Monitoring the agricultural transition period in England, 2022/23

Published 29 February 2024

Applies to England

This release provides an overview of changes to the Basic Payment and agri-environment payments for farm businesses in England in the first years of the agricultural transition period which began in January 2021.

The data are sourced from the Defra Farm Business Survey which is used to monitor and evaluate Government policies and to inform wider research into the economic performance, productivity and competitiveness of the agricultural industry. The data are also widely used by the industry for benchmarking.

Key results

- Across all farm types, the average Basic Payment received in 2020/21 (before the start of the agricultural transition) was approximately £28,400, around 55% of total Farm Business Income (FBI). By 2022/23, this figure had fallen to an average payment of £22,700, just under 25% of the average FBI in that year.

- Comparing the 2022/23 per hectare payment to 2020/21, across all farm types there was a 21% fall in Basic Payment Scheme payments.

- The importance of the Basic Payment varies considerably across individual farm types with grazing livestock and mixed farms the most reliant on the payments in both 2020/21 and 2022/23.

- In 2020/21, average income from the agri-environment cost centre (which includes the Sustainable Farming Incentive, Countryside Stewardship Scheme etc) ranged from £800 for horticulture farms to £10,400 for Less Favoured Area (LFA) grazing livestock farms. In 2022/23, the average return from the agri-environment cost centre had risen to £2,100 for horticulture farms and, at the other end of the scale, £12,900 LFA grazing livestock farms.

- In terms of uptake, within the Farm Business Survey population the proportion of farms with a positive income from the agri-environment cost centre rose from 49% in 2020/21 to 63% in 2022/23.

1 Overview

The data presented in this release are taken from the 2022/23 Farm Business Survey (FBS). Also included are comparisons to the 2020/21 and 2021/22 FBS data. The estimates are representative of the survey and its population of farms. They give an indication of the characteristics of the farm businesses who claimed each payment and the average payment values during the early years of the agricultural transition period. They do not cover all eligible Basic Payment Scheme farms (around 88,000 farms) nor all those eligible for the new agri-environment schemes, only farm businesses which are in scope of the FBS (i.e. farms with a standard output of more than 25,000 euros). All values are based on current prices. For more information on survey coverage see section 6 Technical note.

The agricultural transition period started on the 1 January 2021. Between 2021 and 2027, untargeted Direct Payments are being gradually reduced before ceasing completely. At the same time, new support primarily aimed at sustainable farming practices is being introduced.

Farm Business Income (total output generated by the farm business minus total farm costs) can be broken down into four cost centres (agriculture, agri-environment payments, diversification and the Basic Payment) making it possible to analyse the relative contribution of each to average total income. This is particularly useful for monitoring the impact of the progressive reduction to Direct Payments in England and the introduction of new support, such as the Sustainable Farming Incentive. It can also help show if farms are adapting to the changes by increasing activities which fall into the diversification cost centre. For example, enterprises such as tourism, renewable energy, retailing farm produce and renting out buildings. The ability to diversify does however depend to some extent on the characteristics and location of the farm.

A phased reduction of Direct Payments began in 2021 with a progressive scale of reductions applied to total payments, including the Basic Payment, in each year until 2027 (Annex D The Path to Sustainable Farming: An Agricultural Transition Plan 2021 to 2024). From 2024, the Basic Payment Scheme will be delinked from land. The data shown here reflects the situation prior to this when payments were still area based.

The Sustainable Farming Incentive (SFI) opened for applications on the 30 June 2022. Through the SFI, farmers are primarily paid for looking after the natural environment in the course of their farming. The SFI is captured under the agri-environment cost centre of the FBS along with other new or updated schemes, such as the Countryside Stewardship Scheme.

It is planned to produce further analysis on the agricultural transition as more data becomes available. The majority of the 2021/22 and 2022/23 data in this release can be found in Farm Accounts in England. Earlier editions of the publication, including 2020/21, are available at Historic Farm Accounts in England.

2 The contribution of the Basic Payment Scheme and agri-environment cost centres to Farm Business Income

Figures 2.1 and 2.2 show the relative importance of the Basic Payment and the agri-environment cost centres to Farm Business Income (total output generated by the farm business minus total farm costs) in 2020/21, before the start of the agricultural transition, and 2022/23.

Figure 2.1 Average Farm Business Income (£ per farm) on cropping farms by cost centre, England 2020/21 and 2022/23

Figure notes:

- The legend is presented in the same order as the bars (read the top row from the left to right, then the bottom row from the left to right), except for mixed farms where the values for the agriculture cost centre are negative. The legend is presented in the same order as the bars

- The data shown are the averages across all farm types in the sample, including those that do not have any income within some cost centres.

- The sample size for horticulture farms is relatively small with average incomes subject to greater variation.

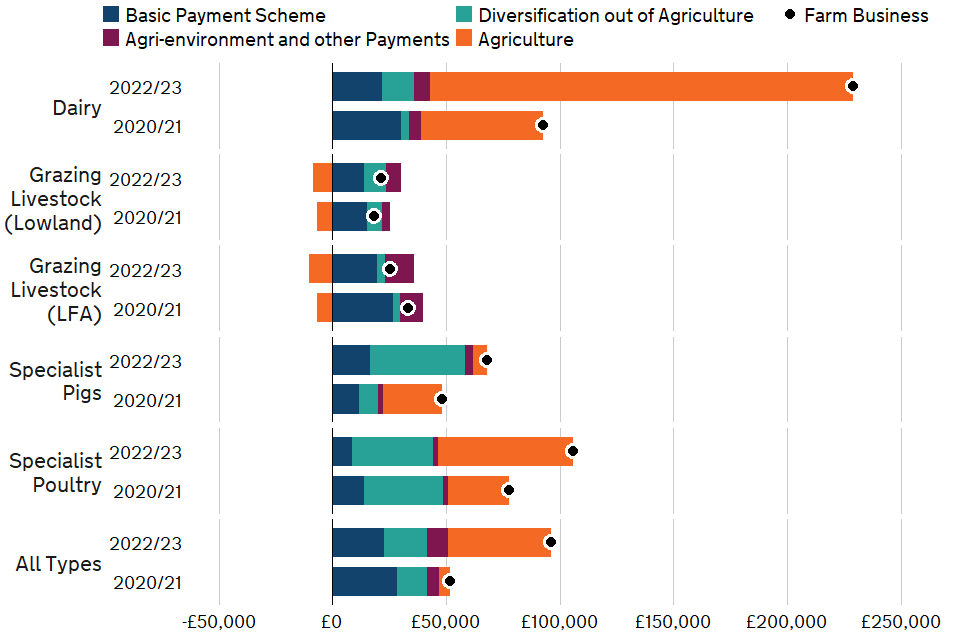

It should be noted that the relative importance of the Basic Payment can be influenced by the income levels of other cost centres and overall Farm Business Income (FBI). This can be seen clearly in 2022/23 when FBI was considerably higher (than the two previous years) for some farm types. It was also a particularly strong year in terms of agricultural income, most notably for cereal, general cropping and dairy farms (Figures 2.1 and 2.2) meaning the Basic Payment cost centre was relatively less important.

Across all farm types, the average Basic Payment received in 2020/21 was approximately £28,400 which accounted for around 55% of total FBI. By 2022/23, this figure had fallen to an average payment of £22,700, which was just under a quarter of the average FBI in that year. However, the importance of the Basic Payment varies considerably across individual farm types with grazing livestock and mixed farms the most reliant on the payments in both 2020/21 and 2022/23. The Basic Payment generally makes up a smaller proportion of FBI for horticulture, pig and poultry farms. This is because fewer of these farm types claim the payment: they tend to be smaller in size and more likely to have land that is ineligible for the payments.

Figure 2.2 Average Farm Business Income (£ per farm) on livestock farms by cost centre, England 2020/21 and 2022/23

Figure notes:

- The legend is presented in the same order as the bars (read the top row from the left to right, then the bottom row from the left to right), except for except for grazing livestock (lowland) and grazing livestock (LFA) where the values for the agriculture cost centre are negative. The legend is presented in the same order as the bars

- The data shown are the averages across all farm types in the sample, including those that do not have any income within some cost centres.

- The sample size for specialist pig and specialist poultry farms is relatively small with average incomes subject to greater variation.

At the all farm level, income from the agri-environment cost centre increased by 73% to £9,200 in 2022/23 compared to the pre-transition level of 2020/21 (Table 4.1). The payment equated to around 10% of total FBI in 2022/23 which, influenced by increased income levels of other cost centres, was the same proportion as in 2020/21.

As with the BPS, there was variation between farm types (Figures 2.1 and 2.2). Agri-environment payments are a particularly important income stream for LFA grazing livestock farms. On this farm type, payments associated with agri-environment activities equated to almost a third of total FBI in 2020/21 and around half of total FBI in 2022/23.

It should be noted that, as with the Basic Payment, the relative importance of agri-environment cost centre can be influenced by income levels of other cost centres. In 2022/23, income from the agricultural cost centre was particularly high for some farm types, such as dairy and cereal farms.

Considering changes to income streams other than the Basic Payment and agri-environment cost centres can also help assess how farms are adapting during the agricultural transition period. Between 2020/21 and 2022/23 the proportion of farms undertaking diversified activities rose from 66% to 69%. Average income from the diversification cost centre at the all farm level was £16,600 in 2020/21, this increased to £18,800 in 2022/23. Full details of diversified income for 2021/22 and 2022/23 can be found in Farm Accounts in England. Data for 2020/21 and earlier years are available at Historic Farm Accounts in England.

3 Changes to the Basic Payment between 2020/21 and 2022/23

Direct payments in England are being phased out between 2021 and 2027. Reductions are being applied to the total payment in each year during this period and this includes the Basic Payment Scheme.

The 2021/22 Farm Business Survey (FBS) captured the first year of the phased reductions where farms saw a minimum reduction of 5% to their Basic Payment.

Overall, the FBS data for 2021/22 (the first year of reductions) shows the average Basic Payment was just 2% lower than 2020/21 at £27,900 (Table 3.1). However, this was partially driven by the average land area for farms in the FBS sample which increased by 6% overall compared to the previous year (and by considerably more for pig farms in the survey, hence their higher Basic Payment in 2021/22). When considered on a per hectare (rather than per farm) basis, the payment was 3% lower in 2021/22 compared to 2020/21 (Table 3.2).

Table 3.1: Average BPS income per farm (£/farm) by farm type, England 2020/21 to 2022/23

| Farm type | 2020/21 | 2021/22 | 2022/23 | % change from 2020/21 to 2022/23 |

|---|---|---|---|---|

| Cereals | 41,800 | 35,900 | 32,600 | -22% |

| General cropping | 42,100 | 49,600 | 34,300 | -19% |

| Dairy | 30,000 | 28,600 | 21,700 | -28% |

| LFA Grazing Livestock | 26,700 | 26,500 | 19,700 | -26% |

| Lowland Grazing Livestock | 15,100 | 16,000 | 13,800 | -9% |

| Pigs (note 3) | 11,600 | 16,500 | 16,700 | 44% |

| Poultry | 13,900 | 15,900 | 8,800 | -37% |

| Mixed | 31,400 | 32,600 | 26,200 | -17% |

| Horticulture | 3,900 | 3,900 | 3,400 | -14% |

| All farms | 28,400 | 27,900 | 22,700 | -20% |

Table notes:

- Figures are rounded to the nearest £100. Percentages rounded to the nearest 1%.

- The sample sizes for specialist pig, specialist poultry and horticulture farms are relatively small with average incomes subject to greater variation.

- In both 2021/22 and 2022/23 the average land area for pig farms in the FBS increased, resulting in a higher BPS for this farm type despite the reducing payment rate.

Table 3.2: Average BPS income per farm (£/hectare) by farm type, England 2020/21 to 2022/23

| Farm type | 2020/21 | 2021/22 | 2022/23 | % change from 2020/21 to 2022/23 |

|---|---|---|---|---|

| Cereals | 196 | 190 | 156 | -21% |

| General cropping | 192 | 185 | 152 | -20% |

| Dairy | 188 | 182 | 144 | -23% |

| LFA Grazing Livestock | 193 | 181 | 142 | -26% |

| Lowland Grazing Livestock | 178 | 174 | 143 | -20% |

| Pigs (note 3) | 98 | 106 | 136 | 38% |

| Poultry | 84 | 98 | 77 | -9% |

| Mixed | 186 | 183 | 149 | -20% |

| Horticulture | 83 | 78 | 60 | -28% |

| All farms | 179 | 174 | 142 | -21% |

Table notes:

- Percentages rounded to the nearest 1%.

- The sample sizes for specialist pig, specialist poultry and horticulture farms are relatively small with average incomes subject to greater variation.

- In 2020/21, the survey included a pig farm not claiming the Basic Payment but with a large farm area. This had a lowering effect on the average per hectare payment for pig farms in 2020/21. Additionally, in 2021/22 and 2022/23, a growing proportion of pig farms in the FBS were receiving the Basic Payment which increased the average per hectare payment in those years.

In 2022, the second year of progressive reduction to the Basic Payment, a 20% reduction was applied to the first £30,000 of the payment with larger incremental deductions on the bigger payment bands. The average Basic Payment was £22,700 (Table 3.1), a fall of 20% compared to 2020/21 (before the start of the agricultural transition). Comparing the 2022/23 per hectare payment to 2020/21 there was a 21% fall in Basic Payment at the all farm level (Table 3.2).

When analysed by performance bands (based on the ratio of outputs to inputs), the lowest 25% of farms had the smallest Basic Payment. Due to the incremental nature of the reductions (larger reductions for higher payments) they also saw the least reduction (-11%) in their average payment between 2020/21 and 2022/23 (Table 3.3).

Table 3.3: Average BPS income per farm (£/farm) by performance band, England 2020/21 to 2022/23

| Performance band | 2020/21 | 2021/22 | 2022/23 | % change from 2020/21 to 2022/23 |

|---|---|---|---|---|

| Low | 11,900 | 12,200 | 10,500 | -11% |

| Medium | 27,500 | 28,000 | 21,400 | -22% |

| High | 46,600 | 43,600 | 37,400 | -20% |

| All farms | 28,400 | 27,900 | 22,700 | -20% |

Table notes:

- Figures are rounded to the nearest £100. Percentages rounded to the nearest 1%.

A similar picture is seen when comparing average Basic Payment by farm business size (based on Standard Labour Requirement), with part-time, small and medium size farms experiencing the lowest reduction in their average payments between 2020/21 and 2022/23 (Table 3.4).

Table 3.4: Average BPS income per farm (£/farm) by Standard Labour Requirement size band, England 2020/21 to 2022/23

| Size band | 2020/21 | 2021/22 | 2022/23 | % change from 2020/21 to 2022/23 |

|---|---|---|---|---|

| Part-time (note 2) | 13,600 | 13,400 | 12,500 | -8% |

| Small | 21,600 | 21,300 | 16,700 | -23% |

| Medium | 29,600 | 28,200 | 25,100 | -15% |

| Large | 40,600 | 38,900 | 29,600 | -27% |

| Very large | 68,700 | 64,800 | 50,300 | -27% |

| All farms | 28,400 | 27,900 | 22,700 | -20% |

Table notes:

- Figures are rounded to the nearest £100.

- In 2022/23, there were a very small number of spare-time farms in the survey. These have been included in the part-time size band for that year.

4 Changes to agri-environment payments between 2020/21 and 2022/23

As Direct Payments reduce during the agricultural transition period, a raft of other payments and grants are being introduced focusing on environmental outcomes and supporting investment on farms. These include the Sustainable Farming Incentive, Local Nature Recovery and Landscape Recovery schemes and will be recorded under the agri-environment cost centre of the Farm Business Survey (FBS). The current data only cover the very early stages of this move, it is anticipated that income in this cost centre will show more changes in the coming years.

In 2020/21, before the start of the agricultural transition, average income from the agri-environment cost centre ranged from £800 for horticulture farms to £10,400 for LFA grazing livestock farms. In 2022/23, the average return from the agri-environment cost centre had risen to £2,100 for horticulture farms and, at the other end of the scale, £12,900 for LFA grazing livestock farms. General cropping, horticulture and cereal farms saw the largest value increase in the agri-environment cost centre compared to 2020/21 with average payments more than doubling (Table 4.1).

In terms of uptake, within the FBS the proportion of farms with a positive income in the from the agri-environment cost centre rose from 49% in 2020/21 to 63% in 2022/23.

Table 4.1: Average income from agri-environment activities per farm (£/farm) by farm type, England 2020/21 to 2022/23

| Farm type | 2020/21 | 2021/22 | 2022/23 | % change from 2020/21 to 2022/23 |

|---|---|---|---|---|

| Cereals | 5,400 | 5,900 | 11,600 | 113% |

| General cropping | 4,700 | 13,200 | 12,400 | 165% |

| Dairy | 5,400 | 4,700 | 7,400 | 36% |

| LFA Grazing Livestock | 10,400 | 12,300 | 12,900 | 24% |

| Lowland Grazing Livestock | 3,700 | 5,000 | 6,600 | 76% |

| Pigs | 2,200 | 3,500 | 3,600 | 65% |

| Poultry | 2,200 | 3,200 | 2,200 | 1% |

| Mixed | 6,600 | 7,400 | 10,100 | 53% |

| Horticulture | 800 | 1,100 | 2,100 | 152% |

| All farms | 5,300 | 6,900 | 9,200 | 73% |

Table notes:

- Figures are rounded to the nearest £100. Percentages are rounded to the nearest 1%.

- The sample sizes for specialist pig, specialist poultry and horticulture farms are relatively small with average incomes subject to greater variation.

Comparing farm performance groups (based on the ratio of outputs to inputs), all groups saw substantial increases to income from agri-environment activities compared to before the start of the agricultural transition. The highest performing farms saw the largest increase in terms of value whilst, on average, low performing farms had the biggest percentage increase; at £4,000 in 2022/23 their agri-environment payments more than doubled compared to 2020/21 (Table 4.2).

Table 4.2: Average income from agri-environment activities per farm (£/farm) by performance band, England 2020/21 to 2022/23

| Performance band | 2020/21 | 2021/22 | 2022/23 | % change from 2020/21 to 2022/23 |

|---|---|---|---|---|

| Low | 1,700 | 2,600 | 4,000 | 138% |

| Medium | 4,900 | 6,300 | 8,800 | 79% |

| High | 9,700 | 12,100 | 15,000 | 56% |

| All farms | 5,300 | 6,900 | 9,200 | 73% |

Table notes:

- Figures are rounded to the nearest £100. Percentages are rounded to the nearest 1%.

When considered by farm business size (based on Standard Labour Requirement), agri-environment payments for part-time farms more than doubled between 2020/21 and 2022/23 to £5,300 (Table 4.3). Farms in the very large category saw the biggest value increase to their payments which rose to an average of £19,800 in 2022/23, an increase of 78% (£8,700) compared to 2020/21.

Table 4.3: Average income from agri-environment activities per farm (£/farm) by Standard Labour Reqiurement size band, England 2020/21 to 2022/23

| Size band | 2020/21 | 2021/22 | 2022/23 | % change from 2020/21 to 2022/23 |

|---|---|---|---|---|

| Part-time (note 2) | 2,300 | 3,000 | 5,300 | 130% |

| Small | 5,000 | 5,600 | 7,700 | 53% |

| Medium | 5,600 | 7,100 | 10,300 | 85% |

| Large | 8,400 | 10,200 | 10,200 | 22% |

| Very large | 11,100 | 15,300 | 19,800 | 78% |

| All farms | 5,300 | 6,900 | 9,200 | 73% |

Table notes:

- Figures are rounded to the nearest £100. Percentages are rounded to the nearest 1%.

- In 2022/23, there were a small number of spare-time farms in the survey. These have been included in the part-time size band for that year.

5 What you need to know about this release

5.1 Availability of results

All Defra statistical notices can be viewed at:

www.gov.uk/government/organisations/department-for-environment-food-rural-affairs/about/statistics

Results from the Farm Business Survey, including time series in spreadsheet format, can be found at:

www.gov.uk/government/collections/farm-business-survey

The next release is expected to be in October/November 2024. The definitive publication date will be announced on the research and statistics webpage on gov.uk.

5.2 Contact details

Responsible statistician: Alison Wray

Public enquiries: [email protected]

For media queries between 9am and 6pm on weekdays:

Telephone: 0330 041 6560

Email: [email protected]

5.3 National Statistics Status

Accredited official statistics are called National Statistics in the Statistics and Registration Service Act 2007. An explanation can be found on the Office for Statistics Regulation website. Our statistical practice is regulated by the Office for Statistics Regulation (OSR). OSR sets the standards of trustworthiness, quality and value in the Code of Practice for Statistics that all producers of official statistics should adhere to.

These accredited official statistics were independently reviewed by the Office for Statistics Regulation in January 2014. They comply with the standards of trustworthiness, quality and value in the Code of Practice for Statistics and should be labelled ‘accredited official statistics’.

You are welcome to contact us directly with any comments about how we meet these standards (see contact details above). Alternatively, you can contact OSR by emailing [email protected] or via the OSR website.

Since the latest review by the Office for Statistics Regulation, we have continued to comply with the Code of Practice for Statistics, and have made the following improvements:

-

Reviewed and improved data presentation to better meet accessibility guidelines.

-

Automated production of the statistics using Reproducible Analytical Pipelines (RAP).

-

Reviewed and improved accompanying commentary.

6 Technical note

6.1 Survey coverage, weighting and accuracy

The Farm Business Survey (FBS) is an annual survey providing information on the financial position and physical and economic performance of commercial farm businesses in England. It covers all types of farming in all regions of the country and includes owner-occupied, tenanted and mixed tenure farms. The FBS only includes farm businesses with a Standard Output of at least €25,000, based on activity recorded in the previous June Survey of Agriculture and Horticulture (this does not cover all eligible farms for Direct Payments nor agri-environmental schemes). In 2022/23, this accounted for approximately 52,500 farm businesses. Between 2019/20 and 2021/22 the samples were slightly smaller as a result of Covid-19 restrictions on data collection. Following contractual changes, the 2022/23 sample was 1,350 farms. Data are collected by face to face interviews with farmers, conducted by highly trained researchers.

Each record is given a weight to make the sample representative of the population. Initial weights are applied to the FBS records based on the inverse sampling fraction. These weights are then adjusted by calibrating certain totals to match published totals from other surveys so that they can be used to produce unbiased estimators of a number of different target variables. Any extreme Farm Business Income outliers are investigated and, if necessary, moved into their own strata and given a weight of 1.

In common with other statistical surveys, the published estimates from the Farm Business Survey are subject to sampling error, as we are not surveying the whole population. More detailed information about the Farm Business Survey and the data collected can be found at: www.gov.uk/farm-business-survey-technical-notes-and-guidance

6.2 Farm type classification

From 2018/19, the classification of farms is based on 2013 standard output coefficients. The 2017/18 results have been recalculated and presented in this release to allow comparability between 2017/18 and 2018/19. The results published here are therefore not directly comparable with those published in earlier years, which are based on previous standard output coefficients.

6.3 Farm Business Income

For non-corporate businesses, Farm Business Income represents the financial return to all unpaid labour (farmers and spouses, non-principal partners and their spouses and family workers) and on all their capital invested in the farm business, including land and buildings. For corporate businesses it represents the financial return on the shareholders capital invested in the farm business.

In essence Farm Business Income is the same as Net Profit, which as a standard financial accounting measure of income is used widely within and outside agriculture. Using the term Farm Business Income rather than Net Profit, gives an indication of the measure’s farm management accounting rather than financial accounting origins, accurately describes its composition and is intuitively recognisable to users as a measure of farm income.

6.4 Classification by size of business

Farm business size is measured by Standard Labour Requirement (SLR) expressed in terms of full-time equivalents under typical conditions. They represent the input of labour required per head of livestock or per hectare of crops for enterprises of average size and performance.

- Part-time - less than 1 SLR

- Small - greater than or equal to 1 less than 2 SLRs

- Medium - greater than or equal to 2 less than 3 SLRs

- Large - greater than or equal to 3 less than 5 SLRs

- Very large - greater than or equal to 5 SLRs

6.5 Economic performance

Economic performance for each farm is measured as the ratio between economic output (mainly sales revenue) and inputs (costs). The inputs for this calculation include an adjustment for unpaid manual labour. The higher the ratio, the higher the economic efficiency and performance. The farms are then ranked and allocated to performance bands based on economic performance percentiles:

- Low performance band - bottom 25% of economic performers

- Medium performance band - middle 50% of economic performers

- High performance band - top 25% of economic performers