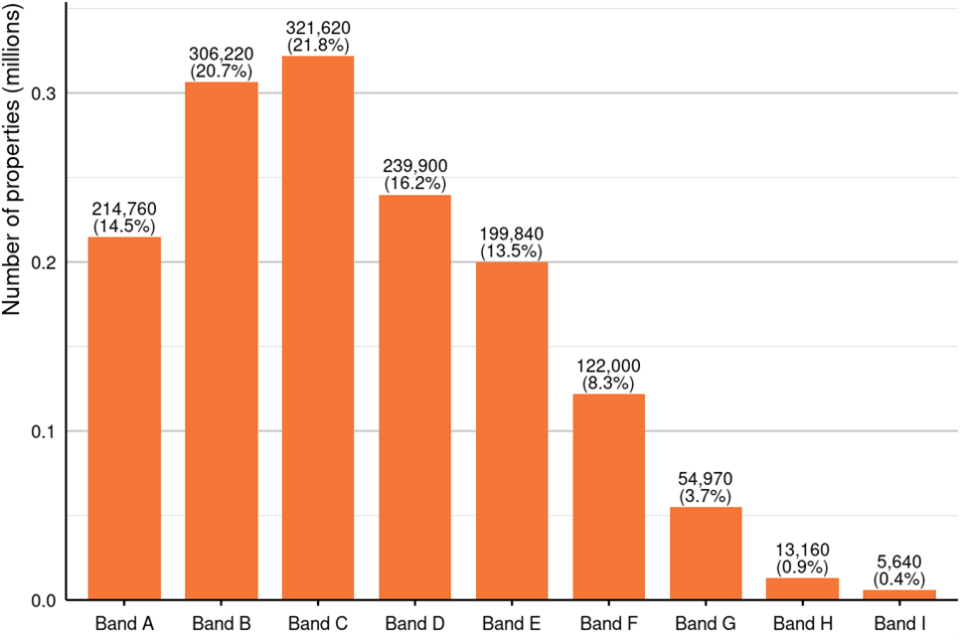

Figure 1.2: The number of properties by Council Tax band in Wales, 31 March 2024

Source: Table CTSOP1.0

Figure notes: Counts are rounded to the nearest ten. Percentages are rounded to one decimal place.

Figure 1.1 shows that in England, the most frequent Council Tax band was band A (6.1 million properties, or 23.8% of all Council Tax-banded properties in England), followed by band C (5.6 million, 21.9%).

Figure 1.2 shows that in Wales, the most frequent Council Tax band was band C (321,620 properties, or 21.8% of all Council Tax-banded properties in Wales), followed by band B (306,220, 20.7%).

In both countries, the highest band contained the fewest properties, with 0.2 million (0.6%) properties in band H in England and 5,640 (0.4%) properties in band I in Wales.

3.2 Properties by country and region, 31 March 2024

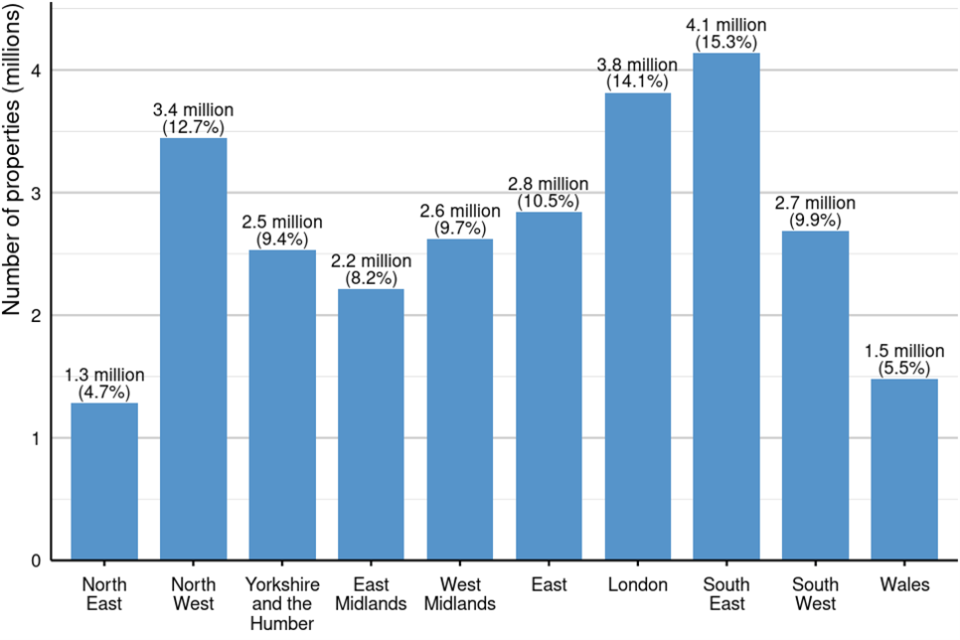

Figure 2: The number of properties by region in England and Wales, 31 March 2024

Source: Table CTSOP1.0

Figure notes: Counts are rounded to the nearest hundred thousand. Percentages are rounded to one decimal place.

Figure 2 shows that the South East contained the highest number of properties (4.1 million properties, or 15.3% of all properties), followed by London (3.8 million, 14.1%) and the North West (3.4 million, 12.7%). Wales (1.5 million, 5.5%) and the North East (1.3 million, 4.7%) contained the fewest properties.

3.3 Properties by Council Tax band, country and region, 31 March 2024

Figure 3: Properties by Council Tax band and region in England and Wales, 31 March 2024

Source: Table CTSOP1.0

Figure 3 shows that the most frequent Council Tax band was band A in the North East, the North West, Yorkshire and the Humber, the East Midlands, and the West Midlands. Between 30% and 52% of properties were in Council Tax band A in these regions.

By contrast, the most frequent Council tax band in the South West was band B (24% of all properties), and band C was most frequent Council Tax band in the East, London, the South East, and Wales (between 22% and 27% of all properties).

In each region, the distribution of council tax bands had a single peak; bands further from that peak contained a progressively smaller proportion of properties.

4. Properties by type and number of bedrooms

4.1 Properties by property type, 31 March 2024

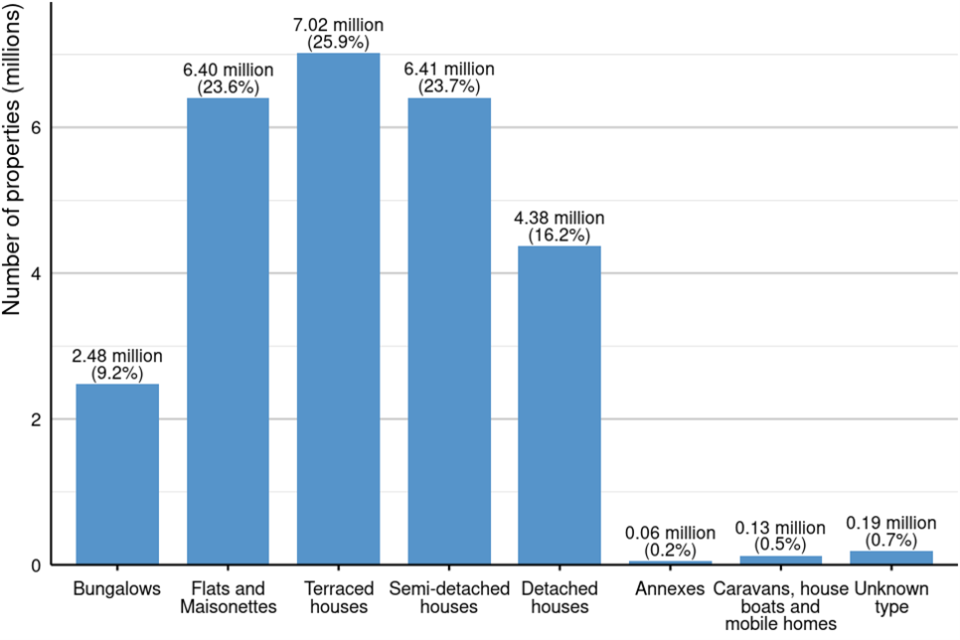

Figure 4: The number of properties by property type in England and Wales, 31 March 2024

Source: Table CTSOP3.0

Figure notes: Counts are rounded to the nearest ten thousand. Percentages are rounded to one decimal place.

Figure 4 shows that the most frequent type of property was terraced houses (7.02 million properties, or 25.9% of all Council Tax-listed properties), followed by semi-detached houses (6.41 million, 23.7%) and flats/maisonettes (6.40 million, 23.6%).

The least frequent property types were caravans/house boats/mobile homes (0.13 million, 0.5%) and annexes (0.06 million, 0.2%). There were also 0.19 million (0.7%) properties where the property type was unknown.

4.2 Properties by property type, country, and region, 31 March 2024

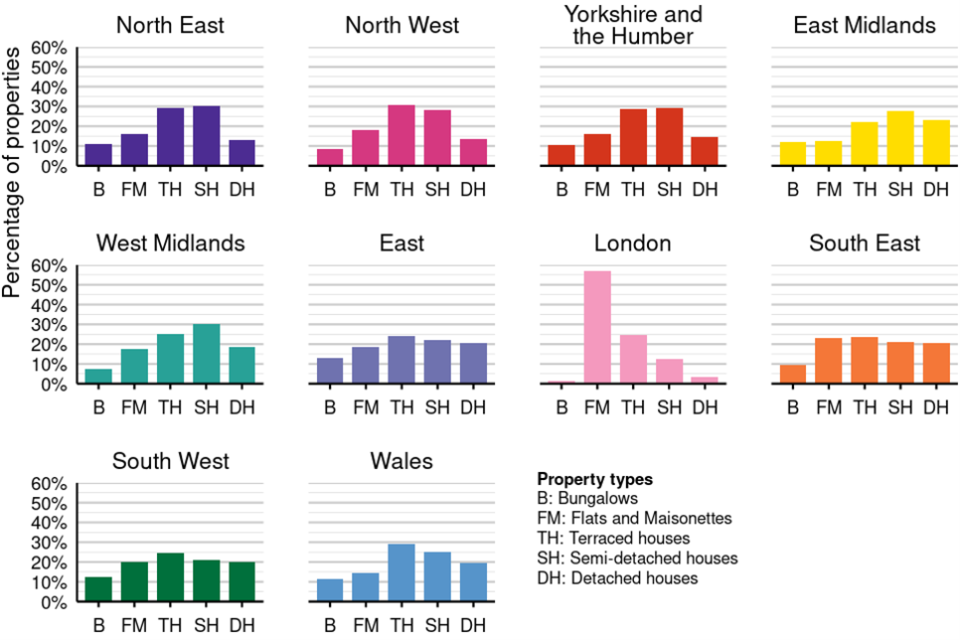

Figure 5: Bungalows, flats/maisonettes and houses by region and property type in England and Wales, 31 March 2024

Source: Table CTSOP3.0

Figure 5 shows that:

- Semi-detached houses were the most frequent property type in the North East, Yorkshire and the Humber, the East Midlands, and the West Midlands (between 28% and 30% of all properties).

- Terraced houses were the most frequent property type in the North West, the East of England, the South East, the South West, and Wales (between 24% and 31% of all properties).

- The most frequent property type in London was flats/maisonettes (57%), with very few bungalows (1.5%) or detached houses (3.5%).

Annexes, caravans/house boats/mobile homes and properties with an unknown property type each made up between 0.04% and 1.15% of the total properties.

4.3 Properties by property type and Council Tax band, 31 March 2024

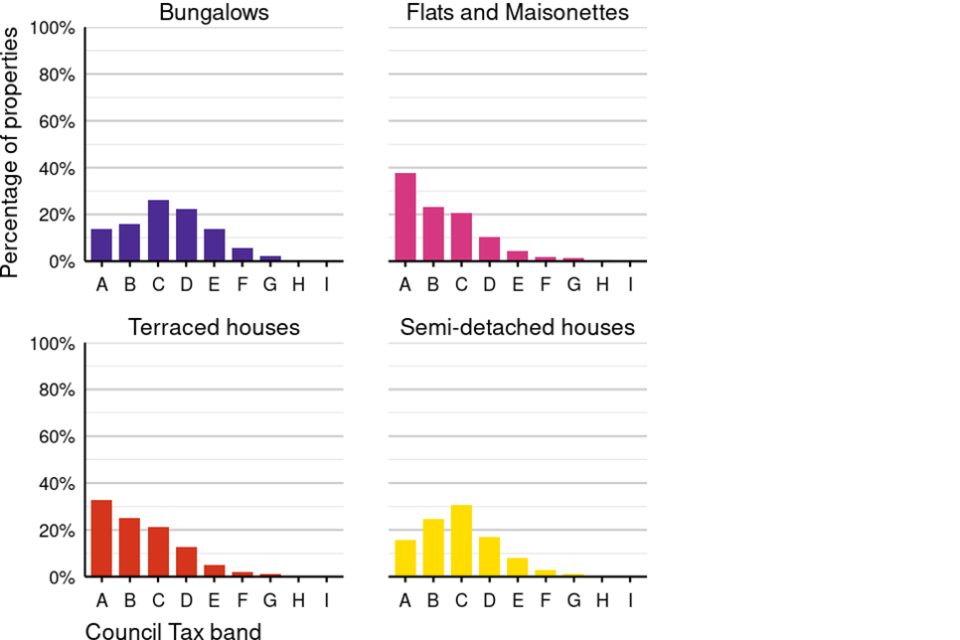

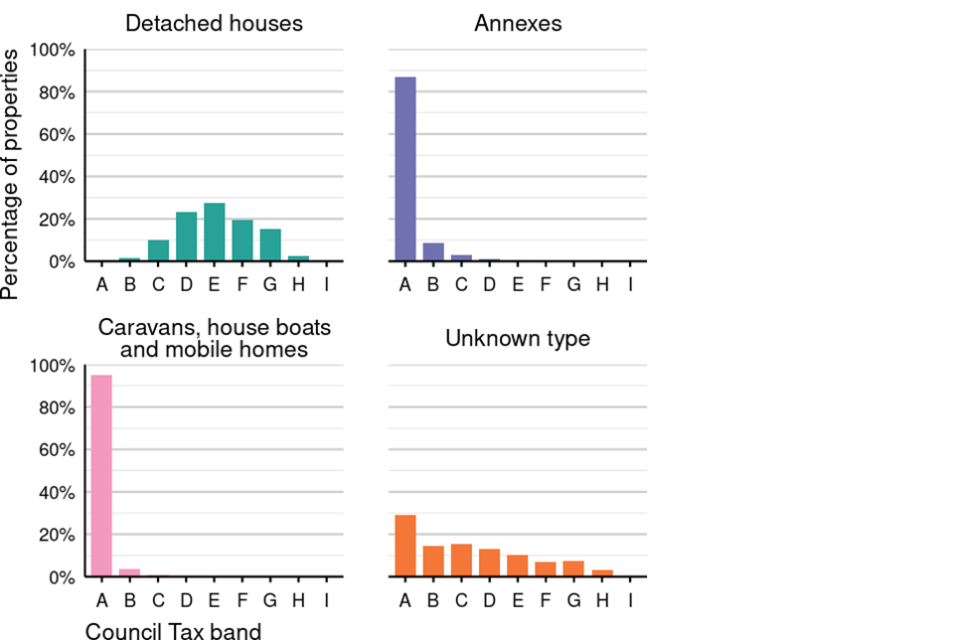

Figure 6: Properties by property type and Council Tax band in England and Wales, 31 March 2024

Source: Table CTSOP3.0

Figure 6 shows that:

-

Band A was the most frequent Council Tax band for flats and maisonettes (38% of all properties), terraced houses (33%), annexes (87%) and caravans/house boats/mobile homes (95%).

-

Band C was the most frequent Council Tax band for bungalows (26%) and semi-detached houses (31%). Band E was most frequent for detached houses (28%).

-

For each type of property, the distribution of council tax bands had a single peak; bands further from that peak contained a progressively smaller proportion of properties.

4.4 Properties by number of bedrooms, 31 March 2024

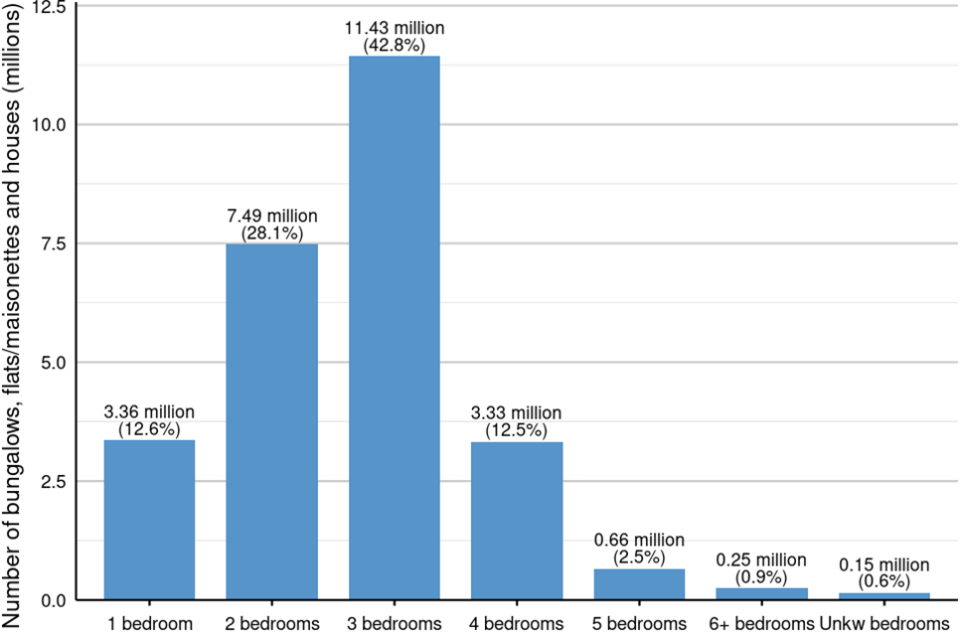

Figure 7: The number of bungalows, flats/maisonettes, and houses, by number of bedrooms in England and Wales, 31 March 2024

Source: Table CTSOP3.0

Figure note: Counts are rounded to the nearest hundred thousand.

Note that all information about the number of bedrooms in a property excludes annexes, caravans, house boats and mobile homes, and properties with an unknown property type. Together these total 0.4 million properties.

Figure 7 shows that:

- Of the 26.7 million bungalows, flats/maisonettes, and houses, most had either three bedrooms (11.43 million, or 42.8% of all bungalows, flats/maisonettes, and houses) or two bedrooms (7.49 million, 28.1%).

- The least frequent number of bedrooms was six or more (0.25 million, 0.9%).

- There were 0.15 million (0.6%) properties with an unknown number of bedrooms.

4.5 Properties by property type and number of bedrooms, 31 March 2024

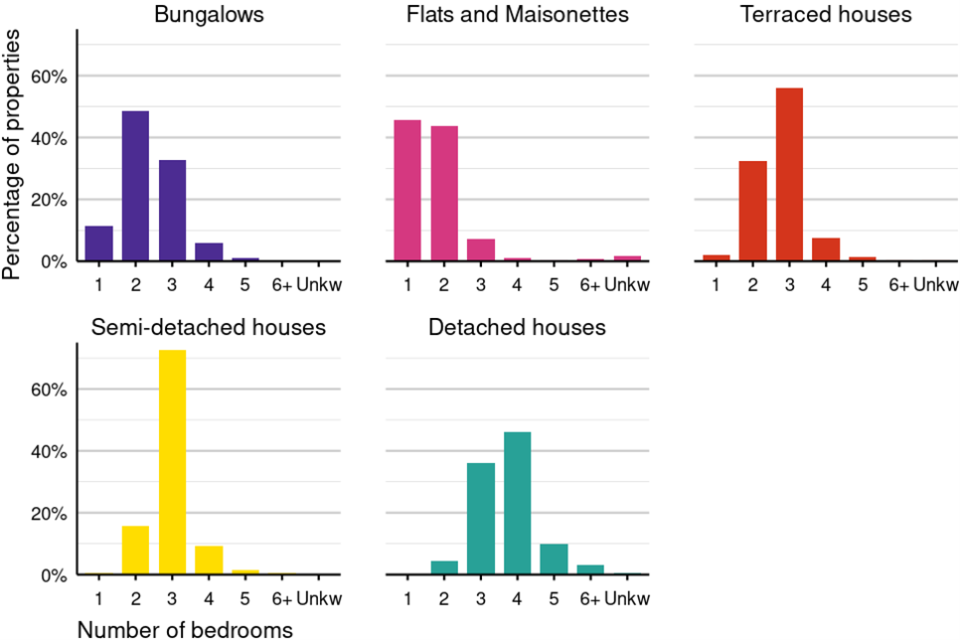

Figure 8: Bungalows, flats/maisonettes and houses by property type and number of bedrooms in England and Wales, 31 March 2024

Source: Table CTSOP3.0

Figure 8 shows that:

- Flats/maisonettes most frequently contained one or two bedrooms (46% and 44% of all flats, respectively).

- Bungalows most frequently contained two bedrooms (49% of all bungalows).

- Terraced houses and semi-detached houses most frequently contained three bedrooms (56% and 72% respectively).

- Detached houses most frequently contained four bedrooms (46%).

- The most frequent band was band A for one-bedroom properties (54% of one-bedroom properties) and two-bedroom properties (29% of two-bedroom properties).

4.6 Properties by number of bedrooms and Council Tax band, 31 March 2024

Figure 9: The number of bungalows, flats/maisonettes and houses by number of bedrooms and Council Tax band in England and Wales, 31 March 2024

Source: Table CTSOP3.0

Figure 9 shows that:

- The most frequent band was band A for one-bedroom properties (54% of one-bedroom properties) and two-bedroom properties (29% of two-bedroom properties).

- Three-bedroom properties were most frequently in band C (28%).

- Four-bedroom properties were most frequently in band E (29%).

- Band G was the most frequent band for five-bedroom properties (34%) and properties with six bedrooms or more (31%).

- Of the properties where the number of bedrooms was unknown, the bands were distributed in a similar pattern to the total number of properties in each band (see figure 1).

- For each number of bedrooms, the distribution of council tax bands had a single peak; bands further from that peak contained a progressively smaller proportion of properties.

4.7 Properties by number of bedrooms, country and region, 31 March 2024

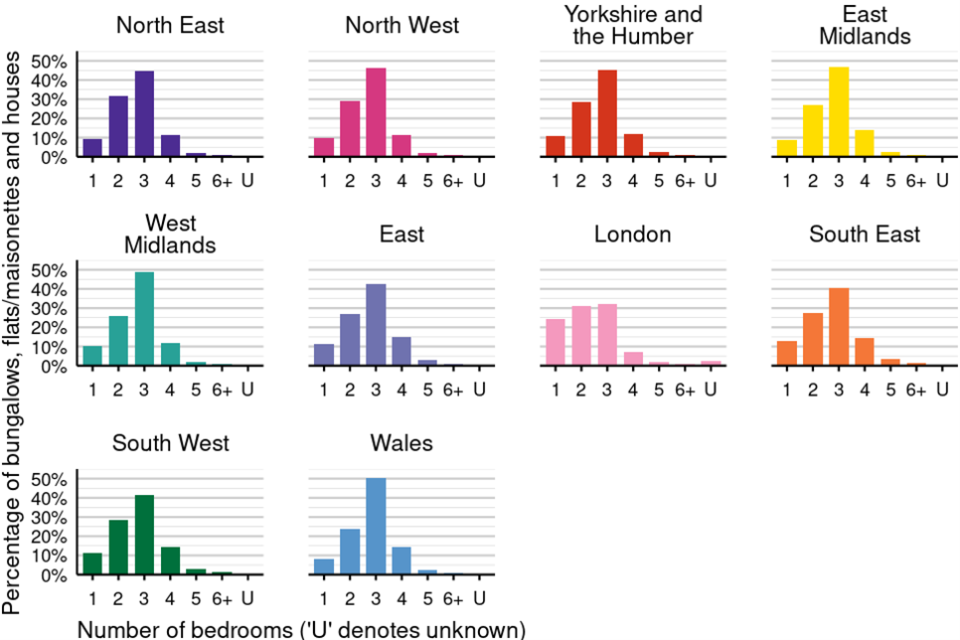

Figure 10: Bungalows, flats/maisonettes and houses by region and number of bedrooms in England and Wales, 31 March 2024

Source: Table CTSOP3.0

Figure 10 shows that in every area, the most frequent number of bedrooms in a property was three. This ranged from 32% of the properties in London to 50% of the properties in Wales.

In London, 24% of properties had one bedroom; in all other areas this figure ranged from 8% to 13%.

5. Properties by build period

For properties built prior to 2009, the VOA records the ‘build period’ of properties rather than the exact year built. Properties built in 2022 and 2024 have been grouped together in the same ‘build period’. This grouping will be reviewed in future publications. Statistics on properties by build period have been created for comparison purposes only and are not a representation of the number of properties built in a year; therefore, these figures should not be compared with the housing supply statistics that are published by DLUHC.

Updates to the number of properties in the list with a build period prior to 2022 to 2024 regularly occur. For further information see the Background Information document.

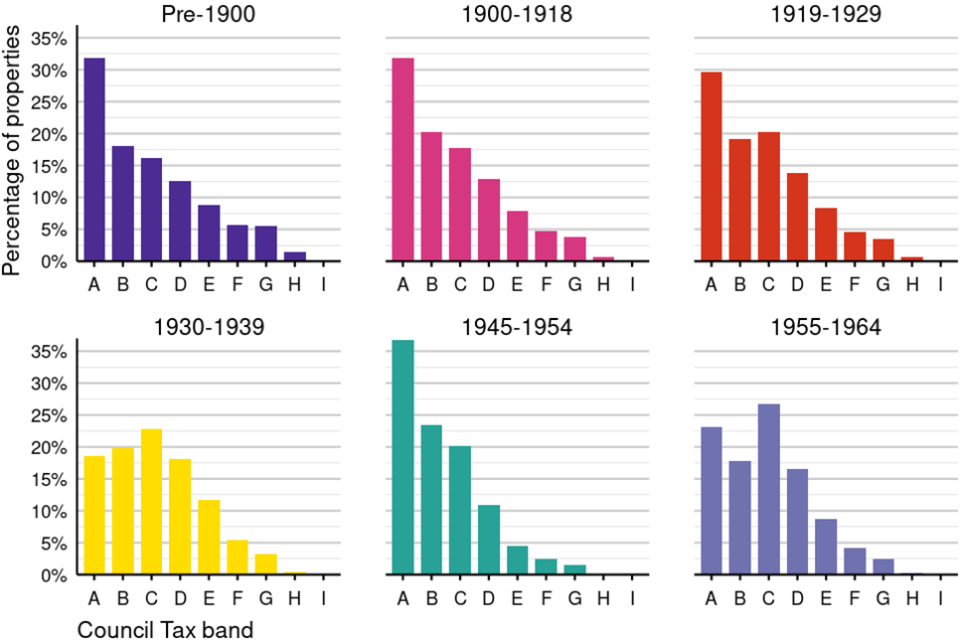

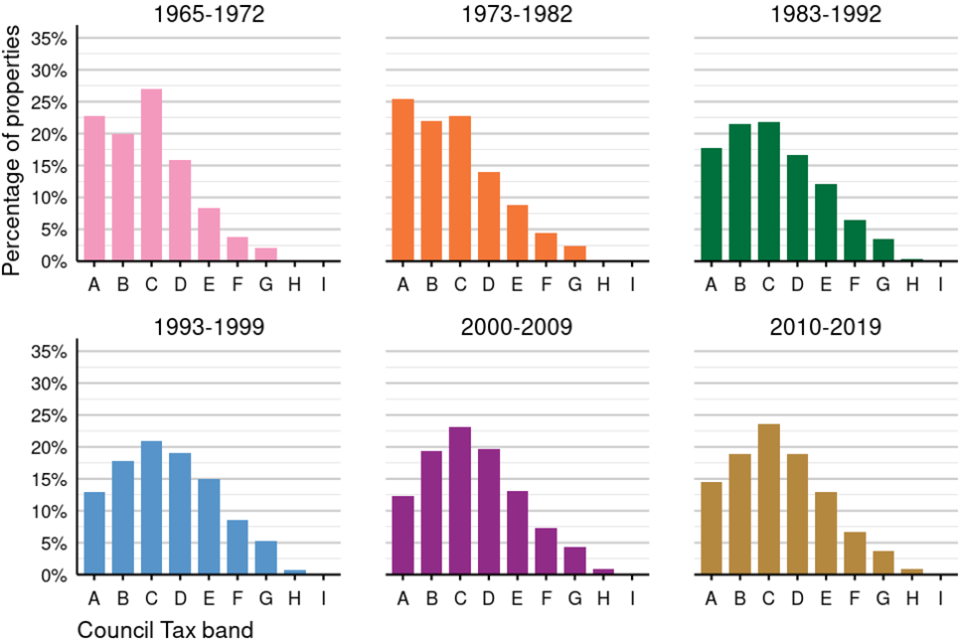

5.1 Properties by build period and Council Tax band, 31 March 2024

Figure 11: Properties by build period and Council Tax band in England and Wales, 31 March 2024

Source: Table CTSOP4.0

Figure note: These statistics only include properties in the Council Tax Valuation Lists as at 31 March 2024.

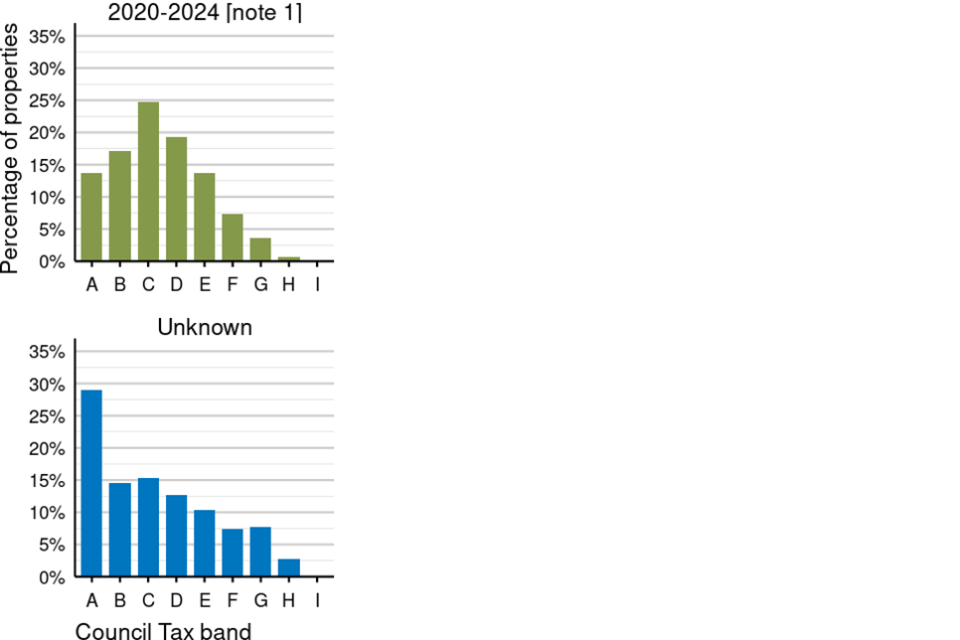

Figure 11 shows the percentage of properties by build period and Council Tax band in England and Wales at 31 March 2024:

- For properties with a build period of pre-1900, 1900-1918, 1919-1929, 1945-1954 and 1973-1982, band A was the most frequent Council Tax band; between 25% and 37% of all properties were in this band.

- For properties with all other build periods, band C was the most frequent Council Tax band (between 21% and 27% of properties)

- Of the properties where the build period was unknown, 29% were in band A.

6. Insertions to and deletions from the Council Tax Valuation Lists

6.1 Net change

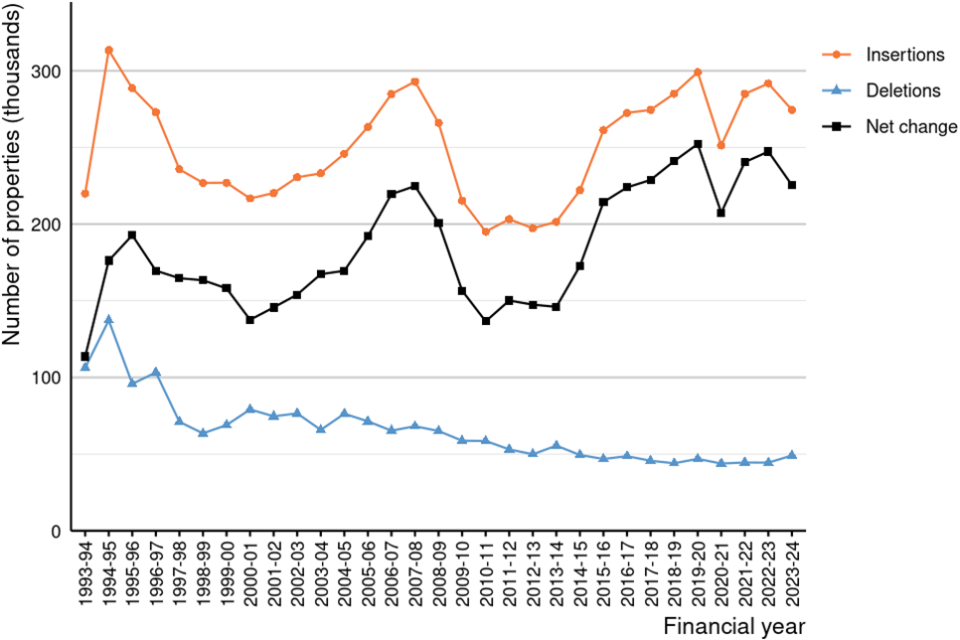

Figure 12: The number of properties inserted into and deleted from the Council Tax Valuation Lists in England and Wales, 1 April 1993 to 31 March 2024

Source: Tables CTSOP5.0 and CTSOP6.0

Figure note: Net change is calculated as the difference between the total number of properties inserted into the lists and the total number of properties deleted from the lists in a financial year.

Figure 12 shows the number of properties inserted to and deleted from the Council Tax Valuation Lists from 1993-94 to 2023-24. The number of properties inserted and deleted was artificially higher in 1994-95 as a result of boundary changes; when changes to the boundaries of local authorities result in a large number of properties moving from one billing authority to another, the VOA processes these changes by removing these properties from the Council Tax Valuation Lists. The properties are then reinserted into the list with the property’s new billing authority. For further information on these changes, please see the ONS web page on local government restructuring.

Generally, the number of properties deleted has tended to decrease over the years:

- In 1993 to 1994 there were 106,300 properties deleted.

- In 2023 to 2024 there were 49,060 properties deleted.

The pattern of properties inserted does not follow the same trend as the pattern of properties deleted:

- In 2007 to 2008 there was a dramatic decline in the number of properties being inserted; this reflects the effects of the global financial crisis that happened in 2007 to 2008.

- The number of properties inserted plateaued between 1 April 2010 and 1 April 2013.

- Increases in the numbers of properties inserted after 1 April 2013 could be attributable to policies that were introduced around this time which were designed to encourage house building, such as the New Homes Bonus (introduced 1 April 2011) and the Help to Buy scheme (introduced 1 April 2013).

- The temporary dip in insertions in 2020 to 2021 is in part attributed to the Covid-19 pandemic and associated UK government lockdown measures affecting the construction industry.

6.2 Insertions

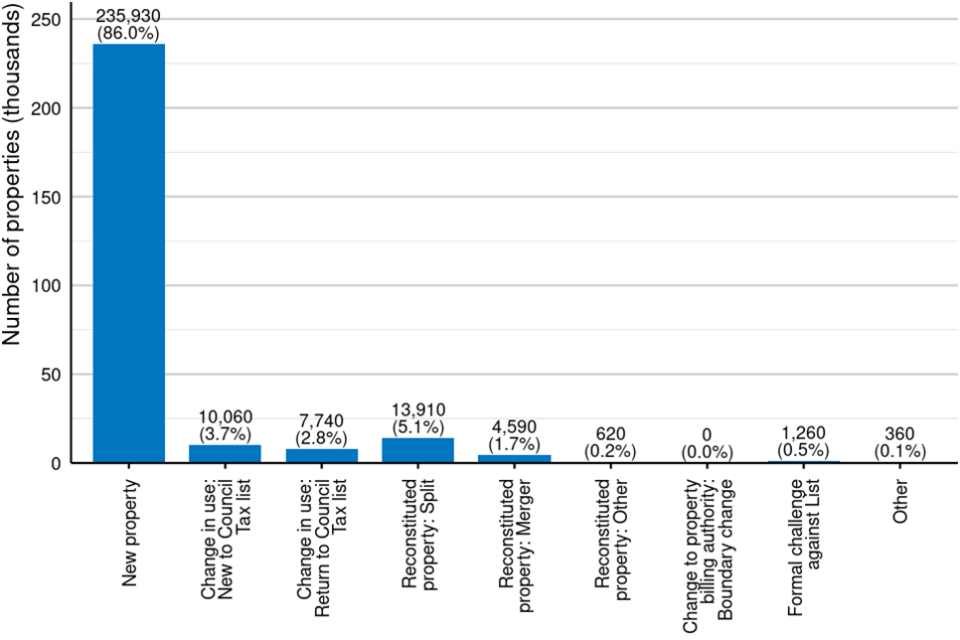

Figure 13: The number of properties inserted into the Council Tax Valuation Lists in England and Wales, 1 April 2023 to 31 March 2024

Source: Table CTSOP5.0

Figure notes: Counts are rounded to the nearest ten. Percentages are rounded to one decimal place. ‘New property’ means a new entry not previously in the Council Tax list; this may not necessarily indicate new build properties, but those that are inserted as a result of a report with this category in the Valuation Office Agency’s administrative database. In most cases the report type is provided by the billing authority.

Figure 13 shows that the main reason that properties were inserted into the Council Tax lists was new properties being added to the list; this reason accounted for 86.0% of all insertions.

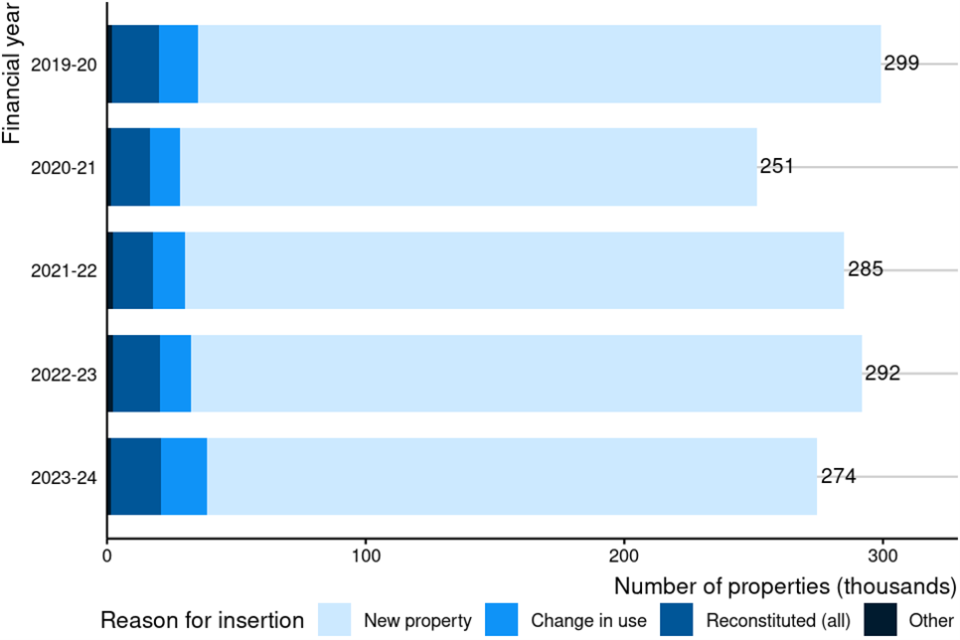

Figure 14: The number of properties inserted into the Council Tax Valuation Lists in England and Wales, 1 April 2019 to 31 March 2024

Source: Table CTSOP5.0

Figure notes: Counts are rounded to the nearest thousand. ‘New property’ means a new entry not previously in the Council Tax list; this may not necessarily indicate new build properties, but those that are inserted as a result of a report with this category in the Valuation Office Agency’s administrative database. In most cases the report type is provided by the billing authority.

Figure 14 shows a time series of the number of properties inserted into the Council Tax Valuation Lists in England and Wales. To make the chart clearer, some of the categories from figure 13 have been grouped together.

In every financial year, the main reason that properties were inserted was new properties being added to the list. In most years, the second most frequent reason was properties being reconstituted; that is, a property being split up into two or more properties, properties being merged into a single property, or another kind of reconstitution. However, in 1996 to 1997, the second most frequent reason was properties inserted as a result of boundary changes (see section Net change).

The increase in insertions due to change in use can be attributable to self-catering holiday homes moving to the council tax list from the non-domestic rating list following the introduction of the Non-Domestic Rating (Definition of Domestic Property) (England) Order 2022.

An increase in insertions due to reconstitution, from 2,000 in 2022 to 2023, to 4,590 in 2023 to 2024, is partially accounted for by a change in how houses in multiple occupation (HMOs) are valued. Further detail can be found in the section below.

6.3 Deletions

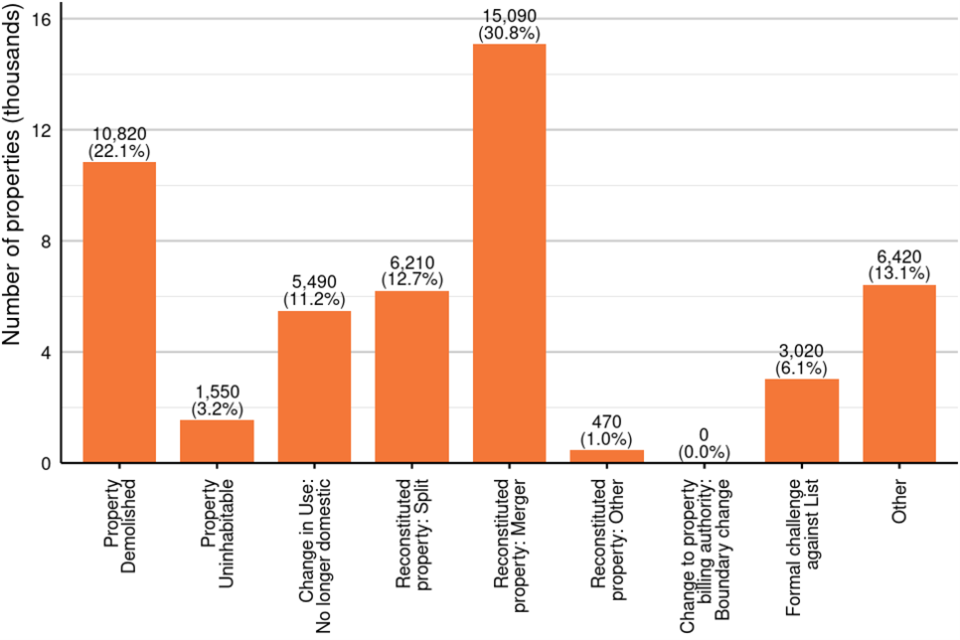

Figure 15: The number of properties deleted from the Council Tax Valuation Lists in England and Wales, 1 April 2023 to 31 March 2024

Source: Table CTSOP6.0

Figure notes: Counts are rounded to the nearest ten. Percentages are rounded to one decimal place.

Figure 15 shows that the main reasons for properties being deleted from the Council Tax lists were properties being merged, which made up 30.8% of all deletions, and properties being demolished (22.1% of deletions).

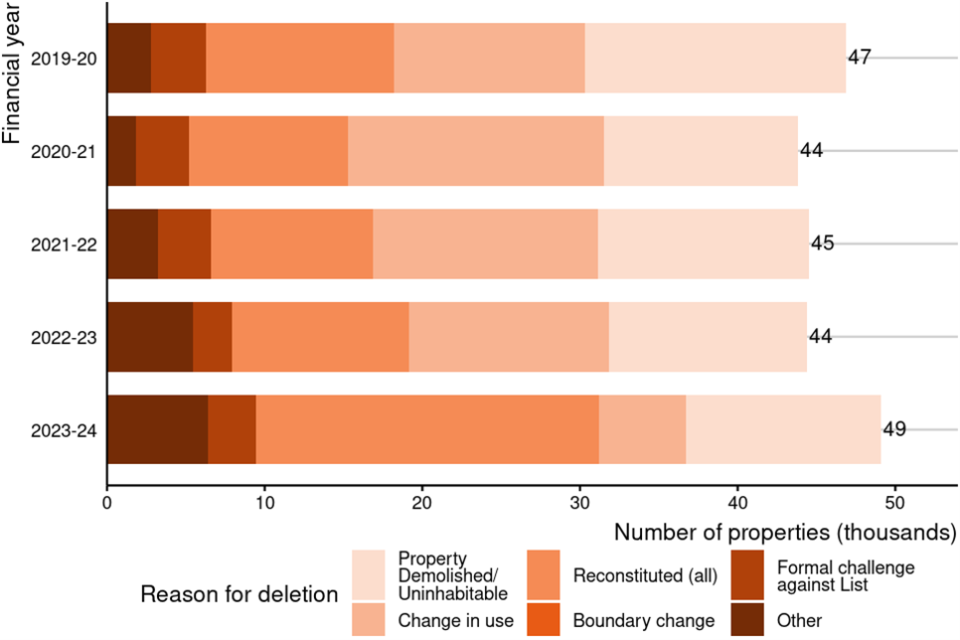

Figure 16: The number of properties deleted from the Council Tax Valuation Lists in England and Wales, 1 April 2019 to 31 March 2024

Source: Table CTSOP6.0

Figure note: Counts are rounded to the nearest thousand.

Figure 16 shows a time series of the number of properties deleted from the Council Tax Valuation Lists in England and Wales. To make the chart clearer, some of the categories from figure 15 have been grouped together.

In most financial years, the main reasons that properties were deleted were properties being demolished or deemed uninhabitable, properties being reconstituted and properties moving from domestic to commercial use. From 1994-95 to 1997-98, a large number of properties were deleted as a result of boundary changes (see section Net change).

Deletions due to mergers increased from 4,150 in 2022 to 2023, to 15,090 in 2023 to 2024.

This increase is partially accounted for by a change in how houses in multiple occupation (HMOs) are valued. From 1 December 2023 all HMOs in England are to be valued as a single property for Council Tax. VOA worked with local councils to identify licensed HMOs that were not valued as a single property, with the aim to re-band affected properties by the end of March 2024.

This exercise resulted in multiple deletions due to mergers, and a single insertion back in to the list. Correspondingly, there has been an increase in insertions due to mergers, of smaller magnitude.

For more information please see the consultation outcome of Council Tax valuation of houses in multiple occupation.

Further Information

Further information about the data and methodology presented in this commentary can be found in the Background Information.

As part of our improvement programme, if you’re interested in participating in user research about this statistical release, please contact us at [email protected].

GOV.UK has more information on:

- how properties are assessed for Council Tax bands

- how to check your Council Tax band

- how to challenge your Council Tax band

Timings of future releases are regularly placed on the VOA research and statistics calendar.

Any updates or announcements regarding VOA’s statistics can be found on our Announcement page

For further information on the geographical information used in this release please refer to the ONS Administrative Geography Guidance.

Housing statistics from other government departments

Office for National Statistics

Department for Levelling Up, Housing and Communities and Homes England (England)

Welsh Government (Wales)

Department for Communities (Northern Ireland)

Housing and Social Justice Directorate (Scotland)