Workplace pension participation and savings trends of eligible employees: 2009 to 2021

Published 28 June 2022

This is the latest release of statistics on Workplace Pension Participation and Savings Trends between 2009 and 2021. This is the ninth edition in the series and provides additional information on the trends over the COVID-19 period on pension saving and contributions.

After years of growth in participation during the roll-out of automatic enrolment, participation rates have stabilised. Trends in stopping saving and contributions have remained relatively stable during and after the COVID-19 period.

Introduction

Automatic enrolment was introduced in 2012 to help address the decline in private pension saving and to make long-term saving the norm. It aims to increase workplace pension saving in the UK and forms part of a wider set of pension reforms designed to enable individuals to achieve financial security in retirement.

The roll-out of automatic enrolment was completed following implementation of the contribution increase in April 2019. This official statistics publication will explain both the post-implementation picture of automatic enrolment and the trends over the COVID-19 period.

Section 1 provides breakdowns of two key measures for evaluating the implementation of automatic enrolment:

- increasing the number of savers, by monitoring trends in workplace pension participation

- increasing the amount of savings, by monitoring trends in workplace pension saving

Section 2 provides information on trends in stopping saving and contributions until March 2022 for evaluating the trends over the COVID-19 period.

ONS Annual Survey of Hours and Earnings (ASHE) is the main data source used in this publication and is the key source of information on participation and contributions.

Supplementary data sources used include DWP Family Resources Survey and HMRC Real-Time Information to provide information on ethnicity, disability and economic status breakdowns in participation and stopping saving and contributions over the COVID-19 period respectively.

Throughout this report eligible employees are defined as employees who meet the automatic enrolment age and earnings criteria in that year. See the Background Information and Methodology Note published alongside this release for full definitions.

Main stories

1. What is the post-implementation picture of Automatic Enrolment?

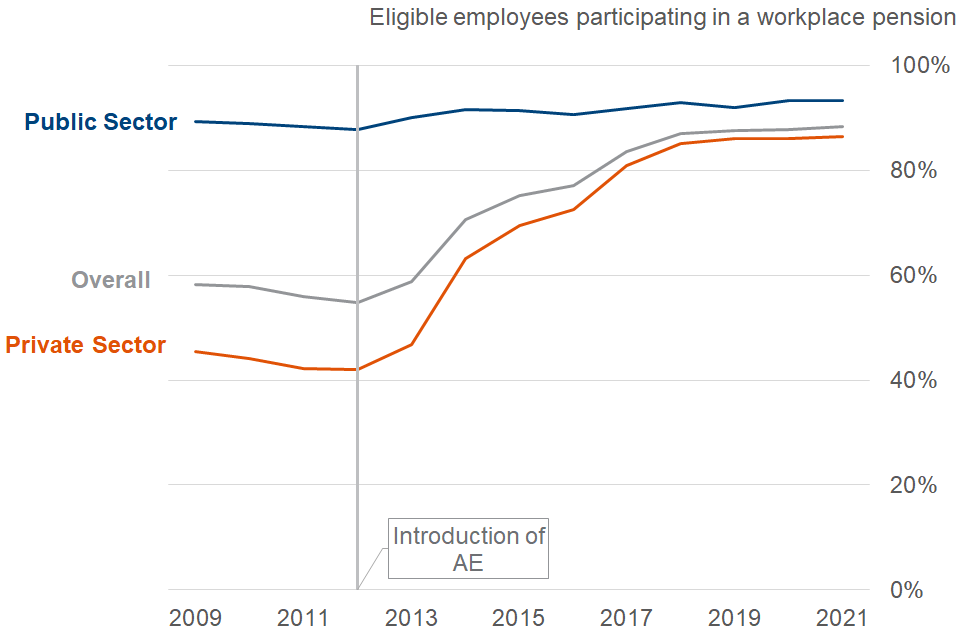

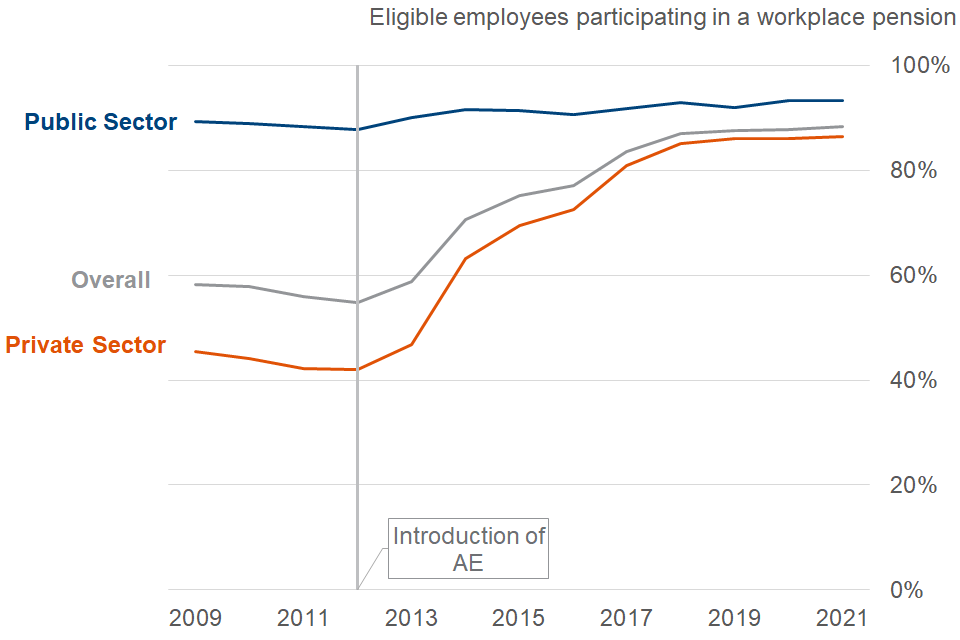

Overall, 88% of eligible employees (20 million) were participating in a workplace pension in 2021. Overall trends in participation have increased since 2012, driven by the private sector while public sector participation has remained high.

Figure 1: Eligible employee participation rate to 2021

- Trends across all breakdowns broadly reflect this overall picture of participation in the public and private sector

- Since 2012, many gaps in participation have narrowed – the largest increases have been seen in Agriculture & Fishing and Distribution, Hotels & Restaurants industries and among small private employers (5 to 49 employees)

- Most groups have seen trends in participation stabilise between 2018 and 2021

- There are some gaps that remain in 2021 and there is relatively low participation of below 65% for some eligible groups including micro employers and around 66% for Pakistani and Bangladeshi employees (ethnicity is calculated using a 3-year average)

ONS Employee Workplace Pensions in the UK also includes information on pension participation rates for all employees, both eligible and non-eligible. This publication also uses ASHE data and shows a similar trend in participation for all employees as we have observed for eligible employees. Workplace pension participation of UK employees increased between 2012 and 2021, up from less than half to 79% of UK employees, before stabilising in recent years.

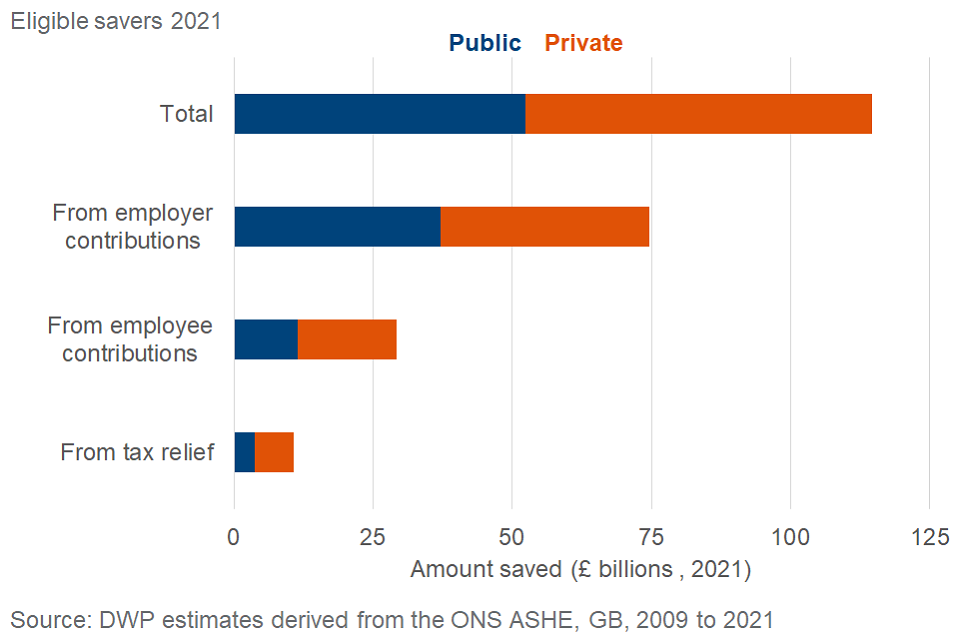

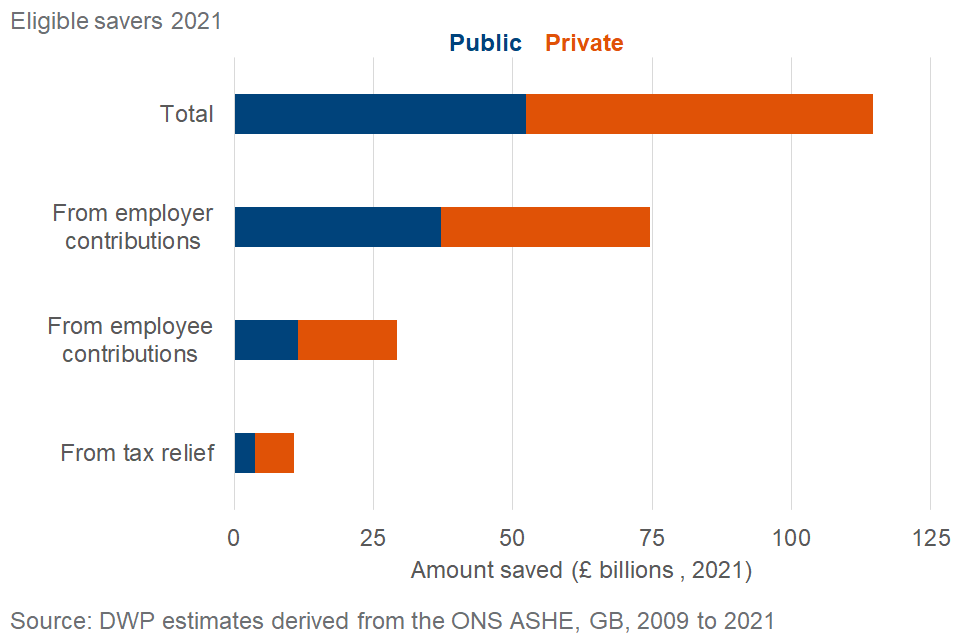

Total annual workplace pension savings for eligible savers increased to £114.6 billion in 2021.

Figure 2: Amount saved by eligible employees in 2021

2. What are the trends following the COVID-19 period?

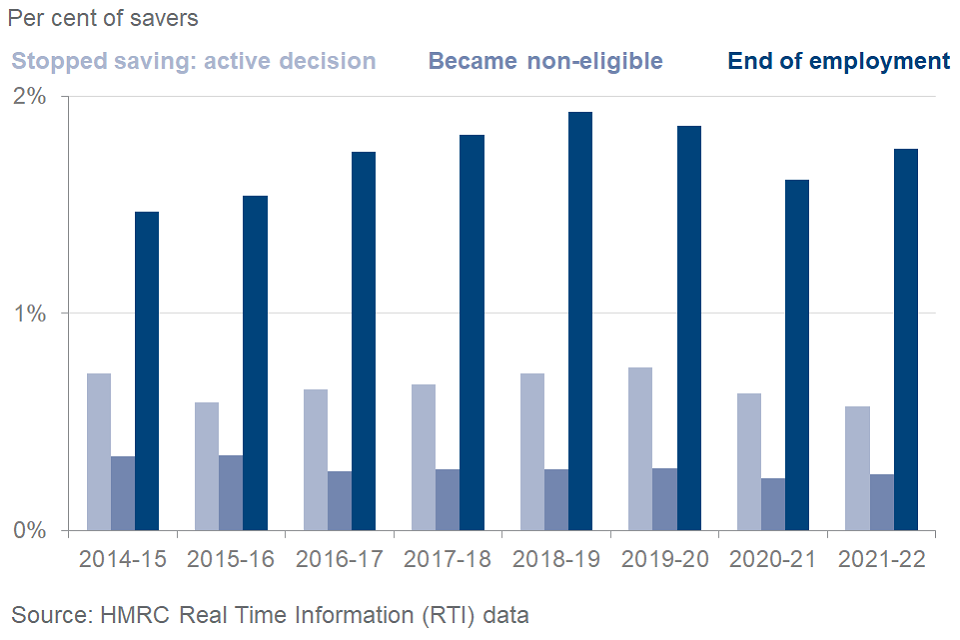

HMRC RTI data shows that the percentage of savers making an active decision to stop saving has decreased again compared to previous years, although the percentage who stop saving owing to the end of an employment increased between 2020 to 2021 and 2021 to 2022.

Figure 3: Stopping saving rates to financial year 2021 to 2022

- In the financial year 2021 to 2022, the percentage of workplace pension savers stopping saving following an active decision to stop saving has decreased again, although the percentage stopping saving through the end of an employment increased between 2020 to 2021 and 2021 to 2022

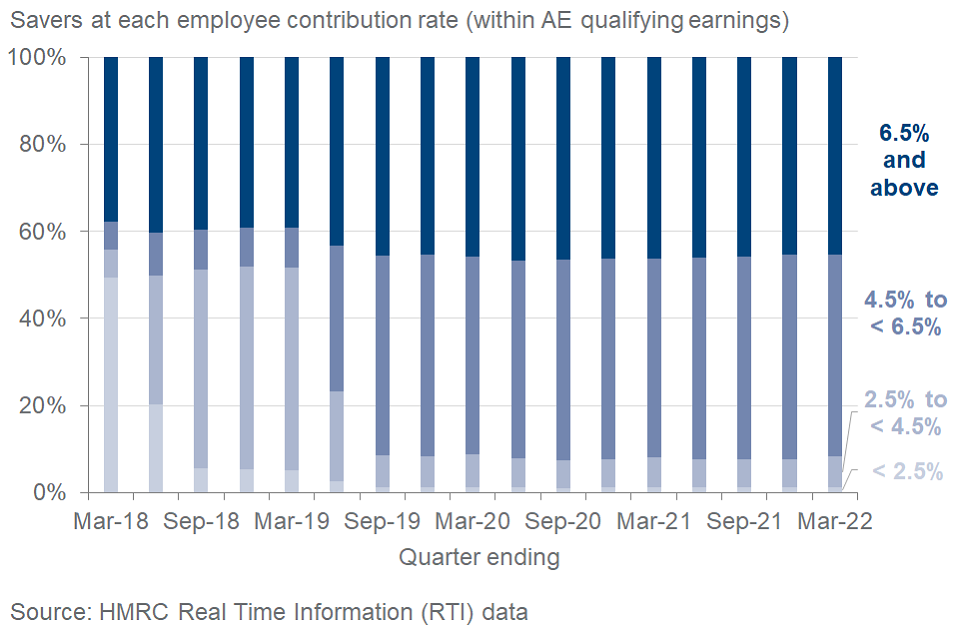

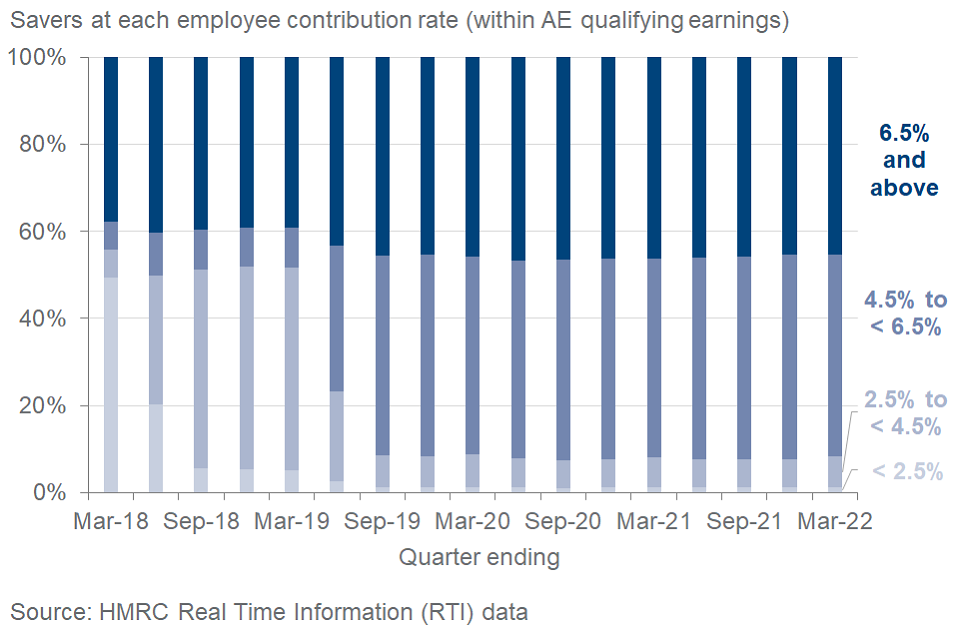

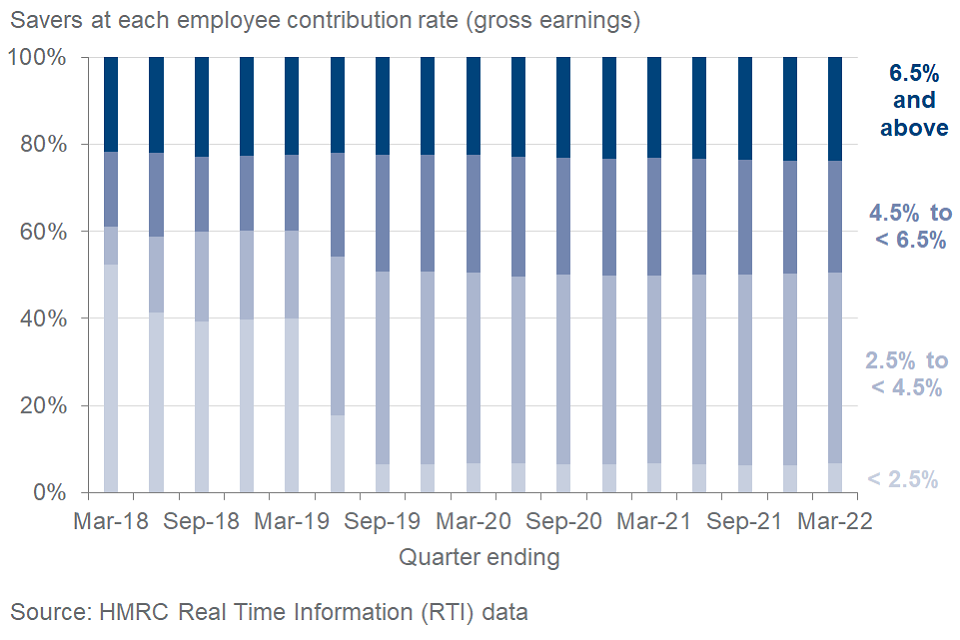

Figure 4: Employee pension contribution rates with pay within AE thresholds to Q4 (Jan to Mar) 2021 to 2022

ONS Funded occupational pension schemes in the UK also includes information on employee contributions over the COVID-19 period.

In April 2018 the minimum contribution rates under AE increased from 4% to 6% of earnings within the qualifying earnings band (QEB) (including an increase in the minimum employer contribution from 1% to 2%).

In April 2019 the minimum contribution rates increased again from 6% to 8% within the QEB (including an increase in the minimum employer contribution from 2% to 3%). HMRC RTI data shows that this led to an increase in the proportion of employees contributing at least 4.5% of their earnings within the QEB since April 2019. Since Q4 2019 to 2020 the proportion of employees contributing at least 6.5% of their earnings has decreased from 46.7% to 45.4% in Q4 2021 to 2022.

What you need to know

Automatic enrolment mandates employers to provide a workplace pension for all workers meeting certain criteria. See the Background Information and Methodology Note for detailed information about eligibility and contribution rates.

Notes

The analysis includes members of all qualifying workplace pension schemes: occupational pension schemes, group personal pensions (GPPs), and group stakeholder pensions (GSHPs). All analysis is based on eligible employees, and uprated using ONS Average Weekly Earnings values.

Subgroup analysis in this publication does not include an assessment of which factors are the primary drivers of differences in participation across different subgroups.

Numbers have been suppressed where the sample size is small. Charts show the percentage of eligible employees participating in a workplace pension unless otherwise stated. We welcome feedback on the material provided to improve future releases.

All the information presented in the charts and figures is included in the accompanying excel tables.

The workplace pension participation and savings trends official statistics previously published information on the persistency of saving, in Table 2.1. This information on persistency has been omitted for the 2021 publication. This is due to a smaller sample size achieved from ASHE in 2020 and 2021 as a result of COVID-19, leading to an increase in indeterminate evidence between the 2016 cohort (29% indeterminate evidence) and 2018 cohort (54% indeterminate evidence). This means the trend in persistent saving cannot be meaningfully followed across these cohorts.

1. Trends in Workplace Pension Participation

The proportion of private sector eligible employees participation in a workplace pension increased sharply between 2012 and 2018 before stabilising. Public sector participation remains high.

Figure 5: Eligible employee participation rate to 2021

Overall participation of eligible employees is 88% (20 million eligible employees), similar to 2020.

Across the whole economy, there was a general downward trend in workplace pension participation among eligible employees between 2009 and 2012, from 58% (11.4 million eligible employees) to a low of 55% (10.7 million eligible employees). Since 2012, there has been a large increase of 9.3 million to 20 million eligible employees participating in a workplace pension (88%) in 2021, showing the positive impact of the workplace pension reforms to date.

The driver for the overall increase is the private sector in which the largest increases have been seen. Since 2012, private sector participation has risen by 44 percentage points to 86% of private sector eligible employees participating in 2021 (14.4 million eligible employees). The gap between public and private sector participation has narrowed to 7 percentage points in 2021. 2020 was the first year the rate did not increase since 2013.

The participation rate of eligible employees in the public sector stayed the same between 2020 and 2021. Public sector participation remains higher compared to those in the private sector. The participation rate of eligible employees in the public sector remained stable in 2021 at 93% (5.6 million), an increase of 5 percentage points since 2012.

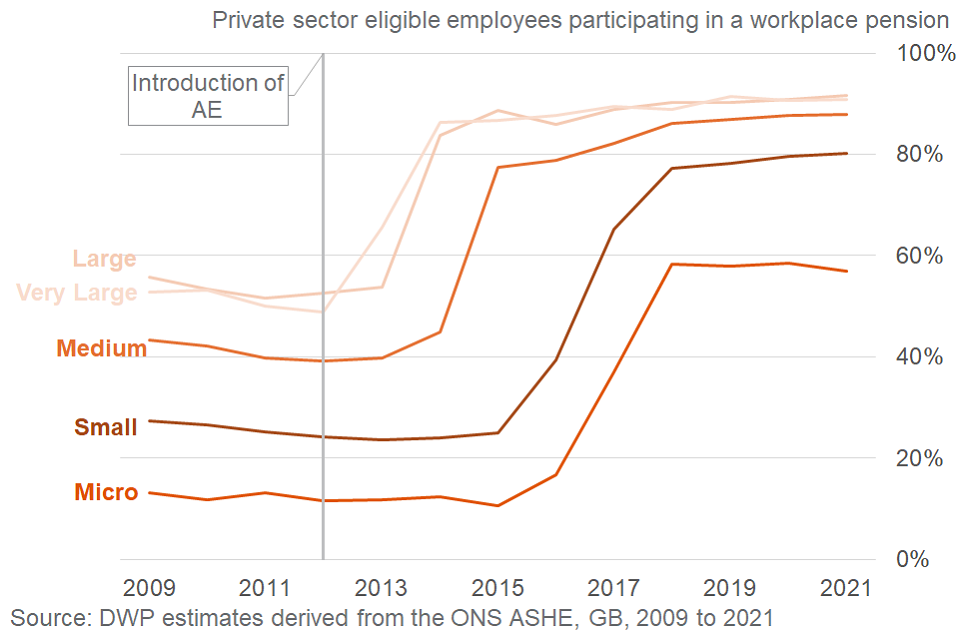

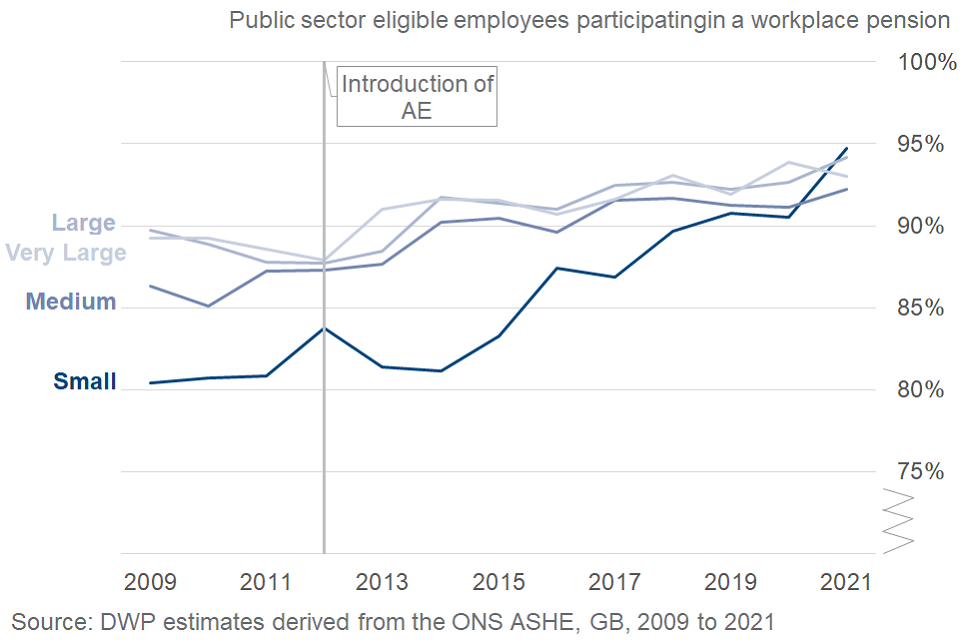

1.1 Employer size, by sector

After large increases since 2012, participation rates in the private sector have stabilised for each employer size band but persistent gaps remain for small and micro private employers.

Figure 6 and 7: Participation by employer size to 2021

All employer sizes have seen large increases in eligible employee participation rates since the start of the relevant automatic enrolment staging date. Since the end of the staging period for each employer size band (with the exception of new-born employers coming into existence after April 2012), participation rates broadly stabilised.

The highest levels of both private and public sector participation in 2021 were seen in the larger employer bands. In the private sector, 91% of eligible employees were participating in the very large (5000+) and 92% large employer bands (250 to 4,999+ employees). In the public sector, participation rates of eligible employees in large and very large employer bands were 93 and 94% respectively.

Participation rates among micro (1 to 4 employees) and small (5 to 49 employees) employers in the private sector have increased since 2012 to their current position of 57% and 80%. However, there is a persistent gap in participation rates of these groups and other sized employers.

Greater gaps in participation among employer sizes persist in the private sector compared to the public sector. In the public sector participation rates have remained stable for most employer sizes. Since 2014, participation rates for small employers (5 to 49 employees) have increased, largely closing the gap in participation by employer size. Participation rates for micro employers (1 to 4 employees) in the public sector are not shown due to small sample sizes.

Staged implementation of automatic enrolment: The automatic enrolment duties were staged in between October 2012 and February 2018 by employer size, starting in October 2012 with the largest employers based on PAYE scheme size, to the smallest in 2017. New PAYE schemes between April 2012 and September 2017 were staged last, in 2017 and 2018. New PAYE schemes from October 2017 have immediate automatic enrolment duties.

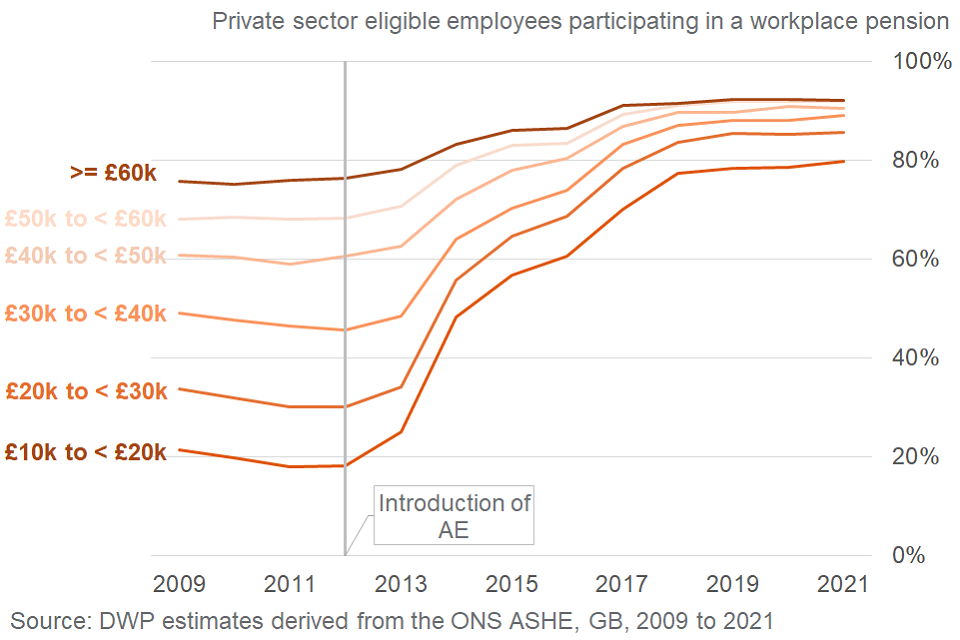

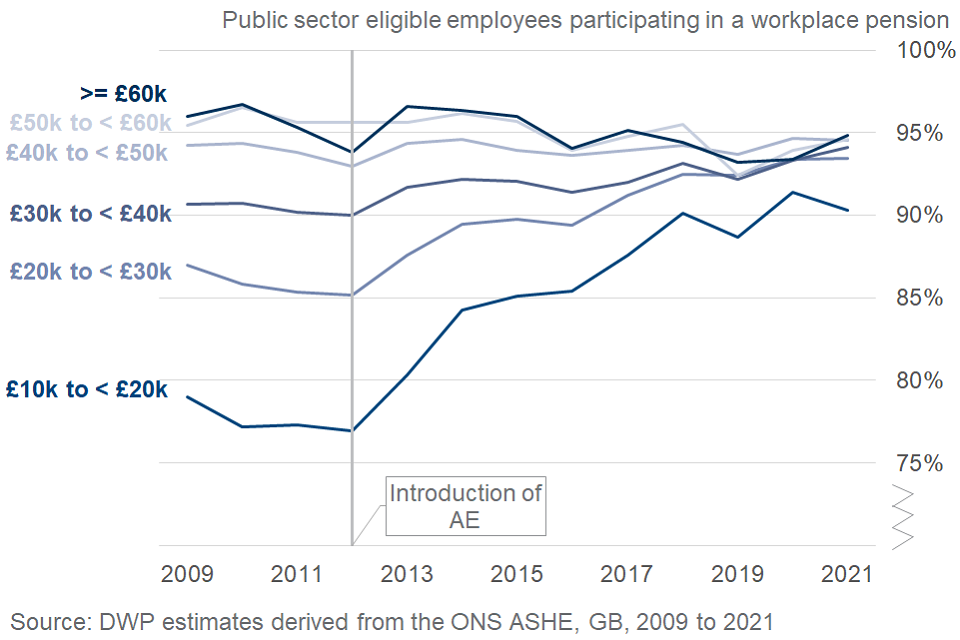

1.2 Earnings, by sector

Higher earners continue to have higher participation rates for both sectors, but the gap has narrowed.

Figure 8 and 9: Participation by earnings to 2021

Across the whole economy the highest earners show the highest participation levels. In 2021, 93% of eligible employees within the top three earnings band were participating in a workplace pension.

In the private sector the gap between the highest and lowest earners has narrowed since the introduction of automatic enrolment. The difference in participation rates between the highest and lowest earning groups was 58 percentage points in 2012, but has fallen to 12 percentage points in 2021.

In the public sector participation trends in higher earnings bands have been broadly stable since 2012 but larger increases have been observed in the lower earnings bands. The greatest increase was seen in the £10,000 to £20,000 earning band which rose by 13 percentage points between 2012 and 2021.

Note that all earnings bands are defined in terms of individuals’ gross annual earnings in 2021 terms.

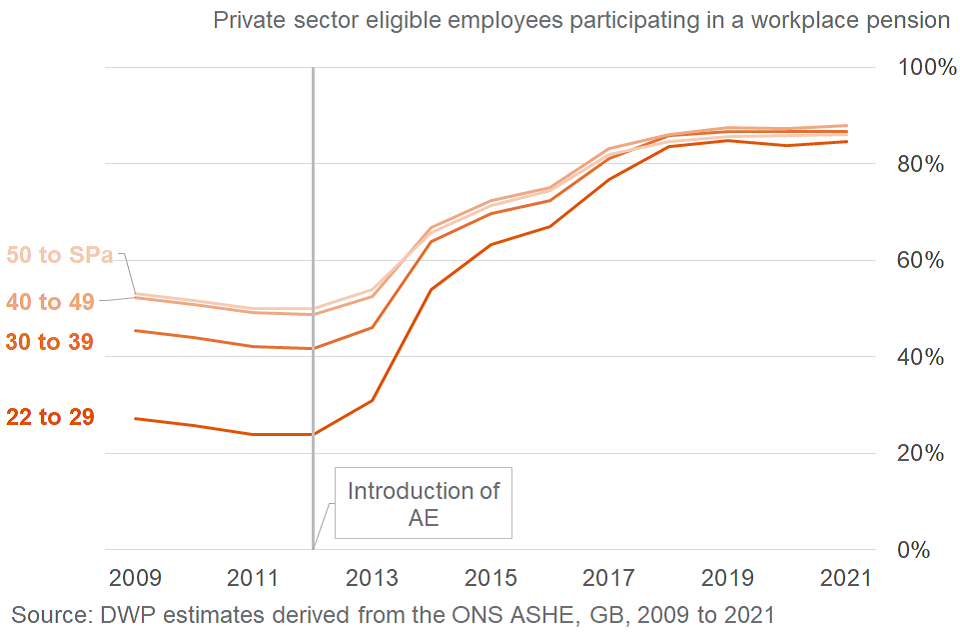

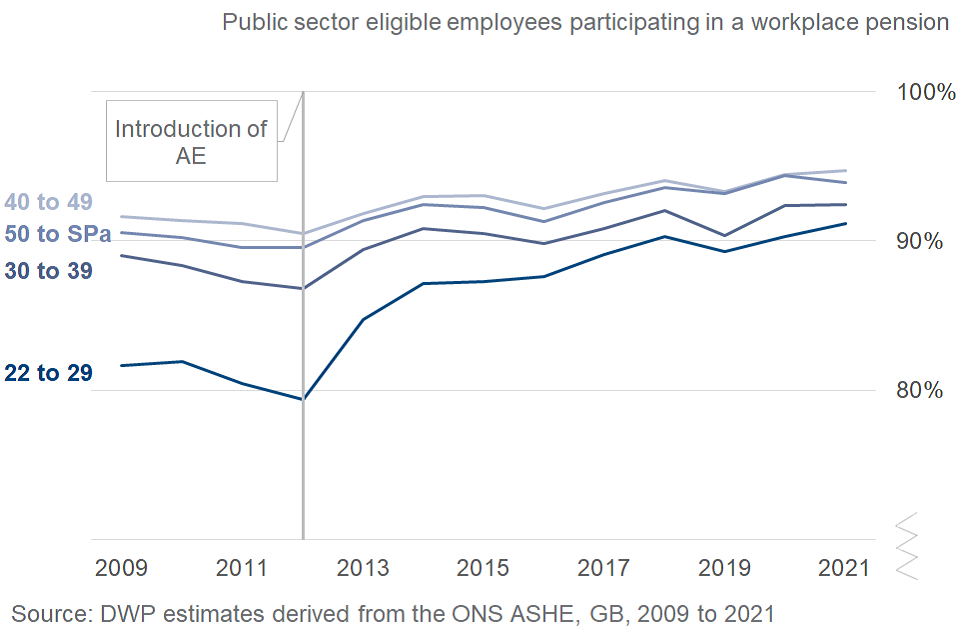

1.3 Age, by sector

The gap in participation rates between age groups for both sectors has narrowed since 2012.

Figure 10 and 11: Participation by age to 2021

Across the whole economy participation rates for eligible employees in 2021 are highest for the 40 to 49 age group (90%) and lowest for the 22 to 29 age group (86%).

Since 2012, pension participation in the private sector has increased for all age groups. The largest increase was seen in the 22 to 29 age group, increasing from 24% in 2012 to 85% in 2021 (a 61 percentage points rise), and the pension participation gap between the youngest and oldest age groups has reduced since 2012 from 26 percentage points to only 1 percentage points in 2021.

Participation rates in the public sector remain high and broadly stable since 2014. Despite narrowing after 2012, there is a small but persistent gap between the youngest and oldest age groups of 3 percentage points.

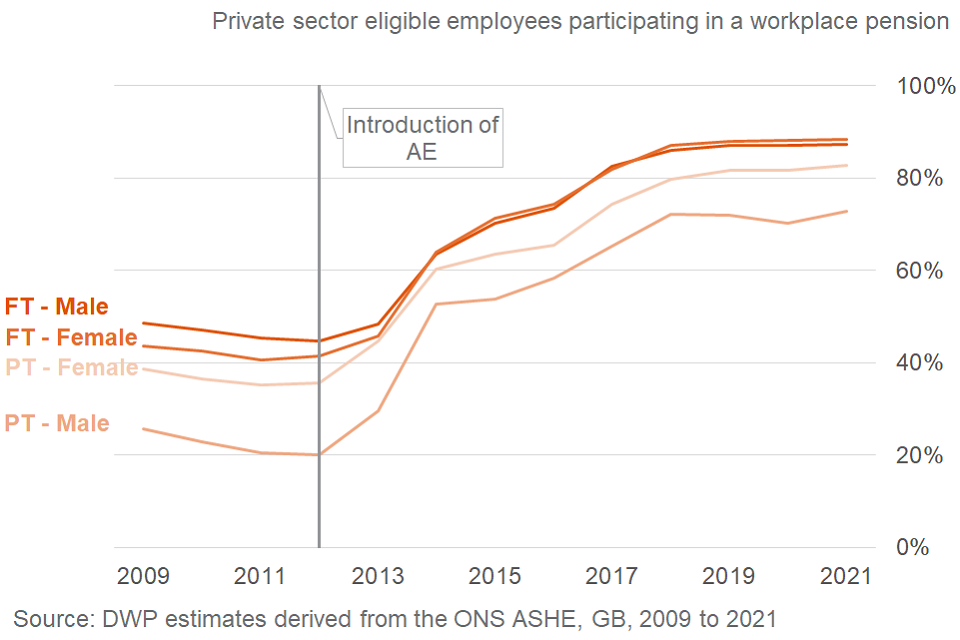

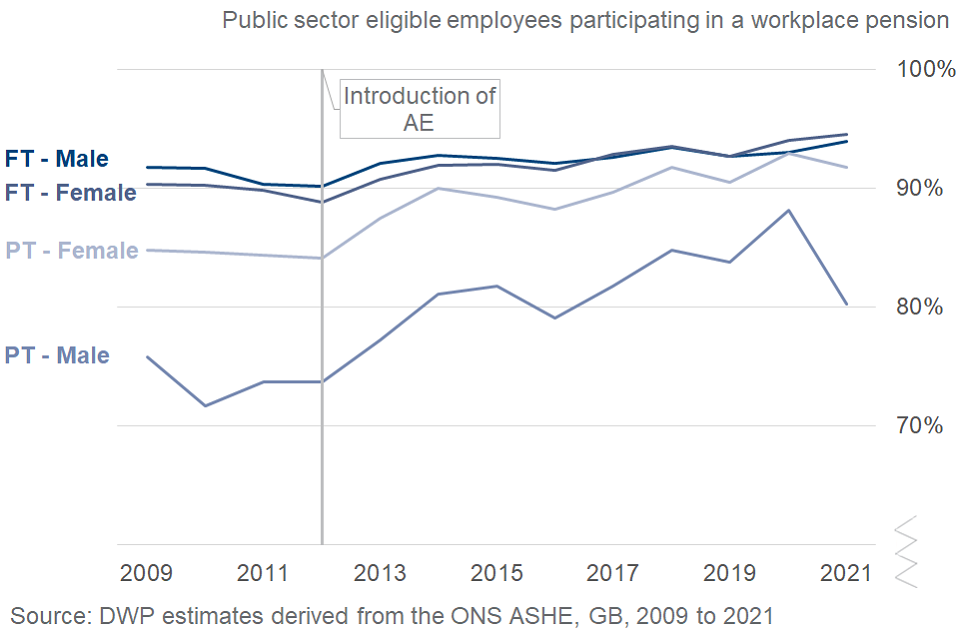

1.4 Gender and working pattern, by sector

The male and female participation rates in the private sector have equalised for full-time employees but gaps remain between full-time and part-time employees and male and female part-time employees.

Figure 12 and 13: Participation by gender and working pattern to 2021

Across the whole economy there is only a small gap in participation rates by gender among full-time eligible employees in 2021 (89% for male employees and 91% for female employees). Among part-time eligible employees the gap is bigger: 86% of female part-time employees are participating compared to only 74% of male part-time employees.

In the private sector overall participation rates for male and female eligible employees were 86 and 87% respectively in 2021, compared to 2012 when the participation rate for male employees was 3 percentage points higher (43% compared to 40% for female employees). The same trend of a narrowing gender gap since 2012 is seen among full-time employees in the private sector, and in 2021 the participation rate for female full-time employees (88%) was slightly higher than for male full-time employees (87%). Among part-time employees the participation rate has remained persistently higher for female than male employees (83% and 73% respectively in 2021), although the rates for both genders have increased greatly since 2012.

In the public sector overall participation rates for both male and female eligible employees have remained stable, and were 93 and 94% respectively in 2021. Among full-time employees in the public sector, there was only a 1 percentage point difference between male and female employees (94% versus 95%), while among part-time employees, the participation rate has remained persistently higher for female than male employees (92 and 80% respectively in 2021).

Every year around 15% of eligible employees in the Annual Survey of Hours and Earnings (ASHE) are classed as part time (i.e., working 30 hours or less per week or, for those in teaching professions, less than 25 hours per week). It should also be noted that part time workers may be more likely to be earning less than the trigger and therefore not included in the eligible population.

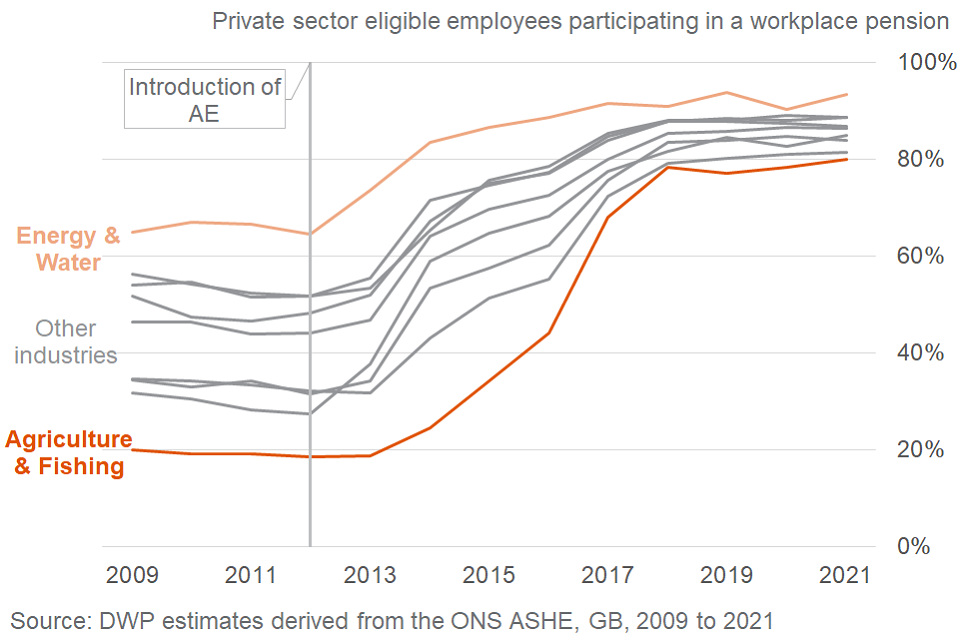

1.5 Industry, by sector

All industries have high participation rates in the private sector of 80% or above.

Figure 14: Private sector participation by industry to 2021

Note: Graphs above show industry breakdowns with the highest and lowest participating industries. All other industries fall within these.

Across the whole economy in 2021, workplace pension participation was highest in the Energy and Water industry with 93% of eligible employees participating and lowest in the Agriculture and Fishing industry with 80% participating.

In the private sector all industries have seen increases in participation since 2012, and the gap between different industries has narrowed. The industry seeing the largest increase in participation since 2012 is the Agriculture and Fishing industry, which saw an increase of 62 percentage points.

Participation in the public sector has remained high in all industries over the time series. Small sample sizes in the data mean that comparisons across industries in the public sector are less meaningful than in the private sector.

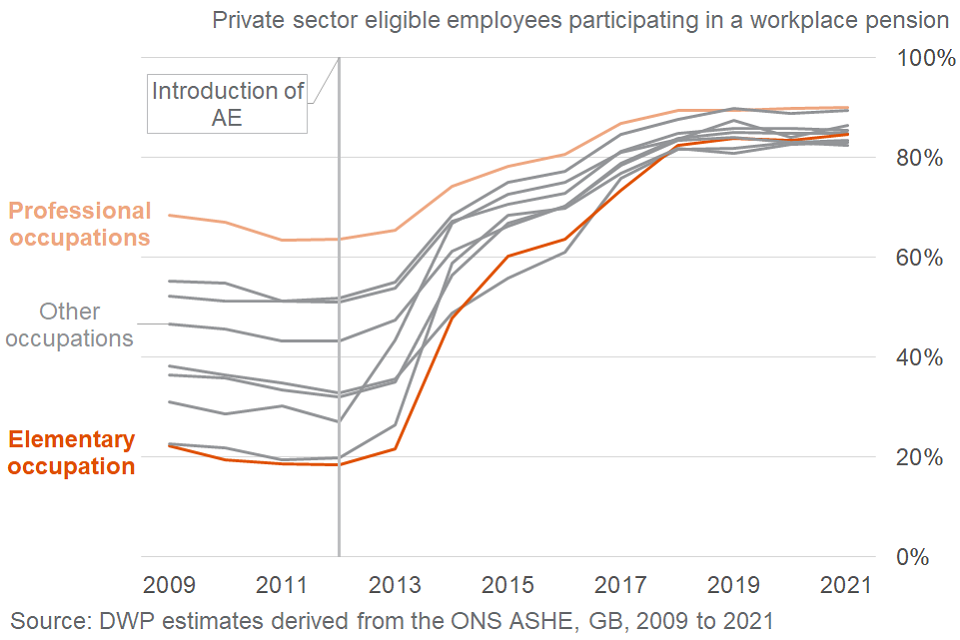

1.6 Occupation, by sector

All occupations have high participation rates in the private sector of 83% or above.

Figure 15: Private sector participation by occupation to 2021

Note: Graphs above show all occupation breakdowns, with the highest and lowest occupations labelled, and all other occupations are within this field.

Across the whole economy workplace pension participation is highest in the Professional and Associate Professional & Technical occupations with 91% of eligible employees in these occupations participating in 2021, compared to the lowest in Skilled Trades occupations where 83% were participating in 2021.

Since 2012, all occupations in the private sector have seen a large increase and the gap in participation between different occupations has narrowed. The largest increase has been seen in Personal Service occupations where the participation rate increased by 66 percentage points from 19% in 2012 to 85% in 2021.

In the public sector participation by occupation remains relatively stable with all occupations continuing to show higher participation levels than those seen in the private sector. Personal Service occupations (such as carers, travel agents and nurses) have shown the largest increases since 2012 of 16 percentage points, from 78% to 94% in 2021.

1.7 Region, by sector

Gaps in participation rates between public and private sector have narrowed for most regions.

Figure 16: Participation by region and sector to 2021

In general, there is little regional variation in workplace pension participation within sectors.

In the private sector in 2021, the highest participation was in Scotland at 88% of eligible employees. The lowest, at 85%, was London and Yorkshire and the Humber.

Within the public sector in 2021, the regions with the highest levels of eligible employees participating in a workplace pension were South West and Scotland with 96%. The lowest participation rate of 88% is observed in the East.

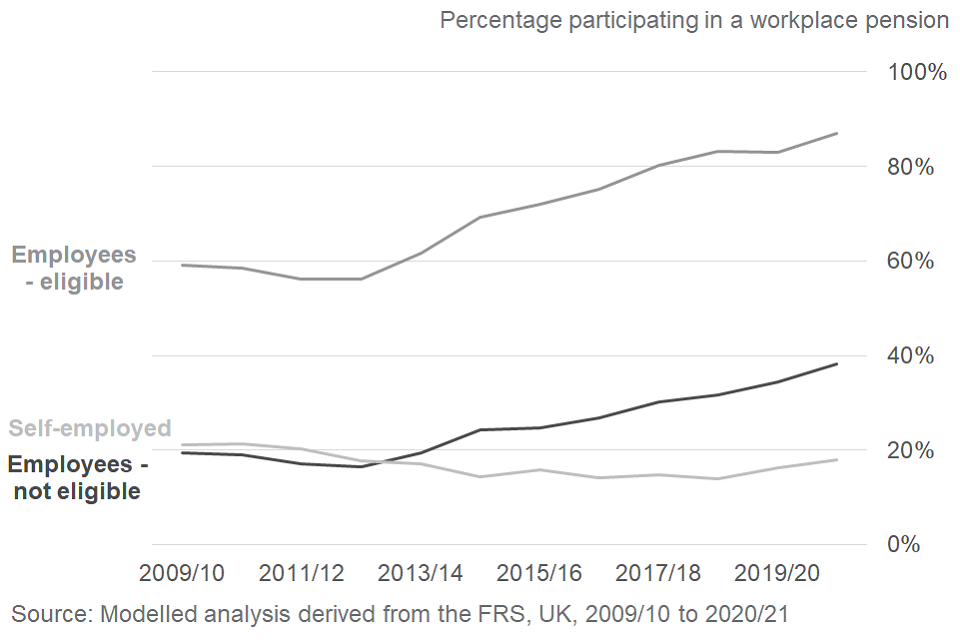

1.8 Economic status, UK

Since 2012 to 2013, non-eligible employee participation has also increased to 38%. However, we have not seen a change in self-employed levels (remained at 18%).

Figure 17: Participation by economic status to 2020 to 2021

This analysis uses the DWP Family Resources Survey (FRS) to provide breakdowns by characteristics not available from ASHE but it is not possible to provide breakdowns by sector. More detail on this analysis can be found in the accompanying Background Information and Methodology note. Differences between the FRS and ASHE surveys mean the overall level of participation measures is not exactly the same. Nevertheless, both FRS and ASHE have seen similar long-term trends in participation. Automatic enrolment scheme participation has increased among eligible employees from 56% in financial year 2012 to 2013 to 87% in financial year ending 2020 to 2021.

For non-eligible employees the long-term trend has been a gradual increase from 16% in 2012 to 2013 to 38% in 2021 to 2022. Unlike employees, both eligible and non-eligible, the self-employed group has seen an overall long-term decline in participation from 21% in 2009 to 2010 to 18% in 2020 to 2021. Participation rates of non-eligible employees and self-employed both increased in 2020 to 2021 from the previous year by 4 and 2 percentage points respectively.

Since 2012 to 2013, participation rates among eligible employees have shown a marked increase from 56% to 87% in 2020 to 2021. This trend is similar to that seen in the ASHE data, though participation rates have increased more over this period in ASHE (from 55% in 2012 to 88% in 2021) than in FRS.

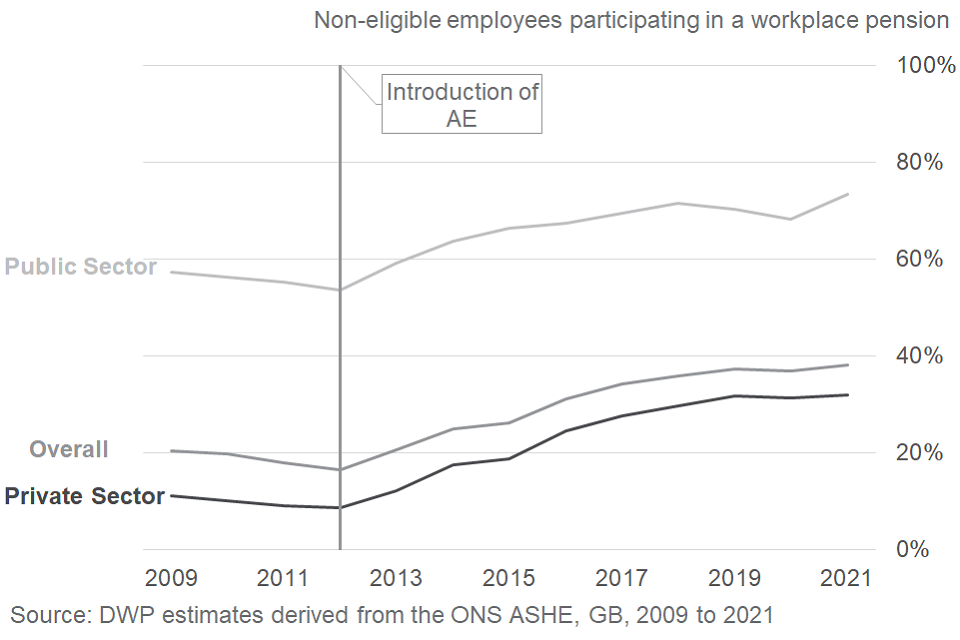

1.9 Non-eligible participation, by sector

While trends in participation among non-eligible employees have followed a similar trend to eligible employees, participation rates remain lower.

Figure 18: Non-eligible participation to 2021

ASHE can be used to provide breakdowns on non-eligible employees by sector. Trends in non-eligible participation have been broadly similar in ASHE and FRS, except for the latest 1 to 2 years. This is likely to be due to differences between these data sources, for example time periods. More details about ASHE and FRS are included in the Background Information and Methodology Note.

Non-eligible jobholders are individuals who earn below the Trigger but above the LEL, earn above the Trigger but are under 22 or above SPA or both earn below the Trigger and are under 22 or above SPA. Non-eligible jobholders are not automatically enrolled but can choose to opt-in to a workplace pension and receive a mandatory employer contribution.

Results from the Employers’ Pension Provision Survey 2019 included in the Automatic Enrolment Evaluation Report 2019 found 5% of employers with a scheme used for automatic enrolment had enrolled some non-eligible employees in 2018 to 2019. This includes those choosing to opt-in or those enrolled as part of a company policy.

Across the whole economy, there was a general downward trend in workplace pension participation among non-eligible employees, from 20% (1.1 million non-eligible employees) to a low of 16% (0.9 million non-eligible employees) between 2009 to 2012. This is a similar trend to what has been observed among eligible employees. Since 2012, there has been a large increase of 22 percentage points to 38% of ineligible employees participating in a workplace pension (1.8 million) in 2021.

The largest increases in workplace pension saving among non-eligible employees have been seen within the private sector. Since 2012, private sector participation has risen by 23 percentage points to 32% of private sector non-eligible employees participating in 2021 (1.3 million ineligible employees). The gap between public and private sector non-eligible participation has remained large (41 percentage points in 2021).

Public sector pension participation among non-eligible employees remains relatively high at 73% in 2021 (0.5 million non-eligible public sector employees), an increase of 19 percentage points since 2012.

Non-eligible employees participating in a workplace pension could be either aged below 22, or earning below the earnings trigger, which was £10,000 in 2021 to 2022.

It should be noted that figures for non-eligible participation in this section will differ from the previous Economic Status breakdown due to different data sources.

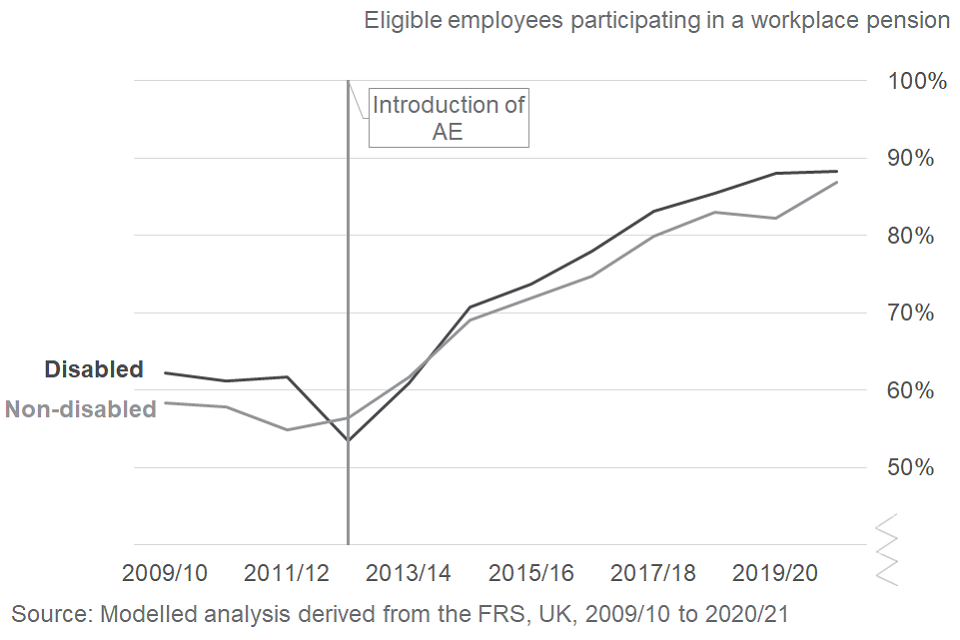

1.10 Disability, UK

Since 2014 to 2015, there has been a small but persistent gap between disabled and non-disabled eligible employees with disabled eligible employees having higher participation rates than non-disabled.

Figure 19: Participation by disability status to financial year 2020 to 2021

The FRS data can be used to show trends in pension participation for disabled and non-disabled eligible employees.

In 2019 to 2020 there was gap in participation between disabled and non-disabled participants of 6 percentage points, but this has reduced to 1 percentage point in 2020 to 2021, with 88% of disabled people participating, and 87% of non-disabled people participating.

Both the disabled and non-disabled groups saw large increases between 2012 to 2013 and 2020 to 2021, rising 35 and 31 percentage points respectively.

The impairment types used to define disability status were changed in the 2012 to 2013 survey to reflect new harmonised standards and therefore caution is needed where making comparisons over time.

It should be noted that disabled employees are generally less likely to be in the eligible group according to FRS data.

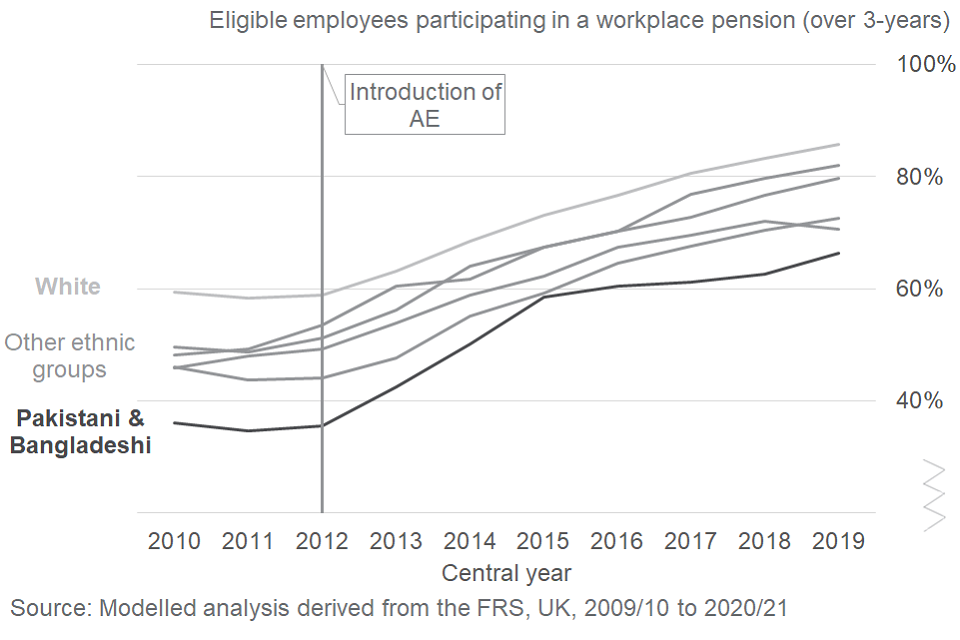

1.11 Ethnicity, UK

Eligible employee participation continues to increase across all ethnic groups but the gap between White and Pakistani and Bangladeshi groups persist, currently 20 percentage points.

Figure 20: Participation by ethnicity to financial year 2020 to 2021

The FRS data can also be used to show trends in pension participation by ethnic group, but 3-year rolling averages must be used to account for volatility in single year results which are caused by small sample sizes and clustering effects.

The White ethnic group has had the highest participation rate over the entire time-series and had an average participation rate of 86% over the period from 2018 to 2019 to 2020 to 2021 This compares to the lowest, Pakistani and Bangladeshi group at 66%.

Between the period 2011/2012 to 2013/2014 and 2018/2019 to 2020/2021 there were large increases among all ethnic groups. The Pakistani & Bangladeshi ethnic group shows the largest increase from 35% to 66% (a 31 percentage points increase).

In comparison the lowest increase in the same period, 2011/12 to 2013/14 and 2018/19 to 2020/21, occurred in the Indian ethnic group. This group saw a 22 percentage points increase from 49% to 71%.

2. Trends in Contributions

Total annual savings for eligible savers increased to £114.6 billion in 2021.

Figure 21: Amount saved by eligible savers in 2021

In the previous year’s publication, separating total annual workplace pension contributions into tax relief, employee contributions and employer contributions was calculated using erroneous income tax rates between 2017 and 2020. This has been corrected in this year’s publication. Therefore, the proportion of contributions attributed to tax relief, employees and employers may slightly differ (around 1ppt) from previous years.

Minimum contribution rates under automatic enrolment started at 2% of qualifying earnings with at least 1% from employers. In April 2018, this increased to 5% with at least 2% from employers. In April 2019, minimum contribution rates increased to their current level of 8% overall with at least 3% from the employer.

The annual total amount saved for eligible savers across both sectors stands at £114.6 billion in 2021, which is an increase of £2.9 billion from 2020. Amounts saved in the private sector increased by £0.2 billion and £2.7 billion in the public sector. These amounts are in 2021 earnings terms.

Overall, in 2021, contributions by employees accounted for 26% of saving, with employer contributions accounting for 65%, and income tax relief on the employee contribution the remaining 9%.

Amount saved per eligible employee increased in both sectors since 2012.

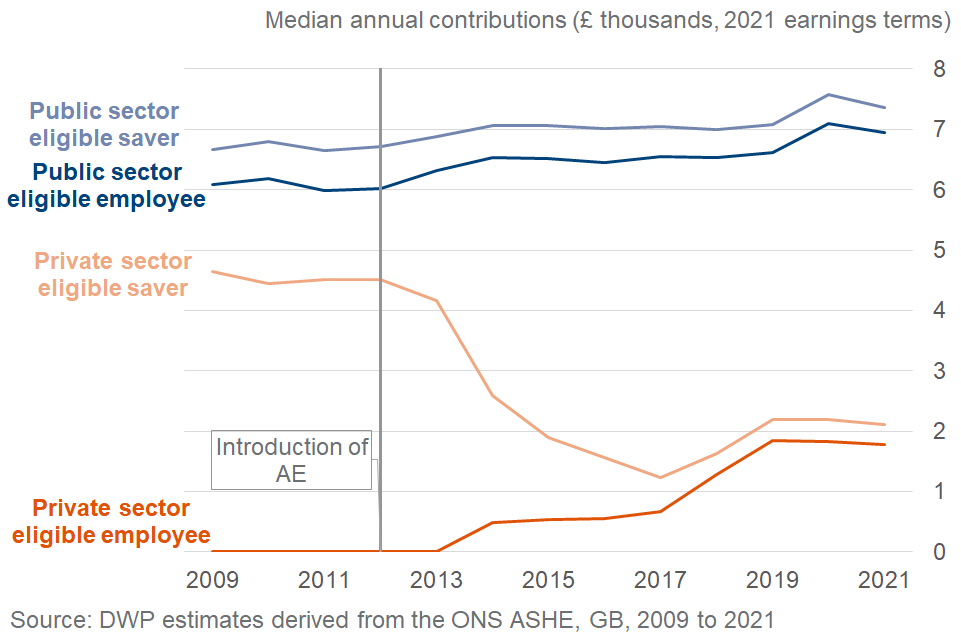

Figure 22: Amount saved per eligible saver and employee by sector to 2021

Note: Average amounts are calculated using medians.

In the private sector the average annual amount saved per eligible saver showed several years of decline from 2012 to 2017. The falling trend was a result of the increased number of savers in the private sector many of whom will be making contributions at the automatic enrolment minimum level and therefore lowering the average. The average amount per eligible saver then saw large increases between 2017 and 2019, increasing £402 between 2017 and 2018 and £553 between 2018 and 2019. These increases are most likely attributable to the phased increases in minimum contribution rates. Following this, the average amount per eligible saver and employee has stayed roughly the same in 2021 as it was in 2020.

Within the public sector there has been a gradual increasing trend for both the amount saved by eligible savers and employees. This reflects continued high participation rates in the public sector. However, in 2021 the average annual amount saved per eligible saver decreased by £210 and the average annual amount saved per eligible employee decreased by £150.

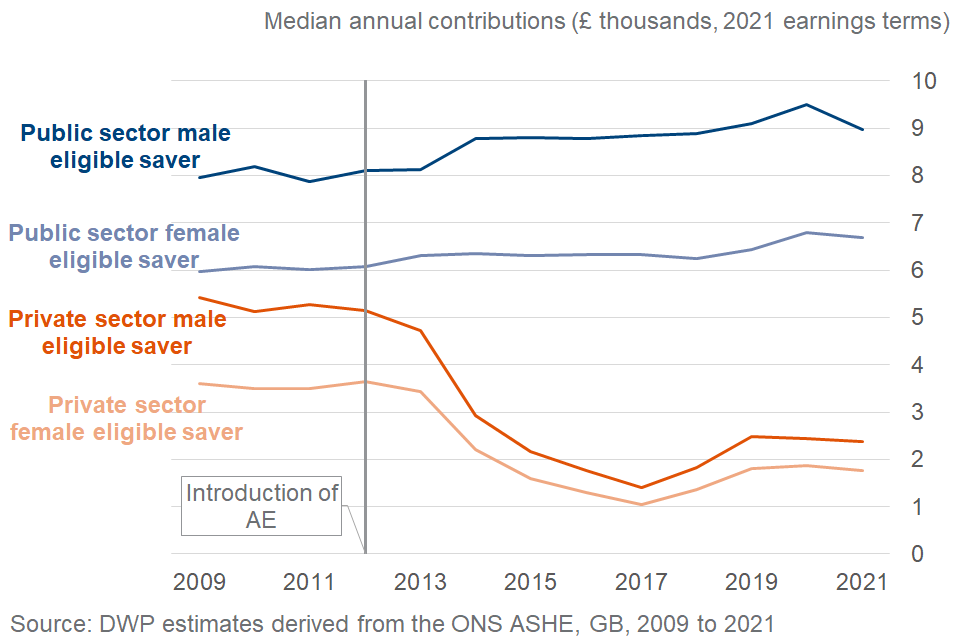

Amount saved per male and female eligible savers in public and private sector have followed similar trends to overall sectoral amount saved trends. However, there are persistent gaps in average amount saved for male and female eligible savers in both sectors.

Figure 23: Amount saved per eligible saver by gender and sector to 2021

Within the private sector, the average amount saved per male eligible savers fell slightly in 2021 compared to 2020, by £60. For women, this decreased by £100.

Within the public sector, the average amount saved per male eligible savers fell in 2021 compared to 2020, by £520. For women, this decreased by £100.

Note that figures for annual amounts saved are derived by converting actual amounts saved during a single pay period in April of the corresponding year to an annual equivalent.

3. Trends after the COVID-19 period

Real Time Information (RTI) is the reporting system for earnings taxed via Pay As You Earn (PAYE). Under RTI, employers are required to report to HMRC information about payments made to their employees through the PAYE system, including details of tax and other deductions from pay. This is an update to the RTI information included in the Automatic Enrolment Evaluation Report 2019.

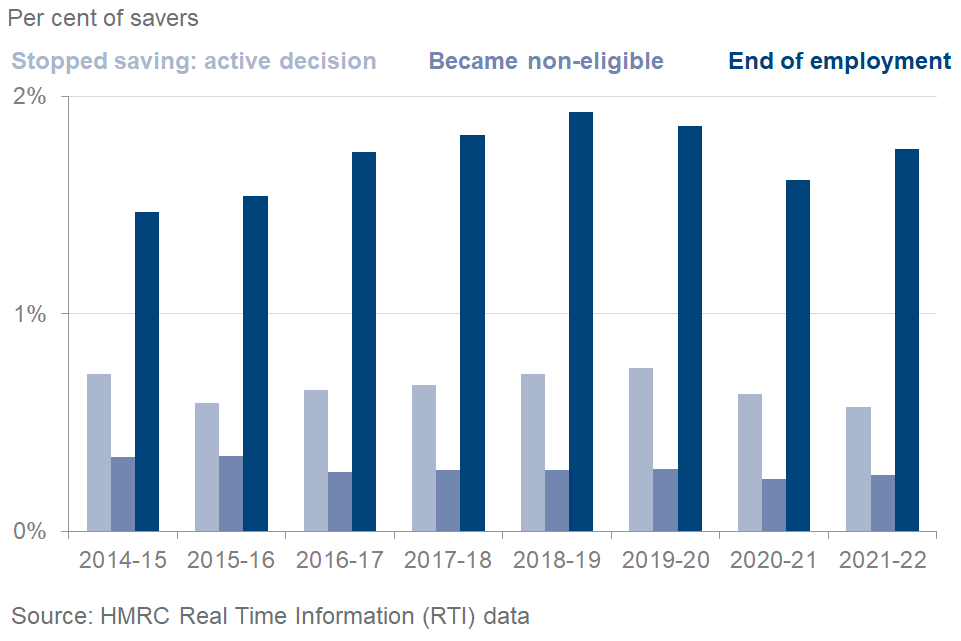

Stopping saving rates in RTI has increased slightly compared to previous years.

Figure 24: Stopping saving rates to financial year 2021 to 2022

This section presents RTI stopping saving rates from April 2014 to March 2022. The RTI stopping saving rate is calculated as the proportion of all employments that are classed as stopping their workplace pension saving within each month on RTI. An employment is defined as stopping saving in the month of its final pension contribution. By looking longitudinally across payments for a given employment, we use the presence and absence of employee pension contributions to identify when pension saving starts and stops within an employment. RTI cannot identify cases where employees have been enrolled but they stopped saving before making their first contribution.

From April 2014 to March 2022, on average 2.7% of employments within RTI were identified as stopping saving each month due to either an active decision being made, the employment becoming non-eligible or the employment ending. Across this period, end of employments account for 64%, with active decisions accounting for 25%, and becoming non-eligible accounting for 11% of employments who are classified as having stopped saving.

In the financial year 2021 to 2022, the overall stopping saving level has increased, mainly driven by a fall in those stopping saving due to ending their employment, which rose from 1.6% to 1.8%.

The active decision stopping saving rate (the proportion of workplace pension savers who make an active decision to stop saving within each period) has remained at 0.6% in the financial year 2021 to 2022.

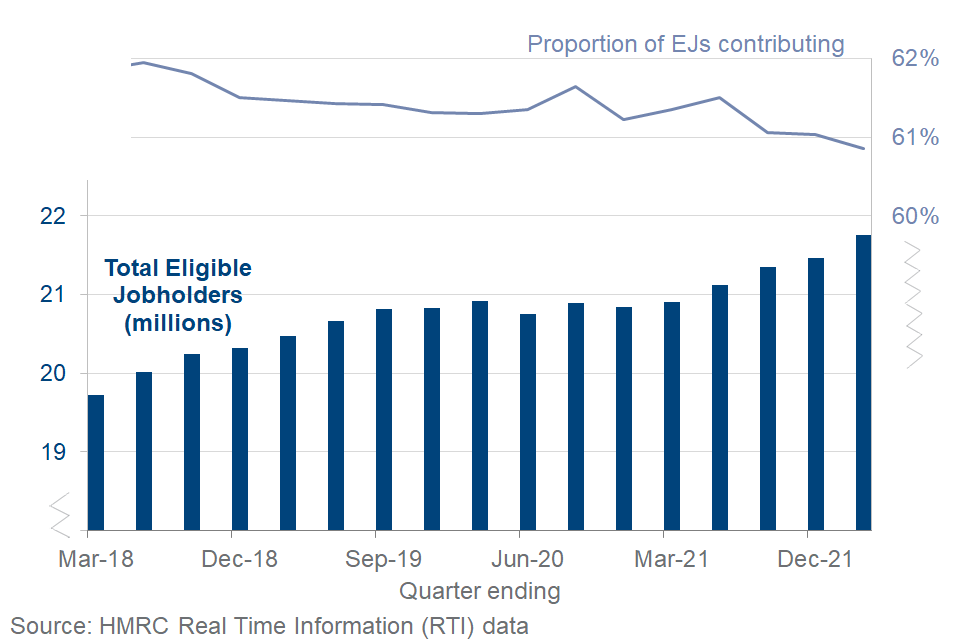

The contributing eligible jobholder rate in RTI has remained stable in recent years.

Figure 25: Contributing eligible jobholders to financial year 2021 to 2022 Q4 (Jan to Mar)

Note that 2018 to 2019 Q1 does not include data from July 2018.

This section presents the counts of eligible contributing jobholders compared with all eligible jobholders in RTI, known as the contributing eligible jobholder rate. This is produced from the number of people in employments who are listed as earning above the earnings trigger of £10,000 and are between the ages of 22 and the state pension age at the time.

Within RTI, there are 13.2 million eligible employments with an employee pension contribution as of the fourth quarter of the financial year 2020 to 2021. This accounts for 60.9% of all employments that are classified as eligible within RTI.

This contributing eligible jobholder (EJ) rate has remained stable since the final quarter of the financial year 2018 to 2019, remaining between 60.9% and 61.9%.

RTI does not collect information on employer pension contributions, so it cannot identify employments with employer-only pension contributions. This could explain the difference in the overall participation rate in Table 1.1 and the contributing eligible jobholder rate in Table 5.1. Pension contributions made via salary sacrifice cannot be identified within RTI as pension contributions. Self-employed individuals are not required to submit RTI. Also note that the figures produced by RTI are based on employments eligible for automatic enrolment, both in the public and private sector. Due to the differences in population coverage and the methodology used, figures produced by RTI will not be directly comparable with other data sources – the focus of this section is to look for changes in RTI measures over time. RTI data in certain sections are presented using financial quarters. For example, Q1 refers to the period from April to June.

Employee pension contribution rates in RTI have remained stable throughout the financial year 2021 to 2022.

Figure 26 and 27: Employee pension contribution rates by AE threshold pay and full taxable pay to financial year 2021 to 2022 Q4 (Jan to Mar)

The RTI data can also be used to monitor employee pension contribution rates of each contributing employment. These contribution rates are calculated by using the pension contribution amount by taxable pay on the RTI reporting system. The pension contribution amounts used includes tax relief from relief at source (RAS) schemes.

These figures present the quarterly percentage of eligible jobholders by banded rate of employee pension contributions between February 2018 and March 2022. The figures are presented in terms of taxable pay falling within the lower and upper automatic enrolment thresholds, as well as percentage of full taxable pay.

Across both metrics, employee pension contribution rates in RTI have been steadily increasing throughout from 2020-21 to 2021-22.

Some PAYE schemes base their pension contribution rates using only the taxable pay that falls within the lower and upper automatic enrolment thresholds. When the contribution rate is calculated using this method, 92% of eligible employments with a recorded employee contribution are contributing 4.5% or more of this amount into their pension as of the fourth quarter of the financial year 2021 to 2022.

Not all PAYE schemes base their pension contribution rates using the automatic enrolment thresholds, so percentage of an employment’s full taxable pay can be used instead. As of the fourth quarter of the financial year 2021 to 2022, 50% of eligible employments with a recorded employee contribution are contributing 4.5% or more of their full taxable pay into their pension.

About these statistics

The main data source for this publication is the Annual Survey of Hours and Earnings (ASHE) published by the Office for National Statistics (ONS) and is a key source of information on workplace pensions in GB as it collects information on all types of workplace pension schemes. The survey results are used widely to monitor the impacts of pension reforms.

Additional data sources used in this publication include DWP Family Resources Survey (FRS) and HMRC Real Time Information (RTI). FRS collects information on the income and circumstances of individuals living in a representative sample of private households in the United Kingdom. RTI is HMRC’s reporting system for income taxed via Pay-As-You-Earn (PAYE) in the United Kingdom. The information is provided by employers and pension providers, with each submission within RTI relating to a payment to an employee or occupational pension recipient.

Full details of the data sources, their key assumptions, limitations and definitions are available in the Background Information and Methodology Note.

Contact details

Contact us for statistical enquiries and publication feedback only.

Produced by: [email protected]

For media enquiries contact DWP press office.

Consultation

We are committed to improving the official statistics we publish and therefore will be launching a user consultation to generate feedback on the long-term future of this publication in Autumn to Winter 2022. Please check the Workplace Pension Participation and Savings Trends collection page for updates.

Published: 28 June 2022

Next edition on: Summer 2023