Public spending statistics: July 2022

Published 20 July 2022

Introduction

This National Statistics release is intended to provide comprehensive information on public spending. Data are arranged thematically by section. Each section contains overview commentary on the statistics being released, statistical tables, and further background information. The key data being updated in this release are for the years 2017-18 to 2021-22. This release contains the first estimate of 2021-22 outturn. All data in this release are National Statistics and are on an outturn basis. Where major revisions to the data for past years have been made we refer to them in the text accompanying the tables. Further background detail is found in the accompanying background material published alongside this release. HM Treasury Public Spending Statistics provide a range of information about public spending. Further detailed explanations are provided in the PSS guidance document. This information can be found on the main release page. The release is classified as National Statistics and conforms to the rules and principles set out in the Code of Practice for Official Statistics overseen by the United Kingdom Statistics Authority.

A user survey gathering feedback on the outturn data presented in the Public Spending Statistics National Statistics releases, has been launched this year. This data also feeds into the PESA outturn statistics. Please note, this also includes a brief guide on some of the statistics within these publications, and some examples of their presentation. If you would like to access the survey to assist with user feedback and share your views, please follow this link: Public Spending Statistics user survey

Related releases from HM Treasury

- The PESA command paper is an annual release, containing plans data for the Spending Review period, alongside the data contained in this release.

- The quarterly public spending statistics releases update the key series found in this release.

- Changes to this release have been made in response to requests from the United Kingdom Statistics Authority and feedback received from users. We welcome further user feedback at [email protected]

What’s new

- The ongoing pressures faced by some departments, due to the impact of the pandemic, may again lead to delays in the laying of some annual reports and accounts (ARAs) this year[footnote 1]. As a result, the 2021-22 outturn published in PESA may be subject to data quality issues, as not all departments will have been able to align data to their ARAs. The public spending statistics (PSS) release, published on a quarterly basis, will reflect any later revisions made by departments to their 2021-22 outturn.

- In September 2021 the government announced that the Ministry of Housing, Communities and Local Government (MHCLG) would be renamed the Department for Levelling Up, Housing and Communities (DLUHC). The department name DLUHC is used in the release tables to reflect this change.

- From 2022-23 departments have adopted the IFRS16 treatment of leases, resulting in some large adjustments to resource and capital budgets[footnote 2].

- The GDP deflator used for real terms calculations in PESA has been produced by the ONS for outturn and by the OBR for plans, as per previous years. However, it should be noted that in 2020-21 and 2021-22 particularly, it reflects the impact of Covid-19 on calculations of GDP and shows negative growth between the two years. The effects on UK GDP and difficulties involved in calculating GDP at this time have been highlighted by the ONS and it should be noted that the deflator is still subject to revision[footnote 3].

- Chapter 1 includes two new tables: Table 1.7a which shows administration budgets excluding depreciation, and Table 1.8a which shows financial transactions and general capital in Capital DEL (CDEL). These were first published in October 2021 as an update to the July 2021 public spending statistics release[footnote 4] to be consistent with the presentation of data in the 2021 Spending Review.

Departmental budgets

The tables for departmental budgets in chapter 1 bring together information on public expenditure within the current budgeting and control framework. This comprises departmental budgets, including all control totals, as well as reconciling from the budgetary framework to the fiscal aggregates in the National Accounts.

DEL expenditure in real terms (billions)

| Expenditure | 2020-21 | 2021-22 |

|---|---|---|

| Resource DEL | 494.8 | 467.3 |

| Depreciation | 23.8 | 15.5 |

| Capital DEL | 94.9 | 93.0 |

| Total DEL | 565.9 | 544.8 |

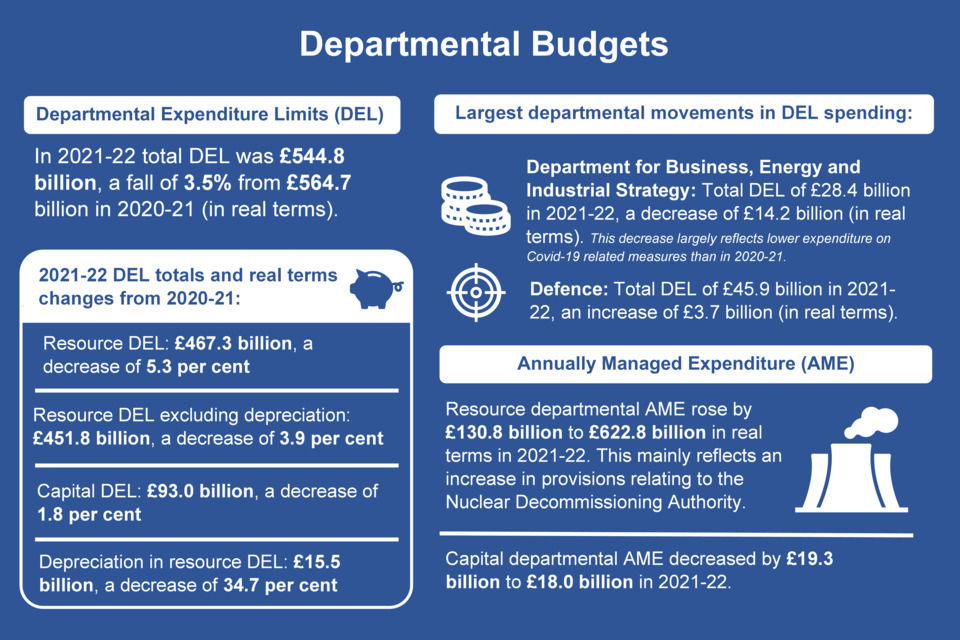

Departmental expenditure limits (DEL)

- Total resource DEL was £467.3 billion in 2021-22, a decrease of 5.3 per cent in real terms on the previous year.

- Total resource DEL (RDEL) excluding depreciation was £451.8 billion in 2021-22, a decrease of 3.9 per cent in real terms on the previous year.

- Depreciation in resource DEL was £15.5 billion in 2021-22, a decrease of 34.7 per cent in real terms on 2020-21.

- Total capital DEL was £93.0 billion in 2021-22, a decrease of 1.8 per cent in real terms on the previous year.

- Total DEL in real terms decreased by 3.5 per cent in 2021-22 from £564.7 billion in 2020-21 to £544.8 billion. The largest decrease in DEL spending in real terms in 2021-22 was for Business, Energy and Industrial Strategy which was down by £14.2 billion to £28.4 billion. This decrease was largely a result of expenditure related to Covid-19 measures in 2020-21.

Total Departmental Expenditure Limits, 2021-22 (£millions)

For the full table, including years from 2017-18 onward, please refer to Table 1.10 in the accompanying Chapter 1 tables ODS file.

| Departmental Group | Total DEL |

|---|---|

| Health and Social Care | 189,758 |

| Education | 75,681 |

| Home Office | 15,295 |

| Justice | 10,187 |

| Law Officers’ Departments | 682 |

| Defence | 45,929 |

| Single Intelligence Account | 3,356 |

| Foreign, Commonwealth and Development Office | 9,282 |

| DLUHC - Housing and Communities | 9,001 |

| DLUHC - Local Government | 21,262 |

| Transport | 29,728 |

| Business, Energy and Industrial Strategy | 28,354 |

| Digital, Culture, Media and Sport | 2,530 |

| Environment, Food and Rural Affairs | 5,541 |

| International Trade | 520 |

| Work and Pensions | 9,334 |

| HM Revenue and Customs | 6,185 |

| HM Treasury | 411 |

| Cabinet Office | 1,439 |

| Scotland | 42,247 |

| Wales | 19,455 |

| Northern Ireland | 15,942 |

| Small and Independent Bodies | 2,702 |

Annually Managed Expenditure (AME)

- Resource departmental AME increased by £130.8 billion to £622.8 billion in real terms in 2021-22. This is mainly reflects increased expenditure for Business, Energy and Industrial Strategy in relation to Cost of Living measures.

- Capital departmental AME decreased by £19.3 billion to £18.0 billion in 2021-22.

Departmental AME expenditure in real terms (billions)

| Expenditure | 2020-21 | 2021-22 |

|---|---|---|

| Resource departmental AME | 492.0 | 622.8 |

| Capital departmental AME | 37.3 | 18.0 |

| Total departmental AME | 529.2 | 640.8 |

Economic analysis of budgets

The tables in chapter 2 of Public Spending Statistics present an analysis by economic category of the budgeting aggregates shown in chapter 1. A description of the economic categories referred to below can be found in the main chapter text of PESA.

Treatment of Coronavirus funding in departments’ budgets

Following the Coronavirus outbreak in 2020, the government announced it was making additional funding available to provide support for households and businesses. In total, departments spent £121.2 billion of RDEL and £5.8 billion of CDEL on COVID-19 related activity in 2020-21. In 2021-22 departments were provided with a further £81.0 billion of RDEL and £2.4 billion of CDEL[footnote 5]. In the OSCAR data supplied by departments and used to produce PESA, it is not always possible to separate Coronavirus related expenditure from departments’ day-to-day spend on existing programmes and economic categories[footnote 6]. Additional expenditure by the NHS on PPE, for example, will be reflected as a higher total for gross current procurement in resource DEL in 2020-21 and 2021-22, but it is not possible to see from the OSCAR data how much of that increase is due to the Coronavirus. Where it has been possible to identify new programmes in the PESA data, they are treated as follows in Table 2.1:

DEL resource budget

-

Current grants to local government: £20.7 billion in 2020-21 and £14.4 billion in 2021-22. This includes Covid Business Support Grants, the Expanded Retail Discount and direct support for local authorities.

-

Subsidies to private sector companies: £12.4 billion in 2020-21 and £1.2 billion in 2021-22 on Covid Business Support Grants, Bounce Back Loan Schemes and Covid Business Interruption Loan Schemes.

AME resource budget

-

Subsidies to private sector companies: £78.8 billion in 2020-21 and £16.5 billion in 2021-22. This is expenditure on the Coronavirus Job Retention and Self-Employment Income Support Schemes and the Eat Out to Help Out scheme.

-

Release of provisions: -£10.8 billion in 2020-21 for Covid Business Support Grants

AME capital budget

- Capital grants to private sector companies: £19.8 billion in 2020-21 and -£3.5 billion in 2021-22 for the Bounce Back Loan Scheme (BBLS) and the Business Interruption Loan Schemes (CLBILS and CBILS).

Departments’ individual Annual Reports and Accounts should include an analysis of COVID-19 related expenditure, alongside a summary of the impact of the pandemic on departmental activities and outcomes. Further information on measures announced by the government in response to the Coronavirus pandemic, how much has been spent, and how it is treated in the National Accounts may also be found in publications by the National Audit Office and the Office for National Statistics.

Resource DEL

- Total resource DEL was £467.3 billion in 2021-22, compared to £494.8 billion in 2020-21, in nominal terms.

- Staff costs increased by 5.9 per cent in 2021-22 (to £152.0 billion) and gross current procurement rose by 12.0 per cent (to £169.4 billion). A breakdown of gross current procurement by individual departments is shown in table 2.2.

- Expenditure on grants to local government totalled £87.2 billion and subsidies to private sector companies totalled £10.2 billion in 2021-22, a decrease of 3.7 percent and 64.3 per cent, respectively. The large fall in subsidies reflects higher covid related spend in 2020-21 compared to 2021-22. The financing of local government expenditure is examined in more detail in chapter 7.

- Spending on administration, composed mainly of pay and procurement, stood at £11.8 billion in 2021-22. This is a rise of 7.0 per cent from the previous year.

Resource AME

- Resource departmental AME increased by £129.8 billion to £622.8 billion in 2021-22. The largest component of spending within resource AME is made up of grants to persons and non-profit bodies, which is mainly social security benefits. Expenditure on this heading rose by 0.6 per cent to £237.3 billion in 2021-22 from £235.9 billion in the previous year.

- In table 2.1 for resource departmental AME, take up of provisions showed the largest increase in 2021-22 of 1358.4 per cent, with a total of £177.5 billion up from £12.2 billion the previous year. This reflects increased provisions by Business, Energy and Industrial Strategy on Nuclear Decommissioning.

- Depreciation increased to £64.0 billion from £58.1billion in 2020-21. This reflects, in part, changes in the fair value of financial assets held by HM Treasury in 2021-22.

Capital budgets

- Capital spending within budgets was £111.1 billion in 2021-22, a decrease of 16.0 per cent on the previous year. The majority of capital spending occurred within DEL.

- Within capital budgets, gross capital procurement increased by £8.2 billion and capital support for local government decreased by £1.5 billion in 2021-22. These are broken down by department in Tables 2.3 and 7.3 respectively.

- Capital grants to private sector companies decreased by £23.0 billion in 2021-22, reflecting expenditure on the Covid-19 measures in 2020-21 (as outlined above). Net lending and investment to the private sector and abroad increased by £1.0 billion to £25.7 billion in 2021-22.

Treatment of financial sector interventions in budgets

In the pre-Budget report of December 2009 the use in fiscal policy of new aggregates excluding the temporary effects of financial interventions was introduced. In these aggregates, banks classified to the public sector in the National Accounts (Northern Rock, Bradford & Bingley, Dunfermline, Lloyds Banking Group and Royal Bank of Scotland) were treated as if they were outside the public sector, reflecting the government’s intention to return these banks or their assets to the private sector. Only Royal Bank of Scotland is still classified to the public sector. The financial sector interventions are treated as follows in Table 2.1:

Resource budget

- Income from sales of goods and services: less than £0.1 billion for 2017-18 and 2018-19. This is mainly underwriting commission and guarantee fee income;

- Depreciation: In 2017-18 there was an impairment of £0.4 billion, followed by gains of £14.0 billion in 2018-19 and £35.2 billion in 2019-20. There were impairments of £44.8 billion and £47.9.0 billion in 2020-21 and 2021-22 respectively.

- Other: income of -£0.5 billion in 2017-18, -£1.1 billion in both 2018-19 and 2019-20, -£0.2 billion in 2020-21 and -£0.6 billion in 2021-22. This is mainly interest paid to government and from the sale of shares.

Capital budget

- Net lending to the private sector: -£0.9 billion in 2017-18, -£2.5 billion in 2018-19, -£1.6 billion in 2019-20, -£2.7 billion in 2020-21 and -£3.8 billion in 2021-22. This is mainly lending to banks, the Financial Services Compensation Scheme and the Republic of Ireland and subsequent repayments, and income from the sale of shares in Lloyds Banking Group and the Royal Bank of Scotland. These transactions score within the HM Treasury AME budget in tables in Chapter 1.

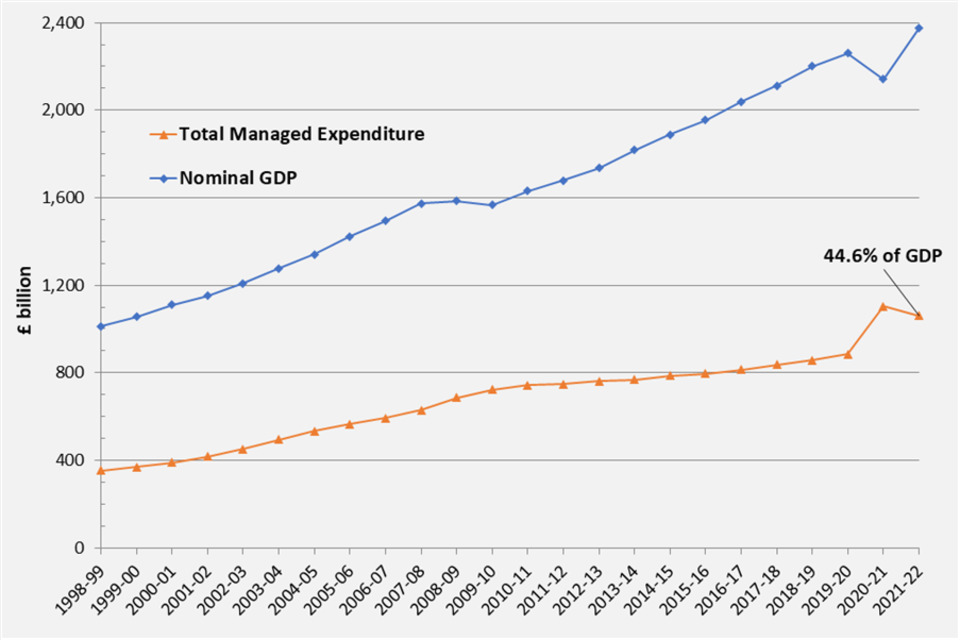

Trends in public spending

The tables in chapter 4 show trends in public spending on a longer run basis than other chapters in this release, in nominal, real (inflation-adjusted) and percentage of GDP terms.

Table 4.1 shows long run trends in Total Managed Expenditure (TME) and its Public Sector Current Expenditure (PSCE) and Public Sector Net Investment (PSNI) components back to 1981-82.

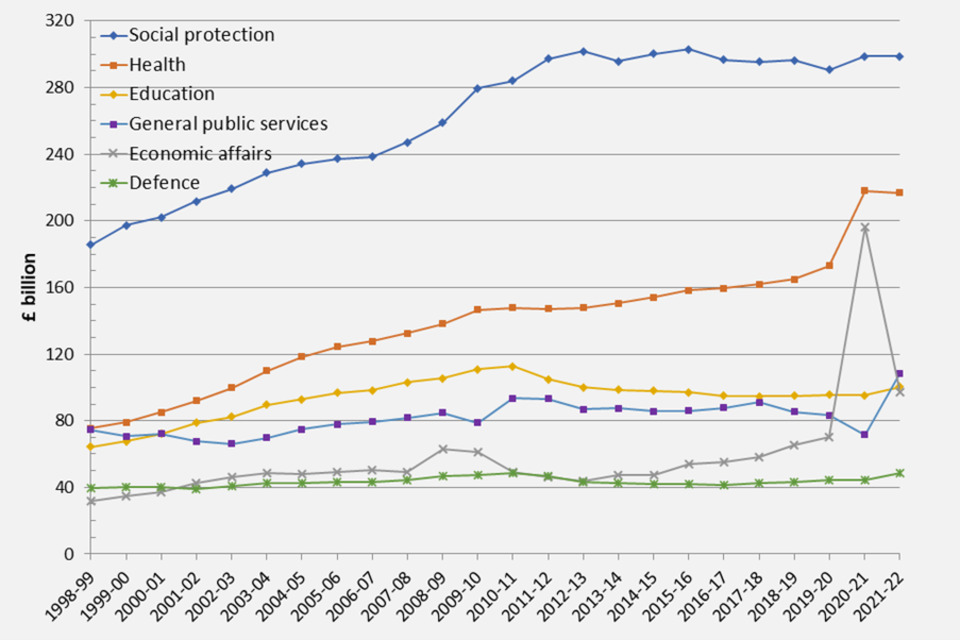

Tables 4.2 to 4.4 show total expenditure on services split by high level spending function (health, education, social protection, etc.) back to 1998-99.

Trends in TME, PSCE and PSNI (Table 4.1)

- During 2021-22, Total Managed Expenditure has decreased in nominal terms by £44.0 billion (4.0 per cent), and also in real (inflation-adjusted) terms by £41.6 billion (3.8 per cent).

- TME as a percentage of GDP, which shows the size of the public sector relative to the size of the whole economy, was 44.6 per cent in 2021-22. This has fallen from 51.6 per cent in 2020-21 where it reflected increased spending and lower GDP as the economy entered recession during the Covid-19 pandemic.

Trends in functional expenditure (Table 4.2 to 4.4)

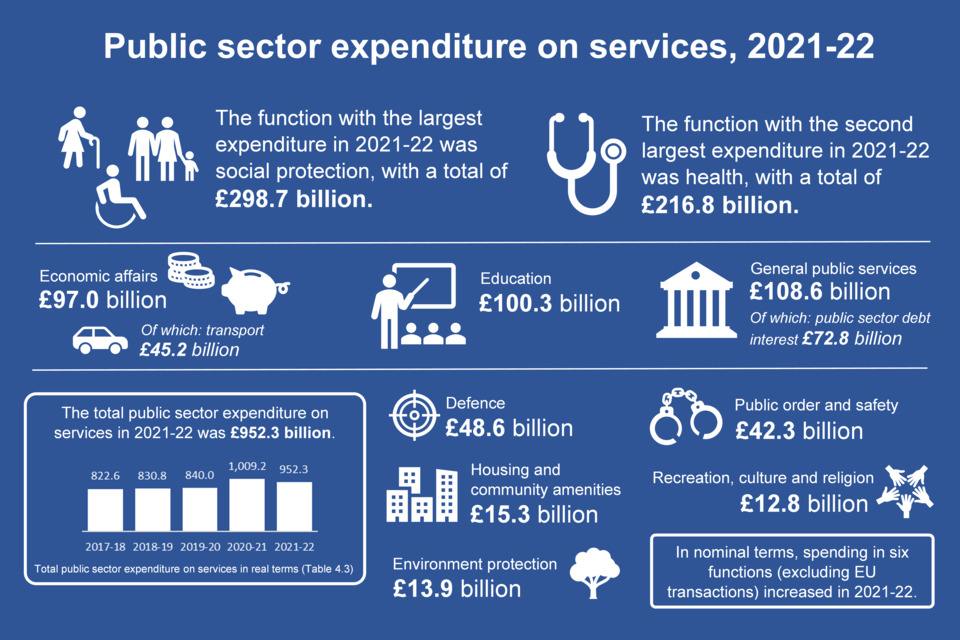

- In real terms, spending in seven of the ten functions (excluding EU transactions) increased whilst spending in three functions fell during 2021-22.

- The largest real terms percentage increases were in ‘General public services’ (51.9 per cent), mainly as a result of an increase in public sector debt interest, and in ‘Housing and community amenities’ (12.7 per cent).

- The largest real terms decreases in spending were in ‘Economic affairs’ (-50.5 per cent), mainly due to higher expenditure in 2020-21 for Covid-19 related measures, and in ‘Recreation, culture and religion’ (-0.7 per cent).

- Spending on ‘Health’ shows a nominal and real terms decrease in 2021-22 (0.8 per cent in nominal terms, 0.6 per cent in real terms). This reflects a fall in expenditure in 2021-22 for Covid-19 related measures.

- For greater detail see Table 5.2, which shows a breakdown of public spending at the sub-functional level.

From 2011-12 onwards the ‘grant-equivalent element of student loans’ is no longer part of the TES framework and has therefore been removed from the Education function. Therefore figures are not directly comparable between 2010-11 and 2011-12. A full explanation of this decision can be found in PESA 2016 Annex E.

Public sector spending by function, sub-function and economic category

- The tables in chapter 5 of this release present analysis of total public sector expenditure on services split by function, sub-function and economic category.

- Year on year changes on a functional basis as described below are derived from tables 4.2 or 5.4, whilst sub-functional changes year on year are derived from table 5.2.

- These presentations are more stable between years than presentations of data by government department on a budgeting basis (Chapters 1 and 2) because they are not affected by changes in the structure of Government over time.

Functional tables

- In nominal terms, spending in six of the ten functions (excluding EU transactions) increased in 2021-22.

- The largest increases in percentage terms were in ‘General public services’ (51.6 per cent), ‘Housing and community amenities’ (12.4 per cent), and ‘Defence’ (9.0 per cent).

- The two functional decreases in percentages terms were in ‘Economic affairs’ (-50.6 per cent) and ‘Recreation, culture and religion’ (-0.9 per cent).

Sub-functional tables

- The largest nominal spending increase by function in 2021-22 was in ‘General public services’, which rose by £37.0 billion to a total of £108.6 billion (an increase of 51.6 per cent). This was largely driven by an increase of £31.0 billion in ‘Public debt transactions’, of which ‘Central government debt interest’ increased by £30.5 billion.

- ‘Education’ saw the second largest nominal increase in 2021-22 of £4.7 billion, of which ‘Secondary education’ rose by £3.8 billion and ‘Pre-primary and primary education’ by £1.0 billion.

- ‘Defence’ saw the third largest nominal increase in 2021-22 of £4.0 billion (an increase of 9.0 per cent). The main contributor to this increase was military defence which rose by £3.3 billion during this period and was largely driven by the purchase of assets and the purchase of goods and services.

Central government own expenditure

The tables in chapter 6 of Public Spending Statistics (PSS) present analyses of central government own expenditure. This is spending by government departments and other central government bodies on their own activities. Central government support for local government and capital support for public corporations is not included.

- Tables 6.1 to 6.3 show central government expenditure on a budgeting basis, consistent with the data shown in chapters 1 and 2.

- Tables 6.4 to 6.6 show expenditure on services, consistent with chapters 4 and 5.

Expenditure in budgets

- Central government own expenditure within DEL stood at £403.0 billion in 2021-22, down 3.6 per cent on the total of £418.0 billion in 2020-21.

- Expenditure within AME increased to £635.8 billion in 2021-22 from £516.3 billion in 2020-21. The increase in AME is largely due to new provisions in 2021-22 relating to the Nuclear Decommissioning Authority.

Expenditure on services

- Central government’s own current expenditure on services decreased to £712.8 billion in 2021-22, from £750.8 billion the previous year. Capital expenditure on services decreased from £88.4 billion in 2020-21 to £65.2 billion in 2021-22.

- As shown in Table 6.4, ‘Social protection’ and ‘Health’ together account for more than half of all of central government own expenditure on services. In 2021-22 spending on social protection increased to £243.5 billion compared to £242.8 billion in the previous year.

- Expenditure on ‘Central government debt interest’ increased from £39.4 billion in 2020-21 to £69.9 billion in 2021-22, an increase of 77.3 per cent.

- Expenditure on ‘Current grants to persons and non-profit bodies’, which is mainly composed of social benefits, fell from £257.3 billion in 2020-21 to £255.4 billion in 2021-22.

- Expenditure on ‘Subsidies to private sector companies’ fell by £78.8 billion to £41.3 billion in 2021-22, down from £120.1 billion in 2020-21. This was driven by lower expenditure on Covid-19 related measures.

Local government financing and expenditure

Chapter 7 analyses central government support for local government within budgets (tables 7.1 to 7.3) and local government expenditure on services (tables 7.4 to 7.8). It deals primarily with Great Britain, as most equivalent spending in Northern Ireland is central government spending carried out by Northern Ireland departments.

Central government support for Local government

- Total central government support in DEL was £98.5 billion in 2021-22, down from £103.3 billion the year before. Support in AME rose from £47.6 billion to £49.2 billion over the same period.

- Capital support for local government fell from £13.8 billion in 2020-21 to £12.3 billion in 2021-22.

Local government expenditure on services

- Total local government current expenditure on services was £143.7 billion in 2021-22, down from £145.6 billion in 2020-21. Over the same period total local government capital expenditure on services rose to £20.7 billion from £18.8 billion.

- As shown in table 7.4, local government current expenditure on ‘Education’ showed an increase from £42.8 billion in 2020-21 to £44.9 billion in 2021-22.

- Local government current expenditure rose in 2021-22 for four of the ten functions. The increases were seen in ‘Education’ (up £2.1 billion), ‘Public order and safety’ (up £0.6 billion), ‘Housing and community amenities’ and ‘Environment protection’ (both up £0.2 billion) over the same period.

- A breakdown of local government expenditure by economic category is shown in table 7.8. Spending on pay, which amounted to £68.5 billion in 2021-22, accounts for over 41 per cent of all spending on services by local government. The majority of this was within the education and public order and safety functions.

Public corporations

Chapter 8 analyses the impact of public corporations on departmental budgets and expenditure on services.

Tables 8.1 and 8.2 examine the impact on departmental budgets (DEL and departmental AME), breaking this down by economic category and departmental group.

Tables 8.3 to 8.5 analyse capital spending by public corporations. They break the expenditure down by individual public corporations as well as by function and economic category. Debt interest payments to the private sector, which is the only public corporation current spending that forms part of Total Managed Expenditure (TME), is also included.

- Public corporations’ capital expenditure was £13.7 billion in 2021-22, up from £10.5 billion the year before.

- Out of this total, expenditure by the Housing Revenue Account (for England, Scotland and Wales) was £5.6 billion, up from £4.4 billion the previous year.

- The other main contributors to public corporations’ capital expenditure were London Underground (as Transport Trading Limited) and Scottish Water.

Public expenditure by country and additional information

Country and regional analysis in this release

The Country and Regional Analysis (CRA) is published each autumn. As a result there are no new substantive data on regional spending for this PSS release. However, the four headline tables of the CRA release published in November 2021 have been included in chapter 9.

Revisions in this release

All of the data contained in the Public Spending National Statistics are open for revision in every publication. The table below summarises the key revisions in this release.

| Revisions to Budgets since July 2021 (£million) | 2017-18 | 2018-19 | 2019-20 | 2020-21 |

|---|---|---|---|---|

| Total Managed Expenditure | -453 | 2,741 | -1,848 | 9,913 |

| Total Departmental Expenditure Limits (DEL) | 14 | 12 | -1 | -3,555 |

| Departmental Annually Managed Expenditure (AME) | 0 | 0 | 7 | 1,177 |

| Other AME | -467 | 2,729 | -1,854 | 12,291 |

| Total resource DEL | 14 | 12 | -1 | -5,212 |

| Total capital DEL | 0 | 0 | 0 | 1,206 |

Figures for Total Managed Expenditure (TME) are taken from the ONS/HM Treasury Public Sector Finances release. The main revisions since last July’s publication are:

- Changes to TME and other AME in all years are due to updated ONS data. More information about these changes is available in the monthly ONS public sector finances (PSF) release.

- Local government expenditure has also been revised.

GDP deflators and population numbers

GDP deflators

A number of the tables in this publication give figures in real terms. Real terms figures are the current price outturns or plans adjusted to a constant price level by excluding the effect of general inflation as measured by the GDP deflator at market prices. The real terms figures in this publication are given in 2021-22 prices. The GDP deflators used in this publication are those given below. The most up to date deflators can be found on the GOV.UK website.

| Financial year | GDP deflator at market prices | Per cent change on previous year | Money GDP (£million) |

|---|---|---|---|

| 1981-82 | 29.199 | 10.53 | 297,719 |

| 1982-83 | 31.347 | 7.36 | 326,894 |

| 1983-84 | 32.844 | 4.78 | 357,532 |

| 1984-85 | 34.713 | 5.69 | 385,441 |

| 1985-86 | 36.646 | 5.57 | 423,319 |

| 1986-87 | 38.171 | 4.16 | 455,208 |

| 1987-88 | 40.349 | 5.71 | 511,132 |

| 1988-89 | 43.059 | 6.72 | 570,568 |

| 1989-90 | 46.466 | 7.91 | 629,075 |

| 1990-91 | 50.361 | 8.38 | 679,572 |

| 1991-92 | 53.354 | 5.94 | 716,288 |

| 1992-93 | 54.817 | 2.74 | 738,955 |

| 1993-94 | 56.248 | 2.61 | 783,211 |

| 1994-95 | 57.042 | 1.41 | 821,875 |

| 1995-96 | 58.801 | 3.08 | 866,242 |

| 1996-97 | 60.899 | 3.57 | 924,297 |

| 1997-98 | 60.642 | -0.42 | 962,708 |

| 1998-99 | 62.027 | 2.28 | 1,012,210 |

| 1999-00 | 62.379 | 0.57 | 1,054,714 |

| 2000-01 | 63.619 | 1.99 | 1,110,346 |

| 2001-02 | 64.947 | 2.09 | 1,151,245 |

| 2002-03 | 66.323 | 2.12 | 1,208,514 |

| 2003-04 | 68.010 | 2.54 | 1,275,904 |

| 2004-05 | 70.029 | 2.97 | 1,341,848 |

| 2005-06 | 72.104 | 2.96 | 1,423,370 |

| 2006-07 | 74.243 | 2.97 | 1,494,225 |

| 2007-08 | 76.318 | 2.80 | 1,572,772 |

| 2008-09 | 78.579 | 2.96 | 1,583,849 |

| 2009-10 | 79.814 | 1.57 | 1,566,720 |

| 2010-11 | 81.145 | 1.67 | 1,631,224 |

| 2011-12 | 82.370 | 1.51 | 1,678,775 |

| 2012-13 | 84.031 | 2.02 | 1,734,589 |

| 2013-14 | 85.956 | 2.29 | 1,817,879 |

| 2014-15 | 86.946 | 1.15 | 1,888,390 |

| 2015-16 | 87.486 | 0.62 | 1,953,366 |

| 2016-17 | 89.442 | 2.24 | 2,039,801 |

| 2017-18 | 90.982 | 1.72 | 2,111,738 |

| 2018-19 | 92.758 | 1.95 | 2,199,704 |

| 2019-20 | 94.865 | 2.27 | 2,260,614 |

| 2020-21 | 100.221 | 5.65 | 2,140,996 |

| 2021-22 | 100.000 | -0.22 | 2,376,012 |

Data are based on the June 2022 National Accounts figures from ONS.

Please note that these deflators do not apply to the real terms Country and Regional Analysis (CRA) tables 9.3 and 9.4 that were originally published in November 2021.

Population numbers by country and region

The population numbers used in Chapter 9 are derived from ONS’s mid-year estimates as used in the November 2021 Country and Regional Analysis release.

ONS’s most recent mid-year population estimates for the UK are directly available online.

Future development of Public Spending Statistics

We would be interested in readers’ views on how PSS might be developed to further increase its value to users. Please write to:

The Editor, PESA

Government Financial Reporting

Floor 2 Red Zone

HM Treasury

1 Horse Guards Road

London

SW1A 2HQ

-

https://www.gov.uk/government/publications/financial-reporting-manual-addendum-2020-21/ ↩

-

IFRS 16 Leases - Supplementary budgeting guidance.docx (publishing.service.gov.uk) ↩

-

Coronavirus and the effects on UK GDP – Office for National Statistics (ons.gov.uk) ↩

-

https://www.gov.uk/government/statistics/public-spending-statistics-release-july-2021/public-spending-statistics-july-2021 ↩

-

For more information on OSCAR see Annex G of PESA 2022. ↩