Bulletin - Commentary

Published 30 June 2022

1. Introduction

1.1 About This Publication

This publication is the annual update of the Income Tax Liabilities Statistics. This Commentary presents information from Tables 2.1 to 2.7, providing detailed statistics on the most recent outturn data and projected estimates of individual Income Tax payer numbers, Income Tax liabilities and average rates of Income Tax. The most recent outturn data is for 2019 to 2020 and is collected from the Survey of Personal Incomes (SPI) and is presented alongside projected estimates for the 3 subsequent tax years. The SPI is based on information held by HMRC on individuals who could be liable to UK Income Tax. It is carried out annually by HMRC and covers income assessable to tax for each tax year.

As a complement to the SPI-based statistics, Section B presents data from Table 2.7 which sets out trends in Income Tax burdens over time for a selection of example individual and couple scenarios and earnings levels. Table 2.7 will be reviewed as part of the next user consultation on the range of HMRC’s statistics, which will be launched in Winter 2022.

Additional supplementary information is published that accompanies this release, which includes:

-

accompanying statistical data in Tables 2.1 to 2.7

-

Supporting Documentation including context and background information, data sources, methodology, quality indicators and a glossary of terms

1.2 New in this release

This release of the Income Tax Liabilities Statistics publication includes the finalised outturn data for the 2019 to 2020 tax year collected from the SPI. In addition, it includes revised projections for tax years 2020 to 2021 and 2021 to 2022 and the first projection estimates for the 2022 to 2023 tax year. The estimates for tax years beyond 2019 to 2020 are projected from the new 2019 to 2020 SPI outturn data using economic assumptions consistent with the Office for Budget Responsibility’s (OBR) March 2022 Economic and Fiscal Outlook.

This release reflects all Income Tax policy changes up to and including the 2022 to 2023 tax year. This includes changes made by both the UK and Scottish Governments following the devolution of Income Tax rates and bands (except the Personal Allowance, which remains reserved) that apply to Scottish Income Tax payers’ non-savings, non-dividend income.

This version of the publication is the second to be published in an accessible format in line with government guidance on publishing accessible content.

Tables 2.1 to 2.7 are provided in an open file format, while the Commentary and Supporting Documentation are published in HTML.

Impacts of the coronavirus pandemic (COVID-19)

The Income Tax liabilities statistics for tax years 2020 to 2021 onwards include estimates of the impact of COVID-19, and, more specifically for this publication, on individual’s incomes and Income Tax liabilities. The COVID-19 impact and the impact of policy measures put in place as part of the Government’s response, for example the Coronavirus Job Retention Scheme, are incorporated into the economic assumptions on which these statistics are based. They reflect the current best estimate of the impacts using outturn data that was available as of March 2022. The assumptions made in respect of the coronavirus pandemic and their limitations are set out in detail in the OBR’s March 2022 Economic and Fiscal Outlook and users are directed to this publication for more detailed information.

Therefore, the statistics presented in this publication for projection years 2020 to 2021, 2021 to 2022 and 2022 to 2023 are uncertain and are likely to change by a greater degree than would normally be expected during future revisions.

The impact of COVID-19 on individual incomes and Income Tax liabilities will be discussed in the relevant sections of this document. Please refer to the OBR’s March 2022 Economic and Fiscal Outlook for details on the COVID-19 impacts on the economy and the current predictions on the timeframe and magnitude of an economic recovery.

Impacts of rising inflation

The Income Tax liabilities statistics for tax years 2020 to 2021 through to 2021 to 2022 include estimated impacts of rising inflation. The OBR suggests that the higher wage growth going into 2022 is driven by the tight labour market, together with higher inflation. Please refer to the OBR’s March 2022 Economic and Fiscal Outlookfor details on the contributions to the inflation and impacts of this on the economy and wage growth.

2. Table 2.1 – Number of individual Income Tax payers by marginal rate, sex and age

Table 2.1 provides data on the number of Income Tax payers between 1990 to 1991, when independent taxation for all individuals was introduced in the UK, and 2022 to 2023. The Income Tax payer population is broken down by marginal rate of Income Tax, sex, and age. Income Tax payers are classified by their highest marginal rate of Income Tax, which is the rate that an extra pound sterling of income that would be charged at. Savers and basic rate Income Tax payers are all considered ‘basic’ rate Income Tax payers as no Income Tax is due at the higher or additional rate. From 2018 to 2019, Scottish Income Tax payers in the starter rate and intermediate rate are considered ‘basic’ rate Income Tax payers, and the Scottish higher and additional rates are grouped with all other Income Tax payers in the same marginal rate bands, despite having different rates. Further details on marginal Income Tax rate can be found in Annex B of the Supporting Documentation.

Please see Table 2.1a for historic years before 1990 to 1991.

2.1 Income Tax payer population

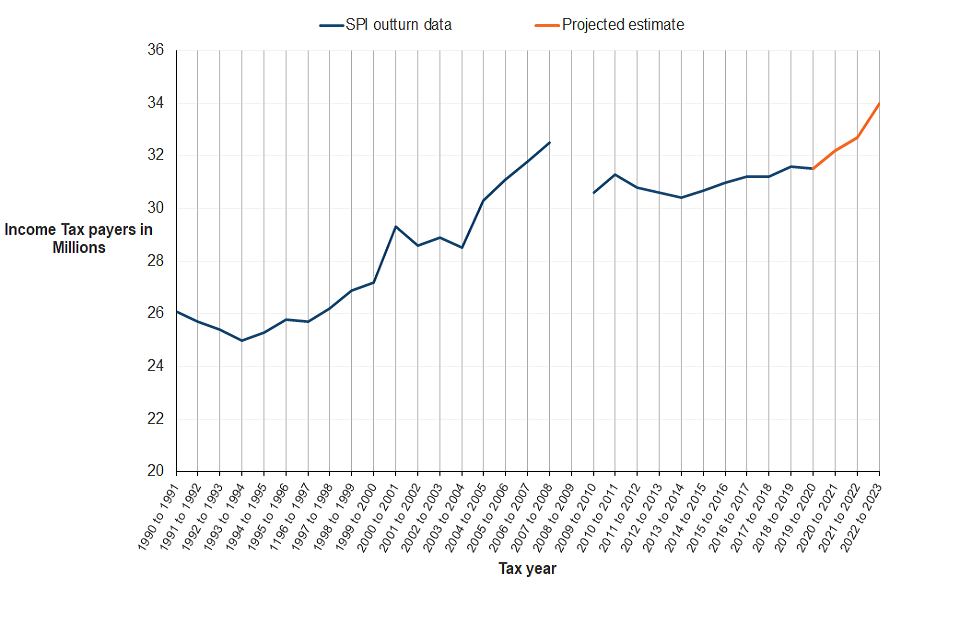

The 2019 to 2020 outturn data shows there was an estimated 31.5 million Income Tax payers in 2019 to 2020. This is a slight decrease compared to 2018 to 2019 which is expected to be driven by the above indexation increase in the Personal Allowance in 2019 2020, somewhat offset by the income growth that leads to a small net reduction in individuals liable for Income Tax. The total number of Income Tax payers is projected to rise to 34.0 million in 2022 to 2023, mainly due to population and employment growth. This increase is exacerbated by the Personal Allowance freeze in 2020 to 2021, a low level of indexation in 2021-22 and then a further freeze in 2022 to 2023, which combined with income growth results in this increase in the Income Tax paying population. The overall number of Income Tax payers from tax year 1990 to 1991 through to 2022 to 2023 can be viewed in Figure 1.

Income Tax payer numbers in 2020 to 2021 through to 2021 to 2022 are likely lower than they would otherwise have been due to the economic impacts of COVID-19. Estimates for these years are highly uncertain and are likely to change by a greater degree than would normally be expected during future revisions.

Figure 1: Number of individual Income Tax payers between 1990 to 1991 and 2022 to 2023. Note that data for tax year 2008 to 2009 is not available.

2.2 Income Tax payers by age and sex

In 2019 to 2020, 13.5 million (43.0%) Income Tax payers were female and 17.9 million (57.0%) were male. Comparatively, for mid-2020 the Office for National Statistics (ONS) population estimate found that just 49.0% of the UK population aged 16 and over were male, suggesting men are overrepresented in the Income Tax payer population whilst women are underrepresented. For the tax year 2022 to 2023, projections show that 14.7 million (43.4%) Income Tax payers are estimated to be female, 19.2 million (56.6%) are male, and 7.3 million (21.5%) are above the state pension age. A comparative view of the ONS population estimates and the statistics presented here can be found in Table 1, with proportions demonstrated in Figure 2.

Published estimates for 2019 to 2020 indicate there are 6.25 million Income Tax payers (19.9%) over the state pension age. The ONS population estimate for mid-2020 instead found that 23.0% of the population who were 16 or over were of state pension age, indicating that this demographic are underrepresented in the Income Tax payer population. For this publication, the state pension age is set as 65.75 years for both sexes in the 2019 to 2020 tax year (reflecting the average age in that year as the state pension transitions up to 66), increasing to 66 years in the subsequent tax years through to 2022 to 2023 inclusive.

Figure 2: Income Tax payer populations in 2019 to 2020 by age and sex, compared to mid-2020 Office for National Statistics population estimates

2.3 Income Tax payers by marginal rate

In 2019 to 2020, 728,000 individuals (2.3%) were ‘savers rate’ Income Tax payers, meaning they had no taxable earnings but had taxable savings and/or dividends (see Glossary). In addition, there were 26.5 million individuals (84.2%) basic rate Income Tax payers, 3.83 million (12.2%) higher rate Income Tax payers, and 421,000 (1.3%) additional rate Income Tax payers.

Figure 3: Income Tax payer population by marginal rate of Income Tax

| Marginal rate | 2019 to 2020 | 2022 to 2023 |

|---|---|---|

| Savers | 728,000 | 611,000 |

| Basic | 26,500,000 | 27,200,000 |

| Higher | 3,830,000 | 5,510,000 |

| Additional | 421,000 | 629,000 |

In 2022 to 2023 it is estimated that 611,000 individuals (1.8%) will be savers rate Income Tax payers, indicating a 0.5 percentage point decrease in the proportion of people paying Income Tax at this rate. In this same period, while there is a projected rise in the number of basic rate Income Tax payers at 27.2 million, this is a decrease on 2019 to 2020 in the proportion of people paying Income Tax at this rate (80.1%). Further, in 2022 to 2023, the higher rate Income Tax paying population is expected to undergo a 4.1 percentage point increase from 2019 to 2020 in the proportion of people paying Income Tax at this rate to 5.5 million (16.2%). The increase in this taxpaying population is largely due to the higher rate threshold being frozen in 2022 to 2023 at the 2021 to 2022 level, as well as the freeze to the higher rate threshold in 2020 to 2021 and the earnings growth in the middle to the higher end of the income distribution. This results in the number of higher rate Income Tax payers increasing again to 4.1 million in 2020 to 2021 as a greater proportion of the population again become eligible for higher rate taxation. Further, the smaller number of this taxpaying population in 2019 to 2020 is largely due to the 2019 to 2020 cash increase (meaning an above-indexation increase) in the Personal Allowance and basic rate limit, raising the higher rate threshold by £3,650 and resulting in fewer people having enough income to qualify for the higher rate of Income Tax in 2019 to 2020.

In addition, there are projected to be 629,000 (1.9%) additional rate Income Tax payers in 2022 to 2023, an increase from 2019 to 2020. The additional rate threshold has been frozen at £150,000 since it was introduced in 2010 to 2011. Therefore, as average total incomes increase more individuals become eligible for the additional rate.

In 2021 to 2022, there is a projected slight decrease of basic rate Tax payers to 26.6 million compared to 2020 to 2021 at 27.0 million. Conversely, there is an increase in higher rate Tax payers to 4.8 million in 2021 to 2022 up from 4.1 million in 2020 to 2021 as well as an increase in additional rate Tax payers up to 563,000 in 2021 to 2022 up from 457,000 in 2020 to 2021. This is due to the combined effects of the freeze in the higher rate threshold in 2021 to 2022 and wage growth being particularly stronger in the middle to higher incomes which results in individuals becoming liable for the higher and additional rates of taxation.

From 2016 to 2017 the Scottish Government have set the higher rate threshold for Scottish Income Tax payers. The assumptions around how a Scottish Income Tax payer is identified, how their marginal rate is allocated, and how the dual higher rate thresholds have been modelled are detailed in Annex B of the Supporting Documentation.

Please note the numbers in Table 2.1 may not sum due to rounding.

3. Table 2.2 – Number of individual Income Tax payers by country and region

Table 2.2 is a collection of tables that provide a breakdown of the number of individuals with positive Income Tax liabilities (Income Tax payers) across different UK countries and Government Office Regions. Each table provides the number of Income Tax payers for a given region, subset by marginal rate of Income Tax, sex, and age. Marginal rate is the rate of tax that an extra pound sterling of income that would be charged at.

An Income Tax payer’s country and region are determined by residential postcode. Projections of Income Tax payer numbers by country and region beyond the 2019 to 2020 outturn are based on economic outturn data and forecast assumptions applying to the UK as a whole and should be regarded as indicative, they do not account for geographical variations in economic or population trends and the regional splits shown have had UK growth rates applied to them (see the Supporting Documentation for further details).

Please see Table 2.2a for historic years before 1999 to 2000.

3.1 Income Tax payers by country and region

Income Tax payer numbers by region from 2020 to 2021 onwards are affected by the economic impacts of COVID-19. Estimates for these years are highly uncertain and are likely to change by a greater degree than would normally be expected during future revisions.

Figure 4 shows the number of basic, higher and additional rate Income Tax payers in each country and region in 2019 to 2020. In 2019 to 2020, the largest proportion of Income Tax payers resided in the South East (14.8% of the total), followed by London (13.5%) and the North West (10.5%). Northern Ireland had the lowest proportion of Income Tax payers (2.5%) of all the countries and regions, followed by the North East (3.6%) and Wales (4.3%). Approximately 1% of Income Tax payers either resided abroad or their address was unknown, and these individuals are not included in Table 2.2.

Figure 4: Number of Income Tax payers by country and region in tax year 2019 to 2020. All higher and additional rate Income Tax payers are also basic rate Income Tax payers, therefore the number for basic rate represents the total for that region.

| Region | 2019 to 2020 | 2022 to 2023 |

|---|---|---|

| South East | 4,640,000 | 4,980,000 |

| London | 4,240,000 | 4,470,000 |

| North West | 3,310,000 | 3,590,000 |

| East of England | 3,090,000 | 3,330,000 |

| South West | 2,740,000 | 2,970,000 |

| West Midlands | 2,610,000 | 2,830,000 |

| Scotland | 2,570,000 | 2,770,000 |

| Yorkshire and the Humber | 2,430,000 | 2,640,000 |

| East Midlands | 2,230,000 | 2,420,000 |

| Wales | 1,360,000 | 1,490,000 |

| North East | 1,140,000 | 1,250,000 |

| Northern Ireland | 783,000 | 841,000 |

3.2 Higher and additional rate Income Tax payers

In 2019 to 2020, the UK had 4.3 million higher and additional rate Income Tax payers. There were 3 regions where the proportion of higher and additional rate Income Tax payers exceeded the UK average of 13.5%: London, which had 21.8% of the total, the South East which had 17.5%, and the East of England which had 15.1%. By contrast, the regions with the least representation of higher and additional rate Income Tax payers were Northern Ireland with 8.0% of the total, Wales with 8.0%, and the North East with 8.4%.

The Scottish higher rate threshold (see Glossary) was frozen in 2020 to 2021, increased with CPI indexation in 2021 to 2022 to £43,662 and then frozen in 2022 to 2023. As a result of no above-indexation increases to the higher rate threshold as well as income growth, the number of higher rate Scottish Income Tax payers is projected to increase in each of these years.

4. Table 2.4 – Shares of total income (before and after tax) and Income Tax for percentile groups

Table 2.4 shows how the distributions of income and Income Tax liabilities have changed between 1999 to 2000 to the current tax year. Income distribution provides one measure of income inequality, while the shares of total Income Tax liabilities reflect the progressivity of the Income Tax system. The table also shows the income breakpoints for each percentile group, meaning the point at which the next percentile group begins. Table 2.4 does not provide a complete picture of individual income inequality in the UK due to the exclusion of those who don’t pay Income Tax, and because the SPI records only include incomes that are assessable for tax (for example, a range of non-taxable social security benefits, some tax credits and non-taxable savings from ISAs are not included).

Income Tax payers are ranked based on total income assessable for tax (earnings, savings and dividend income) before any deductions and tax allowances (such as pension contributions), and then divided into percentile groups ranged on income. For projection estimates for tax years 2020 and 2021 onwards each income component is grown at the same rate for all individuals in each projection year except for pay, where differential earnings growth across the pay distribution is consistent with past trends and includes the impact of forestalling from previous policy changes (for more details see the section on projection estimates in the Supporting Documentation).

Shares of incomes before and after Income Tax, and shares of total Income Tax liability estimates in 2020 to 2021 onwards are likely to be impacted due to the economic impacts of COVID-19. Estimates for this year remains uncertain and is likely to change by a greater degree than would normally be expected during future revisions. Further, shares of incomes before and after Income Tax and shares of total Income Tax liability estimates include impacts from wage growth, as outlined by the OBR OBR’s March 2022 Economic and Fiscal Outlook. Estimates for 2020 to 2021 through to 2022 to 2023 are uncertain and are likely to change to a greater degree than would normally be expected during future revisions.

4.1 Income distribution

Figure 5 shows that Income Tax payers’ total income before tax grew from £533 billion in 1999 to 2000 to £1,160 billion in 2019 to 2020 and is projected to reach £1,380 billion by 2022 to 2023. The top 10% of Income Tax payers accounted for around a third (33.5%) of all income before Income Tax in 2019 to 2020, the top 5% accounted for around a quarter (24.3%), and the top 1% accounted for 12.3%. By contrast, the bottom 10% accounted for just 3.7% of all income before Income Tax, the bottom 5% made up 1.8%, and the bottom 1% made up just 0.3%.

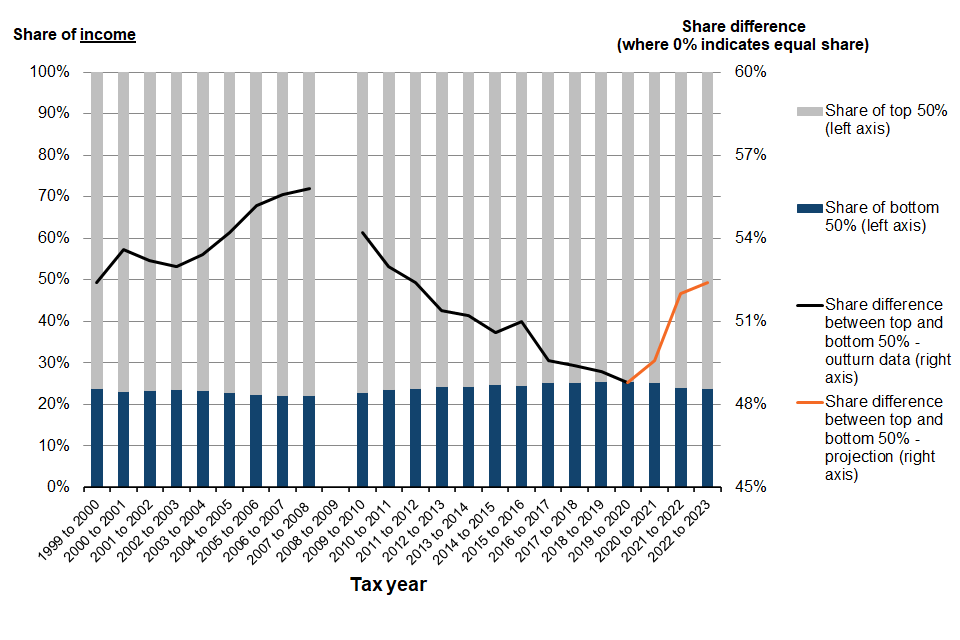

In 1999 to 2000, income inequality between the bottom and top 50% of Income Tax payers was highlighted by a 52.4 percentage point difference in their share of total income before tax: the bottom 50% had 23.8% whilst the top 50% had 76.2%. Inequality by this measure grew in the years leading up to the 2008 recession, showing a 55.8 percentage point difference in 2007 to 2008 (77.9% for the top 50% compared to 22.1% for the bottom 50%). Since then, income inequality has continually decreased, returning to 1999 to 2000 levels by 2011 to 2012 and declining thereafter up to 2020 to 2021. In 2019 to 2020 there was a 48.8 percentage point difference in share of total income before tax, and this measure of income inequality is expected to increase to 52.4 percentage points in 2022 to 2023.This is in part driven by the wages growth in the top 50% in 2021 to 2022 where income inequality increases 2.4 percentage points from 2020 to 2021. It is important to note that the population of Income Tax payers used in these calculations differ each tax year due to variations in the number of individuals liable to Income Tax, which depends in part on Income Tax policy measures at that time. Shares of total income would differ if non-Income Tax payers were included.

Figure 5: Distribution of total income for bottom and top 50% of Income Tax payers (ranged on total income). Note that SPI data is unavailable for 2008 to 2009.

4.2 Share of Income Tax liabilities

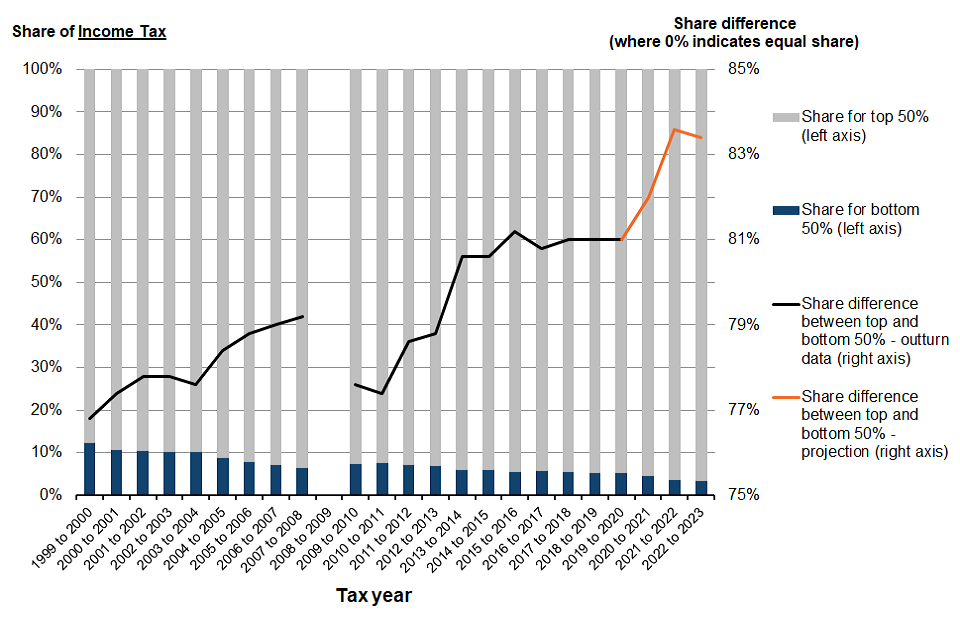

Total Income Tax liabilities were £93 billion in 1999 to 2000, growing to £189 billion in 2019 to 2020 and are expected to reach £251 billion by 2022 to 2023. In 2019 to 2020 the bottom 50% of Income Tax payers were liable for 9.5% of total tax, whilst the top 50% were liable for 90.5%. The top 10% of Income Tax payers were liable for around 60.3% of total Income Tax, while the top 1% were liable for around 29.0%. In comparison, the bottom 10% were liable for 0.4% of total Income Tax and the bottom 1% were liable for a negligible share. The shares of total Income Tax for each percentile group can be viewed in Figure 6.

In 2022 to 2023 the lowest earning Income Tax payers (those in the 5th income percentile group or lower) remain liable for the same percentage of Income Tax (rounded to the nearest 0.1%) as they did in 2019 to 2020, whereas those in the bottom 10th and 25th income percentile group are liable for a slightly decreased percentage of Income Tax compared to 2019 to 2020 at 0.3 and 2.0 percentage points, respectively (see Figure 6). The bottom 50% of Income Tax payers are projected to be liable for a slightly decreased share of total Income Tax at 8.3%, with the top 50% thereby having an increased share of 91.7%. This illustrates the continued progressivity of the Income Tax system. Further, the top 10% income percentile group are liable for an increased percentage of Income Tax compared to 2019 to 2020 by 2.0 percentage points. This is largely driven by increased income growth disproportionate to the higher end of the income distribution, as well as the freeze to the higher rate threshold and personal allowance in 2022 to 2023.

Further, in 2021 to 2022, those in the bottom 50% income percentile group are liable for decreased share of total Income Tax compared to 2020 to 2021 at 8.2%, with the top 50% having an increased share of 91.8%. This is largely driven by the increased wage growth at the higher end of the percentile groups in this year.

In addition, the top 10% and 5% income percentile groups see an increase in their share of Income Tax liability in 2021 to 2022. This is a result of an increased income growth disproportionate to the higher end of the pay distribution in 2021 to 2022. In addition, due to the freeze in the higher rate threshold and personal allowance, there are more Income Tax payers overall in these years, changing the distribution among percentile groups and increasing the share of Income Tax liability for those in the top 10% and 5%.

Figure 6: Share of total Income Tax for bottom and top 50% of Income Tax payers (ranged on total income). Note that the 2008 to 2009 SPI data is unavailable.

4.3 Additional rate impacts

Since its introduction in April 2010, the majority of the additional rate Income Tax payer population is composed of the top 1% of Income Tax payers. The share of total income before Income Tax projected to be received by the top 1% of Income Tax payers increases by 0.7 percentage points to 13.0% between 2019 to 2020 and 2022 to 2023, while their share of total Income Tax decreases by 0.7 percentage points to 28.3%. The highest share of Income Tax to be paid by the top 1% is projected to have been 29.1% in tax year 2020 to 2021. The reduced Income Tax share in 2022 to 2023 compared to 2020 to 2021 is mainly due to the increase in Income Tax payer numbers largely as a result of the Personal Allowance freeze in that year.

The share of total income and total Income Tax liabilities for the top 1% income percentile group since 1999 to 2000 can be viewed in Figure 7. The introduction of the additional rate in 2010 on taxable income over £150,000 led to a behavioural response by individuals bringing forward, or ‘forestalling’, income in 2009 to 2010. Income forestalling in this year was estimated by HMRC at around £16-18 billion or 2% of total Income Tax payer income. Details of these effects were set out in a HMRC report published in March 2012. In April 2013, the additional rate was reduced from 50% to 45% which led to the deferral of income from the 2012 to 2013 tax year to the 2013 to 2014 tax year. This resulted in a ‘below normal’ share of income for the top 1% in 2012 to 2013 (compared to if there was no forestalling) and the subsequent increase of this share in 2013 to 2014. The share of income before Income Tax for the top 1% was expected to have returned to a ‘normal’ level in 2014 to 2015.

Figure 7: Percentage share of total income before Income Tax (dark blue and orange line) and total Income Tax liability (purple and turquoise line) for the top 1% of Income Tax payers. Note that the 2008 to 2009 SPI data is unavailable.

The impact of these behavioural responses means that the share of income before Income Tax for the top 1% percentile group displayed more marked variation in this time period, which is outlined below.

In relation to the introduction of the 50% additional rate in April 2010, the share of income for the top 1% was:

-

artificially high in 2009 to 2010,

-

artificially low between 2010 to 2011 and 2011 to 2012 as forestalling unwinds over these years.

Then, when the additional rate was reduced to 45% in April 2013, the share of income for the top 1% was:

-

artificially low in 2012 to 2013,

-

artificially high in 2013 to 2014,

-

then returned to normal in 2014 to 2015

4.4 Dividend tax changes

Another policy change that resulted in a behavioural response and forestalling of income was the abolishment of the dividend tax credit in 2016 to 2017, combined with an increase in dividend tax rates and the introduction of the dividend allowance. The outturn data for 2015 to 2016 through to 2019 to 2020 will show the impact of forestalling in these years (where income was brought forward to 2015 to 2016), while projected estimates for 2020 to 2021 and 2021 to 2022 have been adjusted to account for estimated income shifting due to the changes to the taxation of dividends (see section on dividend adjustment in Annex B of the Supporting Documentation.

The impact of these estimated behavioural responses means that the top 1% share of income is:

-

artificially high in 2015 to 2016,

-

artificially low in 2018 to 2019 through to 2021 to 2022 as the forestalling continues to unwind over these years. The majority of the unwind effect is captured between 2016 to 2017 and 2018 to 2019

A further policy change that is forecast to drive forestalling of income is the change in dividend tax rates made alongside the introduction of the Health and Social Care Levy in 2022 to 2023. The rates were all increased from 2022-23 by 1.25 percentage points to mirror the new levy on earned incomes. Projected estimates for 2021 to 2022 and 2022 to 2023 have been adjusted to account for estimated income shifting due to the changes to the taxation of dividends (see section on dividend adjustment in Annex B of the Supporting Documentation.

The impact of these estimated behavioural responses means that the top 1% share of income is:

-

artificially high in 2021 to 2022,

-

artificially low in 2022 to 2023 through to 2027 to 2028 as the forestalling continues to unwind over these years.

4.5 Further notes on the top 1% share

The published years that are unaffected by income forestalling or unwinding are the years leading up to and including 2007 to 2008, and 2014 to 2015. As such, when viewing Figure 6 and Table 2.4 only the tax year 2014 to 2015 can be compared directly with the years preceding the additional rate. For example, the share of total income before Income Tax for the top 1% of Income Tax payers declined from 13.4% in 2007 to 2008 to 12.3% in 2014 to 2015, reflecting the reduction in income inequality between these tax years which are unaffected by forestalling or unwinding.

In contrast, the share of total Income Tax liability of the top 1% of Income Tax payers increased from 24.4% in 2007 to 2008 to 27.2% in 2014 to 2015, indicating that the progressivity of the tax system increased over this period. Factors contributing to this increase in progressivity include:

-

the introduction of the additional rate and the Personal Allowance taper,

-

the lowering of the limits on tax relief on pension contributions,

-

the above-indexation increase to the Personal Allowance since 2010 to 2011 with the benefits going mainly to basic rate Income Tax payers

Annex B of the Supporting Documentation describes in more detail HMRC’s estimates of behavioural responses to the additional rate of Income Tax.

5. Table 2.5 – Income Tax liabilities by income range

Table 2.5 provides data on the number of Income Tax payers and their Income Tax liabilities by total income and is grouped by marginal rate of Income Tax, which is the rate that an extra pound sterling of income that would be charged at. Income groups are defined as the lower limit for total income before any deductions, allowances and tax credits. Taxable income is net of these deductions and allowances, which explains why there are Income Tax payers within an income range that is higher than their marginal rate Income Tax band limit (for example, there are some basic rate Income Tax payers within an income range higher than the basic rate limit). Scottish Income Tax payers in the starter rate and intermediate rate are considered ‘basic’ rate Income Tax payers (see Annex B of the Supporting Documentation for further details).

Income Tax liability amounts include those accrued at other rates of tax, for example total liabilities of higher rate Income Tax payers include liabilities due at the basic and other rates of Income Tax. For each income group, the average rate of Income Tax is calculated as the total Income Tax liability expressed as a percentage of total income. Deductions, allowances and tax credits will vary across individuals within each group, contributing to differences in individual tax rates within groups. An individual’s marginal rate of Income Tax places an upper limit on their average rate of tax due on their total income; average tax rates therefore rise with income towards 45% (or 46% for Scottish non-savings non-dividend Income Tax payers).

Income Tax payer numbers, incomes, and liabilities in 2020 to 2021 onwards in each income band are likely lower than they would otherwise have been due to the economic impacts of COVID-19. The averages rates of tax will also have been impacted, including from movements of individuals across the different groups. Estimates for these years are highly uncertain and are likely to change by a greater degree than would normally be expected during future revisions.

Please see Table 2.5a for historic years before 2019 to 2020.

5.1 Number of Income Tax payers by income

In total there were an estimated 31.5 million Income Tax payers in the UK in 2019 to 2020. Of these, an estimated 9.6 million Income Tax payers (30.4%) had total income assessable for tax under £20,000 and 17.4 million Income Tax payers (55.2%) had income from £20,000 to under £50,000. When combined these groups account for 85.6% of all Income Tax payers in 2019 to 2020. In contrast, the number of Income Tax payers with total incomes of £50,000 or more was 4.5 million (14.4%). There were relatively few Income Tax payers with very high incomes, with an estimated 19,000 Income Tax payers with incomes above £1 million, of which just 6,000 had incomes above £2 million.

The projected change in the number of Income Tax payers between 2019 to 2020 and 2022 to 2023 across the income range is shown in Figure 8. Income Tax payer numbers are projected to increase across all income ranges over £15,000 by 2022 to 2023, reflecting expected growth in the population, employment rates and incomes. There is a projected increase in the number of Income Tax payers between 2019 to 2020 and 2022 to 2023 with a total income between £50,000 and £100,000 which reflects the wage growth at the higher end of the income distribution. When comparing with the previous published estimate (which included the impact of COVID-19) for 2020 to 2021, the current estimates have on average 1.2 million more Income Tax payers in total within each year which could be partially attributed to the impact of the economic recovery in the COVID-19 pandemic.

Figure 8: The number of Income Tax payers by income range for 2019 to 2020 and 2022 to 2023. Note the Personal Allowance in 2019 to 2020 was £12,500 compared to £12,570 in 2022 to 2023.

| Income range (lower limit) | 2019 to 2020 | 2022 to 2023 |

|---|---|---|

| Personal Allowance | 3,100,000 | 3,040,000 |

| £15,000 | 6,450,000 | 6,460,000 |

| £20,000 | 9,220,000 | 9,720,000 |

| £30,000 | 8,140,000 | 8,210,000 |

| £50,000 | 3,550,000 | 4,950,000 |

| £100,000 | 547,000 | 902,000 |

| £150,000 | 183,000 | 287,000 |

| £200,000 | 205,000 | 310,000 |

| £500,000+ | 56,000 | 81,000 |

5.2 Liabilities and average Income Tax rates

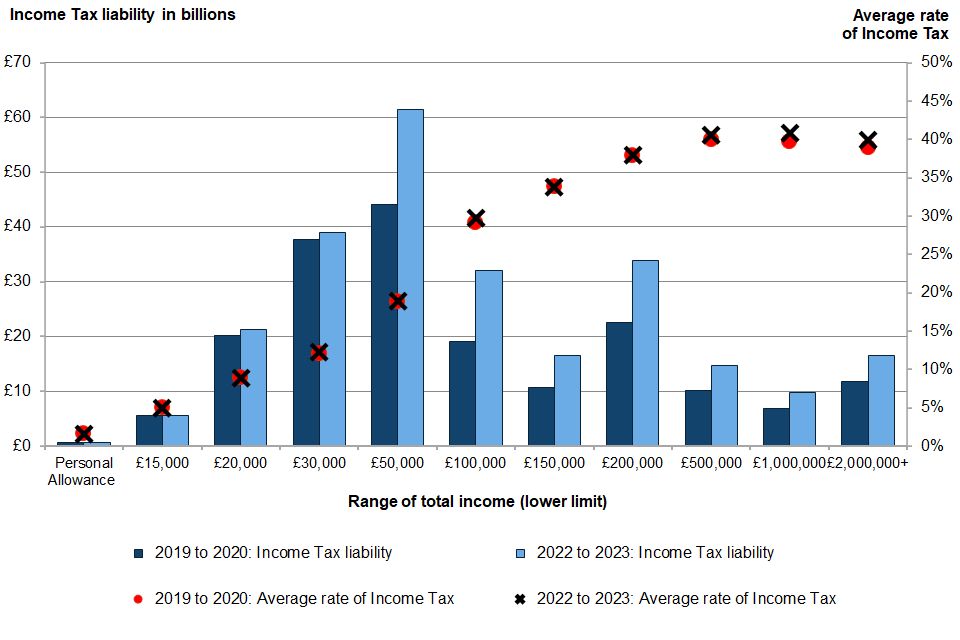

Average rates of Income Tax rose with total income up to £500,000; for income ranges above this the average Income Tax rate was around 40% (see Figure 10). In 2019 to 2020, the average Income Tax rate was 5.0% for those with incomes from £15,000 to below £20,000, increasing to 8.9% for incomes from £20,000, increasing from 12.1% to below £30,000. For incomes between £50,000 and £100,000 (mostly within the higher rate tax band), the average Income Tax rate rose to 18.9% and then rose to 33.9% for incomes from £150,000 to £200,000 (within the additional rate band). For individuals earning between £200,000 up to but not including £2 million, average Income Tax rates rose to a peak of 40.0%, before falling slightly to 38.9% for incomes of £2 million or more.

When looking across marginal rates, the distribution of total Income Tax liabilities shows the opposite pattern to the distribution of Income Tax payer numbers. In 2019 to 2020, savers and basic rate Income Tax payers made up 86.5% of the Income Tax paying population but were liable for just over a third (34.8%) of all Income Tax (see Figure 9). By contrast, higher rate Income Tax payers made up 12.2% of the Income Tax paying population but were liable for 33.0% of Income Tax, while additional rate Income Tax payers made up just 1.3% of all Income Tax payers but were liable for 32.2% of total Income Tax liabilities.

Figure 9: Income Tax paying population and share of Income Tax liabilities by marginal rate. Note proportions may not sum to 100% due to rounding.

| Tax year | Basic rate | Higher rate | Additional rate | All |

|---|---|---|---|---|

| 2019 to 2020: Proportion of population | 86.5% | 12.2% | 1.3% | 100% |

| 2019 to 2020: Share of Income Tax | 34.8% | 33.0% | 32.2% | 100% |

| 2022 to 2023: Proportion of population | 81.9% | 16.2% | 1.9% | 100% |

| 2022 to 2023: Share of Income Tax | 27.4% | 37.1% | 35.5% | 100% |

Total Income Tax liabilities of those with income up to £30,000 is projected to decrease between 2019 to 2020 and 2022 to 2023 (see Figure 10). Conversely, Income Tax payers with income over £30,000 are expected to have a larger proportion of total Income Tax liabilities in 2022 to 2023 at 89.1%, compared to 86.0% in 2019 to 2020.

The average Income Tax liability across all income ranges is expected to increase by around £1,380, from £6,010 to £7,390 between 2019 to 2020 and 2022 to 2023, largely due to an increase in the amount of Income Tax liable at the upper end of the income distribution. Individuals with income between £15,000 and £150,000 are expected to see an average increase in their Income Tax liability of around £720 over this period, mostly due to an increase in Income Tax payers with higher earnings.

Figure 10: A comparison of total Income Tax liabilities and average rate of Income Tax by income range between 2019 to 2020 and 2022 to 2023. The Personal Allowance in 2019 to 2020 was £12,500 compared to £12,570 in 2022 to 2023.

The average rate of Income Tax across all Income Tax payers is projected to increase from 16.4% in 2019 to 2020 to 18.1% in 2022 to 2023. Average rates of Income Tax for those in income groups above £15,000, and not including those in income groups above £150,000 and below £500,000, show increases in 2022 to 2023 compared to 2019 to 2020. This is partly due to the both the Personal Allowance and higher rate threshold being frozen in 2021 to 2022 through to 2022 to 2023, and income growth across all bands meaning there are more Income Tax payers moving into higher earning Income Tax bands that drives up the overall average.

Those with incomes between £15,000 and £20,000 will have the largest decrease in average tax rates of Income Tax from 5.0% in 2019 to 2020 to 4.9% in 2022 to 2023, as they benefit from indexation increases to the Personal Allowance in 2021 to 2022. Likewise those with incomes between £150,000 and £200,000 see falls in average Income Tax rates in part due to the indexation increase to the Personal Allowance and Higher Rate Threshold in 2021 to 2022.

Average Income Tax rates for individuals with income below £50,000 are projected to remain relatively stable in 2022 to 2023 compared to 2019 to 2020 with the most marked change in the income group of £30,000 to £50,000 rising 0.2 percentage points.

For those with incomes between £200,000 and £1 million, average tax rates are projected to increase between 2019 to 2020 and 2022 to 2023. Those with incomes between £1 million and £2 million have the largest increase in average rates of Income Tax from 39.7% in 2019 to 2020 to 40.8% in 2022 to 2023, in part due to the increase in Dividend rates (that increased in line with the new Health and Social Care Levy) in this year, as well as the high income growth at the top end of the income distribution. Such individuals have the Personal Allowance fully withdrawn and therefore do not benefit from its indexation increases but have benefitted from the indexation increase in the higher rate threshold.

6. Table 2.6 – Income Tax liabilities by income source, tax band and marginal rate

Table 2.6 provides data on total Income Tax liabilities by income source (earnings, savings and dividends) and rate of Income Tax. This is provided for all Income Tax payers and for each marginal rate band, which is the tax band that an extra pound sterling of income would be charged at. Income Tax liabilities are classified into three broad sources of income assessable for Income Tax: earnings, savings interest and dividends. Earnings are defined as including pay from employment, profits from self-employment, private and occupational pensions, retirement annuities, state retirement pensions, foreign income, taxable benefits, income from property, and taxable social security income.

Estimates of total Income Tax liabilities for given tax bands include tax accrued on incomes in that band by all Income Tax payers, for example totals for basic rate tax include the liabilities of basic, higher, and additional rate Income Tax payers.

Income Tax liabilities in 2020 to 2021 onwards are likely lower than they would otherwise have been due to the economic impacts of COVID-19. The changes in liabilities and Income Tax payer numbers will have had an impact on the average Income Tax rates in those years as well. Estimates for these years are highly uncertain and are likely to change by a greater degree than would normally be expected during future revisions.

Please see Table 2.6a for historic years before 2019 to 2020.

6.1 Income Tax liabilities by income source

In 2019 to 2020, Income Tax liabilities totalled £189 billion of which 93.0% were due on earnings, with a further 6.1% from dividends and 0.9% from savings interest. The total Income Tax liabilities for 2022 to 2023 is projected to be £251 billion, with the proportion from earnings decreasing slightly to 92.9%, the proportion from dividends decreasing to 5.7% and the proportion from savings interest increasing to 1.4%. Income from savings is significantly more in 2022 to 2023 (up nearly two thirds) than 2019 to 2020, largely due to the forecasted changes in bank and building society interest rates following the large reductions in bank and building society interest rates in 2019 to 2020 through to 2020 to 2021. Dividend income increases overall across the time period, however the percentage share decreases slightly due to a much larger increase in income from savings over the same period, as well as stronger growth in earnings.

6.2 Income Tax liabilities by tax band

In 2019 to 2020, 51.0% of total Income Tax liabilities were due at the basic rate of Income Tax (applying to the first £37,500 of taxable income in that year), compared with 28.6% at the higher rate (taxable income above £37,500 and up to £150,000) and 20.9% at the additional rate. The starting rate for savings is 0% so there are no starting rate Income Tax payers.

The composition of how much Income Tax is liable at each rate is expected to change in 2022 to 2023 compared with 2019 to 2020 is shown in Figure 11. Income Tax liabilities at the basic rate (including at savers rate) are projected to decrease by 5.8 percentage points to 44.7% in 2022 to 2023, while liabilities at the higher rate are projected to increase by 4.0 percentage points to 32.6% and those at the additional rate are projected to increase by 1.9 percentage points to 22.7%.

Further, the largest changes to the composition of how much Income Tax is liable at each rate are seen in 2021 to 2022 (shown in Figure 11). Income Tax liabilities at the basic rate (including the savers rate) shows a projected decrease of 3.8 percentage points to 45.4% in 2021 to 2022 compared to 2020 to 2021 at 49.2%. Conversely, liabilities at the higher rate are projected to increase by 2.4 percentage points to 31.8% in 2021 to 2022 up from 29.5% in 2020 to 2021 and those at the additional rate are projected to increase by 1.4 percentage points to 22.8% in 2021 to 2022 up from 21.4% in 2020 to 2022. This is largely due to the combined effect of wage growth in the middle and higher incomes and the freeze to the higher rate threshold in 2020 to 2021.

Figure 11: Proportion of total Income Tax liabilities at basic, higher and additional rate. Basic rate includes savers rate and the Scottish starter rate and intermediate rate.

| Tax year | Liability at basic rate | Liability at higher rate | Liability at additional rate |

|---|---|---|---|

| 2019 to 2020 | 50.5% | 28.6% | 20.9% |

| 2020 to 2021 | 49.2% | 29.5% | 21.4% |

| 2021 to 2022 | 45.4% | 31.8% | 22.8% |

| 2022 to 2023 | 44.7% | 32.6% | 22.7% |

The freeze in the Personal Allowance in 2020 to 2021 and 2022 to 2023, and small indexation in 2021-22 will contribute to an increase in Income Tax liable at the basic rate. The changes seen at the higher and additional rates suggest a combination of the following:

-

the basic rate limit was frozen in 2020 to 2021 followed by a small indexation increase in 2021 to 2022, resulting in more Income Tax payers paying the higher rate due to income growth.

-

the basic rate limit is frozen from 2022 to 2023, again resulting in more Income Tax payers being taxed at the higher rate though income growth.

*there will be more Income Tax payers paying the higher rate due to COVID-19 recovery and disproportionate wage growth for those with higher levels of pay in 2021 to 2022 compared to 2019 to 2020, when the impacts of COVID-19 showed negative growth for those on lower income in 2019 to 2020 through to 2020 to 2021.

-

the additional rate threshold has been fixed at £150,000 since its introduction in 2010 resulting in an increase in the number of additional rate Income Tax payers over time as income grows, meaning more Income Tax is liable at that rate.

-

there is still some residual unwind of forestalled dividend income liable at the additional rate from income being brought forward in 2015 to 2016 ahead of changes to dividend taxation (see Annex B of the Supporting Documentation). There is minimal unwind in the final impacted year, 2021 to 2022, compare to the low level also in 2019 to 2020, meaning there is less of a reduction in dividend income applied to later years. This increases the amount of Income Tax liable at the additional rate in 2022 to 2023 compared with 2019 to 2020.

*the introduction of a dividend rate increase in 2022 to 2023 alongside the new Health and Social Care Levy is estimated to have caused a small amount of dividend income to be forestalled into 2021 to 2022. (see Annex B of the Supporting Documentation). This increases the estimated amount of Income Tax liable to at all rates in 2021 to 2022, offset by the first year of unwind in 2022 to 2223 reducing Incomes Tax liable at all rates.

6.3 Average rates of Income Tax

As a complement to Table 2.5, average rates of Income Tax by marginal tax rate are also shown in Table 2.6. In 2019 to 2020, average rates of Income Tax are 9.5% for basic rate Income Tax payers, 21.8% for higher rate Income Tax payers, and 38.2% for additional rate Income Tax payers, compared with the tax rates charged on earnings at the basic, higher and additional rates of 20%, 40% and 45%, respectively. The average rates of Income Tax at each marginal rate (meaning the rate applied to the next £1 of income) are lower than the tax rate for that tax band because an Income Tax payer is not charged at that rate on all their income (for example, some is charged at a lower rate or is within an allowance and not subject to Income Tax).

For basic rate Income Tax payers, the average rate of Income Tax is projected to remain unchanged at 9.5% between 2019 to 2020 and 2022 to 2023. The average rate for higher rate Income Tax payers is projected to increase by 0.4 percentage points from 21.8% in 2019 to 2020 to 22.2% in 2022 to 2023. The average rate for additional rate Income Tax payers is projected to increase by 0.2 percentage points to 38.4% in 2022 to 2023.

Average rates of Income Tax vary over time depending on the number of overall Income Tax payers and the number in each marginal rate band, as well as growth in incomes and changes to Income Tax thresholds and allowances.

7. Table 2.7 – Income Tax burden after tax credits as a percentage of gross earnings

Table 2.7 provides data on how Income Tax burdens, or the amount of Income Tax due as a percentage of gross earnings, have changed over time for example individuals and couples with different circumstances and earnings. In some cases, tax credit entitlements exceed Income Tax liabilities leading to negative tax burdens. From tax year 1999 to 2000 onwards, Income Tax burdens take account of the financial support individuals and couples receive in the form of tax credits. In this release additional examples are included to show a greater range of circumstances, for tax year 2019 to 2020 onwards.

Table 2.7 is different from the other tables in this publication in that it does not use SPI data. The gross weekly earnings are derived from the ONS Annual Survey of Hours and Earnings, with latest available provisional data for 2021 and revised estimates for 2020. Income Tax burden outturn data is provided up to tax year 2020 to 2021 and projection estimates are provided for 2021 to 2022 and 2022 to 2023.

The example scenarios are not designed to represent the entire UK Income Tax paying population, whose family circumstances and incomes vary widely. Income Tax burdens do not account for differences from devolved elements of Income Tax and individuals in Scotland will likely have different example Income Tax burdens than those shown here due to differences in rates and thresholds.

7.1 Income Tax burden and tax credits

The impacts of COVID-19 on the economy and incomes can be in part seen in these example incomes, with falls in gross earnings from 2019 to 2020 across all groups in 2020 to 2021 through to 2021 to 2022. Gross earnings have recovered with growth into 2022 to 2023, and show growth on the 2019 to 2020 level for the groups above the 50th percentile and mean gross weekly earnings shows recovery to pre-COVID-19 years. However, groups below the 25th percentile are comparable to earnings levels seen many years earlier (for example mean gross earnings are only just above the levels from 2010 to 2011) and while growing again they have not recovered to pre-COVID-19 levels by 2022 to 2023. This leads to decreased Income Tax burdens, with tax credits seen across lower percentile groups due to the lower gross earnings. Estimates for these years remain uncertain and are likely to change by a greater degree than would normally be expected during future revisions.

Working Tax Credit and Child Tax Credit entitlement is calculated by adding up a number of different elements which an individual or couple qualify for, based on the number of hours worked, the number of children, whether they are a couple or single parent, the level of eligible childcare costs, and the disability status of the claimant(s) and any children. The maximum award an individual or couple are entitled to is reduced as income rises until a certain point, dependent on varying circumstances, where no there is no further entitlement. This means someone who earns a higher income but who qualifies for additional elements can still be entitled to tax credits.

Tax credits are being gradually replaced by Universal Credit and most people are no longer able to make a new tax credit claim. Existing tax credit claimants will eventually be moved across to Universal Credit, therefore over time tax credit claimants make up a smaller proportion of Income Tax payers.

The Income Tax burden after tax credits in 2020 to 2021 for individuals and couples with different circumstances can be viewed in Figure 12, split by gross weekly earnings percentile groups. In general, at higher percentile groups the Income Tax burden increases as entitlement to tax credits is reduced for higher incomes. However, in example cases where additional elements result in a higher tax credit award the Income Tax burden is reduced. For example, in 2020 to 2021 a single person or couple with no children had an estimated Income Tax burden of 10.2% at the median (50th percentile) of the earnings distribution, however a couple with one child, 2 children, one disabled child, or one severely disabled child had Income Tax burdens of 4.4%, -6.6%, -8.9% and -14.3%, respectively. In some example cases tax credits exceed Income Tax liabilities resulting in a negative Income Tax burden. This is most pronounced in tax year 2020 to 2021, where projected Income Tax burdens for a couple with 2 children at the 10th, 25th and 50th percentile are -132.4%, -43.5%, and -6.6% respectively, and are even more negative for couples with one or more disabled children.

In contrast to this, in all years since 2011 to 2012 the Income Tax burden for the highest earners (at the 90th percentile) is the same across all example family scenarios shown, due to having no tax credit entitlement at these levels of gross earnings.

Figure 12: Income Tax burden after tax credits for example families ranged on gross weekly earnings percentile groups in a) 2020 to 2021 and b) 2022 to 2023.

| a) 2020 to 2021 (outturn) | 10th percentile | 25th percentile | 50th percentile | 75th percentile | 90th percentile |

|---|---|---|---|---|---|

| Single individual, no children | -35.7% | 4.9% | 10.2% | 13.5% | 17.1% |

| Couple, no children | -59.7% | -6.1% | 10.2% | 13.5% | 17.1% |

| Single individual/couple, one child | -99.2% | -26.5% | 4.4% | 13.5% | 17.1% |

| Couple, 2 children | -132.4% | -43.5% | -6.6% | 13.5% | 17.1% |

| Couple, one disabled child | -139.2% | -47.1% | -8.9% | 13.5% | 17.1% |

| Couple, one severely disabled child | -155.4% | -55.4% | -14.3% | 11.1% | 17.1% |

| b) 2022 to 2023 (projection) | 10th percentile | 25th percentile | 50th percentile | 75th percentile | 90th percentile |

|---|---|---|---|---|---|

| Single individual, no children | -14.9% | 6.0% | 11.2% | 14.3% | 19.9% |

| Couple, no children | -35.7% | 3.2% | 11.2% | 14.3% | 19.9% |

| Single individual/couple, one child | -69.7% | -16.2% | 11.2% | 14.3% | 19.9% |

| Couple, 2 children | -98.5% | -32.6% | 2.1% | 14.3% | 19.9% |

| Couple, one disabled child | -104.4% | -36.0% | 0.0% | 14.3% | 19.9% |

| Couple, one severely disabled child | -118.4% | -44.0% | -5.0% | 14.3% | 19.9% |

Figure 13 shows the median (50th percentile) gross weekly earnings for tax year 2019 to 2020 to tax year 2022 to 2023, while Figure 14 shows the percentage change in gross weekly earnings compared to the previous tax year. In 2020 to 2021, there was a -4.4% to -110.9% reduction in gross weekly earnings across the income range, followed by a significant projected increase between 4.4% and 9.0% across the income ranges for 2021 to 2022. In addition, the median gross weekly earnings fell from £532.20 in 2019 to 2020 to £491.80 in 2020 to 2021, and these declines are largely due to the impact of COVID-19 and will be subject to larger than normal revision with the release of new outturn data. The projected median gross weekly earnings are expected to grow to pre-COVID-19 figures to £547.90 in 2022 to 2023.

As a result of the reduction in gross weekly earnings, combined with a freeze in the Personal Allowance and basic rate limit and other factors that may affect tax credit applications, the Income Tax burden remains significantly reduced in 2021 to 2022 across the income range and for all example scenarios compared to previous years. However, in comparison to 2020 to 2021, the Income Tax burden in 2021 to 2022 for a couple in the 10th percentile of earnings with 2 children is up by 26.0 percentage points, while a couple with 1 severely disabled child is up by 28.0 percentage points.

Figure 13: Median gross weekly earnings for tax year 2019 to 2020 to tax year 2022 to 2023.

| Median gross weekly earnings | |

|---|---|

| 2019 to 2020 (outturn) | £532.20 |

| 2020 to 2021 (outturn) | £491.80 |

| 2021 to 2022 (projection) | £521.50 |

| 2022 to 2023 (projection) | £547.90 |

For the tax year 2022 to 2023 gross weekly earnings are projected to increase across the income range, with the lower percentile earnings groups seeing the largest increases of 8.2% for the 10th percentile, compared to 3.4% to 6.1% for the 25th percentile and above. Income Tax burdens increased by 0.4 to 9.0 percentile points compared to 2021 to 2022 depending on the position in the earnings distribution and circumstances, with lower earners and those qualifying for higher tax credits seeing the biggest increases. This is in part due to lower earners and those entitled to more tax credits seeing the largest decreases in Income Tax burden in 2020 to 2021, and the recovery in gross earnings being more pronounced at the lower end of the earnings distribution. In addition, mean gross weekly earnings grew by more than the Personal Allowance, which was frozen, meaning that there was more taxable income and therefore a higher Income Tax burden.

Figure 14: Percentage change in gross weekly earnings compared to previous tax year for 2020 to 2021 and projected for 2021 to 2022 and 2022 to 2023.

| 10th percentile | 25th percentile | 50th percentile | 75th percentile | 90th percentile | |

|---|---|---|---|---|---|

| 2020 to 2021 (outturn) | -110.9% | -15.3% | -8.2% | -4.4% | -4.7% |

| 2021 to 2022 (projection) | 9.0% | 4.4% | 5.7% | 6.5% | 6.9% |

| 2022 to 2023 (projection) | 8.2% | 3.4% | 4.8% | 5.7% | 6.1% |

8. Related Publications

Users of the Income Tax Liabilities Statistics may also be interested in HMRC’s other publications including the Survey of Personal Incomes (SPI) statistics and Statistics on Income Tax receipts.

9. Contact Information

If you have any queries regarding this publication, please use the contact information below to get in touch.

Statistical contacts: M Brunning, K Sibley, S Khosla,

Media contact: HMRC Press Office, [email protected]

Publication date: 30th June 2022

Frequency: Published annually

Next publication date: May/June 2023