Farm rents in England 2022/23

Updated 23 January 2024

Applies to England

Data on farm rents are used by tenant farmers and landlords to set rents and by the Department for Environment, Food & Rural Affairs to inform decisions on statutory succession.

This release provides estimates of average annual farm rents in England paid under Full Agricultural Tenancies, Farm Business Tenancies, seasonal agreements and informal agreements for the average period 1 March 2022 to 28 February 2023, together with the area of land covered by these agreements.

The survey period covered the second year of the progressive reduction of the Basic Payment, which saw a 20% reduction on the first £30,000 of the payment and larger incremental deductions on the bigger payment bands (see Annex D of The Path to Sustainable Farming: An Agricultural Transition Plan 2021 to 2024).

For more detail on 2022/23 Farm Business Income, see Farm Accounts in England.

Key Terms

Full Agricultural Tenancy: Any agricultural tenancy agreed before 1 September 1995 is known as a Full Agricultural Tenancy (FAT). These tenancies usually have lifetime security of tenure and those granted before 12 July 1984 also carry statutory succession rights on death or retirement.

Farm Business Tenancy: A tenancy is a Farm Business Tenancy (FBT) if at least part of the tenanted land is farmed throughout the life of the tenancy. The tenancy must also meet one of these two conditions:

- if the tenancy is primarily agricultural to start with, the landlord and tenant can exchange notices before the tenancy begins confirming they intend it to remain a Farm Business Tenancy throughout; this allows tenants to diversify away from agriculture within the terms of the tenancy agreement

- if the landlord and tenant do not exchange notices before the tenancy begins, the tenancy business must be primarily agricultural to be considered a Farm Business Tenancy

Seasonal agreement: An agreement of less than 12 months.

Informal agreement: An agreement where there is no formal tenancy agreement but the land is part of the Utilised Agricultural Area (i.e. not seasonally let).

Points which apply throughout

- All figures relate to England unless otherwise stated and cover a beginning of March to end of February year, with the most recent year shown ending on 28 February 2023.

- To ensure consistency in harvest/crop year and commonality of subsidies within any one Farm Business Survey year, only farms which have accounting years ending between 31 December and 30 April inclusive are allowed into the survey. Aggregate results are presented in terms of an accounting year ending at the end of February; the approximate average of all farms in the Farm Business Survey. Thus the results relate, on average, to March to February years.

- The Farm Business Survey is the source for all data presented in tables and charts unless stated otherwise.

- All agreement types are expressed as either current or real term values:

- current (or nominal) values are the values expressed in historical monetary terms; from section 2 onwards, all prices are at current prices

- real term values are the current values adjusted to take inflation into account, scaled using a GDP deflator

- All downloadable datasets contain data back to the 2013/14 survey year and real term values not presented in the main report.

- The acronym ‘LFA’ refers to Less Favoured Area. These areas were established in 1975 to provide support to mountainous and hill farming areas. They are areas where the natural characteristics (geology, altitude, climate, short growing season, low soil fertility, or remoteness) make it difficult for farmers to compete.

- When ‘other farms’ are mentioned, they refer to the following farm types: mixed, horticulture, poultry and pig farms, which have been combined into one group due to small sample sizes.

- Calculations have been made using unrounded values and then rounded to the nearest whole number, unless stated otherwise.

Key Results

- The average annual rent for Full Agricultural Tenancy (FAT) agreements in 2022/23 had decreased by 7% from the previous year to £165 per hectare, the lowest it has been in the last 10 years. Of the different farm types, LFA grazing livestock farms saw the largest fall, decreasing by 27% to £52 per hectare.

- Farm Business Tenancy (FBT) agreements had marginally risen to £228 per hectare, a 1% increase. Other than cereals and general cropping farms, all farm types saw an increase in average annual rent per hectare.

- Seasonal agreements fell by 13% to an average annual rent of £158 per hectare, the lowest value across all agreement types. Cereal farms had the largest decrease of the different farm types, falling by 34% to £137 per hectare.

- Informal agreements saw a slight increase of 3% to £228 per hectare on average, its highest nominal value in the last decade. Amongst all farm types, dairy farms saw the largest rise of 29% to £334 per hectare.

1 All Agreement Types

The total number of farm tenancy agreements in 2022/23 was estimated to be approximately 86,500; a marginal decrease of 1% from the total number of agreements in 2021/22.

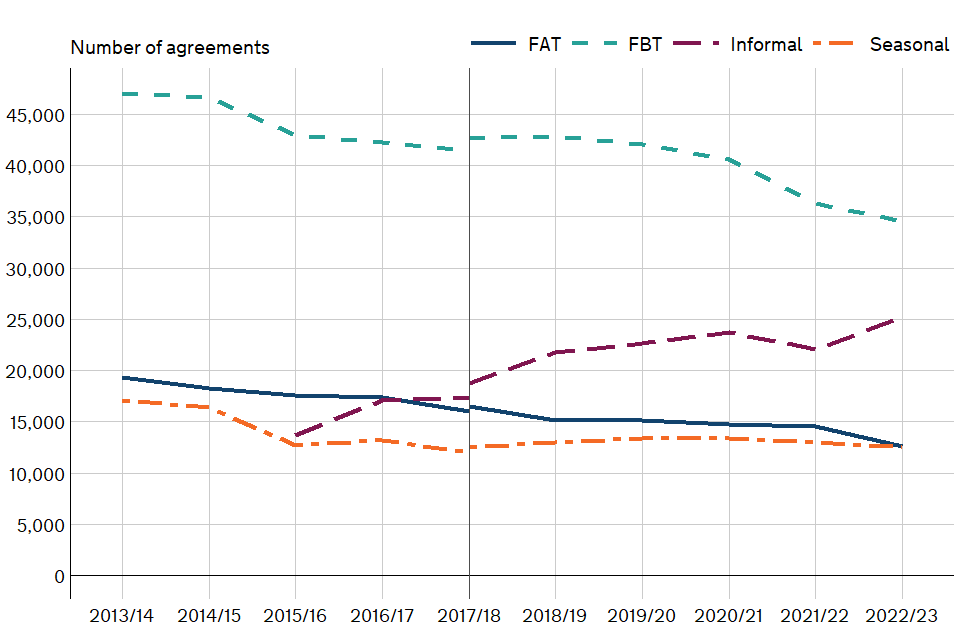

Figure 1.1 Total number of farm tenancy agreements by agreement type in England, 2013/14 to 2022/23

Figure notes:

- The break in the series shown in 2017/18 represents changes in the method used to assign farms to a specific farm type. At this break, average rent per hectare has been calculated using both methods for comparability.

- Before 2015/16, FBT included Farm Business Tenancies and similar informal agreements. Informal agreements in this context were those that are based on the same principles as an FBT but without the accompanying legal documentation.

View the data for this chart

Download the data for this chart

The breakdown of the total number of farm tenancy agreements by agreement type is shown in Figure 1.1. Between 2021/22 and 2022/23, all agreement types except informal agreements declined in number. The number of informal agreements rose by 14%.

1.1 Total Rent Paid

The total annual rent paid varies considerably between different farm tenancy agreements, with FBTs generally being on the higher end and seasonal agreements on the lower end.

Table 1.1 Total annual rent paid for farm tenancies at current prices in British pounds (£ millions) by agreement type in England, 2020/21 to 2022/23

| Tenancy | 2020/21 (£ millions) | 2021/22 (£ millions) | 2022/23 (£ millions) | % Change 2021/22 to 2022/23 | 95% Confidence Interval 2022/23 (£ millions) |

|---|---|---|---|---|---|

| FAT | 227 | 206 | 187 | -9% | 153 to 221 |

| FBT | 381 | 372 | 365 | -2% | 305 to 426 |

| Seasonal | 29 | 33 | 28 | -15% | 22 to 34 |

| Informal | 79 | 76 | 101 | +33% | 80 to 123 |

| All | 734 | 714 | 746 | +4% | 666 to 825 |

Table notes:

- 95% Confidence Intervals are presented to illustrate the range within which the true underlying population average is likely to reside, which provides an indication for the level of uncertainty associated with the sample estimate; see section 7.2 for more details.

- There is considerable variation within and between all agreement types, hence the wide confidence intervals.

- Values have been rounded to the nearest whole number.

- All agreements includes other agreements not shown individually, so these totals may not necessarily agree with the sum of their components.

Download the data for this table

Table 1.1 shows that between 2021/22 and 2022/23, the total annual rent (at current prices) paid under FATs had decreased by 9% to £187 million, whilst for FBTs it slightly fell by 2% to £365 million. Seasonal agreements had decreased by 15% to £28 million, and informal agreements had in comparison substantially risen by 33% to £101 million.

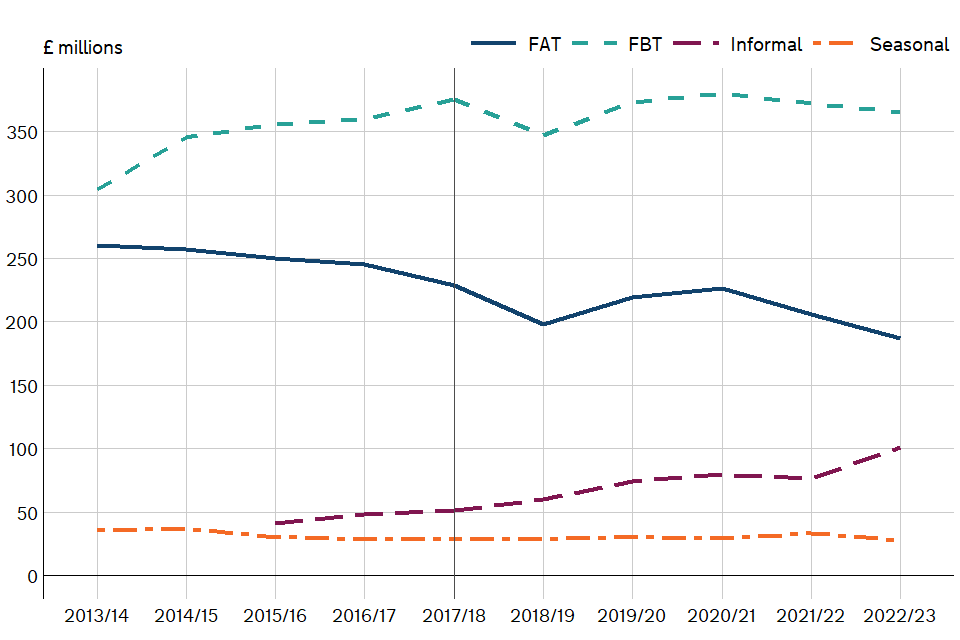

Figure 1.2 Total annual rent paid for farm tenancies at current prices in British pounds (£ millions), by agreement type in England, 2013/14 to 2022/23

Figure notes:

- The break in the series shown in 2017/18 represents changes in the method used to assign farms to a specific farm type. At this break, the total annual rent paid has been calculated using both methods for comparability.

- Before 2015/16, FBT included Farm Business Tenancies and similar informal agreements. Informal agreements in this context were those that are based on the same principles as an FBT but without the accompanying legal documentation.

View the data for this chart

Download the data for this chart

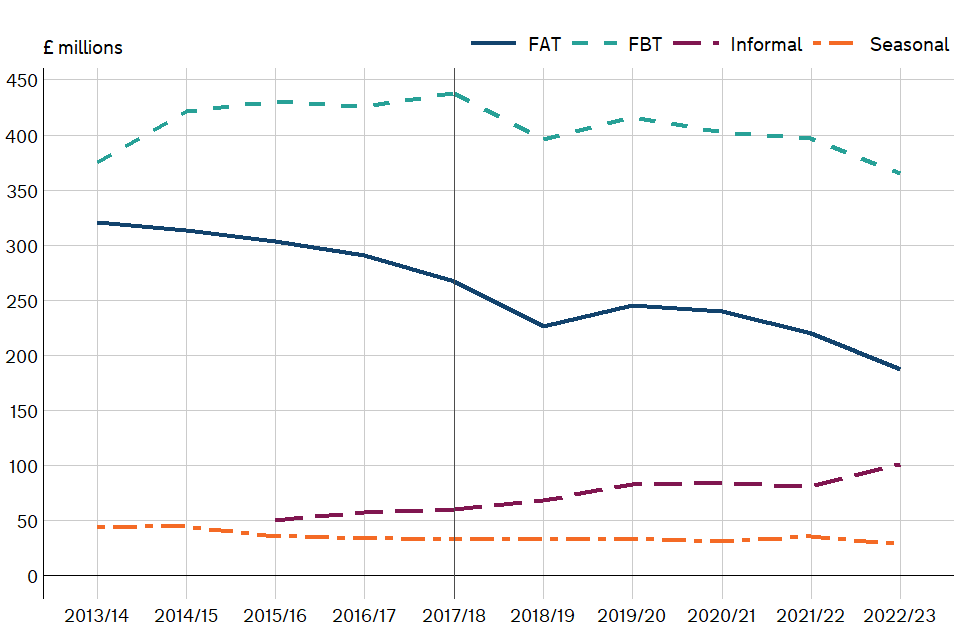

Figure 1.3 Total annual rent paid for farm tenancies at real term 2022/23 prices in British pounds (£ millions) by agreement type in England, 2013/14 to 2022/23

Figure notes:

- The break in the series shown in 2017/18 represents changes in the method used to assign farms to a specific farm type. At this break, the total rent paid has been calculated using both methods for comparability.

- Before 2015/16, FBT included Farm Business Tenancies and similar informal agreements. Informal agreements in this context were those that are based on the same principles as an FBT but without the accompanying legal documentation.

- Real terms prices use the latest GDP deflator data, published 22 December 2023.

View the data for this chart

Download the data for this chart

Figures 1.2 and 1.3 show that the overall trend of total annual rent paid in both current and real term prices are generally consistent. In all years, FBTs had the highest rent paid and seasonal agreements had the lowest. In real terms, the rent paid on both FBTs and seasonal agreements has been relatively stable over the years. Conversely, the difference between total rent paid on FATs and informal agreements, which was initially large, has been getting smaller due to rent paid on FATs decreasing and rent paid on informal agreements increasing.

1.2 Average Rent Paid per Hectare

There is generally less variation in the average annual rent paid per hectare between farm tenancy agreements, though it tends to be higher for FBTs and informal agreements than for FATs and seasonal agreements.

Table 1.2 Average annual rents for farm tenancies at current prices in British pounds per hectare (£/ha) by agreement type in England, 2020/21 to 2022/23

| Tenancy | 2020/21 (£/ha) | 2021/22 (£/ha) | 2022/23 (£/ha) | % Change 2021/22 to 2022/23 | 95% Confidence Interval 2022/23 (£/ha) |

|---|---|---|---|---|---|

| FAT | 185 | 177 | 165 | -7% | 126 to 203 |

| FBT | 239 | 225 | 228 | +1% | 205 to 251 |

| Seasonal | 151 | 181 | 158 | -13% | 140 to 177 |

| Informal | 219 | 221 | 228 | +3% | 197 to 259 |

| All | 213 | 208 | 213 | +2% | 192 to 233 |

Table notes:

- 95% Confidence Intervals are presented to illustrate the range within which the true underlying population average is likely to reside, which provides an indication for the level of uncertainty associated with the sample estimate; see section 7.2 for more details.

- Values have been rounded to the nearest whole number.

Download the data for this table

Table 1.2 shows that between 2021/22 and 2022/23, the average annual rent (at current prices) paid under FATs had decreased by 7% to £165 per hectare, whilst for FBTs it marginally rose by 1% to £228 per hectare. Seasonal agreements had decreased by 13% to £158 per hectare, while in comparison informal agreements had slightly risen by 3% to £228 per hectare.

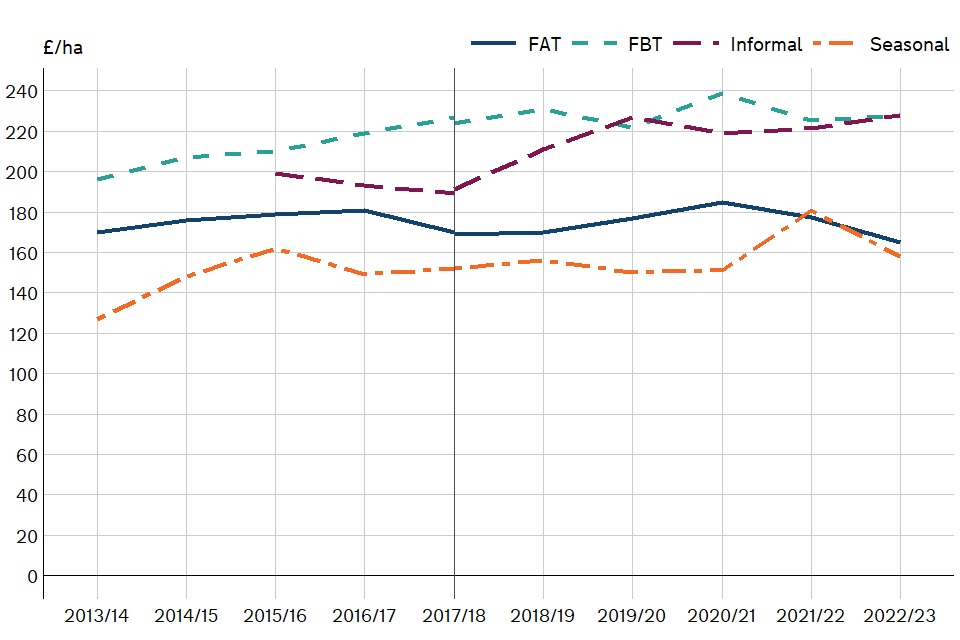

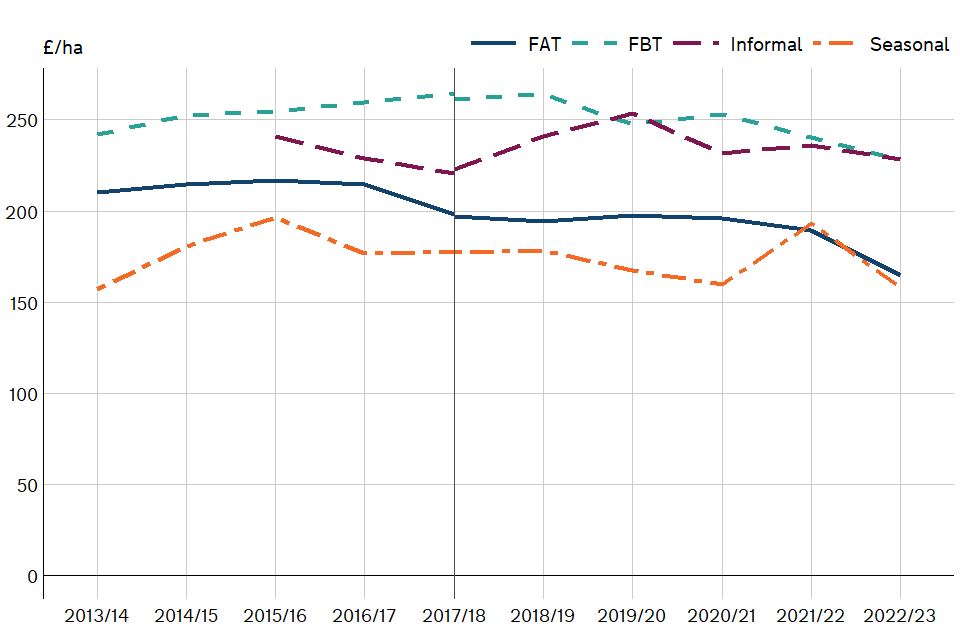

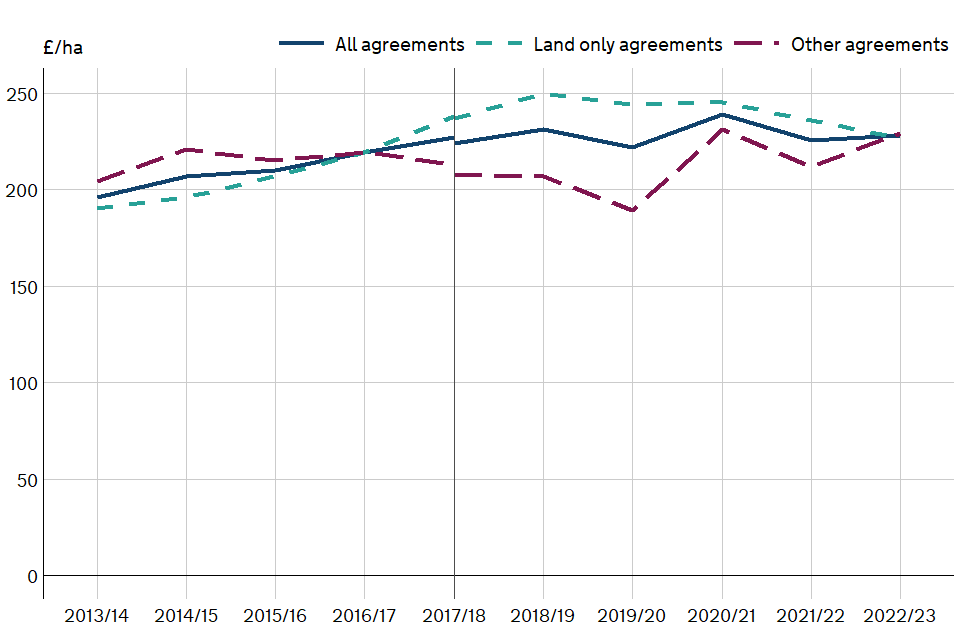

Figure 1.4 Average annual rents for farm tenancies at current prices in British pounds per hectare (£/ha) by agreement type in England, 2013/14 to 2022/23

Figure notes:

- The break in the series shown in 2017/18 represents changes in the method used to assign farms to a specific farm type. At this break, average rent per hectare has been calculated using both methods for comparability.

- Before 2015/16, FBT included Farm Business Tenancies and similar informal agreements. Informal agreements in this context were those that are based on the same principles as an FBT but without the accompanying legal documentation.

View the data for this chart

Download the data for this chart

Figure 1.5 Average annual rents for farm tenancies at real term 2022/23 prices in British pounds per hectare (£/ha) by agreement type in England, 2013/14 to 2022/23

Figure notes:

- The break in the series shown in 2017/18 represents changes in the method used to assign farms to a specific farm type. At this break, average rent per hectare has been calculated using both methods for comparability.

- Before 2015/16, FBT included Farm Business Tenancies and similar informal agreements. Informal agreements in this context were those that are based on the same principles as an FBT but without the accompanying legal documentation.

- Real terms prices use the latest GDP deflator data, published 22 December 2023.

View the data for this chart

Download the data for this chart

In real terms, the average annual rent per hectare has decreased for all agreement types between 2021/22 and 2022/23 (Figure 1.5). Except for this, the trends shown in current (Figure 1.4) and real terms are consistent. While there has been fluctuation over the years, in 2022/23 the average annual rent for FBT and informal agreements converged to the same amount of £228 per hectare, and FAT and seasonal agreements also converged to similar quantities (£165 and £158 per hectare respectively).

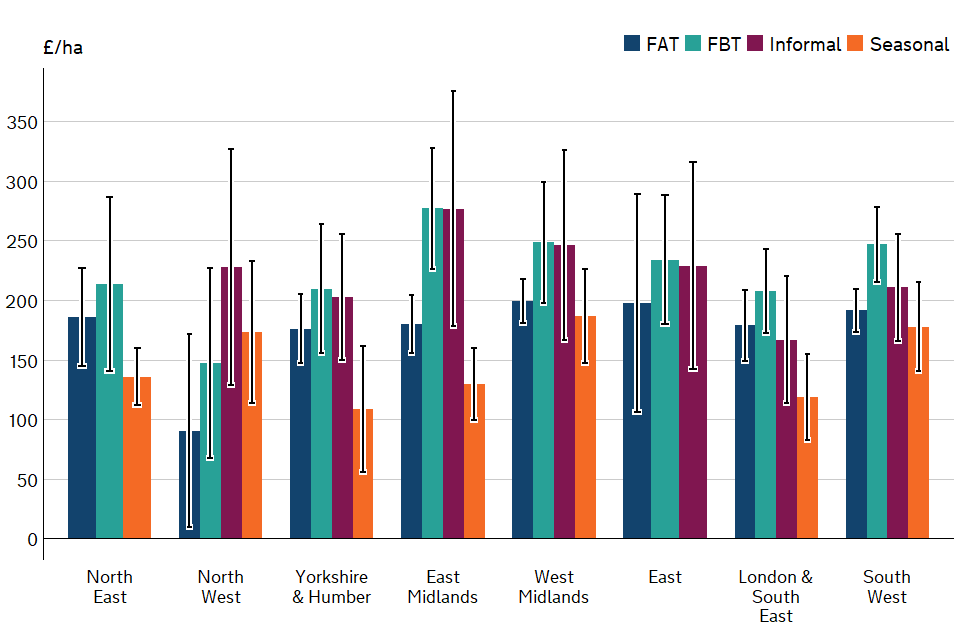

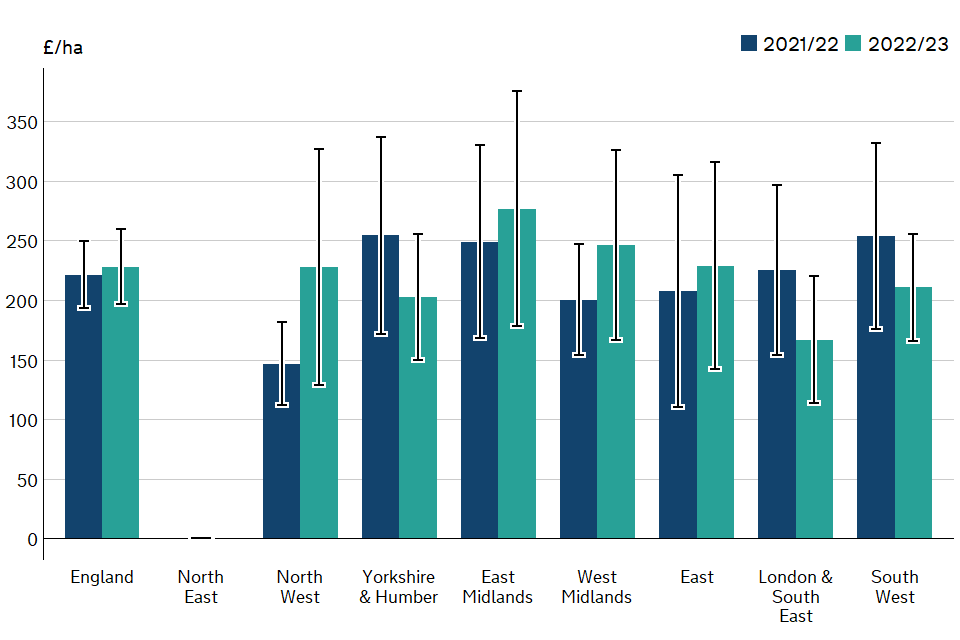

Figure 1.6 Average annual rent for farm tenancies in British pounds per hectare (£/ha) by agreement type and region in England, 2022/23

Figure notes:

- There were too few farms in the sample to calculate an estimate for seasonal agreements in the East, and for informal agreements in the North East region.

- The error bars are large due to these estimates retaining all farm types, including mixed, horticulture, poultry and pig farms for which rents tend to be more variable (see section 7.2 for more details).

- The Department for Environment, Food & Rural Affairs are considering combining the North East and Yorkshire & Humber regions into one area to make it consistent with other Farm Business Survey publications, and to improve the quality of these estimates. For any comments on this change, please contact [email protected].

View the data for this chart

Download the data for this chart

Average annual rent per hectare tends to be higher for FBTs than for FATs, which was true for all regions in the 2022/23 survey year (Figure 1.6). For all agreement types, the Midlands regions had the highest corresponding average rent, with FBTs highest at £277 per hectare in the East Midlands region. There is considerable variation in rents across agreements. This reflects factors such as the quality of the land and that agreements may be for land only or may also include any combination of dwellings, buildings and other assets.

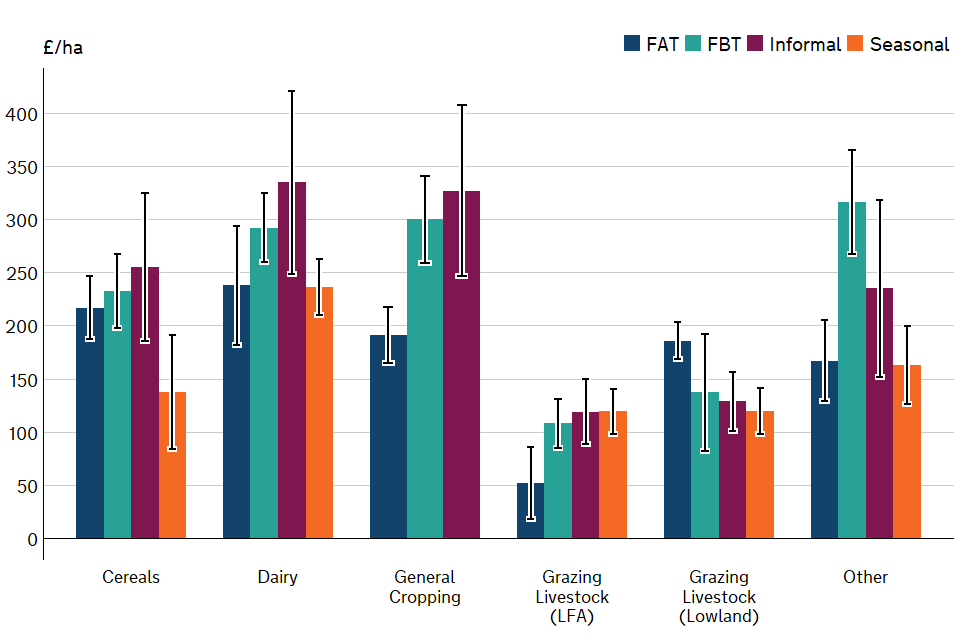

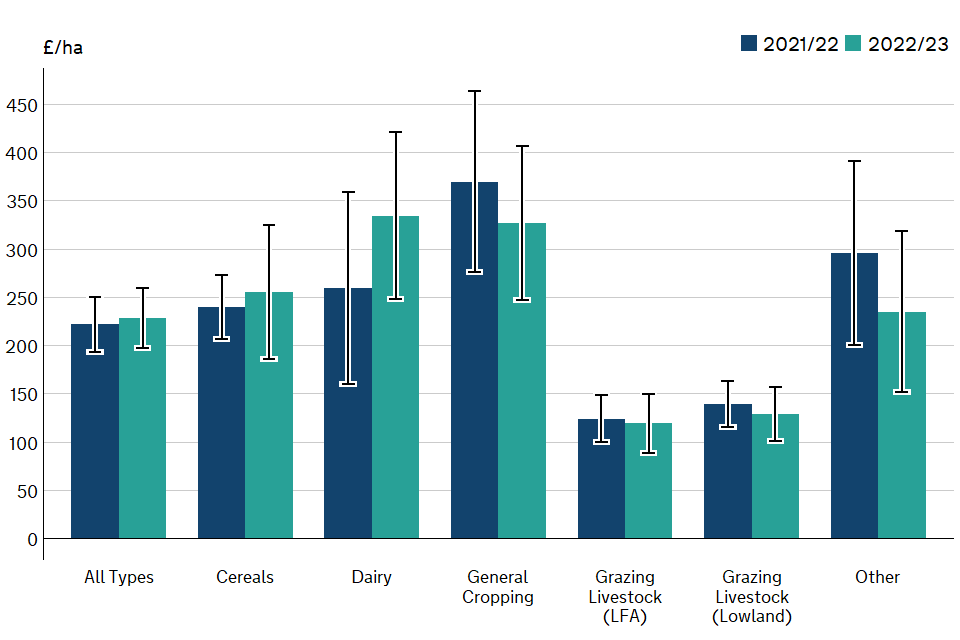

Figure 1.7 Average annual rent for farm tenancies in British pounds per hectare (£/ha) by agreement type and farm type in England, 2022/23

Figure notes:

- Due to low sample numbers, the following farm types have been grouped into the ‘other’ farm type category: mixed, horticulture, poultry and pig farms.

- There were too few farms in the sample to calculate an estimate for seasonal agreements in the general cropping farm type.

View the data for this chart

Download the data for this chart

Figure 1.7 shows that average annual rent for dairy farms was the highest under all agreement types except FBTs, in which ‘other’ farms paid the highest amount. LFA grazing livestock farms paid the lowest in average annual rent across all agreement types, with the lowest being under FATs at only £52 per hectare.

2 Full Agricultural Tenancies

Agricultural tenancies agreed before 1 September 1995 are known as Full Agricultural Tenancies (FATs). These tenancies usually have lifetime security of tenure and those granted before 12 July 1984 also carry statutory succession rights, on death or retirement.

The average annual rent for land under FATs had fallen to £165 per hectare in 2022/23, the lowest amount in the past decade (Figure 1.4).

Table 2.1 Total area of rented land under Full Agricultural Tenancies in hectares (million ha) by farm type in England, 2020 to 2022

| Type | 2020 (million ha) | 2021 (million ha) | 2022 (million ha) | % Change 2021 to 2022 |

|---|---|---|---|---|

| Cereals | 0.41 | 0.40 | 0.40 | 0% |

| General Cropping | 0.19 | 0.17 | 0.16 | -3% |

| Dairy | 0.11 | 0.10 | 0.09 | -7% |

| Grazing Livestock (LFA) | 0.25 | 0.24 | 0.23 | -1% |

| Grazing Livestock (Lowland) | 0.16 | 0.14 | 0.14 | -1% |

| All farms | 1.29 | 1.22 | 1.20 | -2% |

Source: June Survey of Agriculture and Horticulture

Table notes:

- Figures relate to commercial holdings only. Commercial holdings are those with significant levels of farming activities; for further details please see the June Survey methodology.

- Respondents were asked to provide information as of 1 June of each year.

- Areas have been rounded to two decimal places, and percentages to the nearest whole number.

- All farms includes other farms not shown individually, so these totals may not necessarily agree with the sum of their components.

Download the data for this table

Table 2.1 shows that the total area of land under FATs had fallen slightly by 2% between 2021/22 and 2022/23 to around 1.20 million hectares.

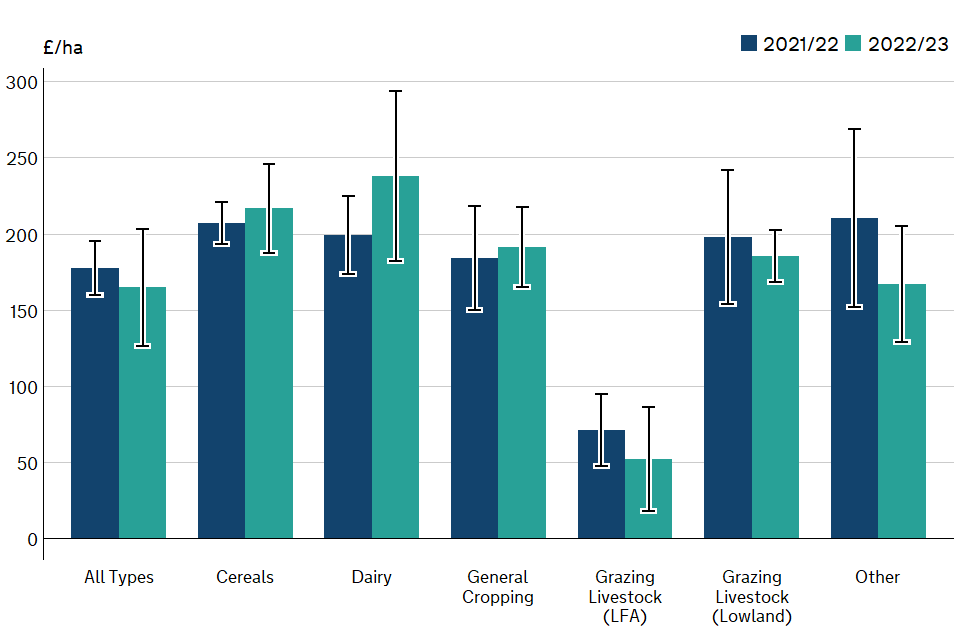

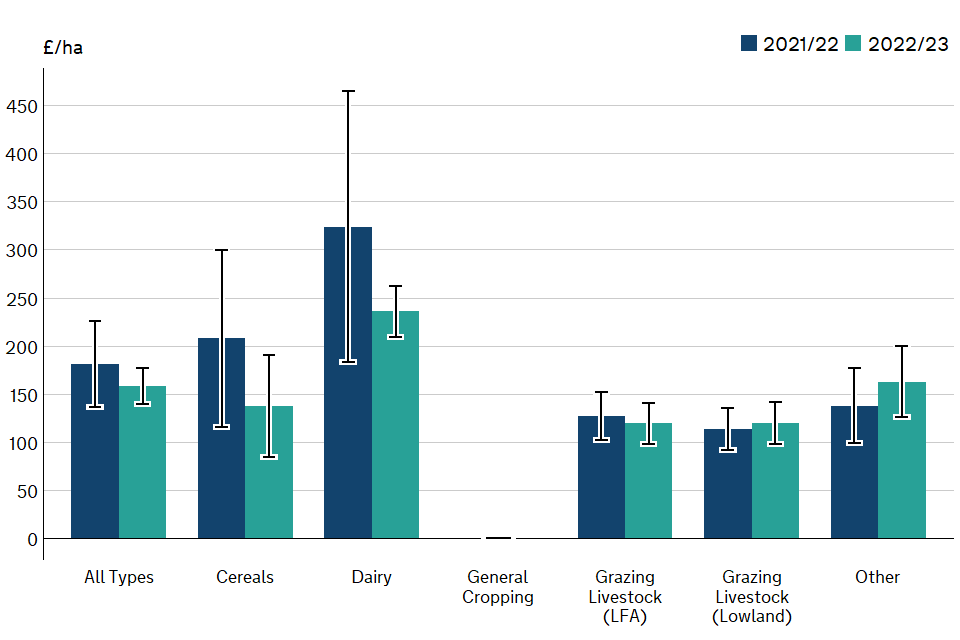

Figure 2.1 Average annual rent in British pounds per hectare (£/ha) for Full Agricultural Tenancies by farm type in England, 2021/22 and 2022/23

Figure notes:

- The legend is presented in the same order as the bars.

- 95% Confidence Intervals are presented to illustrate the range within which the true underlying population average is likely to reside, which provides an indication for the level of uncertainty associated with the sample estimate; see section 7.2 for more details.

View the data for this chart

Download the data for this chart

From 2021/22 to 2022/23, dairy farms saw the largest increase in average FAT rent, rising by 19% to £238 per hectare, whilst LFA grazing livestock farms saw the largest fall, dropping 27% to £52 per hectare. General cropping farms saw the smallest change in average FAT rent, rising by 4% to £191 per hectare.

The highest average rent under FATs was associated with dairy farms at £238 per hectare, and the lowest with the LFA grazing livestock farm type at only £52 per hectare (Figure 2.1).

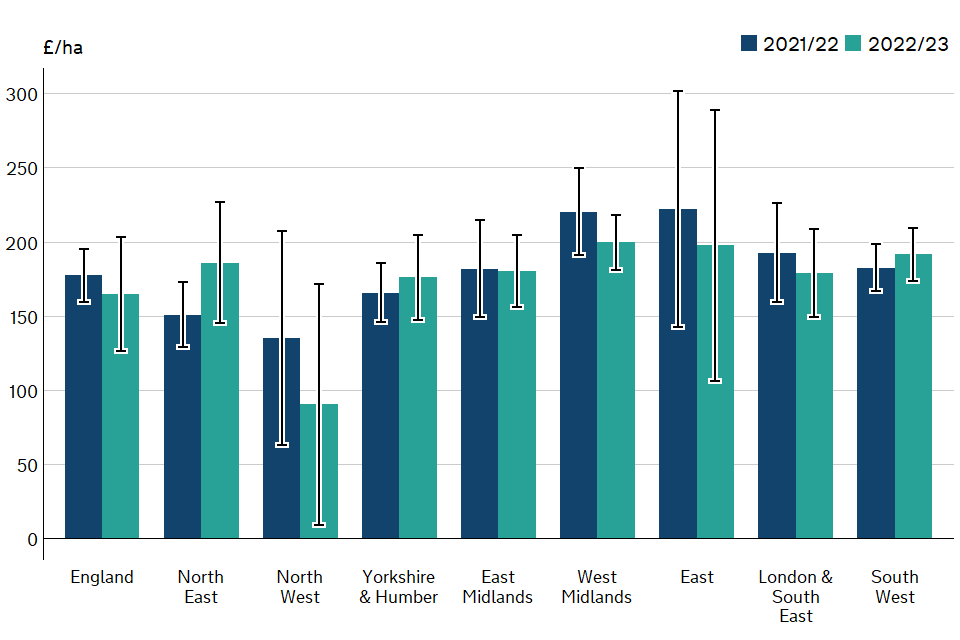

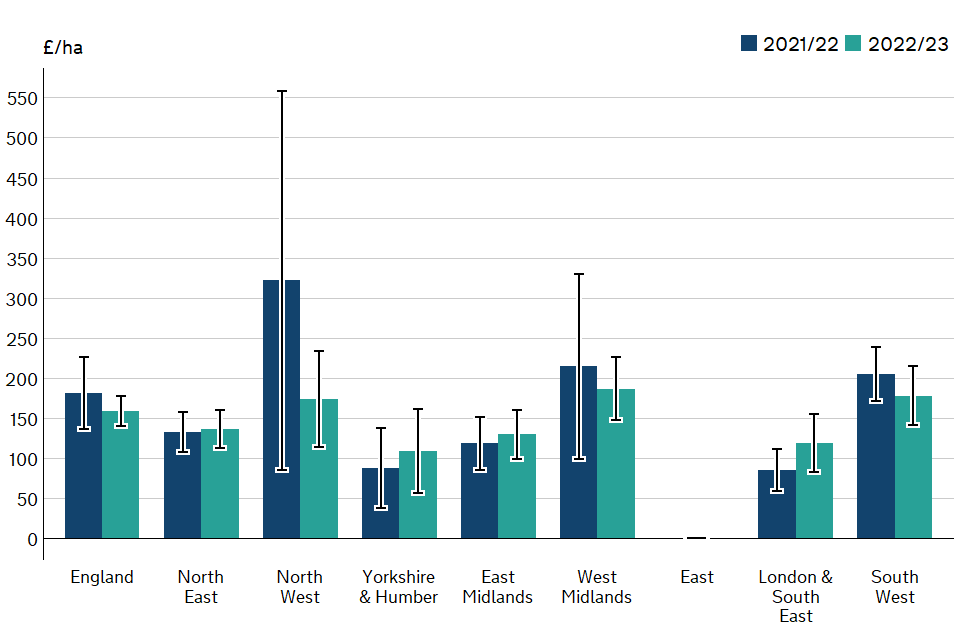

Figure 2.2 Average annual rent in British pounds per hectare (£/ha) for Full Agricultural Tenancies by region in England, 2021/22 and 2022/23

Figure notes:

- The legend is presented in the same order as the bars.

- 95% Confidence Intervals are presented to illustrate the range within which the true underlying population average is likely to reside, which provides an indication for the level of uncertainty associated with the sample estimate; see section 7.2 for more details.

- The East and North West regions have relatively large error bars, so these results should be approached with caution.

View the data for this chart

Download the data for this chart

From 2021/22 to 2022/23, the North East region saw the largest increase in average FAT rent, a rise of 23% to £186 per hectare, whilst the North West saw the largest drop, a fall of 33% to £90 per hectare. The East Midlands saw the smallest change in average FAT rent, falling by only 1% to £180 per hectare.

The highest average rent under FATs was in the West Midlands region at £199 per hectare, while the lowest was in the North West at £90 per hectare (Figure 2.2).

Table 2.2 Average annual rent in British pounds per hectare (£/ha) for Full Agricultural Tenancies by agreements including a recorded rent review or change to terms and conditions in England, 2020/21 to 2022/23

| Type | 2020/21 (£/ha) | 2021/22 (£/ha) | 2022/23 (£/ha) | % Change 2021/22 to 2022/23 | 95% Confidence Interval 2022/23 (£/ha) |

|---|---|---|---|---|---|

| Agreements with a recorded rent review | 227 | 159 | 120 | -25% | 40 to 200 |

| Agreements with recorded change to terms and conditions | 215 | 190 | 186 | -2% | 154 to 219 |

| All | 185 | 177 | 165 | -7% | 126 to 203 |

Table notes:

- 95% Confidence Intervals are presented to illustrate the range within which the true underlying population average is likely to reside, which provides an indication for the level of uncertainty associated with the sample estimate; see section 7.2 for more details.

- Values have been rounded to the nearest whole number.

Download the data for this table

A recorded rent review refers to the formal and documented process used to evaluate and potentially adjust the rental amount for farmland. A recorded change to terms and conditions signifies a documented modification to the specific details of the rental arrangement, which may include alterations to rent, lease duration, responsibilities or other agreed-upon terms.

Average rent per hectare for FAT agreements with a recorded rent review decreased from the previous year by 25% to £120 per hectare in 2022/23, whilst those with a recorded change to terms and conditions slightly decreased by 2% to £186 per hectare (Table 2.2).

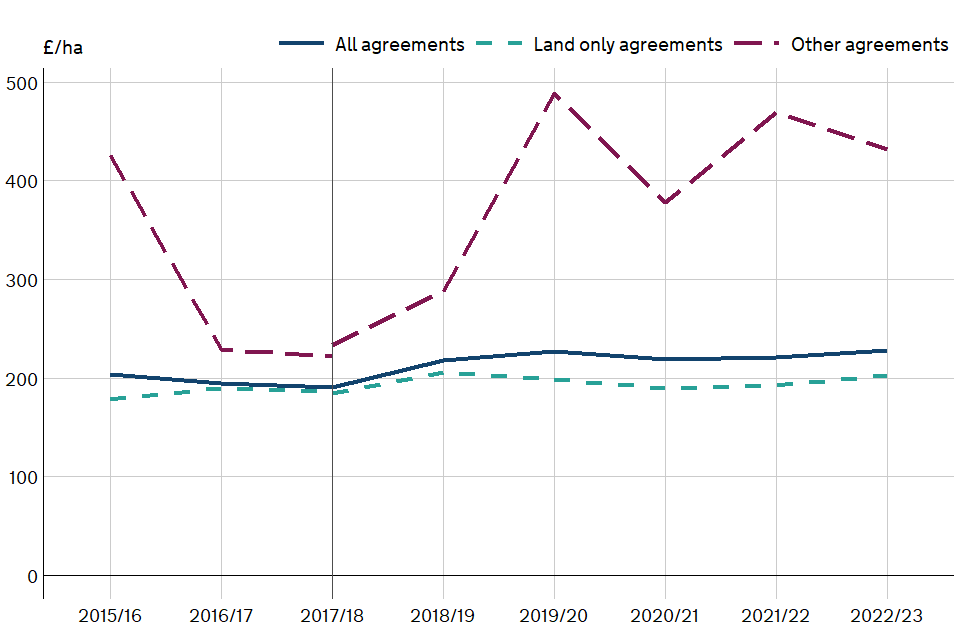

Table 2.3 Average annual rent in British pounds per hectare (£/ha) for Full Agricultural Tenancies by land only or other agreements in England, 2020/21 to 2022/23

| Type | 2020/21 (£/ha) | 2021/22 (£/ha) | 2022/23 (£/ha) | % Change 2021/22 to 2022/23 | 95% Confidence Interval 2022/23 (£/ha) |

|---|---|---|---|---|---|

| Land only agreements | 188 | 167 | 203 | +22% | 165 to 242 |

| Other agreements | 184 | 179 | 156 | -13% | 93 to 220 |

| All agreements | 185 | 177 | 165 | -7% | 123 to 207 |

Table notes:

- The ‘other’ FAT agreements here include those agreements covering land and/or any combination of dwellings, buildings and other assets.

- 95% Confidence Intervals are presented to illustrate the range within which the true underlying population average is likely to reside, which provides an indication for the level of uncertainty associated with the sample estimate; see section 7.2 for more details.

- Values have been rounded to the nearest whole number.

Download the data for this table

Tenancy agreements may relate only to land or include any combination of dwellings, buildings and other assets. FAT agreements relating only to land saw an increase in average rent, rising by 22% to £203 per hectare in 2022/23. Other FAT agreements had fallen by 13% to £156 per hectare (Table 2.3).

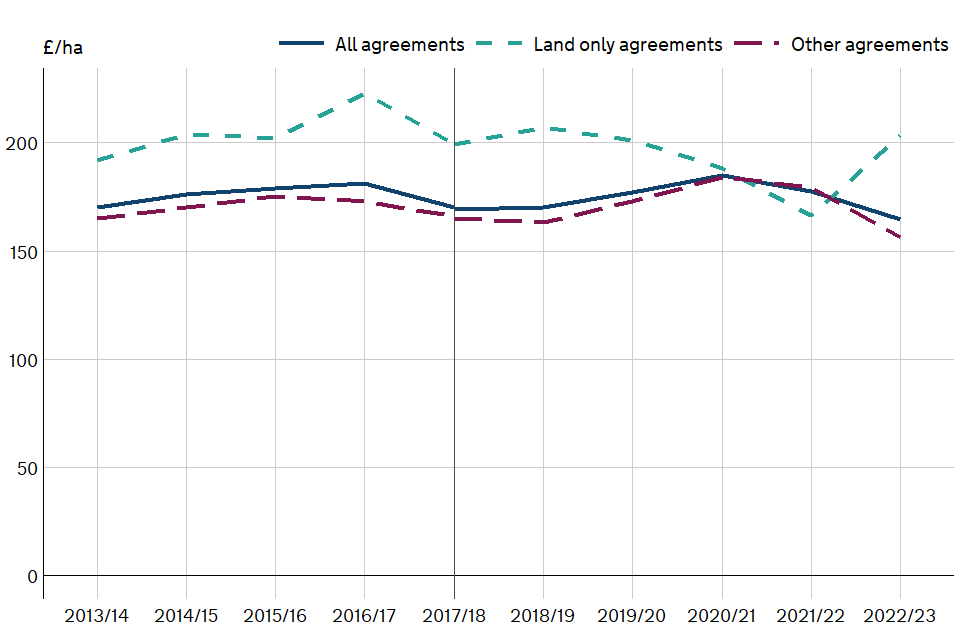

Figure 2.3 Average annual rent at current prices in British pounds per hectare (£/ha) for Full Agricultural Tenancies by land only or other agreements in England, 2013/14 to 2022/23

Figure notes:

- The break in the series shown in 2017/18 represents changes in the method used to assign farms to a specific farm type. At this break, average rent per hectare has been calculated using both methods for comparability.

- Other agreements here include those agreements covering land and/or any combination of dwellings, buildings and other assets.

View the data for this chart

Download the data for this chart

Table 2.4 Average annual rent in British pounds per hectare (£/ha) for Full Agricultural Tenancies by Basic Payment Scheme inclusion in England, 2020/21 to 2022/23

| Type | 2020/21 (£/ha) | 2021/22 (£/ha) | 2022/23 (£/ha) | % Change 2021/22 to 2022/23 | 95% Confidence Interval 2022/23 (£/ha) |

|---|---|---|---|---|---|

| Agreements including BPS entitlements | 182 | 173 | 164 | -5% | 126 to 203 |

| All | 185 | 177 | 165 | -7% | 126 to 203 |

Table notes:

- Agreements excluding BPS entitlements have been removed from this table due to very low sample sizes.

- 95% Confidence Intervals are presented to illustrate the range within which the true underlying population average is likely to reside, which provides an indication for the level of uncertainty associated with the sample estimate; see section 7.2 for more details.

- Values have been rounded to the nearest whole number.

Download the data for this table

Tenancy agreements may include Basic Payment Scheme (BPS) entitlements, which historically were the largest rural payment scheme providing financial support to the farmers and are now being phased out as part of the Agricultural Transition. There were very few FAT agreements excluding BPS entitlements in recent samples. Hence, these figures have been excluded from Table 2.4 since their associated calculations are not statistically robust. The average rent for FAT agreements including BPS entitlements decreased by 5% in 2022/23 to £164 per hectare.

3 Farm Business Tenancies

Agricultural tenancies agreed since 1 September 1995 under the Agricultural Tenancies Act 1995, are known as Farm Business Tenancies (FBTs).

Before the 2015/16 survey, the Farm Business Survey included similar informal agreements within the definition of FBT agreements. Informal agreements in this context were those based on the same principles as an FBT but without the accompanying legal documentation. In 2015/16, the classification of agreements was changed to improve the collection and reporting of data. The FBT agreements now reported here for 2015/16 to 2022/23 are defined as being written or unwritten for any period subject to the provisions of the Act. This will include formal FBTs that have rolled on informally, but in law are still regarded as FBTs.

Informal agreements where there is no formal tenancy agreement, but the land is part of the Utilised Agricultural Area (i.e. not seasonally let) are now being separately recorded and reported. The results presented in this section exclude these informal agreements. Whilst this change has resulted in some reclassification of agreements, it has had a minimal impact on the average FBT results. Including those FBTs now classified as ‘informal’ does not change the average rent per hectare in 2015/16.

Where recorded, the average length of term for FBT agreements was 6 years and 8 months. Since 2013/14, the average annual rent per hectare for FBTs has consistently been higher than all other agreement types, except for in 2019/20 where informal agreements were slightly higher, and in 2022/23 where FBTs and informal agreements were both £228 per hectare (Figure 1.4).

Table 3.1 Total area of rented land under Farm Business Tenancies in England in hectares (million ha) by farm type in England, 2020 to 2022

| Type | 2020 (million ha) | 2021 (million ha) | 2022 (million ha) | % Change 2021 to 2022 |

|---|---|---|---|---|

| Cereals | 0.36 | 0.37 | 0.39 | +6% |

| General Cropping | 0.18 | 0.18 | 0.18 | +2% |

| Dairy | 0.13 | 0.13 | 0.13 | -5% |

| Grazing Livestock (LFA) | 0.20 | 0.20 | 0.21 | +8% |

| Grazing Livestock (Lowland) | 0.18 | 0.18 | 0.18 | 0% |

| All farms | 1.23 | 1.24 | 1.27 | +2% |

Source: June Survey of Agriculture and Horticulture

Table notes:

- Figures relate to commercial holdings only. Commercial holdings are those with significant levels of farming activities. For further details please see the June Survey methodology.

- Respondents were asked to provide information as of 1 June of each year.

- Areas have been rounded to two decimal places, and percentages to the nearest whole number.

- All farms includes other farms not shown individually, so these totals may not necessarily agree with the sum of their components.

Download the data for this table

Table 3.1 shows that the total area of land under FBT agreements slightly increased by 2% between 2021/22 and 2022/23 to about 1.27 million hectares.

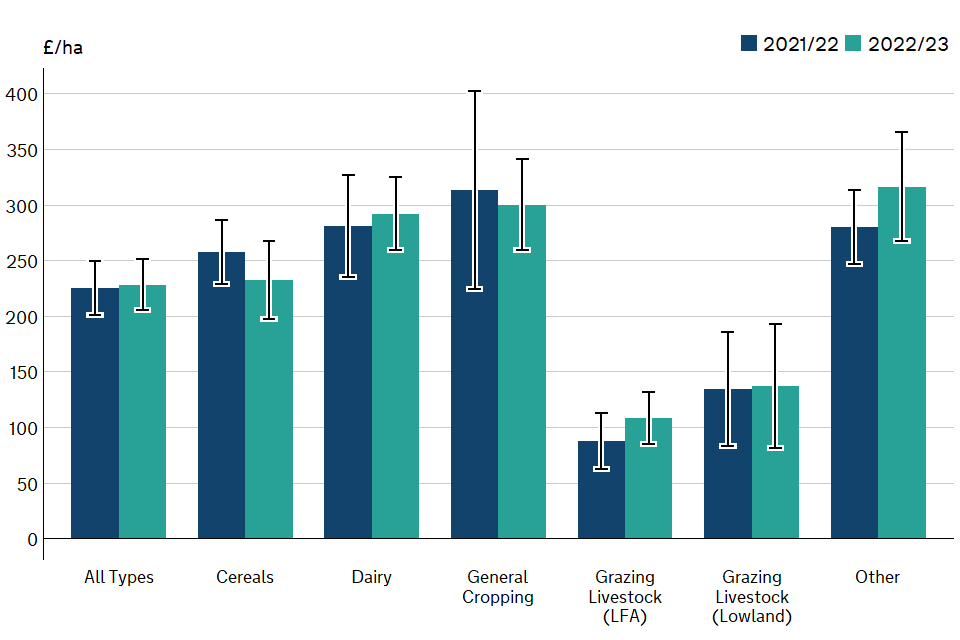

Figure 3.1 Average annual rent in British pounds per hectare (£/ha) for Farm Business Tenancies by farm type in England, 2021/22 and 2022/23

Figure notes:

- The legend is presented in the same order as the bars.

- 95% Confidence Intervals are presented to illustrate the range within which the true underlying population average is likely to reside, which provides an indication for the level of uncertainty associated with the sample estimate; see section 7.2 for more details.

View the data for this chart

Download the data for this chart

From 2021/22 to 2022/23, LFA grazing livestock farms saw the largest increase in average FBT rent, rising by 24% to £108 per hectare, whilst cereals saw the largest fall, dropping by 10% to £232 per hectare. Lowland grazing livestock farms saw the smallest change in average FBT rent, rising by only 2% to £137 per hectare.

The highest average rental cost under FBTs was associated with other farms at £316 per hectare, and the lowest with the LFA grazing livestock farm type at £108 per hectare (Figure 3.1).

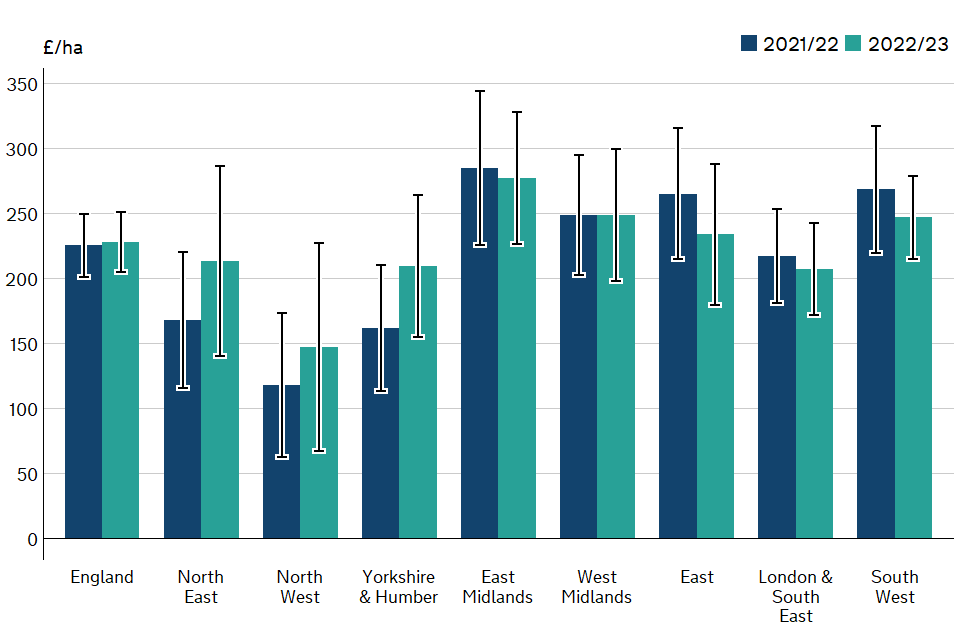

Figure 3.2 Average annual rent in British pounds per hectare (£/ha) for Farm Business Tenancies by region in England, 2021/22 and 2022/23

Figure notes:

- The legend is presented in the same order as the bars.

- 95% Confidence Intervals are presented to illustrate the range within which the true underlying population average is likely to reside, which provides an indication for the level of uncertainty associated with the sample estimate; see section 7.2 for more details.

View the data for this chart

Download the data for this chart

Between 2021/22 and 2022/23, Yorkshire & Humber saw the largest increase in average FBT rent, a rise of 30% to £210 per hectare, whilst the East region saw the largest drop, falling 12% to £234 per hectare. The West Midlands region saw no change in average FBT rent, remaining at £249 per hectare.

The highest average rent under FBTs was in the East Midlands region at £277 per hectare, while the lowest was in the North West region at £147 per hectare (Figure 3.2).

Table 3.2 Average annual rent in British pounds per hectare (£/ha) for Farm Business Tenancies by agreements including a recorded rent review or change to terms and conditions in England, 2020/21 to 2022/23

| Type | 2020/21 (£/ha) | 2021/22 (£/ha) | 2022/23 (£/ha) | % Change 2021/22 to 2022/23 | 95% Confidence Interval 2022/23 (£/ha) |

|---|---|---|---|---|---|

| Agreements with a recorded rent review | 249 | 247 | 281 | +14% | 201 to 361 |

| Agreements with recorded change to terms and conditions | 234 | 182 | 123 | -32% | 90 to 155 |

| All | 239 | 225 | 228 | +1% | 189 to 266 |

Table notes:

- 95% Confidence Intervals are presented to illustrate the range within which the true underlying population average is likely to reside, which provides an indication for the level of uncertainty associated with the sample estimate; see section 7.2 for more details.

- Values have been rounded to the nearest whole number.

Download the data for this table

A recorded rent review refers to the formal and documented process used to evaluate and potentially adjust the rental amount for farmland. A recorded change to terms and conditions signifies a documented modification to the specific details of the rental arrangement, which may include alterations to rent, lease duration, responsibilities or other agreed-upon terms.

Average rent per hectare for FBT agreements with a recorded rent review increased from the previous year by 14% to £281 per hectare in 2022/23, whilst those with a recorded change to terms and conditions had substantially decreased by 32% to £123 per hectare (Table 3.2).

Table 3.3 Average annual rent in British pounds per hectare (£/ha) for Farm Business Tenancies by land only or other agreements in England, 2020/21 to 2022/23

| Type | 2020/21 (£/ha) | 2021/22 (£/ha) | 2022/23 (£/ha) | % Change 2021/22 to 2022/23 | 95% Confidence Interval 2022/23 (£/ha) |

|---|---|---|---|---|---|

| Land only agreements | 245 | 236 | 227 | -4% | 188 to 265 |

| Other agreements | 231 | 212 | 229 | +8% | 166 to 293 |

| All agreements | 239 | 225 | 228 | +1% | 186 to 270 |

Table notes:

- All ‘other’ FBT agreements here include those agreements covering land and/or any combination of dwellings, buildings and other assets.

- 95% Confidence Intervals are presented to illustrate the range within which the true underlying population average is likely to reside, which provides an indication for the level of uncertainty associated with the sample estimate; see section 7.2 for more details.

- Values have been rounded to the nearest whole number.

Download the data for this table

Tenancy agreements may relate only to land or include any combination of dwellings, buildings and other assets. FBT agreements relating only to land saw a decrease in average rent, falling by 4% to £227 per hectare in 2022/23. Other FBT agreements had risen by 8% to £229 per hectare (Table 3.3).

Figure 3.3 Average annual rent at current prices in British pounds per hectare (£/ha) for Farm Business Tenancies by land only or other agreements in England, 2013/14 to 2022/23

Figure notes:

- The break in the series shown in 2017/18 represents changes in the method used to assign farms to a specific farm type. At this break, average rent per hectare have been calculated using both methods for comparability.

- Other agreements here include those agreements covering land and/or any combination of dwellings, buildings and other assets.

View the data for this chart

Download the data for this chart

Figure 3.3 illustrates the information in Table 3.3 as a time series, dated from 2013/14 to 2022/23. The average annual rent for land only and other FBT agreements have converged to very similar values in 2022/23; this occurred previously in 2016/17.

Table 3.4 Average annual rent in British pounds per hectare (£/ha) for Farm Business Tenancies by Basic Payment Scheme inclusion in England, 2020/21 to 2022/23

| Type | 2020/21 (£/ha) | 2021/22 (£/ha) | 2022/23 (£/ha) | % Change 2021/22 to 2022/23 | 95% Confidence Interval 2022/23 (£/ha) |

|---|---|---|---|---|---|

| Agreements excluding BPS entitlements | 249 | 233 | 213 | -9% | 170 to 256 |

| Agreements including BPS entitlements | 238 | 224 | 230 | +2% | 204 to 255 |

| All | 239 | 225 | 228 | +1% | 205 to 251 |

Table notes:

- 95% Confidence Intervals are presented to illustrate the range within which the true underlying population average is likely to reside, which provides an indication for the level of uncertainty associated with the sample estimate; see section 7.2 for more details.

- Values have been rounded to the nearest whole number.

Download the data for this table

Tenancy agreements may include Basic Payment Scheme (BPS) entitlements, which historically were the largest rural payment scheme providing financial support to the farmers and are now being phased out as part of the Agricultural Transition. The average rent for FBT agreements excluding BPS entitlements decreased by 9% in 2022/23 to £213 per hectare, whereas those including BPS entitlements had slightly increased by 2% to £230 per hectare (Table 3.4).

4 Seasonal agreements

Seasonal agreements are farm tenancies where the length of term is less than 12 months. These include licenses for grazing and/or mowing only and may include BPS entitlements. As noted in the previous section, there were changes to the way in which agreement types were classified within the Farm Business Survey in 2015/16.

This resulted in some seasonal agreements being reclassified as informal agreements. Results for 2015/16 have previously been calculated based on both the 2014/15 and 2015/16 agreement classifications to provide comparable results. In practice, the averages calculated in this way are similar and well within the annual confidence intervals.

Where recorded, the average length of term for seasonal agreements was 10 months. In 2022/23, the seasonal average annual rent decreased by 13% to £158 per hectare, once again becoming the agreement type with the lowest average annual rent (Table 1.2 and Figure 1.4).

Figure 4.1 Average annual rent in British pounds per hectare (£/ha) for seasonal agreements by farm type in England, 2021/22 and 2022/23

Figure notes:

- The legend is presented in the same order as the bars.

- 95% Confidence Intervals are presented to illustrate the range within which the true underlying population average is likely to reside, which provides an indication for the level of uncertainty associated with the sample estimate; see section 7.2 for more details.

- Due to low sample numbers, estimates of seasonal agreements for general cropping farms could not be calculated.

View the data for this chart

Download the data for this chart

Between 2021/22 and 2022/23, ‘other’ farms saw the largest increase in average seasonal agreement rent, rising by 18% to £163 per hectare, whilst cereals saw the largest decrease, substantially falling 34% to £137 per hectare. Lowland grazing livestock farms saw the smallest change in average seasonal agreement rent, rising by only 6% to £120 per hectare.

The highest average rental cost under seasonal agreements was associated with dairy farms at £236 per hectare, and the lowest with LFA grazing livestock farms at £119 per hectare (Figure 4.1).

Figure 4.2 Average annual rent in British pounds per hectare (£/ha) for seasonal agreements by region in England, 2021/22 and 2022/23

Figure notes:

- The legend is presented in the same order as the bars.

- 95% Confidence Intervals are presented to illustrate the range within which the true underlying population average is likely to reside, which provides an indication for the level of uncertainty associated with the sample estimate; see section 7.2 for more details.

- Due to low sample numbers, estimates of seasonal agreements for the East could not be calculated.

- For the North West in 2021/22, calculations were made from a small sample which has resulted in a very large error bar, therefore the figure should be approached with caution.

View the data for this chart

Download the data for this chart

Between 2021/22 and 2022/23, the London & South East region saw the largest increase in average seasonal agreement rent, a considerable rise of 40% to £119 per hectare, whilst the North West saw the largest decrease, a fall of 46% to £173 per hectare. The North East saw the smallest change in average seasonal agreement rent, rising by only 2% to £136 per hectare.

The highest average rent under seasonal agreements was in the West Midlands region at £186 per hectare, while the lowest was in Yorkshire & Humber at £108 per hectare (Figure 4.2).

Table 4.1 Average annual rent in British pounds per hectare (£/ha) for seasonal agreements by Basic Payment Scheme inclusion in England, 2020/21 to 2022/23

| Type | 2020/21 (£/ha) | 2021/22 (£/ha) | 2022/23 (£/ha) | % Change 2021/22 to 2022/23 | 95% Confidence Interval 2022/23 (£/ha) |

|---|---|---|---|---|---|

| Agreements excluding BPS entitlements | 153 | 186 | 157 | -15% | 138 to 177 |

| Agreements including BPS entitlements | 135 | 148 | 164 | +11% | 117 to 212 |

| All | 151 | 181 | 158 | -13% | 140 to 177 |

Table notes:

- 95% Confidence Intervals are presented to illustrate the range within which the true underlying population average is likely to reside, which provides an indication for the level of uncertainty associated with the sample estimate; see section 7.2 for more details.

- Values have been rounded to the nearest whole number.

Download the data for this table

Tenancy agreements may include Basic Payment Scheme (BPS) entitlements, which historically were the largest rural payment scheme providing financial support to the farmers and are now being phased out as part of the Agricultural Transition. The average rent for seasonal agreements excluding BPS entitlements decreased by 15% in 2022/23 to £157 per hectare, whereas those including BPS entitlements had increased by 11% to £164 per hectare (Table 4.1).

5 Informal agreements

In 2015/16, there was an improvement to the way in which tenancy agreements were classified in the Farm Business Survey. A new category of ‘informal agreements’ was introduced. These informal agreements are those where there is no formal tenancy agreement but the land is part of the Utilised Agricultural Area (i.e. not seasonally let). This resulted in the reclassification of a number of agreements.

Where recorded, the average length of term for informal agreements was 1 year and 11 months. Between 2021/22 and 2022/23, the average annual rent for informal agreements increased by 3% to £228 per hectare, returning to 2019/20 levels (Figure 1.4).

Figure 5.1 Average annual rent in British pounds per hectare (£/ha) for informal agreements by farm type in England, 2021/22 and 2022/23

Figure notes:

- The legend is presented in the same order as the bars.

- 95% Confidence Intervals are presented to illustrate the range within which the true underlying population average is likely to reside, which provides an indication for the level of uncertainty associated with the sample estimate; see section 7.2 for more details.

View the data for this chart

Download the data for this chart

Between 2021/22 and 2022/23, dairy farms saw the largest increase in average informal agreement rent, rising by 29% to £334 per hectare, whilst the ‘other’ farm type saw the largest decrease, falling by 21% to £235 per hectare. LFA grazing livestock farms saw the smallest change in average informal agreement rent, falling by only 4% to £119 per hectare.

The highest average rental cost under informal agreements was associated with dairy farms at £334 per hectare, and the lowest with the LFA grazing livestock farm type at £119 per hectare (Figure 5.1).

Figure 5.2 Average annual rent in British pounds per hectare (£/ha) for informal agreements by region in England, 2021/22 and 2022/23

Figure notes:

- The legend is presented in the same order as the bars.

- 95% Confidence Intervals are presented to illustrate the range within which the true underlying population average is likely to reside, which provides an indication for the level of uncertainty associated with the sample estimate; see section 7.2 for more details.

- Due to low sample numbers, estimates of informal agreements for the North East could not be calculated.

- Most of the estimates have relatively high error bars, therefore these results must be approached with caution.

View the data for this chart

Download the data for this chart

Between 2021/22 and 2022/23, the North West region saw the largest increase in average informal agreement rent, a rise of 55% to £228 per hectare, whilst the London & South East region saw the largest decrease, a fall of 26% to £167 per hectare. The East saw the smallest change in average informal agreement rent, rising by only 10% to £229 per hectare.

The highest average rent under informal agreements was in the East Midlands at £277 per hectare, while the lowest was in the London & South East region at £167 per hectare (Figure 5.2).

Table 5.1 Average annual rent in British pounds per hectare (£/ha) for informal agreements by land only or other agreements in England, 2020/21 to 2022/23

| Type | 2020/21 (£/ha) | 2021/22 (£/ha) | 2022/23 (£/ha) | % Change 2021/22 to 2022/23 | 95% Confidence Interval 2022/23 (£/ha) |

|---|---|---|---|---|---|

| Land only agreements | 190 | 193 | 203 | +5% | 171 to 234 |

| Other agreements | 378 | 469 | 431 | -8% | 406 to 457 |

| All agreements | 219 | 221 | 228 | +3% | 80 to 376 |

Table notes:

- All ‘other’ informal agreements here include those agreements covering land and/or any combination of dwellings, buildings and other assets.

- 95% Confidence Intervals are presented to illustrate the range within which the true underlying population average is likely to reside, which provides an indication for the level of uncertainty associated with the sample estimate; see section 7.2 for more details.

- Values have been rounded to the nearest whole number.

Download the data for this table

Tenancy agreements may relate only to land or include any combination of dwellings, buildings and other assets. Informal agreements relating only to land saw an increase in average rent, rising by 5% to £203 per hectare in 2022/23. Other informal agreements had fallen by 8% to £431 per hectare (Table 5.1).

Figure 5.3 Average annual rent at current prices in British pounds per hectare (£/ha) for informal agreements by land only or other agreements in England, 2015/16 to 2022/23

Figure notes:

- The break at 2017/18 represents changes in the method used to assign farms to a specific farm type. At this break, average rent per hectare has been calculated using both methods for comparability.

- Other agreements here include those agreements covering land and/or any combination of dwellings, buildings and other assets.

View the data for this chart

Download the data for this chart

Figure 5.3 illustrates the information in Table 5.1 as a time series, dated from 2015/16 to 2022/23. Other informal agreements peaked in 2019/20 and have consistently had a higher average rent per hectare than land only agreements.

Table 5.2 Average annual rent in British pounds per hectare (£/ha) for informal agreements by Basic Payment Scheme inclusion in England, 2020/21 to 2022/23

| Type | 2020/21 (£/ha) | 2021/22 (£/ha) | 2022/23 (£/ha) | % Change 2021/22 to 2022/23 | 95% Confidence Interval 2022/23 (£/ha) |

|---|---|---|---|---|---|

| Agreements excluding BPS entitlements | 237 | 234 | 251 | +7% | 208 to 294 |

| Agreements including BPS entitlements | 188 | 201 | 198 | -2% | 160 to 236 |

| All | 219 | 221 | 228 | +3% | 197 to 259 |

Table notes:

- 95% Confidence Intervals are presented to illustrate the range within which the true underlying population average is likely to reside, which provides an indication for the level of uncertainty associated with the sample estimate; see section 7.2 for more details.

- Values have been rounded to the nearest whole number.

Download the data for this table

Tenancy agreements may include Basic Payment Scheme (BPS) entitlements, which historically were the largest rural payment scheme providing financial support to the farmers and are now being phased out as part of the Agricultural Transition. The average rent for informal agreements excluding BPS entitlements increased by 7% in 2022/23 to £251 per hectare, whereas those including BPS entitlements had slightly decreased by 2% to £198 per hectare (Table 5.2).

6 What you need to know about this release

6.1 Contact details

Responsible statistician: Rakin Ahad

Email:[email protected]

6.2 Media Queries

For media queries between 9am and 6pm on weekdays:

Telephone: 0330 041 6560

Email: [email protected]

6.3 National Statistics Status

Accredited official statistics are called National Statistics in the Statistics and Registration Service Act 2007. An explanation can be found on the Office for Statistics Regulation website. Our statistical practice is regulated by the Office for Statistics Regulation (OSR). OSR sets the standards of trustworthiness, quality and value in the Code of Practice for Statistics that all producers of official statistics should adhere to.

These accredited official statistics were independently reviewed by the Office for Statistics Regulation in January 2014. They comply with the standards of trustworthiness, quality and value in the Code of Practice for Statistics and should be labelled ‘accredited official statistics’.

You are welcome to contact us directly with any comments about how we meet these standards (see contact details above). Alternatively, you can contact OSR by emailing [email protected] or via the OSR website.

Since the latest review by the Office for Statistics Regulation, we have continued to comply with the Code of Practice for Statistics, and have made the following improvements:

- Reviewed and improved data presentation to better meet accessibility guidelines.

- Automated production of the statistics using Reproducible Analytical Pipelines (RAP).

- Reviewed and improved accompanying commentary.

6.4 User engagement

As part of our ongoing commitment to compliance with the Code of Practice for Statistics we wish to strengthen our engagement with users of these statistics and better understand the use made of them and the types of decisions that they inform. Consequently, we invite users to make contact to advise us of the use they do, or might, make of these statistics, and what their wishes are in terms of engagement. Feedback on this statistical release and enquiries about these statistics are also welcome.

6.5 Availability of results

The datasets covering the average rent paid, average rents per hectare and other related datasets can be found on the Farm Rents section from the Farm Business Survey Collection page, where all other results from the Farm Business Survey can also be found.

All Defra statistical notices can be viewed on the Statistics at Defra page.

6.6 Data Uses

Data from the Farm Business Survey are widely used by the industry for benchmarking and inform wider research into the economic performance of the agricultural industry, as well as for evaluating and monitoring current policies. Data on farm rents will help to monitor farm businesses throughout the Agricultural Transition period.

7 Technical note

7.1 Survey coverage and weighting

Results show the average rent paid in British pounds per hectare over the period of a specified year. They cover a wide range of rental agreements including those that are land only and those that include dwellings, farm buildings and other assets. To give an indication of the difference in rents, results have also been produced to show average values for ‘land only’ agreements (see Tables 2.3, 3.3 and 5.1).

The Farm Business Survey (FBS) is an annual survey providing information on the financial position and physical and economic performance of commercial farm businesses in England. It covers all types of farming in all regions of the country and includes owner-occupied, tenanted and mixed tenure farms. The FBS only includes farm businesses with a Standard Output of at least 25,000 Euros, based on activity recorded in the previous June Survey of Agriculture and Horticulture. In 2022/23, the sample of 1,359 farms represented approximately 52,500 farm businesses in England.

Initial weights are applied to the Farm Business Survey records based on the inverse sampling fraction for each design stratum (farm type and farm size). Dataset Table 16 within the Farm Accounts in England Dataset shows the distribution of the sample compared with the distribution of businesses from the 2022 June Survey of Agriculture. These initial weights are then adjusted, using calibration weighting, so that they can produce unbiased estimates of a number of different target variables. More detailed information about the Farm Business Survey can be found on the technical notes and guidance page. This includes information on the data collected, information on calibration weighting and definitions used within the Farm Business Survey.

Data are collected through face to face interviews with farmers, conducted by highly trained research officers. Over the 2019/20 and 2020/21 periods, the sample sizes were slightly smaller due to COVID-19 restrictions on data collection. In the 2022/23 year, the sample consisted of 1,359 farms.

7.2 Accuracy and reliability of the results

It is not logistically feasible to survey the entire population of farms, so the published figures from the Farm Business Survey are subject to sampling error. This is a fundamental premise of conducting statistical surveys, which by design aims to capture a representative sample of the underlying population through various sampling techniques.

The representation of data in this publication attempts to account for this sampling error by providing 95% confidence intervals as a measure of uncertainty for the estimated mean. This is provided as an interval in the tables and through error bars in the bar plots.

Narrower confidence intervals generally reflect larger sample sizes and greater homogeneity within the group and are thus ‘more precise’ of an indicator for where the true population mean may reside. Conversely, wider confidence intervals are generally characterised by smaller sample sizes and greater sample standard deviations, which are thus ‘less precise’. These estimates should be treated with caution.

A confidence interval is therefore a plausible range of values wherein the true underlying population mean lies within, based on the sample data it draws from. A 95% confidence interval hence refers to the interval in which there is a 95% probability that our true population mean resides.

For example, the results in Table 2.3 show that the average annual rent for all agreements under Full Agricultural Tenancies was £165 per hectare for the 2022/23 year, with a 95% confidence interval of £123 to £207 per hectare, which is equivalent to £165 ± £42 per hectare. This suggests that we may be 95% confident that this range contains the true population average rent for all land under FATs.

For the Farm Business Survey, the confidence intervals shown are appropriate for comparing groups within the same year only; they should not be used for comparing with previous years, since they do not allow for the fact that many of the same farms will have contributed to the Farm Business Survey in multiple years. Confidence intervals only give an indication of the sampling error; they do not reflect any other sources of survey errors, such as non-response bias.

It should be noted that the confidence intervals are wider for the regional estimates compared to those for the published farm types. This is because the regional estimates include all farm types including mixed, horticulture, poultry and pig farms for which rents tend to be more variable. Totals may not necessarily agree with the sum of their components due to rounding.