Cyber security breaches survey 2023

Published 19 April 2023

The Cyber Security Breaches Survey is a research study for UK cyber resilience, aligning with the National Cyber Strategy. It is primarily used to inform government policy on cyber security, making the UK cyberspace a secure place to do business. The study explores the policies, processes and approach to cyber security for businesses, charities, and educational institutions. It also considers the different cyber attacks and cyber crimes these organisations face, as well as how these organisations are impacted and respond.

For this latest release, the quantitative survey was carried out in winter 2022/23 and the qualitative element in early 2023.

Responsible analyst:

Emma Johns

Responsible statistician:

Maddy Ell

Statistical enquiries:

Summary

Identification of cyber security breaches and attacks

Cyber security breaches and attacks remain a common threat. However, smaller organisations are identifying them less than last year. This may reflect that senior managers in smaller organisations view cyber security as less of a priority in the current economic climate than in previous years, so are undertaking less monitoring and logging of breaches or attacks.

-

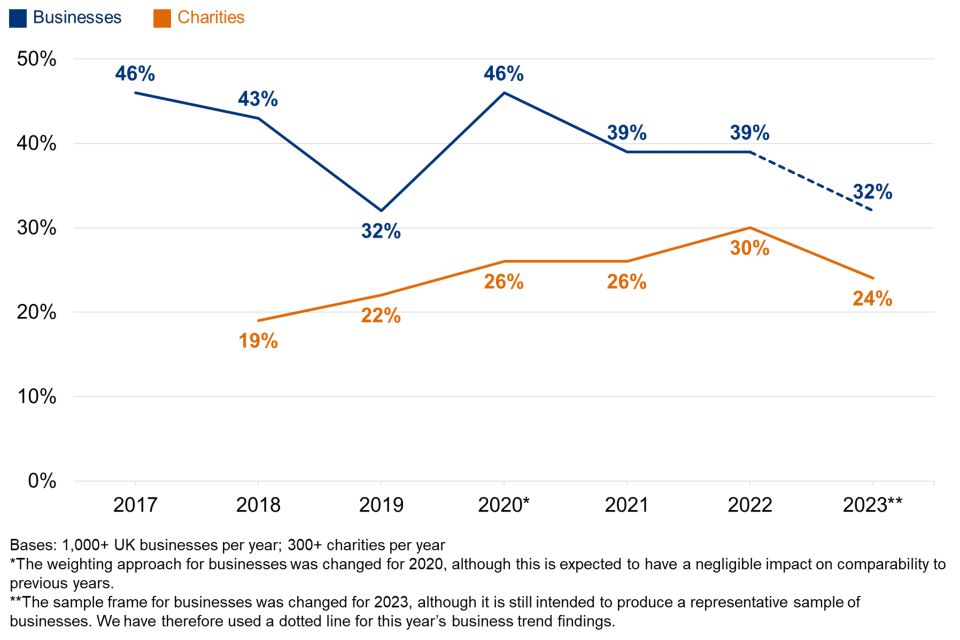

32% of businesses and 24% of charities overall recall any breaches or attacks from the last 12 months. This is much higher for medium businesses (59%), large businesses (69%) and high-income charities with £500,000 or more in annual income (56%).

-

This is a decrease from 39% of businesses and 30% of charities in 2022. The drop is driven by smaller organisations – the results for medium and large businesses, and high-income charities, remain at similar levels to last year.

-

Among those identifying any breaches or attacks, we estimate that the single most disruptive breach from the last 12 months cost each business, of any size, an average of approximately £1,100. For medium and large businesses, this was approximately £4,960. For charities, it was approximately £530.

-

The proportion of micro businesses saying cyber security is a high priority has decreased from 80% in 2022 to 68% this year. Qualitative evidence suggests that cyber security has dropped down the priority lists for these smaller organisations, relative to wider economic concerns like inflation and uncertainty.

Cyber hygiene

The most common cyber threats are relatively unsophisticated, so government guidance advises businesses and charities to protect themselves using a set of “cyber hygiene” measures. A majority of businesses and charities have a broad range of these measures in place. The most common are updated malware protection, cloud back-ups, passwords, restricted admin rights and network firewalls – each administered by two-thirds or more of businesses and half or more charities. However, across the last three waves of the survey, some areas of cyber hygiene have seen consistent declines among businesses. This includes:

-

use of password policies (79% in 2021, vs. 70% in 2023)

-

use of network firewalls (78% in 2021 vs. 66% in 2023)

-

restricting admin rights (75% in 2021, vs. 67% in 2023)

-

policies to apply software security updates within 14 days (43% in 2021, vs. 31% in 2023).

These trends mainly reflect shifts in the micro business population and, to a lesser extent, small and medium businesses – large business results have not changed.

Risk management and supply chains

A larger proportion of businesses take actions to identify cyber risks than charities. Larger businesses are the most advanced in this regard. For the first time, the majority of large businesses are reviewing supply chain risks, although this is still relatively rare across organisations overall.

-

Three in ten businesses have undertaken cyber security risk assessments (29%, vs. 27% of charities) in the last year – rising to 51% of medium businesses and 63% of large businesses.

-

A similar proportion of businesses deployed security monitoring tools (30%, vs. 19% of charities) – rising to 53% of medium businesses and 72% of large businesses.

-

Under four in ten businesses (37%) and a third of charities (33%) report being insured against cyber security risks – rising to 63% of medium businesses and 55% of large businesses (i.e. cyber insurance is more common in medium businesses than large ones).

-

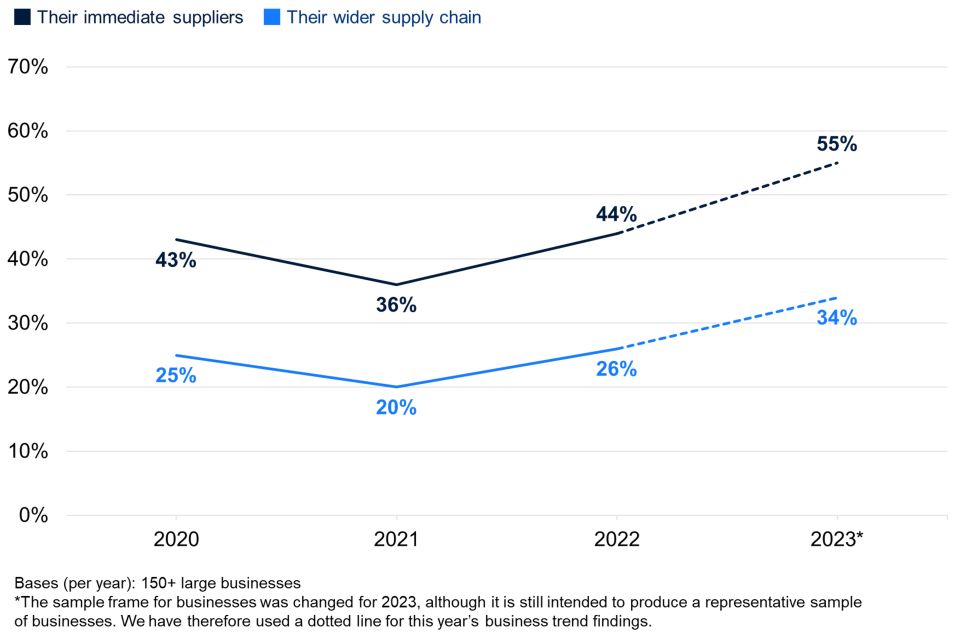

Just over one in ten businesses say they review the risks posed by their immediate suppliers (13%, vs. 11% of charities). More medium businesses (27%) and large businesses (55%) review immediate supplier risks. The latter result is up from 44% of large businesses in 2022.

-

Qualitative data suggests that receiving messaging around supply chain risks from bodies such as the National Cyber Security Centre (NCSC), or having the topic raised in audits, helps encourage organisations to take action in this area.

Board engagement and corporate governance

Board engagement and corporate governance approaches towards cyber security tend to be more sophisticated in larger organisations, although corporate reporting of cyber risks remains relatively uncommon, even among large businesses.

-

Three in ten businesses (30%) and charities (31%) have board members or trustees explicitly responsible for cyber security as part of their job role – rising to 41% of medium businesses and 53% of large businesses.

-

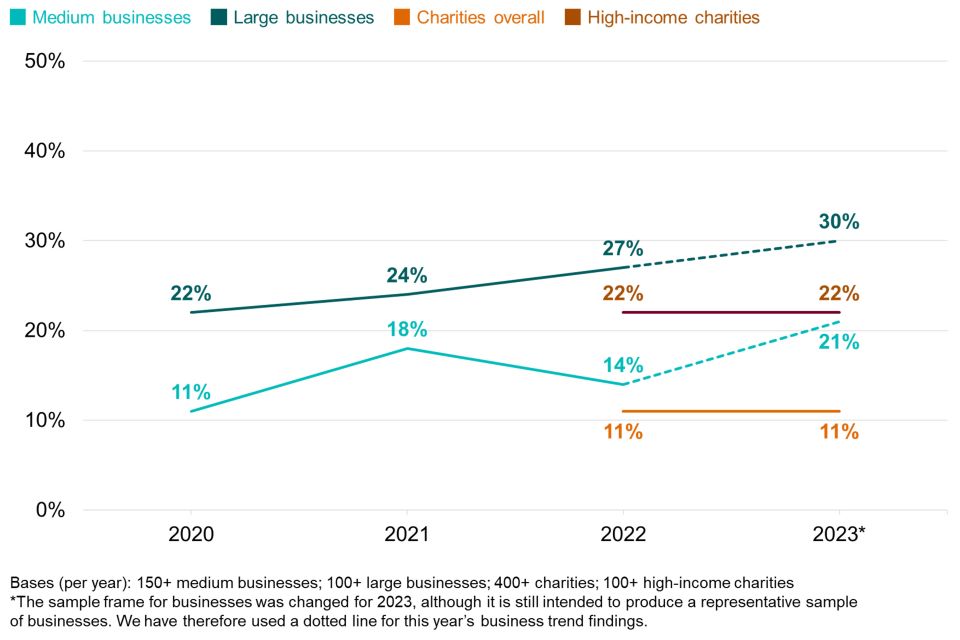

21% of medium businesses and 30% of large businesses have heard of the NCSC’s Board Toolkit – rising from 11% and 22% respectively in 2020 (when it was introduced).

-

49% of medium businesses, 68% of large businesses and 36% of high-income charities have a formal cyber security strategy in place. Qualitative data suggests the impetus to develop strategies can come from management board pressure, audits and business acquisition. It can also coincide with cyber teams gaining operational independence, for example from IT departments.

-

In the last year, 16% of corporate annual reports across medium businesses covered cyber risks, rising to 33% of the reports published by large businesses. Across charities (of all income groups), 9% of these reports covered cyber risks.

-

Qualitative data shows a similar set of issues to previous years that prevent boards from engaging more in cyber security, including a lack of knowledge, training and time. It also highlights the importance of people in cyber roles being able to write persuasive business cases for cyber security spending, especially when they report directly to finance leads.

Cyber accreditations and following guidance

The proportion of organisations seeking external information or guidance on cyber security remains stable, at almost half. However, this means that a sizeable proportion of organisations, including larger organisations, continue to be unaware of government guidance such as the 10 Steps to Cyber Security, and the government-endorsed Cyber Essentials standard. Linked to this, relatively few organisations at present are adhering to recognised standards or accreditations, such as Cyber Essentials or ISO 27001.

-

49% of businesses and 44% of charities report seeking information or guidance on cyber security from outside their organisation in the past year, most commonly from external cyber security consultants, IT consultants or IT service providers.

-

14% of businesses and 19% of charities are aware of the 10 Steps guidance – rising to 32% of medium businesses and 44% of large businesses. Nevertheless, around two-fifths of businesses (37%) and three in ten charities (30%) have taken action on 5 or more of the 10 Steps. This is much more common in medium businesses (75%) and large businesses (89%). Just 2% of businesses and charities have enacted all 10 Steps, increasing to 7% of medium businesses and 20% of large businesses.

-

14% of businesses and 15% of charities are aware of the Cyber Essentials scheme – rising to 50% of medium businesses and 59% of large businesses.

-

A total of 9% of businesses and 5% of charities report adhering to ISO 27001. This is again higher among large businesses (27%).

-

Qualitative findings suggest the desire to seek external accreditation can be because clients demand it. It can also be a convenient way for organisations to generate a standardised set of documentation on their cyber security standards, or to enforce or speed up a positive change in their staff culture.

Incident response

While a large majority of organisations say that they will take several actions following a cyber incident, in reality a minority have agreed processes already in place to support this. This highlights an area for ongoing improvement for the study to continue monitoring next year.

-

The most common processes, mentioned by between a quarter and two-fifths of businesses and charities, are having specific roles and responsibilities assigned to individuals, having guidance on external reporting, and guidance on internal reporting.

-

Formal incident response plans are not widespread (21% of businesses and 16% of charities have them). This rises to 47% of medium-sized businesses, 64% of large businesses and 38% of high-income charities.

-

Qualitative findings suggest another area for potential improvement is the relative disconnect between IT or specialist cyber teams and wider staff (including management boards) when it comes to incident response. Bridging this gap was felt to require good, regular communication between IT teams and wider staff. Post-incident reviews were also seen as a way to engage wider staff in cyber security.

Cyber crime

Some cyber security breaches and attacks do not constitute cyber crimes under the Computer Misuse Act 1990 and the Home Office Counting Rules. New questions were added this year to establish the extent to which the breaches or attacks that organisations experience could be defined as cyber crimes committed against them, using the principles in the Home Office Counting Rules. Further new questions explored the extent of fraud that occurred as a result of cyber crime. More detail about definitions of cyber crime and the rationale for expanding the survey in this way can be found in Chapter 6.

As this is the first year these questions have been asked and there is no baseline for comparison, users should be relatively cautious when interpreting these statistics.

The findings show that cyber crime is more prevalent among larger organisations, although this may be a sign of underreporting among smaller organisations.

-

A total of 11% of businesses and 8% of charities have experienced cyber crime in the last 12 months, rising to 26% of medium businesses, 37% of large businesses and 25% of high-income charities. Looked at another way, among the 32% businesses and 24% of charities identifying any cyber security breaches or attacks, around a third (34% for businesses and 32% for charities) ended up being victims of cyber crime.

-

Separately, a total of 3% of businesses and 1% of charities have been victims of fraud as a result of cyber crime. This accounts for 9% of the businesses and 6% of the charities that identify any cyber security breaches or attacks.

-

We estimate that, across all UK businesses, there were approximately 2.39 million instances of cyber crime and approximately 49,000 instances of fraud as a result of cyber crime in the last 12 months. Across charities, there were approximately 785,000 cyber crimes over this period. The sample sizes do not allow us to estimate the scale of fraud resulting from cyber crime across charities. It should be noted that these estimates of scale will have a relatively wide margin of error.

-

The average (mean) annual cost of cyber crime for businesses is estimated at approximately £15,300 per victim. The sample sizes do not allow this cost calculation for charities.

Chapter 1: Introduction

1.1 Code of practice for statistics

The Cyber Security Breaches Survey is an official statistic and has been produced to the standards set out in the Code of Practice for Statistics.

1.2 Background

Publication date: April 2023

Geographic coverage: United Kingdom

The Department for Science, Technology and Innovation (DSIT), in partnership with the Home Office, commissioned the Cyber Security Breaches Survey of UK businesses, charities and education institutions as part of the National Cyber Security Programme.[footnote 1] The findings of this survey provide a comprehensive description of cyber security for a representative sample of UK organisations, which provides a snapshot of UK cyber resilience at this point in time. It tells us about the cyber threats organisations face and the actions they are taking to stay secure. It also supports the government to shape future policy in this area, in line with the National Cyber Strategy 2022.

To increase the value of these statistics, the 2023 iteration of the study includes, for the first time, estimates of cyber crime, and fraud that occurred as a result of cyber crime (see Chapter 6). As this is the first year these questions have been asked and there is no baseline for comparison, users should be relatively cautious when interpreting these statistics. They should ideally be considered alongside other, related evidence on computer misuse, such as the statistics for retail and wholesale premises collected in the 2021 Commercial Victimisation Survey (CVS), and the general public statistics from the Crime Survey for England and Wales (CSEW). The Cyber Security Breaches Survey adds to the broad picture from these other surveys by looking at these types of crimes across all economic sectors.

The research was conducted by the independent research organisation Ipsos. The project requirements and reporting are approved by DSIT and the Home Office. For the 2023 publication this includes coverage of the following areas:

-

prioritisation, information seeking (including use of government guidance) and decision making on cyber security, including among organisations’ management boards

-

cyber security approaches, covering risk management (including cyber insurance and supply chain risks), technical controls, staff training and responsibilities and governance

-

the cyber threat landscape, including identification of cyber security breaches or attacks, their outcomes and impacts, their estimated financial cost

-

incident response approaches and reporting of cyber security breaches or attacks

-

the prevalence, nature, scale and financial costs of cyber crime, as well as the prevalence, nature and scale of fraud that occurred as a result of cyber crime.

This 2023 publication follows previous surveys in this series, published annually since 2016. In each publication year, the quantitative fieldwork has taken place in the winter of the preceding year (for example, in winter 2022/23, for this latest survey).

This Statistical Release focuses on the business and charity outcomes. The results for educational institutions have been included in a separate Education Annex.

1.3 Methodology

As in previous years, there were two strands to the Cyber Security Breaches Survey:

- We undertook a random probability telephone and online survey of 2,263 UK businesses, 1,174 UK registered charities and 554 education institutions from 27 September 2022 to 18 January 2023. The data for businesses and charities have been weighted to be statistically representative of these two populations.

- We carried out 44 in-depth interviews between December 2022 and January 2023, to gain further qualitative insights from some of the organisations that answered the survey.

Sole traders and public-sector organisations were outside the scope of the survey. In addition, businesses with no IT capacity or online presence were deemed ineligible. These exclusions are consistent with previous years, and the survey is considered comparable across years.

The educational institutions, covered in the separate Education Annex, comprise 241 primary schools, 217 secondary schools, 44 further education colleges and 52 higher education institutions.

More technical details and a copy of the questionnaire are available in the separately published Technical Annex.

1.4 Changes since the 2022 study

The core approach for the 2023 study – data collected from organisations via a random-probability survey, predominantly conducted by telephone – is unchanged from the previous iterations. As such, we continue to make comparisons to previous years. Nevertheless, this year, we made more substantial changes to aspects of the methodology than in previous years. These changes were necessary to be able to deliver the larger sample sizes required this year, in order to explore the new topic of cyber crime. In total, we interviewed 3,991 respondents across all types of organisation (vs. 2,157 in 2022). We also undertook a higher number of qualitative follow-up interviews (44, vs. 35 in 2022).

The noteworthy changes to the methodology were as follows, with full details in the Technical Annex:

- We changed the sample frame for businesses from the Inter-Departmental Business Register (IDBR) to the Market Location business database. This was done to improve the overall sample quality, accuracy and telephone coverage. The sample frames for charities and education institutions were consistent with previous years.

- We adopted a multimode data collection approach, allowing organisations to take part partially or fully online as well as by phone.

- We substantially increased the use of split-sampling in the survey, where certain questions are only asked to a random half of the sample.

- The mapping of the questionnaire to the government’s 10 Steps to Cyber Security guidance has changed, following a review by Professor Steven Furnell from the University of Nottingham. This is fully explained in Section 3.9.

To note, these changes do not prevent us from making year-on-year comparisons. The Technical Annex lays out the steps taken to validate trends and check for mode effects. While we are confident in the trend findings reported throughout, we cannot definitively rule out any potential impact that a change in the sample frame may have had on the business findings. Therefore, in all the charted trend data, we have used a dotted line to mark the trend for businesses from 2022 to 2023. This is simply to suggest to readers that any shifts should be treated with appropriate caution. Further years of data will help to validate the trend.

1.5 Interpretation of findings

How to interpret the quantitative data

The survey results are subject to margins of error, which vary with the size of the sample and the percentage figure concerned. For all percentage[footnote 2] results, subgroup differences have been highlighted only where statistically significant (at the 95% level of confidence).[footnote 3] This includes comparison by size, sector, and previous years. By extension, where we do not comment on differences across years, for example in line charts, this is specifically because they are not statistically significant differences.

There is a further guide to statistical reliability at the end of this release.

Subgroup definitions and conventions

For businesses, analysis by size splits the population into micro businesses (1 to 9 employees), small businesses (10 to 49 employees), medium businesses (50 to 249 employees) and large businesses (250 employees or more).

For charities, analysis by size is primarily considered in terms of annual income band, specifically looking at the subgroups of high-income charities (with annual incomes of £500,000 or more) and very high-income charities (£5 million or more). The sample size for charities (1,174) has substantially increased this year compared to the 2022 sample size (424).

Due to the relatively small sample sizes for certain business sectors, these have been grouped with similar sectors for more robust analysis. Business sector groupings referred to across this report, and their respective SIC 2007 sectors, are:

- administration and real estate (L and N)

- agriculture, forestry, and fishing (A)

- construction (F)

- education (P)[footnote 4]

- health, social care, and social work (Q)

- entertainment, service, and membership organisations (R and S)

- finance and insurance (K)

- food and hospitality (I)

- information and communications (J)

- utilities and production (including manufacturing) (B, C, D and E)

- professional, scientific, and technical (M)

- retail and wholesale (including vehicle sales and repairs) (G)

- transport and storage (H).

Analysis of organisation cyber security split by geographical region is considered to be out of the scope of this reporting. While we may occasionally provide data specific for UK regions (at International Territorial Level 1), we recommend caution in attributing these differences to actions taken or not taken by that region – regional differences may also be attributable to the size and sector profile of the sample in that region.

Where figures in charts do not add to 100%, or to an associated net score, this is due to rounding of percentages or because the questions allow more than one response.

How to interpret the qualitative data

The qualitative findings offer more nuanced insights into the attitudes and behaviours of businesses and charities with regards to cyber security. The findings reported here represent common themes emerging across multiple interviews. Insights and verbatim quotes from individual organisations are used to illustrate findings that emerged more broadly across interviews. However, as with any qualitative findings, these examples are not intended to be statistically representative.

1.6 Acknowledgements

Ipsos UK, DSIT and the Home Office would like to thank all the organisations and individuals who participated in the survey. We would also like to thank the organisations who supported the survey development work, endorsed the fieldwork, and encouraged organisations to participate, including:

- the Association of British Insurers (ABI)

- the Charity Commission for England and Wales

- the Charity Commission for Northern Ireland

- the Institute of Chartered Accountants in England and Wales (ICAEW)

- Jisc, a not-for-profit company that provides digital infrastructure, services, and guidance for UK further and higher education institutions

- the Office for National Statistics (ONS)

- the Office of the Scottish Charity Regulator (OSCR)

- UCISA (formerly known as the Universities and Colleges Information Systems Association).

Chapter 2: Awareness and attitudes

This chapter explores:

-

prioritisation of cyber security within organisations

-

receiving and reacting to information and guidance about cyber security

-

qualitative data on how organisations make decisions on cyber security.

2.1 Perceived importance of cyber security

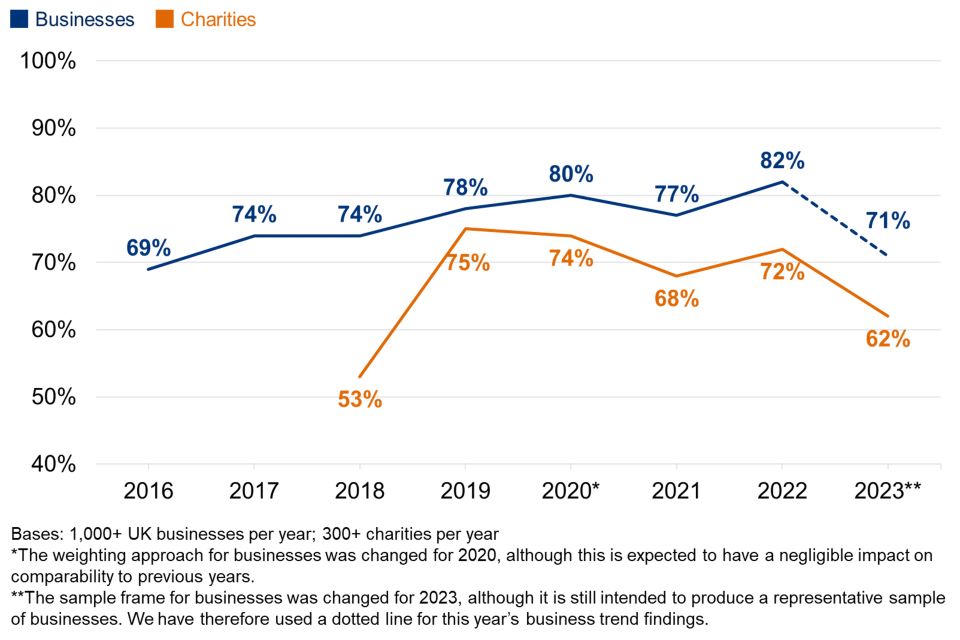

Around seven in ten businesses (71%) and six in 10 charities (62%) report that cyber security is a high priority for their senior management. A roughly equal proportion say this is a very high or fairly high priority (Figure 2.1).

While these are strong majorities, both results represent an apparent decrease in prioritisation from last year – this is explored in more detail in the next section (see Figure 2.2).

In interpreting this question, it is worth noting that in smaller organisations, the individuals responsible for cyber security – i.e. the ones who completed this survey – tend to be senior management, so are answering with regards to their own views. In larger organisations, these individuals may not be part of senior management, so their answers will reflect their own perceptions of their senior management team’s views.

Figure 2.1: Extent to which cyber security is seen as a high or low priority for directors, trustees, and other senior managers

| Organisation type | % very high | % fairly high | % fairly low | % very low | % don’t know | |

|---|---|---|---|---|---|---|

| Businesses overall | 36 | 35 | 19 | 8 | 2 | |

| Charities overall | 30 | 32 | 22 | 12 | 3 |

Bases: 1,152 UK businesses; 570 charities

It is more common for larger businesses to say that cyber security is a high priority (91% of medium businesses and 96% of large businesses, vs. 71% overall). The same is true for high-income charities (90% of those with income of £500,000 or more, vs. 62% overall). This continues the pattern seen in all previous years, where larger organisations tend to treat cyber security more seriously, and consequently allocate more resources to it.

Businesses in the following sectors tend to treat cyber security as a higher priority than others:

-

finance and insurance (73% say it is a “very” high priority, vs. 36% of all businesses)

-

professional, scientific and technical (46% a “very” high priority)

-

information and communications (86% a “very” or “fairly” high priority, vs. 71% overall).

In previous years, the health, social care and social work sector has consistently reported a higher prioritisation of cyber security. This year, due to low sample sizes for this subsector at this question, this difference cannot be validated statistically. However, in other areas such as governance and risk management (covered in Chapter 3), this sector remains ahead of others.

By contrast, and in line with previous years, food and hospitality businesses tend to regard cyber security as a lower priority than those in other sectors (only 58% say it is a high priority, vs. 71% of businesses overall).

Businesses in the South East tend to place a higher prioritisation on cyber security than the average UK business this year (80% say it is a high priority, vs. 71% overall). This does not, however, reflect a consistent trend from previous years. There are no other geographic regions this year that stand out ahead of others.

Trends over time

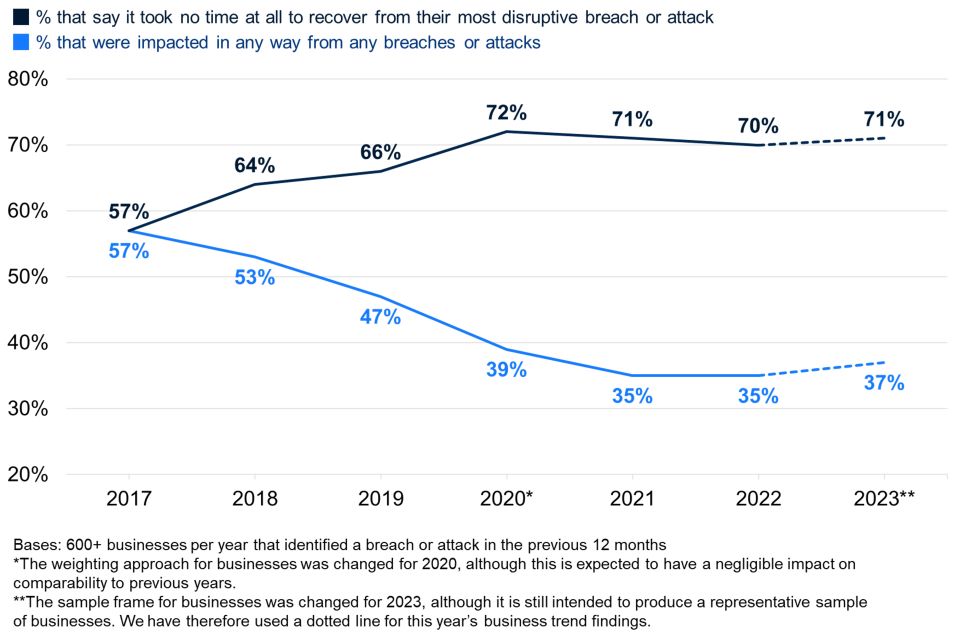

Figure 2.2 shows how the prioritisation score has changed over time. At face value, cyber security has become less of a priority among both businesses and charities, reversing a consistent rising trend for businesses in earlier years.

While there were more substantive changes to the survey methodology this year, such as a change in the business sample frame, we do not believe these to be the cause of this reversal. There is good evidence from the qualitative interviews, covered later in this section, that helps to explain the trend. Nevertheless, we cannot definitively rule out any potential impact that a change in the sample frame may have had. Therefore, on Figure 2.2 and similar charts across this report, we have used a dotted line to mark the trend for businesses from 2022 to 2023. This is simply to suggest to readers that any trends should be treated with appropriate caution. Further years of data will help to validate the trend.

Figure 2.2: Percentage of organisations over time where cyber security is seen as a high priority for directors, trustees, and other senior managers

Primarily, there has been a shift in the proportion saying cyber security is a “fairly” high priority (e.g. from 44% of businesses last year, to 35% this year). The proportions of businesses and charities saying it is a very high priority is more consistent with last year. This potentially creates a clearer distinction this year between the organisations that have maintained their cyber security despite increasing challenges in the business environment, and those where it might be seen as competing against other business challenges or priorities – further evidenced in this year’s qualitative findings.

The drop in overall prioritisation in businesses is also more concentrated among micro businesses (down from 80% in 2022 to 68% this year saying cyber security is a high priority). In other words, cyber security has dropped down the agenda among the businesses where it was already seen as a more marginal priority, and among the businesses that typically have the fewest resources to deploy. By contrast, among small, medium and large businesses, there has been no statistically significant shift in findings:

-

83% of small businesses say it is a high priority (vs. 87% in 2022)

-

91% of medium businesses say this (vs. 92% in 2022)

-

96% of large businesses say this (vs. 95% in 2022).

Similarly, for high-income charities, the result is not significantly different from last year (90% in 2023, vs. 92% in 2022). By contrast, the result for low-income charities (with under £100,000 in annual income) has dropped by 14 percentage points (from 67% to 53%).

It is worth noting that, in each year of this survey, larger organisations have identified substantially more cyber security breaches and attacks than smaller ones (see Section 4.1). In this sense, it is those at greatest risk that have maintained their prioritisation of cyber security. Nevertheless, it is also important to note that most organisations are small. For example, micro businesses account for 82% of all UK businesses (if excluding those with zero employees). Therefore, this drop has significant implications for vast swathes of the business community.

The fall is broadly spread across economic sectors and across regions. The largest percentage point changes are in entertainment, service and membership organisations (down 29 points to 66%) and retailers and wholesalers (down 16 points to 66%).

Qualitative insights on cyber security prioritisation in the current economic and geopolitical environment

The qualitative interviews suggest that these survey findings – the lower proportion of organisations seeing cyber security as a priority this year – may be linked to changes in the external business environment. Various organisations highlighted that they faced rising costs and more difficulty with financial planning, due to inflation, higher energy prices and uncertainty about the economic situation.

There was a sense across interviews that the topic had dropped down the priority list among senior managers, relative to these wider concerns. This seemed to have hit smaller businesses and charities the hardest, given that the same senior individuals taking responsibility for cyber security in these organisations were also dealing with all the other general pressures facing their organisations. One interviewee, the Head of Finance in a high-income charity, highlighted that there were constant pressures to control their use of donor money and that they were nervous about their expected income in the coming year. The following quotes, respectively from a small hospitality business and a machinery retail and repair business, also highlights the focus on survival, leading to a reactive rather than proactive approach to cyber security:

We’re a small company. The biggest issue is trying to survive on a week-by-week basis. We can’t afford to allocate sums to cyber security. I’ll spend it as and when I have it, or when I need to.

– Managing director, small business

In moments of uncertainty, with costs increasing, it’s tempting to cut corners when you see how much cloud systems, antivirus, firewalls are costing. The risk is that pressure on margins leads you to cut corners, to reduce the amount you spend on cyber security.

– Director, small business

At the same time, many of the organisations we spoke to were keen to stress that they had not decreased their spending on cyber security in the face of such pressures. Moreover, larger organisations tended to have maintained their levels of board engagement over the past year (covered fully in Section 2.2), rather than reining back. However, some interviewees flagged that the current situation may make budget negotiations harder for future years, if not now.

Inflation is not affecting cyber security budgets at the moment. Maybe over the next year, as there is a sharp focus on spending, we may need to really be able to justify our case.

– Head of Cyber Security, large business

There were exceptions – organisations saying that cyber security had become a higher priority over the past year – but this was typically off the back of a cyber incident, or near-miss, within the organisation or the industry. For example, one senior manager from a high-income charity described how they had sped up a planned audit of their cyber security approach in response to other charities in their sector getting attacked. The charity had, following the audit, increased their cyber security budget, refreshed their policies around use of hardware and mobile phones, brought in mandatory training on phishing, and were planning to formally test their business recovery plan later in the year. Without this catalyst, organisations tended to take a reactive approach, where they would look at individual problems as and when they arose.

However, even in this case, this senior manager admitted that their trustees found it hard to understand the risks, and relied heavily on the cyber security experts within the charity.

[Cyber security is seen as] a scary, messy business with lots of technical challenges, best left to the experts. But there’s a growing recognition that it’s staff behaviours that drive most of the cyber security risk, so we need to share more with the SMT [Senior Management Team], so they know where the threats are coming from and what behaviours might be seen as risky.

– Business and Resources Director (overseeing Information Security Team), high-income charity

By comparison, recent geopolitical events were felt to have a more limited impact on organisations’ behaviour, and only impacted certain kinds of organisations. Where organisations had an international presence, or international clients, there was typically more awareness and concern about increasing cyber threats from countries such as Russia (linked in interviews to the war in Ukraine), Iran and China. Some organisations had blocked all traffic from these countries.

We think that we know the source of particular hacks we have had, and there’s a group operating from [area of China] … We are keeping a close eye on China because no one knows what way they are going to go. We have feet in both camps, in China and Taiwan. We are back to the balancing game.

– Information Security Manager, large business

There were some instances where larger businesses that traded internationally had taken a different response to state-sponsored attacks than to other types of cyber security beaches or attacks. The broad examples offered included changing the list of critical assets to be protected, giving more tailored training given to staff, and influencing where incidents are reported. For example, one large business specifically mentioned they would be more likely to report a state-sponsored attack to Action Fraud.

For other organisations outside these large multinationals, stories in the media about state-sponsored cyber attacks could rouse the general interest of senior managers. However, such attacks were often not viewed as a threat for their organisations, worthy of special attention.

We’re not on the radar of international actors. We’re flying under the radar.

– Finance Manager, medium business

Moreover, the impact of such news stories was often felt to be impermanent, rather than leading to a lasting change in the senior management or staff culture. In this particular case in a large tech manufacturer, it led to a short-term increase in reporting by the IT manager, moving from monthly to weekly written updates to the board, on top of existing quarterly presentations being delivered by the Chief Information Security Officer.

Last year when it all kicked off in Ukraine, we were doing weekly reports to the board for a short period where they had specific issues.

– Information Security Manager, large business

Some organisations, such as the following high-income charity, also suggested that they could not reasonably change their cyber security approach to match a shifting geopolitical threat, because they had limited information on the source of the attacks they were facing.

We don’t identify the threat sponsor. We do differentiate if it’s insider attacks, malicious or unintended. But that’s it in terms of differentiating the source. It doesn’t matter why they wanted to do it. It’s what they do that impacts us and makes a difference to the organisation.

– Information Security Strategic Lead, high-income charity

Another small business pointed out that even if their incident reports mentioned a specific country, the attack that led to the incident may not have originated there, making it challenging and potentially not useful to have a targeted response.

2.2 Involvement of senior management

How often are senior managers updated on cyber security?

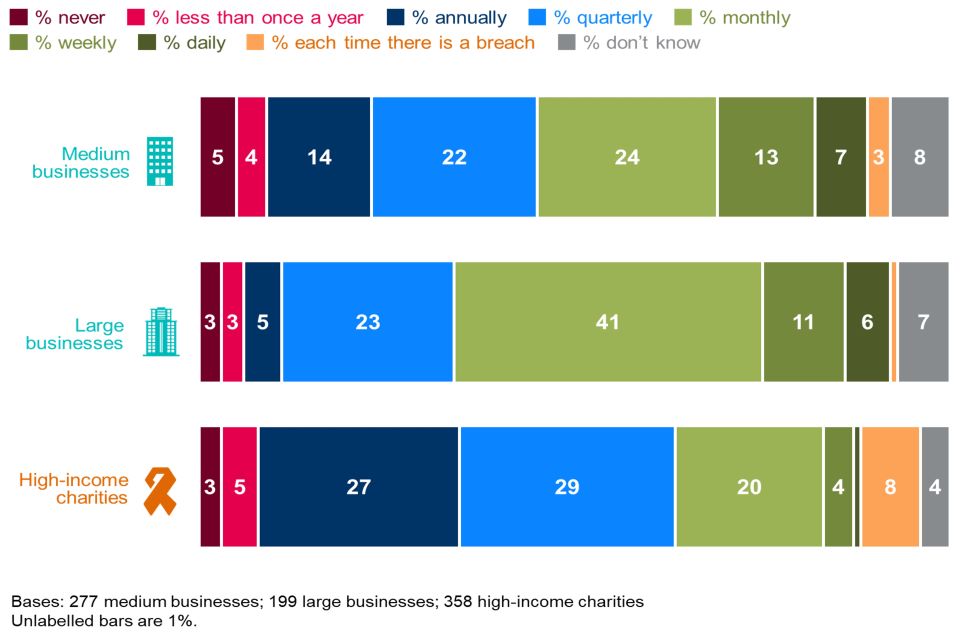

Figure 2.3 breaks down how often senior managers get updates on the state of cyber security and any actions being taken. It shows that updates tend to be more frequent in businesses than in charities, continuing a trend from previous years.

This year, this question was restricted to medium and large businesses, and to high-income charities. While the subgroup results are comparable across years, Figure 2.3 should not be directly compared to the equivalent figure from last year’s report given the changes in the groups being reported.

The new chart highlights that large businesses are also ahead of medium businesses in this respect, while high-income charities are behind both business subgroups. Two-thirds of medium businesses (65%) and eight in ten large businesses (81%) update their senior team at least quarterly, while just over half of all high-income charities (54%) also do this. Four-fifths of these businesses (79% of medium businesses and 86% of large businesses) and a similar proportion of these charities (80%) say senior managers are updated at least once a year.[footnote 5]

The results for these subgroups are similar to last year. Nevertheless, when taking a longer-term view, it is worth noting that in 2016 (the first year of this study), 71% of large businesses reported updating senior managers on cyber security on a quarterly basis, compared with 81% now. This suggests that, among large businesses, senior management discussion of cyber security is now more of a business-as-usual approach. Previous years of the study indicated that this was also the trend among smaller businesses, as well as large ones.

Figure 2.3: How often directors, trustees or other senior managers are given an update on any actions taken around cyber security

Board responsibilities

Three in ten businesses (30%) and a similar proportion of charities (31%) have board members or trustees taking explicit responsibility for cyber security as part of their job (Figure 2.4). This is across all organisations (i.e. not just those that have a formal management board) – although all registered charities have boards of trustees.

As might be expected, board-level responsibility is much more common in larger businesses, where the management board is likely to be larger. Around half of large businesses (53%) have a board member responsible for cyber security (vs. 30% of businesses overall). There is less variation in size among charities – for instance, a third (33%) of charities with incomes of £5 million or more have trustees responsible for cyber security (not significantly different from the 31% average).

Figure 2.4: Percentage of organisations with board members or trustees that have responsibility for cyber security

| Businesses overall | 30% |

| Micro businesses | 28% |

| Small businesses | 34% |

| Medium businesses | 41% |

| Large businesses | 53% |

| Within information and communications | 49% |

| Within finance and insurance | 44% |

| Within professional, scientific and technical | 41% |

| Charities overall | 31% |

Bases: 2,263 UK businesses; 1,387 micro businesses; 400 small businesses; 277 medium businesses; 199 large businesses; 161 information and communications businesses; 178 finance and insurance businesses; 285 professional, scientific and technical businesses; 1,174 charities

Information and communications businesses (49%), finance and insurance businesses (44%) and professional, scientific and technical businesses (41%) are each more likely than average to have board members taking responsibility for cyber security. These sectors, which tend to prioritise cyber security more, were also above average in the 2022 and 2021 surveys. At the other end of the scale, businesses in agriculture (17%), construction (21%) and food and hospitality (22%) are among the least likely to have board members assigned this role.

Trends over time

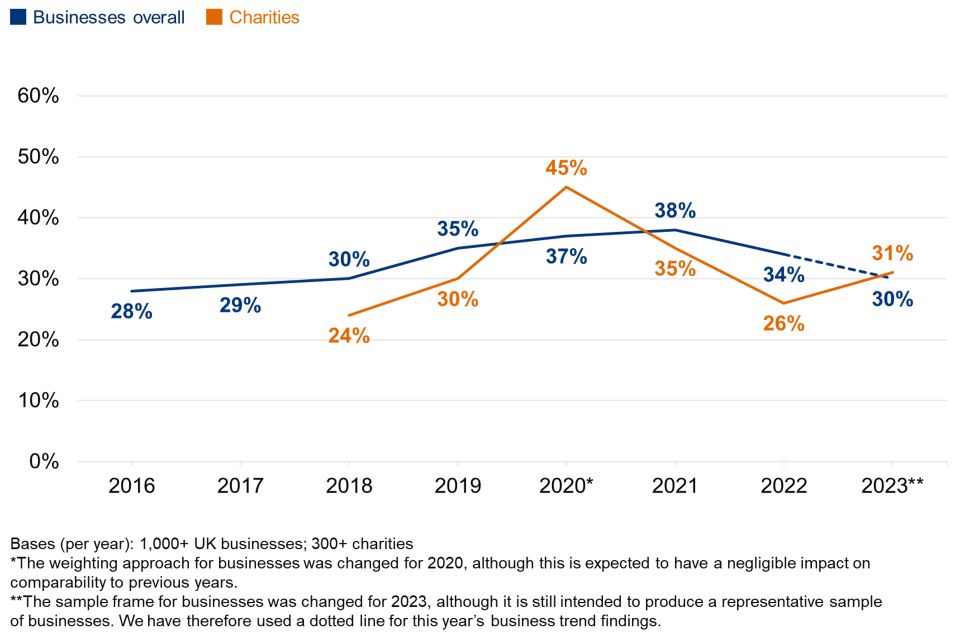

Figure 2.5 shows the trend over time for board members taking on cyber security responsibilities. Among businesses, it suggests a decline in board engagement since the 2021 study, which was the first where fieldwork took place under the COVID-19 pandemic.

Among charities, this year’s result represents an increase from last year (31% vs. 26%).

Figure 2.5: Percentage of organisations over time with board members or trustees with responsibility for cyber security

Qualitative insights on formal versus informal board engagement

In qualitative interviews, the individuals taking day-to-day responsibility for cyber security highly valued engagement from senior board members, as it helped them to get the buy-in of wider staff (e.g. when cyber security directives came with the backing of senior management), to challenge and improve their own approaches, and to get quicker approval for new measures.

One of the trustees is the lead for digital and cyber security. They are well informed about the area and will ask me more difficult questions should they wish to.

– Information Security Strategic Lead, high-income charity

It’s good to have somebody right at the very top who understands the risks and is quite supportive.

– IT Manager, large business

Luckily, at director level, there is the message [to staff] that this is happening, you will toe the line on this, and there is no excuse. I do have the backing to push through what we agreed. They know they need to improve security and change where staff members are positioned.

– Infrastructure and Security Lead, medium business

However, we heard several recurring reasons to explain why board members did not engage, including a lack of understanding or interest in cyber security relative to the day-to-day operations of the organisation, a lack of training, a lack of time and a perception that their kind of organisation was not facing an especially high risk from cyber attacks. The following quote discusses a senior management team who were considered good at their own roles, but tended to leave cyber security matters to the finance director, operations manager and the interviewee (in a human resources role), who dealt with their third-party IT support.

Although we have senior managers who are good at the role, they don’t have awareness in cyber security. I try to ensure they have a basic understanding, training, and knowledge in it. But they are focused on the day-to-day.

– Human Resources Administrator, medium business

The following example from a transport business highlights differing attitudes within the management board when being taken through a cyber awareness course:

The Managing Director rolled his eyes and said it’s all common sense. But the rest of board responded well.

– Finance Manager, medium business

The findings suggest board engagement becomes more structured and formal as organisations grow. Some of the larger organisations we spoke to had regular cyber security reports going to the board, had cyber security as a standing agenda item at board meetings (or at a subcommittee level just below the board), or reviewed cyber security as part of a regular look at their risk register. One high-income charity had webinar training designed specifically for their Chief Executive and Trustees that explained their specific role in supporting cyber security in the organisation, including supporting resource allocation and setting a good example.

By contrast, in small and medium-sized organisations, the approaches for keeping boards informed tended to be more informal. Several of these interviewees mentioned discussing cyber security with senior managers in an ad hoc and reactive manner, i.e. only when specific issues arose. One small social care business suggested their board would only need to hear about cyber security after a serious incident, or if a breach needed to be reported externally, in order to get board approval. Another mid-sized marketing business discussed growing very rapidly from a small boutique agency, meaning that they still had no regular board meetings in place – they would just make themselves available to the security lead as-and-when needed.

Often, in these cases, it was clear that boards were placing a great deal of trust either in their internal IT leads, or in their external IT providers – they assumed that these individuals would flag any serious issues with them. There was a sense among some of the small businesses interviewed that the problem of cyber security had been passed onto external contractors, resulting in senior managers disengaging from the topic and understanding the actions being taken, both internally and externally.

Where boards were engaging with cyber security, we often found this to be led by a single person on the board, as opposed to a more collaborative effort across board members. The nature of this individual’s engagement depended on their wider job role. In organisations where this individual was in a finance role, it often led to cyber security being seen through a financial lens, as a cost centre. Those taking day-to-day responsibility for cyber security, like an IT manager, had to report directly to finance leads for budget requests. In these instances, there was a greater emphasis on having to produce written business cases to justify new spending. This was felt to be a challenging task, as the evidence produced needed to be persuasive. One technology officer who had to write these kinds of business cases talked about the best evidence as referring to the amounts that might be saved or the potential reputational hit. They also talked about their cyber security audits being largely finance driven:

Most of [the cyber security audit] is bullet points showing the money spent and what we got out of it. It shouldn’t be, but it’s more a financial exercise than a governance exercise. You’re competing for budgetary allocation more than anything else.

– Business Technology Office, large business

In other organisations, there was sometimes someone on the board who had a specific interest or background in IT. These individuals could act as interpreters for other board members, but were sometimes entrusted to take sole charge of IT and cyber issues, with the rest of the board disengaging. Nevertheless, in these organisations, there was often a more flexible approach to cyber security spending. In the case of this manufacturing business, for example, there was a direct relationship between the Managing Director and the IT manager, which meant the business case was sometimes easier to argue:

There’s no budget. We’ve never worked on a budget basis. It’s based on merit, which feels weird but means we’re not restricted. We tend to have a lot of flexibility when decisions are justifiable, when the business value is clear.

– IT Manager, large business

2.3 Sources of information

Overall proportion seeking cyber security information or guidance

External sources of information and guidance on cyber security include government sources, third-party cyber security or IT providers, trade bodies, as well as information found through an internet search or from the media. Approximately half of businesses (49%) and just under half of charities (44%) report actively seeking information or guidance on cyber security from outside their organisation in the past year.

These results mirror the previous iterations of the study in 2022 and 2021. For businesses overall, this result is lower than its peak in in 2018 and 2019 (59%), which was seen in the lead up to, and aftermath of General Data Protection Regulation (GDPR) implementation. For charities, it has remained around this level since 2018 (when 36% of charities had sought external information or guidance).

As Figure 2.6 illustrates, external information is less often sought in micro businesses. This is the same pattern in charities – only a third of charities with incomes under £100,000 (34%, vs. 44% overall) have sought external information.

The sectors where businesses are most likely to seek out external information are finance and insurance (79%), and the professional, scientific, and technical sector (58%). Both sectors have stood out in this respect in previous years.

Figure 2.6: Proportion of organisations that have sought external information or guidance in the last 12 months on the cyber security threats faced by their organisation

| Businesses overall | 49% |

| Micro businesses | 46% |

| Small businesses | 57% |

| Medium businesses | 72% |

| Large businesses | 63% |

| Within finance and insurance | 79% |

| Within professional, scientific and technical | 58% |

| Charities overall | 44% |

Bases: 1,152 UK businesses; 686 micro businesses; 211 small businesses; 141 medium businesses; 114 large businesses; 93 finance and insurance businesses; 142 professional, scientific and technical businesses; 570 charities

Under one in ten businesses (8%) and a similar proportion of charities (12%) seek information internally within their organisations. Among both groups, this result is higher than last year (when it was just 3% of businesses and 7% of charities doing so).

As might be expected, internal information seeking is higher within large businesses (38%), which are more likely to employ cyber security specialists. This is higher than in both medium businesses (15%) and high-income charities (22%).

Where do organisations get information and guidance?

As in previous years, the most common individual sources of information and guidance are:

-

external cyber security consultants, IT consultants or IT service providers (mentioned by 21% of businesses and 15% of charities)

-

any government or public sector source, including government websites, regulators, and other public bodies (12% of both businesses and charities)

-

general online searching (8% of businesses and 6% of charities).

To note, this question is unprompted for those doing the survey by telephone (the vast majority), while those doing it online look at a prompted response list.

The wide range of individual sources mentioned, together with the relatively low proportions for each, highlights that there is still no commonly agreed information source when it comes to cyber security. For example, just 2% each of businesses and charities mention the National Cyber Security Centre (NCSC) by name, in line with the previous year. This rises to one in three large businesses (28%) and around half this proportion of high-income charities (15%).

In 2019, nine regional Cyber Resilience Centres (CRCs) were opened across England and Wales, specifically in order to help smaller organisations make their cyber operations safer. It is worth noting that these are most often mentioned as an information source by large businesses (7%) and very high-income charities (5% of those with £5 million or more in annual income). Beyond these larger organisations, specific mentions of the CRCs are negligible at present.

There are a small number of further differences by size, or between businesses and charities that should be noted, particularly around the use of external cyber security consultants, IT consultants or IT service providers:

-

Seeking information and guidance from external consultants or providers is most common among medium businesses (46%) – higher than among large businesses (31%), and replicating a pattern from previous years. It reflects that these businesses may recognise the need for more cyber security expertise, but have to procure it externally, rather than employing experts internally like many large businesses.

-

Among micro businesses, the most common sources are also external consultants or providers (18%). The next most common response is business banks (5%).

-

Among charities, fewer than one in ten (6%) mention charity-specific sources such as their relevant Charity Commission.[footnote 6]

Awareness of government guidance, initiatives, and communications

The question around information sources in the previous subsection tends to underrepresent actual awareness of government communications on cyber security, as it is asked unprompted for individuals doing the telephone survey. In these kinds of unprompted questions, individuals often do not recall specific things they have seen and heard. We therefore ask organisations, in a later set of prompted questions, whether they have heard of specific initiatives or communications campaigns before. These include:

-

the national Cyber Aware communications campaign, which offers tips and advice to protect individuals and organisations against cyber crime

-

the 10 Steps to Cyber Security guidance, which aims to summarise what organisations should do to protect themselves

-

the government-endorsed Cyber Essentials scheme, which enables organisations to be certified independently for having met a good-practice standard in cyber security.

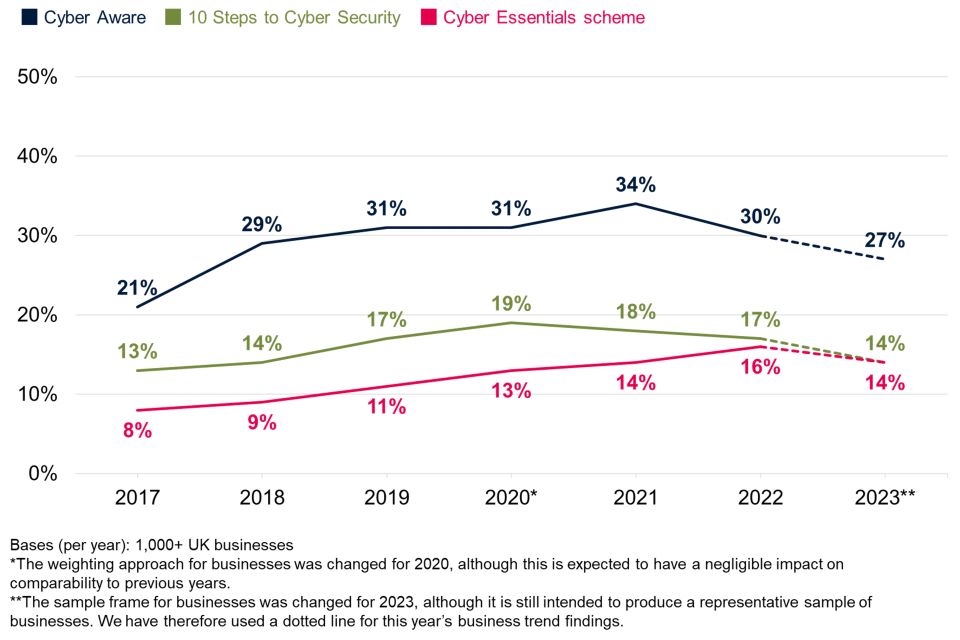

As Figure 2.7 shows, Cyber Aware is the most commonly recognised of these. However, only a minority of businesses and charities have heard of any of these initiatives or campaigns.

Figure 2.7: Percentage of organisations aware of the following government guidance, initiatives, or communication campaigns

| Government guidance, initiative, or communication campaign | Businesses | Charities |

|---|---|---|

| Cyber Aware campaign | 27% | 30% |

| 10 Steps to Cyber Security guidance | 14% | 19% |

| Cyber Essentials scheme | 14% | 15% |

Bases: 2,263 UK businesses; 1,174 charities

Medium and large businesses are substantially more aware of these guidance packages:

-

50% of medium businesses and 59% of large businesses are aware of Cyber Essentials (vs. 14% of all businesses)

-

46% of medium businesses and 54% of large businesses have heard of Cyber Aware (vs. 27% overall)

-

32% of medium businesses and 44% of large businesses are aware of the 10 Steps guidance (vs. 14% overall).

As in previous years, there is little difference between UK nations and regions when it comes to awareness of these different schemes or campaigns.

Trends over time

Figure 2.8 illustrates that business awareness of these schemes and initiatives is close to the previous survey, although there is a pattern of declining awareness of Cyber Aware and the 10 Steps guidance over the last two years. Fewer charities also report having heard of Cyber Aware compared to the previous year (38% in 2022). More have heard of Cyber Aware than the other schemes, but still only a minority of businesses and charities are aware of each one.

Figure 2.8: Percentage of businesses over time aware of the following government guidance, initiatives, or communication campaigns

This chart suggests an ongoing, untapped potential for organisations to make better use of the information and guidance that is already available to them. For example, Cyber Aware campaign materials might be used as a reference for employees, to raise their general awareness on cyber security. Increasing awareness of Cyber Essentials may help to combat the idea, raised in previous years of this study, that some organisations do not know what good minimum standards look like when it comes to cyber security.

Guidance targeted at specific types of organisations

Since 2020, the survey has asked about NCSC guidance that is directed to specific sizes of business or towards charities. This includes:

-

the NCSC’s Small Business Guide and Small Charity Guide, which outline more basic steps that these smaller organisations can take to protect themselves

-

the NCSC’s Board Toolkit, which helps management boards to understand their obligations, and to discuss cyber security with the technical experts in their organisation.

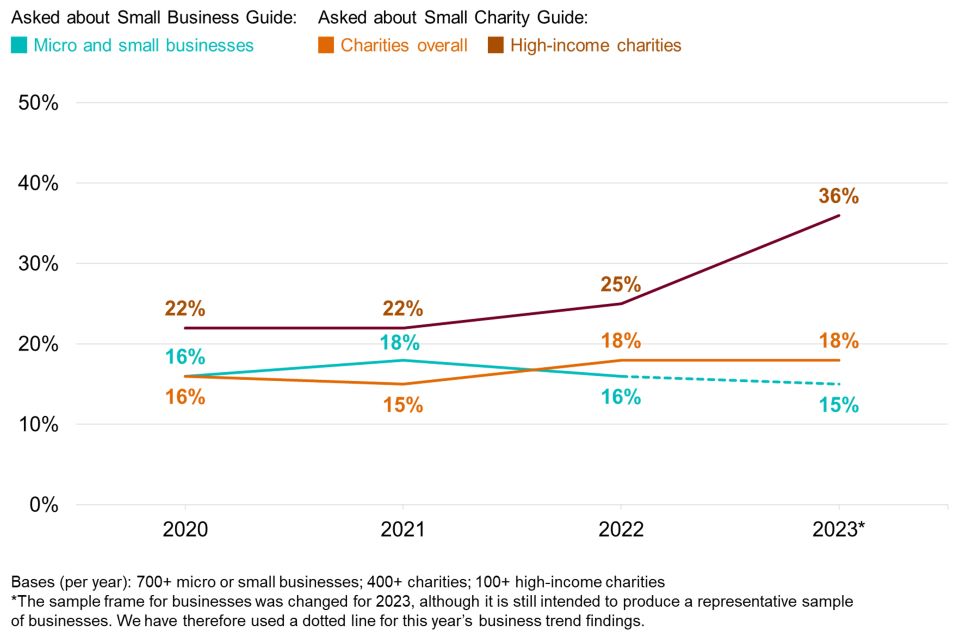

Figure 2.9 shows that just under one in five micro and small businesses (15%) have heard of the Small Business Guide, broadly unchanged from the previous three years. This is similar between micro businesses (15%) and small businesses (17%), which was also the pattern in previous years.

Around one in five charities (18%) have heard of the Small Charities Guide. This result for charities overall has been relatively consistent across years. However, as Figure 2.9 shows, the result for high-income charities specifically has gone up since 2021, now standing at over a third of these charities (36%).

Figure 2.9: Percentage of businesses and charities over time aware of the Small Business Guide and Small Charity Guide

The Board Toolkit was specifically explored with medium and large businesses in the survey, as well as charities of all sizes. Among all groups of larger organisations, as Figure 2.10 shows, awareness of the toolkit has been on the rise, particularly amongst large businesses, since it was first published in 2020. However, the majority of medium and large businesses and high-income charities remain unaware of it.

To note, charities were only asked this question from the 2021 study onwards.

Figure 2.10: Percentage of medium and large businesses, and charities over time aware of the Board Toolkit

Broadly, these findings suggest that larger organisations are increasing their engagement with cyber security, and any stagnation (e.g. the decline in prioritisation discussed at the start of this chapter, or drops in awareness of the Cyber Aware campaign) is more localised among the smallest businesses.

Impact of government information and guidance

A total of 41% of businesses and 49% of charities recall seeing, when prompted, any of the government communications or guidance covered in the previous section, The survey asks a random subsample of these organisations about the changes they have made to their cyber security measures as a result of what they have seen. Over half of these businesses (54%) and around half of these charities (49%) report making any changes. To note, this question is unprompted in both the telephone and online surveys.

The figure for businesses making changes has increased since 2022 (when it was 44%), which itself was an increase from 2021 (37%). The result among charities remains higher than it was in 2021 (38%) and in line with the 2022 figure (also 49%). These changes appear to be across all size and income bands, i.e. they are not driven by larger organisations. It is worth noting that in our 2021 report, individuals in IT and cyber roles reported feeling constrained in taking action, because of the competing pressures on their time from having to adapt to the COVID-19 pandemic. Therefore, while exposure to information may not have increased overall, organisations are now potentially more willing and able to act upon the guidance they see – given that many have stabilised their operations since the pandemic.

Large businesses are significantly more likely to have acted on seeing government initiatives or campaigns (67%, vs 54% of all businesses). Seven in ten high-income charities report having done so on seeing this guidance (71%, vs. 49% of charities overall).

In terms of the specific changes made, there are a wide variety of unprompted responses given. No single response appears especially frequently.

-

25% of businesses and 22% of charities that recall seeing these government communications report making changes of a technical nature (e.g. to firewalls, malware protections, user access or monitoring).

-

21% of businesses and 20% of charities have made resourcing and governance-related changes (e.g. increased spending, or updated policies or documentation).

-

16% of businesses and 14% of charities say they have made changes to do with staffing (e.g. employing new cyber security staff), outsourcing or training.

The top unprompted individual response categories are:

-

changing or updating firewalls or system configurations (10% of businesses and 6% of charities)

-

staff training and communications (9% and 10%)

-

changing or updating antivirus or antimalware software (9% and 7%)

-

updating passwords, or adding multi-factor authentication (MFA, for 8% and 5%).

Chapter 3: Approaches to cyber security

This chapter looks at the various ways in which organisations are dealing with cyber security. This covers topics such as:

-

risk management (including supplier risks)

-

reporting cyber risks

-

cyber insurance

-

technical controls

-

training and awareness raising

-

staffing and outsourcing

-

governance approaches and policies.

We then cover the extent to which organisations are meeting the requirements set out in government-endorsed Cyber Essentials scheme and the government’s 10 Steps to Cyber Security guidance.

3.1 Identifying, managing, and minimising cyber risks

Actions taken to identify risks

Organisations can take a range of actions to identify cyber security risks, including monitoring, risk assessment, audits, and testing. They are not necessarily expected to be doing all these things – the appropriate level of action depends on their own risk profiles.

Figure 3.1 shows the six actions covered by the survey. Deploying security monitoring tools and undertaking risk assessments continue to be the most common actions undertaken by both businesses and charities – although businesses are significantly more likely to be using monitoring tools than charities (30% vs. 19%).

Figure 3.1: Percentage of organisations that have carried out the following activities to identify cyber security risks in the last 12 months

| Activities to identify cyber security risks in the last 12 months | Businesses | Charities |

|---|---|---|

| Any of the listed activities | 51% | 40% |

| Used specific tools designed for security monitoring | 30% | 19% |

| Risk assessment covering cyber security risks | 29% | 27% |

| Tested staff (e.g. with mock phishing exercises) | 19% | 16% |

| Carried out a cyber security vulnerability audit | 15% | 14% |

| Penetration testing | 11% | 9% |

| Invested in threat intelligence | 9% | 7% |

Bases: 2,263 UK businesses; 1,174 charities

Every one of these actions continues to be more common in larger organisations. Eight in ten medium businesses (80%), nine in ten large businesses (88%) and eight in ten high-income charities (79%) have carried out at least one of the listed activities. As specific examples:

-

53% of medium businesses and 72% of large businesses have used security monitoring tools

-

51% and 63% respectively have undertaken cyber security-related risk assessments.

Among these subgroups, threat intelligence remains the least common activity. This is undertaken by around half (47%) of large businesses, while each other activity is carried out by between six and seven in ten large businesses.

Those in the health, social care and social work sector are significantly more likely than the average business to have taken any of these actions (74% vs. 51%), as are finance and insurance businesses (71%), and information and communications businesses (67%).

How organisations undertake audits and implement their findings

Among the 15% of businesses that undertake cyber security vulnerability audits, a third only undertake internal audits (36%), a similar proportion only have external audits (33%) and a quarter (25%) carry out both.

How businesses undertake audits continues to be strongly linked to size:

-

micro businesses are most likely to solely use internal staff to undertake audits (44% of the micro businesses undergoing any type of audit)

-

small businesses have the greatest tendency (44%) to only use external contractors

-

large businesses, likely having greater financial and personnel capacity, are most likely to state that audits have been undertaken both internally and externally (56%).

A similar proportion of charities have carried out cyber security vulnerability audits (14%, similar to 15% of businesses). Among these charities, there is a broadly equal split between those conducted internally (29%), externally (32%) or both (29%).

Reviewing supplier risks

Suppliers can pose various risks to an organisation’s cyber security, for example in terms of:

-

third-party access to an organisation’s systems

-

suppliers storing the personal data or intellectual property of a client organisation

-

phishing attacks, viruses or other malware originating from suppliers.

Despite this, relatively few businesses or charities are taking steps to formally review the risks posed by their immediate suppliers and wider supply chain. Just over one in ten businesses say they review the risks posed by their immediate suppliers (13%) and fewer are looking at their wider supply chain (8%). Among charities, the respective figures are broadly similar (11% look at their immediate suppliers and 6% at their wider supply chain).

As Figure 3.2 shows, the overall figures mask a wide variation by size. Possibly reflecting a more complex supply chain, a quarter of medium businesses (27%) and more than half of large businesses (55%) review the cyber security risks posed by their immediate suppliers. It is still relatively rare for these businesses to review their wider supply chain (15% and 34% respectively do so). However, as the next section discusses, this has been improving.

Among charities, two-fifths (41%, vs. 11% overall) of those with incomes of £5 million or more, and a quarter (26%) of those with incomes of £500,000 or more, have reviewed immediate supplier risks. Among both subgroups, only 15% have reviewed their wider supply chains.

Reflecting a generally more sophisticated approach to cyber security overall, businesses in the finance and insurance (26%), and information and communications (21%) sectors are more likely than average (13%) to monitor the risks posed by their immediate suppliers. However, there are no significant sectoral differences when it comes to reviewing wider supply chains.

Figure 3.2: Percentage of organisations that have carried out work to formally review the potential cyber security risks presented by the following groups of suppliers

| Organisation type | Their immediate suppliers | Their wider supply chain |

|---|---|---|

| Businesses overall | 13% | 8% |

| Micro businesses | 12% | 7% |

| Small businesses | 18% | 10% |

| Medium businesses | 27% | 15% |

| Large businesses | 55% | 34% |

| Within finance and insurance | 26% | 15% |

| Within information and communications | 21% | 9% |

| Charities overall | 11% | 6% |

Bases: 2,263 UK businesses; 1,387 micro businesses; 400 small businesses; 277 medium businesses; 199 large businesses; 178 finance or insurance businesses; 161 information and communications businesses; 1,174 charities

Trends over time

This question has been asked since the 2020 study (the last pre-pandemic study). As Figure 3.3 shows, among large businesses specifically, the proportions saying they review both their immediate supplier and their wider supply chain risks are at their highest ever this year, having recovered from a drop-off during the pandemic.

Figure 3.3: Percentage of large businesses over time that have carried out work to formally review the potential cyber security risks presented by the following groups of suppliers

Barriers to addressing supplier risks

The organisations that review supplier risks (immediate or otherwise) still face challenges when attempting to do this. The predominant challenges identified, among those carrying out any review, have remained relatively consistent over time. They continue to experience a lack of time and money and not being able to elicit information from suppliers. Lack of time and money is a more substantial issue among charities than businesses (46% vs. 32%).

Figure 3.4 shows that a wider range of barriers are also impacting organisations, including barriers around knowledge, skills and prioritisation. The ordering of these issues is in line with the two previous years this question has been asked.

Overall, around three in ten businesses (29%) say none of the six factors in the chart have prevented them from understanding potential cyber security risks within their supply chain. This compares to 32% in 2022 and 36% in 2021. In other words, organisations are more frequently raising one or more of barriers in Figure 3.4 as an issue for them now than before. This suggests that businesses are on-the-whole starting to find supply chain cyber risk management more challenging than before (among those attempting to do it in any form).

Figure 3.4: Barriers to businesses undertaking formal review of supplier or supply chain risks

| Barriers to undertaking formal review of supplier or supply chain risks | Businesses | Charities |

|---|---|---|

| Lack of time of money for this | 32% | 46% |

| Can’t get information from suppliers to carry out checks | 31% | 20% |

| Not knowing what checks to carry out | 25% | 21% |

| Not a priority when working with suppliers | 25% | 18% |

| Lack of skills to be able to check suppliers in this way | 18% | 25% |

| Not knowing which suppliers to check | 13% | 14% |

Bases: 472 UK businesses that have formally reviewed supply chain risks; 233 charities

Qualitative insights on broad supply chain risks

The qualitative interviews suggest that cyber security in supply chains is still an issue where organisations lack awareness. Consideration of these kinds of risks was rare – some interviewees flagged that the interview was the first time they had thought about it. Nonetheless, several of the larger organisations we spoke to felt that there had been a general increase in awareness of the issue compared to previous years – matching the increasing action taken by larger organisations over the years (as charted in Figure 3.3).

Supply chain risk is one of the risks that requires more attention this year as it is most likely to be the cause of an incident … The risk is more likely to come from the third-party that supplies IT support or a cloud-hosting provider without proper security.

– Human Resources Administrator, high-income charity

With that said, there seemed to be a more specific focus on supply chain risks from IT and technology providers, with other physical suppliers sometimes overlooked. For instance, one large organisation mentioned that they did risk assessments for all IT suppliers, but would not necessarily do this for other suppliers. In the view of the Assistant IT Director, this potentially put them at risk if, for example, a department bought a smart device (i.e. connected to the internet) from a foreign equipment supplier that was not treated as IT procurement. Another Information Security Manager in a large business reported that the business had very formal processes in place for IT and software suppliers, including regular lines of communication, but felt that they were more “hit and miss” with non-IT suppliers.

The interviews did highlight various triggers that led organisations to consider the issue:

-

contractual requirements or procurement rules that referred to suppliers

-

information and guidance from sources such as the NCSC

-

organisations hearing about attacks on their supply chains through their customers

-

internal or external cyber security audits raising the issue.

How we manage risks from our wider supply chain is something that was picked up on in our audit. Currently, we have been procuring services with the assumption that their cyber credentials are within a particular procurement framework. We do cloud assessments, but we were not getting physical certificates. We are now undertaking and formalising our suppliers into high, medium and low risk.

– Head of Technical Services, large charity

As customers do their audits, one of the questions they are asking is ‘how do you audit your suppliers?

– Information Security Manager, large business

At the more sophisticated end, organisations dealt with supplier risks in a variety of ways. We came across examples of contractual arrangements, supplier questionnaires, requirements that suppliers agree to external accreditations (e.g. ISO 27001), regular meetings with key suppliers, adding supplier risks to risk registers, and logging of data flows with suppliers on data protection registers. At the other end of the scale, there were a small number of examples of much more informal supply chain cyber risk management, including emailing suppliers ad hoc to ask what they have in place. One Managing Director of a micro digital marketing business said they would discuss things like passwords with suppliers verbally and would manage each supplier’s access to their systems on a project-by-project basis.

The ongoing monitoring of suppliers, post-procurement, was felt to be much more challenging to manage. This was often put down to time pressure and being crowded out by other business priorities. Many organisations felt they simply had to trust suppliers to follow contracts, and that it was difficult to extract further information if suppliers or partners were not forthcoming. There was a suspicion that suppliers or partners would want to keep cyber incidents to themselves. These discussions strongly reflected the top two challenges around supply chain cyber risk management mentioned in the survey (covered in Figure 3.4).

If our partners are compromised, we want to know how and what happened, but they are not always willing to tell us.

– Information Security Manager, large business

Qualitative insights on Digital Service Providers (DSPs)

This year’s qualitative strand also looked at perceptions of the risks posed by Digital Service Providers (DSPs). Relatively few interviewees were able to discuss this topic at all, with several suggesting it did not apply to them (which may indicate a lack of awareness around the topic). This was despite a definition for DSPs being provided, i.e. a supplier that manages a suite of IT services like an organisation’s network, cloud computing and applications.

Among the interviewees that did discuss the topic, this covered a wide range of DSPs, including general IT service providers (including hardware and software maintenance), cloud storage providers, network monitoring, threat identification, and training providers. Smaller organisations seemed especially reliant on DSPs, due to their lack of in-house expertise and capacity.

Among those that did talk about DSPs, cyber security was not commonly raised as a consideration when choosing a DSP. Instead, the focus was on things like track record and cost. One micro business said they had simply used the DSP that came as part of a free deal with the hardware they had purchased.

One large manufacturer mentioned that they had included a question in their tendering process for one DSP about their vetting of staff, but they also had a sense that suppliers might opt not to be truthful and reveal any issues around this for fear of losing contracts. Another interviewee agreed that, while they could enquire about any risks with DSPs, they would ultimately still proceed with procurement if they could not influence these risks.

There was an assumption that the DSP would be responsible for cyber security and would, at a minimum, be keeping back-ups in case of any data loss or disruption. As such, there was a great deal of trust placed in the DSPs that organisations had chosen, especially if they were household name companies like Microsoft or Google. There was an acknowledgement that DSPs took on a high level of responsibility.

You’re effectively giving DSPs the keys to the back door.

– IT Manager, large business

In two of our interviews with large organisations, there were concerns that they might be at greater risk of state-sponsored attacks if their DSPs also serviced at-risk organisations, such as government departments and defence organisations. However, neither organisation was currently taking formal steps to address these concerns.

Corporate reporting of cyber security risks

Very few organisations at present tend to cover their cyber security risks in annual reports. Around a quarter of medium or large businesses (27%) – this question was only asked of larger businesses – published an annual report in the past 12 months.

Among these medium and large businesses, around a fifth (21%) covered their cyber security risks within it, which is broadly in line with last year (19%), when this question was first asked. Large businesses more commonly do so in 2023 (33% include cyber security risks, vs. 16% of medium businesses), which is also similar to last year.