Statistics of government revenues from UK oil and gas production September 2023

Updated 25 September 2024

Statistics of government revenues from UK oil and gas production September 2023

1. About this release

This publication contains statistics of government revenues from UK oil and gas production.

2. Key findings

The headline findings in this year’s publication are that:

- total government revenues from UK oil and gas production were £9 billion in financial year 2022 to 2023, compared with £1.4 billion in 2021 to 2022, an increase of £7.6 billion

- offshore Corporation Tax (CT) receipts (net of repayments), comprising of Ring Fence Corporation Tax (RFCT) and Supplementary Charge (SC), increased from £2 billion in 2021 to 2022 to £6.6 billion in 2022 to 2023

- high energy prices throughout 2022 to 2023, caused by global supply and demand factors, have been the main reason for the large increase in offshore CT receipts

- introduction of the Energy Profits Levy (EPL) in May 2022 resulted in £2.6 billion of additional cash receipts in 2022 to 2023

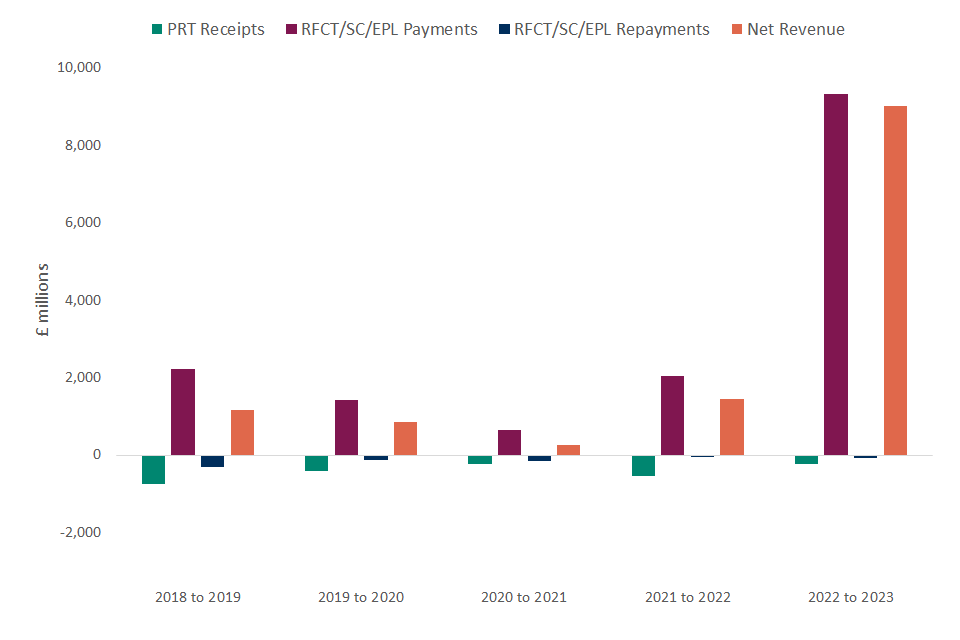

Chart 1 shows oil and gas tax revenues paid to the UK Exchequer in the last 5 years (from financial year 2018 to 2019 up to and including 2022 to 2023). For each year it shows overall net revenue and its constituent parts.

Key observations from chart 1 are:

- Petroleum Revenue Tax (PRT) receipts have been negative throughout the period. Since its rate was set to 0% in 2016, almost all PRT relates to repayments and appears as negative receipts. PRT repayments peaked at close to £750 million in financial year 2018 to 2019 before declining in the next 2 financial years. After an increase to £552 million in 2021 to 2022, 2022 to 2023 saw a decrease of £318 million to £234 million, as high energy prices resulted in smaller losses and repayments

- offshore Corporation Tax (comprising Ring Fence Corporation Tax and Supplementary Charge) payments fell to £0.7 billion in financial year 2020 to 2021 because of the COVID-19 pandemic. As global demand and energy prices recovered, offshore Corporation Tax payments increased by £1.4 billion to £2.1 billion in 2021 to 2022. The chart presents offshore CT figures together with receipts from EPL in 2022 to 2023. Continued high energy prices, together with the introduction of EPL, meant that total offshore CT and EPL receipts reached £9.3 billion in 2022 to 2023

- net revenues across all oil and gas taxes fell to £0.9 billion in financial year 2019 to 2020 and to £0.3 billion in 2020 to 2021. In 2021 to 2022, net revenues increased to £1.4 billion and in 2022 to 2023, they increased by a further £7.6 billion to £9 billion

Chart 1: Government oil and gas revenues from UK Continental Shelf (UKCS)

3. Publication information

Information about the publication is listed below:

- Theme: The economy

- Released: September 2023

- Frequency: Annual

- Next release: Autumn 2024

- Media Contact: HMRC Press Office 03000 585 158

- Statistical Contact: [email protected]

- Media Enquiries: HMRC Press Office 03000 585 158

4. Key statistics

Corporation Tax receipts

Net offshore Corporation Tax receipts (payments minus repayments), composed of Ring Fence Corporation Tax (RFCT) and the Supplementary Charge (SC), increased by 230% from £2 billion in financial year 2021 to 2022 to £6.6 billion in 2022 to 2023. This reflects a significant increase in the offshore Corporation Tax payments, as shown in Table 1.

Losses can be carried back against historical profits to obtain a repayment of previous tax paid.

Petroleum Revenue Tax receipts

PRT repayments were £0.2 billion in financial year 2022 to 2023, a decrease of £0.3 billion compared with 2021 to 2022. Loss-making fields can carry their losses back to relieve profits and tax paid in previous years, subject to time limits and strict ordering.

In 1 January 2016 the PRT rate was reduced to 0% and PRT receipts have since been zero.

Energy Profits Levy receipts

EPL receipts were £2.6 billion in financial year 2022 to 2023. EPL was introduced in May 2022.

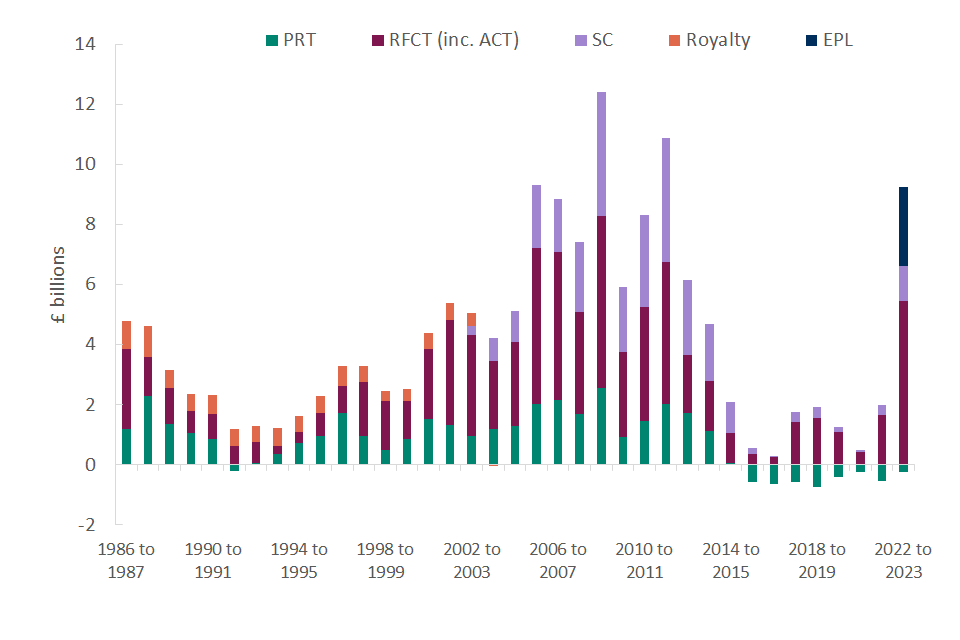

Historic revenues from UK oil and gas production

Government revenues from UK oil and gas production decreased significantly over the last decade before a significant upturn in financial year 2022 to 2023 due to global events. From 2016, the rate of PRT was permanently set to 0% and SC was reduced to 10%. This, together with the general maturing of the oil and gas fields in the UK Continental Shelf (UKCS), resulted in reducing government revenues from oil and gas production. In 2022 to 2023, high energy prices alongside the introduction of the EPL saw government revenues from oil and gas production increase to their highest levels since 2011 to 2012.

Chart 2 shows how net revenues have fluctuated since financial year 1986 to 1987 until 2022 to 2023.

RFCT includes Advance Corporation Tax (ACT), charged between 1978 to 1979 and 1999 to 2000.

Key observations from Chart 2 are:

- government revenues from oil and gas production decreased significantly from a peak of £12.4 billion in financial year 2008 to 2009 to £0.3 billion in 2020 to 2021. The steady recovery of energy prices throughout 2021 and early 2022 reversed this trend. Despite some decline in prices since the second half of 2022, energy prices remained at elevated levels. This, together with the introduction of EPL, resulted in net North Sea receipts of £9 billion recorded in 2022 to 2023

- total net revenues fell below 0, with repayments exceeding payments, for the first time in 2015 to 2016 and again in 2016 to 2017. This was followed by a modest recovery in the next 2 financial years, before falling again in both 2019 to 2020 and 2020 to 2021. Revenues in 2021 to 2022 recovered, before a further increase in 2022 to 2023

Chart 2: Historic UK Government Net Revenues from Oil and Gas Production in the UKCS

6. Exchequer liability from decommissioning

In August 2023, the North Sea Transition Authority’s central estimate was that total industry costs between 2023 and 2063 for decommissioning all upstream UK oil and gas infrastructure would be £40 billion in 2022 prices. The Exchequer cost of tax relief from this expenditure currently projected by HMRC is £12.7 billion, as seen in HMRC’s Annual Report and Accounts. This is made up of £4.5 billion from tax repayments and a reduction in offshore Corporation Tax of £8.2 billion. Decommissioning expenditure reduces company profits and hence lowers the overall tax take.

7. Definitions

How is Corporation Tax applied to oil and gas companies?

This is calculated in the same way as the standard Corporation Tax applicable to all companies but with the addition of a ‘ring fence’ and the availability of 100% first year allowances for virtually all capital expenditure. The ring fence prevents taxable profits from oil and gas extraction in the UK and UK Continental Shelf (UKCS) being reduced by losses from other activities or excessive interest payments. The current rate of tax on ring fence profits is 30% and is set separately from the rate of mainstream Corporation Tax.

What is Supplementary Charge?

This is an additional charge on a company’s ring fence profits (but with no deduction for finance costs). With effect from 1 January 2016 the rate is 10%.

What is Petroleum Revenue Tax?

This is a field-based tax charged on profits arising from oil and gas production from individual oil and gas fields which were given development consent before 16 March 1993. With effect from 1 January 2016, the PRT rate was reduced to 0% (previously the rate was 50%). PRT is a deductible expense in computing profits chargeable to ring fence corporation tax and supplementary charge.

What is Energy Profits Levy?

The Energy Profits Levy (EPL) was brought into effect from 26 May 2022. Initially due to cease at the end of 2025, it is now due to end on 31 March 2028 following changes announced in the 2022 Autumn Statement. The initial rate was 25%, but from 1 January 2023 the rate is 35%.

The tax base is similar to that of Ring Fence Corporation Tax but with some adjustments and restrictions. For example, finance and decommissioning costs cannot be included in the calculation of EPL; and companies are not allowed to use historical losses to reduce their EPL liabilities. When it was brought in, the levy included an additional investment allowance of 80%, that can be claimed at the point of investment. From 1 January 2023, this allowance is 29%, except for investment expenditure on upstream decarbonisation which remained unchanged at 80%. Further details on the Levy are available in this HMRC Policy Paper.