Background information: Fraud and error in the benefit system statistics

Published 13 May 2021

Applies to England, Scotland and Wales

Purpose of the statistics

Context and purpose of the statistics

This document supports our main publication which contains estimates of the level of fraud and error in the benefit system in Financial Year Ending (FYE) 2021.

We measure fraud and error so we can understand the levels, trends and reasons behind it. This understanding supports decision making on what actions DWP can take to reduce the level of fraud and error in the benefit system. The National Audit Office takes account of the amount of fraud and error when they audit DWP’s accounts each year.

Within DWP these statistics are used to evaluate, develop and support fraud and error policy, strategy and operational decisions, initiatives, options and business plans through understanding the causes of fraud and error.

The fraud and error statistics published in May each year feed into the DWP accounts. The FYE 2021 estimates published in May 2021 feed into the FYE 2021 DWP annual report and accounts.

The statistics are also used within the annual HM Revenue and Customs (HMRC) National Insurance Fund accounts. These are available in the National Insurance Fund Accounts section of the HMRC reports page.

The fraud and error estimates are also used to answer Parliamentary Questions and Freedom of Information requests, and to inform DWP Press Office statements on fraud and error.

Limitations of the statistics

The estimates do not include reviews of every benefit each year. In particular, the coronavirus (COVID-19) pandemic severely affected our reviews for FYE 2021, and we have only managed to review Universal Credit and State Pension.

This document includes further information on limitations – for example, on benefits reviewed and changes this year (sections 1 and 2), omissions to the estimates (section 3), our sampling approach (section 4), how we adjust and calculate estimates for individual benefits (section 5), and how we bring these together to arrive at estimates of the overall levels of fraud and error (section 6).

Longer time series comparisons may not be possible for some levels of reporting due to methodology changes. Our main publication and accompanying tables indicate when comparisons should not be made.

We are unable to provide information on individual fraud and error cases or provide sub-national estimates of fraud and error as we are unable to break the statistics down to this level.

Comparisons between the statistics

These statistics relate to the levels of fraud and error in the benefit System in Great Britain.

Social Security Scotland report the levels of fraud and error for benefit expenditure devolved to the Scottish Government within their annual report and accounts.

Northern Ireland fraud and error statistics are comparable to the Great Britain statistics within this report, as their approach to collecting the measurement survey data, and calculating the estimates and confidence intervals, is very similar. Northern Ireland fraud and error in the benefit system high level statistics are published within the Department for Communities annual reports.

HM Revenue and Customs produce statistics on error and fraud in Tax Credits.

When comparing different time periods within our publication, we recommend comparing percentage rates of fraud and error rather than monetary amounts. This is because the amount of fraud and error in pounds could go up, even if the percentage rate of fraud and error stays the same (or goes down even), if the amount of benefit we pay out in total goes up compared to the previous year.

Source of the statistics

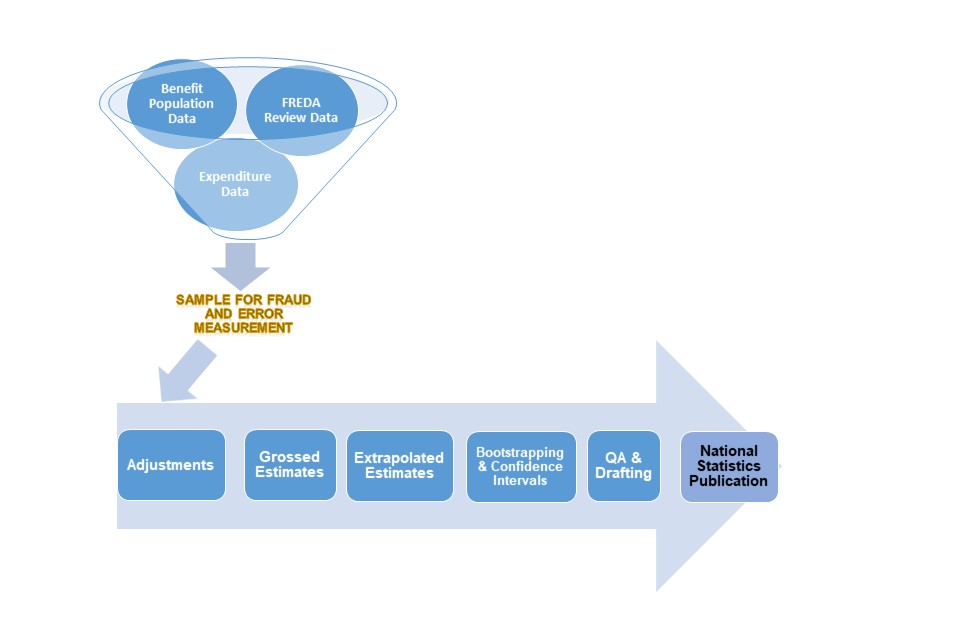

We take a sample of benefit claims from our administrative systems. DWP’s Performance Measurement team contact the benefit claimants to arrange a review. The outcomes of these reviews are recorded on a bespoke internal database called FREDA. We use data from here to produce our estimates.

We also use other data to inform our estimates – for example:

- Benefit expenditure data (aligning with the Spring Budget published forecasts)

- Benefit recovery data (DWP benefits and Housing Benefit) to allow us to calculate estimates of net loss

- Other DWP data sources and models to improve the robustness of, or categorisations within, our estimates – for example, to allow us to see if claimants who leave benefit as a consequence of the fraud and error review process then return to benefit shortly afterwards, and to understand the knock-on effect of fraud and error on disability benefits on other benefits

Further information on the data we use to produce our estimates is contained within sections 4, 5 and 6 of this report.

Definitions and terminology within the statistics

The main publication presents estimates of Fraud, Claimant Error and Official Error. The definitions for these are as follows:

- Fraud: This includes all cases where the following three conditions apply:

- the conditions for receipt of benefit, or the rate of benefit in payment, are not being met

- the claimant can reasonably be expected to be aware of the effect on entitlement

- benefit stops or reduces as a result of the review

- Claimant Error: The claimant has provided inaccurate or incomplete information, failed to report a change in their circumstances, or failed to provide requested evidence, but there is no fraudulent intent on the claimant’s part

- Official Error: Benefit has been paid incorrectly due to inaction, delay or a mistaken assessment by the DWP, a Local Authority or Her Majesty’s Revenue and Customs to which no one outside of that department has materially contributed, regardless of whether the business unit has processed the information

We report overpayments (where we have paid people too much money), and underpayments (where we have not paid people enough money).

We present these in percentage terms (of expenditure on a benefit) and in monetary terms, in millions of pounds.

Further information about the types of errors we report on, abbreviations commonly used and statistical methodology can be found in the appendices at the end of this document.

Revisions to the statistics

Revisions to our statistics may happen for a number of reasons. When we make methodology changes that impact our estimates, we may revise the estimates for the previous year to allow meaningful comparisons between the two. Further details of any changes will be provided in section 2 of this report. Where we introduce major changes, we may denote a break in our time series and recommend that comparisons are not made back beyond a certain point.

Alongside this year’s publication we have also revised estimates from FYE 2020 for UC and SP. For UC we have changed the reason level breakdown and for SP we have made a number of small changes. See section 2 for more details on these changes.

The National Statistics Code of Practice allows for revisions of figures under controlled circumstances: “Statistics are by their nature subject to error and uncertainty. Initial estimates are often systematically amended to reflect more complete information. Improvements in methodologies and systems can help to make revised series more accurate and more useful.”

Unplanned revisions of figures in reports in this series might be necessary from time to time. Under this Code of Practice, the Department has a responsibility to ensure that any revisions to existing statistics are robust and are freely available, with the same level of supporting information as new statistics.

Status of the statistics

National statistics

National Statistics status means that our statistics meet the highest standards of trustworthiness, quality and public value, and it is our responsibility to maintain compliance with these standards.

The continued designation of these statistics as National Statistics was confirmed in December 2017 following a compliance check by the Office for Statistics Regulation. The statistics last underwent a full assessment against the Code of Practice for Statistics in February 2012. Since the latest review by the Office for Statistics Regulation, we have continued to comply with the Code of Practice for Statistics, and have made the following improvements:

- we conducted a user consultation on the frequency of the publication, the benefits measured and on the breakdowns used within the publication. This has resulted in us changing from a bi-annual to an annual publication, and beginning to measure fraud and error on benefits that have not been measured at all or for a long time

- we have made some methodological changes, resulting in better understood methodologies and assumptions, improved accuracy of the fraud and error statistics, and more consistency across benefits

- we have made a number of changes to improve the relevance and accessibility of our statistics. For example, we have: moved away from using the same wording and charts for all the benefits in our publication to instead focus on the key messages for each benefit, updated the categories of error we report in our publication based on user needs, and made the data from our publication available to analysts within DWP to conduct their own analysis. We have also created an online tool to allow users to explore our fraud and error statistics

- we have produced the documents in HTML format and provided an accessible version of the reference tables

Read further information about National Statistics on the UK Statistics Authority website.

Quality Statement

Quality in statistics is a measure of their ‘fitness for purpose’. The European Statistics System Dimensions of Quality provide a framework in which statisticians can assess the quality of their statistical outputs. These dimensions of quality are of relevance, accuracy and reliability, timeliness, accessibility and clarity, and comparability and coherence.

Our Background Quality Report gives more information on the application of these quality dimensions to our Fraud and Error statistics.

Feedback

We welcome any feedback on our publication. You can contact us at: [email protected]

Lead Statistician: Louise Blake

DWP Press Office: 020 3267 5144

Report Benefit Fraud: 0800 854 4400

Useful links

Landing page for the fraud and error statistics.

FYE 2021 estimates, including published tables.

You can also use our online tool to explore DWP’s fraud and error statistics.

1. Introduction to our measurement system

The main statistical release and supporting tables and charts provide estimates of fraud and error for benefit expenditure administered by the Department for Work and Pensions (DWP). This includes a range of benefits for which we derive estimates using different methods, as detailed below. For further details on which benefits are included in the total fraud and error estimates please see Appendix 2. More information can be found online about the benefit system and how DWP benefits are administered.

The fraud and error estimates provide estimates for the amount overpaid or underpaid in total and by benefit, broken down into the types of fraud, claimant error and official error, for benefits reviewed this year. For FYE 2021 only Universal Credit (UC) had a full fraud and error review, as the coronavirus pandemic had a significant impact on our measurement. For more details see section 2.

Estimates of fraud and error for each benefit have been derived using three different methods, depending on the frequency of their review:

Benefits reviewed this year

Fraud, claimant error and official error (see definitions above) have been measured for FYE 2021 only for UC. Expenditure on this benefit accounted for 18% of all benefit expenditure in FYE 2021. Official error is measured continuously for State Pension (SP), which accounted for 48% of benefit expenditure in FYE 2021. In total, 66% of all benefit expenditure was measured for official error in FYE 2021.

Estimates are produced by statistical analysis of data collected through annual survey exercises, in which independent specially trained staff from the Department’s Performance Measurement (PM) team review a randomly selected sample of cases for benefits reviewed this year. See section 4 for more information on the sampling process.

The review process involves the following activity:

- previewing the case by collating information from a variety of DWP or Local Authority (LA) systems to develop an initial picture and to identify any discrepancies between information from different sources

- interviewing the claimant (or a nominated individual where the claimant lacks capacity) using a structured and detailed set of questions about the basis of their claim. For UC (the only benefit fully reviewed this year) the interview is completed as a telephone review in the majority of cases. However, where this is not appropriate, there is usually also the option for a completed review form to be returned by post

- the interview aims to identify any discrepancies between the claimant’s current circumstances and the circumstances upon which their benefit claim was based

If a suspicion of fraud is identified, an investigation is undertaken by a trained Fraud Investigator with the aim of resolving the suspicion.

Between July 2020 and November 2020 for UC, and between October 2019 and September 2020 for SP (with a gap from May to July 2020), the following number of benefit claims were sampled and reviewed by the Performance Measurement (PM) team.

| Benefit | Sample size | Percentage of claimant population reviewed |

|---|---|---|

| Universal Credit | 2,750 | 0.05% |

| State Pension (official error only) | 1,460 | 0.01% |

| Total | 4,210 | 0.02% |

Overall, approximately 0.02% of all benefit claims included in DWP Global (overall) F&E estimates were sampled and reviewed by the PM team.

Information about the Performance Measurement Team can be found online.

The statistical consultation carried out in Summer 2018 included a question on which benefits we should measure in future years. Further information on the consultation can be found online.

Benefits reviewed previously

Since 1995, the Department has carried out reviews for various benefits to estimate the level of fraud and error in a particular financial year following the same process outlined above. These benefits cover around 76% of total expenditure (48% State Pension and 28% other benefits). Please see Appendix 2 for details of benefits reviewed previously.

Benefits never reviewed

The remaining benefits, which account for around 6% of total benefit expenditure, have never been subject to a specific review. These benefits tend to have relatively low expenditure which means it is not cost effective to undertake a review. For these benefits the estimates are based on assumptions about the likely level of fraud and error (for more information please see section 6).

2. Changes to the statistics this year

This section provides detail of changes for the FYE 2021 publication. Any historical changes can be found in previous years’ publications.

Changes to benefits reviewed

The coronavirus outbreak has resulted in some changes in terms of our regular statistical production. The benefit reviews which underpin the estimates were suspended in March 2020.

The reviews restarted in July 2020, focusing on Universal Credit. The usual period of reviews which support our annual estimates is around 12 months (reviews taking place from October to September), but for this year for Universal Credit it was reduced to five months (reviews taking place from July to November 2020). Given the focus on Universal Credit, we have undertaken an increased number of reviews on this benefit. We have also reviewed State Pension for official error as normal.

Categorisation of errors

This year we have made a change to how we attribute the amount overpaid or underpaid to error reasons. For cases that have multiple errors, when capping the error values, we will attribute amounts to reasons in order of which we are most certain of (see section 5 of this document for more information on Netting and Capping).

Previously we attributed errors at netting and capping in the hierarchy Fraud, Claimant Error and Official Error – then within each error type we would take the largest value to the smallest value. The new methodology splits out Fraud into a further hierarchy of those we are most certain of: Actual Fraud, Causal Link (High Suspicion) Fraud, Causal Link (Low Suspicion) Fraud (see the Causal Link text in section 5 of this document for more information on Causal Link errors and how we rate their suspicion level).

Any Fraud that is Causal Link (Low Suspicion) has been recategorised to a new category of “Failure to provide evidence/fully engage in the process”. Cases with an error in this new category have forgone their full benefit entitlement rather than engage in the benefit review process. We therefore make the assumption that the claim was fraudulent, even though the reason for their non-engagement is not clear.

This new methodology allows users to be more certain over which error reasons are responsible for the most Fraud and Error, whilst also acknowledging the uncertainty involved in some of the Causal Link errors.

This change has no effect on the amount overpaid or underpaid at a total level or an error type level (i.e. Fraud, Official Error, Claimant Error).

State Pension changes

Prior to this year we removed some accounting errors from SP, where an overpayment (or underpayment) error on SP was offset by an equivalent underpayment (or overpayment) of the same amount on Pension Credit. However, this was not the correct approach. We have now stopped removing these accounting errors from within SP this year. The impact of making this change is small (adding £1m to overpayments this year and £8m to underpayments).

We have made a change to remove cases that have a deemed error on them from the calculation of the Official Error rate (for more information on deemed errors please see section 4). Previously these cases were treated as benefit correct and kept in the calculation. This change brings State Pension in line with the other benefits on how deemed errors are treated. The impact of making this change is small (reducing overpayments by £3m and increasing underpayments by less than £1m).

We have made a small change to the calculation of our overall estimates for SP to better reflect changes in the split of expenditure each year between claimants resident in GB and those resident overseas. Our previous methodology for rolling forward the rates of fraud and claimant error from the last full review in FYE 2006 incorporated an assumption that the split of total SP expenditure between GB and overseas cases was the same in subsequent years as it was in FYE 2006. However, the expenditure split has changed slightly each year (although it has remained broadly unchanged, with the proportion of total SP expenditure for overseas claimants being 4.0% in FYE 2006 and growing slightly to 4.3% by FYE 2021). The change has increased our SP overpayment estimate for FYE 2021 by £5m (less than 0.01% of expenditure on SP). There has been no impact on the underpayment estimate.

We have also made changes to remove the proportion of fraud and error relating to Dependency Increases from our SP estimates. Adult Dependency Increases and the vast majority of Child Dependency Increases were abolished from April 2020, with payments being stopped; no new claims were accepted from April 2010. The dependency increase caseload has been reducing for a number of years: when we last carried out a full fraud and error review of SP in FYE 2006, over 70 thousand claimants were in receipt of a dependency increase, but by the end of FYE 2020 (before the payments were stopped) the figure was under 10 thousand. The changes have reduced our SP overpayment estimate for FYE 2021 by £19m (or 0.02% of expenditure on SP). There underpayment estimate has been reduced by less than £1m. This has only affected the estimates for FYE 2021 and not previous years.

Shortened review periods for Universal Credit and State Pension

The benefit reviews which underpin the annual fraud and error estimates usually take place over a 12 month period. However, the impact of coronavirus meant that – in addition to us not reviewing all the benefits we had intended to review this year – the reviews on the benefits we did measure took place over a shorter time frame. The UC reviews were condensed into five months (from July to November 2020), and the SP reviews began in October 2019 as planned but had a three month break from May to July 2020 (finishing in September 2020 as planned).

Reviewing over a period shorter than 12 months introduces potential problems – for example, some important seasonal effects could be missed out of the reviews, or could be included and the impact exacerbated by the shorter reviewing period. We carried out detailed analysis of seasonal trends from a number of past years of review data for both UC and SP and were able to conclude that, for both benefits, the likelihood of cases having errors in the months missed by the reviews were not noticeably different to the months that were reviewed.

For UC, we also carried out additional work to better understand the representativeness of the sample in terms of cases whose UC claims began before and after the onset of the coronavirus pandemic. We carried out analysis which showed that the sample was broadly representative of both groups. It also showed that any short-duration cases which began after the onset of the pandemic but which also ended before our review period began (in July) would have a minimal impact on our estimates.

Benefits we had originally planned to review this year

We had originally planned to review a wider range of benefits for fraud and error this year. Due to the impact of coronavirus we were unable to review the following benefits:

- Employment and Support Allowance (ESA)

- Pension Credit (PC)

- Personal Independence Payment (PIP)

- Housing Benefit (HB)

For these benefits we assessed a range of data sources to understand whether rolling forward rates of fraud and error from when the benefits were last reviewed (the previous year) would be reasonable, or whether there seemed to be any changes in levels of fraud and error which might require us to incorporate an adjustment (e.g. due to the impacts of coronavirus). The conclusions from our detailed analysis were that we could apply the previous year’s rates of fraud and error as there did not appear to be any noticeable shifts in fraud and error. Our wide ranging analysis included the following:

For ESA and PC we were able to look at the levels of fraud and error from October and November 2020 (the first two months of reviews that will feed into the FYE 2022 publication). The proportion of cases reviewed with overpayment or underpayment errors was not noticeably different to the levels observed the last time the benefits were fully measured.

For HB and PIP there were no reviews completed after the onset of coronavirus, but we did have a further three months of reviews after the FYE 2020 publication (covering the period October to December 2019). Analysis of these reviews again showed no noticeable difference to the levels of fraud and error from the FYE 2020 publication.

For ESA, PC and PIP, we analysed an additional source of data on official error checks that are carried out within DWP. This covered a number of months after the onset of coronavirus, and allowed us to compare levels of official error to those beforehand, to understand if there had been any changes. Our analysis concluded that there had been no major changes. We were also able to extend this analysis to include Jobseeker’s Allowance and Carer’s Allowance. For Jobseeker’s Allowance we observed a possible reduction in official error, but have not reduced our estimates due to the low monetary impact, given the low expenditure and low levels of official error we report on the benefit (e.g. in FYE 2020 the total reported official error overpayments and underpayment were both only £10m).

For HB, we convened a small group of experts to understand possible impacts of coronavirus on fraud and error. We met and worked further with members of the group and were able to conclude that any impact was negligible. Of the changes to HB that were introduced as a consequence of coronavirus, many did not directly relate to fraud and error, or were disregarded from HB purposes (e.g. where rates of benefits or entitlements were increased). A number of other performance metrics on the benefit seemed to indicate no material change in various levels of performance, including relating to error.

Housing Benefit rates could have been affected by the introduction by HMRC of the Self Employment Income Support Scheme (SEISS) payments.

If someone is self-employed and has been impacted by coronavirus they can apply for a Self-Employment Income Support Scheme (SEISS) grant. The scheme began in April 2020 and eligible claimants could apply for one of these grants every quarter in the last financial year. These grants are calculated to be a top up of the impacted person’s 3-month average trading profits. Read more information about SEISS.

On all benefits, SEISS payments are treated as Self-employed income. For HB, the amount of Self-employed income used to calculate a claimant’s benefit is usually based on their previous year’s tax return. However, if the claimant has a significant change in income then this should be reported to the Local Authority (who administer HB) and their HB recalculated.

We have assumed that any impact from SEISS payments to HB is small. This is due to:

- the coronavirus pandemic and in particular national and regional lockdowns. Self-employed people are likely to have had a decrease in their earnings this year. The SEISS payments would have then taken them more in line with income from their previous year’s tax return, and therefore any overpayment or underpayment would be small

- the uncertainty around what constitutes a significant change in income, and therefore which SEISS payment(s) should have been reported and HB entitlement recalculated (leading to an overpayment or underpayment)

Due to all of the above, we have decided to not adjust the rolled forward HB rates for any additional impact due to SEISS.

It is worth noting that Employment and Support Allowance and Pension Credit could also both be affected by SEISS payments. The proportion of the total number of claimants on these benefits which are Self-employed are very small (and smaller than for HB) so we expect the impact to again be minimal; no adjustment has been applied.

Verification easements due to coronavirus

A number of operational easements and changes to benefit administration were introduced as a consequence of the coronavirus pandemic. Some of these changes were necessary to comply with public health restrictions, and others were introduced to meet departmental aims to protect vulnerable customers and ensure benefit claim processing was as timely as possible.

Many easements related to verification of evidence required to complete a benefit claim. Examples include verification of identity, of household circumstances, and of tenancy agreements.

We carried out some analysis (as detailed in Appendix 3 of the main publication) to understand whether we needed to make any adjustments to the rates of fraud and error from when various benefits were last reviewed, in order to more accurately reflect the current rates of fraud and error.

Other operational changes – PIP Award Reviews

There was a specific change made as a direct result of the coronavirus pandemic with regard to when PIP claims in payment are reviewed. Some PIP claims are subject to reviews through an ‘Award Review’ (AR). The change resulted in claims that were due an AR from April 2020 having their AR paused for four months.

We investigated the potential impact on fraud and error of this change, by taking the extension to ARs into consideration. This was estimated using existing published data on PIP, using numbers of ARs delayed, the length of the pause, and likely changes in the rate of benefit received after the AR.

The latest published data showed that around 37 thousand ARs had been cleared each month from September 2020 to January 2021 (the most recent period during which the volumes had seemed to return to some kind of steady state; published table 6B). We assumed that this many cases had been delayed from each month beginning in April 2020.

Data on the outcomes of ARs could be used to determine the proportions of these cases that had their awards changed (i.e. increased, decreased or disallowed). AR outcomes from the period September 2019 to March 2020 were used (from published table 6B), following advice from PIP policy analysts, as it was thought that this was the most representative period to use (for example, figures from within the FYE 2021 might not be indicative of what would have happened without coronavirus).

The associated monetary changes to PIP awards could be determined by using information on PIP awards before and after the AR (derived from published table 6C and PIP benefit rates. Changes to award rates from the whole period of the published data (June 2016 to January 2021) were used, and these were not noticeably different from those for more recent ARs.

All of this information was then combined, including the number of ARs that had been delayed within FYE 2021, in order to arrive at the initial estimates of £150m overpayments and £50m underpayments on PIP in FYE 2021.

The overpayment estimates were presented as three scenarios, with different possible reductions to take account of adjustments we usually apply for PIP, where claimants may not be reasonably expected to know to report an improvement in their functional needs.

We also noted that claimants may ask for the AR outcome to be reviewed (a Mandatory Reconsideration), and they may also appeal the outcome of that. However, we have not been able to adjust the overpayment estimates in the main publication appendix to account for this, as there is no published data on the rates of these in relation to outcomes of ARs. Over 10% of all PIP initial assessment decisions in FYE 2020 had their award changed after either a Mandatory Reconsideration or an appeal. The true overpayment estimate from our modelling would likely be lower by at least this amount – perhaps more if Mandatory Reconsiderations and appeals are more likely for claimants whose awards are decreased or disallowed (than for claimants whose awards are increased or maintained at an AR).

The estimates for this can be found in appendix 3 of the main publication.

3. Interpretation of the results

Care is required when interpreting the results presented in the main report:

The estimates are based on a random sample of the total benefit caseload and are therefore subject to statistical uncertainties. This uncertainty is quantified by the estimation of 95% confidence intervals surrounding the estimate. These 95% confidence intervals show the range within which we would expect the true value of fraud and error to lie.

When comparing two estimates, users should take into account the confidence intervals surrounding each of the estimates. The calculation to determine whether the results are significantly different from each other is complicated and takes into account the width of the confidence intervals. We perform this robust calculation in our methodology and state in the report whether any differences between years are significant or not.

Unless specifically stated within the commentary in the publication or in the accompanying tables, none of the changes over time for benefits reviewed this year are statistically significant at a 95% level of confidence.

As well as sampling variation, there are many factors that may also impact on the reported levels of fraud and error and the time series presented.

These estimates are subject to statistical sampling uncertainties. All estimates are based on reviews of random samples drawn from the benefit caseloads. In any survey sampling exercise, the estimates derived from the sample may differ from what we would see if we examined the whole caseload. Further uncertainties occur due to the assumptions that have had to be made to account for incomplete or imperfect data or using older measurements.

A proportion of expenditure for benefits reviewed this year cannot be captured by the sampling process. This is mainly because of the delay between sample selection and the interview of the claimant, and also the time taken to process new benefit claims, which excludes the newest cases from the review. The estimates in the tables in this release have been extrapolated to account for the newest benefit claims which are missed in the benefit reviews and cover all expenditure.

The estimates do not encompass all fraud and error. This is because fraud is, by its nature, a covert activity and some suspicions of fraud on the sample cases cannot be proven. For example, cash in hand earnings are harder to detect than those that get paid via PAYE. Complex official error can also be difficult to identify. More information on omissions can be found later in this section.

Some incorrect payments may be unavoidable. The measurement methodology will treat a case as incorrect, even where the claimant has promptly reported a change and there is only a short processing delay.

Omissions from the estimates

The fraud and error estimates do not capture every possible element of fraud and error. Some cases are not reviewed due to the constraints of our sampling or reviewing regimes (or it is impractical to do so from a cost or resource perspective), some cases are out of scope of our measurement process, and some elements are very difficult for us to detect during our benefit reviews. The time period that our reviews relate to means that any operational or policy changes in the second half of the financial year are not covered by our measurements.

For most omissions from our estimates we make adjustments or apply assumptions to those cases. For some omissions we assume that the levels of fraud and error for those cases are the same as for the cases that we do review, and for other omissions we apply specific assumptions where we expect the levels of fraud and error to be different.

This section of this document details the omissions from the estimates as far as possible. The examples that follow are not an exhaustive list, but are an attempt at providing further details on known omissions in the estimates.

There are a number of groups of cases that we are unable to review or which we do not review. Some of the main examples of these are as follows:

From a sampling perspective, we do not review cases in some geographically remote local authorities (see section 4 for more details). We assume that the rates of fraud and error in the areas we do not sample from are the same as for the rest of Great Britain.

We are unable to review short duration cases (of just a few weeks in duration) due to the time lags involved in accessing data on the benefit caseloads, drawing the samples and preparing these for reviewing. For these cases, we assume the rates of fraud and error are the same as in the rest of the benefit caseloads. We do, however, also make an adjustment using “new cases factors” to try to ensure that the results are representative across the entire distribution of lengths of benefit claims (see section 5 for further details).

We are unable to review everyone on PIP. We do not review terminally ill claimants who are categorised as Special Rules Terminally ill cases (around 2% of the PIP caseload), and for these cases we assume there are no underpayments, and only official error overpayments. We do not review cases who had a new claim, award or intervention within the last three months, or who have a forthcoming review, in order to avoid these claimants having to go through an additional lengthy review process. We assume the rates of fraud and error for these cases are the same as the rest of the PIP caseload.

We do not review SP cases resident overseas as part of the annual exercise to review official error on SP. Overseas cases make up around 9% of the SP caseload and around 4% of benefit expenditure. We assume the rates of official error are the same as for the cases resident in Great Britain that we do review.

Get Your State Pension is a relatively new system on which claims to SP are recorded. No cases were selected in the SP sample from the new Get Your State Pension system as we are as yet unable to access the data on it for sampling purposes. The numbers of cases on this new system are very small in comparison to the caseload as a whole. An assumption has been made that the fraud and error present on these cases is the same as those in the legacy recording system from which our sample is drawn.

The time lags involved in the fraud and error measurement process mean that further omissions are possible. Any policy or operational changes in the second half of the financial year of the annual publication will not usually be covered by the reviews feeding into the publication, as the reviews tend to finish in the September of that financial year (although the timings of reviews have been affected by the coronavirus pandemic). In addition, some cases do not have a categorisation by the time the estimates are put together, often due to an ongoing fraud investigation. “Estimated outcomes” are generated for these cases for the purposes of the statistics, made by the review officer estimating the most likely outcome of the case, or based on the results from the reviews of similar cases that have been completed. See section 5 for further details.

Measurement of ESA was first included in the FYE 2014 estimates, and followed the existing methodology for JSA, IS and PC, reviewing the financial side of a claimant’s circumstances. However, the measurement of ESA does not include a review of the Work Capability Assessment.

Some elements are out of scope of our measurement. Benefit advances is one of these (see separate section lower down). Other examples include:

We only review the benefit that has been selected for a review, and do not assess any consequential impacts on other benefits. However, in certain circumstances, for some benefits, there may be a knock-on impact on other benefits. An example of this is how changes in entitlement to DLA and/or PIP affects disability and carer premiums on income-related benefits (specifically IS, PC and HB), as well as CA. We account for this in our estimates by using DWP’s Policy Simulation Model to assess the impact. The Policy Simulation Model is the main micro-simulation model used by DWP to analyse policy changes, and is based on the annual Family Resources Survey.

The accuracy of third party deductions is not measured (i.e. whether the deduction is at the correct amount and is still appropriate). Third party deductions can take place to cover arrears for things like housing charges, fuel and water bills, Council Tax and child maintenance. The rate of benefit is not impacted by any third party deductions, and the amount of any fraud or error is based on the “gross” amount of benefit in pay.

For UC, we do not assess whether the Department follows correct “labour market” procedures and takes any necessary follow up action for non-compliance by claimants (i.e. considers whether a sanction should apply if a claimant fails to apply for a job or leaves a job voluntarily). However, if a sanction decision has already been made when we review a case, then we do assess whether the impact this has on the benefit award is correct.

For UC, we only measure income in the assessment period we are checking. Self Employed people must report their income on a monthly basis. If they receive income that removes their entitlement to UC in one month, and this is above the surplus earnings threshold, then any extra income is carried forward into the next month (the surplus earnings threshold is defined as £2,500 above the amount that removes their entitlement to UC in that month). If a self-employed claimant incurs a loss of any amount within an assessment period, this loss is also rolled forward to the next assessment period. When reviewing the benefit, any rolled forward income or loss is assumed to be correct.

Self Employed Income Support Scheme (SEISS) payments are treated as Self-employed income on UC. As a result of this there are potentially more claimants with rolled forward earnings because they have had large incomes in an assessment period that would remove entitlement, with a surplus to then roll forward to the next assessment period. However, due to the surplus earnings threshold, we think the number of claimants this would affect is small, and therefore the impact minimal.

There are also elements of fraudulent activity that are very hard for us to detect during the benefit reviews which underpin the fraud and error estimates. For example, earnings from the hidden economy that are not declared by claimants, or the impact of cyber-crime on benefit expenditure (e.g. due to fraudulently made claims). The Department does identify cyber-crime through its Integrated Risk and Intelligence Service, which is also used to help identify a range of fraudulent activities. However, these can be very difficult to identify within the measurement process for our fraud and error statistics.

Benefit Advances

One of the largest current omissions from our estimates is benefit advances, which are out of scope of our measurement. The benefit review process for the fraud and error statistics examines cases where benefit is in payment. A benefit advance is not a benefit payment, and is not included in our measurement process. Claimants who progress to receive payment of a benefit will be included within the scope of our measurement, but we will only review the existing benefit payment. This will not examine fraud or error that may have existed in any prior benefit advance payment. Claimants who only receive a benefit advance, but do not go on to receive a subsequent benefit payment, will not be included within the measurement. Advances are available for a number of benefits but, for FYE 2021, advances for UC constituted the vast majority of expenditure on benefit advances.

UC supports those who are on a low income or out of work. It includes a monthly payment to help with living costs. If a claim is made to UC but the claimant is unable to manage financially until their first payment, they may be able to get a UC Advance, which is then deducted a bit at a time from future payments of the benefit.

The latest published figures on the levels of potentially fraudulent UC advances are from a National Audit Office (NAO) report released in March 2020. The data in the report is now over a year out of date, and the Department has done a lot of work to reduce the volume and amount of advances fraud within that time. Therefore, we feel that the estimate contained within the report is not representative of the current situation.

Note: a small (but not insignificant) proportion of expenditure on benefit advances is included in the published expenditure forecasts from Spring Budget, which are used in our estimates. This does not affect the rates of fraud and error we report for various benefits – these are based on the reviews of benefit cases currently in payment that we carry out. However, part of the monetary estimates of fraud and error that we report will effectively relate to advances.

Rounding policy

In the publication and tables, the following rounding conventions have been applied:

- percentages are rounded to the nearest 0.1%

- expenditure values are rounded to the nearest £100 million

- headline monetary estimates are rounded to the nearest £10 million

- monetary estimates for error reasons are rounded to the nearest £1 million

Incorrectness is rounded to the nearest 1% in the publication and expressed in the format “n in 100 cases”. The tables present the same values as a percentage rounded to the nearest 0.1%.

Individual figures have been rounded independently, so the sum of component items do not necessarily equal the totals shown.

4. Sampling and Data Collection

The Fraud and Error statistics are determined using a sample of benefit records, since is it not possible to review every benefit record. The sample of benefit records provide data from which inferences are made about the fraud and error levels in the whole benefit claimant population.

The number of benefit records to be reviewed is determined by a sample size calculation. The sample size calculation is used to ensure that a sufficient number of benefit records are sampled, which allows meaningful changes in the levels of fraud and error to be detected for the whole benefit claimant population.

Benefit records are selected on a monthly basis from data extracts of the administrative systems. The population from which the samples are drawn are the benefit records that are in payment in a particular assessment period, that is where there is evidence of a payment relating to the previous month. This is known as the liveload.

The monthly samples are taken from the liveload in advance of the scheduling of the benefit reviews, to give time for the sample to be checked and for background information to be gathered on each benefit record sampled. Any benefit record relating to a claimant who has been previously sampled in the last 6 months, or meets specific exclusion criteria (e.g. terminally ill) will not be reviewed.

We use Simple Random Sampling to select the sample of benefit records for each benefit that is reviewed in the current year. Benefit records are sampled randomly to ensure an equal chance of being selected for the sample.

The sampling methodology is used to attempt to minimise selection bias in the sample and aims to select a sample that is representative of the entire benefit claimant case population.

The benefits sampled for this year and the methodologies applied are as follows:

- Universal Credit: simple random sample. Reviews by telephone

- State Pension: simple random sample. Official error only reviews (no claimant contact)

The following two LAs are always excluded from the samples as they have been identified as ‘hard to reach’ areas:

- Outer Hebrides

- Shetland Islands

Abandoned Cases

Of the benefit records sampled, there are some that have to be explicitly excluded from the sample that can be reviewed according to strictly defined criteria for abandonment. Benefit records that fall into this category could include:

- The claimant reports a change of circumstances that ends their award before the interview can take place

- The claimant has had a benefit reviewed in the last six months

- If the claimant or their partner is terminally ill

When such cases occur in the sample, they are replaced by another case, from a reserve list. However, for a small number of abandoned cases replacement is not possible for practical reasons.

Official Error Checking

Cases are checked for official errors within a specified sample week. For UC this is the assessment period of one month prior to the last payment (or the date payment was due if no payment is made).

Specially trained DWP benefit review officers carry out the checks. The claimant’s case papers and DWP computer systems are checked to determine whether the claimant is receiving the correct amount of benefit according to their presented circumstances. This identifies any errors made by DWP officials in processing the claim, and helps prepare for the next stage: a telephone or face-to-face review of circumstances with the claimant.

A full review is not completed on every case. There are different types of OE only samples within the measurement:

- For State Pension, OE checks are conducted on the entire sample. No further fraud or error checks are carried out

Claimant Error and Fraud Reviews

For all benefits, benefit review officers normally check for claimant error (CE) or fraud by comparing the evidence obtained from the review to that held by the Department.

The claimant may not be interviewed if:

- the case is already under an ongoing fraud investigation

- a suspicion of fraud arises while trying to secure an interview

- the claimant reports a change of circumstances that materially alters their claim award before the interview can take place

When such cases occur in the sample, they are replaced by another case.

Types of errors excluded from our estimates

Some failures by DWP staff to follow procedures are not counted as official errors; where the failure does not have a financial impact on the benefit award or where the office have failed to take action which could have prevented a claimant error from occurring. These are called procedural errors.

Accounting errors are also excluded from the estimates. These are errors where, despite an error in the claimant’s benefit, an overpayment/underpayment of the benefit undergoing a check could be offset against any corresponding underpayment (or overpayment) on the same benefit.

Deemed errors are official errors where evidence that was available to the department when the award of benefit was made has been misplaced or is not available. This means that the official error check is not complete. These errors are not counted as official errors, since we cannot be sure whether there would have been a financial impact on the claimant. Any case that has a deemed error raised against it is also excluded from the calculation of the official error rate (but may still be counted in the calculation of claimant error and fraud).

Recording Information

Case details relating to the fraud and error reviews are recorded on internal bespoke ‘Fraud and Error’ software (the system is known as FREDA), to create a centrally held data source. This can then be matched against our original sample population to produce a complete picture of fraud and error against review cases across our sample.

5. Measurement Calculation Methodology

Fraud and error measurement relies on three data sources:

- Raw Sample held on ‘FREDA’ (the database on which the review outcomes are recorded), is used to identify the monetary value of fraud and error (MVFE) for individual cases, categorise its cause and quantify it as a proportion of the sample

- Benefit Population data to estimate the extent of fraud and error across the whole claimant caseload from the sample data

- Expenditure data to estimate the total MVFE to the department

Estimates are categorised into overpayments (OP) and underpayments (UP) and one of three incorrectness types; CF, CE or OE. Further sub-categories of error reasons are used to provide more details about the nature of the fraud or error. A glossary of error classifications can be found in the Background Information and Methodology note.

Detailed below are the main calculation steps that the Fraud and Error Measurement Analysis (FEMA) team carry out to produce the final fraud and error estimates.

Causal Link

Cases where there is a change to the claimant’s award as a result of the review activity or, after initial contact the claimant subsequently fails to engage in the review process, are categorised as Claimant Fraud with causal link. Action is taken to suspend their payment and subsequently terminate their claim.

Examples of behaviours that can trigger cases to be categorised as Causal Link include:

- the claimant receives notification of the review and subsequently contacts the service centre to report an immediate change e.g. living with a partner, starting work, self-employment or capital changes. Then supporting evidence needed to verify the change is not provided, resulting in claim suspension and termination

- the claimant completes the review but subsequently declares that a change has happened following the period of the review

- the claimant receives notification of the review and does not engage in the review process or contacts the service centre with a request to withdraw their claim

- the claimant completes a review and a change is declared, however supporting evidence needed to verify the change is not returned, resulting in claim suspension and termination

For UC there are cases where the claimant fails to engage in the review process, but there is supporting evidence that a change is not due to the review. These are categorised as mitigating circumstances. For these cases, information is available on our systems to indicate why the person may not have engaged. In most cases, they have moved into paid work following the Assessment Period under review.

Post-review, every Causal Link error is categorised as either high suspicion or low suspicion. This categorisation is used in the netting and capping procedure to help attribute losses to the error reasons we are most confident about. Any losses attributed to low suspicion Causal Link after netting and capping will have their error reason changed to “Failure to provide evidence/fully engage in the process”.

Examples of high suspicion Causal Link errors include:

- Shortly after review the claimant terminates their claim (rather than send in evidence)

- The claimant told us at the review of a change of circumstances, but we cannot confirm that the change occurred prior to (or in) the assessment period checked

- Post-review, the claimant made a change of circumstances that cannot be confirmed as starting after the assessment period checked

- When asked to send in more information or to clarify further queries on evidence sent in, the claimant stops engaging

The main reason that we would class a case as low suspicion is where the claimant fails to send in evidence but we have no prior suspicions of fraudulent intent.

Adjustments

A series of adjustments are made to the sample data, to allow for various characteristics of the benefits and how their data is collected and recorded.

The following table highlights which adjustments apply to each benefit.

| UC | SP | |

|---|---|---|

| Netting and Capping | Y | Y |

| Estimated Outcomes | Y | N |

| New Cases Factor | N | N |

| Cannot Review Cases | Y | N |

| Underlying Entitlement | N | N |

| Reasonably Expected to know | N | N |

Netting and Capping

Where a case has more than one error, these errors can be “netted off” against one another to produce a total value. For example, if a case is found to have two different OEs, one leading to an UP and one leading to an OP, then these are “netted off” to produce a single OP or UP. This is done to better represent the total monetary loss to the public purse (via OPs) or to the claimant (via UPs).

The monetary loss on each case is the difference between the case award paid at the review or assessment period, and the correct award calculated following the review – the “award difference”.

A case may have OPs of more than one ‘type’ which sum to a total greater than the award difference. To ensure that the total OP does not exceed the total award difference, we ‘cap’ the OP amount using a hierarchy order of actual CF, Causal Link (high suspicion) CF, Causal Link (low suspicion) CF, CE then OE. This capping process means that a small proportion of CE and OE found during the survey is not included in the estimates, and therefore the final estimates may actually be under-reporting CE and OE in the benefit system.

Estimated outcomes

For all benefits reviewed this year for a number of cases the review process had not been completed at the time of the analysis and production of results, often because fraud investigations are still to be completed. Predictions for the final outcomes for these cases have been made in the analysis using either the review officer (RO) estimation of the most likely outcome, or the results from the reviews of similar cases that had been completed.

New Cases Factors

New Cases Factors are an adjustment applied to help ensure that the durations on the sample accurately reflect the duration on benefit within the population.

As a result of the time required to collect the information needed to review a case, as well as other operational considerations, there is an unavoidable delay between sample selection and case review. This delay means that fewer low duration claims will be represented in the sample of cases, which artificially introduces a bias around claim durations at the point of interview.

Cannot Review

Cases that cannot be reviewed, primarily due to the claimant not engaging in the review process resulting in their benefit claim being suspended and later terminated, are initially recorded as fraud.

Not all of these cases will be fraud so additional checks are conducted at a later date to determine if the individuals have reclaimed benefit or a suspicion of fraud recorded on the case at the initial preview. The outcome of these checks will result in these cases being re-categorised for reporting purposes. 1.5% of sampled cases in FYE 2019 did not have an effective review.

There are three different categories that are applied to cannot review cases for reporting purposes:

- Not Fraud – If the individual reclaims benefit within 4 months, with the same circumstances and at a similar rate they were receiving prior to review, then the fraud is removed

- Fraud remains – If an individual does not reclaim benefit and there was a suspicion of fraud raised at the preview stage of the review then the case remains as fraud

- Inconclusive – If the individual does not reclaim benefit and there was no suspicion of fraud at the preview stage of the review then the case is categorised as inconclusive as there is no evidence to suggest the case is fraud or not

Inconclusive cases are excluded from the estimates and reported separately in footnotes in the publication and supporting tables.

Benefit-specific adjustments

This section contains details of any benefit-specific sampling issues, or things that we only do for certain benefits when we calculate our estimates. This section only usually includes details for benefits which we have reviewed this year.

Universal Credit

Zero payment cases: Universal Credit cases still live but with zero entitlement are not included in our sample for benefit reviews. However, when calculating the levels of incorrectness on Universal Credit we scale the final figure to account for these cases.

State Pension

State Pension has been reviewed this year for Official Error only. We do not review overseas cases as part of the SP review. We assume that the rate of Official Error in the overseas cases (which constitute around 4% of total expenditure on SP) is the same as for cases resident in Great Britain.

Personal Independence Payment

PIP has not been reviewed this year, but some information on the benefit is relevant as it links to information contained within appendix 3 of the main publication.

For disability benefits, there are some changes which the claimant should report (for example, hospitalization). However, many changes are gradual improvements or deteriorations in their medical needs, and it is difficult for some claimants to know at what point these needs have changed sufficiently to affect their benefit entitlement.

PIP legislation states that when a case is reassessed and their benefit is reduced, the Department will only seek to recover an overpayment when it is reasonable for the claimant to have known they should have reported the change. In other cases, the benefit will be treated as correct up to the point of reassessment.

It was identified that during PIP reviews there appeared to be variance in the application of “Reasonably expected to know” decisions, resulting in such cases not always having overpayments reported.

In Spring 2017, PM staff completed a joint exercise with PIP Operational staff to reconsider all of the information available to identify improvements to the review process to ensure the measurement of PIP was sufficiently robust.

Accordingly, error cases have been excluded from the headline overpayment estimates where the claimant could not reasonably have been expected to know they should have reported it.

Grossing

Grossing is the term used to describe the creation of population estimates from the sample data; sample results are scaled up to be representative of the whole population.

Example of a simple grossing factor ‘G’, if we were to sample 10 cases from a population of 1,000:

G = N ÷ n

= 1000 ÷ 100

= 10

Where ‘N’ is the population or sampling frame from which the cases are selected and ‘n’ is the sample size taken.

The above grossing factor shows that, in this example (sampling 100 cases from a population of 1,000), then each case would have a grossing factor of 10 (i.e. each sample case represents 10 cases from the population). Hence if a case was shown to be in error, this would represent 10 errors once grossed.

The UC caseload and expenditure is on a significant upward trend, with new case types being introduced as rollout continues. Since UC is replacing other benefits, as UC caseload increases, their caseload will decrease. As a result, grossing for all benefits are calculated on a monthly basis. This ensures that an error identified at the start of the year is grossed up by less than an error identified at the end of the year if the caseload is increasing (or vice versa if it is decreasing).

Grossing factors are different for each benefit due to the sample, population and adjustments made. For all benefits that are not UC, there are two different broad grossing factors, one for official error and one for fraud and claimant error. The official error grossing factor is used on the sample which covers all cases where an official error check was done. The fraud/claimant error grossing factor is used on the sample which covers all cases where a full check was done – i.e. official error check and claimant review. For UC there is only one grossing factor as every case has had both an official error check and a fraud and claimant error check.

Percentage overpaid and underpaid

The grossing factors are then applied to the sample data to calculate values for the grossed awards, the grossed overpayments and grossed underpayments i.e. these are scaled up proportionally to what we would expect to find in the population. In turn, the resulting grossed values are used to calculate the total annual percentage overpaid and underpaid.

Extrapolation

The grossed results provide a core estimate of levels of fraud and error. Due to how and when the data is sampled, there are various reasons why bias may be introduced and where areas of a benefit population may not be fully represented in the sample, including cases outside the scope of the original sample. This is accounted for by applying separate estimations and assumptions which also feed into the central estimate calculations.

Monetary Value of Fraud and Error (MVFE)

To then calculate the MVFE across the benefits, we apply the OP or UP percentage rates to the total annual expenditure for each benefit. This means that the MVFE is affected by the increases and decreases in expenditure, even if the OP and UP percentages are stable. We see the impacts of this in our estimates for benefits not reviewed in the current year, where we use the same rate of fraud and error from previous years but apply it to the expenditure on the benefit in the current year (which will have changed from the year before).

Although expressing fraud and error in monetary terms (i.e. MVFE terms) might be helpful for a reader to contextualize the figures, we recommend making comparisons on a year-on-year basis based on the percentage rates of fraud and error. This is particularly important for benefits where the expenditure changes a lot each year (such as we are seeing for UC at the moment), as comparisons of monetary amounts can be misleading. For example, on a benefit with growing expenditure, it can be possible for the monetary amount of fraud and error to increase, even if the percentage rate of fraud and error has actually gone down.

Central Estimates and Confidence Intervals

The central estimates produced following extrapolation are based on reviews of random samples and hence are subject to variability. Therefore, confidence intervals are provided with the central estimates to quantify the uncertainty associated with these estimates.

The central estimates and confidence intervals are incorporated into the Global (overall) Estimates of Fraud and Error. These combine all separate DWP benefits to calculate an overarching set of Fraud, Claimant Error and Official Error rates for overpayments and underpayments. See section 6 on Measurement of Total Overpayment and Underpayments for more detail.

Incorrectness

The main published figures include fraud and error as a percentage of expenditure, and the associated MVFE. We also calculate figures on incorrectness. These are calculated as the proportion of cases in the sample with any incorrectness (overpayment or underpayment, regardless of magnitude or number of errors). Incorrectness estimates are published as part of the tables accompanying the publication, and may be referenced in the main publication where there has been a statistically significant change from the previous year.

6. Measurement of Total Overpayment and Underpayments

The fraud and error estimates need to include all expenditure on benefits by DWP. Some benefits have been reviewed for fraud and error in the current year, and some have been reviewed in previous years. We also need to include estimates for benefits which have never been reviewed. A full list of which benefits are in scope for each release of the Fraud and Error in the Benefit system estimates is included within Appendix 2 of this document.

We also have an estimate of Interdependencies, the knock on effect of Disability Living Allowance (DLA) fraud and error on other benefits, where receipt of DLA or PIP is a qualifying condition. This is only included within the overpayments calculation and not the underpayments.

Methodology for Benefits never reviewed

Taken together, all of the benefits reviewed this year or in previous years account for approximately 94% of the total benefit expenditure (including Official Error only checks on State Pension). Benefits that have never been reviewed account for 6% of the total.

Estimates for benefits never reviewed are created using a common model. Examination of the qualification conditions and administrative structure suggests that benefits belong in “families” of similar benefits. For example, DLA and Attendance Allowance (AA) are very similar benefits that belong to the same family.

All benefits never reviewed that sit in the same family as a benefit reviewed this year or previously are assigned the same rate of fraud and error, in percentage terms, as the benefit never reviewed. The benefits never reviewed that are in families that do not contain a benefit reviewed this year or previously are assigned the average rate of fraud and error, in percentage terms, of all benefits that have ever been reviewed.

For each of the benefits that have never been reviewed, we apply the estimated percentage of fraud and error to the expenditure on that benefit to get an estimate of the monetary value of fraud and error.

Central Estimate and Confidence Intervals

The percentage estimate (i.e. the overall rate of fraud and error) is the sum of the monetary value of fraud and error for all benefits reviewed this year, those reviewed in previous years, those never reviewed and interdependencies, divided by the overall expenditure. This is done independently for fraud, claimant error, official error and the overall fraud and error.

The central estimate is the estimate obtained from the sample data. It provides our best guess of the unknown value that we are trying to measure.

Confidence intervals are calculated for the percentage estimates, to quantify the statistical uncertainty associated with the central estimate. Some adjustments are made to the individual benefits before this is calculated for overall fraud and error:

- confidence intervals for benefits reviewed previously are deliberately widened

- confidence intervals may be widened further if it is believed that non-sample error could impact the accuracy of the estimates

- confidence intervals are widened for the benefits never reviewed, whereby the standard error is assumed to be 40% of the central estimate, to reflect greater uncertainty given the less robust method of estimation for these benefits

The uncertainty surrounding a central estimate is associated with both the variance of the outcome within the sample and the size of the sample from which it is calculated. A 95% confidence interval is used to indicate the level of uncertainty. It shows the range of values within which we would expect the true value of the estimate to lie. A wider range for the confidence interval implies greater uncertainty in the estimate.

Confidence intervals are calculated using a statistical technique called Bootstrapping. It is used to approximate the sampling distribution for the central estimate. The sampling distribution describes the range of possible values, for the central estimate, that could occur if different random samples had been used.

Bootstrapping is a computationally-intensive technique that simulates resampling. A computer program is used to take 4,000 resamples with replacement, of equal size, from the initial sample data. The percentage rate of fraud and error is calculated for each of the resamples. These estimates are ordered from smallest to largest and this gives the approximated sampling distribution.

The 95% confidence intervals are obtained from the Bootstrapping results, by taking the 100th estimate (2.5th percentile) and the 3,900th estimate (97.5th percentile). We also check the median estimate (50th percentile) against our actual central estimate to ensure that no bias exists.

Calculation of Net Loss estimate

Recoveries refer to money recovered in the same financial year as the overpayment estimates, regardless of the period the debt is from. They include debt recovered by both the Department and Local Authorities (who administer Housing Benefit payments). The recovery data for Housing Benefit covers the period October 2019 to September 2020, due to a time lag on the data being available.

Net loss is calculated as a monetary amount by subtracting the value of the recoveries from the value of the overpayments. The percentage estimate is then calculated by dividing the monetary net loss by the expenditure. Net loss can only be calculated at the overall fraud and error level, because error classification differs between overpayments and recoveries.

As the recoveries are actual values rather than estimates, the calculation of net loss does not affect the uncertainty around the overpayment estimates. The confidence intervals for net loss are calculated by subtracting the value of the recoveries from the upper and lower confidence limits. Percentage confidence intervals are obtained by dividing by the expenditure.

Net loss is calculated overall and individually for benefits reviewed this year and previously reviewed benefits. Net loss is also calculated for the group of benefits never reviewed combined, by subtracting all recoveries relating to these benefits from the total overpayments.

Some recoveries have no associated overpayments for the same period, as these benefits are no longer administered by the Department. This is because the debt relates to expenditure from previous years. In addition, some recoveries the Department makes are not included in our net loss estimate as they do not relate to our fraud and error reporting. For example, recoveries of tax credits and of benefit advances (which are outside the scope of our measurement; see section 3 for more details).

The overall net loss estimate includes the benefits reviewed this year, benefits reviewed in previous years, benefits never reviewed and recoveries for which there is no overpayment.

7. Future Reporting

The future coverage and scope of the national statistics “Fraud and Error in the Benefit System” is kept under review and users are kept informed of our plans via our Publication Strategy document.

Appendix 1: Glossary of abbreviations

| Abbreviation | Full name |

|---|---|

| AA | Attendance Allowance |

| CA | Carer’s Allowance |

| CE | Claimant Error |

| CF | Claimant Fraud |

| DLA | Disability Living Allowance |

| DWP | Department for Work and Pensions |

| ESA | Employment and Support Allowance |

| FEMA | Fraud and Error Measurement and Analysis |

| FYE | Financial Year Ending |

| HB | Housing Benefit |

| HMRC | Her Majesty’s Revenue and Customs |

| IB | Incapacity Benefit |

| IS | Income Support |

| JSA | Jobseeker’s Allowance |

| LA | Local Authority |

| MVFE | Monetary Value of Fraud and Error |

| OE | Official Error |

| OP | Overpayment |

| PC | Pension Credit |

| PIP | Personal Independence Payment |

| PM | Performance Measurement team |

| SP | State Pension |

| UC | Universal Credit |

| UP | Underpayment |

Appendix 2: List of benefits included in fraud and error estimates

Benefits reviewed this year

- Universal Credit

- State Pension (official error)

Benefits reviewed previously

| Benefit | Last Reviewed |

|---|---|

| Employment and Support Allowance | FYE 2020 |

| Pension Credit | FYE 2020 |

| Personal Independence Payment | FYE 2020 |

| Carer’s Allowance | FYE 2020 |

| Housing Benefit: non-passported working age and passported pension age | FYE 2020 |

| Housing Benefit: passported working age and non-passported pension age | FYE 2019 |

| Jobseeker’s Allowance | FYE 2019 |

| Income Support | FYE 2011 |

| Incapacity Benefit | FYE 2015 |

| State Pension - fraud and claimant error | FYE 2006 |

| Disability Living Allowance | FYE 2005 |

Benefits never reviewed

| Benefit | Proxy Measure |

|---|---|

| Maternity Allowance | Employment and Support Allowance |

| Severe Disablement Allowance | Employment and Support Allowance |

| Over 75 TV Licence | State Pension |

| Financial Assistance Scheme | State Pension |

| Industrial Death Benefit | State Pension |

| Winter Fuel Payments | State Pension |

| State Pension Transfers | State Pension |

| Cold Weather Payments | Jobseeker’s Allowance |

| Widow’s Benefit / Bereavement Benefit | Jobseeker’s Allowance |

| Industrial Disablement Benefit | Disability Living Allowance |

| Attendance Allowance | Disability Living Allowance |

| Specialised Vehicle Allowance | Disability Living Allowance |

| Armed Forces Independence Payment | Disability Living Allowance |

| Christmas Bonus | General |

| Statutory Sick Pay | General |

| Statutory Maternity Pay | General |

| Statutory Sick Pay | General |

Note: the General proxy is determined by all benefits which have ever been reviewed:

- Income Support

- Jobseeker’s Allowance

- Pension Credit

- Housing Benefit

- Disability Living Allowance

- State Pension

- Carer’s Allowance

- Incapacity Benefit

- Employment and Support Allowance

- Universal Credit

- Personal Independence Payment

Appendix 3: Further information on types of errors reported

The definitions of the key terms fraud, claimant error and official error are included at the start of this document. This section includes additional information on how we classify errors, including a detailed list of the types of errors we report for benefits reviewed in the current year.

Note that our methodology states that all errors (fraud, claimant error and official error) found on a case are recorded separately and the full values of each error are recorded in isolation of one another. This can lead to the sum of the error values being higher than the benefit award. In such cases a capping calculation is performed (using a fraud, claimant error, official error hierarchy) to ensure that the sum of the errors does not exceed the award, so that the monetary value of fraud and error is not over-reported. This can lead to some of the originally captured fraud, claimant error and official error raw sample values being reduced during the calculation of the estimates.

In addition, it should be notes that an error which is initially categorised as claimant error, will instead be categorised as official error where the error has clearly been caused by an official of the Department/LA, and the ESA/CA/HB business unit (or, for PC, the pension centre) is in possession, from whatever source, of the true facts, regardless of whether the information has been processed by the business unit.

Glossary of the current error types for overpayments and underpayments is given below:

Abroad

Claimant left Great Britain after claim began, did not notify DWP before leaving and is confirmed to be abroad for a period that exceeds any allowable absence limit.

Award Determination

Where a Case Manager from the DWP makes an incorrect award of PIP based on the declared functional needs of the claimant. This includes failing to consider the qualifying period.

Capital

Concealed or incorrect declaration of the amount of savings in bank or building society accounts, cash, ISA/PEPs, premium bonds, other property interests or shares that exceed the minimum value for capital limits.