Commentary - Insolvency Service Enforcement Outcomes 2020/21

Updated 22 April 2021

Released

22 April 2021

Next monthly tables update

11 May 2021

Next annual release

April 2022 (Provisional)

Media enquiries

Steven Fifer

+44 (0)30 3003 1568

Statistical enquiries

David Webster (author)

Kate Palmer (responsible statistician)

1. Main Messages

-

During 2020/21 there were a total of 972 director disqualifications under the Company Directors Disqualification Act (CDDA) 1986, as a result of the work of the Insolvency Service. The number of director disqualifications in 2020/21 was lower than in 2019/20. Previously, the number of disqualifications had been stable at between 1,200 and 1,300 for the past seven years.

-

The mean average length of director disqualification in 2020/21 was 5 years and 6 months, similar to the average length of disqualification enforced in the previous two financial years.

-

During 2020/21 there were 42 companies wound up in the public interest, down 10 cases from the previous financial year, and continuing the long-term decline in the number of companies wound up in the public interest. The decline followed a legislative change in 2016, which increased the number of regulatory and enforcement bodies to which the Insolvency Service could disclose material. In some cases, allowing disclosure to these additional bodies has been more effective than winding up the company.

-

During 2020/21 there were 302 bankruptcy and debt relief restrictions orders and undertakings, compared with 470 in 2019/20. This is the lowest level in the time series since 2009/10. The decline in the number of bankruptcy restriction orders in 2020/21 coincided with a fall in the number of bankruptcies during the same period.

-

As at 31 March there were over 6,800 former directors with active disqualifications and over 2,200 individuals subject to bankruptcy and debt relief restrictions.

-

During 2020/21 there were 56 individuals who faced criminal charges, and all were convicted.

-

There were 189 separate sentences imposed in 2020/21. The most common sentences imposed were community orders, which include a range of requirements such as unpaid work, curfews or periods of supervision.

The numbers of individual and company insolvencies during 2020/21 were lower than recent historical levels. This is likely to have been driven by Government measures put in place to support businesses and individuals during the coronavirus (COVID-19) pandemic. Further information on insolvency trends can be found in the published Quarterly and Monthly Insolvency Statistics.

Impacts associated with the coronavirus pandemic are also likely to have contributed to the lower volume of enforcement outcomes in 2020/21 compared to pre-pandemic levels, in particular the short-term reduced operational running of HM Courts & Tribunals Service.

2. Things you need to know about this release

The coverage of the statistics in this release differs throughout due to differences in legislation and policy across the United Kingdom. The geographic breakdown a particular series relates to is detailed throughout this commentary.

The numbers in this release are broken down by financial year, such that 2020/21 means the period from 1st April 2020 to 31st March 2021.

Further details can be found in the accompanying Methodology and Quality Document and Guide to Insolvency Service Enforcement Outcomes.

3. Director Disqualifications

These statistics relate to individuals that have acted as the director of a company in Great Britain, or a company that has an interest in Great Britain and have been disqualified under the Company Directors Disqualification Act (CDDA) 1986 as a result of the work of the Insolvency Service. All underlying numbers for this section can be found in Tables 1-1d in the accompanying tables.

A director can be disqualified under different sections of the CDDA, depending on the circumstances:

- Section 2 following conviction for an indictable offence in relation to the promotion, formation, management, liquidations or striking off a company;

- Section 6 for unfit conduct in relation to an insolvent company; or

- Section 8 where it is considered expedient in the public interest.

Further details on director disqualifications and the restrictions imposed on disqualified directors can be found in the accompanying Guide to Insolvency Service Enforcement Outcomes.

3.1 Disqualification Orders and Undertakings

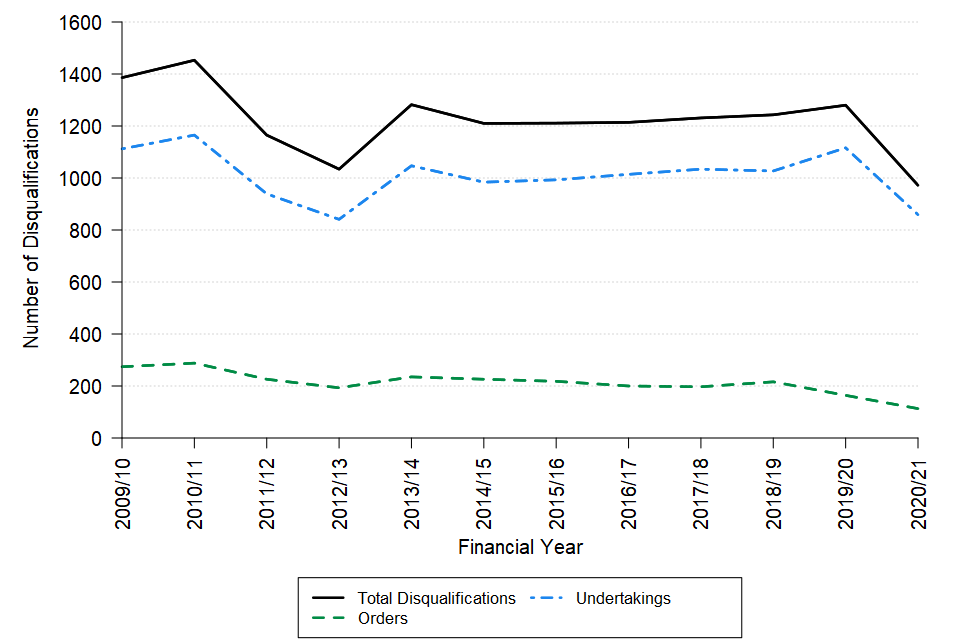

The Insolvency Service obtained, or had significant involvement in obtaining, 972 director disqualifications in 2020/21. Of these, 859 (88%) were undertakings and 113 (12%) were obtained by court order. The number of disqualifications in 2020/21 was 24% lower than in 2019/20 (1,280), following seven years during which the number of director disqualifications remained stable (Figure 1).

Figure 1: Director Disqualification Orders and Undertakings, Great Britain, 2009/10 to 2020/21

Source: Insolvency Service

Most director disqualifications made as a result of the work of the Insolvency Service in 2020/21 were in relation to insolvent companies (Section 6 of the CDDA). There were 948 disqualifications made under Section 6 (down from 1,196 in 2019/20). There were 10 disqualifications made under Section 8, and the Insolvency Service also made a substantial contribution to 14 disqualifications in 2020/21 made under Section 2. See Table 1a of the accompanying tables for more information.

3.2 Length of Director Disqualification Orders and Undertakings

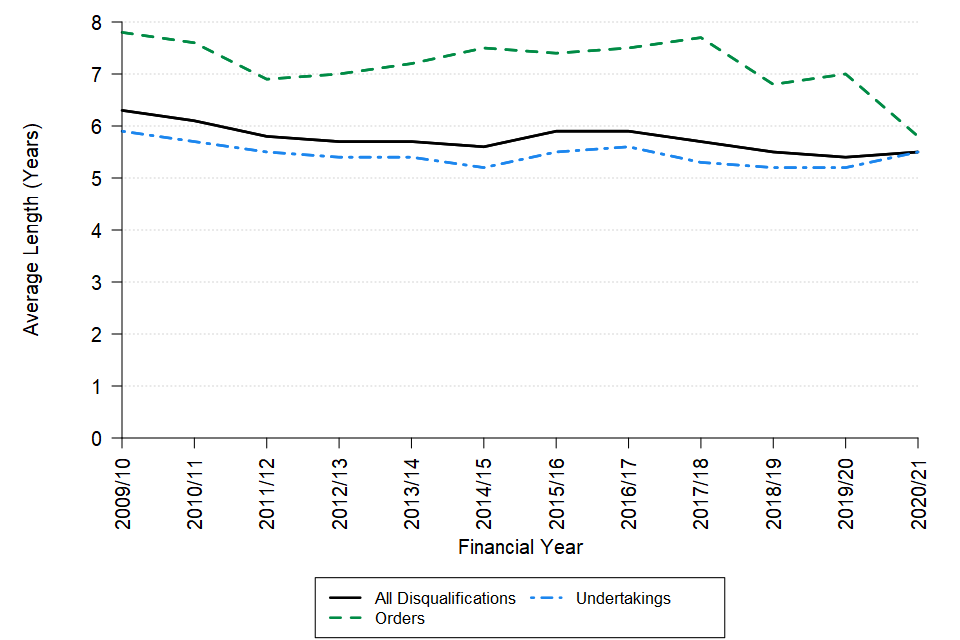

A disqualification order or undertaking is typically enforced for between 2 and 15 years (see Guide to Insolvency Service Enforcement Outcomes for further details). Figure 2 shows the average (mean) length of director disqualifications in 2020/21 was 5 years and 6 months. This includes disqualifications under Section 6 and Section 8 of the Act, along with Section 2 disqualifications which were a result of referral or significant input from the Insolvency Service.

Figure 2: Average Length of Director Disqualification Orders and Undertakings, Great Britain, 2009/10 to 2020/21

Source: Insolvency Service

The average (mean) length of a director disqualification in 2020/21 was similar to the 2018/19 and 2019/20 averages, but slightly lower than the longer-term average. In previous years, undertakings have been shorter on average than orders by more than a year. However, in 2020/21, the difference was three months, with orders having an average length of 5 years, 9 months, while undertakings had an average length of 5 years, 6 months.

A reduction in the length of the disqualification can be offered in certain circumstances if the director accepts an undertaking. This is in recognition of the earlier protection of the public and the costs saved from avoiding court proceedings.

Of the 972 director disqualifications made in 2020/21, 534 (55% of the total), were for between 2 and 5 years, 377 (39%) were for over 5 and up to 10 years, and 61 (6%) of directors were disqualified for over 10 up to 15 years. See Table 1b of the accompanying tables for more information.

3.3 Active Disqualifications

A total of 6,876 directors who were disqualified in the last 12 years remained disqualified as at 31 March 2021. Additionally, there are likely to be some directors with active 12 to 15-year disqualifications that started before 2009/10, however the data from this period are unavailable.

Of the 1,386 disqualifications that came into force in 2009/10, 135 (10%) remain active, while more than half the disqualifications from 2016/17 and all of the disqualifications that came into force in 2018/19 and 2019/20 remain active. See Table 1c of the accompanying tables for more information.

3.4 Allegations in Director Disqualification Cases

The allegations shown here are in relation to disqualifications made under Section 6 of the CDDA only – director disqualifications made in relation to an insolvent company. It is possible for more than one allegation to be made in each disqualification case. Therefore, the number of allegations presented here does not match the number of director disqualifications under Section 6 of the Act.

The allegations presented here relate to those disqualification orders and undertakings obtained in the quarter being reported on in this release, rather than the date the allegations were made. Further information on all allegations can be found in the Guide to Insolvency Service Enforcement Outcomes.

For the 948 disqualifications made under Section 6 of the CDDA in 2020/21, there were a total of 1,034 allegations recorded, as presented in Figure 3.

Figure 3: Allegations in relation to Insolvent Disqualifications, Great Britain, 2020/21

| Type of Allegation | Number of Allegations |

|---|---|

| Unfair Treatment of the Crown | 533 |

| Accounting Matters | 163 |

| Technical Matters | 137 |

| Criminal Matters | 117 |

| Transaction at the detriment of creditors | 68 |

| Misappropriation of Assets | 12 |

| Trading at a time when knowingly or unknowingly insolvent | 4 |

| Phoenix companies or multiple failures | 0 |

| Other | 0 |

Source: Insolvency Service

The most common allegation was in relation to the Unfair treatment of the Crown (which usually refers to HM Revenue and Customs (HMRC)), which was associated with over half of director disqualifications in 2020/21. Unfair treatment of the Crown can range from cases where a director had made a conscious decision to pay other creditors and not HMRC, to cases where a director has defrauded or attempted to defraud HMRC. This has been by far the most common allegation made since comparable records began in 2011/12.

Further information on all allegation categories listed in Figure 3 can be found in the Guide to Insolvency Service Enforcement Outcomes.

4. Companies Wound Up in the Public Interest

These statistics relate to companies, including United Kingdom and foreign companies registered at Companies House and companies that should be registered as they carry out business in the United Kingdom. The compulsory winding up of a company is a legal process where the company is placed into compulsory liquidation by order of the court.

All underlying numbers for this section can be found in Table 2 in the accompanying tables.

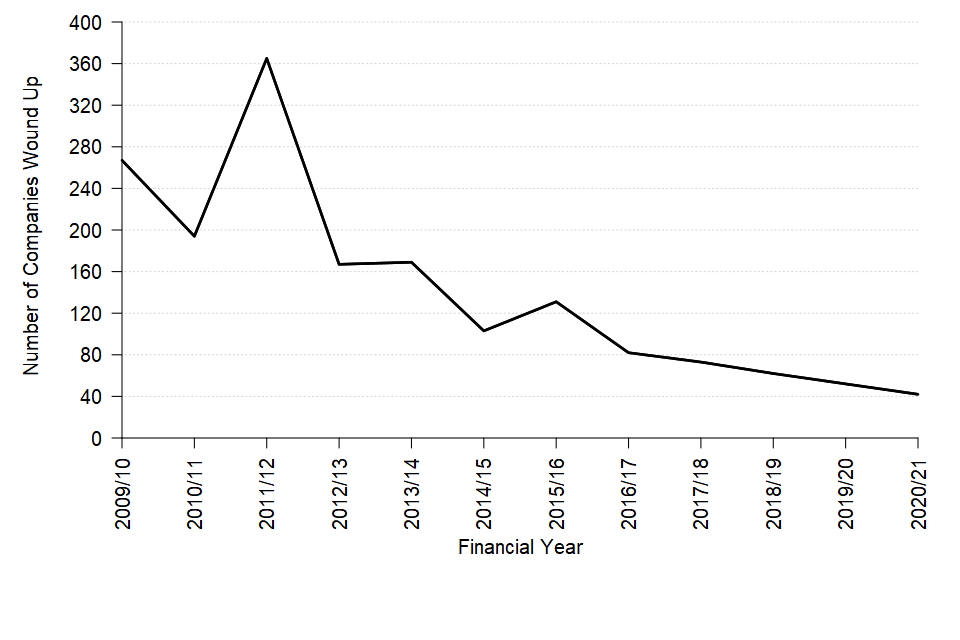

In 2020/21, 42 companies were wound up in the public interest. This was a decrease of 10 cases on 2019/20 and continues the long-term decline in the number of companies wound up (Figure 4).

Figure 4: Companies Wound Up in the Public Interest, United Kingdom, 2009/10 to 2020/21

Source: Insolvency Service

The number of companies wound up in 2011/12 included two major investigations resulting in 61 and 106 winding up orders.

In October 2016, the Companies (Disclosure of Information) (Specified Persons) Order 2016 came into effect. This added a further 5 regulatory and enforcement bodies to the statutory list of those to whom the Insolvency Service can disclose material relating to live investigations. This has widened the range of actions the Insolvency Service can take following a company investigation, allowing disclosure in instances where it was previously not possible. In some cases, it has been more effective to use these disclosure gateways than wind up the company. This may for example include working with Companies House to dissolve a company.

The number of companies wound up in the public interest is included in the total compulsory liquidation cases that are reported in the Insolvency Statistics and as such do not represent additional liquidations.

5. Bankruptcy and Debt Relief Restrictions Orders and Undertakings

These statistics relate to people subject to a bankruptcy or debt relief order in England and Wales – formal insolvency procedures for individuals who have had problems with debt – where the individual is considered to be culpable. A restriction order is made by the court after considering evidence submitted by the official receiver showing the individual to have been dishonest or blameworthy.

Bankruptcy and debt relief restrictions are presented together throughout this release. As there are very few debt relief restrictions made, it is not possible to draw conclusions from analysing them on their own. All underlying numbers for this section can be found in Tables 3-3c in the accompanying tables.

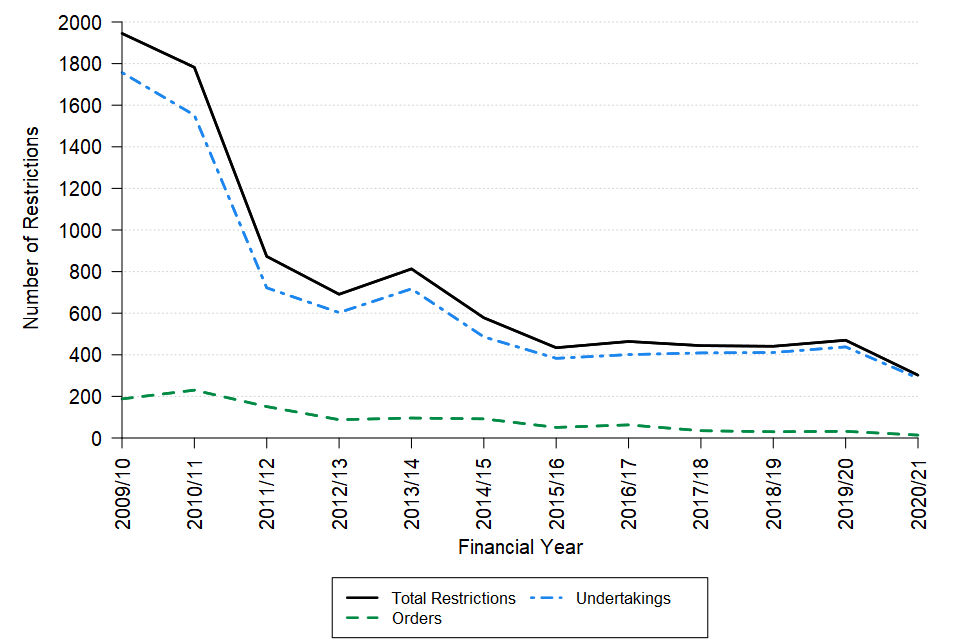

5.1 Restrictions Orders and Undertakings

In 2020/21, a total of 302 bankruptcy and debt relief restrictions orders and undertakings were made, compared to 470 in 2019/20 (Figure 5). This decline followed a period of stability from 2015/16, during which the number of restrictions was between 434 and 470 in each year. Of the restrictions in 2020/21, 14 were restrictions orders (down from 32 in 2019/20) and 288 were restrictions undertakings (compared to 438 in 2019/20).

Figure 5: Bankruptcy and Debt Relief Restrictions Orders and Undertakings, England and Wales, 2009/10 to 2020/21

Source: Insolvency Service

The decline in the number of restrictions orders and undertakings since 2009/10 has been driven by the reduction in the number of individuals that have entered bankruptcy over the period. More information on the trends and drivers of the number of individuals entering into formal insolvency procedures, including bankruptcy, debt relief orders and individual voluntary arrangements, can be found in the published Quarterly and Monthly Insolvency Statistics.

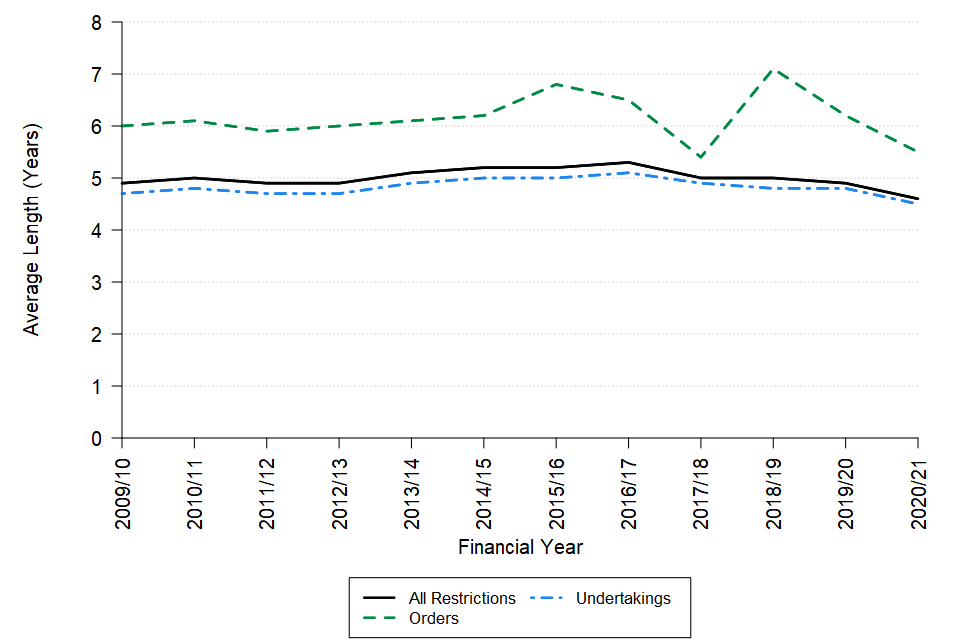

5.2 Length of Bankruptcy and Debt Relief Restrictions Orders and Undertakings

The length of time that a restrictions order or undertaking can be enforced ranges from 2 to 15 years. The average (mean) length of restrictions overall in 2020/21 was 4 years and 7 months, four months shorter than in the previous year (Figure 6).

Figure 6: Average Length of Bankruptcy and Debt Relief Restriction Orders and Undertakings, England and Wales, 2009/10 to 2020/21

Source: Insolvency Service

The average length of restriction orders made in 2020/21 was 5 years and 6 months, eight months lower than the previous year, while the average length of a restrictions undertaking was 4 years and 6 months, four months shorter than the previous year. Overall, the average length of restrictions has largely remained stable since 2009/10.

In 2020/21, 83% of restrictions imposed were for between 2 and 5 years, whilst 15% were for more than 5 years and up to 10 years, and 3% were for restrictions of 10 years or more, up to 15 years. Compared to previous years, there was a greater proportion of restrictions with lengths of 5 years or less. For example, in 2019/20, 72% of restrictions were imposed for between 2 and 5 years and 24% for more than 5 years up to 10 years.

5.3 Active Bankruptcy and Debt Relief Restrictions Orders and Undertakings

A total of 2,264 bankruptcy and debt relief restriction orders and undertakings that began in the last 12 years remain in effect, as at 31 March 2021. This does not include a small number of orders and undertaking still in effect that started before 2009/10 as data are unavailable.

Of the 1,945 bankruptcy and debt relief restrictions orders and undertakings that came into effect in 2009/10, 21 (1%) remain active, while 292 (97%) of the 302 orders and undertakings that came into effect in 2020/21 remain active. See Table 3b of the accompanying tables for more information.

5.4 Allegations in Bankruptcy and Debt Relief Restrictions Cases

It is possible for more than one allegation to be made in each bankruptcy and debt relief restrictions case. Therefore, the number of allegations presented here does not match the number of restrictions orders and undertakings.

The allegations presented here relate to those restrictions orders and undertakings made in the quarter being reported on in this release, rather than the date the allegations were made.

For the 302 restrictions orders and undertakings in 2020/21, there were a total of 309 allegations recorded, as presented in Figure 7. Categories in which no allegations were made in 2020/21 are not presented in Figure 7 but can be found in Table 3c of the accompanying tables.

Figure 7: Types of Allegations made in Bankruptcy and Debt Relief Restriction Cases, 2020/21, England and Wales

| Type of Allegation | Number of Allegations |

|---|---|

| Incurring debt without reasonable expectation of payment | 108 |

| Neglect of business affairs contributing to the bankruptcy | 47 |

| Dissipation of assets | 39 |

| Gambling, rash and hazardous speculation, or unreasonable extravagance | 32 |

| Preferences or transactions at undervalue | 31 |

| Fraud | 16 |

| Prosecutable matters | 12 |

| Non-disclosure of assets | 12 |

| Disposal of goods subject to hire purchase agreements | 8 |

| Failure to supply goods or services | 3 |

| Second bankruptcy | 1 |

Source: Insolvency Service

Over one third of allegations (108) made in relation to restrictions order and undertakings in 2020/21 were related to individuals incurring debt without reasonable expectation of payment. Previously, neglect of business affairs had been the most common allegation type every year since 2010/11, however this year the number of allegations relating to this was down from 127 to 47.

6. Criminal Charge Outcomes

These statistics relate to individuals in England and Wales who have been charged with a criminal offence as a result of the work of the Insolvency Service or by other partner agencies within BEIS, for example Companies House, or directorates, such as the Employment Agency Services Inspectorate. These statistics exclude criminal case outcomes for prosecutions for offences under Part 21 Companies Act 2006 relating to Information about People with Significant Control.

All underlying numbers for this section can be found in Tables 4-4c in the accompanying tables.

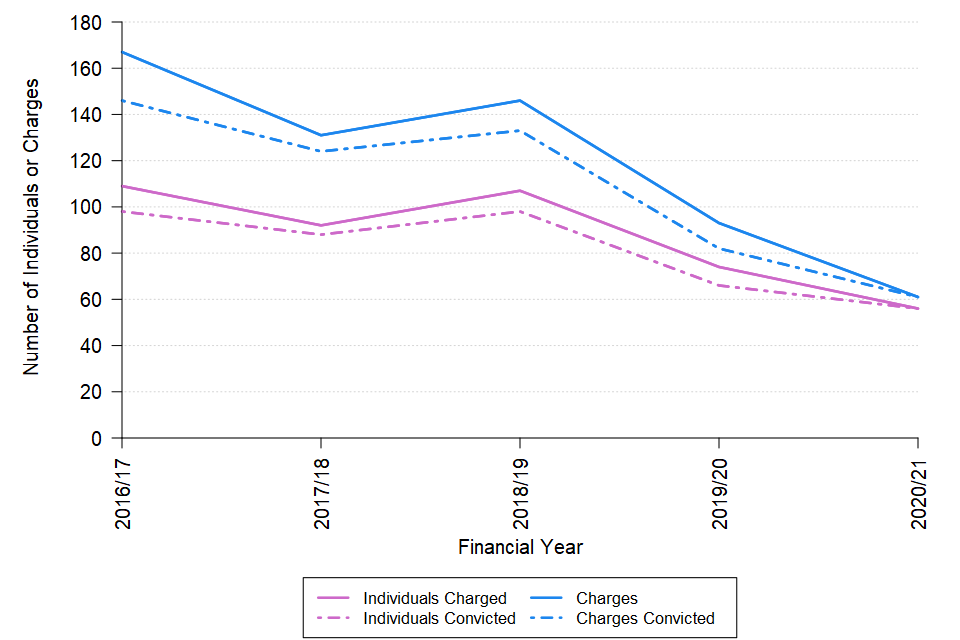

6.1 Criminal Prosecutions by Individual and Charges

In 2020/21, 56 individuals faced a total of 61 criminal charges (Figure 8). This was a 24% decrease compared with the number of individuals charged in 2019/20 and a 34% decrease on the number of charges faced.

All individuals who were charged in 2020/21 were convicted on all charges. In 2019/20, 88% of charges resulted in convictions. For full details, see Table 4 of the accompanying tables.

Figure 8: Number of Criminal Charges Brought by the Insolvency Service, England and Wales, 2020/21

Source: Insolvency Service

6.2 Criminal Convictions by Sentence Imposed

There were 191 separate sentences imposed in 2020/21 (Figure 9). The most common sentences imposed were community orders, which include a range of requirements such as unpaid work, curfews or periods of supervision. In 2020/21, 41 of these sentences were imposed, down from 50 in 2019/20.

Figure 9: Sentences for charges brought by the Insolvency Service, imposed in 2020/21, England and Wales

| Sentence | Number of sentences imposed |

|---|---|

| Community Order | 41 |

| Cost Order | 38 |

| Victim Surcharge | 34 |

| Disqualification | 18 |

| Immediate Imprisonment | 17 |

| Fine | 15 |

| Suspended Imprisonment | 11 |

| Financial Order | 10 |

| No Separate Penalty | 3 |

| Absolute Discharge | 2 |

| Conditional Discharge | 2 |

Source: Insolvency Service

Multiple sentences can be imposed for the same charge, for example, combining a custodial sentence with a confiscation order, costs order and a victim surcharge. In some cases, the court may consider that no separate penalty is appropriate for an offence where the court has already sentenced on other matters, such as a custodial sentence.

6.3 Length and Size of Sentence Imposed.

Figure 10 shows that in 2020/21, 17 sentences of immediate imprisonment were imposed. Twelve of these sentences were for less than 12 months, one was for between 12 and 24 months, and four were for more than 24 months. Forty-one community orders were imposed. Community orders vary, with examples including unpaid work and rehabilitation orders, so these can have durations of either hours or months.

Figure 10: Lengths of sentences for charges brought by the Insolvency Service, imposed in 2020/21, England and Wales

| Length | Immediate Imprisonment | Suspended Imprisonment | Disqualification | Community Order | Total |

|---|---|---|---|---|---|

| Less than 100 hours | 0 | 0 | 0 | 7 | 7 |

| 100 to 199 hours | 0 | 0 | 0 | 9 | 9 |

| 200 hours or more | 0 | 0 | 0 | 8 | 8 |

| Under 12 months | 12 | 8 | 0 | 5 | 25 |

| 12 to 24 months | 1 | 2 | 1 | 11 | 15 |

| Over 24 months | 4 | 1 | 16 | 1 | 22 |

Source: Insolvency Service

Figure 11 shows that there were 97 financial orders made in 2020/21, with the most common (38) being cost orders. Approximately two-thirds of cost orders (26) were for more than £1000, while all 34 victim surcharges were for less than £500. Fifteen fines and ten other financial orders were also imposed.

Figure 11: Size of Financial Sentences Imposed in 2020/21, England and Wales

| Amount | Victim Surcharge | Cost Order | Fine | Other Financial Order | Total |

|---|---|---|---|---|---|

| £500 or less | 34 | 4 | 9 | 0 | 47 |

| £501 to £1000 | 0 | 8 | 5 | 0 | 13 |

| Over £1000 | 0 | 26 | 1 | 10 | 37 |

Source: Insolvency Service

7. Data and Methodology

7.1 Data Sources

Data are compiled from a range of administrative databases and spreadsheets held by the Insolvency Service. Full details of the data sources are provided in the separate Statement of Administrative Sources.

7.2 Coverage

The coverage of the statistics in this release differs throughout due to differences in legislation and policy across the United Kingdom. The geographic breakdown a particular series relates to is detailed within each section of this commentary.

7.3 Methodology and data quality

Detailed methodology and quality information for this statistical release can be found in the accompanying Enforcement Outcomes Methodology and Quality document.

The main quality and coverage issues to note:

-

The coverage of the statistics in this release differs throughout due to differences in legislation and policy across the United Kingdom. The geographic breakdown a particular series relates to is detailed throughout the commentary.

-

Enforcement outcomes are reported based on the date of the order or undertaking, rather than on the date it was recorded on the administrative system. In practice this means there is likely to be an element of under-coverage in the first release of new data.

-

These statistics report on enforcement outcomes obtained as a result of the work of the Insolvency Service. Therefore, any activity conducted outside of the Insolvency Service, or where the Insolvency Service has not had significant involvement, will be excluded.

-

Information presented on directors disqualified under the Company Directors Disqualification Act may not be consistent with information held by Companies House. Full reasons why are provided in the accompanying Enforcement Outcomes Methodology and Quality document.

7.4 Revisions

These statistics are subject to scheduled revisions, as set out in the Revisions Policy. Revisions tend to be made as a result of data being entered onto administrative systems after the cut-off date for data being extracted to produce the statistics. Such revisions tend to be small in the context of overall totals; nonetheless all figures in this release that have been revised since the previous edition have been highlighted in the relevant tables.

8. Glossary

Definitions are provided below for key terms only. Full definitions, including for all allegations, can be found in the accompanying Guide to Insolvency Service Enforcement Outcomes document.

| Allegations | Grounds for Orders and Undertakings to proceed (for both director disqualifications and bankruptcy and debt relief restrictions orders). |

|---|---|

| Bankruptcy | A form of debt relief available for anyone who is unable to pay their debts. Assets owned will vest in a trustee in bankruptcy, who will sell them and distribute the proceeds to creditors. Discharge from debts usually takes place 12 months after the bankruptcy order is granted. |

| Bankruptcy and debt relief restrictions Order or Undertaking | A legal order from the court that extends the length of time an individual may be subject to bankruptcy or Debt Relief Order restrictions. This order can be applied for a number of reasons, lasting anywhere between two and 15 years. In most cases, it is applied due to reckless, dishonest and fraudulent behaviour. If the individual accepts the allegations, they may offer to enter into a bankruptcy or debt relief restrictions undertaking. This has the same effect as an order but does not involve court proceedings. |

| Companies Wound Up in the Public Interest | Following an investigation into the corporate abuse by a limited company or limited liability partnership, the Insolvency Service can apply to the court to have the company put into compulsory liquidation, with a liquidator appointed to investigate and wind up its affairs. Corporate abuse could include serious misconduct, fraud, scams or sharp practice in the way the company operates. Winding up in the public interest can be a powerful tool to disrupt fraudulent or criminal behaviour by removing the companies used to perpetuate the crimes. |

| Debt Relief Order | A form of debt relief available to those who have a low income, low assets and less than £20,000 of debt. There is no distribution to creditors, and discharge from debts takes place 12 months after the DRO is granted. |

| Director disqualification Order or Undertaking | Order made by the court under the Company Directors Disqualification Act 1986 (CDDA) to disqualify a person or a specified period, from becoming a director of a company, or directly or indirectly being concerned or taking part in the promotion, formation or management of a company without permission from the court. If an individual accepts the allegations made against them, they can offer to enter into a disqualification undertaking. This has the same effect as a director disqualification order but does not involve court proceedings. |

| Liquidation | Liquidation is a legal process in which a liquidator is appointed to ‘wind up’ the affairs of a limited company. The purpose of liquidation is to sell the company’s assets and distribute the proceeds to its creditors. At the end of the process, the company is dissolved – it ceases to exist. |