Section 2 – Landings

Updated 17 December 2024

1. Key Statistics - Landings

In 2023, UK vessels landed 719 thousand tonnes of sea fish with a value of £1.1 billion. Compared to 2022, this is an increase of 12% in quantity and an increase in value of 5%. The increase in value is mainly driven by the increase in landings, although of lower value fish. Landings into the UK by foreign vessels in 2023 was 19 thousand tonnes, which compared to 2022 represents a 6% increase. Landings abroad by UK vessels increased 13% to 279 thousand tonnes.

2. Section 2: Landings

View the tables accompanying this section here.

3. UK summary

In 2023, UK vessels landed 719 thousand tonnes [12] of sea fish into the UK and abroad with a value of £1.10 billion [13]. Compared to 2022, this is an increase in the quantity of sea fish landed (12%), and a 5% increase in value landed.

Multiple factors impact fishing, and landings tend to fluctuate considerably over time. Since 2020, the biggest impact on sea fisheries was the effect of the UK’s departure from the EU. This had an impact on the stocks the UK fleet had access to fish in subsequent years.

Value is reported in current prices, or as the value at the time of the transaction. No adjustments have been made to account for changes in inflation over time.

Species groups

Fish are commonly split into three groups of similar species.

-

Demersal fish inhabit the bottom of the ocean. Key demersal species fished by the UK fleet include cod and haddock.

-

Pelagic fish inhabit the water column (not near the seabed or shore). The two main pelagic species fished by the UK fleet are mackerel and herring.

-

Shellfish include various species of molluscs (e.g. scallops, whelks) and crustaceans (e.g. crabs and Nephrops).

The quantity of landings in 2023 increased compared to 2022 driven by an increase (14%) of pelagic species landed. The overall value of landings also increased mainly due to landings of pelagic species, increasing by 17%.

4. Vessel nationality

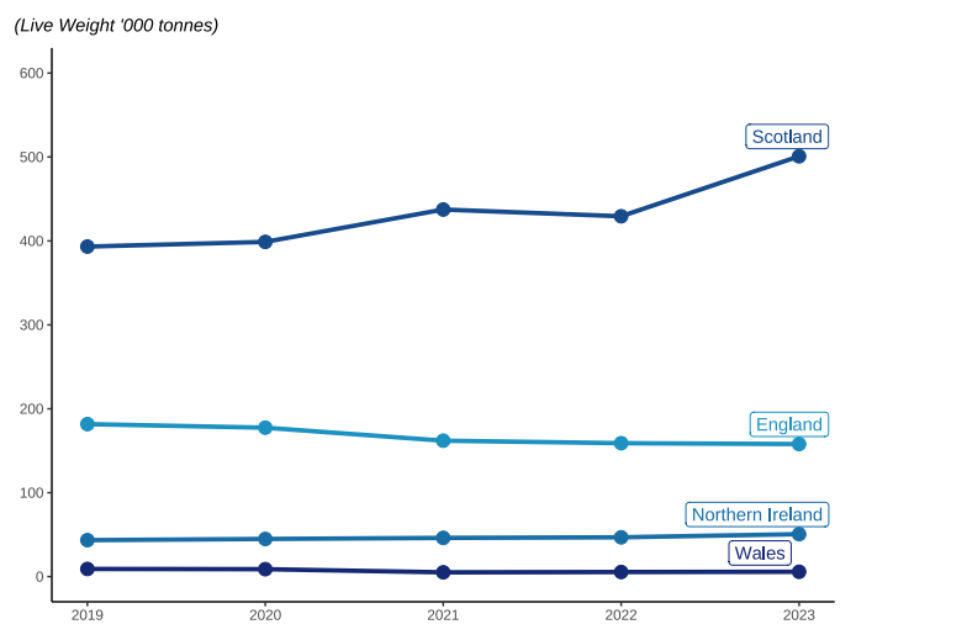

Figure 2.1: Quantity of landings by the UK fleet between 2019 and 2023 by fisheries administration.

Of the four UK nations, Scotland lands the most fish by quantity and value. At the country level, the landed weight of fish by each of the four nations has remained relatively stable over time. However, there was a 17% increase in landings by Scottish vessels between 2022 and 2023. This increase was mainly driven by an increase in landings of pelagic species, which is an important economic sector for the Scottish fleet, due to an increase in quota for key pelagic species including Mackerel and Blue Whiting in 2023.

5. Vessel length

Over three quarters of the total quantity of fish caught by UK vessels in 2023 was landed by vessels over 24 metres in length. In 2023, these vessels represented just 4% of the UK fleet by number. The large volume of landings by these large vessels is explained by their very high fishing capacity and power.

Landings of pelagic species by vessels over 24 metres in length accounted for 97% of the annual total pelagic landings for the whole UK fleet. 74% of all landings of demersal species by the UK fleet were by vessels over 24 metres in length.

In contrast, landings of shellfish are more evenly distributed across the fleet, with vessels 10 metres and under in length accounting for 22% of the total quantity of shellfish landings. Landings of shellfish made by over 24m vessels accounted for 63% of shellfish landings.

Table 2.2: Quantity of landings by UK vessels 10m and under and over 10m.

| Vessel Length | 2022 | 2023 | Percentage Change |

| Quantity (‘000 Tonnes) | |||

| 10m and under | 32.6 | 34.0 | 4% |

| Over 10m | 612.2 | 685.2 | 12% |

| Value (£ million) | |||

| 10m and under | 129.9 | 134.2 | 3% |

| Over 10m | 921.8 | 970.5 | 5% |

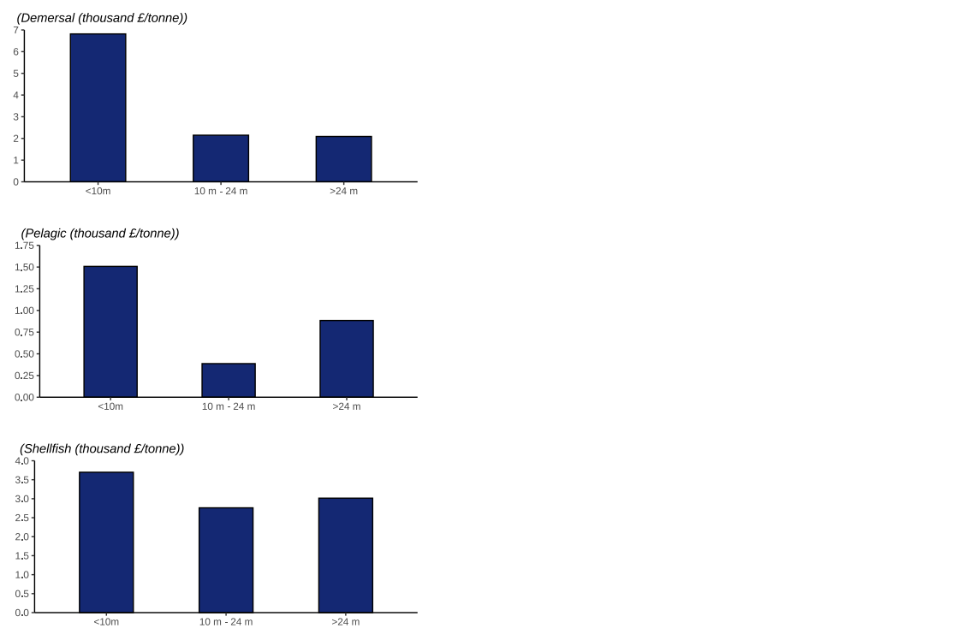

Figure 2.3: Value of landings by the UK fleet in 2023 by fishing vessel length and species group.

Overall, vessels under 10 metres fetch a higher price per tonne for their landings (£3,900) compared to vessels over 24 metres (£1,200). This is especially true for demersal catches. Landings of demersal species by larger vessels tend to be frozen on board the vessel and sold in bulk, contributing to their lower price per tonne.

6. Industry group[14]

Around 90% of the quantity of landings by the UK fleet in 2023 were landed by vessels in a Fish Producer Organisation (FPO) [15]. The vessels registered with the largest FPO, Scottish FPO, accounted for 20% of the quantity and 19% of value of fish landed by the UK fleet.

Some Producer Organisations target specific species groups. For example, vessels in Klondyke, Interfish, Humberside FPO, Lunar Group and Anglo Northern Irish primarily target pelagic species. Other FPOs are segregated more by region. For example, Wales and West Coast FPO and South Western FPO.

Over a third of UK vessels over 10 metres in length were in the non-sector (vessels without Producer Organisation membership). These vessels typically have limited access to fishing quota [16] and primarily target shellfish species, which are mostly non-quota stocks. In 2023 they caught 48% of all shellfish, 3% of demersal and 1% of pelagic species landed by the UK fleet.

Vessels 10 metres and under in length without Producer Organisation membership (the ‘10 metre and under pool’) also landed relatively small quantities of demersal and pelagic species, with 81% shellfish landings. The fishing methods used by this sector and the different species targeted mean that they typically gain higher than average prices for their catch (Figure 2.3).

7. Species group

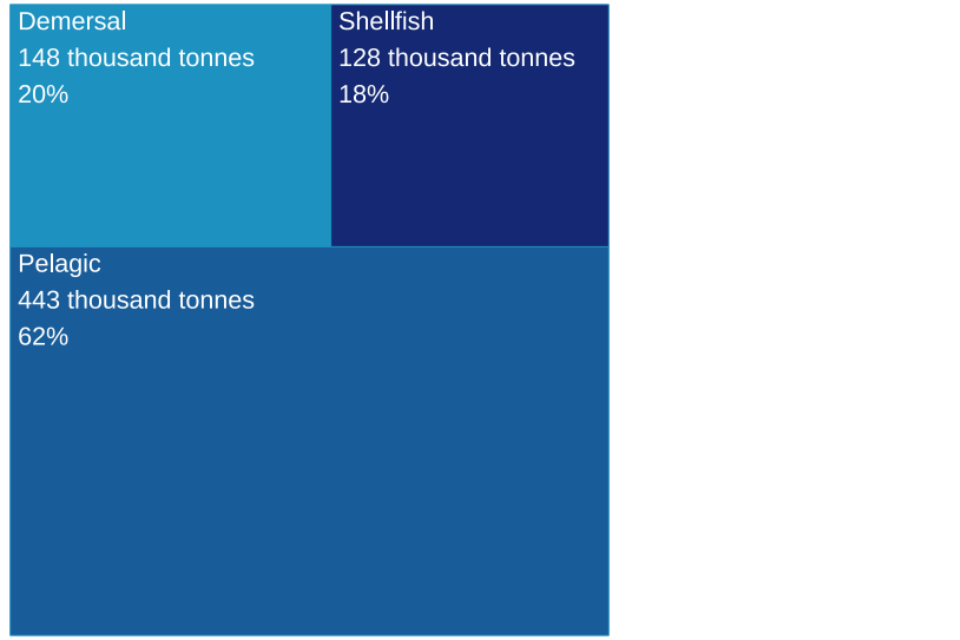

Figure 2.4: Quantity of landings by UK vessels in 2023 by species group.

Pelagic species make up 62% of the total quantity of landings by UK vessels, while only contributing just over a third of the value landed [17]. This is because pelagic species typically fetching a lower price per tonne. Shellfish landings made up 18% of the total quantity landed but accounted for 35% of the value landed, which was slightly less than the value of pelagic landings.

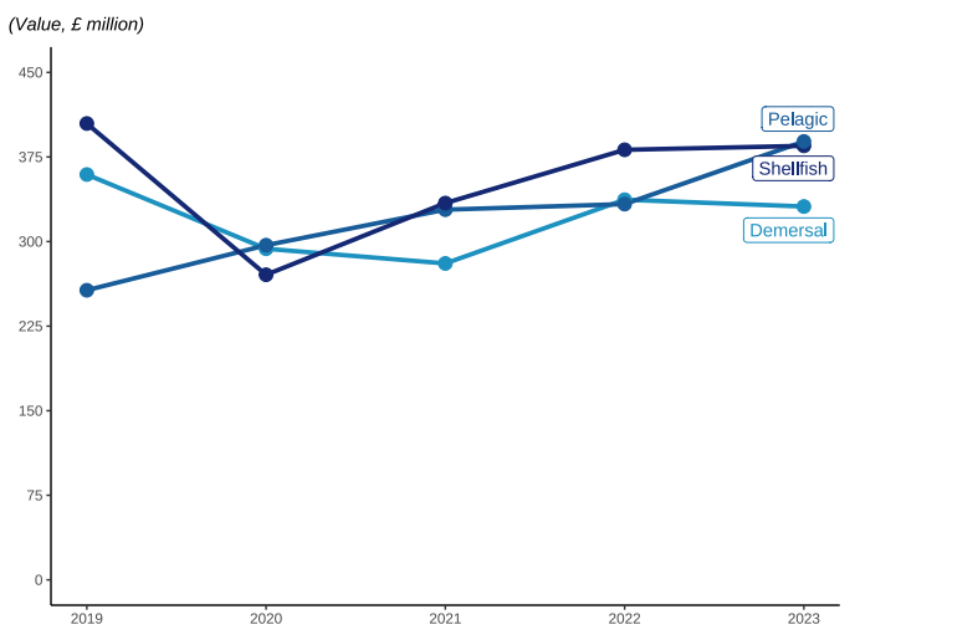

Figure 2.5: Value of landings by UK vessels between 2019 and 2023 by species group.

The value of landings increased in 2023 for pelagic and shellfish, with a slight decrease for demersal species when compared to 2022.

The quantity of demersal landings increased by 8% while the value of those landings decreased by 2%. Shellfish landings increased by 5% and their value also increased by 1%.

8. Demersal

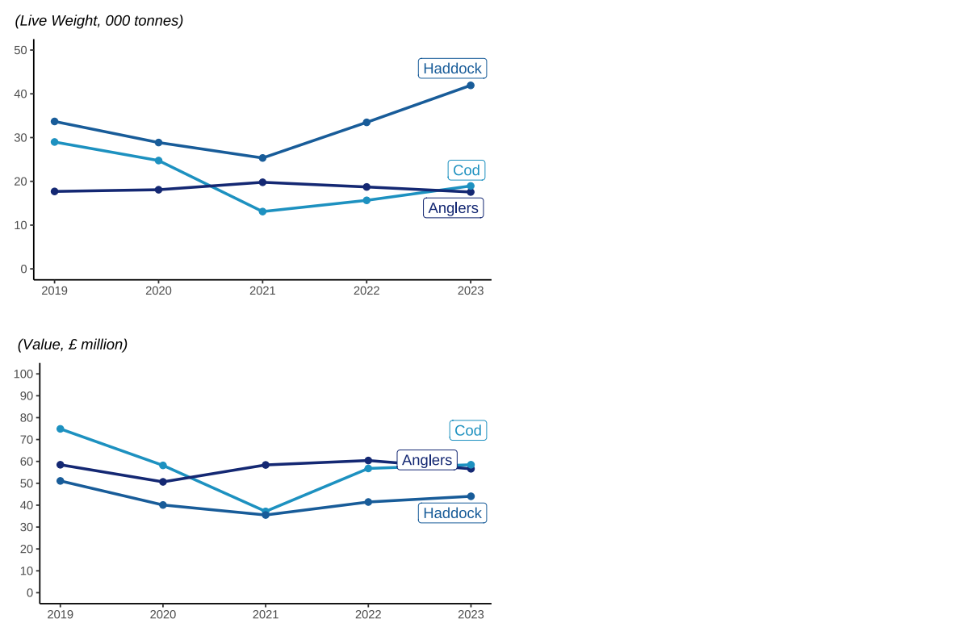

Figure 2.6: Quantity and value of landings between 2019 and 2023 by UK vessels of different demersal species fish; Cod, Haddock, and Monks or Anglers.

Landings of key demersal species, specifically cod and haddock, increased in 2023. Landings of cod increased compared to 2022 (21%) leading to an increase in the value landed (3%).

Landings of demersal species, particularly cod and haddock, have fallen considerably since 1996. This follows the long-term declining trend reported since 1938 [18]. In 2023, landings of demersal fish were around 17% of the quantity landed in 1938.

The decline in landings of demersal fish has several causes, including reductions in fleet size, declining fish stocks and restricted fishing opportunities. National and international regulations have limited demersal fishing activity in recent decades, through decommissioning of fishing vessels, reductions in quotas and fishing effort limits and other provisions of stock management plans.

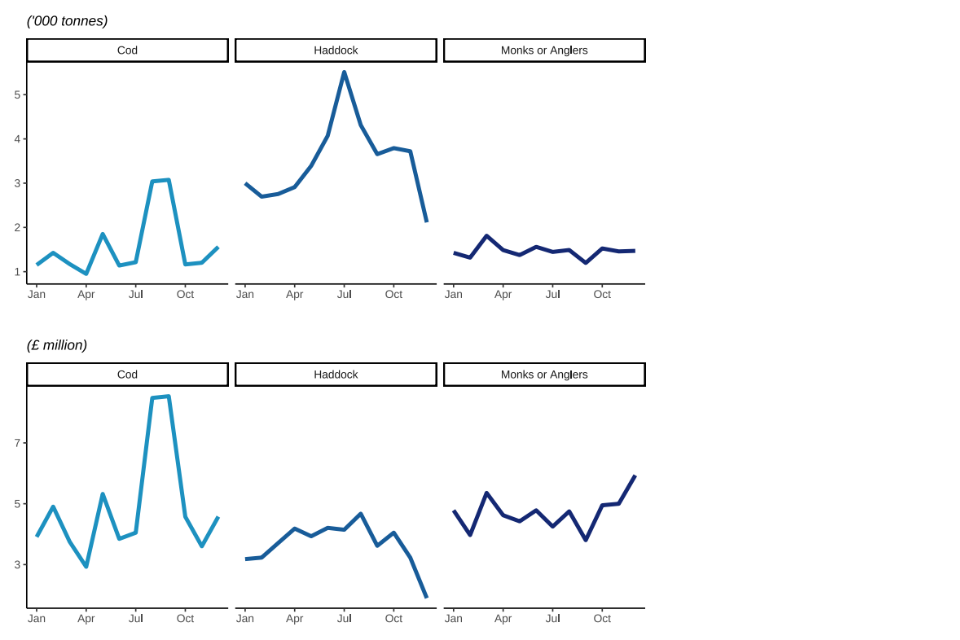

Figure 2.7: Quantity and value of landings in 2023 by UK vessels of different demersal species fish; Cod, Haddock, and Monks or Anglers.

Landings of cod fluctuate more than haddock and anglerfish as the UK’s distant water fleet has targeted cod in e.g., Faroese waters and the waters around Svalbard. The distant water fleet are vessels that fish outside their own territories and often into other countries Exclusive Economic Zones (EEZ) and international waters. These large vessels can be out to sea for months and land huge volumes of fish at a time. This explains the spikes in quantity landed every few months.

Sole, turbot and halibut all command the highest price of demersal species landed by the UK fleet, ranging between £11,000 and £15,000 per tonne in 2023 [19]. These high prices, particularly for sole, are likely down to reduced supply following the introduction of the Sole Recovery Zone [20].

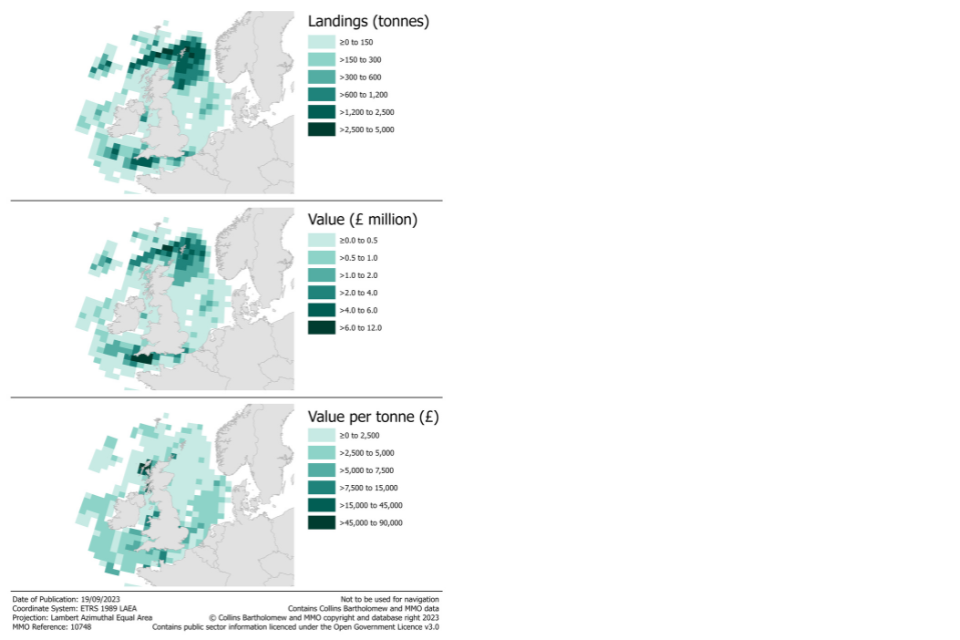

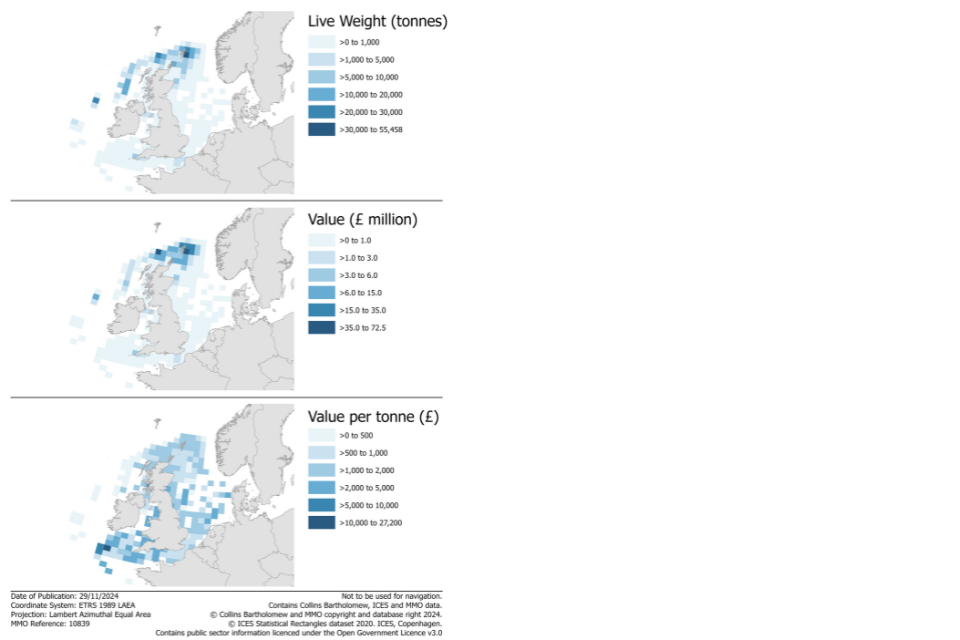

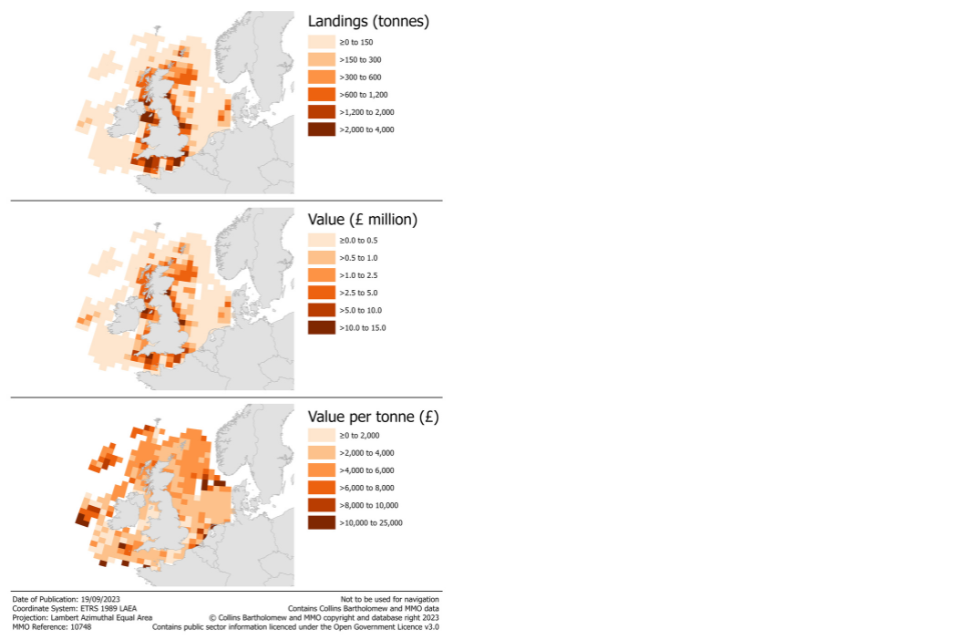

ICES rectangle

The International Council for the Exploration of the Seas (ICES) standardise the division of sea areas for analysis. Each ICES statistical rectangle is 30 min latitude by 1-degree longitude, which is approximately 30 nautical miles by 30 nautical miles. Note that the area of ICES rectangles varies because the Earth is a sphere. ICES rectangles are amalgamated to create ICES areas.

The following maps show landings of demersal species by the UK fleet in 2023 by ICES rectangle of capture. In 2023, the largest quantities and value of demersal species caught by the UK fleet were in the north-east of Scotland and the English Channel. Demersal species with the highest average prices were captured by the UK fleet from waters along the west coast of Scotland.

Figure 2.8: Quantity and value of landings of demersal species by the UK fleet in 2023 by ICES rectangle. [21]

9. Pelagic

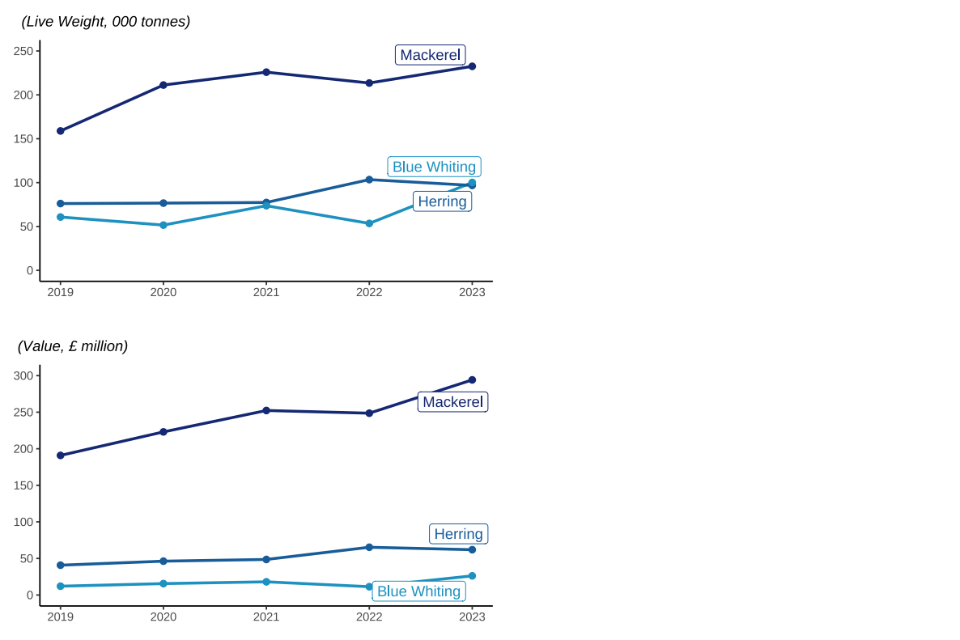

Figure 2.9: Quantity and value of landings between 2019 and 2023 by UK vessels of different pelagic species fish; Blue Whiting, Herring, and Mackerel.

In 2023, the quantity of mackerel landed by UK vessels was 9% higher than in 2022 leading to an increase in value landed for Mackerel (18%). This increase was due to an increase in available quota for the UK fleet in Mackerel stocks in 2023.

The UK fleet catches more mackerel than any other species – over 232 thousand tonnes in 2023, comprising 32% of the total UK catch in 2023. 54% of mackerel landings by UK vessels were landed abroad in 2023.

Most pelagic species are under stock management plans with quotas. Their annual landings therefore track quota limits. There have been increases to quotas for key pelagic species (Herring and Blue Whiting) in the last couple of years due to transfers of quotas and access arrangements made by the UK as an independent coastal state.

Even though the majority of both pelagic species and demersal species fall within quota species, pelagic landings have not seen the same reduction as demersal species over the very long term. When compared to 1938, pelagic landings in 2023 were 33% lower, while demersal landings were down 83%.

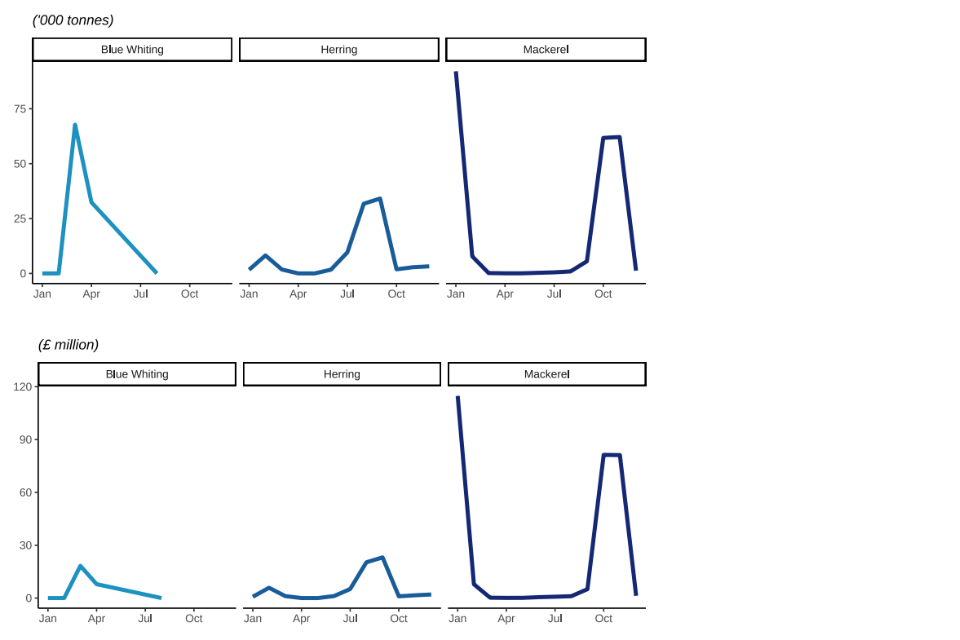

Figure 2.10: Quantity and value of landings in 2023 by UK vessels of different pelagic species fish; Blue Whiting, Herring, and Mackerel.

Pelagic landings follow seasonal patterns. Mackerel is a winter fishery for larger vessels therefore, large volumes of landings are seen annually in January, February and October and November. Quotas had almost been exhausted by the end of the year, so catches are consistently lower in December. Around 97% of all mackerel landings into the UK by the UK fleet in 2023 were in those four peak months.

A two-month period (August to September) accounts for 84% of herring landed into the UK by the UK fleet. Landings in June and July came primarily from the Northern North Sea and were supplemented in August and September by fisheries in the Irish Sea.

The following maps show landings of pelagic species by the UK fleet in 2023 by ICES rectangle of capture. In 2023, the largest quantities and value of pelagic species caught by the UK fleet were captured from rectangles near Shetland and from the north coast of Scotland down to the north-west coast of Ireland. Price per tonne was more evenly spread across ICES rectangles, with the highest prices fetched closer to the southwest coast.

Figure 2.11: Quantity and value of landings of pelagic species by the UK fleet in 2023 by ICES rectangle.

10. Shellfish

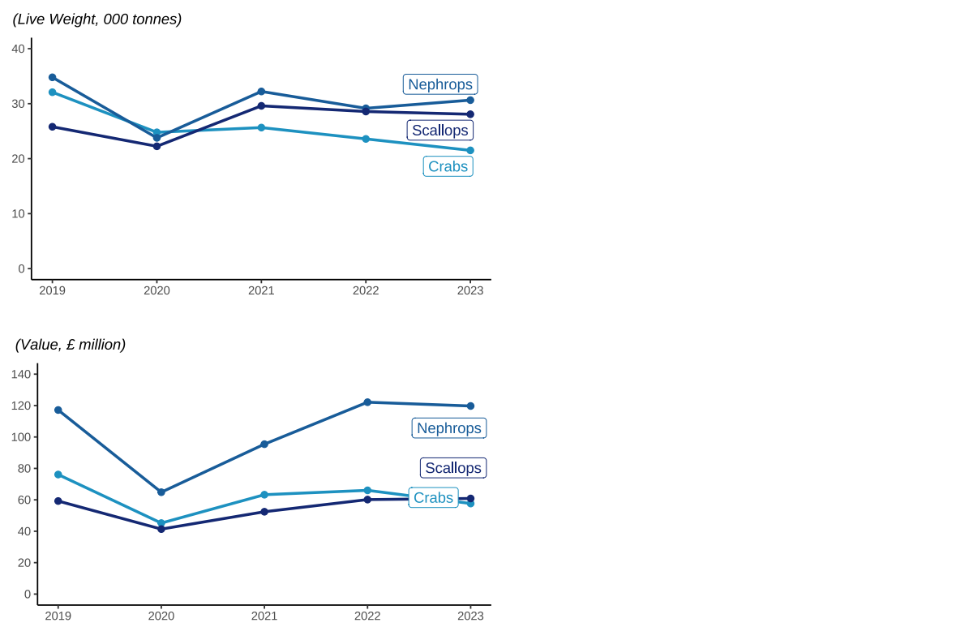

Figure 2.12: Quantity and value of landings between 2019 and 2023 by UK vessels of different shellfish species fish; Edible Crabs, Nephrops, and King Scallops.

Nephrops (also known as langoustine or Norway lobster), edible crabs and king scallops are the main shellfish species landed by the UK fleet, accounting for 69% of all shellfish landings made by the UK fleet in 2023.

The value of landings of these three key species decreased between 2022 and 2023, mainly for crabs with a decrease in value of 12%.

Over the last eighty-five years, landings of demersal and pelagic landings have decreased substantially (discussed above). In contrast, landings of shellfish have increased by over 284%, from 32 thousand tonnes in 1938 to 123 thousand tonnes in 2023.

This is partly driven because, for shellfish species, quotas only apply to Nephrops. Further, the increase in shellfish landings by the UK fleet is likely due to the industry diversifying into the shellfish sector, where there are often fewer restrictions on fishing opportunities.

Successive improvements in data collection for this sector in recent years, including the introduction of mandatory reporting of first sales of fish, may account for some of the increase in reported landings.

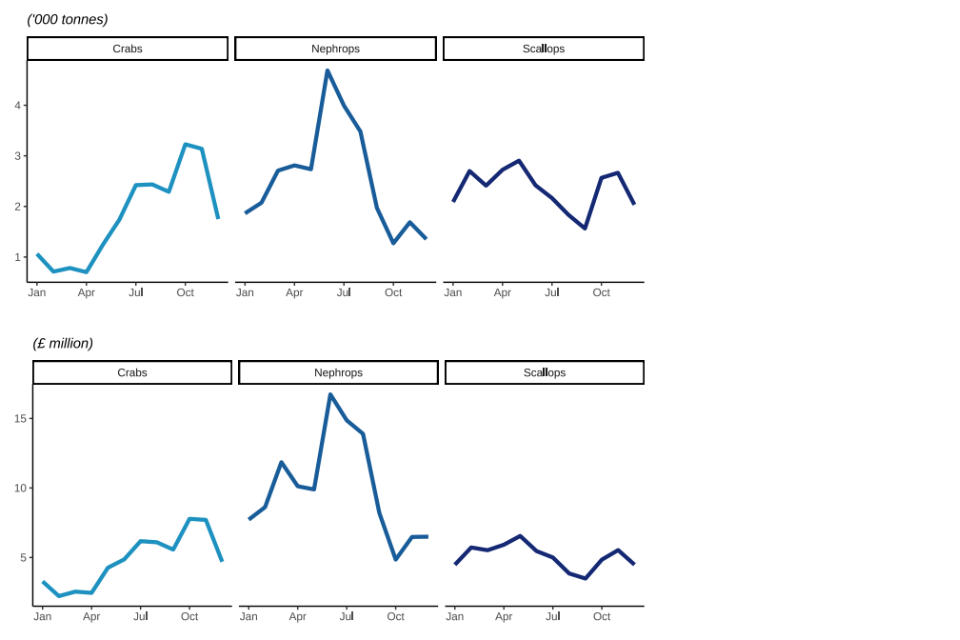

Figure 2.13: Quantity and value of landings in 2023 by UK vessels of different shellfish species fish; Edible Crabs, Nephrops, and King Scallops.

Landings of Nephrops fluctuate but show the highest peak in summer months. Crabs and scallops peak in landings towards the end of the year before the Christmas period.

The following maps show landings of shellfish species by the UK fleet in 2023 by ICES rectangle of capture. In 2023, both the largest quantity and value of shellfish species were captured in rectangles relatively close to the coast of the UK. However, shellfish species with high prices were typically captured in rectangles away from coastal areas.

Figure 2.14: Landings of shellfish species by the UK fleet in 2023 by ICES rectangle.

11. Landings by port

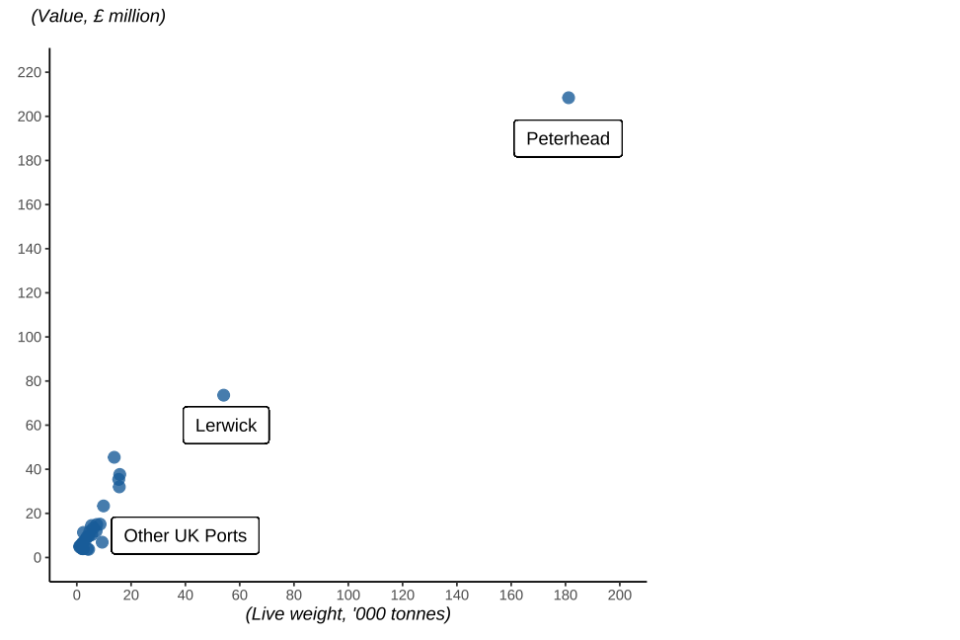

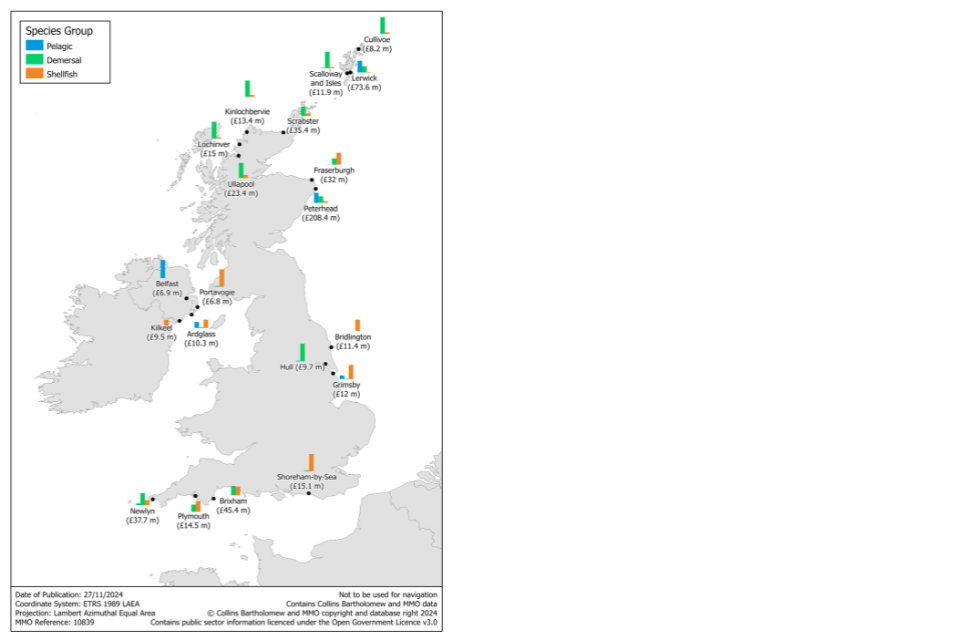

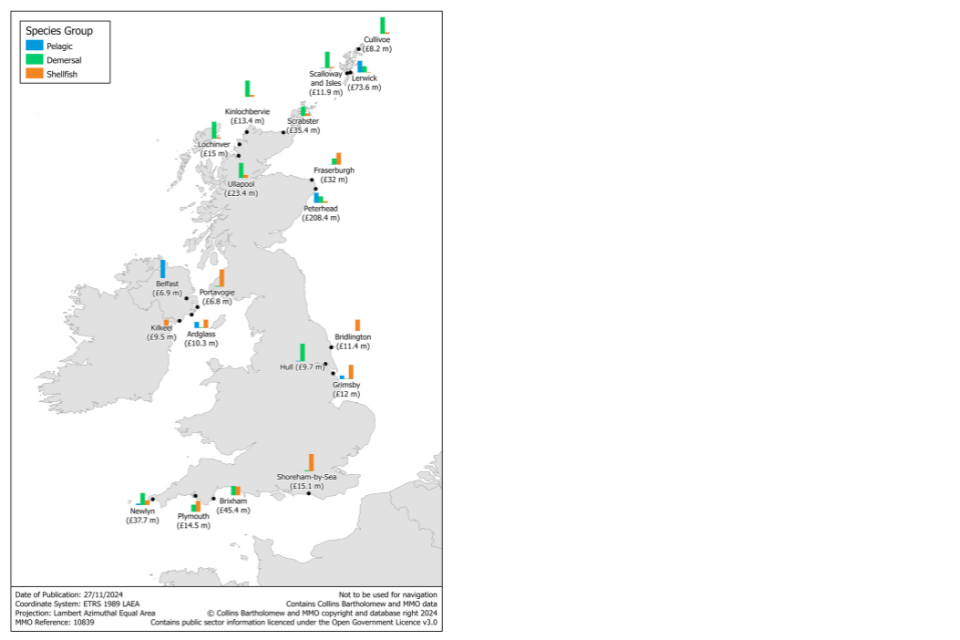

Figure 2.15: Quantity and value of landings in 2023 into UK ports.

Peterhead continually ranks highest for landings by port, with Lerwick in second place. These ports are both in Northern Scotland. In England, Newlyn was the port with the highest quantity of landings, while Brixham had the highest value of landings.

Approximately 72% of all landings by UK vessels into Scotland were into Peterhead and Lerwick. This is because Peterhead and Lerwick specialise in pelagic species.

In contrast, landings into Newlyn and Brixham (the top 2 English ports) accounted for only 32% of landings into England, with the remaining landings more evenly spread around the English coast.

Figure 2.16: Quantity of landings into the UK’s top 20 ports in 2023.

Figure 2.17: Value of landings into the UK’s top 20 ports in 2023.

12. Landings abroad by the UK fleet

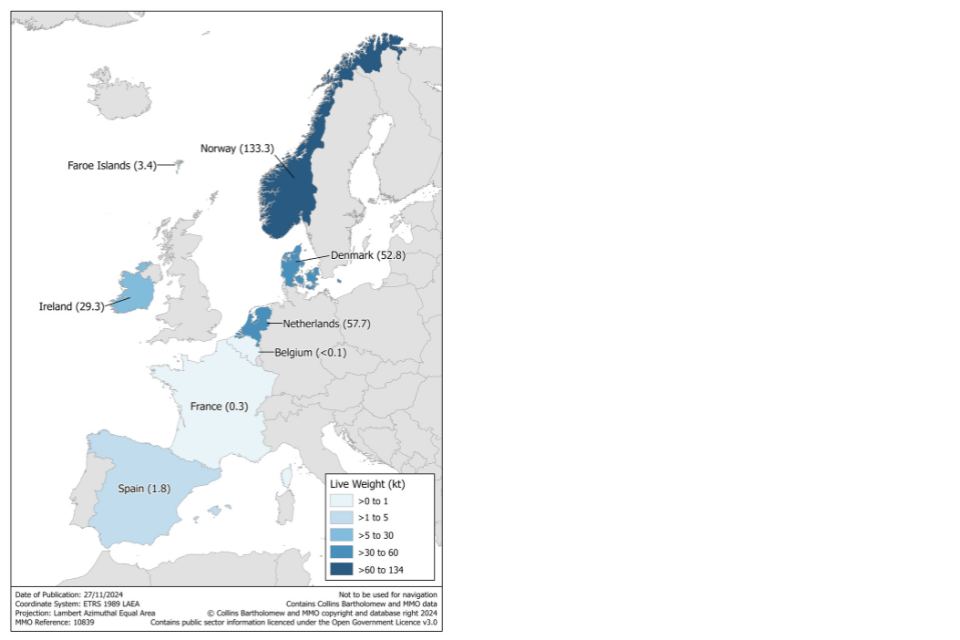

Figure 2.18: Quantity of landings abroad by the UK fleet in 2023.

In total in 2023, UK vessels landed 279 thousand tonnes of fish abroad. This is 39% of the total quantity of fish landed by UK vessels and represents 26% of the value of all fish landed by UK vessels (slight increase when compared to 2022). The majority of landings abroad are pelagic fish species (90%), of which 45% was mackerel. Half of all landings abroad were into Norway, followed by landings into ports in the Netherlands (20%). A small number of the UK registered fishing fleet is in Dutch economic ownership; landings by these vessels contribute to the large quantities of fish landed into the Netherlands.

13. Landings into UK ports by foreign vessels

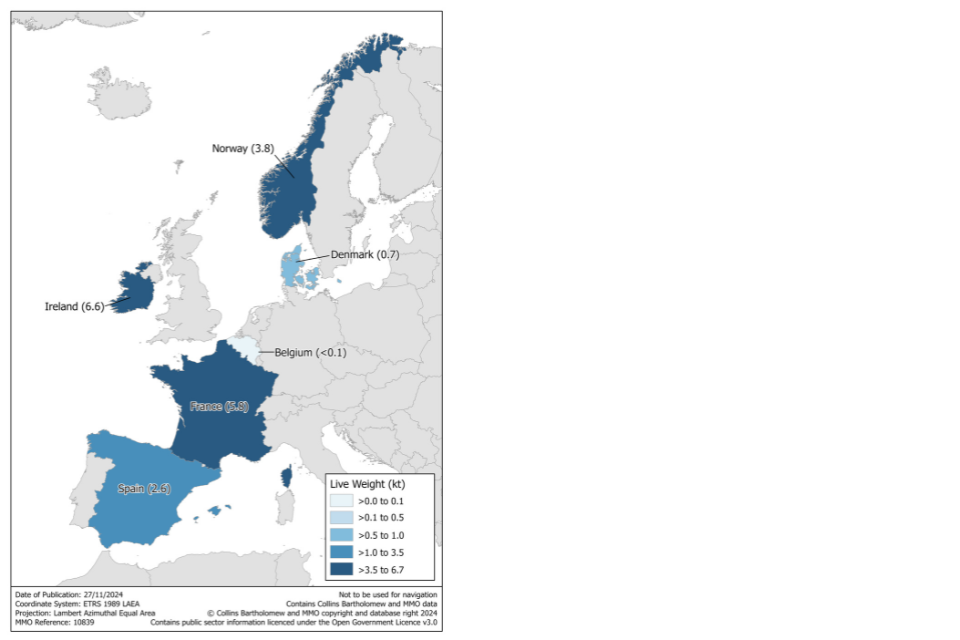

Figure 2.19: Quantity of landings in UK ports by foreign vessels in 2023.

In 2023, 19 thousand tonnes of fish were landed into the UK by foreign vessels, which was an increase of 3% compared to 2022. Landings decreased significantly between 2019 and 2021 (down 62%), however have remained similar since this date. This decrease in landings can be attributed to the reduced access for foreign vessels into UK waters following EU exit.

Close to 97% (19 thousand tonnes) of fish landed into the UK by foreign vessels were either demersal or pelagic. The remainder was shellfish landings, accounting for less than one thousand tonnes.

14. Area of capture

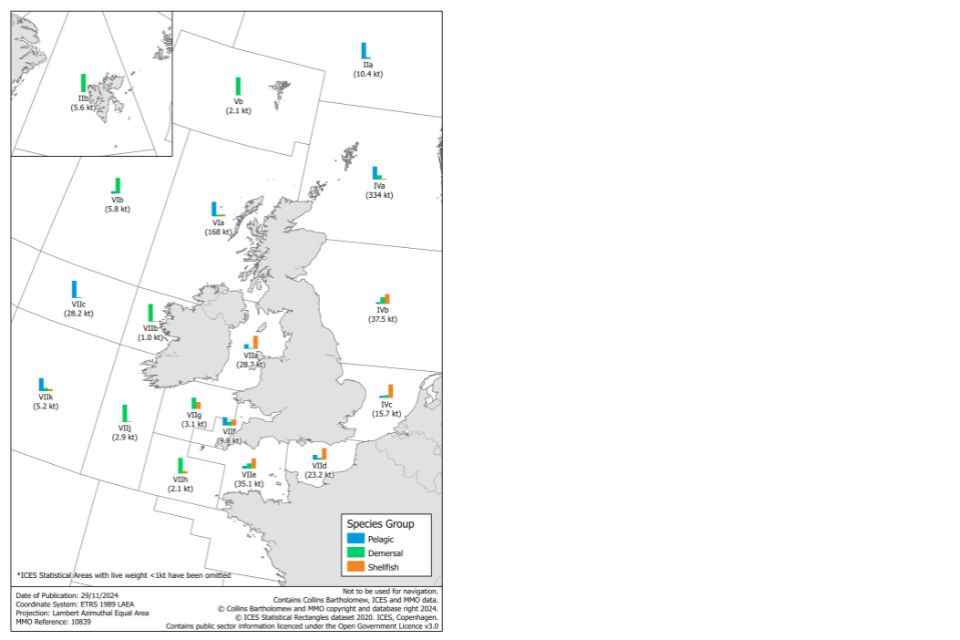

Figure 2.20: Quantity of landings by area of capture and species group in 2023.

Different sea areas yield different proportions of species.

-

53% (78 thousand tonnes) of the demersal fish landed by the UK fleet was from the Northern North Sea in 2023.

-

54% (240 thousand tonnes) of pelagic fish landed by the UK fleet was from the Northern North Sea in 2023.

-

27% (35 thousand tonnes) of shellfish landed by the UK fleet is from the English Channel.

Typically, shellfish landings form a high proportion of landings from enclosed sea areas with large coastal stretches (Irish Sea, Bristol Channel, English Channel and the Southern North Sea), while pelagic species form the majority of landings from open waters such as the West of Scotland, Northern North Sea, West of Ireland and Porcupine Bank.

15. Landings by Exclusive Economic Zone

Exclusive Economic Zone

The term Exclusive Economic Zone is taken to mean the entire zone under the exclusive jurisdiction of a coastal state or international organisation. This will include the territorial seas which spans 0-12 nautical miles from the coast as well as the UNCLOS Exclusive Economic Zone from 12 up to 200 nautical miles (or roughly 22 to 370 kilometres) from the coast. Where EEZs would overlap a median line is used to delineate the sovereignty of waters.

ICES Statistical Rectangles

The International Council for the Exploration of the Sea (ICES) has implemented spatial divisions of the sea for statistical analysis in major fishing area 27. ICES rectangles are the lowest broadly available unit of spatial reporting for this area. Each rectangle is 0.5 degrees latitude by 1 degree longitude.

From 2021 vessels were required to report fishing activity by EEZ, differentiating between UK and EU waters. From this date the EEZ of capture will be determined by using the landings data as reported in vessel logbooks. Landings data by EEZ published prior to 2021 is based on the estimated EEZ by ICES rectangle spatial apportioning, therefore caution is advised when assessing differences with years before this date due to the alternative methodology used. This is however the most reliable data available to the MMO to determine EEZ for UK fishing vessel activity prior to 2021.

Figure 2.21: The UK’s Exclusive Economic Zone.

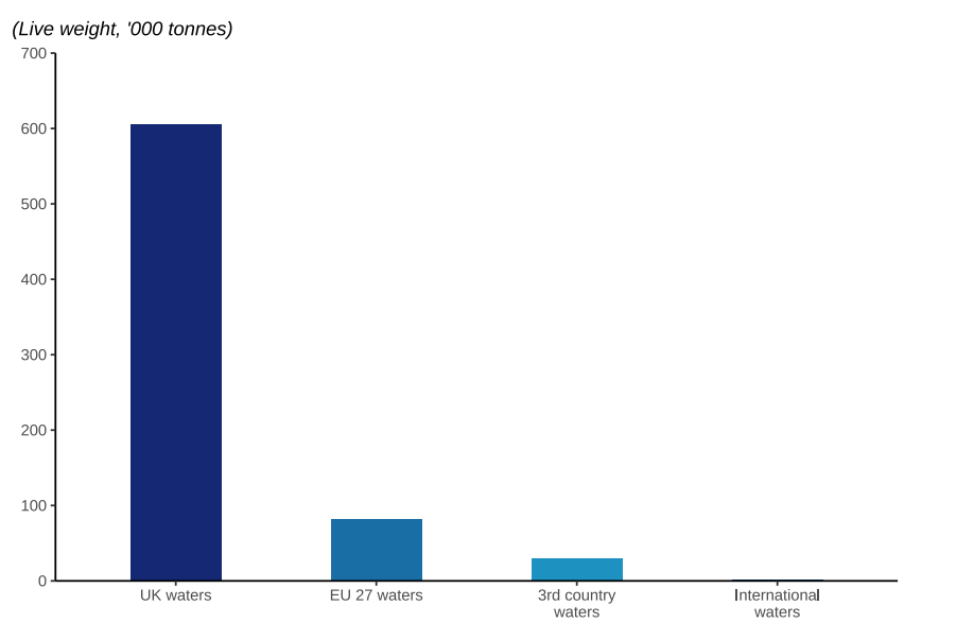

Figure 2.22: Quantity of landings caught by UK vessels in 2023 by waters.

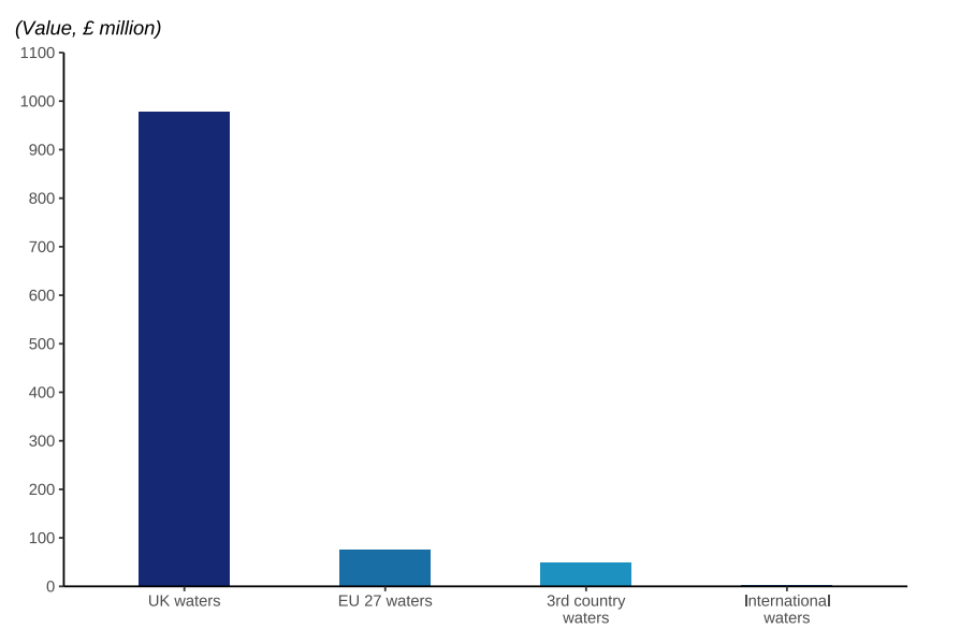

Figure 2.23: Value of landings caught by UK vessels in 2023 by waters.

In 2023, 84% of landings and 89% of the value of landings by UK vessels were from UK waters.

Outside the UK’s waters the most important coastal state or bloc was EU-27 waters, where UK vessels caught and landed 82 thousand tonnes of fish and shellfish for a value of £75 million in 2023 (down 17% compared to 2022). This equates to 11% by weight and 7% by value of the UK fleet’s landings.

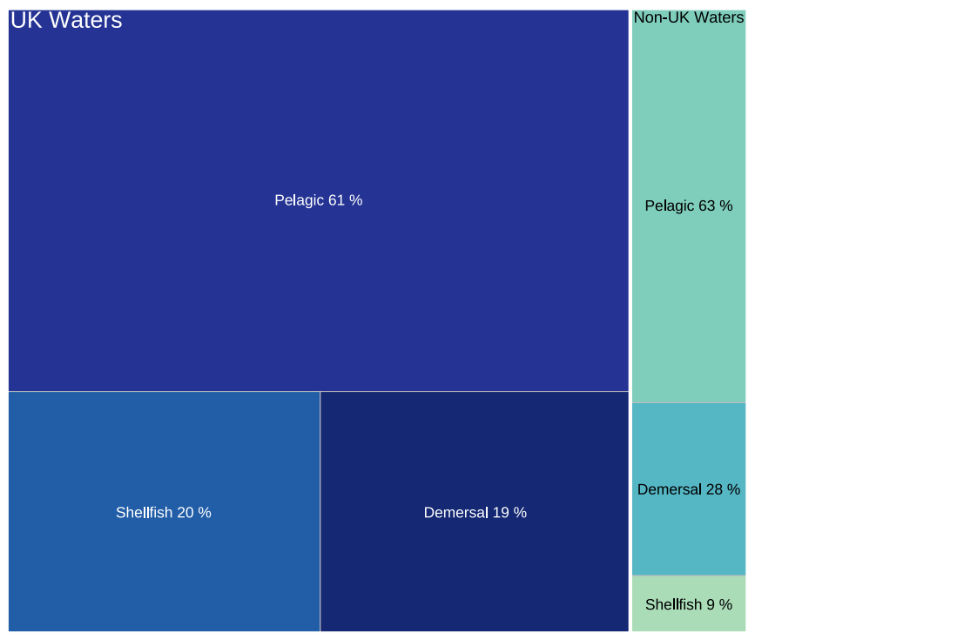

Figure 2.24: Percentage of species group landed by UK vessels caught from both UK and nonUK waters in 2023.

Pelagic species made up the majority of landings caught from both UK and non-UK waters in 2023. UK vessels landed a total of around 606 thousand tonnes of fish and shellfish from UK waters with a first sale value of approximately £978 million. By tonnage 53% of this was from UK waters of area 27.4.a (Northern North Sea); mackerel and herring made up 73% of those UK in UK Northern North Sea landings.

16. Fishing gear

Gear

Different types of fishing gear are used to catch different species of fish. A single vessel can use several gears, or individual vessels may be more specialised. Gears can be grouped several ways. One grouping is active versus passive. Active gears follow the target fish while target fish come to passive gears which remain in one place.

Active gears

-

Beam trawlers target fish on the seabed by towing a net from either side of the boat.

-

Demersal trawlers fish along or just above the seafloor to catch demersal fish. A funnelshaped net is towed behind one or two boats.

-

Dredges are rigid structures that are towed along the seabed by a boat. They are used to target shellfish species such as scallops and oysters.

-

Seine netting uses a net that is vertical in the water. Demersal seines target bottom dwelling fish while pelagic seines target fish that inhabit the water column.

Passive gears

-

Drift and fixed nets usually target pelagic fish and hang in the water column. They are suspended from buoys or the seabed.

-

Gears using hooks attract fish by placing bait on a hook fixed to the end of e.g. a line.

-

Pots and traps are rigid structures into which fish, mainly shellfish, are enticed through funnels that are hard to escape from.

Most (91% in 2023) of fish landed by UK vessels was captured using active gears. 99% of pelagic fish were caught using active gears and 92% of demersal fish [22]. 63% of all shellfish were caught using active gears, mainly by scallop dredges and otter trawls.

The type of gear used can make a difference to the average price of fish. For demersal species, the average price of fish captured using passive gears is higher than for active gears. Price differentials are also observed between different gears of the same class. For example, shellfish caught using demersal trawls and seines are sold at a higher average price than dredges. This variation in prices partly reflects the different species caught by different gears. For example, demersal trawls and seines capture the majority of the Nephrops landed by the UK fleet, while the bulk of the landings from dredges are scallops, which sell at a lower average price [23]. However, there can also be a premium attached to the method by which the fish are captured. This is driven partly by consumer choice around the environmental impact of different gears.

17. Landings by quota and non-quota stocks

Quota and non-quota stocks

Landings of quota stocks are those fish which are managed via quota limits, i.e. there is an upper limit set on the amount of fish that can be harvested from the sea. Non-quota stocks do not have an upper limit set on the quantity of fish that can be caught, however some are managed via different regimes, e.g. effort limits on days at sea.

Non-quota species include almost all commercial shellfish species, Nephrops being the exception.

In 2023, landings of quota species make up 84% of the total quantity of landings by the UK fleet and 72% of the value.

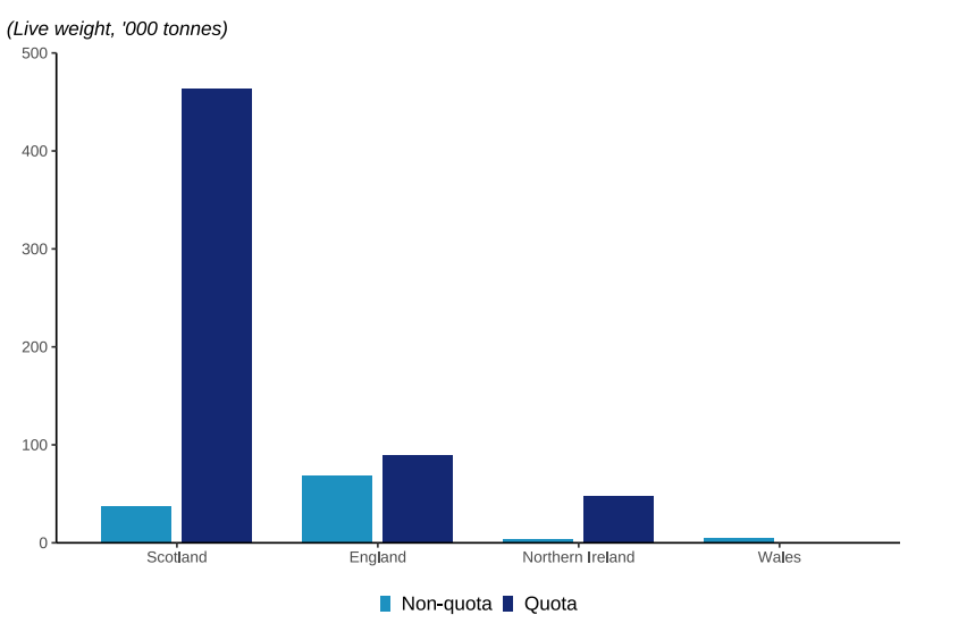

Figure 2.25: Quantity of landings by UK vessels of non-quota and quota species in 2023 by fisheries administration.

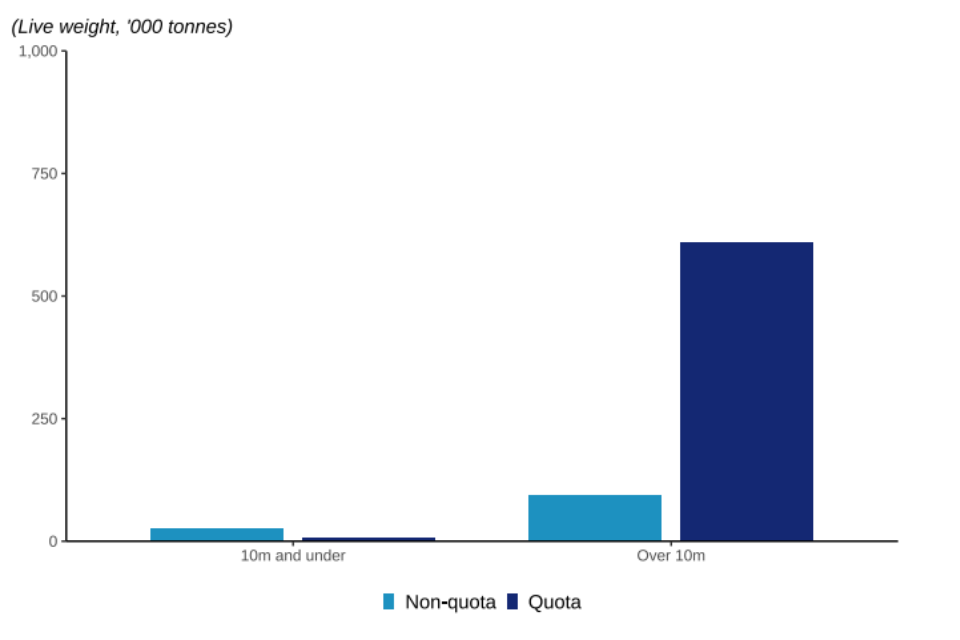

Figure 2.26: Quantity of landings by UK vessels of non-quota and quota species in 2023 by 10m and under and over 10m vessels.

Quota allocations and management

Quota is allocated to the sector (Fish Producer Organisations) and the non-sector. The non-sector is split into two categories based on vessel length – over 10 metre and 10 metre and under.

Each UK nation holds the quota and manages uptake via catch limits for the non-sector. For the sector, individual Fish Producer Organisations are responsible for managing their members quota.

Scottish vessels landed 77% of UK landings of quota species in 2023.

Landings of non-quota species by under 10 metre vessels were 3 times higher than their landings of quota species. Conversely, landings of quota species by over 10 metre vessels were almost 6 times higher than their landings of non-quota species. Vessels over 10 metres in length landed 99% of the landings of quota species by UK vessels.

Quota allocations are primarily based on Fixed Quota Allocation (FQA) units. These are mainly held by vessels in the sector based on their fishing track record of catching quota species. Most vessels in the sector – a member of a Fish Producer Organisation – are vessels over 10 metres in length. Vessels under 10 metres in length are mainly part of the non-sector and are allocated a small proportion of the total UK quota. Their landings of quota species are therefore less.

[12] In this section, tonnes always refer to live weight tonnes. This is the sum of the live weight of fish caught, prior to any processing e.g. gutting or shelling.

[13] Table 2.1.

[14] Table 2.9.

[15] Fish Producer Organisations (FPOs) are officially recognised bodies set up by fishery or aquaculture producers.

[16] Fishing quota allocations for England and the UK - GOV.UK

[17] Table 2.1.

[18] Table 2.7 – note this table includes landings into the UK by UK and foreign vessels.

[19] Table 2.16.

[20] Sole Recovery Zone rules - GOV.UK.

[21] The very high value per tonne records included here are landings of wrasse species, commonly referred to as “cleaner fish”. These are sold for their use in fish farms.

[22] Table 2.11.

[23] Table 2.16.