Check your payslip if you work through an umbrella company

Check your payslip to make sure you are not involved in a tax avoidance scheme, operated by some umbrella companies.

Your responsibilities

Many umbrella companies follow the tax rules, but some do not. These companies may try to attract you by claiming that you’ll be able to take home a higher percentage of your pay.

You need to understand how you get paid, to make sure you are not involved in a tax avoidance scheme. Check that your payslip includes all your income, and that tax and National Insurance have been correctly deducted.

HMRC does not approve or endorse umbrella companies or tax avoidance schemes. You are responsible for your own tax affairs and making sure you pay the right amount of tax and National Insurance.

Read more about how and what you’ll get paid when working through an umbrella company.

What to look out for

If an umbrella company pays you more than the amount shown on your payslip, it could be a sign of tax avoidance.

Payments described as loans or expenses

You might receive extra payments into your bank account and an email to confirm you have received an amount of money in loans. This could be a sign of tax avoidance.

These payments might be described as one of the following:

- loan

- annuity

- bonus

- profit share

- fiduciary receipt

- credit facility

- capital payment

- capital advance

Some payslips will not show all payments made by the umbrella company, particularly where they involve loan-type payments. Your payslip may only show payments paid through PAYE, to make it look compliant with the tax rules.

You should look out for any payments that have not been subject to PAYE. If the umbrella company tells that some of your employment income is not taxable, this could be a sign of tax avoidance.

For example, your payslip might show non-taxable payments, described as expenses, even though you have not claimed any work-related expenses.

Pay rates, loan amounts and ways in which umbrella companies calculate these will vary.

If you’re charged fees

If you’re charged fees by the company or person selling the arrangement for their services, these fees may not always be visible on your payslip. They should have told you about these fees when you signed your contract.

You should compare these fees with other companies, to make sure you are not paying higher than the normal fees. This could be a sign of tax avoidance.

Payslip examples

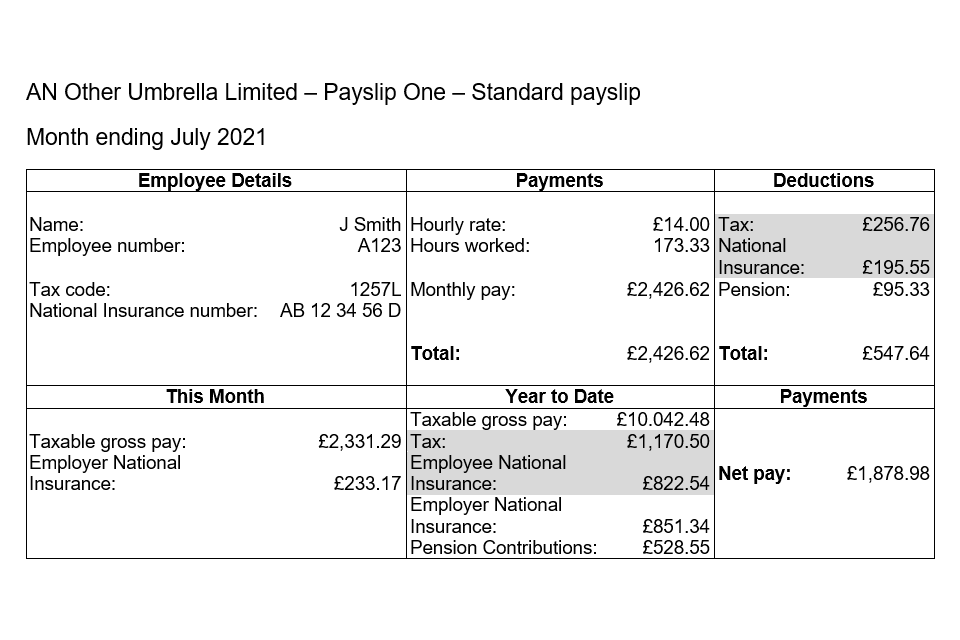

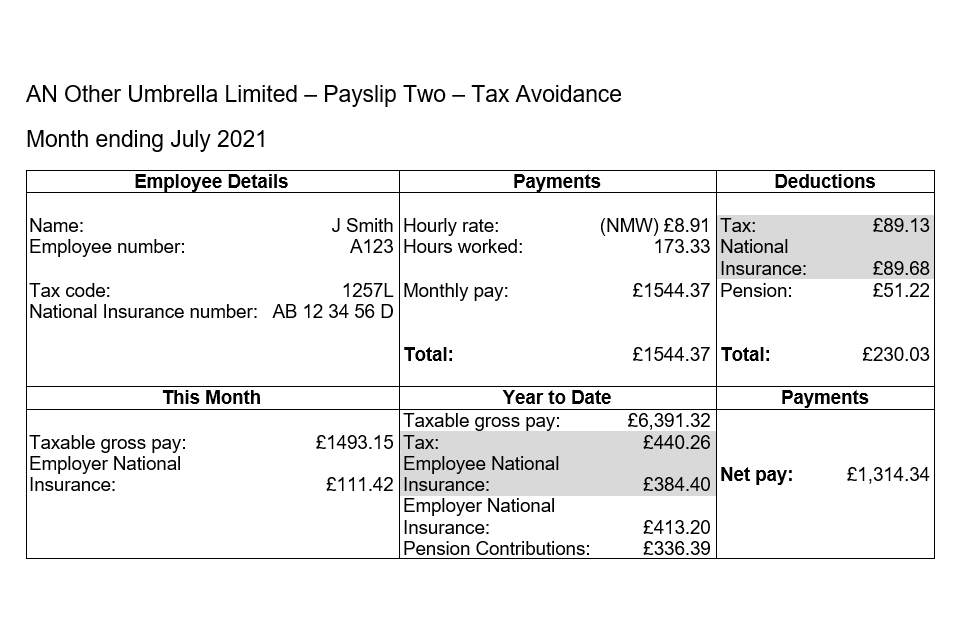

Joe is a supply teacher and is paid monthly. He works a 40-hour week and is paid £14 per hour. Joe works through an umbrella company for an agency.

The 2 examples of payslips for the month ending July 2021 show different amounts of net pay (also known as take-home pay).

Payslip 1 — a standard payslip

The hourly rate for Joe shows on payslip 1 as £14 an hour. The total hours worked shows 173.33 and the total net pay shows £1,878.98.

Payslip 1 shows the correct amount of pay and deductions for Income Tax and National Insurance contributions that Joe should be expecting to see.

Payslip 2 — a payslip involving tax avoidance

The hourly rate for Joe shows on payslip 2 as National Minimum Wage rate of £8.91 an hour. The total hours worked shows 173.33 and the total net pay shows £1,314.34.

Payslip 2 is an example of what could be seen if Joe used a disguised remuneration tax avoidance scheme.

What are the differences between the payslips

Payslip 2 differs from payslip 1 because:

- Joe has been paid at the National Minimum Wage rate, which gives him a lower net pay

- Joe’s employer has not used his actual hourly rate of £14 an hour

- the rest of Joe’s salary gets paid directly into his bank account as a loan of £882.25, which does not appear on his payslip

Both payslips show the correct amount of tax and National Insurance contributions have been deducted, based on the gross pay shown. However, for payslip 2, Joe used a disguised remuneration tax avoidance scheme. He paid less tax and National Insurance contributions, because the loan was not included in PAYE calculations.

The risks of using tax avoidance schemes

Using an umbrella company that claims you’ll be able to take home a higher percentage of your pay is very risky.

If we find out that you’ve used a tax avoidance scheme, you’ll be personally liable to pay:

- the tax and National Insurance contributions that are legally due

- interest on tax legally due

- any associated penalty

These payments are in addition to any fees that you have paid to those selling the scheme.

Due diligence

Use our tools to:

How to report an umbrella company

If you’re concerned about the schemes you’re currently using, you can:

- get independent professional tax advice

- contact HMRC by email: [email protected]

You should report any tax avoidance arrangements to HMRC.

Add the reference ‘TAC’ when you describe the activity on the online form, or give this reference when you call HMRC.

More information

Read more about:

- your right to a payslip as an employee

- how to understand your pay

- the check your pay campaign focussed on the National Living Wage and National Minimum Wage

- the guidance on payslips, on the Acas website

Updates to this page

Published 18 November 2021Last updated 3 December 2024 + show all updates

-

A link to the tool 'work out pay from an umbrella company' has been added.

-

First published.