Plant Health – international trade and controlled consignments, 2015-2019 – experimental statistics publication (html version)

Published 19 November 2020

These statistics present an analysis of international trade in plant and plant commodities[footnote 1] (including live plants, fruit, vegetables and cereals) – covering both the financial value and the physical scale (mass) of this trade. This release also presents an analysis of the notifications of controlled commodities – i.e., where checks are carried out to ensure that traded goods meet required standards. Data cover the period 2015 to 2019 (Forestry Commission data cover 2015/16-2019/20). Geographical coverage is specified at the start of each section.

1. Key findings

- During the period 2015-2019 the overall value of trade in plants and plant commodities increased while the overall net mass remained stable. Such trends were not always linear due to the volatile nature of the trade, which can be affected by climate events, pest and disease and other factors.

- In 2019, imports accounted for 88.7 per cent of all trade value and 78.6 per cent of net mass of trade in plants and plant commodities.

- The value of trade in plant and plant commodities between the UK and the European Union increased between 2015 and 2019, however the corresponding net mass decreased slightly. The value of trade with non-EU countries also increased between 2015 and 2019 but so did the net mass.

- In 2019, over 112,000 consignments of controlled material were notified to the Plant Health and Seeds Inspectorate (PHSI), an increase of around 16 per cent since 2015. Over half of these consignments originated in Africa.

- In 2019/20, over 3,200 consignments of controlled material were notified to the Forestry Commission. The number of consignments was lower (-684) than in 2015/16 while the volume of material in the consignments also decreased (-97,354m).

2. Contents

Trade in plants and plant products

Plant Health and Seeds Inspectorate

3. Introduction

Plants are environmentally, economically, and socially important, providing a vital contribution to our food and timber supply and to the rural economy. Plants also perform an essential ecosystem service in shaping the landscape and supporting biodiversity and have been linked to improved health and wellbeing[footnote 2].

The globalisation of trade has facilitated an increase in the volume and diversity of plants and plant commodities which enter the UK. This trade generates economic value but also needs to be regulated (controlled), noting the links, along with other factors, to increased risk of pest and disease[footnote 3].

Hence plant health legislation[footnote 4] controls the import and movement of certain plants, trees, seeds and organic matter - such as soil - and certain plant products, including fruit, potatoes, vegetables, cut flowers, timber, foliage and grain.

The analysis below explores both the overall UK trade in plants and plant commodities, and also the trade in regulated plant health and forestry commodities which informs the inspections undertaken by the Plant Health and Seeds Inspectorate (PHSI) and the Forestry Commission (FC) to prevent plant pests and diseases from entering England and Wales, and, for Forestry Commission, Scotland[footnote 5].

Please note that the three datasets explored in this publication are not directly comparable. There are key differences in how each dataset is compiled and these are outlined further in the accompanying quality and methodology report.

4. Experimental Statistics

This statistical release is intended as a contribution to increasing wider understanding about trade in these commodities and about plant health. It is designed to provide stakeholders, internal and external to government, with information on the patterns of trade over time for a specific set of commodities. The primary aim is to facilitate discussion and aid decision making around biosecurity.

The release is not intended for the purpose of drawing inferences as to the effectiveness of plant health and forestry inspectorates.

New statistical releases are classified as experimental statistics in order to secure feedback from users – for example about the long-term need for the information (the user value) and the technical fitness for purpose (the quality). If you have any comments or feedback on this release – or about other needs for formal statistics in policy areas of trade and biosecurity - please contact

Sam Grant,

Plant Health Statistics,

Horizon House,

Deanery Rd,

Bristol

BS1 5TL.

Guidance on Experimental Statistics

5. Trade in plants and plant products

Her Majesty’s Revenue and Customs (HMRC) compiles statistics on commodities physically leaving and entering the UK, traded with both European Union (EU) Member States and non-EU countries. Non-EU trade is collected from customs declarations. EU trade is collected via Intrastat which covers VAT-registered businesses whose annual value of arrivals and/or dispatches exceeds a given exemption threshold[footnote 6]

Although not collected for plant health purposes the HMRC data does allow us to examine the patterns of trade for a sub-section of commodities, i.e., raw and simply processed plants and plant commodities, and to group these into categories. The categories covered in this release are:

- Plants and planting material. This category includes bulbs, plants for planting, forest tree seed and cut flowers.

- Food and crops. This category includes fruit, vegetables, cereals, nuts, herbs and spices.

- Forestry: This category includes timber (unprocessed or simply processed: sliced, planed or chipped), packing cases, casks and barrels.

6. Table 1: Value of trade in plants and plant commodities, by sector, 2015-2019

| Sector | 2015 | 2016 | 2017 | 2018 | 2019 | Value change 2015 to 2019 | Percentage change 2015 to 2019 |

|---|---|---|---|---|---|---|---|

| Imports | |||||||

| Plants and planting material | 915 | 1,018 | 1,045 | 1,003 | 1,005 | 90 | 9.8 |

| Food and crops | 8,067 | 8,981 | 9,857 | 9,742 | 9,987 | 1,920 | 23.8 |

| Forestry | 1,637 | 1,708 | 1,933 | 2,070 | 1,987 | 349 | 21.3 |

| Total | 10,619 | 11,707 | 12,835 | 12,815 | 12,978 | 2,359 | 22.2 |

| Exports | |||||||

| Plants and planting material | 91 | 103 | 119 | 123 | 119 | 28 | 31.0 |

| Food and crops | 1,254 | 1,494 | 1,112 | 1,065 | 1,342 | 89 | 7.1 |

| Forestry | 142 | 144 | 170 | 186 | 189 | 47 | 33.4 |

| Total | 1,487 | 1,742 | 1,401 | 1,374 | 1,651 | 164 | 11.0 |

| All trade | |||||||

| Plants and planting material | 1,006 | 1,122 | 1,164 | 1,126 | 1,124 | 118 | 11.7 |

| Food and crops | 9,321 | 10,475 | 10,970 | 10,806 | 11,329 | 2,009 | 21.6 |

| Forestry | 1,779 | 1,852 | 2,103 | 2,256 | 2,176 | 397 | 22.3 |

| Total | 12,106 | 13,449 | 14,237 | 14,188 | 14,629 | 2,523 | 20.8 |

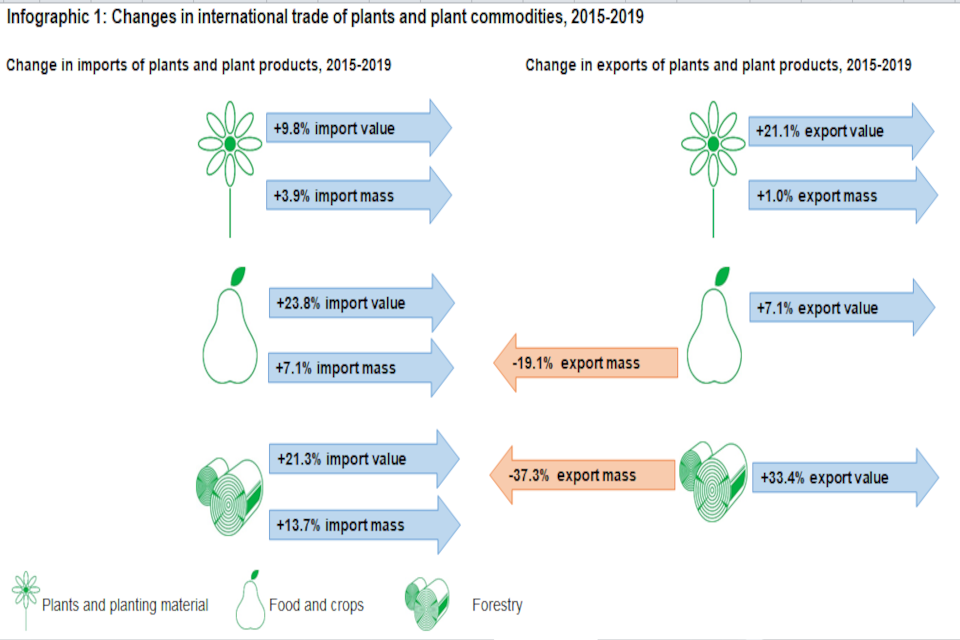

Table 1 shows the total value of trade in plants and plant commodities, by sector, between 2015 and 2019.

-

The total value of trade in plants and plant commodities has shown a broad upward trend over the time period. This trend could be seen across all sectors and across both imports and exports.

-

Whilst the value of total trade and imports both increased by over 20 per cent during the time frame, the increase for exports was around half this level, at 11 per cent.

-

There were larger percentage increases in the value of exports than imports for the plants and planting materials and forestry sectors however the reverse was true for food and crops.

-

The import value of the plants and planting materials sector increased by 9.8 per cent over the time period (£915m in 2015 to £1,005m in 2019) however the value of exports in this sector increased by 31 per cent (£91m in 2015 to £119m in 2019) despite a decrease in value between 2018 and 2019.

7. Table 2: Net mass of trade in plants and plant commodities, by sector, 2015-2019

| Sector | 2015 | 2016 | 2017 | 2018 | 2019 | Value change 2015 to 2019 | Percentage change 2015 to 2019 |

|---|---|---|---|---|---|---|---|

| Imports | |||||||

| Plants and planting material | 347 | 351 | 388 | 358 | 361 | 14 | 3.9 |

| Food and crops | 11,889 | 11,707 | 12,939 | 13,077 | 12,728 | 839 | 7.1 |

| Forestry | 4,107 | 4,154 | 4,321 | 4,521 | 4,669 | 562 | 13.7 |

| Total | 16,343 | 16,212 | 17,647 | 17,955 | 17,759 | 1,415 | 8.7 |

| Exports | |||||||

| Plants and planting material | 36 | 44 | 55 | 48 | 50 | 13 | 36.4 |

| Food and crops | 5,059 | 6,229 | 3,031 | 2,487 | 4,095 | -964 | -19.1 |

| Forestry | 1,091 | 784 | 809 | 761 | 684 | -407 | -37.3 |

| Total | 6,186 | 7,057 | 3,895 | 3,296 | 4,828 | -1,358 | -22.0 |

| All trade | |||||||

| Plants and planting material | 384 | 395 | 443 | 406 | 411 | 27 | 7.0 |

| Food and crops | 16,949 | 17,937 | 15,970 | 15,564 | 16,824 | -125 | -0.7 |

| Forestry | 5,198 | 4,938 | 5,130 | 5,281 | 5,353 | 155 | 3.0 |

| Total | 22,530 | 23,269 | 21,542 | 21,251 | 22,587 | 57 | 0.3 |

Table 2 shows the total net mass of trade in plants and plant commodities, by sector, between 2015 and 2019.

-

Overall levels of trade were similar in 2019 and 2015. All sectors experienced an increase in the net mass of imports with forestry seeing the biggest increase (+13.7 per cent).

-

Plants and planting materials was the only sector to see an increase in the net mass of exports (+36.4 per cent) between 2015 and 2019 however, at 50 thousand tonnes, levels in 2019 were lower than the peak of 55 thousand tonnes seen in 2017.

-

Food and crops was the only sector to experience a slight decrease in the overall net mass of trade between 2015 and 2019 despite an increase in the net mass of imports (+7.1 per cent).

8. Figure 1: Changes in international trade of plants and plant commodities, 2015-2019

9. Table 3: Value of UK-EU trade in plants and plant commodities, by sector, 2015-2019

| Sector | 2015 | 2016 | 2017 | 2018 | 2019 | Value change 2015 to 2019 | Percentage change 2015 to 2019 |

|---|---|---|---|---|---|---|---|

| EU Imports | |||||||

| Plants and planting material | 737 | 838 | 858 | 811 | 819 | 82 | 11.1 |

| Food and crops | 3,884 | 4,306 | 4,679 | 4,670 | 4,796 | 912 | 23.5 |

| Forestry | 1,181 | 1,262 | 1,480 | 1,628 | 1,551 | 370 | 31.3 |

| Total | 5,803 | 6,406 | 7,016 | 7,108 | 7,166 | 1,363 | 23.5 |

| EU Exports | |||||||

| Plants and planting material | 70 | 82 | 92 | 96 | 89 | 19 | 26.6 |

| Food and crops | 921 | 1,124 | 914 | 888 | 1,097 | 176 | 19.1 |

| Forestry | 104 | 110 | 132 | 147 | 145 | 41 | 40.0 |

| Total | 1,095 | 1,315 | 1,138 | 1,132 | 1,331 | 236 | 21.6 |

| All EU trade | |||||||

| Plants and planting material | 807 | 920 | 950 | 907 | 908 | 100 | 12.4 |

| Food and crops | 4,805 | 5,430 | 5,593 | 5,558 | 5,893 | 1,088 | 22.6 |

| Forestry | 1,285 | 1,372 | 1,611 | 1,775 | 1,697 | 411 | 32.0 |

| Total | 6,898 | 7,722 | 8,154 | 8,240 | 8,497 | 1,599 | 23.2 |

Table 3 shows the value of commodities that are imported into the UK from the EU and commodities that are exported from the UK to the EU, by sector.

-

The value of all trade flows between the UK and the EU increased by over a fifth between 2015 and 2019. At sector level the increase in flows was more variable with forestry showing the biggest increases (+31.3 per cent increase in import value and +40.0 per cent increase in export value).

-

Although the value of trade increased over the time period, the peak year of value of imports from the EU was 2017 for plants and planting material (£858m compared to £819m in 2019) and 2018 for forestry (£1,628m compared to £1,551m in 2019).

-

For exports to the EU, the value of plants and planting material peaked in 2018 (£96m compared to £89m in 2019) and this was also true for forestry (£147m compared to £145m in 2019). Food and crops saw its highest export value in 2016 (£1,124m compared to £1,097m in 2019).

10. Table 4: Net mass of UK-EU trade in plants and plant commodities, by sector, 2015-2019

| Sector | 2015 | 2016 | 2017 | 2018 | 2019 | Value change 2015 to 2019 | Percentage change 2015 to 2019 |

|---|---|---|---|---|---|---|---|

| EU Imports | |||||||

| Plants and planting material | 276 | 283 | 326 | 293 | 308 | 32 | 11.7 |

| Food and crops | 6,384 | 5,959 | 6,338 | 6,376 | 5,609 | -775 | -12.1 |

| Forestry | 3,492 | 3,548 | 3,803 | 3,988 | 4,138 | 646 | 18.5 |

| Total | 10,152 | 9,790 | 10,467 | 10,657 | 10,055 | -97 | -1.0 |

| EU Exports | |||||||

| Plants and planting material | 30 | 37 | 32 | 41 | 42 | 12 | 40.5 |

| Food and crops | 3,604 | 4,473 | 2,646 | 2,164 | 3,437 | -167 | -4.6 |

| Forestry | 1,024 | 725 | 723 | 678 | 594 | -429 | -42.0 |

| Total | 4,657 | 5,236 | 3,401 | 2,883 | 4,073 | -584 | -12.5 |

| All EU trade | |||||||

| Plants and planting material | 306 | 320 | 358 | 334 | 350 | 44 | 14.5 |

| Food and crops | 9,988 | 10,432 | 8,984 | 8,540 | 9,046 | -942 | -9.4 |

| Forestry | 4,516 | 4,274 | 4,526 | 4,666 | 4,732 | 216 | 4.8 |

| Total | 14,809 | 15,025 | 13,868 | 13,540 | 14,128 | -681 | -4.6 |

Table 4 shows commodities that are imported into the UK from the EU and commodities that are exported from the UK to the EU, by sector.

-

During the period 2015-2019 the net mass of trade in plants and planting materials and forestry increased but the net mass of food and crops decreased.

-

Both plants and planting materials and forestry saw increases in the net mass of imports from the EU over the time period (32 thousand tonnes and 646 thousand tonnes respectively) however only plants and planting materials saw an increase in the net mass of exports which increased 40.5 per cent, from 30 thousand tonnes in 2015 to 42 thousand tonnes in 2019.

-

There was a decrease in the net mass of forestry exports to the EU over the time period, from 1,024 thousand tonnes in 2015 to 594 thousand tonnes in 2019.

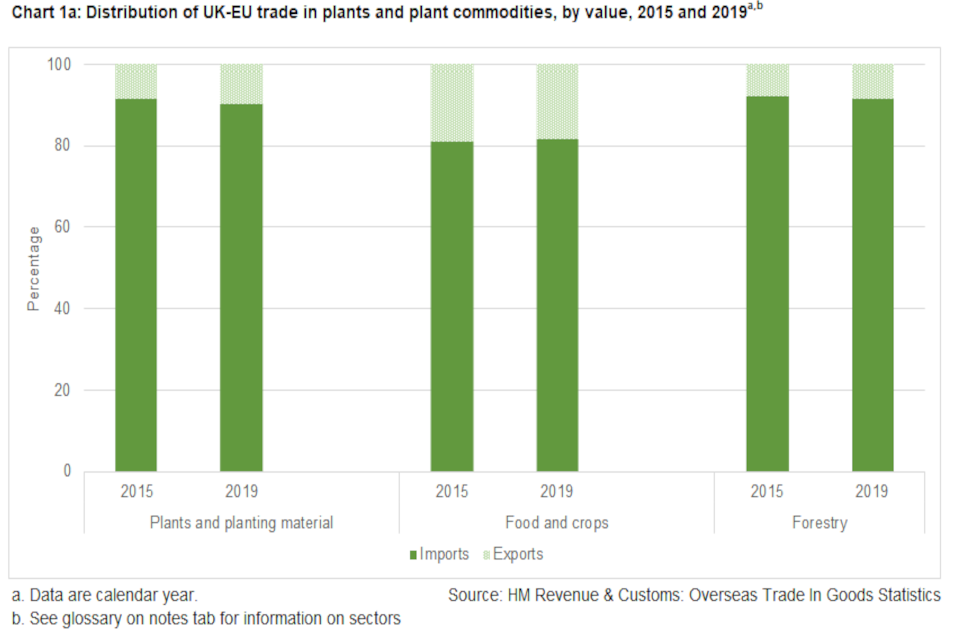

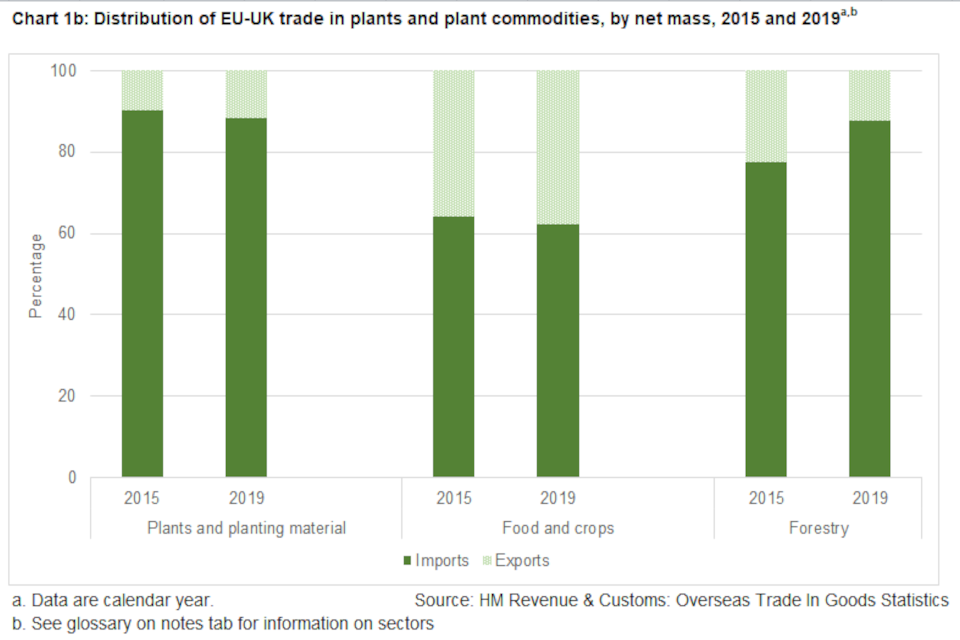

11. Charts 1a and 1b: Distribution of UK-EU trade in plants and plant commodities, 2015-2019

11.1 1.a. Value

11.2 1.b. Net Mass

-

Imports accounted for the majority of UK-EU trade in terms of both value and net mass.

-

The proportion of EU trade value that was imports was higher for plants and planting material and forestry (over 90 per cent) than for food and crops (over 80 per cent). For net mass the picture was more mixed with plants and planting material imports and forestry comprising around 87-88 per cent of the trade in 2019 compared to food and crops at 62 per cent.

-

The proportion of trade value that was EU imports remained fairly stable for all sectors between 2015 and 2019. The associated changes across all sectors were around 1 percentage point or less.

-

In terms of the net mass of EU trade, the proportion of trade that was imports decreased for plants and planting material (-2.2 percentage points) and food and crops (-1.9 percentage points). For forestry the proportion of net mass that was imports increased by 10.1 percentage points between 2015 and 2019.

12. Table 5: Value of UK-non-EU trade in plants and plant commodities, by sector, 2015-2019

| Sector | 2015 | 2016 | 2017 | 2018 | 2019 | Value change 2015 to 2019 | Percentage change 2015 to 2019 |

|---|---|---|---|---|---|---|---|

| Non-EU Imports | |||||||

| Plants and planting material | 178 | 180 | 187 | 193 | 186 | 8 | 4.6 |

| Food and crops | 4,183 | 4,675 | 5,178 | 5,072 | 5,191 | 1,008 | 24.1 |

| Forestry | 456 | 446 | 453 | 442 | 435 | -21 | -4.5 |

| Total | 4,817 | 5,301 | 5,819 | 5,706 | 5,812 | 996 | 20.7 |

| Non-EU Exports | |||||||

| Plants and planting material | 20 | 22 | 26 | 27 | 30 | 9 | 46.1 |

| Food and crops | 333 | 370 | 199 | 176 | 246 | -87 | -26.2 |

| Forestry | 38 | 34 | 39 | 39 | 44 | 6 | 15.6 |

| Total | 392 | 427 | 263 | 241 | 320 | -72 | -18.3 |

| All non-EU trade | |||||||

| Plants and planting material | 199 | 202 | 213 | 219 | 216 | 18 | 8.9 |

| Food and crops | 4,516 | 5,045 | 5,377 | 5,248 | 5,437 | 921 | 20.4 |

| Forestry | 494 | 480 | 492 | 481 | 479 | -15 | -3.0 |

| Total | 5,208 | 5,727 | 6,082 | 5,948 | 6,132 | 924 | 17.7 |

Table 5 shows the value of commodities that are imported into the UK from countries outside of the EU and commodities that are exported from the UK to these non-EU countries, by sector.

-

The total value of non-EU trade increased for plants and planting material and for food and crops between 2015 and 2019. For the food and crops sector, the total trade value increased by around one fifth despite a decrease in the value of exports (-26.2 per cent since 2015).

-

The export value of non-EU trade in plants and planting material increased year-on-year, from £20m in 2015 to a high of £30m in 2019. Forestry also experienced its highest export value of the time period in 2019 at £44m.

-

The value of non-EU imports of food and crops were at the highest of the time period in 2019, standing at £5,191m.

13. Table 6: Net mass of non-EU trade in plants and plant commodities, 2015-2019

| Sector | 2015 | 2016 | 2017 | 2018 | 2018 | Value change 2015 to 2019 | Percentage change 2015 to 2019 |

|---|---|---|---|---|---|---|---|

| Non-EU Imports | |||||||

| Plants and planting material | 71 | 68 | 62 | 65 | 53 | -19 | -26.1 |

| Food and crops | 5,505 | 5,748 | 6,601 | 6,700 | 7,120 | 1,614 | 29.3 |

| Forestry | 615 | 606 | 517 | 532 | 531 | -83 | -13.6 |

| Total | 6,585 | 6,191 | 6,422 | 7,180 | 7,298 | 713 | 10.8 |

| Non-EU Exports | |||||||

| Plants and planting material | 7 | 7 | 23 | 7 | 8 | 1 | 18.1 |

| Food and crops | 1,455 | 1,756 | 385 | 323 | 658 | -797 | -54.8 |

| Forestry | 67 | 58 | 86 | 83 | 89 | 22 | 33.2 |

| Total | 1,529 | 1,822 | 494 | 413 | 755 | -774 | -50.6 |

| All non-EU trade | |||||||

| Plants and planting material | 78 | 75 | 85 | 72 | 61 | -17 | -22.3 |

| Food and crops | 6,961 | 7,505 | 6,986 | 7,024 | 7,778 | 817 | 11.7 |

| Forestry | 682 | 664 | 604 | 615 | 620 | -61 | -9.0 |

| Total | 7,721 | 8,244 | 7,674 | 7,711 | 8,459 | 738 | 9.6 |

Table 6 shows the net mass of commodities that are imported into the UK from countries outside of the EU and commodities that are exported from the UK to these non-EU countries, by sector.

-

Overall, the net mass of the non-EU annual trade in plants and plant commodities stood at 8,459 thousand tonnes in 2019, an increase of just under 10 per cent on the 2015 tonnage.

-

Imports of plants and planting materials and forestry from non-EU countries both decreased over the time period (-26.1 per cent and -13.6 per cent respectively) however imports of food and crops increased (+29.3 per cent).

-

Conversely, exports of food and crops to non-EU countries decreased by 54.8 per cent whilst exports of plants and planting materials and forestry increased (+18.1 per cent and +33.2 per cent respectively).

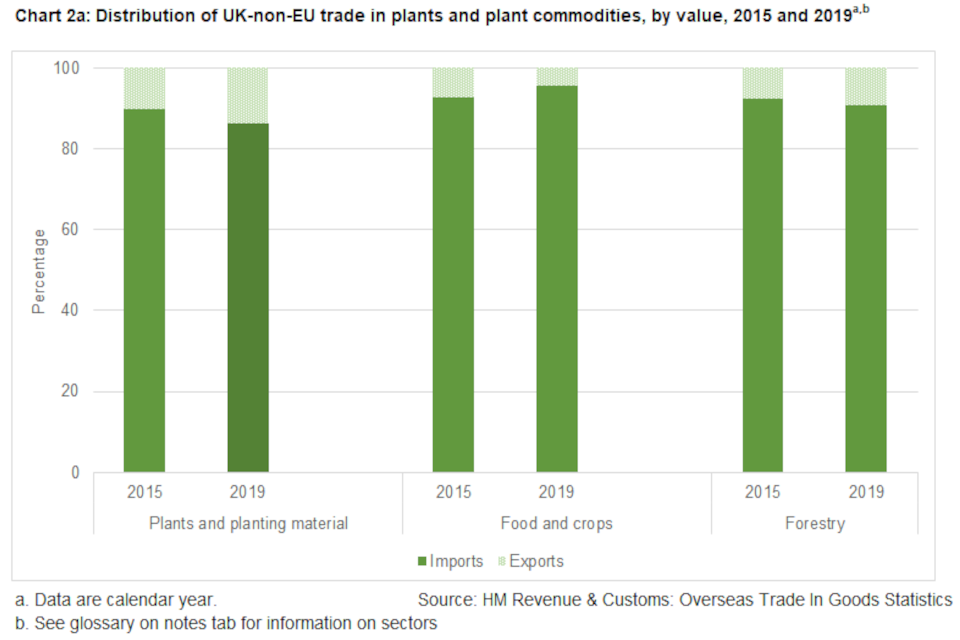

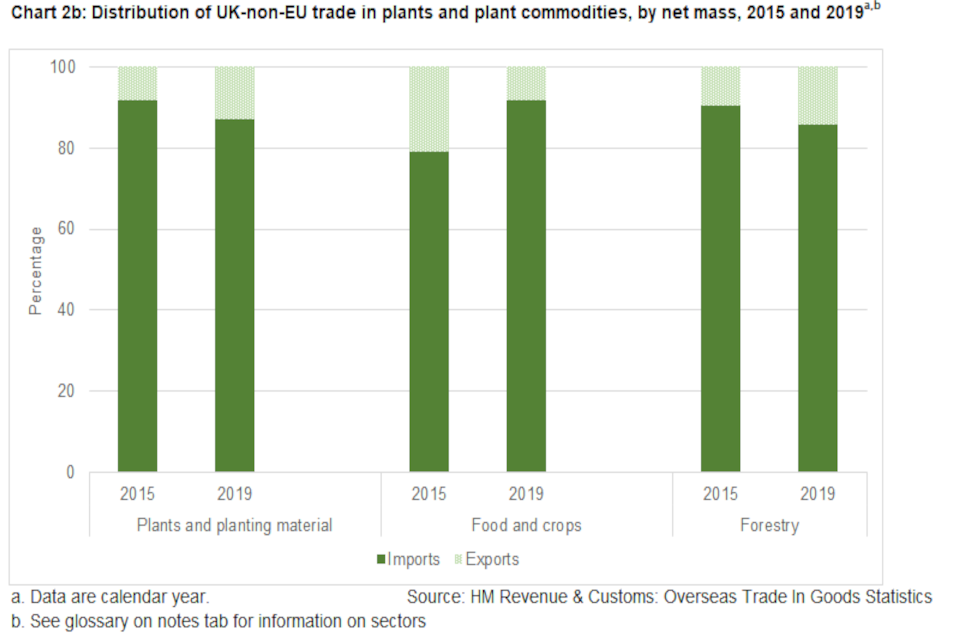

14. Chart 2a and 2b: Distribution of UK-non-EU trade in plants and plant commodities, 2015-2019

14.1 2.a. Value

14.2 2.b. Net Mass

-

Imports accounted for the majority of trade between the UK and countries outside of the EU in terms of both value and net mass.

-

Imports accounted for around 90 per cent of all non-EU trade value in all sectors in 2015. In 2019 imports as a proportion of the trade value in a sector had increased for food and crops (+2.9 percentage points) but decreased for plants and planting material (-3.5 percentage points) and for forestry (-1.5 percentage points).

-

The net mass of non-EU trade saw imports increase their share of trade in food and crops over the time period (+12.4 percentage points) but decrease for plants and planting material (-4.4 percentage points) and forestry (-4.6 percentage points).

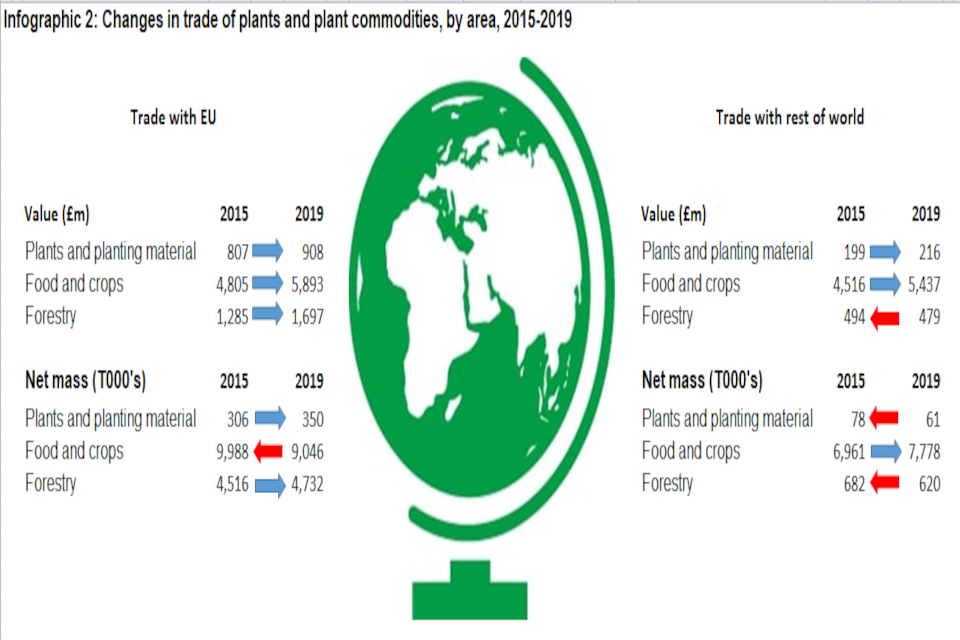

15. Figure 2: Changes in trade of plants and plant commodities between 2015-2019, by area

16. Controlled Commodities

The Plant Health and Seeds Inspectorate (PHSI) implements and enforces plant health policy in England and in Wales (on behalf of the Welsh Government). The Forestry Commission (FC) implements and enforces plant health policy in England and Scotland, and in Wales via Natural Resources Wales (NRW).

PHSI and FC carry out inspections of controlled plant materials, including plants for planting. The controls of such materials differ according to the species - and what quarantine organisms they may carry – but may include phytosanitary certificates, plant passports and/or physical inspection. Information on the volume of inspections is available in the annual Multi Annual National Control Plan[footnote 8]. Information covering interceptions of material that does not meet EU phytosanitary requirements is published in the annual Europhyt report [footnote 9].

Plants, fruit, vegetables and plant material from outside the EU[footnote 10] fall into 3 categories:

- ‘unrestricted’ material you can bring to the UK without any conditions;

- ‘controlled’ material that you can only bring into the UK with a ‘phytosanitary certificate’ to show it meets the requirements for entry to the EU;

- ‘prohibited’ material you can’t bring into the UK unless you get a scientific research licence or an exception (‘derogation’) to the rules.

Moving controlled plants or plant commodities in the EU[footnote 11] requires a plant passport with which commodities can move freely within the EU. Inspections of relevant businesses are carried out ‘in field’, generally between 2 and 4 times per year, depending on the business’s risk to plant health.

In December 2019 the EU introduced new legislation pertaining to plants and plant products. Implementing Regulation (EU) 2019/2072 and its Annexes replaced the Annexes of Directive 2000/29/EC. Implementing Regulation (EU) 2019/2072 covers more plants and plant commodities than the previous legislation however the impact of this legislative change will not be seen in full until we have data for 2020.

For trade with countries outside of the EU, plant health checks are made at approved points of entry into Great Britain (England and Wales for PHSI, England, Wales and Scotland for FC). To gain approved status, a port or airport authority must provide certain minimum conditions necessary to ensure that inspections can be carried out efficiently and safely and, in the event that it becomes necessary, relevant material can be treated or destroyed.

The UK has now left the EU, and the transition period ends on 31 December 2020. Changes to the plant health procedures for importing plants, plant products including wood and wood products from the EU are detailed in the Guidance on importing and exporting plants and plant products from 1 January 2021 https://www.gov.uk/guidance/importing-and-exporting-plants-and-plant-products-from-1-january-2021 . The products that will become controlled and require a phytosanitary certificate instead of a plant passport as is currently required are detailed in the High priority plants list https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/923654/high-priority-plants-list.odt

The analyses below focuses on consignments of commodities classed as controlled and originating outside the EU and arriving at points of entry in Great Britain (England and Wales for PHSI, England, Wales and Scotland for FC). These consignments are subject to inspection activities ranging from document checks to physical inspections. The level of checks required for different types of commodities can be considered as full (100 per cent) or reduced [footnote 12] . In addition, emergency measures [footnote 13] can be introduced which may restrict trade due to changes in import requirements. All controlled Forestry commodities are required to be checked (100 per cent).

Controlled commodities are a subset of the trade analysis shown above (which also includes unrestricted commodities), however data are not comparable to that provided by HMRC due to differences in measurement units, geographies and purpose. More information can be found in the accompanying quality and methodology report.

Where geographical breakdowns are provided for PHSI and FC, these use United Nations Statistics Division classifications. https://unstats.un.org/unsd/methodology/m49/

17. Plant Health and Seeds Inspectorate

The Plant Health and Seeds Inspectorate (PHSI) is part of the Animal and Plant Health Agency (APHA) and implements and enforces plant health policy in England, and in Wales on behalf of the Welsh Government. PHSI carry out inspections of plants, seeds, bulbs, cut flowers, planting materials, fruits and vegetables. They also inspect agricultural machinery for export however exports are not covered in this analysis.

It is important to note that changes in the number of consignments may be influenced by changes in trade patterns as well as by legislative changes. Factors which can contribute to changes in trade patterns include climate events, changes in market demand, social unrest or change, pest outbreaks etc. Controls may be applied to any number of countries where there is a pest risk but additionally countries may apply self-prohibition if they are aware of a pest issue in their country. Where self-prohibition is applied there are no formal reporting routes and often information cannot be confirmed.

Some key bans thought to have affected imports to the UK were:

- India: Colocasia Schott and plants other than seeds of Momordica L., Solanum melongena L. and Trichosanthes L. and Mangifera were banned from 24/04/2014 until 31/12/2016 with the exception of Trichosanthes L. and Mangifera for which the ban was lifted in February 2016.

- Ghana: Capsicum L., Lagenaria Ser., Luffa Mill., Momordica L. and Solanum L., other than S. lycopersicum L. were banned from 13/10/2017 until 31/12/2017.

- Trade in fresh curry leaves was stopped from 26/04/2014 due to countries outside of the EU being unable to meet EU requirements.Israel now fulfils the necessary requirements.

New controls being introduced may also impact trade patterns. For example: - Decision 2014/78 required all imports of Capsicum to become regulated as from 1st Oct 2014. The decision also included the application of controls on some other commodities. - EU Directive 2017/1279 required tomatoes originating from all third countries (outside the EU but including Canary Islands, Ceuta, Melilla and the French Overseas Departments) and pomegranates originating from countries of the African continent, Cape Verde, Saint Helena, Madagascar, La Reunion, Mauritius and Israel to be imported with a phytosanitary certificate. - Decision 2019/523 added controls on fruits of Kiwi, Papaya, Strawberry, Avocado, Rubus, Grapes and used agricultural machinery - Decision 2019/1598 added controls on maize.

- There has been self-imposed bans from Thailand, Bangladesh and Vietnam.These can be very limited (for example to one exporter ) or more general.

New EU legislation came into effect on 14 December 2019: Implementing Regulation (EU) 2019/2072 and its Annexes replaced the Annexes of Directive 2000/29/EC. Implementing Regulation (EU) 2019/2072 covers more plants and plant commodities than the previous legislation however the impact of this legislative changes will not be seen until we have data for 2020.

18. Table 7: Number of controlled consignments, by commodity type, 2015-2019

| Year | Plants and planting material | Fruit | Vegetables | Other commodities | Total |

|---|---|---|---|---|---|

| 2015 | 27,512 | 44,352 | 22,761 | 2,522 | 97,147 |

| 2016 | 28,802 | 47,542 | 24,357 | 2,476 | 103,177 |

| 2017 | 27,534 | 47,919 | 24,550 | 2,196 | 102,199 |

| 2018 | 27,948 | 55,280 | 23,478 | 2,474 | 109,180 |

| 2019 | 25,777 | 60,204 | 23,581 | 3,078 | 112,640 |

| Value change 2015-2019 | -1,735 | 15,852 | 820 | 556 | 15,493 |

| Percentage change 2015-2019 | -6.3 | 35.7 | 3.6 | 22.0 | 15.9 |

Table 7 shows the number of controlled consignments notified to PHSI, by commodity type.

-

Overall, the number of controlled consignments notified to PHSI increased by 15.9 per cent between 2015 and 2019 from 97,147 consignments in 2015 to a high of 112,640 consignments in 2019.

-

Increases were seen for all commodity types other than plants and planting material which decreased by 6.3 per cent, from 27,512 consignments in 2015 to 25,777 consignments in 2019.

-

The number of controlled consignments of fruit increased year-on-year leading to an overall increase of 35.7 per cent between 2015 and 2019. Fruit was the commodity type with the highest level of controlled consignments every year.

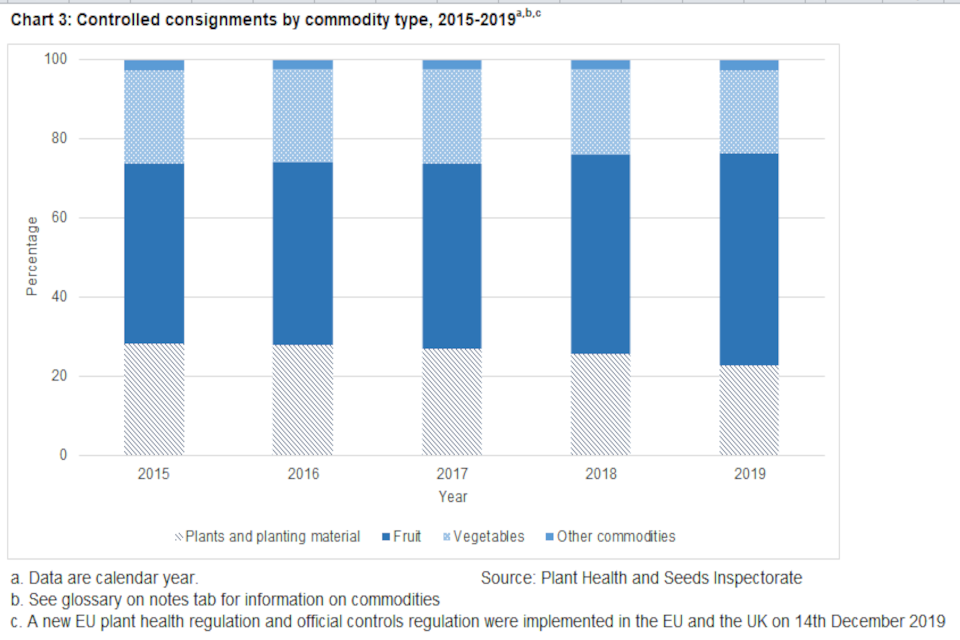

19. Chart 3: Controlled consignments by commodity type, 2015-2019

-

Controlled consignments of fruit accounted for over half of all consignments in 2018 and 2019 (50.6 per cent and 53.4 per cent respectively), prior to 2018 these consignments accounted for around 46-47 per cent of all consignments.

-

As a proportion of all consignments, plants and planting material decreased from 28.3 per cent in 2015 to 22.9 per cent in 2019.

20. Table 8: Number of controlled consignments, by region of origin, 2015-2019

| Year | Africa | Americas | Asia | Europe (non-EU) | Oceania | Total |

|---|---|---|---|---|---|---|

| 2015 | 52,679 | 20,335 | 21,695 | 96 | 2,342 | 97,147 |

| 2016 | 54,720 | 21,321 | 24,934 | 122 | 2,080 | 103,177 |

| 2017 | 54,998 | 21,354 | 23,361 | 121 | 2,365 | 102,199 |

| 2018 | 59,315 | 22,980 | 23,520 | 1,076 | 2,289 | 109,180 |

| 2019 | 60,099 | 26,241 | 22,990 | 1,279 | 2,031 | 112,640 |

| Value change 2015-2019 | 7,420 | 5,906 | 1,295 | 1,183 | -311 | 15,493 |

| Percentage change 2015-2019 | 14.1 | 29.0 | 6.0 | 1,232.3 | -13.3 | 15.9 |

Table 8 shows the number of controlled consignments notified to PHSI, by region of origin.

- Controlled consignments from European (non-EU) countries were over 13 times higher in 2019 than in 2015. This followed the introduction of controls on tomatoes from non-EU countries as of January 2018.

- Controlled consignments originating in the Americas increased by 29.0 per cent between 2015 and 2019 with the largest increase seen between the years 2018 and 2019.

- Oceania was the only region where trade decreased (-13.3 per cent) over the time period 2015 to 2019. Trade from Africa has shown a year-on-year increase however the largest increases were seen prior to 2018.

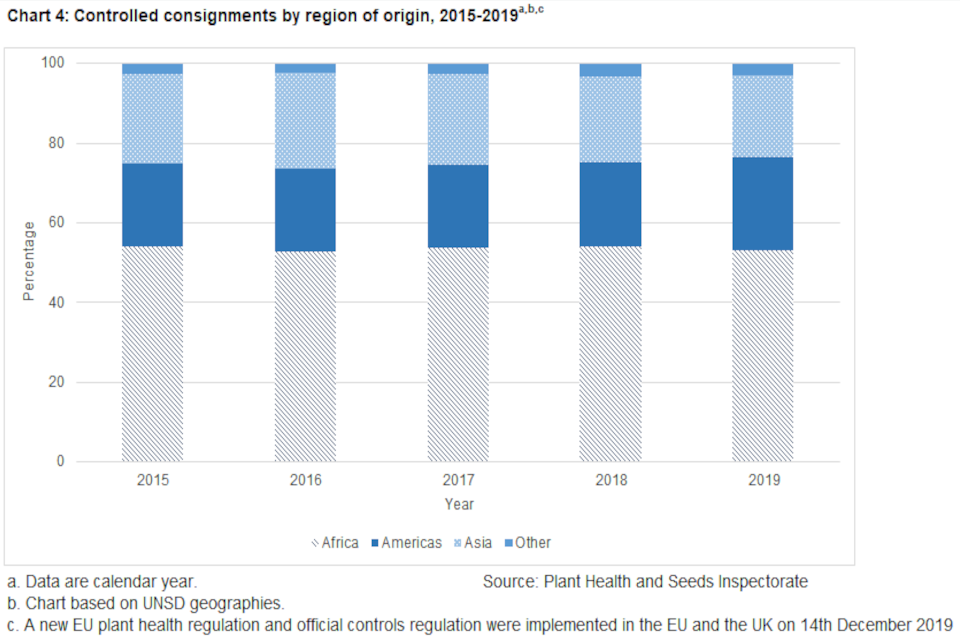

21. Chart 4: Controlled consignments by region of origin, 2015-2019

- Controlled consignments originating in Africa represented over half of all controlled consignments in each year shown.

- The Americas and Asia were each responsible for around 20-25 per cent of all controlled consignments in 2019. The proportion of controlled consignments for Asia decreased slightly between 2015 and 2019 (-1.9 percentage points) but increased for the Americas (+2.4 percentage points).

22. Forestry Commission

The Forestry Commission (FC) are responsible for inspections of timber, including sawn timber, wood shavings, wood chips, sawdust and prefabricated buildings made of wood being imported to England, Scotland and Wales. The Forestry Commission are also responsible for inspections of wood packaging and controlled firewood[footnote 14] however these trades are not covered in this release.

Controlled forestry commodities are required to undergo full checks (100 per cent) thus the number of consignments is also the number of inspections.

It is important to note that changes in the number of consignments may be influenced by changes in trade patterns as well as by legislative changes. Factors which can contribute to changes in trade patterns include climate events, changes in market demand, social unrest or change, pest outbreaks etc. Controls may be applied to any number of countries where there is a pest risk but additionally countries may apply self-prohibition if they are aware of a pest issue in their country.

New EU legislation came into effect on 14 December 2019: Implementing Regulation (EU) 2019/2072 and its Annexes replaced the Annexes of Directive 2000/29/EC. Implementing Regulation (EU) 2019/2072 covers more plants and plant commodities than the previous legislation however the impact of this legislative changes will not be seen until we have data for 2020.

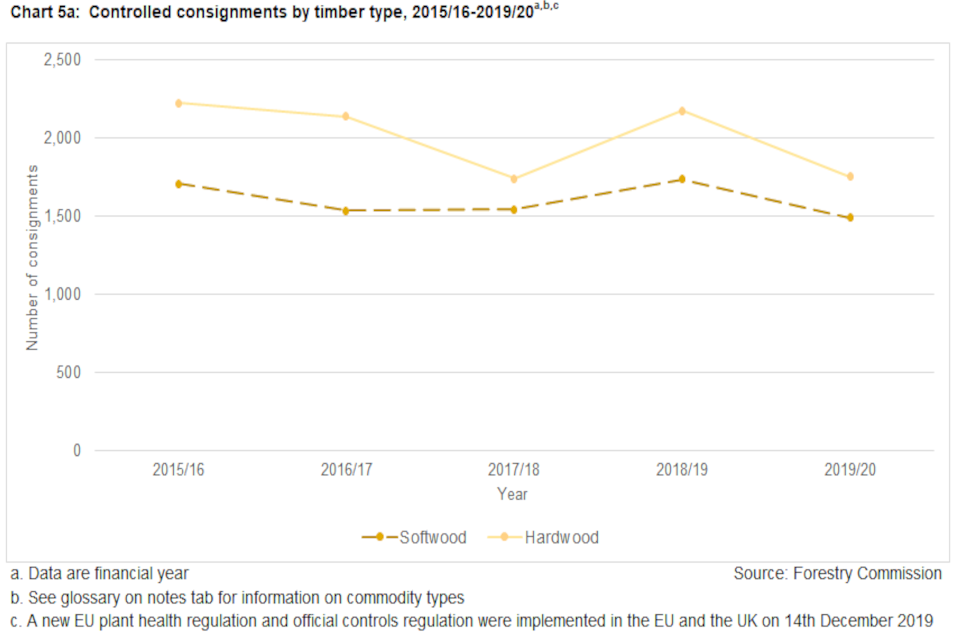

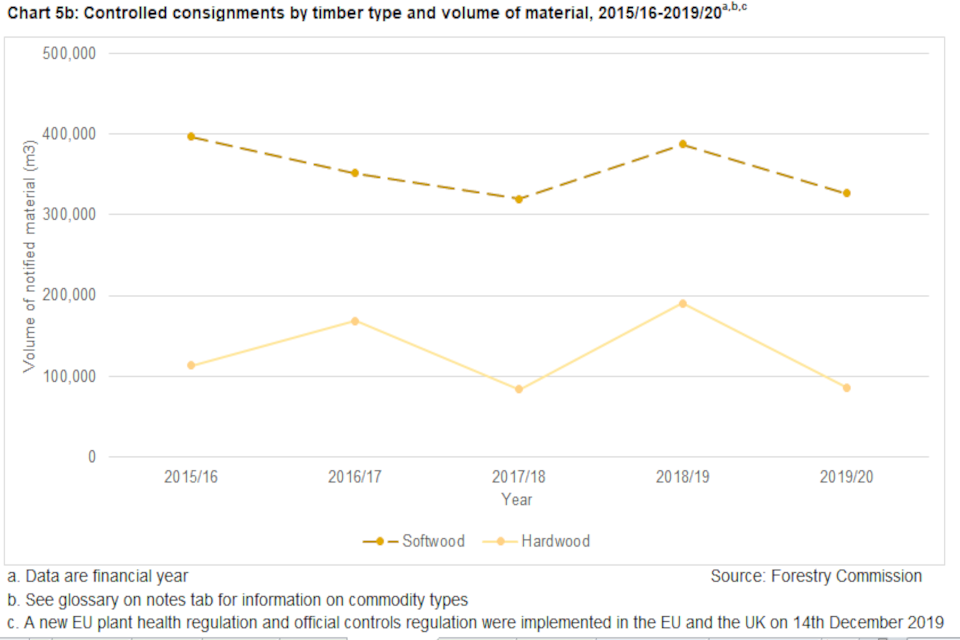

23. Chart 5a and 5b: Controlled consignments by timber type, 2015/16-2019/20

23.1 5a Number of consignments

23.2 5b. Volume of material

- The number of controlled consignments of hardwood fluctuated over the period 2015/16 to 2019/20 with the latest years number of consignments (1,754) only slightly higher than the low point seen in 2017/2018 (1,738). Intervening years comprised 2,000+ consignments. The number of controlled consignments of softwood also decreased in 2019/20 to 1,492 consignments, the lowest level of the time period after reaching a high of 1,735 in 2018/19.

- The volume of material in controlled consignments of hardwood also decreased between 2015/16 and 2019/20, standing at 86,233m3 in 2019/20,compared to 113,305m3 in 2015/16 and 190,337m3 in 2018/19. The volume of softwood also decreased, but to a lesser degree than hardwood, from 396,962m3 in 2015/16 to 326,680m3 in 2019/20.

- Hardwood consignments accounted for 56.6 per cent of all controlled consignments in 2015/16 but decreased to 54.0 per cent in 2019/20 while the volume of hardwood decreased from 22.2 per cent of the total volume of controlled consignments in 2015/16 to 20.9 per cent in 2019/20.

24. Table 9: Controlled consignments of softwood, by region of origin, 2015/16-2019/20

| 2015/16 | 2016/17 | 2017/18 | 2018/19 | 2019/20 | Value change 2015/16-2019/20 | Percentage change 2015/16-2019/20 | |

|---|---|---|---|---|---|---|---|

| Number of consignments | |||||||

| Africa | 0 | 0 | 0 | 4 | 8 | 8 | z |

| Asia | c | 8 | 15 | 13 | 17 | z | z |

| Oceania | 19 | 13 | 21 | 49 | 63 | 44 | 231.6 |

| Central and South America | 52 | 32 | 32 | 41 | 41 | -11 | -21.2 |

| North America | 1,169 | 1,030 | 1,108 | 1,036 | 860 | -309 | -26.4 |

| Europe (non-EU) | 466 | 453 | 367 | 592 | 503 | 37 | 7.9 |

| Total | 1,706 | 1,536 | 1,543 | 1,735 | 1,492 | -214 | -12.5 |

| Volume of notified product (m3) | |||||||

| Africa | 0 | 0 | 0 | 200 | 400 | 400 | z |

| Asia | c | 278 | 532 | 392 | 1,128 | z | z |

| Oceania | 704 | 529 | 876 | 2,629 | 2,997 | 2,293 | 325.7 |

| Central and South America | 4,556 | 3,259 | 2,574 | 4,162 | 3,472 | -1,084 | -23.8 |

| North America | 84,479 | 59,684 | 58,041 | 53,315 | 56,189 | -28,290 | -33.5 |

| Europe (non-EU) | 307,223 | 287,685 | 257,789 | 326,675 | 262,494 | -44,729 | -14.6 |

| Total | 396,962 | 351,435 | 319,812 | 387,373 | 326,680 | -70,282 | -17.7 |

Table 9 shows the number of controlled consignments of softwood and the volume of material notified to FC, by region of origin.

- There are more consignments of softwood arriving from North America than Europe but the European consignments are much bigger in size. In 2019/20 North America was the origin of over half of all consignments of softwood (57.6 per cent) whilst Europe accounted for a third (33.7 per cent). This contrasts with the volume of softwood material where 80.4 per cent originated in Europe in 2019/20 compared to 17.2 per cent from North America.

- In 2015/16 there were 1,169 controlled softwood consignments originating in North America however this fell to 860 in 2019/20. The volume of softwood associated with these consignments also fell, from 84,479m3 in 2015/16 to 56,189m3 in 2019/20. In contrast, controlled softwood consignments from Europe increased from 466 in 2015/16 to 503 in 2018/20 however the volume of material in these consignments decreased from 307,223m3 to 262,494m3.

- Both the number of consignments and the volume of material originating in Oceania have increased with consignments in 2019/20 over 3 times higher than in 2015/16 and volume over 4 times higher than in 2015/16.

- Consignments of softwood from Africa increased to 8 after standing at 0 during the period 2015/16 to 2017/18. This was double the number of consignments compared to the previous year and a corresponding doubling was seen in the volume associated with these consignments.

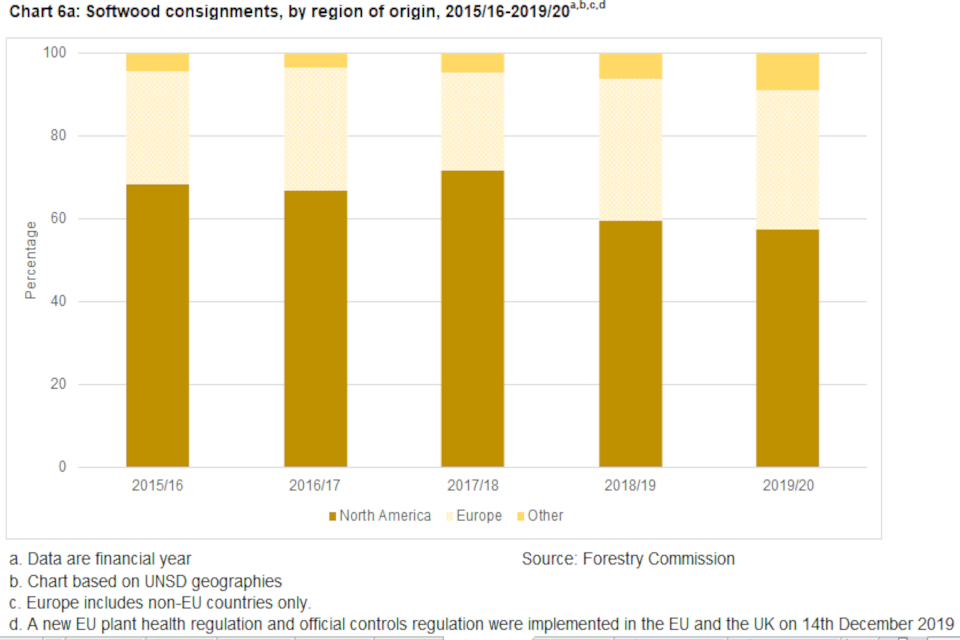

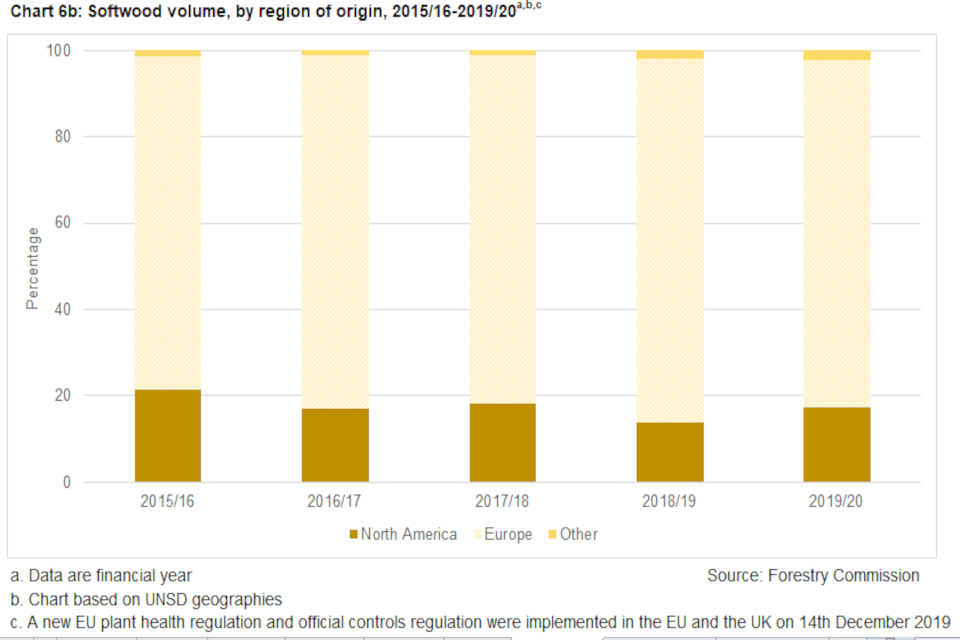

25. Chart 6a and 6b: Softwood consignments and volume, by region of origin, 2015/16-2019/20

25.1 6a Number of consignments

25.2 6b. Volume of material

- The proportion of controlled softwood consignments originating in North America stood at 68.5 per cent in 2015/16 but had decreased to 57.6 per cent in 2019/20. Despite the high number of consignments, the volume of softwood material from North America accounted for only 21.3 of all controlled softwood in 2015/16, falling to 17.2 per cent in 2019/20.

- In contrast, controlled softwood consignments from Europe accounted for 27.3 per cent of all consignments and 77.4 per cent of all volume in 2015/16 increasing to 33.7 per cent of all consignments and 80.4 per cent of all volume in 2019/20.

- The proportion of softwood consignments from ‘other’ regions increased between 2015/16 and 2019/20 (4.2 per cent to 8.6 per cent) whilst the volume of material associated with these consignments also increased (1.3 per cent to 2.4 per cent).

26. Table 10: Controlled consignments of hardwood, by region of origin, 2015/16-2019/20

| 2015/16 | 2016/17 | 2017/18 | 2018/19 | 2019/20 | Value change 2015/16-2019/20 | Percentage change 2015/16-2019/20 | |

|---|---|---|---|---|---|---|---|

| Number of consignments | |||||||

| North America | 2,224 | 2,137 | 1,737 | 2,164 | 1,734 | -490 | -22.0 |

| Europe (non-EU) | 0 | 0 | c | 11 | 20 | 20 | z |

| Total | 2,224 | 2,137 | 1,737 | 2,175 | 1,754 | -470 | -21.1 |

| Volume of notified product (m3) | |||||||

| North America | 113,305 | 168,403 | 83,472 | 189,544 | 84,980 | -28,325 | -25.0 |

| Europe (non-EU) | 0 | 0 | c | 793 | 1,253 | 1,253 | z |

| Total | 113,305 | 168,403 | 83,472 | 190,337 | 86,233 | -27,072 | -23.9 |

Table 10 shows the number of controlled consignments of hardwood and the volume of material, notified to FC, by region of origin.

- The total number of hardwood consignments fell from 2,224 to 1,754 between 2015/16 and 2019/20. The decrease was driven by a 22.0 per cent fall in consignments from North America.

- The volume of controlled hardwood decreased from 113,305m3 to 86,233m3 between 2015/16 to 2019/20 reflecting a fall of one quarter in material from North America.

- In 2019/20 the total volume of hardwood material (86,233m3) was less than half the amount of material imported in 2018/19 (190,337m3).

27. Table 11: Controlled consignments of oak and ash timber, 2015/16-2019/20

| 2015/16 | 2016/17 | 2017/18 | 2018/19 | 2019/20 | Value change 2015/16-2019/20 | Percentage change 2015/16-2019/20 | |

|---|---|---|---|---|---|---|---|

| Number of consignments | |||||||

| Ash | 362 | 329 | 285 | 335 | 240 | -122 | -33.7 |

| Oak | 1,747 | 1,681 | 1,330 | 1,562 | 1,227 | -520 | -29.8 |

| Total | 2,109 | 2,010 | 1,615 | 1,897 | 1,467 | -642 | -30.4 |

| Volume of notified product (m3) | |||||||

| Ash | 13,141 | 13,538 | 10,537 | 11,531 | 22,128 | 8,987 | 68.4 |

| Oak | 55,305 | 109,695 | 41,524 | 140,852 | 38,330 | -16,975 | -30.7 |

| Total | 68,446 | 123,233 | 52,061 | 152,383 | 60,458 | -7,988 | -11.7 |

Ash originating in Canada, China, Japan, Mongolia, North Korea, South Korea, Russia, Taiwan and USA and Oak (Quercus suber) originating in the USA are both controlled and account for the majority of controlled hardwood imports.

- Oak and Ash accounted for 83.6 per cent of controlled hardwood consignments in 2019/20, having decreased from 94.8 per cent in 2015/16. These two species accounted for 70.1 per cent of the volume of controlled hardwood in 2019/20, an increase from 60.4 per cent in 2015/16.

- Oak accounted for 83.6 per cent of controlled consignments of ash and oak and 63.4 per cent of the associated controlled material in 2019/20, a small increase from 2015/16 in the number of consignments (from 82.8 per cent) but a considerable decrease in the volume of material (from 80.8 per cent).

28. Glossary

Commodity:

A type of plant, plant product, or other article being moved for trade or other purpose [FAO, 1990; revised ICPM, 2001]

Consignment:

A quantity of plants, plant products or other articles being moved from one country to another and covered, when required, by a single phytosanitary certificate (a consignment may be composed of one or more commodities or lots) [FAO, 1990; revised ICPM, 2001]. For PHSI data a consignment is a commodity type declared on a phytosanitary certificate. Some phytosanitary certificates will cover more than one commodity type and so the number of consignments declared will be more than the number of phytosanitary certificates.

Controlled plant products:

Plants and plant commodities which are required to undergo checks for pest and disease on crossing a customs border. For countries within the European Union (EU) this means upon entry to the EU while for countries.

Country of origin:

Country where the plants were grown [FAO, 1990; revised CEPM, 1996; CEPM, 1999]

Customs declaration:

An official document that lists and gives details of goods that are being imported or exported. In legal terms, a customs declaration is the act whereby a person indicates the wish to place goods under a given customs procedure. This legal procedure is described in the Union Customs Code (UCC) (Articles 5 (12) and 158 to 187).

Exports (HMRC trade data):

The country of destination as declared at the time of export. However, where goods can be traded while in transit (e.g. grain and crude oil), this may not necessarily be the final destination of the goods.

Food and crops:

Commodities traded for the primary purpose of human consumption.

Forestry:

Timber and wood commodities but not live trees.

Fruit:

The sweet and fleshy product of a tree or other plant that contains seed and can be eaten as food.

Hardwood:

Timber from broadleaved trees.

Imports (HMRC trade data):

The country from which the goods were originally dispatched to the UK without any commercial transaction in any intermediate country (either with or without breaking bulk in the course of transport). This is not necessarily the country of origin, manufacture or the last country from which the goods were shipped to the UK.

Inspection:

Official visual examination of plants, plant products or other regulated articles to determine if pests are present or to determine compliance with phytosanitary regulations [FAO, 1990; revised FAO, 1995; formerly “inspect”].

Non-EU European countries:

Countries outside of the European Union but geographically part of Europe.

‘Other’ commodities:

Plants and parts of plants (including seeds and fruits) used primarily in perfumery or pharmacy or for insecticidal, fungicidal or similar purposes.

Phytosanitary certificate:

An official paper document or its official electronic equivalent, consistent with the model certificates of the IPPC, attesting that a consignment meets phytosanitary import requirements [FAO, 1990; revised CPM, 2012]

Plants and plant commodities:

Goods including plants, trees, bulbs, seeds, fruit, vegetables and timber. Commodities are included if they are (1) raw plant products or (2) simply processed, i.e., processed in a manner that would not, in theory, remove the pest and disease risk.

Plants and planting material:

Live or dormant plants, seeds, bulbs or tubers of plants and trees and cut flowers.

Simple processing:

Simple processing can include peeling, grinding, chopping and debarking but excludes cooking, fermenting and preservation in liquid. For further information please see International Standards for Phytosanitary Measures; ISPM No. 32; Categorisation of commodities according to their pest risk (2009).

Softwood:

Timber from coniferous trees.

Vegetable:

A plant or part of a plant used as food, such as a cabbage, potato, turnip, or bean.

-

Includes raw products and those that can be defined as ‘simply processed’. Please see the glossary at the end of this document and the associated quality and methodology report for more information. ↩

-

Tree health legislation and [Plant health controls[(https://www.gov.uk/guidance/plant-health-controls). ↩

-

Plant Health is devolved thus Scotland carries out its own plant health inspections. ↩

-

Information on methodology and quality for HMRC overseas trade statistics can be accessed at: HMRC trade statistics - policies and methodologies ↩

-

Food Standards Agency - Multi-Annual National Control Plan ↩

-

Guidance on importing plants, fruit, vegetables, cut flowers and other regulated objects to the UK and Guidance on importing wood, wood products or bark from non-EU countries ↩

-

Guidance on issuing plant passports to trade plants in the EU and [Guidance on importing and exporting wood and timber products(https://www.gov.uk/government/collections/importing-and-exporting-wood-and-timber-products) ↩