Commentary - Individual Insolvency Statistics April to June 2021

Published 30 July 2021

Released

30 July 2021

Next release

29 October 2021

Media enquiries

Steven Fifer

+44 (0)30 3003 1568

Statistical enquiries

David Webster (author)

Kate Palmer (responsible statistician)

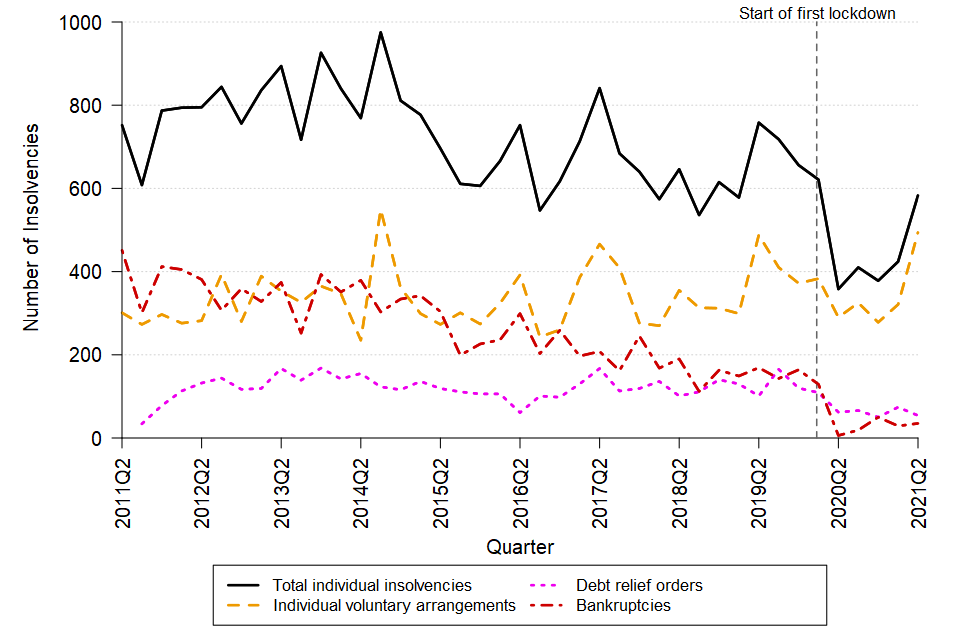

1. Main messages for England and Wales

- One in 443 adults (at a rate of 22.6 per 10,000 adults) entered insolvency between 1 July 2020 and 30 June 2021. This is a decrease from the 25.8 per 10,000 adults who entered insolvency in the 12 months ending 30 June 2020.

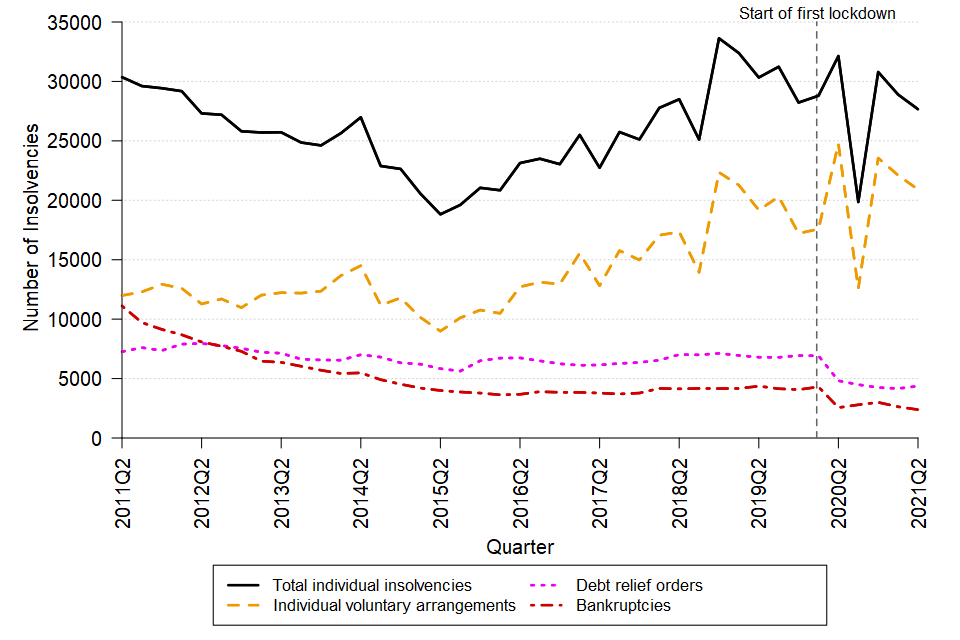

- During Q2 2021, there were 27,662 (seasonally adjusted) individual insolvencies, as shown in Figure 1, comprised of 20,910 individual voluntary arrangements (IVAs), 4,367 debt relief orders (DROs) and 2,385 bankruptcies.

- After seasonal adjustment, the number of individual insolvencies was 4% lower than in Q1 2021, with numbers of IVAs and bankruptcies slightly lower while DRO numbers were slightly higher. Total insolvencies were 14% lower than in Q2 2020.

- Between the launch of the Breathing Space scheme on 4 May 2021, and 30 June 2021, there were 11,747 registrations, comprised of 11,636 Standard breathing space registrations and 111 Mental Health breathing space registrations.

Figure 1: Individual insolvencies decreased in Q2 2021, with bankruptcies and IVAs lower than in Q1, while DROs were higher.

England and Wales, Q2 2011 to Q2 2021, seasonally adjusted

Source: Insolvency Service

The long-term series back to Q1 1984 (where applicable) can be found in the csv file that accompanies this release.

The numbers of bankruptcies and DROs have remained low since the start of the first UK lockdown in March 2020, when compared with pre-pandemic levels. This is likely to be partly driven by government measures put in place in response to the coronavirus (COVID-19) pandemic, including enhanced government financial support for companies and individuals.

As the Insolvency Service does not record whether an insolvency is directly related to the coronavirus pandemic, it is not possible to state its direct effect on insolvency volumes.

2. Things you need to know about this release

This statistics release contains the latest data on individual insolvency in the UK, presenting the numbers of individuals who have entered a formal insolvency procedure after being unable to pay their debts. Information is presented separately for England and Wales, Scotland and Northern Ireland.

The Insolvency Service separately publishes monthly statistics to provide more up to date information on the numbers of company and individual insolvencies during this time of economic uncertainty. However, they have not replaced the quarterly National Statistics, since the information presented on a monthly basis is less granular and is less reliable for monitoring changes in trends over time. Note that the monthly statistics on individual insolvency may not be fully consistent with data presented within this statistical release.

Underlying data for these quarterly statistics for England and Wales were adjusted where there was evidence of seasonality, to account for variation in individual insolvencies across the year and allow for comparison to the most recent period within years. Data for Scotland and Northern Ireland were not adjusted. The seasonal adjustment models are typically reviewed on an annual basis. However, the trend in individual insolvencies during the 2020/21 financial year has reflected a very different pattern to that seen in previous years; largely a result of the coronavirus (COVID-19 pandemic). Therefore the 2021 review was not conducted, and 2021 data will continue to be seasonally adjusted using the 2020 model. See methodology section for further details.

The Breathing Space scheme, launched on 4 May 2021, gives people legal protections from their creditors for 60 days, with most interest and penalty charges frozen, and enforcement action halted. Because problem debt can be linked to mental health issues, these protections are also available for people in mental health crisis treatment – for the full duration of their crisis treatment plus another 30 days. The number of breathing space registrations are included in these statistics.

A breathing space is not an insolvency procedure, but breathing space statistics are included to provide additional information relating to individuals with problem debt. Individuals that register for breathing space may or may not end up entering a formal insolvency procedure. Those that do enter a formal insolvency procedure will be counted accordingly in Tables 1 to 5 of the accompanying tables.

Quarters referred to in this publication are calendar year quarters, such that Q2 2021 is the period from 1 April to 30 June 2021.

2.1 Designation as National Statistics

The United Kingdom Statistics Authority has designated these statistics as National Statistics, in accordance with the Statistics and Registration Service Act 2007 and signifying compliance with the Code of Practice for Statistics. Once statistics have been designated as National Statistics it is a statutory requirement that the Code of Practice shall continue to be observed.

The last compliance review was conducted in July 2019.

Designation can be broadly interpreted to mean that the statistics meet identified user needs; are well explained and readily accessible; are produced according to sound methods, and are managed impartially and objectively in the public interest.

3. Individual insolvency in England and Wales

3.1 Numbers of individual insolvencies

After seasonal adjustment (where applicable), there were 27,662 individual insolvencies registered in Q2 2021, 4% lower than the number of individual insolvencies registered in the previous quarter and 14% lower than during the same quarter in the previous year.

Individual voluntary arrangements (IVAs) were the most common individual insolvency procedure (76% of cases), followed by DROs (16% of cases) and bankruptcies (9% of cases).

Unlike the monthly statistics, quarterly statistics are seasonally adjusted to account for seasonal variation in insolvencies across the year and allow for comparison to the most recent period within years.

Table 1: The numbers of bankruptcies and IVAs were lower in Q2 2021 than Q1, while DROs were higher

England and Wales, Q2 2020 to Q2 2021, seasonally adjusted

| Total individual insolvencies | Bankruptcies | Debt relief orders | Individual voluntary arrangements | |

|---|---|---|---|---|

| 2020Q2 | 32,134 | 2,558 | 4,820 | 24,756 |

| 2020Q3 | 19,857 | 2,795 | 4,489 | 12,573 |

| 2020Q4 | 30,792 | 2,999 | 4,244 | 23,549 |

| 2021Q1 | 28,895 | 2,628 | 4,161 | 22,106 |

| 2021Q2 | 27,662 | 2,385 | 4,367 | 20,910 |

| Percentage change, latest quarter (Q2 2021) compared with: | ||||

| vs 2021Q1 | -4% | -9% | 5% | -5% |

| vs 2020Q2 | -14% | -7% | -9% | -16% |

Source: Insolvency Service

The long-term series back to Q1 1984 (where applicable) can be found in the csv file that accompanies this release.

IVAs

After seasonal adjustment, the number of IVAs registered in Q2 2021 decreased by 5% from the previous quarter and decreased by 16% from Q2 2020. However, the numbers of IVAs registered in Q2 2020 were artificially high as a result of one IVA provider experiencing technical issues which resulted in a large volume of IVAs being registered in Q2 2020 that would have otherwise been registered in Q1 2020.

Caution needs to be applied when interpreting the IVA numbers. IVAs are counted within these statistics once they are registered with the Insolvency Service by licensed insolvency practitioners. There can be a time lag between the date on which the IVA is accepted and the date of registration. Changes in volumes of registered IVAs may be in part due to changes in how insolvency practitioner firms operate.

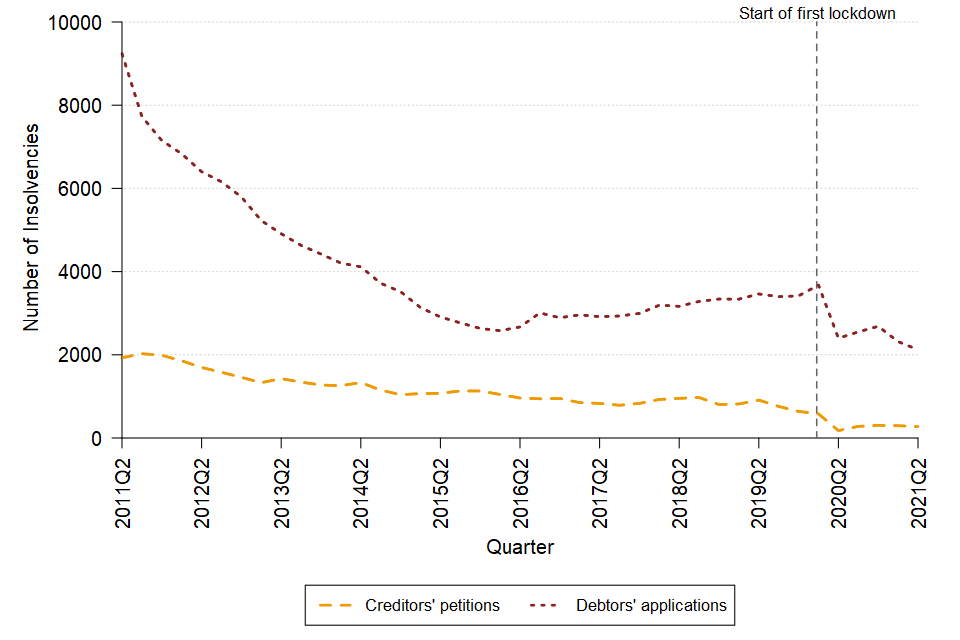

Bankruptcies

After seasonal adjustment, the number of bankruptcies registered in Q2 2021 decreased by 9% from the previous quarter and by 7% from the same quarter last year. The number of bankruptcies was the lowest since Q1 1990.

Bankruptcies consisted of:

- 2,122 debtors’ applications, which was 8% lower than Q1 2021 and 12% lower than Q2 2020,

- 274 creditors’ petitions, which was 7% lower than Q1 2021 and 55% higher than Q2 2020.

Nearly 90% of bankruptcies resulted from debtor applications. This is typical of the proportion during the COVID-19 pandemic, but is higher than pre-pandemic values of 75-85%. The numbers of debtors’ applications and creditors’ petitions were both amongst the lowest seen since 1998 when data on petition type started to be captured.

Figure 2: Bankruptcies made on both debtors’ and creditors’ applications remain historically low

England and Wales, Q2 2011 to Q2 2021, seasonally adjusted

Source: Insolvency Service

The long-term series back to Q1 1984 (where applicable) can be found in the csv file that accompanies this release.

DROs

The number of DROs increased by 5% in Q2 2021 compared with the previous quarter, but was 9% lower than the same quarter last year. When DROs were first introduced in Q2 2009 their volumes increased for a few quarters before stabilising between 6,000 and 7,000 per quarter for most of the past decade. However, during the COVID-19 pandemic, the numbers of DROs have been lower, with Q2 2021 seeing the third-fewest DROs in any quarter since the quarter they were introduced, with only Q4 2020 and Q1 2021 being lower.

Changes to DRO eligibility came into effect on 29th June 2021, so applied only to the final two days of this publication period. Any impact of these changes is unlikely to be visible until the next edition of this publication.

The fall in DROs and debtor bankruptcies over the past 15 months corresponds with a reduction in applications for these services, which coincided with the announcement of enhanced government financial support for individuals and businesses since the emergence of the coronavirus pandemic.

Breathing Space Registrations

Between 4 May (when the scheme was launched) and 30 June 2021 there were 11,747 breathing space registrations. These composed of 11,636 standard breathing space registrations and 111 mental health crisis breathing space registrations (for those receiving mental health crisis treatment).

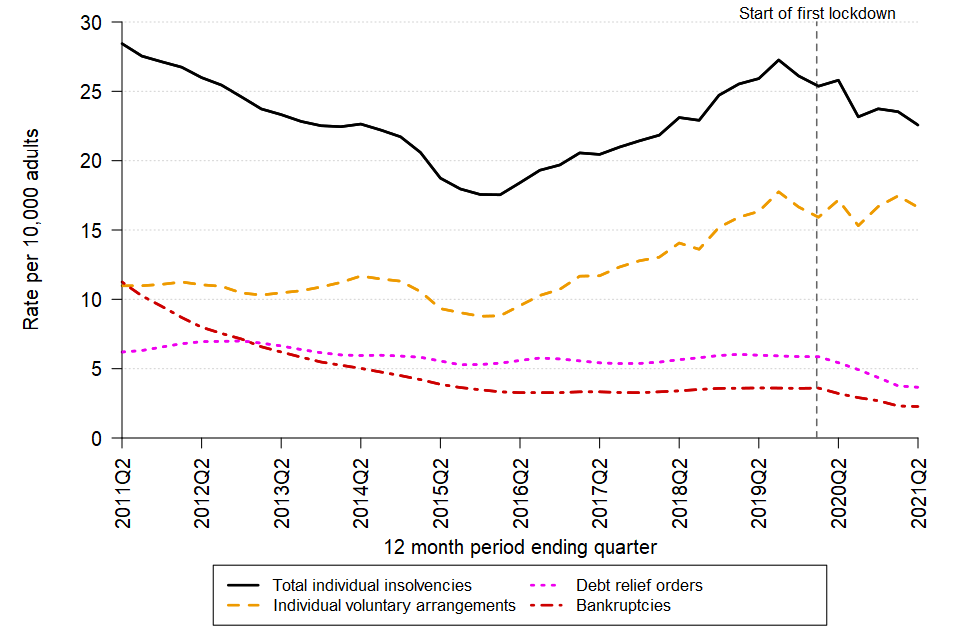

3.2 Rates of individual insolvency per 10,000 adults

In the four quarters ending Q2 2021, the individual insolvency rate was 22.6 per 10,000 adults in England and Wales (Table 2 and Figure 3 below). This corresponds to 1 in 443 adults having become insolvent in the 12 months ending Q2 2021.

The insolvency rate gives an indication of the probability of an individual becoming insolvent in the previous 4 quarters. As the rates are calculated as a proportion of the total number of adults, they are more comparable over longer time periods than the absolute numbers.

The rates presented for each quarter reflect a 4-quarter rolling rate per 10,000 adults. Therefore, the Q2 2021 rates, for example, were calculated using data covering the period Q3 2020 to Q2 2021.

Table 2: The rate of individual insolvencies in the 12 months ending Q2 2021 was lower than for the 12 months ending Q2 2020

England and Wales, 4-quarter rolling rate per 10,000 adults

| Total individual insolvencies | Bankruptcies | Debt relief orders | Individual voluntary arrangements | |

|---|---|---|---|---|

| 2020Q2 | 25.8 | 3.2 | 5.4 | 17.2 |

| 2020Q3 | 23.2 | 2.9 | 4.9 | 15.3 |

| 2020Q4 | 23.7 | 2.7 | 4.4 | 16.7 |

| 2021Q1 | 23.5 | 2.3 | 3.8 | 17.5 |

| 2021Q2 | 22.6 | 2.3 | 3.7 | 16.6 |

| Change in rate per 10,000 adults, 12 months ending latest quarter (Q2 2021) compared with: | ||||

| vs 2021Q1 | -1.0 | 0.0 | -0.1 | -0.8 |

| vs 2020Q2 | -3.2 | -0.9 | -1.8 | -0.5 |

Source: Insolvency Service

Change in rate numbers may not equal the difference in rates presented due to rounding.

The long-term series back to Q1 1984 (where applicable) can be found in the csv file that accompanies this release.

In the four quarters ending Q2 2021:

- The IVA rate decreased by 0.8 in comparison to the 12 months ending Q1 2021, and by 0.5 from the 12 months to Q2 2020;

- the rate of bankruptcy was similar to the 12 months to Q1 2021, but fell by 0.9 in comparison to the 12 months ending Q2 2020;

- the rate of DROs fell by 0.1 in comparison to the 12 months ending Q1 2021, and by 1.8 from the 12 months ending Q2 2020.

Figure 3: The individual insolvency rate declined in the 12 months to Q2 2021 in comparison to the 12 months to Q1 2021

England and Wales, 4-quarter rolling rate per 10,000 adults, not seasonally adjusted

Source: Insolvency Service

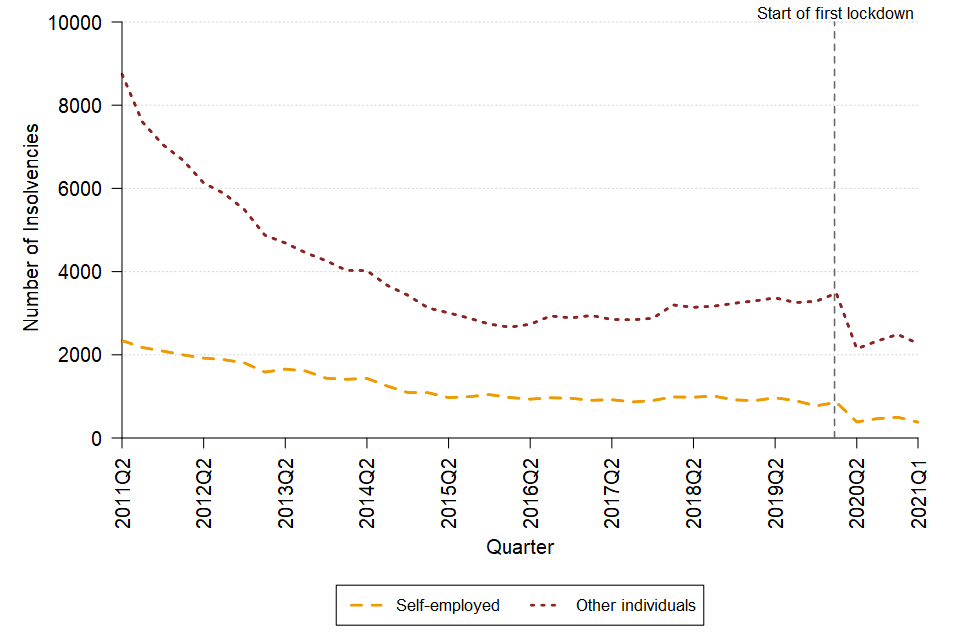

3.3 Bankruptcies by self-employment status

Bankruptcies by self-employment status are presented with a lag of one quarter on most other statistics in this release. This is because it can take several weeks for trading status to be recorded following the date of the bankruptcy order.

In Q1 2021, there were 381 bankruptcies (seasonally adjusted) where the individual was self-employed, a decrease of 24% on Q4 2020 and 56% lower than the same period last year.

There were 2,272 bankruptcies among other individuals in Q1 2021, a decrease of 9% compared with the previous quarter and 35% lower than the same quarter of the previous year.

Both bankruptcies amongst the self-employed and other individuals remained historically low. The four quarters covering the COVID pandemic to date (Q2 2020 to Q1 2021) saw the lowest levels of bankruptcies in both groups since self-employment status was recorded in 2003.

Figure 4: Bankruptcies for the self-employed and other individuals both decreased compared to Q4 2020, remaining lower than before the COVID-19 pandemic

England and Wales, Q2 2011 to Q1 2021, seasonally adjusted

Source: Insolvency Service

The long-term series back to Q1 1984 (where applicable) can be found in the csv file that accompanies this release.

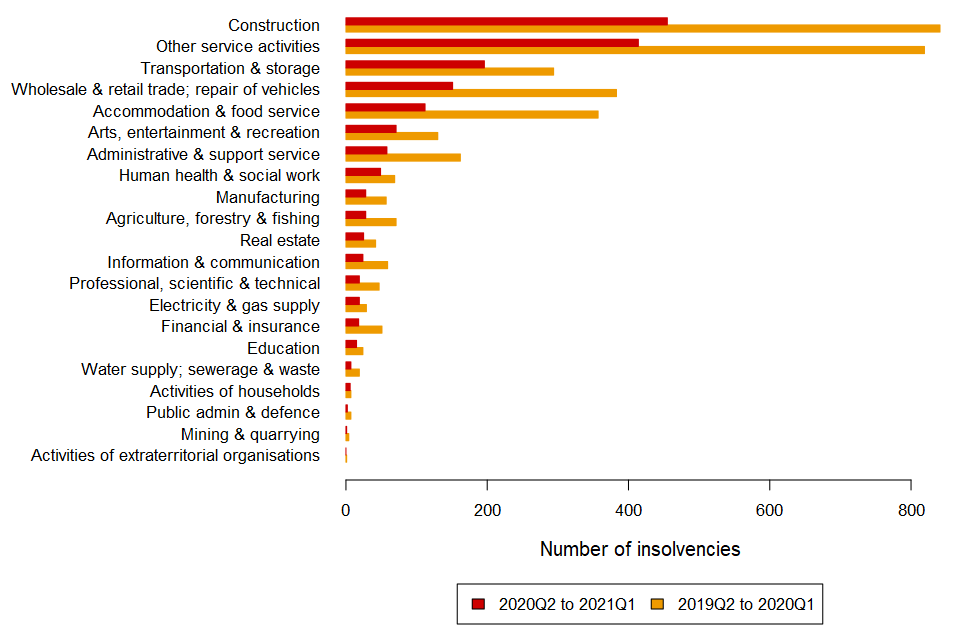

3.4 Self-employed/Trader bankruptcies by Industry (SIC 2007)

This section breaks down the self-employed bankruptcies (also referred to as ‘trader bankruptcies’) in the previous section by Standard Industrial Classification (SIC 2007) categories. Figures in this section are summed over four quarters to reduce the volatility associated with quarter-to-quarter changes. As noted in the previous section, data for Q2 2021 are not yet available.

The industries (in accordance with SIC 2007) that experienced the highest number of trader bankruptcies in the 12 months ending Q1 2021 were:

-

Construction (455, which was 27% of trader bankruptcies);

-

Other service activities (414, 24%);

-

Transportation and storage (196, 12%);

-

Wholesale and retail trade; repair of vehicles (151, 9%); and

-

Accommodation and food service activities (112, 7%).

These five categories made up 78% of trader bankruptcies between 1 April 2020 and 1 April 2021. They were also the most common categories in the 12 months ending 1 April 2020, when they made up 77% of trader bankruptcies. The numbers of bankruptcies in each of the five most common categories were lower than in the four quarters ending Q1 2020, reflecting the overall decline in trader bankruptcies during the COVID-19 pandemic.

The numbers in these categories are likely to be driven by the number of self-employed people trading in a given category rather than the relative likelihood of traders in each category becoming bankrupt.

Figure 5: All industries saw fewer trader bankruptcies in the four quarters ending Q1 2021 than in the period ending Q1 2020

England and Wales, Q2 2019 to Q1 2021, non-seasonally adjusted

Source: Insolvency Service

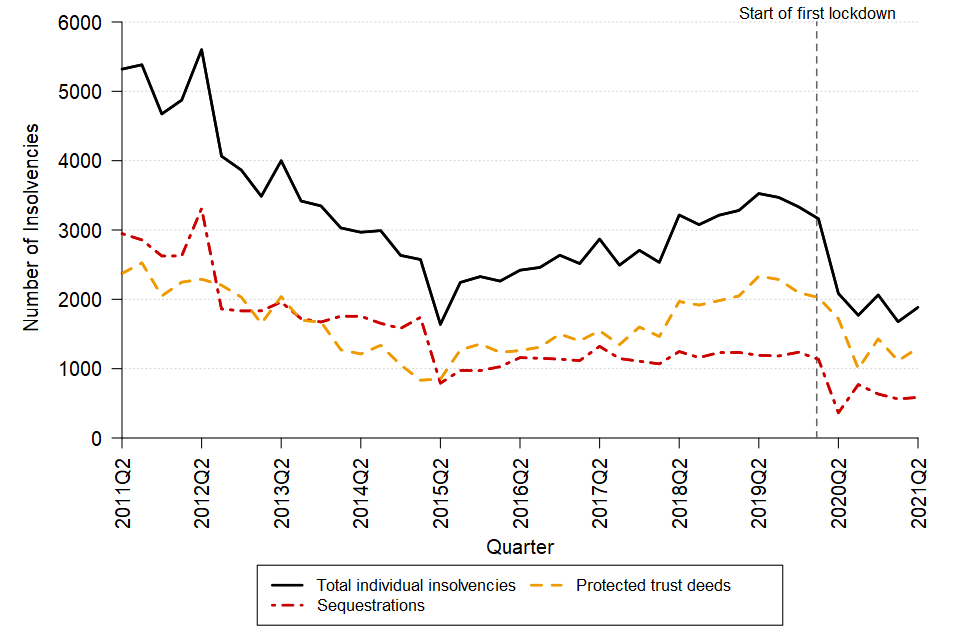

4. Individual insolvency in Scotland

Legislation relating to individual insolvency in Scotland is devolved. The Accountant in Bankruptcy, Scotland’s Insolvency Service, administers individual insolvency in Scotland. The figures below are not seasonally adjusted.

In Q2 2021, there were 1,884 individual insolvencies in Scotland, 10% lower than during the same quarter of 2020. This comprised of 1,298 protected trust deeds and 586 bankruptcies (also known as sequestrations), of which 398 went into bankruptcy via the minimal asset process route. The rules regarding bankruptcy differ to those in England and Wales, so numbers of bankruptcies are not directly comparable.

Figure 6: Total individual insolvencies were lower in Q2 2021 than in Q2 2020, remaining below pre-pandemic levels

Scotland, Q2 2011 to Q2 2021, not seasonally adjusted

Source: Accountant in Bankruptcy, Scotland

The long-term series back to Q1 1984 (where applicable) can be found in the csv file that accompanies this release.

In April 2015, the Minimal Asset Process replaced LILA, and other changes affected bankruptcies, resulting in a large decrease during Q2 2015.

More detail can be found in the Accountant in Bankruptcy statistical release.

5. Individual insolvency in Northern Ireland

Individual insolvency in Northern Ireland is governed by separate, but broadly similar, legislation to England and Wales, and so figures are presented separately.

In Q1 2021 there were 583 individual insolvencies in Northern Ireland, 63% up on the same quarter of 2020. This comprised 494 IVAs, 54 DROs and 35 bankruptcies.

Figure 7: Total individual insolvencies were higher in Q2 2021 than in Q2 2020 and were close to pre-pandemic levels

Northern Ireland, Q2 2011 to Q2 2021, not seasonally adjusted

Source: Department for the Economy, Northern Ireland

The long-term series back to Q1 1984 (where applicable) can be found in the csv file that accompanies this release.

6. Data and Methodology

6.1 Data Sources

Individual insolvency data for England and Wales were sourced from the Insolvency Service case information system (ISCIS), data for Scotland were sourced from the Accountant in Bankruptcy (AIB), and data for Northern Ireland from the Department for the Economy.

Breathing space data were sourced from the Breathing Space register, owned by HM Treasury (HMT), for which the Insolvency Service is a custodian.

Population estimates for persons over the age of 18, as published by the Office for National Statistics were used to calculate individual insolvency rates. For 2021, for which population estimates were not yet available, the 2018-based population projections were used.

More information on the administrative systems used to compile insolvency statistics can be found in the Statement of Administrative Sources.

6.2 Methodology and data quality

Seasonal adjustment

To aid analysis between quarters, underlying data for England and Wales were adjusted where there was evidence of seasonality to minimise the effect of the time of year and provide a true picture of the trends in insolvency. Full details on the models used to adjust the data can be found in the Seasonal Adjustment Review published in April 2020.

The data series for Scotland and Northern Ireland do not demonstrate consistent seasonality and only the unadjusted series have been presented, as agreed with the appropriate officials in the devolved administrations.

The seasonal adjustment models for England and Wales are typically reviewed on an annual basis, in accordance with the Insolvency Service Official Statistics Revisions Policy. However, the trend in individual insolvencies during the 2020 reflected a very different pattern to that seen in previous years; largely a result of the coronavirus (COVID-19 pandemic). Therefore the 2021 review was not conducted and data for 2021 will continue to be seasonally adjusted using the 2020 model.

Rates of insolvency in England and Wales

Insolvency rates were calculated by dividing the total number of individuals entering insolvency in the previous twelve months by the mean average number of persons aged 18 residing in England and Wales over the corresponding period.

Detailed methodology and quality information for these statistics can be found in the accompanying Quarterly Statistics Methodology and Quality document.

The main quality and coverage issues to note:

-

Data for the latest quarter were extracted approximately ten working days after quarter end. There is an increased likelihood that data on individual insolvencies may be revised in the future due to potential delays in data being entered onto Insolvency Service administration systems. Therefore, these statistics for the latest quarter are provisional and marked with a ‘[p]’.

-

These statistics may not equal the sum of monthly statistics, published separately, which cover the period January 2019 to June 2021, due to differing methodologies including seasonal adjustment. In addition, the administrative systems used to capture data are live systems and are subject to amendments.

-

Bankruptcy statistics by employment status, and industry breakdowns for those who were self-employed, are less timely than all other individual insolvency statistics, and are reported one quarter in arrears. This is because it can take several weeks for employment status to be recorded following the date of the bankruptcy order. Therefore, numbers for the latest quarter are not presented due to the known large undercount.

6.3 Revisions

These statistics are subject to scheduled revisions, as set out in the published Revisions Policy. Other revisions tend to be made as a result of data being entered onto administrative systems after the cut-off date for data being extracted to produce the statistics. Any revisions to these statistics will be marked with an ‘[r]’ in the relevant table.

Non-routine revisions since previous release

Previous editions of these statistics did not include Debt Relief Orders that were approved but later revoked. This has now been corrected, resulting in a larger number of revisions in Tables 1a, 1b and 2 than usual.

The process used to remove duplicate IPAs by IPA date has been improved, bringing it in line with the process used for IPAs by bankruptcy date. This has resulted in a larger number of revisions to Table 5c than usual.

Further details on routine and non-routine revisions can be found in the accompanying Quarterly Statistics Methodology and Quality document.

7. Glossary

7.1 Key terms used within this statistical bulletin

| Term | Definition |

|---|---|

| Bankruptcy | A form of debt relief available for anyone who is unable to pay their debts. Assets owned will vest in a trustee in bankruptcy, who will sell them and distribute the proceeds to creditors. Discharge from debts usually takes place 12 months after the bankruptcy order is granted. Bankruptcies result from either Debtor application – where the individual is unable to pay their debts, and applies online to make themselves bankrupt, or Creditor petition – if a creditor is owed £5,000 or more, they can apply to the court to make an individual bankrupt. These statistics relate to petitions where a court order was made as a result, although not all petitions to court result in a bankruptcy order. In Scotland, bankruptcy is often referred to as sequestration. On 1 April 2008, Part 1 of the Bankruptcy and Diligence etc. (Scotland) Act 2007 came into force making significant changes to some aspects of sequestration (bankruptcy), debt relief and debt enforcement in Scotland. This included the introduction of the new route into bankruptcy for people with low income and low assets (LILA). On 1 April 2015, part of the Bankruptcy and Debt Advice (Scotland) Act came into force making significant changes, including the introduction of the Minimal Asset Process (MAP), which replaced the LILA route into sequestration; mandatory debt advice for people seeking statutory debt relief; a new online process for applying for sequestration; and an additional year for people to make contributions to repaying their debts (increasing from three years to four, in line with protected trust deeds). |

| Breathing Space | For individuals, the Breathing Space scheme, launched on 4 May 2021, gives people legal protections from their creditors for 60 days, with most interest and penalty charges frozen, and enforcement action halted. Because problem debt can be linked to mental health issues, these protections are also available for people in mental health crisis treatment – for the full duration of their crisis treatment plus another 30 days. |

| Debt Relief Order (DRO) | A form of debt relief available to those who have a low income, low assets and less than £20,000 of debt. There is no distribution to creditors, and discharge from debts takes place 12 months after the DRO is granted. A change in eligibility criteria was introduced from 29th June 2021 in which there is a new upper limit of £30,000 of debt. However, due to the timing this has not had a material impact on these statistics. |

| Deed of Arrangement | An alternative way for a debtor to deal with their affairs than entering into bankruptcy or an individual voluntary arrangement. Deeds of arrangement require the approval of a simple majority of creditors in number and value, and do not require a nominee, report to court or a meeting of creditors to be held. |

| Income payment orders (IPOs) and agreements (IPAs) | If a Bankrupt has a higher income than needed to pay for their reasonable day-to-day living expenses, the Trustee in Bankruptcy may ask them to make payments towards their Bankruptcy Estate for the benefit of creditors. The Trustee in Bankruptcy may ask a Bankrupt to enter into an Income Payments Agreement (IPA) and if the Bankrupt refuses to enter into an IPA, the Trustee in Bankruptcy can apply to the Court for an Income Payments Order (IPO). |

| Individual Voluntary Arrangement (IVA) | A voluntary means of repaying creditors some or all of what they are owed. Once approved by 75% or more of creditors, the arrangement is binding on all. IVAs are supervised by licensed Insolvency Practitioners. |

| Protected Trust Deeds | Protected trust deeds are voluntary arrangements in Scotland and fulfil much the same role as IVAs in England and Wales. However, there are differences in the way they are set up and administered, meaning the figures shown here are not consistent with those provided for England and Wales. |

| Standard Industrial Classification (SIC 2007) | Used in classifying business establishments and other statistical units by the type of economic activity in which they are engaged. Further information can be found on the ONS website. |