National non-domestic rates collected by councils in England: forecast for 2024 to 2025

Updated 9 May 2024

Applies to England

This release provides data on the forecast of non-domestic rating income due to local authorities in 2024-25, including data relating to the amount of business rates reliefs forecast to be given to businesses. This release includes data from all 296 authorities.

1. In this release:

- Local authorities estimate the non-domestic rating income for 2024-25 will be £26.3 billion. This is what authorities estimate they will collect after all reliefs, accounting adjustments and sums retained outside the rates retention scheme are taken into consideration.

- Local authorities estimate that they will grant a total of £8.3 billion of relief from business rates in 2024-25. Of this £5.5 billion is the cost of mandatory relief and £2.7 billion is the cost of discretionary relief

- Within the mandatory relief, £2.0 billion is expected to be given in small business rate relief, £2.3 billion in relief given as charitable occupation relief and £1.0 billion in empty property relief.

- Within discretionary relief, £2.4 billion is the cost of the retail, hospitality and leisure relief.

Release date: 21 February 2024

Date of next release: February 2025

Contact: [email protected] (Responsible Statistician: Jo Coleman)

Media enquiries: 0303 444 1209 / [email protected]

2. Introduction

This release has been compiled by the Department for Levelling Up, Housing and Communities (DLUHC) and it provides information on national non-domestic rates and associated information for the financial year 2024-25. This information is derived from the national non-domestic rates (NNDR1) returns submitted by the 296 billing authorities in England that will be in existence from 1 April 2024.

The data in this release are not directly compared from year to year because of different changes to business rates arising from regular revaluations of businesses, changes to reliefs and, in 2024-25, the decoupling of the business rates multipliers and changes to how some reliefs can be given. Notes are provided to these changes under each table and explained in the special factors below.

Non-domestic rates, or business rates, are collected by billing authorities and are the way in which those that occupy a non-domestic property (or hereditament) contribute towards local services. Since 2013-14 local authorities are allowed to retain a proportion of the revenue that is generated in their area. The NNDR1 form collects data that estimates what authorities will collect and the outturn data (collected on the NNDR3) is what was collected.

Apart from properties that are exempt from business rates, such as agricultural land, parks and places of worship, each non-domestic property has a rateable value which is set by the Valuation Office Agency (VOA). Billing authorities work out the business rates liability for every hereditament by multiplying the rateable value of the property by the appropriate multiplier. There are two multipliers, the standard non-domestic rate multiplier (previously called the non-domestic rate multiplier) and the small non-domestic rate multiplier.

The multipliers are set each financial year for England according to formula set by legislation, which, from 2018-19 have been determined by the increase in the previous September’s Consumer Price Index. Government can then cap the multiplier and compensate authorities for the loss of income through Section 31 grant. From 2024-25, the multipliers have been decoupled so that the standard and small multipliers can be set differently.

Rateable properties may be eligible for discounts or reliefs on their business rates bills. Some of these are mandatory i.e. they are automatic entitlements in any billing authority area, and some are discretionary relief which are granted at a billing authority’s discretion. As new reliefs have been introduced since the start of this series, and some of these reliefs were time limited, changes across years are not strictly comparable. Further information about the types of reliefs available are presented in Table 2.

Further details about the business rates retention scheme and an explanation of hereditaments can be found in the Definitions section of the accompanying technical document.

2.1 Technical Information

Please see the accompanying technical notes document for further details.

Revaluation and transitional relief

Every few years, the government adjusts the rateable value of business properties to reflect changes in the property market. This is known as a revaluation. At revaluation, the Government also revises the non-domestic and small business standard multipliers to reflect the aggregate change in rateable values.

The latest revaluation came into effect on the 1 April 2023 and reflects the rental market as at 1 April 2021. The tables in this release therefore show a discontinuity between 2023-24 and 2024-25 because this affects gross business rates and the amount of relief granted.

At a Revaluation, the Government also puts in place a transitional scheme that protects business ratepayers from significant step-changes in bills, by phasing in increases over a number of years. The cost of the transitional scheme is shown in Table 1. From 2023-24, this reflects the revenue foregone because the rates bills of ratepayers are being phased down as a result of the transitional scheme. In previous years authorities reported a net cost, reflecting that the cost of revenue foregone by delaying increases to bills was offset by additional income raised by delaying reductions to bills.

Small business rates relief

Small business rates relief provides 100% relief to all businesses that have a rateable value of below £12,000, and a tapering relief for businesses with a rateable value between £12,000 and £15,000. The threshold at which a higher multiplier is applied is £51,000.

Multipliers

The Non Domestic Rating (NDR) Act 2023 created a number of changes to the way business rates multipliers are calculated and applied, including de-coupling the small business rating and standard rating multipliers. Previously the standard multiplier was equal to the small business rating multiplier, plus a supplement figure (originally designed to recover the cost of small business rate relief), set at 1.3p above the small multiplier in recent years. The two multipliers therefore only changed when the small business rating multiplier changed and in recent years, the small business rates multiplier has either been frozen or capped below the CPI.

The Act has allowed, from 2024-25, Government to treat the multipliers differently – and the concept of the supplement removed. Both will be independently linked to CPI as default. At Autumn Statement 2023, the Chancellor announced that the small business rates multiplier would be frozen at 49.9p for 2024-25 while the standard business rates multiplier will be uprated in line with September CPI from 51.2p to 54.6p.

Further details of the standard multiplier and small business rate multiplier and the new reliefs can be found in the technical notes accompanying this release.

2.2 Special factors affecting 2024-25

Changes arising from the Non-Domestic Rating Act

(a) Decoupling of the multiplier

As described above the multipliers have been decoupled. This has affected what data has been collected from authorities, although it does not affect the tables presented in this release.

For most authorities, data has been provided on gross rates and reliefs split between the small and standard business rating multiplier. These changes can be seen in the local authority level table. For a small number of authorities, this split is not yet possible for 2024-25, so data on reliefs has been recorded in the small business rates columns.

The disaggregation of the data allows the compensation shown in Table 3 to be calculated more accurately for each relief. This means that a proportion of compensation that would previously have been calculated for the individual reliefs are now showing within the figure for the cost of compensation for the capping of the multiplier. See Table 3 for more details.

(b) From 1 April 2024, the small business multiplier’s eligibility will be extended to properties below the threshold for the national multiplier at £51,000 which are vacant, on the central list or occupied by charities.

(c) From 1 April, the rural rate relief will be a mandatory 100% relief, rather than a mandatory 50% relief, with a further 50% relief to be given through discretionary relief (funded and unfunded). Authorities will continue to be compensated via section 31 grant for 50% of the relief that they award, reflecting government’s decision to change the percentage rate of relief.

(d) From 1 April, the Low Carbon Heat Network relief will be a mandatory relief, rather than the section 47 discretionary relief that has been in place since 1 April 2022.

(e) Although Improvement relief is in the Act, regulations were not finalised in time for this data collection exercise. For 2024-25 the value of any relief granted in 2024-25 will be collected on outturn.

(f) The restriction preventing billing authorities from making a decision to award discretionary relief more than 6 months after the end of the relevant financial year has been removed. From 1 April 2024 there will be no restriction in respect of the financial year 2023-24 onwards. This does not apply to years before 2023-24.

(g) Investment zones that have met the requirements to be designated will be designated in regulations. Those that have received that designation have been included in this data collection.

Revaluation

The latest revaluation came into effect on the 1 April 2023 so there is a discontinuity between 2022-23 and 2023-24. Transitional arrangements are reduced in the years after the revaluation, so that transitional relief will be lower in 2024-25.

Business rates multiplier

As well as the changes to the multiplier as described above, business rates multipliers were capped in each year from 2020-21. The compensation for this cap is included in Table 3, and is affected by both the cumulative effect of capping the multiplier for the last four consecutive years, and the level of inflation in September 2023.

Additional reliefs

In the November 2023 Autumn Statement, the Government announced the continuation of the Retail, Hospitality and Leisure Business Rates Relief Scheme into 2024-25. This relief, previously expanded in response to the coronavirus pandemic, was continued to support businesses with significant inflationary pressures. In 2023-24 and 2024-25, eligible properties will receive a 75% relief on business rates, up to a cash cap of £110,000 per business. This is an increase from 50% in 2022-23, which was itself a decrease from 100% in 2020-21 and the first three months of 2021-22 and 66% in the remaining months of 2021-22.

3. National non-domestic rates to be collected by local authorities in England 2024-25

Table 1 gives details of the amount of national non-domestic rates local authorities estimate they will collect in 2024-25 and the reliefs they will grant. The multipliers used are also shown. Until 2024-25, the national non-domestic multiplier included a 1.3p supplement to fund the Small Business Rate Relief scheme, and that additional yield was deducted from the cost of the relief. As described in the introduction, the multipliers have been decoupled and the supplement is no longer used, , resulting in an increase to the reported total cost of mandatory relief.

The cost of transitional arrangements shown in the table since 2023-24 reflects only the revenue foregone because the only increases in bills are phased down as a result of the transitional scheme. Previously this has been a net cost with the cost of revenue foregone by delaying increases to bills offset by additional income by delaying reductions to bills.

Chart 1 shows the flow from gross rates to net rates forecast in 2024-25. Chart 2 shows how gross and net rates have changed since 2013-14.

-

Local authorities estimate the non-domestic rating income for 2024-25 will be £26.3 billion. This is what authorities estimate they will collect after all reliefs, accounting adjustments and sums retained outside the rates retention scheme are taken into consideration.

-

Local authorities report they will grant a total of £8.3 billion of relief from business rates in 2024-25. Of this £5.5 billion is the cost of mandatory relief and £2.7 billion is the cost of discretionary relief.

3.1 Appeals

As part of the NNDR1 process authorities are required to make an estimate of how much income they will forego as a result of changes to rating lists, including appeals by businesses against their valuations. This includes both income not collected in year and also refunds they have to make in respect of previous years.

- Local authorities estimate the appeals provision will be £986 million in 2024-25. The figure for 2024-25 represents authorities’ best estimate of the total future loss of non-domestic rates on the new 2023 Rating list.

Table 1: National non-domestic rates to be collected by local authorities 2020-21 to 2024-25

| 2020 to 2021 Outturn | 2021 to 2022 Outturn | 2022 to 2023 Outturn | 2023 to 2024 Forecast | 2024 to 2025 Forecast | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Gross rates payable in year | 30,942 | 30,801 | 30,731 | || | 33,979 | 36,356 [r] | ||||

| Total cost of reliefs [Note 1] | 16,031 | || | 10,275 | 7,684 | || | 7,276 | || | 8,277 [r] | ||

| Of which mandatory relief [Note 1] | 4,728 | 5,005 | 4,891 | || | 4,630 | || | 5,543 [r] | |||

| Of which discretionary relief [Note 2], [Note 3] | 11,303 | || | 5,270 | 2,793 | || | 2,645 | 2,733 [r] | |||

| Gross Rates Payable in year less total cost of reliefs | 14,912 | || | 20,526 | 23,047 | || | 26,704 | || | 28,079 [r] | ||

| Net cost of transitional arrangement [Note 3] | 192 | 182 | 121 | || | [z] | [z] | ||||

| Cost of transitional arrangement [Note 4] | [z] | [z] | [z] | || | -1,795 | -684 [r] | ||||

| Net Rates Yield (Gross Rates Payable less reliefs plus net cost of Transition) | 15,103 | || | 20,708 | 23,167 | || | 24,909 | 27,396 [r] | |||

| Total cost of accounting adjustments | 1,692 | -211 | -194 | || | 1,406 | 1,381 | ||||

| Of which losses in collection [Note 5] | 821 | 136 | 175 | || | 449 | 394 [r] | ||||

| Of which net addition to appeals provision [Note 6] | 870 | -348 | -369 | || | 956 | 986 [r] | ||||

| Of which interest payable | 0 | 0 | 0 | || | [z] | [z] | ||||

| Other deductions from collectable rates [Note 7] | 288 | 278 | 217 | || | -1,699 | -586 [r] | ||||

| Of which transitional protection payments made to authorities | 192 | 182 | 121 | || | -1,795 | -684 [r] | ||||

| Of which other deductions | 96 | 96 | 96 | || | 97 | 98 | ||||

| Total Disregarded Amounts | 148 | 199 | 220 | || | 268 | 334 | ||||

| Of which amounts retained in respect of Designated Areas | 64 | 106 | 110 | || | 153 | 198 | ||||

| Of which amounts retained in respect of Renewable Energy schemes | 85 | 93 | 109 | || | 115 | 136 | ||||

| Of which amounts retained in respect of Shale Gas | 0 | 0 | 0 | || | 0 | 0 | ||||

| Non-domestic rating income from rates retention scheme (Net Rates yield less Accounting adjustments, Other deductions & Disregarded amounts) | 12,976 | 20,442 | 22,925 | || | 24,933 | 26,267 [r] |

| 2020 to 2021 | 2021 to 2022 | 2022 to 2023 | 2023 to 2024 | 2024 to 2025 | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Small business rate multiplier (pence) | 49.9 | 49.9 | 49.9 | 49.9 | 49.9 | |||||

| Standard business rate multiplier (pence) [Note 8] | 51.2 | 51.2 | 51.2 | 51.2 | 54.6 | |||||

| Number of hereditaments on rating list close to 30 Sept (`000s) | 1,976 | 1,996 | 2,006 | 2,015 | 2,011 | |||||

| Total aggregate rateable value of all hereditaments on rating list close to 30 Sept (million pounds) [Note 9] | 64,045 | 63,910 | 63,634 | || | 67,877 | || | 67,968 |

Source: Outturn data are taken from NNDR3 forms, forecast data are taken from NNDR1 forms.

[r] Revised since the original publication of these tables. These tables were revised on 23 February 2024 to reflect revisions to the data submitted by Bolton, Birmingham, Central Bedfordshire, Liverpool, North West Leicestershire, and Reigate and Banstead. A further revision was made on 8 March 2024 to reflect revisions to the data submitted by Hastings.

[Note 1] Prior to 2024-25, the small business rates relief was partially funded through the small business rates supplement. This was set at 1.3p. In 2024-25, the small and standard multipliers were decoupled, and the concept of the supplement removed. Therefore the total mandatory relief will appear to be greater, because there is no additional yield from the small business rates supplement.

[Note 2] The discretionary section 31 funded reliefs include the retail, hospitality and leisure relief. In 2020-21 the previous relief scheme was expanded in response to the coronavirus pandemic to provide a 100% relief to all retail, hospitality and leisure businesses. In 2021-22 the relief gave a 100% discount for the first three months and then a 66% discount for the remaining months with a cap on the relief for each business. In 2023-24 it was a 50% discount with a cap on the relief, increasing to 75% in 2023-24 and remaining unchanged in 2024-25.

[Note 3] The transitional relief scheme from the 2017 revaluation expired in 2021-22. In 2023-24, authorities could give the same support to businesses using the supporting small business relief (a discretionary relief), and so what would normally be the cost of the transitional scheme is included in the Discretionary Reliefs figure.

[Note 4] From 2023-24 onwards, the transitional relief scheme changed so that it was fully funded by central government. In previous years authorities reported a net cost with the cost of revenue foregone by delaying increases to bills offset by additional income by delaying reductions to bills. This is now shown on a separate line. From 2023-24 the cost only reflects the revenue foregone by delaying increases to bills. Figures are shown as negative as they are deducted from Net Rates Yield.

[Note 5] Write offs to the allowance for non-collection are not included in the Total cost of Accounting Adjustments.

[Note 6] The outturn data for net addition to appeals is systematically lower than the forecast data as local authorities do not forecast reductions in the appeals provision.

[Note 7] Other deductions from collectable rates includes an allowance for cost of collection & legal costs, a special authority deduction for the City of London, and the cost of transitional protection payments made to authorities to reverse the effects of transitional arrangements.

[Note 8] Prior to 2024-25 this was known as the Non-Domestic Rating Multiplier.

[Note 9] 2020-21 VOA data is as at 3 October 2019, 2021-22 VOA data is at 7 October 2020, 2023-24 VOA data is as at 15 October 2021, 2024-25 VOA data is the draft 2023 list published on 17 November 2022 and 2024-25 VOA data is at 4 October 2023.

3.2 Chart 1: Breakdown of gross rates payable

Chart 1 shows how reliefs and other adjustments are deducted from gross rates to arrive at the forecast net business rates income for 2024-25.

3.3 Chart 2: Business rates over time

Chart 2 shows gross rates collected increasing steadily until the pandemic in 2020-21, it then shows a period of little change, until a step change due to the 2023 revaluation. Gross rates has increased in 2024-25 due to the increase in the standard multiplier. Net income was increasing steadily prior to 2020-21, then fell sharply due to the retail, hospitality and leisure discount relief introduced in response to the pandemic but has increased steadily year on year since then as the relief and eligibility has changed.

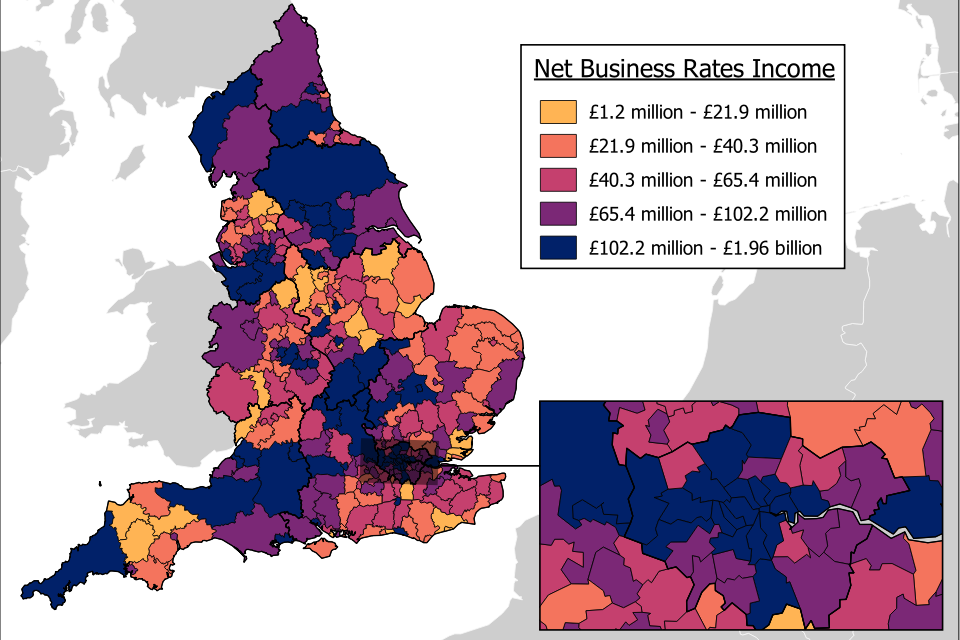

There are data for each local authority in England in the tables accompanying this release covering the amount of business rates income and reliefs granted. Map 1 provides an overview of how forecast net business rates income in 2024-25 differs across England, with a zoomed-in box for the London boroughs.

3.4 Map 1: Net rates income in England

4. Reliefs to be granted by local authorities in 2024-25

Table 2 shows figures for mandatory and discretionary reliefs which billing authorities expect they will grant in 2024-25. Mandatory reliefs are automatic entitlements in any billing authority area whereas discretionary reliefs are granted at a billing authority’s discretion. Chart 3 shows how the largest reliefs have changed since 2020-21.

-

Of the estimated £8.3 billion relief to be granted from business rates in 2024-25, £5.5 billion is mandatory relief which consists primarily of small business, charity and empty premises relief.

-

Authorities estimate the amount to be granted in small business rates relief will be £2.0 billion and empty premises relief will be £1.0 billion.

-

Total relief provided to charitable occupations is expected to amount to £2.4 billion in respect of 2024-25, of which £2.3 billion is mandatory. These reliefs account for 29% of the total relief to be granted.

-

Local authorities expect to grant a total of £2.7 billion discretionary relief in 2024-25 of which £2.4 billion is the cost of the retail, hospitality and leisure relief. The retail, hospitality and leisure relief accounts for 29% of the total relief to be granted.

Table 2: Cost of reliefs from national non-domestic rates: 2020-21 to 2024-25 [Note 1]

| 2020 to 2021 Outturn | 2021 to 2022 Outturn | 2022 to 2023 Outturn | 2023 to 2024 Forecast | 2024 to 2025 Forecast | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Total cost of mandatory relief [Note 2] | 4,728 | 5,005 | 4,891 | || | 4,630 | || | 5,543 [r] | |||

| Of which total mandatory relief in respect of current year [Note 2] | 4,621 | 4,811 | 4,806 | || | 4,528 | || | 5,467 | |||

| Of which small business relief in respect of current year | 2,100 | 2,161 | 2,211 | || | 1,963 | 2,026 [r] | ||||

| And of which relief on existing properties where a 2nd property is occupied | 5 | 5 | 5 | || | 3 | 2 | ||||

| Of which deduction due to additional yield generated from the small business supplement [Note 2] | -630 | -626 | -626 | || | -669 | [z] | ||||

| Of which charitable occupation | 2,021 | 2,040 | 2,036 | || | 2,181 | 2,347 | ||||

| Of which community Amateur Sports Clubs (CASCs) | 22 | 22 | 22 | || | 21 | 23 | ||||

| Of which rural rate relief [Note 4] | 4 | 4 | 4 | || | 3 | 6 | ||||

| Of which telecoms relief | 0 | 2 | [z] | || | [z] | [z] | ||||

| Of which Public Lavatories relief | [z] | 5 | 5 | || | 4 | 4 | ||||

| Of which low carbon heat networks relief | [z] | [z] | [z] | || | [z] | 3 | ||||

| Of which partially occupied hereditaments | 22 | 16 | 13 | || | 17 | 14 | ||||

| Of which empty premises | 1,082 | 1,187 | 1,141 | || | 1,008 | 1,043 [r] | ||||

| Of which mandatory relief in respect of previous years | 107 | 195 | 85 | || | [z] | [z] | ||||

| Of which changes as a result of local estimates of growth or decline in mandatory relief | [z] | [z] | [z] | || | 102 | 77 | ||||

| Total cost of discretionary relief | 11,303 | 5,270 | 2,793 | || | 2,645 | 2,733 [r] | ||||

| Of which discretionary relief in respect of current year | 98 | 101 | 103 | || | 101 | 108 [r] | ||||

| Of which charitable occupation | 42 | 45 | 48 | || | 48 | 49 | ||||

| Of which Non-profit making bodies | 31 | 33 | 36 | || | 36 | 37 | ||||

| Of which Community Amateur Sports Clubs (CASCs) | 1 | 1 | 1 | || | 2 | 1 | ||||

| Of which rural rate relief | 0 | 0 | 0 | || | 0 | [z] | ||||

| Of which small rural businesses | 1 | 1 | 1 | || | 1 | 1 | ||||

| Of which other ratepayers under s47 | 20 | 20 | 16 | || | 15 | 20 [r] | ||||

| Of which hardship relief | 3 | 1 | 0 | || | [z] | [z] | ||||

| Of which unfunded discretionary relief in respect of previous years | 1 | 6 | 5 | || | [z] | [z] | ||||

| Of which total cost of discretionary reliefs funded through S31 grant in respect of current year | 11,180 | || | 5,188 | 1,726 | || | 2,542 | 2,624 | |||

| Of which Flooding relief | 1 | 0 | 0 | || | [z] | [z] | ||||

| Of which Rural Rate relief | 4 | 4 | 4 | || | 3 | [z] | ||||

| Of which Local Newspaper Temporary relief | 0 | 0 | 0 | || | 0 | 0 | ||||

| Of which Supporting Small Businesses relief [Note 3], [Note 5] | 13 | 11 | 20 | || | 173 | 211 | ||||

| Of which Discretionary Scheme relief | 3 | [z] | [z] | || | [z] | [z] | ||||

| Of which retail, hospitality and leisure relief [Note 6] | 11,061 | || | 4,940 | 1,701 | || | 2,366 | 2,413 | |||

| Of which nursery relief | 98 | 63 | [z] | || | [z] | [z] | ||||

| Of which COVID-19 additional relief | [z] | 171 | [z] | || | [z] | [z] | ||||

| Of which low carbon heat networks relief | [z] | [z] | 1 | || | 1 | [z] | ||||

| Of which discretionary relief funded through S31 grants in respect of previous years | 25 | -25 | 959 | || | [z] | [z] | ||||

| Of which changes as a result of local estimates of growth or decline in discretionary relief | [z] | [z] | [z] | || | 1 | 2 | ||||

| TOTAL COST OF ALL RELIEFS | 16,031 | 10,275 | 7,684 | || | 7,276 | 8,277 [r] |

Source: Outturn data are taken from NNDR3 forms, forecast data are taken from NNDR1 forms.

[r] Revised since the original publication of these tables. These tables were revised on 23 February 2024 to reflect revisions to the data submitted by Bolton, Birmingham, Central Bedfordshire, Liverpool, North West Leicestershire, and Reigate and Banstead. A further revision was made on 8 March 2024 to reflect revisions to the data submitted by Hastings.

[Note 1] 0 values are below £0.5 million.

[Note 2] Prior to 2024-25, the small business rates relief was partially funded through the small business rates supplement. This was set at 1.3p. In 2024-25, the small and standard multipliers were decoupled, and the concept of the supplement removed. Therefore the total mandatory relief will appear to be greater, because there is no additional yield from the small business rates supplement.

[Note 3] The transitional relief scheme from the 2017 revaluation expired in 2021-22. In 2022-23, authorities could give the same support to businesses using the supporting small business relief (a discretionary relief), and so what would normally be the cost of the transitional scheme is included in the Discretionary Reliefs figure.

[Note 4] From 2024-25, mandatory rural rate relief has increased from 50% to 100%, and discretionary rural rate relief (both funded and unfunded) has not been required.

[Note 5] From 2023-24, supporting small business relief capped bill increases at £600 per year for businesses that lost eligibility for, or saw reductions in, Small Business Rate Relief (SBRR) or Rural Rate Relief (RRR) as a result of the 2023 business rates revaluation. This meant that there was a large increase in 2023-24 as the scheme applied to the new revaluation.

[Note 6] The discretionary section 31 funded reliefs include the retail, hospitality and leisure relief. In 2020-21 the previous relief was expanded in response to the coronavirus pandemic to provide a 100% relief to all retail, hospitality and leisure businesses. In 2021-22 the relief gave a 100% discount for the first three months and then a 66% discount for the remaining months with a cap on the relief for each business. In 2022-23 it was a 50% discount with a cap on the relief, increasing to 75% in 2023-24. and remaining unchanged in 2024-25.

4.1 Chart 3: Business rates reliefs over time

Chart 3 shows that there is little change in the amount of the larger business rates reliefs granted since 2020-21, with the exception of the retail, hospitality and leisure relief which has changed due to changes in the amount of relief given and the eligibility criteria of the relief.

5. Reliefs to be funded by Section 31 grants

Since 2013-14, a number of measures have been announced by the Chancellor in Autumn Statements and Budgets which have made changes to the national non-domestic rates scheme. Central government compensates local authorities for these changes and this compensation is made outside of the rate retention scheme by means of a Section 31 (S31) grant. The grants are given to local authorities to fund activities which are not covered by existing payment schedules or methods. Details on the measures in Table 3 can be found in the technical notes published alongside this release.

The amounts shown in Table 3 are the Section 31 grant to be paid to local authorities to compensate them for the loss of income arising from the measures listed, depending on what share of the total they can retain. They differ from the amounts shown in Table 2 which show the total amount of relief to be granted to business ratepayers under each of the measures as they exclude the central government share of the reliefs.

As a result of the decoupling of the small and standard rating multiplier in 2024-25, authorities were asked to disaggregate the reliefs between those on the small and standard multiplier. For a small number of authorities, where disaggregation was not possible, an estimate of the split has been used.

The disaggregation of the data allows the compensation to be calculated more accurately for each relief. This means that a proportion of compensation that would previously have been calculated for the individual reliefs now showing within the figure for the cost of compensation for the capping of the multiplier. This has resulted in decreases to the reported compensation for all other reliefs and a corresponding larger increase to the reported cost of capping the increase in the small business rates multiplier in 2024-25.

Table 3 shows the Section 31 grants paid to local authorities from 2020-21 to 2022-23 and what authorities expect to be paid in 2023-24 and 2024-25.

Table 3: Section 31 grants due to authorities for national non-domestic rates measures 2020-21 to 2024-25 [Note 1]

| 2020 to 2021 Outturn | 2021 to 2022 Outturn | 2022 to 2023 Outturn | 2023 to 2024 Forecast | 2024 to 2025 Forecast [Note 2] | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Capping the increase in the small business rates multiplier [Note 3] | 327 | 668 | 1,467 | || | 2,662 | || | 3,547 | |||

| Cost of doubling SBRR and threshold changes | 1,014 | 1,030 | 1,102 | || | 1,007 | || | 895 | |||

| Maintaining small business rates relief on “first” properties | 5 | 4 | 4 | || | 2 | || | 1 | |||

| Relief to newly built properties [Note 2] | 0 | 0 | 0 | || | [z] | || | [z] | |||

| Relief awarded on the occupation of “long-term empty” properties | 0 | 0 | 0 | || | [z] | || | [z] | |||

| Retail relief | 4 | 4 | -1 | || | [z] | || | [z] | |||

| Flooding relief | 1 | 0 | 0 | || | [z] | || | [z] | |||

| Rural Rate relief | 2 | 2 | 2 | || | 2 | || | 1 [r] | |||

| Local Newspaper Temporary relief | 0 | 0 | 0 | || | 0 | || | 0 | |||

| In Lieu of Transitional relief [Note 4] | 0 | 0 | 1 | || | [z] | || | [z] | |||

| Supporting Small Businesses relief [Note 4], [Note 5] | 8 | 7 | 13 | || | 123 | || | 129 | |||

| Discretionary Scheme relief | -1 | -1 | -1 | || | [z] | || | [z] | |||

| Pub relief | 0 | 0 | 0 | || | [z] | || | [z] | |||

| Enterprise Zone relief provided in 100% Pilot Areas | 3 | 3 | 2 | || | 1 | || | 1 | |||

| Telecoms relief | 0 | 3 | 0 | || | [z] | || | [z] | |||

| Retail, hospitality and leisure relief [Note 6] | 7,117 | 3,212 | 1,091 | || | 1,706 | || | 1,485 | |||

| Nursery Relief | 62 | 42 | 1 | || | [z] | || | [z] | |||

| Public Lavatories relief | [z] | 5 | 3 | || | 3 | || | 2 | |||

| COVID-19 Additional Relief | [z] | 101 | 748 | || | [z] | || | [z] | |||

| Freeports relief | [z] | [z] | [z] | || | 2 | || | 9 | |||

| Low carbon heat networks relief | [z] | [z] | 1 | || | 1 | || | 2 | |||

| Investment zones relief [Note 7] | [z] | [z] | [z] | || | [z] | || | 0 | |||

| Total amount of reliefs funded by Section 31 grants | 8,542 | 5,079 | 4,432 | || | 5,509 | 6,072 |

Source: Outturn data are taken from NNDR3 forms, forecast data are taken from NNDR1 forms.

[r] Revised since the original publication of these tables. These tables were revised on 23 February 2024 to reflect revisions to the data submitted by Bolton, Birmingham, Central Bedfordshire, Liverpool, North West Leicestershire, and Reigate and Banstead. A further revision was made on 8 March 2024 to reflect revisions to the data submitted by Hastings.

[Note 1] 0 values are below £0.5 million.

[Note 2] As a result of the decoupling of the small and standard multiplier, a proportion of compensation that would previously have been calculated for the individual reliefs are now showing within the figure for the cost of compensation for the capping of the multiplier.

[Note 3] The relief in respect of capping the small business rates multiplier is particularly high in 2023-24 and 2024-25 as inflation increased more during 2022 than it did in the prior years. The cap was at the same level of 49.9p throughout these years. This means the difference between the multiplier and what it would have been without the cap increased more than usual in those years.

[Note 4] The transitional relief scheme from the 2017 revaluation expired in 2021-22. In 2023-24, authorities could give the same support to businesses using the supporting small business relief (a discretionary relief), and so what would normally be the cost of the transitional scheme is included in the Discretionary Reliefs figure.

[Note 5] From 2023-24, supporting small business relief capped bill increases at £600 per year for businesses that lost eligibility for, or saw reductions in, Small Business Rate Relief (SBRR) or Rural Rate Relief (RRR) as a result of the 2023 business rates revaluation. This meant that there was a large increase in 2023-24 as the scheme applied to the new revaluation.

[Note 6] The discretionary section 31 funded reliefs include the retail, hospitality and leisure relief. In 2020-21 the previous relief scheme was expanded in response to the coronavirus pandemic to provide a 100% relief to all retail, hospitality and leisure businesses. In 2021-22 the relief gave a 100% discount for the first three months and then a 66% discount for the remaining months with a cap on the relief for each business. In 2022-23 it was a 50% discount with a cap on the relief, increasing to 75% in 2023-24 and remaining unchanged in 2024-25.

[Note 7] No local authority estimated relief for an investment zone in 2024-25.

6. Accompanying tables and open data

6.1 Symbols used

[r] = revised since the original publication

0 = zero or negligible (usually less than 0.5 million)

[z] = not relevant

|| = a discontinuity in data between years

6.2 Rounding

Where figures have been rounded, there may be a slight discrepancy between the total and the sum of constituent parts.

7. Tables

Accompanying tables are available to download alongside this release. These include Tables 1 to 3 for England and local authority level data. Table 4 with the number of hereditaments in receipt of mandatory and discretionary rate relief and data for individual local authorities will be available in a later update in March.

8. Open data

These statistics are available in fully open and linkable data formats.

9. Technical Notes

Please see the accompanying technical notes document for further details.

Information about statistics at DLUHC is available via the Department’s website.

Our statistical practice is regulated by the Office for Statistics Regulation (OSR).

OSR sets the standards of trustworthiness, quality and value in the Code of Practice for Statistics that all producers of official statistics should adhere to.

You are welcome to contact us directly with any comments about how we meet these standards.

Alternatively, you can contact OSR by emailing [email protected] or via the OSR website.