Family Resources Survey: background information and methodology

Published 25 March 2021

1. Introduction

This note accompanies the main Family Resources Survey 2019 to 2020 report

The purpose of this note is to provide further contextual information to aid understanding of the statistics presented in the main report and detailed tables. It outlines points to note as well as strengths and limitations of the information presented in each section of the main report; alternative data sources; as well as changes to the survey this year compared to last year.

A detailed description of the FRS methodology, fieldwork operations, data processing and quality assurance is also presented.

Editorial team

Claire Cameron, Matt Jarvis, Harrison Jones, Justyna Owen, Kyle Robertson, Amy Skates, Clive Warhurst

Feedback

If you have any comments or questions about any aspect of the FRS, or are interested in receiving information on consultations, planned changes, and advance notice of future releases, please contact:

Claire Cameron,

Surveys Branch,

Department for Work and Pensions,

2nd Floor,

Caxton House,

Tothill Street,

London,

SW1H 9NA

Email: [email protected]

Direct line: 020 7449 7332

Acknowledgements

Thank you to all the respondents in households across the United Kingdom who agreed to be interviewed; to the interviewers at the Office for National Statistics, NatCen Social Research and the Northern Ireland Statistics and Research Agency, and colleagues in those organisations; to those who have contributed towards the Family Resources Survey 2019 to 2020 report through providing quality assurance and feedback; and to our web support team.

2. Background

The Family Resources Survey (FRS) is a continuous survey which collects information on the income and circumstances of individuals living in a representative sample of private households in the United Kingdom. The survey has been running in Great Britain since October 1992 and was extended to cover Northern Ireland in 2002 to 2003.

The primary objective of the FRS is to provide the Department for Work and Pensions (DWP) with information to inform the development, monitoring and evaluation of social welfare policy. Detailed information is collected on: respondents’ incomes from all sources including benefits, tax credits and pensions; housing tenure; caring needs and responsibilities; disability; expenditure on housing; education; childcare; family circumstances; child maintenance.

Microsimulation is central to DWP’s use of the data. Therefore, careful attention is paid to the accurate collection of information followed by meticulous data processing, editing, and quality assurance.

The FRS data are designated by the UK Statistics Authority as National Statistics. The FRS provides the data for a number of other DWP National Statistics publications: Households Below Average Income, Pensioners’ Incomes Series and Income-Related Benefits: Estimates of Take-up.

The survey contains information of much interest to other government departments and, in particular, is used for tax and benefit policy purposes by Her Majesty’s Revenue and Customs and Her Majesty’s Treasury. The survey is also used extensively by academics and research institutes for social research purposes.

Status and Development

These statistics underwent a full assessment against the Code of Practice for Statistics in 2011 and were confirmed as National Statistics in November 2012 by the Office for Statistics Regulation.

Since the latest review by the Office for Statistics Regulation, the FRS has continued to comply with the Code of Practice for Statistics, with a number of improvements including:

- The timeliness of the publication has been improved so that reports are released within 12 months of the completion of the survey; made possible by a detailed Lean Six Sigma review and implementation of the recommendations. This led to an improvement in timeliness of three months

- The quality of statistics has improved as audits of processing methodology have been made, ensuring that imputation reflects changes to the questionnaire and subsequent changes to variables or formats. The publication code has been revised allowing both a more streamlined process for publication and a clearer approach to update for annual changes, while retaining the core structure for consistency and harmonisation

- A review of the Grossing regime used was conducted to follow the move to use of 2011 Census results in the production of mid-year population estimates by ONS. The new grossing regime was implemented in the 2012 to 2013 publication

- Value has been added in line with DWP statistics reporting practices. Publications have been made significantly shorter to enable a focus on commentary and analysis. This aids interpretation and increases clarity and insight, while still allowing a more in-depth scrutiny of the data in Excel or ODS table format

- The content of the FRS has evolved in response to user needs: the addition of “guest chapters” to focus on topical areas of interest such as Social & Cultural Participation; additional regular chapters for emerging areas of increased policy interest such as Self Employment and Household Food Security; and further tables by ethnicity to respond to Cabinet Office requirements for Ethnicity Facts and Figures

- New questions and variables have been added to reflect changes in policy, such as benefit changes specific to some areas of the UK, and in the field of pensions policy. This enables related policy analysis to be conducted

3. Uses of FRS Data

The FRS is used extensively both within and outside DWP. The main uses are as follows.

Households Below Average Income (HBAI)

The HBAI publication uses household disposable incomes, adjusted for household size and composition, as a proxy for material living standards or, more precisely, for the level of consumption of goods and services that people could attain given the disposable income of the household in which they live.

Pensioners’ Incomes Series

The HBAI dataset is used in the Pensioners’ Incomes Series, the Department’s analysis of trends in components and levels of pensioners’ incomes.

Income-Related Benefits: Estimates of Take-Up

Figures are based on a combination of administrative and survey data. The FRS provides information about people’s circumstances, which is used to estimate numbers of people who are not claiming benefits to which they may be entitled. Read the Take-up publications.

DWP Policy Simulation Model and other policy analysis

DWP’s Policy Simulation Model (PSM) is used extensively for the development and costing of policy options. FRS responses are uprated to current prices, benefits and earnings levels and can be calibrated to the DWP Departmental Report forecasts of benefit caseload. Using FRS data has made it possible to model some aspects of the benefit system which could not be done previously, for example severe disability premiums or allowances for childcare costs.

In addition to their use in formal modelling, FRS data play a vital role in the analysis of patterns of benefit receipt for policy monitoring and evaluation, and benefit forecasting.

Other government departments and the wider research community

The survey is widely used by other government departments, including Her Majesty’s Treasury and Her Majesty’s Revenue and Customs.

The Department for Communities (Northern Ireland) uses the FRS to produce similar reports to those from DWP, which are focused on Northern Ireland.

Researchers and analysts outside government can also access the data through the UK Data Service.

The Office for National Statistics produces small area model-based income estimates as the official estimates of annual household income at the middle layer super output area (MSOA) level in England and Wales. The estimates are produced using a combination of survey data from the Family Resources Survey and previously published data from the 2011 Census and a number of administrative data sources.

The Race Disparity Unit published the first in a series of summaries of data from the ‘Ethnicity Facts and Figures’ website in June 2019 and this was updated in October 2020. Ethnicity Facts and Figures provides information about the different experiences of people from a variety of ethnic backgrounds. It gathers data collected by Government in one place, making it available to the public, specialists and charities. Family Resources Survey data is used to provide state support data, by ethnicity and type of benefit.

4. Points to Note

This section presents contextual detail as well as strengths and limitations of the information presented in each section of the main FRS report.

Impact of COVID-19

The data in this report are from interviews conducted between April 2019 and March 2020. Interviews were suspended in mid-March 2020 in line with the national lockdown. At this point, nearly a full year’s worth of FRS interviews had already taken place and there is no material impact of COVID-19 upon these results. FRS 2019 to 2020 forms a key, pre-pandemic baseline of household incomes.

Income and state support

All income figures are presented gross of tax, national insurance and before other deductions from wages except where noted.

It is thought that household surveys underestimate income from both self employment and investment income. We rely on respondent recall of very detailed financial information across a comprehensive range of income sources. Some of these are hard for respondents to recall. The FRS interviewers ask respondents to check pay-slips, tax returns and other financial paperwork at the time of the face-to-face interview. This helps to improve the reliability of what respondents report they earn.

The FRS captures detailed information on benefit receipt. In most cases this is analysed at a benefit unit (family) level because income-related benefits are paid to families as a whole rather than being separately assessed for each individual.

Some respondents do not know or do not have the necessary information to answer specific questions about individual benefits which makes it difficult to collect accurate information: see State Benefits on the Family Resources Survey (WP115).

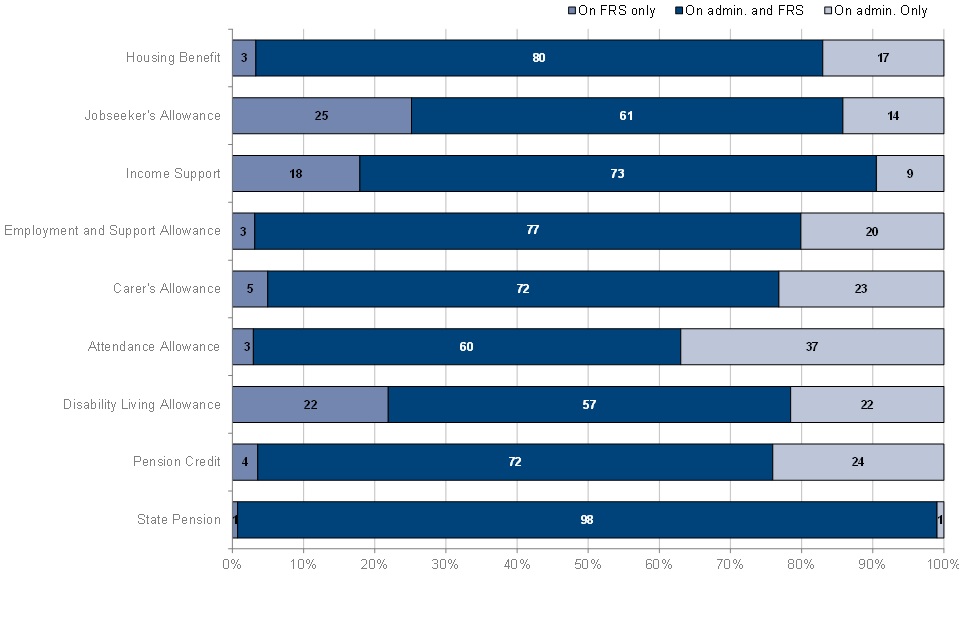

Relative to administrative records, the FRS under-reports numbers on benefit (caseload). See Methodology Tables M.6a and M.6b for a comparison of (i) numbers on benefit (caseload) and also (ii) the average £ per week received, showing any differences between DWP administrative data and the numbers implied by the survey results. One of the strengths of the FRS is that it collects many personal and family characteristics which are not available from administrative sources. This means that the FRS can be used to analyse income and benefit receipt in ways which are not possible from administrative sources alone.

Tenure

As presented in the FRS, the “social rented sector” is a combination of the categories “Rented from Council” and “Rented from a Housing Association”. These categories are combined because some housing association tenants may misreport that they are council tenants. For instance, where their home used to be owned by the council and although ownership has now transferred to a housing association, the tenant may still think that their landlord is the council (local authority).

Disability

The way in which disabled people have been identified in the FRS has changed over time. From 2002 to 2003 statistics were based on responses to questions about barriers across a number of areas of life; figures from FYE 2005 to FYE 2012 are based on those reporting barriers across nine areas of life.

From 2012 to 2013 a person is considered to have a disability if they regard themselves as having a long-standing illness, disability or impairment which causes substantial difficulty with day-to-day activities. This updated definition is consistent with the core definition of disability under the Equality Act 2010, and complies with harmonised standards for social surveys published in August 2011 and updated in June 2019

An impairment is different to a medical condition. It looks at the functions that a person either cannot perform or has difficulty performing because of their health condition. For example, glaucoma is a medical condition but being unable to see or being partially sighted is an impairment

Some people classified as disabled and having rights under the Equality Act 2010 are not captured by this definition, such as people with a long-standing illness or disability which is not currently affecting their day-to-day activities. More information is available from the GSS Policy Store.

Care

FRS respondents are asked if they receive care from anyone. This includes both professional help; paid-for care from the local authority, health professionals or domestic staff, but it also includes informal care. This is any care where their carer is not doing it as a paid job; it can be for many, or only a few hours a week, and can take several different forms. The survey is intentionally not prescriptive about what counts as care; it could, for example, include going shopping for someone, or helping them with paperwork.

Where respondents are receiving care at least once a week, they are further asked about the nature and frequency of that care. FRS respondents are also asked if they provide care to someone else, on an informal basis. That person could be living with them, in their household, or they could live somewhere else (outside the household).

Pension Participation

The FRS pension participation reference tables present data for both ‘all adults’ and ‘working-age adults only’. Those over State Pension age are often excluded from analysis of pension participation in other publications, although they could continue to work and participate in pension schemes. The ‘all adults’ category allows data for this group to be represented and also provides continuity across all chapters within the FRS.

Employer-sponsored pensions comprise any company or occupational pension scheme run by an employer including group personal pensions and group stakeholder pensions.

Individual pensions include individual stakeholder pensions and retirement annuity contracts as well as personal pensions.

Although the numbers are relatively small, self-employed people can contribute to an employer-sponsored pension scheme, for a variety of reasons. Doctors and dentists in private practice can be members of an occupational scheme. People who have recently become self-employed can continue to contribute to their previous employer scheme and people whose main job is self-employed, may work part-time as an employee and contribute to an employer scheme. These circumstances are captured within the FRS tables under the ‘Self-employed – Other’ category.

Savings and investments

The FRS does not capture information on non-liquid assets. Physical wealth and pensions accruing are not included in FRS estimates. The survey also does not capture detailed information on expenditure (except for housing costs). Therefore, it is not possible to show how households are coping financially, in terms of income versus outgoings.

However, the FRS does capture information on liquid financial assets, referred to in the survey as ‘savings and investments’. Estimates for savings and investments should be treated with caution, as they are likely to be under-estimates, since respondents often inaccurately report their account details. In view of this, the information is gathered as follows:

-

Respondents are asked, as a benefit unit, to say which of several £ bands their total level of savings and investments are in

-

Benefit units that report between £1,500 and £20,000 (28% of benefit units) are then asked, for each of their accounts and assets, how much each is worth and how much interest they accrue. The total level of savings and investments is then calculated using this set of reported values

-

Benefit units with reported savings and investments below £1,500 and above £20,000 (72% of benefit units) are only asked how much interest each account and asset accrues. These respondents are also asked to estimate the value of all of their current accounts and basic bank accounts combined

Methodological change for 2019 to 2020

The level of savings and investments, for some families (benefit units) and households in this category, has been estimated using a slightly different methodology in 2019 to 2020 than in previous years. The new method more accurately estimates savings in current accounts and basic bank accounts.

For current and basic bank accounts only, the new method avoids imputation of the account balance from interest paid, instead basing account balances on the figure given by the respondent. 33% of all accounts are covered by this new methodology.

Benefit unit respondents with reported savings and investments below £1,500 and above £20,000 are not asked to estimate the value of any of their accounts, other than current and basic bank accounts, so it is not possible to apply the new methodology to any other accounts.

This change has caused a large shift in the division of families (benefit units) and households between the two categories of (i) those with no savings at all to (ii) those with less than £1,500 in savings. This has produced estimates of savings in the relevant categories which are closer to those of other related surveys, but it should be noted that figures in this publication are not directly comparable with figures in previous FRS publications.

Self Employment

The FRS asks a detailed set of questions to capture earnings from self employment:

- Self-employed respondents are asked questions on their most recent business accounts as submitted to HMRC: dates of the accounts, profit or loss figures, and amounts paid in tax and National Insurance

- They are then asked if they draw money from their business accounts for non-business purposes, such as for payments to themselves, personal spending, paying domestic bills etc. and how much this is per month on average. They are also asked if they receive other income from their business for personal use, e.g. cash in hand, and how much this is per month on average

- Those who do not keep annual business accounts and do not draw money for non-business purposes are asked for their income after paying for materials, equipment, goods etc. and whether they make tax and National Insurance payments on this amount

The FRS does not fully capture information on all types of income in kind accurately – for example, benefits of vehicles, computers and mobile phones purchased by the business – that are also for personal use. And these benefits are likely to be more important for the self-employed than for employees. Therefore, the FRS earnings measures are likely to underestimate the true monetary and other benefits of self employment. However, it is very difficult to quantify this.

Other benefits of self employment compared to employment are not captured, such as flexibility in working patterns, independence and flexibility in the way money is drawn from the business. The complexity of self employment circumstances, with irregular income and benefits-in-kind coming from a range of sources, could also contribute to inaccuracy of information capture.

One of the significant advantages of the FRS is that it has captured self employment in a consistent way over time. Therefore, the trends in self employment compared to employment are likely to be reasonably accurate.

The FRS does undercount the number of people reporting self employment compared to the Labour Force Survey, although the trends and proportions by age, gender etc. are consistent across the two surveys. The LFS is considered the definitive source where numbers participating in the labour market are concerned.

For self-employed individuals, net income figures are presented after any deductions which include, but are not limited to tax, national insurance and pension contributions. Where gross income figures are presented these include all of these elements.

Household Food Security

For the 2019 to 2020 survey year, a new set of questions on this subject were added to the questionnaire. The new questions provide evidence on the standing of households in relation to their food security. “Food security” as a concept is defined as “access by all people at all times to enough food for an active, healthy life”. Questions relate to the household’s experience in the 30 days immediately before the interview. The questions are put to the person in each household who is best placed to answer about food shopping and preparation. These respondents are asked the first three questions, on whether they are concerned about:

- food running out before they had enough money to buy more

- the food they had bought not lasting, and not having money to buy more

- not being able to afford balanced meals

The possible answers are ‘often, ‘sometimes’ or ‘never’ true. If respondents say that all three statements are never true they will not be asked further questions on food security. If respondents answer that any of these statements are sometimes or often true they will be asked further questions on the extent of their food security.

Taking the responses together, a household ‘score’ for food security is then derived. For further information on the questions, scoring system and data generation, see the Questionnaire Changes and Glossary sections, and the relevant publication tables.

The broad structure and sequence of the questions is the same as those used internationally. They are used within the UK (Food Standards Agency) and are also used by other countries, including the United States Department of Agriculture, enabling broad international comparability of the results.

Adjusting for inflation

Some figures in the main FRS report and the accompanying tables combine several years of income data. In these circumstances, uprating factors are used to adjust for inflation by bringing values from previous years into current price terms.

Prior to the 2014 to 2015 FRS report, the Retail Prices Index (RPI) was used to adjust for inflation. In March 2016, the National Statistician recommended that the RPI should no longer be used to adjust for inflation in statistical publications.

Since the 2014 to 2015 FRS, the Consumer Price Index (CPI) has been used to adjust for inflation. Read more information concerning this methodological change.

5. Alternative data sources

Income

A Guide to Sources of Data on Earnings and Income

The Effects of Taxes and Benefits on Households

Annual Survey of Hours and Earnings

Benefits statistics on Stat-Xplore

Households Below Average Income on Stat-Xplore

Pensioners’ Incomes Series on Stat-Xplore

Income Dynamics: Income movements and persistence of low incomes

ONS: explanation of incomes and earnings

Tenure

Index of Private Housing Rental Prices

Housing affordability in England and Wales: 2020

More information about housing statistics is available from Housing research summaries

Housing and planning statistics

Disability

ONS Outcomes for Disabled People in the UK

Care

Department of Health Personal Social Services survey of adult carers in England

GSS Health and care stsatistics

GSS Adult social care statistics

Pension Participation

Occupational Pension Schemes Survey

Note that the collection and publication of the annual Occupational Pension Schemes Survey (OPSS) has ceased. The quarterly Financial Survey of Pension Schemes (FSPS) has superseded this.

Employers’ Pension Provision Survey

The Pensions Regulator – DC Trust: a presentation of scheme return data

The Pensions Regulator – annual report on UK defined benefit and hybrid scheme

English Longitudinal Study of Ageing

Annual Survey of Hours and Earnings (pension tables)

Self employment

Understanding Self Employment: A Labour Force Survey follow-up survey by the Department for Business, Innovation and Skills.

Department for Business Innovation & Skills report on self employment

Trends in self employment in the UK

Labour Market overview UK, including breakdown of the self-employed.

Household Food Security

The Food and You Survey Wave 5: Combined report for England, Wales and Northern Ireland

The Food and You 2 Survey Wave 1: Combined report for England, Wales and Northern Ireland

6. FRS changes in year 2019 to 2020

Policy changes

Council Tax

In England, the Ministry of Housing, Communities and Local Government estimated that the average Band D council tax set by local authorities in 2019 to 2020 represented an increase of 4.7% on 2018 to 2019 levels.

In Wales, the average Band D council tax in 2019 to 2020 represented an increase of 6.6% on 2018 to 2019 levels.

In Scotland, the average Band D council tax in 2019 to 2020 represented an increase of 3.6% on 2018 to 2019 levels.

In Northern Ireland, the Regional Rate for the tax year ending 2020 increased by 4.8% on 2019 levels.

Housing Benefit

In 2019 to 2020, most Local Housing Allowance (LHA) rates remained frozen at 2015 to 2016 cash values. Rates in the least affordable areas were given Targeted Affordability Fund (TAF), which amounts to a three per cent increase.

The majority of Housing Benefit rates for 2019 to 2020 remained unchanged.

Income Tax

In 2019 to 2020, the standard income tax personal allowance increased by £650 to £12,500.

National Living Wage

In April 2019, the National Living Wage was increased to £8.21 per hour for employees aged 25 years and over. Employees under the age of 25 continue to get the National Minimum Wage, which increased from April 2019 to £7.70 per hour for those aged 21 to 24 years and £6.15 per hour for those aged 18 to 20 years.

Pension Participation

Automatic enrolment completed its roll-out in 2018. From April 2019, the minimum contribution increased by three percentage points to eight per cent with at least three per cent from the employer.

Pension Credit

From May 2019, couples where only one person is over State Pension Age, will no longer be able to claim Pension Credit. Instead, mixed age couples will be able to claim Universal Credit until both parties reach State Pension Age.

Personal Independence Payment

PIP was introduced from April 2013 for new claimants and from October 2013 DWP began inviting claimants in receipt of DLA for those aged 16 to 64 years on 8 April 2013, or reached age 16 after that date, to claim PIP.

State Pension

The new single-tier State Pension launched on 6 April 2016 for people who reach pension age on or after April 2016. This consolidated the basic State Pension and additional State Pension into one single amount. The amount paid to individuals depends on recipients’ National Insurance contributions.

From 6 April 2010, the State Pension age has been increasing gradually for both men and women. The data in this report were collected throughout the financial year 2019 to 2020, during which the State Pension age for both men and women increased from 65 years 2 months to 65 years 8 months.

Support for Mortgage Interest

In April 2018 Support for Mortgage Interest Loans (SMIL) were introduced to provide support for mortgage interest through a loan instead of benefits. In tandem with this change, Mortgage Payment Protection Insurance (MPPI) payments are fully disregarded in all means-tested benefits if the claimants would be entitled to a SMIL and all MPPI is disregarded in the calculation of Universal Credit.

Universal Credit

Since April 2013, Universal Credit has been replacing income-based Jobseeker’s Allowance, income-related Employment and Support Allowance, Income Support, Working Tax Credit, Child Tax Credit and Housing Benefit.

National roll-out of Universal Credit, for all new relevant claims, completed in December 2018. Existing exceptions within the two child policy for kinship carers and adopters were extended to apply to any eligible children in a household from November 2018.

Existing claimants on legacy benefits without a change in circumstance can currently remain on their legacy benefit(s) until there is a change in circumstance.

In July 2019, The Universal Credit (Managed Migration Pilot and Miscellaneous Amendments) Regulations 2019 were introduced. These provided for the removal of the Severe Disability Premium (SDP) Gateway from 27 January 2021, meaning that from this date, SDP recipients will be able to make a new claim to Universal Credit.

The regulations also introduced the SDP transitional payments to those claimants who were previously entitled to the SDP as part of their legacy benefit and had moved to Universal Credit before the SDP Gateway came into effect on 16 January 2019. The SDP transitional payments consisted of:

- an ongoing monthly amount of either £120, £285 or £405 depending on a person’s circumstances; and

- an additional lump-sum payment to cover the period since they moved onto UC

Up-rating

From FYE 2017 to FYE 2020 certain working-age benefits were frozen at 2015 to 2016 cash values.

- Working-age benefits, including the main rates of Jobseeker’s Allowance, Income Support, Universal Credit, Employment and Support Allowance and Housing Benefit remained frozen at 2015 to 2016 cash values

- Child Benefit, along with some elements of tax credits, was frozen at 2015 to 2016 cash values. Family and childcare elements of tax credit were frozen in cash terms

Benefits excluded from the freeze included:

- Disability Living Allowance

- Personal Independence Payment

- Employment and Support Allowance Support Group component

- UC Limited Capability for Work and Work-Related Activity Element

- Premiums paid to disabled people receiving working-age benefits, where they, their partner or their children are disabled

- Carer benefits

- Pension benefits

- Attendance Allowance

- Maternity Allowance

- Statutory Sick Pay

- Statutory Maternity Pay

- Statutory Paternity Pay

- Statutory Shared Parental Pay

- Statutory Adoption Pay

In April 2019:

- The State Pension was up-rated by 2.6% (CPI) in line with the triple lock, which ensures that it increases by the highest of the increase in earnings, price inflation (as measured by the CPI) or 2.5%

- In 2019 to 2020, the Standard Minimum Guarantee in Pension Credit was increased by earnings resulting in a 2.6% increase for a single person from £163.00 a week to £167.25, a cash increase of £4.25. For couples, the Standard Minimum Guarantee in Pension Credit was increased by earnings resulting in a 2.6% increase from £248.80 a week to £255.25, a cash increase of £6.45

- Universal Credit work allowances were increased by £1,000 per year

COVID-19 (March 2020 onwards)

Some policy changes were implemented from March 2020 as a result of COVID-19. These will not be reflected in the data collected during the survey year 2019 to 2020 as interviews were suspended with the announcement of the first national lockdown, mid-March 2020.

Questionnaire changes

Household Food Security questions

These questions were introduced at the start of the survey year and were asked throughout the whole year. They were asked of all households in the survey.

The question set is comparable to those used both by other branches of Government and internationally. It is based on the Adult Food Security Survey Module from the United States Department of Agriculture. This module can be used for households with and without children, and allows for better comparison between these two groups than utilising two different survey methodologies for households with and without children.

This section outlines both the question set and the treatment of the resulting data, in terms of onward generation of a household score, for analysis purposes.

Layout of questions

Step 1: If the household has two or more members, to identify the most appropriate person in the household to answer the question, the section on household food security is prefaced with:

“The next questions should be answered by the person who has the best information about the food preparation and shopping for the household.”

The respondent is identified by the variable WhoFood on the FRS dataset (for that respondent, WhoFood will equal 1).

Step 2: The Household Food Security question block is then introduced:

“These next questions are about the food eaten in your household in the last 30 days, that is since [date 30 days ago], and whether you were able to afford the food you need.”

Step 3: The respondent (WhoFood=1) is then read three statements, and asked if the statement was “Often true”, “Sometimes true” or “Never true” for the last 30 days:

FoodQ1: “[I or We] worried whether [my or our] food would run out before [I or we] got money to buy more.”

FoodQ2: “The food that [I or we] bought just didn’t last, and [I or we] didn’t have money to get more.”

FoodQ3: “[I or We] couldn’t afford to eat balanced meals.”

If all three questions are answered as being “Never true”, then the respondent does not answer any further questions on household food security and moves on to the next section of the survey. If any of these questions are answered “Often true” or “Sometimes true”, then the respondent continues with the other questions on household food security, as follows.

Step 4: The same respondent is asked the next questions in the set. Some are answered either ‘yes’ or ‘no’, and some by providing a number of days an event happened. The questions are:

FoodQ4a: “Did [you or other adults in your household] skip or cut meals because there wasn’t enough money for food?”

-

FoodQ4b: “How many days did this happen?

-

FoodQ4c: [only asked if unsure at FoodQ4b] “Please tell me, did this happen on 3 or more days out of the last 30?”

FoodQ5: “Did you ever eat less than you felt you should because there wasn’t enough money for food?”

FoodQ6: “Were you ever hungry but didn’t eat because there wasn’t enough money for food?”

FoodQ7: “Did you lose weight because there wasn’t enough money for food?”

FoodQ8a: “Did [you or other adults in your household] ever not eat for a whole day because there wasn’t enough money for food?”

-

FoodQ8b: “How many days did this happen?”

-

FoodQ8c: [only asked if unsure at FoodQ8b] “Please tell me, did this happen for 3 or more days out of the last 30?”

Household food security scores

From the questions, a ten-point household score is generated. One point is scored for each ‘positive’ answer, that is, answers of “Often true”, “Sometimes true”, “Yes”, (or “3 days or more” for questions 4b, 4c and 8b, 8c). For questions 4b and 4c, and 8b and 8c, only a single point can be scored from each pair, since the latter question of each pair is only asked where respondents are unsure of an answer at 4b, 8b.

| Question | Points | Scoring answer | Scoring answer | Non-scoring answer | Non-scoring answer |

|---|---|---|---|---|---|

| FoodQ1 | 1 | “Sometimes true” | “Often true” | “Never true” | |

| FoodQ2 | 1 | “Sometimes true” | “Often true” | “Never true” | |

| FoodQ3 | 1 | “Sometimes true” | “Often true” | “Never true” | |

| FoodQ4a | 1 | “Yes” | “No” | ||

| FoodQ4b/4c | 1 | 3 or more | “Yes” | 2 or fewer | “No” |

| FoodQ5 | 1 | “Yes” | “No” | ||

| FoodQ6 | 1 | “Yes” | “No” | ||

| FoodQ7 | 1 | “Yes” | “No” | ||

| FoodQ8 | 1 | “Yes” | “No” | ||

| FoodQ8b/8c | 1 | 3 or more | “Yes” | 2 or fewer | “No” |

From the questions, a ten-point household score is generated, and the household is placed into one of four categories of household food security status:

- High food security (score = 0): The household has no problem, or anxiety about, consistently accessing adequate food

- Marginal food security (score = 1 or 2): The household had problems at times, or anxiety about, accessing adequate food, but the quality, variety, and quantity of their food intake were not substantially reduced

- Low food security (score = 3 to 5): The household reduced the quality, variety, and desirability of their diets, but the quantity of food intake and normal eating patterns were not substantially disrupted

- Very low food security (score = 6 to 10): At times during the last 30 days, eating patterns of one or more household members were disrupted and food intake reduced because the household lacked money and other resources for food

Households with high or marginal food security are “food secure”. Food secure households are considered to have sufficient, varied food to facilitate an active and healthy lifestyle. Households with low or very low food security are “food insecure”. Food insecure households have a risk of, or lack of access to, sufficient, varied food.

Introduction of questions to capture new grants available

In Scotland, Wales and Northern Ireland, parents on low incomes may be eligible for a grant for school clothing. The names of the grants and amounts payable vary, depending where they are issued.

A new question has been added to collect information about receipt of the Young Carer Grant in Scotland. The Young Carer Grant is a new benefit which the Scottish Government has introduced and has been in place since 21 October 2019. The grant, which can be applied for annually by young carers with significant caring responsibilities, aims to provide financial support to young carers in the form of a single payment of £300. For context, Carer’s Allowance was set at £66.15 per week during this survey year.

Numerous other minor updates and changes to the questionnaire have been made to reflect changing categories, definitions etc. and in response to feedback on the operation of the questionnaire from interviewers.

7. Population and sample selection methodology

The FRS sample is designed to be representative of private households in the United Kingdom.

The sampling frame in Great Britain

The Great Britain FRS sample is drawn from the Royal Mail’s small users Postcode Address File (PAF). The small users PAF is limited to addresses which receive, on average, fewer than 50 items of post per day and which are not flagged with Royal Mail’s “organisation code”. An updated version of this list is obtained twice a year.

By using only the small-user delivery points most large institutions and businesses are excluded from the sample. Small-user delivery points which are flagged as small business addresses are also excluded. However, some small businesses and other ineligible addresses remain on the sampling frame. If sampled, they are recorded as ineligible once the interviewer verifies that no private household lives there.

The sample design in Great Britain

The Great Britain FRS uses a stratified clustered probability sample design. The survey samples 1,417 postcode sectors, from around 9,200 in Great Britain, with a probability of selection that is proportional to size. Each postcode sector is known as a Primary Sampling Unit (PSU).

The PSUs are stratified by 27 regions and three other variables, described below, derived from the 2011 Census of Population. Stratifying ensures that the proportions of the sample falling into each group reflect those of the population.

Within each region the postcode sectors are ranked and grouped into eight equal bands using the proportion of households where the household reference person (HRP) is in National Statistics Socio-Economic Classification (NS-SEC) 1 to 3. Within each of these eight bands, the PSUs are ranked by the proportion of economically active adults aged 16-74 years and formed into two further bands, resulting in sixteen bands for each region. These are then ranked according to the proportion of economically active men aged 16-74 years who are unemployed. This set of stratifiers is chosen to have maximum effectiveness on the accuracy of two key variables: household income and housing costs. The table below summarises the stratification variables.

Within each PSU a sample of addresses is selected. In 2019 to 2020, 28 addresses were selected per PSU. The total Great Britain set sample size in 2019 to 2020 was 39,676 addresses. Each address had approximately a 1-in-705 chance of being included in the survey. For England and Wales each address had approximately a 1-in-772 chance of inclusion in the survey. In order to improve the quality of estimates for Scotland the PSUs in Scotland are over-sampled. Approximately twice the numbers of PSUs were sampled in Scotland than would be required under an equal-probability sample of the UK. Therefore, 6,832 addresses were selected in Scotland, with approximately a 1-in-385 chance of being included in the survey.

FRS sample stratification variables for Great Britain

| Strata | |

|---|---|

| Regions | 19 in England (including Metropolitan vs non-Metropolitan split |

| Regions | 4 in London |

| Regions | 2 in Wales |

| Regions | 6 in Scotland |

| The proportion of households where the HRP is in NS-SEC 1 to 3 | 8 equal bands |

| The proportion of economically active adults aged 16-74 | 2 equal bands |

| The proportion of economically active men aged 16-74 who are unemployed | Sorted within above bands |

Each year, half of the PSUs are retained from the previous year’s sample, but with new addresses chosen; for the other half of the sample, a fresh selection of PSUs is made (which in turn will be retained for the following year). This is to improve comparability between years.

The sampling frame in Northern Ireland

The sampling frame employed on the Northern Ireland FRS is the NISRA Address Register (NAR). The NAR is developed within NISRA and is primarily based on the Land and Property Services (LPS) Pointer database, the most comprehensive and authoritative address database in Northern Ireland, with approximately 745,000 address records available for selection.

The sample design in Northern Ireland

A systematic random sample of 4,080 addresses was selected for the 2019 to 2020 Northern Ireland FRS from the NISRA Address Register. Addresses are sorted by district council and ward, so the sample is effectively stratified geographically. Each address had approximately a 1-in-183 chance of being selected for the survey.

8. Data collection

Data collection in Great Britain

A consortium consisting of the Office for National Statistics (ONS) and NatCen Social Research conducts fieldwork for the FRS in Great Britain on behalf of the Department for Work and Pensions (DWP).

Each month the PSUs are systematically divided between the two organisations and then assigned to the field staff.

Before interviewers visit the selected addresses, a letter is sent to the occupier explaining that they have been chosen for the survey and that an interviewer will call. The letter also explains that the survey relies on the voluntary co-operation of respondents and emphasises that information given in the interview will be treated in the strictest confidence and used only for research and statistical analysis purposes. As a token of appreciation and to encourage participation, a £10 Post Office voucher is included with the letter.

In 2019 to 2020, ONS interviewers averaged about five calls per address before returning the address as a non-contact. This data is not currently available for NatCen and NISRA interviewers. Addresses returned as non-contacts or partial refusals can be re-issued to another interviewer where appropriate, in the hope that an interview at the non-responding household can still be achieved. Interviewing at re-issued addresses can be carried out at any point in the remaining survey year.

Data collection in Northern Ireland

In Northern Ireland the sampling and fieldwork for the survey are carried out by the Central Survey Unit at the Northern Ireland Statistics and Research Agency. The responsibilities for programming the survey questionnaire, making annual modifications, initial data processing and data delivery are retained within ONS and NatCen.

Length of interview

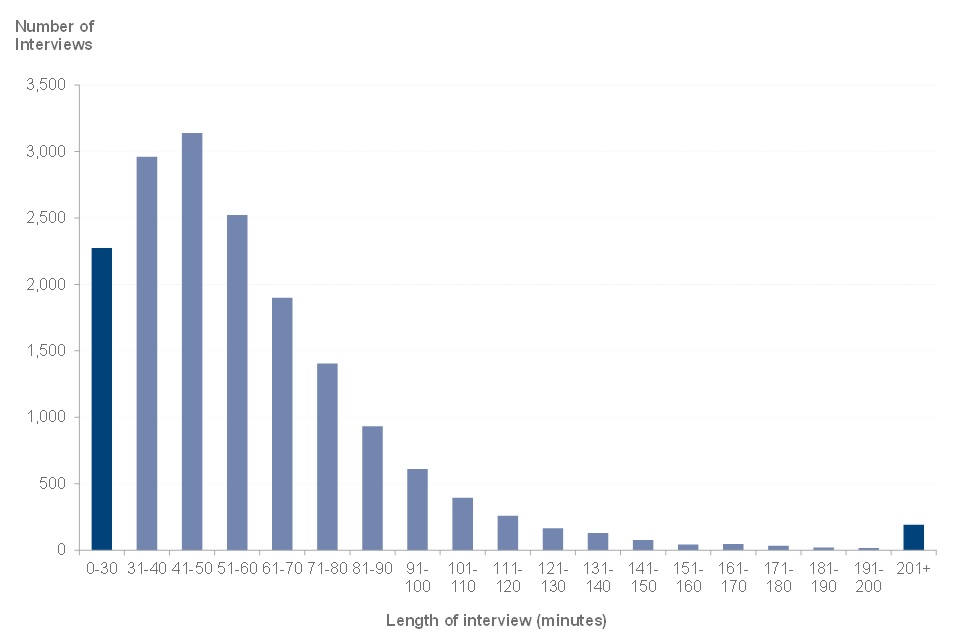

Interviews are conducted face-to-face. The length of each fully co-operating interview is recorded by the interviewer. In 2019 to 2020 the median face-to-face interview length for Great Britain was 52 minutes, but the time varies according to the size of household and its circumstances. The distribution of interview lengths in Great Britain is shown below, with full data in Methodology Table M.7. The timings exclude interviewer time spent preparing for and completing administration tasks after the face-to-face interview and are based on completed audit data from 17,128 fully productive ONS and NatCen interviews.

Distribution of FRS interview lengths, 2019 to 2020, Great Britain

Respondent Burden

The Code of Practice for Statistics states that producers of statistics should consider the burden on survey respondents. The FRS can measure the burden placed on respondents by using measured interview times for 17,128 full interviews, in Great Britain.

Great Britain Respondent burden is calculated as Number of responses x Median interview time

The median interview time for these 17,128 interviews was 52.2 minutes. Therefore, the respondent burden for the FRS in 2019 to 2020 was 894,100 minutes [621 days].

Multi-household procedures

If more than one household receives mail at an address a single household is interviewed. Multi households are not selected in Northern Ireland.

Ineligible addresses

Addresses containing no private households are classed as ineligible and excluded. The most common types of excluded addresses are non-residential or vacant addresses, and addresses that contain only communal establishments, such as hostels, hotels, and boarding houses.

9. The FRS questionnaire

FRS interviews are conducted using Computer Assisted Personal Interviewing (CAPI). The questionnaire is divided into three parts. The first part is the household schedule which is addressed to one person in the household (usually the household reference person, although other members are encouraged to be present) and mainly asks household level information, such as relationships of individuals to each other, tenure and housing costs. Next is the individual schedule which is addressed to each adult in turn and asks questions about employment, benefits and Tax Credits, pensions, investments, and other income. Information on children in the household is collected by proxy from a responsible adult. A final section asks the value of investments by type for respondents with savings between £1,500 and £20,000.

Interviewers new to the FRS are briefed on the questionnaire and an annual re-briefing is given to all interviewers on changes to the questionnaire. Those who have been working on the survey for some time also complete a written field report each year, describing their experiences with particular parts of the questionnaire and commenting on how changes are received in the field.

Prior to the start of fieldwork, DWP consults FRS users and draws up a list of possible questionnaire changes. Users are asked to identify individual questions or sections which were no longer of interest. The FRS questionnaire is lengthy and demanding and a key concern is, where possible, to reduce (or at least not increase) its length, so as not to overburden respondents or interviewers.

As part of the process of agreeing annual changes, suggestions from contractors are also considered, as well as those arising from an evaluation of feedback from interviewers. Any changes to the questionnaire are checked for consistency with the harmonised standards for Government social surveys.

Consultation of Documentation

Interviewers encourage respondents to consult documentation at all stages of the interview to ensure that the answers provided are as accurate as possible. For some items whether or not certain documents are consulted is recorded on the questionnaire. This assists FRS users in assessing the accuracy of the data.

- Employees have consulted their latest payslip for 32% of jobs they have reported. Of all employees, 93% reported to have one job only and seven per cent reported to have more than one job

- Employees did not have a payslip to consult for seven per cent of jobs they have reported; 22% could not consult a payslip because their payslips were only received electronically

- Fifty-six per cent of all reported benefit and payable Tax Credit receipt involved consultation of documentation (a letter from DWP or HM Revenue and Customs, or a bank statement)

- Fifty-four per cent of households in Great Britain consulted a Council Tax bill or statement in answering questions on their Council Tax payments

Response

Response in the FRS, 2019 to 2020, United Kingdom

In each eligible household, the aim is to interview all adults aged 16 years and over, except those aged 16 to 19 years who were classed as dependent children. A household is defined as fully co-operating when it meets this requirement and there are fewer than 13 ‘don’t know’ or ‘refusal’ answers to monetary amount questions in the benefit unit schedule (i.e. excluding the assets section of the questionnaire).

Proxy interviews are accepted when a household member is unavailable for interview. In 2019 to 2020, for those households classed as fully co-operating, proxy responses were obtained for 22% of adults.

It should be noted that all data shown in the main body of this publication refer only to fully co-operating households. Households that are not fully co-operating are further classified as partially co-operating, refusals, or unable to make contact. To be classified as partially co-operating a full interview has to be obtained from the Household Reference Person’s (HRP’s) benefit unit.

This table summarises the household response. The UK-wide sample chosen for 2019 to 2020 consisted of 43,756 households. Eligibility of the households was confirmed and the total number of households was adjusted to reflect only the households that were fully eligible. In total, 4,419 households were found to be ineligible. Households are classed as ineligible if they are empty or if they do not contain any private households.

A further 1,169 households were identified as households with unknown eligibility, where the interviewer was unable to establish whether the property was a residential address (e.g. the property was inaccessible). Addresses of unknown eligibility have been allocated as eligible and ineligible proportional to the levels of eligibility for the remainder of the sample. The total number of ineligible household post-adjustment was 4,540 and the effective, post-adjustment sample was 39,216 households.

In total 19,244 households UK-wide fully co-operated (49%), 375 partially co-operated (one per cent) and 15,990 refused to proceed with the interview (41%). The interviewer was unable to make contact with 2,559 households (seven per cent) and 1,048 households were of unknown eligibility (three per cent).

Response rates are calculated as follows:

The number of fully co-operating households, multiplied by 100 / Divided by the number of eligible households after adjustment

The overall response rate for the FRS in 2019 to 2020 was 49%.

When respondents refuse to participate in the FRS, interviewers record up to three reasons for refusal. The most common reasons for refusal in 2019 to 2020 are shown below

Reasons for refusal to participate in the FRS, Great Britain, 2019 to 2020

| Reason for refusal | Percentage of households |

|---|---|

| Couldn’t be bothered | 25 |

| Invasion of privacy | 18 |

| Genuinely too busy | 17 |

| Don’t believe in surveys | 17 |

| Concerns about confidentiality | 9 |

| Disliked survey of income | 8 |

| Personal problems | 6 |

| Anti-government | 5 |

| Temporarily too busy | 4 |

| Total number who gave a reason for refusal | 9,211 |

| Total number of refusals | 12,825 |

This table shows response rates broken down by region. Yorkshire and the Humber had the highest response rate in England, where 55% of all households selected responded fully. London had the lowest response rate where 42% of the chosen households fully co-operated. The variations in response rates reflect those of other major surveys and the Census of Population i.e. response rates are generally lower in large city areas.

Non-response

The lower the response rate to a survey, the greater the likelihood that those who responded are significantly unlike those who did not, and so the greater the risk of systematic bias in the survey results. Unless information is available about the nature and extent of such bias there are likely to be problems in generalising the sample results to the population.

For a United Kingdom survey of the size and complexity of the FRS, the total non-response rate in 2019 to 2020 of 51% is not considered unreasonable. However, any information that can be obtained about the non-respondents is useful both in terms of future attempts to improve the overall response rate and potentially in improving the weighting of the sample results. It is considered to be important for the FRS to obtain as much information as possible about non-respondents. The following sections outline some of the analyses that have been carried out in this area.

Non-response and Council Tax band

Comparisons were made by country between 2019 to 2020 Great Britain FRS data and administrative data on the number of households within each Council Tax band.

Methodology Table M.3 shows that FRS percentages were similar to those obtained from examining administrative data.

Non-response form analysis

Direct information about the non-responding households is valuable, although by definition difficult to obtain. However, some non-responding households who are not willing to take part in the full survey are willing to provide some basic information by completing a non-response form. Analysis of these forms is used to monitor characteristics of non-respondents and trends in non-response.

10. Validation, editing, conversion and imputation

In addition to unit non-response, where a household does not participate, a problem inherent in all large surveys is item non-response. This occurs when a household agrees to give an interview, but either does not know the answer to certain questions or refuses to answer them. This does not prevent them being classified as fully co-operating households because there is enough known data to be of good use to the analyst (although see the first paragraph of the Response section above for information about non-response to monetary questions).

The fact that the FRS allows missing values in the data collection can create problems for users, so missing values are imputed where appropriate. The policy is that for variables that are components of key derived variables, such as total household income and housing costs, and areas key to the work of DWP, such as benefit receipt, there should be no missing information in the final data.

In addition to imputation, prior to publication FRS data are put through several stages of validation and editing. This ensures the final data presented to the public are as accurate as possible.

The stages in the validation, editing, conversion and imputation process are laid out below:

Stage one – the interview

One of the benefits of interviewing using CAPI is that in-built checks can be made at the interview stage. This helps to check respondents’ responses and also that interviewers do not make keying errors. There are checks to ensure that amounts are within a valid range and also cross-checks which make sure that an answer does not contradict a previous response. However, it is not possible to check all potential inconsistencies, as this would slow down the interview to an unacceptable degree, and there are also capacity constraints on interviewer notes. FRS interviewers can override most checks if the answers are confirmed as accurate with respondents.

Stage two – post-interview checks

Once an interview has taken place, data are returned to ONS, NatCen, or NISRA. At this stage, editing takes place, based on any notes made by interviewers. Notes are made by the interviewer when a warning has been overridden, for example, where an amount is outside the expected range, but the respondent has documentation to prove it is correct. Office-based staff make editing decisions based on these notes. Other edits taking place at this stage are checking amounts of fixed-rate benefits and, where possible, separating multiple benefit payments into their constituent parts, such as separating Disability Living Allowance into the Care and Mobility components.

Stage three – data conversion

Before further validation, FRS data are converted from CAPI format into SAS readable tables. Using DWP specifications, SAS tables are created by ONS, with each table displaying information from different parts of the questionnaire. Both DWP and ONS then carry out validation checks on key input and output variables to ensure that the data have converted correctly to the new format. Checks include ensuring that the number of adults and children recorded is correct, and that records are internally consistent.

Stage four – state support validation

Information on benefit and tax credit receipt is one of the key areas of the FRS, and it is very important that this section is thoroughly validated and cleaned.

It is not appropriate to use the imputation methods outlined in stages five and six (below) for benefits data so instead a separate procedure of validation and editing is used. The following types of validation were carried out for 2019 to 2020 FRS data:

Missing values

For cases where a respondent had answered ‘yes’ to whether they are in receipt of a particular benefit, but did not give the amount received, an imputation decision has been made, depending on the benefit. For benefits such as Universal Credit, where the rate could vary greatly depending on the situation of the respondent, individual benefit assessments have been carried out. However, for benefits such as State Pension, where fewer rates apply, a more general method has been used.

Near-zero amounts

Where benefit amounts are recorded as near-zero, the case is examined individually and an edit decision is made.

Multiple benefits

Any combined benefit amounts (for example where State Pension is paid with Attendance Allowance) are edited by carrying out benefit entitlement assessments on individual cases, while preserving the reported total wherever possible.

Validation reports

Computer programs are run to carry out a final check for benefit entitlement and to output any cases that look unreasonable. All cases detected as a result of this validation exercise are individually checked and edited where necessary.

Stage five – other pre-imputation cleaning

In preparation for imputing missing values, data are made as clean as possible. This involves edits and checks of the following nature:

Weekly amounts

In the FRS, most monetary amounts are converted to a weekly equivalent. To calculate this, respondents are usually asked the amount, then the length of time this amount covered. The latter is known as a “period code”. Period codes are used in conjunction with amounts to derive weekly figures for all receipts and payments. Some variables, such as interest on savings accounts, refer to the amount paid in the whole of the past year. These are also converted to a weekly amount.

Sometimes the period code relates to a lump sum or a one-off payment. In these cases, the corresponding value does not automatically convert to a weekly amount. In order for the data to be consistent across the survey, edits are applied to convert most lump sums and one-off payments to weekly amounts. In the same way, where period codes are recorded as ‘don’t know’ or ‘refused’, these are imputed so that the corresponding amount can be converted to a weekly value in the final dataset.

Near-zero amounts

It is not possible for interviewers to enter zero amounts where it is inappropriate to do so. For example, in response to a question on receipt of benefit, a zero amount will result in a warning message being displayed. Some interviewers try to avoid this message by recording near-zero amounts. As a result, all near-zero values are examined and a decision taken as to whether the value is genuine or whether the value should be treated as missing.

Outliers

Statistical reports of the data are produced to show those cases where an amount was greater than four standard deviations from the mean. For the seven largest values over this limit, the individual record is examined and where necessary (but only if a value looks unrealistic), the case is edited. The outliers remaining in the dataset are verified by examining other relevant data. Compared with earlier FRS years, only a small number of these edits are now carried out, because of the many range checks in the CAPI questionnaire.

Credibility checks

Checks are carried out for the internal consistency of certain variables. For example, one check on mortgage payments ensures that payments to the mortgage from outside the household are not greater than the mortgage payment itself. Such cases are examined and edited where necessary.

Stage six – imputation

The responses to some questions are much more likely to have missing values than others. For example, it is very unlikely that a respondent will refuse to give or will not know their age or marital status; whereas it is much more likely that they will not be able to provide precise information on the amount of interest received from their investments.

Two areas where missing values are a problem are (1) income from self employment and (2) income from investments. Results in the tables provided in this publication include imputed values. Elsewhere however, values are left to remain as missing in some variables (such as hours of care).

This table illustrates the extent of missing values. Of the 13.6 million set values in the 2019 to 2020 FRS dataset, one per cent were originally recorded as either ‘don’t know’ or ‘refused’. Out of 129,611 missing values, approximately 89% were then imputed. The main imputation methods are summarised below, in the order in which they were applied.

Closing down routes

As with any questionnaire, a typical feature of the FRS is a gatekeeper question positioned at the top of a sequence of questions, at which a particular response will open up the rest of the sequence. If the gatekeeper question is answered as ‘don’t know’ or ‘refused’ then the whole sequence is skipped.

A missing gatekeeper variable could be imputed such that a further series of answers would be expected. However, these answers will not appear because a whole new route has been opened. For example, if the amount of rent is missing for a record and has since been imputed, any further questions about rent would not have been asked. From the post-imputed dataset, it will appear that these questions should have been asked because a value is present for rent.

For this reason, where the gatekeeper question has been skipped the onward routes should be closed down. In most cases, gatekeeper variables are of the ‘yes or no’ type. If missing, these would be imputed to ‘no’, assuming that if a respondent does not know whether an item is received or paid, then it is not.

Hot-decking

This process looks at characteristics within a record containing a missing value to be imputed, and matches it up to another record with similar characteristics for which the variable is not missing. It then takes the known variable and copies it to the missing case. For example, when imputing the Council Tax Band of a household, the number of bedrooms, type of accommodation and region are used to search for a case with a similar record. This method ensures that imputed solutions are realistic, and allows a wide range of outcomes which maintain variability in the data.

Algorithms

These are used to impute missing values for certain variables, for example variables relating to mortgages. The algorithms range from very simple calculations to more sophisticated models, based on observed relationships within the data and individual characteristics, such as age and gender.

‘Mop-up’ imputation

This is achieved by running a general validation report of all variables and looking at those cases where missing values are still present. At this stage, variables are examined on a case-by-case basis to decide what to impute. Credibility checks are re-run to identify any inconsistencies in the data caused by imputation, and further edits are applied where necessary. All imputations, by each of the methods above, are applied to the un-imputed dataset via a transaction database. This ensures auditability in that it is always possible to reproduce the original data.

Points to note with imputed data

- Whilst several processes are used to impute missing values, it should be remembered that they represent only a very small proportion (typically one per cent) of the dataset as a whole

- Imputation will have a greater effect on the distribution of original data for variables that have a higher proportion of non-response, as proportions of imputed data will be higher

- As mentioned above, in certain situations, imputed values will be followed by ‘skipped’ values. It was decided in some cases that it was better to impute the top of a route only, and not large amounts of onward data. For a small proportion of imputed values, it is not possible to close down a route. These cases are followed by ‘skipped’ responses (where a value might otherwise be expected)

Stage seven – derived variables

Derived variables (DVs) are those which are not created by the original interview, but instead are made by combining information, both within the survey and from other sources.

They are created at the FRS user’s request. Their main purpose is to make it easier for users to carry out analysis and to ensure consistent definitions are used in all FRS analyses. For example, INDINC is a DV which sums all components of income to find an individual’s total income. This is possible because of the various sources collected by the survey. As new information is collected in the survey, the relevant DVs are updated as necessary.

11. Grossing

The FRS publication presents tabulations where the percentages refer to sample estimates grossed-up to apply to the whole population. Grossing-up is the term given to the process of applying factors to sample data so that they yield estimates for the overall population. The simplest grossing system would be a single factor e.g. the number of households in the population divided by the number in the achieved sample. However, surveys are normally grossed by a more complex set of grossing factors that attempt to correct for differential non-response, at the same time as they scale up sample estimates.

The system used to calculate grossing factors for the FRS divides the sample into different groups. The groups are designed to reflect differences in response rates among different types of household. The FRS stratified sample structure is designed to minimise differential non-response in the achieved sample. Grossing is then designed to account for residual differential non-response.

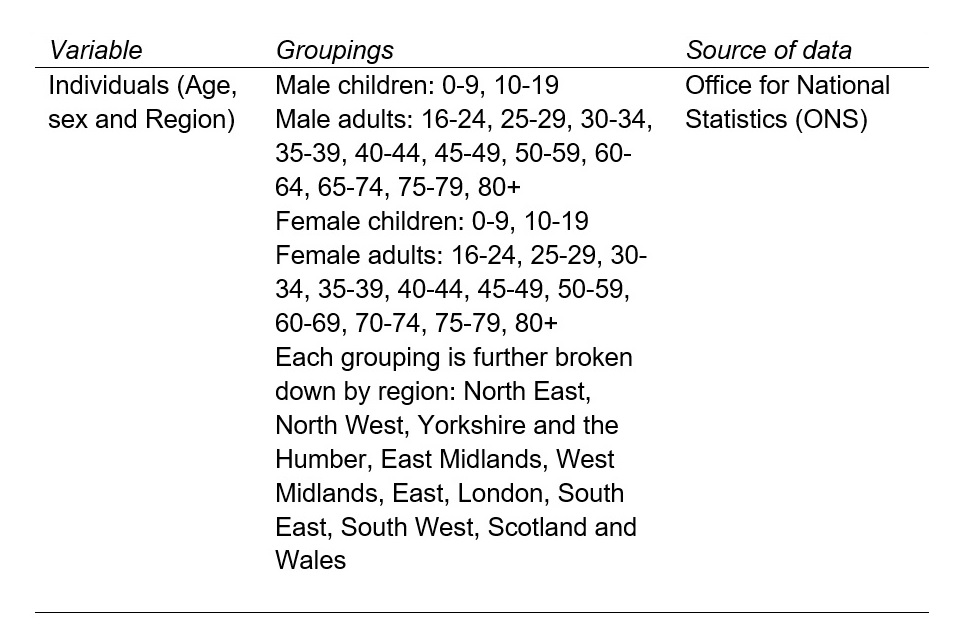

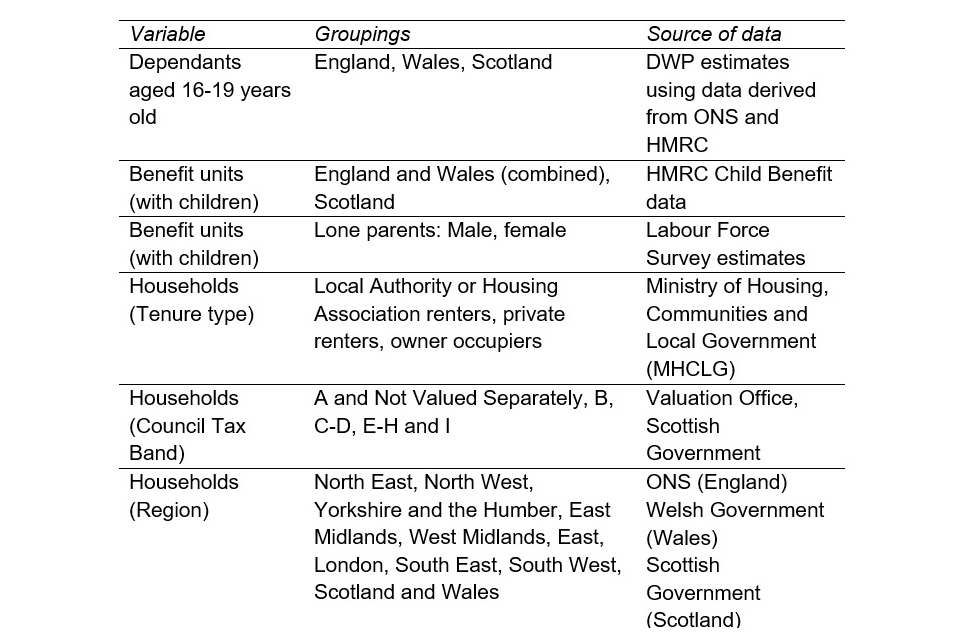

They have also been chosen with the aims of DWP analysis in mind. The population estimates for these groups, obtained from official data sources, provide control variables. The grossing factors are then calculated in a way which ensures the FRS produces population estimates that are as close as possible to the control variables. As an example, a grossed FRS count of the number of men aged 35-39 years would be consistent with the ONS population estimates of the same group.

In developing the grossing regime careful consideration has been given to the combination of control totals, and the way age ranges, Council Tax Bands and so on, are grouped together. The aim has been to strike a balance so that the grossing system will provide, where possible, accurate estimates in different dimensions without significantly increasing variances.

Some adjustments are made to the original control total sources so that definitions match those in the FRS, e.g. an adjustment is made to the demographic data to exclude people whose residence is not a private household. It is also the case that some totals have to be adjusted time-wise, to correspond to the FRS survey year which runs from April to March.

A software package called CALMAR, provided by the French National Statistics Institute, is used to reconcile control variables at different levels and estimate their joint population. This software makes the final weighted sample distributions match the population distributions through a process known as calibration weighting. It should be noted that if a few cases are associated with very small or very large grossing factors, grossed estimates will have relatively wide confidence intervals.

A review of the FRS grossing methodology was carried out by the ONS Methodological Advisory Service in 2013.

A number of relatively minor methodological improvements were made as a result, with the grossing calculations updated to use 2011 Census data at that point. Further details on the methodological changes have also been published.

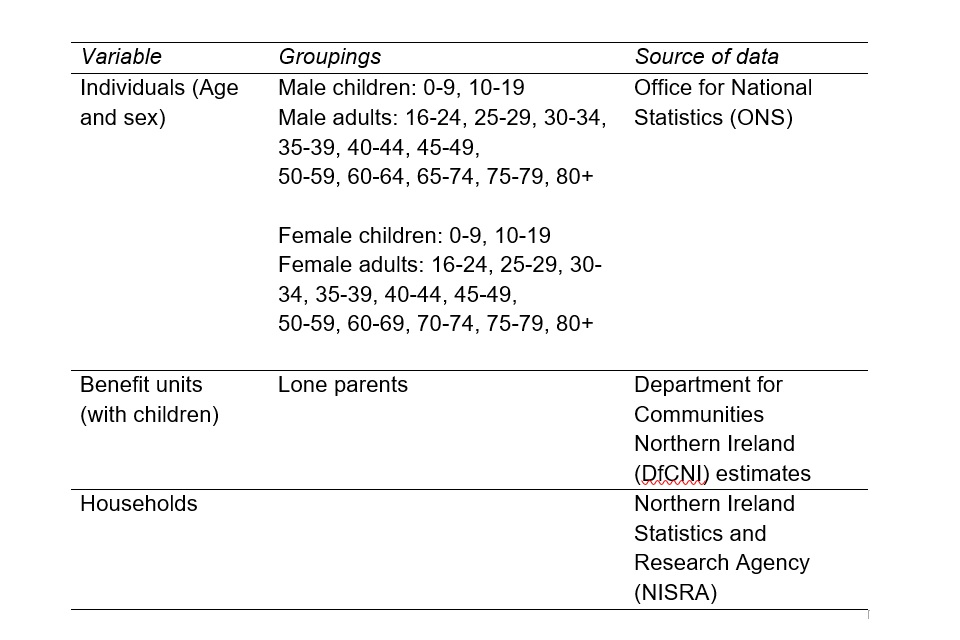

Both Great Britain and Northern Ireland data use the same CALMAR software to reconcile control variables at different levels, and estimate their joint population. There are minor differences between the methods used to gross the Northern Ireland sample as compared with the Great Britain sample:

- Local taxes in Northern Ireland are collected through the rates system, so Council Tax Band is not applicable as a control variable

- Northern Ireland housing data are based largely on small-sample surveys. It is not desirable to introduce the variance of one survey into another by using it to compute control totals; therefore tenure type is not used as a control variable

Details of the control variables used in the grossing regimes for Great Britain and Northern Ireland are shown below.

Grossing regime for Great Britain, 2019 to 2020

Control variables used to generate grossing factors for private households

Control variables used to generate grossing factors for private households

Grossing regime for Northern Ireland, 2019 to 2020

Control variables used to generate grossing factors for private households

12. Reliability of estimates

All survey estimates have a sampling error attached to them, calculated from the variability of the observations in the sample. From this, a margin of error (confidence interval) is estimated. It is this confidence interval, rather than the estimate itself, that is used to make statements about the likely ‘true’ value in the population; specifically, to state the probability that the true value will be found between the upper and lower limits of the confidence interval. In general, a confidence interval of the estimate plus or minus two standard errors is used to state, with 95% confidence, that the true value falls within that interval. A small margin of error will result in a narrow interval, and hence a more precise estimate of where the true value lies.

The sample in Great Britain for the FRS, as described earlier, is selected using a stratified multi-stage design, based on addresses clustered within postcode sectors. As a result, FRS sampling error is not just dependent on the variability among units in the sample (whether households or individuals), but is also a function of variability within and between postcode sectors. For example, if a sample characteristic is distributed differently by postcode sector (i.e. is clustered) the sampling variability is greater overall than would occur in a simple random sample of the same size. Therefore, the complex (actual) sampling error is normally greater than the standard error calculated under the assumption of simple random sampling.

The size of the actual standard error relative to the standard error calculated under the assumption of simple random sampling is represented by the design factor, which is calculated as the ratio of the two. Where the standard errors are the same, the design factor equals one, implying that there is no loss of precision associated with the use of a clustered sample design. In most cases, the design factor will be greater than one, implying that the estimates based on the clustered sample are less precise than those of a simple random sample of the same size. Conversely a design factor of less than one implies the estimate is more precise than would be obtained from a simple random sample.

Standard Errors

These tables provide standard errors, design factors and confidence intervals for a selection of variables from the 2019 to 2020 FRS. An example of how to interpret figures in this table follows:

Example: Standard errors for household composition, table SE.1

Table SE.1 shows that 72.0% of households did not contain any children. The standard error is estimated as 0.4%. This is the final estimate after rounding and taking into account the design factor.

The design factor for this variable is 1.1. That is, the effect of using a clustered sample rather than a simple random sample is a loss in precision of 10% on standard errors. In contrast, a design factor of 0.9 would have denoted a gain in precision of 10%.

The 95% confidence interval (of plus or minus two standard errors) is therefore between 71.2% and 72.8%. That is, if sampling error is the sole source of error, in 95 out of 100 samples the percentage of households without children will lie within this range.

The sampling errors shown are likely to be slightly larger than the true sampling errors because the software used for the calculation does not take into account the improvement in precision due to post-stratification.

See the linked paper for information on estimating variance and confidence intervals in special circumstances, for example where the occurrences of a response in the sample are very small.

In addition to sampling errors, consideration should also be given to non-sampling errors. Sampling errors arise through the process of random sampling and the influence of chance. Non-sampling errors arise from the introduction of some systematic bias in the sample compared with the population it is supposed to represent.

As well as response bias, such biases include inappropriate definition of the population; misleading questions; data input errors; data handling problems; or any other factor that might lead to the survey results systematically misrepresenting the population. There is no simple control or measurement for such non-sampling errors, although the risk can be minimised through careful application of the appropriate survey techniques from the questionnaire and sample design stages through to analysis of results.

13. Linking FRS data to administrative data

As a national statistic, and in line with the Code of Practice for Statistics (Value V4.1) DWP looks to improve the FRS, year on year.

A review of legal requirements for informed consent led to a successful trial of a new approach to achieving consent from January to May 2017. This was followed by a full rollout within Great Britain. The new approach was to inform people prior to interview that their responses would be linked. Participation in the survey thereby demonstrated consent to linking.

With implementation of the General Data Protection Regulation (GDPR) in May 2018, the survey moved away from consent as the legal basis and instead used the GDPR provision (Article 6.1.e). This allows data processing that is necessary for DWP to carry out its functions as a public body. This gives us a firm, ongoing legal basis to link all FRS respondents to their administrative records.

The FRS makes an up-front statement that DWP will link respondent information to administrative records held by DWP, as the responsible department for Great Britain. Northern Ireland retained an explicit consent question for the 2019 to 2020 survey. FRS data for these respondents are linked to DWP administrative data applying matching routines using a combination of date of birth, forename, surname and full postcode. Names and addresses of respondents are kept confidential and only made available to a small team of named staff at DWP who carry out the linking. Linked data are anonymised and only used for research and statistical purposes.

We have previously advised users of our intention to match those taking part in the survey to their benefit records. Matching happens across the range of administrative datasets available to DWP. The successful match rate for linking respondents to their administrative data was 95% in 2019 to 2020. This means that 89% of all United Kingdom FRS respondents have been matched to their administrative records.

This enables a check on the accuracy of monetary amounts reported during the interview, as well as the respondent’s eligibility for the various elements of state support.

For the current survey year, 2019 to 2020, some developments in this area have been taken forward. The matching exercise described above has supplied helpful information for the benefit recipients in the FRS sample. This was most notably the case for the Universal Credit data (UC), for which:

- It is likely to be harder for individuals to respond in terms of amounts, given that payments can vary each month, unlike the benefits UC replaces

- Respondents are asked for a single amount in the survey – we do not ask about different components