Workplace pension participation and savings trends of eligible employees: 2009 to 2023

Published 31 July 2024

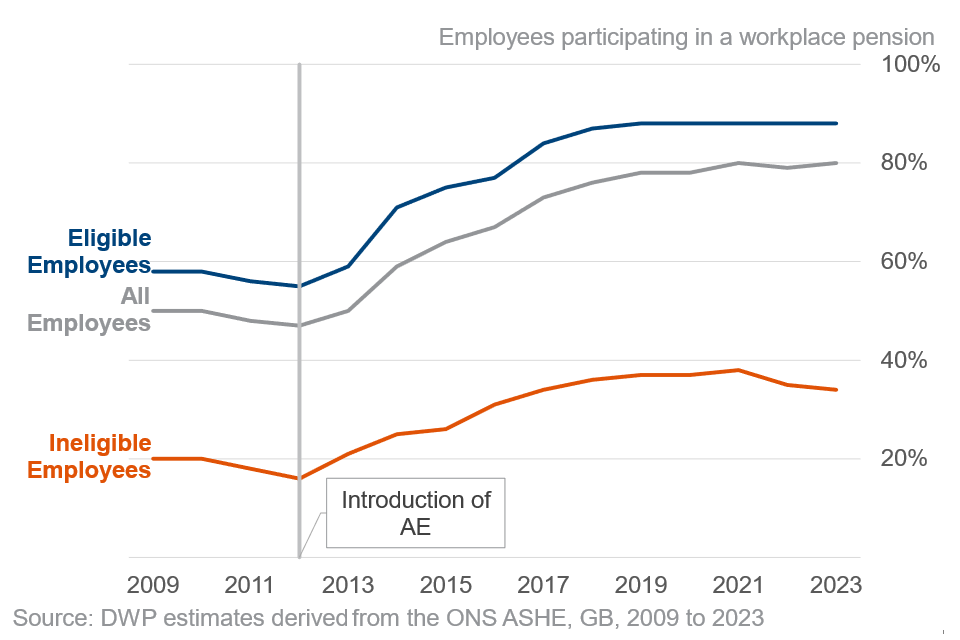

This is the latest release of statistics on Workplace Pension Participation and Savings Trends. This newest edition in the series extends the data series to 2023 and provides 2 new additions to the statistical series, offering information on the workplace pension participation of all employees, not just those eligible for Automatic Enrolment (AE), as well as information on the trend in private pension withdrawals.

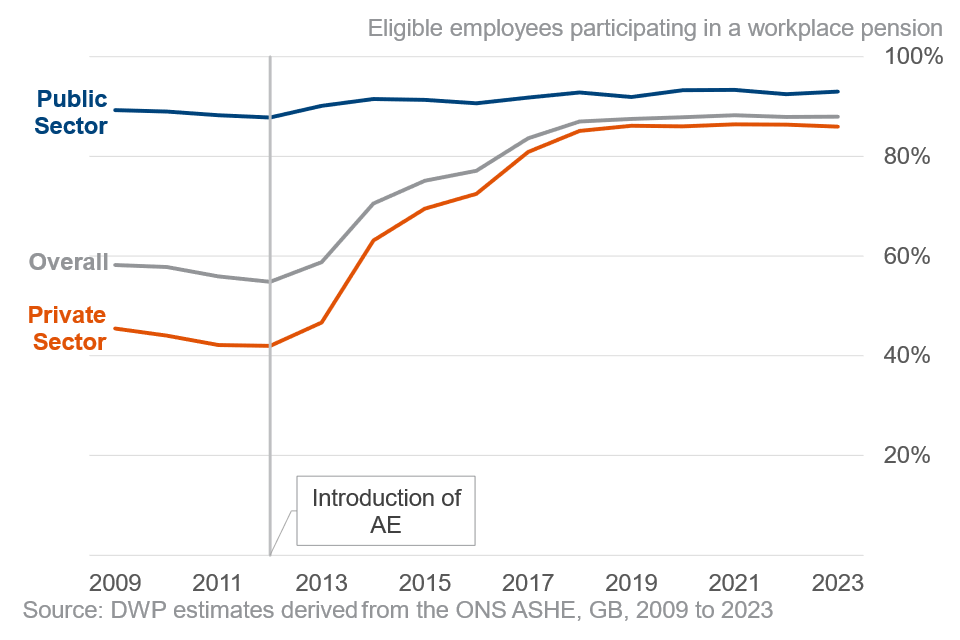

After years of growth in participation during the roll-out of Automatic Enrolment, participation rates have stabilised in recent years. Trends in stopping saving levels and contributions have also remained relatively stable.

There are 2 important groups considered in this publication:

-

Eligible Employees – these are the group of employees who are eligible for AE (that is, they are aged 22 to State Pension Age and earn over £10,000 a year)

-

All Employees – this captures all employees, regardless of AE eligibility

1. Trends in Workplace Pension Participation

The workplace pension participation rate of eligible employees in Great Britain was at 88% (20.8 million) in 2023. This is the same participation level as last year, but an increase in the total number of eligible employees saving into a pension (up 0.4 million).

Most groups have seen trends in participation stabilise in recent years.

The overall participation rate of all employees in Great Britain into a workplace pension was 80% (22.3 million) in 2023, similar to the 79% (22.1 million) participating the year previous.

Figure 1: Eligible Employee pension participation rate to 2023

Figure 2: All Employee pension participation rate to 2023

Since AE was introduced in 2012, participation differences across the population have narrowed. There are some gaps that remain in 2023, with some eligible groups having relatively low pension participation levels, such as around 57% for employees of micro employers in the private sector and 73% for Pakistani and Bangladeshi employees (note, ethnicity participation rates are calculated using a 3-year average). Estimates of workplace pension participation by different breakdowns can be found in the accompanying tables.

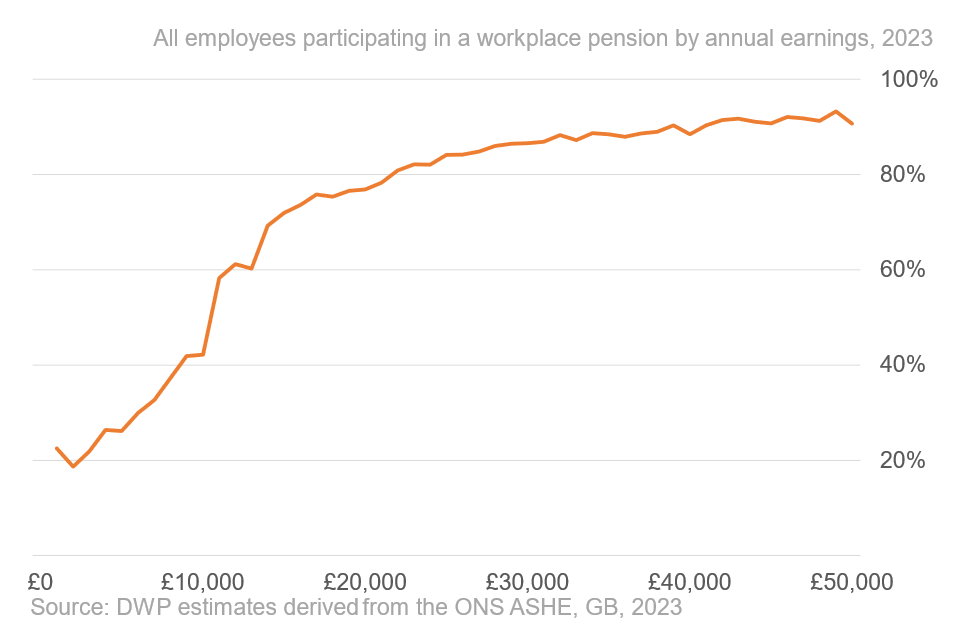

Workplace pension participation increases with annual earning levels, appearing to stabilise when earnings reach around the mid-£20,000s. There is also a clear upshift in participation either side of the £10,000 trigger; the point at which individuals become eligible for Automatic Enrolment.

Figure 3: All Employee pension participation rate by annual earnings, 2023

2. Trends in Workplace Pension Saving

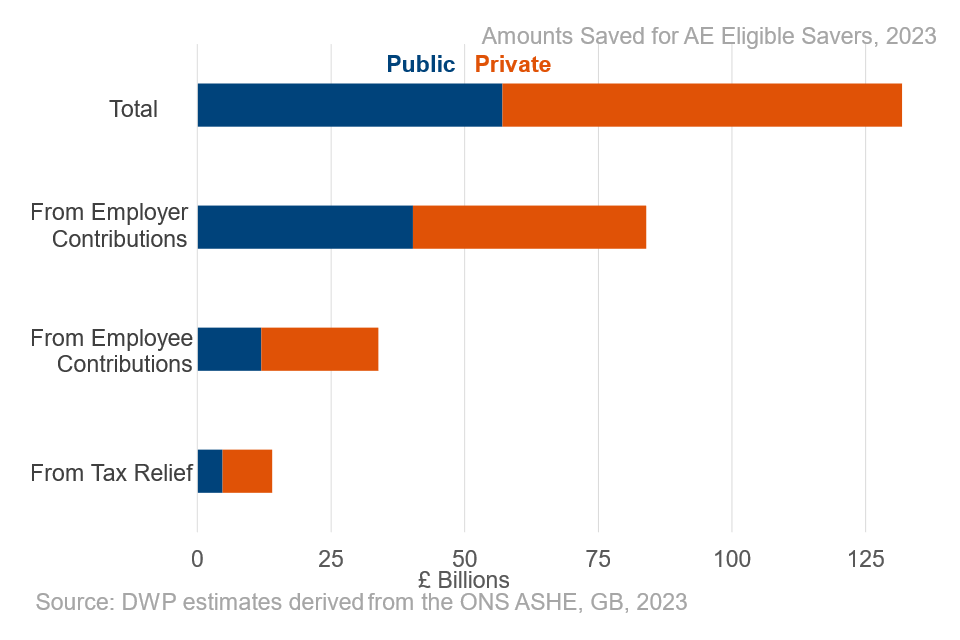

Total annual workplace pension savings for eligible savers was £131.8 billion in 2023. This is a £43.2 billion real terms increase compared to 2012 (in 2023 earnings terms).

Overall in 2023, contributions by employees accounted for 26% of saving, with employer contributions accounting for 64%, and income tax relief on the employee contribution the remaining 11%.

Amount saved per male and female eligible savers in public and private sector have followed similar trends to overall sectoral amount saved trends. However, there are persistent gaps in average amount saved for male and female eligible savers in both sectors.

Estimates of amounts saved can be found in the accompanying tables, however due to changes across years in the validation and cleaning of pension saving data, comparison of recent year-to-year changes should be treated with caution.

Figure 4: Amounts saved for eligible employees in 2023

3. Timely Monitoring of Pension Trends

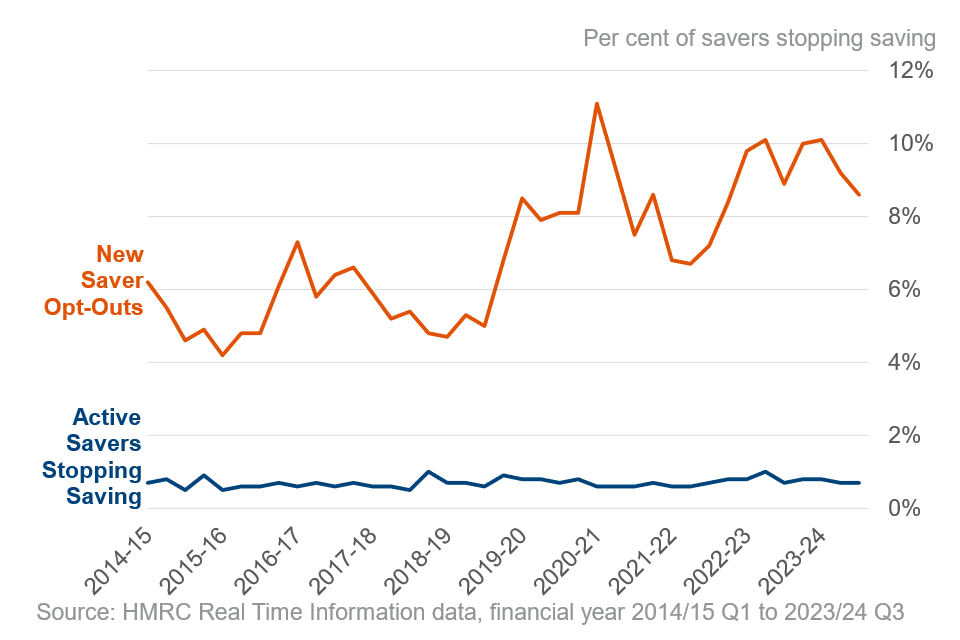

The number of active savers who stop saving each quarter as a proportion of total active savers has been stable over multiple years at under 1%.

The number of people who have newly started saving and actively opted out as a proportion of newly started savers has proven to be more volatile in recent years, perhaps driven by COVID-19 and periods of higher cost-of-living. In the last year this has been around 8 to 10%.

To examine across timelier indicators of pension saving, aggregated data from a number of pension providers is also included in the accompanying tables which finds similar rates of opt outs and stopping saving.

Figure 5: Stopping saving rates to financial year 2023 to 2024 Q3

4. Trends in Pension Withdrawals

Automatic Enrolment has increased the number of pension savers over the last 12 years. As a result, there is an increase in the number of people accessing a pension. Therefore, for the first time, the publication includes additional details on the number and type of pension being accessed. There are 2 types of workplace pension:

-

Defined Contribution – a pension pot based on how much is paid in and investment returns

-

Defined Benefit – a pension based on your salary and how long you’ve worked for your employer

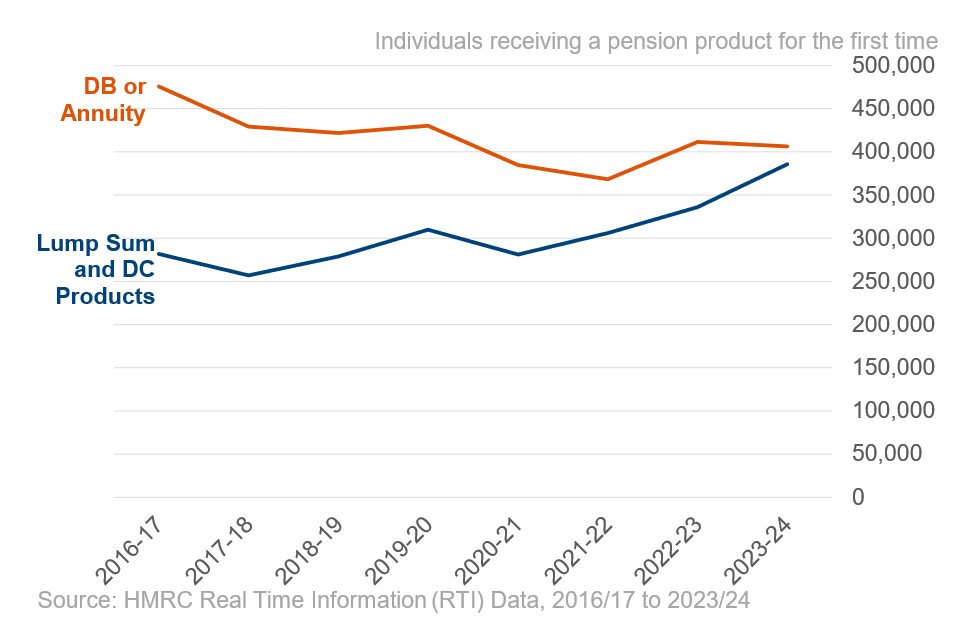

Overall, the vast majority, 95%, of the 12.7 million individuals in receipt of a private pension payment in 2023 to 2024 are in receipt of a Defined Benefit or an annuity.

However, this is slowly changing. When assessing private pensions accessed for the first time, the proportion receiving a lump sum or other Defined Contribution product has risen from 37% (280,000) in the 2016/17 financial year to 49% (390,000) in the 2023 to 2024 financial year.

Further statistics on those in receipt of a private payment pension can be found in the accompanying tables, covering gender and age bands, as well as private pension payments in the same financial year as employment income.

Figure 6: Private pension withdrawals for those accessing for the first time, by product type to financial year 2023 to 2024

About these statistics

Automatic Enrolment (AE) was introduced in 2012 to help address the decline in private pension saving and to make long-term saving the norm. It aims to increase workplace pension saving in the UK and forms part of a wider set of pension reforms designed to enable individuals to achieve financial security in retirement.

Statistics within this release allow continued evaluation of the success of AE in increasing both the number of savers, and the amount of savings. To continue understanding the role of AE on individual savers, this year the publication has expanded to include information on those accessing a private pension, helping us to understand trends in decumulation, not just accumulation.

ONS Annual Survey of Hours and Earnings (ASHE) is the principal data source of information on participation and amounts saved. ASHE is a key source of information on workplace pensions in GB as it collects information on all types of workplace pension schemes. The survey results are used widely to monitor the impacts of pension reforms.

Supplementary data sources used include DWP Family Resources Survey (FRS) for information on ethnicity, disability, and economic status breakdowns in participation, FRS collects information on the income and circumstances of individuals living in a representative sample of private households in the United Kingdom.

HMRC Real-Time Information (RTI) data providers information on stopping saving and contributions at monthly intervals, and also information on private pension withdrawals. RTI is HMRC’s reporting system for income taxed via Pay-As-You-Earn (PAYE) in the United Kingdom. The information is provided by employers and pension providers, with each submission within RTI relating to a payment to an employee or occupational pension recipient.

Alongside these, data supplied to DWP by a number of pension providers is also utilised, having been anonymised and aggregated following receipt for the purpose of information on stopping saving and contributions.

Throughout this report eligible employees are defined as employees who meet the automatic enrolment age and earnings criteria in that year unless otherwise stated. Full details of the data sources, their key assumptions, limitations and definitions are available in the background information and methodology note published alongside this statistics release.

Estimates of the Gender Pension Gap were published in June 2023.

Other pension statistics are also available containing more information, for example:

-

HMRC publish information on private pension statistics

-

Financial Conduct Authority publish information on Retirement Income Market data

Contact details

Feedback and queries about the statistics can be sent to: [email protected]

For media enquiries please contact the DWP press office.

Published: 31 July 2024

Next edition: Summer 2025