Off-farm Income in England: 2022/23

Published 11 July 2024

Applies to England

Introduction

This release uses information collected in the Farm Business Survey (FBS) to present data on Off-Farm Income for the 2022/23 survey year. Off-Farm Income is the gross annual income of the principal farmer and their spouse or common law partner from any employment, self-employment or investments not related to the farm. It also includes any pensions, social payments and other off-farm income, for example, income from diversified activities set up independently of the farm business. Off-Farm Income does not include any capital gains, welfare payments made in kind (for example, free school meals), or windfall receipts and losses (for example, an inheritance).

Defra are monitoring the role of Off-Farm Income within farm households as they move through the Agricultural Transition period. The survey module used to collect household income data has been under development for several years. Off-Farm Income data was collected between 2004/05 and 2014/15, however, these figures included Off-Farm Income generated by the entire household. The 2021/22 and 2022/23 data only include Off-Farm Income generated by the farmer and their spouse, therefore, these data are not comparable to the previous figures without equivalisation. Equivalisation requires data on household members, i.e., the number of adults and children in the household. However, these data were not collected in the 2022/23 survey. Therefore, only unequivalised figures are shown in this publication. Equivalisation will be reintroduced for the 2023/24 survey results.

This release includes data from 2021/22 and 2022/23. The 2022/23 survey year covers the second year of the Agricultural Transition period and relates to the 2022/23 Farm Business Income results. This release provides the proportion of farms earning each type of Off-Farm Income as well as average (median) total Off-Farm Income (unequivalised). Breakdowns are shown for farm type, farm business size, tenure type and economic performance band.

Key Results

Sources of Off-Farm Income:

-

Pensions were the most common type of Off-Farm Income in 2022/23, present in around a quarter of farms.

-

Of the income types recorded in the 2022/23 survey, the least common was green energy technologies, found in just 2% of farms.

Average Off-Farm Income:

-

The average (median) total Off-Farm Income in England in 2022/23 was £12,200, an increase of 96% compared to 2021/22. However, there was significant turnover in the sample between 2021/22 and 2022/23; when comparing matched samples, the increase was 41%. For more information, see section 2.

-

Off-Farm Income was highest in cereal farms, whose average rose from £1,500 to £12,600 between 2021/22 and 2022/23.

-

The lowest Off-Farm Income was found in dairy and specialist pig and poultry farms, both at £500. This was a negligible change compared to the 2021/22 average for specialist pig and poultry farms, however, for dairy farms, it was a fall of 87%.

Points which apply throughout

-

The Farm Business Survey is the source for all data presented in tables and charts unless otherwise stated.

-

All figures relate to England, unless otherwise stated, and cover a March to February fiscal year, with the most recent year shown ending in February 2023. Fiscal years are shown in YYYY/YY format, for example, the period of 1 March 2022 to 28 February 2023 is shown as 2022/23. To ensure consistency in harvest/crop year and commonality of subsidies within any one Farm Business Survey year, only farms which have accounting years ending between 31 December and 30 April are included in the survey. Aggregate results are presented in terms of an accounting year ending on the last day of February, which is the approximate average of all farms in the Farm Business Survey.

-

All figures have been rounded to the nearest £100. Percentages have been calculated on unrounded data and are rounded to the nearest 1%.

-

Due to the small sample sizes, pig and poultry farms have been combined into a single farm type.

-

The acronym ‘LFA’ refers to Less Favoured Area. These areas were established in 1975 to provide support to mountainous and hill farming areas. They are areas where the natural characteristics (geology, altitude, climate, short growing season, low soil fertility, or remoteness) make it difficult for farmers to compete.

-

The Off-Farm Income questions were only asked of a sub-sample of farms. Therefore, all years have been reweighted to maintain consistency with the survey population estimates. See section 4.1 for more detail.

-

Where dataset tables are referred to in the text, this refers to the ‘Off-Farm Income in England, 2022/23 - dataset’ file, which can be found on the publication landing page.

-

For the purpose of this publication, ‘farms’ refers to the primary household of the farm business who was interviewed as part of the FBS. Some farm businesses have multiple households linked to them, however, because the primary aim of the survey is to collect farm business data, it is not possible to collect data from all households, nor all adults within the primary household.

1 Sources of Off-Farm Income

Survey respondents were asked to report how much Off-Farm Income they received from the following sources: employment, self-employment, investments, pensions, social payments, income from green energy technologies, and other income. This income was reported as banded data. Due to small sample sizes, sensible medians could not be estimated from the data, therefore, the following section provides data on the proportion of farms in England earning each type of Off-Farm Income.

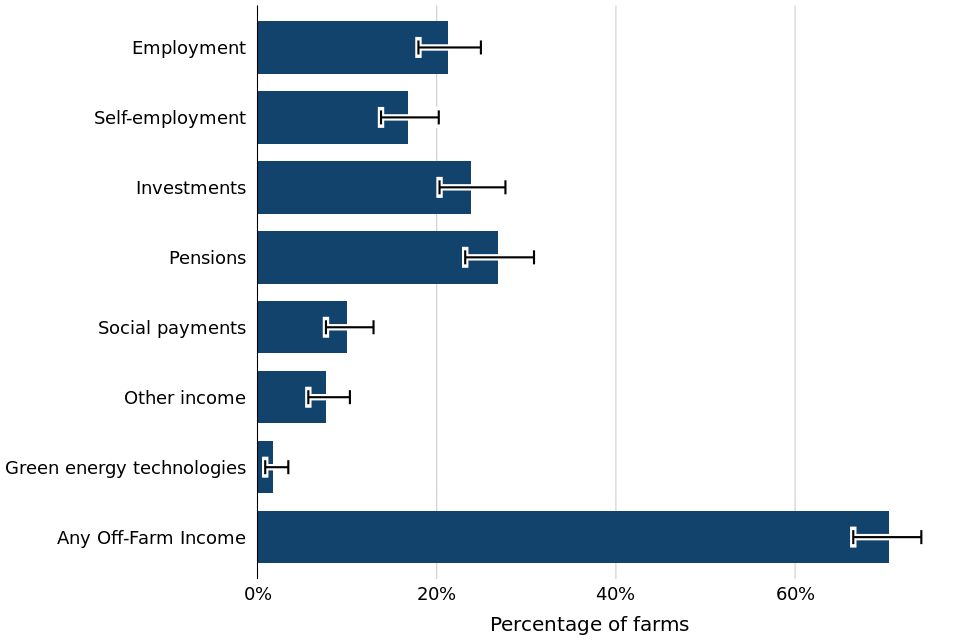

Figure 1.1 Sources of Off-Farm Income for farms in England, 2022/23

Source: Dataset table 1

Figure note: 95% Confidence Intervals have been presented to show the range where the true value is likely to lie and provides an indication of the degree of uncertainty of the estimate; see section 4.2 for more detail.

In 2022/23, 70% of farms had some type of Off-Farm Income. Pensions were the most common type of Off-Farm Income, at around a quarter (27%) of farms.

In 2022/23, only 2% of farms got Off-Farm Income from green energy technologies; of the income types collected in the survey, this was the least common. However, this income type is only recorded as Off-Farm Income if the farmer has set up a separate green energy business, which is uncommon. Most farms which produce green energy do so as part of their diversification of the farm business, which is analysed in Chapter 5 of Farm Accounts in England.

1.1 Off-farm employment

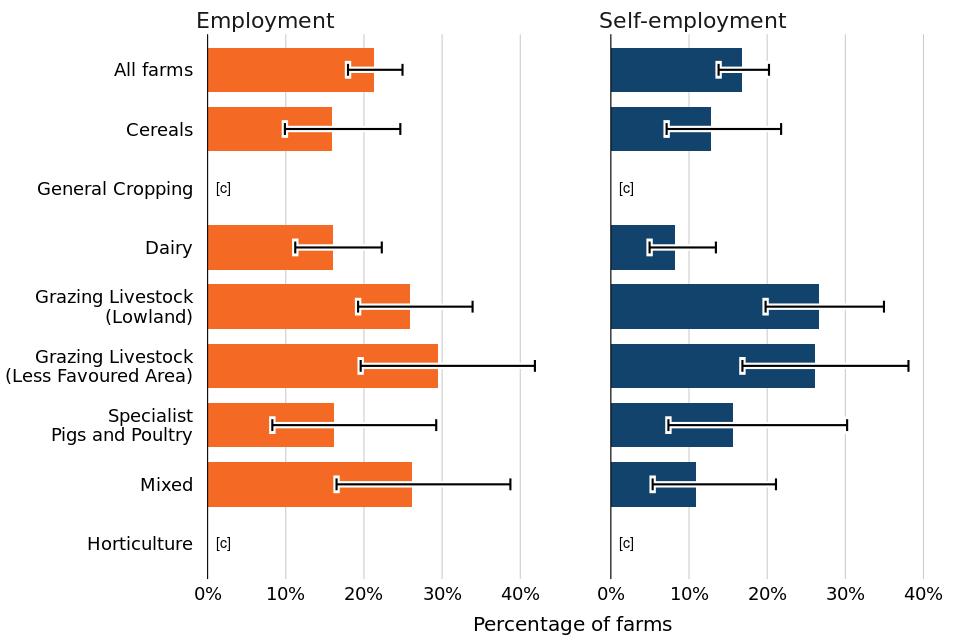

Figure 1.2 Off-Farm Income from employment and self-employment by farm type in England, 2022/23

Source: Dataset table 1

Figure notes:

1. 95% Confidence Intervals have been presented to show the range where the true value is likely to lie and provides an indication of the degree of uncertainty of the estimate; see section 4.2 for more detail.

2. The symbol [c] indicates that results have been suppressed due to a small sample size; suppressed values are included in the ‘All farms’ averages.

Figure 1.2 shows the percentage of farms where the principal farmer or spouse earned Off-Farm Income from employment and self-employment in 2022/23. LFA grazing livestock farms had the highest percentage of farms earning Off-Farm Income from employment, at 30%. The lowest percentages were in specialist pig and poultry, dairy and cereal farms, all at 16%.

The percentage of farms earning Off-Farm Income from self-employment in 2022/23 was generally lower than from off-farm employment, except for in lowland grazing livestock farms, which also had the highest percentage earning self-employment Off-Farm Income, at around a quarter (27%) . The lowest percentage was seen in dairy farms, at 8%.

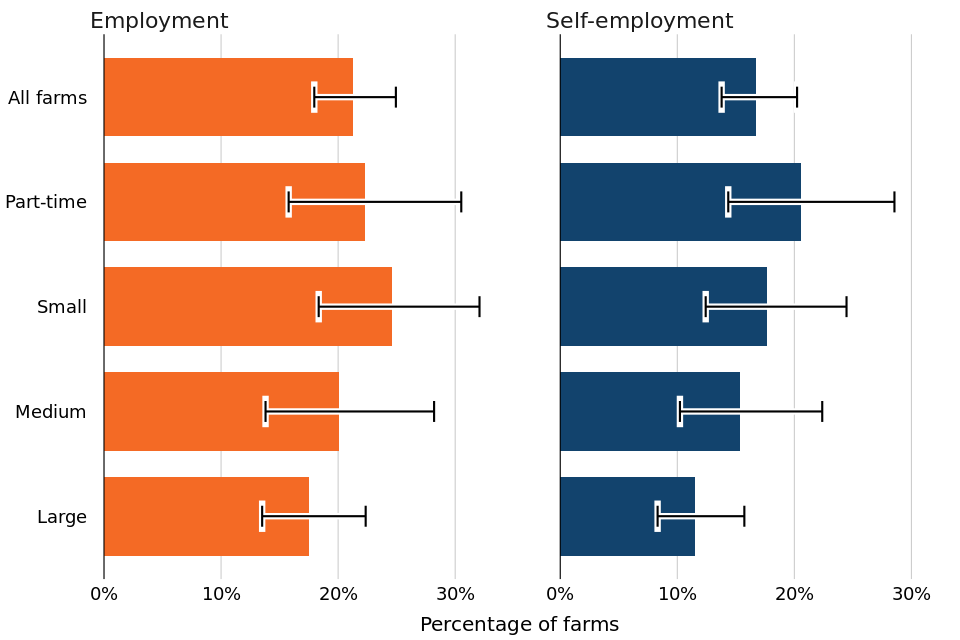

Figure 1.3 Off-Farm Income from employment and self-employment by farm business size based on Standard Labour Requirement (SLR) in England, 2022/23

Source: Dataset table 1

Figure note: 95% Confidence Intervals have been presented to show the range where the true value is likely to lie and provides an indication of the degree of uncertainty of the estimate; see section 4.2 for more detail.

Farm business size is based on the estimated Standard Labour Requirement (SLR) for the business, rather than its land area. For more detail see Table 4.2.

Figure 1.3 shows how farm business size (based on SLR) affects the proportion of farms whose principal farmer or spouse had off-farm employment and self-employment. In general, the percentage of farms with Off-Farm Income from both employment and self-employment increased as farm business size decreased, however, this trend was more clear for self-employment.

A quarter of small farms earned Off-Farm Income from employment in 2022/23; this was the highest proportion when comparing farms by business size. Farms with a large SLR had the lowest percentage, 17%, and they also had the lowest percentage with Off-Farm Income from self-employment, 12%. Off-Farm Income from self-employment was most common in part-time farms, at 21%.

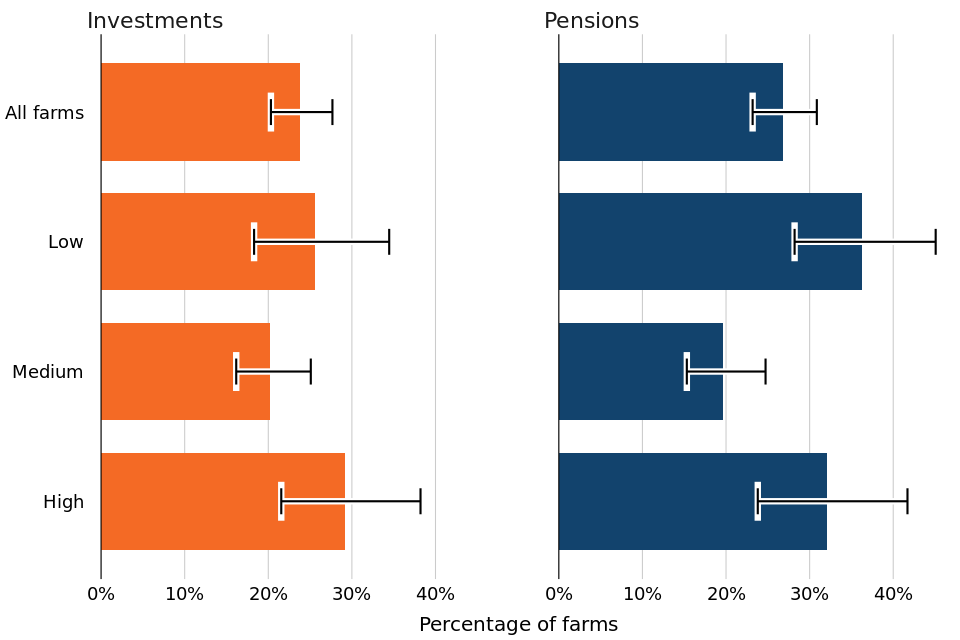

1.2 Investments and pensions

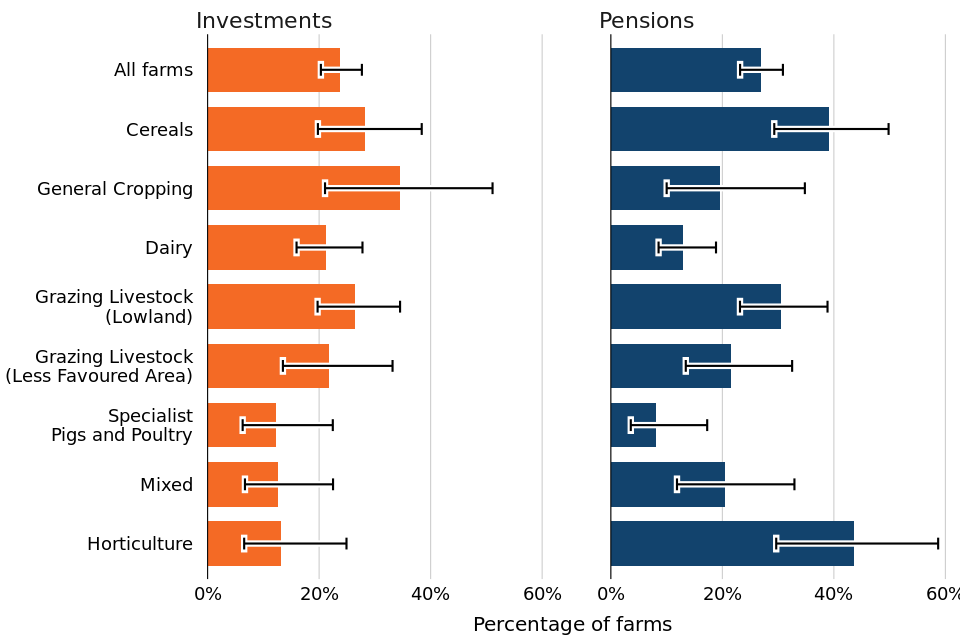

Figure 1.4 Off-Farm Income from investments and pensions by farm type in England, 2022/23

Source: Dataset table 1

Figure note: 95% Confidence Intervals have been presented to show the range where the true value is likely to lie and provides an indication of the degree of uncertainty of the estimate; see section 4.2 for more detail.

The proportion of farms where the farmer or spouse earned Off-Farm Income from investments and pensions in 2022/23 is shown in figure 1.4. The farm type with the lowest proportion earning Off-Farm Income from investments was specialist pig and poultry farms, at 12%. Investment Off-Farm Income was most common in general cropping farms, at around a third (35%).

Off-Farm Income from pensions was most common in horticulture farms, at 44%, and it was least common in specialist pig and poultry farms, at 8%.

Figure 1.5 Off-Farm Income from investments and pensions by farm economic performance in England, 2022/23

Source: Dataset table 1

Figure note: 95% Confidence Intervals have been presented to show the range where the true value is likely to lie and provides an indication of the degree of uncertainty of the estimate; see section 4.2 for more detail.

Figure 1.5 shows how farm economic performance affected the proportion of farms whose farmer or spouse had an income from investments and pensions in 2022/23. Economic performance is split into three bands: the bottom 25%, the middle 50% and the top 25% of performers. These bands are labelled as ‘Low’, ‘Medium’ and ‘High’ respectively. The differences in the all farm level proportions were generally reflected in the performance band breakdowns, with the proportion of farms with Off-Farm Income from investments markedly dropping, whereas the proportion with Off-Farm Income from pensions only marginally changed.

Medium performing farms had both the lowest proportion with Off-Farm Income from investments and the lowest proportion with Off-Farm Income from pensions, both at 20%. High performing farms most commonly had Off-Farm Income from investments, at 29%, and Off-Farm Income from pensions was most common in low performing farms, at 36%.

2 Total Off-Farm Income in England

Off-Farm Income is reported within the Farm Business Survey as banded data. The true value is estimated for each farm using statistical methods: Mean Constrained Integration over Brackets and Robust Pareto Midpoint Estimator. For more detail on these methods, see section 4.3.

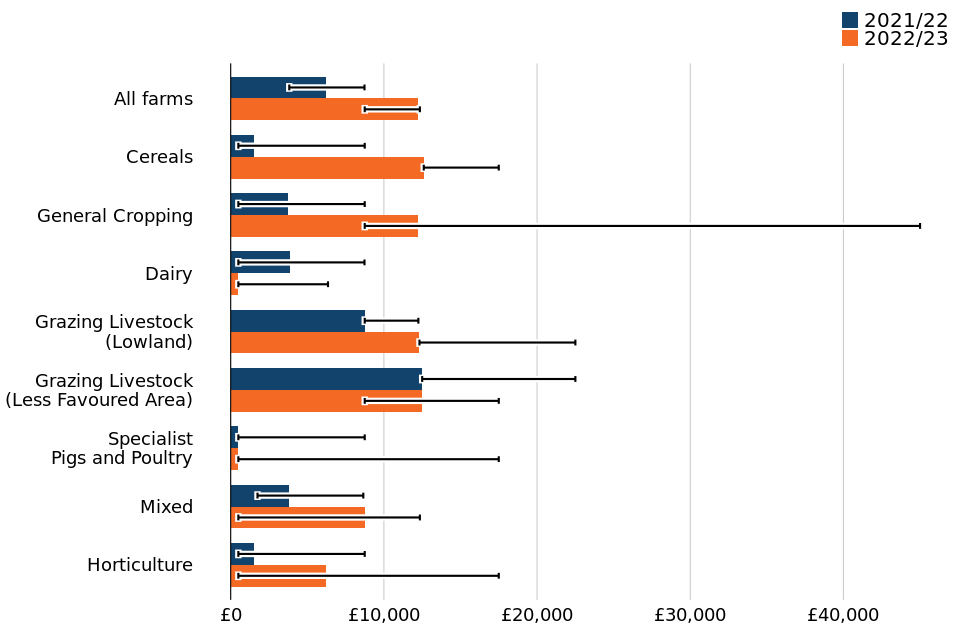

Figure 2.1 Median Off-Farm Income by farm type in England, 2021/22 and 2022/23

Source: Dataset table 2

Figure notes:

1. The legend is presented in the same order as the bars.

2. 95% Confidence Intervals have been presented to show the range where the true value is likely to lie and provides an indication of the degree of uncertainty of the estimate; see section 4.2 for more detail.

3. The 95% Confidence Interval for General Cropping is extremely large, so this figure should be treated with caution.

Figure 2.1 shows the average (median) total Off-Farm Incomes in 2021/22 and 2022/23 by farm type. At the all farm level, it rose by 96% in 2022/23, from £6,200 to £12,200. However, between 2021/22 and 2022/23 there was significant turnover in the sample; only around 55% of each year’s sample was present in both years. When comparing the matched samples, the average for 2021/22 was around £2,500 higher than in the full sample and the average for 2022/23 was around £100 higher. This meant that the increase in median Off-Farm Income for the matched samples was less severe, at 41%.

In 2021/22, the highest Off-Farm Incomes were found in lowland grazing livestock and LFA grazing livestock farms, both with an average of £12,500. However, where Off-Farm Income for lowland grazing livestock farms increased by 41% to £12,300 in 2022/23, the average for LFA grazing livestock farms did not change from the 2021/22 average. The highest average Off-Farm Income of 2022/23 was in cereal farms, at £12,600, and the averages for general cropping and both grazing livestock farm types were just below this figure.

In both 2021/22 and 2022/23, the farm type with the lowest average Off-Farm Income, at £500 in both years, was specialist pig and poultry farms. However, in 2022/23, dairy farms also had an average Off-Farm Income of £500, which was a fall of 87% compared to the 2021/22 average.

Figure 2.2 Median Off-Farm Income by farm economic performance in England, 2021/22 and 2022/23

Source: Dataset table 2

Figure notes:

1. The legend is presented in the same order as the bars.

2. 95% Confidence Intervals have been presented to show the range where the true value is likely to lie and provides an indication of the degree of uncertainty of the estimate; see section 4.2 for more detail.

Figure 2.2 shows how farm economic performance affected average (median) Off-Farm Income. In both 2021/22 and 2022/23, average Off-Farm Income was lower for the better performing farms. As with the all farms average, average Off-Farm Income increased for farms of all performance bands. The biggest difference was in high performing farms, whose average more than doubled to £8,800. The average for both low and medium performing farms increased by around 40%.

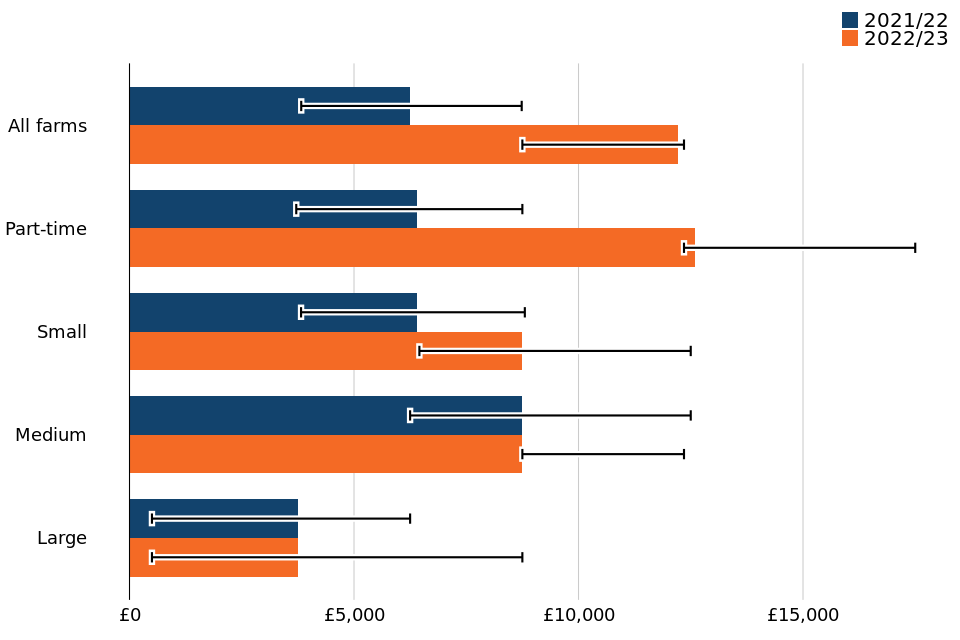

Figure 2.3 Median Off-Farm Income by farm business size based on Standard Labour Requirement (SLR) in England, 2021/22 and 2022/23

Source: Dataset table 2

Figure notes:

1. The legend is presented in the same order as the bars.

2. 95% Confidence Intervals have been presented to show the range where the true value is likely to lie and provides an indication of the degree of uncertainty of the estimate; see section 4.2 for more detail.

Figure 2.3 shows the average (median) total Off-Farm Incomes in 2021/22 and 2022/23 by farm business size (based on SLR). In both 2021/22 and 2022/23, large farms had lower average Off-Farm Income than smaller farms. Compared to 2021/22, Off-Farm Income averages in 2022/23 show a clearer pattern of smaller farms earning more in Off-Farm Income; the average for part-time farms almost doubled to £12,600 and for small farms it increased by 37% to £8,700. The increase in the all farms average seems to have been driven by smaller farms earning more Off-Farm Income in 2022/23.

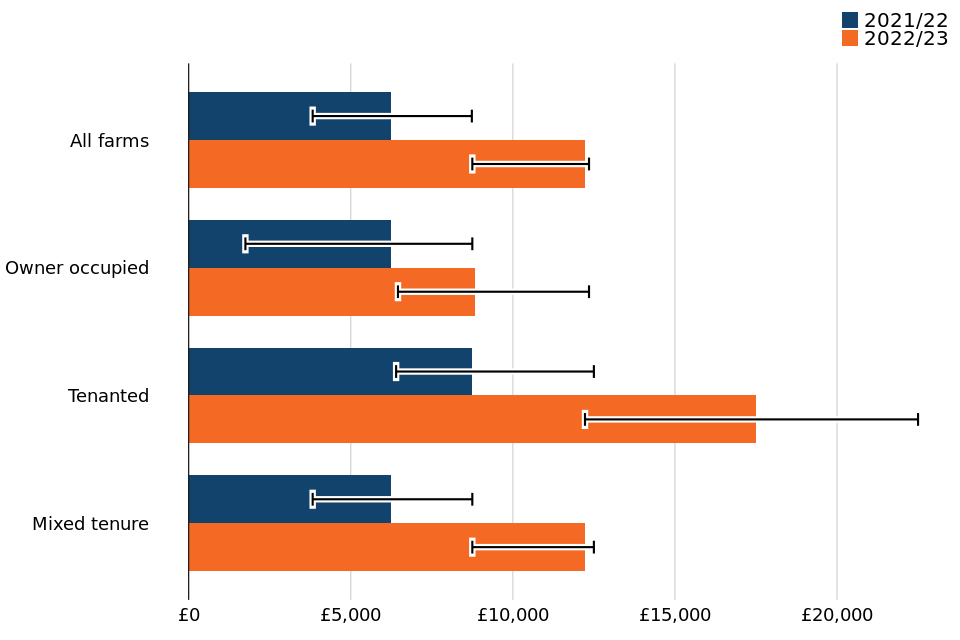

Figure 2.4 Median Off-Farm Income by tenure type in England, 2021/22 and 2022/23

Source: Dataset table 2

Figure notes:

1. The legend is presented in the same order as the bars.

2. 95% Confidence Intervals have been presented to show the range where the true value is likely to lie and provides an indication of the degree of uncertainty of the estimate; see section 4.2 for more detail.

The way that the tenure type of farms affected average (median) Off-Farm Income is shown in figure 2.4. As with the performance band breakdown, average Off-Farm Income follows the trend in the all farm average, increasing for farms of all tenure types between 2021/22 and 2022/23. When comparing between tenure type averages, owner occupied farms had the lowest average Off-Farm Income, at £8,800, an increase of 41% compared to the 2021/22 average. The average Off-Farm Income of mixed tenure farms almost doubled to £12,200 between 2021/22 and 2022/23. Tenanted farms had an average Off-Farm Income of £17,500 in 2022/23, which was more than double the average for the previous year.

3 What you need to know about this release

3.1 Contact details

Responsible statistician: Cat Hand

Public enquiries: [email protected]

For media queries between 9am and 6pm on weekdays:

Telephone: 0330 041 6560

Email: [email protected]

3.2 National Statistics Status

Accredited official statistics are called National Statistics in the Statistics and Registration Service Act 2007. An explanation can be found on the Office for Statistics Regulation website. Our statistical practice is regulated by the Office for Statistics Regulation (OSR). OSR sets the standards of trustworthiness, quality and value in the Code of Practice for Statistics that all producers of official statistics should adhere to.

These accredited official statistics were independently reviewed by the Office for Statistics Regulation in January 2014. They comply with the standards of trustworthiness, quality and value in the Code of Practice for Statistics and should be labelled ‘accredited official statistics’.

You are welcome to contact us directly with any comments about how we meet these standards (see contact details above). Alternatively, you can contact OSR by emailing [email protected] or via the OSR website.

Since the latest review by the Office for Statistics Regulation, we have continued to comply with the Code of Practice for Statistics, and have made the following improvements:

-

Reviewed and improved data presentation to better meet accessibility guidelines

-

Automated production of the statistics using Reproducible Analytical Pipelines (RAP)

-

Reviewed and improved accompanying commentary.

3.3 User engagement

As part of our ongoing commitment to compliance with the Code of Practice for Official Statistics we wish to strengthen our engagement with users of these statistics and better understand the use made of them and the types of decisions that they inform.

We invite users to make contact to advise us of the use they do, or might, make of these statistics, and what their wishes are in terms of engagement. Feedback on this statistical release and enquiries about these statistics are also welcome.

3.4 Survey content, methodology and data uses

The Farm Business Survey is an annual survey providing information on the financial position, physical characteristics, and economic performance of farm businesses in England. The sample of farm businesses covers all regions of England and all types of farming.

Data for the Farm Business Survey are collected through face-to-face interviews with farmers, conducted by highly trained research officers.

The data are widely used by the industry for benchmarking and inform wider research into the economic performance of the agricultural industry, as well as for evaluating and monitoring current policies. The data will also help to monitor farm businesses throughout the Agricultural Transition period.

3.5 Availability of results

All Defra statistical notices can be viewed on the Statistics at Defra page.

More publications and results from the Farm Business Survey are available on the Farm Business Survey Collection page.

4 Technical note

4.1 Survey coverage and weighting

The Farm Business Survey only includes farm businesses with a Standard Output of at least 25 thousand Euros, based on activity recorded in the previous June Survey of Agriculture and Horticulture. In 2022/23, the sample of 1,359 farms represented approximately 52,500 farm businesses in England.

Initial weights are applied to the Farm Business Survey records based on the inverse sampling fraction for each design stratum (farm type and farm size). Dataset table 16 from the Farm Accounts in England publication shows the distribution of the sample compared with the distribution of businesses from the 2022 June Survey of Agriculture. These initial weights are then adjusted, using calibration weighting, so that they can produce unbiased estimates of a number of different target variables. More detailed information about the Farm Business Survey can be found on the technical notes and guidance page. This includes information on the data collected, information on calibration weighting and definitions used within the Farm Business Survey.

The data used for this analysis is from those farms present in the Farm Business Survey that reported their Off-Farm Income. In 2022/23 this subsample consisted of 947 farms (70% of the full sample). This subsample has been reweighted using a method that preserves marginal totals for populations according to farm type and farm size groups. As such, values shown in this publication may not exactly match results calculated using the main FBS weights.

4.2 Accuracy and reliability of the results

It is not logistically feasible to survey the entire population of farms, therefore, the published figures from the Farm Business Survey are subject to sampling error. This is a fundamental premise of conducting statistical surveys, which by design aim to capture a representative sample of the underlying population through various sampling techniques.

The representation of data in this publication attempts to account for this sampling error by providing 95% confidence intervals as a measure of uncertainty for the estimated average. This is provided through error bars in the bar plots.

Narrower confidence intervals generally reflect larger sample sizes and greater homogeneity within the group and are thus ‘more precise’ of an indicator for where the true population average may reside. Conversely, wider confidence intervals are generally characterised by smaller sample sizes and greater sample standard deviations, which are thus ‘less precise’. These estimates should be treated with caution.

A confidence interval is therefore a plausible range of values wherein the true underlying population average lies within, based on the sample data it draws from. A 95% confidence interval hence refers to the interval in which there is a 95% probability that our true population average resides.

For the Farm Business Survey, the confidence intervals shown are appropriate for comparing groups within the same year only; they should not be used for comparing with previous years, since they do not allow for the fact that many of the same farms will have contributed to the Farm Business Survey in multiple years. Confidence intervals only give an indication of the sampling error; they do not reflect any other sources of survey errors, such as non-response bias.

4.3 Methodology for calculating Off-Farm Income

Off-Farm Income is collected at a gross level as banded data:

Table 4.1 Off-farm income data collection

| Band | Off-farm income |

|---|---|

| 1 | £0 |

| 2 | £1 to below £1,000 |

| 3 | £1,000 to below £2,500 |

| 4 | £2,500 to below £5,000 |

| 5 | £5,000 to below £7,500 |

| 6 | £7,500 to below £10,000 |

| 7 | £10,000 to below £15,000 |

| 8 | £15,000 to below £20,000 |

| 9 | £20,000 to below £25,000 |

| 10 | £25,000 to below £30,000 |

| 11 | £30,000 to below £40,000 |

| 12 | £40,000 to below £50,000 |

| 13 | £50,000 to below £75,000 |

| 14 | £75,000 to below £100,000 |

| 15 | £100,000 to below £150,000 |

| 16 | £150,000 to below £200,000 |

| 17 | £200,000 or more |

To estimate the true value from banded data for each farm, two methods were used. The first method was Mean Constrained Integration over Brackets (MCIB), developed by Paul Jargowsky and Christopher Wheeler (2018), and involved estimating density functions for each income bracket. These functions captured the variation and relative frequency of households within each bracket, using either linear or uniform approximations. By estimating these density functions, the MCIB methodology provided a more accurate representation of the income distribution.

The MCIB could not estimate the open top band without a grand mean. To address this, the Robust Pareto Midpoint Estimator (RPME), developed by Paul von Hippel et al (2014), was used. The RPME fitted a Pareto distribution to the top band, determining a minimum shape parameter cut-off and using a different mean for estimation, geometric for this report.

Both methods were more accurate than simply taking the midpoint of each band and allowed for the calculation of accuracy measures. The estimates for each band were calculated for each survey year and farm type, and then these were assigned to the corresponding farms as the Off-Farm Income value. The median income could then be calculated conventionally.

4.4 Definitions

Farms, for the purpose of this publication, refers to the primary household of the farm business who was interviewed as part of the FBS. Some farm businesses have multiple households linked to them, however, because the primary aim of the survey is to collect farm business data, it is not possible to collect data from all households, nor all adults within the primary household.

Farm Type refers to the ‘robust type’, which is a standardised farm classification system; for this publication, pigs and poultry have been combined into a single farm type category.

Farm Sizes are based on the estimated Standard Labour Requirement (SLR) for the business, rather than its land area. The farm size bands used within the detailed results tables which accompany this publication are shown in the table below. Standard Labour Requirement (SLR) is defined as the theoretical number of workers required each year to run a business, based on its cropping and livestock activities. Table 4.2 shows how each farm size is assigned.

Table 4.2: Farm size by Standard Labour Requirement (SLR)

| Farm size | Definition |

|---|---|

| Spare & Part-time | Less than 1 SLR |

| Small | 1 to less than 2 SLR |

| Medium | 2 to less than 3 SLR |

| Large | 3 or more SLR |

Household is defined, in this publication, as the principal farmer and their spouse or common law partner.

The median is a type of average and is the middle value of the population values, after the values have been ranked by an output variable.