Family Resources Survey: background information and methodology

Updated 12 May 2023

1. Introduction

This report accompanies the main Family Resources Survey 2020 to 2021 report.

The purpose of this report is to provide further contextual information to aid understanding of the statistics presented in the main report and detailed tables. It outlines points to note as well as strengths and limitations of the information presented in each section of the main report; alternative data sources; as well as changes to the survey this year compared to last year.

A detailed description of the Family Resources Survey (FRS) methodology, fieldwork operations, data processing and quality assurance are presented within the relevant sections in this report. These descriptions are intended to help users in the use and interpretation of FRS 2020 to 2021 data.

The FRS is a major study of income levels in the UK. Given its prominence in the landscape of income data resources, a decision was taken to continue with fieldwork throughout the 2020 to 2021 financial year, albeit recognising the need for several coronavirus (COVID-19) related adaptations. The aim was to maintain the output of FRS estimates and data for 2020 to 2021, the first twelve months of the pandemic, because of the depth of insight the FRS gives on household circumstances.

The coronavirus (COVID-19) pandemic impacted the FRS at several levels, all of which have some bearing on the survey results. Later sections discuss the changes to the survey questionnaire and fieldwork approaches, both of which were materially different to a typical FRS year. Later sections also set out the difference in response rate, and composition of responses, achieved this year. There have also been changes to the production process of the survey results, in particular around the grossing regime and suppression policy applied to estimates.

Editorial team

Alex Brandon-Bravo, Anna Britton, Claire Cameron, Annabel Connolly, Marwan Hassan, Harrison Jones, Sheridan Lomas, Charlotte McCaughey, Justyna Owen, Clive Warhurst.

Feedback

If you have any comments or questions about any aspect of the FRS, or are interested in receiving information on consultations, planned changes, and advance notice of future releases, please contact: Claire Cameron, Surveys Branch, Department for Work and Pensions. Email: [email protected]

Acknowledgements

In this year of challenging circumstances, we wish to give special acknowledgement to:

- all the respondents in households across the United Kingdom who agreed to and made the time to be interviewed

- interviewers from the Office for National Statistics, NatCen Social Research and the Northern Ireland Statistics and Research Agency who adapted to the change, from face-to-face to telephone interviewing

- colleagues in those organisations who supported us in developing in-year questionnaire changes, to capture important information about the pandemic

- all those who have contributed towards the Family Resources Survey 2020 to 21 publication, through providing quality assurance and feedback

- our web support team

- the UK Data Service, who distribute our research data

2. Background

The Family Resources Survey (FRS) is a continuous survey which collects information on the income and circumstances of individuals living in a representative sample of private households in the United Kingdom. The survey has been running in Great Britain since October 1992 and was extended to cover Northern Ireland in the survey year 2002 to 2003.

The primary objective of the FRS is to provide the Department for Work and Pensions (DWP) with information to inform the development, monitoring and evaluation of social welfare policy. Detailed information is collected on: respondents’ incomes from all sources including benefits, tax credits and pensions; housing tenure; caring needs and responsibilities; disability; expenditure on housing; education; childcare; family circumstances; child maintenance; household food security.

Microsimulation is central to DWP’s use of the data. Therefore, careful attention is paid to the accurate collection of information followed by meticulous data processing, editing, and quality assurance.

The FRS data are designated by the Office for Statistics Regulation (OSR) as National Statistics. The FRS provides the data for a number of other DWP National Statistics publications:

- Households Below Average Income

- Pensioners’ Incomes Series

- Income-Related Benefits: Estimates of Take-up

The survey contains information of much interest to other government departments, particularly for tax and benefit policy analysis by Her Majesty’s Revenue and Customs and Her Majesty’s Treasury. The survey is also used extensively by academics and research institutes for social research purposes.

Status and Development

These statistics underwent a full assessment against the Code of Practice for Statistics in 2011 and were confirmed as National Statistics in November 2012 by the Office for Statistics Regulation.

The OSR published its Review of Income-based Poverty Statistics on 19 May 2021. As announced in our Statistical Work Programme, we have taken several recommendations on board. This release includes the following recommendations which were relevant to the Family Resources Survey data and publication:

-

the Alternative Data Sources section of this Background Information and Methodology report has been expanded with additional links to sources to provide clearer and more detailed signposting to other income-based poverty statistics

-

DWP and Office for National Statistics (ONS) have worked together to provide clear guidance about the strengths and limitations of the FRS household survey, this year taking particular account of the impacts of the coronavirus (COVID-19) pandemic on data collection methods and the quality of the achieved sample data

-

particular regard has been given to how under-sampled groups could accurately be presented in the population-level statistics, clearly setting out the changes in the methodology to adjust for this and being transparent about any remaining areas for concern

-

the use of an accessibility checklist has further improved the accessibility of both our main publication text, charts and images in HTML, and also the Excel and ODS versions of our accompanying tables. We have also reviewed our supporting guidance to ensure accessibility to lay users

-

in both the technical advice provided alongside the publication, and in the supporting documentation provided to the UK Data Archive with the dataset, we have been clear on the appropriate uses and quality of the statistics and data, being transparent in how this may differ in this COVID-19 impacted year

In addition to further tables by ethnicity, to respond to Cabinet Office requirements and the inclusion of FRS based statistics in Ethnicity facts and figures ethnicity representation rates are now calculated from known declarations and exclude ‘choose not to declare’ and ‘unknown’.

Please see the DWP Statistical Work Programme for more details.

A summary of historical improvements since the latest review by the Office for Statistics Regulation includes:

- the timeliness of the publication has been improved so that, since the 2015 to 2016 survey year, reports have been released within 12 months of the completion of the survey

- audits of processing methodology have been made, and subsequent changes to imputation methodology have led to improvements in the quality of statistics

- the publication code has been revised allowing both a more streamlined process for publication and a clearer approach to update for annual changes, while retaining the core structure for consistency and harmonisation

- a review of the grossing regime was conducted to follow the move to use of 2011 Census results in the production of mid-year population estimates by ONS. The new grossing regime was implemented in the 2012 to 2013 publication

- value has been added in line with DWP statistics reporting practices. Publications have been made significantly shorter to enable a focus on commentary and analysis

- a publication consultation was held in Autumn 2020 to capture views of users of the publication

- the content of the FRS has evolved in response to user needs, with the addition of additional regular chapters for emerging areas of increased policy interest such as Self Employment and Household Food Security

- the previous, March 2021 publication included a section on Household Food Security for the first time. It included the proportion of households with low or very low household food security and:

- (i) whether or not they receive state benefits

- (ii) educational attainment

- (iii) overall level of income

- new questions and variables are added each year, as necessary to reflect changes in policy, such as benefit changes specific to some areas of the UK, and in different policy fields. This enables related policy analysis to be conducted

3. Uses of FRS Data

The FRS is used extensively both within and outside DWP. The main uses are as follows.

Households Below Average Income (HBAI)

The HBAI publication uses household disposable incomes, adjusted for household size and composition, as a proxy for material living standards or, more precisely, for the level of consumption of goods and services that people could attain given the disposable income of the household in which they live.

Pensioners’ Incomes Series

The HBAI dataset is used in the Pensioners’ Incomes Series, the Department’s analysis of trends in components and levels of pensioners’ incomes.

Income-Related Benefits: Estimates of Take-Up

The Estimates of Take-Up figures are based on a combination of administrative and survey data. The FRS provides information about people’s circumstances, which is used to estimate numbers of people who are not claiming benefits to which they may be entitled.

DWP Policy Simulation Model and other policy analysis

DWP’s Policy Simulation Model (PSM) is used extensively for the development and costing of policy options. FRS responses are uprated to current prices, benefits and earnings levels and can be calibrated to the DWP Departmental Report forecasts of benefit caseload. Using FRS data has made it possible to model some aspects of the benefit system which could not be done previously, for example severe disability premiums or allowances for childcare costs.

In addition to their use in formal modelling, FRS data play a vital role in the analysis of patterns of benefit receipt for policy monitoring and evaluation, and benefit forecasting.

Other government departments and the wider research community

The survey is widely used by other government departments, including Her Majesty’s Treasury, Her Majesty’s Revenue and Customs, the Department for Environment, Food and Rural Affairs and the Children’s Commissioner’s Office (an executive non-departmental public body, sponsored by the Department for Education).

The Department for Communities Northern Ireland uses the FRS to produce similar reports to those from DWP, which are focused on Northern Ireland.

Researchers and analysts outside government can also access the data through the UK Data Service.

The Office for National Statistics produces small area model-based income estimates. These are the official estimates of annual household income at the middle layer super output area (MSOA) level in England and Wales. The estimates are produced using a combination of survey data from the Family Resources Survey and previously published data from the 2011 Census plus a number of administrative data sources.

The Race Disparity Unit published the first in a series of summaries of data on their ‘Ethnicity Facts and Figures’ website in June 2019. Ethnicity Facts and Figures provides information about the different experiences of people from a variety of ethnic backgrounds. It gathers data collected by Government in one place, making it available to the public, specialists and charities. The FRS contributes data on state support, that is, receipt by ethnicity and type of benefit.

4. Points to Note

Impact of Coronavirus (COVID-19)

FRS 2020 to 2021 is an important data resource, which gives several insights into British household incomes during the coronavirus (COVID-19) pandemic. Nevertheless, caution should be taken when interpreting some of the statistics reported in this release. Each of the sections below provides further insight into the challenges to the results which were presented by the pandemic. The first section outlines several overarching factors which affected every topic area in the survey. Subsequent sections then step through each chapter, to discuss the impacts specific to them. This is contextual detail, which aims to show the strengths and limitations of the survey. It is intended to aid users in their interpretation of FRS 2020 to 2021 data.

The data in this report are from interviews conducted between April 2020 and March 2021. The whole of the fieldwork year was affected by the coronavirus (COVID-19) pandemic, and there are several overarching ways in which the pandemic might have affected the survey results. Most of these stem from the achieved sample, including the data collection method, the response rate achieved and the distribution of characteristics among respondents. All of these represent ways in which the 2020 to 2021 survey is different to previous survey years. The key changes to consider are:

- changes in people’s behaviours and circumstances

- changes in the methods used to contact survey participants and response

- change in the mode, to telephone interviewing

Changes in people’s behaviours and circumstances

It is not possible to outline all issues that affected either participation in the FRS itself, or how differently circumstances were reported this year, in comparison to previous years. But from a social research perspective, it is clear that the pandemic not only changed the UK labour market and household circumstances, but also our ability to measure them. This is because our measurement relies on data collected from a survey of households.

Many societal changes took place during 2020 to 2021, including an increase in remote working, home-schooling and the introduction of social distancing, and all of these could have impacted survey participation. Other factors, such as personal restrictions, health, and attitudes to social interaction may also have influenced the amount and type of data that the survey has been able to collect.

This extends to family formation, which is the key building block of FRS results. Pandemic restrictions may have resulted in differences to previous surveys, as people chose to form support bubbles with friends and family. This implies a reduction in house sharing amongst unrelated adults and an increase in multi-generational households (as adult children moved in with their parents or parents moved in with their children).

FRS data for 2020 to 2021 supports this view. Compared to 2019 to 2020: the percentage of adults living with cohabiting adults has increased (13.6% to 14.7 %); the percentage of adults living with unrelated (not cohabiting) people has decreased (5.0% to 2.9%), and the number of households containing multiple generations has increased (15.3% to 16.2%).

It should be noted that many of these “additional adults” in the household may not have been captured by the FRS, if they were not considered to be usually resident at the address. Moreover, and later on in the survey year, it is possible that respondents ceased to view such living arrangements as temporary and would instead regard them as being permanent (for survey purposes). The FRS results are structured to minimise such in-year effect, as they relate to the survey year as a whole.

It is also the case that the government response to the pandemic had a significant effect in supporting incomes, and on the UK labour market: government interventions allowed for the furloughing of workers, which affects both reported incomes and also other variables such as working hours. This factor sits alongside wider labour market and business developments, whereby some businesses ceased operations, and many others altered their working practices. All of these factors may have impacted the type and number of respondents taking part in the FRS.

Changes in the methods used to contact survey participants and response

The approach to engage with respondents to encourage them to participate in the survey did evolve during the year, whereas in a normal survey year there is a consistent approach throughout. This was partly because of changing COVID-19 restrictions during the year, and partly the need to set up new fieldwork operations at pace early in the year.

Full details of how engagement with respondents evolved is given in the Methodology section.

Change in the mode, to telephone interviewing

In mid-March 2020, as a result of Government restrictions introduced in response to coronavirus (COVID-19), face-to-face interviewing was halted across the UK. For this survey year, starting in April 2020, FRS processes were changed to allow data collection by telephone. These changes remained in place for the whole of the 2020 to 2021 survey year. Full details of how the survey adapted to a telephone basis are given in the Methodology section.

Ordinarily such changes would not be made without thorough testing to examine the impact on the data collected. In the time available, this was not possible. It is therefore difficult to quantify precisely how far the 2020 to 2021 survey results have changed since previous surveys because the mode was by telephone, as distinct from real-world changes.

In broad terms, DWP’s assessment is that, where data has been collected, it is not materially different to what would have been collected from the same respondent face-to-face. This is because the FRS is almost wholly a survey of factual information rather than attitudinal information. Wherever possible, as part of the quality assurance process, results have been compared both with other data sources, and to previous FRS years.

However, the FRS achieved sample this year is significantly smaller than usual, with around 10,000 households interviewed in 2020 to 2021 (down from between 19,000 and 20,000 in a normal year). In terms of the effect of the smaller sample on confidence in the results, the later section on Reliability of estimates sets out how much more uncertain this year’s results are, when compared with a normal FRS year.

The change in fieldwork approach also affected the composition of the FRS achieved sample. For example, there were significantly more outright owners and fewer renters in the sample. There was also a skew toward older respondents (aged 65 or over), and fewer households with children than in 2019 to 2020. Later sections discuss the impacts and limitations this brings to results. It should be noted that the impact of several aspects of difference have been mitigated by an alteration to the survey grossing regime (and the later section on grossing outlines the steps taken to improve the representativeness of the sample).

Whilst some change from year to year can be expected as a result of real-world changes in household circumstances, the pandemic would likely have prevented some households from taking part in the survey who would otherwise have done so (for example, home schooling, caring responsibilities, and ill health meant that some households would be less inclined to respond).

Income and State Support

The FRS captured information about people on the Coronavirus Job Retention Scheme (CJRS) via a new set of interview questions. Employees who were out on furlough were classified as employed, but temporarily away from work. This will mean that workers on furlough will still count towards the number of people in employment (or the employment rate). The classification of Economic Status remains the same as in previous years, with anyone on furlough in the Benefit Unit being classified as an employee.

The calculation of ‘income from employment’ uses Wages which are treated as income from employment (as opposed to state support), irrespective of any support payments from CJRS that the respondent’s employer was receiving in respect of their employment.

The calculation of earnings uses actual pay (GRWAGE) over usual pay (UGROSS) for people on furlough. This aligns to the Annual Survey of Household Earnings (ASHE) employee earnings methodology, which uses actual payments made to the employee from company payrolls.

The calculation of self-employed income and then total individual income does not include grants received from the Self-Employment Income Support Scheme (SEISS).

The decision to treat both CJRS and SEISS in this way follows our discussions with experts.

All income figures are presented gross of tax, national insurance and before other deductions from wages except where noted.

It is thought that household surveys underestimate income from both self-employment and investment income. We rely on respondent recall of very detailed financial information across a comprehensive range of income sources. Some of these are hard for respondents to recall. The FRS interviewers ask respondents to check pay slips, tax returns and other financial paperwork at the time of the interview. This helps to improve the reliability of what respondents report they earn.

The FRS captures detailed information on benefit receipt. In most cases this is analysed at a benefit unit (family) level because income-related benefits are paid to families as a whole rather than being separately assessed for each individual.

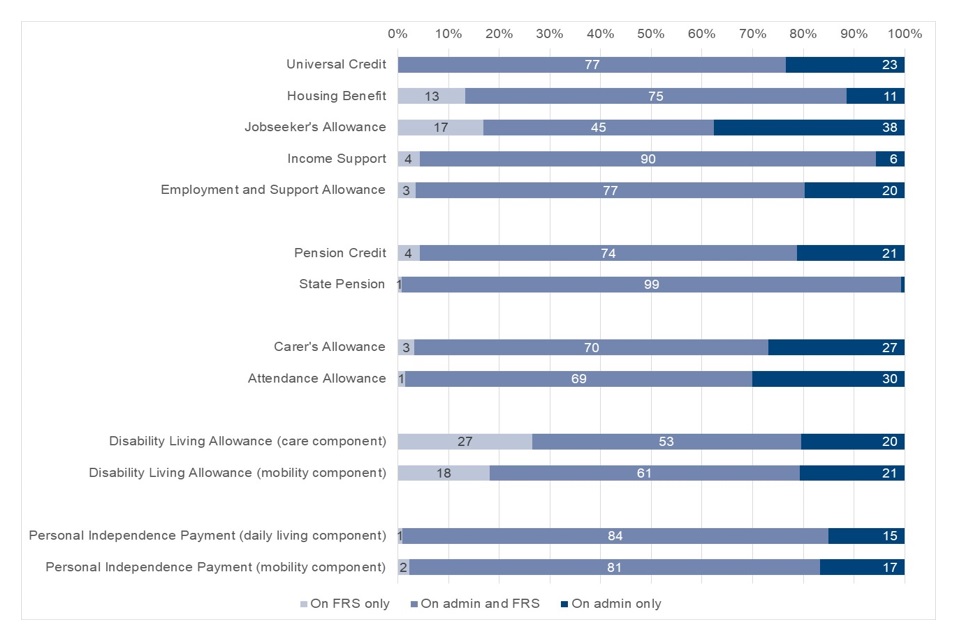

Some respondents do not know or do not have the necessary information to answer specific questions about individual benefits which makes it difficult to collect accurate information. (State Benefits on the Family Resources Survey (WP115))

Relative to administrative records, the FRS under-reports numbers on benefit (caseload). See Methodology Tables M.6a and M.6b for a comparison of (i) numbers on benefit (caseload) and also (ii) the average £ per week received, showing any differences between DWP administrative data and the numbers implied by the survey results. However, one of the strengths of the FRS is that it collects many personal and family characteristics which are not available from administrative sources. This means that the FRS can be used to analyse income and benefit receipt in ways which are not possible from administrative sources alone.

Tenure

In 2020 to 2021, the achieved sample had a higher proportion of households in the higher Council Tax bands (band C and above) than in recent survey years. This was reflected in the accommodation mix of the achieved sample, which showed a higher proportion of owner-occupier properties (rather than rented), and also a higher proportion of detached houses (rather than flats or terraced or semi-detached houses).

However, the difference made to survey estimates has been minimised by the grossing regime applied. This uses both Council Tax band and also the numbers renting versus owning as control totals, which will weight publication results to the real-world numbers seen of each different type of property.

It should be noted that the grossing regime was more effective in enabling a representative dataset of English households, than in Scotland or Wales, where sample sizes were relatively smaller. See Methodology Table M3.

As presented in the FRS, the “social rented sector” is a combination of the categories “Rented from Council” and “Rented from a Housing Association”. These categories are combined because some housing association tenants may misreport that they are council tenants. For instance, where their home used to be owned by the council and although ownership has now transferred to a housing association, the tenant may still think that their landlord is the council (local authority).

FRS outcomes are similar in composition to the English Housing Survey (EHS), but it should be noted that the EHS also switched from face-to-face interviews to telephone, so the ability to contact interviewees would have been similar to that of FRS interviewers.

Disability

There were changes in the prevalence of disability reported in 2020 to 2021 FRS, with a two percentage-point increase in the proportion of working-age adults reporting a disability, and a four percentage-point decline in the proportion of those over State Pension age reporting a disability.

For those of working age, the change may be linked to restrictions limiting movement outside of the home. For those above State Pension age, the reduction may be a consequence of the change in mode, as fewer participants reported impairments in hearing, memory or vision.

Results show a substantial increase in the number of disabled people who classified their impairment as ‘Other’. In the early months of the pandemic, those asked by the NHS to shield in the home may have been more responsive to the telephone survey. Many of the conditions covered by the shielding guidance – for example, conditions causing a weakened immune system – may have been reported as ‘Other’ because they do not fit neatly into another category of impairment.

Our assessment is that while some of the change in disability may have been genuine, we believe a substantial portion of it was due to sample bias. This is because we are unable to explain some of the changes in the sample with reference to changes in the real world. Therefore, they are likely to be a consequence of the change in mode rather than a real-world reduction in prevalence. It was not possible to further adapt the FRS grossing regime to adjust for this observable bias.

It has been recognised that in this survey year the FRS may be reporting a wider disability employment gap when compared with other sources. The FRS should be looked at in conjunction with both the Annual Population Survey (APS) and the Labour Force Survey (LFS).

The APS aims to provide more detailed analysis of key labour market indicators (employment, unemployment, and economic inactivity) for sub-groups of the population including disability. The latest analysis considers long-term trends as well as the more recent impacts of the coronavirus (COVID-19) pandemic.

The APS is not a stand-alone survey: it uses data combined from two waves of the main Labour Force Survey (LFS), alongside a local sample boost. The APS is a recommended source for employment statistics for smaller groups of the population. The LFS is the source recommended for employment-related statistics, such as estimates of the number of people in employment and is the key source for trend data on different measures of disability employment. The latest releases can be found in the Alternative Data Sources section of this report.

The way in which disabled people have been identified in the FRS has changed over time. From 2002 to 2003 statistics were based on responses to questions about barriers across a number of areas of life; figures from 2004 to 2012 are based on those reporting barriers across nine areas of life.

From 2012 to 2013 a person is considered to have a disability if they regard themselves as having a long-standing illness, disability or impairment which causes substantial difficulty with day-to-day activities. This updated definition is consistent with the core definition of disability under the Equality Act 2010, and complies with harmonised standards for social surveys published in August 2011 and updated in June 2019

An impairment is different to a medical condition. It looks at the functions that a person either cannot perform or has difficulty performing because of their health condition. For example, glaucoma is a medical condition but being unable to see or being partially sighted is an impairment

Some people classified as disabled and having rights under the Equality Act 2010 are not captured by this definition, such as people with a long-standing illness or disability which is not currently affecting their day-to-day activities. More information is available from the GSS Policy Store.

Care

FRS respondents are asked if they receive care from anyone. This includes both professional help – paid-for care from the local authority, health professionals or domestic staff – but it also includes informal care. This is any care where their carer is not doing it as a paid job; it can be for many, or only a few hours a week, and can take several different forms. The survey is intentionally not prescriptive about what counts as care; it could, for example, include going shopping for someone, or helping them with paperwork.

Where respondents are receiving care at least once a week, they are further asked about the nature and frequency of that care. FRS respondents are also asked if they provide care to someone else, on an informal basis. That person could be living with them, in their household, or they could live somewhere else (outside the household).

Pension participation

The FRS pension participation reference tables present data for both ‘all adults’ and ‘working-age adults only’. Those over State Pension age are often excluded from analysis of pension participation in other publications, although they could continue to work and participate in pension schemes. The ‘all adults’ category allows data for this group to be represented and also provides continuity across all chapters within the FRS.

Employer-sponsored pensions comprise any company or occupational pension scheme run by an employer including group personal pensions and group stakeholder pensions.

Individual pensions include individual stakeholder pensions and retirement annuity contracts as well as personal pensions.

Although the numbers are relatively small, self-employed people can contribute to an employer-sponsored pension scheme, for a variety of reasons. Doctors and dentists in private practice can be members of an occupational scheme. People who have recently become self-employed can continue to contribute to their previous employer scheme and people whose main job is self-employed, may work part-time as an employee and contribute to an employer scheme. These circumstances are captured within the FRS tables under the ‘Self Employed – Other’ category.

Savings and investments

The FRS does not capture information on non-liquid assets. Physical wealth and pensions accruing are not included in FRS estimates. The survey also does not capture detailed information on expenditure (except for housing costs). Therefore, it is not possible to show how households are coping financially, in terms of income versus outgoings.

However, the FRS does capture information on liquid financial assets, referred to in the survey as ‘savings and investments’. Estimates for savings and investments should be treated with caution, as they are likely to be under-estimates, since respondents often inaccurately report their account details.

The process of gathering information on savings and investments was the same as in previous survey years, but with adjustments to the pound thresholds:

-

respondents are asked, as a benefit unit, to say which of several £ bands their total level of savings and investments are in

-

benefit units that report between £1,500 and less than £30,000 (£20,000 in 2019 to 2020) (42% of benefit units) are then asked, for each of their accounts and assets, how much each is worth and how much interest they accrue. The total level of savings and investments is then calculated using this set of reported values

-

benefit units with reported savings and investments outside those limits – below £1,500 or above £30,000 (£20,000 in 2019 to 2020) (58% of benefit units) – are only asked how much interest each account and asset accrue. These respondents are also asked to estimate the value of all their current accounts and basic bank accounts combined

It should be noted that in April and May question changes that were approved prior to the coronavirus (COVID-19) pandemic were included within the questionnaire. For interviews in these two months respondents with estimated total assets of between the wider scope of £100 and £30,000 and benefit units where respondent (or partner) were of State Pension age with reported total assets between £100 and £200,000, answered the ‘Benefit Unit’s Assets block of questions with more detail about their savings and investments.

There was also an in-year change to the questionnaire, to reduce respondent burden for a telephone interview, which is outlined in the later section on Questionnaire Changes. From June onwards, this reversed the approach of April and May 2020, where routing was decided by virtue of the respondent being State Pension age or otherwise. The routing bracket for estimated savings should have returned to £1,500 to £30,000.

However, due to the complexities of the software routing, this was only partially successful as a mid-survey exercise, meaning that many households who should have been asked to report their “Estimated value of current accounts/investments” were not. The survey therefore collected no information on the value of a household’s current and basic bank accounts for these interviews.

As is standard for missing survey responses, this missing data was imputed to ensure that the amount of savings / investments held by each household has not been under-estimated. Levels of imputation are shown in Methodology Table M.4.

Self employment

It is difficult to calculate current-year income for the self-employed. In line with international standards, the FRS calculates self-employed income from the profit data for a previous tax year or regular self-employment income over the past twelve months. Whilst this provides less of an issue when incomes are broadly stable, this was more of a challenge in 2020 to 2021 given the sharp changes in self-employed incomes caused by the pandemic.

The survey has also had to adapt to several forms of government assistance for the self-employed:

- for those claiming Universal Credit (UC), the government announced that from 6 April 2020 the Minimum Income Floor would be temporarily relaxed. Self-employed people claiming UC would thereafter have their UC calculation based on their submitted earnings and not the Minimum Income Floor. It follows that where FRS incomes include UC, that UC payment will include the additional amount

- the government introduced the Self-Employment Income Support Scheme (SEISS) to help the self-employed who were affected by the coronavirus (COVID-19) pandemic. Although the FRS specifically asked about receipt of SEISS grants from June 2020, self-employed income amounts reported in the FRS do not include the grants received from SEISS. This means that household and individual income amounts do not directly include grants received from SEISS

The expected impact of SEISS in reporting levels and characteristics of self-employment is that people will remain as self-employed but may class themselves as temporarily away from work and record no hours of employment. However, as under the terms of the scheme, they can continue to work or take on other employment, their economic status and number of hours worked may change during the scheme’s lifespan. This may affect the reporting of self-employed income.

The FRS asks a detailed set of questions to capture earnings from self-employment, as described in the Glossary, at the end of this document.

The FRS does not fully capture information on all types of income in kind accurately – for example, benefits of vehicles, computers and mobile phones purchased by the business – that are also for personal use. And these benefits are likely to be more important for the self-employed than for employees. Therefore, the FRS earnings measures are likely to underestimate the true monetary and other benefits of self-employment. However, it is very difficult to quantify this.

Other benefits of self-employment compared to employment are not captured, such as flexibility in working patterns, independence and flexibility in the way money is drawn from the business. The complexity of self-employment circumstances, with irregular income and benefits-in-kind coming from a range of sources, could also contribute to inaccuracy of information capture.

One of the significant advantages of the FRS is that it has captured self-employment in a consistent way over time. Therefore, the trends in self-employment compared to employment are likely to be reasonably accurate.

The Labour Force Survey is considered the definitive source where numbers participating in the labour market are concerned. It has previously been recognised that the FRS does undercount the number of people reporting self-employment compared to the LFS. This is still the case, although where previously the trends and proportions by gender were consistent across the two surveys, in 2020 to 2021 both overall and for female respondents, the fall in the numbers of self-employed is larger for the FRS than in the LFS. Correspondingly, there is a large difference in the percentage decrease in both groups, and especially for female respondents only.

For self-employed individuals, net income figures are presented after any deductions which include, but are not limited to tax, National Insurance and pension contributions. Where gross income figures are presented these include all of these elements.

Household Food Security

Restrictions put in place due to the pandemic may have influenced the requirement for and the opportunity to buy food as easily as before the pandemic.

Since the introduction of questions on household food security in the 2019 to 2020 survey year the FRS continues to provide evidence on the standing of households in relation to their food security. Household Food Security is a measure of whether households have sufficient food to facilitate an active and healthy lifestyle. Questions are asked of the person in the household who knows the most about buying and preparing food. In common with the rest of the FRS, the focus is on the period immediately before the interview (30 days).

The questions are comparable to those used by other public bodies in the UK, and also internationally. The following points should be noted when interpreting these statistics:

-

where a household is food insecure, information about the individual experiences of food insecurity within the household is not available. A young child’s experience in a food insecure household may be very different from their parent’s, for example

-

these statistics do not directly measure hunger. They instead explore the financial situation of households and how that affects their access to food. Only households with very low food security would anticipate substantive disruption to their food intake

For further information see the Glossary section and the relevant publication tables.

Adjusting for inflation

Some figures in the main FRS report and the accompanying tables combine several years of income data. In these circumstances, uprating factors are used to adjust for inflation by bringing values from previous years into current price terms.

Since the 2014 to 2015 FRS, the Consumer Price Index (CPI) has been used to adjust for inflation. Read more information concerning this methodological change

5. Policy changes for the year 2020 to 2021

Council Tax

The Department for Levelling Up, Housing and Communities estimated that the average Band D tax set by local authorities in England for 2020 to 2021 represented an increase of 3.9% from 2019 to 2020 levels.

In Wales, the average Band D council tax for 2020-21 increased by 4.8% from 2019 to 2020 levels.

In Scotland, the average Band D council tax for 2020-21 represented an increase of 4.8% from 2019 to 2020 levels.

In Northern Ireland, the domestic Regional Rate was frozen for 2020 to 2021. Consequently, it was no higher for 2020 to 2021 than for 2019 to 2020.

Housing Support for private renters

In April 2020, Local Housing Allowance rates were made more generous, as they increased to the 30th percentile of market rents.

National Living Wage

In April 2020, the National Living Wage increased to £8.72 per hour for employees aged 25 years and over. Employees aged under 25 years continued to receive the National Minimum Wage. In April 2020, the National Minimum Wage increased to £8.20 per hour for those aged 21 to 24 years, £6.45 per hour for those aged 18 to 20 years, £4.55 per hour for those aged under 18 years and £4.15 per hour for apprentices.

State Pension

In October 2020, the State Pension age increased to 66 years for both men and women.

Pensioner TV licences

From 1 August 2020, anyone who was aged 75 years or over and received Pension Credit was entitled to a free TV licence.

Universal Credit £20 uplift

From April 2020, the government increased the standard allowance in Universal Credit by £1,040.04 per year and the basic element in Working Tax Credit by £1,045 per year. Both new and existing Universal Credit claimants and existing Working Tax Credit claimants received an additional £20 per week on top of annual uprating.

Universal Credit removal of Minimum Income Floor for self-employed people

Between April 2020 and July 2021, the government temporarily suspended the Minimum Income Floor (MIF) so that a drop in a claimant’s earnings was reflected in their monthly Universal Credit payment.

Severe Disability Premium transitional payments

From 27 January 2021, the Severe Disability Premium (SDP) Gateway was removed. SDP recipients would instead claim Universal Credit from this date onwards.

The SDP transitional payments were introduced for those who were entitled to the SDP and migrated to Universal Credit before the SDP Gateway commenced on 16 January 2019. These payments comprised of the following:

- £285 a month for single claimants who were not receiving the Universal Credit limited capability for work and work-related activity (LCWRA) addition

- £120 a month for single claimants who were receiving the LCWRA addition

- £405 a month for joint claimants who were receiving the higher couple rate SDP in their legacy benefit

- £285 a month for joint claimants who were receiving the lower couple rate SDP and were not receiving the LCWRA addition in UC

- £120 a month for joint claimants who were receiving the lower couple rate SDP and were receiving the LCWRA addition in UC

- an additional lump-sum payment to encompass the time period since the claimant moved onto Universal Credit

Up-rating

For 2020 to 2021, the uprating of inflation-linked benefit and tax credit rates resumed.

This resulted in an increase of 1.7% which was consistent with the Consumer Prices Index (CPI). This followed a four-year period from 2016 to 2020 where most working-age benefits including Jobseeker’s Allowance, Income Support, Universal Credit, Employment and Support Allowance and Housing Benefit; Child Benefit and some elements of Tax Credit were frozen at their 2015 to 2016 values.

Benefits for carers were excluded from the freeze and continued to be up-rated in line with prices during the period from 2016 to 2020.

In April 2020:

- the State Pension increased by average weekly earnings of 3.9% in line with the ‘triple lock’. The ‘triple lock’ ensured that in 2020-21 the State Pension increased by the highest of the increase in earnings, price inflation as measured by the CPI or 2.5%

- the Standard Minimum Guarantee in Pension Credit was up-rated by 3.9% in line with earnings. For those who were single, the Standard Minimum Guarantee in Pension Credit increased from £167.25 per week to £173.75 per week which was a cash increase of £6.50. For couples, this increased from £255.25 per week to £265.20 per week which was a cash increase of £9.95

- Universal Credit Work Allowances were up-rated in line with CPI

Rent and mortgage payments

On 17 March 2020, the Government announced that anyone struggling to pay their mortgage or rent as a result of the coronavirus (COVID-19) pandemic, as well as landlords with buy-to-let mortgages whose tenants were unable to pay the rent could apply for a payment holiday. Mortgage holidays were initially set to run until October 2020 but were then extended to 31 July 2021.

Payment holidays could either last up to three months or up to six months. For those continuing to struggle financially once their payment holiday had ended, lenders should have provided additional support through tailored forbearance options.

Landlords and lenders were prevented from evicting those occupying their properties by the Coronavirus Act 2020. From March 2020 to September 2020, housing possession action was suspended in courts and a ban on repossessions was in place from November 2020 until the end of May 2021.

Self-Employment Income Support Scheme

The Government introduced the Self-Employment Income Support Scheme (SEISS) to help self-employed individuals who were affected by coronavirus (COVID-19). SEISS is for people who are self-employed or a member of a partnership in the UK and have lost income because of coronavirus (COVID-19). The first round of the SEISS paid taxable grants worth 80% of the claimant’s average monthly trading profit, up to £7,500 in total, and covered a three-month period.

The government announced the second round of SEISS in May 2020 with taxable grants worth 70% of the claimant’s average monthly trading profit, up to £6,570 in total, and encompassing a three-month period.

In September 2020, the Government announced an extension to the SEISS which firstly covered from November 2020 to January 2021 and then from February 2021 to April 2021. The first of these two grants was worth 80% of the claimant’s average monthly trading profit, up to £7,500 in total, and the second was partly determined by the amount that claimant’s turnover had reduced from April 2020 to April 2021.

‘Furlough’: Coronavirus Job Retention Scheme

In March 2020, the government announced the Coronavirus Job Retention Scheme (CJRS). Employers who were unable to maintain their workforce because of the coronavirus (COVID-19) pandemic could put their employees on furlough and apply for a grant. Government and employer contributions varied during the scheme to ensure that an employee received at least 80% of their monthly wage, up to £2,500 a month, including National Insurance and any pension contributions. This scheme was in place from March 2020 to September 2021.

6. Alternative data sources

Income

A Guide to Sources of Data on Earnings and Income

The Income and Earnings Interactive Tool where you can filter by government department and country of interest to find relevant statistics

The Effects of Taxes and Benefits on Households

Income, spending and wealth: how do you compare? – joined-up data from the Wealth and Assets Survey (WAS) and the Living Costs and Food Survey (LCF) providing insight into the financial vulnerability of different households.

Annual Survey of Hours and Earnings

Benefits statistics on Stat-Xplore

Households Below Average Income on Stat-Xplore

Pensioners’ Incomes Series on Stat-Xplore

Income Dynamics: Income movements and persistence of low incomes

ONS: explanation of incomes and earnings

Changing trends and recent shortages in the labour market, UK: 2016 to 2021

Tenure

English Private Landlords Survey 2018

Index of Private Housing Rental Prices

Housing affordability in England and Wales: 2021

Rent affordability: Literature and evidence review: 2019

More information about housing statistics Housing and planning statistics

Disability

Outcomes for disabled people in the UK: 2021

The employment of disabled people 2021

Labour market data for protected groups in Wales and the UK, April 2004 to March 2021

Disabled people in the labour market in Scotland: 2019

Disability Employment Gap in Northern Ireland 2020

Care

Department of Health Personal Social Services survey of adult carers in England

Health and care statistics for England

Pension Participation

Occupational Pension Schemes Survey

Note that the collection and publication of the annual Occupational Pension Schemes Survey (OPSS) has ceased. A quarterly publication has superseded this Employers’ Pension Provision Survey

The Pensions Regulator – DC Trust: a presentation of scheme return data

English Longitudinal Study of Ageing Wave 9: 2002-2019

Annual Survey of Hours and Earnings (pension tables)

Self Employment

Trends in self-employment in the UK

Labour Market overview UK (including breakdown of the self-employed)

Household Food Security

The Food and You 2 Survey - Wave 3: Combined report for England, Wales and Northern Ireland

7. Population and sample selection methodology

The FRS sample is designed to be representative of private households in the United Kingdom.

The sampling frame and selection methods for the FRS did not change in response to the coronavirus (COVID-19) pandemic.

The sampling frame in Great Britain

The Great Britain FRS sample is drawn from the Royal Mail’s small users Postcode Address File (PAF). The small users PAF is limited to addresses which receive, on average, fewer than 50 items of post per day and which are not flagged with Royal Mail’s “organisation code”. An updated version of this list is obtained twice a year. By using only the small-user delivery points most large institutions and businesses are excluded from the sample. Small-user delivery points which are flagged as small business addresses are also excluded. However, some small businesses and other ineligible addresses remain on the sampling frame. If sampled, they are recorded as ineligible once the interviewer verifies that no private household lives there.

The sample design in Great Britain

The Great Britain FRS uses a stratified clustered probability sample design. The survey samples 1,417 postcode sectors, from around 9,200 in Great Britain, with a probability of selection that is proportional to size. Each postcode sector is known as a Primary Sampling Unit (PSU).

The PSUs are stratified by 27 regions and three other variables, described below, derived from the 2011 Census of Population. Stratifying ensures that the proportions of the sample falling into each group reflect those of the population.

Within each region the postcode sectors are ranked and grouped into eight equal bands using the proportion of households where the household reference person (HRP) is in National Statistics Socio-Economic Classification (NS-SEC) 1 to 3. Within each of these eight bands, the PSUs are ranked by the proportion of economically active adults aged 16-74 and formed into two further bands, resulting in sixteen bands for each region. These are then ranked according to the proportion of economically active men aged 16-74 who are unemployed. This set of stratifiers is chosen to have maximum effectiveness on the accuracy of two key variables: household income and housing costs. The table below summarises the stratification variables.

Within each PSU a sample of addresses is selected. In 2020 to 2021, 28 addresses were selected per PSU. The total Great Britain set sample size in 2020 to 2021 was 39,676 addresses. Each address had approximately a 1-in-713 chance of being included in the survey. For England and Wales each address had approximately a 1-in-780 chance of inclusion in the survey. In order to improve the quality of estimates for Scotland, PSUs there are over-sampled. Approximately twice the numbers of PSUs were sampled in Scotland than would be required under an equal-probability sample of the UK. Therefore, 6,832 addresses were selected in Scotland, with approximately a 1-in-389 chance of being included in the survey.

FRS sample stratification variables for Great Britain

| Regions | 19 in England (inc. Metropolitan vs non-Metropolitan split |

| Regions | 4 in London |

| Regions | 2 in Wales |

| Regions | 6 in Scotland |

| The proportion of households where the HRP is in NS-SEC 1 to 3 | 8 equal bands |

| The proportion of economically active adults aged 16-74 | 2 equal bands |

| The proportion of economically active men aged 16-74 who are unemployed | Sorted within above bands |

Each year, half of the PSUs are retained from the previous year’s sample, but with new addresses chosen; for the other half of the sample, a fresh selection of PSUs is made (which in turn will be retained for the following year). This is to improve comparability between years.

The sampling frame in Northern Ireland

The sampling frame employed on the Northern Ireland FRS is the NISRA Address Register (NAR). The NAR is developed within NISRA and is primarily based on the Land and Property Services (LPS) Pointer database, the most comprehensive and authoritative address database in Northern Ireland, with approximately 752,000 address records available for selection.

The sample design in Northern Ireland

A systematic random sample of 4,080 addresses was selected for the 2020 to 2021 Northern Ireland FRS from the NISRA Address Register. Addresses are sorted by district council and ward, so the sample is effectively stratified geographically. Each address had approximately a 1-in-184 chance of being selected for the survey.

8. Data collection

Fieldwork operations for the Family Resources Survey (FRS) were rapidly changed in response to the coronavirus (COVID-19) pandemic and the subsequent introduction of national lockdown restrictions. The established face-to-face interviewing approach employed on the FRS was suspended and replaced with telephone interviewing for the whole of the 2020 to 2021 survey year.

Data collection in Great Britain

A consortium consisting of the Office for National Statistics (ONS) and NatCen Social Research conducts fieldwork for the FRS in Great Britain on behalf of the Department for Work and Pensions (DWP).

Each month the PSUs are systematically divided between the two organisations and then assigned to the field staff.

Fieldwork operations for the 2020 to 2021 FRS were changed in response to the coronavirus (COVID-19) pandemic and the social distancing measures that were implemented in Spring 2020. The normal FRS approach of interviewing face-to-face was suspended and changed to a telephone interview from April 2020 to ensure that there was no face-to-face contact between interviewers and respondents. Interviewers who would ordinarily conduct the survey in the respondent’s home changed approach to interviewing by telephone, whilst working from their own homes.

A number of operational changes were introduced to the FRS in order to facilitate this switch to phone interviewing. Other measures were subsequently put in place with the aim of improving response.

Before interviewers contacted the selected addresses, a letter was sent to the occupier explaining that they had been chosen for the survey and that how they should provide their contact phone number in preparation for a telephone interview. The letter also explained that the survey relies on the voluntary co-operation of respondents and emphasised that information given in the interview would be treated in the strictest confidence and used only for research and statistical analysis purposes. As a token of appreciation and to encourage participation, a £10 Post Office voucher was included with the letter.

Respondents were offered various options to provide their telephone numbers, including an online portal, which was set up in May 2020. Telephone numbers for sampled addresses were also obtained where possible to supplement those provided directly by respondents. This included telematching sourced via ‘UKChanges’, which ONS adopted from April and NatCen introduced in June. In September, additional telephone numbers were sourced by matching the FRS sample with telephone numbers held on DWP’s internal databases and other administrative systems.

From November, and where local lockdown restrictions allowed, interviewers who had agreed to take part in “Knock to Nudge” visited addresses for which they had not received any contact details. The aim was to collect a phone number in person and make an appointment for a later phone interview. It should be noted that the success of this by geographical region may have been affected by local lockdown restrictions that existed between the specific lockdown in Leicester in July 2020, followed by the tier system that began in October 2020 and lasted until March 2021 (interspersed with National lockdown restrictions).

ONS interviewers remained available for work throughout 2020 to 2021 and therefore all cases (i.e. those with and without telephone numbers) were issued as sampled to interviewers at the start of data collection. When a telephone number became available for a case (either via the portal or through telematching), it was supplied to the interviewer who had been assigned the case for them to attempt to make contact. ONS interviewers also received some contact numbers directly from respondents in response to the “introductory” letter they sent out.

A proportion of NatCen interviewers were initially put on furlough and therefore unable to work. NatCen therefore took a different approach, whereby those cases which had “opted in” (i.e. got in touch via the central freephone number, central email address or online portal to provide a contact number) were prioritised and issued to a central pool of interviewers. Once the portal had been closed and all cases with contact details sourced in this way had been issued to interviewers, a review of the cases which had been successfully tele-matched was carried out. Any cases which had not already been successfully contacted were identified and issued in further batches to interviewers for them to attempt to contact.

Until November, those NatCen cases for which no contact telephone number was available from either source were not routinely issued to interviewers, since they would have no means of attempting contact. From November, all cases with no portal number available were issued to interviewers and included in the doorstep recruitment, subject to field capacity and local lockdown restrictions.

Data collection in Northern Ireland

In Northern Ireland the sampling and fieldwork for the survey are carried out by the Central Survey Unit at the Northern Ireland Statistics and Research Agency. The responsibilities for programming the survey questionnaire, making annual modifications, initial data processing and data delivery are retained within ONS and NatCen.

NISRA interviewers remained available for work throughout 2020 to 2021 and therefore all cases were issued as sampled to interviewers at the start of data collection. When a telephone number became available for a case via the portal it was supplied to the interviewer who had been assigned the case. NISRA interviewers also received some contact numbers directly from respondents in response to the “follow-up” letter issued to addresses in which they provided respondents with their own contact number. However, telematching was not used as a supplementary source of telephone numbers in Northern Ireland and “Knock to Nudge” was not rolled out to NISRA interviewers.

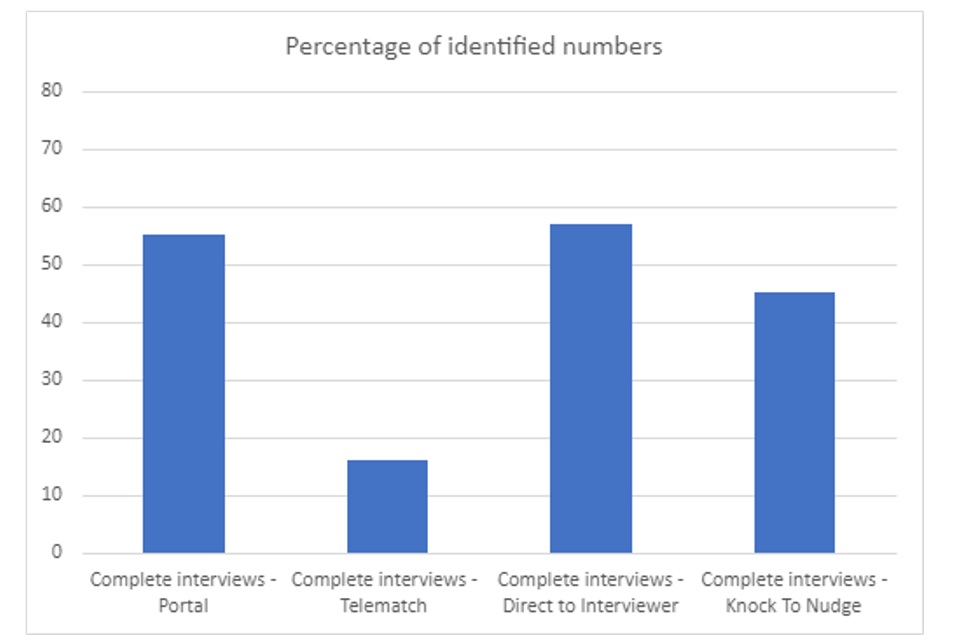

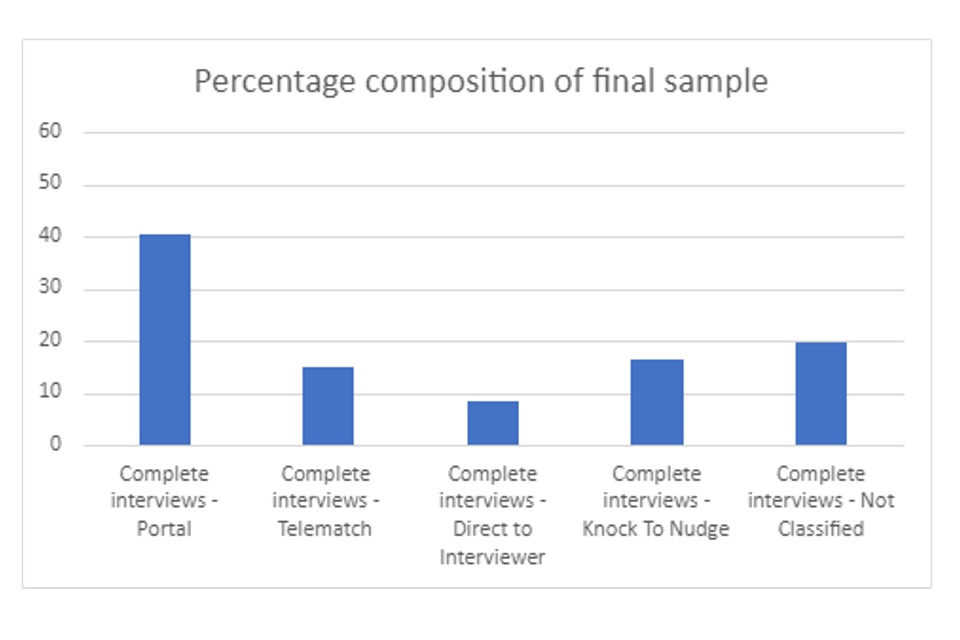

Success rates of different methods of contacting respondents

Composition of final sample, by mode of contact

In April, May and June the mode of contact was not collected in the data. Therefore these are represented here as “Not Classified”.

Length of interview

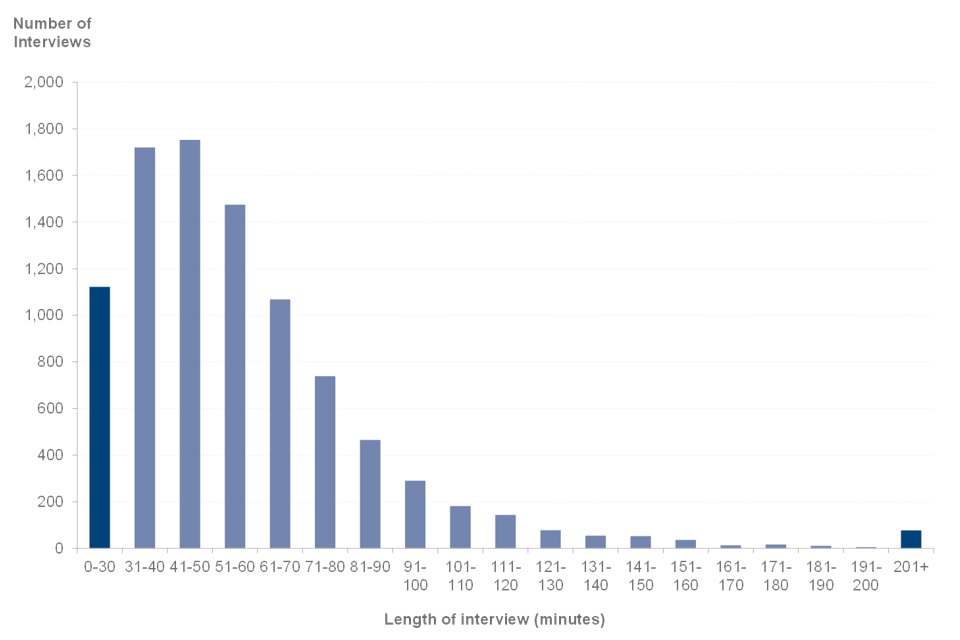

Due to the coronavirus (COVID-19) restrictions interviews were conducted by telephone for the whole of the 2020 to 2021 survey year and questions required for monitoring the impact of the pandemic (e.g. questions on the furlough scheme) were added to the questionnaire from May onwards.

The length of each fully co-operating interview is recorded by the questionnaire program. In 2020 to 2021 the median interview length for Great Britain was 52 minutes, but the time varied according to the size of household and its circumstances. The distribution of interview lengths in Great Britain is shown below, with full data in Methodology Table M.7. The timings exclude interviewer time spent preparing for and completing administration tasks after the interview. They are based on completed audit data from 9,299 fully productive ONS and NatCen interviews.

Distribution of FRS interview lengths, 2020 to 2021, Great Britain

Respondent Burden

The Code of Practice for Statistics states that producers of statistics should consider the burden on survey respondents. The FRS can measure the burden placed on respondents by using measured interview times for 9,299 full interviews, in Great Britain.

Great Britain Respondent burden is calculated as Number of responses x median interview time.

The median interview time for these 9,299 interviews was 51.9 minutes. Therefore, the respondent burden for the FRS in 2020 to 21 was 482,618 minutes [335 days].

Multi-household procedures

If more than one household receives mail at an address a single household is interviewed. Multi households are not selected in Northern Ireland.

9. The FRS questionnaire

Changes to the FRS questionnaire were made during the fieldwork year to collect information on new government support initiatives, and to manage respondent burden for a telephone survey. This was important to enable the statistics to reflect changes in the economy and society in response to the pandemic, and to inform policy. Due to the impact of coronavirus (COVID-19) FRS interviews were conducted using Computer Assisted Telephone Interviewing (CATI) during 2020 to 2021.

The questionnaire is divided into three parts.

-

the first part is the household schedule which is addressed to one person in the household (usually the household reference person, although other members are encouraged to be present) and mainly asks household level information, such as relationships of individuals to each other, tenure and housing costs

-

next is the individual schedule which is addressed to each adult in turn and asks questions about employment, benefits, pensions, investments, and other income. Information on children in the household is collected by proxy from a responsible adult

-

a final section asks the value of investments (by type) for respondents with savings between a lower and an upper pound limit

Interviewers new to the FRS are briefed on the questionnaire and an annual re-briefing is given to all interviewers on changes to the questionnaire. For 2020 to 2021 additional training was provided to interviewers on key aspects of the questionnaire to be aware of with respect to telephone interviewing. This included how to ask questions which were designed to reference showcards, including:

-

adapting the question wording to avoid mentioning the showcard

-

for most questions simply reading aloud all responses as listed on the showcard

-

some further specific guidance for certain questions with unusually long showcards

Recommended approaches for collecting information from two-person benefit units were also covered, ideally speaking to both respondents at once (for example, via speakerphone or two handsets).

Interviewers who have worked on the survey for some time also completed a written field report each year, describing their experiences with specific parts of the questionnaire and commenting on how changes were received in the field.

Prior to the start of fieldwork, DWP consults FRS users and draws up a list of possible questionnaire changes. Users are asked to identify individual questions or sections which were no longer of interest. The FRS questionnaire is lengthy and demanding and a key concern is, where possible, to reduce (or at least not increase) its length, so as not to overburden respondents or interviewers.

As part of the process of agreeing annual changes, suggestions from contractors are also considered, as well as those arising from an evaluation of feedback from interviewers. Any changes to the questionnaire are checked for consistency with the harmonised standards for social surveys across government.

Questionnaire changes

Whilst the questionnaire was largely unchanged from the previous 2019 to 2020 survey year, a number of changes were made in response to collecting data on the coronavirus (COVID-19) pandemic. This included the reversal, from June onwards, of some changes which had been introduced in April 2020, to reduce respondent burden on a telephone interview while maintaining core FRS questions.

Employment Status block – May

The most significant change was the introduction of questions around the CJRS ‘furlough’ scheme; and for those who were put on furlough in their main job, to clarify answers to the preceding question about whether they were working in the week they were interviewed.

Further changes to several Questionnaire blocks – June

Changes were introduced to capture several other COVID-19 related policy measures. These included questions within the Self-Employed Earnings block to capture Self-Employment Income Support Scheme (SEISS) grants, both applied for and received. There were additions to the Employee Pay Details block to capture furlough in second jobs if the respondent had more than one job as an employee.

There was an insertion to the Owned Accommodation and Mortgages block to ask whether the householder had taken a mortgage holiday.

In the State & Other Benefits and Pensions block, the question on receipt of Employment and Support Allowance was supplemented by asking whether receipt was due to coronavirus (COVID-19). A similar approach was taken to the Statutory Sick Pay question in the Employment Status block.

Total Assets block – April and May

All benefit units were asked the Reported Total Savings (TOTSAV) question. Depending on their answer, they might be routed to the more detailed asset-by-asset block of questions. This would be the case if they reported total assets of:

- between £100 and £30,000, where the respondent (and any partner) were (both) below State Pension age

- between £100 and £200,000, if the respondent (or their partner) were over State Pension age

This addition to the 2020-21 questionnaire was intended to yield more detailed information from working-age benefit units with assets, and for the first time from those with between £100 to £1,500 and £20,000 to £30,000. It also aimed to capture information on the high proportion of pensioner benefit units who report more than £30,000 in savings.

Total Assets block – from June

The routing of these questions was largely reverted to the setup of the previous survey year, such that the lower limit reverted from £100 to £1,500, and the age distinction was removed. However the upper limit was retained at £30,000 (previously £20,000). This allowed the new bands on the survey showcard to stay unaltered.

For all benefit units – regardless of age – who responded that they had between £1,500 and £30,000 in assets, the subsequent questions on asset-by-asset values were retained.

Debt block

Several new questions on personal debt, including personal loans and credit card debt, were introduced in April 2020. These were removed from June to reduce interview length.

Expenditure block

The Expenditure block of questions was suspended from June, for the remainder of the survey year. This was to save interview time, which was given to new questions relating to coronavirus (COVID-19).

Other changes

Numerous minor updates and changes to the questionnaire were made in response to feedback from interviewers on the operation of the questionnaire. Changes also stemmed from categories or definitions which were new for the 2020 to 2021 survey year. These included changes in relation to areas of policy overseen by the devolved administrations.

As in every survey year, a small number of removals were made, of questions which were either no longer relevant, or which were answered by too small a pool of respondents to yield useful information.

Consultation of documentation

Interviewers encourage respondents to consult documentation at all stages of the interview to ensure that the answers provided are as accurate as possible. For some items whether certain documents are consulted or not is recorded on the questionnaire. This assists FRS users in assessing the accuracy of the data.

It should be noted that due to the switch to telephone interviewing in 2020 to 2021 the consultation rates reported below may be less reliable than for face-to-face interviewing as the interviewer was not able to observe directly whether documents were being checked.

- employees have consulted their latest payslip for 32% of jobs they have reported. Of all employees, 96% reported having one job only and four per cent reported having more than one job

- employees did not have a payslip to consult for 9% of jobs they reported; 27% could not consult a payslip because their payslips were only received electronically

- 63% of all reported benefit and payable Tax Credit receipt involved consultation of documentation (that is, a letter from DWP or HM Revenue and Customs, or a bank statement)

- 55% of households in Great Britain consulted a Council Tax bill or statement in answering questions on their Council Tax payments

Response

In each eligible household, the aim is to interview all adults aged 16 and over, except those aged 16 to 19 who are classed as dependent children. A household is defined as fully co-operating when it meets this requirement and there are fewer than 13 ‘don’t know’ or ‘refusal’ answers to monetary amount questions in the benefit unit schedule (i.e. excluding the assets section of the questionnaire).

Proxy interviews are accepted when a household member is unavailable for interview. In 2020 to 2021, for those households classed as fully co-operating, proxy responses were obtained for 25% of adults. It should be noted that all data shown in the main body of this publication refer only to fully co-operating households.

Households that are not fully co-operating are further classified as partially co-operating, refusals, or unable to make contact. To be classified as partially co-operating a full interview has to be obtained from the Household Reference Person’s (HRP’s) benefit unit.

Methodology Table M.1 summarises the household response.

The UK-wide sample chosen for 2020-21 consisted of 43,756 households. In total 10,020 households UK-wide fully co-operated (23%), 244 partially co-operated (one per cent) and 7,855 refused to proceed with the interview (18%). The interviewer was unable to make contact with 25,637 households (59%).

Response rates are calculated as follows.

The number of fully co-operating households, multiplied by 100 / Divided by the number of eligible households after adjustment

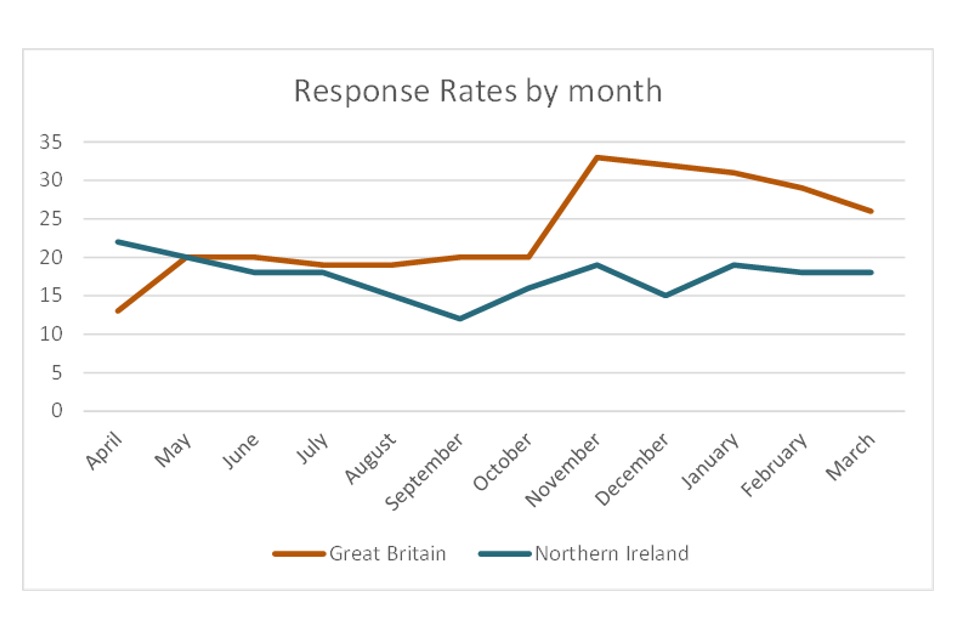

The overall response rate for the FRS in 2020 to 2021 was 23%.

The response rate varied by month as different methods of contacting respondents were introduced.

When respondents refuse to participate in the FRS, interviewers record up to three reasons for refusal. The most common reasons for refusal in 2020 to 2021 are shown in the following table.

Reasons for refusal to participate in the FRS, Great Britain, 2020 to 21

| Reason for refusal | Percentage of households |

|---|---|

| Couldn’t be bothered | 17 |

| Invasion of privacy | 15 |

| Concerns about confidentiality | 15 |

| Genuinely too busy | 10 |

| Don’t believe in surveys | 10 |

| Disliked survey of income | 8 |

| Personal problems | 6 |

| Anti-government | 2 |

| Temporarily too busy | 2 |

| Total number who gave a reason for refusal | 3,663 |

| Total number of refusals | 6,591 |

Methodology Table M.2 shows response rates broken down by region. All regions have seen a fall in response in 2020-21, which reflects the impact of coronavirus (COVID-19) on data collection and similar trends have been seen across other social surveys such as the Labour Force Survey and the Living Costs and Food Survey. The North East had the highest response rate in England, where 28% of all households selected responded fully. London had the lowest response rate where 17% of the chosen households fully co-operated.

Non-response

The lower the response rate to a survey, the greater the likelihood that those who responded are significantly unlike those who did not, and so the greater the risk of systematic bias in the survey results.

For a United Kingdom survey of the size and complexity of the FRS, the total non-response rate typically seen of around 50% is not considered unreasonable. However, given the impact of coronavirus (COVID-19) on data collection, the non-response rate for the 2020 to 2021 survey year was 77%.

Any information that can be obtained about non-respondents is useful both in terms of future attempts to improve the overall response rate and potentially in improving the weighting of the sample results.

Non-response form analysis

Direct information about the non-responding households is valuable, although by definition difficult to obtain.

In a normal survey year, some non-responding households who are not willing to take part in the full survey are willing to provide basic information by completing a non-response form. A detailed analysis of these forms is usually conducted to monitor characteristics of non-respondents and trends in non-response. However, due to the switch to telephone interviewing and other changes to field procedures introduced because of the coronavirus (COVID-19) pandemic, it was not possible for interviewers to record full non-response information during 2020 to 2021.

As interviewers were not able to visit sampled properties for most of the year, they were not able to record features such as barriers to entry that are relevant to non-response. They were also not able to record any observable characteristics of non-responding households such as the age and sex of non-responders.

FRS non-response and Council Tax band

Comparisons were made between the achieved sample of FRS responses in Great Britain, and 2020 to 2021 administrative data on the number of households within each Council Tax band.

Methodology Table M.3 shows that the achieved (ungrossed) FRS sample has a smaller proportion of households in the lower Council Tax bands than the administrative data.

Conversely, the ungrossed sample has a higher proportion of households in higher Council Tax bands than administrative data shows. Table M.3 also shows the extent to which the FRS grossing regime controls for this bias in the achieved sample, effectively correcting it to be closer to the proportions seen on the administrative data.

10. Validation, editing, conversion and imputation

In addition to unit non-response, where a household does not participate, a problem inherent in all large surveys is item non-response. This occurs when a household agrees to give an interview, but either does not know the answer to certain questions or refuses to answer them. This does not prevent them being classified as fully co-operating households because there is enough known data to be of good use to the analyst (although see the first paragraph of the Response section above for information about non-response to monetary questions).

The fact that the FRS allows missing values in the data collection can create problems for users, so missing values are imputed where appropriate. The policy is that for variables that are components of key derived variables, such as total household income and housing costs, and areas key to the work of DWP, such as benefit receipt, there should be no missing information in the final data.

In addition to imputation, prior to publication FRS data are put through several stages of validation and editing. This ensures the final data presented to the public are as accurate as possible.

The stages in the validation, editing, conversion and imputation process are as follows.

Stage one – the interview

One of the benefits of interviewing using CATI is that in-built checks can be made at the interview stage. This helps to check respondents’ responses and also that interviewers do not make keying errors. There are checks to ensure that amounts are within a valid range and also cross-checks which make sure that an answer does not contradict a previous response. However, it is not possible to check all potential inconsistencies, as this would slow down the interview to an unacceptable degree, and there are also capacity constraints on interviewer notes. FRS interviewers can override most checks if the answers are confirmed as accurate with respondents.

Stage two – post-interview checks

Once an interview has taken place, data are returned to ONS, NatCen, or NISRA. At this stage, editing takes place, based on any notes made by interviewers. Notes are made by the interviewer when a warning has been overridden, for example, where an amount is outside the expected range, but the respondent has documentation to prove it is correct. Office-based staff make editing decisions based on these notes. Other edits taking place at this stage are checking amounts of fixed-rate benefits and, where possible, separating multiple benefit payments into their constituent parts, such as separating Disability Living Allowance into the Care and Mobility components.

Stage three – data conversion