New Enterprise Allowance statistics: April 2011 to June 2020

Published 5 January 2021

Applies to England, Scotland and Wales

The latest release of these statistics can be found in the collection of New Enterprise Allowance statistics.

This is a summary of the latest Official Statistics on the outcomes and operations of the New Enterprise Allowance (NEA).

Coverage: Great Britain

Next Release: April 2021

1. Main Stories

Here are the main headlines about NEA:

-

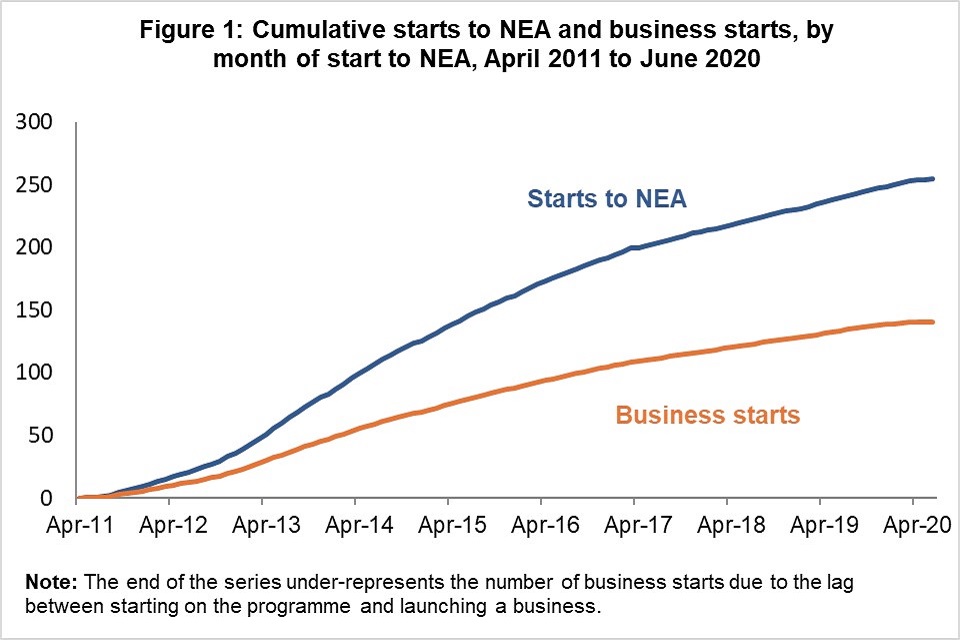

there were 254,000 starts on NEA programme by 237,000 individuals as of June 2020

-

140,000 business were set up through the NEA programme by 137,000 individuals as of June 2020

-

in May 2020, around 83% of those starting NEA were claiming Universal Credit (UC)

-

the number of starts on NEA in May 2020 were significantly impacted by Covid-19 restrictions, reaching their lowest monthly value since June 2011 at just 210 starts

2. An Introduction to New Enterprise Allowance

New Enterprise Allowance (NEA) is a programme for unemployed people who wish to start-up their own business. It was introduced in April 2011, and is open to people aged 18 and over, who are either claiming Jobseeker’s Allowance (JSA) or Employment and Support Allowance (ESA); the dependent partners of JSA/ESA claimants; Income Support (IS) claimants who are lone parents or who are sick/disabled; and some Universal Credit (UC) claimants.

Participants receive access to a business mentor who provides them with guidance and support as they develop their business plan. This is referred to as a start to NEA.

Once a claimant has shown they have a viable Business Plan that demonstrates the business’ sustainability potential, they are able to access financial aid alongside the business mentor continuing to provide support through the first six months of trading. This is referred to as a business start. This financial aid consists of an allowance worth £1,274 over 26 weeks, paid at £65 a week for the first 13 weeks and £33 a week for a further 13 weeks. Participants may also be able to access a start-up loan, if required.

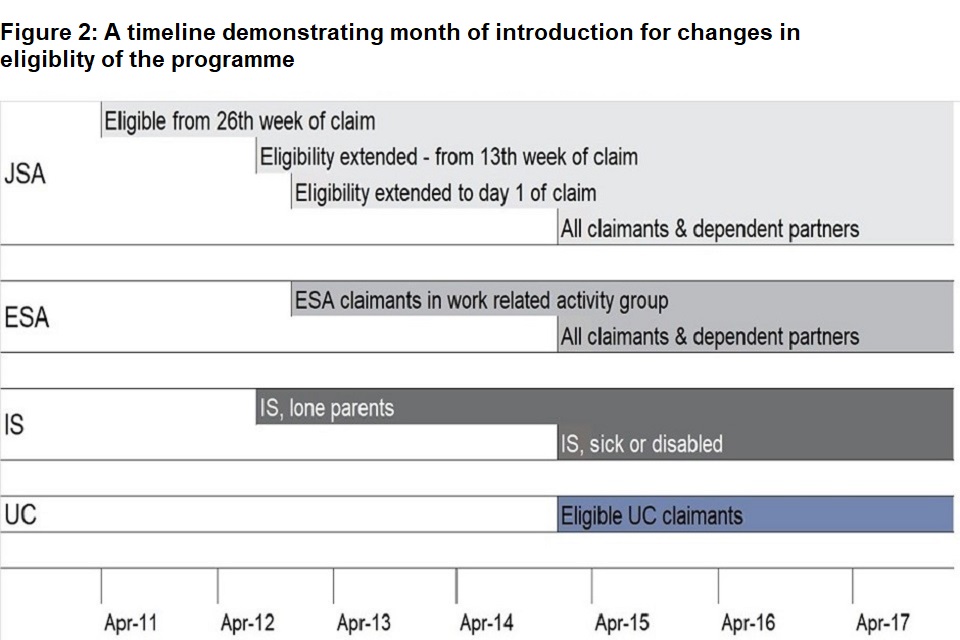

NEA is available across Great Britain. It was initially rolled out in stages across 17 target districts between April and July 2011. Roll out across the remaining 20 districts was completed at the end of August 2011. It was introduced for people 18 and over, claiming Jobseeker’s Allowance (JSA) for 26 weeks or more. Since October 2012, however, JSA claimants could apply from day one of their claim.

3. Eligibility for New Enterprise Allowance

Initially, NEA was only introduced for JSA Claimants after 26 weeks of claiming. From October 2012, eligible claimants were able to participate from day one of their claim.

As of January 2015, eligibility was expanded to cover all claimants in receipt of Jobseeker’s Allowance and Income Support, Employment and Support Allowance in the Work Related Activity Group, and UC claimants who are not in employment, education or training.

NEA Phase 2, launched in April 2017, includes an additional category of eligible claimants; UC recipients with existing businesses whose earnings fall under their Minimum Income Floor. This new phase of the programme involves a slightly different customer journey according to which claimants should first attend a Link Up: Start Up (LUSU) Workshop before moving on to start to NEA.

From January 2015 new starts to NEA have been delivered by contracted providers. The way data is collected for these official statistics has changed to reflect this; data for starts prior to January 2015 are taken from the Labour Market System and data for starts since January 2015 taken from the Provider Referral and Payment (PRaP) system.

For starts prior to January 2015 a start to NEA is defined as the date the claimant first met with their business mentor. For starts since January 2015, a start to NEA is defined as the date the provider accepted the claimant on the programme. These starts have previously been recorded in the Official Statistics as “mentor starts”.

For starts prior to January 2015, a business start is recorded when the claimant begins claiming the weekly allowance. For starts since January 2015, a business start is recorded when the claimant starts trading. This statistical release includes starts on both phase 1 and 2 of the programme.

4. All starts to New Enterprise Allowance

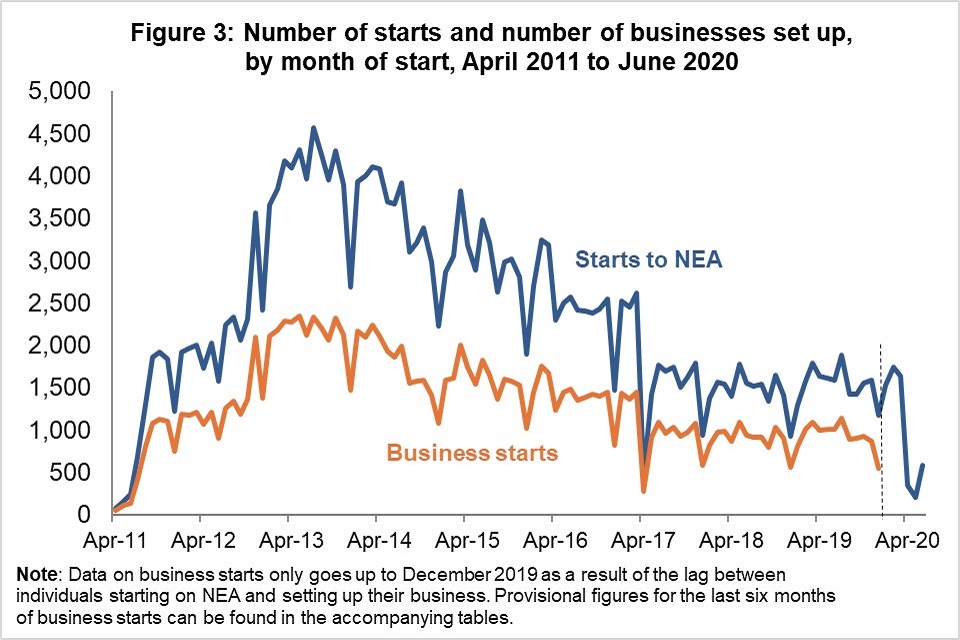

NEA and business starts peaked in 2013 and declined to a steady state of around 1,500 and 1,000 starts respectively until April 2020.

-

there have been 254,000 starts to NEA and 140,000 businesses set up through the programme since April 2011

-

so far in 2020, there have been around 6,000 starts to NEA; this is down from 9,500 starts for the same period in 2019, due to the impact of COVID-19 restrictions

The fall in starts to NEA and business starts in April 2017 was a result of an introduction of the Link Up Start Up (LUSU) workshop process.

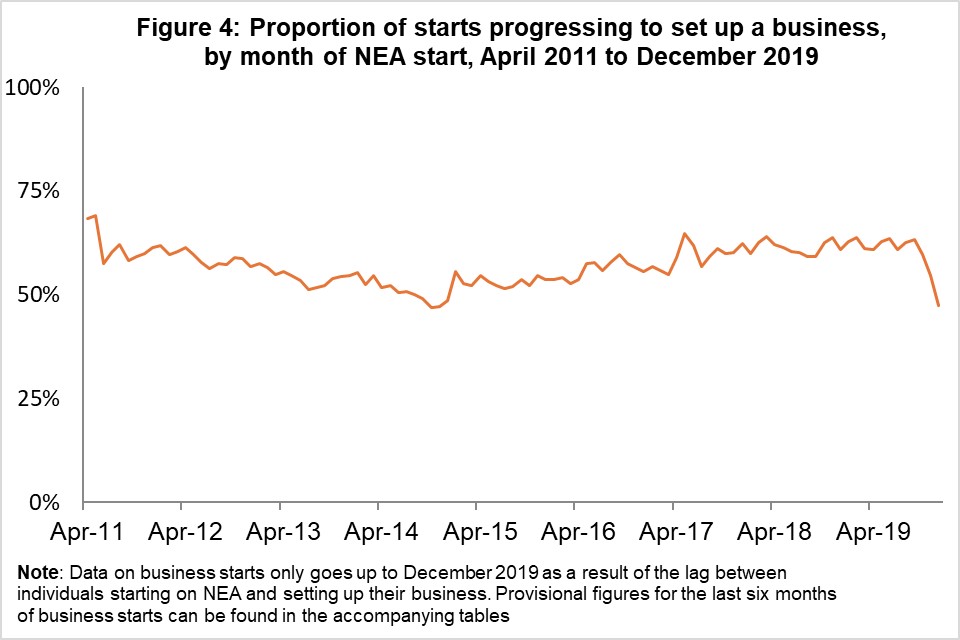

It is possible that people will participate more than once on NEA. Since April 2011, a total of 237,000 individuals have started on the programme and up to June 2020 137,000 individuals (58%), have progressed to set up a business.

The proportion of business starts over NEA starts had been steadily increasing since November 2014 to almost 65%, before seeing a significant drop in December 2019 to 47% due to the impact of COVID-19 restrictions.

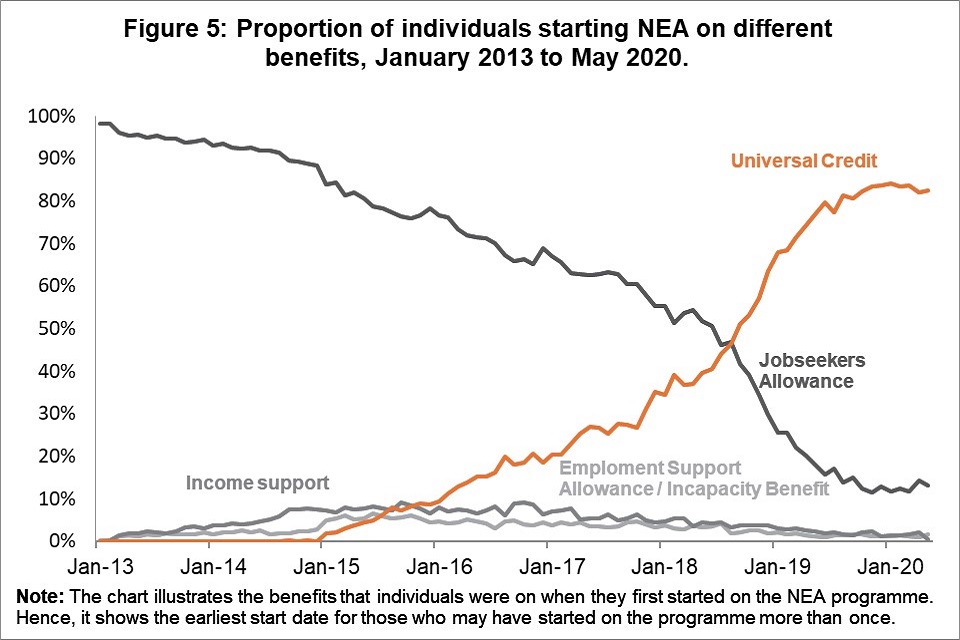

5. Main benefit of individuals starting New Enterprise Allowance

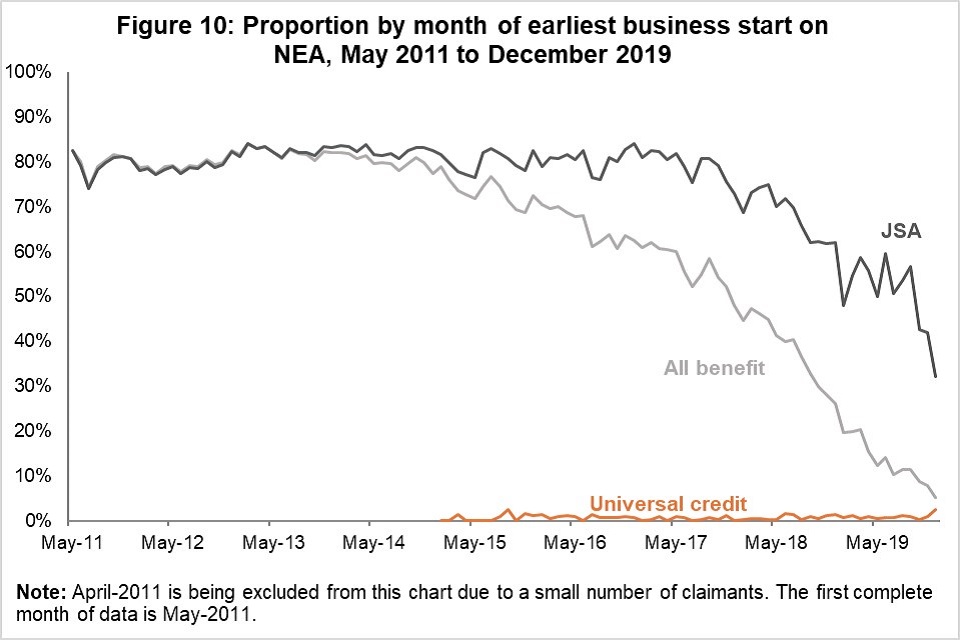

The proportion of participants have gradually shifted from Jobseekers Allowance to Universal Credit over the years.

Of those starting on NEA in May 2020 around 83% were on UC, 13% were on JSA, 2% were on ESA or IB and 1% were on IS.

Initially, New Enterprise Allowance was only available to JSA claimants. It has since been gradually rolled out to Employment Support Allowance/Incapacity Benefit, Income Support and Universal Credit claimants.

Universal Credit will eventually replace all non-contributory out of work benefits, including Jobseeker’s Allowance, Employment and Support Allowance and Income Support.

Now that all new income-related benefit claims are made to Universal Credit, the majority of people claim UC before they take part in New Enterprise Allowance. While some UC claimants are in-work, but require in-work financial aid, the NEA programme is only available to those UC claimants who are not in employment, education or training. Phase 2 of the programme has been made available to a wider range of claimants, including UC recipients with existing businesses. NEA Starts for this group of claimants are reported separately within this publication.

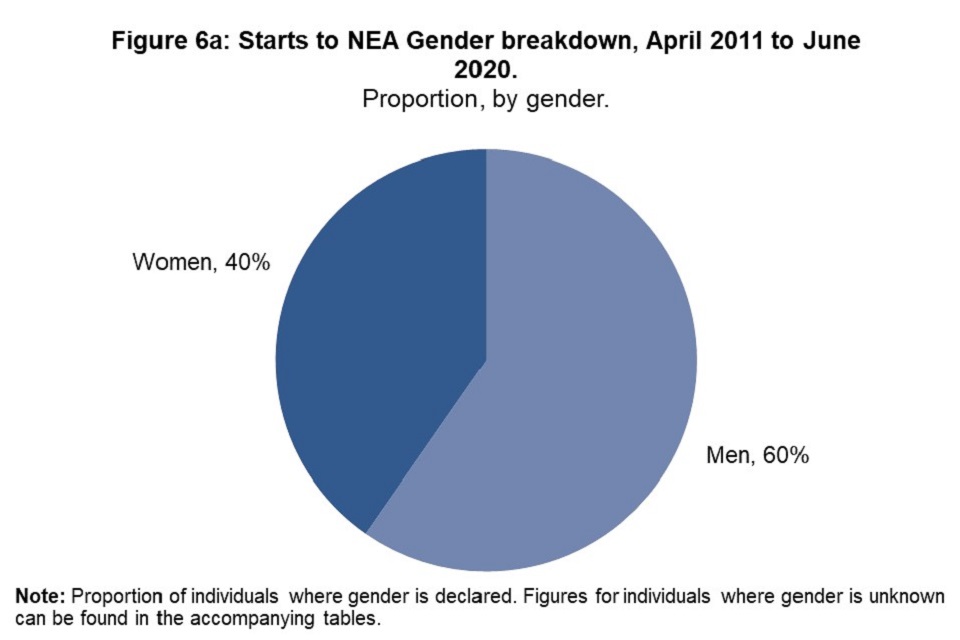

6. Characteristics of those on New Enterprise Allowance

Out of the people who started on NEA, around 94,000 (40%) are women of which around 56,000 have progressed to set up a business.

Around 60% of women move on to set up a business when starting NEA compared with 57% of men.

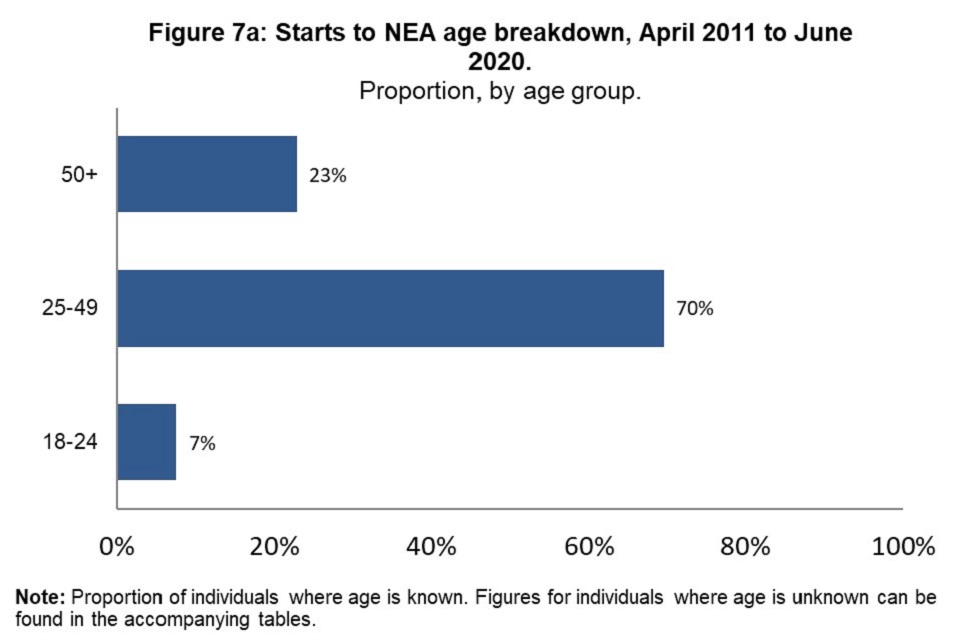

Most people are aged 25 to 49, with around 162,000 individuals starting NEA in this age group.

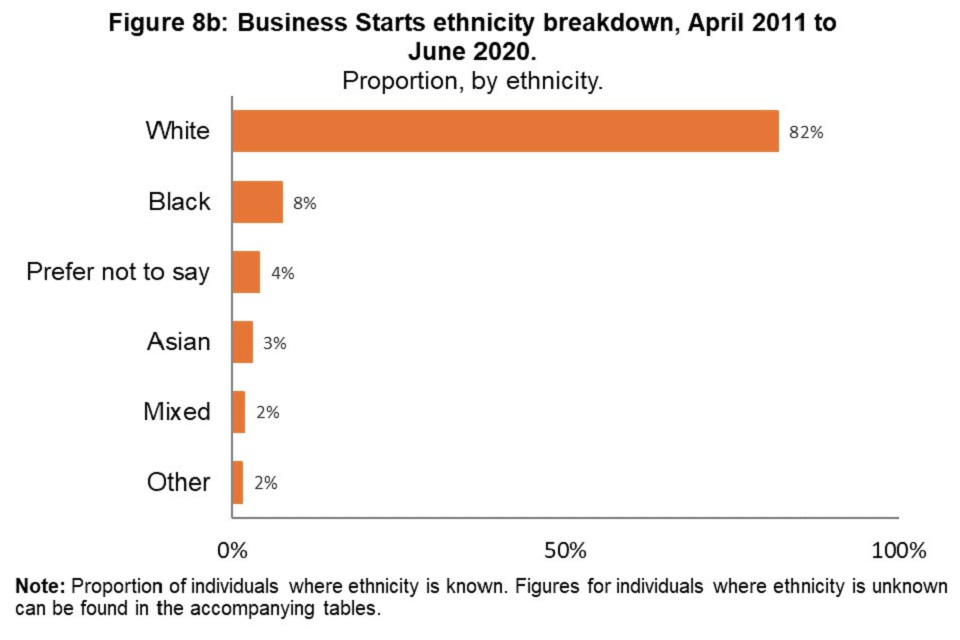

Around 183,000 (79%) of those who started the programme have identified as white, with a further 17% from ethnic minorities and 6% where ethnicity was not identified.

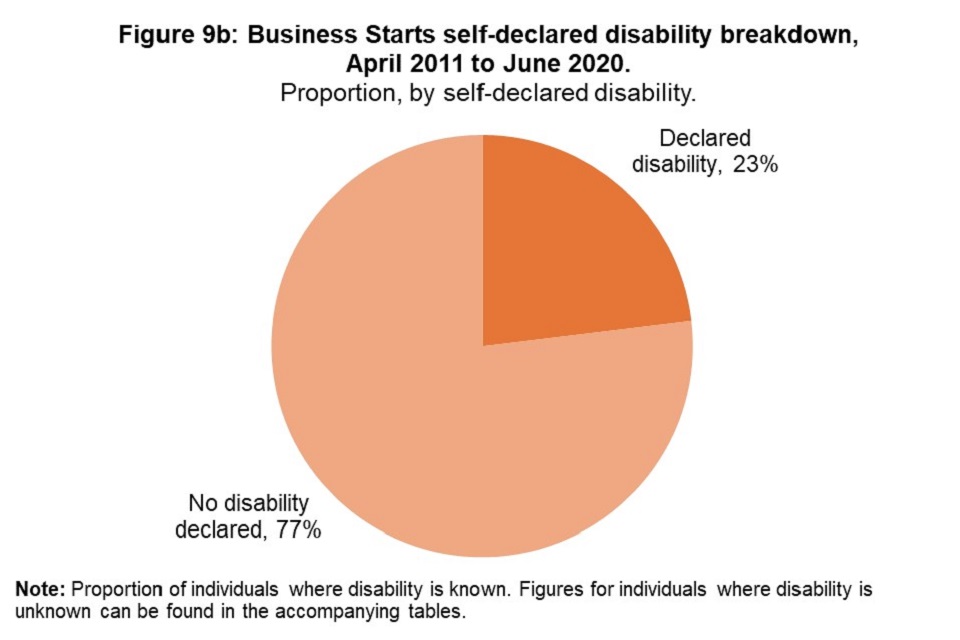

Of those starting on NEA around 58,000 had a self-declared disability, with around 31,000 of these individuals progressing to set up a business.

7. Proportion of individuals off benefits continuously, for 26 weeks following the business start

When tracking participants for 26 weeks (6 months), after business start, we looked at those who were off benefit continuously (all 26 weeks, without a break).

Overall, since the start of the programme, the average proportion of NEA participants who were off benefit for 26 weeks continuously following their business start was around 71%.

In the last year the decreasing trend in the proportion of individuals who remained off-benefit for 26 weeks following a business start continued.

This is mainly driven by an increasing number of starts to NEA coming from Universal Credit claimants, who remain on Universal Credit after they start trading.

The decline in the proportion of individuals who were on JSA who remain off-benefit for 26 weeks following a business start is likely due to these claimants moving onto Universal Credit once they begin trading.

Before the introduction of Universal Credit, claimants who had been on JSA were required to cease claiming DWP benefits in order to be entitled to payment of the trading allowance.

With the introduction of Universal Credit, low-earning self-employed people may be entitled to claim Universal Credit as an in-work benefit. These in-work Universal Credit claimants are captured in this data, and result in a reduction in the proportion of individuals off-benefit.

8. New Enterprise Allowance: Contractual performance

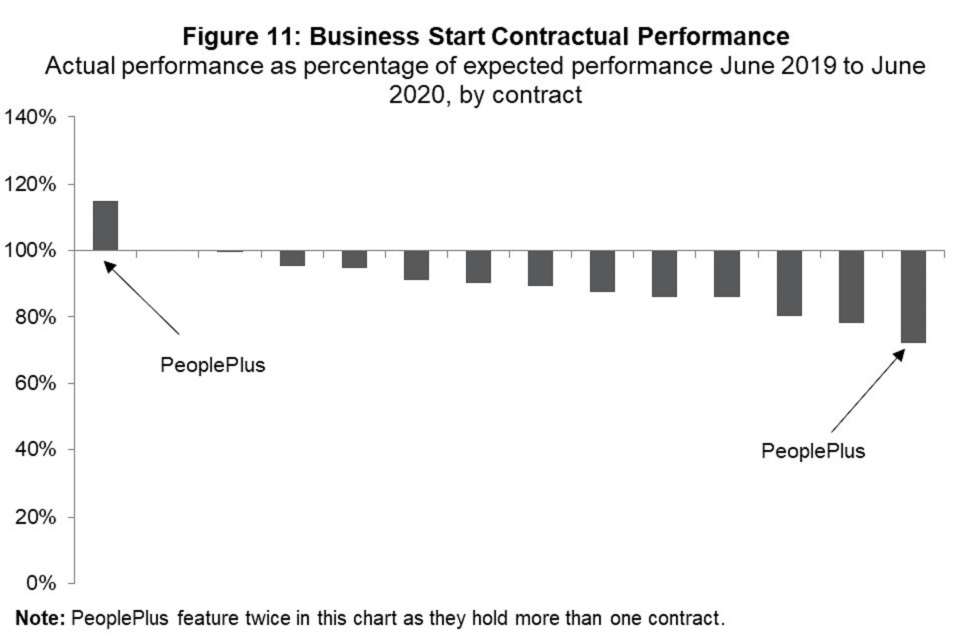

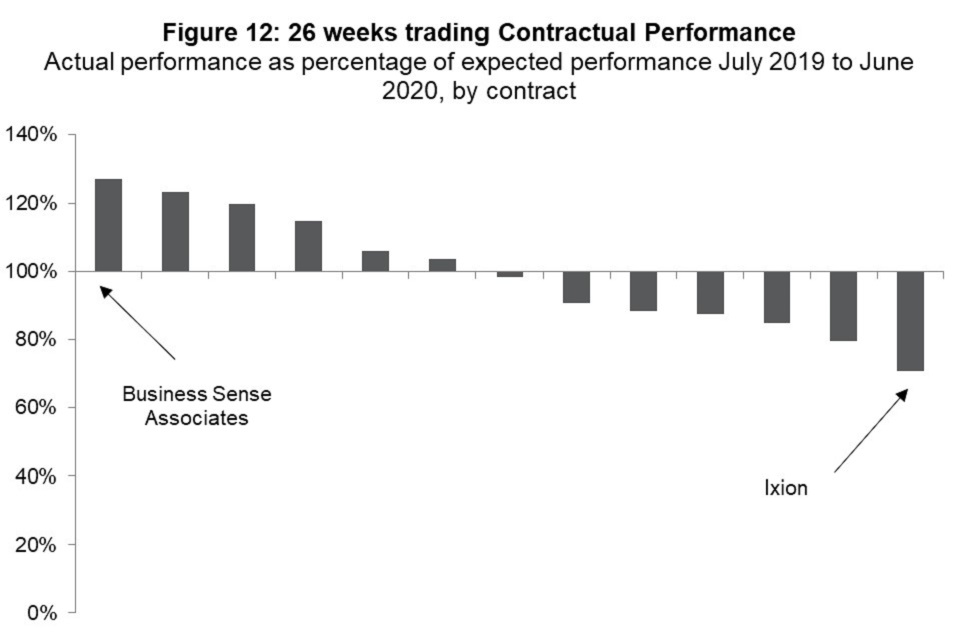

The contractual performance data is for the NEA Phase 2 programme over the period July 2019 to June 2020.

The programme is delivered by 7 providers operating in 14 Contract Package Areas (CPAs). For each CPA there is an expected performance level of the numbers of business starts and also of the number reaching 26 weeks trading. The actual performance as a percentage of the expected performance is reported.

For business starts, only one CPA has performance above that expected, at 115%. The performance of the other CPAs ranges between 100% and 72%.

For 26 weeks trading, performance ranges from 127% to 71% with CPA performance spread evenly between these points.

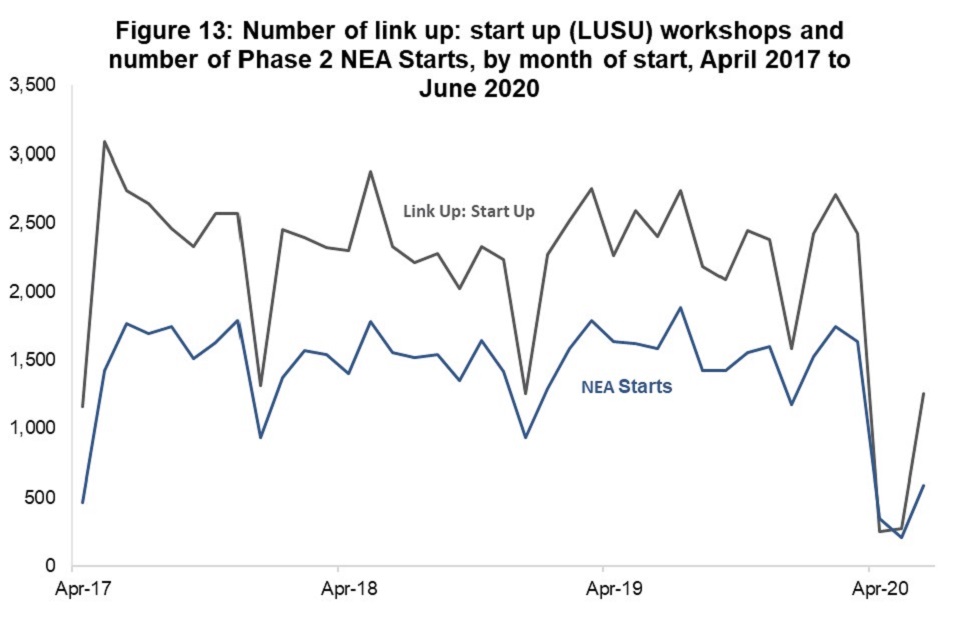

9. NEA Phase 2: Starts from April 2017 to December 2019

Phase 2 of the programme, introduced in April 2017, involves claimants attending a Link Up: Start Up (LUSU) Workshop before moving on to start to NEA.

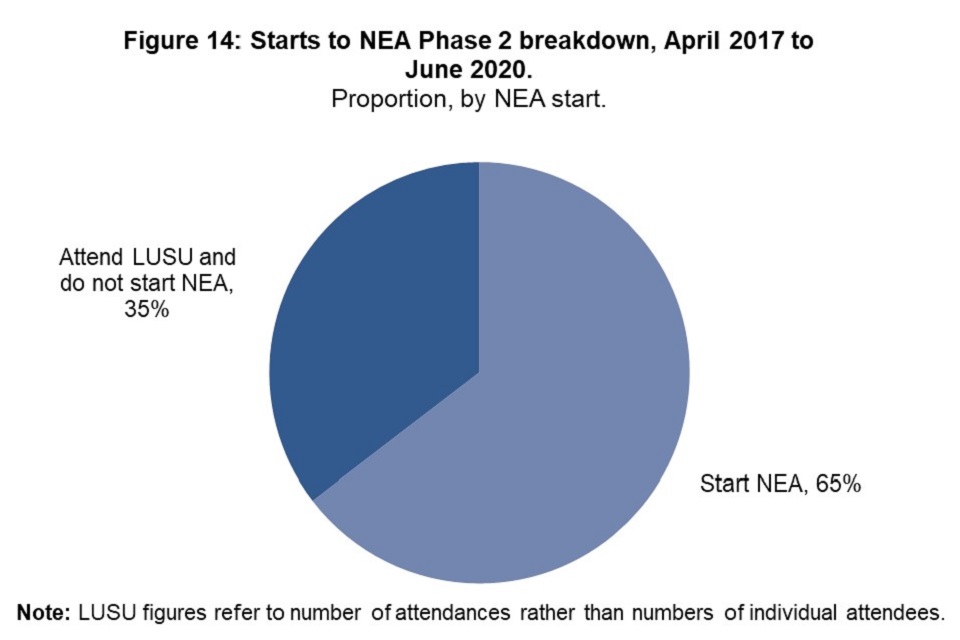

Over the period, April 2017 to June 2020, 85,000 link up: start up (LUSU) starts were reported and lead to 55,000 NEA Starts.

Since April 2017, 65% of LUSU workshop attendances have resulted in a start to NEA. This compares all starts to NEA, rather than tracking individuals.

10. NEA delivery

The delivery model for NEA changed in April 2017.

New Enterprise Allowance is delivered by private providers on behalf of the Secretary of State for Work and Pensions. Providers compete via competitive tender, and contracts are awarded regionally. DWP assesses these contracts in order to ensure value for public funds is met.

Role of the Provider

Jobcentre Plus will inform those eligible about the NEA Mentoring Programme.

New Business Starts

For new business starts, the process is as follows:

-

the Jobcentre Plus (JCP) adviser will make a referral to the Link-up: Start-up (LUSU) workshop which will create a referral in the Provider Referrals and Payment (PRaP) System

-

If, having attended the LUSU, the claimant wishes to pursue self-employment, the JCP adviser will make a referral to the core NEA programme. The provider then can accept or reject the referral

-

providers conduct an initial assessment within 10 working days of referral date in order to assess if participant has a viable business plan with a reasonable chance of success

-

providers then notify Jobcentre Plus via the PRaP system within 15 working days of the referral. The outcome of the initial assessment is also notified to the Jobcentre Plus Work Coach on a NEA1/UCNEA1 form within 2 working days of the initial assessment. This part of the provision is not ESF match funded so there is no ESF paperwork to complete

-

the provider also completes an ESF1420 form with the participant as part of the assessment process and this must be sent electronically to DWP within 10 working days of the participant signing it

Existing Self-Employed

For Universal Credit Existing Self-Employed:

-

the JCP adviser will make a referral for an initial assessment, which the provider then can accept or reject

-

providers conduct an initial assessment within 10 working days of referral date in order to assess if participant will benefit from the support of the NEA Phase 2, where the business has potential to grow, become more efficient and more profitable

The aim is to improve the business earnings to reach a level up to or above their Minimum Income Floor (MIF) over the 12 month (52 week) mentoring period.

The remaining process for new business starts and existing self-employed is as follows:

-

providers assign a business mentor who assists the participant to develop a business plan (or a Business Development and Growth Plan, for UC Full Service existing self-employed participants). For the participant with actively seeking work in their conditionality, this is replaced with participants must make full commitment to the NEA mentoring programme.

-

Participants then submit business plans for consideration.

-

If approved, participants proceed to trading (or for those existing self-employed participants, receive help to grow their business). At this stage, participants who are not claiming UC are no longer eligible for out of work benefits.

-

In order to support the participants, the business mentor continues to support the participant for the first 12 months.

New business start participants are also eligible for the NEA financial support which is administered by Jobcentre Plus. The allowance element of NEA is paid weekly at £65 for the first 13 weeks of trading followed by £33 for the remaining 13 weeks.

Providers must also ensure participants are informed of start-up loans provided by the government-backed Start-Up Loans Company in order to access additional start-up capital (this is for new business cases only).

11. About these statistics

These official statistics have been compiled using data from:

-

Labour Market System (LMS) Opportunities Dataset

-

Provider Referral and Payment System (PRaP), August 2020

-

National Benefit Database, June 2020

-

Universal Credit (UC) Official Statistics Dataset, August 2020

-

Client Extract Data, September 2020

Status of the statistics

This document includes figures from April 2011 to December 2019 for the New Enterprise Allowance programme. Prior to 2015, data was taken from the Labour Market System (LMS). Since January 2015, data has been taken from the Provider Referrals and Payments (PRaP) dataset. The August 2020 PRaP dataset has been used, with data taken up to the end of June 2020.The June 2020 National Benefit Database and the August 2020 UC Official Statistics Dataset have also been used.

Where to find out more

Read the summary data tables published along with this release.

Read older releases of these statistics. Please note that figures are subject to change.

A detailed background note provides information on the New Enterprise Allowance programme and the statistics.

A statistical notice has information about a methodology review and revisions to the New Enterprise Allowance statistics.

Statistician: Anisha Roberts, [email protected]

Analyst: Jakob Reinholdsson, [email protected]