UK House Price Index summary: November 2022

Published 18 January 2023

1. Headline statistics for November 2022

The average price of a property in the UK was £294,910

The annual price change for a property in the UK was 10.3%

The monthly price change for a property in the UK was -0.3%

The monthly index figure (January 2015 = 100) for the UK was 154.7

Estimates for the most recent months are provisional and are likely to be updated as more data is incorporated into the index. Read Revisions to the UK HPI data.

Next publication of UK HPI

The December 2022 UK HPI will be published at 9.30am on Wednesday 15 February 2023. See the calendar of release dates for more information.

2. Economic statement

The annual percentage change for average UK house prices was 10.3% in the year to November 2022, compared with 12.4% in the year to October 2022 and 9.8% in the year to September 2022.

The average UK house price was £295,000 in November 2022, which is £28,000 higher than this time last year. Average house prices increased over the year to £315,000 (10.9%) in England, to £220,000 in Wales (10.7%), to £191,000 in Scotland (5.5%) and to £176,000 in Northern Ireland (10.7%).

On a non-seasonally adjusted basis, average UK house prices decreased by 0.3% between October and November 2022, while average UK house prices increased by 1.5% during the same period last year.

House price annual growth was strongest in the North West where prices increased by 13.5% in the year to November 2022. The lowest annual growth was in Scotland, where prices increased by 5.5% in the year to November 2022. London was the English region with the lowest annual growth, where prices increased by 6.3% in the year to November 2022.

The Royal Institution of Chartered Surveyors’ (RICS’) November 2022 UK Residential Market Survey reported that overall activity continues to weaken across the sales market, with higher interest rates and a difficult macroeconomic outlook taking their toll on buyer sentiment.

The Bank of England’s Agents summary of business conditions 2022 Q4 reported the supply of homes for sale increased faster than demand with higher borrowing costs and concerns about affordability weighing significantly on demand from first-time buyers.

The UK Property Transactions Statistics showed that in November 2022, on a seasonally adjusted basis, the estimated number of transactions of residential properties with a value of £40,000 or greater was 107,190. This is 13.3% higher than a year ago (November 2021). Between October and November 2022, UK transactions increased by 0.2% on a seasonally adjusted basis.

The Bank of England’s Money and Credit November 2022 release reported that mortgage approvals for house purchases, an indicator of future borrowing, decreased to 46,100 in November 2022, from 57,900 in October 2022. This is the lowest level since June 2020 (40,500).

3. Price changes

3.1 Annual price change

Annual price change for UK by country over the past 5 years

Download this chart’s data (CSV, 1KB)

Average house prices in the UK increased by 10.3% in the year to November 2022, down from 12.4% in October 2022.

At the country level, the highest annual house price percentage change in the year to November 2022 was recorded in England, where house prices increased by 10.9%.

Wales saw house prices increase by 10.7% in the year to November 2022.

Scotland saw houses prices increase by 5.5% in the year to November 2022.

Northern Ireland saw house prices increase by 10.7% over the year to Quarter 3 (July to September) 2022.

3.2 Average price by country and government office region

Price, monthly change and annual change by country and government office region

| Country and government office region | Price | Monthly change | Annual change |

|---|---|---|---|

| England | £315,073 | -0.2% | 10.9% |

| Northern Ireland (Quarter 3 - 2022) | £176,131 | 4.1% | 10.7% |

| Scotland | £191,492 | -1.2% | 5.5% |

| Wales | £220,366 | -1.6% | 10.7% |

| East Midlands | £253,498 | 0.2% | 12.2% |

| East of England | £365,144 | 0.6% | 10.2% |

| London | £542,311 | 0.1% | 6.3% |

| North East | £162,596 | -2.6% | 11.6% |

| North West | £221,224 | 0.4% | 13.5% |

| South East | £402,466 | -0.5% | 10.0% |

| South West | £337,144 | -0.3% | 11.8% |

| West Midlands Region | £256,937 | -0.1% | 12.3% |

| Yorkshire and The Humber | £212,329 | -0.7% | 11.4% |

Download this table’s data (CSV, 1KB)

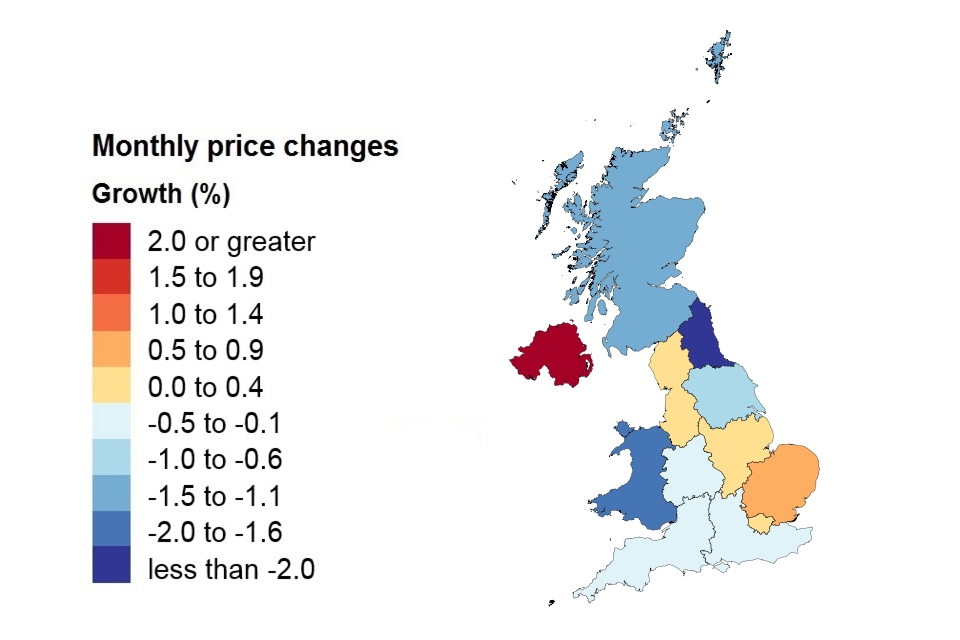

Price changes by country and government office region

On a non-seasonally adjusted basis, average house prices in the UK decreased by 0.3% between October 2022 and November 2022. This is down from an increase of 1.5% during the same period a year earlier (October and November 2021). On a seasonally adjusted basis, average house prices in the UK increased by 0.1% between October 2022 and November 2022.

Note: The Northern Ireland figure represents a 3-month change and is not comparable with the other regions and countries.

3.3 Average price by property type

Average monthly price by property type

| Property type | November 2022 | November 2021 | Difference |

|---|---|---|---|

| Detached | £464,745 | £420,244 | 10.6% |

| Semi-detached | £286,285 | £257,282 | 11.3% |

| Terraced | £242,533 | £216,637 | 12.0% |

| Flat or maisonette | £232,762 | £220,260 | 5.7% |

| All | £294,910 | £267,370 | 10.3% |

Download this table’s data (CSV, 1KB)

4. Sales volumes

The amount of time between the sale of a property and the registration of this information varies. It typically ranges between 2 weeks and 2 months but can be longer. Volume figures for the most recent 2 months are not yet at a reliable level for reporting, so they are not included in the report. Published transactions for recent months will increase as later registered transactions are incorporated into the index.

Sales volume data is also available by property status (new build and existing property) and funding status (cash and mortgage) in our downloadable data tables. Transactions involving the creation of a new register, such as new builds, are more complex and require more time to process. Read Revisions to the UK HPI data for more information.

4.1 Sales volumes

Number of sales volumes by country

Comparing the provisional volume estimate for the current month with the revised volume estimate for the corresponding month in the previous year

| Country | September 2022 | September 2021 |

|---|---|---|

| England | 53,772 | 112,689 |

| Northern Ireland (Quarter 3 - 2022) | 2,134 | 2,821 |

| Scotland | 9,862 | 9,477 |

| Wales | 2,935 | 4,281 |

Note: Comparing the provisional volume estimate for the current month with the revised 12-month volume estimate.

Download this table’s data (CSV, 1KB)

Note: The ‘Difference’ column has been removed from this table as the latest month’s data are not yet complete.

Note: The number of property transactions for September 2022 will increase as more transactions are incorporated into the index. See our Revisions Policy for more information.

Comparing the provisional volume estimate for September 2021 with the provisional estimate for September 2022, volume transactions increased by 31.4% in England, increased by 6.6% in Scotland and increased by 84.6% in Wales. Northern Ireland’s volume transactions decreased by 15.0% in the year to Quarter 3 2022.

UK Property Transaction Statistics published by HM Revenue & Customs (which differ in coverage but are more complete for this period) report that on a non-seasonally adjusted basis, in the year to September 2022 volume transactions decreased by 34.1% in England, decreased by 12.3% in Wales, increased by 6.5% in Scotland, and decreased by 31.2% in Northern Ireland.

4.2 Sales volumes for the UK over the past 5 years

Sales volumes for 2018 to 2022 by country: September

Download this table’s data (CSV, 1KB)

Note: The number of property transactions for September 2022 will increase as more transactions are incorporated into the index. See our Revisions Policy for more information.

Comparing the provisional volume estimate for September 2021 with the provisional estimate for September 2022, UK volume transactions increased by 70.7% in the year to September 2022.

UK Property Transaction Statistics published by HM Revenue & Customs (which differ in coverage but are more complete for this period) report that on a non-seasonally adjusted basis, UK volume transactions increased by 8.1% in the year to September 2022.

5. Property status for UK

Transactions involving the creation of a new register, such as new builds, are more complex and need more time to process. This means they can take longer to appear in the land registers. The volume of new build transactions for the most recent 2 months are not at a reliable level for reporting the breakdown between new build and existing resold property, so they are not included in the report.

New build and existing resold property

| Property status | Average price September 2022 | Monthly change | Annual change |

|---|---|---|---|

| New build | £396,667 | 4.8% | 19.3% |

| Existing resold property | £288,332 | 0.5% | 8.8% |

Download this table’s data (CSV, 1KB)

Note: Since the October 2017 release, amendments have been made to our estimation model when calculating our provisional estimate. Find out further information and the impact of this change in the methods used to produce the UK HPI.

6. Buyer status for Great Britain

First time buyer and former owner occupier

For Great Britain only, Northern Ireland data is not available for buyer status.

| Type of buyer | Average price November 2022 | Monthly change | Annual change |

|---|---|---|---|

| First time buyer | £245,522 | -0.4% | 10.3% |

| Former owner occupier | £345,576 | -0.3% | 10.3% |

Download this table’s data (CSV, 1KB)

7. Funding status for Great Britain

Cash and mortgage

For Great Britain only, Northern Ireland data is not available for funding status.

| Funding status | Average price November 2022 | Monthly change | Annual change |

|---|---|---|---|

| Cash | £279,138 | -0.4% | 9.7% |

| Mortgage | £307,887 | -0.3% | 10.5% |

Download this table’s data (CSV, 1KB)

8. Access the data

Download the data as CSV files or access it with our UK HPI tool.

Data revisions

View any revisions to previously published data in the data downloads or find out more about revisions in our guidance About the UK HPI.

10. About the UK House Price Index

The UK House Price Index (UK HPI) is calculated by the Office for National Statistics and Land & Property Services Northern Ireland. Find out about the methodology used to create the UK HPI.

Data for the UK House Price Index is provided by HM Land Registry, Registers of Scotland, The Land & Property Services/Northern Ireland Statistics & Research Agency and the Valuation Office Agency.

Find out more about the UK House Price Index.

11. Contact

Eileen Morrison, Data Services Team Leader, HM Land Registry

Email [email protected]

Telephone 0300 006 5288

Aimee North, Head of Housing Market Indices, Office for National Statistics

Email [email protected]

Telephone 01633 456400

Ciara Cunningham, Statistician for the Northern Ireland HPI

Email [email protected]

Telephone 028 90 336035

Anne MacDonald, Land & Property Data Team, Registers of Scotland

Email [email protected]

Telephone 0131 378 4991